Abstract

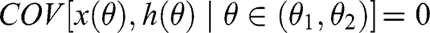

I study a monopolist who sells a signal to a consumer with a hidden type. The consumer uses this signal to obtain social status, defined as the expectation of the consumer’s type conditional on the signal. The monopolist must decide how accurately different types are revealed. When pooling subsets of types, she reduces social surplus, but extracts greater information rents. I derive the optimal mechanism by examining the covariance between the consumer’s type and his virtual marginal value of social status.

7 Appendix: Omitted proofs

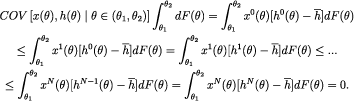

Proof of lemma 1. ( ) Let x be an arbitrary nondecreasing function, and let

) Let x be an arbitrary nondecreasing function, and let  . Define, recursively, for each n = 0, 1, 2, …, two functions,

. Define, recursively, for each n = 0, 1, 2, …, two functions,  , and three finite collections of intervals,

, and three finite collections of intervals,  ,

,  , and

, and  , as follows:

, as follows:

equals the collection of maximal intervals in (θ1, θ2) over which

equals the collection of maximal intervals in (θ1, θ2) over which  ordered so that

ordered so that  .

. equals the complementary set of maximal intervals in (θ1, θ2), also ordered so that

equals the complementary set of maximal intervals in (θ1, θ2), also ordered so that  .

.(Notice that the intervals in these two sets must alternate and, since h satisfies NC, the left-most interval must be

, and the right-most interval is an element of

, and the right-most interval is an element of  only when

only when  over such interval.)

over such interval.) , or

, or  if

if  is the right-most interval.

is the right-most interval.And, for every n ≥ 1 i, and

,

,

(Notice that every hn also satisfies NC.)

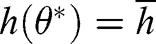

Since every step merges at least two intervals, there exists an n such that  , and therefore

, and therefore  . Let N be the smallest integer such that this holds. We now have

. Let N be the smallest integer such that this holds. We now have

( )Suppose condition NC is violated for some θ. Then, any “one-step”function x that has a constant value over (θ1, θ), and a higher constant value over [θ, θ2), has a positive covariance with h over (θ1, θ2). ■

)Suppose condition NC is violated for some θ. Then, any “one-step”function x that has a constant value over (θ1, θ), and a higher constant value over [θ, θ2), has a positive covariance with h over (θ1, θ2). ■

Proof of remark 3. Notice that the collection of all open intervals over which h is weakly decreasing satisfies conditions (a) and (b). Denote this collection  . Now, for each interval D ɛ

. Now, for each interval D ɛ  let P(D) be the largest open interval containing D while satisfying the condition NC. Notice that the collection {P(D): D ɛ

let P(D) be the largest open interval containing D while satisfying the condition NC. Notice that the collection {P(D): D ɛ  } satisfies the conditions (a)-(c).15

} satisfies the conditions (a)-(c).15

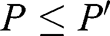

For uniqueness, suppose toward a contradiction that both  and

and  ′ ≠

′ ≠  satisfy (a)-(c). Since the complement of ∪

satisfy (a)-(c). Since the complement of ∪ P consists of intervals over which h is increasing, it cannot be the case that some P′ ≠

P consists of intervals over which h is increasing, it cannot be the case that some P′ ≠  ′ lies outside ∪

′ lies outside ∪ P, or vice versa (otherwise condition (b) would not hold). Therefore, there must exist a pair of intervals P ∈

P, or vice versa (otherwise condition (b) would not hold). Therefore, there must exist a pair of intervals P ∈  , and P′ ≠

