Abstract

Given the inclusiveness of digital inclusive finance (DFI) and its complex impact mechanism on the labor economy, this study uses the characteristics of adaptive and self-learning ability of artificial neural network (ANN) to simulate the process of delivering stimuli to nerve cells in the human brain through linear weighted summarization and functional mapping, and implement the optimization learning algorithm to adjust the weights in the network structure, thus completing the hierarchical analysis of index weight. At the same time, the neural network structure is used to approach the greatest extent and Garson algorithm is used for sensitivity analysis. We use data on the labor economy and digital financial inclusion in Heilongjiang, Jilin, and Liaoning provinces in China from 2011 to 2021 as a training dataset. The study found that (1) the indexes of DFI have different importance to the indexes of labor economy, among which the most important are the number and amount of insurance per capita and the proportion of the number and amount paid by digital technology, which have a normalized importance of 100 and 99.3%, further, R-square coverage is above 0.95, respectively, for labor economy indicators; (2) For different subdivided indicators, the indexes of DFI determine different significance. This study employs tools and policies related to DFI to address labor economy challenges, so as to promote the overall economic construction. This study studies the response and transmission mechanism of the concept of DFI to the labor economy, and explores the labor economy problems such as improving labor productivity and labor mismatch in the economy under its “inclusive” principle. Compared with the traditional weight analysis, it is closer to the real situation and has a stronger ability to fit the reality. In the future, the model could be rebased and measured against absolute indicators and a wider dataset could be adopted for extension to more areas.

1 Introduction

The term “inclusive finance” was first formally proposed by the United Nations in 2005. It is defined as a financial system that can effectively and comprehensively serve all sectors and groups of society and aims to promote the provision of banking services on affordable terms to the broadest segments of society (Corrado & Corrado, 2017). The purpose of achieving inclusive finance is to enable economic entities of different social strata to obtain necessary and reasonable financial services and financial support (Qiu, 2022). In recent years, technical means represented by artificial intelligence, big data, cloud computing, blockchain, and the Internet of Things have contributed to a digital and intelligent development path represented by intelligent investment advisors, big data risk control, and blockchain collaboration, driving the rapid development of inclusive finance. As inclusive finance has become an important concept of global development, while traditional financial institutions have increased their practice of inclusive finance, Internet finance, which relies on innovative technologies, has further expanded the service scope and accessibility of inclusive finance and reduced financial constraints (Feng et al., 2024). The framework of traditional finance based on “credit” has gradually been changed to digital realization based on “data,” which broadens the boundary of traditional economic theory, among which the transmission mechanism of digital inclusive finance (DFI) is the most critical part.

At present, there are abundant macro-level studies on DFI, mainly discussing its relationship with economic development and regional inequality. Empirical analysis shows that the development of DFI can significantly narrow the income gap between urban and rural residents (Zhang et al., 2023). The development of digital finance can significantly improve the level of inclusive financial development, and the improvement of inclusive financial development can significantly narrow the income gap between urban and rural areas. DFI can significantly improve China’s agricultural green total factor productivity, and the optimization of agricultural industrial structure can bring significant “structural growth effect” (Hong et al., 2022). In addition, DFI has narrowed the regional differences in China’s urban-rural income gap. At the same time, DFI has also narrowed the urban-rural gap between primary distribution and redistribution (Zhou et al., 2022). Further research shows that DFI contributes to sustainable economic growth by increasing loans from financial institutions, the number of household savings, the number of household consumption, etc. (Sun & Tang, 2022). Poor households can use digital finance to smooth survival consumption and accumulate development factors, but the effect is not significant. While non-poor households can effectively use digital financial functions to prevent risks, smooth consumption, and accumulate factors, they can also have leisure and entertainment. The Matthew effect of digital financial development is obvious (Liu et al., 2022). For rural development, research shows that DFI plays a significant and positive role in promoting high-quality rural development mainly through economic efficiency, urban-rural structure, green ecological development, people’s livelihood harmony, innovation and development potential, and other channels (Sun & Zhu, 2022). The above research has explored the various effects of DFI on labor production. This study uses the labor economy as a starting point, and uses artificial neural network (ANN) contribution analysis to study the transmission mechanism of various aspects of DFI to the labor economy.

The structure of this work is as follows. In Section 2, we review the relevant research on DFI and labor economy and construct a framework for the impact mechanism of DFI. In Section 3, we introduce the algorithms and evaluation metrics used in this study. In Section 4, we make a specific analysis of Northeast China. Sections 5 and 6 show the importance of DFI indices and review our work.

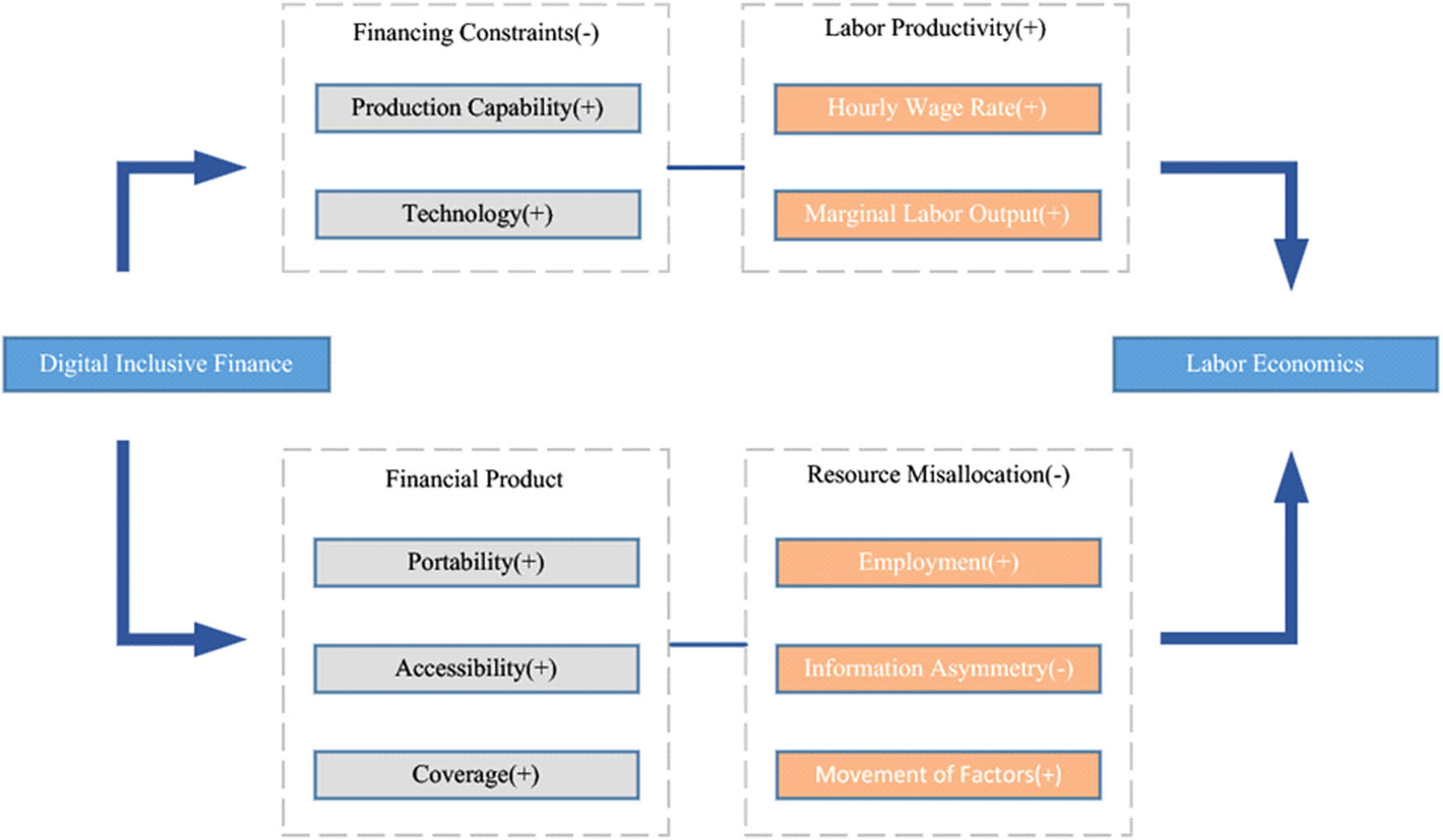

In summary, the structure of this article is shown in Figure 1.

Mechanism analysis and corresponding research architecture.

This study has the following four contributions:

In view of the inclusiveness of DFI, the research perspective is locked in its research object, i.e., the labor relationship between workers and capital owners, and the micro-study of the transmission and response mechanism of DFI to the labor economy (Aisaiti et al., 2019).

Using ANN algorithm to deal with the nonlinear, non-convex, and non-limitation problems that may arise in the correlation of multiple secondary indicators in the field of DFI and labor economy (Maia & Menezes, 2014; Wu et al., 2009).

Using the characteristics of adaptive and self-learning ability of ANN, the analytic hierarchy process of index weight problem is completed. At the same time, in order to approach the neural network structure of the real response index data as much as possible and adaptively adjust the link weight between neurons, the Garson algorithm is used for sensitivity analysis (Casadei & Astolfi, 2018; Fischer, 2015; Wu et al., 2009).

As a microscopic study of the transmission and response mechanism of DFI to the labor economy, testing the empirical marginal effects of research results from the perspective of contribution analysis has practical guiding significance in policy formulation, economic prospect development and sinking market extension (Wang & Chen, 2022; Zhou et al., 2022).

