Abstract

This study empirically applies de Soto’s representative property system to Colonial Korea, based on the theoretical approach of Han’s 2020 work. The number of property registrations increased drastically after the completion of the Land Survey Project in 1918, along with the mortgage count and bank loan balance. Structural change tests confirm this observation, and Johansen cointegration tests show that property registration, mortgage, bank loan, and gross domestic product are cointegrated with each other. One-way causality/exogeneity is revealed from property registration, mortgage, and bank loans to GDP by Granger, vector error correction model, and impulse response function models, with the role of mortgage standing out. These findings support the hypothesis that a representative property system established in the 1920s in Colonial Korea has paved the way for an economic take-off of Korea (South) over the course of the next several decades.

1 Introduction

One of the persistent challenges in development economics is the limited number of countries that have successfully achieved advanced economies since World War II. Meanwhile, numerous developing economies and countries in the Third World continue to struggle with economic take-off and surpassing the “hard ceiling” (Morris, 2010, p. 393) imposed by “ecological constraints” (Marks, 2015, p. 40). Traditional growth models predicted a scenario of general economic modernization based on factor scarcity and marginal factor productivity, aiming for a “catch-up” effect. However, despite 250 years since the initial Industrial Revolution in the late eighteenth century and 75 years of global decolonization after World War II, the persistent dichotomy between developed and developing economies shows limited signs of convergence, despite notable recent growth rates in countries such as India, Vietnam, Uzbekistan, or Tanzania.

Among the former colonies, only the Four Tigers in East Asia have successfully transitioned to the First World, while other countries that were once considered leading candidates have faced prolonged periods of economic stagnation. Russia, East Europe, and the Ottoman Turks (Turkey) were historical competitors to the West. India, a traditional economic superpower spanning centuries and connecting China and Europe, began its industrialization in the nineteenth century even under British colonial rule. Iran (Persia) and Thailand (Siam) managed to maintain their independence and were recognized as regional powers. Malaysia, Myanmar, and Vietnam, though experiencing colonial rule, flourished through their engagement in the Maritime Silk Road since the sixteenth century, where “a half dozen trade-dependent cities counted around 100,000 inhabitants plus a large number of seasonal and annual visitors, (…) and within these cities, such institutions as bottomry, profit-sharing, and lending for interest were well established” (Frank, 1998, p. 104). Latin America inherited European institutions and culture, embarking on industrialization in the nineteenth century.

Why have these countries not achieved economic success? Their historical data, as shown in Table 1, were better than Korea (South), which ranked twenty-seventh in terms of GDP per capita worldwide in 2019 (excluding small nations) and had the fourth-highest average net income within the OECD at 44,892 USD in 2018.[1] This issue is ultimately connected to the question of economic take-off itself and the ongoing debates regarding the factors that drove the British economy during the Industrial Revolution. In this context, this article adopts an institutionalist approach, drawing upon the theoretical frameworks of Besley and Ghatak (2010), de Soto (2000), Hodgson (2017), and Ogilvie and Carus (2014), to investigate the role of property rights in the industrialization of Korea. Han (2020) proposed that the Land Survey Project (1910–1918) in Colonial Korea by the Japanese Colonial Government served as a critical moment for the transition to the “representative property system” advocated by de Soto (2000), triggering the economic take-off. This article aims to examine the empirical significance of Han (2020) by surveying property registration and relevant activities in Korean economic growth.

Real GDP per capita 1820 and 1870 (2011 USD)

| Year | India | Egypt | Malaysia | Poland | Turkey | Thailand | Iran | Argentina | Korea |

|---|---|---|---|---|---|---|---|---|---|

| 1820 | 937 | 936 | 961 | 818 | 974 | 909 | 877 | 1591 | 816 |

| 1870 | 850 | 1195 | 1055 | 1575 | 1009 | 969 | 956 | 2300 | 820 |

Source: Maddison Project; https://www.rug.nl/ggdc/historicaldevelopment/maddison.

The subsequent section presents the development of property registration and relevant economic activities in Colonial Korea, building upon the scheme of institutional approaches to property rights and its empirical studies. The third section provides the econometric results, followed by the conclusion.