, and P′ ≠  ′, such that P∩

′, such that P∩ ′ ≠ Ø, and P ≠

′ ≠ Ø, and P ≠  ′. Suppose without loss that

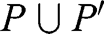

′. Suppose without loss that  . I now show that

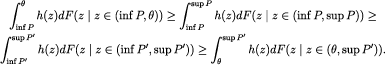

. I now show that  satisfies condition NC, a contradiction to (c). Let θ ɛ P ∪ P′. We have two cases to consider, according to whether or not θ ɛ P ∩ P′. Suppose first that θ ɛ P ∩ P′. From condition (b), applied to both P and P′, one obtains the desired inequality:

satisfies condition NC, a contradiction to (c). Let θ ɛ P ∪ P′. We have two cases to consider, according to whether or not θ ɛ P ∩ P′. Suppose first that θ ɛ P ∩ P′. From condition (b), applied to both P and P′, one obtains the desired inequality:

The case in which θ ∉ P ∩ P′ is similar, and left to the reader.

Finally, the claim that all intervals in  are disjoint and never adjacent follows from the same reasoning as above, namely, the union of two intervals in

are disjoint and never adjacent follows from the same reasoning as above, namely, the union of two intervals in  that intersect, or are adjacent, also satisfies NC, a contradiction to (c). ■

that intersect, or are adjacent, also satisfies NC, a contradiction to (c). ■

Proof of theorem 1. Suppose  is non-empty, otherwise the theorem follows from proposition 1. Let

is non-empty, otherwise the theorem follows from proposition 1. Let  denote the collection of maximal intervals complementary to

denote the collection of maximal intervals complementary to  , i.e., the largest intervals in

, i.e., the largest intervals in  , and let

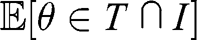

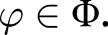

, and let  (which constitutes a partition of [θL, θH]). Also let Φ denote the set of truthful filters

(which constitutes a partition of [θL, θH]). Also let Φ denote the set of truthful filters  satisfying the following condition:

for every P ∈

satisfying the following condition:

for every P ∈ , θ ∈ P, and θ′ ∉ cl (P) φ is such that φ(θ) φ(θ′).

, θ ∈ P, and θ′ ∉ cl (P) φ is such that φ(θ) φ(θ′).

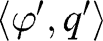

I proceed in two steps. I first show that every truthful filter φ′ outside Φ is dominated by some truthful filter within this set, and then show that the truthful filter φ* in the theorem, which belongs to Φ, weakly dominates every other member of Φ.

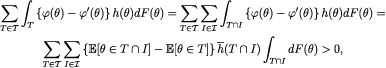

Let φ′∉Φ, and suppose it maximally pools a collection of intervals  . Now suppose one replaces

. Now suppose one replaces  with

with  , which, instead, maximally pools the collection of smaller intervals

, which, instead, maximally pools the collection of smaller intervals  ∩

∩ : (T∩I)T∈

: (T∩I)T∈ ,I∈

,I∈ and is otherwise equal to θ. Notice that

and is otherwise equal to θ. Notice that  belongs to

belongs to  Also, from the properties of

Also, from the properties of , for every T∈

, for every T∈ , both the average

, both the average  and the expectation

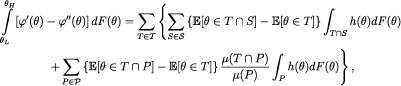

and the expectation  must be increasing in I. The change in the objective is given by

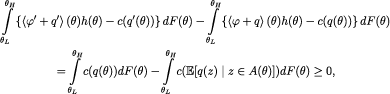

must be increasing in I. The change in the objective is given by

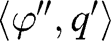

where the inequality follows from the fact that each term in the outside sum, which is proportional to the covariance between  and

and  across intervals I, is always non-negative, and any term in this sum becomes positive whenever T intersects more than one interval I with positive probability (which must occur for at least one interval T ∈

across intervals I, is always non-negative, and any term in this sum becomes positive whenever T intersects more than one interval I with positive probability (which must occur for at least one interval T ∈  This concludes the first step of the proof.

This concludes the first step of the proof.

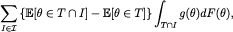

For the second step, let  be any element of other

be any element of other  than

than  . We can write

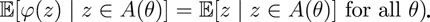

. We can write

![[6]](/document/doi/10.1515/bejte-2012-0003/asset/graphic/bejte-2012-0003_eq34.png)

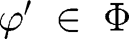

Consider the first sum. Since  , it follows that, for every P ∈

, it follows that, for every P ∈  ,

,  , and therefore each term in the sum is proportional to

, and therefore each term in the sum is proportional to

But, from lemma 1, this quantity is non-negative.

