Abstract

In the framework of foreign direct investments (FDI) and green finance (GF), environmental regulations (ERs) and green technologies have influenced China’s green economic recovery between 2000 and 2020. The idea is to conduct an empirical investigation of the main drivers behind China’s green economic revival. Second-generation panel cointegration techniques were adopted for the analysis. The relationship among ERs, green technological investment, GF, and green economic recovery is supported by the long-run cointegration results. In this context, some of the most important measures include ER, GF, and increased investment in environmentally friendly technologies. The estimated results demonstrate a positive contribution towards the green economic recovery from GF, the development of green technologies, and ERs. Evidence suggests that green economic recovery is inversely associated with FDI. The establishment of an environmentally sustainable economy can be rendered by policy implications to continue advocating for the green shift in financial institutions along with enforcing the appropriate regulations and laws.

1 Introduction

There has been much discussion concerning about the influence of global warming on carbon emissions and the connection between those emissions and economic expansion and energy utilization (Chen et al., 2021). The nature of the environment is the most important component in determining or achieving sustainable development, as stated by the United Nations (UN) Convention on Changing Environments since the Third Millennium, which was negotiated in December 1997. According to the UNs Convention on Climate Change’s Kyoto Protocol, this has been true since the turn of the millennium (Sadiq et al., 2021). Summits are also scheduled to take place in Johannesburg and Rio de Janeiro. Nevertheless, the development of economic activity and the rise in energy consumption are the principal causes of environmental damage because these factors constitute key conduction routes (Wei & Lihua, 2022). In order to slow down the rate at which the environment is deteriorating, growth strategies need to consider environmental concerns. Striking this delicate balance can be challenging for politicians. The recent economic development acceleration is mainly regarded as industrialization, urbanization, and transport infrastructure development. All three processes depend significantly on fossil fuels such as oil and coal. Oil and coal are essential to the functioning of industrial processes, electric power generation, and transportation systems (Khan et al., 2021).

A high level of energy efficiency is often cited as a benefit when discussing rapid economic expansion, new industries’ creation, and cities’ growth.

The expansion of the financial sector is an additional source of carbon emissions (Tang et al., 2019). The increased availability of financing that results from financial development is beneficial to both individuals and businesses. As a result of an increase in the demand for machines and automobiles, there will be growth in both the manufacturing and transportation industries (Zhou et al., 2006). The advancement of finance has a complex impact on energy use on a global scale. It is also essential to give some thought to the use of environmentally friendly funding in order to reduce pollution. The importance of literature on environmentally responsible finance has been rapidly growing. The world is now aware that the best strategy for halting the rise in average temperatures across the globe is to put money into environmentally friendly financial projects. As a result of the decreased usage of energy, there has been an increase in the need for environmentally friendly financing (Qiu et al., 2021). If more people spend their money on environmentally friendly financial programs, there will be less pollution across the earth. The needs of a good and sustainable society can be met in the long run by a global economic system that can generate, regulate, and manage investment resources. Allotting funds for renewable growth, agricultural goods, and methods with the specific intention of bringing about a green financial shift in order to mitigate the increasing carbon dioxide (CO2) emissions in a humane and environmentally responsible manner is what is meant by the term “green financing” (Liu et al., 2021).

The management of environmental issues and the reduction of anticipated levels of risk are two of the primary objectives of green finance (GF). It is a vital step towards ensuring that investments that perpetuate unsustainable growth tendencies are placed lower on the list of priorities than green efforts. Green finance is aided by long-term investment and receptiveness to environmental concerns, which encompasses many of the scenarios for sustainable development described in the United Nations’ Sustainable Development Goals (SDGs). This is due to the fact that many of the prerequisites for sustainable development are already present in GF (Zhao et al., 2022). Along with investments in green technology, coordinating the marketing of green products across the supply chain can significantly impact a company’s long-term viability (Khan & Chaudhry, 2021; Wen & Zhang, 2022; Xie et al., 2021). In order to translate consumer concern for the environment into action at the register, stores must engage in “green marketing” (Zhao et al., 2022). Many stores, however, are hesitant to invest in green marketing because they are typically not subject to emission controls (Yu & Wang, 2021). As a result, there needs to be a coordinated effort to split the costs of green marketing. To work together, the manufacturer will put money into green technology, and the retailer will promote green products through green marketing. In addition, the retailer’s willingness to engage in green marketing is increased if the manufacturer bears a portion of the marketing expenses (Khan et al., 2021). Improvements in energy efficiency and mitigation of pollution’s negative effects on the environment are two areas where environmental regulation (ER) has consistently shown positive results (Ngo, 2022). Investments in environmental protection, energy efficiency, and robust economic growth largely fell flat. For this reason, the ruling elite is looking for strategies to boost energy efficiency (Raza, 2020). Similarly, most economies have introduced a novel deployment model from an institutional standpoint, focusing on reworking the current environmental management system, carrying out the local government’s environmental responsibility, safeguarding citizens’ health, and promoting sustainable social development (Dai et al., 2021). Foreign Direct Investment (FDI) is critical to the progress of developing countries and should not be underestimated. The positive effects of FDI on financial resource provision, technology spillovers, human capital formation, research and development (R&D), international trade integration, market expansion, and economies of scale have led many to label it a key driver of economic growth (Kinyondo & Huggins, 2021). The advantages of FDI are beneficial to the growth of the manufacturing sector (Bashir et al., 2022; Zhang et al., 2021).

The significance of this research study is to examine the relationships between ER, GF, FDI, and investment in green technology innovation (GTI) and their effects on different forms of green economic recovery (CO2 emissions). Moreover, this study is highly important to investigate how China’s green productivity development was affected by the ER strategy between 2000 and 2020. The distinctive and novel feature of this research is characterized by categories and selected factors in the context of China from 2000 to 2020, which have not been thoroughly studied in many research. The study provides new perspectives and policy implications to support a quick revival of the green economy. The significance of this research emphasizes the necessity of strict environmental laws. Furthermore, we use the GF, FDI, and GTI functions to explore GER further. As a result, the environmental and economic sectors may provide additional insight into the factors contributing to green output. Iin contrast to the previous investigation on traditional efficiency, which has mostly concentrated on a beneficial result, the authors used various econometric tools to investigate negative yield and address the potential limitation of energy and environmental restrictions. The results will help policymakers and other interested parties determine which industries should and should not be involved in environmental protection.

2 Review of Literature

2.1 Green Technology Investment and Green Economic Recovery

Since carbon emission is one of the time’s most pressing environmental issues, many studies have focused on it from various angles (Hsu et al., 2021). The need for carbon emissions-based green certificates is investigated by Li et al. (2020). Towards this end, Cai et al. (2020) examine how renting green investment, energy use, financial growth, and natural resources can help bring about the desired reduction in carbon emissions. While they ignore green technologies (GTs) practical application, we consider it in the context of GTI optimization. CO2 emissions strongly correlate with GT developments (Ouyang et al., 2020). Disaggregated levels of non-renewable energy show a long-term relationship, while renewable energy does not show a long-term association across the quantile distribution. The findings show that CO2 emissions are positively impacted by renewable energy providers; coal has the largest coefficient, subsequent to oil and gas. Renewable energy sources, nevertheless, have little effect on lowering CO2 emissions. Comparably, overall energy use positively affects CO2 emissions and shows signs of extreme variable sensitivity. The quantile causality test reveals a bidirectional causative association between emissions of CO2, non-renewable energy and renewable energy usage, and total energy consumption (Ahad, 2024). In their study, Mulatu (2017) examines the connection between new eco-friendly technologies and rising incomes. They conclude that green technology innovation and economic growth are subject to a moderating influence from ERs. The most compelling aspect of research – the provision of an optimal GTI subsidy policy – is also ignored by these reports: carbon emission. As part of carbon emission trading schemes, GT implementation is crucial to reducing carbon dioxide emissions. That strategy has been used to lower emissions by a few researchers. For instance, Duan et al. (2021), for example, zeroed in on the growth of eco-friendly construction in a developing nation. Our study is unique because we focus on monopoly market choices for G.T. implementation. In their research, Cai et al. (2020) show how crucial G.T. is to achieving SDGs. There is some thought given to the decision to implement G.T., but no consideration is given to offering a subsidy to cut carbon emissions. To lower greenhouse gas emissions, we think about using G.T.s and how to best subsidize their price. Although environmental policy stringency (EPI) provides a long-term beneficial influence on green growth (GG), economic policy uncertainty (EPU) exerts the opposite effect. Furthermore, according to the error correction approach, EPU and GG have a negative association in Denmark, China, Sweden, and Brazil, although EPI and GG have a favourable relationship throughout a short run. Additionally, a feedback causality connection between the Human Development Index, GG, EPU, and EPI has been established. Conversely, a unidirectional causal link from trading to GG has been observed. Additionally, this investigation offers policymakers various fresh perspectives (Rasheed et al., 2023).

