Abstract

In the context of the global spread of the Corona Virus Disease 2019, improving enterprise performance, promoting regional economic development, and solving the problem of unbalanced and inadequate regional development are important considerations for regional policy formulation. To understand the relationship between regional policies and corporate performance, this study starts with theories related to regional policies and corporate performance, and proposes two hypotheses. The Western Development, Northeast Revitalization of the Old Industrial Base, and Central Rise Plan are selected as typical representatives of regional policies, and the hypotheses are verified through a double difference model. The results showed that regional policies could improve corporate performance, especially for state-owned enterprises (SOEs). The correlation between the revitalization of the old industrial base in Northeast China and the performance of SOEs was strong, with a correlation coefficient of 0.832. When conducting robustness tests by changing time periods, the correlation values between the performance of SOEs and policies in the three policy implementation areas of revitalizing Northeast China, western development, and central rise were 0.887, 0.764, and 0.652, respectively. Compared to non-SOEs, SOEs had a more significant effect on regional policy improvement. This conclusion was consistent with the empirical results of hypotheses 1 and 2. Based on this foundation, recommendations are offered for the suitability of regional policies to furnish theoretical frameworks for enhancing the regional policy structure and augmenting the precision and inclusivity of regional policy development. The research model is utilized to reveal the important role of regional policies in promoting enterprise performance improvement and promoting regional economic development. It can provide strong evidence support for policy makers. The study offers a scientific theoretical basis and empirical support that assist policymakers in comprehending policy objectives and implementation strategies with greater precision. Therefore, the coordinated advancement of regional economic development is facilitated.

1 Introduction

Since the reform and opening up, China has implemented an unbalanced development strategy of “force-rich drives post-rich.” The unbalanced development strategy has promoted China’s economic development, but it has also led to a widening of the income gap between regions and an imbalance in industrial development. At different historical stages, countries have formulated corresponding regional policies for different regions to achieve coordinated and balanced development, narrow regional economic disparities, and promote social stability. Regional policy refers to the sum of a series of policies and measures formulated by the state to realize the economic and social development goals of a specific region. These policies aim to promote the coordinated development of the regional economy by adjusting the allocation of resources, optimizing industrial structure, improving the investment environment, etc. Enterprise performance, conversely, is an important indicator of the economic and social benefits of an enterprise, which reflects the operating results and development of an enterprise in a certain period of time. In 2000, the “Western Development” strategy was proposed, and in 2003, the “Revitalization of Northeast Old Industries” strategy was proposed (Wang & Zhou, 2020). Regional policies, as an important component of national policies, played a crucial role in improving industrial spatial layout and comprehensively promoting rural revitalization (Vanthillo et al., 2021). Scholars such as Tm A analyzed the impact of regional innovation policies on the innovation and upgrading process of small and medium-sized enterprises (SMEs). Through empirical analysis, it was found that regional policies could promote the development and upgrading of human resources in SMEs and promote enterprise innovation (Matsuzaki et al., 2021). The development of the economy has put forward higher requirements for the flexibility and sensitivity of regional policies. How to mobilize the enthusiasm of enterprises, improve their performance, and promote high-quality development of the regional economy has become one of the urgent problems to be solved in regional policy formulation (Oh, 2021). Meanwhile, enterprise performance management had an important role in the operation of state-owned enterprises (SOEs), private enterprises and multi-national corporations. It could enhance the efficiency of company management and reduce management costs. However, there was a relative lack of relevant data to support the effectiveness of corporate performance management in SOEs (Mehlabani & Chandramohanan, 2024). To enhance the smoothness of enterprises in response to the financial crisis, numerous enterprises have conducted in-depth analysis of the smoothness of all variables of business operations using augmented time series data. The study found that the long-run positive impact of real exchange rate volatility on trade deficit is discernible. Although the study revealed the macro-economic impact on business operations, it did not analyze the specific measures of impact (Chu & Liu, 2024). In the process of business development, the transportation sector is a unique intersection of economic, social, political, and security considerations. To provide a more accurate assurance of the transportation sector, the study analyzed the operation of the ports in Mazandaran province using the research method of exploration and investigation. The results suggested that statistical hypothesis review contributed to the academic discourse around transit dynamics and provided practical insights that can inform strategic interventions. However, there were limitations to the generalization of this approach due to the port environment (Le et al., 2023). To improve the reliability of companies in new product development, the study collected a large amount of data using a fuzzy approach to optimize the development framework. The results showed that the development framework based on the fuzzy approach can enhance quality and technology improvement and provide data support for marketing strategies in the company’s business process. For this purpose, four regional policies are selected to study: The Western Development, Northeast Revitalization of the Old Industrial Base, Central Rise Plan, and the the Belt and Road Initiative. To deeply analyze the relationship between regional policies and corporate performance, this study analyzes the impact of the three different policies on regional corporate performance and validates the hypothesis through a double difference model. Therefore, it is possible to understand the mechanism of this impact at the micro-enterprise level. Compared to previous studies that focused on policy effects at the macro level, this study is innovative in investigating the influence mechanism of regional policies from the viewpoint of micro-enterprises. In summary, the study fills the gaps of previous research by exploring in depth the relationship between regional policies and enterprise performance and provides useful references and lessons for policymakers. The study also contributes positively to the research and practice of the coordinated development of the regional economy.

The first part of the study is the introduction, which mainly explains the background and motivation of the study. The second part is the theoretical analysis and research hypotheses, which explains the theoretical content of the study and puts forward the hypotheses made by the study on regional development. The third part is the construction of the model, which chooses the three regions as the objects of the study and will set up the corresponding variable information. The fourth part is the empirical test, through the relevant experiments using the model to verify the authenticity of hypotheses 1 and 2. The fifth part is the conclusions and recommendations, using the results of the experiments to summarize the relevant aspects of the regional economy and analyze the strengths and weaknesses of the study.

2 Theoretical Analysis and Research Hypothesis

Regional policies refer to the four policies of the Western Development, Northeast Revitalization of the Old Industrial Base, Central Rise Plan, and the Belt and Road Initiative. The model mainly focuses on these four policies. As a complex of economic and social development, there is strong heterogeneity in the development of various industries and regions within the region. The existence of development gaps between regions is due to different conditions such as geographical location, development history, and industrial positioning. To narrow the gap, the government needs to analyze the national, regional development focus based on the actual development situation between regions. Therefore, corresponding regional policies can be formulated to compensate for the insufficient allocation of market resources and improve the quality and speed of regional development (Grillitsch et al., 2019; Jahanger, 2020). Regional policies mainly affect corporate performance through three aspects: enterprise clustering, enterprise investment, and knowledge effects. Regional policies can leverage the externalities of agglomeration economies. The so-called externality refers to the improvement of efficiency and welfare levels that enterprises can enjoy without incurring costs or investments. The knowledge spillover effect results from the dissemination and diffusion of knowledge. Regional policies guide investment behavior by influencing micro-enterprise execution, thereby enabling enterprises to benefit from expanding investments. There are three types of effects involved, namely infrastructure spillover effects, fiscal subsidy effects, and tax preferential effects. Infrastructure construction is an indispensable component of regional policies. Under the promotion of policies, some regions have made substantial progress in infrastructure construction. The primary beneficiaries of significant infrastructure investments are predominantly businesses in regions where regional policies are implemented, and such investments also have a multiplying effect. Infrastructure development in regional policies enhances the area’s support measures and updates the hardware environment and transportation network, leading to a reduction in financing restrictions, lower operating costs, and better business performance. Regional policies often come with fiscal subsidies, which are often distributed to enterprises in the form of monetary funds, directly increasing their disposable profits. Enterprises also have other forms of asset subsidies to alleviate the pressure of purchasing assets and alleviate financing constraints. Financial subsidies to some extent guide the investment behavior of enterprises. One of the primary objectives of regional policies is to lower taxes and ease the burden on enterprises, thereby optimizing the investment environment in the area and enhancing the return on capital investment. In particular, tax incentives have the potential to attract both domestic and foreign capital, leading to an even higher level of development. From the perspective of enterprise clustering, regional policies attract related industries to gather in space by defining industrial structure and dividing industrial production areas. As a result, production costs are reduced, and the convenience of production cooperation and commodity circulation is improved (Harrison et al., 2020; Zhang, 2020). From the perspective of corporate investment, regional policies bear some risks for corporate investment through fiscal and tax subsidies. Thus, it can stimulate the investment enthusiasm and market vitality of enterprises, encourage them to engage in scientific and technological research and development, and provide sustained impetus for their development (Liao & Wang, 2021). Regional policy accelerates the concentration of enterprises and industries, fostering conditions of knowledge exchange, technological advancement, and marketing strategies among clusters. Enterprises use information sharing to train employees and improve the professional skills of talents within the enterprise. Enterprises also enhance the adaptability and flexibility of employees to cope with market changes, give full play to the potential of employees, and create effective value for enterprise development. Although regional policies can improve firm performance to a certain extent, some studies have argued that information asymmetry may lead to over-investment by firms, thus resulting in a wasteful allocation of funds and a decline in firm performance (Kegui et al., 2021). Some researchers argue that regional policies may lead to increased dependence of enterprises on government aid, resulting in reduced independence and autonomy for enterprise development. Such policies may not promote industrial progress and may even contradict the original purpose of regional policies (Shen et al., 2020). In the study of the relationship between regional policies and firm performance, the choice of control variables does require in-depth and comprehensive justification from the theoretical framework. On the basis of the existing control variables, adding some relevant firm-specific variables, such as export intensity and ownership, can further enrich and improve the dimensions of the study and enhance its accuracy and reliability. Based on the above theory, hypothesis 1 is proposed.

