Abstract

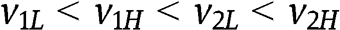

We consider an asymmetric auction setting with two bidders such that the valuation of each bidder has a binary support. First, we characterize the unique equilibrium outcome in the first price auction for any values of parameters. Then we compare the first price auction with the second price auction in terms of expected revenue. Under the assumption that the probabilities of low values are the same for the two bidders, we obtain two main results: (i) the second price auction yields a higher revenue unless the distribution of a bidder’s valuation first-order stochastically dominates the distribution of the other bidder’s valuation “in a strong sense” and (ii) introducing reserve prices implies that the first price auction is never superior to the second price auction. In addition, in some cases, the revenue in the first price auction decreases when all the valuations increase.

Appendix

Proof of Proposition 1

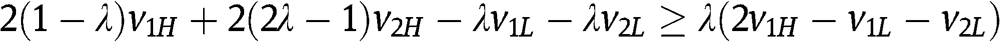

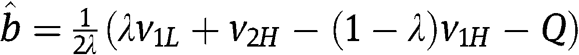

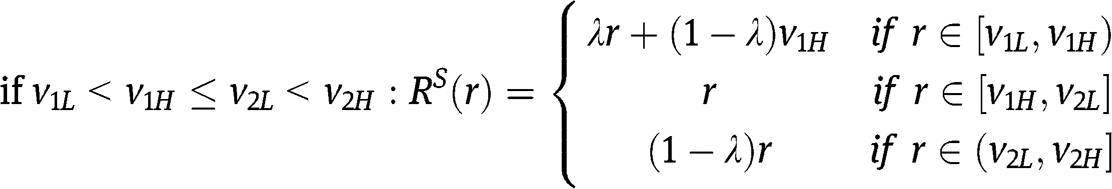

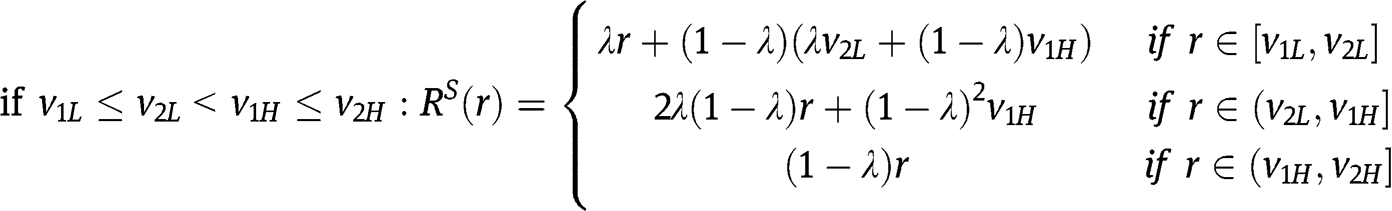

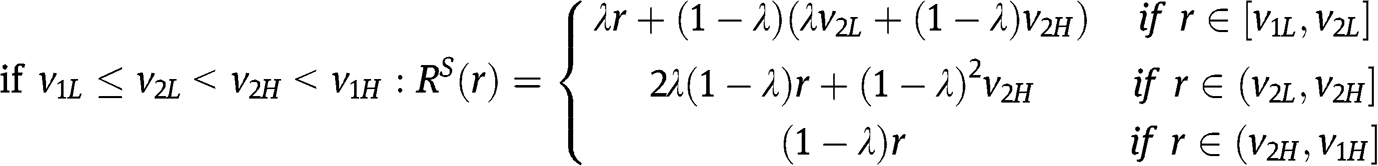

The complete proof of Proposition 1 is long, mainly because of the proof of essential equilibrium uniqueness. Here we provide a partial proof, in which we verify that (i) if [4] is satisfied, then the strategy profile described by Proposition 1(ii) is a BNE; (ii) if [7] is satisfied, then the strategy profile in Proposition 1(iii) is a BNE.29

The case in which [4] is satisfied

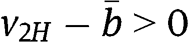

Suppose that the inequalities in [4] are satisfied, and moreover that  . Then we obtain that

. Then we obtain that  is such that

is such that  (if

(if  , then

, then  is equal to

is equal to  , which actually would simplify matters), which implies that the strategies described by Proposition 1(ii) make sense. Now we verify that for each type of each bidder the strategy specified by Proposition 1(ii) is a best reply given the strategies of the two types of the other bidder. We use

, which actually would simplify matters), which implies that the strategies described by Proposition 1(ii) make sense. Now we verify that for each type of each bidder the strategy specified by Proposition 1(ii) is a best reply given the strategies of the two types of the other bidder. We use  and

and  to denote the payoff of type

to denote the payoff of type  and his probability to win – respectively – as a function of his bid b, given the strategies of the two types of the other bidder. Notice that

and his probability to win – respectively – as a function of his bid b, given the strategies of the two types of the other bidder. Notice that  for any

for any  and

and  for any

for any  ; thus we do not need to consider bids below

; thus we do not need to consider bids below  or above

or above  . The same remark applies to the BNE described by Proposition 1(iii).

. The same remark applies to the BNE described by Proposition 1(iii).

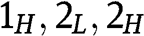

Type . The strategies of types 2L and 2H are such that each type of bidder 2 bids at least

. The strategies of types 2L and 2H are such that each type of bidder 2 bids at least  with probability one. Therefore, the payoff of 1L is zero if he bids

with probability one. Therefore, the payoff of 1L is zero if he bids  as specified by Proposition 1(ii), and it is impossible for him to obtain a positive payoff.

as specified by Proposition 1(ii), and it is impossible for him to obtain a positive payoff.

Type . For any

. For any  , the payoff of type

, the payoff of type  is

is  , which is constant and equal to

, which is constant and equal to  . If

. If  , then 1H loses against

, then 1H loses against  and loses also against 2L unless 2L bids

and loses also against 2L unless 2L bids  , in which case 1H ties with 2L – an event with probability

, in which case 1H ties with 2L – an event with probability  . Consider the most favorable case for

. Consider the most favorable case for  , which means that he wins the tie-break against 2L with probability one (this occurs if

, which means that he wins the tie-break against 2L with probability one (this occurs if  ): his expected payoff from bidding

): his expected payoff from bidding  is then

is then  , which turns out to be equal to

, which turns out to be equal to  .

.

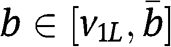

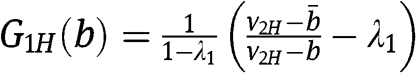

Type . For any

. For any  , the payoff of type

, the payoff of type  is

is  , which is constant and equal to

, which is constant and equal to  . For bids b in

. For bids b in  we find

we find  , which is decreasing in b, and therefore

, which is decreasing in b, and therefore  for any

for any  .

.