However, there is less information available about how to maximize profits in monopoly markets than in other types of markets. In their analysis of the impact of oil supply on capital assets, Hou et al. (2020) assume a market dominated by a single oil company. They look at the Valorem tax when oil extraction causes climate change. They don’t think about how to implement G.T.s or how to subsidize them. Our research differs from others because we focus on G.T. deployment while assuming optimal GTI subsidy and GTI provision. Zhang et al. (2020d) analyse a monopolized energy and ancillary services market in which electrical energy storage generates revenue. They link the cost of fuel and the initial investment in thermal power plants to the cost of electrical energy storage. The researchers did not look into GTI or emission-cutting policies in their study. To clean up the environment, we evaluate a discrete simulation-based optimization to increase profitability with G.T. adoption and minimize carbon dioxide emissions, taking into account the best subsidy for GTI. Health and welfare in the monopoly market are presented by Ngo (2022). In contrast, our research considers a subsidized G.T. price set by the government in the monopoly market. Our results will aid policymakers in maximizing profits in a monopoly market where G.T. investments are subsidized.

2.2 ERs and Carbon Emissions

Current ERs are widely regarded as crucial tools for addressing environmental issues. Previous studies in this field have shown that ERs do help to lower carbon emissions. Emissions requirements, taxes, monitoring, environmental impact study systems, industrial technology requirements, and so on are all examples of control and command regulation tools that the government might use to begin cutting carbon dioxide emissions (Zhang et al., 2020a). The government has concluded that these administrative actions are necessary to accomplish emission reduction objectives by guiding enterprises to conduct low-carbon technology changes and encouraging select businesses to introduce advanced technological solutions. The government has also implemented stringent administrative measures to promote the relocation or closure of certain highly polluting enterprises (He et al., 2020). Numerous prior studies have corroborated this viewpoint. Using dynamic spatial models, Yameogo et al. (2021) examined the results of a variety of environmental policies and regulations on carbon emissions. The findings supported the idea that command and control regulations aided in cutting down on emissions. Shuai and Fan (2020) looked at how environmental rules affect eco-efficiency. Their findings indicated that ERs based on command and control helped boost eco-efficiency in both central and western China.

However, market-based restrictions, such as taxes on fossil fuels, sewage charges, clean growth mechanisms, carbon trading schemes, government subsidies, and so on, have also helped the government reach its goal of reducing emissions (Wellalage et al., 2021). Research shows that by taking these steps, the government can increase businesses’ manufacturing and environmental governance costs, ultimately lowering their reliance on fossil fuels. Some companies will take initiatives to develop clean technology and boost the levels of technological development in order to achieve the intended carbon reduction (Pan & Chen, 2021). Many empirical studies have confirmed this viewpoint as well. For example, Guo and Yuan (2020) built a model for cross-provincial emissions trading and found that such systems reduced carbon emissions at a low cost. Additionally, Zhang et al. (2020b) studied the effects of three environmental rules on carbon reduction in the Chinese power sector and concluded that government subsidies and market-based regulations would favour carbon discharge reductions. In another related study, Hsu et al. (2021), another related study, found that environmental rules based on the market and voluntary compliance have contributed positively to eco-efficiency gains in eastern China.

However, it was noted that other studies showed that environmental rules would potentially raise carbon emissions, which runs counter to the above-mentioned conclusions. It was Xiang et al. (2022) who first put up the idea of a “green paradox,” the belief that climate change mitigation policies will hasten the use of fossil fuels and increase carbon emissions. In addition, Dong et al. (2021) investigated a “green paradox,” highlighting how the impacted oil markets would anticipate a future decrease in demand and enhance the existing supply before the imposition of ERs, which could increase the current carbon emissions standards. Li et al. (2019) observed the detrimental effects of announcing environmental policies too soon. Consequently, households tended to increase their fossil energy usage in the lead-up to the taxes being applied, which boosted carbon emissions. Energy use and carbon emissions could rise due to a number of factors, including those mentioned by Wang and Zhang (2022), such as gradual increases in carbon tax rates, delays in their implementation, and subsidies for alternative sources of energy.

2.3 Green Finance and Green Economic Recovery

Green finance is not just about funding to combat climate change. Environmental objectives include reducing industrial pollution, improving water quality, and protecting biological variety. Money can be found to implement mitigation and adaptation plans (Wu et al., 2021). Any company or project that strives to decrease or avoid the emission of greenhouse gases (GHGs) results in a financial flow known as a “mitigation flow”. Money being spent making products and people more resistant to the consequences of climate change is known as “adaptation financial flow.” Economic growth and energy use were found to be related in N11 nations when the distributed lag metric causality approach was put to the test (Peng et al., 2020). Energy environmental protection efforts were found to have been undertaken by Israel, Egypt, Italy, Guatemala, Nepal, Korea, Netherlands, and Argentina. It has been noted that countries in the Eurozone and around the world have become more aware of how international trade can spur infrastructure facilities (Wei & Lihua, 2022), specifically by creating a clean environmental framework that encourages the implementation of RE. From a monetary point of view, the development of financial sources has been recommended to provide a number of energy and environmental improvements (Ren et al., 2018).

There will be a growing reliance on the international financial industry to help mitigate climate change. This sector will be significantly aided by introducing new green assets, particularly renewable energy. Therefore, investors may help reduce the impact of climate change and pollution by allocating a portion of their portfolios to green investments. There are a number of approaches to factor climate risk into financial decisions (Song et al., 2021). Alternative solution financing, venture capital for clean technologies, and project finance are all examples of how green traders put their money to work. These strategies include negative and positive testing, energetic possession, and growth (Ahmad et al., 2021).

However, there remains some ambiguity around what constitutes “green” investments and how specific investment businesses should be categorized. Overhyped “green” financial derivatives (“greenwashing”) are common, in which companies overestimate their positive effect on the environment. As a rule, asset management firms and issuers are left to their own devices when determining how much weight to give to environmental metrics when valuing a company (Ye & Wang, 2019). Conflicts of interest among buyers, creditors, and some target providers lead to inconsistent and incorrect data on the environmental impact of different government issuers. In order to direct new investors towards borrowers who can undertake the shift towards a low-carbon environment, shareholders and rating issuers need to be transparent and consistent in their recommendations (Zhu & Qiu, 2019).

3 Data and Methods

The relationship between GF and green economic revival is explored using up-to-date research methods (CO2 emissions). We utilize the market capitalization of green bonds as a surrogate for GF and as a metric for GER. From DataStream, we get information from the year 2000 until 2020. The International Energy Agency provides the fundamental factor of interest: the amount of money spent on renewable energy technology. Carbon emissions and their spatial spillovers are both affected by the same sources. However, carbon emission and FDI data come from the World development indicators.

The hypothesis of the study:

H1: Environmental regulation significantly increases green economic recovery in China.

H2: Green finance has a positive role for GER in selected economies.

H3: Investment in green technologies significantly contributes to GER for the selected panel.

H4: FDI has a significantly negative association with green economic recovery.

Panel data from 2000 to 2020 from 11 YREB regions (local governments) in China are used in this study. The Chinese Environmental Statistics The yearbook, the Chinese National Bureau of Statistical Data, and municipal statistical publications of the 11 cities constitute the underlying sources for data. A small number of missing data intervals were plugged through the method of linear interpolation.

3.1 Model Creation

First, hypothesis emphasizes ERs, which exert an explicit or implicit impact on the interaction between GF and restructuring industries. By implementing particular financing regulation criteria and incorporating financial institutions’ green credit ratings into a macroprudential risk evaluation framework, environmental legislation limits funding to particular sectors. This increases barriers to entry for polluting firms and strengthens the comparative advantages of environmentally friendly industries. In order to increase the effectiveness of environmentally friendly financial services and, consequently, the advancement of regional green phases, the public sector implicitly administers environmental disclosure requirements to provide financial institutions with comprehensive sustainability data on leased business ventures. However, the “pollution refuge hypothesis” suggests that heavily polluting businesses might move and make investments based on differences in the level of regulation across different nations or areas. Environmentally strict places would attract polluting firms to transfer to less restrictive areas, preventing improvements in the industrial framework and the betterment of the natural realm at this point in China’s growth (Zhang et al., 2023; Zhong et al., 2015).

The second hypothesis focuses on innovation and positive environmental spillover effects and innovative green technology. Multiple routes exist. The distribution of resources is optimized by innovations in green technology (Su & Fan, 2022). Convergence and integration of environmentally friendly innovation assets with high-productivity sectors advance the course of corporate structure creation towards knowledge of superior quality amplification. Second, innovations in environmentally friendly technologies have mediated the equation of supply and demand (Xu et al., 2021). Green technology innovation produces new goods and procedures that drive demand from consumers for environmentally friendly use, influence capital flow, and modify the blueprint of investments. Furthermore, the new sectors brought about by innovations in green technology also draw innovative ideas and excess labour to the collegiate sector, which greatly enhances the workforce and quality system of the workforce as well as optimizes the structure of the economy (Yan et al., 2018).

Third, Green technology innovation depends on the funding, plan of action, and risk-diversification that green financing offers (Guo et al., 2019). The monetary backing to innovation in green technology is provided by environmental legislation, which also serves as a blueprint for financial institutions. The task guidance is necessary because, in order to comply with national environmental preservation standards, many energy-intensive and highly polluting businesses need to incorporate novel green technologies into their current manufacturing techniques. This reinforces the guiding implications of environmentally friendly financing. Governments, corporations, academic institutions, and others are encouraged by ERs to work together to create novel green innovations that are both beneficial to the environment and energy-efficient, hence distributing the potential danger of technology.

