Abstract

One of the most outstanding accomplishments of the economic science over the last decades is the development of a sound and coherent theory of economic growth. Research in growth theory has demonstrated that significant and systematic increases in well-being are attainable whenever the right formula is implemented. When combined with efficiency, the ingredients of this formula – innovation, the diffusion of ideas, and human capital accumulation – can drive the economy toward a virtuous path of sustained growth. Notwithstanding, this is an overly optimistic view of growth that does not account for the many obstacles that the creation of wealth may encounter. The current essay surveys cutting-edge research on growth theory to conclude in favor of a paradigm shift: the main concern is no longer just with how to correctly combine production inputs, but with how their efficient use is eventually hampered by a large collection of worldwide risks and threats. Global risks come in many shapes (they can be classified as economic, environmental, geopolitical, societal, and technological) but, in any case, they call for a reexamination of growth theory.

1 Introduction

The World Economic Forum, an independent international organization whose main purpose is to foster public-private cooperation at the highest levels of decision-making, publishes every year, since 2006, the Global Risks Report. The aims and scope of this publication consist of a thorough systematization and assessment of the main and most pressing threats that humanity currently faces. The report defines global risk as “the possibility of the occurrence of an event or condition which, if it occurs, would negatively impact a significant proportion of global GDP, population or natural resources.” (2023 Report, p. 5). As characterized, the notion of risk should be interpreted loosely, to include every danger, menace, and potential disaster that threatens our fragile collective existence.

The mentioned report compartmentalizes risks into five broad categories: economic, environmental, geopolitical, societal, and technological. The contents of each category are self-explanatory. On the economic front, macroeconomic risks are highlighted; these include the prospect of economic stagnation and recessions, rising inflation and unemployment, asset bubbles, and debt crises, especially in large economies. Also relevant, regarding the threats posed to the world economy, are the possibility of commodity shocks, the collapse of supply chains, and the proliferation of illicit activities, such as organized crime, trade in counterfeit goods, and tax evasion and fraud.

In what concerns the second category, the environment, a long list of threats can also be enunciated, including human-made environmental damages, overexploitation and mismanagement of critical natural resources, climate change, the loss of biodiversity, extreme weather events, and geophysical disasters. Geopolitical risks encompass terrorism, the threat posed by weapons of mass destruction, geoeconomic and geopolitical confrontations, civil wars, and the dismemberment of multilateral organizations and arrangements.

The societal category covers a wide array of risks, from those associated with the spread of infectious diseases (epidemics and pandemics) to many other issues raised by our coexistence in society (e.g., the erosion of public institutions and social cohesion, the deterioration of working conditions and job opportunities, the disillusionment of the youth, or the emergence of large-scale involuntary migrations). Finally, technological risks are, currently, associated with cybercrime and cyberespionage, digital inequality and digital power concentration, and, among others, the eventual inadvertent or malicious breakdown of critical information infrastructures.

Most of the aforementioned risks do not manifest themselves in isolation. Although a global crisis may erupt from a single seed of dystopia, this can spread fast, to other areas of the economy and the society, creating what one might designate as a perfect storm. The COVID-19 pandemic and the recent escalation of geopolitical tensions are two prototypical examples of seeds of dystopia that fueled the uprise of many other meaningful threats (e.g., soaring inflation, increasingly worrisome cyber-security breaches, deeper social fragmentation, massive refugee crises, or the rise of inequalities within and among countries). The substantiation of some of the enunciated threats, and even the mere perception that they might somehow materialize, may seriously hamper economic growth in a variety of ways. The challenge that growth theorists nowadays face is precisely to incorporate these threats into their models and to effectively explain how they might influence the pace of material progress as we know it today.

This essay undertakes a selective survey of growth theory (of contributions published from 2020 onward) to clarify that most recent additions to the theory acknowledge and are aware of the main obstacles that worldwide economic growth faces. This contrasts with earlier contributions, which were much more focused on efficiency issues and on how countries should successfully combine the available physical, human, and technological inputs with the objective of maximizing intertemporal utility. Although the aim continues to be the same, i.e., the promotion of material well-being, the focal point is that scholars have, today, a much clearer perception that the existing risks might threaten the efficacy of the conventional formulas leading to sustained economic growth.

The remainder of the article is organized as follows. Section 2 highlights the pieces of literature that directly and generically approach the impact of probable significant disasters and rare events on the economy’s growth rate. Special focus is placed on an analytical framework capable of quantifying the growth effects of a disaster and, also, the growth impact of the risk itself. In Section 3, technological risks are addressed. The relevant literature is surveyed, and the typical endogenous growth model is reinterpreted in light of the presence of an additional input: robotic capital and/or artificial intelligence.

Section 4 proceeds with a reflection on the interplay between the spread of infectious diseases and economic growth. To share ideas and knowledge, human contact is required; however, with increased human contact comes the possibility of faster dissemination of diseases. The worldwide fast dissemination of the COVID-19 pandemic was the direct consequence of the globalized and interconnected world we live in today, which leads to an undeniable piece of evidence: the closer the globalization process brings us together, the stronger it becomes the risk of catastrophic public health events. In Section 5, environmental risks are highlighted. Environmental concerns are progressively becoming an inseparable part of growth analyses. This is illustrated by exploring an adapted version of a recently proposed model of climate change and growth. In Section 6, geopolitical risks are briefly debated. These may take many forms and they can be associated with growth models in many ways. A typical neoclassical growth model allowing for political instability is characterized to illuminate the impactfulness of this type of risk.

In Section 7, a few additional notes on economic risks are added to the survey, and Section 8 concludes.

2 The Accommodation of Risks and Disasters in Growth Models

Global economic growth is subject to a wide variety of risks. Although these may be somehow interconnected, they are different in nature, and therefore, as expected, different strands of literature deal with the impact of dissimilar threats in distinct ways, as the sections that follow will highlight. Despite this diversity, there are a few recent studies that address, in a generic and abstract way, the potential impact of menaces and actual disasters on growth. These include Barro and Jin (2021), Douenne (2020), Hao et al. (2020), Jovanovic and Ma (2022), and Krishna et al. (2023). The common point in the mentioned studies is the presence of uncertainty associated with some aspects of the growth process: the outcome of the adoption of new technologies might be uncertain, investment decisions might be unpredictable, or stochastic rare events may cause unforeseeable changes in consumption.

The model by Douenne (2020) is particularly well-suited to approach the impact of risks on growth. It is a relatively standard optimal growth model where the combination of recursive utility with a stochastic capital accumulation process allows for the quantification of the effect of disaster risks and of the consequences of actual disasters over the growth rate derived under an endogenous growth setup. In this section, Douenne’s framework is recovered, and its discussion is further extended.

Let

Douenne’s model is particularly appealing because it allows for a clear distinction between the notions of intertemporal elasticity of substitution and the coefficient of relative risk aversion (CRRA). This separation is feasible if the agent’s preferences are represented through a recursive utility function of the Epstein-Zin type. In this model, the utility function takes the form:

In expression (1),

The maximization of utility is subject to a constraint on the accumulation of capital. This is a stochastic differential equation, which is represented under the following form:

In equation (2),

For the characterized dynamics, the average growth of the stock of capital is written as follows:

The maximization of utility in (1) subject to capital accumulation constraint (2) requires employing optimal control techniques for stochastic problems. Following the same procedure as in Douenne (2020), the computation of the Hamilton–Jacobi–Bellman equation conducts to an optimal solution in which the consumption–capital ratio is constant. Under the proposed formulation, on the optimal path, the consumption–capital ratio is as follows:

The impact of risk and risk aversion over the consumption-capital ratio is contingent on the value of the elasticity of intertemporal substitution,

Substituting the optimal consumption–capital ratio in (4) into (3), one obtains the expected growth rate or the average long-run growth rate (of capital, consumption, and income),

The growth rate in expression (5) involves three terms with different meanings. The first term corresponds to the no-risk outcome, the well-known Euler equation result, according to which the pace of growth is essentially determined by the difference between the marginal return on capital and the rate of time preference. The second term represents the impact of risks on growth; the risk may increase the pace of growth if

The above reasoning considers multiple risks (n risks, to be precise) but no association between them. As mentioned in the introduction, the threat of a large-scale nefarious event (e.g., a pandemic or a war) is just a probable seed of dystopia that easily spreads to many other areas of society or the economy. Hence, one may conceive a scenario in which an initial high-probability–high-intensity risk is just the first step in a chain of foreseeable events with progressively lower intensity and probability of occurring. A stylized form of representing the above reasoning consists of taking a first risk of probability

Taking

If risks following the initial threat are of some significance, meaning that the values of

Douenne (2020) introduces an additional relevant topic, namely the possibility of deliberate risk mitigation. In what respects global risks, the effort to lower them requires an international coordination of efforts, because the large majority of the already highlighted risks are associated with global commons (e.g., the preservation of the environment, peacekeeping, or the prevention of infectious diseases). Because free riding is unavoidable, the international community should at least guarantee a coalition of the willing.

