Abstract

In the era of big data, data information has exploded, and all walks of life are impacted by big data. The arrival of big data provides the possibility for the realization of intelligent financial analysis of enterprises. At present, most enterprises’ financial analysis and decision-making based on the analysis results are mainly based on human resources, with poor automation and obvious problems in efficiency and error. In order to help the senior management of enterprises to conduct scientific and effective management, the study uses big data web crawler technology and ETL technology to process data and build an intelligent financial decision support system integrating big data together with Internet plus platform. J Group in S Province is taken as an example to study the effect before and after the application of intelligent financial decision support system. The results show that the crawler technology can monitor the basic data and the big data in the industry in real time, and improve the accuracy of decision-making. Through the intelligent financial decision support system which integrates big data, the core indexes such as profit, net asset return, and accounts receivable of the enterprises can be clearly displayed. The system can query the causes of financial changes hidden behind the financial data. Through the intelligent financial decision support system, it is found that the asset liability ratio, current assets growth rate, operating income growth rate, and financial expenses of J Group are 55.27, 10.38, 20.28%, and 1,974 million RMB, respectively. The growth rate of real sales income of J Group is 0.63%, which is 31.27% less than the excellent value of the industry 31.90%. After adopting the intelligent financial decision support system, the monthly financial statements of the enterprises increase significantly, and the monthly report analysis time decreases. The maximum number of financial statements received by the Group per month is 332, and the processing time at this time is only 2 h. According to the results, it can be seen that the intelligent financial decision support system integrating big data as the research result can effectively improve the financial management level of enterprises, improve the usefulness of financial decision-making, and make practical contributions to the field of corporate financial decision-making.

1 Introduction

Intelligent financial decision support system is a human-computer interaction system based on modern management science theories that uses computer technology to carry out the financial analysis, financial control, and financial forecasting of enterprises [1]. At present, most enterprises’ financial analysis and decision-making based on the analysis results are mainly based on human resources, with poor automation and obvious problems in efficiency and error. The remedy measures for these shortcomings are one of the main research contents in the field of corporate financial analysis. This research is also to improve the company’s financial analysis and decision-making system, improve the degree of automation and increase the efficiency of analysis. With the development of data processing technology, big data web crawler technology has emerged, which has substantially improved the ability of enterprises to process big data [2]. At the same time, the development of artificial intelligence and expert systems also improves the informatization and networking of modern financial management to a certain extent, prompting the intelligence of enterprise financial management [3]. In the context of big data, data have become the core asset of enterprises, and artificial intelligence technology can realize multi-dimensional analysis of data and help managers to dig out the information hidden in financial data, so intelligent financial decision support system has become the development trend of enterprise financial informatization [4,5]. The relevant decision makers of enterprises should focus on semi-structured and unstructured enterprise financial data, set heterogeneous data from multiple sources in one data warehouse, and combine artificial intelligence algorithms to constitute a knowledge base to assist enterprise management decisions, and finally display the information in a visual interface. The contribution of this study is to bring practical research results to the field of financial analysis and decision-making of the company and increase work efficiency.

2 Related works

Under the influence of big data, the current data technology used in the processing and analysis of corporate financial data is constantly advancing. A number of studies with implications for the computerization of corporate financial data and the processing of big data already exist [6]. Jin and his team analyzed the historical data from financial institutions. The analysis tools included non-statistical algorithms such as random forest and logistic regression, and a loan default model was built based on the analysis results. The model was designed to effectively assess and identify bad debt risk before lending. The experimental results showed that the importance ranking of features based on random forest could effectively improve the accuracy of loan risk judgment [7]. Zhu and Yang introduced the techniques and related strategies of big data analytics to the bank’s internal financial processes. The study found that big data elements had a significant impact on both the stability and financial performance of the bank’s internal processes. Finally, they used the results of big data analysis to propose a strategy to reduce the stress in the bank’s operating environment, which effectively increased the bank’s financial performance [8]. Tavera Romero et al. led his group to propose a multiple customer data management system based on big data and business intelligence. The results of the study showed that the system can effectively organize customer data and improve the financial performance of the firm [9]. Xiao and Ke proposed a financial data mining algorithm that combines big data and artificial intelligence. The algorithm is able to mine effective data in financial markets to optimize asset pricing and management [10].

According to the results compiled from the literature, the current field of financial research has noticed the impact of big data on the industry and the market, and is actively applying various new technologies to the field of financial research. Most of the relevant studies so far focus on the analysis of a specific financial indicator and cannot automate the analysis and decision making of the overall financial situation of the enterprise in a simple way. Therefore, this study proposes an intelligent financial decision support system that incorporates big data.

3 Construction of intelligent financial decision support system integrating big data

3.1 Web big data crawler technology and ETL data process

The user gives instructions through the computer, and the web crawler technology starts acting according to the accepted instructions and automatically collects the target data [11]. Web crawler technology has the characteristics of real-time collection and automatic collection, the former guaranteeing the timeliness of the data and the latter guaranteeing the accuracy and integrity of the data, which is conducive to the diverse storage and analysis of the data [12]. In order to improve resource utilization, this study proposes a web scraping algorithm and applies it to a financial decision support system. During the use of web crawling technology, important information on web pages should be extracted. The study uses the best-first search method to judge topic similarity.

where term frequency (TF) refers to the frequency of a specific word in the selected text, which is mainly used to increase the weight of keywords.

where IDF denotes the reverse document frequency, which is used to reduce the topic weight of public words [13].

where

where the weight of specific keyword

which is the topic-defining equation of page

Formula (6) is an expression for the usage harvest rate, which is the ratio of the number of topic-related pages to the number of pages that have been extracted. This index is mainly used to judge the relevance of pages. The meaning of each letter in it represents the same as the description of the above formulas. Considering the real situation, a threshold r is set, and when

In the ETL of data warehouse, “E” refers to “Extracting data,” “T” refers to “Transforming data,” and “L” refers to “Loading data.” The ETL also includes “Cleaning “ which means “Cleaning data” [15]. Data warehouse can be divided into client layer (querying and customizing reports), server layer (filtering system junk data, transforming data formats), and online analysis server layer (simplifying processes and increasing data transfer quality) [16].