2 Property Registration in Colonial Korea

2.1 Property System as the Institutional Trigger for the Economic Take-Off

The institutional approach of Ogilvie and Carus (2014) offers an explanation of the economic take-off, specifically the Industrial Revolution, by examining general, non-particularized public order institutions characterized by open access. A crucial element of this approach is the presence of well-defined, private, and secure property rights that enable ownership, use, and transfer, supported by effective contracting institutions. Ogilvie and Carus (2014) compared various aspects of property rights and other institutions in England, such as strong parliaments, socioeconomic groups like guilds, labor and credit markets, infrastructure, demography and marriage patterns, education as human capital investment, and the presence of serfdom, with its competitors at the time, such as France, Netherlands, Sweden, Spain, and Germany, concluding that only England was supposed to be equipped with open access to general public order institutions and property rights. So, the institutionalist approach provides insights into how property rights and growth-favoring institutions can contribute to an economic take-off. However, it leaves unanswered the question of why the majority of world economies, approximately 5/6 of them, have still not achieved sustained economic take-off even after 250 years since the initial take-off, whereas the dropped competitors of that time managed to overcome their institutional blind spots and join the ranks of economic take-off decades later.

de Soto (2000) presented a paradigm of the representative property system that aimed to illustrate how the “property” of pre-modern economies could be transformed into the “capital” of modernity, shedding light on the chronic underdevelopment in the Third World.[2] This transformation involves two key elements: technical and institutional. The technical elements encompass cadastral measurements and infrastructures such as roads, electric cables, and water systems. The institutional elements involve property registration and civil procedures in the modern sense. The transformation process requires the conversion of property from the “biological old regime,” which primarily consists of real estate, into capital through legal transactions such as rent, collateral pledging, allotment, auction, trust formation, securitization, and open, objective, standardized, and anonymous economic activities like investment, financing, development, leasing, real estate investment trusts, appraisal, financial funding, asset division, and securities issuance. The failure to achieve this transformation can help explain the phenomenon of the “middle-income trap” observed in developing economies and the recurring challenges hindering their economic take-off in the Third World.

