Abstract

The payment and clearing system can objectively record the operation of funds for social and economic activities, and the use of payment and clearing data can be made to monitor regional economic changes sensitively. Employing panel data of cities and prefectures in Sichuan Province from 2010 to 2021, this article employs econometric analysis to examine the link between payment and clearing data and the regional economy. The paper’s focus includes the payment and clearing system and economic indicators. The increase in the total amount of payment and clearing data has a significant positive correlation with digital economic development. Only by regression between the total amount of payment and clearing and regional gross domestic product (GDP), it can be found that every 1% increase in payment and clearing can increase regional GDP by 0.476%. After controlling factors such as important production factors, openness, and government intervention, the elasticity coefficient is still 0.1%, and the correlation is significant. Therefore, the amount of payment and liquidation is a valuable predictor of regional economic development. And thus providing Intelligent decision-making references for the policy formulation and strategic planning of governmental departments and regulatory agencies.

1 Introduction

Methods, equipment, efficiency, and habits connected to payments in social and commercial activities have undergone substantial changes due to the growth of science and technology Qian et al. (2020). The rapid and efficient transfer of societal finances is a result of the payment industry’s ever-improving operational efficiency, organizational structure, and system development (Tao et al., 2016). This has helped keep the economy and finances stable, which in turn has encouraged society and the economy to grow at a high standard. For the sake of economic operation and risk management, it is very relevant to do more study into the relationship between payment and clearing data and economic growth, as well as to better understand the value of payment and clearing data in and of itself (Zhang, 2012).

To get important insights into changes in regional economies, the payment and clearing system is vital for objectively tracking the movement of money within social and economic activities. A live view of the financial environment is made possible by the use of clearing and payment data, which permits the careful tracking of economic changes. Using panel data from cities and prefectures in Sichuan Province from 2010 to 2021, this study uses econometric research to examine the connection between payment and clearance data and regional economic growth (Jiang and Jiang, 2020).

Investigating the complex relationships between the clearing and payment system and important economic metrics is the main objective of the article. Regional economic development is positively and significantly correlated with total payment and clearance statistics. Regression research showed that there is a strong correlation between regional gross domestic product (GDP) and overall payment and clearing amounts; more precisely, it found that a 1% rise in payment and clearing amounts to a 0.476% increase in regional GDP. The correlation’s lasting importance is shown by the fact that the elasticity coefficient stays at 0.1% even after controlling for key production aspects, trade openness, and government intervention (Shu-yang et al., 2022).

The payment clearing time entails matching the payment with an open item and clearing both. The system selects the right business partner and opens the item based on payment reference information (invoice number, payment amount, bank account, etc.). The term "clearing" is used in the banking and financial industries to describe the process that begins with a commitment for a transaction and ends with its settlement. By going through this procedure, transferring funds from one account to another becomes a reality rather than just an abstract idea (like a check or an electronic payment request).

The research here suggests that liquidation and payment amounts are good indicators of future regional economic growth (Zhou, 2011). The strong association observed in the empirical research lays the groundwork for using it as a prediction tool, which may help regulatory bodies and government departments make better decisions (Jun, 2017a). Policymakers may create more robust and dynamic regional economies by gaining a deeper grasp of the complex link between payment and clearance data and economic development (Jun, 2017b).

The importance of analyzing the relationship between payment and clearing data and economic development is highlighted in the introduction, which also highlights how technology improvements have transformed payment systems (Xiangfeng, 2018). This study is crucial for good risk management and economic operation (Weimin, 2009).

2 Contribution

The paper’s detailed econometric study of payment and clearance data from Sichuan Province’s cities and prefectures from 2010 to 2021 is notable. This empirical technique strengthens the analysis and quantifies the payment and clearing system’s impact on regional economic growth.

One important contribution is quantifying the influence of payment and clearance data on regional economic indicators. The article shows that regional GDP increases significantly as payment and clearance data increases. Policymakers can quantify the economic effects of payment and clearing modifications by discovering that a 1% increase in payment and clearing corresponds with a 0.476% rise in regional GDP.

The study shows that payment and clearance data predict regional economic growth, which helps policymakers and regulators. The article proposes that payment and liquidation amounts might anticipate policy and strategic plan decisions. This contribution contributes to developing regional economic policies and strategies to promote economic stability and development.

Econometric examination of Sichuan Province’s payment and clearing data from 2010 to 2021 shows a strong positive link between higher payment and clearing and regional economic growth. Even after allowing for important variables, a 1% increase in payment and clearance increases regional GDP by 0.476%. Policymakers may use the study’s empirical methodology to make educated economic and strategic planning decisions.

2.1 Literature Review

2.1.1 Study on the Relationship between Payment Clearing and Macroeconomic Indicators

Several studies have extensively explored the correlation between payment-clearing activities and macroeconomic indicators. One group from Guangdong Province’s payment and settlement businesses, for example, used 36 different metrics in their 2013 study. They were linked with the Guangzhou Branch of the People’s Bank of China. They constructed leading and coincident indicators to monitor economic performance, revealing that the leading indicator had a notable predictive effect on forecasting regional economic indicators and business operations. Zhijun et al., (2012) employed linear regression analysis on interbank payment data and GDP, suggesting that observing capital activity within the payment system could swiftly evaluate current macroeconomic operations (Zhijun et al., 2012). This observation serves as a pivotal basis for formulating economic and financial management policies. From a theoretical perspective, Yun (2012) established the "resident-vendor" economic growth model based on nationwide panel data from various provinces (Yun, 2012). The empirical research conducted examines the relationship between capital flow and economic development. It concludes that a larger capital flow corresponds to more developed economies and higher price levels. Additionally, it posits that a region’s economic development level indeed impacts the efficiency of capital output. An essential role in promoting China’s economic growth is played by the payment system of the People’s Bank of China, according to the empirical investigation. It is seen as a key factor propelling expansion in the economy. The report suggests that payment system enterprises should be structured strategically and developed further so that they can contribute more to economic growth as a whole.

2.1.2 Study on the Relationship between Payment Clearing and Regional Economic Development

Existing literature examines the relationship between payment and clearing indicators and socio-economic development, revealing insights into their strong correlation. The majority of China’s capital flow concentrates in economically developed regions such as Shanghai, Beijing, and Jiangsu (Youhui, 2018). Conversely, central and western regions account for roughly 30% of the national total, reflecting the actual economic development levels of specific regions. Several empirical studies further support this notion. The Research Team at the Jinan Branch of the People’s Bank of China (2011) conducts an empirical study within the Shandong Peninsula Blue Economic Zone, emphasizing the endogenous force of capital flow (Xin, 2019). The relationship between payment system fund flow and regional GDP in Anshan, Liaoning Province (Xinhong and Ping, 2011). The study establishes a strong promotional factor between the payment system and economic development, showcasing a dependent and mutually beneficial relationship. In addition, Wenji and Jiang (2022) empirically study large-value real-time payment system data in Henan Province, concluding an equilibrium relationship between payment system fund flow and economic growth, with the funds’ impact often manifesting after two lag periods. Multidimensional vector autoregressive model in Jilin Province (Jakšič and Marinč, 2019), establishing the fund flow’s significant positive effect on social consumer goods’ scale and its impact on the gross product development trend (Gomber et al.)

To comprehensively assess the degree of digital economy growth in 31 Chinese provinces(Efanov and Roschin, 2018) and cities from 2013 to 2019, Su et al. (2022) used the grey correlation analysis with the upgraded VIKOR model. An examination of the data reveals an uneven growth of the digital economy throughout China’s four main economic zones and a general tendency of superimposition and increase in the country’s digital economy. At last, we provide focused views on developing the digital economy in China’s provinces.

Aiming to analyse the influence and mechanism of the digital economy on the sustainable growth of firms, Zhou et al. (2022) seek to delve into the topic. Consequently, this study used panel data of 280 A-share listed companies in cities from 2011 to 2019 to empirically analyse the impact of the digital economy on enterprise sustainable development and its mechanism. The study was based on measuring the level of urban digital economy and the level of sustainable development of enterprises. First, there is clear regional heterogeneity between the digital economy and sustainable business growth, according to the report.

To find the best portfolio of loans posted by banks in the Tehran Stock Exchange for 2017, Fallah et al. (2021) used a data envelopment analysis technique. The most efficient banks are chosen using this approach, which ranks them according to their highest score. The current research found that the Sarmayeh, Dey, and Gardeshgari banks had the worst performance compared to the other lending institutions. In contrast, the Pasar-gad, Parsian, and Saman banks had the highest performance overall.

According to Lin et al. (2024), a prerequisite for high-quality growth is green development. The findings provide credence to the idea that digital economy and green innovation can positively impact green development in the long run, and they also confirm the existence of cointegration relationships between green innovation and green growth, green development and digital economy, and digital economy and green innovation.

Colombo et al. (2023) use a novel, entropy-weighted Multiple Attribute Decision Making model to unravel these complex linkages. This research relies on the Stepwise Weight Assessment Ratio research approach to determine the relative relevance of several social media indicators. The impact of various financial variables on these utility functions is mapped out using the analytical power of neural network regressions.