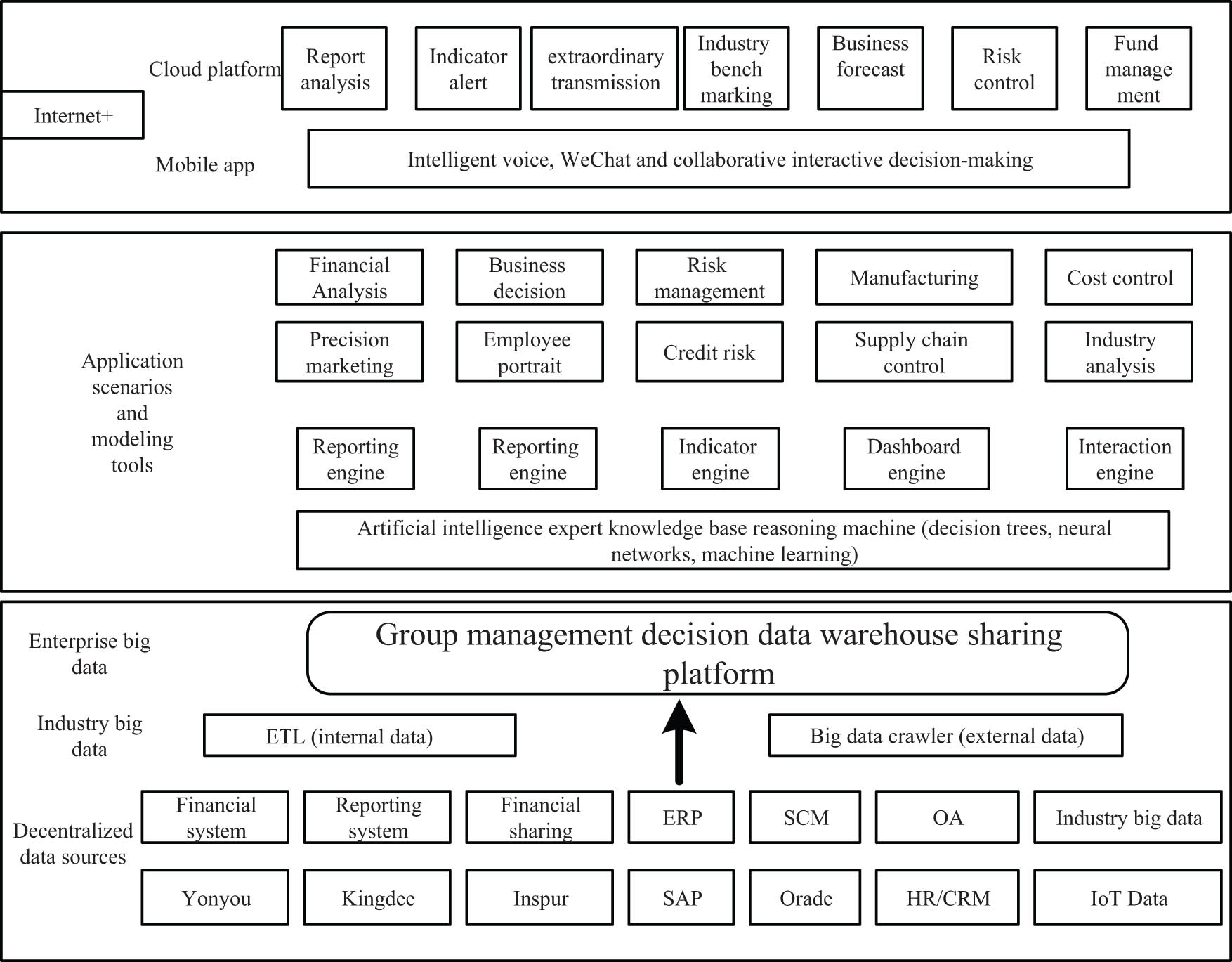

Figure 1 shows the schematic diagram of the ETL architecture of the data warehouse of J Group company. The source data system includes enterprise accounting system, reporting system, financial sharing system, UFIDA software, Kingdee software, and Longchao software. After the data are extracted, transformed, cleaned, loaded, and other series of operations are completed, they enter the data warehouse sharing platform of the group’s operation distance vehicle together with the external data obtained through the network big data crawler system. If the data are stored in a relational database and the data are structured, the extraction of the data is completed using SOL statements, and the target data are extracted into a temporary database through metadata mapping rules, combined with a SQL language generator, and processed and output to the target database [17,18].

ETL architecture diagram.

3.2 Intelligent financial decision support system architecture

Intelligent financial decision support system is a technology that combines computer artificial intelligence with management science. It achieves the construction of a working environment with a combination of knowledge, initiative, and information processing capabilities by means of artificial intelligence dialogues to provide decision support work for corporate decision makers and substantially improve the management of dry-level managers [19,20]. The study selected 50 enterprises in province S for analysis, 36 of which belong to groups, 7 to shares/units, 3 to group finance companies, 3 to administrative institutions, and 1 is of banking nature.

Table 1 shows the demand analysis results of 50 enterprises in S province for intelligent financial decision support system. The above 50 enterprises have the strongest demand for data analysis, followed by demand for industry benchmarking, demand for processing and analysis of external big data, demand for smart financial analysis report, demand for risk warning, demand for artificial intelligence modeling, demand for intelligent interaction, and demand for self-service. Among them, industry benchmarking is mainly for the comparison of financial data in the same industry, and intelligent prediction is mainly for the prediction of enterprise profit and enterprise capital structure.

Functional analysis of intelligent financial decision support system requirements

| Functions | Number of enterprises |

|---|---|

| Data analysis | 14 |

| Smart financial analysis report | 10 |

| Industry benchmarking | 12 |

| Smart interaction | 5 |

| Risk warning | 9 |

| Self-service | 3 |

| External big data | 11 |

| Artificial intelligence modeling | 7 |

Figure 2 shows that the intelligent financial decision support system contains components such as multi-source heterogeneous data layer, application scenarios, and operating decision data sharing platform. The application scenarios are built by the expert reasoning and financial intelligence support platform, where the modeling tool platform includes the reporting engine, interaction engine, dashboard engine, and indicator engine. Based on the data processing technology to generate financial analysis portal, the human-computer interaction layer is established so that the top management of the enterprise can understand the operation status of their own enterprise in a timely, comprehensive, and accurate manner and help the top management to make decisions.

Intelligent financial decision support system architecture.