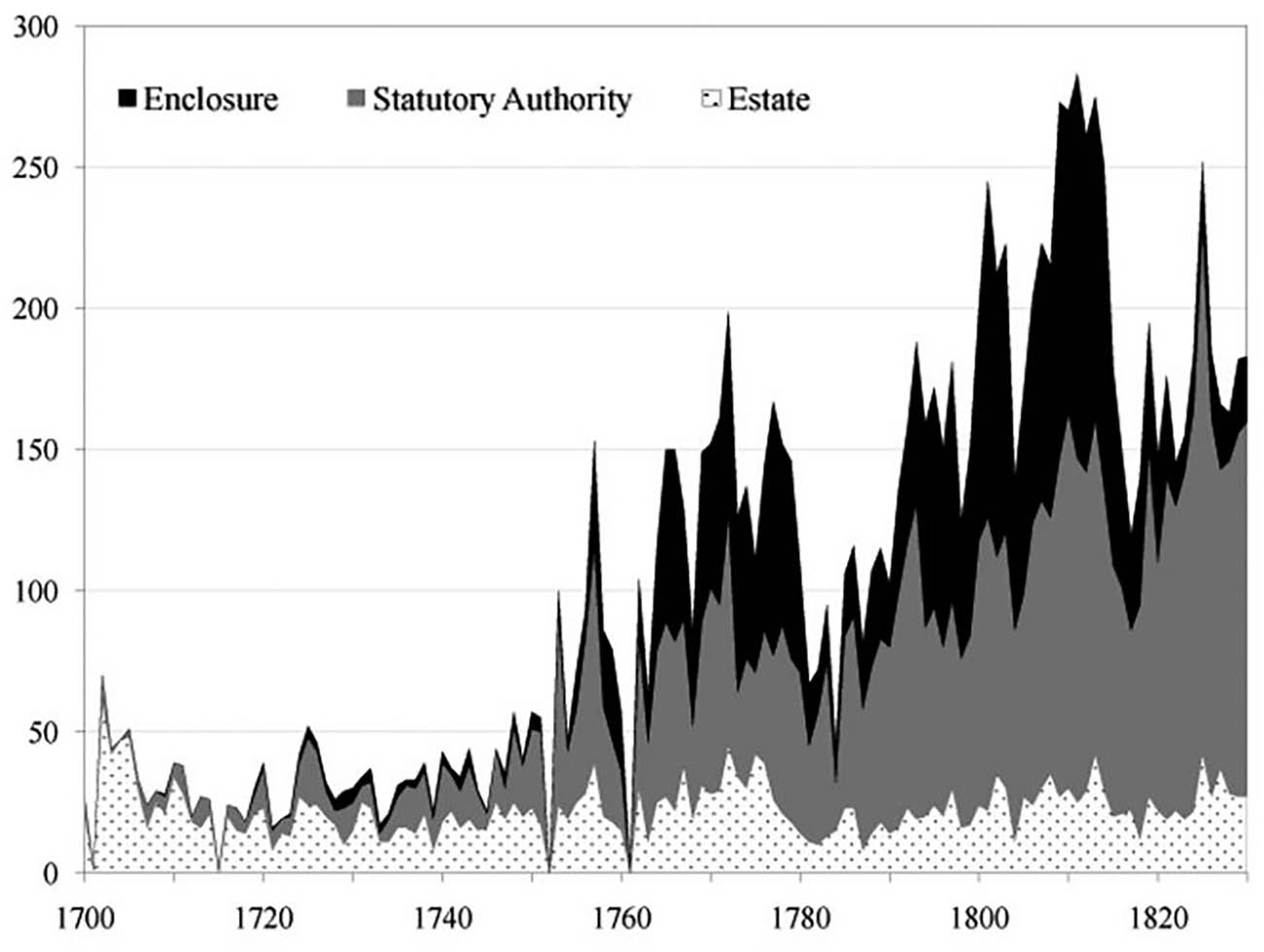

de Soto (2000) referred to the “mystery of capital,” which Hodgson (2017, p. 101) describes as the “missing causal link.” Hodgson, after synthesizing the literature on the British Industrial Revolution, categorized the institutional characteristics of economic take-off as “collateralizable property, a financial system enabling saleable debt and credit creation, and state administration power.” In his detailed analysis of the role and significance of property rights in the economic take-off, Hodgson (2017, p. 84) concluded that even England, which had been equipped with “secure property rights” since the thirteenth century, had to address the “feudal nature of landed rights,” including entails and commons, to render land “saleable and usable as collateral.” While traditional and feudal property rights in England were “reasonably secure,” they necessitated a process of “reform” to facilitate support for investment and entrepreneurship. This process of land reform, which coincided with the financial revolution of the eighteenth century, can be observed in Figure 1, which illustrates the increasing number of parliamentary acts reorganizing landed property rights between 1700 and 1830.

Number of UK acts reorganizing property rights 1700–1830. Source: Bogart and Richardson (2011, p. 250).

Over 5,200 acts were passed between 1750 and 1830, involving up to 6.8 million acres, around 21% of England’s surface area (Hoppit, 2011, p. 100). Reorganized landed property served as collateral, as well as a means of liquidation, for financing investments in infrastructure and industry.

Hodgson’s (2017) concept of the “administrative revolution” in UK history seems to correspond to the “developmental states” scheme of Eckert (1991), Johnson (1982), and Kohli (1994) explaining economic growth in Japan and Korea. Yet, contrary to England where collateralizing land initiated the building of roads, railways, and canals as a means to “make money,” the governments of Japan and Korea took the lead in financing most infrastructure investments. The “financial revolution” in Korea was rapidly and coercively injected by the Government General around 1910, contrasting with the English experience, characterized as “a protracted affair, lasting decades,” but was established quite effectively due to the “administration power” of the Japanese Colonial Government.

Empirical studies on the general institutional paradigm, mostly on the microeconomic level, have a long history and are still ongoing, as shown by Ogilvie and Carus (2014). Acemoglu et al. (2001) and Acemoglu and Johnson (2005) introduced the macroeconomic cross-country empirical research with international comparisons, representing pioneering empirical studies on economic growth and property rights, but they were criticized for not overcoming the different institutional backgrounds of property rights in different countries and for not embodying a convincing property rights model because the key factor of property rights was treated by instrument variables as the settler’s mortality (Pande & Udry, 2005, p. 8).