H1: Regional policies can improve the overall performance of firms within the region.

As an important political and material foundation of China’s modernization, SOEs play a key role in national defense construction, improving people’s livelihood and scientific and technological progress. Unlike non-SOEs, the operation of SOEs will have government participation and control. The purpose is to achieve national economic regulation, guarantee national security, and maintain the normal operation of the national economy with public welfare (Lin et al., 2020; Zhou et al., 2019). According to the amount of government investment, SOEs are divided into wholly SOEs and state-owned holding enterprises. A wholly owned enterprise in China refers to an enterprise whose all assets are owned by the state, with the aim of achieving social and public goals and controlling the economic lifeline of the country. This type of enterprise includes electricity, railways, natural gas, etc. State-owned holding enterprises refer to enterprises controlled by SOEs with a high proportion of state-owned capital equity in the total capital of the enterprise (Deng et al., 2019; Zhan & Zhu, 2021). To achieve the social public goals of SOEs, it is necessary to concentrate some core technologies and strategic industries in SOEs. By leveraging the special advantages of capital and talent, the operational efficiency of SOEs can be improved. It continuously expands the total amount of state-owned assets, promotes modern technological progress, and matures industrial development. Therefore, national security should be ensured while safeguarding the development of SOEs (Dang et al., 2020; Sazegari et al., 2022; Tang et al., 2020). By analyzing the impact of economic policy uncertainty on firm performance, it has been found that economic policy uncertainty reduces the incentives of firms to expand their operations through the mechanisms of risk-taking, cash-holding, and tax burden. The study of this micro-mechanism provides a valuable reference for policymakers to effectively reduce economic volatility (Feng et al., 2023). By analyzing 33 studies from 26 countries around the world, the effects of attempted government policies to promote firms’ exports in the short run are identified. These policies aim to increase firms’ exports and include export promotion, public grants, etc. The study gains a deeper understanding of the effectiveness of these policies, emphasizes the impact of differences in corporate characteristics, and provides new evidence for policy spillovers (Srhoj et al., 2023). By analyzing the relationship between the spatial dynamics of the Italian Cultural and Creative Industries (CCIs) and their social and economic outcomes, using the Economic Complexity Index as a proxy, it is found that the economic complexity of CCIs has an impact on the performance of CCI firms. Additionally, it has no impact on the economic complexity of the rest of the economy. This finding applies to all CCI firms, regardless of their industry type (Burlina et al., 2023). Through analyzing 26 studies on the relationship between financial constraints and the performance of listed companies, it is found that financial constraints are positively correlated with the overall performance of the company. Different measurement and control variables have a significant impact on the relationship between the two, such as return on assets, return on equity, and external financing having a negative effect, while market value and White&Wu index have a positive effect. The study helps to understand the differences in empirical results on the impact of financial constraints (Ahamed et al., 2023). A study analyzes panel data of Chinese A-share renewable energy listed companies using the text analysis method and quantifies the degree of digital transformation. Combining fixed effects and intermediary effects models, it is found that digital transformation significantly improves the performance of renewable energy enterprises, with a greater impact on SOEs, large enterprises, and enterprises in the eastern region. Digital transformation can improve operational efficiency, reduce costs, and increase innovation success rates for enterprises (Ren et al., 2023). By analyzing the impact of smart city policy (SCP) on green technology innovation (GTI) of Chinese listed firms, it is found that SCP significantly promotes GTI. The findings remain valid after a robustness test. SCP improves GTI through government environmental subsidies, firms’ environmental awareness, and investment in R&D. It is especially significant in the growth stage, high-tech industries, and the eastern region. This is crucial for urban ecology and high-quality economic development (Guo et al., 2024). Therefore, while regulating the social economy, SOEs also play the role of “leaders.” It drives the development of SMEs through technology spillovers, talent transfer, financial assistance, and other means, supporting the development of downstream enterprises in the industrial chain. From the perspective of regional policy formulation and implementation, SOEs are more sensitive to policies and are more conducive to grasping policy information, thus implementing more accurate economic activities and improving enterprise performance. From the perspective of SOE leaders, regional policy support for SOEs is more conducive to leveraging the advantages of centralized technology and other elements of SOEs. It can promote cooperation and communication among different types of enterprises and improve the performance of various enterprises in the region. Based on the above theory, this study proposes hypothesis 2.

H2: The effect of regional policies on the performance of SOEs is more pronounced compared to other types of enterprises in the region.

Combining the above hypothesized elements, the study first needs to consider the infrastructure spillover effects of regional policies. Improvements in infrastructure, such as transportation, communication, and energy supply, can reduce the operating costs of firms and increase productivity, thus enhancing firm performance. Therefore, from this perspective, regional policies help to improve the overall performance of firms within the region, supporting H1. Second, financial subsidies are one of the common instruments in regional policies. By providing financial subsidies to enterprises, the government aims to reduce the burden of enterprises and encourage them to increase investment and technological innovation, thus enhancing enterprise performance. For SOEs, it is possible that they will have more straightforward access to fiscal subsidies, and that the size of the subsidies may be larger due to their strong ties with the government. This financial support helps SOEs to expand their production scale and upgrade their technology level, which in turn improves their performance. At the same time, the improved performance of SOEs, as leaders in the industry, may also lead to the development of the entire industrial chain, including the non-SOEs with which they cooperate. Therefore, the regional policy through financial subsidies and other means to improve the performance of SOEs may be more obvious, which can strongly support H2.

3 Model Construction

Hypotheses 1 and 2 are theoretically analyzed, and the research effect of regional policies on the performance of SOEs is enhanced. The study focuses on the three main regional policies: revitalizing the old industrial bases in northeastern China, developing the western region, and rising in central China. These three strategies were proposed in 2003, 2000, and 2003, and their implementation was in 2004, 2000, and 2006. Due to the lag effect of more than 2 years required by the double-difference method, the implementation time of the policy for the central rise region was in 2006. Therefore, the listed enterprise data from 1998 to 2008 in the China Industrial Enterprise Database was selected as the basic data for the enterprise industry, including light industry, heavy industry, equipment manufacturing, etc. The databases used the China Stock Market & Accounting Research (CSMAR) database. The CSMAR database is a series of financial and economic databases consisting of macroeconomic, industry research, listed companies, stock markets, fund markets, bond markets, futures markets, foreign exchange and gold markets, overseas research, and other organic and unified entities. To ensure the validity of the model, it is necessary to eliminate invalid enterprise data, including enterprises that have been specially treated, enterprises with incomplete data and enterprises with obvious errors in liquidity, etc. In the sample information of listed companies in the processing group and control group, there are a total of 9,807, 8,741, and 8,922 control group sample points in Northeast Revitalization Old Industrial Base, Western Development, and Central Rise, while there are 821, 2,044, and 1,706 processing group sample points.

After collecting the enterprise data, an econometric model is constructed for H1. West,

In equation (1),

On the basis of the above model, the dummy variable of property rights is added to explore whether the effect of regional policies on corporate performance is more significant in SOEs. The property rights variable is used for cross-product regression, and the model in equation (2) is used to test hypothesis 3.