Concerning strategic methods for dealing with EWEs that have a high effect but a low likelihood, Skouloudis et al. (2020) try to outline the new literature. By doing this research, we hope to shed light on how small and medium-sized enterprises (SMEs) can better withstand these types of natural disasters by developing strategies for resilience and adaptation. The research shows that SMEs confront several difficulties due to the complexity of the problem of resistance to EWEs.

According to Kian and Obaid (2022), clients may mistrust the bank when new technology is used in the system. Hence, it is necessary to provide systems that can identify fraudulent financial activities. This essay aims to find a model for in-person transactions and set up a mechanism to prevent illegally issued transactions. A big data clustering algorithm is developed to detect bribery in financial transactions on time. The findings demonstrate that the big data clustering approach can identify and prevent potential financial transaction fraud in the shortest amount of time.

The authors Imeni and Edalatpanah (2023) guide companies by introducing the ideas of resilience and risk management and explaining the connection between the two. Depending on their resilience level, businesses may use the results to implement sound planning and risk management procedures. The policy recommendations and insights it offers may aid businesses in building resilience and risk management systems to better withstand and recover from catastrophes of this kind.

Najafi et al. (2015) set out to use a multiple-attribute decision-making procedure to assess feasible technologies inside Isfahan’s science and technology corridor. Given the novelty of the science corridor and technology in Iran and the lack of prior research on the topic, this study’s innovative approach stands out. The study’s application of three decision-making criteria to improve reliability is also noteworthy.

A Structural equation model using Smart PLS3 software was developed by Osintsev and Khalilian (2023) to investigate the interrelationships of the variables. According to the findings, innovation has a favourable effect on organizational performance. In addition, the research discovered that strategic planning positively impacted organizational performance. These results may help healthcare industry managers and decision-makers improve organizational performance by creating successful initiatives.

To confirm the correlation between energy price fluctuations and regional GDP development, Wang (2022) utilized data from 30 Chinese provinces (excluding Tibet) covering the years 2005–2020 and used the FMOLS cointegration estimate technique. The growth of the area’s economy is being boosted by both industrial structure and foreign direct investment. There is a positive correlation between the index of consumer prices and the development of regional economies. The following results: (1) From a national viewpoint, China’s domestic economy is affected by coal, power, and oil price indices changes.

The goal of the proposed research by Tan and Lv (2022) is to provide credible recommendations for improving the Jiangxi Province economy by analyzing the issue of regional economic disequilibrium in the province. The paper executes the geographical and industrial decomposition to derive the Taylor index and Gini coefficient and then computes the GDP per capita standard deviation and the population-weighted variation coefficient in Jiangxi Province. Then, we examine the regional economic differences among numerous cities at the prefecture level of the province.

Collectively, these studies demonstrate the correlation between payment and clearing indicators and economic development. Leveraging the objectivity and timeliness of payment and clearing data for fitting analysis effectively monitors economic performance and financial system stability. However, challenges persist, including diverse payment subjects, tools, and methods, which hinder comprehensive and complete statistical data collection. Regional disparities in data lead to variations in results, complicating the establishment of a unified measurement model and statistical analysis method nationwide. To utilize payment and clearing data for economic analysis, it is imperative to adopt regionally appropriate mathematical and statistical analysis methods. Commencing with the impact mechanism of payment and clearing on the economy, this approach analyses factors such as social productivity, capital flow efficiency, and money supply. By considering data timeliness, accessibility, and stability, employing large-value real-time payment system business volume as a proxy variable for regression modeling with regional economic indicators yields promising fitting effects. This methodology could aid in predicting regional economic operation, offering valuable insights for government policy formulation and regulatory agencies, presenting significant practical application value.

2.2 Proposed Method

2.2.1 Mechanisms of the Impact of Payment Clearing on Economic Performance

The payment clearing system serves as a fundamental pillar for upholding social operations and financial market stability. Simultaneously, it significantly influences the efficacy of economic operations and policy efficiency. The stability of this system holds substantial implications for social stability and economic security.

2.2.1.1 Stimulating Consumption Potential

Emergence of third-party payment services has spurred industry innovation, necessitating new dimensions of business oversight (Jakšič & Marinč, 2019). Dominated by market giants such as Alipay and Tenpay, commanding nearly 90% of the market, the landscape represents a typical oligopoly market structure. With the widespread adoption of smartphones and Internet-based social platforms, third-party payment services have permeated into the everyday lives and consumption patterns of residents. They provide a seamless payment experience and cultivate the habit of mobile payments, exhibiting a considerable substitutive effect for cash-type micro-payments. This shift away from cash transactions mitigates inconveniences associated with cash carrying and management. The safety, convenience, and online-oriented nature of payment methods play a pivotal role in stimulating demand-side growth potential in the consumer market.

Moreover, Gomber et al., (2018) suggests that consumers leveraging the financial market for consumption intertemporal smoothing demonstrate increased capability to unleash suppressed consumption demand (Gomber et al., 2018). In other words, alleviating liquidity constraints aids in augmenting residents’ consumption levels.

The parameter (

The innovative amalgamation of third-party payment entities with Internet finance fulfills users’ temporary short-term borrowing requirements, further galvanizing their propensity to consume. Platforms like Alipay Payments and WeChat Payments leverage consumers’ online and offline consumption patterns and other financial transaction records, coupled with their investment behaviors within the platform. Utilizing intelligent big data models, these platforms assess users’ credit risks, offering a certain overdraft credit line as a purely credit-guaranteed standby arrangement that users can access at any time. This mechanism effectively addresses consumers’ transient financial constraints, circumventing the issue of reduced consumption due to liquidity constraints, thereby invigorating consumers’ purchasing desires.

2.2.1.2 Enhancing Efficiency in Funds Operation

The modernized payment clearing system leverages advanced IT solutions to swiftly execute intricate transactions, eliminating various impediments that might arise during payment processes. It transcends the physical constraints of time and space, significantly curtails transaction costs, and realizes secure and efficient capital transfers and circulation. Specifically, the RMB payment and clearing system are robustly structured, with numerous participating entities centralized around the People’s Bank of China’s payment system. This is complemented by banks’ and financial institutions’ payment systems within their jurisdictions, UnionPay’s inter-bank, and NetsUnion’s clearing platforms. Moreover, the system boasts diversified payment modes and settlement tools, including debit and credit bank cards, bills, cellphone number payments, QR code payments, Facial Recognition Payments (FRP), and fingerprint payments. This comprehensive range of payment and clearing options furnishes secure and efficient technical support for the operation of the entire society’s capital flow.

In equation (2), (

Secondly, the cross-border RMB payment and clearing system amalgamates settlement channels and resources, facilitating cross-border RMB payment transactions. This streamlined process facilitates the internationalization of the RMB and expedites the cross-border circulation of the currency. Furthermore, the foreign currency clearing system and domestic foreign currency payment system play pivotal roles in fulfilling the demands of foreign currency payment businesses. Globally renowned clearing systems like SWIFT, Clearing House Interbank Payment System, and Clearing House of Automated Payment System significantly dominate cross-border foreign currency clearing. SWIFT, for instance, serves over 110 million banks, securities institutions, financial infrastructures, and corporate users worldwide. This vast network provides multi-currency clearing and settlement services for cross-border commodity trade and other global services. These systems transcend regional limitations and currency settlement barriers, enhancing the convenience of economic and trade exchanges among countries worldwide. They facilitate cross-region and cross-border trade cooperation, playing a pivotal role in bolstering balance of payments and economic growth in the era of globalization.

The RMB payment clearing system, alongside the foreign currency clearing and settlement system, largely fulfill the clearing requirements of major global settlement currencies. These systems provide technical underpinnings for the seamless circulation of RMB and foreign currency funds, fostering both domestic and international economic exchanges. They serve as catalysts for cross-border trade and the ongoing development of economic globalization.

2.2.1.3 Augmenting the Influence of the Money Multiplier

The evolution of the payment and clearing system reverberates across the base currency supply, the money multiplier, and the velocity of money flow, thereby influencing the overall money supply. GDP is intricately tied to factors like money supply, foreign investment volumes, and fiscal revenue, as determined through econometric analysis models (Efanov & Roschin, 2018). Firstly, the payment and clearing system substantially abbreviates the duration of open market operations. This streamlining fosters enhanced efficiency in the People’s Bank of China’s currency supply and withdrawal processes. It broadens the repertoire of precision monetary policy tools at the disposal of the People’s Bank of China, ensuring greater flexibility and diversification in executing monetary policies.

The predicted fee of the provincial economic boom indicator for the cutting-edge time, just like the GDP of Sichuan Province, is represented by means of (

Secondly, this system facilitates efficient fund circulation among residents, enterprises, financial institutions, and the government. A stable and secure payment and clearing system significantly amplifies the efficacy of fund exchanges. Improved efficiency in commercial banks’ utilization of excess reserves leads to increased current funds held within the units’ excess reserves. This decrease in the excess reserve ratio deposited by commercial banks with the People’s Bank of China augments the scope of asset allocation, such as loan investments, thereby expanding the credit scale. The credit scale escalation prompts a surge in derivative deposits, thereby elevating the impact of the money multiplier.