Consider now the second sum. Notice that, for any S ∈  , the problem of maximizing the integral

, the problem of maximizing the integral  , subject to

, subject to  , is identical to the original problem [I] with [θL, θH] = S. From proposition 1, this problem is solved by setting φ′(θ) = θ for all θ ∈ S As a result, each term in this second sum is also non-negative. ■

, is identical to the original problem [I] with [θL, θH] = S. From proposition 1, this problem is solved by setting φ′(θ) = θ for all θ ∈ S As a result, each term in this second sum is also non-negative. ■

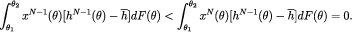

Proof of lemma 2. Let P = (θ1,θ2) ∈  , and suppose x is non-constant and nondecreasing. Also, let

, and suppose x is non-constant and nondecreasing. Also, let  be such that either

be such that either  for all

for all  , or x(θ)≥(<)x(θ)* for all

, or x(θ)≥(<)x(θ)* for all  .

.

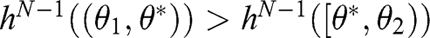

Suppose towards a contradiction that  From the algorithm in the proof of lemma 1, this requires that, for every

From the algorithm in the proof of lemma 1, this requires that, for every  is constant over

is constant over  for all i. Therefore,

for all i. Therefore,  for some

for some  and as a result

and as a result  This implies in turn that xn is non-constant over (θ1, θ2) for all

This implies in turn that xn is non-constant over (θ1, θ2) for all  . So that, in particular, xN−1 is non-constant over

. So that, in particular, xN−1 is non-constant over  , and

, and  implying that

implying that  and

and  . From the latter equalities

. From the latter equalities  for all θ<θ*, and

for all θ<θ*, and  for all θ<θ* for all

for all θ<θ* for all  . But, since h is generic, and

. But, since h is generic, and  , the boundary conditions for (θ1,θ2)∈

, the boundary conditions for (θ1,θ2)∈  imply that the first expectation must be larger than the second, i.e.,

imply that the first expectation must be larger than the second, i.e.,  . By combining this with the fact that xN−1 is non-constant, one obtains a strict inequality in the final step of the algorithm, which is a contradiction:

. By combining this with the fact that xN−1 is non-constant, one obtains a strict inequality in the final step of the algorithm, which is a contradiction:

■

Proof of Corollary 1. Consider the proof of theorem 1 for a generic h. By invoking lemma 2, at least one of the summations in [6] must be positive when  and

and  differ over a positive-measure subset. It follows that when a given truthful filter

differ over a positive-measure subset. It follows that when a given truthful filter  differs from

differs from  over a positive-measure subset, it is dominated by

over a positive-measure subset, it is dominated by  whether or not

whether or not  . ■

. ■

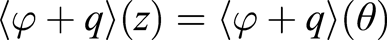

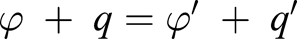

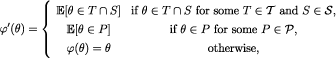

Proof of lemma 3. Suppose φ, q satisfy constraints [3] and [4]. I show that there exist schedules  , with

, with  a truthful filter, that satisfy constraints [3] and [4] and deliver profits weakly higher than

a truthful filter, that satisfy constraints [3] and [4] and deliver profits weakly higher than  . For any given type θ, let A(θ) denote the largest type interval (possibly a singleton) such that

. For any given type θ, let A(θ) denote the largest type interval (possibly a singleton) such that  for every

for every  , and set

, and set

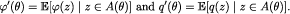

By construction, the new schedules  satisfy constraints [3] and [4], and

satisfy constraints [3] and [4], and  is a truthful filter (indeed,

is a truthful filter (indeed,  and [

and [ for all θ. Moreover, if one replaces

for all θ. Moreover, if one replaces  with

with  profits change by

profits change by

where the inequality follows from the convexity of c. ■

Proof of lemma 5. Consider schedules φ, q satisfying the constraints in problem [III], such that q satisfies lemma 4, but is not constant over some P ∈  . I consider a specific change in this schedule, resulting in a new schedule

. I consider a specific change in this schedule, resulting in a new schedule  , such that q′ is constant over every interval in

, such that q′ is constant over every interval in  , and then show that this change is weakly profitable.