Several studies have empirically tested the significance of the de Soto (2000) model using microeconomic data. Field (2005, 2007) reported that property titles issued in Peru from 1996 until 2003 led to a significant increase in labor supply, as households shifted from house-protecting labor to participation in the labor market, as well as an increase in residential investments. However, it did not have a significant impact on collateral credit. Field and Torero (2006) found that property titles were associated with higher approval rates for public-sector loans but did not have a significant effect on private-sector loans, indicating that titled properties received lower interest rates than untitled properties. Wang (2012) argued that property titling of official housing in China since the 1980s reform and opening up enabled substantial financing of entrepreneurial ventures using property collateral. Galiani and Schargrodsky (2010) examined the effects of property titling on urban slums in Buenos Aires, Argentina, since the 1980s, which presented a unique natural experiment due to legal disputes by original owners. They found significant effects of property titling on home investment, household size, and child education, but no significant impact on credit access. While these studies utilized microeconomic data from specific local regions, the de Soto (2000) paradigm focuses on the long-run macroeconomic process towards modernity, encompassing the entire scale of a national economy. So new methodological challenges to test the de Soto model on the macroeconomic plane are to come.

As the first step to examine the macroeconomic effect of the de Soto model empirically, this study analyzes the development of real estate registration and relevant activities in Colonial Korea, thereafter building some econometric models.

2.2 Property Registration and Related Activities 1908–1943 in Colonial Korea

The real estate registration statistics in the “Statistics Annual of Government General Chosun (Korea)” do not begin with the Japanese annexation in 1910 but rather from 1907, during the times of the Japanese Residency General (1905–1909). However, the “Essential Report to Real Estate Law” (1909), published by the “Research Commission for Real Estate Law” established in 1906, concluded that “entire land institutions, including the taxation system, in Korea were in disorder.” Therefore, the recorded real estate registration cases of 4,158 in the chaotic period of 1907, according to the old registration system, raise doubts, especially considering that it is higher than the real estate registration cases of 2,546 in 1913. Additionally, ship registration was integrated with building registration until 1909, indicating that reliable data may only be available from 1910 onwards.