4 Application effectiveness of intelligent financial decision support system

4.1 The operational effect of intelligent financial decision support system

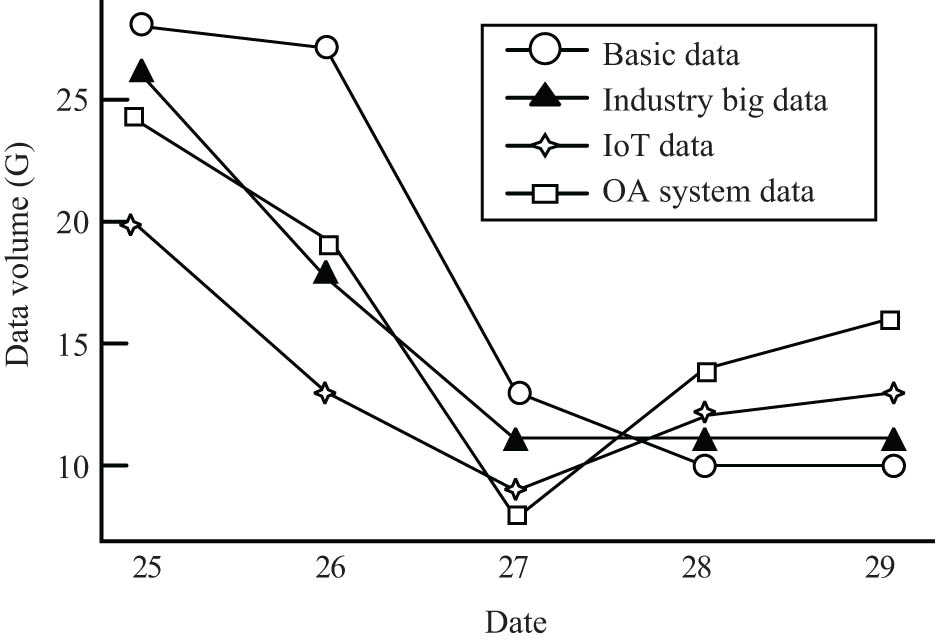

The experiment takes J Group in S province as an example. After investigation, the problems in J Group’s financial management include: first, too many forms, which are not easy to manage. Second, the data are easy to be lost and leaked. Third, the lack of in-depth analysis of financial data. Fourth, some information is entered several times, lacking reference to the same industry data. Fifth, cannot automatically generate charts and text as well as the corresponding enterprise financial management reports. In the architecture of intelligent financial decision support system, the effective mining of external data is realized through big data web crawling technology, and the crawling process is presented through visualization tools, see Figure 3 for details.

Real-time monitoring of external data.

As shown in Figure 3, with the date as the horizontal coordinate and the data volume as the vertical coordinate, it can be seen that the data collected by the big data web crawler technology are in a state of real-time change. The crawler technology collects and shows the changes in the enterprise finance-related data, including basic data, industry big data, Internet of Things (IOT) data, OA system data, and many other external data, which can supplement the contents of the corresponding enterprise’s decision support items and improve the accuracy of decision support.

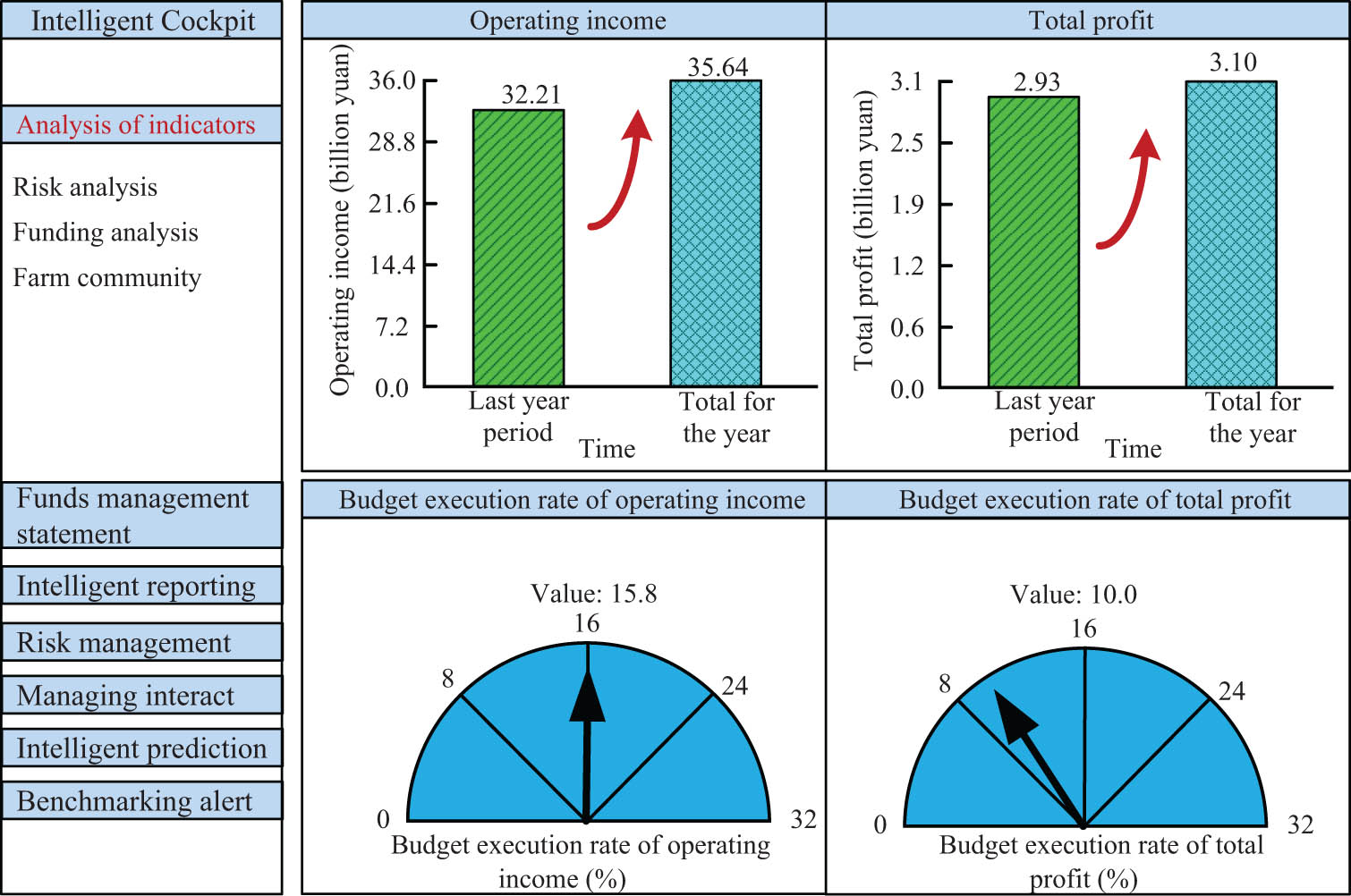

As shown in Figure 4, multi-dimensional analysis of financial data is completed by OLAP technology. The bar chart is used to display the core indicators of the enterprise such as profits, return on net assets, and accounts receivable. The dashboard is used to display the budget situation of different indicators of the enterprise. Using drill-down to establish the correlation between data and drill-down by company hierarchy, it is convenient for company management to query the status of corporate financial data and conduct linkage queries on the causes of financial variances hidden behind the financial data. Managers can click on the bar chart to view the specific situation of different segments of the enterprise such as operating income, return on net assets, and budget execution rate.

Partial operation results of J Group’s intelligent financial decision support system.