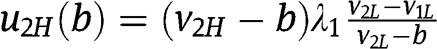

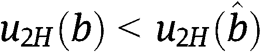

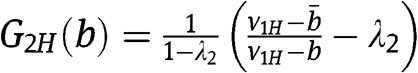

Type . For any

. For any  , the payoff of type

, the payoff of type  is

is  , which is constant and equal to

, which is constant and equal to  . For bids b in

. For bids b in  we find

we find  and

and  , which is increasing in b and therefore

, which is increasing in b and therefore  for any

for any  .

.

The case in which [7] is satisfied

Suppose that the inequality in [7] is satisfied. Then  in eq. [8] and we verify that for each type of each bidder the strategy specified by Proposition 1(iii) is a best reply given the strategies of the two types of the other bidder. Let

in eq. [8] and we verify that for each type of each bidder the strategy specified by Proposition 1(iii) is a best reply given the strategies of the two types of the other bidder. Let  .

.

Type . The same argument given in the proof above for type

. The same argument given in the proof above for type  applies.

applies.

Type . For any

. For any  , the payoff of type

, the payoff of type  is

is  , which is equal to

, which is equal to  for any

for any  .30 If

.30 If  , then

, then  ties with type 2L and loses against 2H, unless also 2H bids

ties with type 2L and loses against 2H, unless also 2H bids  – an event with probability

– an event with probability  . Consider the most favorable case for

. Consider the most favorable case for  , which means that he wins the tie-break against each type of bidder 2 with probability one (this occurs if

, which means that he wins the tie-break against each type of bidder 2 with probability one (this occurs if  ): his expected payoff from bidding

): his expected payoff from bidding  is then

is then  which turns out to be equal to

which turns out to be equal to  .

.

Type . The payoff of type

. The payoff of type  from bidding

from bidding  is

is  . If he bids

. If he bids  , then

, then  and thus

and thus  is decreasing in b.

is decreasing in b.

Type . For any

. For any  , the payoff of type

, the payoff of type  is

is  , which is equal to

, which is equal to  for any

for any  .

.

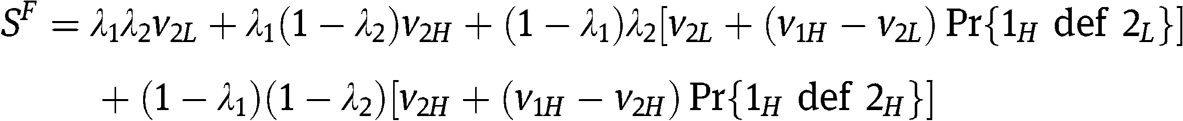

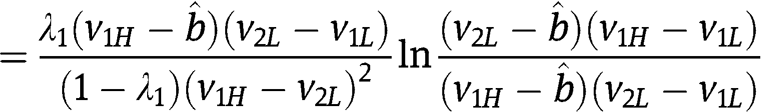

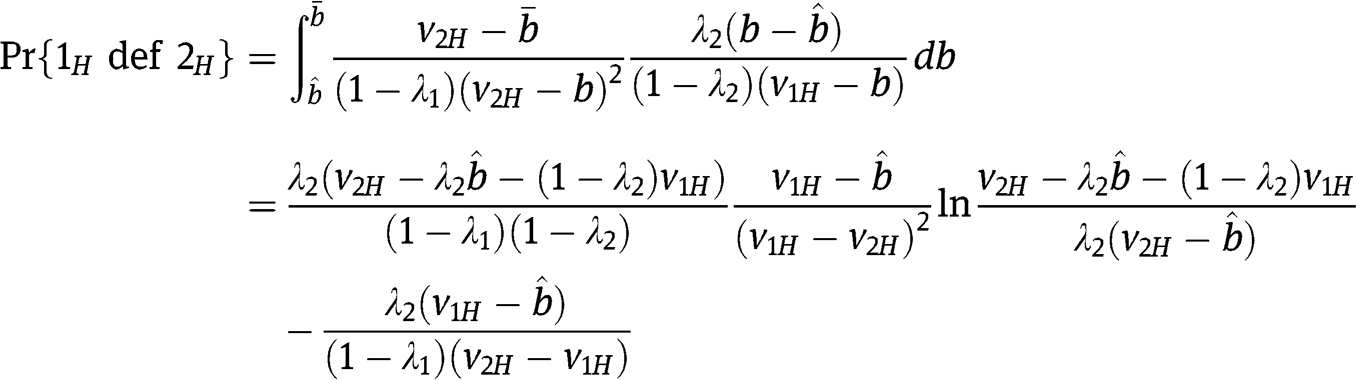

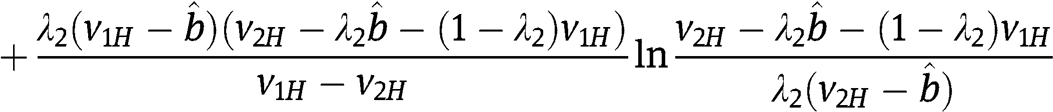

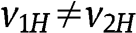

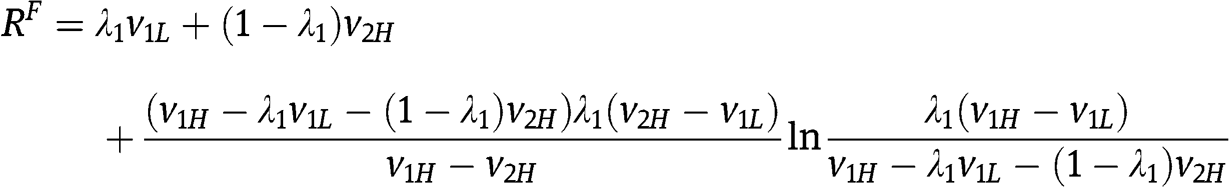

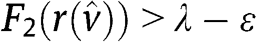

Derivation of  given the BNE described by Proposition 1

given the BNE described by Proposition 1

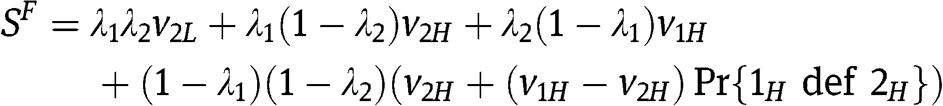

The BNE of Proposition 1(ii) when

We evaluate  as the difference between the social surplus

as the difference between the social surplus  generated by the FPA minus the bidders’ rents

generated by the FPA minus the bidders’ rents  :

:  . Thus, we need to derive

. Thus, we need to derive  and

and  :

:

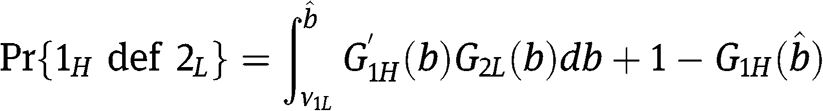

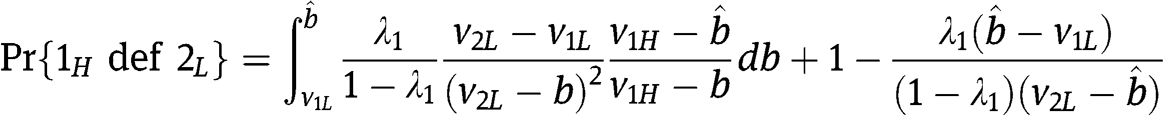

in which  def

def  , for

, for  , is the probability that

, is the probability that  wins when he faces type

wins when he faces type  .

