Abstract

We study optimal fiscal and monetary policy in a Ramsey economy where firms learn from their production experience and incur a real cost in changing their prices. Two central results emerge from our study. First, optimal tax policy is counter-cyclical – tax rates fall during recession and rise during boom. This finding contrasts with pro-cyclical tax results obtained in standard sticky price Ramsey models. In presence of learning-by-doing (LBD) mechanism, the Ramsey planner finds it relatively more costly to raise taxes in response to a negative technology shock. Higher taxes would reduce hours, output, and hence future level of organizational capital which will magnify the shock further by lowering future productivity. Hence, in response to a negative productivity shock, the planner finds it optimal to lower taxes in order to raise the after tax return to work and minimize the welfare-reducing effects of the shock. Second, optimal inflation is very stable and persistent over the business cycle. We show that while a dynamic link between current production and future productivity generates the inflation persistence, the real cost of price adjustment is the key factor behind the very low volatility in optimal inflation. Both of these mechanisms work through the monopolistic firms’ optimal pricing condition – namely the New Keynesian Philips Curve.

Acknowledgments

I am extremely grateful to Alok Johri for his advice, guidance and encouragement. I would like to thank the associate editor and two anonymous referees for constructive comments, Marc-André Letendre, and William Scarth for helpful discussions and advice, Katherine Cuff, Maxim Ivanov, Stephen Jones, Lonnie Magee, Mike Veall, and seminar participants at Midwest Macro Meetings, Canadian Economics Association Meetings, several universities including McMaster University, and Saint Mary’s University for insightful comments.

Appendix A: The New Keynesian Phillips Curve (NKPC)

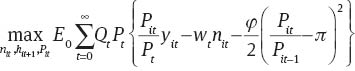

We derive the New Keynesian Phillips Curve from intermediate goods producing firms’ profit maximization problem. The representative firm i chooses the plans for nit, hit+1, and Pit so as to maximize the present expected discounted value of life-time profits. That is the firms problem is to

subject to technological constraint on output production

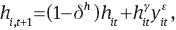

technological constraint on organizational capital accumulation

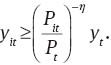

and taking as given the demand function for variety i,

Letting QtPtmcit, and QtPtΨit denote Lagrange multipliers associated with constraints (33) and (34) respectively, the Lagrangian associated with the firm’s optimization problem is

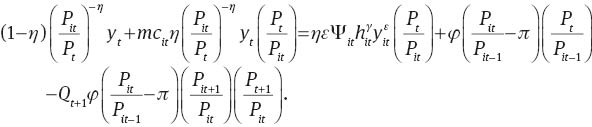

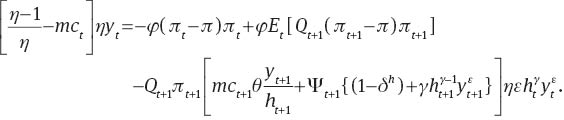

The first order condition with respect to intermediate firm’s price, Pit, (i.e., the New Keynesian Phillips Curve) is,

Since all intermediate firms face the same wage rate, face the same downward sloping demand curves, and have access to the same production technology, marginal costs, mcit, are identical across all firms. Consequently, they hire the same amount of labor and produce the same amount of output. Therefore, we can restrict our attention to a symmetric equilibrium in which all firms make the same decisions. We thus drop all the subscripts i. That is, in equilibrium yit=yt, pit=pt, mcit=mct, Ψit=Ψt, nit=nt, hit=ht. Therefore, equations (36), can be simplified as:

where,

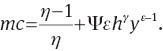

Steady state NKPC

Note that all the (πt/t+1–π) terms become zero in the steady state. Now, imposing steady sate in equation (A.6), and after some algebraic manipulations, we can express the steady-state NKPC as

Appendix B: Sensitivity analysis

Sensitivity of dynamic results with respect to the intertemporal elasticity of substitution (CRRA).

| Variable | Mean | Std. Dev. | Auto. corr. | Corr(x,y) | Corr(x,g) | Corr(x,z) |