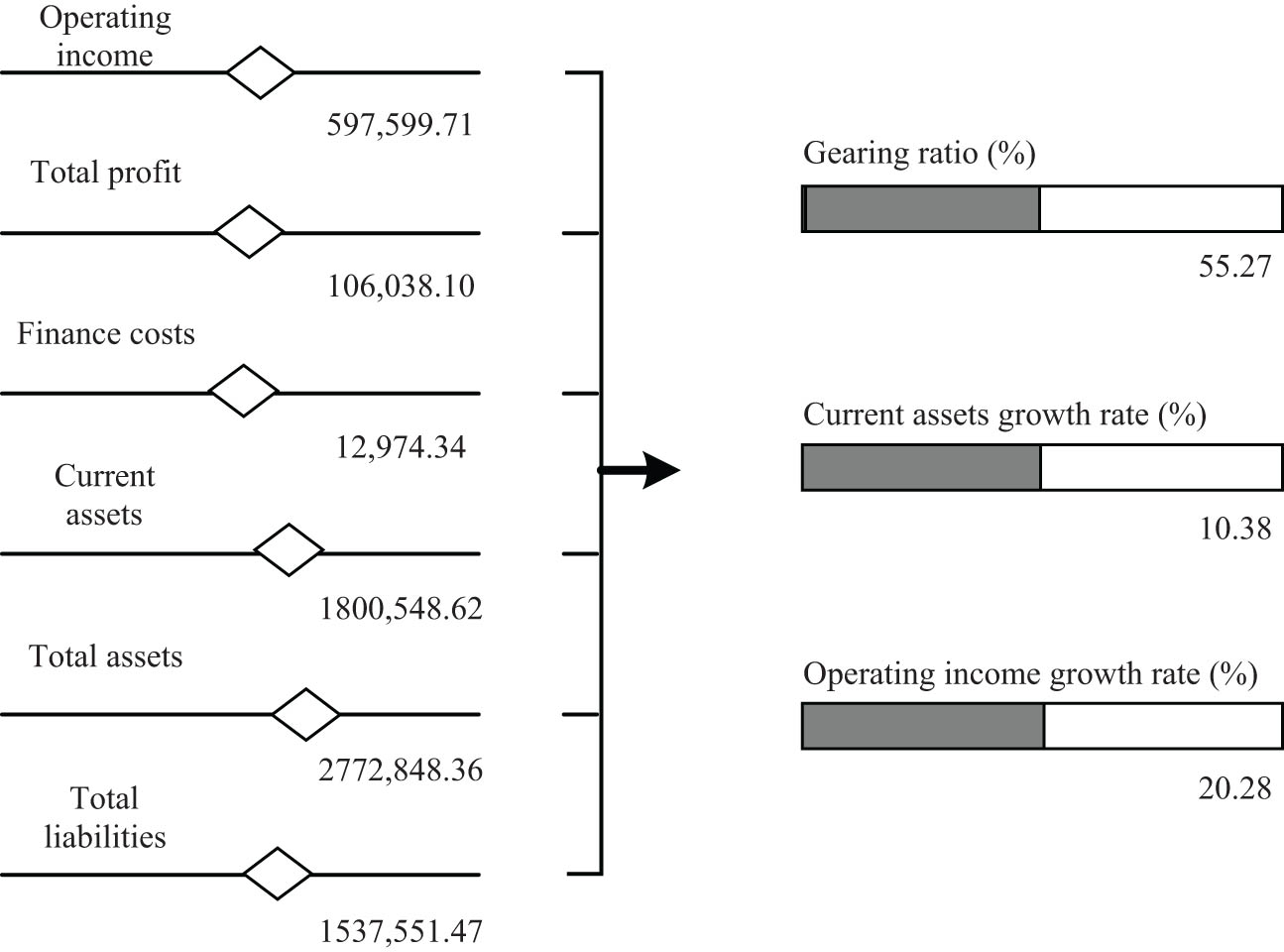

As shown in Figure 5, according to the intelligent financial decision support system, J Group’s gearing ratio reaches 55.27%, current assets growth rate reaches 10.38%, and operating income growth rate reaches 20.28%. Its financial expenses reach $19.74 million. Its return on total assets is at an excellent level in the industry rating, while the growth rate of total assets is 4.77%, which is at a lower level in the same industry. Overall, its current assets growth is slower than the growth of main business revenue, while the profitability of assets improved and the enterprise’s asset structure improves regionally. Managers of this enterprise should make financial decisions with the main purpose of increasing the growth rate of total assets and maintaining the total assets return of the enterprise in a targeted manner.

Intelligent prediction results of Group J.

4.2 Discussion of the operational effect

According to the test results of the system operation, the system proposed by the research is far better than the traditional operation mode of the company in terms of data mining capability. The data mining ability of the system proposed by the research institute is mainly realized through crawler technology. According to the test results, the daily mining volume of the system for basic data, industry big data, IoT data, and OA system data reaches 28 G, 26 G, 20 G, and 24 G, which is significantly higher than the traditional data means used by the company. According to the test results, the research institute proposes that the system has user interaction interface and data visualization capabilities. Users can obtain the desired data statistics results through simple operations. These results are displayed in the form of visual charts, enabling users to easily obtain the useful information contained in the data. The data display interface of the system contains multiple core financial indicators. The specific data processing results page can be further expanded by users.

