Abstract

The asset-liability management problem with cash flow under an uncertain exit time has been investigated in this article, which is based on the fundamental framework of the mean-variance model in the multi-period version. The liability and random cash flow will affect asset optimization, while the investor may be forced to withdraw from investments with a random probability at each period in our model. The closed-form expressions for the mean-variance optimal portfolio selection and its corresponding efficient frontier are obtained by employing the mean-field formulation and dynamic programming approach. Moreover, some numerical examples are provided to illustrate the validity and accuracy of the theoretical results.

1 Introduction

With an explosive development of the economy in the recent 50 years, it is becoming more common that lots of private assets have been invested in the financial market. After a series of financial crises, the significance of handling private assets has been attached considerably. Mean-variance formulation is a famous tool that aims at balancing the risk and return of the investment. Owing to the seminal work of Markowitz [1], the mean-variance model has provided a fundamental basis for designing the optimal strategy balancing the contradiction between return and risk. Hundreds of applications and extensions have been developed over the past decade. For instance, Merton [2] derived the analytical expression of the mean-variance efficient frontier in a single-period setting. Li and Ng [3] developed the mean-variance model from the single period to the dynamic discrete-time version and derived the analytical solution by using the embedding method to overcome the difficulty of non-separability. Zhou and Li [4] used the same technique and further introduced the stochastic linear quadratic control as a general framework to solve the continuous-time mean-variance portfolio selection problem. Li et al. [5] developed it with the no-shorting constraint. Moreover, some recent approaches [6,7] based on enhanced index tracking are employed to deal with portfolio optimization.

There is no doubt that the embedding method is indeed a classic way to solve the problems with the nonseparable property. We also need to admit that this method is liable to lead to complicated calculation and inefficiency during the derivation of the optimal portfolio selection if the problem has other constraints, such as uncertain exit time, asset-liability management, and serial correlated returns or risk control over bankruptcy. Typically, we will prefer another method called mean-field formulation to the embedding scheme, where a long list of notations should be established, and an auxiliary problem should be assumed.

The mean-field formulation is a simple but powerful tool to derive the optimal strategy of a multi-period mean-variance portfolio selection problem. By using this method, which was first introduced by Cui et al. [8], we can resolve the mean-variance problem with many other additional constraints and derive the optimal strategy in a simpler and more direct manner. Yi et al. [9] used the mean-field method to study the mean-variance model under the uncertain exit time condition but did not consider the cash flow and liability. Cui et al. [10] extend it to the asset-liability management, but none of them considered the situation of random cash flow or investigated the closed-form of computational formulas for a series of coefficients.

Yao et al. [11] studied the mean-variance model with a given level of expected terminal surplus. Li and Xie [12] studied the optimal investment with stochastic income under the uncertain exit time. They derived the analytical optimal strategy and explicit expression of the efficient frontier by using the Lagrange method and traditional dynamic programming with the additional conditions of endogenous liabilities if the investors exit the market randomly. Wu and Li [13] investigated the multi-period mean-variance model with different market states and stochastic cash flows. A reinforcement learning framework is employed to investigate the continuous-time mean-variance portfolio selection [14]. Ni et al. [15] derived equilibrium solutions of multi-period mean-variance and established a general theory to characterize the open-loop equilibrium control problem. However, all of the literature did not consider the correlation among cash flow, asset, and liability, which should be taken into account in the real world because the random cash flow would be affected by the return rate of companies. For example, the government will provide funding to companies in terms of their past performance. Furthermore, since the analytical solution of the mean-variance model contains the correlation coefficient, the optimal strategy will be changed due to different return rates among the asset, cash flow, and liability. Moreover, the uncorrelated case can be regarded as a special case of the correlated one, of which the correlation coefficient is zero. We extended the special case to the general case.

In this paper, we employed the mean-field formulation [8,9,10] to study the general case of correlation in which the financial parameters are correlated at every period. On the basis of the aforementioned mean-field formulation, we have added some additional conditions such as random cash flow and liability to improve the accuracy of the investment strategy. During each time period, the cash flow and risky investment returns are random variables, while the risk-free investment return is deterministic. Furthermore, we have derived the analytical solutions of the mean-variance model which is lacked by using the embedding method [3,11, 12,13]. Employing the embedding method, the classical model mentioned earlier has certain limitations since they need to define a deterministic expectation of surplus, which is a single-objective optimization problem. Besides, the numerical solution needs some algorithms to compute the corresponding best auxiliary parameter or Lagrangian parameter, which will bring the inaccuracy and complexity in simulation. However, the mean-field formulation is more clear and powerful, which offers an analytical solution scheme in solving the nonseparable problems as the principle of optimality no longer applies. When both cash flow and mean-field formulation are presented in the same model, we shed light on the explicit solutions of the optimal portfolio under mean-variance criteria. In this paper, we are not only concerned about the return rate but also concerned with the volatility in the objective function in terms of a multi-objective optimization problem. We study the portfolio selection problem by adopting the mean field, and consider the cash flow, liability, etc. base on the mean variance model. Compared with the numerical solution, the analytical solution we derived in this paper is more efficient and applicable when the aforementioned additional conditions are added to our model.