.

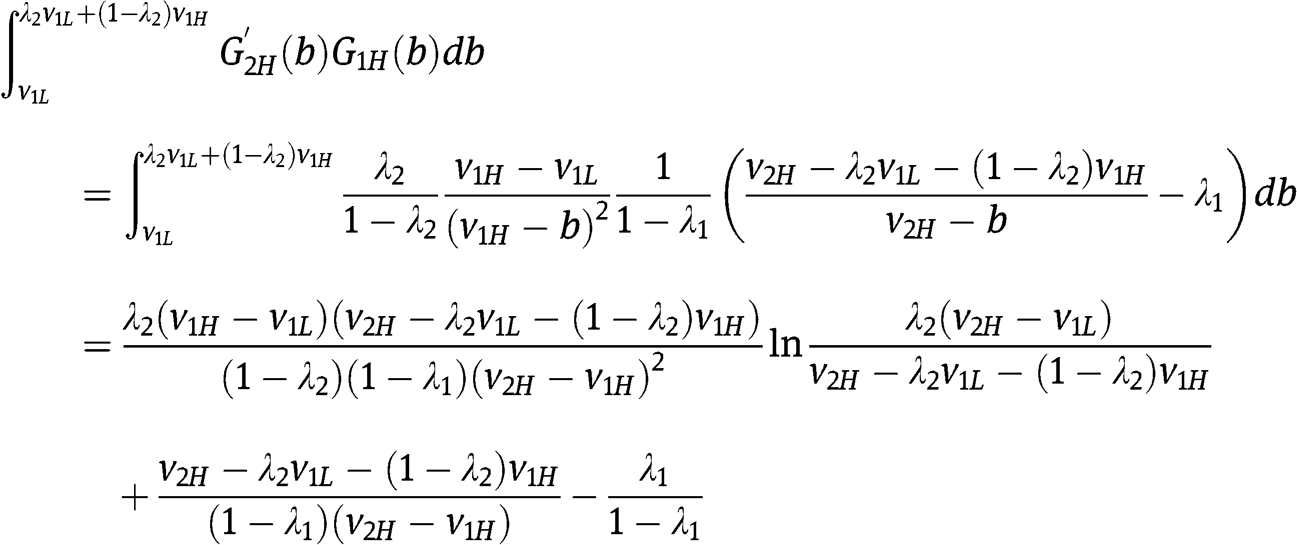

In order to derive  def

def  , for the case that

, for the case that  , we need to evaluate

, we need to evaluate

and using  in

in  we find

we find  . Hence

. Hence

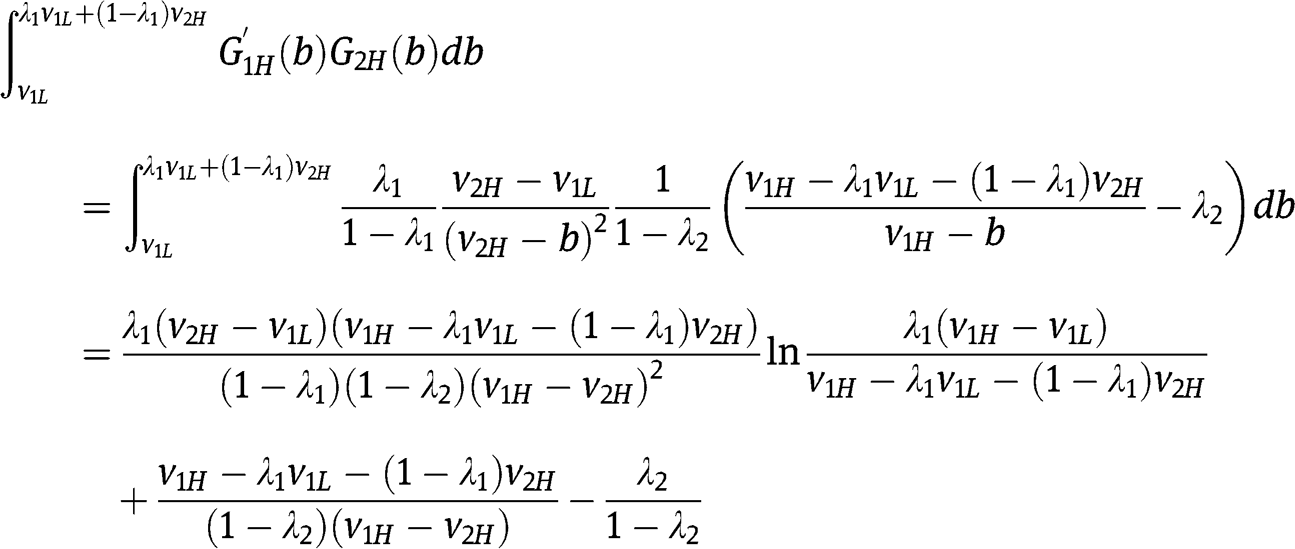

In order to derive  def

def  , for the case that

, for the case that  , we need to evaluate

, we need to evaluate

and using  in

in  we find

we find  . Hence

. Hence

Now we can evaluate  :

:

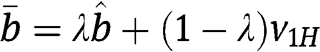

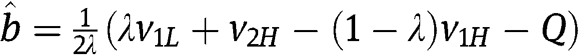

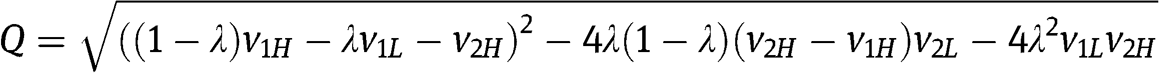

An expression for  is found by solving eq. [2]:

is found by solving eq. [2]:

![[15]](/document/doi/10.1515/bejte-2012-0014/asset/graphic/bejte-2012-0014_eq15.png)

with

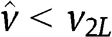

The BNE of Proposition 1(ii) when  (footnote 10)

(footnote 10)