Data selection and collection have certain limitations in this study. The shift in manufacturing expenditure on interest is primarily associated with financing scale, and the variation in interest expenditure ratio indirectly corresponds to the alteration in financing dimension ratio because green lending data are bank-based, provinces statistics are scarce, and industrial financial assistance in China has a comparatively tiny rate of return gap. The primary targets of national development limits in recent years have been the high-energy-consuming sectors that are typically characterized by a surplus of capacity excessive use, and considerable emissions. It acts as a counterbalance to the financial sector’s attempts to stop the depletion of natural resources and the environment.

Log transformation is effective. It restores a certain consistency to skewed initial data. The correlation between dependent and independent variables gets strengthened by it. It increases the reliability of findings from statistical analysis. However, we must exercise caution when evaluating the log-transformed parameter coefficients. The ability to interpret prediction mistakes within the logs series as estimated percentage errors in the original series prediction is another intriguing feature of the logarithms; however, it should be noted that the calculated percentages are based on predicted values rather than actual values. The ability to comprehend prediction mistakes in the logs series as approximated percentage errors compared to the original series prediction is a further intriguing characteristic of the logarithms; however, it should be noted that the percentages are based on predicted values rather than actual values.

This study focuses on green economic recovery, and it uses investment in green technology innovation (GTI), ER, FDI, and GF as determinants. However, the general form of the selected variables is written as

where GER, GTI, ER, FDI, and GF represent the green economic recovery, green technology investment, ERs, FDI, and GF; however, µ is a random error, i refers to a number of cross-sections, and t is the time period (Table 1).

Variables and their description

| Type of variable | Name of variable | Code applied | Description |

|---|---|---|---|

| Explained variable | Green economic recovery | GER | Calculated according to equation (8) |

| Regulatory variable | Environmental regulation | ER | Estimated through entropy value technique |

| Explanatory variable | Green finance | GF | Through Section 4 calculated result |

| Control variable | Foreign direct investment | FDI | FDI = The actual used FDI natural log |

4 Results and Discussion

Primarily, it is necessary to check out the basic condition of the test via descriptive statistics and pairwise correlation. Data are presented using both descriptive and inferential statistics. The number of observations, standard deviation, maximum, mean, minimum, and median for each study variable is presented in Table 2.

Descriptive statistics of the selected variables

| Mean | Median | Maximum | Minimum | SD | |

|---|---|---|---|---|---|

| GEC | 23584.2 | 6432.96 | 48976.7 | 1.2831 | 46460.6 |

| ER | 22493.6 | 6787.46 | 51307.7 | 1.29255 | 44,229 |

| GF | 23438.6 | 6778.01 | 50152.7 | 1.27155 | 44,229 |

| FDI | 22266.9 | 6808.48 | 46349.4 | 1.28205 | 25845.2 |

| GTI | 11,179 | 4477.68 | 22727.1 | 2.5641 | 69947.7 |

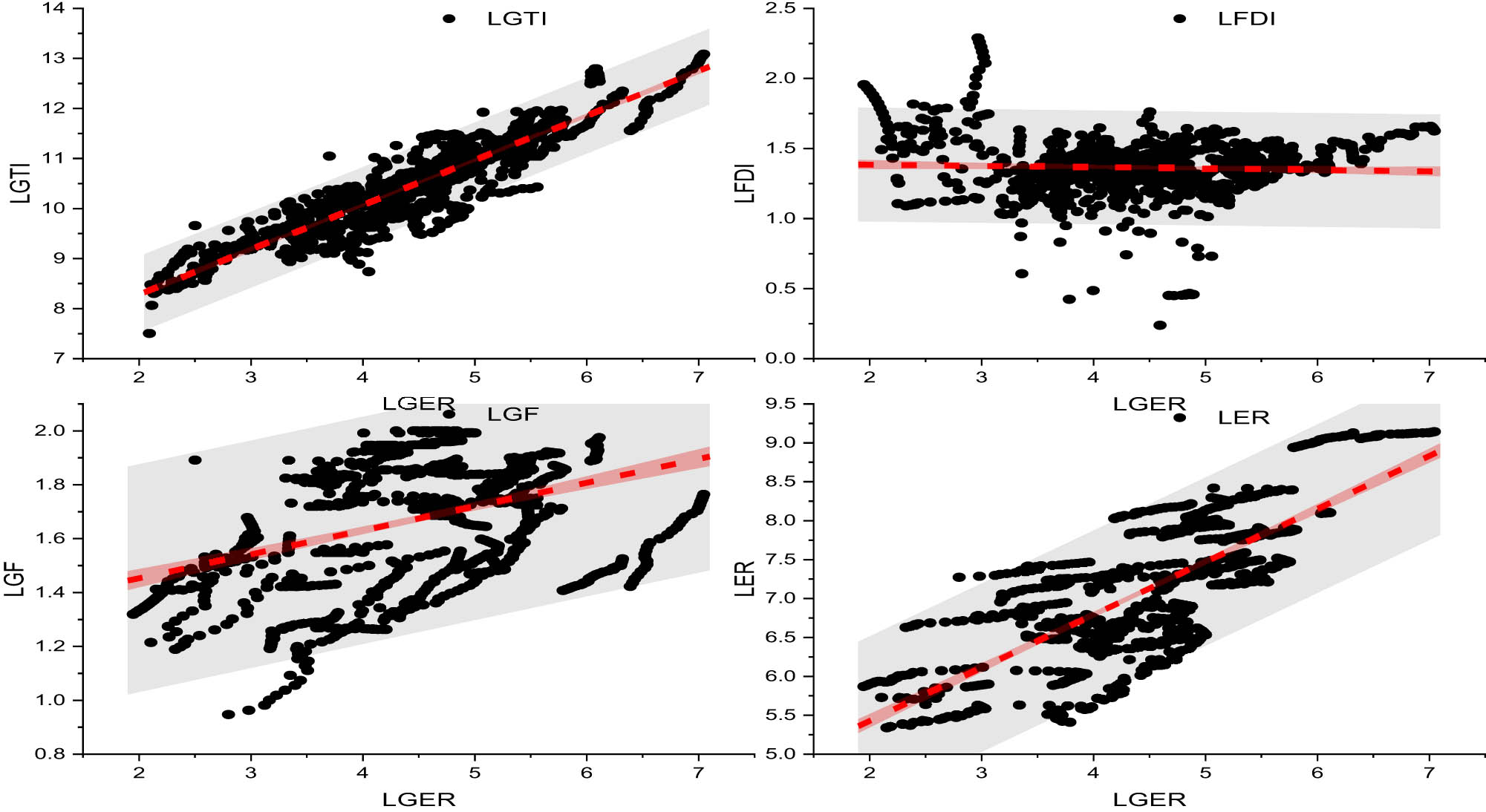

Table 3 and Figure 1 show the results of the pairwise correlation. The results found a negative correlation between GF, GTI, and green economic recovery. Moreover, ERs and FDI have a positive association with the explained variable. From such outcomes, there exists no multicollinearity in the selected panel data. However, the VIF test outcomes are presented in Table 4.

Pairwise correlation test

| GEC | ER | GF | FDI | GTI | |

|---|---|---|---|---|---|

| GEC | 1.000 | ||||

| ER | 0.598* | 1.000 | |||

| GF | −0.293* | 0.668** | 1.000 | ||

| FDI | 0.751* | 0.080* | 0.617* | 1.000 | |

| GTI | −0.633** | 0.395* | 0.689* | 0.386* | 1.000 |

Notes: t statistics are in parenthesis: **p < 0.05, *p < 0.1.

Correlation analysis.

VIF test

| VIF | Tolerance | |

|---|---|---|

| GEC | 4.965 | 0.2014 |

| ER | 3.266 | 0.3061 |

| GF | 1.245 | 0.8032 |

| FDI | 5.652 | 0.1769 |

| GTI | 1.999 | 0.5002 |

| Mean VIF | 3.425 | |

4.1 Estimation Strategy

Dealing with cross-sectional dependence (CD) across regions is an important topic in panel causality analysis. Therefore, the CD ratio has been calculated using the method described in Zhang (2021). Further, tests that were deemed necessary were also used. When the period is larger than the number of observations (T > N), the test proposed by Zhou et al. (2021) becomes plausible. However, when T < N, the test becomes useful for both symmetric and asymmetric datasets. Using omitted common effects when common stocks are present can lead to the cross-correlation of error (Zhang & Song, 2021). This could be due to the influence of unseen parts. There is more of a tendency for CD to occur in panel data than not. Ignoring the CD can disrupt the standard panel’s unbiased and consistent nature, resulting in inaccurate statistical results. Therefore, verifying the CD of chosen datasets is crucial before moving on to a more complex analysis. We employed three tests in this study to verify CD’s validity. Table 5 shows that H0 is rejected at a 1% significance level, and CD is found in the series because the probability values of the co-integrated equation are less than 0.001. In light of these results, the second-generation UR tests taking the CD into account are applied to the preferred environmental and ED factors (Table 5).