Furthermore, the streamlined operation of the payment and clearing system expedites the settlement of financial transactions. This effectively diminishes the transit duration or volume of funds. Consequently, residents, enterprises, public institutions, and government agencies demonstrate enhanced flexibility and efficiency in their financial arrangements. Their precautionary motives for holding cash diminish, accelerating currency flow speed, thereby amplifying the influence of the currency multiplier.

The payment and clearing system’s impact, rooted in monetary policy implementation, fund utilization efficiency, and currency circulation velocity, shapes the social money supply. This indirect influence extends to the relationship between supply and demand in the capital market, fund liquidity, money’s purchasing power, and the overall gamut of socio-economic activities.

2.2.1.4 Facilitating Factor Support

Within the framework of economic growth theory, productivity is shaped by various factors including natural resources, human capital, physical capital, scientific advancements, and the institutional environment. Among these, technological advancements play a catalytic role in propelling economic growth. Traditional economic theory emphasizes the contribution of economic factors to this growth.

As society progresses and the economy rapidly evolves, the labor force’s contribution to economic development is expected to marginally decrease, while capital input and technological progress contributions will likely escalate gradually.

The focus at that centered on the towns and prefectures of Sichuan Province explored a link that is encapsulated in equation (4). The shift in location GDP is illustrated with the aid of the

The establishment, enhancement, and seamless functioning of the payment system, a vital financial infrastructure, along with the efficient execution of fund delivery and settlement across financial markets (bonds, stocks, foreign exchange, futures, etc.), provide a secure and efficient clearing channel. This expedites capital flow and enhances the efficiency of economic and financial activities. It serves as the fundamental assurance for the orderly advancement of economic and financial activities, offering essential resource-based support and robust technical underpinning for driving economic development.

Methods for deriving useful statistics from time series data are the purview of time series analysis. Many models, including those for predicting, take advantage of this. Panel datasets are a kind of multi-dimensional data collection that includes measurements taken over time for the same company, business, area, or individual. The text presents them as independent and somewhat different modelling frameworks for educational reasons.

Growth in the economy (GDP), consumption, investment, and foreign trade are all examples of economic indicators. Things like government spending, pricing, the money supply, and the balance of payments measure stability in the economy. Policymakers, people, businesses, and investors may learn about the economy’s current and potential future state via economic indicators like GDP, unemployment, inflation, or specific pricing.

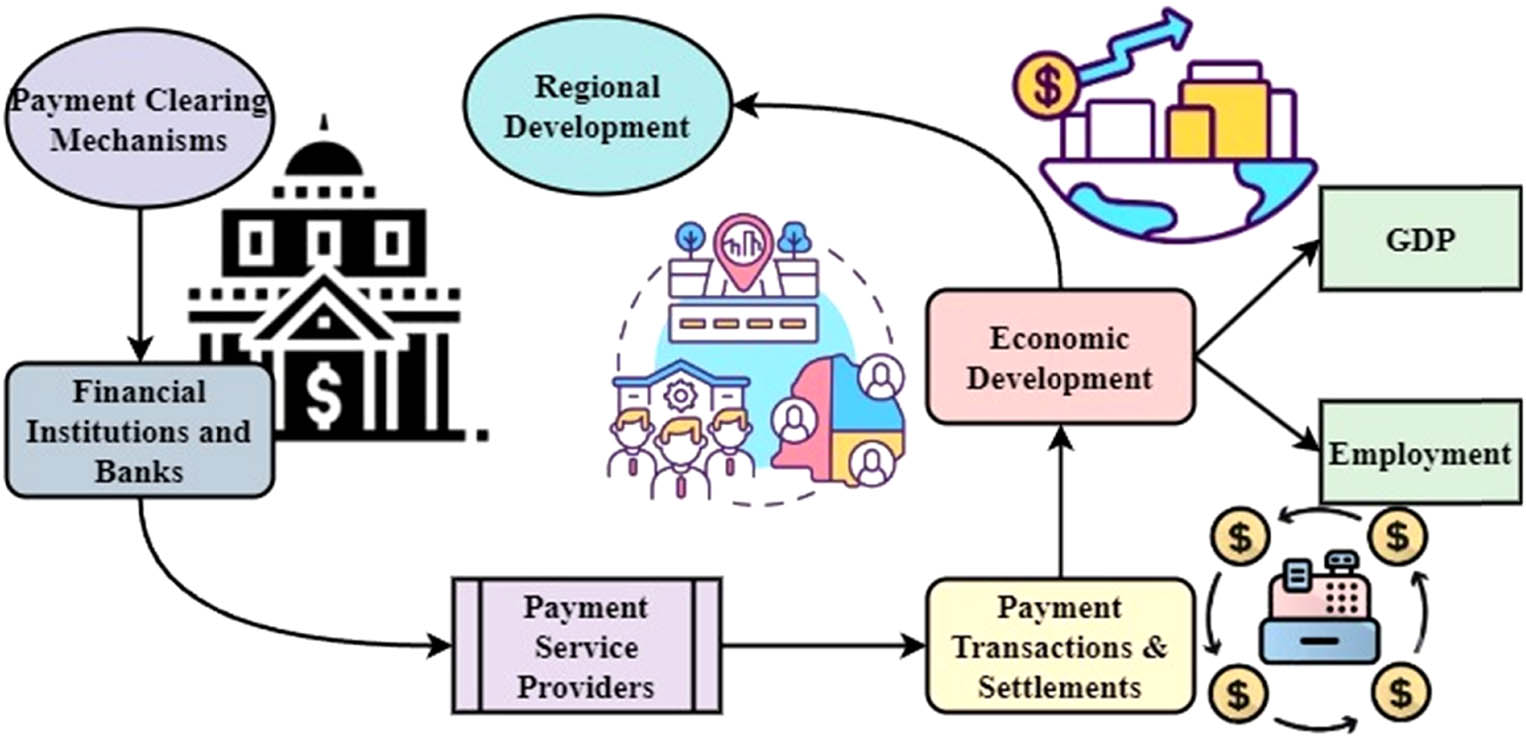

Figure 1 explains the evolution of payment and settlement methods – from traditional cash and bank card payments to contemporary online, QR code, FRP, cellphone number payments, and other innovative methods – is a result of practical applications of internet technology, biometrics, and other advanced technologies within the payment sphere. The integration of financial technology in the payment industry has led to the optimization and refinement of payment systems. It has enabled access to a more extensive array of payment scenarios, broadening the scope and depth of payment system coverage. This transformation into online and digital platforms has elevated the quality and efficiency of inclusive financial payment services, thereby fueling economic and social development.

The evolution of payment and settlement methods.

Additionally, the payment and clearing system stands as the fundamental linchpin for economic and financial stability. Payment and clearing data serve as accurate reflections of economic activities. Through meticulous monitoring of this data, it not only mirrors currency circulation speed, transaction activity frequency, cross-border payments, debt defaults, and more but also enables analyses of regional economic development characteristics, industrial structures, sub-sectors, and the impact of sudden occurrences like the COVID-19 outbreak on the economy. This analytical capacity holds substantial practical significance for understanding socio-economic phenomena and development patterns.

This research examines the level of economic development, county finances, industrialization, urbanization, and education scale in the county to demonstrate how EPSC reform has affected these factors. It may be useful for figuring out how the strengthened counties’ extended jurisdiction affects the availability of essentials at the county level. A clear separation of impact route and impact effect is achieved, and suggestions for the relevant government decision-making agencies’ subsequent reform course of action are offered.

2.2.2 Modelling and Data Description

2.2.2.1 Modelling

To verify the effect of payment and clearing on the economy, the following basic static panel model is constructed:

Equation (5) explains

One of the most influential networks within the ever-converting financial panorama of south-western China is the Sichuan Province Payment Clearing and Regional Economic Development Ecosystem. Figure 2 depicts this linked machine, which emphasizes the significance of powerful charge strategies in promoting local growth by way of revealing the complicated relationships between exceptional parts. These surroundings revolve around the Payment Clearing System. Facilitating smooth transactions and settlements, this mechanism is the spine of monetary interactions in Sichuan Province. Figure 2 suggests that banks and different monetary organizations are vital to this gadget due to the manner money flows thru them. When it comes to managing the complexities of financial transactions and preserving the machine strong, those institutions are vital. Assembled around the Payment Clearing Process are Payments Service Providers, an extensive style of groups that useful resource with the convenience and effectiveness of financial transactions.

Sichuan Province’s mechanism for clearing payments and promoting regional economic development.