2 Literature Review

2.1 DFI

DFI, through big data, blockchain, and other technologies to break the boundaries of space and time, provides convenient, efficient, and reliable financial services to people in non-developed areas and rural areas. It specifically encompasses two concepts, one is “inclusion” and the other is “digital” (Ozili, 2018). To further clarify the connotation and meaning of DFI, this study understands it from the following two dimensions:

First, “Inclusion” is the core purpose of the financial system. It can be divided into two characters in Chinese which respectively mean “universal” and “benefit.” That is to say, the financial system not only emphasizes the universality and wide coverage of the audience but also emphasizes its essence of benefiting the people (Zhang et al., 2022). The concept of inclusive finance was first introduced by the United Nations in 2005 and is defined as “a financial system that effectively and comprehensively serves all segments and groups of society, especially poor, low-income people” (Yang & Zhang, 2020). In the early days, inclusive finance was mainly in the form of microfinance, providing affordable capital lending to the general public, especially the disadvantaged, and also providing channels for start-ups to raise funds. And with its gradual development, both internationally and in China, inclusive finance has gradually moved from a focus on microfinance to cover a wide range of business areas such as payments, deposits, loans, insurance, credit services, and securities (Li et al., 2022). However, while China has made significant progress in financial inclusion, digital financial services are still crucial to fill the gaps in financial inclusion (Ji et al., 2021).

Therefore, digital is an effective way to promote the vision of “inclusive.” Unlike traditional inclusive finance, DFI combines “digital” with “inclusive,” using digital technologies such as big data and cloud computing to increase the scope and coverage of financial services, lower the threshold for financial services, and provide lower cost, faster and wider coverage of financial services to a wider range of people (Gabor & Brooks, 2017). It also further reduces the financing constraints on entrepreneurial activities due to information asymmetry in financial transactions and thus improves the efficiency of financing (Fan & Zhang, 2017; Shen et al., 2022). In addition, DFI can contribute to urban innovation through improved access to credit, consumption, and industrial upgrading (Li & Li, 2022). Studies have shown that financial inclusion in practice is now strongly correlated with innovative digital finance, and it is evident that new digital economic models have become important drivers and sources of growth for sustainable financial inclusion (Chen et al., 2023).

In summary, DFI is a financial system that combines digital technology and finance to achieve inclusive purposes, and the addition of digital technology has opened up a new and viable path for the sustainable development of inclusive finance. To understand the current status of DFI development in each region and further achieve the goal of promoting inter-regional inclusive finance development, a set of indicators to measure the level of DFI development in different regions is essential (Chen et al., 2020). In 2011, a team of researchers from Peking University’s Digital Finance Research Centre and Ant Group Research Institute used Ant Group’s massive data on DFI to compile a “Peking University Digital Inclusion Index,” which provides a set of instrumental data reflecting the current status and evolution of DFI development in China. Based on clarifying the connotation and meaning of DFI, this study introduces and explains the first two dimensions of the index system, and explores the construction of a DFI -related index system in China, thus providing a reference for the construction of an international digital financial inclusion index system.

The Peking University Digital Inclusive Finance Index of China (PKU-DFIIC) meets all the principles in the construction process, conforms to the connotation of DFI, and provides a reliable and authoritative indicator system for measuring the development status of this financial system (Arner et al., 2020), which can provide a reference for the construction of an international digital financial inclusion index system. In this study, the PKU-DFIIC is compiled as follows (Table 1).

Digital financial inclusion indicators and meanings

| Tier 1 indicators | Tier 2 indicators | Indicator description | Indicator number |

|---|---|---|---|

| DFI index | Index | Combined values calculated for each indicator |

|

| Breadth of digital financial coverage | Breadth | Alipay account coverage and number of bank cards per capita |

|

| Depth of digital financial usage | Depth | A calculated composite of all indicators on depth of use |

|

| Payments | Number and value of payments per capita |

|

|

| Insurance | Number and value of insurance policies per capita |

|

|

| Money funds | Number and value of money fund purchases per capita |

|

|

| Investments | Number and value of investments per capita |

|

|

| Credit | Number of credits calls per capita for natural persons |

|

|

| Credit | Number and value of loans per capita |

|

|

| Digitization of financial inclusion | Degree of digitization | Number and value of payments made using digital technology |

|

2.2 Labor Economics

The theory of labor economics mainly focuses on labor relations and summarizes the laws of development of labor economy. It analyzes how to create the highest economic efficiency with the lowest labor cost (Wu et al., 2022). With the development of labor economics, it was labeled as “personal economics” in 1980 (Yuan & Lin, 2011). However, this label ignored the impact of intrinsic management on labor economics. There are two important assets in labor economics, namely, fixed assets and human assets, among which there is a distinction between individual human assets and team human assets (Arif, 2021). Also, human capital is an indirect market influenced by salary designation mechanism and labor market wages (Chen & Ji, 2020). Thus, it can be concluded that labor economics is an emerging doctrine with a special character because it takes “labor force” as its object of study (Bobba et al., 2021). The core of this doctrine is to study the factors affecting labor supply and labor demand in the labor market and the interaction between them (Shi, 2021; Villamil et al., 2020). Since labor has special properties that make it different from ordinary commodities, classical theories that do not distinguish it cannot fully take into account the problem of unsystematic risks and residuals (Cui et al., 2018; Singh, 2023). In summary, labor economics is used here as a primary indicator, while secondary indicators are established by considering the factors that affect labor supply and labor demand from a microeconomics perspective and the factors that cause interactions from a macroeconomics perspective. The labor economic indicators and related meanings are shown in Table 2.

Labor economic indicators and their meanings

| Level 1 indicators | Level 2 indicators | Indicator description | Indicator number |

|---|---|---|---|

| Labor economics | Gross regional product | The sum of the value added of each industry in the region |

|

| Gross regional product per capita | Gross regional product calculated on average for the entire resident population in a year |

|

|

| Total retail price index | A relative number reflecting the trend and extent of changes in retail prices of goods over a certain period of time |

|

|

| Consumer price index | Relative measure of price changes over time for consumer goods and services |

|

|

| Birth rate | Ratio of births per 1,000 population in a year |

|

|

| Mortality rate | Ratio of average number of deaths per 1,000 population in a year |

|

|

| Natural growth rate | Ratio of natural population growth per unit of time in a year to the average annual total number of people |

|

|

| Total wages | The total amount of labor compensation paid directly to all employees of each unit in a certain period of time |

|

|

| Average wages | The average amount of monetary wages received per person in a certain period |

|

|

| Average wage index | Ratio of the average wage of employees in the reporting period to the average wage of employees in the base period |

|

|

| Number of employed persons | Number of people who are engaged in certain social labor and receive labor compensation or business income in a certain period |

|

|

| Unemployed persons | Persons of working age who have the ability to work, are currently unemployed, and are seeking work in some way |

|

|

| Unemployment rate | Number of employed people who meet all employment conditions in a given period who are still not working in the labor force |

|

2.2.1 Analysis of the Impact Mechanism of DFI

DFI facilitates the action of financial inclusion through digital technology, which contains mobile payment and microfinance to serve the majority of micro and small enterprises as well as residents (Sun et al., 2020). The labor economy contains various factors such as labor supply and demand allocation, macro and micro management of labor, labor efficiency, and labor reproduction, and the specific influence mechanism is shown in Figure 2.

The transmission mechanism of DFI on labor economy.

From the connotation of both, DFI has a coupling effect with the benign development of the labor economy. First of all, a sound financial system also has very good support for financial products and services for the lack of credit history, non-high-income groups, and micro and small enterprises (Ren et al., 2023; Wang & Chen, 2022). A complete credit system for micro and small enterprises brought by DFI can, to a certain extent, alleviate the financing constraints of micro and small enterprises (Xu et al., 2023) and facilitate the expansion of business scale (Dai et al., 2023). In addition, the development of DFI can stimulate the demand side of business and improve the unemployment problem to some extent and raise the hourly wage rate of workers (Du et al., 2023; Zhu, 2023).

In addition, the development of DFI can further enhance the productive capacity and technology level of firms by alleviating the level of financing constraints in the financial market (Li et al., 2024; Sun & Tang, 2022), which leads to an increase in the marginal output per unit of labor in firms, which in turn increases the demand for labor or the ability of firms to pay wages, and this transmission mechanism promotes labor productivity and employment levels (Wu & Chen, 2023). As a result, this study proposes hypothesis H1.

H1: DFI can alleviate the financing constraint of business operation and entrepreneurship process and thus promote the labor economy.

DFI contributes to the mobility and convenience of services, and on this basis, it has both breadth and depth of service coverage, and digital inclusive means represented by mobile payment contribution to the development of the platform economy (Liu & Xu, 2022). The development of platform economy contributes to the refinement of the demand side of labor, the increase in labor flexibility, the diversification of employment forms, and the significant increase in the number of payments and insurance holdings per capita of labor (Li & Wan, 2022). As a result, this study proposes hypothesis H2.

H2: DFI can promote the development of labor economy by promoting the mobility, convenience, and coverage of various services and thus the development of labor economy.

Second, due to the existence of market segmentation, factors of production cannot flow freely, or it is difficult to promote the flow of factors to more efficient areas due to information asymmetry, which will lead to factor mismatch (Zhang & Wang, 2020). DFI can improve information asymmetry and alleviate the problem of weakened free mobility of factors for the purpose of protecting local industries, thus improving labor mismatch and macro and micro management of labor, but there is some heterogeneity in this mechanism, so DFI has a moderating effect on the benign development of labor economy. As a result, this study proposes hypothesis H3.

