Abstract

Turkey has been suffering from a persistent deficit in its current account for decades. The connection between the oil price, the real exchange rate, the terms of trade, industrial production, the foreign direct investments, and the current account balance was investigated by using the structural vector autoregression (SVAR) model. The exchange rate and industrial production accounted for the largest explanatory shares in the balance, according to variance decomposition, although their impacts diminished with time. The balance was also strongly influenced by the terms of trade. In the first few months, the oil price had a weak influence on the balance. However, its impact gradually grew over the course of the following periods. The impulse response functions showed that the exchange rate, industrial production, and terms of trade had a positive and significant effect on the current account balance in the short-term. Furthermore, the SVAR model was applied to the time frame before the COVID-19 pandemic. The results indicated that although the basic findings for the exchange rate and industrial production remained unchanged, their explanatory significance for the current account balance decreased. As a consequence, the country must formulate fiscal and monetary strategies that are advantageous in mitigating the impact of these variables on the balance.

1 Introduction

Turkey has been experiencing a chronic current account deficit for decades. Although the country implemented many growth policies, it could not successfully reduce this problem. Having a current account deficit can make the country vulnerable to crises, turmoil, economic uncertainties, and political instabilities. Constant depreciation in the exchange rate, lower economic growth, trade deficit, default, and many problems can be followed by current account imbalances. Hence, the nation needs to eradicate this issue by determining the consequences of the primary variables that are responsible for the deficit. The main goal of this article is to investigate the effects of the various factors chosen as determinants of the balance. It is anticipated that several factors contribute to the deficits. The factors to consider are the oil price, the real exchange rate, the terms of trade, the industrial production index, and foreign direct investments (FDI). An application of a model known as structural vector autoregression (SVAR) was used to carry out the study over the monthly time period spanning January 2005 to October 2022. The investigation of potential solutions to Turkey’s persistent current account deficit is also the primary aim of the article. The first step is to explain the influences of the chosen factors. The second question inquiries into which factors have the most significant effect on the balance as well as the extent of the influences that the variables have. This final query determines the range of feasible policy suggestions. The purpose of this work is to search for solutions to the aforementioned questions.

The Turkish economy experienced a structural transformation in the 2000s. Although its economic growth significantly increased, the current account deficit became larger than before as seen in Figure 1. In 2001, the current account balance was around 3.7 billion US dollars. However, it dramatically rose to a 74.4 billion US dollar deficit in 2011, which was a record level in the history of the country. Despite the COVID-19 pandemic causing a decrease in consumption and output, it was anticipated that this decline would alleviate the deficit. However, the current account deficit remained a persistent issue, amounting to around 48.8 billion US dollars in 2022. Having policy implications for the Turkish economy may serve as a model for other developing nations who constantly struggle with deficits in their current account. In light of this, performing an analysis of the economy of this country may be a source of knowledge for other nations to follow and assess their own conditions.

Total current account balance for Turkey (annual, million USD). Source: The CBRT.

One of the most significant dynamics that determines the current account balance is the oil price (Bousnina et al., 2021). A nation that is an oil exporter could experience an improvement in its balance when the oil price continues to rise. It may exacerbate the deficit of countries that are net oil importers. A drop in the price of oil can help these sorts of nations get their external balances back in order. In spite of the fact that Turkey is geographically close to a number of nations that have abundant energy resources, it does not have enough of its own to meet its needs. As compared to the economies of the surrounding area, Turkey’s industrialized economy is at the forefront. Due to the fact that it has the capacity to expand, there is a need for energy. Oil is a significant energy source for the nation since it is used in production, everyday living, and transportation. This means that domestic demand for oil accounts for a significant portion of the deficit.

Trade is one of the most significant factors that determines the nation’s current account balance. The connection between an economy’s exports and imports is one factor that may unquestionably influence the stability of its current account balance (Greenidge et al., 2011; Sahoo et al., 2016; Song, 1997). To deal with trade imbalances, Turkey implemented import substitution industrialization policies in the 1960s and 1970s. However, this did not create a satisfactory result. It was suggested that exports could grow faster if the country can create a free and flexible economy. In spite of this, the economy continues to struggle with the same issue. In terms of the Harberger–Laursen–Metzler (HLM) effects, an improvement in the terms of trade can have distinct impacts on the country’s balance. In other words, it is assumed that a decline in the terms of trade may lead to an increase in the current account deficit. For this reason, the terms of trade were taken into account throughout the investigation, since this variable might have a substantial influence on the current account balance.

For the current account balance, financial regulations and reserves may both play important deciding roles (Moral-Benito & Roehn, 2016; Steiner, 2014). Fluctuations in currency rates, namely depreciations and appreciations, can have a strong influence on a nation’s current account balance (Çalışkan & Karimova, 2017; Mussa, 2007). For instance, as a response to the economic crisis that occurred in 2000–2001, the Turkish economy enacted a number of financial regulations for the banking as well as the industrial sectors. A floating exchange rate system was implemented in place of the previous fixed one. In light of this, it was anticipated that the overvaluation of the currency may be lowered, which would potentially assist in the elimination of the issue of the current account deficit. However, easing capital movements and making reforms toward a free market economy attracted a large number of investments which gave way to an overvalued currency. Thus, the country started experiencing a large amount of imports which deepened the current account deficit problem.

Growth can play a determining role in the balance (Cheung et al., 2013). The dependency of economic growth on imported intermediate goods can stimulate the deficit (Ünal, 2017). However, in some nations, growth that is supported by exports can create a surplus. Therefore, economic growth should be considered for the analysis. For that industrial production was taken into account. Its purpose was to assess the extent how industrial production might contribute to maintaining the balance. In addition, there could be a high connection between investments and the current account balance (Comunale, 2018; Janko, 2020). The FDI may come from both developed and developing nations, and the investments can be designed to generate goods for either the domestic market or for international trade. Intensifying investments in the economy can stimulate both imports and exports. Foreign capital can lead to growth in the export of goods and services which can also contribute to economic growth (Metwally, 2004). In other words, economic growth can be improved through investments. However, if the FDI is directed to produce for the domestic market by importing necessary intermediate or final products, a deterioration of the current account balance and a slower pace of growth are both to be anticipated as possible outcomes. If this is the case, then it is essential to investigate the function that the FDI plays in current account imbalances.

Turkey was chosen for the analysis because of several reasons. First, the nation has a persistent current account deficit, which makes it susceptible to economic upheaval, hazards, and instabilities like fluctuations in the currency rate. Moreover, significant devaluations and depreciations of the lira are brought on by massive current account deficits. Although the country had several instances of currency depreciation throughout its history, this approach did not effectively improve the balance. Second, although the nation has an industrialized economy and borders energy-rich economies, it constantly experiences a deficit because of its energy demand. Third, Turkey has the most developed industries in the region. However, it ends up with trade imbalances. Fourth, it is a good example for developing countries to understand how to deal with current account imbalances. This issue also results in macroeconomic imbalances, a reduction in the country’s capacity for future development, high interest rates, and pressure on the currency rate. Lastly, to our best, there has not been any study that has appropriately concentrated its attention on the dynamics that determine the balance. In this study, which is the first of its kind, an SVAR model was employed to create an analysis of Turkey.

Section 2 provided a detailed study of existing research and the originality of the work by further exploring the notions of short-term analysis. Section 3 outlined an explanation of the assumptions, the data collection processes, and the graphical representation of the variables. The SVAR model was applied to both the whole period sample and the period before the COVID-19 pandemic in Section 4. The discussion in Section 5 focused on the policy implications. The article is concluded in Section 6.

2 Previous Research and the Current Work

2.1 Previous Research

A persistent current account deficit may be experienced by various countries. Turkey is among the countries that have the issue of a chronic current account deficit. There are still areas of study that need to be addressed to understand this complex situation. Despite the fact that there are not a great number of recent works that investigate this matter, there are publications that are accessible on the subject. This section provides an introduction to these works.

Sahoo et al. (2020) used linear cointegration methods to examine the influence of imports of crude oil and gold on India’s balance for the yearly period spanning 1980–2017. The outcome suggested that there was substantial prove of a significant and positive association between imports of oil and the current account balance. The relationship was negative and significant when gold imports were considered. The balance suffers from the rising price of crude oil, but benefits from the rising price of gold in the short term. Ayele (2019) investigated whether or not a devaluation in the real exchange rate might significantly contribute to the balance of four severely indebted developing nations in East Africa. A pooled mean group technique was implemented for the analysis of the data for the annual period from 1970 to 2016. In addition, the applied bound testing and the autoregressive distributed lag (ARDL) model were also employed in this research. According to the findings of the panel estimate, a depreciation in the currency rate did not cause a substantial impact on the country’s balance in either the short term or the long term. Nevertheless, it was claimed that the findings of bound testing and the ARDL model revealed that a depreciation in the real currency rate improved the balance only for Ethiopia in the long term. The Markov-switching approach was implemented by Topalli and Dogan (2016) for the four-year period beginning in 1990/1 and ending in 2014/2. According to the estimates, the most significant factors that determine Turkey’s current account balance were the country’s energy consumption, its openness rate, its GDP, its exchange rate, and its investments. Also, it was indicated that the sustainability of the balance was poor, but that it became much worse when the economy was in a contractionary phase.