The rest of the paper is structured as follows. We construct a mean-variance portfolio selection problem with cash flow and define the meaning of some symbols in Section 2. In Section 3, the considered model is equivalently transferred into a linear quadratic optimal stochastic control problem in the mean-field type. Then, we identify the optimal portfolio strategy with closed-form expressions by adopting the dynamic programming approach in Section 4. Some numerical examples are provided in Section 5 to illustrate the accuracy and efficiency of the optimal strategy. Finally, the conclusion and future work are given in Section 6.

2 Multi period mean-variance portfolio selection model

We assume the financial market has one liability, one risk-free asset, and

In different time periods

Then, for

Let

where

Therefore,

At the beginning of every period

The investor plans to optimize the portfolio selection during the whole time period. However, the investment might be forced to be changed or abandoned at an uncertain time

The main investigation of this model is to find the optimal portfolio selection,

where

Then, we can rewrite the aforementioned model as follows:

Since the smoothing property is no longer valid on the variance term, we cannot decompose the nonseparable problem into a stage wise backward recursion formulation, which can be tackled with traditional dynamic programming method. We solve it by employing the mean-field method.

3 Mean-field formulation

First, we construct the mean-field type of model (3). According to the independence between

with

Combining the dynamic equations in (3) and (4), we have

Therefore, we can equivalently reformulate problem (3) into a linear quadratic optimal problem in the mean-field type.

Thus, we are able to solve it by the dynamic programming method since it is separable.

4 The optimal strategy

With the notations given in (1), the seven parameters of the sequence

with boundary conditions defined as follows:

The solution scheme adopted in this paper involves two steps. The first step is to construct the cost-to-go functional and derive the backward recursion. The second step is to prove that it still holds at each period according to mathematical induction. Thus, the optimal portfolio strategy can be obtained in the following theorem.

Theorem 1

Assume that the return rates among asset, liability, and cash flow are correlated. Thus, we have the optimal portfolio selection of problem (6) as follows:

The expected value of optimal wealth can be derived as follows:

for

If the additional condition of liability is not considered in our case, the original model (6) would be degenerated to the one mentioned by Yao et al. [11], which will be introduced in the following corollary.

Remark 1

Assume that an investor participates in the initial investment under uncertain exit time without liability. Thus, the degenerated problem is equivalently reformulated as the following mean-variance model.

The optimal strategies of problem 7 are represented as follows:

Thus, we get the optimal expected level of wealth

The optimal strategy of the model in Corollary 1 can be obtained according to Theorem 1, which is consistent with the results derived by Yao et al. [11]. Therefore, the accuracy of the solution derived in this paper has been verified. In comparison, Zhu et al. [16] analyzed the Lagrangian problem via the embedding method and were unable to obtain an analytical form of the optimal objective value function. Thus, they invoked a prime-dual iterative algorithm to identify the optimal Lagrangian multiplier vector. Moreover, compared with the classical embedding method, which needs a Bellman equation and the Lagrangian multiplier, the mean-field formulation has been employed in this paper, which avoids the complicated computation. In the following section, a few numerical examples from real-world applications are given to demonstrate the efficiency of the obtained optimal strategy.

5 Numerical example

According to the data given in the study by Elton et al. [17], we investigate a portfolio selection consisting of S&P 500 (SP), the index of emerging market (EM), and small stock (MS) of the U.S. market. Moreover, we consider uncertain exit time and cash flow in the model. Table 1 presents three different assets, a liability, and a random cash flow, and it also presents the expected values, variances, and the correlation coefficients among them. The annual risk free return rate is set as

Data for assets and cash flow

| SP | EM | MS | Cashflow | Liability | |

|---|---|---|---|---|---|

| Expected return |

|

|

|

1 |

|

| Standard deviation |

|

|

|

|

|

| Correlation coefficient | |||||

| SP | 1 | 0.64 | 0.79 |

|

|

| EM | 0.64 | 1 | 0.75 |

|

|

| MS | 0.79 | 0.75 | 1 |

|

|

| Cashflow |

|

|

|

1 |

|

| Liability |

|

|

|

|

1 |

Thus, for every period

The correlation coefficient between cash flow and

and

In addition, we define the correlation of the cash flow and liability

Then, we have

Assume that

Substituting the data in the equations, we have

Example 1

An example with the terminal exit time

The probability mass function

for

Under the certain exit time, we derive the final optimal surplus as follows,

Example 2

An example without liability under uncertain exit time

Consider the example as corollary. Here, we ignore the information of liability, i.e., ignore the last line and last column of Table 1 and do not fix the terminal expectation but balance the variance and expectation by the trade-off parameter.