CSDs test

| Pearson’s test | Frees’s test | Freidman’s test | |

|---|---|---|---|

| Value | 7.999 | 2.845 | 77.256 |

| p-Value | 0.000 | 0.000 | 0.000 |

Assessing whether or not the underlying variables are stationary is the first step towards producing reliable results of estimates. Commonly used procedures include the Levin-Lin-Chu test by Huang et al. (2021), the (Koçak et al., 2020), and the Shin (IPS) test by Saidi and Mbarek (2017). however, their reliance on the cross-sectional independence hypothesis means they fail to account for the CD. In order to circumvent the issue of CD, the authors of this work apply second-generation unit root tests like cross-sectional augmented Dickey-Fuller (CADF) and augmented cross-sectional IPS (CIPS). Due to their ability to resolve CD and heterogeneity issues, these tests are more reliable than their simplistic counterparts. CADF’s statistical significance is calculated using the formula:

where X ̅_(t − 1) is the average value over all slices. The CIPS analysis can also be written as (equation (3))

The error correction-dependent cointegration method considers the CSD and is used to test for a long-term relationship between the chosen variables (Westerlund & Edgerton, 2008). Because the Westerlund test mitigates the annoyance caused by the endogeneity of the repressors, it was selected. This test builds four no-co-integration null hypotheses and uses two statistical tests to determine whether or not the panel is co-integrated (Table 6). The following error correction equation forms the basis for both CSD and non-strictly exogenous regressor tests:

CADF and CIPS unit root tests

| Variable | CADF unit root test | CIPS unit root test | ||

|---|---|---|---|---|

| Level | First difference | Level | First difference | |

| LGER | −3.541* | −5.411 | −4.885* | −7.245 |

| LGTI | −1.325 | −3.852* | −1.963 | −2.987* |

| LER | −2.777** | −3.583 | −3.554* | −5.841 |

| LGF | −1.620 | −3.652* | −1.524 | −3.999* |

| LFDI | −1.325 | −4.880* | −1.522 | −3.365* |

Notes: t statistics are in parenthesis: **p < 0.05, *p < 0.1.

where

where the deterministic components are given by

Westerlund cointegration test

| Statistics | Value | Z-value | p-Value | Robust p-value |

|---|---|---|---|---|

| G t | −7.653 | 5.246 | 0.000 | 0.000 |

| G a | −1.349 | 4.995 | 1.000 | 1.000 |

| P t | −13.295 | 6.231 | 0.051 | 0.000 |

| P a | −5.856 | 3.652 | 1.000 | 0.002 |

4.2 Augmented Mean Group (AMG) and Long-term Relationship

Panel estimators can be misleading, inferior, and even inconsistent when models have a cross-sectional dependency, heteroscedasticity, and serial correlation, as stated by Luo et al. (2021). The purpose of this work is to remove these obstacles. CCE (common correlated effects) was first proposed by Pesaran’s and expanded upon by Ye et al. (2021) and others (Khan et al., 2021). Compared to traditional, first-generation econometric methods, there are a number of benefits to using this approach instead. This does not include factor loadings or estimates of undiscovered common factors. At this point, the AMG estimator will have been used in the current investigation. Ju et al. (2020) created the AMG algorithm in this analysis. By incorporating a dynamic effect parameter into its two-stage operation, AMG can deal with CD and evaluate the reported common dynamic effect (Brandi et al., 2020). An additional benefit of the AMG technique is that it allows for the estimation of parameters that depend on non-stationary factors (Zhang et al., 2020c). An overview of the primary panel model is provided below:

The above equation is calculated with the first differenced form and T − 1 period dummy as follows,

where ADt denotes T − 1 period dummy first differences and pt denotes period dummy parameters. The following is an example of an exchange between the predicted values pt and the T parameters that are part of the dynamic process:

The mean values of design variables for each group are then determined after the group-specific regression model has been fitted with t. However, FMOLS, DOLS, and CCE-MG estimation methods are used to ensure the reliability of the results in this study.

4.3 Outcomes of the FMOLS, DOLS, AMG, and CCE-MG Models

Descriptive and inferential statistics are used to present the results. Table 8 shows the outcomes of the FMOLS, DOLS, AMG, and CCE-MG models. It appears that carbon emissions are inversely proportional to the pollutant discharge fee, which can be considered a surrogate for environmental legislation. This shows the value of environmental restrictions in the case of some economies and how they aid in reducing carbon emissions. According to the numbers, raising the pollutant discharge price by one percentage point reduces carbon emissions by a respective −1.861, −1.162, −1.552, and −1.826%. That environmental laws in China are helping to accomplish targeted nationally decided contributions and then reduce them further was confirmed by the negative and statistically significant link. The findings revealed here are consistent with those of Yu and Wang (2021), Zhang et al. (2020a).

Impact of study variables on GER (CO2 emissions)

| Variables | DOLS | FMOLS | AMG | CCE-MG |

|---|---|---|---|---|

| ER | −1.8616* | 1.1627** | −1.5526** | −1.8261*** |

| (1.162) | (1.8626) | (1.2866) | (1.8161) | |

| GF | −1.7616* | −1.2627** | −1.6626** | −1.7161*** |

| (1.262) | (2.8626) | (6.2866) | (6.8161) | |

| FDI | 1.8267** | 1.6886** | 1.6671** | 1.8621** |

| (2.777) | (1.67) | (2.1866) | (2.1176) | |

| IGT | −1.1116** | −1.1311* | −1.1188** | −1.1162** |

| (6.1716) | (1.1627) | (2.6862) | (6.681) | |

| Constant | 7.6727** | 8.7817** | 6.1812* | 1.6671** |

| (11.6162) | (8.8767) | (1.8666) | (1.8666) | |

| R 2 | 1.6616 | 1.6668 | N/A | N/A |

| Obs. | 140 | 140 | 140 | 140 |

Notes: t statistics are in parenthesis: ***p < 0.001, **p < 0.05, *p < 0.1.

Additionally, there is a statistically significant negative correlation between green funding and carbon emissions. The empirical findings confirm that GF helps lower carbon emissions in some economies (Yuan & Xiang, 2018). Funding in environmentally friendly techniques and the reputation of an organization or a firm that how much that particular company is in line with ERs and laws may be at the root of the aforementioned negative relationship between the two. Loans are given to only those businesses and industries that abide by environmental standards. The Green Credit policy and the Five-Year Development Plan assist some economies in cutting carbon emissions. Carbon emissions can be reduced by using green money in research and development activities. However, further investment in this field is required to introduce more eco-friendly technology. The same holds for the environment; pollution levels rise due to FDI. An increase of 1% in this variable would lead to increases of 1.826, 1.688, 1.667, and 1.862% in CO2 emissions. Since FDI is so influential, it is safe to assume that it is invested in polluting sectors in low-emissions countries. Although tougher environmental restrictions may be in place and more attention paid to environmental issues in countries with large emissions.

Therefore, FDI may not benefit high-emitting countries, as it may not lead to the development of management, technical expertise, and production technology. In addition, these technologies will not be transferred indirectly to domestic enterprises through backward or forward interconnection. There is a risk that multinational corporations would export dirty technology that is even more detrimental to the environment than that used in nations with high emissions. Consequently, increased FDI in countries with high emissions reduces environmental quality in those areas. In a few countries, the findings support the heaven effect idea. The study results are consistent with those of Wang et al. (2022), who use fixed and random effects panel models to examine the connection between FDI and pollution in ASEAN nations. The author’s findings are consistent with the halo effect hypothesis, and they show no sign of an adverse effect of FDI on the environment. However, this finding does not contribute to a fuller understanding of the processes that affect carbon emissions. Dong et al. (2021) provide similar support for the halo effect concept but use data from the Middle East and North Africa (MENA) rather than the China we examine in our research.

Similarly, spending on environmentally friendly technologies leads to less pollution. This means that a 1% increase in this component would result in a −1.111, −1.131, −1.118, and −1.116% decrease in environmental pollution. In order to lower carbon emissions, subsidies are important (Shao et al., 2021). As we focus on the GTI to decrease carbon dioxide emissions in the economies of China, our findings surpass the ignored portion of some research (Ramzan et al., 2022). Our results are consistent with those of Ngo (2022) because of the presence of vegetation. Compared to their studies, ours stands out because of our unique focus on the growth of environmentally friendly technology as a determinant of industrial power consumption. The study findings guide policymakers as they determine the best GTI and how much money to allocate to energy subsidies to solve the industrial sector’s energy consumption issues.

The authors then ran a heterogeneity test to see how spending on alternative energy sources, green technology, ERs, FDI, and GF affected GER. It proved useful in proving to the writers that all forms of economic and social progress contribute to GER. The study sample was split into several groups based on their responses to each variable, as shown in Table 8. Although ER, GF, GTI, and GER all showed negative and statistically significant relationships, LFDI and GER showed no such results. The results show that ER, GTI, and GF are all responsible for more environmentally friendly growth and revival. Meaningful regulation should be rigid and unyielding to ensure consistent application (Table 9).