Yurdakul and Cevher (2015) made an effort to determine whether or not there is a correlation between shifts in macroeconomic factors and those in the current account deficit in Turkey. Throughout the course of the research, quarterly data between 2003/1 and 2014/2 were taken into consideration. The conditional and partial Granger causality tests revealed a robust link between the current account balance/GDP and the real effective currency rate. Moreover, it was anticipated that the balance is affected by growth, energy imports, and openness. The effect of the FDI, on the other hand, revealed just a little influence. Gnimassoun (2015) conducted research to determine whether or not the adoption of a currency rate system may have an effect on the imbalances in countries located in sub-Saharan Africa. To analyze data for a yearly time period spanning 1980–2012, the Bayesian model averaging approach was combined with the General-to-Specific technique. It was determined that exchange rate regimes that allowed for some degree of flexibility were more successful in reducing imbalances. Furthermore, it was claimed that the fiscal policies and resource policies both contributed to the imbalances. By applying the ARDL approach, İnsel and Kayıkçı (2013) evaluated the theoretical and statistical connection between macroeconomic factors and the deficit. In the period of the research, quarterly data from 1987/4 through 2009/4 were taken into consideration. According to assessments, inflation had a positive impact on the balance. Nonetheless, economic growth, open trade, rising energy costs, and an appreciation in the currency all contributed to a worsening of the balance in Turkey. Peru was the focus of an investigation of the HLM effect by Aquino and Espino (2013). The result of this impact is a reduction in a nation’s overall level of savings as a direct consequence of a worsening in its trade position. The application of vector autoregression (VAR) models was carried out during the years 1950–2009. The findings suggested that an unexpected and sustained rise in export prices contributed to an improvement in the balance. Jaffri et al. (2012) employed research to find out how the FDI affects Pakistan’s balance and income outflows. ARDL model was applied from 1983 until 2011. Increases in the FDI were shown to be the source of higher income outflows and a deepening country’s current account imbalances in both the short term and the long term of the analysis. Arratibel et al. (2011) conducted research on the link between nominal currency rate volatility and macroeconomic dynamics, including economic growth, credit, the FDI, and the current account balance for the nations that constitute the EU. The years 1995–2008 were covered by the panel data analyses that were performed. It was estimated that reduced fluctuation in currency was related to faster growth, higher FDI, larger current account deficits, and excessive credit usage. In their investigation of the connection between volatility in the price of oil and Nigeria’s balance, Chuku et al. (2011) used an SVAR model. For the purpose of this study, a specific time range spanning from 1970/1 to 2008/4 was chosen. In general, it was discovered that sudden changes in the price of oil caused a considerable influence on the current account balance for the short term. Tsen (2009) implemented several basic econometric approaches such as the Johansen cointegration and error correction models by including Japan, Hong Kong, and Singapore. Different quarterly sample sizes were considered for the selected countries. For the results of the research, the price of oil, domestic demand, international demand, terms of trade, and trade balance were all interconnected and cointegrated. These were determined to be significant factors, both in the short term and in the long term, in determining the state of the trade balance.

2.2 The Current Work and the Research Gap

In contrast to the abovementioned literature from İnsel and Kayıkçı (2013), Topalli and Dogan (2016), Yurdakul and Cevher (2015), and others that focused on the current account balance, our work presents various innovative contributions. According to the best of our knowledge, the SVAR model was applied to evaluate the impact that the macroeconomic variables would have on the current account balance of Turkey. The effects of the HLM, the influences of the exchange rate, and industrial production were brought up for discussion in the study. In particular, the variable of terms of trade was taken into consideration in the research. For the purpose of setting the constraints of the SVAR model, not only economic theory is taken into account, but also the present economic situations in Turkey are taken into consideration. Regarding the constraints of the study, there are works that provide empirical evidence of the factors that dominate the Turkish economy. In their study, Köse et al. (2024) examined the effects of fluctuations in the gold price, the oil price, and the exchange rate on imports using a time-varying methodology. Imports were considered to be a key determinant of the current account imbalance. Therefore, it was deliberated that addressing the challenges in imports would help alleviate the difficulty in the current account balance. The oil price and the exchange rate were shown to have significant effects on driving imports in the nation. Ünal (2017) conducted input–output analysis and found that the Turkish economy exhibits a significant level of dependence on imports for production in exports. This suggests that the factors that determine the conditions of trade have a crucial role in international trade. This study also showed that a substantial rise in the FDI led to a more pronounced current account deficit, highlighting the severity of the issue. Industrial production grew heavily reliant on imported items, which contributed to an increase in the current account deficit. Furthermore, it was stated that the exchange rate was deliberately maintained at an artificially high value in order to encourage domestic manufacturing by reducing the cost of imports. However, the deficit might exert upward pressure on the exchange rate, leading to depreciation. Moreover, the persistent deficit might impede industrial production that is influenced by uncompetitive manufacturing. Therefore, our study posits that there are reciprocal and instantaneous causal connections between the current account and industrial production, as well as between the current account and the real exchange rate. In other words, the current account balance is affected by both industrial production and the real exchange rate, but at the same time, the current account balance also influences both factors. Köse and Ünal (2021) used an SVAR model and ascertained that the oil price and the exchange rate possess the capacity to have an impact on macroeconomic indicators in Turkey. Köse and Aslan (2023) employed an SVAR model to examine the effects of the exchange rate and industrial production, serving as a proxy for income, on international trade in Turkey. Based on this study, it was determined that industrial production had a significant effect on the fluctuations observed in international trade indicators. In addition, it was proven that the exchange rate had a significant impact on determining international trade. In our SVAR model, the oil price has an instantaneous impact on all other variables, but it is not instantaneously influenced by any other variable. The second variable, which is the terms of trade, has an instantaneous impact on the variables that follow after it, but it receives no instantaneous influence from those variables. These relationships persist in a comparable manner for additional variables. Using the information provided above, this research constructed and applied constraints of the SVAR model. Selected tests were employed to elucidate the variations in the current account balance.

Although the determinants of the current account balance have been discussed in previous works, the research remained limited for the Turkish economy by a novelty approach and determinants. The exchange rate, energy, and investment were all taken into consideration for the analysis of the deficit. Nevertheless, additional research is required to fully comprehend how the terms of trade and the industrial production index influence the balance. Previous works empirically examined the condition of the Turkish economy but the economic structure of the country was neglected. In this work, the economy was analyzed both theoretically and structurally. The country followed import substitution industrialization between 1960 and 1980 but this only stimulated the current account imbalances because this process made the economy more dependent on imported intermediate goods. To cover the current account balance, the economy carried out several reforms by creating openness, export growth strategies, and transforming the currency regime from a fixed system to a managed one. Despite this, the structure of the balance stayed the same up till the present day. A significant issue that contributes to the continuous depreciation of the lira is the substantial deficit in the current account. Hence, the objective of this research is to identify a resolution to this problem.

The research employed the structural VAR model, which is capable of accommodating the assumptions. The process involves arranging the variables in a certain order, starting with exogenous variables and ending with endogenous variables. In the standard VAR model, these assumptions are established using the Cholesky decomposition. However, the requirement of organizing the variables in a certain order for the Cholesky decomposition may not align with economic theory. The reason for this is that Cholesky decomposition does not allow for the incorporation of these assumptions. Instead of Cholesky decomposition, structural factorization is employed in the structural VAR model. The Cholesky decomposition assumes that causal relationships between variables only occur in one direction. The study used structural factorization using an SVAR model, which allows for bidirectional instantaneous causal connections between variables. Utilizing the SVAR model enables the achievement of more realistic findings for Turkey. The Engle-Granger, Johansen cointegration tests, and the Pesaran ARDL model (Bounds test) may be applied to analyze the connection between variables in both the short and long term. In order to perform any of these procedures, it is essential that the current account balance is not integrated with an order of zero. The integration order for Turkey’s current account balance in the SVAR model is zero. To examine the short-term and dynamic connections between the variables, the stationary SVAR model can be implemented, using the stationary levels of the variables under investigation.

Findings using structural factorization are more reliable as it is grounded in economic theories. Furthermore, the economic structures of countries may be included while performing the structural factorization in the SVAR model. This research incorporates both the economic factors and the specific economic circumstances of Turkey into the structural factorization in the SVAR model. In the SVAR model, it is assumed that there is an instantaneous bidirectional connection between the real exchange rate and the current balance of payments. The relationship between the real exchange rate and the current account balance is supported by economic theory, whereas the impact of the current account balance on the real exchange rate is contingent upon Turkey’s economic state. The reason for this is that Turkey has been operating a current account deficit for a considerable amount of time, and as a natural consequence of this, the demand for foreign currency is larger than the supply of foreign currency on the market. This scenario exerts strain on the exchange rate in Turkey, leading to a depreciation of the lira versus international currencies. In this regard, the study sets itself apart from earlier investigations in the existing body of literature.