By facilitating new sorts of fee and supplying novel thoughts, these service providers, which include technological platforms and charge gateways, improve the surroundings as a whole. It plays a critical position in growing a stimulating atmosphere for economic operations with the aid of catering to the numerous needs of customers and firms. Detailed facts approximately Payment Transactions and Settlements are protected within the next layer of Figure 2. This element indicates how cash moves from the beginning of a transaction all the way to its final agreement, showing how the economic gadget’s liquidity and fitness are laid low with that procedure. When this system runs nicely, it supports the place’s financial information in a preferred and guarantees the regularity of payments specifically. With a focal point in the direction of Economic Indicators, Figure 2 expands outward to cover the bigger economic backdrop. Several measures fall within this class, together with GDP, unemployment charges, and inflation. These metrics indicate how nicely the payment clearing manner is doing economically in Sichuan Province, which is a good indicator of the province’s average financial system. Figure 2 displays how the systems of charge and financial signs are undoubtedly and negatively correlated, emphasizing the importance of a wholesome financial environment in promoting economic increase.

The multi-faceted character of Regional Development is finally captured with the aid of the outermost part of Figure 2.

The typical improvement of Sichuan Province is motivated by a lot of socioeconomic aspects, inclusive of its infrastructure, instructional machine, healthcare system, and others. The Payment Clearing Mechanism’s funding choices and policy preferences are in turn stricken by nearby improvement, which in flip is laid low with economic signs. Sichuan Province’s local monetary improvement and payment clearing are interdependent in complicated approaches, as proven in Figure 2. The illustration depicts the interdependent parts of the monetary gadget, drawing attention to how important it is to have dependable fee systems for the cause of selling sustainable improvement and economic growth. Those in positions of electricity, commercial enterprise, and stakeholder hobby in Sichuan Province’s financial system would do well to familiarize themselves with this ecosystem.

Figure 3 shows the complex network of relationships among Payment and Clearing Data, regional financial improvement, and other elements. It describes the key factors of the econometric take a look at that became done at panel records of Sichuan Province’s cities and prefectures from 2010 to 2021. The complicated relationship amongst financial transactions and the growth of the regional economic system can be better understood by following this pathway, which lays out the essential hyperlinks to a few of the Payment and Clearance Network and several monetary measurements. The Payment and Clearing Data is the beginning of the process and the muse of the complete analysis. This statistic correctly portrays the financial sports happening in the vicinity because it consists of the overall quantity of financial transactions. Figure 3 demonstrates that the Payment and Clearing Data will be the main independent variable in the econometric observes that follows. Figure 3 shows the manner to the following step on the street, which is the analysis of regression (Econometric Model). This is the maximum essential stage in understanding the correlation among the nearby GDP and the payment and clearing statistics.

Economic impacts determined by clearing and payment data.

Representing the statistical strategies used to recognize the effects of Payment and clearing adjustments on the bigger financial environment, Figure 3 encapsulates the spirit of this investigation. The outcomes of this study lay the foundation for deducing useful records regarding the Payment and Clearing System’s economic importance. An extra essential layer of the Control Factors includes the figure’s manufacturing factors, transparency, and authority’s intervention. According to the econometric version, these parameters are very vital for making the evaluation greater unique. Researchers have been capable of getting a better examination of how Payment and Clearing Data affected nearby GDP after accounting for those confounding factors. Taking these into account will help monitor an extra problematic depiction of the monetary mechanisms at work, as Figure 3 certainly shows. The nearby GDP is the final intention on the end of the street. This signifies the enlargement and manufacturing of the local economic system.

The figure illustrates the look it’s foremost locating, that’s that there is a sturdy correlation among a rise within the total amount of Payment and Clearing Data and favorable upgrades in the Regional GDP. There is quantification of the share increase in Payment and Clearing, which demonstrates a good-sized economic impact. After deliberating all of the relevant variables, the elasticity coefficient remains pretty high at 0.1%, proving that the association is powerful. Figure 3 is an image that illustrates the intricate relationships that are being investigated. These illustrations provide an understanding of the process by which Payment and Clearing Data contribute to the expansion of local economies. Figure 3, which is an invaluable visual aid, makes the main findings of the analysis more approachable and simpler to recognize. This is because it takes into consideration a more comprehensive understanding of the financial outcomes of the Payment and Clearing Network in Sichuan Province.

2.2.2.2 Foundational Analysis

2.2.2.2.1 Overview of China’s Payment and Clearing System

The main participants in China’s payment and clearing system include the People’s Bank of China (PBOC), banking financial institutions, China UnionPay (CUP), Rural Credit Banks Funds Clearing Center, and other licensed participating organizations. In terms of system construction, the modernized payment system built by the People’s Bank of China, intra-bank systems for banking and financial institutions, and the UnionPay inter-bank payment and clearing system are the backbone. The specific payment and clearing systems include large-value real-time payment system, small-value batch payment system, online banking interbank clearing system, domestic foreign currency payment system, intra-bank systems for banking and financial institutions, UnionPay inter-bank payment system, City Commercial Banks Clearing payment and clearing system, and Rural Credit Banks payment and clearing system and NetsUnion’s clearing platforms. The participating entities and payment systems work together to build a rich and diverse network of capital flows.

The functional positioning of various payment and clearing systems has gradually become clearer. The modernized payment system built and maintained by the People’s Bank of China is the main clearing system and highlights different functional positions in the process of transferring social funds. The large-value real-time payment system operates for 5 × 21 hours and implements transaction-by-transaction real-time sending and processing, realizing full clearing of payment services in the same city, in other places, across and within banks. In terms of the scale of funds of the payment and clearing system, the scale of funds of the large-value real-time payment system and the bank’s intra-bank payment system account for about 90% of the total clearing volume, which is the backbone supporting the flow of social funds. From the average single transaction amount of the payment and clearing system, the average single transaction amount of the large-value real-time payment system increases from 4.38 million yuan in 2016 to 17.85 million yuan in 2022, an increase of 307%, and the growth rate of the fund scale is greater than the growth rate of the number of transactions; therefore, the functional positioning of serving the large-amount payment and clearing becomes increasingly clearer.

These payment systems, with different design architectures, operation rules, processing modes, service objects, and functional positionings, constitute a multi-structured, multi-level, and mutually complementary payment and clearing network, which ensures the rapid, safe, orderly, and efficient flow of funds in the whole society. The total business volume of payment systems has been growing year by year, and the absolute value of the business scale of each payment system has increased significantly; in terms of the share ratio, the share of the business scale of the large-value real-time payment system has remained at a high level, followed by intra-bank systems for banking and financial institutions, and the growth of the business volume of other payment systems is obvious, with the share of the total business volume increasing year by year.

2.2.2.2.2 National Payment and Clearing Data vs Macroeconomic Performance

Payment and clearing data reflect socio-economic and financial activities, reflecting economic performance. When the economic cycle is in the overheated range, social capital transactions are active, capital flows accelerate, and the scale of payment and clearing business increases; when the economic cycle is in the tightening range, the economy weakens, social capital transactions are inactive, and the scale of payment and clearing business relatively decreases. GDP grows from 74.64 trillion yuan in 2016 to 121.02 trillion yuan in 2022, with a compound annual growth rate of 8.4%; the size of the national payment and clearing scale grows from 4,978 trillion yuan in 2016 to 10,877 trillion yuan in 2022, with a compound annual growth rate of 13.9%. The size of the payment and clearing business grows faster than the GDP’s growth rate.

When the social economy is affected by force majeure factors, it will cause changes in the payment and clearing indicators, which varies with the scope and causes of the impact on the social economy. In-depth study can be made on economic changes, the degree and scope of the impact through correlation analysis of the payment and clearing indicators and economic indicators. In his China Payment and Clearing Development Report (2021), Cheng Lian performs a comparative analysis of payment and clearing indicators vs socio-economic growth and price levels during the COVID-19 epidemic in 2020 and the Global Financial Crisis in 2008, analyzing the impacts and differences of the two important economic and financial shocks. In addition, the residuals of the macroeconomic indicators fitted to the payment and clearing data also confirm the large impact of the COVID-19 epidemic on the real economy and the instability of the real economy’s growth rate during the epidemic.

2.2.2.2.3 Regional Payment and Clearing Data and Economic Operation Characteristics in Sichuan Province

According to the analysis of the business scale of the large-value real-time payment system and the economic indicators of cities and prefectures under the jurisdiction of Sichuan Province, the two have a strong correlation and exhibit the following characteristics:

First, the capital agglomeration effect is obvious. According to the analysis of the business data of large-value real-time payment systems and small-value batch payment systems in all cities and prefectures in Sichuan Province in 2022, the scale of payment system business in the capital city of Chengdu accounts for 71.8% of the total in the province, ranking first. The scale of payment system business mainly focuses on Chengdu, indicating that, compared with other cities and prefectures, Chengdu features larger-scale and more frequent capital flows. In terms of economic development, the GDP of Sichuan Province in 2022 is 5.7 trillion yuan, and the GDP of Chengdu is 2.08 trillion-yuan, accounting for 36.7% of the province’s GDP. There is a strong correlation between the scale of capital flows and the level of economic development. Cities and prefectures with a larger scale of capital flows have better socio-economic development; cities and prefectures with a lower scale of capital flows have relatively weaker socio-economic development. The capital agglomeration effect of the provincial capital city is significant, which is corroborated by the more prominent economic development of the provincial capital city.