Assume that an investor plans a five-period investment with an initial wealth

To investigate the impact of uncertain exit time on the optimal policy and efficient frontier clearly, we choose four different probability mass functions at the exit time

where

Then, the optimal expected wealth level

which are given by

Therefore, the optimal strategy is specified as follows:

where

which are given as follows:

Thus,we have

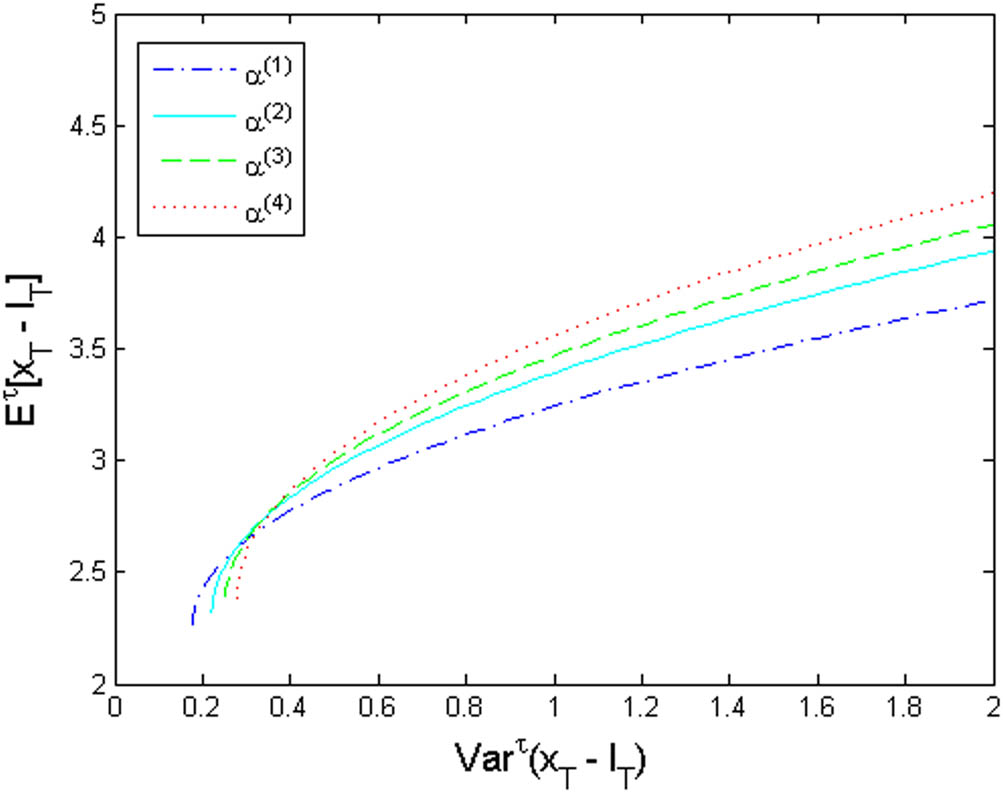

Figure 1 depicts the efficient frontier with different probability mass function of the exit time. We can see that the one exits at the terminal time gets the most expected wealth return at the same risk level compared with others. It is also indicated that if the investment is more stable, the investors can obtain higher expected returns at the same level of the risk, which is consistent with the real life.

Efficient frontiers with different probability mass functions of exit time.

Example 3

An example under uncertain exit time with liability

The probability mass function of an exit time

Thus, the optimal expected value of assets in different time periods is given by

Suppose the initial wealth of the investor

Furthermore, the final value of mean and variance under the optimal strategy are

Following Example 2, we choose four different probability mass functions at the exit time

Figure 2 is the efficient frontier of M–V model with liability and random cashflow under uncertain exit time. It can be seen that as the expectation go up, the more stable the investment, the less risk it takes, which has the same conclusion as Figure 1. Actually, Example 2 is a special case of Example 3, where we degenerate the term of liabilities to zero.

Efficient frontiers with different exit time.

6 Conclusion

The focus of the paper is placed on investigating the optimal strategy of multi-period mean-variance model with cash flow, and liability under uncertain exit time. It is a nonseparable dynamic programming problem that cannot be solved by the traditional method. In this paper, we transform the original model into a mean-field type and apply a dynamic programming approach and matrix theory to derive the optimal strategy explicitly. Our methods are shown to be much more efficient and accurate compared with other methods in the literature. For further research, we will try to employ the mean-field method to derive the mean-variance model with various additional conditions such as regime switching, bankruptcy constraints, and time inconsistency.

Acknowledgements

The authors express their appreciation for the anonymous referees comments and suggestions.

-

Funding information: This work was sponsored by the Philosophy and Social Science Planning Project of Guangdong Province (Grant No. GD20YGL12), Basic and Applied Basic Project of Guangzhou City (Grant No. 202102020629), Philosophy and Social Science Planning Project of Guangzhou City (Grant No. 2021GZGJ48), National Natural Science Foundation of China (Grant No. 71771058), and Guangdong Basic and Applied Basic Research Foundation (Grant No. 2020A1515110991).

-

Conflict of interest: The authors state no conflict of interest.

Appendix

The Proof of Theorem 1

Proof

Given an information set

From time

Next, we will prove that the aforementioned formulation (7) still hold at time

With the boundary condition given as

the optimal strategies at time

Substituting the optimal strategies back to (7), we get

Thus,

Substituting

Therefore, there holds

Typically, it is trivial that the optimal value of 6 is equal to

Then, the proof of Theorem 1 is complete.□

References

[1] H. M. Markowitz, Portfolio selection, J. Finance 7 (1952), 77–91. 10.12987/9780300191677Search in Google Scholar

[2] R. C. Merton, An analytic derivation of the efficient portfolio frontier, J. Financ. Quant. Anal. 7 (1972), 1852–1872. 10.2307/2329621Search in Google Scholar