It is possible to employ a VAR model as a simplified version of an SVAR model (Sims, 1986). The foundation of SVAR models is the identification of assumptions that are consistent with the construction of contemporaneous connections between endogenous variables. Institutional knowledge, economic theory, and extraneous limitations are considered as the foundation for these assumptions (Bernanke, 1986). SVAR models provide us with the opportunity to create assumptions by allowing us to examine the reactions of the model (Blanchard & Watson, 1986; Kilian, 2013; Stock & Watson, 2001). The econometric research conducted in our work utilizes the SVAR model, which focuses on short-term analysis. Ayele (2019) and Sahoo et al. (2020) conducted a study of yearly data. However, the models, methods, and results were categorized as either short term or long term based on their respective findings. The ARDL model with error correction is employed to derive short-term findings. Tsen (2009) applied the Johansen cointegration method to conduct a long-term study and employed an error correction model to determine short-term outcomes. Chuku et al. (2011) employed an SVAR model, imposing certain constraints on its structure, to perform a short-term investigation based on quarterly data. Köse and Ünal (2020) established their structural restrictions to conduct a short-term study for the purpose of explaining the effect of oil price shocks on the stock exchanges in the countries that are located in the Caspian Basin by using the SVAR model. Köse and Ünal (2021) implemented an investigation that specifically examined the influence of the oil price on inflation, using a monthly analysis. Moreover, it was stated that given the specified assumptions, the SVAR model, characterized by non-recursive short-term restrictions, can be applied to examine the dynamic effects of the chosen variables. The structural shocks of these variables can be utilized to generate impulse response functions and variance decomposition. Based on the consideration of previously conducted studies, this article categorizes the research as a short-term examination. Upon examining the impulse-response functions, it is found that the response of the current account deficit to positive shocks in both industrial production and real exchange rate is statistically significant only for the initial 3 months. Nevertheless, this effect becomes statistically insignificant in the subsequent forecast periods. In other words, the current account deficit in the short term is influenced by both industrial production and real exchange.

3 Criteria and Data Selection

This section presents assumptions on the potential effects of the selected main factors, which might lead to significant changes in Turkey’s balance. The oil price is one element that may have a considerable effect on the balance. According to Uneze and Ekor (2012), using empirical study, it was stated that the oil price had a significant impact on the current account balance. However, the impacts might be substantially different in countries that are net importers of oil and those that are net exporters of oil. There is a correlation between rising oil prices and an improvement in the current account balance of oil-rich nations. The effect may have a detrimental impact on economies that are dependent on oil imports.

It is necessary for a nation to pay attention to the pricing of both its imports and exports if it wants to become competitive and cover its current account deficit. Under a system with a flexible exchange rate, output can decline when there is an improvement in the terms of trade, but it can rise when there is a deterioration in the terms of trade. Notwithstanding this, advances in a country’s rate of productivity have the potential to have a significant impact on the terms of trade (Laursen & Metzler, 1950). Because of this, the terms of trade become more significant when the exchange rate is flexible. In addition, Harberger (1950) pointed out that under the situation of inelastic demand for imports, such significant depreciations in the currency rate might make the balance of payments worse. If this is the case, then it is reasonable to expect these nations to implement appropriate policies regarding employment and income to improve their balance of payments. This suggests that the terms of trade and the current account balance have a positive connection with one another. The HLM effect is an alternative term for this phenomenon. This pattern suggests that an increase in the terms of trade is expected to improve the trade balance (Erauskin & Gardeazabal, 2017; Otto, 2003; Shafiullah et al., 2020). In other words, this impact is anticipated to reduce the trade imbalance. Afza et al. (2016) stated that via empirical investigation, an improvement in the terms of trade leads to an improvement in the trade balance in Pakistan. According to Tsen (2006), there is a link in the long term between Malaysia’s trade balance and the terms of trade based on the commodity approach. Moreover, it was discovered that the trade balance was estimated to be caused by the terms of trade through the Granger causality. In certain nations, an improvement in the balance can be brought about by rising the terms of trade. This probably is not really the case in every nation. It is presumable that this variable might be considerably connected with imbalances in the current account. Therefore, it is essential to conduct a study on the impact that the terms of trade have on the Turkish economy.

An increase in the value of one currency relative to another can cause a detrimental effect on the nation’s balance (Batdelger & Kandil, 2012). A positive contribution to the balance can be made by a surplus brought about by a depreciation in the currency rate. It is possible for depreciations in the flexible exchange rate to occur in order to generate a balanced power in international trade and to minimize the worsening of the balance of trade. The method of threshold regression was employed by Doudou et al. (2022) in order to evaluate whether or not there exist threshold levels of depreciation and appreciation in the currency rate for the purpose of explaining the trade balance. It was discovered that rises in the value of the currency rate that is more than a certain critical value might make the trade balance worse. Depreciation in the currency rate can make the situation better. Chinn and Lee (2009) conducted an analysis to determine how much of the deficit requires modifications to the real currency rate. It was claimed that there is a need for a depreciation in the currency rate in the US. Adjustments need to be made in Japan to generate appreciations in the exchange rate that exists between Japan and the eurozone. A devaluation of the currency can both boost the country’s overall competitiveness and make local products much more competitive on the global market. This may result in a better balance for the current account. Consequently, our article assumes that the lira may be a critical factor in the process of identifying solutions to the current account imbalances.

Economic growth can affect the current account balance (Freund, 2005). Output can be stimulated by exports and imports of intermediate goods. Hence, a rising growth rate can be followed by a rising current account deficit, if the country is highly dependent on imports of goods. In addition, if a country is led by export growth, then rising growth can also create a current account surplus. Therefore, industrial production was considered for the analysis in this article. It was assumed that this variable could be a significant explanatory factor of the balance.

The FDI is a strong variable that can impact the current account balance (Herrmann & Winkler, 2009). It is not easy for developing countries to compete with industries in developed economies. Therefore, these countries need the FDI to attract technology and novel production techniques. Investments can improve the quality of products and can make a country become a competitive one in international trade. The direction of the FDI can also be for the domestic markets. Jaffri et al. (2012) discovered a negative connection between the FDI and current account imbalances. Ünal (2021) mentioned that strategy of the multinational companies is important in the home country. This can stimulate imports of production which can deteriorate the current account balance.

Data collection was conducted from sources based on the assumptions outlined. In the process of determining where to start collecting the data, the average time period that includes the largest length of time was taken into consideration. Brent and West Texas Intermediate are both well-known benchmarks for the price of oil across the world. It is reasonable to assume that these two sets of data are cointegrated, yet Turkey is a nation that is geographically closer to the countries of Europe. As a result, the price of Brent crude oil based on monthly data expressed in US dollars per barrel was chosen for the investigation. This report was sourced from the St. Louis Federal Reserve Bank. The terms of trade were calculated using the foreign trade export unit value index and foreign trade import unit value index, which are obtained from the electronic data delivery system of the Central Bank of the Republic of Türkiye (CBRT). The real exchange rate, industrial production index, FDI, and current account balance were also obtained via the electronic data delivery system of the CBRT.

The information on the oil price was obtained from the global source. Nevertheless, it was assumed that the data pertaining to the national level should be obtained directly from the main source. Furthermore, all of this data were transformed into logarithmic form, denoted by the prefix

Description of variables

| Variables | Notations | Detail | Time period | Source |

|---|---|---|---|---|

| Brent crude oil price |

|

Crude Oil Prices: Brent-Europe, US Dollars per Barrel | Monthly samples of data between January 2005 and October 2022 | Federal Reserve Bank of St. Louis |

| Terms of trade |

|

Indexes are based on 2010 = 100, the terms of trade are estimated by using the equation: (Export unit value)/(Import unit value) | Statistical Data (EVDS), CBRT | |

| Real exchange rate |

|

The data is derived by considering Consumer Price Index as 2003 = 100 index | Statistical Data (EVDS), CBRT | |

| Industrial production index |

|

The data is based on seasonal and calendar adjusted 2015 = 100 index | Statistical Data (EVDS), CBRT | |

| Foreign direct investments |

|

As million US dollars | Statistical Data (EVDS), CBRT | |

| Current account balancea |

|

As million US dollars | Statistical Data (EVDS), CBRT |

Note: Collected data are in logarithmic form and are described by the notation

aThe current account balance (cab) at the monthly frequency for Turkey is usually negative and rarely positive. All values were positive by means of the linear transformation of 4,105-cab on the current account balance data. Thus, the logarithm of the current account balance data can be obtained. Furthermore, the increase in data obtained by this linear transformation means that the deficit in Turkey will increase.