Analytically, in the context of the model, risk mitigation consists of diverting a share of income,

One considers that the risk reduction effort is exerted only upon the first risk (the seed of dystopia). Because all other risks depend on the first, the risk reduction spreads over all potential subsequent disasters. In this case, the optimal consumption–capital ratio is

and the expected growth rate comes,

The prevention of disasters has a negative direct impact on growth because it diverts resources from capital accumulation, but it has a positive effect via disaster avoidance. The growth effect via risk is, again, dependent on the intertemporal elasticity of substitution.

The characterized model is general enough to be applicable to any kind of global risk. However, different types of risks have specificities, concerning growth, that are worth exploring. This exploration begins in the following section, with a discussion about threats of a technological nature.

3 The Wonders of Automation and Artificial Intelligence: What Can Go Wrong?

The progress associated with computational capabilities and artificial intelligence opens new significant promising prospects regarding long-term growth. In this respect, a pertinent question is raised by Nordhaus (2021): are we heading toward a singularity point, i.e., toward a moment in history in which, without much human intervention, growth could accelerate further and further? This idyllic scenario is rapidly discarded by the author, based on empirical estimates and the use of a few logical arguments. The strong idea is that technological wonders are necessarily accompanied by relevant technological risks that must be accounted for in order to prevent major technological disasters.

Technological risks are an unavoidable side effect of the progressive sophistication of digital tools and other technical novelties. Such tools rely on increasingly high levels of connectivity and integration, which is necessarily accompanied by rising vulnerabilities. One must not forget that the technologies that foster growth are the same technologies that can be used for criminal activities, espionage, and other fraudulent and destructive activities. Moreover, the eventual path toward the creation of super-intelligent machines can be a threat on its own, because with intelligence comes the ability to reason and to create and frame moral norms. For these reasons, and others (namely, the scarcity and non-renewable nature of most physical resources), it is safe to assert that we are not heading toward a singularity.

Most of the endogenous growth literature that equates the role of automation and artificial intelligence is a little bit more down to earth than what the above paragraphs might suggest. The main concern that transpires from such literature respects to the short- and medium-term impact of the new technologies on employment and income distribution. These new technologies support a new form of capital that, unlike physical capital, is a substitute and not a complement to labor. Recent studies addressing automation and growth include Acemoglu and Restrepo (2022), Abeliansky and Prettner (2023), Gasteiger and Prettner (2022), Hémous and Olsen (2022), Klarl (2022), Lu (2021, 2022), Moll et al. (2022), Irmen (2021), Prettner and Strulik (2020), Ray and Mookherjee (2022), and Sasaki (2023).

The above-mentioned research proposes a wide variety of models and frameworks that are distinct in their structure and approach, but that share some common ground: in any of the cases, automation replaces labor (at least low-skilled labor), and it allows for enhanced productivity. At the end of the day, the new production capabilities are likely to foster growth, but one should not jump immediately to this conclusion. With automation comes the polarization of jobs and wages and the concomitant increase in income inequality (low-skilled workers lose for high-skilled workers and capital owners). As a significant part of the population loses income, two potentially damaging consequences emerge: a fall in aggregate demand and an increase in social discontentment. These collateral effects might overcome the productivity gains from automation, in what respects growth and, most evidently, in what concerns social welfare.

Accounting for automation in standard growth analysis requires adding a new input to the short list of production factors that are typically assumed. This new input is robotic capital (automated machines and processes, and artificial intelligence algorithms). As highlighted by Abeliansky and Prettner (2023), robotic capital mixes features of both traditional inputs: it is like labor, because it occupies the same role as human labor in the production process, and it is like capital, because it can be accumulated and it represents the non-human contribution to production. In the study by Lu (2021), the automation input is directly interpreted as artificial intelligence. This is a special form of capital, with singular and non-trivial properties. It has similarities with human capital, because it can learn and accumulate knowledge by itself; it has similarities with ideas, because they are both nonrival.

In the study by Bloom et al. (2023), the distinction between industrial robots and artificial intelligence is made analytically explicit. These are interpreted as two separate inputs in production. Roughly speaking, while robots are a replacement for low-skilled workers in the development of routine tasks, artificial intelligence substitutes for high-skilled workers, who perform non-routine creative tasks. This distinction is important and has consequences for the organization of work, income distribution and, ultimately, growth. While conventional automation processes place downward pressure on the wages of low-skilled workers, thus increasing the skill premium (i.e., the value of the ratio between the wages of high-skilled workers and low-skilled workers), ChatGPT and related technologies that replicate human thinking and creativity predominantly influence the wages of high-skilled labor (although these cutting-edge technologies may put pressure as well on the subsistence of low-skilled jobs).

Consequently, artificial intelligence is likely to contribute to a reduction in the skill premium, as the performance of high-skilled tasks becomes no longer exclusive to imaginative human minds. In either case (i.e., whether machines and algorithms replace humans in the completion of routine activities or cognitive demanding tasks), the phenomenal increase in the efficiency of technologies that replace human participation and effort in production threatens jobs, welfare, and also growth, as it concentrates the means of production in the hands of a few capital owners in detriment of the large army of workers that populate society.

Besides industrial robots and ChatGPT-like technologies, yet another novel input might be considered to compose the aggregate production function that underlies growth analyses. This input is big data (Cong et al., 2022), and it differs from robotic capital/artificial intelligence in the sense that it is not a substitute for labor. However, these factors also share some properties: they are nonrival and, unlike human capital, they can be detached from people and concentrated in the hands of a few, thus contributing to strong levels of income and wealth inequality. Besides this, the use of data raises another critical risk for people, namely the risk associated with their privacy.

Based on the mentioned literature, a synthesis model can be compiled. Start by assuming a Cobb–Douglas production function, with robotic capital denoted by

In equation (1), standard notation is adopted:

Define

In a competitive economy, factor returns correspond with their respective marginal products. In the devised scenario, the wage rate is identical to the rate of return on robotic capital,

The rate of return on physical capital is:

Under this simple formulation, it is straightforward to observe that the labor income share falls with an increase in the employment of robotic capital:

In contrast, if one defines capitalists as the agents who hold any form of capital (physical and robotic), their income share is:

From expression (15), one concludes that as the participation of robotic capital in production increases, the income share of capitalists increases as well.

The above logical argumentation can be extended to include the separation between industrial robots and artificial intelligence (Bloom et al., 2023). In this case, production function (10) can be augmented by splitting the human workforce into unskilled labor (

In intensive form,

In equation (17),

In the current case, wages and returns from different forms of capital are, respectively,

The skill premium is straightforward to display, given expressions (18) and (19),

The computation of derivative

Other meaningful results are attached to the weight of wages and capital returns on income. Equations (18) and (19) directly indicate that the higher the values of ϱ(t) and ς(t), the lower will be the wage income share; i.e., additional automation, via robotic capital and artificial intelligence, contributes to a decline of the relative income of workers. Consequently, as the values of ϱ(t) and ς(t) rise, reflecting the stronger relative presence of automated processes in production, the more income will be concentrated in the hands of capital owners, which poses a real and concrete danger for social and political stability.

To associate all the above reasoning to a growth model, one would need to consider a standard physical capital accumulation equation and an intertemporal felicity function. Then, it would be necessary to add one (or more) robotic capital sector(s) to the analysis: the self-replicating features of robots and, essentially, of artificial intelligence make it reasonable to consider that no other input is required for its generation and that, probably, in the current stage of development, this input would escape the prevalence of diminishing marginal returns. As a result, in this framework, robotic capital and ChatGPT-like technologies become the drivers of endogenous growth. However, this is a different type of growth; it is a growth process that largely amplifies inequalities and that changes the structure of demand in the economy.

Hence, the analysis of growth in the automated economy clearly requires a modeling framework with heterogeneous agents: by separating workers from capital owners, one will be able to discern how the ongoing unconstrained evolution of technology represents a risk, not only for those who directly suffer with the loss of jobs, but to all people that may end up living in a dystopian world populated by an ever-increasing army of excluded.