Heterogeneity analysis

| Variables | LGER | LER | LGF | LFDI | LGTI |

|---|---|---|---|---|---|

| LER | −0.4551 | 1.4525*** | 0.2277 | 2.0207*** | 1.0897*** |

| (0.52) | (2.5275) | (0.572) | (2.5052) | (2.4123) | |

| LGF | −0.7577 | 2.7525* | 0.2277 | 5.0207** | 3.6245*** |

| (2.757) | (5.5275) | (0.572) | (5.5052) | (2.8541) | |

| LFDI | 0.7505 | 0.7702** | 0.7570 | 0.7725** | 1.2587** |

| (5.757) | (2.7527) | (7.057) | (2.0775) | (0.0111) | |

| LGTI | −0.0077 | 0.0557* | 0.0052 | 0.0227** | 0.0999** |

| (2.705) | (0.5557) | (5.702) | (0.2705) | (0.1174) | |

| Constant | 5.5572* | 5.0707** | 5.7777* | 5.2727* | 5.8932* |

| (2.2757) | (2.5507) | (5.777) | (2.725) | (2.557) | |

| R 2 | 0.7725 | 0.72 | 0.7722 | 0.7757 | 0.7701 |

| Obs. | 140 | 140 | 140 | 140 | 140 |

Note: This table shows the findings of heterogeneity results. t statistics are in parenthesis: ***p < 0.001, **p < 0.05, *p < 0.1. Source: Author’s conception, based on Stata software.

4.4 Robustness Test

As suggested by Gonzalez-Trevizo et al. (2021), the authors conducted a secondary analysis utilizing additional emissions factors, such as environmental legislation, to account for the impact of ER variation depending on the evaluations of green economic recovery. Similarly, this study shows that everything but FDI helps the green economic recovery greatly. Table 10 shows the first test with the ER, GTI, green financing, and explained variable. Both studies showed that GER benefited greatly from research aspects.

Robustness test

| Variables | (1) | (2) [t−1] |

|---|---|---|

| LER | −0.2944** | −4.2444** |

| (4.4441) | (4.6644) | |

| LGF | −0.1444** | −4.4444** |

| (4.5541) | (4.231) | |

| LFDI | 0.3404 | 0.3404 |

| (4.1141) | (4.7714) | |

| LGTI | −0.4124* | −0.1444* |

| (1.4044) | (0.1774) | |

| Constant | 4.4441* | 4.1404** |

| (4.4764) | (1.2404) | |

| R 2 | 0.5644 | 0.434 |

| Obs. | 140 | 140 |

Note: This table shows the findings of the robustness test. t statistics are in parenthesis: **p < 0.05, *p < 0.1. Source: Author’s conception, based on Stata software.

4.5 Mechanism Analysis

All the variables, as mentioned earlier, with the exception of FDI, contribute to green economic recovery, as shown by the baseline regression and robustness analysis. However, the mechanism analysis needs to be examined by rerunning the regression with each variable. If higher-ups pay attention to any signs highlighted in this analysis, they can achieve rapid green economic growth. Table 11 shows a negative correlation between carbon emissions and column 1’s depiction of the results of green technology investment, suggesting that a sizable shift in the latter would result in a 5.77 percentage-point hastening of the green economic recovery. On the one hand, environmental rules and GF contribute significantly to the rapid green economic recovery by 0.116 and 1.965%, respectively. On the other hand, FDI substantially raises carbon emissions and is some countries’ biggest obstacle to green economic recovery.

Mechanism analysis

| D.V. | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| LGER | LGER | LGER | LGER | |

| LGTI | −5.778* | |||

| (0.042) | ||||

| LER | −0.116*** | |||

| (0.034) | ||||

| LFDI | 3.417* | |||

| (0.175) | ||||

| LGF | −1.9652* | |||

| (0.174) | ||||

| Control excludes | Yes | Yes | Yes | Yes |

| Cons. | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| N | 140 | 140 | 140 | 140 |

| Adj. R 2 | 0.735 | 0.779 | 0.713 | 0.754 |

Notes: Standard errors of estimated parameters are shown in parentheses; t statistics are in parenthesis: ***p < 0.001, *p < 0.1.

4.6 Heterogeneity Analysis

This section’s final paragraph presents some empirical proof of heterogeneity. The heterogeneity of the main variable and the lagged explained variable are investigated and the estimated results were shown in the Table 12.

Heterogeneity analysis

| LGER | LGER t−1 | LGER | LGER t−1 | LGER | LGER t−1 | LGER | LGER t−1 | |

|---|---|---|---|---|---|---|---|---|

| Panel group | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| LGTI | −3.758* | −1.897* | ||||||

| (0.549) | (0.164) | |||||||

| LER | −0.961** | −0.909* | ||||||

| (0.226) | (0.301) | |||||||

| LFDI | 1.491* | 0.716** | ||||||

| (0.234) | (0.207) | |||||||

| LGF | −1.526* | −1.096** | ||||||

| (0.332) | (0.785) | |||||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Cons. | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 140 | 140 | 140 | 140 | 140 | 140 | 140 | 140 |

| Adj. R 2 | 0.766 | 0.734 | 0.914 | 0.890 | 0.832 | 0.793 | 0.871 | 0.859 |

Notes: Standard errors of estimated parameters are shown in parentheses; t statistics are in parenthesis: **p < 0.05, *p < 0.1.

However, according to the given outcomes, the investment in green technology, ERs, and GF significantly improves the environmental quality, which refers to improving the green economic recovery at both stages (main and lagged explained variable). However, there is a significant increase in emissions, which is not suitable for green economic recovery at the main and lagged defined variable China.

4.7 Key Findings and Policy Recommendations

Taking into account the associated empirical data, we can say that environmental restrictions can effectively boost the green economic recovery and have a knock-on effect on pollution. In a nutshell, the primary reason environmental-related patents may have a beneficial influence on CO2 emissions is that they erect barriers against the adoption of technology that is harmful to the environment (Liu et al., 2021). Although helpful in reducing pollution, environmental policies geared towards economic growth in China are not efficient enough to counteract the negative impact of energy use on pollution.

Investment in green technologies can cut CO2 emissions while encouraging economic growth, so the world urgently needs to support emerging economies’ green innovation capabilities to fight climate change. Investments in environmentally friendly technologies continue to be crucial in the fight against climate change (Peng, 2020), but they are effective primarily in advanced economies. As documented by Ai et al. (2021), support for basic research is a key factor in fostering technological advancement. So, governments in rich economies should invest more in research and development and push businesses to put money into environmentally friendly technologies. However, a new framework for the global dissemination and implementation of green technologies must be built. Since green technology is often out of reach for those living in low-income economies, new mechanisms involving intellectual property, green financing, and government backing are needed to speed up its spread and increase its use. Given the state of industrial technology, low-income nations should also encourage green management practices that boost resource use efficiency (Hsu et al., 2021).

FDI has been shown to boost economies in ways that go beyond the initial returns on investment. As a result, the rise in CO2 emissions may be attributable to the fact that FDI-accompanied technological advancement did not immediately lead to a massive improvement in the efficient utilization of energy resources. The Asian economies have not made substantial technological progress or innovation in energy utilization or the manufacturing of energy carriers, which has prevented the creation of environmentally friendly products and services. FDI does not automatically result in a paradigm shift towards green innovation and growth that boosts energy efficiency and creates new forms of renewable power. FDI does not improve nations’ capacity to address environmental issues, but it does result in the development of environmentally friendly goods and services that profit business, society, and government.

5 Conclusion

The primary objective of this research is to examine the effect of green financing, FDI, GTI, and environmental policies on the green economic recovery in China from 2000 to 2020 using a panel dataset. Sequential regression is used to examine the potential connections. The estimating method shows that GF, GTI, and environmental restrictions all have a beneficial impact on GER. Further, FDI has been shown to have a negative impact on environmentally friendly economic revival. Research shows that spending money on environmentally friendly technologies significantly affects GER for the same group. As a policy recommendation, the first major conclusion draws attention to the centrality of green financing in enabling green economic growth. Therefore, it is essential to keep pushing for financial institutions’ green evolution and create appropriate rules and regulations to facilitate this change. At this time, GF has established itself as a cornerstone of the eco-friendly economy. Local governments should develop provincial GF-development institutions in order to effectively realize a win–win situation of ongoing green evolution of finance and energy poverty elimination.

-

Funding information: Author states no funding involved.

-

Author contributions: The author confirms the sole responsibility for the conception of the study, presented results and manuscript preparation. CL took responsibility for writing – original draft, writing – review & editing, conceptualization, methodology, software, validation, formal analysis, and data curation.

-

Conflict of interest: Author states no conflict of interest.