Figure 2 displays the time plot of the variables throughout the chosen time periods. The oil price exhibits significant volatility and an unpredictable pattern. Specifically, the oil price reached its lowest points at times of turmoil, such as the substantial impact of the COVID-19 pandemic worldwide. Subsequent to these dramatic decreases, the oil price witnessed a substantial surge. The figure depicts a significant increase in the oil price during the beginning of the 2010s. The same pattern may be observed when the influence of the pandemic eventually waned. While the terms of trade patterns for Turkey were constant until April 2020, the statistics thereafter showed a significant drop. Consequently, it may be inferred that the competitiveness of the country declined after the COVID-19 pandemic, resulting in a fall in the value of exports. The real exchange rate experienced a persistent depreciation. More precisely, the variable demonstrated a consistent decrease throughout the decade of the 2010s. This suggests that the lira experienced significant depreciation during the stated period. In general, the industrial production index had a positive path of expansion. The variable experienced a significant reduction as a consequence of the global crisis and the COVID-19 pandemic. The FDI patterns indicated substantial fluctuations over time. Moreover, it is evident that the variable witnessed a substantial decline after 2016. During the specified time period, the current account balance consistently showed a deficit. Within a very short period of time, there was an excess in the balance. Turkey had a surplus in its current account balance, especially during periods of sluggish economic growth. The data indicate a positive connection between Turkey’s current account deficit and its economic growth. The 2008 global financial crisis led to a substantial reduction in the current account deficit. Nevertheless, the COVID-19 pandemic has substantially worsened the existing current account deficit. Hence, it is essential to include the examination of the COVID-19 pandemic in the analysis. This will provide a more thorough comprehension of the elements that contribute to the current account deficit. Furthermore, it might support policymakers in formulating specific strategies to tackle the economic implications of a turmoil on the deficit.

Time plots of variables.

The availability of data on the FDI was a critical determinant in the selection of samples. Our investigation is subject to certain constraints, as is the case with any econometric investigation. The analysis is limited to monthly data between the years 2005 and 2022 since the database that is utilized for Turkey dates back to 2005, which is the starting point for monthly data. Following the economic crisis that occurred in the years 2000–2001, the nation made the decision to adopt economic policies that were more liberal in nature by encouraging direct investments in its market. Furthermore, starting from 2004, the current account balance experienced a significant shift towards a deficit. The selection of the data period is important in assessing the impact of the COVID-19 pandemic on the balance. In particular, the selected variables had a considerable change in their patterns during the extreme events. The selection of the data period that encompasses the significant events would pave the way for policymakers, investors, and scholars to obtain a knowledge of the potential implications that the crises may have on the macroeconomic factors. Consequently, this would make it possible to concentrate on novel economic policies.

4 Analyses and Findings

4.1 Tests for Unit Root

The stationarity of the variables was analyzed employing three distinct unit root tests: The Augmented Dickey-Fuller (ADF), the Phillips-Perron (PP), and the Vogelsang-Perron (WP) tests. The results of the test to determine the unit root are shown in Table 2. The outcomes of all of the unit root tests, including the three alternatives, came to identical conclusions for all of the variables. It was discovered that the order of integration was one for the oil price, the terms of trade, the real exchange rate, and the industrial production index, while it was zero for the FDI and the current account deficit. Hence, the FDI and the current account balance, which are variables in the VAR model, are at logarithmic levels, while the other variables are at logarithmic first-order differences. Therefore, since all variables exhibit stationarity in the SVAR analysis, there is no need to use the vector error correction model. In addition, the current account balance is the variable that is the focus of the study, and it is stationary at the logarithmic level (the order of integration is zero). As a result, it is not feasible for us to investigate long-term relationships within the framework of cointegration analyses employing any econometric method, including the Pesaran bound test.

Tests

| Variable | Augmented Dickey–Fuller (ADF) | Phillips–Perron (PP) | Breakpoint Unit Root Test (Vogelsang and Perron, WP) | |||

|---|---|---|---|---|---|---|

| t-Statistic | p-Value | Adj. t-Stat | p-Value | t-Statistic | p-Value | |

|

|

−2.6982 | 0.0757 | −2.8331 | 0.0551 | −3.2944 | 0.5064 |

|

|

−11.0199 | 0.0000 | −11.4034 | 0.0000 | −12.0789 | <0.01 |

|

|

−1.4863 | 0.5390 | −0.8297 | 0.8084 | −4.0174 | 0.1511 |

|

|

−4.3634 | 0.0004 | −17.2108 | 0.0000 | −17.2412 | <0.01 |

|

|

0.5038 | 0.9866 | 0.5567 | 0.9883 | −2.3288 | 0.9415 |

|

|

−10.1091 | 0.0000 | −11.7366 | 0.0000 | −12.0422 | <0.01 |

|

|

−0.2338 | 0.9306 | −2.4981 | 0.1173 | −3.1476 | 0.5983 |

|

|

−4.5287 | 0.0002 | −70.2843 | 0.0001 | −22.8735 | <0.01 |

|

|

−4.2374 | 0.0007 | −12.1171 | 0.0000 | −12.3904 | <0.01 |

|

|

−7.0491 | 0.0000 | −9.9473 | 0.0000 | −9.7715 | <0.01 |

The exogenous variable is the only one that is constant. Using the Akaike information criterion (AIC), an appropriate lag length has been chosen for the ADF and WP tests, with a maximum lag of 12 periods. The Bartlett kernel is used to decide what the favorable Newey–West bandwidth for PP unit root testing should be. The Dickey-Fuller min-t is applied to determine when the break occurs. ∆ is a first-order difference operator.

4.2 SVAR Analysis

A–B model can be specified in terms of its short-term SVAR(p) as follows:

where

The development of exports in Turkey as well as the economy overall is reliant on imports. The majority of Turkey’s exports are supported by the country’s imports of intermediates. To put it another way, a major portion of Turkey’s manufacturing requirements are met by importing goods from other nations. Moreover, the fact that Turkey is an oil importer results in an increase in its reliance on other countries. Under these conditions, maintaining production will need a certain quantity of imported intermediate input. In addition, there are two important pieces of evidence that point to the dependent production structure being the case. To begin, the amount of Turkey’s foreign trade tends to decrease during times of crisis, and this trend is dependent on both exports and imports. In another version, although the volume of imports falls as a result of the economic slump, the level of exports falls relative to the level of imports since exports are reliant on imports. Furthermore, it has been noted that Turkey’s current account deficit shrinks during times of crisis. Second, it has been observed that Turkey’s current account deficit widens at times when Turkey’s economic growth is at a high level. At periods of economic expansion, the amount of exports grows, but the rate at which imports are expanding becomes greater than the rate at which exports are growing. This contributes to a growth in Turkey’s deficit, which is produced by the country’s deficit in its trade with other countries. There are two different theories that might be given for the reason why domestic income has such a significant impact on exports. To begin, the cash earned inside the country is used to pay for imports, which serve as the raw material for exports. Second, the index of industrial production, which stands for the national income, is an indication of the production statistics in Turkey. The circumstance further demonstrates that Turkey is dependent on the trade it does with other countries. To summarize, it is possible to draw the conclusion that Turkey’s current account deficit may become permanent in the future (Köse & Aslan, 2023).

Turkey is a country that has been experiencing a deficit for many years. The price of oil, the country’s terms of trade, the real exchange rate, the country’s rate of economic growth, and the FDI are the primary factors that determine Turkey’s deficit.

Imports are of critical significance to the expansion of the country’s economy. For this reason, during the periods when Turkey has a low current account deficit, its economic growth is below its potential growth. In light of this, the instantaneous connection between the deficit and economic growth, specifically industrial production, is regarded to be bidirectional due to the nature of the economy.

A further point to consider is that the real exchange rate creates an impact on the deficit. However, despite this, the deficit continues to exert stress on the exchange rate. Hence, it would be reasonable to presume that the instantaneous link between Turkey’s currency and its deficit is bidirectional.

It was assumed that shifts in the terms of foreign trade had an immediate influence not just on the currency rate but also on the deficit. This variable is not immediately influenced by all of the other factors that are being considered by the VAR model.

Oil prices are external variables for Turkey. Because of the increase in the price of oil, Turkey’s current account balance is expected to also worsen. Because of this, the price of oil will only create an immediate effect on the deficit, but it will not, in turn, be instantly influenced by the variables of other factors.

The FDI has an instantaneous impact on the balance. The variables that instantaneously affect the FDI were taken into account as the growth and the currency. Moreover, the FDI instantaneously affects the deficit as well as economic growth.

For the purpose of the short-term study, the SVAR model is implemented in its stationary version. The SVAR model that includes the A and B matrices is then stated as follows when these constraints are applied. The constraints are incorporated into the model in a matrix format as follows:

The optimum lag length for the VAR model is selected as 12, using the AIC with a maximum lag of 12. The Likelihood Ratio (LR) test for over-identification was executed due to the fact that the SVAR model is over-identified. The p-value for the LR statistic was discovered as 0.3374, which was determined to be larger than 0.05, which is the null hypothesis. This suggests that over-identification is justified, and it cannot be rejected at the 5% significant level.

4.3 Forecast Error Variance Decomposition Analysis

Table 3 indicates the conclusions drawn from the forecast error variance decomposition analysis performed on Turkey’s current account balance. The findings were presented after an examination over a period of one year. According to the data shown in the table, the effect of the shift in the oil price on the balance during the first month was 0.05%. In the sixth month, its influence was up to 4.01%, but in the final month, it was down to 3.79%. According to the findings, the influence of the oil price on the balance was far less significant than the effect of the other factors, although the effect did become significantly more important towards the middle of the period. Between the first and twelfth months, there was no discernible shift in the influence that the terms of trade had on the balance. The repercussions amounted to 11.23% in the first month and 11.53% in the twelfth month. This suggests that the influence of terms of trade stayed almost unchanged throughout the course of the whole time period.