H3: DFI can improve labor allocation and macro and micro management and thus promote the development of labor economy.

3 Methodology

3.1 ANN Method

The ANN system, a highly advanced computational model inspired by the information processing mechanism of nerve cells in the human brain, simulates the process of receiving and transmitting stimuli to nerve cells in the form of linear weighted summaries and functional mappings, which replicate to a large extent the basic principles of the work of the human brain. Unlike traditional linear regression, which is single-threaded, unidirectional, and difficult to deal with the defects of complex problems, ANN is possible to adjust the weights in the network structure by means of optimized learning algorithms, thus achieving astonishing accuracy and efficiency in the learning and information processing process. We highlight and use the ability of the ANN system to self-organize, to automatically discover patterns and regularities in the input data without explicit instructions, and to adjust its internal structure accordingly. Associated with this is its self-learning ability, where the system is able to optimize and improve its performance on its own, meaning that with training, the ANN system can become more accurate and progressively improve its problem-solving capabilities.

As a means of statistical modelling, ANNs have the following characteristics: (1) They have the ability to perform better for complex non-linear relationships. (2) No pre-specified fitting functions are required, with learning and highly adaptive recognition patterns, i.e., they do not require a pre-determined mathematical relationship for mapping between input and output, and can reproduce complex non-linear input-output relationships and be applied in the sequence training process. ANNs as deep learning methods are highly adaptive and better able to interactively respond to increasingly complex real-world economic systems than predictions from traditional linear fitting models or traditional machine learning methods

The network consists of at least three layers of nodes forming a synaptic hierarchical framework: the basic components of an ANN are an input layer, a hidden layer, and an output layer, combined by weights, biases, and activation functions (Pua et al., 2022). The general topology of the ANN is shown in Figure 3. The dots represent the nodes of the neural network and are often referred to as neurons. The lines connecting the neurons are called synapses, which can be understood as connections between neurons, and serve to allow signals from the previous layer to be received by the next layer of neurons. Figure 4 illustrates the working mechanism of neurons in a typical ANN structure.

ANN training architecture.

Hidden layer cell activation function.

During ANN training, each neuron in the input layer receives data, multiplies the values by the weights and passes the results to the hidden layer. The neuron in the hidden layer generates the output signal by means of an activation function on the activation signal transmitted by the previous layer. The activation signal is a weighted sum of all signals entering the neuron, as shown in equation (1).

3.2 Sensitivity Analysis

Sensitivity analysis is a very important class of methods for quantitatively describing the degree of importance of a model’s input variables to its output variables by varying each of the model’s attributes over a range of possible variations, and examining and predicting the degree to which changes in these attributes affect the output values and quantifying them as sensitivity coefficients.

Garson’s algorithm is a method for weight analysis based on the connection weights between layers of a neural network (Wong et al., 2011). It is a typical algorithm for sensitivity analysis based on connection weights. The basic principle is to calculate the contribution of the input variables to the output variables by the product of the connection weights, and the Garson method takes into account the effect of the interaction of multiple variables on the output compared to other methods (Zheng et al., 2018). The Garson algorithm uses the connection weights between each input signal in the network as a “bridge” and calculates the relative contribution of each input parameter to the output parameter using a matrix of weights (Cao et al., 2022). In overall, the algorithm determines the contribution of each input value by allocating the connection weights between the hidden layer and the output layer of each hidden layer neuron to the connection weights of each related input signal (Bai et al., 2020). The formula for the degree of influence of the algorithm’s input variables on the output variables is

where

3.3 Algorithm Test Index Setting

The number of nodes in the hidden layer is determined by training the network, and in order to construct the optimal performance network, when testing the trained ANN model with test samples, some test metrics need to be selected to better guide the evaluation of the results of the trained model. In this work, two common tests are selected, the mean absolute percentage error (MAPE) and the coefficient of determination (

4 Result

4.1 Selection of the Study Data

The Northeast China region, which comprises the three provincial administrative divisions of Heilongjiang, Jilin, and Liaoning provinces (from 118°53′E in the west to 135°05′E in the east, from 38°43′N in the south to 53°33′N in the north), was an extremely important center of heavy industry in the early years of China’s history, based on its geographical location, natural resources, and history. The data from the Northeast region of China is chosen because its major economic sectors are more closely aligned with the labor economy, and the data from the Northeast region is more representative of the impact of financial inclusion on the labor economy than the more advanced regions, which is of greater importance to the empirical evidence in this study (Figure 5).

Geographical location of the North East Region. Source: Ministry of Natural Resources of PRC.

As the origin of the rapid industrial development of new China, the Northeast rapidly developed an industrial and agricultural economic production model in the 1950s, characterized by planned production and Soviet model management. By the end of the 1950s, the GDP of the Northeast had exceeded 15% of China’s total GDP, reaching 19% at one point, and has remained at around 13% since then.

However, as China’s modernization process has increased the need for productive forces and relations of production, the main contradictory features of the old industrial bases in the Northeast, such as a single industrial structure, a rigid management system, and a lack of innovation, have gradually come to light, leading to a slowdown in economic growth and, with it, a gradual loss of labor. According to the data disclosed in the China Labor Statistics Yearbook by year, the number of laid-off workers in the Northeast Region has been increasing rapidly year on year, from a total of 60,500 in 1992, accounting for 3.7% of the region’s working population, to 225,400 in 2000, accounting for 10.95% of the region’s working population, which was among the highest in China during the economic transformation and reform of the 1990s. Between 1998 and 2000, the number of registered urban unemployed nationwide reached 5.71, 5.75, and 5.95 million, respectively, while the number of unemployed workers in the Northeast Region reached 833,000, 854,000, and 895,000. In the twenty-first century, in the context of the current new industrialization path of high quality and light pollution, the focus on innovation-driven, transformational development and digitization has led to the integration of information technology into the industrial model, led the Northeast to finally face the serious challenges posed by the resource-based industrial layout for sustainable urban development after decades of resource consumption and environmental pollution. With a total GDP of RMB 5.57 trillion by 2021, the economic growth rate of the Northeast has been lower than China’s average growth rate of 8.1%.

The Northeast, with its natural resources and other advantages, was once the lifeblood of China’s economic development as the first heavy industrial base built after the founding of New China. However, the problem of slow economic growth and overall economic decline caused by a series of factors such as difficulties in industrial transformation, severe environmental pollution problems, and a large loss of young people is a dilemma that the Northeast has always faced.

4.2 Data Collection and Pre-processing

In summary, the Northeast region of China is used as the objective of this study. Combined with the character of informatization and universality of DFI, the purpose of this study is to quantify the response mechanism and correlation degree of digital financial inclusion to the labor economy by taking into account the problems of an aging population, imbalance of labor supply and demand, and weak blood generation mechanism in the Northeast region, and to explore the solution of labor economy problems through the construction of digital financial inclusion, thus further promoting the modernization process. Given the small number of years for which laboratory data and instantaneous sampling data were available, and that some of these years had missing data, we first performed Multiple Imputation using IBM SPSS Statistics 26.0, using standardization for data categories with inconsistent exposure, and focused fitting on a few important samples. Tables 3 and 4 show the data of DFI and labor economy after descriptive statistical processing.

Data on digital financial inclusion indicators

| Tier 1 indicators | Tier 2 indicators | Max | Min | Std error | Mean value |

|---|---|---|---|---|---|

| DFI Index | X 1 | 345.93 | 33.79 | 97.13 | 216.71 |

| Breadth of digital financial coverage | X 2 | 331.03 | 29.94 | 95.74 | 196.19 |

| Depth of use of digital finance | X 3 | 344.44 | 34.99 | 95.23 | 209.31 |

| X 4 | 248.66 | 35.62 | 79.79 | 169.51 | |

| X 5 | 651.16 | 37.40 | 205.46 | 465.72 | |

| X 8 | 237.91 | 33.91 | 63.34 | 138.27 | |

| Digitization of financial inclusion | X 10 | 414.42 | 44.34 | 119.87 | 297.93 |

Labor economic indicators data

| Tier 1 indicators | Tier 2 indicators/unit | Max | Min | Std error | Mean value |

|---|---|---|---|---|---|

| Labor economy | Y 1/billion | 18566.27 | 9538.35 | 2512.49 | 14353.57 |

| Y 2/yuan | 55914.00 | 25650.76 | 8635.15 | 40846.63 | |

| Y 3 | 104.80 | 100.13 | 1.33 | 101.76 | |

| Y 4 | 105.40 | 100.77 | 1.22 | 102.37 | |

| Y 5/% | 8.13 | 4.96 | 0.93 | 7.00 | |

| Y 6/% | 9.83 | 6.19 | 1.01 | 7.16 | |

| Y 7/% | 1.46 | −2.92 | 1.48 | −0.16 | |

| Y 8/billion | 2733.12 | 1245.03 | 495.85 | 2216.18 | |

| Y 9/yuan | 77340.33 | 31353.00 | 15180.70 | 52574.59 | |

| Y 10 | 110.67 | 105.47 | 1.63 | 108.08 | |

| Y 11/million people | 1856.07 | 1691.81 | 51.07 | 1798.73 | |

| Y 12/million people | 37.53 | 32.20 | 1.75 | 34.97 | |

| Y 13/% | 3.90 | 3.60 | 0.08 | 3.80 |

4.3 Multiple Imputation

Among the above data and indicators, three of the digital financial inclusion indicators, X 6 (monetary funds), X 7 (investment), and X 9 (credit) are identified as invalid variables and removed from this study because of the large amount of missing data. The labor economic indicators of Y 5 (birth rate), Y 6 (mortality rate), Y 7 (natural growth rate), Y 10 (average wage index), and Y 11 (employed persons) have missing data for individual provinces in individual years. Therefore, this study performs multiple interpolations of missing data for the scalar variables Y 5, Y 6, Y 7, Y 10, and Y 11 by the fully conditional designation (Markov Chain Monte Carlo) method.

