Abstract

This paper considers procurement auctions with costly bidding when the auctioneer is unable to commit himself to restrict the number of bidders. The auctioneer can, however, publicly pledge to pay a financial reward to every contractor he has invited to bid, as an indirect commitment device. Rewards for short-listed bidders are costly. Nevertheless, it is generally optimal for the procurer to credibly implement the same restriction of the number of bidders that is optimal under full commitment.

Appendix

Here, we prove Lemma 1.

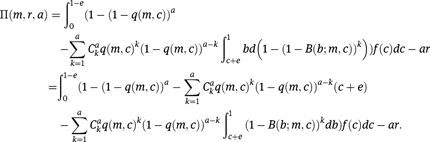

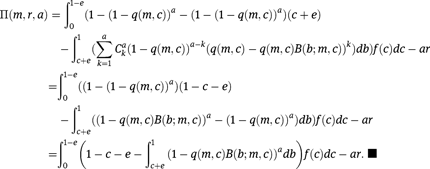

Proof. The c.d.f of the winning bid b, conditional on receiving k bids, is equal to  , and the expected profit of the procurer is

, and the expected profit of the procurer is

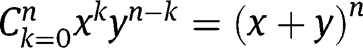

By a well-known result,  ,

,  , and

, and  . Therefore,

. Therefore,

Acknowledgement

I thank Elmar Wolfstetter, the editor and two referees for advice and suggestions. Research support by the Deutsche Forschungsgemeinschaft (DFG), SFB Transregio 15, “Governance and Efficiency of Economic Systems” is gratefully acknowledged.

References

Celik, G., and Yilankaya, O. 2009. “Optimal Auctions with Simultaneous and Costly Participation.” The BE Journal of Theoretical Economics 9(1):1–31.10.2202/1935-1704.1522Suche in Google Scholar

Fan, C., and Wolfstetter, E. 2008. “Procurement with Costly Bidding, Optimal Shortlisting, and Rebates.” Economics Letters 98:327–34.10.1016/j.econlet.2007.05.012Suche in Google Scholar

Gal, S., Landsberger, M., and Nemirovski, A. 2007. “Participation in Auctions.” Games and Economic Behavior 60:75–103.10.1016/j.geb.2006.08.010Suche in Google Scholar

Kaplan, T., and Sela, A. 2006. “Second Price Auctions with Private Entry Costs.” Technical Report, Ben-Gurion University.Suche in Google Scholar

Lang, K., and Rosenthal, R. W. 1991. “The Contractors’ Game.” RAND Journal of Economics 22:329–38.10.2307/2601050Suche in Google Scholar

Tan, G. 1992. “Entry and R & D in Procurement Contracting.” Journal of Economic Theory 22:41–60.10.1016/0022-0531(92)90100-VSuche in Google Scholar

- 1

For example, the World Bank is bound by its procurement rules to short-list six bidders, if feasible, and to publish the short-list of bidders when they are invited to make a bid.

- 2

Kaplan and Sela (2006) consider entry costs without reimbursements, assuming that entry costs are private information and find that paradoxically bidders’ equilibrium payoffs may be decreasing in their valuations. Celik and Yilankaya (2009) analyze the optimal auction when bidding is costly, assuming a private values model.

- 3

For simplicity, one may invoke that bidders do not participate in the auction if they predict that the procurer invites more than the announced number of bidders. This avoids glutted notation that would be necessary if one allowed for discrepancies between the announced size of the short-list and bidders’ prediction of it.

- 4

Of course, if m=n, upward deviations are impossible; therefore, r*(n) = 0 is trivially true.

©2013 by Walter de Gruyter Berlin / Boston

Artikel in diesem Heft

- Masthead

- Masthead

- Advances

- Dependence and Uniqueness in Bayesian Games

- Monopolistic Signal Provision†

- Multi-task Research and Research Joint Ventures

- Transparent Restrictions on Beliefs and Forward-Induction Reasoning in Games with Asymmetric Information

- A Simple Bargaining Procedure for the Myerson Value

- On the Difference between Social and Private Goods

- Optimal Use of Rewards as Commitment Device When Bidding Is Costly

- Labor Market and Search through Personal Contacts

- Contributions

- Learning, Words and Actions: Experimental Evidence on Coordination-Improving Information

- Are Trust and Reciprocity Related within Individuals?

- Optimal Contracting Model in a Social Environment and Trust-Related Psychological Costs

- Contract Bargaining with a Risk-Averse Agent

- Academia or the Private Sector? Sorting of Agents into Institutions and an Outside Sector

- Topics

- Poverty Orderings with Asymmetric Attributes

- Dictatorial Mechanisms in Constrained Combinatorial Auctions

- When Should a Monopolist Improve Quality in a Network Industry?

- On Partially Honest Nash Implementation in Private Good Economies with Restricted Domains: A Sufficient Condition

- Revenue Comparison in Asymmetric Auctions with Discrete Valuations

Artikel in diesem Heft

- Masthead

- Masthead

- Advances

- Dependence and Uniqueness in Bayesian Games

- Monopolistic Signal Provision†

- Multi-task Research and Research Joint Ventures

- Transparent Restrictions on Beliefs and Forward-Induction Reasoning in Games with Asymmetric Information

- A Simple Bargaining Procedure for the Myerson Value

- On the Difference between Social and Private Goods

- Optimal Use of Rewards as Commitment Device When Bidding Is Costly

- Labor Market and Search through Personal Contacts

- Contributions

- Learning, Words and Actions: Experimental Evidence on Coordination-Improving Information

- Are Trust and Reciprocity Related within Individuals?

- Optimal Contracting Model in a Social Environment and Trust-Related Psychological Costs

- Contract Bargaining with a Risk-Averse Agent

- Academia or the Private Sector? Sorting of Agents into Institutions and an Outside Sector

- Topics

- Poverty Orderings with Asymmetric Attributes

- Dictatorial Mechanisms in Constrained Combinatorial Auctions

- When Should a Monopolist Improve Quality in a Network Industry?

- On Partially Honest Nash Implementation in Private Good Economies with Restricted Domains: A Sufficient Condition

- Revenue Comparison in Asymmetric Auctions with Discrete Valuations