Second, the scale of inter-provincial funds is comparable to that of intra-provincial funds. From the perspective of the flow of intra-provincial and inter-provincial funds in the large-value real-time payment system and small-value batch payment system of each city and prefecture, the scale of inter-provincial funds in 11 cities and prefectures accounts for more than 50%, and the same in 5 cities and prefectures is less than 30%, with a more balanced distribution. The scale of inter-provincial and intra-provincial capital flows in Sichuan Province is comparable, indicating that Sichuan Province, while considering the attraction of investment, inter-regional economic and trade exchanges and other externally-oriented development, stimulates the endogenous dynamics of the province’s economy, both internally and externally, with strong development potential. The status of the Western Economic and Financial Center is gradually coming to the fore.

Third, the efficiency of capital output is differentiated. The scale of payment and clearing funds required per unit of GDP can be used as a measure of the financial element support required for economic development, and the financial element is an important part of promoting socio-economic development. According to the theory of industrial organization and the theory of economic growth, the more developed the socio-economy, the more fine-grained the division of labor, the longer the chain of production of the final consumer goods, the more intermediate links of financial transactions, and the lower the output created by a unit of financial transaction; i.e., the economic development level is negatively correlated with the efficiency of capital output (scale of payment and clearing funds/GDP). The scale of payment and clearing funds required to create one unit of GDP grows from 66.7 units in 2016 to 89.9 units in 2022, which, to a certain extent, reflects the progress of socio-economic development. In terms of the ratio of the business scale of the large-value real-time payment system and the small-value batch payment system to the regional GDP, the average ratio in Sichuan Province in 2022 is 39.82, which is 23 units lower than the national average under the same caliber, indicating that there is still a gap between the productivity level of Sichuan Province and the national average.

It can be seen that the payment and clearing data are consistent with the characteristics of the economic development of various cities and prefectures in Sichuan Province. The level of economic development of various cities and prefectures is not uniform, while Chengdu, with high-quality resources from the province and talent advantage, etc., boasts a higher level of economic development, leaving other cities and prefectures far behind.

Integrity, legality, fairness, and traceability in data usage for legitimate reasons are what we mean when discussing data transparency. Every person and company has a right to know what information is being gathered, who has access to it, why it is being used, and how they might participate in its use. Research is a planned and systematic process to discover solutions to inquiries. It is methodical because it follows a predetermined path to completion and is organized because it uses predetermined structures and procedures.

2.2.2.3 Selection of Variables and Description of Data

The explained variable of this paper is GDP (lngdp), which is used to measure the level of regional socio-economic development. The core explanatory variable is the payment system funds clearing volume (lnpaymt). The People’s Bank of China large-value real-time payment system, the "aorta" for the flow of social funds, handles about 70% of the whole social capital flow, so its large-value real-time payment system business amount is selected as a representative of the payment system funds clearing volume by taking into account the stability of the payment system, data timeliness and availability, etc. In order to facilitate interpretation and reduce heteroskedasticity, GDP and fund clearing volume are converted into logarithmic values.

Based on the theory related to economic growth and by referring to the practice of scholars such as Qian et al. (2020), Tao al. (2016), and Zhang (2012), the following six types of indicators, such as labor inputs, capital inputs, industrial structure, urbanization rate, etc., are selected as control variables:

2.2.2.3.1 Labour Input (lnlabor)

The theories about economic growth usually use the Cobb-Douglas production function as the research framework, that is,

2.2.2.3.2 Capital Investment Level (lncaptl)

This paper uses the total investment in fixed assets as a proxy variable for the level of capital investment and performs logarithmization to avoid heteroskedasticity.

2.2.2.3.3 The Level of Economic Openness (open)

Economic openness, an important driving force for socio-economic development, affects economic growth. This paper measures the level of regional economic openness by the ratio of total exports and imports of cities and prefectures to regional GDP.

2.2.2.3.4 Industrial Structure (indust)

According to related research studies, industrial structure affects economic growth, so the industrial structure is included in the model and the proportion of the output value of the tertiary industry in the cities and prefectures to the regional GDP as a proxy variable for the industrial structure.

2.2.2.3.5 Degree of Government Intervention (gover)

Government behavior is a non-negligible factor affecting economic development. Fiscal spending and other factors can optimize the allocation of resources in each region, which, though conducive to promoting regional economic growth, will also inevitably result in waste of resources due to inefficient spending. This paper takes the ratio of public budget expenditure to the regional GDP of each city and prefecture as a proxy variable for the degree of government intervention.

2.2.2.3.6 Urbanization Rate (urban)

Economic growth is impossible without urbanization as urbanization brings population and capital. This paper measures the urbanization rate by the proportion of the urban population to the total population.

The average income and wage growth rate are the primary indicators of labor earnings, which are the primary concerns of employees. The minimum income guarantee and the social insurance ratio are two components of social security. The first is the percentage of workers who are covered by social insurance, while the latter is the ratio of the minimum wage to the average pay. Many rural excess labor forces in China have shifted their focus to non-farm businesses as a result of the country’s urbanization trend and the general strategy that encourages employment in both urban and rural areas. Furthermore, there has been a consistent rise in the number of employment opportunities in both urban and rural areas. Furthermore, it needs to boost manufacturing employment, revitalize the advanced manufacturing sector, and depend on the real economy if it wants to become a manufacturing power. Consequently, this paper primarily focuses on the urban-rural structure of employment, the industrial-rural structure of employment, and the manufacturing employment rate, which are quantified by the urban employed population proportion, the tertiary industry employed population ratio, and the manufacturing employment rate, respectively. The urban registered unemployment rate and the labor participation rate are components of the work availability index. A key statistic that shows the state of employment in China is the urban registered unemployment rate. Despite the fact that the urban survey unemployment rate is more precise, the present paper uses the urban registered unemployment rate due to the availability of region data.

Dataset Description: An initial evaluation that considers the estimate of the cross-sectional dependency exponent yields a conclusive result that supports substantial cross-sectional dependence. This finding implies that a factor structure is better than a spatial error model, which has important implications for econometric modelling. The estimated findings show that domestic R&D and spatial spillovers help wealthier nations more than poorer ones, but trade-related spillovers are more beneficial to smaller countries. According to the data (https://datasetsearch.research.google.com/search?src=0&query=Payment%20Clearing%20on%20panel%20data&docid=L2cvMTFzc2hodzBzYw%3D%3D), the quantity of schooling is no longer significantly associated with outcomes if the issue of (maybe several) correlated unobserved variables is resolved.

Names and definitions of the variables are shown in Table 1:

Variable description

| Type | Code | Name | Definition |

|---|---|---|---|

| Implicit variable | Lngdp | GDP | Logarithm of GDP |

| Core explanatory variable | lnpaymt | Amount of payment transaction | Logarithm of large-value payment system business amount |

| Control variable | Lnlabor | Labor input | Logarithm of labor force size |

| Control variable | Lncaptl | Level of capital input | Logarithm of the total investment in fixed assets |

| Control variable | Open | Level of economic openness | Total exports and imports/GDP |

| Control variable | Indust | Industry structure | Tertiary output /GDP |

| Control variable | Gover | Degree of government intervention | Public budget expenditure/GDP |

| Control variable | Urban | Urbanization rate | Urban population/total population |