The multiple imputation process incorporates analytical weights into the regression models used to interpolate missing values, excluding cases with negative or zero analytical weights. The fully conditional specification (FCS) method fits a single dependent variable model using other variables in the model as predictors and then interpolates missing values for the fitted variables. This method is executed continuously until the maximum number of iterations is reached and the interpolated values are saved to the interpolated dataset.

Finally, the parameters, mean values, labelled differences, and confidence intervals of the initial data and multiple interpolated datasets are compared to select the most reasonable dataset.

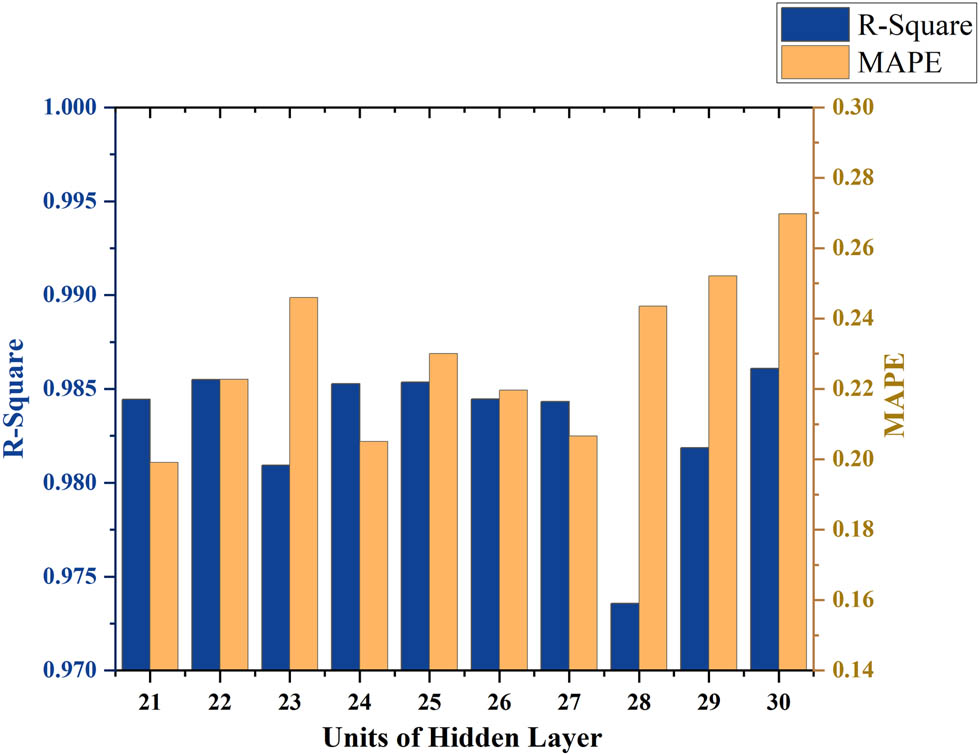

4.4 ANN Training and Results

The article uses IBM SPSS Statistics 26.0 as the ANN training software. The ANN is trained using a neural network multiple perceptions, with a hyperbolic tangent function for the hidden layer activation function with a range of 10–30 hidden layer units on a single hidden layer, to measure the R 2, and MAPE between the predicted and true values for different hidden layer units, as a criterion to evaluate the optimal model. It was found that the prediction deviation was the smallest for a single hidden layer of unit 14, and the model converges to an optimal state or achieves a high level of accuracy. In this study, a single hidden layer of unit 14 is chosen as the optimal parameter.

R² represents the proportion of variance explained by the model and is the Sum of the Squares Regression and the Sum of the Squares Total between the actual and predicted values (SSR/SST), which is the default metric for scikit-learn regression problems. R 2 is used to measure the proportion of variance explained by the model to all variance on a relative basis. R 2 tends to 1 representing the more variance that can be covered by the model predictions.

MAPE based on the mean absolute error (MAE), the mean value of the absolute error between the predicted and true values is determined as a percentage unit instead of an absolute value unit. MAPE is more sensitive to relative error and does not change due to the global scaling of the target variable, which makes it suitable for problems where there is a large gap between the target scales of the metric variables. The closer the MAPE index converges to 0%, the better the model is set up, while the MAPE index is greater than 100%, which means that the model is a poor-quality model (Figure 6).

The degree of prediction deviation under different hidden layer units (layers 10–20).

5 Discussion

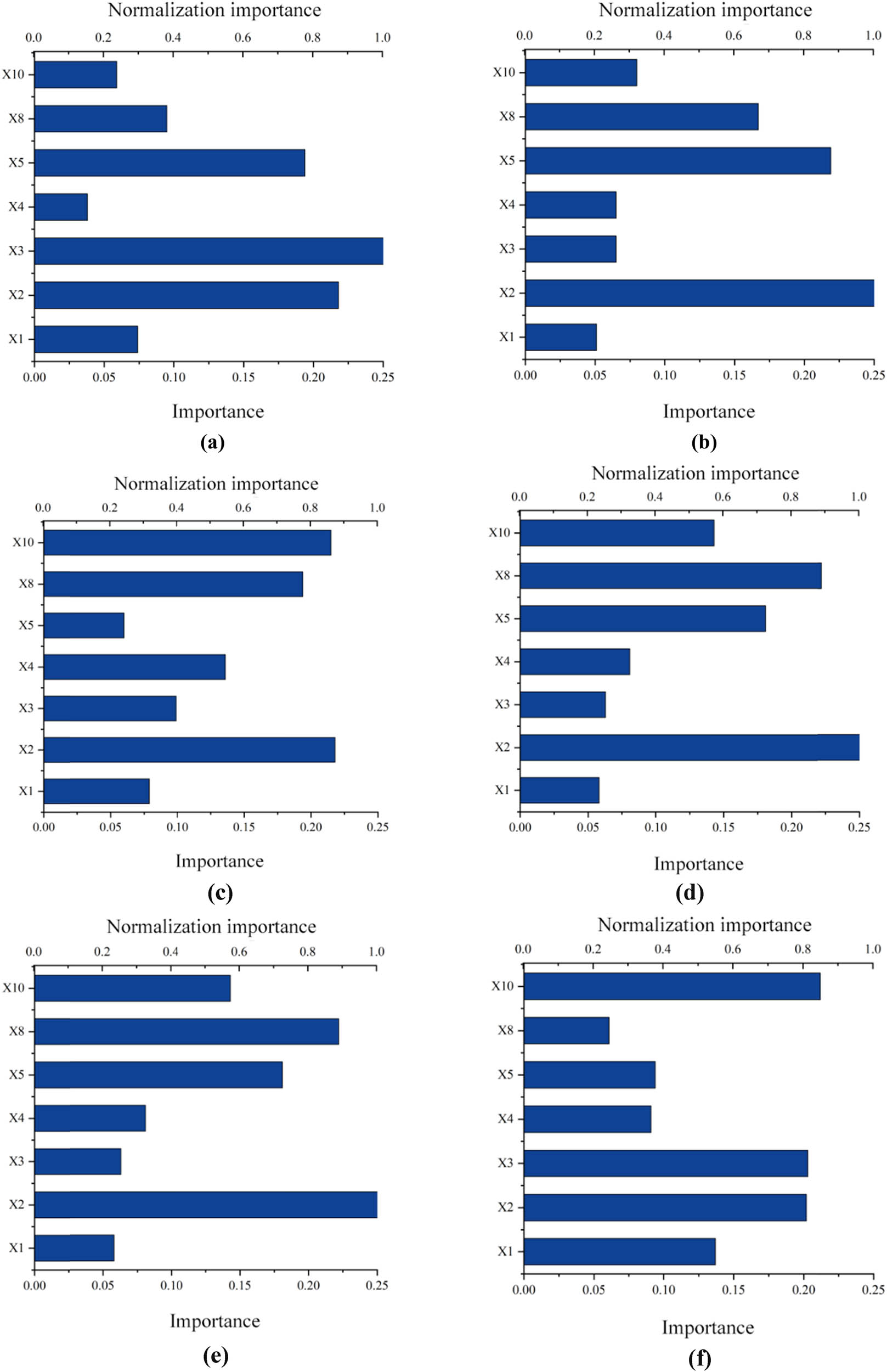

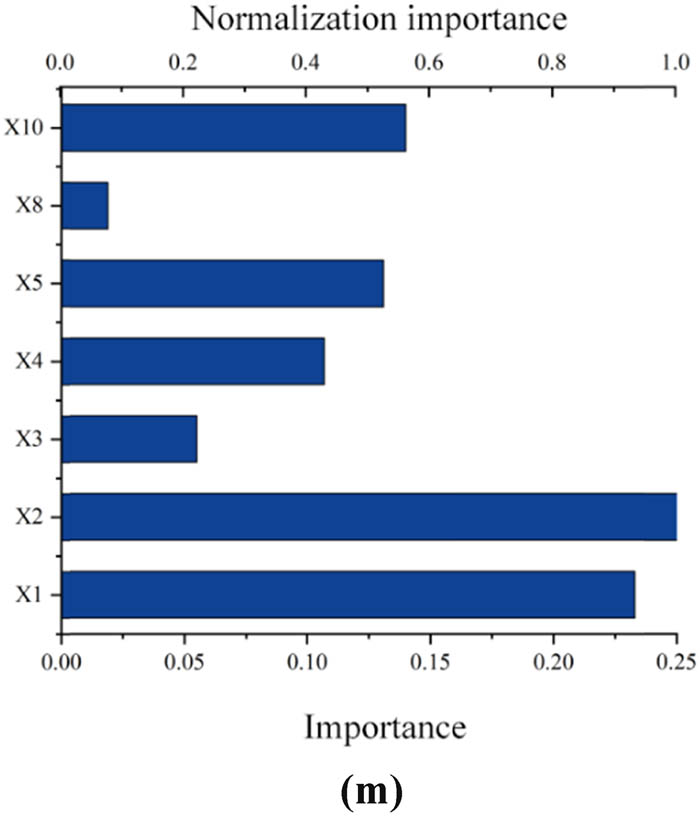

Based on the training results in Section 4.3, i.e., the importance of digital inclusion finance for the labor economy and the overall independent variable importance analysis, the following discussion is derived in conjunction with the mechanism analysis:

For the overall DFI-labor economy variable weights, the normalized importance of the number and value of insurance policies per capita, and the number and value of payments made using digital technology for labor economy indicators in the Northeast China Region between 2011 and 2020 were 100 and 99.3%, with very significant determination and transmission effects. The transmission effect of digital payment technologies in enhancing monetary liquidity and thus contributing to national economic dynamism cannot be ignored. Against the backdrop of a well-developed e-payment infrastructure and the functionality and convenience of individual platforms, almost all workers use digital payments as their primary means of payment, both in their macro-orientation and in their personal economic lives. On the other hand, the issue of workers’ rights and interests is also reflected in the labor economy through the importance of the independent variable of insurance, as the development of the economic base brings new demands for the distribution of individual labor endowments and labor protection. Meanwhile, the importance of the digital financial inclusion index, digital financial coverage breadth, and digital financial usage depth indicators also reflect the role of digital finance in influencing the whole labor economy, as shown, respectively, in Figures 7–9.

The degree of prediction deviation under different hidden layer units (layers 21–30).

ANN training architecture and synaptic weights.

Ranking of variable importance according to Garson algorithm outputs.

For gross regional product (Y 1), the significance of the two independent variables, depth of digital financial use and breadth of digital financial coverage, is highly significant, fully reflecting the transmission of the impact of digital financial system building on capital inputs in the production relations to the final regional output. Similar to the overall digital financial inclusion-labor economy, the insurance variable also has a high degree of impact on regional gross product (Y 1). As for the per capita gross regional product (Y 2), the depth of digital financial use (X 3) and the insurance variable (X 5) are the two most significant independent variables, while the credit variable (X 8) also shows relatively significant importance because of its focus on the number of credits calls per capita for natural persons.

For the total retail price index of goods (Y 3) and the total consumer price index (Y 4), the breadth of digital financial coverage (X 2), the number of payments per capita (X 4), and the digitalization index (X 10) are of significant importance because they are directly related to residents’ personal consumption issues, and the credit variable (X 8) is also of more significant importance because it is directly related to residents’ credit consumption.

Concerning the demographic composition of the labor economy (Y 5 and Y 6), the breadth of digital financial coverage, credit, insurance, and digitalization (X 2, X 5, X 8, and X 10) are also significant, while the depth of digital financial use and digital inclusion indices are relatively significant in relation to the natural growth rate of the population.

The complexities in the characterization of the revitalization efforts are closely entwined with the challenges faced during the transformation and upgrading of the Northeast Region. These challenges are multifaceted: first, the late planned economy’s target production processes have impeded the operational efficiency of the long-established industrial bases in Northeast China. Second, the downsizing and restructuring of state-owned enterprises in the 1990s precipitated widespread unemployment among workers. Finally, the relatively slower reform of economic models, within the overall context of the national reform and opening up, has hampered the pace of rejuvenation for these aged industrial hubs.

Despite the presence of excellent educational resources, the Northeast Region has been grappling with a pronounced brain drain, particularly of the workforce possessing medium to high levels of educational attainment. This exodus has contributed to a sustained negative natural growth rate, further complicating the regeneration of this historically significant industrial locale. This shows that the depth of digital financial usage and the digital financial inclusion index have a significant effect on the response of the economic and financial system to demographic and talent issues.

For total wages (Y 8), the digital financial inclusion index (X 1) shows particularly significant importance, while for average wages (Y 9), the breadth of digital financial coverage (X 2) shows particularly significant importance, and for the average wage index (Y 10), the number and amount of insurance per capita (X 5) shows relatively significant importance. Meanwhile, the number of credits calls per capita for natural persons (X 8) and the depth of digital financial usage (X 3) also occupy a significant proportion of this normalized importance.

In terms of the number of people employed (Y 11), the number and frequency of payments per capita (X 8) is the most important variable. For the unemployed and the unemployment rate (Y 12 and Y 13), there is a strong significance for the degree of digitization, the digital inclusion index, and the breadth of digital financial coverage (X 1, X 2, and X 10), which is consistent with the additional focus on the more vulnerable labor groups in the “inclusiveness” principle of digital inclusion finance (Figure 10).

Labor economic impact of DFI. (a) Gross regional product/

Based on the research results of this work, the following policy recommendations are proposed:

Improve the construction of digital infrastructure in backward regions, promote the popularity of economical smartphones among rural residents, narrow the differences in residents’ external digital resource endowments, encourage financial institutions to provide digital products and services to lower net worth, and improve the coverage of DFI. The digital dividend is used to improve residents’ living standards and achieve universal benefits for the people, thus contributing to the realization of the goal of common prosperity.

Strengthen the public welfare counseling and training of residents’ basic financial knowledge, and enhance their willingness and ability to use DFI, so as to fully enhance the accessibility of digital financial services and products, thus providing the possibility for low-income people to increase their property income.

Further guide DFI to focus on serving less developed regions, complementing traditional financial tools to better provide affordable financial support for production and living in less developed regions, narrowing the income gap between different regions, so that DFI can better promote the common prosperity of all people.

6 Conclusion

This study utilizes the PKU-DFIIC to investigate the effects of DFI on the labor economy. It explores how DFI, with its innovative blend of digital technology and finance, impacts labor productivity and mismatches. At the same time, compared with most of the internationally constructed traditional inclusive finance indices, the concept of DFI is also innovative in terms of combining digital technology and finance, which can improve information asymmetry, and alleviate the problem of reduced free mobility of factors caused by the purpose of protecting local industries.

In terms of research methodology, the study utilizes ANN in research methodology to address the indicator weighting problem, employing the Garson algorithm for sensitivity analysis. Compared to linear regression methods, ANN can better capture complex relationships between variables and handle nonlinearity. It finds that different components of the DFI index correlate significantly with various labor economy indicators, suggesting its potential to improve labor productivity and alleviate financial constraints. Among which the most important are the number and amount of insurance per capita and the proportion of the number and amount paid by digital technology, which have a normalized importance of 100 and 99.3%, respectively, for labor economy indicators.

This study delves into the intricate relationship between DFI and the labor economy, examining how DFI impacts labor market dynamics. Through empirical analysis and neural network methodologies, it identifies the nuanced effects and contributions of DFI to various aspects of the labor economy. The findings offer practical insights for policy-making, economic development strategies, and market expansion efforts. Furthermore, the study sheds light on the potential of DFI to leverage digital technology in transforming labor market dynamics, showcasing its advantages over traditional inclusive finance approaches.

Having measured the significance of DFI on labor economy under the sub-indicators, the study suggests to consider measuring its impact coefficients using linear regression analysis for further validation and expansion. The targeted geographic scope of the study is the Northeast region, which shows strong sensitivity to labor economy indicators. In the future, the scope of the study can be further extended.

-

Funding information: Authors state no funding involved.

-

Author contributions: All authors have accepted responsibility for the entire content of this manuscript and consented to its submission to the journal, reviewed all the results and approved the final version of the manuscript. GX writing and review, ZC: writing and review, and LH: models and data collection. The order of the author’s name is in alphabetical order, and the workload of each author is equivalent.

-

Conflict of interest: Authors state no conflict of interest.