In equation (2),

According to the two models, the model variables are selected as shown in Table 1. In Table 1, the explanatory variables are enterprise efficiency. The explanatory variables are the nature of property rights of SOEs for revitalizing the regional policies in Northeast, West, and Central China, and dummy variables for the time of implementation of the three regional policies. The control variables are enterprise cash asset ratio (CAR), time to market, enterprise size, enterprise debt ratio, innovation input, comprehensive tax rate (CTR), and fixed asset ratio (FAR). In the dependent variable, Tobin Q value is used as an indicator to measure corporate performance, which can better reflect the value of the enterprise. Although indicators such as return on equity can also measure a company’s performance level, there is a possibility of human manipulation in nitrogen. The Tobin Q value is the ratio of a company’s market value to the cost of capital replacement, which can more accurately measure the company’s performance level. Intangible assets, as an important “soft power” of listed companies, play an increasingly important role in their value. The development strength of enterprises often comes from intangible resources such as research and innovation, so the intangible asset ratio (IAR) is used to control the influencing factors in this regard. Among them, CAR is the year-end monetary fund holdings/year-end total assets, asset-liability ratio (ALR) is the year-end total liabilities/year-end total assets, FAR is the net fixed assets/year-end total assets, CTR is the (business tax and surcharges + income tax expenses)/total operating income. IAR is the total intangible assets/total assets at the end of the year. The size of the enterprise (Size) is the natural logarithm of the total assets at the end of the year. Among them, the firm’s cash holding ratio reflects the firm’s liquidity position, which has a direct impact on operational efficiency. The time to market may be related to the firm’s accumulated market experience and managerial resources, which in turn affects efficiency. The firm’s size may either bring about an increase in efficiency due to economies of scale or reduce efficiency due to an increase in managerial complexity. The firm’s debt ratio affects the cost of capital and risk tolerance, which in turn correlates with efficiency. The innovation input is the key for enterprises to improve efficiency and optimize the production process through innovation. The CTR affects the operating costs of enterprises, which in turn affects efficiency. The FAR reflects the asset structure and capital allocation efficiency of enterprises, which has a direct impact on operational efficiency. By controlling these variables, the study is able to more accurately estimate the independent impact of regional policies on firms’ efficiency and reduce the interference of other factors.

Model variables and their specific meanings

| Variable type | Variable symbol | Variable meaning |

|---|---|---|

| Interpreted variable |

|

Performance of enterprise

|

| Explanatory variable |

|

Fictitious variables for Revitalizing Northeast China |

|

|

Dummy variable of Western development | |

|

|

Dummy variable of the rise of Central China | |

|

|

The virtual variable of the implementation time of Northeast revitalization | |

|

|

The dummy variable of the implementation time of the Western policy | |

|

|

Dummy variable of policy implementation time in Central China | |

| SOEs | Nature of enterprise property right | |

| Control variable | CAR | Enterprise’s ability to directly pay current liabilities |

| Age | Time of listing | |

| Size | Enterprise scale | |

| ALR | Enterprise debt level | |

| IAR | Enterprise innovation input | |

| CTR | Overall tax rate | |

| FAR | Idle capital level of enterprises |

The study uses the double DID method to analyze the impact of regional policies on the performance of firms within a region. For the application of the DID test method, regional policies are required to satisfy both the randomness assumption, the uniqueness assumption, and the parallel trend assumption (Arad et al., 2023; Ding, 2022; Misakov et al., 2019). From the assumption of randomness, the determination of the implementation location of regional policies is mainly based on the local economic level. There is a cross-zone between economically impoverished areas and developed areas. Before the implementation of the policy, a series of processes, such as formulation, deliberation, and revision, are carried out, making the specific implementation time random. As a result, the location and time of regional policy implementation are random, and the assumption of randomness holds. From the uniqueness hypothesis, the three regional policies have not been used repeatedly during 1998–2008, and their implementation areas are also specific. From the perspective of time and area, the regional policies are consistent with the uniqueness hypothesis.

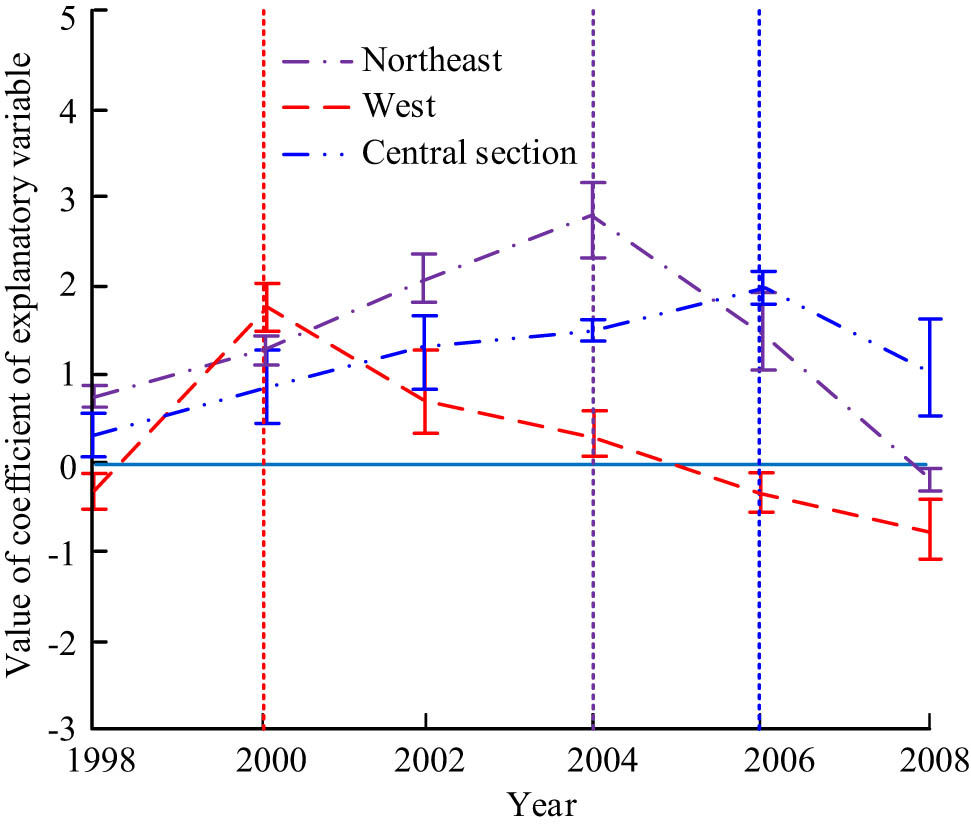

From the parallel trend hypothesis, the significance of the coefficients of the explanatory variables between the two groups of treatment and control groups before the implementation of the regional policy is observed, as shown in Figure 1. The analysis in Figure 1 shows that the coefficient values of the explanatory variables are distributed in different intervals before the implementation of the three regional policies, namely, western development, northeast revitalization, and central rise plan. Among them, the coefficient values of the northeast revitalization policy mainly range from 0.5 to 2.5, while the Western development policy ranges from 0 to 2, and the central rise plan policy ranges from 0.4 to 2. These coefficient values are not statistically significant. It suggests that prior to the implementation of the policies, the firms in the treatment and control groups show similar trends in efficiency performance, i.e., the two groups of firms show a clear parallelism between them. This finding provides important support for the subsequent research and verifies the rationality of the parallel trend hypothesis.

Parallel trend chart of three regional policies.

Combined with the above research analysis, in the construction of the model, the study chooses the three regional policies as the objects of the study. They are the Western Development, Northeast Revitalization of the Old Industrial Base, and Central Rise Plan. The study utilizes the data of listed enterprises in the database of China’s industrial enterprises in the period of 1998–2008 for the analysis. The study adopts the double DID method to test the impact of regional policies on firm performance. A series of control variables are selected to minimize the influence of other factors. However, endogeneity problems such as omitted variable bias and reverse causality may be faced in model construction. Omitted variable bias may lead to biased estimation of the effects of regional policies. As a result, the study proposes strategies such as expanding the range of control variables and using a panel data model to mitigate this problem. The result of the fixed effects regression model is shown in Table 2, which shows the impact of regional policies on firm performance. The significance level of all variables and parameters in the fixed effects model is 0.01.

Fixed effects model regression results

| Variable | Revitalization | Northeast western development | Central rise |

|---|---|---|---|

| CAR | 0.945(***) | 0.941(***) | 0.913(***) |

| Age | 0.587(***) | 0.591(***) | 0.565(***) |

| Size | −0.846(***) | −0.863(***) | −0.861(***) |

| ALR | 0.512(***) | 0.516(***) | 0.534(***) |

| IAR | 0.763(***) | 0.764(***) | 0.742(***) |

| CTR | −0.175(***) | −0.164(***) | −0.153(***) |

| FAR | −0.328(***) | −0.346(***) | −0.331(***) |

| N | 27,413 | 27,413 | 27,413 |

Note: *** indicates significance at the 0.01 level.