4 Lessons from the Pandemic

The ravaging global pandemic of the early 2020s raised disquieting interrogations about the reality that we had taken for granted concerning world prosperity and growth. It revealed how a low-risk, huge-impact event may suddenly affect the lives of everyone on this planet. It also showed that accounting for growth is not just an exercise of measuring the quantity and quality of inputs and the efficiency in their use; there are relevant societal issues, in this case about public health, that must be accounted for. As it is evident, the COVID pandemic led to a rethinking of growth theory in the presence of health emergencies and disasters. Meaningful recent work on the macroeconomic consequences of the spread of infectious diseases comprehends the works of Carmona and León (2023), Fogli and Veldkamp (2021), Hao et al. (2023), Lu (2023), and Shi (2023).

The most common strategy in assessing the growth implications of the propagation of infectious diseases, followed by most of the above-mentioned literature, consists of merging benchmark optimal growth models with standard epidemiological analytical frameworks of the SIR (susceptible–infectious–recovered) type. As individuals pass from each epidemiological state to the next, the economy also evolves from one growth stage to another. Evidently, periods in which a significant percentage of the population is in an infectious state are periods of slower growth. The channels from disease to growth are essentially three: labor productivity, human capital accumulation, and population growth. Combined, the various negative effects might have devastating consequences for the world economy and the living standards of people around the world.

Some of the work on the impact of infectious diseases on growth, most noticeably that of Fogli and Veldkamp (2021), establish a link between the spread of diseases and the diffusion of ideas and technology. The argument is that interaction among people diffuses both ideas and diseases. Therefore, given their health conditions and systems, countries must choose an adequate balance between knowledge diffusion and the risk of the transmission of infirmities. Knowledge and infectious pathogens have one characteristic in common: they are both nonrival; however, they have an antagonistic nature in the sense that the first is a global good, while the second is a global bad. The assessment of externalities must be pondered: the positive externalities originating in knowledge diffusion must be weighed against the negative externalities that the diffusion of virus and germs brings.

As an illustration of the growth implications of disease propagation, consider the following straightforward reasoning. Imagine a standard growth model, with physical and human capital as production inputs. In this setup, the driver of growth is human capital accumulation; thus, let us concentrate on the motion of this input, represented in what follows by variable

With the above information, one can display the growth rate of human capital (which will also be the growth rate of the economy under a trivial two-sector optimal growth setup) in the following terms:

Assume that

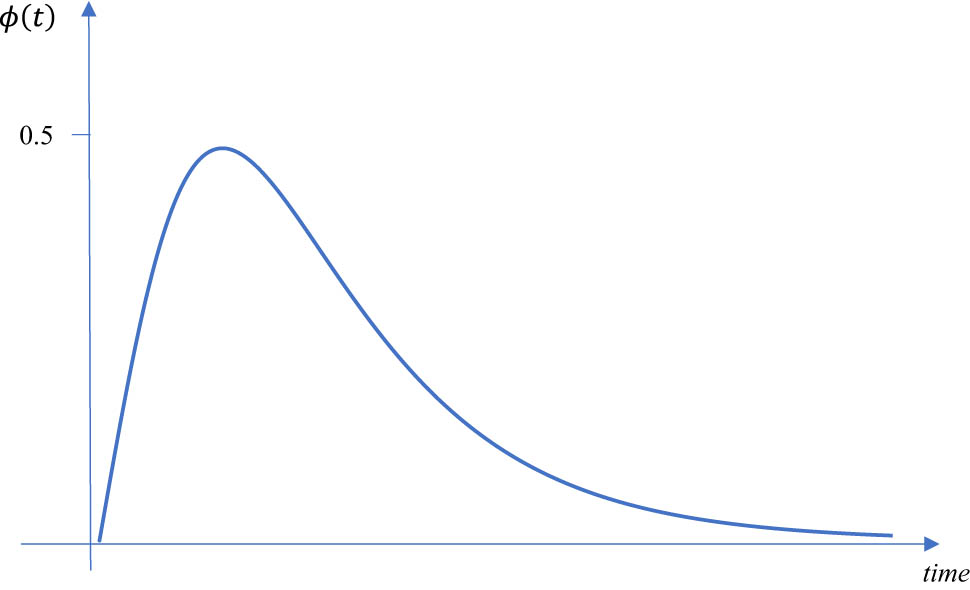

All parameters in equation (23) are positive values. Figure 1 illustrates the evolution of the infection rate for

Double-logistic epidemic diffusion.

In this simple framework, given equation (22), in the absence of the disease, the economy grows at a constant rate. The effect of the epidemic is to provoke a transient fall in the growth rate. Figure 2 illustrates this effect for the spreading mechanism displayed in Figure 1 and characterized through equation (23).

Transitional path implied by the spread of an infectious disease.

The above reasoning directly applies to the dissemination of a disease but, in fact, it is adaptable to many other societal threats. Any event leading to social distrust or the breakdown of social ties (e.g., the growing youth disillusionment mentioned in the introduction) may cause a negative impact on the accumulation of human capital. In the sketched framework, the impact is transitory, in the sense that it is expected that the health issue will be resolved sooner or later. Some societal problems might be more profound and eventually trigger a growth slowdown of a more permanent nature.

5 The Greatest of Them All: The Environmental Externality

As remarked in the latest editions of the Global Risks Report, environmental threats (climate change, extreme weather episodes, biodiversity losses, depletion of natural resources, and man-made disasters) occupy the first place in the ranking of global risks, in terms of both likelihood and expected damaging impact. Due to their catastrophic nature, environmental risks are hard to reconcile with economic theory and, in particular, with growth theory, which privileges “business as usual.” Nonetheless, there is a voluminous new literature searching for a coherent integration between the two. It is safe to say that environmental concerns have become an increasingly relevant part of the theory of economic growth.

Contributions are dispersed and approach diverse aspects of the environmental menace. One of the most prominent topics concerns the impact of pollution or, more precisely, carbon emissions (Oliveira & Lima, 2022; Olijslagers et al., 2023; van den Bremer & van der Ploeg, 2021). Measuring the social cost of carbon is a complicated task, given the inherent long-term uncertainty that makes it unfeasible to compute undisputable discount rates to quantify the current value of future damages. In growth models, the environment is frequently added to the analysis through the exploration of the pollution-growth trade-off: pollution is a by-product of production, while environmental quality is an argument of the utility function. The solution for the underlying conundrum consists of promoting the transition to clean production technologies (Hart, 2020).

Casey (2024) and Hassler et al. (2021) develop growth models in which technical change endogenously evolves to increase energy efficiency and to adapt to environmental changes. Energy dependence will then determine the structure of production and the pace of growth. Fabozzi et al. (2022) look at the economy from the perspective of green growth. Green growth is associated with the notion of putting science and technology at the service of environmental preservation, at the same time they facilitate growth. This requires rethinking technological change and, also, the very own concept of growth. One way of following such a path is to recenter attention to the ideas of recycling, reusing, and refurbishing (i.e., to adopt a circular economy worldview). However, as Zhou and Smulders (2021) highlight, the conversion to a circular economy also has its perils: excessive resource savings may hamper innovation and, consequently, have detrimental growth effects.

Addressing environmental issues in the context of growth theory requires, as well, assembling models capable of integrating, in a single framework, the management of scarce and non-renewable resources, population dynamics, innovation, and the accumulation of knowledge, in order to search for the most likely drivers of sustained growth in a world of finite physical resources (Peretto, 2021; Sriket & Suen, 2022). Other ingredients can be added as well, namely health (Wei & Aadland, 2022): environmental degradation is detrimental to human health, which can compromise productivity and human capital accumulation.

To exemplify how environmental risks can be associated with the analytics of growth, a simple model of climate change, based on the study by Cruz and Rossi-Hansberg (2024), is now devised. The framework is a typical optimal growth model, where the consumption–capital accumulation trade-off is complemented by a series of considerations regarding energy use, carbon dioxide emissions, local amenities, and climate change.

Consider a world economy (O) with multiple locations indexed by r. At date t and location r, per capita consumption, income, and physical capital are represented by

Function

Parameter

where value

Variable

In this setting, productivity is impacted by climate change, with productivity falling as the temperature eventually departs from the optimal level at location r,

In expression (29),

Concerning preferences, the utility function of the representative agent in location r encloses two arguments: consumption and local amenities,

The amenities term takes a shape similar to productivity in (29), i.e.,

If the temperature remains at its optimal level, the utility from consumption comes multiplied by

The above-characterized growth apparatus is a Ramsey growth model involving climate change considerations. The main point to retain is that although energy is an input in production in region r, this contributes only partially to global emissions. A tragedy of the commons scenario clearly emerges, as in any other assessment of possible environmental damages. Therefore, the key environmental variable,

6 A Tumultuous and Conflicted World

Politics and geostrategic interests are, on many occasions, influential contextual factors underlying growth performance. Fragile political systems and social unrest prevent the creation of a stimulating environment for the accumulation and efficient use of production inputs. Geopolitical risks embrace many different types of threats, which implies the need for a wide variety of growth frameworks to approach different topics from different perspectives.