| φ=1.15 | ||||||

| τn | 0.2374 | 0.3856 | 0.9577 | 0.7121 | 0.6118 | 0.4642 |

| π–1 | –2.3978 | 0.0093 | 0.9599 | –0.1381 | 0.7042 | –0.3437 |

| R–1 | 1.5040 | 0.3158 | 0.8515 | –0.2497 | –0.6693 | 0.1562 |

| y | 0.7529 | 0.0054 | 0.9144 | 1.0000 | 0.5308 | 0.8928 |

| n | 0.3310 | 0.0026 | 0.9033 | –0.2264 | 0.7508 | –0.5688 |

| c | 0.6970 | 0.0052 | 0.9250 | 0.8102 | –0.2221 | 0.9603 |

| m/g | 0.4335 | 0.0174 | 0.9095 | –0.3585 | 0.2708 | –0.7820 |

| φ=1.25 | ||||||

| τn | 0.2375 | 0.4274 | 0.9652 | 0.7404 | 0.4541 | 0.4947 |

| π–1 | –2.3165 | 0.0106 | 0.9600 | –0.1785 | 0.6727 | –0.4010 |

| R–1 | 1.5191 | 0.3406 | 0.8097 | –0.2602 | –0.5986 | 0.1764 |

| y | 0.7139 | 0.0052 | 0.9140 | 1.0000 | 0.5660 | 0.9136 |

| n | 0.3330 | 0.0029 | 0.8816 | –0.2365 | 0.7155 | –0.6123 |

| c | 0.6760 | 0.0049 | 0.9270 | 0.7926 | –0.2124 | 0.9597 |

| m/g | 0.4337 | 0.0170 | 0.8831 | –0.4572 | 0.2302 | –0.7948 |

Sensitivity of dynamic results with respect the elasticity of substitution between monopolistically competitive goods.

| Variable | Mean | Std. Dev. | Auto. corr. | Corr(x,y) | Corr(x,g) | Corr(x,z) |

| η=5 | ||||||

| τn | 0.2416 | 0.3387 | 0.9470 | 0.7275 | 0.8058 | 0.4730 |

| π–1 | –2.5895 | 0.0408 | 0.9146 | –0.0029 | 0.7551 | –0.4524 |

| R–1 | 1.3442 | 0.2117 | 0.9179 | –0.1979 | –0.8212 | 0.2389 |

| y | 0.8305 | 0.0122 | 0.9005 | 1.0000 | 0.4865 | 0.8358 |

| n | 0.3138 | 0.0033 | 0.9106 | –0.0437 | 0.8068 | –0.5373 |

| c | 0.6887 | 0.0106 | 0.8977 | 0.7578 | –0.1364 | 0.9873 |

| m/g | 0.4476 | 0.0085 | 0.9270 | –0.4650 | 0.3555 | –0.7883 |

| η=7 | ||||||

| τn | 0.2254 | 0.3187 | 0.9577 | 0.6335 | 0.8359 | 0.3687 |

| π–1 | –2.4102 | 0.0412 | 0.9324 | –0.0008 | 0.7638 | –0.4277 |

| R–1 | 1.5397 | 0.1725 | 0.9409 | –0.2544 | –0.6542 | 0.0593 |

| y | 0.8826 | 0.0133 | 0.9009 | 1.0000 | 0.4646 | 0.8504 |

| n | 0.3335 | 0.0033 | 0.9136 | –0.0250 | 0.8352 | –0.4982 |

| c | 0.7319 | 0.0118 | 0.8975 | 0.7729 | –0.1387 | 0.9876 |

| m/g | 0.4461 | 0.0080 | 0.9500 | –0.4394 | 0.3496 | –0.7282 |

Sensitivity of dynamic results with respect to the the degree of substitution between cash and credit goods.

| Variable | Mean | Std. Dev. | Auto. corr. | Corr(x,y) | Corr(x,g) | Corr(x,z) |

| σ=0.60 | ||||||

| τn | 0.2325 | 0.3191 | 0.9519 | 0.7229 | 0.6116 | 0.5293 |

| π–1 | –2.3627 | 0.0481 | 0.9562 | 0.1087 | 0.7360 | –0.3930 |

| R–1 | 1.6502 | 0.2830 | 0.9201 | –0.2125 | –0.1388 | 0.1298 |

| y | 0.8609 | 0.0131 | 0.9030 | 1.0000 | 0.5487 | 0.7909 |

| n | 0.3252 | 0.0038 | 0.9197 | 0.0722 | 0.8347 | –0.4968 |

| c | 0.7138 | 0.0108 | 0.8939 | 0.7714 | –0.0470 | 0.9930 |

| m/g | 0.4494 | 0.0142 | 0.9706 | –0.1359 | 0.4625 | –0.6360 |

| σ=0.64 | ||||||

| τn | 0.2337 | 0.3479 | 0.9256 | 0.5942 | 0.8677 | 0.3477 |

| π–1 | –2.5320 | 0.0354 | 0.8809 | –0.0813 | 0.7389 | –0.4619 |

| R–1 | 1.4461 | 0.2824 | 0.8902 | –0.0734 | –0.8322 | 0.3265 |

| y | 0.8614 | 0.0128 | 0.8999 | 1.0000 | 0.4181 | 0.8765 |

| n | 0.3254 | 0.0030 | 0.9087 | –0.1064 | 0.8102 | –0.5283 |

| c | 0.7143 | 0.0118 | 0.8999 | 0.7699 | –0.1927 | 0.9757 |

| m/g | 0.4251 | 0.0066 | 0.9004 | –0.6092 | 0.2125 | –0.7553 |

Sensitivity of dynamic results with respect the the price stickiness parameter.