The regression results of the random effects model are shown in Table 3. From Table 3, the significance level of different variables for enterprises is 0.01. The significance level of variable changes in different regions and regions is also 0.01.

Regression results of random effects model

| Variable | Revitalization | Northeast western development | Central rise |

|---|---|---|---|

| CAR | 0.910(***) | 0.902(***) | 0.885(***) |

| Age | 0.575(***) | 0.578(***) | 0.551(***) |

| Size | −0.832(***) | −0.850(***) | −0.848(***) |

| ALR | 0.500(***) | 0.504(***) | 0.521(***) |

| IAR | 0.749(***) | 0.750(***) | 0.728(***) |

| CTR | −0.169(***) | −0.158(***) | −0.147(***) |

| FAR | −0.320(***) | −0.338(***) | −0.323(***) |

| N | 27,413 | 27,413 | 27,413 |

Note: *** indicators significance at the 0.01 level.

4 Empirical Test

To verify the performance of the model, the study utilizes descriptive analysis, correlation analysis, regression analysis, and robustness analysis to verify the accuracy of hypotheses 1 and 2.

4.1 Descriptive Analysis

Descriptive analysis is first conducted for each variable within the model to explore the distribution among the variable data, and the results of the descriptive analysis are shown in Table 4. From Table 4, the average age of listed enterprises is 8.456 years, of which the maximum age is 32 years, and standard deviation is 7.854 years. The maximum and minimum values of enterprise size are 32.894 and 16.128, respectively, and its mean value is 22.670, and the standard deviation is 1.567. There are more medium-sized enterprises in the region, and the maturity of enterprises is relatively high. The mean value of enterprise CAR is 0.152%, and its maximum and minimum values are 0.102 and 0.004%, respectively. Its standard deviation is small, and the liquidity effect of enterprise assets is good. The mean values of enterprise FAR and innovation investment are 0.349 and 0.513%, respectively, which are relatively low. The surplus capital of enterprises in the region is low; meanwhile, the investment for innovation such as technology is still insufficient. The corporate debt ratio remains within the range of 0.0024–12.895%, with a mean value of 0.561%. This indicates that the indebtedness of enterprises in the region is more common, and the level of enterprise operation needs to be improved.

Descriptive analysis of variables in the model

| Variable | Maximum | Minimum | Mean value | Standard deviation | Observations |

|---|---|---|---|---|---|

| SOE | 1.247 | −1.353 | 0.485 | 0.768 | 1.36 × 108 |

| CAR (%) | 0.102 | 0.004 | 0.152 | 0.138 | 1.36 × 108 |

| Age (Year) | 32.000 | −6.000 | 8.456 | 7.854 | 1.36 × 108 |

| Size | 32.894 | 16.128 | 22.670 | 1.567 | 1.36 × 108 |

| ALR | 12.895 | 0.0024 | 0.561 | 0.307 | 1.36 × 108 |

| IAR (%) | 0.506 | 0.0002 | 0.513 | 0.074 | 1.36 × 108 |

| CTR (%) | 3.647 | −1.254 | 0.457 | 0.501 | 1.36 × 108 |

| FAR (%) | 0.106 | 0.0000 | 0.349 | 0.184 | 1.36 × 108 |

4.2 Correlation Analysis

The correlation analysis is conducted for the correlations among the variables within the model to explore the intrinsic association between the model variables. The results of the correlation analysis are shown in Table 5. In Table 5, the correlation coefficients between corporate CAR and innovation investment and corporate performance are 0.226 and 0.114, its significance level is 0.01. This indicates that corporate CAR and innovation investment are positive factors in improving corporate performance. The correlation coefficients between corporate debt ratio, CTR, and FAR, and corporate performance are −1.478, −0.145, and −0.103. The coefficient is significant at the 0.05 level, which indicates that the above three indicators have a negative correlation with corporate performance. The correlation coefficients of the corporate debt ratio, CTR, and FAR are −1.478, −0.145, and −0.103, respectively, indicating that the three indicators have a negative correlation with corporate performance. The higher the absolute value of the correlation coefficient between corporate debt ratio, the more significant the impact of corporate debt ratio on corporate performance (P < 0.001). The correlation coefficients between firm Age, Size, and CAR are less than zero, and the model variables show a negative proportional increase in the relationship between them. There is a significant correlation between FAR and enterprises (P < 0.001). The positive correlation between the three regional policies and firm performance indicates that the three regional policies can promote the performance of firms within the region, which lays the foundation for the next regression analysis.

Correlation analysis results among variables in the model

| Variable |

|

SOE | CAR | Age | Size | ALR | IAR | CTR | FAR |

|---|---|---|---|---|---|---|---|---|---|

|

|

1.000 | — | — | — | — | — | — | — | — |

| SOE | −3.015** (85.16) | 1.000 | — | — | — | — | — | — | — |

| CAR | 0.226* (3.05) | −0.123 | 1.000 | — | — | — | — | — | — |

| Age | −0.103* (−46.81) | 0.348 | −0.265 | 1.000 | — | — | — | — | — |

| Size | −0.506** (−38.62) | 0.374* (29.61) | −0.145 | 0.341* (27.53) | 1.000 | — | — | — | — |

| ALR | −1.478*** (−86.43) | 0.135* (14.28) | −0.412 | 0.203 | 0.147 | 1.000 | — | — | — |

| IAR | 0.114** (2.39) | −0.089 | −0.129** (−3.57) | 0.123 | 0.231 | −0.459** (−4.83) | 1.000 | — | — |

| CTR | −0.145* (−5.75) | 0.104 | −0.069 | −0.152 | 0.167 | 0.084 | 0.216** (10.29) | 1.000 | — |

| FAR | −0.103*** (−1.93) | 0.137 | −0.441 | 0.147 | 0.231 | 0.036 | 0.164*** (15.88) | 0.562** (26.81) | 1.000 |

Note: * indicates significance at the 10% level. ** indicates significance at the 5% level. *** indicates significance at the 1% level.

Comprehensive analysis of the above content shows that there are complex interaction effects between ownership and policy variables. Due to their close relationship with the government, SOEs are sensitive to policy changes and may be more likely to reap policy dividends, but they are also subject to more constraints. At the same time, ownership structure is significantly correlated with policy variables such as return on investment and gearing, reflecting differences in corporate behavior across ownership contexts. To fully understand this interaction, moderating factors such as firm size and gearing need to be taken into account.

4.3 Regression Analysis

4.3.1 Analysis of the Role of Regional Policies in Improving Business Performance

To investigate the role of regional policies in enhancing firm performance, the study uses regression analysis to analyze the regression effect of firm performance before and after the implementation of regional policies. The specific results of the analysis are shown in Table 6. From Table 6, under the three regional policies, all enterprise indicators show significance at the 0.01 level, with significant changes in performance before and after policy implementation. Among them, the Central Rise policy has the most significant impact on enterprise performance with the highest correlation coefficient of 0.071, with a significance level of 0.01. This is because the Central Rise policy emphasizes the geographical and resource advantages of the central region. It is committed to building a national production and processing base for commodity food and agricultural and sideline products, an energy production base, and a high-tech industry base. The promotion of modern agriculture serves to adjust the industrial structure of the central region, enhance the level of external engagement, and thus stimulate enterprise investment and development. In terms of each specific index, the levels of CAR, Age, IAR, and FAR indicators show a positive proportional increasing change trend, while the enterprise scale, CTR and FAR levels present the opposite effect. The policy of revitalizing the heavy industrial bases in Northeast China has the greatest impact on the level of enterprise indebtedness, with a correlation coefficient of 0.945. Due to the policy’s emphasis on the integration of technology and economic development, it encourages the establishment and development of private financial institutions through financial support for enterprises. Therefore, the financial services and the enthusiasm of enterprises are increased. On this basis, a series of policies such as intellectual property rights, regional innovation, and the introduction and training of highly qualified personnel are formulated and implemented to promote the transformation and upgrading of industrial structures, for example, promoting the development of resource-leaning and heavy industries and the development of new enterprises such as supply chain logistics and e-commerce. Accelerating the infrastructure construction of heavy industrial bases in the northeast attracts reasonable investment from enterprises in the region and activates the vitality of private enterprises. Under the policy of Western Development, the CAR and IAR of enterprises have increased significantly, reaching 0.941 and 0.764, respectively. Their significance levels are all 0.01. This is because the policy focuses on developing a green economy and coordinating economic development with the ecological environment. Through preferential policies such as land and mineral resources, emphasis is placed on coordinating the use rights of resources such as land and cultivated land in the measures of returning farmland to forests and grasslands. At the same time, this policy is based on the natural environment of the northwest region, vigorously developing industries such as tourism and encouraging and attracting enterprise investment. In addition, efforts have been made to increase assistance to ethnic minorities and impoverished remote areas, promoting sustainable economic development in the western region.