4.3 Application effectiveness of intelligent financial decision support system

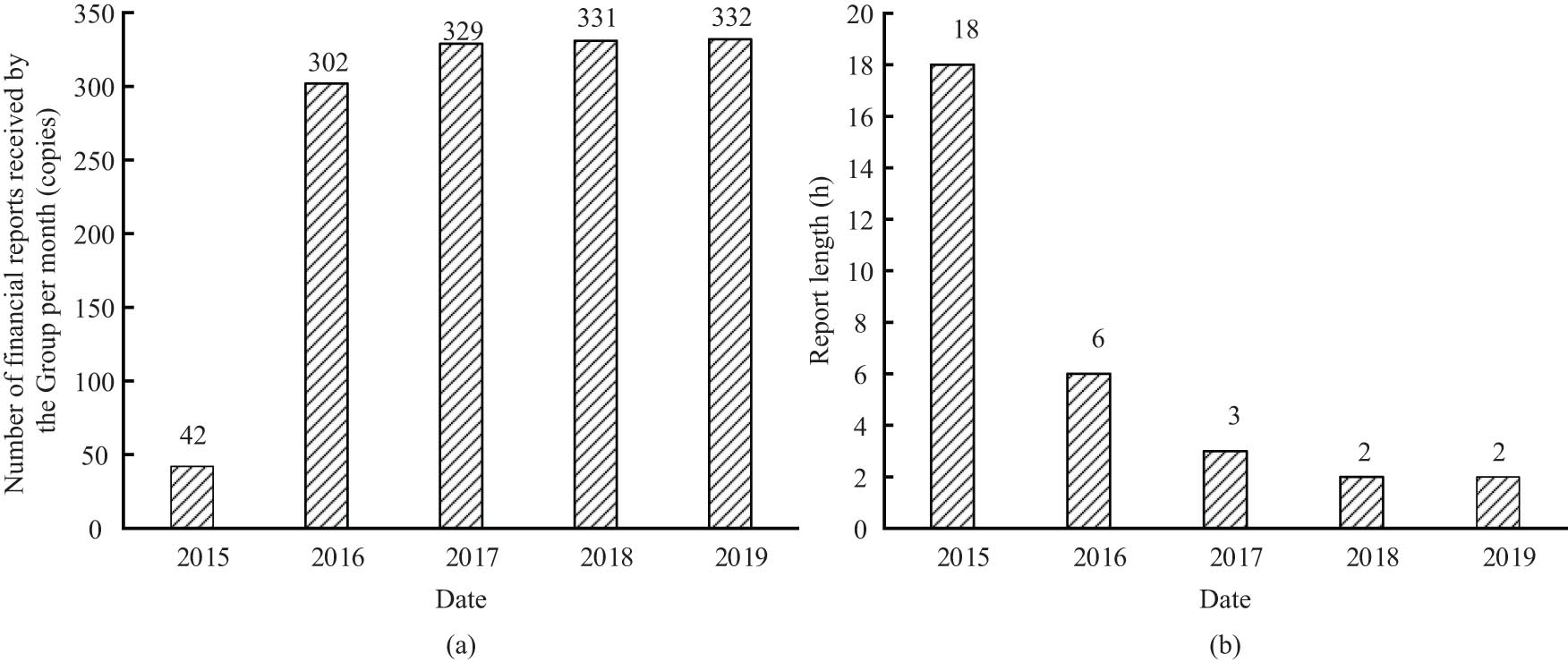

By comparing the changes in work efficiency of the group before and after applying the intelligent financial decision support system, the practical application effect of the intelligent financial decision support system designed in this study is analyzed, as shown is Figure 6.

Changes in the efficiency of finance staff before and after the system is on. (a) Number of financial reports received by the Group per month. (b) Monthly time for the Group to complete analysis.

After adopting this intelligent financial decision support system, the number of financial reports received by the enterprise from its subsidiaries per month has increased significantly, and the length of time the enterprise takes to complete the analysis reports per month shows a significant decrease. It indicates that the financial analysis workload of the enterprise is reduced after the application of the intelligent financial decision support system. The application of intelligent financial decision support system also solves the problem of information asymmetry to a certain extent, which is conducive to the group to grasp the financial status of its subsidiaries in a timely manner and improve the control of the enterprise.

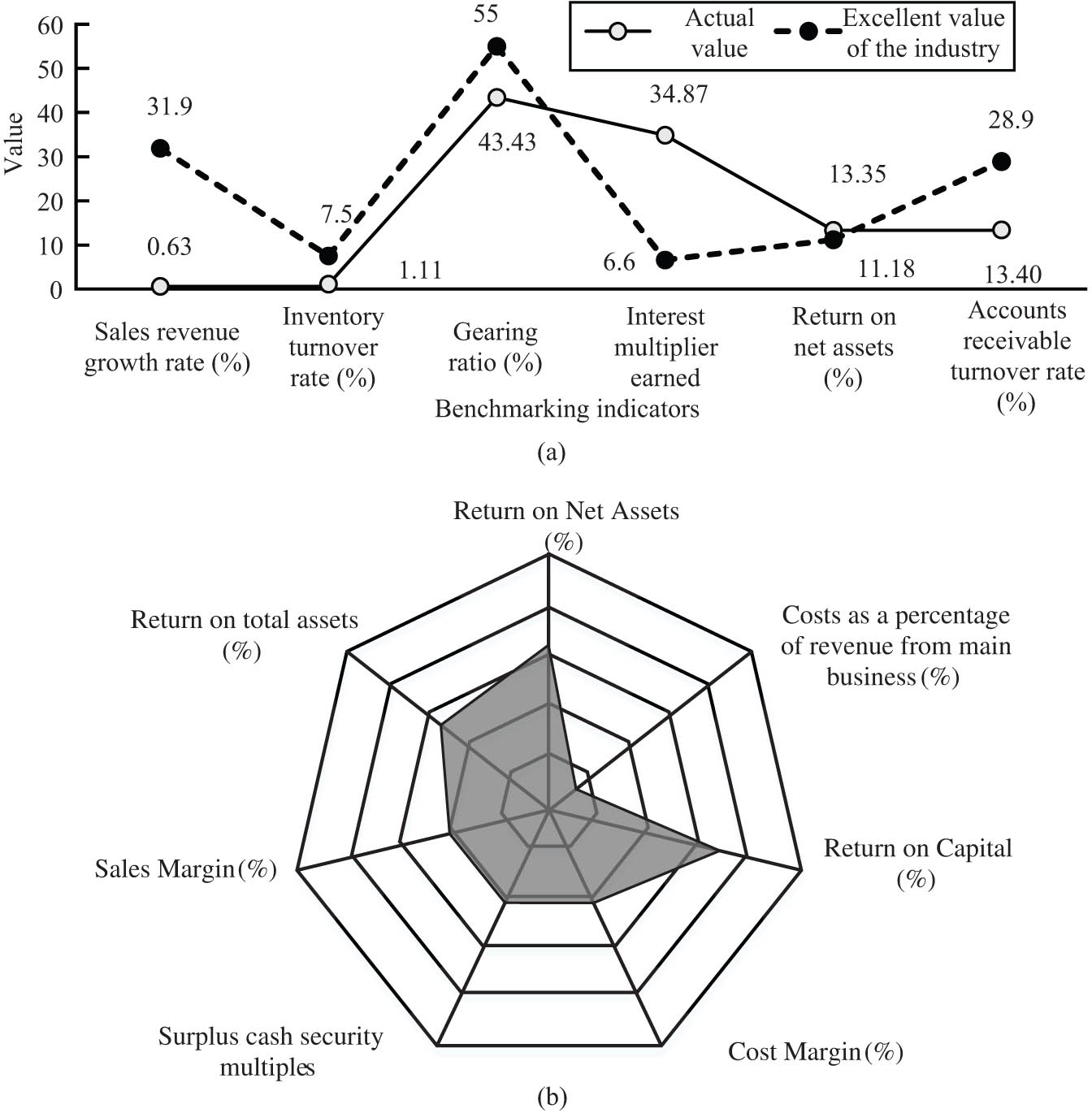

From Figure 7(a), it can be seen that this intelligent financial decision support system is applied to the benchmarking analysis of Group J. In terms of sales revenue growth rate analysis, the actual value of Group J is 0.63%, which is 31.27% less than the industry excellent value of 31.90%. The inventory turnover ratio, asset load ratio, and accounts receivable turnover ratio of Group J are lower than the industry excellent value. The interest multiplier earned and return on net assets of Group J are higher than the industry excellent value. Figure 7(b) shows the evaluation results of the profitability of the companies within Group J against the early warning through this system. It can be seen that the return on capital and return on net assets of Group J are at the excellent level, i.e., the return on capital and return on net assets of Group J have reached the level of the excellent value in the industry. Through this intelligent financial decision support system incorporating big data, enterprise managers can technically access relevant data, analyze moving indicators, address existing problems in a timely manner, take effective corrective actions, and ensure the sustainable and healthy development of the enterprise.

Evaluation of group financial indicators after the system is on. (a) Enterprise benchmarking analysis return on net assets. (b) Industry benchmarking radar chart of corporate profitability.