| Variable | Mean | Std. Dev. | Auto. corr. | Corr(x,y) | Corr(x,g) | Corr(x,z) |

| ϕ=4 | ||||||

| τn | 0.2337 | 0.3262 | 0.9531 | 0.6747 | 0.8279 | 0.4119 |

| π–1 | –2.4865 | 0.0596 | 0.9250 | –0.0034 | 0.7608 | –0.4392 |

| R–1 | 1.4563 | 0.1685 | 0.9297 | –0.2529 | –0.7249 | 0.1037 |

| y | 0.8613 | 0.0128 | 0.9007 | 1.0000 | 0.4732 | 0.8448 |

| n | 0.3254 | 0.0033 | 0.9123 | –0.0339 | 0.8235 | –0.5149 |

| c | 0.7142 | 0.0113 | 0.8976 | 0.7668 | –0.1381 | 0.9875 |

| m/g | 0.2468 | 0.0080 | 0.9405 | –0.4682 | 0.3404 | –0.7663 |

| ϕ=7 | ||||||

| τn | 0.2319 | 0.3267 | 0.9529 | 0.6726 | 0.8283 | 0.4109 |

| π–1 | –2.4858 | 0.0345 | 0.9248 | –0.0052 | 0.7607 | –0.4398 |

| R–1 | 1.4569 | 0.1884 | 0.9342 | –0.2243 | –0.7658 | 0.1598 |

| y | 0.8613 | 0.0128 | 0.9007 | 1.0000 | 0.4718 | 0.8456 |

| n | 0.3254 | 0.0033 | 0.9122 | –0.0354 | 0.8233 | –0.5150 |

| c | 0.7142 | 0.0113 | 0.8976 | 0.7669 | –0.1394 | 0.9872 |

| m/g | 0.4468 | 0.0081 | 0.9404 | –0.4614 | 0.3528 | –0.7647 |

References

Argote, L., S. L., Beckman, and D. Epple. 1990. “The Persistence and Transfer of Learning in Industrial Settings.” Management Science 36: 140–154.10.1287/mnsc.36.2.140Search in Google Scholar

Atkeson, A., and P. J. Kehoe. 2005. “Modeling and Measuring Organization Capital.” Journal of Political Economy 113: 1026–1053.10.1086/431289Search in Google Scholar

Bahk, B. H., and M. Gort. 1993. “Decomposing Learning by doing in New Plants.” Journal of Political Economy 101: 561–583.10.1086/261888Search in Google Scholar

Benkard, C. L. 2000. “Learning and Forgetting: The Dynamics of Aircraft Production.” American Economic Review 90: 1034–1054.10.1257/aer.90.4.1034Search in Google Scholar

Calvo, G. A., and P. E. Guidotti. 1993. “On the Flexibility of Monetary Policy: The Case of the Optimal Inflation Tax.” Review of Economic Studies 60: 667–687.10.2307/2298130Search in Google Scholar

Chang, Y., J. F. Gomes, and F. Schorfheide. 2002. “Learning-by-doing as a Propagation Mechanism.” American Economic Review 92: 1498–1520.10.1257/000282802762024601Search in Google Scholar

Chari, V., and P. J. Kehoe. 1999. “Chapter 26 Optimal Fiscal and Monetary Policy.” In Part 3 of Handbook of Macroeconomics, edited by John B. Taylor and Michael Woodford, vol. 1, 1671–1745. Elsevier.10.1016/S1574-0048(99)10039-9Search in Google Scholar

Chari, V. V., L. J. Christiano, and P. J. Kehoe. 1991. “Optimal Fiscal and Monetary Policy: Some Recent Results.” Journal of Money, Credit and Banking 23: 519–539.10.2307/1992686Search in Google Scholar

Chugh, S. K. 2006. “Optimal Fiscal and Monetary Policy with Sticky Wages and Sticky Prices.” Review of Economic Dynamics 9: 683–714.10.1016/j.red.2006.07.001Search in Google Scholar

Chugh, S. K. 2007. “Optimal Inflation Persistence: Ramsey Taxation with Capital and Habits.” Journal of Monetary Economics 54: 1809–1836.10.1016/j.jmoneco.2006.07.005Search in Google Scholar