[3] D. Li and W. L. Ng, Optimal dynamic portfolio selection: Multi-period mean-variance formulation, Math. Finance 10 (2000), 387–406. 10.1111/1467-9965.00100Search in Google Scholar

[4] X. Y. Zhou and D. Li, Continuous-time mean-variance portfolio selection: A stochastic LQ framework, Appl. Math. Optim. 42 (2000), 19–33. 10.1007/s002450010003Search in Google Scholar

[5] X. Li, X. Y. Zhou, and A. E. B. Lim, Dynamic mean-variance portfolio selection with no-shorting constraints, SIAM J. Control Optim. 40 (2002), 1540–1555. 10.1137/S0363012900378504Search in Google Scholar

[6] N. A. Canakgoz and J. E. Beasley, Mixed-integer programming approaches for index tracking and enhanced indexation, European J. Oper. Res. 196 (2009), 384–399. 10.1016/j.ejor.2008.03.015Search in Google Scholar

[7] R. Bruni, F. Cesarone, A. Scozzari, and F. Tardella, A linear risk-return model for enhanced indexation in portfolio optimization, OR Spectrum 37 (2015), 735–759. 10.1007/s00291-014-0383-6Search in Google Scholar

[8] X. Y. Cui, X. Li, and D. Li, Unified framework of mean-field formulations for optimal multi-period mean-variance portfolio selection, IEEE Trans. Autom. Control 59 (2014), 1833–1844. 10.1109/TAC.2014.2311875Search in Google Scholar

[9] L. Yi, X. P. Wu, X. Li, and X. Y Cui, A mean-field formulations for optimal multi-period mean-variance portfolio selection with an uncertain exit time, Oper. Res. Lett. 42 (2014), 489–494. 10.1016/j.orl.2014.08.007Search in Google Scholar

[10] X. Y. Cui, X. Li, X. P. Wu, and L. Yi, A mean-field formulation for optimal multi-period asset-liability mean-variance portfolio selection with an uncertain exit time, J. Oper. Res. Soc. 69 (2018), 487–499. 10.2139/ssrn.2680109Search in Google Scholar

[11] H. X. Yao, Y. Zeng, and S. M. Chen, Multi-period mean-variance asset-liability management with uncontrolled cash flow and uncertain time-horizon, Econ. Model. 30 (2013), 492–500. 10.1016/j.econmod.2012.10.004Search in Google Scholar

[12] Z. F. Li and S. X. Xie, Mean-variance portfolio optimization under stochastic income and uncertain exit time, Dyn. Contin. Discrete Impuls. Syst. 17 (2010), 131–147. Search in Google Scholar

[13] H. L. Wu and Z. F. Li, Multi-period mean-variance portfolio selection with regime switching and a stochastic cash flow, Insurance Math. Econom. 50 (2012), 371–384. 10.1016/j.insmatheco.2012.01.003Search in Google Scholar

[14] H. Wang and X. Y. Zhou, Continuous-time mean-variance portfolio selection: A reinforcement learning framework, Math. Finance 30 (2020), no. 4, 1273–1308. 10.1111/mafi.12281Search in Google Scholar

[15] Y. H. Ni, X. Li, J. F. Zhang, and M. Krstic, Equilibrium solutions of multi-period mean-variance portfolio selection, IEEE Trans. Autom. Control 65 (2019), no. 4, 1716–1723. 10.1109/TAC.2019.2931463Search in Google Scholar

[16] S. S. Zhu, D. Li, and S. Y. Wang, Risk control over bankruptcy in dynamic portfolio selection: A generalized mean-variance formulation, IEEE Trans. Autom. Control 49 (2004), 447–457. 10.1109/TAC.2004.824474Search in Google Scholar

[17] E. J. Elton, M. J. Gruber, S. J. Brown, and W. N. Goetzmann, Modern Portfolio Theory and Investment Analysis, John Wiley & Sons, New York, 2009. Search in Google Scholar

© 2022 Wei Liu et al., published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- Regular Articles

- A random von Neumann theorem for uniformly distributed sequences of partitions

- Note on structural properties of graphs

- Mean-field formulation for mean-variance asset-liability management with cash flow under an uncertain exit time

- The family of random attractors for nonautonomous stochastic higher-order Kirchhoff equations with variable coefficients

- The intersection graph of graded submodules of a graded module

- Isoperimetric and Brunn-Minkowski inequalities for the (p, q)-mixed geominimal surface areas

- On second-order fuzzy discrete population model

- On certain functional equation in prime rings

- General complex Lp projection bodies and complex Lp mixed projection bodies

- Some results on the total proper k-connection number

- The stability with general decay rate of hybrid stochastic fractional differential equations driven by Lévy noise with impulsive effects

- Well posedness of magnetohydrodynamic equations in 3D mixed-norm Lebesgue space

- Strong convergence of a self-adaptive inertial Tseng's extragradient method for pseudomonotone variational inequalities and fixed point problems

- Generic uniqueness of saddle point for two-person zero-sum differential games

- Relational representations of algebraic lattices and their applications

- Explicit construction of mock modular forms from weakly holomorphic Hecke eigenforms

- The equivalent condition of G-asymptotic tracking property and G-Lipschitz tracking property

- Arithmetic convolution sums derived from eta quotients related to divisors of 6