4.4 Discussion of the application effectiveness

There may be obvious deviation between the performance of a system in the running test and the actual application. Therefore, after the running test, the system needs to be placed in the actual application environment for testing. According to the changes in the work efficiency of the financial staff after the system went online, the number of financial statements received by the company each month increased significantly. In 2015, the Group received only 42 financial reports per month, and the analysis time of the report was up to 18 h. Since 2016, the number of financial reports received by the Group has exceeded 300, while the time of analysis has been declining. By 2019, the time of analysis has decreased to 2 h. According to the results, the system has significantly increased the amount of data analysis, while the analysis time has decreased, which shows that with the help of the system, the speed and efficiency of the analysts in processing information have increased. From the perspective of data analysis, the experiment then tested the evaluation of the group’s profitability after the system was launched. The results show that the system can display the financial analysis results of the group in a visual and numerical way, and the analysts can efficiently obtain relevant data and solve problems.

In summary, after the enterprise applies the intelligent financial decision support system designed by the experiment, the enterprise’s financial strategy can be better implemented, the enterprise’s management is optimized, the enterprise’s financial report generation time is shortened and can be generated intelligently, and the usefulness of the enterprise’s management decisions are also improved to a certain extent.

5 Conclusion

In the era of big data, low automation of enterprise business data and financial data processing technology needs to be improved. The mining ability of available enterprise financial decision-making information has an important impact on the development speed and stability of enterprises. In order to increase the automation and efficiency of enterprise financial decision support, an intelligent financial decision support system integrating big data is proposed. The system conducts mining and analysis of external and internal data through network big data crawler technology and ETL technology, builds a data warehouse sharing platform for group business decision-making based on the effective data obtained, and uses the cloud computing platform in Internet plus for enterprise report analysis. The analysis content includes indicator warning, abnormal penetration, industry benchmarking, risk control, capital supervision, etc. Combined with the application scenario model, the system can complete the financial analysis, credit risk evaluation, industry analysis, cost control, precision marketing and other management analysis of enterprises. The research results show that big data web crawler technology facilitates real-time monitoring of relevant enterprise data. Enterprise executives can use the intelligent financial decision support system to show the core indicators of the enterprise such as profit, return on net assets, and accounts receivable. Take J Group as an example, after the group applied the intelligent financial decision support system, it can visually analyze the group’s asset and liability ratio, current asset growth rate, and operating income growth rate of 55.27, 10.38, and 20.28%, respectively. The number of enterprise’s monthly financial reports increased significantly, while the time efficiency of enterprise monthly analysis reports decreased significantly. The actual sales revenue growth rate of the Group was 0.63%, which was less than the excellent value of the industry. The interest earned multiple and return on net assets were higher than the industry’s excellent values. The system successfully realizes the real-time interaction of data, and has the characteristics of penetration, linkage, and efficiency, which plays a certain role in promoting the process of big data application management. It also improves the intelligent financial decision support system to a certain extent. The system designed is mainly used for enterprise risk management and control through historical data. Although it has achieved success, it still lacks comprehensive functions. In the future, functions should be expanded to predict and control future risks.

-

Funding information: No funding was received.

-

Author contributions: Danna Tong wrote the first manuscript. Guixian Tian reviewed and revised the manuscript. They read and approved the final manuscript.

-

Conflict of interest: It is declared by the authors that this article is free of conflict of interest.

-

Data availability statement: All data generated or analyzed during this study are included in this published article.

References

[1] Lakshmi G, Afrin BK, Afrin F, Divya C. A study on the financial analysis of reliance industries limited. Int J Adv Res. 2021;9(5):149–61. 10.21474/IJAR01/12818.Search in Google Scholar

[2] Faria V, Andrade A, Santos J, Gasi F. Measuring the impacts of database processing utilization in innovation processes on companies. Int J Dev Res. 2020;10(3):34190.Search in Google Scholar

[3] Panigrahi AK, Vachhani K. Financial analysis by return on equity (ROE) and return on asset (ROA)-A comparative study of HUL and ITC. J Manag Res Anal. 2021;8(3):131–8. 10.18231/j.jmra.2021.027.Search in Google Scholar

[4] Ma Y. Feasibility study on listing of pharmaceutical enterprises based on financial analysis: Take company Y as an example. Open J Bus Manag. 2021;9(3):1325–37. 10.4236/ojbm.2021.93072.Search in Google Scholar

[5] Deng C, Li G, Zhou Q, Li J. Guarantee the quality-of-service of control transactions in real-time database systems. IEEE Access. 2020;8(1):110511–22. 10.1109/ACCESS.2020.3002335.Search in Google Scholar

[6] Qi E, Deng M. R&D investment enhance the financial performance of company driven by big data computing and analysis. Comput Syst Sci Eng. 2019;34(4):237–48. 10.32604/csse.2019.34.237.Search in Google Scholar

[7] Jin H, Luo L, Wang X, Zhu X, Qian L, Zhang Z. Financial credit default forecast based on big data analysis. Vol. 3, No. 8. Francis Academic Press; 2021. p. 51–6. 10.25236/AJBM.2021.030810.Search in Google Scholar

[8] Zhu X, Yang Y. Big data analytics for improving financial performance and sustainability. J Syst Sci Inf. 2021;9(2):175–91. 10.21078/JSSI-2021-175-17.Search in Google Scholar

[9] Tavera Romero CA, Ortiz JH, Khalaf OI, Prado AR. Web application commercial design for financial entities based on business intelligence. Comput Mater Contin. 2021;67(3):3177–88. 10.32604/cmc.2021.014738.Search in Google Scholar

[10] Xiao F, Ke J. Pricing, management and decision making of financial markets with artificial intelligence: Introduction to the issue. Financ Innov. 2021;7(1):1757–9. 10.1186/s40854-021-00302-9.Search in Google Scholar PubMed PubMed Central

[11] Yun U, Nam H, Kim J, Kim H, Baek Y, Lee J, et al. Efficient transaction deleting approach of pre-large based high utility pattern mining in dynamic databases. Future Gener Comput Syst. 2020;103(1):58–78. 10.1016/j.future.2019.09.024.Search in Google Scholar

[12] Cuzzocrea A, Karras P, Vlachou A. Effective and efficient skyline query processing over attribute-order-preserving-free encrypted data in cloud-enabled databases. Future Gener Comput Syst. 2022;126(1):237–51. 10.1016/j.future.2021.08.008.Search in Google Scholar

[13] Rodríguez GG, Gonzalez-Cava JM, Pérez JAM. An intelligent decision support system for production planning based on machine learning. J Intell Manuf. 2020;31(5):1257–73. 10.1007/s10845-019-01510-y.Search in Google Scholar

[14] Geng C, Xu Y, Metawa N. Intelligent financial decision support system based on data mining. J Intell Fuzzy Syst. 2021;(2):1–10. 10.3233/JIFS-189838.Search in Google Scholar