, and then show that this change is weakly profitable.

Let  denote the collection of intervals T over which

denote the collection of intervals T over which  is constant. Suppose the new schedule

is constant. Suppose the new schedule  satisfies

satisfies

and q′ satisfies

Notice that these new schedules satisfy all the constraints in problem [III].

Consider now the change in the objective. In order to measure this change, it is useful to decompose the shift from  to

to  into a shift from

into a shift from  to an intermediate regime

to an intermediate regime  , plus a shift from

, plus a shift from  to

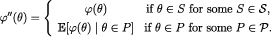

to  . Define the intermediate schedule φ″ as follows:

. Define the intermediate schedule φ″ as follows:

In other words, the intermediate regime  is equal to the original one,

is equal to the original one,  , except for the fact that, within each interval in

, except for the fact that, within each interval in  , both

, both  and q are replaced with their expected values. (

and q are replaced with their expected values. ( need not satisfy the constraints as it is only a device for calculating profits.)

need not satisfy the constraints as it is only a device for calculating profits.)

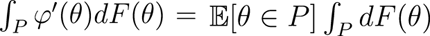

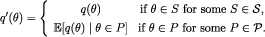

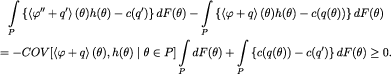

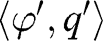

Consider first the change in the objective when shifting from  to

to  . This change only affects the intervals in

. This change only affects the intervals in  . For each P ∈

. For each P ∈  , the change is equal to

, the change is equal to

The inequality follows because both terms on the right are non-negative: The first term

is non-negative because  is nondecreasing and h satisfies condition NC over P (lemma 1). The second term is non-negative because c is convex.

is nondecreasing and h satisfies condition NC over P (lemma 1). The second term is non-negative because c is convex.

Consider now the change in the objective when shifting from  to

to  . After some algebra, this change is given by

. After some algebra, this change is given by

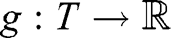

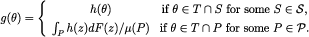

where μ(A) := ∫AdF (θ). Every term in this sum is non-negative. To see this, fix T ∈  and define a new function

and define a new function  such that

such that

Notice from the boundary conditions for the intervals in  that g(θ) is nondecreasing. Each term in brackets in the above sum over intervals T ∈

that g(θ) is nondecreasing. Each term in brackets in the above sum over intervals T ∈  can now be written as

can now be written as

which is proportional to the covariance between  and

and  across intervals I ∈

across intervals I ∈ , and is therefore non-negative. ■

, and is therefore non-negative. ■

Acknowledgments

I am grateful to my Ph.D. advisor Douglas Bernheim for generously guiding this project. I am also grateful to my Ph.D. advisor Jonathan Levin for offering valuable suggestions. (Any errors are my own.) I wish to thank Roger Myerson, Alessandro Pavan, Lars Stole, my editors Armin Schmutzler and Joel Watson, seminar participants at Stanford University, participants at the 2nd Duke-Northwestern-Texas IO Conference, and three anonymous referees for their insightful comments. I gratefully acknowledge financial support from the University of Chicago Booth School of Business, the University of Utah David Eccles School of Business, and the LSE Department of Management.