In order to derive  , for the case that

, for the case that  , we need to evaluate

, we need to evaluate

Now we can evaluate  :

:

![[16]](/document/doi/10.1515/bejte-2012-0014/asset/graphic/bejte-2012-0014_eq16.png)

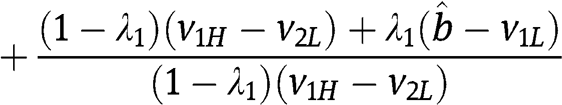

The BNE in Proposition 1(iii)

For the case that  we need to evaluate

we need to evaluate  def

def  , which is equal to

, which is equal to

Now we can evaluate  :

:

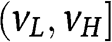

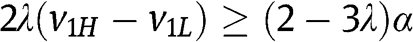

Proof of Lemma 1

Given  and

and  , when

, when  Proposition 1(ii) (footnote 10) applies and reveals that types

Proposition 1(ii) (footnote 10) applies and reveals that types  bid as in the benchmark symmetric setting, whereas

bid as in the benchmark symmetric setting, whereas  and

and  with support

with support  , in which

, in which  . It is simple to see that both

. It is simple to see that both  and

and  are decreasing with respect to

are decreasing with respect to  for any

for any  , and this implies that

, and this implies that  and 2H are both more aggressive, in the sense of first-order stochastic dominance, the larger is

and 2H are both more aggressive, in the sense of first-order stochastic dominance, the larger is  in

in  .31 Given that

.31 Given that

![[17]](/document/doi/10.1515/bejte-2012-0014/asset/graphic/bejte-2012-0014_eq17.png)

we infer that  is increasing in

is increasing in  .

.

When  , Proposition 1(iii) applies and reveals that types

, Proposition 1(iii) applies and reveals that types  bid as in the benchmark symmetric setting, whereas

bid as in the benchmark symmetric setting, whereas  for any

for any  . Since

. Since  is strictly increasing in

is strictly increasing in  for any

for any  , we infer that 2H is less aggressive, in the sense of first-order stochastic dominance, the larger is

, we infer that 2H is less aggressive, in the sense of first-order stochastic dominance, the larger is  . Using again eq. [17], after replacing

. Using again eq. [17], after replacing  with

with  and

and  with

with  , it follows that

, it follows that  is strictly decreasing with respect to

is strictly decreasing with respect to  .

.

Proof of Proposition 4

The proof when [9] or [10] is satisfied

The proofs for these results are provided in the text.

The proof when [11] is satisfied

Since  when [9] is satisfied and

when [9] is satisfied and  and

and  are continuous functions of the valuations, it follows that

are continuous functions of the valuations, it follows that  if

if  and

and  is close to

is close to  .

.

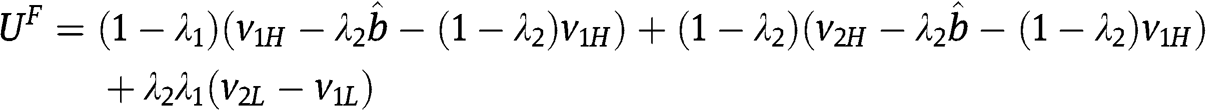

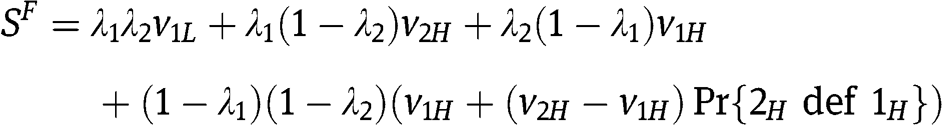

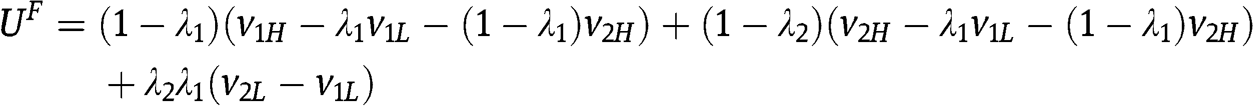

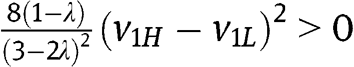

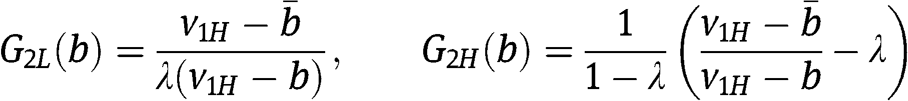

The proof when [12] is satisfied

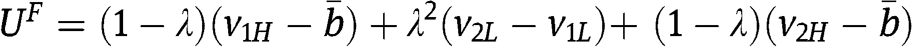

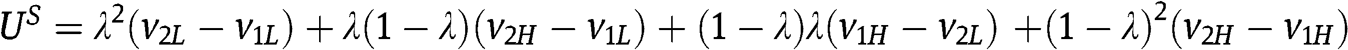

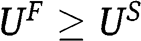

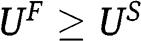

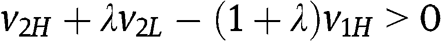

Recall from our final remark in Section 3.2.2 that in the BNE described by Proposition 1(ii) the highest valuation bidder does not always win. Conversely, the efficient allocation is always achieved in the SPA. Therefore a sufficient condition for  is that the aggregate bidders’ rents in the FPA,

is that the aggregate bidders’ rents in the FPA,  , are (weakly) larger than the rents in the SPA,

, are (weakly) larger than the rents in the SPA,  . Indeed, we show that

. Indeed, we show that  in region B if

in region B if  by proving that

by proving that  for any profile of values in B. Since

for any profile of values in B. Since  , Proposition 1(ii) applies and thus the aggregate bidders’ rents in the FPA are

, Proposition 1(ii) applies and thus the aggregate bidders’ rents in the FPA are  with

with  . On the other hand, the bidders’ rents in the SPA are

. On the other hand, the bidders’ rents in the SPA are  . Hence, the inequality

. Hence, the inequality  reduces to

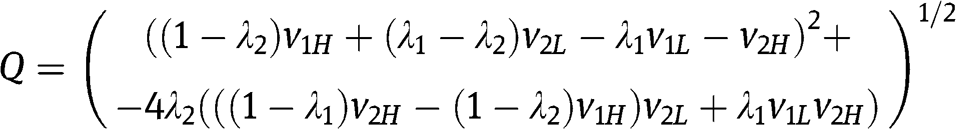

reduces to  . From eq. [15] we obtain

. From eq. [15] we obtain  with

with  . Therefore

. Therefore  boils down to

boils down to  and (after squaring – notice that

and (after squaring – notice that  in B) ultimately to

in B) ultimately to  . Given

. Given  and

and  , we find that

, we find that  , which is positive in region B.