The type of political regime is a relevant element. The intrinsic characteristics of freedom and participation that are typical of democratic societies contain some of the seeds that allow growth to germinate, but this effect is neither linear nor universal (Eberhardt, 2022). Paradoxically, in certain geographies, economic growth and political control appear to go hand in hand. Beraja et al. (2023) argue that artificial intelligence technologies and autocratic regimes might reinforce each other; autocrats benefit from the mechanisms of control that new technologies allow for (e.g., facial recognition), and therefore, they have reasons to incentivize innovation. Obviously, this can backfire if the evolution of the technology becomes uncontrollable from the point of view of the political regime.

Another important element is conflict. Both at the national and at the international levels, armed conflicts entail heavy macroeconomic costs, typically materializing on significant falls in consumption and trade (De Groot et al., 2022; Le et al., 2022; Novta & Pugacheva, 2021; Thies & Baum, 2020). As argued by Geloso and Ponder (2023), there is no silver lining attached to armed conflicts: the illusion of wartime prosperity emerging from the mobilization effort (with direct effects on government spending and employment) is rapidly overtaken by the costs associated with the loss of lives and the destruction of physical and human capital; furthermore, there is an opportunity cost of the resources employed in the conflict and that, thus, are diverted from improving people’s lives.

Conflict is a key factor in holding back economic development; it is one of the most relevant seeds of dystopia, awakening many other risks. A sound political environment is associated with the absence of conflict and with the building of trust. Bjørnskov (2022) argues that social trust enhances productivity growth and has also a role in consolidating formal institutions. O’Reilly (2021) adds to the discussion the argument that war has an important impact on institutional quality, and this impact tends to be strongly negative.

Regarding economic theory, conflict and war are frequently modeled through strategic interaction frameworks, namely those that rely on the tools of game theory. Modeling conflicts requires understanding the incentives economic agents have in confronting others or refraining from confrontation. Conflicts arise because there are contestable resources, i.e., resources that the players consider to be worth attempting to violently monopolize them. The study by Kimbrough et al. (2020) shows a detailed survey on the economic theory of conflict.

Also relevant, from the geostrategic risks’ perspective, is the behavior and practices of politicians in power. Such behavior conveys an important sign for those who strive, in society, to accomplish better lives. The type of leadership (i.e., the personality of the leaders and their technical capabilities), or the extent to which corruption and nepotism are more or less pervasive, create the incentives (bad or good) for people to engage in activities that foster innovation, human capital accumulation, and the creation of wealth (Brown, 2020; Perez-Alvarez & Strulik, 2021; Varvarigos, 2023). Political instability can also be interpreted as an impactful force underlying growth, as in the growth model proposed by Tohmé et al. (2022).

Let us concentrate attention on Tohmé’s model. The model (a standard neoclassical optimal growth setup) sets the stage to address the implications of political instability on growth and welfare. The baseline assumption is the heterogeneity associated with the rate of time preference. Specifically, it is assumed that the intertemporal discount rate is a decreasing function of income (agents with a low income are the most impatient agents). In this setup, a political system selects a ruler. This ruler governs the economy taking into consideration her own intertemporal preferences, which become the intertemporal preferences of the society. Political systems may vary, in the sense that the ruler might be selected by majority voting, proportional representation, or not chosen at all if a dictatorship is established.

The ruler may be overthrown. Political instability sets in whenever the deposition of the ruler in power is frequent, and the regime is characterized by short periods of office. If the probable horizon in power is shortened, then the ruler will increase the rate of time preference, with the objective of compensating for the expected loss of utility for not staying a longer period of time in power. The shorter horizon will trigger higher levels of consumption and lower levels of capital accumulation in the short run, which might compromise long-term growth, thus imposing an inferior steady-state outcome.

The above logic can be analytically translated in the following terms. Let

The maximization of objective function (32) is subject to a trivial capital accumulation differential equation,

Parameter

In equation (34),

Therefore, the steady state will be poorer (lower levels of consumption and capital) when the instability is stronger; i.e., the effort of the government to remain in office makes growth fall. Hence, under the simple structure of the model, there is a negative correlation between political instability and economic growth. In practice, the intuition for this outcome is obvious: unstable executives tend to be more corrupt, suffer from myopia in fiscal policy decisions, and spend more and contract higher levels of debt.

7 […] and Much More

The discussion thus far has highlighted a large collection of risks that have the potential to disturb the world economy in a more or less persistent way. There are many other substantial risks that economists have considered in their analyses of development and growth, and that were not yet mentioned. Some of them blend in naturally in growth models, as they have an eminently economic nature. This section proceeds with a short survey of the literature dealing with some of the risks that did not deserve particularly special attention in previous sections.

Let us begin by recovering the central role that innovation and diffusion play in framing the pace of growth. Innovation and the adoption of technologies are intrinsically associated with firm dynamics and market concentration. Hence, a relevant risk of the creation and exchange of ideas comes from rigid market structures, where incumbent firms obstruct entry and concentrate power, thus imposing low business dynamism (Akcigit & Ates, 2021; Aghion et al., 2023). The diffusion of ideas and technological interdependence are particularly relevant at the international level (Buera & Oberfield, 2020); however, one must not forget the associated perils, namely the rising inter-state inequality, the undesired migratory movements, and the hardship for developing countries that emerges from unfair trading practices (Afonso & Longras, 2022; Chattopadhyay, 2020; Jin & Zhou, 2022; Lindner & Strulik, 2020; Parello, 2022).

Bubbles, understood as strong, persistent, and pervasive deviations of asset prices from their fundamental values, are typically interpreted as a short-term macro phenomenon associated with income variations over the business cycle. However, bubbles may have long-lasting effects and constitute an effective risk for growth (Guerron-Quintana et al., 2023; Xavier, 2023). Regarding growth, two mechanisms that work in opposite directions need to be considered: the bubbly episodes per se tend, by definition, to incentivize investment and, thus, to speed up capital accumulation, with a positive effect on growth (realized bubbles provoke a crowding-in effect). On the contrary, the expectation of future bubbles triggers a crowding-out effect, because economic agents will anticipate higher future wealth and react by increasing current consumption to the detriment of savings and investment.

In general, the architecture of the financial system and how public authorities choose to regulate it is a clear potential source of risks for the world economy. Growth models that take into account the globalization of financial markets and their underlying risks tend to admit that the straightforward impact of financial liberalization over the creation of wealth is positive. However, with global finance, there comes a rise in inequality that, as insistently mentioned in this essay, may compromise growth (Heimberger, 2022; Ho, 2022; Lee, 2023; Marrero & Rodríguez, 2023).

As a final remark, let us pose the following question: is the world at risk of running out of ideas? Ideas and knowledge are fundamental growth drivers; therefore, it is not absurd to ask whether one of the risks the world economy faces is an eventual unrecoverable loss of creativity. There are two reasons to argue that the growth of ideas is in danger. On the one hand, there is evidence pointing to the fact that the current process of accumulation of ideas is subject to diminishing marginal returns. As documented in the study by Bloom et al. (2020), research productivity is declining sharply, even where and when the research effort and the number of researchers are increasing. On the other hand, Jones (2022a) emphasizes that the main reason for the decline in the number of new ideas is the world’s lower rates of fertility. In a future with negative rates of population growth, we might be heading to an empty planet result, where the stock of knowledge and living standards may stagnate or decline.

In counterpoint to the above arguments, Jones (2022b) elaborates on two lines of thought. First, the empty planet outcome can be counteracted by a better allocation of human resources: inclusive societies can discover new talents (missing Einsteins) and stimulate the creativity of more people over longer periods of time (Agénor et al., 2021; Celik, 2023; Kuhn & Prettner, 2023). The second answer for the exhaustion of ideas resides in the powers of artificial intelligence; artificial intelligence can assist (or, in the limit, replace) people in research.