References

Bagwell, Laurie Simon, and B. Douglas Bernheim. 1996. “Veblen Effects in a Theory of Conspicuous Consumption.” American Economic Review86(3):349–73.Search in Google Scholar

Banks, JeffreyS., and Joel Sobel. 1987. “Equilibrium Selection in Signaling Games.” Econometrica55(3):647–61.10.2307/1913604Search in Google Scholar

Becker, GaryS., and KevinM. Murphy. 2000. Social Economics: Market Behavior in a Social Environment. Cambridge: Harvard University Press.10.4159/9780674020641Search in Google Scholar

Becker, GaryS., KevinM., Murphy, and EdwardL. Glaeser. 2000. “Social Markets and the Escalation of Quality: The World of Veblen Revisited.” in Becker, GaryS., and Murphy, KevinM. (2000).Search in Google Scholar

Bergemann, Dirk, and Martin Pesendorfer. 2007. “Information Structures in Optimal Auctions.” Journal of Economic Theory137(1):580–609.10.1016/j.jet.2007.02.001Search in Google Scholar

Bernheim, B. Douglas. 1994. “A Theory of Conformity.” Journal of Political Economy102(5):841–77.10.1086/261957Search in Google Scholar

Board, Simon. 2009. “Monopolistic Group Design with Peer Effects.” Theoretical Economics4(1):89–125.Search in Google Scholar

Cho, In-Koo, and DavidM. Kreps. 1987. “Signaling Games and Stable Equilibria.” Quarterly Journal of Economics102(2):179–221.10.2307/1885060Search in Google Scholar

Cho, In-Koo, and Joel Sobel. 1990. “Strategic Stability and Uniqueness in Signaling Games.” Journal of Economic Theory50(2):381–413.10.1016/0022-0531(90)90009-9Search in Google Scholar

Damiano, Ettore, and Hao Li. 2007. “Price Discrimination and Efficient Matching.” Economic Theory30(2):243–63.10.1007/s00199-005-0058-2Search in Google Scholar

Damiano, Ettore, and Hao Li. 2008. “Competing Matchmaking.” Journal of the European Economic Association6(4):789–818.10.1162/JEEA.2008.6.4.789Search in Google Scholar

Daughety, AndrewF., and JenniferF. Reinganum. 2010. “Public Goods, Social Pressure, and the Choice Between Privacy and Publicity.” American Economic Journal: Microeconomics2(2):191–221.10.1257/mic.2.2.191Search in Google Scholar

Diaz-Diaz, Miguel, and Luis Rayo. 2012. “Conspicuous Consumption with Imperfect Competition.” mimeo, Central Bank of Mexico and LSE.Search in Google Scholar

Fudenberg, Drew, and Jean Tirole. 2000. Game Theory. Cambridge: MIT Press.Search in Google Scholar

Glazer, Amihai, and KaiA. Konrad. 1996. “A Signaling Explanation for Charity.” American Economic Review86(4):1019–28.Search in Google Scholar

Gomes, Renato, and Alessandro Pavan. 2011. “Price Discrimination in Many-to-Many Matching Markets.” mimeo, Toulouse School of Economics and Northwestern University.Search in Google Scholar

Guesnerie, Roger, and Jean-Jacques Laffont. 1984. “A Complete Solution to a Class of Principal-Agent Problems with an Application to the Control of a Self-Managed Firm.” Journal of Public Economics25(3):329–69.10.1016/0047-2727(84)90060-4Search in Google Scholar

Harbaugh, WilliamT. 1998. “What do Donations Buy? A Model of Philanthropy Based on Prestige and Warm Glow.” Journal of Public Economics67(2):269–84.10.1016/S0047-2727(97)00062-5Search in Google Scholar

Hoppe, HeidrunC., Benny Moldovanu, and Emre Ozdenoren. 2011. “Coarse Matching with Incomplete Information.” Economic Theory47(1):75–104.10.1007/s00199-009-0514-5Search in Google Scholar

Lizzeri, Alessandro. 1999. “Information Revelation and Certification Intermediaries.” Rand Journal of Economics30(2):214–31.10.2307/2556078Search in Google Scholar

Maskin, Eric, and John Riley. 1984. “Monopoly with Incomplete Information.” Rand Journal of Economics15(2):171–96.10.2307/2555674Search in Google Scholar