Variance decomposition for the current account balance

| Period | Oil price | Terms of trade | Exchange rate | Industrial production | Foreign direct investments | Current account |

|---|---|---|---|---|---|---|

| 1 | 0.05 | 11.23 | 58.50 | 28.54 | 0.36 | 1.31 |

| 2 | 3.66 | 11.12 | 54.22 | 26.59 | 2.91 | 1.49 |

| 3 | 3.70 | 11.02 | 53.75 | 27.23 | 2.84 | 1.45 |

| 4 | 4.03 | 11.52 | 53.05 | 27.01 | 2.69 | 1.69 |

| 5 | 4.06 | 11.13 | 51.77 | 27.97 | 3.37 | 1.70 |

| 6 | 4.01 | 10.68 | 50.92 | 26.93 | 4.81 | 2.65 |

| 7 | 3.79 | 10.49 | 50.31 | 25.39 | 6.32 | 3.71 |

| 8 | 3.67 | 10.33 | 48.59 | 25.16 | 6.19 | 6.06 |

| 9 | 3.57 | 10.42 | 47.32 | 24.85 | 6.42 | 7.42 |

| 10 | 3.51 | 10.62 | 46.05 | 24.16 | 7.94 | 7.72 |

| 11 | 3.70 | 10.45 | 45.34 | 24.49 | 7.83 | 8.19 |

| 12 | 3.79 | 11.53 | 44.29 | 24.45 | 7.65 | 8.29 |

The exchange rate was the variable that contributed the most amount to the overall explanation of the balance. The impact it had on the balance in the first month was 58.5%. It reached a low of 44.29% in the final month after steadily falling to a high of 50.92% in the sixth month. Data shown in the table indicate that the influence of the exchange rate on the Turkish economy is absolutely critical. Industrial production was responsible for the second largest proportion of the explanatory shares. For the first month, this variable’s contribution to the explanation of the balance was around 28.54%. After that, its influence was reduced to 26.93% in the sixth month, and it continued to diminish progressively to 24.45% in the twelfth month. The impact of the FDI on the balance remained minimal in the first month, accounting for just around 0.36% of the total. Despite this, its influence reached its highest point of around 7.94% in the tenth month, and then gradually fell to 7.65% in the last month. This demonstrates that in the longer term, the FDI can become more essential. The current account balance only made up a very little part of the overall impact when trying to explain itself. In the first month, its explanatory share was 1.31%, but by the twelfth month, it had climbed to 8.29%. As seen in the table, the roles that the exchange rate and industrial production play in resolving the problem of the current account deficit are quite essential.

4.4 The Impulse Response Functions

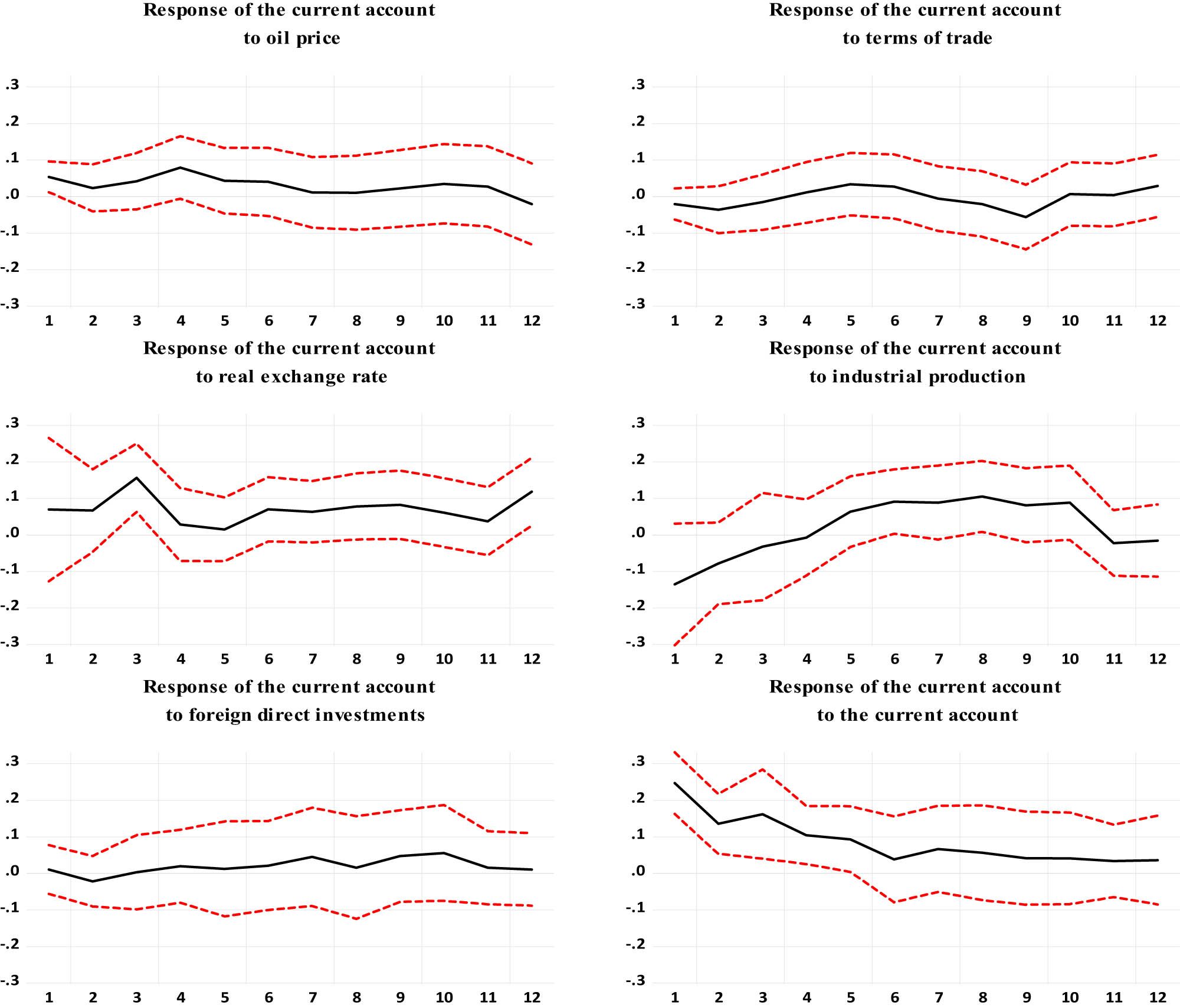

Figure 3 illustrates how the balance responds to the factors that were chosen as determinants. The oil price, the terms of trade, the real exchange rate, the industrial production index, and the FDI are the impulses. The response is the current account balance. Estimates were made for the dynamics of the response of the balance to structural positive innovations that were one standard deviation in magnitude. It was possible to evaluate both the significance of the responses and the degree to which they were significant.

Response of the current account balance to structural one standard deviation positive innovation. Note: y-axis shows responses and x-axis shows monthly periods.

According to the findings that are gleaned from the figure, the response of the balance to shifts in the oil price during the first month was statistically negligible. It was only in the second month that it became negative and reached a level of statistical significance. It was statistically insignificant for the remainder of the time period. Up until the second month, the response of the balance to the terms of trade was statistically significant and positive. After then, it was no longer statistically significant for the remainder of the time frame. This finding suggests that there may be a short-term impact on the balance resulting from changes in the terms of trade. The balance exhibited a statistically significant and positive response to the real exchange rate up to the third month. This response was positive and statistically significant. After that certain time frame, it ceased to be significant and the result remained unchanged for the rest of the period. The findings demonstrate that increases in the exchange rate could produce a significant impact on the deficit. This demonstrates how important the policy regarding the exchange rate is for the country’s balance. The response to the industrial production index suggested that conditions were comparable. Until the second month, it was statistically significant and showed a positive trend. After then, its significance stayed unchanged for the whole of the historical period. The response to the FDI was insignificant, and only in the second month did the negative response become statistically significant. This indicates that lower levels of the FDI could give way to an increase in the imbalances. The response of the current account balance to itself was insignificant until the eighth month, when it became negative. After that, however, the response became significant. When that month had passed, it was no longer of any significance.

Figure 4 illustrates which factor had a more significant influence on the balance. The exchange rate was the decisive element in determining how to interpret the balance, as shown in the figure. Following this dynamic, the one showing substantial influence on the current account balance was the industrial production index, followed by the terms of trade. The picture provides visual evidence that the variables’ explanatory shares in the variance decomposition analysis are appropriate. However, the figure also illustrates that the effects were much higher in the early months. Then, their effects gradually decreased over the period.

Response of the current account balance to innovations using SVAR factors. Note: y-axis shows responses and x-axis shows monthly periods.