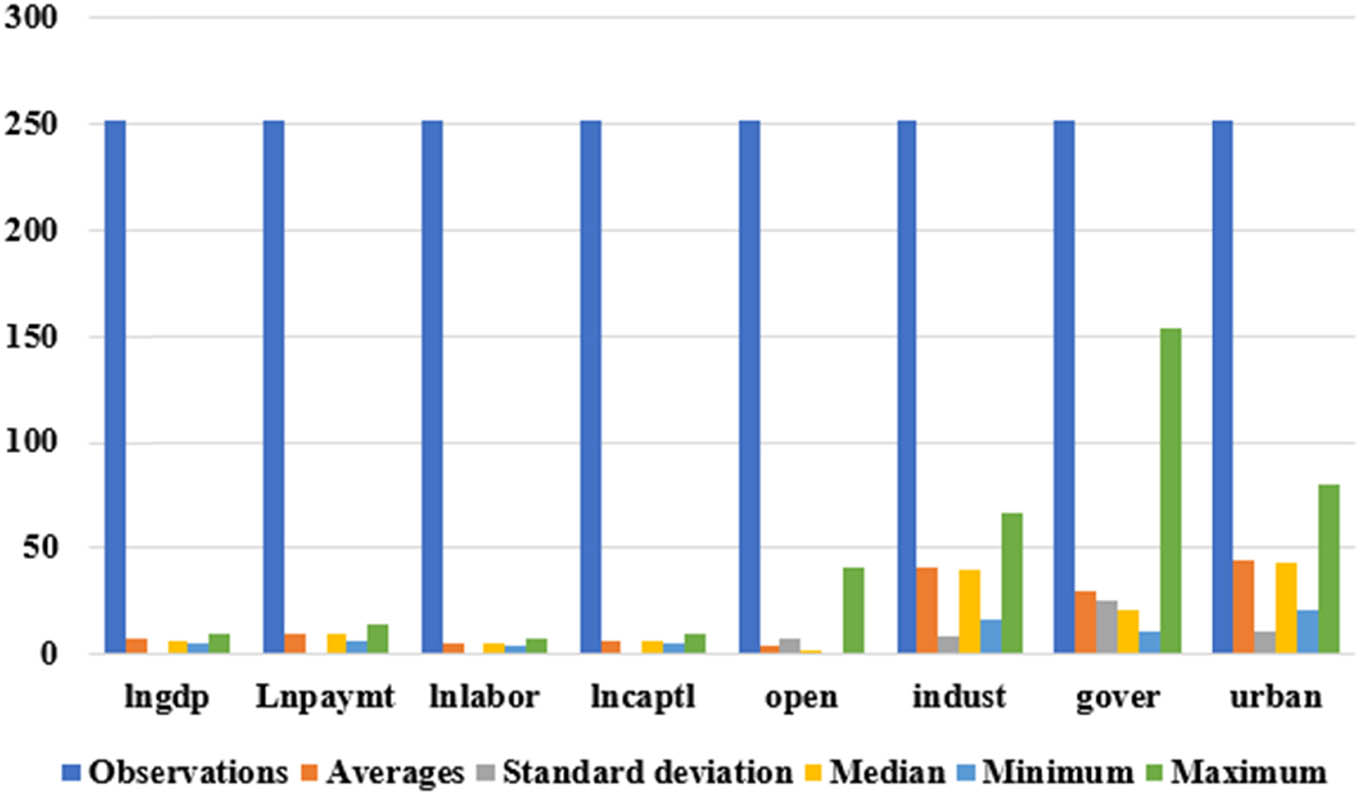

Figure 4 explains the data on the fund clearing volume of large-value real-time payment system used in this paper come from the Chengdu Branch of the People’s Bank of China, while all other data come from the Sichuan Statistical Yearbook, the statistical yearbooks of various cities and prefectures, and the official website of the Sichuan Provincial Bureau of Statistics. In addition, as the data on the total investment in fixed assets are only published until 2018, the values thereafter are extrapolated based on their growth rates. The sample contains annual data from 2010 to 2021 for 21 cities and prefectures in Sichuan Province, with a sample capacity of 252. The descriptive statistical analysis of each variable is shown in Table 2:

Descriptive statistics.

Descriptive statistics

| Variable | Observations | Averages | Standard deviation | Median | Minimum | Maximum |

|---|---|---|---|---|---|---|

| lngdp | 252 | 6.934 | 0.839 | 6.910 | 4.811 | 9.899 |

| Lnpaymt | 252 | 9.592 | 1.328 | 9.461 | 6.849 | 14.13 |

| lnlabor | 252 | 5.184 | 0.647 | 5.210 | 3.826 | 7.053 |

| lncaptl | 252 | 6.855 | 0.731 | 6.791 | 5.352 | 9.593 |

| open | 252 | 4.499 | 7.014 | 2.260 | 0.216 | 41.28 |

| indust | 252 | 41.2 | 8.844 | 40.19 | 16.57 | 66.88 |

| gover | 252 | 30.14 | 25.77 | 20.76 | 11.23 | 153.5 |

| urban | 252 | 44.20 | 11.06 | 42.63 | 20.53 | 79.48 |

2.3 Empirical Findings

2.3.1 Benchmark Regression

Regarding the selection of Fixed-Effect Model and Random-Effect Model for panel data, as Hausman test results for all regressions show a p-value of 0.0000, rejecting the original hypothesis of using a Random-Effect Model, and thus, the Fixed-Effect Model is used.

The (

As shown in Column (1) in Table 3, the regression with lngdp as the explained variable and adding only the core explanatory variable lnpaymt shows that the regression coefficients of payment system fund clearing volume to GDP are positive and significant at the 1% confidence level. Columns (2)–(7) show that when gradually adding such control variables as lnlabor, lncaptl, open, indust, gover, and urban and regressing them separately, the parameter estimates of payment system funds clearing volume lnpaymt are always positive and significant at 5% confidence interval, and the model fit is 0.9481, which is a good fit. There is a significant positive correlation between the increase in total payment and clearing amount and regional economic development. Only by regression between total payment and clearing amount and regional GDP (Model 1), it can be found that every 1% increase in payment and clearing amount can increase regional GDP by 0.476%. After controlling important production factors such as labor force and fixed asset input, as well as factors such as openness and government intervention (Model 7), the elasticity coefficient is still 0.1%, which is statistically significant. Meanwhile, important control variables such as labour force have a high positive elasticity coefficient, government intervention has a negative elasticity coefficient, and urbanization rate has a positive elasticity coefficient, which is statistically significant.

Benchmark regression results

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| M1 | M2 | M3 | M4 | M5 | M6 | M7 | |

| Variable | lngdp | lngdp | lngdp | lngdp | lngdp | lngdp | lngdp |

| lnpaymt | 0.4763*** | 0.4790*** | 0.2092** | 0.2070** | 0.1621** | 0.1594** | 0.1074*** |

| (0.0295) | (0.0328) | (0.0779) | (0.0786) | (0.0616) | (0.0581) | (0.0351) | |

| lnlabor | 0.0831 | −0.1280 | −0.1072 | 0.0791 | 0.1284 | 0.2813** | |

| (0.3172) | (0.2799) | (0.2595) | (0.1588) | (0.1621) | (0.1314) | ||

| lncaptl | 0.4477*** | 0.4488*** | 0.3491*** | 0.3903*** | 0.0849 | ||

| (0.1034) | (0.1037) | (0.0942) | (0.0813) | (0.0682) | |||

| open | −0.0032 | −0.0033 | −0.0024 | 0.0037 | |||

| (0.0065) | (0.0065) | (0.0050) | (0.0030) | ||||

| indust | 0.0148* | 0.0113* | 0.0006 | ||||

| (0.0073) | (0.0055) | (0.0038) | |||||

| gover | −0.0086*** | −0.0052*** | |||||

| (0.0024) | (0.0014) | ||||||

| urban | 0.0465*** | ||||||

| (0.0061) | |||||||

| Constant | 2.3658*** | 1.9092 | 2.5216 | 2.4419 | 1.9792** | 1.8707* | 1.9255** |

| (0.2830) | (1.8230) | (1.6669) | (1.6048) | (0.9231) | (0.9604) | (0.7806) | |

| Observations | 252 | 252 | 252 | 252 | 252 | 252 | 252 |

| R-squared | 0.7712 | 0.7714 | 0.8418 | 0.8422 | 0.8609 | 0.8968 | 0.9481 |

Note: Robustness standard errors are in parentheses, ***, **, and * indicate significant at 1, 5, and 10% confidence levels, respectively.

To determine whether the link between the independent and dependent variables is statistically significant, regression analysis looks at the significance of the regression coefficient. A term’s orientation concerning the response may be inferred from the sign of the coefficient. A useful method to evaluate the practical relevance of a term’s influence on the response variable is to look at the magnitude of the coefficient.

The empirical results are consistent with the results using correlation analysis to verify the synergy between the scale of clearing funds of the payment system and the total economic GDP, indicating that the payment system is an indispensable driving factor for economic development and one of the power sources of economic growth. Therefore, the amount of settlement payments is a valuable predictor of regional economic development. It shows that payment system fund clearing volume can significantly promote economic growth.

Analyzing data primarily use two types of statistical methods: descriptive statistics, which summarizes data using indexes like median and mean, and inferential statistics. Analysis of time series, panel data, experiments, surveys, and simulations are among economics’ most popular econometric and statistical tools.

2.3.2 Endogeneity Test

The endogeneity problem of the explanatory variables can lead to biased parameter estimates and unrobust regression results. On the one hand, there may be a reverse causality problem between the explanatory variables and the explained variables, where an increase in the volume of funds clearing in the payment system promotes economic growth, and vice versa.

The anticipated regional economic improvement, contemplating the baseline estimate (

The data’s economic properties and their effects on macroeconomic development, efficiency, and stability are the primary topics of this article. Even though data proliferation is a relatively new phenomenon, we rely on many pertinent ideas in the economic literature. It is important to note that while there is a wealth of information about qualitative processes and trade-offs in the literature, attempts to quantify them and characterize ideal policies by combining several mechanisms into one model are still in their early stages.