- Dynamical behaviors of a k-order fuzzy difference equation

- The transfer ideal under the action of orthogonal group in modular case

- The multinomial convolution sum of a generalized divisor function

- Extensions of Gronwall-Bellman type integral inequalities with two independent variables

- Unicity of meromorphic functions concerning differences and small functions

- Solutions to problems about potentially Ks,t-bigraphic pair

- Monotonicity of solutions for fractional p-equations with a gradient term

- Data smoothing with applications to edge detection

- An ℋ-tensor-based criteria for testing the positive definiteness of multivariate homogeneous forms

- Characterizations of *-antiderivable mappings on operator algebras

- Initial-boundary value problem of fifth-order Korteweg-de Vries equation posed on half line with nonlinear boundary values

- On a more accurate half-discrete Hilbert-type inequality involving hyperbolic functions

- On split twisted inner derivation triple systems with no restrictions on their 0-root spaces

- Geometry of conformal η-Ricci solitons and conformal η-Ricci almost solitons on paracontact geometry

- Bifurcation and chaos in a discrete predator-prey system of Leslie type with Michaelis-Menten prey harvesting

- A posteriori error estimates of characteristic mixed finite elements for convection-diffusion control problems

- Dynamical analysis of a Lotka Volterra commensalism model with additive Allee effect

- An efficient finite element method based on dimension reduction scheme for a fourth-order Steklov eigenvalue problem

- Connectivity with respect to α-discrete closure operators

- Khasminskii-type theorem for a class of stochastic functional differential equations

- On some new Hermite-Hadamard and Ostrowski type inequalities for s-convex functions in (p, q)-calculus with applications

- New properties for the Ramanujan R-function

- Shooting method in the application of boundary value problems for differential equations with sign-changing weight function

- Ground state solution for some new Kirchhoff-type equations with Hartree-type nonlinearities and critical or supercritical growth

- Existence and uniqueness of solutions for the stochastic Volterra-Levin equation with variable delays

- Ambrosetti-Prodi-type results for a class of difference equations with nonlinearities indefinite in sign

- Research of cooperation strategy of government-enterprise digital transformation based on differential game

- Malmquist-type theorems on some complex differential-difference equations

- Disjoint diskcyclicity of weighted shifts

- Construction of special soliton solutions to the stochastic Riccati equation

- Remarks on the generalized interpolative contractions and some fixed-point theorems with application

- Analysis of a deteriorating system with delayed repair and unreliable repair equipment

- On the critical fractional Schrödinger-Kirchhoff-Poisson equations with electromagnetic fields

- The exact solutions of generalized Davey-Stewartson equations with arbitrary power nonlinearities using the dynamical system and the first integral methods

- Regularity of models associated with Markov jump processes

- Multiplicity solutions for a class of p-Laplacian fractional differential equations via variational methods

- Minimal period problem for second-order Hamiltonian systems with asymptotically linear nonlinearities

- Convergence rate of the modified Levenberg-Marquardt method under Hölderian local error bound

- Non-binary quantum codes from constacyclic codes over 𝔽q[u1, u2,…,uk]/⟨ui3 = ui, uiuj = ujui⟩

- On the general position number of two classes of graphs

- A posteriori regularization method for the two-dimensional inverse heat conduction problem

- Orbital stability and Zhukovskiǐ quasi-stability in impulsive dynamical systems

- Approximations related to the complete p-elliptic integrals

- A note on commutators of strongly singular Calderón-Zygmund operators

- Generalized Munn rings

- Double domination in maximal outerplanar graphs

- Existence and uniqueness of solutions to the norm minimum problem on digraphs

- On the p-integrable trajectories of the nonlinear control system described by the Urysohn-type integral equation

- Robust estimation for varying coefficient partially functional linear regression models based on exponential squared loss function

- Hessian equations of Krylov type on compact Hermitian manifolds

- Class fields generated by coordinates of elliptic curves

- The lattice of (2, 1)-congruences on a left restriction semigroup

- A numerical solution of problem for essentially loaded differential equations with an integro-multipoint condition

- On stochastic accelerated gradient with convergence rate

- Displacement structure of the DMP inverse

- Dependence of eigenvalues of Sturm-Liouville problems on time scales with eigenparameter-dependent boundary conditions

- Existence of positive solutions of discrete third-order three-point BVP with sign-changing Green's function

- Some new fixed point theorems for nonexpansive-type mappings in geodesic spaces

- Generalized 4-connectivity of hierarchical star networks

- Spectra and reticulation of semihoops

- Stein-Weiss inequality for local mixed radial-angular Morrey spaces

- Eigenvalues of transition weight matrix for a family of weighted networks

- A modified Tikhonov regularization for unknown source in space fractional diffusion equation

- Modular forms of half-integral weight on Γ0(4) with few nonvanishing coefficients modulo ℓ

- Some estimates for commutators of bilinear pseudo-differential operators

- Extension of isometries in real Hilbert spaces

- Existence of positive periodic solutions for first-order nonlinear differential equations with multiple time-varying delays

- B-Fredholm elements in primitive C*-algebras

- Unique solvability for an inverse problem of a nonlinear parabolic PDE with nonlocal integral overdetermination condition