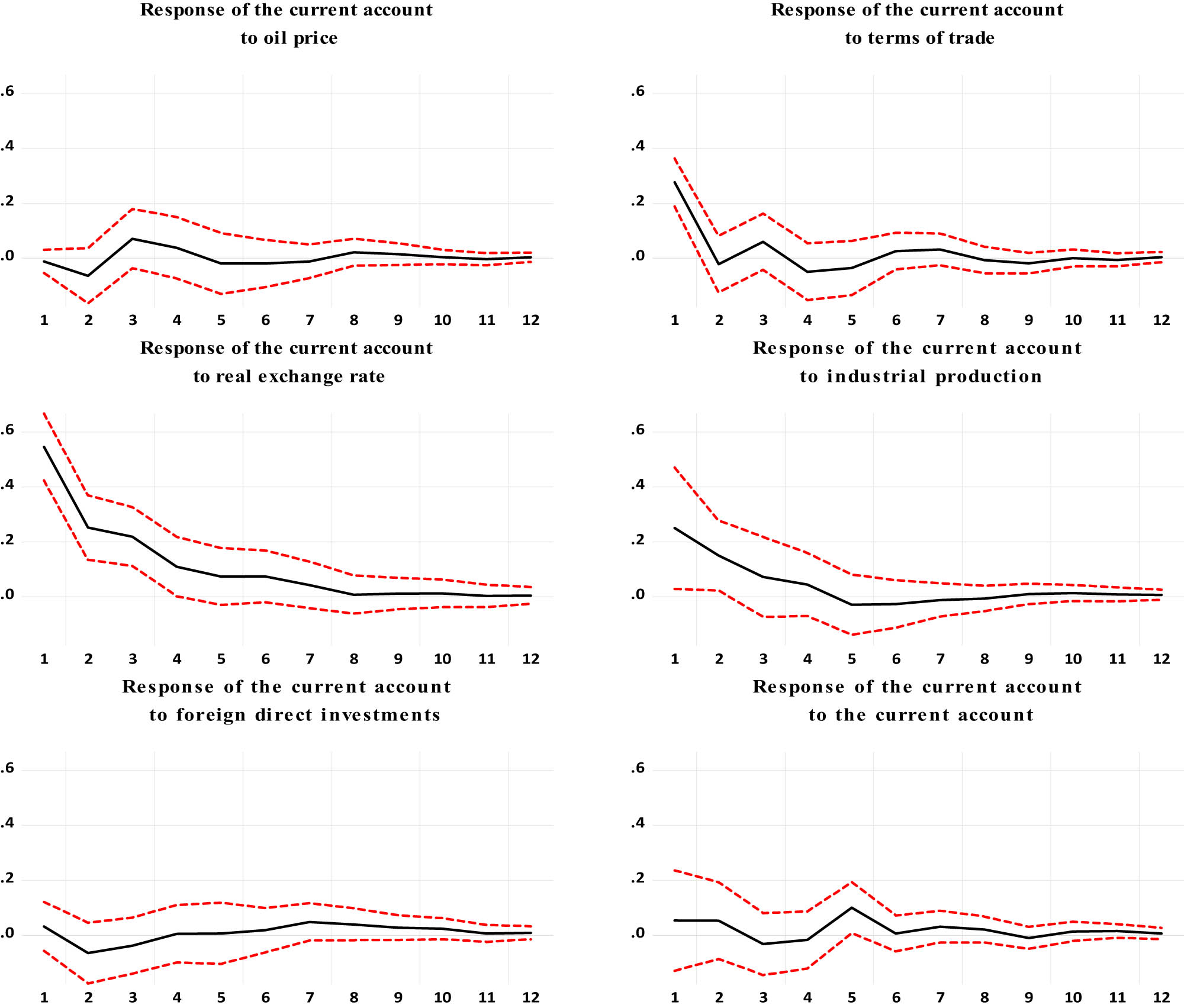

4.5 Forecast Error Variance Decomposition Analysis Before the COVID-19 Pandemic

For the current account balance in the pre-COVID-19 pandemic, the variance decomposition is provided in Table 4. This table takes into consideration the monthly period between January 2005 and December 2019. The oil price exhibited a pattern that was comparable to the analysis that was performed when the new period of the study was brought into consideration. The oil price had a 3.32% influence in the first month, which increased to 6.70% in the sixth month, but reduced to 5.61% in the final month. Excluding the period of the pandemic, new findings suggest that the influence of the oil price was more pronounced in comparison to the effects of the terms of trade and the FDI. There was a negligible impact of the terms of trade on the balance for the indicated time periods. The first month had an explanatory share of 0.48%, which then rose to 2.61% in the last month. The impact of the terms of trade remained modest throughout the periods. The exchange rate had a substantial role in influencing the current account deficit. The first month witnessed a 5.51% impact, which then escalated to a substantial 23.42% in the last month. It had the greatest effect in comparison to the other factors. This implies that the exchange rate can have a significant impact on the current account balance over the periods. In the first month, industrial production accounted for the majority portion, approximately 20.89%. The impact decreased to 13.29%, its lowest share, in the fourth month and then rose to 22.19% in the last month. The FDI had a negligible effect on the balance, around 0.13%, during the first month. The impact rose to 2.93% during the last month. During the time before the COVID-19 pandemic, the ability of the current account balance to explain itself becomes stronger. In the first month, the explanatory share of the current account amounted to 69.68%. Its impact steadily diminished and ultimately dropped to 43.23% in the last month. When compared to other factors, industrial production has the greatest effect in the short term for the first two projection periods. On the other hand, industrial production and exchange rate both have about a comparable share in the longer term when it comes to their impact on the current account balance.

Variance decomposition for the current account balance before the COVID-19 pandemic (January 2005 and December 2019)

| Period | Oil price | Terms of trade | Exchange rate | Industrial production | Foreign direct investments | Current account |

|---|---|---|---|---|---|---|

| 1 | 3.32 | 0.48 | 5.51 | 20.89 | 0.13 | 69.68 |

| 2 | 2.91 | 1.44 | 7.80 | 20.50 | 0.49 | 66.85 |

| 3 | 3.03 | 1.13 | 19.57 | 14.70 | 0.34 | 61.23 |

| 4 | 6.06 | 1.09 | 18.09 | 13.29 | 0.51 | 60.96 |

| 5 | 6.49 | 1.55 | 16.79 | 14.22 | 0.54 | 60.41 |

| 6 | 6.70 | 1.77 | 17.68 | 16.82 | 0.70 | 56.33 |

| 7 | 6.24 | 1.65 | 17.99 | 18.76 | 1.47 | 53.88 |

| 8 | 5.79 | 1.67 | 18.85 | 21.47 | 1.45 | 50.78 |

| 9 | 5.53 | 2.65 | 19.86 | 22.20 | 2.12 | 47.64 |

| 10 | 5.61 | 2.51 | 19.94 | 23.48 | 3.02 | 45.43 |

| 11 | 5.79 | 2.49 | 20.13 | 23.33 | 3.06 | 45.20 |

| 12 | 5.61 | 2.61 | 23.42 | 22.19 | 2.93 | 43.23 |

Excluding the COVID-19 period from the study, the influence of the exchange rate and industrial production on the current account deficit diminished. The reason for this is that the pandemic caused enormous disruptions in both production and trade around the world. As a result of the COVID-19 pandemic, the current account deficit was positively impacted by the reduction in economic activity. Despite the decline in the oil price during this period, there was a deceleration in industrial production. The manufacturing costs experienced a substantial increase in the course of the global economic instability. The current account balance was considerably influenced by the explanatory role of industrial production, despite the fact that the real exchange rate continued to decline. In other words, the findings imply that the explanatory effect of the real exchange rate and industrial production on the current account balance is more significant during the upheaval period.

4.6 The Impulse Response Functions Before the COVID-19 Pandemic

Figure 5 indicates the response of the current account balance to structural one standard deviation positive innovation before the COVID-19 pandemic. The analysis considers the monthly data from January 2005 to December 2019. There was a substantial variation in the impulse response function. The current account deficit was particularly self-explanatory. Based on the information presented in the figure, it can be concluded that the impact of the oil price on the balance was both statistically significant and positive but only during the first month. Throughout the remaining duration, the response had a statistically insignificant outcome. Over the whole of the time period, the response of the balance to the terms of trade was statistically insignificant. The current account balance showed a statistically significant response to shocks in the real exchange rate in the third month. However, the response to shocks in industrial production was positive and statistically significant only in the sixth and eighth months. The findings suggest that both the real exchange rate and industrial production had an impact on the current account deficit. The response of the balance to the FDI was statistically insignificant over the whole of the time period. The response of the current account balance to itself was positive and significant until the fifth month. Subsequently, its impact became insignificant and stayed steady for the duration of the whole time period.

Response of the current account balance to structural one standard deviation positive innovation before the COVID-19 pandemic (January 2005 and December 2019). Note: y-axis shows responses and x-axis shows monthly periods.

4.6.1 Robustness Checks with the Different Lag for all Periods

The findings from SVAR models may be sensitive to the selected sample period or lag length. In this section, the robustness checks were made by determining lag as 4 according to the Final Prediction Error (FPE) criterion. The LR test for over-identification was executed due to the fact that the SVAR model is over-identified. The p-values for the LR statistic were discovered as 0.6391 for the VAR (4) model. These results suggest that over-identification is justified for the VAR (4), because the null hypothesis cannot be rejected at the 5% significant level. To reach more robust results in dynamic analyses based on the SVAR model, the findings of VAR (4) are given in this section.