8 Conclusion

In his seminal work on economic growth, Robert Lucas initiates the article’s introduction with the following words (Lucas, 1988, p. 3):

“By the problem of economic development I mean simply the problem of accounting for the observed pattern, across countries and across time, in levels and rates of growth of per capita income. This may seem too narrow a definition, and perhaps it is, but thinking about income patterns will necessarily involve us in thinking about many other aspects of societies too (…)”

As bluntly stated in the citation, the study of economic growth is essentially about the characterization of income patterns. To understand how income evolves, one needs to know what lies behind its replication, namely which factors need to be accumulated and how should they be combined in order to generate progressively larger levels of output. This is growth theory, or at least the growth theory that we, economists and researchers, have become used to know and accept.

The current study argues in favor of a fundamental shift in growth theory. Although models explaining the role of product and process innovation, creative destruction, basic and applied research, and dissemination of ideas, continue to populate growth literature, there is a growing concern with the large collection of real-world episodes and events that threaten our way of life and our capacity to continuously raise living standards. Such concern is, today, very much present in growth theory, as evidenced in this survey. It is no exaggeration to assert that growth theory is evolving to a theory in which challenges and menaces are an indissociable part of the way in which we think about economic progress.

Table 1 synthesizes and systematizes the main contents of the discussion, by highlighting the five categories of risks and by assigning to each of the three examples of relevant references (other influential references are mentioned throughout the text) and five keywords that connect global threats to the development of a more robust economic growth theory.

The five risks in growth theory: a synthesis

| Risk category | Examples of contributions to growth theory | Keywords |

|---|---|---|

| Economic | Jones (2022b) |

|

| Aghion et al. (2023) | ||

| Guerron-Quintana et al. (2023) | ||

| Environmental | van den Bremer and van der Ploeg (2021) |

|

| Zhou and Smulders (2021) | ||

| Cruz and Rossi-Hansberg (2024) | ||

| Geopolitical | Novta and Pugacheva (2021) |

|

| Perez-Alvarez and Strulik (2021) | ||

| Tohmé et al. (2022) | ||

| Societal | Fogli and Veldkamp (2021) |

|

| Hao et al. (2023) | ||

| Shi (2023) | ||

| Technological | Prettner and Strulik (2020) |

|

| Nordhaus (2021) | ||

| Bloom et al. (2023) |

Most of the risks faced by national and local economies are global risks. This essentially signifies that they are somehow associated with common goods whose management requires international coordination (e.g., the environment, geopolitical stability, or digital networks). It also implies the need for a new look over growth: first, no country or region is an island, and no growth model should envision to explain growth without embracing a global perspective; second, free-riding is a relevant issue to take into consideration in a world of common threats and private interests; third, as mentioned throughout the article, global risks are intertwined and they cannot be compartmentalized if one truly seeks an overarching understanding of their implications for growth.

Accounting for risks and threats of every sort is today a pressing task growth theory must embrace. Along with the text, it became clear that most of the relevant risks are already on the radar of growth theorists. However, an integrated theory of global risks and economic growth (a GREG theory) is still missing. Developing and deepening such theory is a vital task now in the hands of those who embraced the mission of developing further this discipline.

Acknowledgements

The author is pleased to acknowledge the financial support from Fundação para a Ciência e a Tecnologia (Portugal) under Project UIDB/04007/2020. The author also acknowledges the helpful assessment of two anonymous referees and thanks them for their comments and insights. The usual disclaimer applies.

-

Funding information: Financial support from Fundação para a Ciência e a Tecnologia (Portugal) under Project UIDB/04007/2020 has been received.

-

Conflict of interest: The author has no relevant financial or non-financial interests to disclose.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Abeliansky, A. L., & Prettner, K. (2023). Automation and population growth: Theory and cross-country evidence. Journal of Economic Behavior & Organization, 208(April), 345–358.10.1016/j.jebo.2023.02.006Suche in Google Scholar

Acemoglu, D., & Restrepo, P. (2022). Demographics and automation. Review of Economic Studies, 89(1), 1–44.10.1093/restud/rdab031Suche in Google Scholar

Afonso, Ó., & Longras, A. R. (2022). Corruption, institutional quality, and offshoring: How do they affect comparative advantage, inter‐country wage inequality, and economic growth? Metroeconomica, 73(4), 987–1020.10.1111/meca.12388Suche in Google Scholar

Agénor, P. R., Ozdemir, K. K., & Pinto Moreira, E. (2021). Gender gaps in the labour market and economic growth. Economica, 88(350), 235–270.10.1111/ecca.12363Suche in Google Scholar

Aghion, P., Bergeaud, A., Boppart, T., Klenow, P. J., & Li, H. (2023). A theory of falling growth and rising rents. Review of Economic Studies, 90(6), 2675–2702.10.1093/restud/rdad016Suche in Google Scholar

Akcigit, U., & Ates, S. T. (2021). Ten facts on declining business dynamism and lessons from endogenous growth theory. American Economic Journal: Macroeconomics, 13(1), 257–298.10.1257/mac.20180449Suche in Google Scholar

Barro, R. J., & Jin, T. (2021). Rare events and long-run risks. Review of Economic Dynamics, 39(January), 1–25.10.1016/j.red.2020.08.002Suche in Google Scholar

Beraja, M., Kao, A., Yang, D. Y., & Yuchtman, N. (2023). AI-tocracy. Quarterly Journal of Economics, 138(3), 1349–1402.10.1093/qje/qjad012Suche in Google Scholar

Bjørnskov, C. (2022). Social trust and patterns of growth. Southern Economic Journal, 89(1), 216–237.10.1002/soej.12590Suche in Google Scholar

Bloom, N., Jones, C. I., van Reenen, J., & Webb, M. (2020). Are ideas getting harder to find? American Economic Review, 110(4), 1104–1144.10.1257/aer.20180338Suche in Google Scholar

Bloom, D. E., Prettner, K., Saadaoui, J., & Veruete, M. (2023). Artificial intelligence and the skill premium. BETA Working Paper, 2023–2037.10.2139/ssrn.4607353Suche in Google Scholar

Brown, C. O. (2020). Economic leadership and growth. Journal of Monetary Economics, 116(December), 298–333.10.1016/j.jmoneco.2019.11.004Suche in Google Scholar

Buera, F. J., & Oberfield, E. (2020). The global diffusion of ideas. Econometrica, 88(1), 83–114.10.3982/ECTA14044Suche in Google Scholar

Carmona, J., & León, A. (2023). Pandemic effects in the solow growth model. Bulletin of Economic Research, 75(3), 671–687.10.1111/boer.12376Suche in Google Scholar

Casey, G. (2024). Energy efficiency and directed technical change: Implications for climate change mitigation. Review of Economic Studies, forthcoming.10.1093/restud/rdad001Suche in Google Scholar

Celik, M. A. (2023). Does the cream always rise to the top? The misallocation of talent in innovation. Journal of Monetary Economics, 133(January), 105–128.10.1016/j.jmoneco.2022.11.003Suche in Google Scholar

Chattopadhyay, S. (2020). Growth, income distribution and unemployment in a two‐sector economy. Metroeconomica, 71(4), 715–733.10.1111/meca.12299Suche in Google Scholar

Cong, L. W., Wei, W., Xie, D., & Zhang, L. (2022). Endogenous growth under multiple uses of data. Journal of Economic Dynamics and Control, 141(August), 104395.10.1016/j.jedc.2022.104395Suche in Google Scholar

Cruz, J. L., & Rossi-Hansberg, E. (2024). The economic geography of global warming. Review of Economic Studies, forthcoming.10.1093/restud/rdad042Suche in Google Scholar

De Groot, O. J., Bozzoli, C., Alamir, A., & Bruck, T. (2022). The global economic burden of violent conflict. Journal of Peace Research, 59(2), 259–276.10.1177/00223433211046823Suche in Google Scholar

Douenne, T. (2020). Disaster risks, disaster strikes, and economic growth: The role of preferences. Review of Economic Dynamics, 38(October), 251–272.10.1016/j.red.2020.04.007Suche in Google Scholar

Eberhardt, M. (2022). Democracy, growth, heterogeneity, and robustness. European Economic Review, 147(August), 104173.10.1016/j.euroecorev.2022.104173Suche in Google Scholar

Fabozzi, F. J., Focardi, S., Ponta, L., Rivoire, M., & Mazza, D. (2022). The economic theory of qualitative green growth. Structural Change and Economic Dynamics, 61(June), 242–254.10.1016/j.strueco.2022.02.005Suche in Google Scholar

Fogli, A., & Veldkamp, L. (2021). Germs, social networks, and growth. Review of Economic Studies, 88(3), 1074–1100.10.1093/restud/rdab008Suche in Google Scholar