, which is positive in region B.

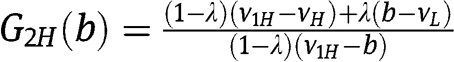

For valuations in region C, that is such that  , we show that

, we show that  if [12] is satisfied. As above, the bidders’ rents in the FPA are

if [12] is satisfied. As above, the bidders’ rents in the FPA are  with

with  . However, the rents in the SPA in region C are

. However, the rents in the SPA in region C are  , and the inequality

, and the inequality  reduces to

reduces to  . Using again

. Using again  we see that

we see that  boils down to

boils down to  and, after squaring – notice that

and, after squaring – notice that  – ultimately to

– ultimately to

![[18]](/document/doi/10.1515/bejte-2012-0014/asset/graphic/bejte-2012-0014_eq18.png)

We prove that this inequality holds for each  by verifying that the left-hand side of [18] is positive both at

by verifying that the left-hand side of [18] is positive both at  and at

and at  . At

. At  , the left-hand side in [18] reduces to

, the left-hand side in [18] reduces to  which is positive since (i) it is increasing in

which is positive since (i) it is increasing in  ; (ii) has value

; (ii) has value  at

at  . At

. At  , the left-hand side in [18] reduces to

, the left-hand side in [18] reduces to  .

.

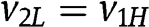

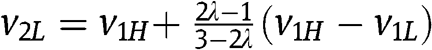

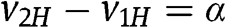

Proof for the case of distribution shift

In the case of shift,  and

and  . If

. If  , then

, then  and

and  . As a consequence,

. As a consequence,  reduces to

reduces to  . If

. If  , then this inequality is satisfied for any

, then this inequality is satisfied for any  ; if instead

; if instead  , then the inequality is violated for

, then the inequality is violated for  and it holds if and only if

and it holds if and only if  .

.

If  , then

, then  and

and  . As a consequence,

. As a consequence,  reduces to

reduces to  . In order for this inequality to be satisfied by an

. In order for this inequality to be satisfied by an  larger than

larger than  it is necessary that

it is necessary that  .

.

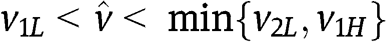

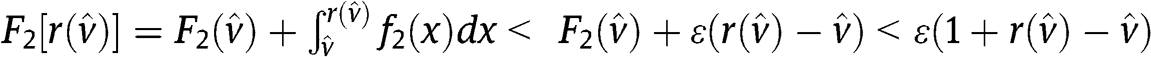

Proof of the claim in Section 4.3 about the approximation of our discrete setting using a continous model

Suppose that  and consider

and consider  such that

such that  ; let

; let  be close to zero. If

be close to zero. If  are continuously differentiable c.d.f.s which approximate well our discrete setting, then

are continuously differentiable c.d.f.s which approximate well our discrete setting, then  ,

,  ,

,  , and

, and  by definition of

by definition of  . We show that [14] is violated at

. We show that [14] is violated at  by deriving a contradiction if the inequality

by deriving a contradiction if the inequality  holds for each

holds for each  . Indeed, if this condition were satisfied then

. Indeed, if this condition were satisfied then  , but we know that

, but we know that  .32 In other terms,

.32 In other terms,  needs to be small for

needs to be small for  , and [14] requires that

, and [14] requires that  is smaller than

is smaller than  for any x between

for any x between  and

and  . But since

. But since  , it is necessary that

, it is necessary that  grows substantially in

grows substantially in  , which is impossible given that

, which is impossible given that  is small.33

is small.33

Proof of Proposition 5

The expression of  depends as follows on

depends as follows on  :

:

In the case of  , for instance,

, for instance,  is increasing in

is increasing in  , is increasing in

, is increasing in  , and is increasing in

, and is increasing in  , thus

, thus  . A similar argument applies in the other cases.

. A similar argument applies in the other cases.

Proof of Proposition 6

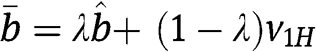

Step 1 If  , then the optimal reserve price in the FPA belongs to

, then the optimal reserve price in the FPA belongs to  .

.

First notice that if  , then bidding

, then bidding  allows bidder 2 to win with certainty. Hence, no type of bidder 2 (or of bidder 1) bids above

allows bidder 2 to win with certainty. Hence, no type of bidder 2 (or of bidder 1) bids above  in equilibrium and

in equilibrium and  for each

for each  . Second, if

. Second, if  then bidder 1 does not participate in the auction. Bidder 2 participates, and bids r, if and only if

then bidder 1 does not participate in the auction. Bidder 2 participates, and bids r, if and only if  . Therefore

. Therefore  if

if  (both types of bidder 2 bid r), and

(both types of bidder 2 bid r), and  if

if  (only type

(only type  bids r).

bids r).

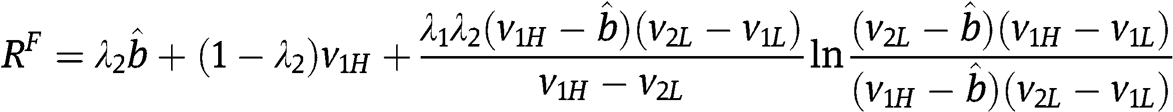

Step 2 If  , then the optimal reserve price in the FPA belongs to

, then the optimal reserve price in the FPA belongs to  .

.

The result follows from Steps 2.1 and 2.2 below.

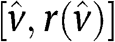

Step 2.1 If we consider only values of r in  , then the optimal r is in

, then the optimal r is in  .

.

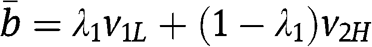

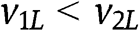

Let bidders i and j be such that  (if

(if  , then we set

, then we set  ,

,  ). Thus

). Thus  is the type of bidder with valuation equal to

is the type of bidder with valuation equal to  .

.

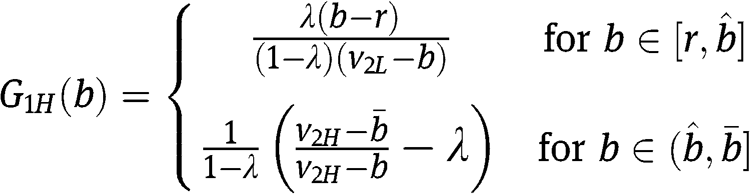

From  and

and  it follows that

it follows that  . For r such that

. For r such that  the BNE is such that types

the BNE is such that types  do not bid; types

do not bid; types  play mixed strategies, each with support

play mixed strategies, each with support  , with

, with  , and c.d.f.s

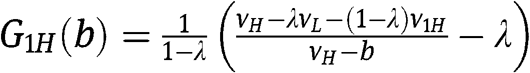

, and c.d.f.s

![[19]](/document/doi/10.1515/bejte-2012-0014/asset/graphic/bejte-2012-0014_eq19.png)

Since both types  bid more aggressively as r increases in

bid more aggressively as r increases in  , it follows that

, it follows that  is increasing with respect to r in the interval

is increasing with respect to r in the interval  , and

, and  .