2.2.1 Real Estate Registration (Total; Cases and Pieces 1907–1943)

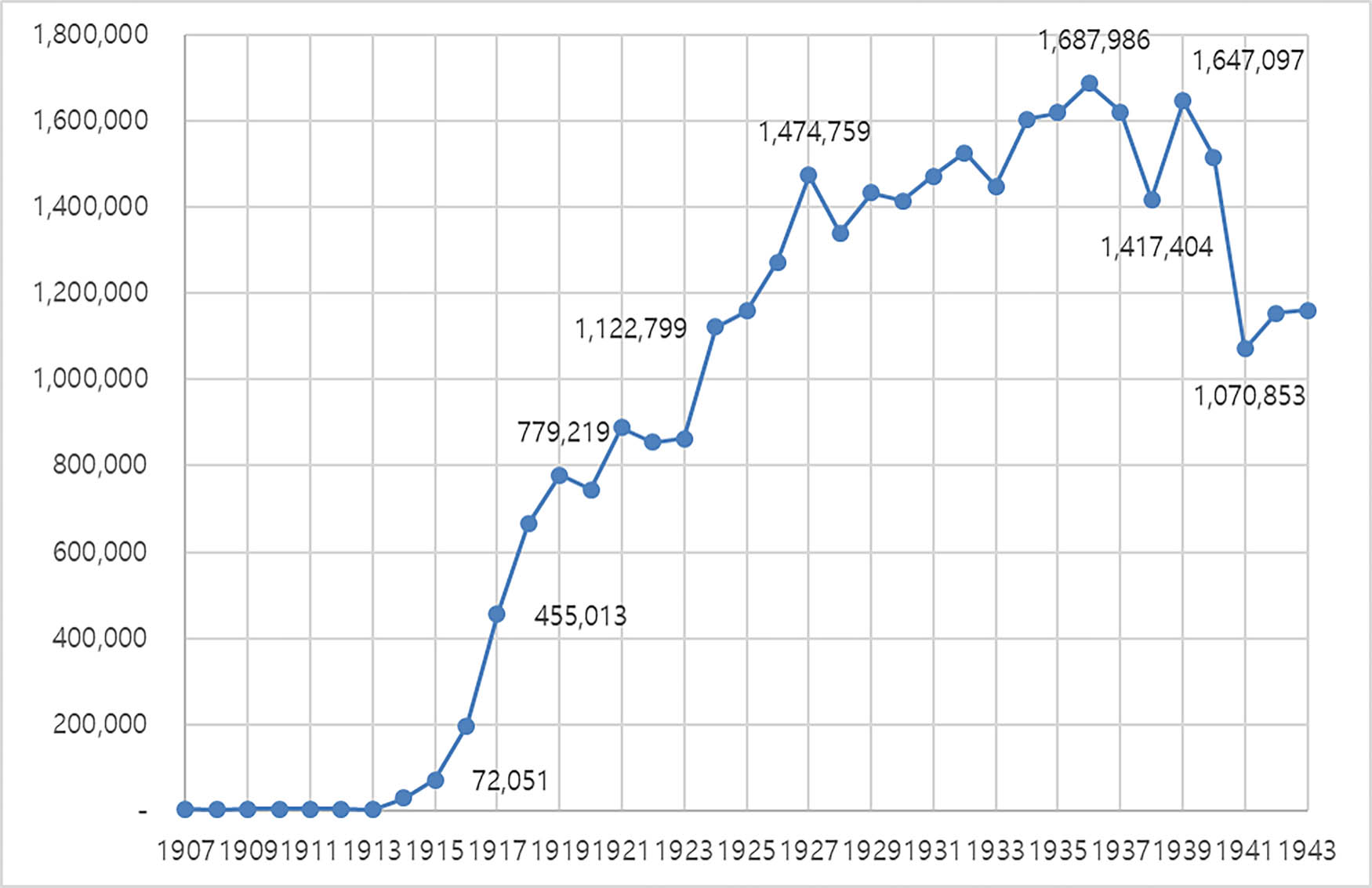

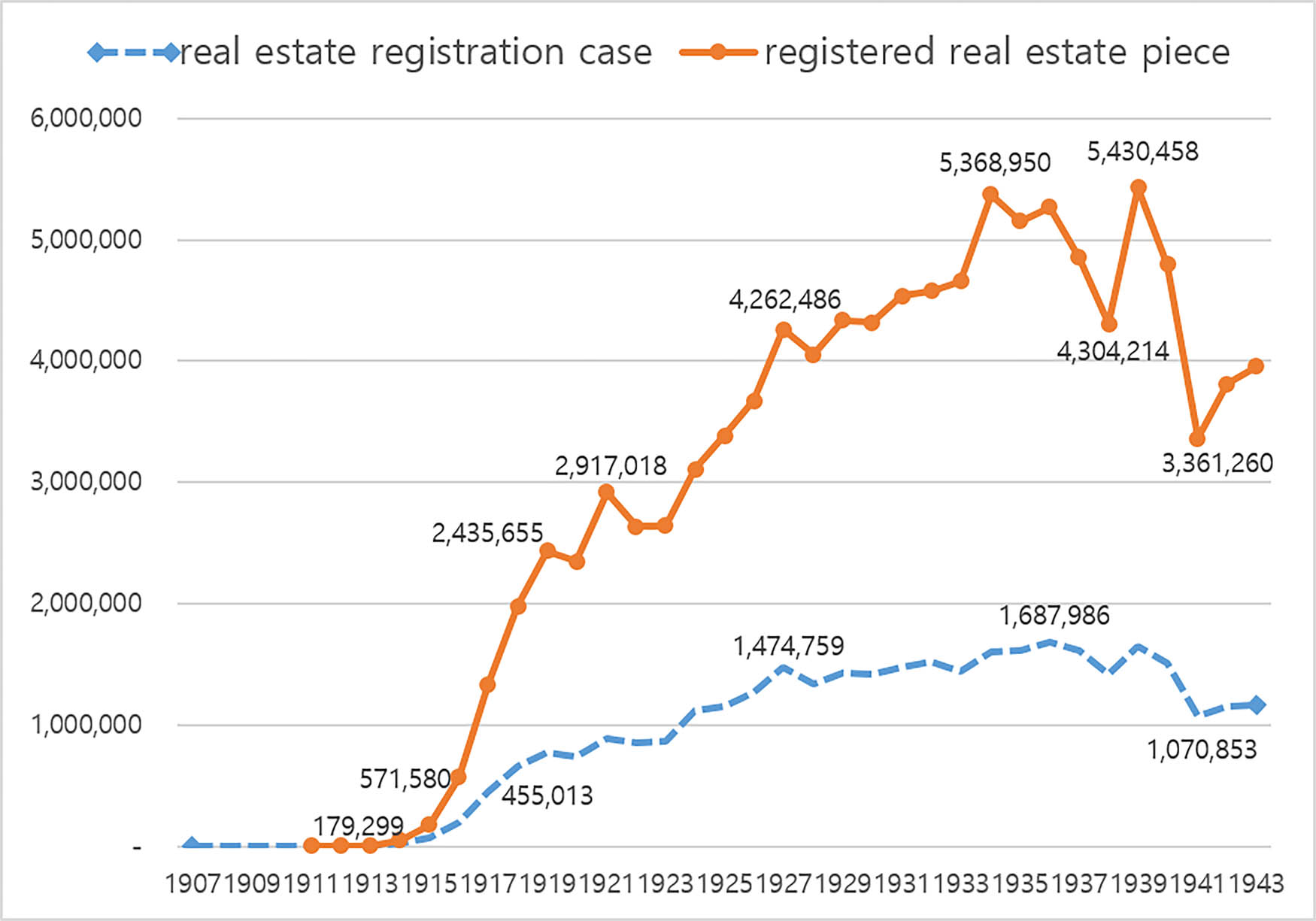

Immediately after the annexation, the Land Survey Project began, which ended in 1918. The Land Survey Project aimed to create a modern real estate register for land and buildings. In 1912, the Government General announced the “Korean Civil Act,” which allowed for the enforcement of 23 Japanese civil legislations, including the Civil Law, the Civil Procedure Code, and the Commercial Law, in the Korean Colony. It can be expected that during the years around 1913–1914, as the Korean Civil Act was implemented throughout cities and provinces and the Land Survey Project measured approximately half of the designated area, the Government General started to establish more accurate real estate registration statistics. The number of real estate registration cases rapidly increased to 28,651 in 1914 and 72,051 in 1915, compared to the annual average of 3,236 cases from 1907 to 1913. Similarly, the number of registered real estate pieces surged from an annual average of 7,946 between 1911 and 1913 to 54,517 in 1914 and 179,299 in 1915.[3]

The real estate registration cases shown in Figure 2 exhibit a local peak of 779,219 in 1919, 1 year after the completion of the Land Survey Project, followed by a period of decline until 1923. This pattern appears to be linked to the conclusion of the Land Survey and the economic boom experienced by the Japanese Empire during World War I, followed by a post-war recession accompanied by inflation.[4] Subsequently, the number of real estate registration cases surpassed one million in 1924 and exhibited a significant increase to 1,474,759 in 1927, marking a remarkable surge of over one million cases in a span of 10 years. After the peak in 1927, there were periods of stagnation until 1933, although 1936 witnessed the highest number of cases throughout the colonial period, reaching 1,687,986. Following this, there was a rapid decline in the number of cases, experiencing a loss of over 36% and reaching 1,070,853 in 1941. The figures slightly recovered to 1,160,706 in 1943, which was the last recorded data before Korean independence in 1945.[5]

Real estate registration (cases) 1907–1943.

The trend of real estate registration reflects the macroeconomic trajectory of the Korean economy, encompassing the agricultural revolution of the 1920s, the impact of the Great Depression in the early 1930s, the industrialization efforts under the “Japan-Korea-Manchu Block Economy Plan” led by Governor-General Ugaki (1931–1936), and the transition to a wartime control economy following the Sino-Japanese War in 1937. All graphics from Figures 2–9 are sourced from the Statistics Annual of Government General Chosen, with the exception of Figure 5.