Chugh, S. K. 2009. “Does the Timing of the Cash-in-advance Constraint Matter for Optimal Fiscal and Monetary Policy?” Macroeconomic Dynamics 13: 133–150.10.1017/S1365100509080158Search in Google Scholar

Cooper, R., and A. Johri. 2002. “Learning-by-doing and Aggregate Fluctuations.” Journal of Monetary Economics 49: 1539–1566.10.1016/S0304-3932(02)00180-0Search in Google Scholar

Darr, E. D., L. Argote, and D. Epple. 1995. “The Acquisition, Transfer, and Depreciation of Knowledge in Service Organizations: Productivity in Franchises.” Management Science 41: 1750–1762.10.1287/mnsc.41.11.1750Search in Google Scholar

Ericson, R., and A. Pakes. 1995. “Markov-perfect Industry Dynamics: A Framework for Empirical Work.” Review of Economic Studies 62: 53–82.10.2307/2297841Search in Google Scholar

Faia, E., and T. Monacelli. 2007. “Optimal Interest Rate Rules, Asset Prices, and Credit Frictions.” Journal of Economic Dynamics and Control 31: 3228–3254.10.1016/j.jedc.2006.11.006Search in Google Scholar

Gunn, C., and A. Johri. 2011. “News and Knowledge Capital.” Review of Economic Dynamics 14: 92–101.10.1016/j.red.2010.07.003Search in Google Scholar

Irwin, D. A., and P. J. Klenow. 1994. “Learning-by-doing Spillovers in the Semiconductor Industry.” Journal of Political Economy 102: 1200–1227.10.1086/261968Search in Google Scholar

Jarmin, R. S. 1994. “Learning by doing and Competition in the Early Rayon Industry.” The RAND Journal of Economics 25: 441–454.10.2307/2555771Search in Google Scholar

Johri, A. (2009) “Delivering Endogenous Inertia in Prices and Output.” Review of Economic Dynamics 12: 736–754.10.1016/j.red.2009.03.001Search in Google Scholar

Johri, A., and A. Lahiri. 2008. “Persistent Real Exchange Rates.” Journal of International Economics 76: 223–236.10.1016/j.jinteco.2008.07.003Search in Google Scholar

Johri, A., and B. Talukdar. 2011. “Organizational Capital and Optimal Ramsey Taxation.” Department of Economics Working Papers 2011-09. McMaster University.Search in Google Scholar

Lev, B., and S. Radhakrishnan. 2005. “The Valuation of Organization Capital.” In Measuring Capital in the New Economy, edited by Carol Corrado, John Haltiwanger and Dan Sichel, 73–110. National Bureau of Economic Research, Inc. NBER Chapters.10.7208/chicago/9780226116174.003.0004Search in Google Scholar

Lucas, R. E., and N. L. Stokey. 1983. “Optimal Fiscal and Monetary Policy in an Economy without Capital.” Journal of Monetary Economics 12: 55–93.10.1016/0304-3932(83)90049-1Search in Google Scholar

Prescott, E. C., and M. Visscher. 1980. “Organization Capital.” The Journal of Political Economy 88: 446–461.10.1086/260879Search in Google Scholar

Ramsey, F. P. 1927. “A Contribution to the Theory of Taxation.” The Economic Journal 37: 47–61.10.2307/2222721Search in Google Scholar

Rosen, S. 1972. “Learning by Experience as Joint Production.” The Quarterly Journal of Economics 86, 366–382.Search in Google Scholar

Rotemberg, J. J. 1982. “Sticky Prices in the United States.” Journal of Political Economy 90: 1187–1211.10.1086/261117Search in Google Scholar

Schmitt-Grohé, S., and M. Uribe. 2004a. “Optimal Fiscal and Monetary Policy Under Imperfect Competition.” Journal of Macroeconomics 26: 183–209.10.1016/j.jmacro.2003.11.002Search in Google Scholar

Schmitt-Grohé, S., and M. Uribe. 2004b. “Optimal Fiscal and Monetary Policy Under Sticky Prices.” Journal of Economic Theory 114: 198–230.10.1016/S0022-0531(03)00111-XSearch in Google Scholar

Schmitt-Grohé, S., and M. Uribe. 2004c. “Solving Dynamic General Equilibrium Models Using a Second-order Approximation to the Policy Function.” Journal of Economic Dynamics and Control 28: 755–775.10.1016/S0165-1889(03)00043-5Search in Google Scholar