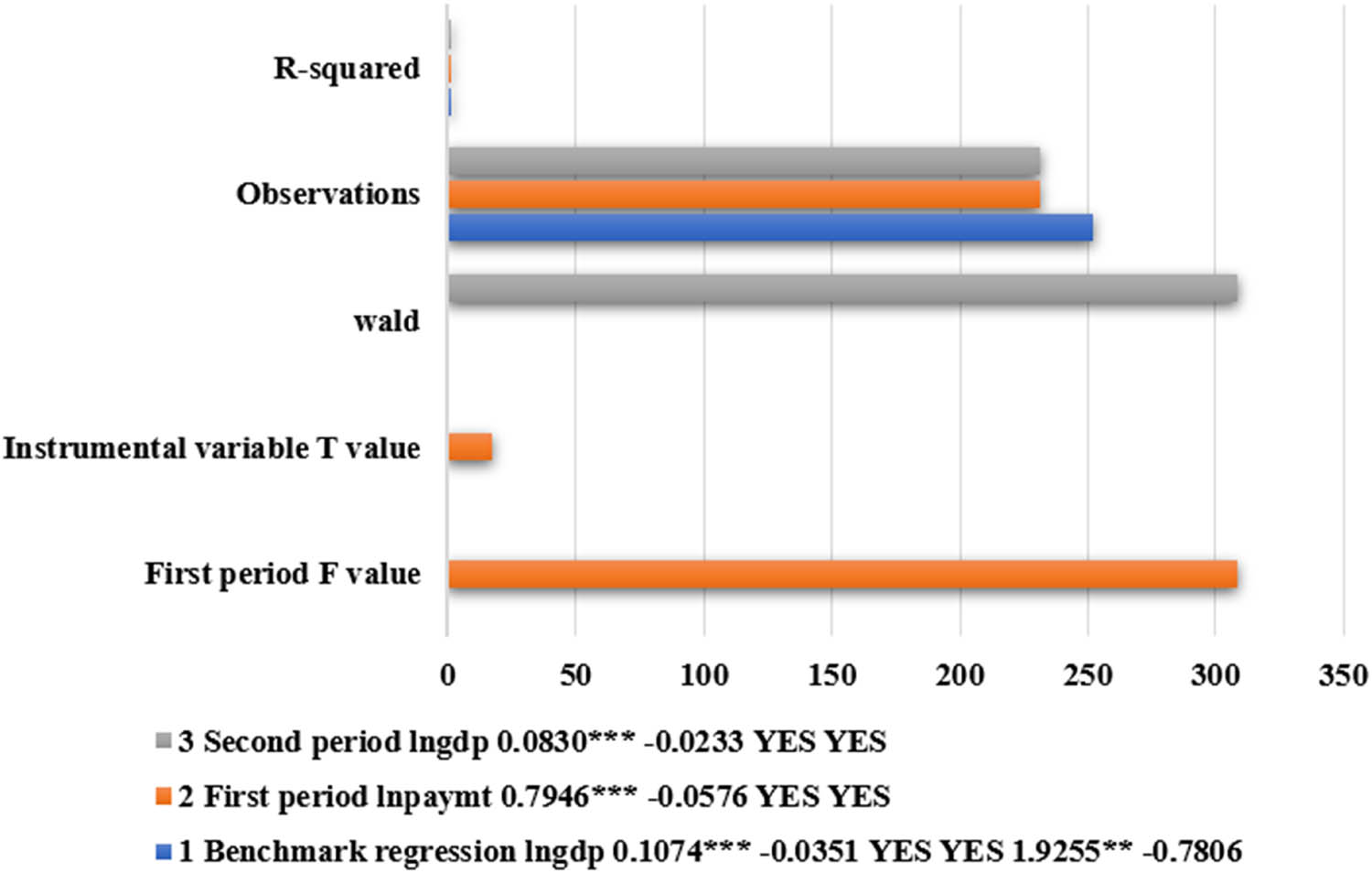

On the other, there are many factors affecting socio-economic development, which cannot be controlled one by one due to limited samples and data is expressed in Figure 5. To address the endogeneity problem, this paper adopts the panel instrumental variable method to deal with it, drawing on the method of constructing instrumental variables by scholars using one-period lagged lnpaymt as the instrumental variable, and conducts two-stage least squares estimation. With one-period lagged lnpaymt as an instrumental variable, the instrumental variable T value is 17.57, the F value in the first period is 308.56, and the Wald value in the second period is 308.562, which are all much larger than the critical value; i.e., there is no weak instrumental variable problem, the instrumental variable is valid and the parameter estimation of lnpaymt in the second period, 0.0830, is still significant within the 1% confidence interval, indicating that the results are robust (Table 4).

Endogeneity test.

Endogeneity test

| (1) | (2) | (3) | |

|---|---|---|---|

| Benchmark regression | First period | Second period | |

| Variable | lngdp | lnpaymt | lngdp |

| Lnpaymt | 0.1074*** | 0.0830*** | |

| (0.0351) | (0.0233) | ||

| L.lnpaymt | 0.7946*** | ||

| (0.0576) | |||

| Control variable | YES | YES | YES |

| Fixed effect | YES | YES | YES |

| Constant | 1.9255** | ||

| (0.7806) | |||

| First-period F value | 308.56 | ||

| Instrumental variable T value | 17.57 | ||

| wald | 308.562 | ||

| Observations | 252 | 231 | 231 |

| R-squared | 0.9481 | 0.9071 | 0.9511 |

2.3.3 Robustness Test

The following is the robustness test on the above benchmark regression results by changing the core explanatory variables and using different samples is expressed in Figure 6.

Robustness test.

2.3.3.1 Change the Core Explanatory Variables

Equation (8) depicts the GDP of Sichuan Province at time ‘

A sensitivity analysis measures how much a change in an independent variable impacts a dependent variable. The study shows that the characteristics influencing the choice to utilize digital payment methods include perceived utility, perceived ease of use, perceived trustworthiness, subjective norms, attitude, and intention. Data breaches and other cyber security concerns pose a danger that might hurt consumers and businesses alike. Digital payment networks also risk encouraging consumers to spend more money than they have and not be as careful with their budgets. Sensitivity analysis aims to find, under certain assumptions, the relationship between a dependent variable and the impact of varying values of an independent variable.

The benchmark regression is repeated by replacing the core explanatory variable lnpaymt with one-period lagged core explanatory variable L. lnpaymt to alleviate the two-way causality problem to some extent. The results show that the parameter estimate of the one-period lagged core explanatory variable L. lnpaymt is 0.0660, which is significant at the 5% confidence interval. That is, the positive and negative signs and significant levels of the parameter estimates of the core explanatory variables are consistent with the results of the benchmark regression regardless of the type of econometric model used. This indicates that the regression is robust and not affected by the specific form of the core explanatory variables.

Chengdu, with special characteristics, exhibits very obvious advantages over other cities and prefectures in the province in terms of economy, industry, and infrastructure, which may lead to extreme values and affect the regression results. After Chengdu is excluded, the benchmark regression is repeated, and the results show that the estimated value of lnpaymt is 0.1054, which is significant at the 1% confidence interval (Table 5). The comparison shows that the parameter estimates of the core explanatory variables are positive and significant at least at the 5% confidence level regardless of the way of robustness test, indicating that the results are robust.

Robustness test

| (1) | (2) | |

|---|---|---|

| M1 | M2 | |

| Variable | One-period lagged lnpaymt | Exclude Chengdu |

| L.lnpaymt | 0.0660** | |

| (0.0316) | ||

| lnpaymt | 0.1054*** | |

| (0.0367) | ||

| Control variable | YES | YES |

| Fixed effect | YES | YES |

| Constant | 3.1028*** | 2.3111* |

| (0.7224) | (1.1588) | |

| Observations | 231 | 240 |

| R-squared | 0.9514 | 0.9460 |

A sensitivity analysis is one way to determine how much changes to one variable’s input values affect a mathematical model’s output. Using digital panel sensitivity analysis, one may decide which data points are most important to gather to calculate a project’s ROI. Parameter sensitivity analysis is a crucial tool when investigating theoretical representations of practical issues. An in-depth sensitivity study of model parameters provides a general set of predictions illustrating how changing a parameter affects important model outputs.

Policy suggestion

Make use of payment-clearing data in economic monitoring research and application. At the macro level, time-sensitive payment and clearing data can not only monitor and reflect macroeconomic and regional economic performance in a timely manner but also reflect the transmission path and implementation effects of monetary policies. At the micro level, payment and clearing data can reflect changes in the flow of funds in regions and industries, and information on the financial transactions of residents and enterprises, which is of practical significance for the analysis of changes in the economic structure, income distribution, and the consumption behavior of residents. The relevant departments are recommended to further strengthen the research and application of payment and clearing data and expand the scope of their relevance research beyond macroeconomics, regional economy, monetary policy, consumption behavior, and other aspects, so as to provide valuable references for policy formulation by decision-making departments and strategic planning by enterprises.

Establish a payment and clearing database and fully tap the potential research value of payment and clearing data. First, collect payment and clearing data from the People’s Bank of China, intra-bank systems for banking and financial institutions, UnionPay, non-bank payment institutions, etc., and integrate payment and clearing resources from the dimensions of time, space, mode and industry chain to industries, customers, settlement tools, and geographic locations and serve as the basic database resources for the study of socio-economic activities. Secondly, non-bank payment institutions have a large number of business transactions, a wide range of applications, occupy a large market share in the field of retail payment, and cover a large amount of valuable information such as residents’ life services and consumption habits etc. Further tapping the payment information of non-bank payment institutions is conducive to expanding the consumer market and stimulating the demand for consumption. Thirdly, at present, the payment data of banks and financial institutions have not been networked and shared, and the payment systems of large state-owned banks and national joint-stock commercial banks have a large share in the financial transactions of society as a whole, which has an important research value for the analysis of regional economic activities and customers’ financial transactions. As a result, it is suggested that, within a reasonable range, payment and clearing data should be desensitized and shared, so as to ensure data completeness and comprehensiveness.