Registration cases and registered pieces of real estate 1907–1943. Note: The real estate registration statistics in Japan and Korea distinguish real estate registration cases from registered real estate pieces. A case corresponds to a legal act of application for registration, which can include several real estate pieces. On average, one real estate registration case is related to the registration of 3.1 real estate pieces.

Mortgaged real estate pieces 1911–1943.

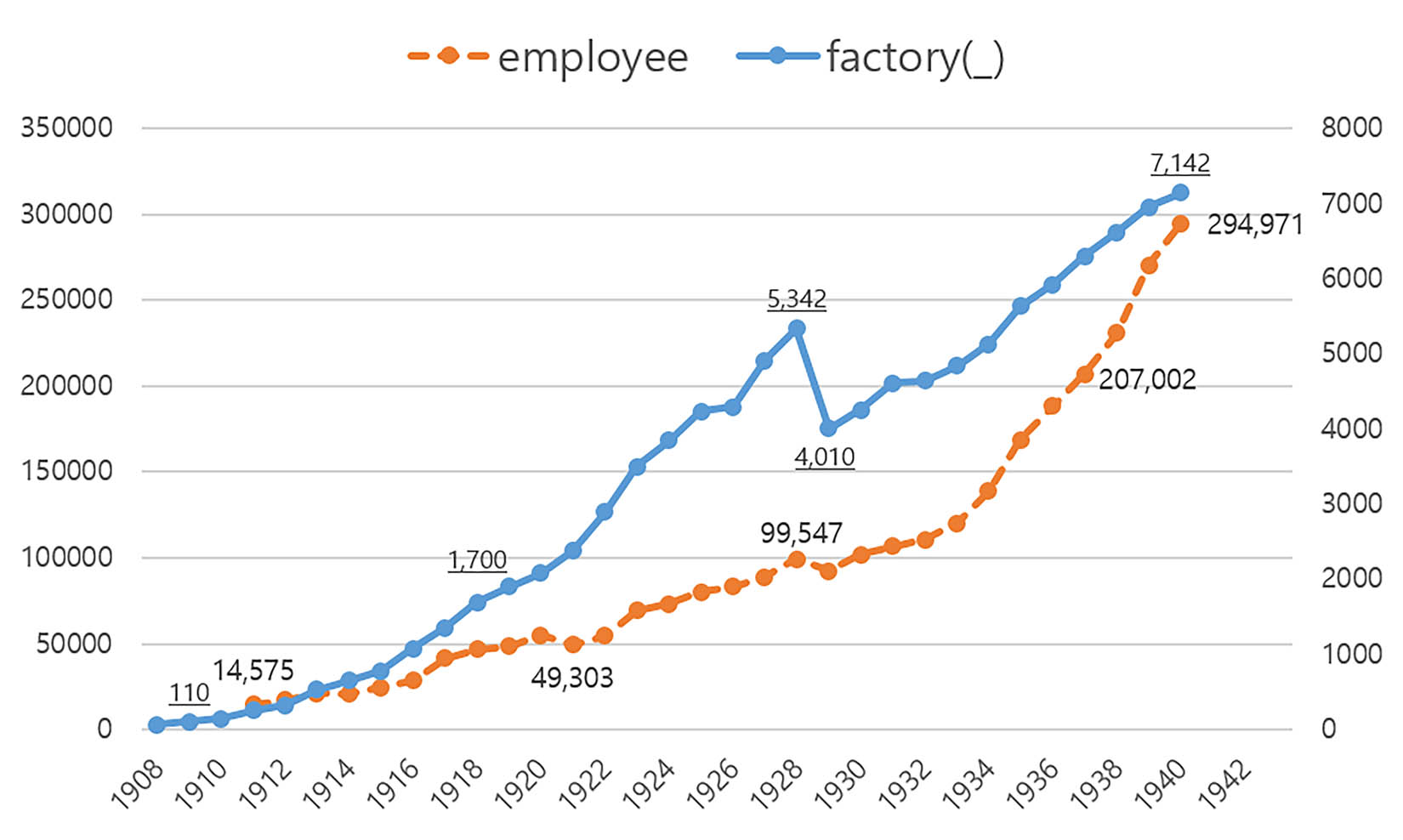

Bank loan (m. Yen) 1909–1943 (1936 price).