[15] Xian X, Liu J. Application of chaos theory in incomplete randomized financial analysis. Sci Publ Group. 2019;6(6):306–10.Search in Google Scholar

[16] Kang Q. Financial risk assessment model based on big data. Int J Model Simul Sci Comput. 2019;(4):38–51. 10.1142/S1793962319500211.Search in Google Scholar

[17] Jung K, Kim D, Yu S. Next generation models for portfolio risk management: An approach using financial big data. J Risk Insur. 2022;89(3):765–87. 10.1111/jori.12374.Search in Google Scholar

[18] Yang A. Analysis on internet financial business and construction of credit system. Proc Bus Econ Stud. 2020;3(2):1–4. 10.26689/pbes.v3i2.1164.Search in Google Scholar

[19] Liu H, Sun G. Research on the application of big data technology in the integration of enterprise business and finance. J Big Data. 2021;3(4):175–82. 10.32604/jbd.2021.024074.Search in Google Scholar

[20] Tang Y. Big data analytics of taxi operations in New York City. Am J Oper Res. 2019;9(4):192–9. 10.4236/ajor.2019.94012.Search in Google Scholar

© 2023 the author(s), published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- Research Articles

- Salp swarm and gray wolf optimizer for improving the efficiency of power supply network in radial distribution systems

- Deep learning in distributed denial-of-service attacks detection method for Internet of Things networks

- On numerical characterizations of the topological reduction of incomplete information systems based on evidence theory

- A novel deep learning-based brain tumor detection using the Bagging ensemble with K-nearest neighbor

- Detecting biased user-product ratings for online products using opinion mining

- Evaluation and analysis of teaching quality of university teachers using machine learning algorithms

- Efficient mutual authentication using Kerberos for resource constraint smart meter in advanced metering infrastructure

- Recognition of English speech – using a deep learning algorithm

- A new method for writer identification based on historical documents

- Intelligent gloves: An IT intervention for deaf-mute people

- Reinforcement learning with Gaussian process regression using variational free energy

- Anti-leakage method of network sensitive information data based on homomorphic encryption

- An intelligent algorithm for fast machine translation of long English sentences

- A lattice-transformer-graph deep learning model for Chinese named entity recognition

- Robot indoor navigation point cloud map generation algorithm based on visual sensing

- Towards a better similarity algorithm for host-based intrusion detection system

- A multiorder feature tracking and explanation strategy for explainable deep learning

- Application study of ant colony algorithm for network data transmission path scheduling optimization

- Data analysis with performance and privacy enhanced classification

- Motion vector steganography algorithm of sports training video integrating with artificial bee colony algorithm and human-centered AI for web applications

- Multi-sensor remote sensing image alignment based on fast algorithms

- Replay attack detection based on deformable convolutional neural network and temporal-frequency attention model

- Validation of machine learning ridge regression models using Monte Carlo, bootstrap, and variations in cross-validation

- Computer technology of multisensor data fusion based on FWA–BP network

- Application of adaptive improved DE algorithm based on multi-angle search rotation crossover strategy in multi-circuit testing optimization

- HWCD: A hybrid approach for image compression using wavelet, encryption using confusion, and decryption using diffusion scheme

- Environmental landscape design and planning system based on computer vision and deep learning

- Wireless sensor node localization algorithm combined with PSO-DFP

- Development of a digital employee rating evaluation system (DERES) based on machine learning algorithms and 360-degree method

- A BiLSTM-attention-based point-of-interest recommendation algorithm

- Development and research of deep neural network fusion computer vision technology

- Face recognition of remote monitoring under the Ipv6 protocol technology of Internet of Things architecture

- Research on the center extraction algorithm of structured light fringe based on an improved gray gravity center method

- Anomaly detection for maritime navigation based on probability density function of error of reconstruction

- A novel hybrid CNN-LSTM approach for assessing StackOverflow post quality

- Integrating k-means clustering algorithm for the symbiotic relationship of aesthetic community spatial science

- Improved kernel density peaks clustering for plant image segmentation applications

- Biomedical event extraction using pre-trained SciBERT

- Sentiment analysis method of consumer comment text based on BERT and hierarchical attention in e-commerce big data environment

- An intelligent decision methodology for triangular Pythagorean fuzzy MADM and applications to college English teaching quality evaluation

- Ensemble of explainable artificial intelligence predictions through discriminate regions: A model to identify COVID-19 from chest X-ray images

- Image feature extraction algorithm based on visual information

- Optimizing genetic prediction: Define-by-run DL approach in DNA sequencing

- Study on recognition and classification of English accents using deep learning algorithms

- Review Articles

- Dimensions of artificial intelligence techniques, blockchain, and cyber security in the Internet of medical things: Opportunities, challenges, and future directions

- A systematic literature review of undiscovered vulnerabilities and tools in smart contract technology

- Special Issue: Trustworthy Artificial Intelligence for Big Data-Driven Research Applications based on Internet of Everythings

- Deep learning for content-based image retrieval in FHE algorithms

- Improving binary crow search algorithm for feature selection

- Enhancement of K-means clustering in big data based on equilibrium optimizer algorithm

- A study on predicting crime rates through machine learning and data mining using text

- Deep learning models for multilabel ECG abnormalities classification: A comparative study using TPE optimization

- Predicting medicine demand using deep learning techniques: A review

- A novel distance vector hop localization method for wireless sensor networks

- Development of an intelligent controller for sports training system based on FPGA

- Analyzing SQL payloads using logistic regression in a big data environment

- Classifying cuneiform symbols using machine learning algorithms with unigram features on a balanced dataset

- Waste material classification using performance evaluation of deep learning models

- A deep neural network model for paternity testing based on 15-loci STR for Iraqi families

- AttentionPose: Attention-driven end-to-end model for precise 6D pose estimation

- The impact of innovation and digitalization on the quality of higher education: A study of selected universities in Uzbekistan

- A transfer learning approach for the classification of liver cancer

- Review of iris segmentation and recognition using deep learning to improve biometric application

- Special Issue: Intelligent Robotics for Smart Cities

- Accurate and real-time object detection in crowded indoor spaces based on the fusion of DBSCAN algorithm and improved YOLOv4-tiny network

- CMOR motion planning and accuracy control for heavy-duty robots

- Smart robots’ virus defense using data mining technology

- Broadcast speech recognition and control system based on Internet of Things sensors for smart cities

- Special Issue on International Conference on Computing Communication & Informatics 2022

- Intelligent control system for industrial robots based on multi-source data fusion

- Construction pit deformation measurement technology based on neural network algorithm

- Intelligent financial decision support system based on big data

- Design model-free adaptive PID controller based on lazy learning algorithm

- Intelligent medical IoT health monitoring system based on VR and wearable devices

- Feature extraction algorithm of anti-jamming cyclic frequency of electronic communication signal

- Intelligent auditing techniques for enterprise finance

- Improvement of predictive control algorithm based on fuzzy fractional order PID