Milgrom, Paul, and Ilya Segal. 2002. “Envelope Theorems for Arbitrary Choice Sets.” Econometrica70(2):583–601.10.1111/1468-0262.00296Search in Google Scholar

Moldovanu, Benny, Aner Sela, and Xianwen Shi. 2007. “Contests for Status.” Journal of Political Economy115(2):338–63.10.1086/518010Search in Google Scholar

Mussa, Michael, and Sherwin Rosen. 1978. “Monopoly and Product Quality.” Journal of Economic Theory18(2):301–17.10.1016/0022-0531(78)90085-6Search in Google Scholar

Myerson, RogerB. 1981. “Optimal Auction Design.” Mathematics of Operations Research6(1):58–73.10.1287/moor.6.1.58Search in Google Scholar

Pesendorfer, Wolfgang. 1995. “Design Innovation and Fashion Cycles.” American Economic Review85(4):771–92.Search in Google Scholar

Ramey, Garey. 1996. “D1 Signaling Equilibria with Multiple Signals and a Continuum of Types.” Journal of Economic Theory69(2):508–31.10.1006/jeth.1996.0066Search in Google Scholar

Rayo, Luis, and Ilya Segal. 2010. “Optimal Information Disclosure.” Journal of Political Economy118(5):949–987.10.1086/657922Search in Google Scholar

Veblen, ThorsteinB. 1899. The Theory of the Leisure Class: An Economic Study of Institutions. London: Unwin Books.Search in Google Scholar

Vikander, NickE. 2010. “Targeted Advertising and Social Status.” Tinbergen Institute Discussion Paper 11–016/1.10.2139/ssrn.1747664Search in Google Scholar

Zubrickas, Robertas. 2012. “Optimal Grading.” mimeo, University of Zurich.10.2139/ssrn.989322Search in Google Scholar

- †

This paper is a revised version of chapter 3 of my Ph.D. dissertation.

- 1

fn 3 provides an example of such a model.

- 2

In principle, there may exist multiple valid versions of the above conditional expectation, all of which coincide over a full measure subset of Θ. I focus on the standard version in which

whenever the monopolist sells signal s to type θ′ only.

whenever the monopolist sells signal s to type θ′ only. - 3

The following setting, borrowed from Rayo and Segal (2010), delivers the above reduced-form preferences. After observing the consumer’s signal s, the social contact must either “accept” or “reject” the consumer. Acceptance is worth υ(θ) to the consumer and θ – r to the social contact, where r is an outside option drawn from a uniform distribution over Θ. If Θ is normalized to [0, 1], the probability of acceptance is

.

. - 4

Note that the second term in h vanishes as θ → θH and F (θ) → 1.

- 5

Note that υ′(0) does not exist when α< 1. Theorem 1 remains valid, however, because υ′(θ) is well defined for all other types.

- 6

One can only hope for uniqueness almost-everywhere because profits are not affected by whether the boundary points of the intervals in

are included or not in the pools.

are included or not in the pools. - 7

For a formal definition of D1 equilibria for a continuum of types, see Ramey (1996).

- 8

D1 is a stronger requirement than the “Intuitive Criterion” (Cho and Kreps 1987). Unfortunately, the Intuitive Criterion does not guarantee a unique equilibrium when the sender has more than two types (see, for example, Fudenberg and Tirole 2000).

- 9

If Lizzeri’s monopolist could charge a report-contingent price, but could not verify the seller’s type directly or use stochastic disclosure rules, his setting would be the same as the present one (with his sellerin the place of my consumer) except for a crucial difference: his seller’s preferences are not single-crossing (namely,

. In this case, one can see from problem (I) (Section 2.1) that the monopolist would obtain the same expected profits,

. In this case, one can see from problem (I) (Section 2.1) that the monopolist would obtain the same expected profits,  , under any truthful filter.

, under any truthful filter. - 10

Damiano and Li (2008) study the case of competition across matchmakers. Hoppe, Moldovanu, and Ozdenoren (2011) study the value of course matching schemes.