Gasteiger, E., & Prettner, K. (2022). Automation, stagnation, and the implications of a robot tax. Macroeconomic Dynamics, 26(1), 218–249.10.1017/S1365100520000139Suche in Google Scholar

Geloso, V., & Ponder, C. (2023). The myth of wartime prosperity: Evidence from the canadian experience. Social Science Quarterly, 104(4), 377–394.10.1111/ssqu.13252Suche in Google Scholar

Guerron-Quintana, P. A., Hirano, T., & Jinnai, R. (2023). Bubbles, crashes, and economic growth: Theory and evidence. American Economic Journal: Macroeconomics, 15(2), 333–371.10.1257/mac.20220015Suche in Google Scholar

Hao, J., Gregg, H., & Yao, Y. (2023). COVID-19 and long-term economic growth. Australian Economic Review, 56(2), 221–237.10.1111/1467-8462.12500Suche in Google Scholar

Hao, Y., Su, H., & Zhu, X. (2020). Rare disaster concerns and economic fluctuations. Economics Letters, 195(October), 109454.10.1016/j.econlet.2020.109454Suche in Google Scholar

Hart, R. (2020). Growth, pollution, policy!. European Economic Review, 126(July), 103455.10.1016/j.euroecorev.2020.103455Suche in Google Scholar

Hassler, J., Krusell, P., & Olovsson, C. (2021). Directed technical change as a response to natural resource scarcity. Journal of Political Economy, 129(11), 3039–3072.10.1086/715849Suche in Google Scholar

Heimberger, P. (2022). Does economic globalisation promote economic growth? A meta‐analysis. World Economy, 45(6), 1690–1712.10.1111/twec.13235Suche in Google Scholar

Hémous, D., & Olsen, M. (2022). The rise of the machines: Automation, horizontal innovation, and income inequality. American Economic Journal: Macroeconomics, 14(1), 179–223.10.1257/mac.20160164Suche in Google Scholar

Ho, W. H. (2022). Financial market globalization, deglobalization policies and growth. Economica, 89(356), 1024–1049.10.1111/ecca.12434Suche in Google Scholar

Irmen, A. (2021). Automation, growth, and factor shares in the era of population aging. Journal of Economic Growth, 26(4), 415–453.10.1007/s10887-021-09195-wSuche in Google Scholar

Jin, W., & Zhou, Y. (2022). Growth and convergence through technological interdependence. Macroeconomic Dynamics, 26(5), 1338–1374.10.1017/S1365100520000589Suche in Google Scholar

Jones, C. I. (2022a). The end of economic growth? Unintended consequences of a declining population. American Economic Review, 112(11), 3489–3527.10.1257/aer.20201605Suche in Google Scholar

Jones, C. I. (2022b). The past and future of economic growth: A semi-endogenous perspective. Annual Review of Economics, 14(august), 125–152.10.1146/annurev-economics-080521-012458Suche in Google Scholar

Jovanovic, B., & Ma, S. (2022). Uncertainty and growth disasters. Review of Economic Dynamics, 44(April), 33–64.10.1016/j.red.2021.04.002Suche in Google Scholar

Kimbrough, E. O., Laughren, K., & Sheremeta, R. (2020). War and conflict in economics: Theories, applications, and recent trends.” Journal of Economic Behavior & Organization, 178(C), 998–1013.10.1016/j.jebo.2017.07.026Suche in Google Scholar

Klarl, T. (2022). Fragile robots, economic growth and convergence. Economic Modelling, 112(July), 105850.10.1016/j.econmod.2022.105850Suche in Google Scholar

Krishna, P., Levchenko, A. A., Ma, L., & Maloney, W. F. (2023). Growth and risk: A view from international trade. Journal of International Economics, 142(May), 103755.10.1016/j.jinteco.2023.103755Suche in Google Scholar

Kuhn, M., & Prettner, K. (2023). Rising longevity, increasing the retirement age, and the consequences for knowledge‐based long‐run growth. Economica, 90(357), 39–64.10.1111/ecca.12445Suche in Google Scholar

Le, T. H., Bui, M.T., & Uddin, G.S. (2022). Economic and social impacts of conflict: A cross-country analysis. Economic Modelling, 115(October), 105980.10.1016/j.econmod.2022.105980Suche in Google Scholar

Lee, B. (2023). Wealth inequality and endogenous growth. Journal of Monetary Economics, 133(January), 132–148.10.1016/j.jmoneco.2022.11.004Suche in Google Scholar

Lindner, I., & Strulik, H. (2020). Innovation and inequality in a small world. International Economic Review, 61(2), 683–719.10.1111/iere.12437Suche in Google Scholar

Lu, C. H. (2021). The impact of artificial intelligence on economic growth and welfare. Journal of Macroeconomics, 69(September), 103342.10.1016/j.jmacro.2021.103342Suche in Google Scholar

Lu, C. H. (2022). Artificial intelligence and human jobs. Macroeconomic Dynamics, 26(5), 1162–1201.10.1017/S1365100520000528Suche in Google Scholar

Lu, C. H. (2023). A note on infectious disease, economic growth, and related government policy. Macroeconomic Dynamics, 27(5), 1481–1494.10.1017/S1365100522000268Suche in Google Scholar

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3–42.10.1016/0304-3932(88)90168-7Suche in Google Scholar

Marrero, G. A., & Rodríguez, J. G. (2023). Unfair inequality and growth. Scandinavian Journal of Economics, 125(4), 1056–1092.10.1111/sjoe.12531Suche in Google Scholar

Moll, B., Rachel L., & Restrepo P. (2022). Uneven growth: Automation’s impact on income and wealth inequality. Econometrica, 90(6), 2645–2683.10.3982/ECTA19417Suche in Google Scholar

Nordhaus, W. D. (2021). Are we approaching an economic singularity? Information technology and the future of economic growth. American Economic Journal: Macroeconomics, 13(1), 299–332.10.1257/mac.20170105Suche in Google Scholar

Novta, N., & Pugacheva, E. (2021). The macroeconomic costs of conflict. Journal of Macroeconomics, 68(June), 103286.10.1016/j.jmacro.2021.103286Suche in Google Scholar

Olijslagers, S., van der Ploeg, F., & van Wijnbergen, S. (2023). On current and future carbon prices in a risky world. Journal of Economic Dynamics and Control, 146(January), 104569.10.1016/j.jedc.2022.104569Suche in Google Scholar

Oliveira, G., & Lima, G. T. (2022). Economic growth as a double-edged sword: The pollution-adjusted Kaldor-Verdoorn effect. Ecological Economics, 199(September), 107449.10.1016/j.ecolecon.2022.107449Suche in Google Scholar

O’Reilly, C. (2021). Violent conflict and institutional change. Economics of Transition and Institutional Change, 29(2), 257–317.10.1111/ecot.12269Suche in Google Scholar

Parello, C. P. (2022). Migration and growth in a schumpeterian growth model with creative destruction. Oxford Economic Papers, 74(4), 1139–1166.10.1093/oep/gpab065Suche in Google Scholar

Peretto, P. F. (2021). Through scarcity to prosperity: Toward a theory of sustainable growth. Journal of Monetary Economics, 117(January), 243–257.10.1016/j.jmoneco.2020.01.004Suche in Google Scholar

Perez-Alvarez, M., & Strulik, H. (2021). Nepotism, human capital and economic development. Journal of Economic Behavior & Organization, 181(January), 211–240.10.1016/j.jebo.2020.11.034Suche in Google Scholar

Prettner, K., & Strulik, H. (2020). Innovation, automation, and inequality: Policy challenges in the race against the machine. Journal of Monetary Economics, 116(December), 249–265.10.1016/j.jmoneco.2019.10.012Suche in Google Scholar

Ray, D., & Mookherjee, D. (2022). Growth, automation, and the long-run share of labor. Review of Economic Dynamics, 46(October), 1–26.10.1016/j.red.2021.09.003Suche in Google Scholar

Sasaki, H. (2023). Growth with automation capital and declining population. Economics Letters, 222(January), 110958.10.1016/j.econlet.2022.110958Suche in Google Scholar

Shi, S. (2023). Knowledge, germs, and output. Review of Economic Dynamics, 48(April), 297–319.10.1016/j.red.2022.06.002Suche in Google Scholar

Sriket, H., & Suen, R. M. (2022). Sources of economic growth in models with non-renewable resources. Journal of Macroeconomics, 72(June), 103416.10.1016/j.jmacro.2022.103416Suche in Google Scholar

Thies, C. F., & Baum, C. F. (2020). The effect of war on economic growth. Cato Journal, 40(1), 199–212.Suche in Google Scholar