-

Data availability statement: The data will be made available on reasonable request.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Ahad, M. (2024). Quantile-based assessment of energy-CO2 emission nexus in Pakistan. Environmental Science and Pollution Research, 31(5), 7345–7363. doi: 10.1007/s11356-023-31699-8.Suche in Google Scholar

Ahmad, M., Jabeen, G., & Wu, Y. (2021). Heterogeneity of pollution haven/halo hypothesis and Environmental Kuznets Curve hypothesis across development levels of Chinese provinces. Journal of Cleaner Production, 285, 124898. doi: 10.1016/j.jclepro.2020.124898.Suche in Google Scholar

Ai, H., Hu, Y., & Li, K. (2021). Impacts of environmental regulation on firm productivity: Evidence from China’s Top 1000 Energy-Consuming Enterprises Program. Applied Economics, 53(7), 830–844. doi: 10.1080/00036846.2020.1815642.Suche in Google Scholar

Bashir, M. F., Ma, B., Bashir M. A., Radulescu, M., & Shahzad, U. (2022). Investigating the role of environmental taxes and regulations for renewable energy consumption: Evidence from developed economies. Economic Research-Ekonomska Istraživanja, 35(1), 1262–1284. doi: 10.1080/1331677X.2021.1962383.Suche in Google Scholar

Brand, C., Schwab, J., Berger, A., & Morin, J. F. (2020). Do environmental provisions in trade agreements make exports from developing countries greener? World Development, 129, 104899. doi: 10.1016/j.worlddev.2020.104899.Suche in Google Scholar

Cai, X., Zhu, B., Zhang, H., Li, L., & Xie, M. (2020). Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Science of The Total Environment, 746, 140810. doi: 10.1016/j.scitotenv.2020.140810.Suche in Google Scholar

Chen, Y., Cheng, L., Lee, C. C., & Wang, C. (2021). The impact of regional banks on environmental pollution: Evidence from China’s city commercial banks. Energy Economics, 102, 105492. doi: 10.1016/j.eneco.2021.105492.Suche in Google Scholar

Dai, L., Mu, X., Lee, C. C., & Liu, W. (2021). The impact of outward foreign direct investment on green innovation: The threshold effect of environmental regulation. Environmental Science and Pollution Research, 28, 34868–34884. doi: 10.1007/S11356-021-12930-W.Suche in Google Scholar

Dong, Y., Tian, J., & Ye, J. (2021). Environmental regulation and foreign direct investment: Evidence from China’s outward FDI. Finance Research Letters, 39, 101611. doi: 10.1016/j.frl.2020.101611.Suche in Google Scholar

Duan, Y., Ji, T., Lu, Y., & Wang, S. (2021). Environmental regulations and international trade: A quantitative economic analysis of world pollution emissions. Journal of Public Economics, 203, 104521. doi: 10.1016/j.jpubeco.2021.104521.Suche in Google Scholar

Gonzalez-Trevizo, M. E., Martinez-Torres, K. E., Armendariz-Lopez, J. F., Santamouris, M., Bojorquez-Morales, G., & Luna-Leon, A. (2021). Research trends on environmental, energy and vulnerability impacts of Urban Heat Islands: An overview. Energy and Buildings, 246(1), 111051. doi: 10.1016/j.enbuild.2021.111051.Suche in Google Scholar

Guo, R., & Yuan, Y. (2020). Different types of environmental regulations and heterogeneous influence on energy efficiency in the industrial sector: Evidence from Chinese provincial data. Energy Policy, 145, 111747. doi: 10.1016/j.enpol.2020.111747.Suche in Google Scholar

Guo, T., Wei, S., & Li, X. (2019). Building a green technology innovation system: Problems and suggestions. Stud. Dialectics Nat, 35, 46–50.Suche in Google Scholar

He, Q., Wang, Z., Wang, G., Zuo, J., Wu, G., & Liu, B. (2020). To be green or not to be: How environmental regulations shape contractor greenwashing behaviors in construction projects. Sustain. Sustainable Cities and Society, 63, 102462. doi: 10.1016/j.scs.2020.102462.Suche in Google Scholar

Hou, S., Xu, J., & Yao, L. (2020). Integrated environmental policy instruments driven river water pollution management decision system. Socio-Economic Planning Sciences, 75, 100977. doi: 10.1016/j.seps.2020.100977.Suche in Google Scholar

Hsu, C. C., Quang-Thanh, N., Chien, F. S., Li, L., & Mohsin, M. (2021). Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environmental Science and Pollution Research, 28, 57386–57397. doi: 10.1007/s11356-021-14499-w.Suche in Google Scholar

Huang, S. Z., Chien, F., & Sadiq, M. (2021). A gateway towards a sustainable environment in emerging countries: The nexus between green energy and human Capital. Economic Research-Ekonomska Istraživanja, 35(1), 1–18. doi: 10.1080/1331677X.2021.2012218.Suche in Google Scholar

Ju, K., Zhou, D., Wang, Q., Zhou, D., & Wei, X. (2020). What comes after picking pollution intensive low-hanging fruits? Transfer direction of environmental regulation in China. Journal of Cleaner Production, 258, 120405. doi: 10.1016/j.jclepro.2020.120405.Suche in Google Scholar

Khan, M., & Chaudhry, M. N. (2021). Role of and challenges to environmental impact assessment proponents in Pakistan. Environmental Impact Assessment Review, 90, 106606. doi: 10.1016/j.eiar.2021.106606.Suche in Google Scholar

Khan, S. A. R., Ponce, P., Thomas, G., Yu, Z., Al-Ahmadi, M. S., & Tanveer, M. (2021). Digital technologies, circular economy practices and environmental policies in the era of covid-19. Sustainability, 13, 12790. doi: 10.3390/su132212790.Suche in Google Scholar

Kinyondo, A., & Huggins, C. (2021). State-led efforts to reduce environmental impacts of artisanal and small-scale mining in Tanzania: Implications for fulfilment of the sustainable development goals. Environmental Science & Policy, 120, 157–164. doi: 10.1016/j.envsci.2021.02.017.Suche in Google Scholar

Koçak, E., Ulucak, R., & Ulucak, Z. Ş. (2020). The impact of tourism developments on CO2 emissions: An advanced panel data estimation. Tourism Management Perspectives, 33, 100611. doi: 10.1016/j.tmp.2019.100611.Suche in Google Scholar

Li, H., Zhu, X., Chen, J., & Jiang, F. (2019). Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecological Economics, 165, 106397. doi: 10.1016/j.ecolecon.2019.106397.Suche in Google Scholar

Li, W., Sun, H., Du, Y., Li, Z., & Taghizadeh-Hesary, F. (2020). Environmental regulation for transfer of pollution-intensive industries: Evidence from Chinese Provinces. Frontiers in Energy Research, 8, 604005. doi: 10.3389/fenrg.2020.604005.Suche in Google Scholar

Liu, W., Du, M., & Bai, Y. (2021). Mechanisms of environmental regulation’s impact on green technological progress—evidence from china’s manufacturing sector. Sustainability, 13(4), 1–23. doi: 10.3390/su13041600.Suche in Google Scholar

Luo, Y., Salman, M., & Lu, Z. (2021). Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Science of The Total Environment, 759, 143744. doi: 10.1016/j.scitotenv.2020.143744.Suche in Google Scholar

Mulatu, A. (2017). The structure of UK outbound FDI and environmental regulation. Environmental and Resource Economics, 68(1), 65–96. doi: 10.1007/s10640-017-0145-4.Suche in Google Scholar

Ngo, T. Q. (2022). How do environmental regulations affect carbon emission and energy efficiency patterns? A provincial-level analysis of Chinese energy-intensive industries. Environmental Science and Pollution Research, 29, 3446–3462. doi: 10.1007/s11356-021-15843-w.Suche in Google Scholar

Ouyang, X., Fang, X., Cao, Y., & Sun, C. (2020). Factors behind CO2 emission reduction in Chinese heavy industries: Do environmental regulations matter? Energy Policy, 145, 111765. doi: 10.1016/j.enpol.2020.111765.Suche in Google Scholar

Pan, D., & Chen, H. (2021). Border pollution reduction in China: The role of livestock environmental regulations. China Economic Review, 69, 101681. doi: 10.1016/j.chieco.2021.101681.Suche in Google Scholar

Peng, B., Chen, H., Elahi, E., & Wei, G. (2020). Study on the spatial differentiation of environmental governance performance of Yangtze river urban agglomeration in Jiangsu province of China. Land Use Policy, 99, 105063. doi: 10.1016/j.landusepol.2020.105063.Suche in Google Scholar

Peng, X. (2020). Strategic interaction of environmental regulation and green productivity growth in China: Green innovation or pollution refuge? Science of The Total Environment, 732, 139200. doi: 10.1016/j.scitotenv.2020.139200.Suche in Google Scholar

Qiu, S., Wang, Z., & Geng, S. (2021). How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. Journal of Environmental Management, 287, 112282. doi: 10.1016/j.jenvman.2021.112282.Suche in Google Scholar

Ramzan, M., Raza, S. A., Usman, M., Sharma, G. D., & Iqbal, H. A. (2022). Environmental cost of non-renewable energy and economic progress: Do ICT and financial development mitigate some burden? Journal of Cleaner Production, 333, 130066. doi: 10.1016/j.jclepro.2021.130066.Suche in Google Scholar

Rasheed, M. Q., Ahad, M., Shahzad, K., & Imran, Z. A. (2023). Economic policy uncertainty and green growth in IEA member countries: A role of environmental stringency policy. In Natural resources forum. Blackwell Publishing Ltd. doi: 10.1111/1477-8947.12376.Suche in Google Scholar