.

For r such that  , only type

, only type  participates, and bids r. Thus

participates, and bids r. Thus  is increasing with respect to r in the interval

is increasing with respect to r in the interval  , and

, and  . Hence the optimal r in

. Hence the optimal r in  belongs to

belongs to  ■

■

Notice that when  , Step 2.1 implies immediately that the optimal r belongs to

, Step 2.1 implies immediately that the optimal r belongs to  . Therefore in the following of the proof, we assume that

. Therefore in the following of the proof, we assume that

Step 2.2 If we consider only values of r in  , then the optimal r is

, then the optimal r is

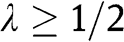

Given  , we need to consider two cases:

, we need to consider two cases:  and

and  .

.

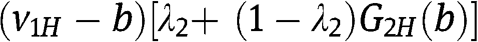

Step 2.2.1 If  , then

, then  is increasing with respect to r in the interval

is increasing with respect to r in the interval  .

.

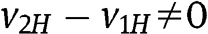

When  the BNE is similar to the BNE described in Proposition 1(ii), with

the BNE is similar to the BNE described in Proposition 1(ii), with  replaced by r: type

replaced by r: type  does not bid; types

does not bid; types  play mixed strategies with support

play mixed strategies with support  for

for  ,

,  for

for  ,

,  for

for  , in which

, in which  is the smaller solution to

is the smaller solution to

![[20]](/document/doi/10.1515/bejte-2012-0014/asset/graphic/bejte-2012-0014_eq20.png)

and  . The c.d.f.s for the mixed strategies of

. The c.d.f.s for the mixed strategies of  are, respectively:

are, respectively:

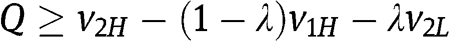

Since  is the smaller solution to eq. [20] and the left-hand side in eq. [20] is increasing in r, it follows that

is the smaller solution to eq. [20] and the left-hand side in eq. [20] is increasing in r, it follows that  is increasing in r and also

is increasing in r and also  is so. Hence, it is immediate that an increase in r induces both types

is so. Hence, it is immediate that an increase in r induces both types  and

and  to bid more aggressively. The same result holds for type

to bid more aggressively. The same result holds for type  as well since

as well since  for

for  , and both

, and both  and

and  are decreasing in r. Therefore

are decreasing in r. Therefore  is increasing in r. ■

is increasing in r. ■

Step 2.2.2 If  , then

, then  is increasing with respect to r in the interval

is increasing with respect to r in the interval  .

.

When  the BNE is similar to the BNE described in Proposition 1(iii), with

the BNE is similar to the BNE described in Proposition 1(iii), with  replaced by r: type

replaced by r: type  does not bid; type

does not bid; type  bids r; types

bids r; types  play mixed strategies with the same support

play mixed strategies with the same support  , in which

, in which  and the c.d.f.s are given by eq. [19], with

and the c.d.f.s are given by eq. [19], with  ,

,  . Hence

. Hence  is increasing in r. ■

is increasing in r. ■

Proof of Proposition 7

For the case of  , see the arguments immediately after the statement of Proposition 7. When

, see the arguments immediately after the statement of Proposition 7. When  , first notice that

, first notice that  ,

,  . For instance, if

. For instance, if  (similar results are obtained if

(similar results are obtained if  ) then

) then  because given

because given  , in both auctions the object is not sold when

, in both auctions the object is not sold when  , and in the other states of the world the winning bidder pays

, and in the other states of the world the winning bidder pays  . In case that

. In case that  , we have

, we have  because in both auctions the object is sold if and only if

because in both auctions the object is sold if and only if  . On the other hand,

. On the other hand,  (

( ) is equal to the expected revenue in the FPA (in the SPA) when

) is equal to the expected revenue in the FPA (in the SPA) when  , and we know from Proposition 4 (condition [9]) that

, and we know from Proposition 4 (condition [9]) that  , unless

, unless  .

.

References

Cantillon, E. 2008. “The Effect of Bidders’ Asymmetries on Expected Revenue in Auctions.” Games and Economic Behavior62:1–25.10.1016/j.geb.2006.11.005Search in Google Scholar

Cheng, H. 2006. “Ranking Sealed High-Bid and Open Asymmetric Auctions.” Journal of Mathematical Economics42:471–98.10.1016/j.jmateco.2006.05.008Search in Google Scholar

Cheng, H.2010. “Asymmetric First Price Auctions with a Linear Equilibrium.” Mimeo.Search in Google Scholar

Cheng, H. 2011. “Asymmetry and Revenue in First-Price Auctions.” Economics Letters111:78–80.10.1016/j.econlet.2010.12.004Search in Google Scholar

Doni, N., and D.Menicucci. 2012a. “Revenue Comparison in Asymmetric Auctions with Discrete Valuations.”http://www1.unifi.it/dmd-old/persone/d.menicucci/WpAsymmetric.pdf.10.1515/bejte-2012-0014Search in Google Scholar

Doni, N., and D.Menicucci. 2012b. “Information Revelation in Procurement Auctions with Two-Sided Asymmetric Information.” Journal of Economics and Management Strategy forthcoming.Search in Google Scholar

Fibich, G., and N.Gavish. 2011. “Numerical Simulations of Asymmetric First-Price Auctions.” Games and Economic Behavior73:479–95.10.1016/j.geb.2011.02.010Search in Google Scholar

Fibich, G., and A.Gavious. 2003. “Asymmetric First-Price Auctions – A Perturbation Approach.” Mathematics of Operations Research28:836–52.10.1287/moor.28.4.836.20510Search in Google Scholar

Fibich, G., A.Gavious, and A.Sela. 2004. “Revenue Equivalence in Asymmetric Auctions.” Journal of Economic Theory115:309–21.10.1016/S0022-0531(03)00251-5Search in Google Scholar

Gavious, A., and Y.Minchuk. 2013. “Ranking Asymmetric Auctions.” Mimeo. International Journal of Game Theory forthcoming. DOI: 10.1007/s00182-013-0383-9.10.1007/s00182-013-0383-9Search in Google Scholar

Gayle, W., and J.-F.Richard. 2008. “Numerical Solutions of Asymmetric, First Price, Independent Private Values Auctions.” Computational Economics32:245–75.10.1007/s10614-008-9125-7Search in Google Scholar

Kaplan, T. R., and S.Zamir. 2012. “Asymmetric First Price Auctions with Uniform Distributions: Analytical Solutions to the General Case.” Economic Theory50:269–302.10.1007/s00199-010-0563-9Search in Google Scholar