Regression effect results of enterprise performance before and after the implementation of regional policies

| Variable | Revitalization of Northeast China | Western development | Central rise plan |

|---|---|---|---|

|

|

0.031 | — | — |

|

|

— | 0.052 | — |

|

|

— | — | 0.071*** (3.05) |

| CAR | 0.945*** (13.37) | 0.941*** (13.35) | 0.913*** (13.29) |

| Age | 0.587*** (19.83) | 0.591*** (20.66) | 0.565*** (20.37) |

| Size | −0.846*** (−75.16) | −0.863*** (−75.18) | −0.861*** (−75.06) |

| ALR | 0.512*** (51.06) | 0.516*** (51.29) | 0.534*** (51.33) |

| IAR | 0.763*** (5.31) | 0.764*** (5.32) | 0.742*** (5.27) |

| CTR | −0.175*** (−9.08) | −0.164*** (−9.01) | −0.153*** (−9.87) |

| FAR | −0.328*** (−5.49) | −0.346*** (−5.69) | −0.331*** (−5.52) |

| N | 27,413 | 27,413 | 27,413 |

| Adj R 2 | 0.234 | 0.234 | 0.234 |

Note: *** indicates significant at the 0.01 level.

The regression analysis of the performance of enterprises in various industries in the region before and after the implementation of the regional policy is conducted, and the results are shown in Table 7. From Table 7, under the three regional policies, the performance of enterprises in light industry, heavy industry, and equipment manufacturing industry in the region is significantly improved, and the effect is significant at the 0.01 level. Among them, under the policy of revitalizing the Northeast heavy industry base, the improvement effect of various indicators of heavy industry enterprises is more significant than that of light industry and equipment manufacturing enterprises. The correlation coefficients of CAR and IAR are 0.834 and 0.679, and their significance level is 0.01, which is at the highest level among the corresponding indicators of all industrial enterprises. This is due to the policy and core of the region lies in the comprehensive revitalization of heavy industry, promoting technological innovation of heavy industry enterprises, promoting the upgrading and transformation of heavy industry in Northeast China, and consolidating its important position in the economic development of Northeast China. Under the Western Development policy, the CAR and IAR correlation coefficients of light industrial enterprises are 0.814 and 0.530, with a significance level of 0.01. The CAR and IAR correlation coefficients of equipment manufacturing industries are 0.834 and 0.521, with a significance level of 0.01. Both of them are higher than the corresponding index levels of heavy industries. This indicates that due to the advantages of the primary industry in the western region and the construction of projects such as the West–East Gas Pipeline, the performance of the light industry and equipment manufacturing industry in the region has improved more significantly. This has also promoted the development of light industry and equipment manufacturing in the western region. Under the Central Rise policy, the correlation coefficients of the three industries do not differ much, which indicates that the three industries have been developed in a balanced way. Due to the abundant natural resources in the central region, various industries and enterprises have a certain development foundation, and the industrial structure is relatively balanced. The regression analysis of the overall performance of enterprises and the performance of enterprises in each industry before and after the implementation of the regional policy found that the regional policy can improve the performance of enterprises in the region. Hypothesis 1 holds.

Regression analysis results of enterprise performance in various industries in the region

| Enterprise industry | Variable | Revitalization of Northeast China | Western development | Central rise plan |

|---|---|---|---|---|

| Light industry | CAR | 0.725*** (12.56) | 0.814*** (12.79) | 0.733*** (12.62) |

| Age | 0.013*** (18.63) | 0.102*** (20.66) | 0.213*** (23.97) | |

| Size | −0.031*** (−60.57) | −0.024*** (−59.32) | −0.016*** (−52.49) | |

| ALR | 0.536*** (5.91) | 0.447*** (5.19) | 0.385*** (4.62) | |

| IAR | 0.463*** (26.71) | 0.530*** (27.59) | 0.419*** (25.99) | |

| CTR | −0.329*** (−74.58) | −0.330*** (−73.94) | −0.327*** (−73.66) | |

| FAR | −0.443*** (−6.33) | −0.430*** (−6.37) | −0.439*** (−6.29) | |

| Heavy industry | CAR | 0.834*** (14.69) | 0.753*** (13.71) | 0.762*** (13.95) |

| Age | 0.015*** (17.62) | 0.127*** (23.18) | 0.133*** (26.97) | |

| Size | −0.134*** (−68.71) | −0.156*** (−70.05) | −0176*** (−73.68) | |

| ALR | 0.443*** (5.18) | 0.653*** (6.87) | 0.670*** (6.95) | |

| IAR | 0.679*** (28.71) | 0.553*** (27.15) | 0.540*** (24.95) | |

| CTR | −0.219*** (−70.59) | −0.287*** (−75.15) | −0.302*** (−78.05) | |

| FAR | −0.450*** (−6.84) | −0.395*** (−6.05) | −0.428*** (−6.25) | |

| Equipment manufacturing industry | CAR | 0.710*** (12.08) | 0.834*** (15.27) | 0.730*** (12.51) |

| Age | 0.012*** (16.88) | 0.043*** (19.68) | 0.021*** (17.52) | |

| Size | −0.031*** (−59.74) | −0.046*** (−60.28) | −0.062*** (−65.71) | |

| ALR | 0.512*** (7.85) | 0.432*** (6.95) | 0.311*** (5.98) | |

| IAR | 0.450*** (27.95) | 0.521*** (28.71) | 0.514*** (28.74) | |

| CTR | −0.219*** (−70.88) | −0.187*** (−69.84) | −0.163*** (−68.95) | |

| FAR | −0.437*** (−6.98) | −0.510*** (−7.53) | −0.446*** (−6.95) | |

| N | 11,723 | 11,723 | 11,723 | |

| Adj R 2 | 0.216 | 0.216 | 0.216 | |

Note: *** indicates significance at the 0.01 level.

4.3.2 The Significant Role of Regional Policies in Improving the Performance of SOEs Analysis

To investigate the role of regional policies in improving the performance of SOEs, the study uses regression analysis to analyze the regression effect of SOE performance before and after the implementation of regional policies. The specific results of the analysis are shown in Table 8. In Table 8, the correlation coefficients of SOE performance under the policies of Revitalization of Northeast China, Northwest Development, and Central Rise are 0.832, 0.651, and 0.527, respectively. This shows that the three regional policies have a positive driving effect on SOE performance. The correlation coefficients of −0.854, −0.321, and −0.404 for the performance of non-SOEs are lower, and the policy has a relatively small role in enhancing the performance of non-SOEs. This is due to the fact that the actual operator of SOEs is the government, which has advantages in terms of information access, etc. Meanwhile, most SOEs hold the lifeline of the national economy and have a leading role in high-tech industries. The improvement of SOEs’ performance is conducive to safeguarding national economic security, while giving full play to their driving role, strengthening the cooperation between SMEs and SOEs, and promoting the steady development of the overall economy. The impact of three policies on the performance of SOEs shows that the correlation coefficient between the Revitalization of Northeast and Central Rise of China and the performance of SOEs is significant at the 0.01 level. This indicates that the improvement effect of policies for the Revitalization of Northeast and Central Rise of China is more significant. This is because there are many social public projects for enterprises in the Revitalization of Northeast and Central Rise of China, such as electricity, natural gas, machinery, etc. Expanding the number of SOEs and reforming SOEs are the key focus of regional policies. In summary, the effect of regional policies on the performance of SOEs is more significant. Hypothesis 2 holds.