- An algebraic semigroup method for discovering maximal frequent itemsets

- Class-preserving Coleman automorphisms of some classes of finite groups

- Exponential stability of traveling waves for a nonlocal dispersal SIR model with delay

- Existence and multiplicity of solutions for second-order Dirichlet problems with nonlinear impulses

- The transitivity of primary conjugacy in regular ω-semigroups

- Stability estimation of some Markov controlled processes

- On nonnil-coherent modules and nonnil-Noetherian modules

- N-Tuples of weighted noncommutative Orlicz space and some geometrical properties

- The dimension-free estimate for the truncated maximal operator

- A human error risk priority number calculation methodology using fuzzy and TOPSIS grey

- Compact mappings and s-mappings at subsets

- The structural properties of the Gompertz-two-parameter-Lindley distribution and associated inference

- A monotone iteration for a nonlinear Euler-Bernoulli beam equation with indefinite weight and Neumann boundary conditions

- Delta waves of the isentropic relativistic Euler system coupled with an advection equation for Chaplygin gas

- Multiplicity and minimality of periodic solutions to fourth-order super-quadratic difference systems

- On the reciprocal sum of the fourth power of Fibonacci numbers

- Averaging principle for two-time-scale stochastic differential equations with correlated noise

- Phragmén-Lindelöf alternative results and structural stability for Brinkman fluid in porous media in a semi-infinite cylinder

- Study on r-truncated degenerate Stirling numbers of the second kind

- On 7-valent symmetric graphs of order 2pq and 11-valent symmetric graphs of order 4pq

- Some new characterizations of finite p-nilpotent groups

- A Billingsley type theorem for Bowen topological entropy of nonautonomous dynamical systems

- F4 and PSp (8, ℂ)-Higgs pairs understood as fixed points of the moduli space of E6-Higgs bundles over a compact Riemann surface

- On modules related to McCoy modules

- On generalized extragradient implicit method for systems of variational inequalities with constraints of variational inclusion and fixed point problems

- Solvability for a nonlocal dispersal model governed by time and space integrals

- Finite groups whose maximal subgroups of even order are MSN-groups

- Symmetric results of a Hénon-type elliptic system with coupled linear part

- On the connection between Sp-almost periodic functions defined on time scales and ℝ

- On a class of Harada rings

- On regular subgroup functors of finite groups

- Fast iterative solutions of Riccati and Lyapunov equations

- Weak measure expansivity of C2 dynamics

- Admissible congruences on type B semigroups

- Generalized fractional Hermite-Hadamard type inclusions for co-ordinated convex interval-valued functions

- Inverse eigenvalue problems for rank one perturbations of the Sturm-Liouville operator

- Data transmission mechanism of vehicle networking based on fuzzy comprehensive evaluation

- Dual uniformities in function spaces over uniform continuity

- Review Article

- On Hahn-Banach theorem and some of its applications

- Rapid Communication

- Discussion of foundation of mathematics and quantum theory

- Special Issue on Boundary Value Problems and their Applications on Biosciences and Engineering (Part II)

- A study of minimax shrinkage estimators dominating the James-Stein estimator under the balanced loss function

- Representations by degenerate Daehee polynomials

- Multilevel MC method for weak approximation of stochastic differential equation with the exact coupling scheme

- Multiple periodic solutions for discrete boundary value problem involving the mean curvature operator

- Special Issue on Evolution Equations, Theory and Applications (Part II)

- Coupled measure of noncompactness and functional integral equations

- Existence results for neutral evolution equations with nonlocal conditions and delay via fractional operator

- Global weak solution of 3D-NSE with exponential damping

- Special Issue on Fractional Problems with Variable-Order or Variable Exponents (Part I)

- Ground state solutions of nonlinear Schrödinger equations involving the fractional p-Laplacian and potential wells

- A class of p1(x, ⋅) & p2(x, ⋅)-fractional Kirchhoff-type problem with variable s(x, ⋅)-order and without the Ambrosetti-Rabinowitz condition in ℝN

- Jensen-type inequalities for m-convex functions

- Special Issue on Problems, Methods and Applications of Nonlinear Analysis (Part III)

- The influence of the noise on the exact solutions of a Kuramoto-Sivashinsky equation

- Basic inequalities for statistical submanifolds in Golden-like statistical manifolds

- Global existence and blow up of the solution for nonlinear Klein-Gordon equation with variable coefficient nonlinear source term

- Hopf bifurcation and Turing instability in a diffusive predator-prey model with hunting cooperation

- Efficient fixed-point iteration for generalized nonexpansive mappings and its stability in Banach spaces

Articles in the same Issue

- Regular Articles

- A random von Neumann theorem for uniformly distributed sequences of partitions

- Note on structural properties of graphs

- Mean-field formulation for mean-variance asset-liability management with cash flow under an uncertain exit time

- The family of random attractors for nonautonomous stochastic higher-order Kirchhoff equations with variable coefficients

- The intersection graph of graded submodules of a graded module

- Isoperimetric and Brunn-Minkowski inequalities for the (p, q)-mixed geominimal surface areas

- On second-order fuzzy discrete population model

- On certain functional equation in prime rings

- General complex Lp projection bodies and complex Lp mixed projection bodies

- Some results on the total proper k-connection number

- The stability with general decay rate of hybrid stochastic fractional differential equations driven by Lévy noise with impulsive effects