Tohmé, F., Caraballo, M. A., & Dabús, C. (2022). Instability, political regimes and economic growth. A theoretical framework. Metroeconomica, 73(1), 291–317.10.1111/meca.12362Suche in Google Scholar

van den Bremer, T. S., & van der Ploeg, F. (2021). The risk-adjusted carbon price. American Economic Review, 111(9), 2782–2810.10.1257/aer.20180517Suche in Google Scholar

Varvarigos, D. (2023). Cultural persistence in corruption, economic growth, and the environment. Journal of Economic Dynamics and Control, 147(February), 104590.10.1016/j.jedc.2022.104590Suche in Google Scholar

Wei, S., & Aadland, D. (2022). Physical capital, human capital, and the health effects of pollution in an OLG model. Macroeconomic Dynamics, 26(6), 1522–1563.10.1017/S1365100520000668Suche in Google Scholar

World Economic Forum. (2023). Global Risks Report, 2023 edition. Geneva, Switzerland.Suche in Google Scholar

Xavier, I. (2023). Bubbles and stagnation. Journal of the European Economic Association, 21(6), 2460–2484.10.1093/jeea/jvad024Suche in Google Scholar

Zhou, S., & Smulders, S. (2021). Closing the loop in a circular economy: Saving resources or suffocating innovations? European Economic Review, 139(October), 103857.10.1016/j.euroecorev.2021.103857Suche in Google Scholar

© 2024 the author(s), published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Regular Articles

- Political Turnover and Public Health Provision in Brazilian Municipalities

- Examining the Effects of Trade Liberalisation Using a Gravity Model Approach

- Operating Efficiency in the Capital-Intensive Semiconductor Industry: A Nonparametric Frontier Approach

- Does Health Insurance Boost Subjective Well-being? Examining the Link in China through a National Survey

- An Intelligent Approach for Predicting Stock Market Movements in Emerging Markets Using Optimized Technical Indicators and Neural Networks

- Analysis of the Effect of Digital Financial Inclusion in Promoting Inclusive Growth: Mechanism and Statistical Verification

- Effective Tax Rates and Firm Size under Turnover Tax: Evidence from a Natural Experiment on SMEs

- Re-investigating the Impact of Economic Growth, Energy Consumption, Financial Development, Institutional Quality, and Globalization on Environmental Degradation in OECD Countries

- A Compliance Return Method to Evaluate Different Approaches to Implementing Regulations: The Example of Food Hygiene Standards

- Panel Technical Efficiency of Korean Companies in the Energy Sector based on Digital Capabilities

- Time-varying Investment Dynamics in the USA

- Preferences, Institutions, and Policy Makers: The Case of the New Institutionalization of Science, Technology, and Innovation Governance in Colombia

- The Impact of Geographic Factors on Credit Risk: A Study of Chinese Commercial Banks

- The Heterogeneous Effect and Transmission Paths of Air Pollution on Housing Prices: Evidence from 30 Large- and Medium-Sized Cities in China

- Analysis of Demographic Variables Affecting Digital Citizenship in Turkey

- Green Finance, Environmental Regulations, and Green Technologies in China: Implications for Achieving Green Economic Recovery

- Coupled and Coordinated Development of Economic Growth and Green Sustainability in a Manufacturing Enterprise under the Context of Dual Carbon Goals: Carbon Peaking and Carbon Neutrality

- Revealing the New Nexus in Urban Unemployment Dynamics: The Relationship between Institutional Variables and Long-Term Unemployment in Colombia

- The Roles of the Terms of Trade and the Real Exchange Rate in the Current Account Balance

- Cleaner Production: Analysis of the Role and Path of Green Finance in Controlling Agricultural Nonpoint Source Pollution

- The Research on the Impact of Regional Trade Network Relationships on Value Chain Resilience in China’s Service Industry

- Social Support and Suicidal Ideation among Children of Cross-Border Married Couples

- Asymmetrical Monetary Relations and Involuntary Unemployment in a General Equilibrium Model

- Job Crafting among Airport Security: The Role of Organizational Support, Work Engagement and Social Courage

- Does the Adjustment of Industrial Structure Restrain the Income Gap between Urban and Rural Areas

- Optimizing Emergency Logistics Centre Locations: A Multi-Objective Robust Model

- Geopolitical Risks and Stock Market Volatility in the SAARC Region

- Trade Globalization, Overseas Investment, and Tax Revenue Growth in Sub-Saharan Africa

- Can Government Expenditure Improve the Efficiency of Institutional Elderly-Care Service? – Take Wuhan as an Example

- Media Tone and Earnings Management before the Earnings Announcement: Evidence from China

- Review Articles

- Economic Growth in the Age of Ubiquitous Threats: How Global Risks are Reshaping Growth Theory

- Efficiency Measurement in Healthcare: The Foundations, Variables, and Models – A Narrative Literature Review

- Rethinking the Theoretical Foundation of Economics I: The Multilevel Paradigm

- Financial Literacy as Part of Empowerment Education for Later Life: A Spectrum of Perspectives, Challenges and Implications for Individuals, Educators and Policymakers in the Modern Digital Economy

- Special Issue: Economic Implications of Management and Entrepreneurship - Part II

- Ethnic Entrepreneurship: A Qualitative Study on Entrepreneurial Tendency of Meskhetian Turks Living in the USA in the Context of the Interactive Model

- Bridging Brand Parity with Insights Regarding Consumer Behavior

- The Effect of Green Human Resources Management Practices on Corporate Sustainability from the Perspective of Employees

- Special Issue: Shapes of Performance Evaluation in Economics and Management Decision - Part II

- High-Quality Development of Sports Competition Performance Industry in Chengdu-Chongqing Region Based on Performance Evaluation Theory

- Analysis of Multi-Factor Dynamic Coupling and Government Intervention Level for Urbanization in China: Evidence from the Yangtze River Economic Belt

- The Impact of Environmental Regulation on Technological Innovation of Enterprises: Based on Empirical Evidences of the Implementation of Pollution Charges in China

- Environmental Social Responsibility, Local Environmental Protection Strategy, and Corporate Financial Performance – Empirical Evidence from Heavy Pollution Industry

- The Relationship Between Stock Performance and Money Supply Based on VAR Model in the Context of E-commerce

- A Novel Approach for the Assessment of Logistics Performance Index of EU Countries

- The Decision Behaviour Evaluation of Interrelationships among Personality, Transformational Leadership, Leadership Self-Efficacy, and Commitment for E-Commerce Administrative Managers

- Role of Cultural Factors on Entrepreneurship Across the Diverse Economic Stages: Insights from GEM and GLOBE Data

- Performance Evaluation of Economic Relocation Effect for Environmental Non-Governmental Organizations: Evidence from China

- Functional Analysis of English Carriers and Related Resources of Cultural Communication in Internet Media

- The Influences of Multi-Level Environmental Regulations on Firm Performance in China

- Exploring the Ethnic Cultural Integration Path of Immigrant Communities Based on Ethnic Inter-Embedding

- Analysis of a New Model of Economic Growth in Renewable Energy for Green Computing

- An Empirical Examination of Aging’s Ramifications on Large-scale Agriculture: China’s Perspective

- The Impact of Firm Digital Transformation on Environmental, Social, and Governance Performance: Evidence from China

- Accounting Comparability and Labor Productivity: Evidence from China’s A-Share Listed Firms

- An Empirical Study on the Impact of Tariff Reduction on China’s Textile Industry under the Background of RCEP

- Top Executives’ Overseas Background on Corporate Green Innovation Output: The Mediating Role of Risk Preference

- Neutrosophic Inventory Management: A Cost-Effective Approach

- Mechanism Analysis and Response of Digital Financial Inclusion to Labor Economy based on ANN and Contribution Analysis

- Asset Pricing and Portfolio Investment Management Using Machine Learning: Research Trend Analysis Using Scientometrics

- User-centric Smart City Services for People with Disabilities and the Elderly: A UN SDG Framework Approach

- Research on the Problems and Institutional Optimization Strategies of Rural Collective Economic Organization Governance

- The Impact of the Global Minimum Tax Reform on China and Its Countermeasures

- Sustainable Development of Low-Carbon Supply Chain Economy based on the Internet of Things and Environmental Responsibility

- Measurement of Higher Education Competitiveness Level and Regional Disparities in China from the Perspective of Sustainable Development

- Payment Clearing and Regional Economy Development Based on Panel Data of Sichuan Province

- Coordinated Regional Economic Development: A Study of the Relationship Between Regional Policies and Business Performance