- Multilevel thresholding image segmentation algorithm based on Mumford–Shah model

- Special Issue: Current IoT Trends, Issues, and Future Potential Using AI & Machine Learning Techniques

- Automatic adaptive weighted fusion of features-based approach for plant disease identification

- A multi-crop disease identification approach based on residual attention learning

- Aspect-based sentiment analysis on multi-domain reviews through word embedding

- RES-KELM fusion model based on non-iterative deterministic learning classifier for classification of Covid19 chest X-ray images

- A review of small object and movement detection based loss function and optimized technique

Articles in the same Issue

- Research Articles

- Salp swarm and gray wolf optimizer for improving the efficiency of power supply network in radial distribution systems

- Deep learning in distributed denial-of-service attacks detection method for Internet of Things networks

- On numerical characterizations of the topological reduction of incomplete information systems based on evidence theory

- A novel deep learning-based brain tumor detection using the Bagging ensemble with K-nearest neighbor

- Detecting biased user-product ratings for online products using opinion mining

- Evaluation and analysis of teaching quality of university teachers using machine learning algorithms

- Efficient mutual authentication using Kerberos for resource constraint smart meter in advanced metering infrastructure

- Recognition of English speech – using a deep learning algorithm

- A new method for writer identification based on historical documents

- Intelligent gloves: An IT intervention for deaf-mute people

- Reinforcement learning with Gaussian process regression using variational free energy

- Anti-leakage method of network sensitive information data based on homomorphic encryption

- An intelligent algorithm for fast machine translation of long English sentences

- A lattice-transformer-graph deep learning model for Chinese named entity recognition

- Robot indoor navigation point cloud map generation algorithm based on visual sensing

- Towards a better similarity algorithm for host-based intrusion detection system

- A multiorder feature tracking and explanation strategy for explainable deep learning

- Application study of ant colony algorithm for network data transmission path scheduling optimization

- Data analysis with performance and privacy enhanced classification

- Motion vector steganography algorithm of sports training video integrating with artificial bee colony algorithm and human-centered AI for web applications

- Multi-sensor remote sensing image alignment based on fast algorithms

- Replay attack detection based on deformable convolutional neural network and temporal-frequency attention model

- Validation of machine learning ridge regression models using Monte Carlo, bootstrap, and variations in cross-validation

- Computer technology of multisensor data fusion based on FWA–BP network

- Application of adaptive improved DE algorithm based on multi-angle search rotation crossover strategy in multi-circuit testing optimization

- HWCD: A hybrid approach for image compression using wavelet, encryption using confusion, and decryption using diffusion scheme

- Environmental landscape design and planning system based on computer vision and deep learning

- Wireless sensor node localization algorithm combined with PSO-DFP

- Development of a digital employee rating evaluation system (DERES) based on machine learning algorithms and 360-degree method

- A BiLSTM-attention-based point-of-interest recommendation algorithm

- Development and research of deep neural network fusion computer vision technology

- Face recognition of remote monitoring under the Ipv6 protocol technology of Internet of Things architecture

- Research on the center extraction algorithm of structured light fringe based on an improved gray gravity center method

- Anomaly detection for maritime navigation based on probability density function of error of reconstruction

- A novel hybrid CNN-LSTM approach for assessing StackOverflow post quality

- Integrating k-means clustering algorithm for the symbiotic relationship of aesthetic community spatial science

- Improved kernel density peaks clustering for plant image segmentation applications

- Biomedical event extraction using pre-trained SciBERT

- Sentiment analysis method of consumer comment text based on BERT and hierarchical attention in e-commerce big data environment

- An intelligent decision methodology for triangular Pythagorean fuzzy MADM and applications to college English teaching quality evaluation

- Ensemble of explainable artificial intelligence predictions through discriminate regions: A model to identify COVID-19 from chest X-ray images

- Image feature extraction algorithm based on visual information

- Optimizing genetic prediction: Define-by-run DL approach in DNA sequencing

- Study on recognition and classification of English accents using deep learning algorithms

- Review Articles

- Dimensions of artificial intelligence techniques, blockchain, and cyber security in the Internet of medical things: Opportunities, challenges, and future directions

- A systematic literature review of undiscovered vulnerabilities and tools in smart contract technology

- Special Issue: Trustworthy Artificial Intelligence for Big Data-Driven Research Applications based on Internet of Everythings

- Deep learning for content-based image retrieval in FHE algorithms

- Improving binary crow search algorithm for feature selection

- Enhancement of K-means clustering in big data based on equilibrium optimizer algorithm

- A study on predicting crime rates through machine learning and data mining using text

- Deep learning models for multilabel ECG abnormalities classification: A comparative study using TPE optimization

- Predicting medicine demand using deep learning techniques: A review

- A novel distance vector hop localization method for wireless sensor networks

- Development of an intelligent controller for sports training system based on FPGA

- Analyzing SQL payloads using logistic regression in a big data environment

- Classifying cuneiform symbols using machine learning algorithms with unigram features on a balanced dataset

- Waste material classification using performance evaluation of deep learning models

- A deep neural network model for paternity testing based on 15-loci STR for Iraqi families

- AttentionPose: Attention-driven end-to-end model for precise 6D pose estimation

- The impact of innovation and digitalization on the quality of higher education: A study of selected universities in Uzbekistan

- A transfer learning approach for the classification of liver cancer

- Review of iris segmentation and recognition using deep learning to improve biometric application

- Special Issue: Intelligent Robotics for Smart Cities

- Accurate and real-time object detection in crowded indoor spaces based on the fusion of DBSCAN algorithm and improved YOLOv4-tiny network

- CMOR motion planning and accuracy control for heavy-duty robots

- Smart robots’ virus defense using data mining technology

- Broadcast speech recognition and control system based on Internet of Things sensors for smart cities

- Special Issue on International Conference on Computing Communication & Informatics 2022

- Intelligent control system for industrial robots based on multi-source data fusion

- Construction pit deformation measurement technology based on neural network algorithm

- Intelligent financial decision support system based on big data

- Design model-free adaptive PID controller based on lazy learning algorithm

- Intelligent medical IoT health monitoring system based on VR and wearable devices

- Feature extraction algorithm of anti-jamming cyclic frequency of electronic communication signal

- Intelligent auditing techniques for enterprise finance

- Improvement of predictive control algorithm based on fuzzy fractional order PID

- Multilevel thresholding image segmentation algorithm based on Mumford–Shah model

- Special Issue: Current IoT Trends, Issues, and Future Potential Using AI & Machine Learning Techniques

- Automatic adaptive weighted fusion of features-based approach for plant disease identification

- A multi-crop disease identification approach based on residual attention learning

- Aspect-based sentiment analysis on multi-domain reviews through word embedding

- RES-KELM fusion model based on non-iterative deterministic learning classifier for classification of Covid19 chest X-ray images

- A review of small object and movement detection based loss function and optimized technique