- Well posedness of magnetohydrodynamic equations in 3D mixed-norm Lebesgue space

- Strong convergence of a self-adaptive inertial Tseng's extragradient method for pseudomonotone variational inequalities and fixed point problems

- Generic uniqueness of saddle point for two-person zero-sum differential games

- Relational representations of algebraic lattices and their applications

- Explicit construction of mock modular forms from weakly holomorphic Hecke eigenforms

- The equivalent condition of G-asymptotic tracking property and G-Lipschitz tracking property

- Arithmetic convolution sums derived from eta quotients related to divisors of 6

- Dynamical behaviors of a k-order fuzzy difference equation

- The transfer ideal under the action of orthogonal group in modular case

- The multinomial convolution sum of a generalized divisor function

- Extensions of Gronwall-Bellman type integral inequalities with two independent variables

- Unicity of meromorphic functions concerning differences and small functions

- Solutions to problems about potentially Ks,t-bigraphic pair

- Monotonicity of solutions for fractional p-equations with a gradient term

- Data smoothing with applications to edge detection

- An ℋ-tensor-based criteria for testing the positive definiteness of multivariate homogeneous forms

- Characterizations of *-antiderivable mappings on operator algebras

- Initial-boundary value problem of fifth-order Korteweg-de Vries equation posed on half line with nonlinear boundary values

- On a more accurate half-discrete Hilbert-type inequality involving hyperbolic functions

- On split twisted inner derivation triple systems with no restrictions on their 0-root spaces

- Geometry of conformal η-Ricci solitons and conformal η-Ricci almost solitons on paracontact geometry

- Bifurcation and chaos in a discrete predator-prey system of Leslie type with Michaelis-Menten prey harvesting

- A posteriori error estimates of characteristic mixed finite elements for convection-diffusion control problems

- Dynamical analysis of a Lotka Volterra commensalism model with additive Allee effect

- An efficient finite element method based on dimension reduction scheme for a fourth-order Steklov eigenvalue problem

- Connectivity with respect to α-discrete closure operators

- Khasminskii-type theorem for a class of stochastic functional differential equations

- On some new Hermite-Hadamard and Ostrowski type inequalities for s-convex functions in (p, q)-calculus with applications

- New properties for the Ramanujan R-function

- Shooting method in the application of boundary value problems for differential equations with sign-changing weight function

- Ground state solution for some new Kirchhoff-type equations with Hartree-type nonlinearities and critical or supercritical growth

- Existence and uniqueness of solutions for the stochastic Volterra-Levin equation with variable delays

- Ambrosetti-Prodi-type results for a class of difference equations with nonlinearities indefinite in sign

- Research of cooperation strategy of government-enterprise digital transformation based on differential game

- Malmquist-type theorems on some complex differential-difference equations

- Disjoint diskcyclicity of weighted shifts

- Construction of special soliton solutions to the stochastic Riccati equation

- Remarks on the generalized interpolative contractions and some fixed-point theorems with application

- Analysis of a deteriorating system with delayed repair and unreliable repair equipment

- On the critical fractional Schrödinger-Kirchhoff-Poisson equations with electromagnetic fields

- The exact solutions of generalized Davey-Stewartson equations with arbitrary power nonlinearities using the dynamical system and the first integral methods

- Regularity of models associated with Markov jump processes

- Multiplicity solutions for a class of p-Laplacian fractional differential equations via variational methods

- Minimal period problem for second-order Hamiltonian systems with asymptotically linear nonlinearities

- Convergence rate of the modified Levenberg-Marquardt method under Hölderian local error bound

- Non-binary quantum codes from constacyclic codes over 𝔽q[u1, u2,…,uk]/⟨ui3 = ui, uiuj = ujui⟩

- On the general position number of two classes of graphs

- A posteriori regularization method for the two-dimensional inverse heat conduction problem

- Orbital stability and Zhukovskiǐ quasi-stability in impulsive dynamical systems

- Approximations related to the complete p-elliptic integrals

- A note on commutators of strongly singular Calderón-Zygmund operators

- Generalized Munn rings

- Double domination in maximal outerplanar graphs

- Existence and uniqueness of solutions to the norm minimum problem on digraphs

- On the p-integrable trajectories of the nonlinear control system described by the Urysohn-type integral equation

- Robust estimation for varying coefficient partially functional linear regression models based on exponential squared loss function

- Hessian equations of Krylov type on compact Hermitian manifolds

- Class fields generated by coordinates of elliptic curves

- The lattice of (2, 1)-congruences on a left restriction semigroup

- A numerical solution of problem for essentially loaded differential equations with an integro-multipoint condition

- On stochastic accelerated gradient with convergence rate

- Displacement structure of the DMP inverse

- Dependence of eigenvalues of Sturm-Liouville problems on time scales with eigenparameter-dependent boundary conditions

- Existence of positive solutions of discrete third-order three-point BVP with sign-changing Green's function

- Some new fixed point theorems for nonexpansive-type mappings in geodesic spaces