- 11

In other words, our papers intersect only when the two populations in Damiano and Li (2007) have identical distributions, utility is linear, and virtual values are monotone, in which case both models are identical and deliver perfect sorting. Another difference between the two papers is methodological. Damiano and Li use properties of supermodular functions to obtain a suffcient condition for perfect sorting, and local variations in the matching schedule to obtain a necessary condition. In contrast, I focus on the overall covariance structure between virtual marginal values and consumer types to find optimal pooling regions.

- 12

Diaz-Diaz and Rayo (2012) study the intermediate case of imperfect competition. They find excessive quality consumption and “Veblen effects:” goods with identical intrinsic quality sold at different prices. Daughety and Reinganum (2010) study private provision of public goods when consumers have a status motive and Vikander (2010) studies advertising when a status motive is also present. Glazer and Konrad (1996) argue that signaling wealth is a primary motivation behind charitable contributions.

- 13

The two papers also differ in their methodology. I use optimal nonlinear pricing methods, whereas Moldovanu et al. use methods of optimal contest design.

- 14

The Stanford Fund, 1998–99, gsbwww.uchicago.edu/campaign, 01/2003. See Harbaugh (1998) for further discussion of charitable donations.

- 15

Notice also that we might have P (D) = P (D′) for two different intervals D, D′ ∈

.

.

©2013 by Walter de Gruyter Berlin / Boston

Articles in the same Issue

- Masthead

- Masthead

- Advances

- Dependence and Uniqueness in Bayesian Games

- Monopolistic Signal Provision†

- Multi-task Research and Research Joint Ventures

- Transparent Restrictions on Beliefs and Forward-Induction Reasoning in Games with Asymmetric Information

- A Simple Bargaining Procedure for the Myerson Value

- On the Difference between Social and Private Goods

- Optimal Use of Rewards as Commitment Device When Bidding Is Costly

- Labor Market and Search through Personal Contacts

- Contributions

- Learning, Words and Actions: Experimental Evidence on Coordination-Improving Information

- Are Trust and Reciprocity Related within Individuals?

- Optimal Contracting Model in a Social Environment and Trust-Related Psychological Costs

- Contract Bargaining with a Risk-Averse Agent

- Academia or the Private Sector? Sorting of Agents into Institutions and an Outside Sector

- Topics

- Poverty Orderings with Asymmetric Attributes

- Dictatorial Mechanisms in Constrained Combinatorial Auctions

- When Should a Monopolist Improve Quality in a Network Industry?

- On Partially Honest Nash Implementation in Private Good Economies with Restricted Domains: A Sufficient Condition

- Revenue Comparison in Asymmetric Auctions with Discrete Valuations

Articles in the same Issue

- Masthead

- Masthead

- Advances

- Dependence and Uniqueness in Bayesian Games

- Monopolistic Signal Provision†

- Multi-task Research and Research Joint Ventures

- Transparent Restrictions on Beliefs and Forward-Induction Reasoning in Games with Asymmetric Information

- A Simple Bargaining Procedure for the Myerson Value

- On the Difference between Social and Private Goods

- Optimal Use of Rewards as Commitment Device When Bidding Is Costly

- Labor Market and Search through Personal Contacts

- Contributions

- Learning, Words and Actions: Experimental Evidence on Coordination-Improving Information

- Are Trust and Reciprocity Related within Individuals?

- Optimal Contracting Model in a Social Environment and Trust-Related Psychological Costs

- Contract Bargaining with a Risk-Averse Agent

- Academia or the Private Sector? Sorting of Agents into Institutions and an Outside Sector

- Topics

- Poverty Orderings with Asymmetric Attributes

- Dictatorial Mechanisms in Constrained Combinatorial Auctions

- When Should a Monopolist Improve Quality in a Network Industry?

- On Partially Honest Nash Implementation in Private Good Economies with Restricted Domains: A Sufficient Condition

- Revenue Comparison in Asymmetric Auctions with Discrete Valuations