Table 5 presents the results of the variance decomposition analysis performed using lag 4. The findings indicate that there was no obvious change in the impact that the terms of trade had on the balance. The terms of trade contributed 17.31% of the explanation share for the current account balance during the first month. Following that month, in the sixth month, the influence dropped to 13.11% and stayed around this level throughout the periods. This suggests that the impact of the terms of trade was generally stable across the whole duration of the time period. There was no change with regard to the outcome of the exchange rate. Overall, this variable was the one that contributed the most to the explanation. In the first month, the exchange rate had a 67.59% effect on the current account balance. By the twelfth month, the impact had slightly diminished to 65.90%. Overall, industrial production accounted for the second largest proportion of the explanatory factors for the balance. The variable contributed 14.18% to the explanation of the current account balance in the first month. Its impact barely fluctuated, remaining at approximately 14.32% in the twelfth month.

Variance decomposition for the current account balance (Lag = 4)

| Period | Oil price | Terms of trade | Exchange rate | Industrial production | Foreign direct investments | Current account |

|---|---|---|---|---|---|---|

| 1 | 0.03 | 17.31 | 67.59 | 14.18 | 0.24 | 0.65 |

| 2 | 0.80 | 14.25 | 67.11 | 15.80 | 0.98 | 1.06 |

| 3 | 1.55 | 13.32 | 67.92 | 14.98 | 1.11 | 1.12 |

| 4 | 1.73 | 13.33 | 67.86 | 14.86 | 1.08 | 1.13 |

| 5 | 1.75 | 13.16 | 66.78 | 14.57 | 1.05 | 2.69 |

| 6 | 1.78 | 13.11 | 66.84 | 14.51 | 1.09 | 2.66 |

| 7 | 1.79 | 13.13 | 66.45 | 14.39 | 1.45 | 2.79 |

| 8 | 1.85 | 13.09 | 66.20 | 14.34 | 1.69 | 2.84 |

| 9 | 1.88 | 13.11 | 66.05 | 14.32 | 1.80 | 2.85 |

| 10 | 1.88 | 13.09 | 65.96 | 14.32 | 1.88 | 2.88 |

| 11 | 1.88 | 13.08 | 65.92 | 14.32 | 1.89 | 2.91 |

| 12 | 1.88 | 13.08 | 65.90 | 14.32 | 1.90 | 2.91 |

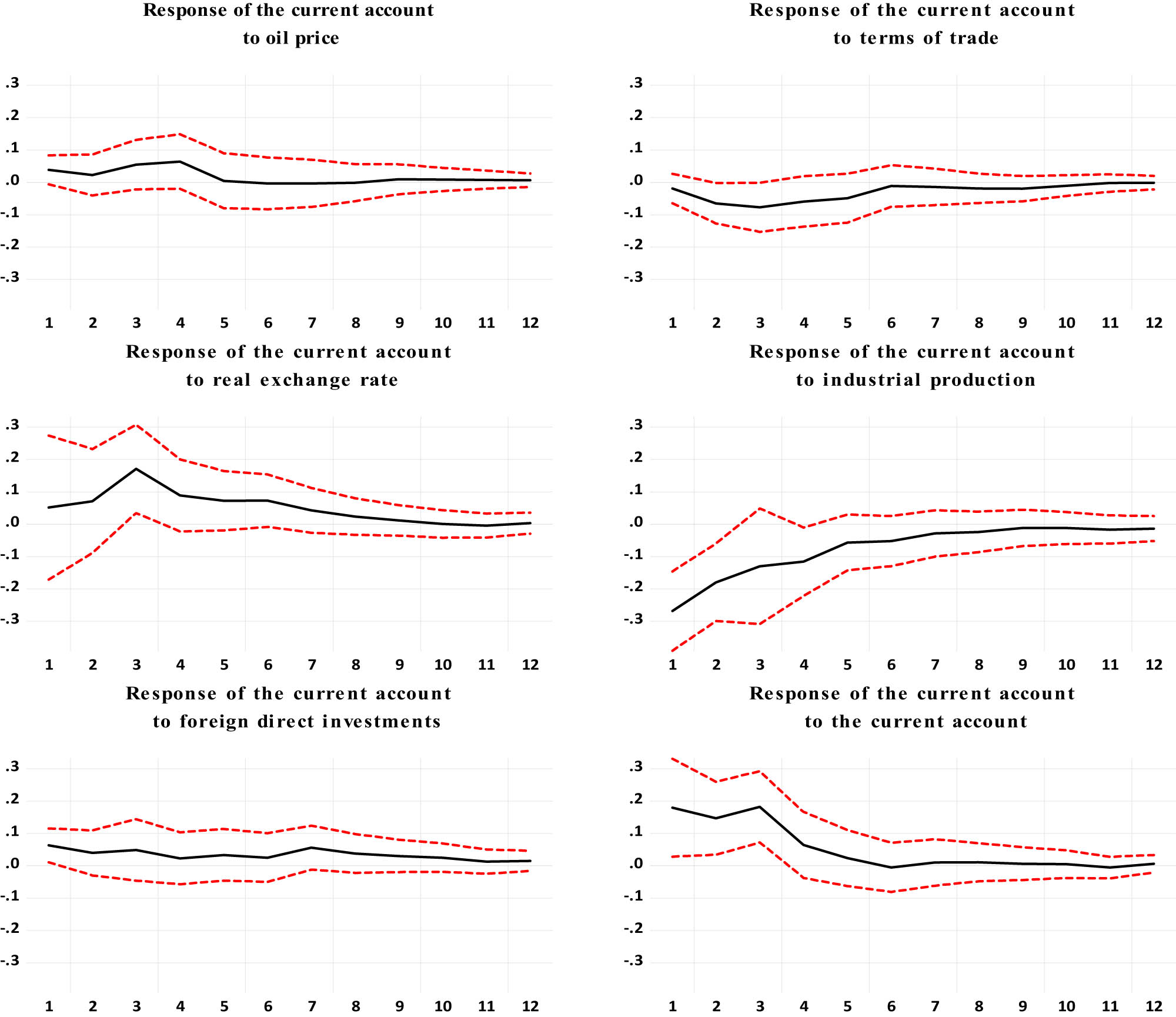

Figure 6 demonstrates the relationship between the current account balance and each of the variables, particularly when considering the lag 4 in the FPE. The response of the balance to the terms of trade was statistically significant and positive for about two months. Subsequently, it lost its statistical significance for the rest of the period. The response of the current account balance to the real exchange rate was significant and positive up to the fourth month. Beyond that point, it was no longer significant and the result remained consistent for the rest of the term. With regard to the industrial production index, the response of the balance indicated that the conditions were similar. The finding was statistically significant and illustrated a positive trend up to the second month. Afterwards, its impact became insignificant and remained constant over the time periods. In conclusion, the results were consistent with the findings from the AIC lag 12.

Response of the current account balance to structural one standard deviation positive innovation (Lag = 4).

Figure 7 shows the response of the current account balance to innovations using SVAR model with FPE lag 4. The exchange rate was the primary determinant in explaining the balance. The industrial production index and the terms of trade both played important roles in explaining the current account balance. However, the figure also illustrates that the effects were significantly more pronounced during the initial months. This finding is similar to the findings obtained from the SVAR model with lag 12 based on the AIC criterion.

Response of the current account balance to innovations using SVAR factor (Lag = 4).

4.6.2 Robustness Checks with the Different Lag for the pre-COVID-19 Pandemic

The research presented the findings of variance decomposition and impulse response functions using the SVAR model in this section. The findings were examined using the lag 4 that was determined based on the FPE criteria. The analysis was conducted on monthly data from January 2005 to December 2019, which represents the period before the COVID-19 pandemic. Upon comparing the findings of this section with the findings obtained from the whole sample period, it was found that the overall conclusions drawn from the results remained unchanged. The analysis revealed that there was no substantial difference in the overall outcomes obtained from the SVAR model with a lag 4. The consistency of the overall findings across various sample times and lag lengths suggests that the results obtained from the SVAR model are robust.

Table 6 indicates the results of the variance decomposition analysis, specifically utilizing a lag 4 and removing the time period affected by the COVID-19 pandemic. Based on the findings, the impact of the terms of trade on the balance was modest during the first month. From the fourth month onwards, there was a sustained and considerable rise in the impact, which stayed consistently over 5% for the remaining periods. The results regarding the exchange rate showed that this variable had a significant effect on explaining the balance. The initial impact on the current account balance was 2.33% in the first month, but it climbed to 17.15% by the twelfth month. Industrial production accounted for the largest proportion of explanatory shares. The impact on the current account balance was 63.97% in the first month. While its significance diminished with time, the effect remained consistently strong at around 42.49% in the twelfth month. The main finding of the study did not change even when a different lag was used for the time before the COVID-19 outbreak. The balance was significantly influenced by the exchange rate, industrial production, and the terms of trade.