Kirkegaard, R. 2012a. “A. Mechanism Design Approach to Ranking Asymmetric Auctions.” Econometrica80:2349–64.10.3982/ECTA9859Search in Google Scholar

Kirkegaard, R.2012b. “Ranking Asymmetric Auctions: Filling the Gap Between a Distributional Shift and Stretch.”http://www.uoguelph.ca/~rkirkega/BetweenShiftStretch.pdf.Search in Google Scholar

Klemperer, P. 1999. “Auction Theory: A Guide to the Literature.” Journal of Economic Surveys13:227–86.10.1111/1467-6419.00083Search in Google Scholar

Lebrun, B. 1998. “Comparative Statics in First Price Auctions.” Games and Economic Behavior25:97–110.10.1006/game.1997.0635Search in Google Scholar

Lebrun, B. 2002. “Continuity of the First-Price Auction Nash Equilibrium Correspondence.” Economic Theory20:435–53.10.1007/s001990100227Search in Google Scholar

Lebrun, B. 2009. “Auctions with Almost Homogeneous Bidders.” Journal of Economic Theory144:1341–51.10.1016/j.jet.2008.11.013Search in Google Scholar

Li, H., and J.Riley. 2007. “Auction Choice.” International Journal of Industrial Organization25:1269–98.10.1016/j.ijindorg.2006.10.003Search in Google Scholar

Marshall, R. C., M. J.Meurer, J.-F.Richard, and W.Stromquist. 1994. “Numerical Analysis of Asymmetric First Price Auctions.” Games and Economic Behavior7:193–220.10.1006/game.1994.1045Search in Google Scholar

Marshall, R. C., and S. P.Schulenberg2003. “Numerical Analysis of Asymmetric Auctions with Optimal Reserve Prices.” Mimeo, Department of Economics, Penn State University, State College, PA.Search in Google Scholar

Maskin, E., and J.Riley1983. “Auction with Asymmetric Beliefs.” Discussion Paper n. 254, University of California-Los Angeles.Search in Google Scholar

Maskin, E., and J.Riley. 1985. “Auction Theory with Private Values.” American Economic Review75:150–5.Search in Google Scholar

Maskin, E., and J.Riley. 2000a. “Asymmetric Auctions.” Review of Economic Studies67:413–38.10.1111/1467-937X.00137Search in Google Scholar

Maskin, E., and J.Riley. 2000b. “Equilibrium in Sealed High Bid Auctions.” Review of Economic Studies67:439–54.10.1111/1467-937X.00138Search in Google Scholar

Myerson, R. B. 1981. “Optimal Auction Design.” Mathematics of Operations Research6:58–73.10.1287/moor.6.1.58Search in Google Scholar

Plum, M. 1992. “Characterization and Computation of Nash-Equilibria for Auctions with Incomplete Information.” International Journal of Game Theory20:393–418.10.1007/BF01271133Search in Google Scholar

Vickrey, W. 1961. “Counterspeculation, Auctions, and Competitive Sealed Tenders.” Journal of Finance16:8–37.10.1111/j.1540-6261.1961.tb02789.xSearch in Google Scholar

- 1

This result contrasts with a claim in Maskin and Riley (1985) for the case in which the only deviation from a symmetric setting is given by unequal high valuations [this claim is reproduced in Klemperer (1999)]. However, for this case, Maskin and Riley (1983) agree with our ranking between the FPA and the SPA.

- 2

In fact, the latter result is known, and in more general settings, since Maskin and Riley (2000a).

- 3

As we mentioned above, these results hold if the probability of a low value is the same for each bidder. In Doni and Menicucci (2012a), we study the case in which the probabilities of a low value for the two bidders are different. We also partially extend our results to a setting in which each bidder’s valuation has a three-point support.

- 4

Doni and Menicucci (2012b) study a procurement setting in which the auctioneer privately observes the qualities of the products offered by the suppliers and needs to decide how much of the own information on qualities should be revealed to suppliers before a (first score) auction is held. Our results on the comparison between the FPA and the SPA contribute to determine the best information revelation policy for the auctioneer.

- 5

Cheng (2010) studies the environments such that each bidder’s equilibrium bidding function is linear.

- 6

Cheng (2011) employs the same setting of Maskin and Riley (1983) in order to show that in some special cases the asymmetry increases the expected revenue in the FPA, unlike in the examples studied in Cantillon (2008).

- 7

In order to circumvent this problem, some authors apply numerical methods: see Fibich and Gavish (2011), Gayle and Richard (2008), Li and Riley (2007), and Marshall et al. (1994).

- 8

A very similar idea appears in Lebrun (2002), in the auction he denotes with

.

. - 9

For instance, 1H bids according to the uniform distribution on

with α < 1 and close to 1.

with α < 1 and close to 1. - 10

In the case that

(which occurs if and only if

(which occurs if and only if  ), 2L bids

), 2L bids  and

and  , thus

, thus  and

and  for each

for each  .

. - 11

In a setting with continuously distributed valuations, Maskin and Riley (2000a) identify an analogous BNE and provide the intuition we describe here and after Proposition 2. In addition, Maskin and Riley (1983) identify the BNE we describe in Proposition 1 for the case of

. Thus Proposition 1 is a new result for the case in which

. Thus Proposition 1 is a new result for the case in which  and [3] is violated.

and [3] is violated. - 12

This fact may appear similar to the main message in Cantillon (2008), but in fact in our analysis the benchmark symmetric setting is fixed, whereas in Cantillon (2008) it is not.

- 13

Obviously, an analogous result holds if

is kept fixed and

is kept fixed and  is allowed to vary.

is allowed to vary. - 14

Lebrun (1998) considers a setting with continuously distributed valuations and assumes that the valuation distribution of one bidder changes into a new distribution which dominates the previous one in the sense of reverse hazard rate domination (the support is unchanged). He show that, as a consequence, for each bidder the new bid distribution first-order stochastically dominates the initial bid distribution and thus the expected revenue increases.

- 15

In particular,

for any small deviation from the symmetric setting, that is when

for any small deviation from the symmetric setting, that is when  and

and  are close to zero, but

are close to zero, but  and/or

and/or  .

. - 16

Since they assume

, Maskin and Riley (1983) do not consider the various cases covered in our Proposition 4, and they do not have the results in our Lemma 1 and Propositions 5 to 7.

, Maskin and Riley (1983) do not consider the various cases covered in our Proposition 4, and they do not have the results in our Lemma 1 and Propositions 5 to 7. - 17

Proposition 1 still holds even though

violates our assumption

violates our assumption  . However, when

. However, when  the Vickrey tie-breaking rule is needed also if

the Vickrey tie-breaking rule is needed also if  .