Schmitt-Grohé, S., and M. Uribe. 2006. “Optimal Fiscal and Monetary Policy in a Medium-scale Macroeconomic Model.” Working Paper Series 612. European Central Bank.10.2139/ssrn.891011Search in Google Scholar

Schmitt-Grohé, S., and M. Uribe. 2007. “Optimal Simple and Implementable Monetary and Fiscal Rules.” Journal of Monetary Economics 54: 1702–1725.10.1016/j.jmoneco.2006.07.002Search in Google Scholar

Siu, H. E. 2004. “Optimal Fiscal and Monetary Policy with Sticky Prices.” Journal of Monetary Economics 51: 575–607.10.1016/j.jmoneco.2003.07.008Search in Google Scholar

Talukdar, B. 2013. “Learning-by-doing and Optimal Ramsey Interest Rate.” Manuscript, Saint Mary’s University.Search in Google Scholar

Talukdar, B. 2014. “Learning-by-doing, Intangible Capital and Optimal Markup Variations.” Manuscript, Saint Mary’s University.Search in Google Scholar

Thornton, R. A., and P. Thompson. 2001. “Learning from Experience and Learning from Others: An Exploration of Learning and Spillovers in Wartime Shipbuilding.” American Economic Review 91: 1350–1368.10.1257/aer.91.5.1350Search in Google Scholar

Woodford, M. D. 2003. Interest and Prices. Princeton, New Jersey: Princeton University Press.Search in Google Scholar

©2014 by De Gruyter

Articles in the same Issue

- Frontmatter

- Advances

- Optimal portfolios with wealth-varying risk aversion in the neoclassical growth model

- Inventories and the stockout constraint in general equilibrium

- Optimal second best taxation of addictive goods in dynamic general equilibrium: a revenue raising perspective

- Inflation effects on capital accumulation in a model with residential and non-residential assets

- Optimal capital-income taxation in a model with credit frictions

- Contributions

- Interest rate fluctuations and equilibrium in the housing market

- News shocks and learning-by-doing

- Capacity utilization and the effects of energy price increases in Japan

- Small-scale New Keynesian model features that can reproduce lead, lag and persistence patterns

- Optimal policy and Taylor rule cross-checking under parameter uncertainty

- The impact of American and British involvement in Afghanistan and Iraq on health spending, military spending and economic growth

- Why does natural resource abundance not always lead to better outcomes? Limited financial development versus political impatience

- The skill bias of technological change and the evolution of the skill premium in the US since 1970

- Aggregate impacts of recent US natural gas trends

- Organizational learning and optimal fiscal and monetary policy

- Industrial specialization, financial integration and international consumption risk sharing

- Leverage, investment, and optimal monetary policy

- Public debt in an OLG model with imperfect competition: long-run effects of austerity programs and changes in the growth rate

- Temporal aggregation and estimated monetary policy rules

- International transmission of productivity shocks with nonzero net foreign debt

- Did the euro change the effect of fundamentals on growth and uncertainty?

- Topics

- Real factor prices and factor-augmenting technical change

- Monetary policy and TIPS yields before the crisis

Articles in the same Issue

- Frontmatter

- Advances

- Optimal portfolios with wealth-varying risk aversion in the neoclassical growth model

- Inventories and the stockout constraint in general equilibrium

- Optimal second best taxation of addictive goods in dynamic general equilibrium: a revenue raising perspective

- Inflation effects on capital accumulation in a model with residential and non-residential assets

- Optimal capital-income taxation in a model with credit frictions

- Contributions

- Interest rate fluctuations and equilibrium in the housing market

- News shocks and learning-by-doing

- Capacity utilization and the effects of energy price increases in Japan

- Small-scale New Keynesian model features that can reproduce lead, lag and persistence patterns

- Optimal policy and Taylor rule cross-checking under parameter uncertainty

- The impact of American and British involvement in Afghanistan and Iraq on health spending, military spending and economic growth

- Why does natural resource abundance not always lead to better outcomes? Limited financial development versus political impatience

- The skill bias of technological change and the evolution of the skill premium in the US since 1970

- Aggregate impacts of recent US natural gas trends

- Organizational learning and optimal fiscal and monetary policy

- Industrial specialization, financial integration and international consumption risk sharing

- Leverage, investment, and optimal monetary policy

- Public debt in an OLG model with imperfect competition: long-run effects of austerity programs and changes in the growth rate

- Temporal aggregation and estimated monetary policy rules

- International transmission of productivity shocks with nonzero net foreign debt

- Did the euro change the effect of fundamentals on growth and uncertainty?

- Topics

- Real factor prices and factor-augmenting technical change

- Monetary policy and TIPS yields before the crisis