Raza, Z. (2020). Effects of regulation-driven green innovations on short sea shippinǵs environmental and economic performance. Transportation Research Part D: Transport and Environment, 84, 102340. doi: 10.1016/j.trd.2020.102340.Suche in Google Scholar

Ren, S., Li, X., Yuan, B., Li, D., & Chen, X. (2018). The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. Journal of Cleaner Production, 173, 245–255. doi: 10.1016/j.jclepro.2016.08.113.Suche in Google Scholar

Sadiq, M., Hsu, C., Zhang, Y., & Chien, F. (2021). COVID-19 fear and volatility index movements : Empirical insights from ASEAN stock markets. Environmental Science and Pollution Research, 28, 67167–67184. doi: 10.1007/s11356-021-15064-1.Suche in Google Scholar

Saidi, K. A., & Mbarek, M. (2017). The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environmental Science and Pollution Research, 24, 12748–12757. doi: 10.1007/s11356-016-6303-3.Suche in Google Scholar

Shao, L., Zhang, H., & Irfan, M. (2021). How public expenditure in recreational and cultural industry and socioeconomic status caused environmental sustainability in OECD countries? Economic Research-Ekonomska Istraživanja, 35(1), 1–18. doi: 10.1080/1331677X.2021.2015614.Suche in Google Scholar

Shuai, S., & Fan, Z. (2020). Modeling the role of environmental regulations in regional green economy efficiency of China: Empirical evidence from super efficiency DEA-Tobit model. Journal of Environmental Management, 261, 110227. doi: 10.1016/j.jenvman.2020.110227.Suche in Google Scholar

Song, Y., Li, Z., Liu, J., Yang, T., Zhang, M., & Pang, J. (2021). The effect of environmental regulation on air quality in China: A natural experiment during the COVID-19 pandemic. Atmospheric Pollution Research, 12, 21–30. doi: 10.1016/j.apr.2021.02.010.Suche in Google Scholar

Su, Y., & Fan, Q. M. (2022). Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China's provinces. Technological Forecasting and Social Change, 180, 121727. doi: 10.1016/j.techfore.2022.121727.Suche in Google Scholar

Tang, J., Zhang, C., & Zhou, W. (2019). Environmental regulatory efficiency and its influencing factors in China. Energy Efficiency, 12, 947–962. doi: 10.1007/s12053-018-9732-7.Suche in Google Scholar

Wang, H., & Zhang, R. (2022). Effects of environmental regulation on CO2 emissions: An empirical analysis of 282 cities in China. Sustainable Production and Consumption, 29, 259–272. doi: 10.1016/j.spc.2021.10.016.Suche in Google Scholar

Wang, Y., Deng, X., Zhang, H., Liu, Y., Yue, T., & Liu, G. (2022). Energy endowment, environmental regulation, and energy efficiency: Evidence from China. Technological Forecasting and Social Change, 177, 121528. doi: 10.1016/j.techfore.2022.121528.Suche in Google Scholar

Wei, Z., & Lihua, H. (2022). Effects of tourism and eco-innovation on environmental quality in selected ASEAN countries. Environmental Science and Pollution Research, 1, 1–15. doi: 10.1007/s11356-021-17541-z.Suche in Google Scholar

Wellalage, N. H., Kumar, V., Hunjra, A. I., & Al-Faryan, M. A. S. (2021). Environmental performance and firm financing during COVID-19 outbreaks: Evidence from SMEs. Finance Research Letters, 47, 102568. doi: 10.1016/J.FRL.2021.102568.Suche in Google Scholar

Wen, Q., & Zhang, T. (2022). Economic policy uncertainty and industrial pollution: The role of environmental supervision by local governments. China Economic Review, 71, 101723. doi: 10.1016/j.chieco.2021.101723.Suche in Google Scholar

Westerlund, J., & Edgerton, D. L. (2008). A simple test for cointegration in dependent panels with structural breaks. Oxford Bulletin of Economics and Statistics, 70(5), 665–704. doi: 10.1111/j.1468-0084.2008.00513.x.Suche in Google Scholar

Wu, B., Fang, H., Jacoby, G., Li, G., & Wu, Z. (2021). Environmental regulations and innovation for sustainability? Moderating effect of political connections. Emerging Markets Review, 50, 100835. doi: 10.1016/j.ememar.2021.100835.Suche in Google Scholar

Xiang, D., Zhao, T., & Zhang, N. (2022). How can government environmental policy affect the performance of SMEs: Chinese evidence. Journal of Cleaner Production, 336, 130308. doi: 10.1016/j.jclepro.2021.130308.Suche in Google Scholar

Xie, L., Li, Z., Ye, X., & Jiang, Y. (2021). Environmental regulation and energy investment structure: Empirical evidence from China’s power industry. Technological Forecasting and Social Change, 167, 120690. doi: 10.1016/j.techfore.2021.120690.Suche in Google Scholar

Xu, Y., Zhang, R., & Sun, W. (2021). Green technology innovation, factor market distortion and industrial structure upgrading. RE Dev. Manag, 33, 75–86.Suche in Google Scholar

Yameogo, C. E. W., Omojolaibi, J. A., & Dauda, R. O. S. (2021). Economic globalisation, institutions and environmental quality in Sub-Saharan Africa. Research in Globalization, 3, 100035. doi: 10.1016/j.resglo.2020.100035.Suche in Google Scholar

Yan, S., Guo, K., & Hang, J. (2018). Final demand structure, structural transformation and productivity growth. Economic Research Journal (Jingji Yanjiu), 12, 83–96.Suche in Google Scholar

Ye, F. F., & Wang, Y. M. (2019). The effects of two types of environmental regulations on economic efficiency: An analysis of Chinese industries. Energy & Environment, 30(5), 898–929. doi: 10.1177/0958305X18813690.Suche in Google Scholar

Ye, F., Quan, Y., He, Y., & Lin, X. (2021). The impact of government preferences and environmental regulations on green development of China’s marine economy. Environmental Impact Assessment Review, 87, 106522. doi: 10.1016/j.eiar.2020.106522.Suche in Google Scholar

Yu, X., & Wang, P. (2021). Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Science of The Total Environment, 753, 142004. doi: 10.1016/j.scitotenv.2020.142004.Suche in Google Scholar

Yuan, B., & Xiang, Q. (2018). Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. Journal of Cleaner Production, 176, 895–908. doi: 10.1016/j.jclepro.2017.12.034.Suche in Google Scholar

Zhang, D. (2021). Marketization, environmental regulation, and eco-friendly productivity: A Malmquist–Luenberger index for pollution emissions of large Chinese firms. Journal of Asian Economics, 76, 101342. doi: 10.1016/j.asieco.2021.101342.Suche in Google Scholar

Zhang, J., Kang, L., Li, H., Ballesteros-Pérez, P., Skitmore, M., & Zuo, J. (2020a). The impact of environmental regulations on urban Green innovation efficiency: The case of Xi’an. Sustainable Cities and Society, 57, 102123. doi: 10.1016/j.scs.2020.102123.Suche in Google Scholar

Zhang, J., Liang, G., Feng, T., Yuan, C., & Jiang, W. (2020b). Green innovation to respond to environmental regulation: How external knowledge adoption and green absorptive capacity matter? Business Strategy and the Environment, 29(1), 39–53. doi: 10.1002/bse.2349.Suche in Google Scholar

Zhang, J., Ouyang, Y., Ballesteros-Pérez, P., Li, H., Philbin, S. P., Li, Z., & Skitmore, M. (2021). Understanding the impact of environmental regulations on green technology innovation efficiency in the construction industry. Sustainable Cities and Society, 65, 102647. doi: 10.1016/j.scs.2020.102647.Suche in Google Scholar

Zhang, M., Sun, X., & Wang, W. (2020c). Study on the effect of environmental regulations and industrial structure on haze pollution in China from the dual perspective of independence and linkage. Journal of Cleaner Production, 256, 120748. doi: 10.1016/j.jclepro.2020.120748.Suche in Google Scholar

Zhang, N., Sun, J., Tang, Y., Zhang, J., Boamah, V., Tang, D., & Zhang, X. (2023). How do green finance and green technology innovation impact the Yangtze River economic belt’s industrial structure upgrading in China? A moderated mediation effect model based on provincial panel data. Sustainability, 15(3), 2289. doi: 10.3390/su15032289.Suche in Google Scholar

Zhang, Y., & Song, Y. (2021). Environmental regulations, energy and environment efficiency of China’s metal industries: A provincial panel data analysis. Journal of Cleaner Production, 280, 124437. doi: 10.1016/j.jclepro.2020.124437.Suche in Google Scholar

Zhang, Y., Xiong, Y., Li, F., Cheng, J., & Yue, X. (2020d). Environmental regulation, capital output and energy efficiency in China: An empirical research based on integrated energy prices. Energy Policy, 146, 111826. doi: 10.1016/j.enpol.2020.111826.Suche in Google Scholar