. - 18

This similarity should not be overstated, since the uniform distribution on

gives zero probability to

gives zero probability to  , unlike the uniform distribution on

, unlike the uniform distribution on  . See Section 4.3 for a discussion on the relationship between the results in our model and in the rest of the literature.

. See Section 4.3 for a discussion on the relationship between the results in our model and in the rest of the literature. - 19

If we set

, then

, then  , which violates the assumption

, which violates the assumption  , but nevertheless

, but nevertheless  is the c.d.f. of the equilibrium mixed strategy of bidder 2 when

is the c.d.f. of the equilibrium mixed strategy of bidder 2 when  .

. - 20

This effect appears also in Example 3 in Maskin and Riley (2000a).

- 21

Maskin and Riley (2000a) prove the same result under slightly stronger assumptions.

- 22

In fact, we can prove that a small shift reduces

as it has a zero first-order effect on the bidding of types

as it has a zero first-order effect on the bidding of types  , but induces

, but induces  to bid less aggressively.

to bid less aggressively. - 23

A similar result is obtained if we fix

and set

and set  ,

,  , with

, with  . For the case of a large

. For the case of a large  , [3] is satisfied and thus

, [3] is satisfied and thus  . If instead

. If instead  is close to 1, then [11] reveals that

is close to 1, then [11] reveals that  . On the other hand, Kirkegaard (2012b) proves that

. On the other hand, Kirkegaard (2012b) proves that  if

if  is such that

is such that  is convex and logconcave,

is convex and logconcave,  is such that

is such that  and

and  is not much larger than 1.

is not much larger than 1. - 24

Kirkegaard (2012b) provides an economic interpretation of this order linked to the relative steepness of the demand function of bidder 1 with respect to the demand function of bidder 2.

- 25

We are grateful to one referee for suggesting the main ideas in this paragraph.

- 26

We thank one referee for suggesting to investigate the effect of reserve prices.

- 27

Kirkegaard (2012a) shows that if [13] and [14] are satisfied, then the FPA is superior to the SPA for any common reserve price smaller than

, that is such that it allows participation of some type of the weak bidder. Asymmetric auctions with reserve prices are analyzed, using numerical techniques, also in Gayle and Richard (2008), Li and Riley (2007), and Marshall and Schulenberg (2003). In these papers, introducing a reserve price tipically either makes the SPA superior to the FPA (even though the reverse result holds when there is no reserve price) or reduces the revenue advantage of the FPA over the SPA. The latter results are consistent with our results in this section.

, that is such that it allows participation of some type of the weak bidder. Asymmetric auctions with reserve prices are analyzed, using numerical techniques, also in Gayle and Richard (2008), Li and Riley (2007), and Marshall and Schulenberg (2003). In these papers, introducing a reserve price tipically either makes the SPA superior to the FPA (even though the reverse result holds when there is no reserve price) or reduces the revenue advantage of the FPA over the SPA. The latter results are consistent with our results in this section. - 28

In fact, a small shift reduces

as in the case of binary supports (see footnote 22), mainly because it induces type

as in the case of binary supports (see footnote 22), mainly because it induces type  to bid less aggressively.

to bid less aggressively. - 29

We do not provide here the proof for the case in which [3] is satisfied since the BNE in that case is similar to a BNE in Maskin and Riley (2000a): see footnote 11. Doni and Menicucci (2012a) provide a complete proof.

- 30

Notice that

given [7].

given [7]. - 31

Precisely, if

, then

, then  and

and  given

given  first-order stochastically dominate, respectively,

first-order stochastically dominate, respectively,  and

and  given

given  .

. - 32

In case that

we can prove that [13] is violated.

we can prove that [13] is violated. - 33

Actually, [14] can be replaced in Theorem 1 in Kirkegaard (2012a) with a weaker condition, inequality [8] in Kirkegaard (2012a), but our argument establishes that also such a condition is violated. Furthermore, our argument does not require that

and

and  have binary supports, consistently with the results we describe in Section 5.2 for the case in which supports are three-point sets.

have binary supports, consistently with the results we describe in Section 5.2 for the case in which supports are three-point sets.

©2013 by Walter de Gruyter Berlin / Boston

Articles in the same Issue

- Masthead

- Masthead

- Advances

- Dependence and Uniqueness in Bayesian Games

- Monopolistic Signal Provision†

- Multi-task Research and Research Joint Ventures

- Transparent Restrictions on Beliefs and Forward-Induction Reasoning in Games with Asymmetric Information

- A Simple Bargaining Procedure for the Myerson Value

- On the Difference between Social and Private Goods

- Optimal Use of Rewards as Commitment Device When Bidding Is Costly

- Labor Market and Search through Personal Contacts

- Contributions

- Learning, Words and Actions: Experimental Evidence on Coordination-Improving Information

- Are Trust and Reciprocity Related within Individuals?

- Optimal Contracting Model in a Social Environment and Trust-Related Psychological Costs

- Contract Bargaining with a Risk-Averse Agent

- Academia or the Private Sector? Sorting of Agents into Institutions and an Outside Sector

- Topics

- Poverty Orderings with Asymmetric Attributes

- Dictatorial Mechanisms in Constrained Combinatorial Auctions

- When Should a Monopolist Improve Quality in a Network Industry?

- On Partially Honest Nash Implementation in Private Good Economies with Restricted Domains: A Sufficient Condition

- Revenue Comparison in Asymmetric Auctions with Discrete Valuations

Articles in the same Issue

- Masthead

- Masthead

- Advances

- Dependence and Uniqueness in Bayesian Games

- Monopolistic Signal Provision†

- Multi-task Research and Research Joint Ventures

- Transparent Restrictions on Beliefs and Forward-Induction Reasoning in Games with Asymmetric Information

- A Simple Bargaining Procedure for the Myerson Value

- On the Difference between Social and Private Goods

- Optimal Use of Rewards as Commitment Device When Bidding Is Costly

- Labor Market and Search through Personal Contacts

- Contributions

- Learning, Words and Actions: Experimental Evidence on Coordination-Improving Information

- Are Trust and Reciprocity Related within Individuals?

- Optimal Contracting Model in a Social Environment and Trust-Related Psychological Costs

- Contract Bargaining with a Risk-Averse Agent

- Academia or the Private Sector? Sorting of Agents into Institutions and an Outside Sector

- Topics

- Poverty Orderings with Asymmetric Attributes

- Dictatorial Mechanisms in Constrained Combinatorial Auctions

- When Should a Monopolist Improve Quality in a Network Industry?

- On Partially Honest Nash Implementation in Private Good Economies with Restricted Domains: A Sufficient Condition

- Revenue Comparison in Asymmetric Auctions with Discrete Valuations