Variance decomposition for the current account balance before the COVID-19 pandemic (January 2005 and December 2019; Lag = 4)

| Period | Oil price | Terms of trade | Exchange rate | Industrial production | Foreign direct investments | Current account |

|---|---|---|---|---|---|---|

| 1 | 1.31 | 0.33 | 2.33 | 63.97 | 3.51 | 28.55 |

| 2 | 1.11 | 2.60 | 4.31 | 58.65 | 3.10 | 30.22 |

| 3 | 1.85 | 3.95 | 13.71 | 45.18 | 2.95 | 32.36 |

| 4 | 2.99 | 4.68 | 14.80 | 44.62 | 2.80 | 30.12 |

| 5 | 2.88 | 5.27 | 15.85 | 43.86 | 3.05 | 29.09 |

| 6 | 2.80 | 5.17 | 17.06 | 43.52 | 3.16 | 28.30 |

| 7 | 2.75 | 5.13 | 17.29 | 42.96 | 4.06 | 27.81 |

| 8 | 2.73 | 5.20 | 17.30 | 42.74 | 4.45 | 27.58 |

| 9 | 2.74 | 5.29 | 17.25 | 42.56 | 4.71 | 27.46 |

| 10 | 2.75 | 5.31 | 17.20 | 42.48 | 4.88 | 27.38 |

| 11 | 2.76 | 5.30 | 17.17 | 42.50 | 4.92 | 27.35 |

| 12 | 2.77 | 5.29 | 17.15 | 42.49 | 4.98 | 27.32 |

Figure 8 shows the response of the balance to the factors for the time period before the COVID-19 pandemic when FPE lag 4 was included. The impulse response functions revealed that the balance exhibited a positive and statistically significant response only during the third month in relation to the real exchange rate. The industrial production index exhibited a negative and statistically significant connection up to the third month period. This evidence suggests that an increase in output may result in a fall in the current account balance, which is in contradiction to the results reported with lag 12. This may be ascribed to the examined time frame. The FDI had the potential to boost the current account balance in the short term. The balance exhibited a positive and statistically significant response to itself until the fourth month. All of these findings are comparable to the prior findings with lag 12, except for the industrial production index.

Response of the current account balance to structural one standard deviation positive innovation before the COVID-19 pandemic (January 2005 and December 2019; Lag = 4).

5 Policy Implications

The article highlights significant political implications that the government may pursue. Upon examination of the variance decomposition analysis and impulse response functions, it becomes evident that the terms of trade had a significant role in influencing the imbalances. According to the SVAR model, the terms of trade had an important part in explaining the changes in the balance. The model suggests that the impact of the terms of trade remained significant throughout the periods. This indicates that this factor had the potential to have an effect that is long-lasting, spanning from the first period to the last period. The impulse response functions demonstrated that the terms of trade had a significant effect on the current account balance. The functions indicate that there was a significant and positive relationship between the current account balance and the terms of trade in the first period. Through the utilization of innovations of SVAR factors, the response to the terms of trade suggested that the influence was strong and significant in the first period. However, as time progressed, the significance of the terms of trade diminished. Excluding the period of the COVID-19 pandemic, the variance decomposition analysis revealed that the effect was initially restricted in the first month but thereafter rose dramatically over time. This indicates that the ratio of export unit value to import unit value has substantial implications for the Turkish economy. The greater the increase in the unit value of exports, the greater the deficits that the nation creates. Thus, it can be stated that the HLM effect does not exist in the context of Turkey. This signifies a separate result, in opposition to the discoveries of Afza et al. (2016), Aquino and Espino (2013), Otto (2003), and Tsen (2006, 2009). In other words, the HLM impact was not detected in the Turkish economy. The historical relationship between the terms of trade and the current account balance indicates that a substantial increase in the terms of trade, particularly during the COVID-19 pandemic, led to a major rise in the current account deficit. Following the pandemic, the current account balance experienced positive improvements. The reliability of this condition may also be corroborated by the fluctuations in the exchange rate. The exchange rate underwent substantial devaluation after the pandemic, demonstrating a corresponding shift in line with the conditions of trade. The variance decomposition analysis showed the long-lasting impact of the terms of trade on the current account balance. To put it another way, this factor, in addition to the exchange rate, has the potential to play an important part in managing the current account balance. Therefore, the nation should implement measures to reduce the cost of exporting goods. Furthermore, enhancing competitiveness in international trade might lead to an improvement in the current account balance (Ünal, 2021). This strategy is referred to as export-led growth model. In this growth model, the country aims to enhance its competitiveness in international trade by reducing the costs of low and medium-tech goods. Upon the completion of that stage, the country initiates an increase in the exportation of intermediate goods, particularly in the medium and high-tech industries. A model of this progression was observed in China, where the country first focused on exporting low- and medium-tech goods and eventually transitioned to engaging in international trade with high-tech industries (Uni, 2018). The strategy of growth that is driven by exports may be used to transform a country into a high-tech nation that exports sophisticated items. Ultimately, the country should prioritize the development of innovative industries that make significant contributions to the exports of sophisticated products (Blyde et al., 2018). Consequently, this strategy offers the potential to significantly improve the current account balance. To enhance the exports of goods, it is essential to achieve a significant rise in production. Technological advancements and increasing global demand may lead to higher productivity growth, resulting in lower prices and an opportunity for a nation to enhance its competitive power. In light of this, implementing export-focused policies has the ability to positively impact the current account balance and offer support for the exchange rate strategy of the country. Furthermore, this may incentivize investments that would simultaneously bolster economic growth and stability.

Our study suggests that the decrease in the real exchange rate in Turkey had a positive and explanatory effect on the balance in the short term. The findings of the study showed that the currency had the ability to modify the current account balance in the short term, and this impact remained strong over the periods. This result contradicts the findings of Bleaney and Tian (2014), who discovered that the depreciation in the currencies of emerging markets may not have a substantial impact on the trade balance in the short term. This is because it was assumed that these markets have similarities with industrialized nations. This might be attributed to the diminished significance of sudden currency crushes in the global economy. As the severity of the traditional currency crisis decreased, the markets became more stable. However, the currency maintains its significant role in the Turkish economy. According to the SVAR model, the exchange rate is the primary factor that explains variations in the current account balance. Moreover, our findings do not support the investigation that was performed by Mesagan et al. (2022), who projected that the appreciation in the currency may increase trade and growth in the short term for countries such as Egypt and Morocco. There are also side effects of depreciation in the exchange rate on inflation. In particular, the countries that are sensitive to changes in exchange rates should critically consider implementing regulations to mitigate the impact of currency depreciation on imported products (Köse & Ünal, 2024). In the context of the Turkish economy, the increasing trade imbalances should be addressed by implementing substantial currency depreciations to reduce the demand for imported goods. Nevertheless, the effect of the exchange rate might vary across various industries (Bahmani-Oskooee & Aftab, 2017). Hence, it is essential to formulate policies that take into account industries capable of making a significant contribution to the trade balance. Edwards and Cabezas (2022) examined the impact of the exchange rate pass-through on inflation in Iceland. The analysis highlighted that the pass-through impact was more pronounced for tradable goods compared to non-tradable goods, with a specific emphasis on the significance of monetary policy. Ünal (2016) investigated the potential strategies that China might employ to address the issue of an undervalued currency, while also reducing inflation. The analysis took into account both tradable and non-tradable goods. It was stated that the pass-through effect can be limited when the fiscal policy is implemented in accordance with the productivity of industries. In 1994, China decreased the value of its currency and simultaneously implemented contractionary fiscal measures to restrict domestic spending inside the nation. This approach effectively reduced prices of tradable goods in international trade and made a major contribution to the current account balance of the country.

The empirical studies explored that the real exchange rate was the variable that was most capable of explaining the shifts in the balance. That was the determinant that contributed the most amount to the whole explanation. In addition, the variance decomposition analysis was validated by the impulse response functions. During the first months, the exchange rate had a positive and statistically significant effect on the current account deficit. This suggests that an increase in the deficit will occur in direct proportion to an appreciation of the exchange rate. Thus, it is necessary for the Turkish economy to bring the lira’s overvaluation down to a more appropriate level. The monetary policies should be designed for unnecessary appreciations in the exchange rate. In particular, during the economic crisis that occurred in 2000–2001, the Turkish economy went through a number of deregulation programs in an effort to eliminate macroeconomic imbalances. The fixed exchange rate system was replaced with a floating one, and both inflation and the cost of production fell by a large amount. The number of privatizations also rose during this time. Nevertheless, the economic policies continued to suppress the value of the lira, resulting in an exchange rate system that was overvalued. As a consequence, the current account imbalances deepened in the 2000s. Hence, the country should use fiscal policy to repress inflation and monetary policy to eliminate overvaluation in the currency. This can help the country to reduce its current account imbalances to a greater degree. It is widely accepted that depreciation in the lira can make imports more expensive and exports cheaper in international trade. Thus, this macroeconomic imbalance can be reduced by efficient economic policies. However, after the 2000–2001 economic crisis, the macroeconomic imbalance was worsened by record-level deficits in the history of the Turkish economy. This can be explained that the lira remains overvalued and further artificial depreciation by the policies of the central bank is necessary.