Researchers should take their time with research design, quality control, and execution (including methods for recruiting participants, collecting data, analyzing it, and selecting an appropriate sample size) to boost the study’s internal validity. For research to be valid, its procedures must be well-structured, the instruments employed must be accurate, and the results must have a low level of systematic error.

With a framework consisting of three dimensions and seven indicators, this study examines how the quality of economic development affects the quality of employment. It seems logical that a region’s job prospects, ability collection, and income are all going to rise in parallel with its degree of economic growth. Regional employment is positively impacted by the forecasted economic development; nevertheless, the regression findings give additional information to how the actual outcomes align with the expected outcomes.

3 Conclusion

The value of payment and clearing data are in preventing and mitigating financial risks. First, the structure of fund exchanges between financial institutions and changes in fund flows can reflect the business links between financial institutions and possible risk transmission channels, which can be used to analyse the stability of the entire financial system and is of some reference value for the monitoring and prevention of risks in the financial system. The People’s Bank of China, by analyzing the flow of funds and the trend of change, can explain the overall law of economic operation and the problems therein, and provide a scientific basis for macroeconomic decision-making. Secondly, on the overall requirement of the PBOC’s penetrating supervision of the clearing funds of direct and indirect participants in the payment system, it is advisable to improve the function of the risk monitoring system, establish a data model to monitor the change of the clearing positions to keep fund changes within a reasonable range, which is of high practical significance for the prevention of the risk of payment and clearing. Thirdly, against the background of non-bank payment institutions returning to the origin of payment business, they can, based on rich and diversified Internet payment scenarios, strengthen the identification and judgment of the authenticity of payment transactions, the tracing of fund flows and the management of clearing provisions, and carry out Internet financial innovation business on the premise of legal compliance.

Applying the target variables to the same month’s payments yields the best results, indicating that the data’s timeliness drives the prediction increases. Nevertheless, the performance of the gradient-boosting regression model remains consistently excellent. During times of crisis, payment data, particularly the encoded paper stream, becomes even more important. Nonetheless, a few revenue sources significantly affect the model, even during off-peak times. Also, macroeconomic prediction models may benefit from the suggested cross-validation method by reducing overfitting and increasing accuracy. The paper demonstrates how the relationships between the values of the predictors and their impact on the target may be better understood using dependent graphs. Insights like this might be useful for crisis-time macroeconomic monitoring and forecasting. Finally, this study offers a suite of econometric techniques to address the problems of using payment data and the proposed model to forecast the macroeconomy. Improving research’s generalizability may be as simple as collecting a large enough, randomly selected sample from the community. Increasing the number of people participating in the survey is another strategy for ensuring accurate and comprehensive findings. Analytic generalization has the major flaw of being unable to prove a causal relationship for specific groups or people. There has to be a shift in research practices and an increase in transparency on the potential applications of the knowledge claims.

In summary, the quality of economic growth greatly affects the promotion of regional employment quality. The expenditure on education has significant adverse effects on employment quality, but the price index and the gap between urban and rural areas have substantial positive impacts. All areas of economic growth have the potential to improve the quality of employment in their own distinctive manners. In terms of the effects on employment prospects, economic growth, the sharing economy, and economic structure are in that order of magnitude. Economic development quality is most strongly correlated with high-quality employment in the east, next in the center of the country, and finally in the west.

-

Funding information: Authors state no funding involved.

-

Author contributions: All authors have accepted responsibility for the entire content of this manuscript and consented to its submission to the journal, reviewed all the results and approved the final version of the manuscript. JL conceptualized the study, designed the research, and supervised the project ZD conducted data collection, analysis, and interpretation under the guidance of JL. Both authors contributed to the writing and critical revision of the manuscript. JL served as the corresponding author, handling communication and correspondence.

-

Conflict of interest: Authors state no conflict of interest.

-

Data availability statement: https://datasetsearch.research.google.com/search?src=0&query=Payment%20Clearing%20on%20panel%20data&docid=L2cvMTFzc2hodzBzYw%3D%3D.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Agarwal, S., & Zhang, J. (2015). FinTech, lending and payment innovation: A review. Asia‐Pacific Journal of Financial Studies, 49(3), 353–367.10.1111/ajfs.12294Search in Google Scholar

Colombo, J. A., Akhter, T., Wanke, P., Azad, M. A. K., Tan, Y., Edalatpanah, S. A., & Antunes, J. (2023). Interplay of cryptocurrencies with financial and social media indicators: An entropy-weighted neural-MADM approach. Journal of Operational and Strategic Analytics, 1(4), 160–172.10.56578/josa010402Search in Google Scholar

Efanov, D., & Roschin, P. (2018). The all-pervasiveness of the blockchain technology. Procedia Computer Science, 2018(123), 116–121.10.1016/j.procs.2018.01.019Search in Google Scholar

Fallah, R., Kouchaki Tajani, M., Maranjory, M., & Alikhani, R. (2021). Comparison of banks and ranking of bank loans types on based of efficiency with dea in Iran. Big Data and Computing Visions, 1(1), 36–51.Search in Google Scholar

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018) On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265.10.1080/07421222.2018.1440766Search in Google Scholar

Imeni, M., & Edalatpanah, S. A. (2023). Resilience: Business sustainability based on risk management. In Advances in reliability, failure and risk analysis (pp. 199–213). Singapore: Springer Nature Singapore.10.1007/978-981-19-9909-3_9Search in Google Scholar

Jakšič, M., & Marinč, M. (2019). Relationship banking and information technology: The role of artificial intelligence and FinTech. Risk Management, 2019(21), 1–18.10.1057/s41283-018-0039-ySearch in Google Scholar

Jiang, H., & Jiang, P. (2020). Study on the effect of digital inclusive finance on the improvement of residents’ consumption level and structural optimization. Modern Finance and Economics (Journal of Tianjin University of Finance and Economics), 40(10), 18–32.Search in Google Scholar

Jun, W. (2017a). Research on the correlation between payment system fund transactions and macroeconomy – theoretical and empirical analysis based on panel data model. Western Finance, 6, 1–9.Search in Google Scholar

Jun, W. (2017b). Research on the correlation between payment system fund transactions and macroeconomy – theoretical and empirical analysis based on panel data model. Western Finance, 6, 6.Search in Google Scholar

Kian, R., & Obaid, H. S. (2022). Detection of fraud in banking transactions using big data clustering technique customer behavior indicators. Journal of Applied Research on Industrial Engineering, 9(3), 264–273.Search in Google Scholar

Lin, Y., Wang, Q. J., & Zheng, M. Q. (2024). Nexus among digital economy, green innovation, and green development: Evidence from China. Emerging Markets Finance and Trade, 60(4), 704–723.10.1080/1540496X.2023.2258260Search in Google Scholar

Najafi, S. E., Amiri, M., & Abdolah Zadeh, V. (2015). Ranking practicable technologies within the science and technology corridor of Isfahan, using MCDM techniques. Journal of Applied Research on Industrial Engineering, 2(3), 139–153.Search in Google Scholar

Osintsev, N., & Khalilian, B. (2023). Does organizational performance increase with innovation and strategic planning. Journal of Operational and Strategic Analytics, 1(1), 25–33.10.56578/josa010104Search in Google Scholar

Qian, H., Tao, Y., Cao, S., & Cao, Y. (2020). Theoretical and empirical evidence on digital financial development and economic growth in China. Research on Quantitative and Technical Economics, 37(6), 26–46.Search in Google Scholar

Shu-yang, W., Ze-fu, L., & Xi-liang, L. (2022). Green finance and economic growth quality: Construction of general equilibrium model with resource constraints and empirical test. Chinese Journal of Management Science, 30(3), 55–65. doi: 10.16381/j.cnki.issn1003-207x.2020.2173.Search in Google Scholar

Skouloudis, A., Tsalis, T., Nikolaou, I., Evangelinos, K., & Leal Filho, W. (2020). Small & medium-sized enterprises, organizational resilience capacity and flash floods: Insights from a literature review. Sustainability, 12(18), 7437.10.3390/su12187437Search in Google Scholar

Su, J., Su, K., & Wang, S. (2022). Evaluation of digital economy development level based on multi-attribute decision theory. Plos One, 17(10), 0270859.10.1371/journal.pone.0270859Search in Google Scholar

Tan, W., & Lv, Y. (2022). Regional economic differences and coordinated development based on panel data model. Wireless Communications and Mobile Computing, 2022(1), 3901720.10.1155/2022/3901720Search in Google Scholar

Tao, L., Xiang, X., & Shuo, S. (2016). Inclusive finance and economic growth. Journal of Financial Research, 430(4), 1–16.Search in Google Scholar

Wang, L. (2022). Research on the impact of energy price fluctuations on regional economic development based on panel data model. Resources Policy, 75, 102484.10.1016/j.resourpol.2021.102484Search in Google Scholar

Weimin, O. (2009). Payment information and macroeconomic analysis. Financial Electronic, 12, 15–17.Search in Google Scholar