Regression analysis results of regional policies on the performance of SOEs

| Variable | Revitalization of Northeast China | Western development | Central rise plan |

|---|---|---|---|

|

|

0.832*** (7.59) | — | — |

|

|

— | 0.651 | — |

|

|

— | — | 0.527*** (5.16) |

|

|

−0.854*** (−24.19) | — | — |

|

|

— | −0.321*** (−15.99) | — |

|

|

— | — | −0.404*** (−17.95) |

| SOE | −0.986*** (−41.28) | −0.968*** (−40.15) | −0.990*** (−41.59) |

| CAR | 1.138*** (18.94) | 1.136*** (18.92) | 1.128*** (18.05) |

| Age | 0.097*** (29.48) | 0.095*** (29.15) | 0.089*** (29.01) |

| Size | −0.765*** (−68.27) | −0.759*** (−68.05) | −0.744*** (−67.89) |

| ALR | 0.305*** (3.95) | 0.296*** (3.84) | 0.287*** (3.51) |

| IAR | 1.339*** (10.59) | 1.285*** (10.08) | 1.340*** (10.65) |

| CTR | −0.213*** (−17.59) | −0.204*** (−17.08) | −0.216*** (−17.96) |

| FAR | −0.348*** (−5.96) | −0.339*** (−5.48) | −0.345*** (−5.69) |

| N | 26,453 | 26,453 | 26,453 |

| Adj R 2 | 0.189 | 0.193 | 0.191 |

Note: *** indicates significance at the 0.01 level.

4.4 Robustness Analysis

To improve the reliability and scientificity of research results, it is necessary to conduct robustness tests on empirical results. The purpose is to avoid interference from factors such as data accuracy and variable complexity and to improve the validity and accuracy of research results. Prior to this, endogeneity testing is conducted using the instrumental variable method. In the second stage, the regression coefficients of regional policy and corporate performance are significantly positive at the 1% level, consistent with the above results. Then, the results are analyzed for robustness using a placebo test, and the results of the analysis are shown in Table 9. To improve the robustness of the research results, the method of replacing time periods is used for testing. In the double DID model, different time periods are selected to observe the impact of regional policies on firm performance. Regarding the policy of Northeast Revitalization of the Old Industrial Base, the adjusted period is from 2001 to 2006. Regarding the Western Development policy, the time period is from 1998 to 2004. In response to the Central Rise Plan, the period is from 2003 to 2008. The robustness of the research results is verified by adjusting the time period to ensure that the results are not affected by the selection of specific time periods. From Table 9, before the policy implementation, for hypothesis 1, the correlation coefficients between Northeast Revitalization of the Old Industrial Base, Western Development, and Central Rise Plan and firm performance are −0.426, −0.344, and 0. The level of significance is 0.05. This indicates that the first two regional policies have a negative proportional effect on firm performance, while the Central Rise Plan policy has no effect on firm performance in the region. For hypothesis 2, the correlation coefficients between Northeast Revitalization of the Old Industrial Base, Western Development, and Central Rise Plan and SOE performance have correlation coefficients of −0.987, −0.879, and −0.563. The level of significance is 0.01. This implies that the three policies have little effect on SOE performance enhancement. The placebo test results contradict the empirical results of hypothesis 1 and hypothesis 2, which indicates that the empirical results of hypotheses 1 and 2 are valid. This suggests that in the context of regional economic policy, policy choices should be based on objective economic indicators and regional development needs, rather than subjective choices or the influence of specific interest groups. In addition, the specific time of policy implementation should be randomly determined to avoid bias in the results due to non-randomness in time. To test the randomness hypothesis, the randomness of policy choices can be tested by comparing the changes in economic indicators in the region before and after the implementation of the policy, as well as with other regions that have not implemented the policy. The results of the robustness test indicate that within the adjusted time period, the impact of regional policies on corporate performance remains significant, especially for SOEs. The correlation coefficient between the Northeast Revitalization policy and the performance of SOEs is 0.887, the Western Development policy is 0.764, and the Central Rise policy is 0.652. The policy indicators are significantly higher than those of non-SOEs. This indicates that regional policies have consistent and robust impacts on corporate performance across different time periods. This indicates that compared to non-SOEs, regional policies have a more significant impact on the performance of SOEs. In the process of formulating and implementing regional policies, more attention should be paid to the characteristics and needs of SOEs. Due to the advantages of SOEs in obtaining policy information and resources, the implementation effect of policies is more significant in SOEs. Therefore, policymakers should fully consider the special position and role of SOEs in regional economic development and formulate more targeted policy measures.

Analysis of placebo test results

| Hypothesis | Variable | Revitalization of Northeast China | Western development | Central rise plan |

|---|---|---|---|---|

| Hypothesis 1 |

|

−0.426 | — | — |

|

|

— | −0.344*** (−6.81) | — | |

|

|

— | — | 0 | |

| Hypothesis 2 |

|

−0.987*** (−9.57) | — | — |

|

|

— | −0.879 | — | |

|

|

— | — | −0.563 | |

|

|

0 | — | — | |

|

|

— | 0.342 | — | |

|

|

— | — | 0.357*** (9.51) | |

| N | 27,563 | 27,640 | 27,356 | |

| Adj R 2 | 0.223 | 0.223 | 0.217 | |

Note: *** indicates significance at the 0.01 level.

In the testing of stabilizers, there may be some deviation in the data, which may be due to bias in the selection and processing of sample data. In addition, before implementing regional policies, there may be differences at the baseline level between the treatment group and the control group, leading to incomplete validity of the parallel trend hypothesis. The modeling may have resulted in the omission of some key variables or the use of insufficient control variables in the model, thus affecting the accuracy of the results. In the selection of data, the range of time may not be sufficient to capture the long-term impact of regional policies on firm performance, resulting in an insignificant effect in the short term. Heterogeneity in the level of economic development and the effects of policy implementation in different regions may also lead to differences in the results.

Therefore, it is necessary to ensure that the sample selection is representative and avoid differences in results due to sample bias. By increasing the sample size and adjusting the sample selection criteria, the reliability of the results can be improved. More relevant control variables are introduced in the model to ensure the completeness of the model setting. Therefore, subsequent research can also incorporate variables such as the industry in which the enterprise operates and the level of regional economic development. This can further control other factors that may affect corporate performance. This study further tests the hypothesis that the experimental group and the control group have parallel trends before policy implementation. The consistency of trends between the two groups before policy implementation is ensured.

The results of the robustness test using propensity score matching are shown in Table 10. In Table 10, the correlation coefficients between the policies of Revitalization of Northeast China, Western Development, and Central Rise and firm performance are 0.028, 0.062, and 0.088. The level of significance is 0.01. The firm performance under the Central Rise policy reflects significance at the 0.01 level, while the levels of CAR, IAR, and ALR indicators within each region are significantly influenced by the regional policies. This indicates a positive correlation between the three regional policies and the performance of enterprises within the region. The performance level of enterprises has been improved by improving their innovation capabilities, which is consistent with hypothesis 1.

Robustness test results of propensity score matching method

| Variable | Revitalization of Northeast China | Western development | Central rise plan |

|---|---|---|---|

|

|

0.028 | — | — |

|

|

— | 0.062 | — |

|

|

— | — | 0.088*** (2.57) |

| CAR | 0.880*** (12.58) | 0.876*** (12.45) | 0.904*** (12.79) |

| Age | 0.654*** (41.28) | 0.578*** (40.15) | 0.580*** (40.28) |

| Size | −0.860*** (−78.19) | −0.875*** (−79.24) | −0.883*** (−80.05) |

| ALR | 0.498*** (5.06) | 0.408*** (4.73) | 0.530*** (5.72) |

| IAR | 0.809*** (6.07) | 0.798*** (5.91) | 0.773*** (5.76) |

| CTR | −0.166*** (−9.85) | −0.167*** (−9.89) | −0.143*** (−9.59) |

| FAR | −0.309*** (−5.16) | −0.353*** (−5.93) | −0.322*** (−5.74) |

| N | 25,673 | 26,890 | 25,321 |

| Adj R 2 | 0.241 | 0.246 | 0.236 |

Note: *** indicates significance at the 0.01 level.

The study analyzes the omitted variables, where the main variables are the economic control macro-uncertainty and the inclusion of other macroeconomic variables, as shown in Table 11. Table 11 shows the results of the stability test of the omitted variables.

Stability test results for omitted variables

| Project | Controlling macroeconomic uncertainty | Add macroeconomic leading index | Join the entrepreneur confidence index | Join the enterprise prosperity index |

|---|---|---|---|---|

| Economic policy uncertainty | 0.027* (2.209) | 0.162*** (3.159) | 0.151** (3.0593) | 0.158*** (3.332) |

| Economic policy uncertainty squared | −0.007* (−2.153) | −0.053** (−3.068) | −0.039** (−2.659) | −0.051** (−3.002) |

| Macroeconomic uncertainty | 0.006** (2.631) | |||

| Macroeconomic leading index | 0.229*** (4.122) | |||

| Entrepreneur confidence index | 0.071*** (4.298) | |||

| Business climate index | 0.073*** (3.664) | |||

| Control variables | Yes | Yes | Yes | Yes |

| Individual and seasonal effects | Yes | Yes | Yes | Yes |

Note: *indicates significance at the 10% level; **indicates significance at the 5% level; ***indicates significance at the 1% level.