- A Novel Perspective on Prioritizing Investment Projects under Future Uncertainty: Integrating Robustness Analysis with the Net Present Value Model

- Research on Measurement of Manufacturing Industry Chain Resilience Based on Index Contribution Model Driven by Digital Economy

- Special Issue: AEEFI 2023

- Portfolio Allocation, Risk Aversion, and Digital Literacy Among the European Elderly

- Exploring the Heterogeneous Impact of Trade Agreements on Trade: Depth Matters

- Import, Productivity, and Export Performances

- Government Expenditure, Education, and Productivity in the European Union: Effects on Economic Growth

- Replication Study

- Carbon Taxes and CO2 Emissions: A Replication of Andersson (American Economic Journal: Economic Policy, 2019)

Artikel in diesem Heft

- Regular Articles

- Political Turnover and Public Health Provision in Brazilian Municipalities

- Examining the Effects of Trade Liberalisation Using a Gravity Model Approach

- Operating Efficiency in the Capital-Intensive Semiconductor Industry: A Nonparametric Frontier Approach

- Does Health Insurance Boost Subjective Well-being? Examining the Link in China through a National Survey

- An Intelligent Approach for Predicting Stock Market Movements in Emerging Markets Using Optimized Technical Indicators and Neural Networks

- Analysis of the Effect of Digital Financial Inclusion in Promoting Inclusive Growth: Mechanism and Statistical Verification

- Effective Tax Rates and Firm Size under Turnover Tax: Evidence from a Natural Experiment on SMEs

- Re-investigating the Impact of Economic Growth, Energy Consumption, Financial Development, Institutional Quality, and Globalization on Environmental Degradation in OECD Countries

- A Compliance Return Method to Evaluate Different Approaches to Implementing Regulations: The Example of Food Hygiene Standards

- Panel Technical Efficiency of Korean Companies in the Energy Sector based on Digital Capabilities

- Time-varying Investment Dynamics in the USA

- Preferences, Institutions, and Policy Makers: The Case of the New Institutionalization of Science, Technology, and Innovation Governance in Colombia

- The Impact of Geographic Factors on Credit Risk: A Study of Chinese Commercial Banks

- The Heterogeneous Effect and Transmission Paths of Air Pollution on Housing Prices: Evidence from 30 Large- and Medium-Sized Cities in China

- Analysis of Demographic Variables Affecting Digital Citizenship in Turkey

- Green Finance, Environmental Regulations, and Green Technologies in China: Implications for Achieving Green Economic Recovery

- Coupled and Coordinated Development of Economic Growth and Green Sustainability in a Manufacturing Enterprise under the Context of Dual Carbon Goals: Carbon Peaking and Carbon Neutrality

- Revealing the New Nexus in Urban Unemployment Dynamics: The Relationship between Institutional Variables and Long-Term Unemployment in Colombia

- The Roles of the Terms of Trade and the Real Exchange Rate in the Current Account Balance

- Cleaner Production: Analysis of the Role and Path of Green Finance in Controlling Agricultural Nonpoint Source Pollution

- The Research on the Impact of Regional Trade Network Relationships on Value Chain Resilience in China’s Service Industry

- Social Support and Suicidal Ideation among Children of Cross-Border Married Couples

- Asymmetrical Monetary Relations and Involuntary Unemployment in a General Equilibrium Model

- Job Crafting among Airport Security: The Role of Organizational Support, Work Engagement and Social Courage

- Does the Adjustment of Industrial Structure Restrain the Income Gap between Urban and Rural Areas

- Optimizing Emergency Logistics Centre Locations: A Multi-Objective Robust Model

- Geopolitical Risks and Stock Market Volatility in the SAARC Region

- Trade Globalization, Overseas Investment, and Tax Revenue Growth in Sub-Saharan Africa

- Can Government Expenditure Improve the Efficiency of Institutional Elderly-Care Service? – Take Wuhan as an Example

- Media Tone and Earnings Management before the Earnings Announcement: Evidence from China

- Review Articles

- Economic Growth in the Age of Ubiquitous Threats: How Global Risks are Reshaping Growth Theory

- Efficiency Measurement in Healthcare: The Foundations, Variables, and Models – A Narrative Literature Review

- Rethinking the Theoretical Foundation of Economics I: The Multilevel Paradigm

- Financial Literacy as Part of Empowerment Education for Later Life: A Spectrum of Perspectives, Challenges and Implications for Individuals, Educators and Policymakers in the Modern Digital Economy

- Special Issue: Economic Implications of Management and Entrepreneurship - Part II

- Ethnic Entrepreneurship: A Qualitative Study on Entrepreneurial Tendency of Meskhetian Turks Living in the USA in the Context of the Interactive Model

- Bridging Brand Parity with Insights Regarding Consumer Behavior

- The Effect of Green Human Resources Management Practices on Corporate Sustainability from the Perspective of Employees

- Special Issue: Shapes of Performance Evaluation in Economics and Management Decision - Part II

- High-Quality Development of Sports Competition Performance Industry in Chengdu-Chongqing Region Based on Performance Evaluation Theory

- Analysis of Multi-Factor Dynamic Coupling and Government Intervention Level for Urbanization in China: Evidence from the Yangtze River Economic Belt

- The Impact of Environmental Regulation on Technological Innovation of Enterprises: Based on Empirical Evidences of the Implementation of Pollution Charges in China

- Environmental Social Responsibility, Local Environmental Protection Strategy, and Corporate Financial Performance – Empirical Evidence from Heavy Pollution Industry

- The Relationship Between Stock Performance and Money Supply Based on VAR Model in the Context of E-commerce

- A Novel Approach for the Assessment of Logistics Performance Index of EU Countries

- The Decision Behaviour Evaluation of Interrelationships among Personality, Transformational Leadership, Leadership Self-Efficacy, and Commitment for E-Commerce Administrative Managers

- Role of Cultural Factors on Entrepreneurship Across the Diverse Economic Stages: Insights from GEM and GLOBE Data

- Performance Evaluation of Economic Relocation Effect for Environmental Non-Governmental Organizations: Evidence from China

- Functional Analysis of English Carriers and Related Resources of Cultural Communication in Internet Media

- The Influences of Multi-Level Environmental Regulations on Firm Performance in China

- Exploring the Ethnic Cultural Integration Path of Immigrant Communities Based on Ethnic Inter-Embedding

- Analysis of a New Model of Economic Growth in Renewable Energy for Green Computing

- An Empirical Examination of Aging’s Ramifications on Large-scale Agriculture: China’s Perspective

- The Impact of Firm Digital Transformation on Environmental, Social, and Governance Performance: Evidence from China

- Accounting Comparability and Labor Productivity: Evidence from China’s A-Share Listed Firms

- An Empirical Study on the Impact of Tariff Reduction on China’s Textile Industry under the Background of RCEP

- Top Executives’ Overseas Background on Corporate Green Innovation Output: The Mediating Role of Risk Preference

- Neutrosophic Inventory Management: A Cost-Effective Approach

- Mechanism Analysis and Response of Digital Financial Inclusion to Labor Economy based on ANN and Contribution Analysis

- Asset Pricing and Portfolio Investment Management Using Machine Learning: Research Trend Analysis Using Scientometrics

- User-centric Smart City Services for People with Disabilities and the Elderly: A UN SDG Framework Approach

- Research on the Problems and Institutional Optimization Strategies of Rural Collective Economic Organization Governance

- The Impact of the Global Minimum Tax Reform on China and Its Countermeasures

- Sustainable Development of Low-Carbon Supply Chain Economy based on the Internet of Things and Environmental Responsibility

- Measurement of Higher Education Competitiveness Level and Regional Disparities in China from the Perspective of Sustainable Development

- Payment Clearing and Regional Economy Development Based on Panel Data of Sichuan Province

- Coordinated Regional Economic Development: A Study of the Relationship Between Regional Policies and Business Performance

- A Novel Perspective on Prioritizing Investment Projects under Future Uncertainty: Integrating Robustness Analysis with the Net Present Value Model

- Research on Measurement of Manufacturing Industry Chain Resilience Based on Index Contribution Model Driven by Digital Economy

- Special Issue: AEEFI 2023

- Portfolio Allocation, Risk Aversion, and Digital Literacy Among the European Elderly

- Exploring the Heterogeneous Impact of Trade Agreements on Trade: Depth Matters

- Import, Productivity, and Export Performances

- Government Expenditure, Education, and Productivity in the European Union: Effects on Economic Growth

- Replication Study

- Carbon Taxes and CO2 Emissions: A Replication of Andersson (American Economic Journal: Economic Policy, 2019)