-

Data availability statement: The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Aisaiti, G., Liu, L. H., Xie, J. P., & Yang, J. (2019). An empirical analysis of rural farmers’ financing intention of inclusive finance in China. The moderating role of digital finance and social enterprise embeddedness. Industrial Management & Data Systems, 119(7), 1535–1563. doi: 10.1108/imds-08-2018-0374.Suche in Google Scholar

Arif, I. (2021). Productive knowledge, economic sophistication, and labor share. World Development, 139, 105303.10.1016/j.worlddev.2020.105303Suche in Google Scholar

Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and financial inclusion. European Business Organization Law Review, 21(1), 7–35. doi: 10.1007/s40804-020-00183-y.Suche in Google Scholar

Bai, L., Wang, Z., Wang, H., Huang, N., & Shi, H. (2020). Prediction of multiproject resource conflict risk via an artificial neural network. Engineering Construction & Architectural Management (ahead-of-print), 28(10), 2857–2883.10.1108/ECAM-03-2020-0201Suche in Google Scholar

Bobba, M., Flabbi, L., Levy, S., & Tejada, M. (2021). Labor market search, informality, and on-the-job human capital accumulation. Journal of Econometrics, 223(2), 433–453.10.1016/j.jeconom.2019.05.026Suche in Google Scholar

Cao, X., Huang, M., Wu, B., & Yang, X. (2022). Research on traffic accident prediction of high bridge-tunnel ratio section based on BP-Garson algorithm. Journal of Chongqing University of Technology (Natural Science), 36(3), 119–125.Suche in Google Scholar

Casadei, G., & Astolfi, D. (2018). Multipattern output consensus in networks of heterogeneous nonlinear agents with uncertain leader: A nonlinear regression approach. IEEE Transactions on Automatic Control, 63(8), 2581–2587. doi: 10.1109/tac.2017.2771316.Suche in Google Scholar

Chen, S., Luo, J., Wang, G., Zhao, T., Yin, H., Zheng, Z., & Qiao, C. Optimization of glucose fermentation conditions for pullulan polysaccharide production by artificial neural network based on genetic algorithm. Food and Fermentation Industry, 49(8), 60–66. doi: 10.13995/j.cnki.11-1802/ts.032594.Suche in Google Scholar

Chen, X., & Ji, X. (2020). Research on the effect of bank credit on labor allocation among industries. Management Review, 32(12), 3–14.Suche in Google Scholar

Chen, Y. Y., Kumara, E. K., & Sivakumar, V. (2020) Investigation of finance industry on risk awareness model and digital economic growth. Annals of Operations Research, 326(6), 1–22. doi: 10.1007/s10479-021-04287-7.Suche in Google Scholar

Corrado, G., & Corrado, L. (2017). Inclusive finance for inclusive growth and development. Current Opinion in Environmental Sustainability, 24, 19–23.10.1016/j.cosust.2017.01.013Suche in Google Scholar

Cui, Y., Meng, J., & Lu, C. (2018). Recent developments in China’s labor market: Labor shortage, rising wages and their implications. Review of Development Economics, 22(3), 1217–1238.10.1111/rode.12391Suche in Google Scholar

Dai, D., Fu, M., Ye, L., & Shao, W. (2023). Can digital inclusive finance help small- and medium-sized enterprises deleverage in China? Sustainability, 15(8), 6625.10.3390/su15086625Suche in Google Scholar

Du, Y., Wang, Q., & Zhou, J. (2023). How does digital inclusive finance affect economic resilience: Evidence from 285 cities in China. International Review of Financial Analysis, 88, 102709.10.1016/j.irfa.2023.102709Suche in Google Scholar

Fan, Z. B., & Zhang, R. H. (2017). Financial inclusion, entry barriers, and entrepreneurship: Evidence from China. Sustainability, 9(2), Article 203. doi: 10.3390/su9020203.Suche in Google Scholar

Feng, R., Shen, C., & Guo, Y. (2024). Digital finance and labor demand of manufacturing enterprises: Theoretical mechanism and heterogeneity analysis. International Review of Economics & Finance, 89, 17–32.10.1016/j.iref.2023.07.065Suche in Google Scholar

Fischer, A. (2015). How to determine the unique contributions of input-variables to the nonlinear regression function of a multilayer perceptron. Ecological Modelling, 309, 60–63. doi: 10.1016/j.ecolmodel.2015.04.015.Suche in Google Scholar

Gabor, D., & Brooks, S. (2017). The digital revolution in financial inclusion: International development in the fintech era. New Political Economy, 22(4), 423–436. doi: 10.1080/13563467.2017.1259298.Suche in Google Scholar

Hong, M., Tian, M., & Wang, J. (2022). Digital inclusive finance, agricultural industrial structure optimization and agricultural green total factor productivity. Sustainability, 14(18), 11450–11450.10.3390/su141811450Suche in Google Scholar

Ji, X. M., Wang, K., Xu, H., & Li, M. C. (2021). Has digital financial inclusion narrowed the urban-rural income gap: The role of entrepreneurship in China. Sustainability, 13(15), Article 8292. doi: 10.3390/su13158292.Suche in Google Scholar

Li, E., Tang, Y., Zhang, Y., & Yu, J. (2024). Mechanism research on digital inclusive finance promoting high-quality economic development: Evidence from China. Heliyon, 10(3), e25671.10.1016/j.heliyon.2024.e25671Suche in Google Scholar

Li, J. R., & Li, B. W. (2022). Digital inclusive finance and urban innovation: Evidence from China. Review of Development Economics, 26(2), 1010–1034. doi: 10.1111/rode.12846.Suche in Google Scholar

Li, J., Tan, D., & Li, G. (2022). Try to analyze the application of artificial neural network in value-added evaluation China Test, (7), 77–84. doi: 10.19360/j.cnki.11-3303/g4.2022.07.012.Suche in Google Scholar

Li, P., & Peng, S. (2018). The application of a new combination weight in combination forecasting model. Journal of Henan University of Science and Technology (Natural Science Edition), 39(2), 87–93. doi: 10.15926/j.cnki.issn1672-6871.2018.02.016.Suche in Google Scholar

Li, X., & Wan, S. (2022). The employment structure effect of digital finance on labor force: Theory and test. Economic and Management Review, 38(4), 113–123.Suche in Google Scholar

Liu, C., Wang, Y., & Zhang, L. (2022). Does digital inclusive finance increase the share of labor income? Economic Science, (3), 143–154.Suche in Google Scholar

Liu, L., & Xu, H. (2022). Digital inclusive finance and urban and rural consumption upgrading from the perspective of mobile payment - based on the provincial panel. Business Economics Research, (14), 68–71.Suche in Google Scholar

Maia, A. G., & Menezes, E. (2014). Economic growth, labor and productivity in Brazil and the United States: A comparative analysis. Brazilian Journal of Political Economy, 34(2), 212–229. <Go to ISI >://SCIELO:S0101-31572014000200003.10.1590/S0101-31572014000200003Suche in Google Scholar

Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), 329–340. doi: 10.1016/j.bir.2017.12.003.Suche in Google Scholar

Pua, Z. Y., Hermansson, A. W., & Lim, C. H. (2022). ANN based multi model predictive control for pH-control. IOP Conference Series: Materials Science and Engineering, 1257(1), 012035.10.1088/1757-899X/1257/1/012035Suche in Google Scholar

Qiu, M. (2022). Development and transformation of inclusive finance in my country’s commercial banks. Academic Journal of Business & Management, 4(1), 85–90.10.25236/AJBM.2022.040115Suche in Google Scholar

Ravnik, J., Jovanovac, J., Trupej, A., Vištica, N., & Hriberšek, M. (2021). A sigmoid regression and artificial neural network models for day-ahead natural gas usage forecasting. Cleaner and Responsible Consumption, 3, 100040.10.1016/j.clrc.2021.100040Suche in Google Scholar

Ren, J., Gao, T., Shi, X., Chen, X., & Mu, K. (2023). The impact and heterogeneity analysis of digital financial inclusion on non-farm employment of rural labor. Chinese Journal of Population, Resources and Environment, 21(2), 103–110.10.1016/j.cjpre.2023.06.006Suche in Google Scholar

Shen, Y., Guo, X., & Zhang, X. (2022). Digital inclusive finance, factor mismatch and industrial intelligent manufacturing. Industrial Technology and Economics, 41(7), 13–20.Suche in Google Scholar

Shi, L. (2021). Labor industry allocation, industrial structure optimization, and economic growth. Discrete Dynamic in Nature and Society, 2021(4), 1–8.10.1155/2021/5167422Suche in Google Scholar

Singh, A. (2023). Economic growth and labor investment efficiency. International Review of Finance, 23(4), 886–902.10.1111/irfi.12415Suche in Google Scholar

Sun, G., Zeng, M., & Liao, H. (2020). Research on the development of mobile payment in rural China under the background of digital inclusive finance – Taking Gongcheng Yao Autonomous County of Guangxi Zhuang Autonomous Region as a sample. Rural Economy and Technology, 31(5), 124–126.Suche in Google Scholar

Sun, L., & Zhu, C. (2022). Impact of digital inclusive finance on rural high-quality development: Evidence from China. Discrete Dynamics in Nature and Society, 2022, 7939103.10.1155/2022/7939103Suche in Google Scholar

Sun, Y., & Tang, X. (2022). The impact of digital inclusive finance on sustainable economic growth in China. Finance Research Letters, 50, 103234.10.1016/j.frl.2022.103234Suche in Google Scholar

Villamil, A., Wang, X., & Zou, Y. (2020). Growth and development with dual labor markets. Manchester School, 88(6), 801–826.10.1111/manc.12341Suche in Google Scholar

Wang, X. Y., & Chen, X. (2022). An empirical study on financing constraints of digital inclusive finance development on small and medium-sized technology-based enterprise. Kybernetes, 52(2), 585–600. doi: 10.1108/k-01-2022-0095.Suche in Google Scholar

Wong, T. C., Law, K., Yau, H. K., & Ngan, S. C. (2011). Analyzing supply chain operation models with the PC-algorithm and the neural network. Expert Systems with Applications an International Journal, 38(6), 7526–7534.10.1016/j.eswa.2010.12.115Suche in Google Scholar

Wu, C. L., Chau, K. W., & Li, Y. S. (2009). Methods to improve neural network performance in daily flows prediction. Journal of Hydrology, 372(1–4), 80–93. doi: 10.1016/j.jhydrol.2009.03.038.Suche in Google Scholar