As analyzed in Table 11, the regression coefficient of economic policy uncertainty is significantly positive (0.027) in the period of controlling for macroeconomic control. This indicates that economic policy uncertainty still positively affects firm performance against the background of high macroeconomic uncertainty. Meanwhile, the regression coefficient of its squared term is significantly negative (−0.007), which further supports the main conclusion of the study that there is an inverted U-shaped effect of economic policy uncertainty on firm performance. When the macroeconomic prior index is added, the regression coefficient of economic policy uncertainty is significantly positive (0.162), and the value of the coefficient increases compared to the baseline model. This further strengthens the positive impact of economic policy uncertainty on firm performance. When the entrepreneurial confidence index is added, the regression coefficient of economic policy uncertainty is still significantly positive (0.151), and the coefficient value remains stable. This indicates that the entrepreneurial confidence index does not change the basic impact of economic policy uncertainty on enterprise performance. The regression coefficient of economic policy uncertainty remains significantly positive (0.158) after the inclusion of the entrepreneurial sentiment index. This further validates the robustness of our main findings. Meanwhile, the regression coefficient of the enterprise prosperity index is significantly positive (0.073). This indicates that the overall favorable or unfavorable business conditions of enterprises have a positive impact on enterprise performance. In summary, the inverted U-shaped effect of economic policy uncertainty on enterprise performance still holds after controlling for macroeconomic uncertainty and adding other macroeconomic variables. Meanwhile, variables such as the macroeconomic advance index, entrepreneurial confidence index, and business sentiment index also have a significant impact on enterprise performance.

The results of the robustness type test using the replacement time period approach are shown in Table 12. In Table 12, the implementation time of Revitalization of Northeast China, Western Development, and Central Rise policies are adjusted to 2001–2006, 1998–2004, and 2003–2008, respectively. The significance between each policy and firm performance is positive in this time period. The correlation values between the performance of SOEs and the policies within the three policy implementation regions are 0.887, 0.764, and 0.652. The level of significance is 0.01. The data are more significantly enhanced by regional policies compared to non-SOEs. This finding is consistent with the empirical results of hypothesis 1 and hypothesis 2, which proves the robustness of the data. The uniqueness assumption requires that no other policies or events have a significant impact on the study population during the study period to ensure that the observed changes can be attributed to the policy under study. In the study of regional economic policies, other factors that may affect the performance of firms, such as other economic policies, market changes, or technological advances, need to be excluded. To ensure that the uniqueness assumption holds, other potential influences can be identified and controlled for by collecting and analyzing relevant policy documents and data.

Analysis of robust inspection results in replacement time period mode

| Hypothesis | Variable | Revitalization of Northeast China | Western development | Central rise plan |

|---|---|---|---|---|

| Hypothesis 1 |

|

0.043 | — | — |

|

|

— | 0.064 | — | |

|

|

— | — | 0.085*** (3.74) | |

| Hypothesis 2 |

|

0.887*** (15.96) | — | — |

|

|

— | 0.764** (13.85) | — | |

|

|

— | — | 0.652*** (12.67) | |

|

|

−0.793 | — | — | |

|

|

— | −0.366*** (−9.84) | — | |

|

|

— | — | −0.458*** (−12.71) | |

| Time | 2001–2006 | 1998–2004 | 2003–2008 | |

| N | 26,880 | 26,735 | 26,839 | |

| Adj R 2 | 0.215 | 0.220 | 0.218 | |

Note: *** indicates significance at the 0.01 level. ** indicates significance at the 0.05 level.

In the coordinated development of regional economy, regional policies significantly affect the performance of enterprises in the region, which is conducive to improving the level of enterprise performance. Gao et al. explored the impact of digital finance on green innovation through mechanism analysis. From the results, digital finance has promoted the development of green innovative technologies. Diversified behavior supported by policies will strengthen this impact. The development of technology has a certain promoting effect on enterprise performance (Gao et al., 2023). Fang and Sheng (2021) found in their policy-oriented analysis that it is beneficial for promoting green product innovation, thereby promoting the development of enterprises. Liu et al. (2021) analyzed the impact of positive regional policies on the migration of manufacturing enterprises. The results showed that industrial transfer policies have a positive impact. From this, regional policies have a positive impact on corporate performance. Reasonably formulating regional policies is conducive to promoting the good development of enterprises. Therefore, in the parallel trend assumption, it is required that the trend of changes in corporate performance should be parallel before policy implementation, that is, there should be no systematic differences (Nezhadkian et al., 2023). It indicates that the two groups of firms should have similar performance and trends in performance before the implementation of the policy. To test the parallel trend hypothesis, performance data of enterprises before and after policy implementation can be compared. Statistical methods can also be used to test the consistency of performance trends between two groups of enterprises.

5 Conclusions and Recommendations

As an important part of the macroeconomic regulation of enterprises, regional policies can mobilize local motivation and promote regional modernization and high-quality development. To improve the accuracy and effectiveness of regional policies, two hypotheses on regional policies and enterprise performance were proposed. A corresponding model was constructed, and an empirical analysis was carried out. The analysis results indicated that regional policies were capable of enhancing the performance of enterprises in the respective region. However, performance improvement from regional policies on non-SOEs was not significant compared to that of SOEs, considering the nature of their property rights. The study proposed three recommendations for the current status of regional policy formulation: The first is to adhere to a problem-oriented approach and formulate regional policies accurately. In formulating regional policies, the shortcomings and bottlenecks of economic development in each region should be analyzed in depth to ensure that the policies can accurately meet actual needs. The second is to coordinate the relationship between the government and the market to stimulate the vitality of enterprises. In the coordinated development of regional economy, the government should give full play to its macro-control function. At the same time, it should also respect the laws of the market and avoid excessive intervention. The third is to focus on the guiding role of SOEs and balance the policy relationship. SOEs play an important role in the regional economy, and their operating conditions and performance levels have an important impact on regional economic development. Therefore, when formulating regional policies, the special status and role of SOEs should be fully considered, and their guiding role should be played. Meanwhile, management also plays a core role in modern society, which realizes the effective configuration and integration of organizational resources through planning, organizing, commanding, coordinating, and controlling and then reaches organizational goals. In the process of coordinated regional economic development and enterprise performance improvement, management plays a crucial role. Management improves the efficiency of policy implementation and ensures the rapid implementation and effectiveness of policies. It also optimizes resource allocation, making policy and financial resources more effectively serve regional economic development. Although the study has achieved certain results, due to the limitations of time and other conditions, the policy implementation time selected for the study is not long enough. Future research needs to increase policy implementation time, enrich sample data, improve the scientific and comprehensive nature of research results, and provide scientific and reliable regional policies.

-

Funding information: The research is supported by Research Project Support from the Zhejiang Provincial Department of Education (Project Number: Y202352536).

-

Author contributions: All authors have accepted responsibility for the entire content of this manuscript and consented to its submission to the journal, reviewed all the results and approved the final version of the manuscript. Conceptualization, WL and XC; methodology, WL; software, WL; validation, WL, and XC; formal analysis, WL; investigation, WL; resources, WL; data curation, WL; writing – original draft preparation, WL; writing – review & editing, WL; visualization, WL; supervision, WL; project administration, WL.

-

Conflict of interest: Authors state no conflict of interest.