Zhao, X., Mahendru, M., Ma, X., Rao, A., & Shang, Y. (2022). Impacts of environmental regulations on green economic growth in China: New guidelines regarding renewable energy and energy efficiency. Renewable Energy, 187, 728–742. doi: 10.1016/J.RENENE.2022.01.076.Suche in Google Scholar

Zhong, M. C., Li, M. J., & Du, W. J. (2015). Can environmental regulation force industrial structure adjustment: An empirical analysis based on provincial panel data. China Popul. Resour. Environ, 25, 107–115.Suche in Google Scholar

Zhou, P., Ang, B. W., & Poh, K. L. (2006). Slacks-based efficiency measures for modeling environmental performance. Ecological Economics, 60, 111–118. doi: 10.1016/j.ecolecon.2005.12.001.Suche in Google Scholar

Zhou, Q., Zhong, S., Shi, T., & Zhang, X. (2021). Environmental regulation and haze pollution: Neighbor-companion or neighbor-beggar? Energy Policy, 151, 112183. doi: 10.1016/j.enpol.2021.112183.Suche in Google Scholar

Zhu, W., & Qiu, Z. (2019). Effects of environmental regulations on technological innovation efficiency in China’s industrial enterprises: A spatial analysis. Sustainability, 11, 2186. doi: 10.3390/su11072186.Suche in Google Scholar

© 2024 the author(s), published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Regular Articles

- Political Turnover and Public Health Provision in Brazilian Municipalities

- Examining the Effects of Trade Liberalisation Using a Gravity Model Approach

- Operating Efficiency in the Capital-Intensive Semiconductor Industry: A Nonparametric Frontier Approach

- Does Health Insurance Boost Subjective Well-being? Examining the Link in China through a National Survey

- An Intelligent Approach for Predicting Stock Market Movements in Emerging Markets Using Optimized Technical Indicators and Neural Networks

- Analysis of the Effect of Digital Financial Inclusion in Promoting Inclusive Growth: Mechanism and Statistical Verification

- Effective Tax Rates and Firm Size under Turnover Tax: Evidence from a Natural Experiment on SMEs

- Re-investigating the Impact of Economic Growth, Energy Consumption, Financial Development, Institutional Quality, and Globalization on Environmental Degradation in OECD Countries

- A Compliance Return Method to Evaluate Different Approaches to Implementing Regulations: The Example of Food Hygiene Standards

- Panel Technical Efficiency of Korean Companies in the Energy Sector based on Digital Capabilities

- Time-varying Investment Dynamics in the USA

- Preferences, Institutions, and Policy Makers: The Case of the New Institutionalization of Science, Technology, and Innovation Governance in Colombia

- The Impact of Geographic Factors on Credit Risk: A Study of Chinese Commercial Banks

- The Heterogeneous Effect and Transmission Paths of Air Pollution on Housing Prices: Evidence from 30 Large- and Medium-Sized Cities in China

- Analysis of Demographic Variables Affecting Digital Citizenship in Turkey

- Green Finance, Environmental Regulations, and Green Technologies in China: Implications for Achieving Green Economic Recovery

- Coupled and Coordinated Development of Economic Growth and Green Sustainability in a Manufacturing Enterprise under the Context of Dual Carbon Goals: Carbon Peaking and Carbon Neutrality

- Revealing the New Nexus in Urban Unemployment Dynamics: The Relationship between Institutional Variables and Long-Term Unemployment in Colombia

- The Roles of the Terms of Trade and the Real Exchange Rate in the Current Account Balance

- Cleaner Production: Analysis of the Role and Path of Green Finance in Controlling Agricultural Nonpoint Source Pollution

- The Research on the Impact of Regional Trade Network Relationships on Value Chain Resilience in China’s Service Industry

- Social Support and Suicidal Ideation among Children of Cross-Border Married Couples

- Asymmetrical Monetary Relations and Involuntary Unemployment in a General Equilibrium Model

- Job Crafting among Airport Security: The Role of Organizational Support, Work Engagement and Social Courage

- Does the Adjustment of Industrial Structure Restrain the Income Gap between Urban and Rural Areas

- Optimizing Emergency Logistics Centre Locations: A Multi-Objective Robust Model

- Geopolitical Risks and Stock Market Volatility in the SAARC Region

- Trade Globalization, Overseas Investment, and Tax Revenue Growth in Sub-Saharan Africa

- Can Government Expenditure Improve the Efficiency of Institutional Elderly-Care Service? – Take Wuhan as an Example

- Media Tone and Earnings Management before the Earnings Announcement: Evidence from China

- Review Articles

- Economic Growth in the Age of Ubiquitous Threats: How Global Risks are Reshaping Growth Theory

- Efficiency Measurement in Healthcare: The Foundations, Variables, and Models – A Narrative Literature Review

- Rethinking the Theoretical Foundation of Economics I: The Multilevel Paradigm

- Financial Literacy as Part of Empowerment Education for Later Life: A Spectrum of Perspectives, Challenges and Implications for Individuals, Educators and Policymakers in the Modern Digital Economy

- Special Issue: Economic Implications of Management and Entrepreneurship - Part II

- Ethnic Entrepreneurship: A Qualitative Study on Entrepreneurial Tendency of Meskhetian Turks Living in the USA in the Context of the Interactive Model

- Bridging Brand Parity with Insights Regarding Consumer Behavior

- The Effect of Green Human Resources Management Practices on Corporate Sustainability from the Perspective of Employees

- Special Issue: Shapes of Performance Evaluation in Economics and Management Decision - Part II

- High-Quality Development of Sports Competition Performance Industry in Chengdu-Chongqing Region Based on Performance Evaluation Theory

- Analysis of Multi-Factor Dynamic Coupling and Government Intervention Level for Urbanization in China: Evidence from the Yangtze River Economic Belt

- The Impact of Environmental Regulation on Technological Innovation of Enterprises: Based on Empirical Evidences of the Implementation of Pollution Charges in China

- Environmental Social Responsibility, Local Environmental Protection Strategy, and Corporate Financial Performance – Empirical Evidence from Heavy Pollution Industry

- The Relationship Between Stock Performance and Money Supply Based on VAR Model in the Context of E-commerce

- A Novel Approach for the Assessment of Logistics Performance Index of EU Countries

- The Decision Behaviour Evaluation of Interrelationships among Personality, Transformational Leadership, Leadership Self-Efficacy, and Commitment for E-Commerce Administrative Managers

- Role of Cultural Factors on Entrepreneurship Across the Diverse Economic Stages: Insights from GEM and GLOBE Data

- Performance Evaluation of Economic Relocation Effect for Environmental Non-Governmental Organizations: Evidence from China

- Functional Analysis of English Carriers and Related Resources of Cultural Communication in Internet Media

- The Influences of Multi-Level Environmental Regulations on Firm Performance in China

- Exploring the Ethnic Cultural Integration Path of Immigrant Communities Based on Ethnic Inter-Embedding

- Analysis of a New Model of Economic Growth in Renewable Energy for Green Computing

- An Empirical Examination of Aging’s Ramifications on Large-scale Agriculture: China’s Perspective

- The Impact of Firm Digital Transformation on Environmental, Social, and Governance Performance: Evidence from China

- Accounting Comparability and Labor Productivity: Evidence from China’s A-Share Listed Firms

- An Empirical Study on the Impact of Tariff Reduction on China’s Textile Industry under the Background of RCEP

- Top Executives’ Overseas Background on Corporate Green Innovation Output: The Mediating Role of Risk Preference

- Neutrosophic Inventory Management: A Cost-Effective Approach

- Mechanism Analysis and Response of Digital Financial Inclusion to Labor Economy based on ANN and Contribution Analysis

- Asset Pricing and Portfolio Investment Management Using Machine Learning: Research Trend Analysis Using Scientometrics

- User-centric Smart City Services for People with Disabilities and the Elderly: A UN SDG Framework Approach

- Research on the Problems and Institutional Optimization Strategies of Rural Collective Economic Organization Governance

- The Impact of the Global Minimum Tax Reform on China and Its Countermeasures

- Sustainable Development of Low-Carbon Supply Chain Economy based on the Internet of Things and Environmental Responsibility

- Measurement of Higher Education Competitiveness Level and Regional Disparities in China from the Perspective of Sustainable Development

- Payment Clearing and Regional Economy Development Based on Panel Data of Sichuan Province

- Coordinated Regional Economic Development: A Study of the Relationship Between Regional Policies and Business Performance

- A Novel Perspective on Prioritizing Investment Projects under Future Uncertainty: Integrating Robustness Analysis with the Net Present Value Model

- Research on Measurement of Manufacturing Industry Chain Resilience Based on Index Contribution Model Driven by Digital Economy

- Special Issue: AEEFI 2023

- Portfolio Allocation, Risk Aversion, and Digital Literacy Among the European Elderly

- Exploring the Heterogeneous Impact of Trade Agreements on Trade: Depth Matters

- Import, Productivity, and Export Performances

- Government Expenditure, Education, and Productivity in the European Union: Effects on Economic Growth

- Replication Study

- Carbon Taxes and CO2 Emissions: A Replication of Andersson (American Economic Journal: Economic Policy, 2019)

Artikel in diesem Heft