Wu, D., & Chen, Y. (2023). Digital inclusive finance development and labor productivity: Based on a capital-deepening perspective. Sustainability, 15(12), 9243.10.3390/su15129243Suche in Google Scholar

Wu, S., Yang, D., Xia, F., Zhang, X., Huo, J., Cai, T., & Sun, J. (2022). The effect of labor reallocation and economic growth in China. Sustainability, 14(7), 4312.10.3390/su14074312Suche in Google Scholar

Xu, Y., Wang, Y., Lu, F., & Sheng, D. (2023). A study of the impact of digital inclusive finance on firm value from the perspective of financing constraints. Applied Economics, 56(33), 4033–4047.10.1080/00036846.2023.2209309Suche in Google Scholar

Yang, L., & Zhang, Y. T. (2020). Digital financial inclusion and sustainable growth of small and micro enterprises-evidence based on China’s new third board market listed companies. Sustainability, 12(9), Article 3733. doi: 10.3390/su12093733.Suche in Google Scholar

Yuan, L. Q., & Lin, Y. (2011). The formation and development of labor economics. China’s Circulation Economy, 25(6), 55–58. doi: 10.14089/j.cnki.cn11-3664/f.2011.06.003.Suche in Google Scholar

Zhang, C., Zhu, Y., & Zhang, L. (2023). Effect of digital inclusive finance on common prosperity and the underlying mechanisms. International Review of Financial Analysis, 91, 102940.10.1016/j.irfa.2023.102940Suche in Google Scholar

Zhang, J., Dong, X., & Li, J. (2022). Can digital inclusive finance promote common prosperity— Empirical research based on micro household data. Financial Research, 48(7), 4–17.Suche in Google Scholar

Zhang, L. (2015). Establishment and analysis of linear regression equation for slope monitoring in reservoir area of a hydropower station. Northwest Hydropower, (2), 16–19.Suche in Google Scholar

Zhang, Y., & Wang, J. (2020). Has the development of digital economy reduced the level of factor mismatch in China? Forum on Statistics and Information, 35(9), 62–71.Suche in Google Scholar

Zhao, H., Zheng, X., & Yang, L. (2022). Does digital inclusive finance narrow the urban-rural income gap through primary distribution and redistribution? Sustainability, 14(4), 2120–2120.10.3390/su14042120Suche in Google Scholar

Zheng, P., Xue, L., Huang, J., & Huang, J. (2018). High pressure GMAW weld forming analysis based on multi-factor weight method. Journal of Welding, 39(10), 75–80.Suche in Google Scholar

Zhi, Y., Wang, H., & Wang, L. (2022). A state of health estimation method for electric vehicle Li-ion batteries using GA-PSO-SVR. Complex & Intelligent Systems (prepublish), 8(3), 2167–2182.10.1007/s40747-021-00639-9Suche in Google Scholar

Zhou, Z. J., Yao, Y., & Zhu, J. M. (2022). The impact of inclusive finance on high-quality economic development of the Yangtze River Delta in China. Mathematical Problems in Engineering, 2022, Article 3393734. doi: 10.1155/2022/3393734.Suche in Google Scholar

Zhu, W. (2023). Digital financial inclusion and the share of labor income: Firm-level evidence. Finance Research Letters, 56, 104160.10.1016/j.frl.2023.104160Suche in Google Scholar

© 2024 the author(s), published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Regular Articles

- Political Turnover and Public Health Provision in Brazilian Municipalities

- Examining the Effects of Trade Liberalisation Using a Gravity Model Approach

- Operating Efficiency in the Capital-Intensive Semiconductor Industry: A Nonparametric Frontier Approach

- Does Health Insurance Boost Subjective Well-being? Examining the Link in China through a National Survey

- An Intelligent Approach for Predicting Stock Market Movements in Emerging Markets Using Optimized Technical Indicators and Neural Networks

- Analysis of the Effect of Digital Financial Inclusion in Promoting Inclusive Growth: Mechanism and Statistical Verification

- Effective Tax Rates and Firm Size under Turnover Tax: Evidence from a Natural Experiment on SMEs

- Re-investigating the Impact of Economic Growth, Energy Consumption, Financial Development, Institutional Quality, and Globalization on Environmental Degradation in OECD Countries

- A Compliance Return Method to Evaluate Different Approaches to Implementing Regulations: The Example of Food Hygiene Standards

- Panel Technical Efficiency of Korean Companies in the Energy Sector based on Digital Capabilities

- Time-varying Investment Dynamics in the USA

- Preferences, Institutions, and Policy Makers: The Case of the New Institutionalization of Science, Technology, and Innovation Governance in Colombia

- The Impact of Geographic Factors on Credit Risk: A Study of Chinese Commercial Banks

- The Heterogeneous Effect and Transmission Paths of Air Pollution on Housing Prices: Evidence from 30 Large- and Medium-Sized Cities in China

- Analysis of Demographic Variables Affecting Digital Citizenship in Turkey

- Green Finance, Environmental Regulations, and Green Technologies in China: Implications for Achieving Green Economic Recovery

- Coupled and Coordinated Development of Economic Growth and Green Sustainability in a Manufacturing Enterprise under the Context of Dual Carbon Goals: Carbon Peaking and Carbon Neutrality

- Revealing the New Nexus in Urban Unemployment Dynamics: The Relationship between Institutional Variables and Long-Term Unemployment in Colombia

- The Roles of the Terms of Trade and the Real Exchange Rate in the Current Account Balance

- Cleaner Production: Analysis of the Role and Path of Green Finance in Controlling Agricultural Nonpoint Source Pollution

- The Research on the Impact of Regional Trade Network Relationships on Value Chain Resilience in China’s Service Industry

- Social Support and Suicidal Ideation among Children of Cross-Border Married Couples

- Asymmetrical Monetary Relations and Involuntary Unemployment in a General Equilibrium Model

- Job Crafting among Airport Security: The Role of Organizational Support, Work Engagement and Social Courage

- Does the Adjustment of Industrial Structure Restrain the Income Gap between Urban and Rural Areas

- Optimizing Emergency Logistics Centre Locations: A Multi-Objective Robust Model

- Geopolitical Risks and Stock Market Volatility in the SAARC Region

- Trade Globalization, Overseas Investment, and Tax Revenue Growth in Sub-Saharan Africa

- Can Government Expenditure Improve the Efficiency of Institutional Elderly-Care Service? – Take Wuhan as an Example

- Media Tone and Earnings Management before the Earnings Announcement: Evidence from China

- Review Articles

- Economic Growth in the Age of Ubiquitous Threats: How Global Risks are Reshaping Growth Theory

- Efficiency Measurement in Healthcare: The Foundations, Variables, and Models – A Narrative Literature Review

- Rethinking the Theoretical Foundation of Economics I: The Multilevel Paradigm

- Financial Literacy as Part of Empowerment Education for Later Life: A Spectrum of Perspectives, Challenges and Implications for Individuals, Educators and Policymakers in the Modern Digital Economy

- Special Issue: Economic Implications of Management and Entrepreneurship - Part II

- Ethnic Entrepreneurship: A Qualitative Study on Entrepreneurial Tendency of Meskhetian Turks Living in the USA in the Context of the Interactive Model

- Bridging Brand Parity with Insights Regarding Consumer Behavior

- The Effect of Green Human Resources Management Practices on Corporate Sustainability from the Perspective of Employees

- Special Issue: Shapes of Performance Evaluation in Economics and Management Decision - Part II

- High-Quality Development of Sports Competition Performance Industry in Chengdu-Chongqing Region Based on Performance Evaluation Theory

- Analysis of Multi-Factor Dynamic Coupling and Government Intervention Level for Urbanization in China: Evidence from the Yangtze River Economic Belt

- The Impact of Environmental Regulation on Technological Innovation of Enterprises: Based on Empirical Evidences of the Implementation of Pollution Charges in China

- Environmental Social Responsibility, Local Environmental Protection Strategy, and Corporate Financial Performance – Empirical Evidence from Heavy Pollution Industry

- The Relationship Between Stock Performance and Money Supply Based on VAR Model in the Context of E-commerce

- A Novel Approach for the Assessment of Logistics Performance Index of EU Countries

- The Decision Behaviour Evaluation of Interrelationships among Personality, Transformational Leadership, Leadership Self-Efficacy, and Commitment for E-Commerce Administrative Managers

- Role of Cultural Factors on Entrepreneurship Across the Diverse Economic Stages: Insights from GEM and GLOBE Data

- Performance Evaluation of Economic Relocation Effect for Environmental Non-Governmental Organizations: Evidence from China

- Functional Analysis of English Carriers and Related Resources of Cultural Communication in Internet Media

- The Influences of Multi-Level Environmental Regulations on Firm Performance in China

- Exploring the Ethnic Cultural Integration Path of Immigrant Communities Based on Ethnic Inter-Embedding

- Analysis of a New Model of Economic Growth in Renewable Energy for Green Computing

- An Empirical Examination of Aging’s Ramifications on Large-scale Agriculture: China’s Perspective

- The Impact of Firm Digital Transformation on Environmental, Social, and Governance Performance: Evidence from China

- Accounting Comparability and Labor Productivity: Evidence from China’s A-Share Listed Firms

- An Empirical Study on the Impact of Tariff Reduction on China’s Textile Industry under the Background of RCEP

- Top Executives’ Overseas Background on Corporate Green Innovation Output: The Mediating Role of Risk Preference