- Generalized 4-connectivity of hierarchical star networks

- Spectra and reticulation of semihoops

- Stein-Weiss inequality for local mixed radial-angular Morrey spaces

- Eigenvalues of transition weight matrix for a family of weighted networks

- A modified Tikhonov regularization for unknown source in space fractional diffusion equation

- Modular forms of half-integral weight on Γ0(4) with few nonvanishing coefficients modulo ℓ

- Some estimates for commutators of bilinear pseudo-differential operators

- Extension of isometries in real Hilbert spaces

- Existence of positive periodic solutions for first-order nonlinear differential equations with multiple time-varying delays

- B-Fredholm elements in primitive C*-algebras

- Unique solvability for an inverse problem of a nonlinear parabolic PDE with nonlocal integral overdetermination condition

- An algebraic semigroup method for discovering maximal frequent itemsets

- Class-preserving Coleman automorphisms of some classes of finite groups

- Exponential stability of traveling waves for a nonlocal dispersal SIR model with delay

- Existence and multiplicity of solutions for second-order Dirichlet problems with nonlinear impulses

- The transitivity of primary conjugacy in regular ω-semigroups

- Stability estimation of some Markov controlled processes

- On nonnil-coherent modules and nonnil-Noetherian modules

- N-Tuples of weighted noncommutative Orlicz space and some geometrical properties

- The dimension-free estimate for the truncated maximal operator

- A human error risk priority number calculation methodology using fuzzy and TOPSIS grey

- Compact mappings and s-mappings at subsets

- The structural properties of the Gompertz-two-parameter-Lindley distribution and associated inference

- A monotone iteration for a nonlinear Euler-Bernoulli beam equation with indefinite weight and Neumann boundary conditions

- Delta waves of the isentropic relativistic Euler system coupled with an advection equation for Chaplygin gas

- Multiplicity and minimality of periodic solutions to fourth-order super-quadratic difference systems

- On the reciprocal sum of the fourth power of Fibonacci numbers

- Averaging principle for two-time-scale stochastic differential equations with correlated noise

- Phragmén-Lindelöf alternative results and structural stability for Brinkman fluid in porous media in a semi-infinite cylinder

- Study on r-truncated degenerate Stirling numbers of the second kind

- On 7-valent symmetric graphs of order 2pq and 11-valent symmetric graphs of order 4pq

- Some new characterizations of finite p-nilpotent groups

- A Billingsley type theorem for Bowen topological entropy of nonautonomous dynamical systems

- F4 and PSp (8, ℂ)-Higgs pairs understood as fixed points of the moduli space of E6-Higgs bundles over a compact Riemann surface

- On modules related to McCoy modules

- On generalized extragradient implicit method for systems of variational inequalities with constraints of variational inclusion and fixed point problems

- Solvability for a nonlocal dispersal model governed by time and space integrals

- Finite groups whose maximal subgroups of even order are MSN-groups

- Symmetric results of a Hénon-type elliptic system with coupled linear part

- On the connection between Sp-almost periodic functions defined on time scales and ℝ

- On a class of Harada rings

- On regular subgroup functors of finite groups

- Fast iterative solutions of Riccati and Lyapunov equations

- Weak measure expansivity of C2 dynamics

- Admissible congruences on type B semigroups

- Generalized fractional Hermite-Hadamard type inclusions for co-ordinated convex interval-valued functions

- Inverse eigenvalue problems for rank one perturbations of the Sturm-Liouville operator

- Data transmission mechanism of vehicle networking based on fuzzy comprehensive evaluation

- Dual uniformities in function spaces over uniform continuity

- Review Article

- On Hahn-Banach theorem and some of its applications

- Rapid Communication

- Discussion of foundation of mathematics and quantum theory

- Special Issue on Boundary Value Problems and their Applications on Biosciences and Engineering (Part II)

- A study of minimax shrinkage estimators dominating the James-Stein estimator under the balanced loss function

- Representations by degenerate Daehee polynomials

- Multilevel MC method for weak approximation of stochastic differential equation with the exact coupling scheme

- Multiple periodic solutions for discrete boundary value problem involving the mean curvature operator

- Special Issue on Evolution Equations, Theory and Applications (Part II)

- Coupled measure of noncompactness and functional integral equations

- Existence results for neutral evolution equations with nonlocal conditions and delay via fractional operator

- Global weak solution of 3D-NSE with exponential damping

- Special Issue on Fractional Problems with Variable-Order or Variable Exponents (Part I)

- Ground state solutions of nonlinear Schrödinger equations involving the fractional p-Laplacian and potential wells

- A class of p1(x, ⋅) & p2(x, ⋅)-fractional Kirchhoff-type problem with variable s(x, ⋅)-order and without the Ambrosetti-Rabinowitz condition in ℝN

- Jensen-type inequalities for m-convex functions

- Special Issue on Problems, Methods and Applications of Nonlinear Analysis (Part III)

- The influence of the noise on the exact solutions of a Kuramoto-Sivashinsky equation

- Basic inequalities for statistical submanifolds in Golden-like statistical manifolds

- Global existence and blow up of the solution for nonlinear Klein-Gordon equation with variable coefficient nonlinear source term

- Hopf bifurcation and Turing instability in a diffusive predator-prey model with hunting cooperation

- Efficient fixed-point iteration for generalized nonexpansive mappings and its stability in Banach spaces