-

Data availability statement: Data will be available on a reasonable request.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Ahamed, F. T., Houqe, M. N., & van Zijl, T. (2023). Meta‐analysis of the impact of financial constraints on firm performance. Accounting & Finance, 63(2), 1671–1707.10.1111/acfi.12923Suche in Google Scholar

Arad, H., Imeni, M., & Salehpour, Z. (2023). Political connections, family ownership and earnings quality: Some evidence from Iran. International Journal of Finance and Managerial Accounting, 8(32), 103–116.Suche in Google Scholar

Burlina, C., Casadei, P., & Crociata, A. (2023). Economic complexity and firm performance in the cultural and creative sector: Evidence from Italian provinces. European Urban and Regional Studies, 30(2), 152–171.10.1177/09697764221125336Suche in Google Scholar

Chu, C. H., & Liu, S. C. (2024). The impact of corporate core values on service quality management strategies: A study of grand earl hotel in Taiwan. Management Analytics and Social Insights, 1(1), 40–49.Suche in Google Scholar

Dang, C., Wang, B., & Hao W. (2020). An optimal banking structure from the perspective of enterprise technological innovation – empirical evidence from Chinese industrial enterprises. Applied Economics, 52(59), 6386–6399.10.1080/00036846.2020.1795069Suche in Google Scholar

Deng, K, Ding, Z, & Xu, M. (2019). Population agglomeration and the effectiveness of enterprise subsidies: A Chinese analysis. Regional Studies, 54(8), 1136–1148.10.1080/00343404.2019.1681586Suche in Google Scholar

Ding, Y. Y. (2022). Symbiotic relationship between smart enterprises in an entrepreneurial ecosystem. Enterprise Information Systems, 16(3), 494–507.10.1080/17517575.2020.1844304Suche in Google Scholar

Fang, L, & Sheng, Z. (2021). Policy orientation, knowledge dynamic ability and green innovation: A mediation model based on China provincial panel data. Zbornik radova Ekonomskog fakulteta u Rijeci/Proceedings of Rijeka Faculty of Economics, 39(1), 9–37.10.18045/zbefri.2021.1.9Suche in Google Scholar

Feng, X., Luo, W., & Wang, Y. (2023). Economic policy uncertainty and firm performance: Evidence from China. Journal of the Asia Pacific Economy, 28(4), 1476–1493.10.1080/13547860.2021.1962643Suche in Google Scholar

Gao, K., Chen, H., Tian, S., Sun, R., Cui, K., & Zhang, Y. (2023). A nexus between green digital finance and green innovation under asymmetric effects on renewable energy markets: A study on Chinese green cities. Environmental Science and Pollution Research International, 30(16), 46632–46646.10.1007/s11356-022-24750-7Suche in Google Scholar

Grillitsch, M., Rekers, J. V., & Toedtling, F. (2019). When drivers of clusters shift scale from local towards global: What remains for regional innovation policy? Geoforum, 102(JUN.), 57–68.10.1016/j.geoforum.2019.03.010Suche in Google Scholar

Guo, C., Wang, Y., Hu, Y., Wu, Y., & Lai, X. (2024). Does smart city policy improve corporate green technology innovation? Evidence from Chinese listed companies. Journal of Environmental Planning and Management, 67(6), 1182–1211.10.1080/09640568.2022.2157708Suche in Google Scholar

Harrison, R. T., Leitch, C. M., & Maura, M. A. (2020). Woman’s entrepreneurship as a gendered niche: The implications for regional development policy. Journal of Economic Geography, 20(4), 1041–1067.10.1093/jeg/lbz035Suche in Google Scholar

Jahanger A. (2020). Influence of FDI characteristics on high-quality development of China’s economy. Environmental Science and Pollution Research, 28(15), 18977–18988.10.1007/s11356-020-09187-0Suche in Google Scholar

Kegui, C., Xinyu, W., Min, H., & Ren, L. (2021). Monitoring strategies of enterprise’s emission reduction with asymmetric information. RAIRO – Operations Research, 55(Suppl.), S2455–S2470.10.1051/ro/2020095Suche in Google Scholar

Le, T. H., Park, D., Castillejos-Petalcorin, C. (2023). Performance comparison of state-owned enterprises versus private firms in selected emerging Asian countries. Journal of Asian Business and Economic Studies, 30(1), 26–48.10.1108/JABES-08-2021-0116Suche in Google Scholar

Liao, C., & Wang, S. (2021). The political economy of the differential regional effects of monetary policy: Evidence from China. The Developing Economies, 59(4), 351–370.10.1111/deve.12272Suche in Google Scholar

Lin, K. J., Lu, X., Zhang, J., Xiaoyan, L., & Zheng Y. (2020). State-owned enterprises in China: A review of 40 years of research and practice. China Journal of Accounting Research, 13(1), 31–55.10.1016/j.cjar.2019.12.001Suche in Google Scholar

Liu, Y., Yeung, G., Liang, Y. T., & Li, X. (2021). Pro-active regional policy and the relocation of manufacturing firms: A case study of state-led industrial relocation in Guangdong, China. Eurasian Geography and Economics, 63(3), 1–28.10.1080/15387216.2020.1870515Suche in Google Scholar

Matsuzaki, T., Shigeno, H., Ueki, Y., & Tsuji, M. (2021). Innovation upgrading of local small and medium-sized enterprises and regional innovation policy: An empirical study. Industrial Marketing Management, 9, 128–136.10.1016/j.indmarman.2020.07.009Suche in Google Scholar

Mehlabani, E. G., & Chandramohanan, A. (2024). Intersecting realms: Analyzing impediments to efficient transit operations in maritime ports. Management Analytics and Social Insights, 1(1), 28–39.Suche in Google Scholar

Misakov, V. S., Tsurova, L. A., Yandarbayeva, L. A., Tkhamadokova, I. K., & Gapurovna, G. M. (2019). Certification of a regional economic complex as a highly effective tool for analysis and diagnostics of its development. Amazonia Investiga, 8(20), 451–458.Suche in Google Scholar

Nezhadkian, M., Azimi, S. M., Ferro, A., & Nafei, A. H. (2023). A model for new product development in business companies based on grounded theory approach and fuzzy method. Journal of Computational and Cognitive Engineering, 2(2), 124–132.10.47852/bonviewJCCE2202260Suche in Google Scholar

Oh, S Y. (2021). China’s race to the top: Regional and global implications of China’s industrial policy. World Trade Review, 20(2), 169–185.10.1017/S147474562000052XSuche in Google Scholar

Ren, Y., Li, B., & Liang, D. (2023). Impact of digital transformation on renewable energy companies’ performance: Evidence from China. Frontiers in Environmental Science, 10(1), 1105686–1105687.10.3389/fenvs.2022.1105686Suche in Google Scholar

Sazegari, S., Davoodi, S. M. R., & Goli, A. (2022). Pricing the green products in a sustainable supply chain with data envelopment analysis approach (case study: Home appliance companies). Journal of Applied Research on Industrial Engineering, 9(2), 165–179.Suche in Google Scholar

Shen, C., Li, S., Wang, X., & Liao, Z. (2020). The effect of environmental policy tools on regional green innovation: Evidence from China. Journal of Cleaner Production, 254(May 1), 1–10.10.1016/j.jclepro.2020.120122Suche in Google Scholar

Srhoj, S., Vitezić, V., & Wagner, J. (2023). Export boosting policies and firm performance: Review of empirical evidence around the world. Jahrbücher für Nationalökonomie und Statistik, 243(1), 45–92.10.1515/jbnst-2022-0019Suche in Google Scholar

Tang, Y., Sun, M., Ma, W., & Bai, S. (2020). The external pressure, internal drive and voluntary carbon disclosure in China. Emerging Markets Finance and Trade, 56(14), 3367–3382.10.1080/1540496X.2019.1689356Suche in Google Scholar

Vanthillo, T., Beckers, J., & Verhetsel, A. (2021). The changing nature of regional policy in Europe. Oxford Review of Economic Policy, 37(1), 201–220.10.1093/oxrep/graa058Suche in Google Scholar

Wang, R, & Zhou, W. C. (2020). The influence of regional institutional setting on the performance of innovative entrepreneurship: An emerging market perspective. Chinese Management Studies, 14(3), 639–659.10.1108/CMS-08-2019-0294Suche in Google Scholar

Zhan, J, & Zhu, J. (2021). The effects of state ownership on innovation: Evidence from the state-owned enterprises reform in China. Applied Economics, 53(1), 145–163.10.1080/00036846.2020.1796918Suche in Google Scholar

Zhang, Z. (2020). Inter-region transportation costs, regional economic growth, and disparities in China. Frontiers of Economics in China, 15(2), 282–311.Suche in Google Scholar

Zhou, W., Gao, H., & Bai, X. (2019). Building a market economy through WTO-inspired reform of state-owned enterprises in China. International & Comparative Law Quarterly, 68(4), 977–1022.10.1017/S002058931900037XSuche in Google Scholar

© 2024 the author(s), published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Regular Articles

- Political Turnover and Public Health Provision in Brazilian Municipalities

- Examining the Effects of Trade Liberalisation Using a Gravity Model Approach

- Operating Efficiency in the Capital-Intensive Semiconductor Industry: A Nonparametric Frontier Approach

- Does Health Insurance Boost Subjective Well-being? Examining the Link in China through a National Survey

- An Intelligent Approach for Predicting Stock Market Movements in Emerging Markets Using Optimized Technical Indicators and Neural Networks

- Analysis of the Effect of Digital Financial Inclusion in Promoting Inclusive Growth: Mechanism and Statistical Verification

- Effective Tax Rates and Firm Size under Turnover Tax: Evidence from a Natural Experiment on SMEs