- Neutrosophic Inventory Management: A Cost-Effective Approach

- Mechanism Analysis and Response of Digital Financial Inclusion to Labor Economy based on ANN and Contribution Analysis

- Asset Pricing and Portfolio Investment Management Using Machine Learning: Research Trend Analysis Using Scientometrics

- User-centric Smart City Services for People with Disabilities and the Elderly: A UN SDG Framework Approach

- Research on the Problems and Institutional Optimization Strategies of Rural Collective Economic Organization Governance

- The Impact of the Global Minimum Tax Reform on China and Its Countermeasures

- Sustainable Development of Low-Carbon Supply Chain Economy based on the Internet of Things and Environmental Responsibility

- Measurement of Higher Education Competitiveness Level and Regional Disparities in China from the Perspective of Sustainable Development

- Payment Clearing and Regional Economy Development Based on Panel Data of Sichuan Province

- Coordinated Regional Economic Development: A Study of the Relationship Between Regional Policies and Business Performance

- A Novel Perspective on Prioritizing Investment Projects under Future Uncertainty: Integrating Robustness Analysis with the Net Present Value Model

- Research on Measurement of Manufacturing Industry Chain Resilience Based on Index Contribution Model Driven by Digital Economy

- Special Issue: AEEFI 2023

- Portfolio Allocation, Risk Aversion, and Digital Literacy Among the European Elderly

- Exploring the Heterogeneous Impact of Trade Agreements on Trade: Depth Matters

- Import, Productivity, and Export Performances

- Government Expenditure, Education, and Productivity in the European Union: Effects on Economic Growth

- Replication Study

- Carbon Taxes and CO2 Emissions: A Replication of Andersson (American Economic Journal: Economic Policy, 2019)

Artikel in diesem Heft

- Regular Articles

- Political Turnover and Public Health Provision in Brazilian Municipalities

- Examining the Effects of Trade Liberalisation Using a Gravity Model Approach

- Operating Efficiency in the Capital-Intensive Semiconductor Industry: A Nonparametric Frontier Approach

- Does Health Insurance Boost Subjective Well-being? Examining the Link in China through a National Survey

- An Intelligent Approach for Predicting Stock Market Movements in Emerging Markets Using Optimized Technical Indicators and Neural Networks

- Analysis of the Effect of Digital Financial Inclusion in Promoting Inclusive Growth: Mechanism and Statistical Verification

- Effective Tax Rates and Firm Size under Turnover Tax: Evidence from a Natural Experiment on SMEs

- Re-investigating the Impact of Economic Growth, Energy Consumption, Financial Development, Institutional Quality, and Globalization on Environmental Degradation in OECD Countries

- A Compliance Return Method to Evaluate Different Approaches to Implementing Regulations: The Example of Food Hygiene Standards

- Panel Technical Efficiency of Korean Companies in the Energy Sector based on Digital Capabilities

- Time-varying Investment Dynamics in the USA

- Preferences, Institutions, and Policy Makers: The Case of the New Institutionalization of Science, Technology, and Innovation Governance in Colombia

- The Impact of Geographic Factors on Credit Risk: A Study of Chinese Commercial Banks

- The Heterogeneous Effect and Transmission Paths of Air Pollution on Housing Prices: Evidence from 30 Large- and Medium-Sized Cities in China

- Analysis of Demographic Variables Affecting Digital Citizenship in Turkey

- Green Finance, Environmental Regulations, and Green Technologies in China: Implications for Achieving Green Economic Recovery

- Coupled and Coordinated Development of Economic Growth and Green Sustainability in a Manufacturing Enterprise under the Context of Dual Carbon Goals: Carbon Peaking and Carbon Neutrality

- Revealing the New Nexus in Urban Unemployment Dynamics: The Relationship between Institutional Variables and Long-Term Unemployment in Colombia

- The Roles of the Terms of Trade and the Real Exchange Rate in the Current Account Balance

- Cleaner Production: Analysis of the Role and Path of Green Finance in Controlling Agricultural Nonpoint Source Pollution

- The Research on the Impact of Regional Trade Network Relationships on Value Chain Resilience in China’s Service Industry

- Social Support and Suicidal Ideation among Children of Cross-Border Married Couples

- Asymmetrical Monetary Relations and Involuntary Unemployment in a General Equilibrium Model

- Job Crafting among Airport Security: The Role of Organizational Support, Work Engagement and Social Courage

- Does the Adjustment of Industrial Structure Restrain the Income Gap between Urban and Rural Areas

- Optimizing Emergency Logistics Centre Locations: A Multi-Objective Robust Model

- Geopolitical Risks and Stock Market Volatility in the SAARC Region

- Trade Globalization, Overseas Investment, and Tax Revenue Growth in Sub-Saharan Africa

- Can Government Expenditure Improve the Efficiency of Institutional Elderly-Care Service? – Take Wuhan as an Example

- Media Tone and Earnings Management before the Earnings Announcement: Evidence from China

- Review Articles

- Economic Growth in the Age of Ubiquitous Threats: How Global Risks are Reshaping Growth Theory

- Efficiency Measurement in Healthcare: The Foundations, Variables, and Models – A Narrative Literature Review

- Rethinking the Theoretical Foundation of Economics I: The Multilevel Paradigm

- Financial Literacy as Part of Empowerment Education for Later Life: A Spectrum of Perspectives, Challenges and Implications for Individuals, Educators and Policymakers in the Modern Digital Economy

- Special Issue: Economic Implications of Management and Entrepreneurship - Part II

- Ethnic Entrepreneurship: A Qualitative Study on Entrepreneurial Tendency of Meskhetian Turks Living in the USA in the Context of the Interactive Model

- Bridging Brand Parity with Insights Regarding Consumer Behavior

- The Effect of Green Human Resources Management Practices on Corporate Sustainability from the Perspective of Employees

- Special Issue: Shapes of Performance Evaluation in Economics and Management Decision - Part II

- High-Quality Development of Sports Competition Performance Industry in Chengdu-Chongqing Region Based on Performance Evaluation Theory

- Analysis of Multi-Factor Dynamic Coupling and Government Intervention Level for Urbanization in China: Evidence from the Yangtze River Economic Belt

- The Impact of Environmental Regulation on Technological Innovation of Enterprises: Based on Empirical Evidences of the Implementation of Pollution Charges in China

- Environmental Social Responsibility, Local Environmental Protection Strategy, and Corporate Financial Performance – Empirical Evidence from Heavy Pollution Industry

- The Relationship Between Stock Performance and Money Supply Based on VAR Model in the Context of E-commerce

- A Novel Approach for the Assessment of Logistics Performance Index of EU Countries

- The Decision Behaviour Evaluation of Interrelationships among Personality, Transformational Leadership, Leadership Self-Efficacy, and Commitment for E-Commerce Administrative Managers

- Role of Cultural Factors on Entrepreneurship Across the Diverse Economic Stages: Insights from GEM and GLOBE Data

- Performance Evaluation of Economic Relocation Effect for Environmental Non-Governmental Organizations: Evidence from China

- Functional Analysis of English Carriers and Related Resources of Cultural Communication in Internet Media

- The Influences of Multi-Level Environmental Regulations on Firm Performance in China

- Exploring the Ethnic Cultural Integration Path of Immigrant Communities Based on Ethnic Inter-Embedding

- Analysis of a New Model of Economic Growth in Renewable Energy for Green Computing

- An Empirical Examination of Aging’s Ramifications on Large-scale Agriculture: China’s Perspective

- The Impact of Firm Digital Transformation on Environmental, Social, and Governance Performance: Evidence from China

- Accounting Comparability and Labor Productivity: Evidence from China’s A-Share Listed Firms

- An Empirical Study on the Impact of Tariff Reduction on China’s Textile Industry under the Background of RCEP

- Top Executives’ Overseas Background on Corporate Green Innovation Output: The Mediating Role of Risk Preference

- Neutrosophic Inventory Management: A Cost-Effective Approach

- Mechanism Analysis and Response of Digital Financial Inclusion to Labor Economy based on ANN and Contribution Analysis

- Asset Pricing and Portfolio Investment Management Using Machine Learning: Research Trend Analysis Using Scientometrics

- User-centric Smart City Services for People with Disabilities and the Elderly: A UN SDG Framework Approach

- Research on the Problems and Institutional Optimization Strategies of Rural Collective Economic Organization Governance

- The Impact of the Global Minimum Tax Reform on China and Its Countermeasures

- Sustainable Development of Low-Carbon Supply Chain Economy based on the Internet of Things and Environmental Responsibility

- Measurement of Higher Education Competitiveness Level and Regional Disparities in China from the Perspective of Sustainable Development

- Payment Clearing and Regional Economy Development Based on Panel Data of Sichuan Province

- Coordinated Regional Economic Development: A Study of the Relationship Between Regional Policies and Business Performance

- A Novel Perspective on Prioritizing Investment Projects under Future Uncertainty: Integrating Robustness Analysis with the Net Present Value Model

- Research on Measurement of Manufacturing Industry Chain Resilience Based on Index Contribution Model Driven by Digital Economy

- Special Issue: AEEFI 2023

- Portfolio Allocation, Risk Aversion, and Digital Literacy Among the European Elderly

- Exploring the Heterogeneous Impact of Trade Agreements on Trade: Depth Matters

- Import, Productivity, and Export Performances

- Government Expenditure, Education, and Productivity in the European Union: Effects on Economic Growth

- Replication Study

- Carbon Taxes and CO2 Emissions: A Replication of Andersson (American Economic Journal: Economic Policy, 2019)