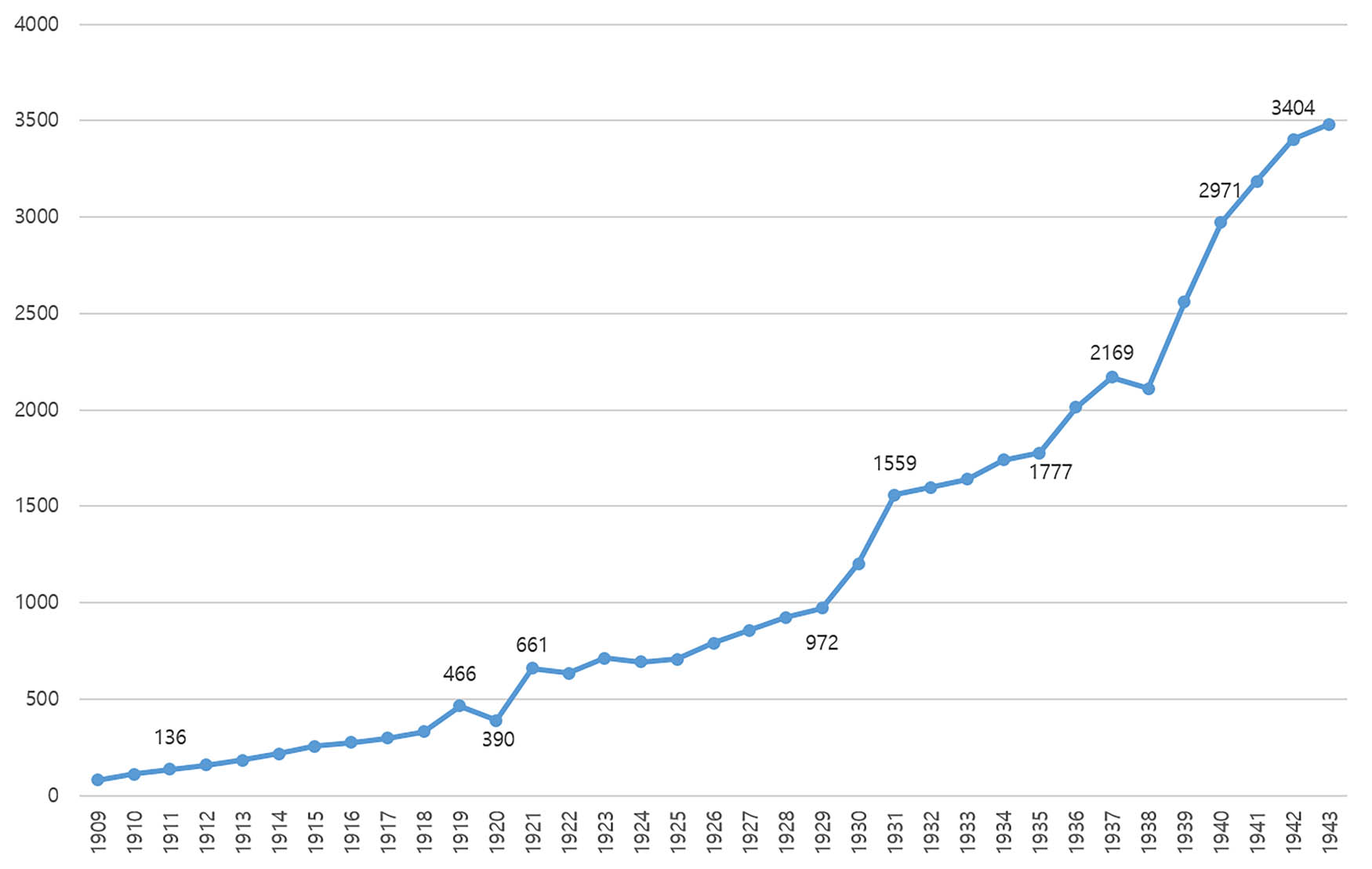

Real estate auction 1909–1943.

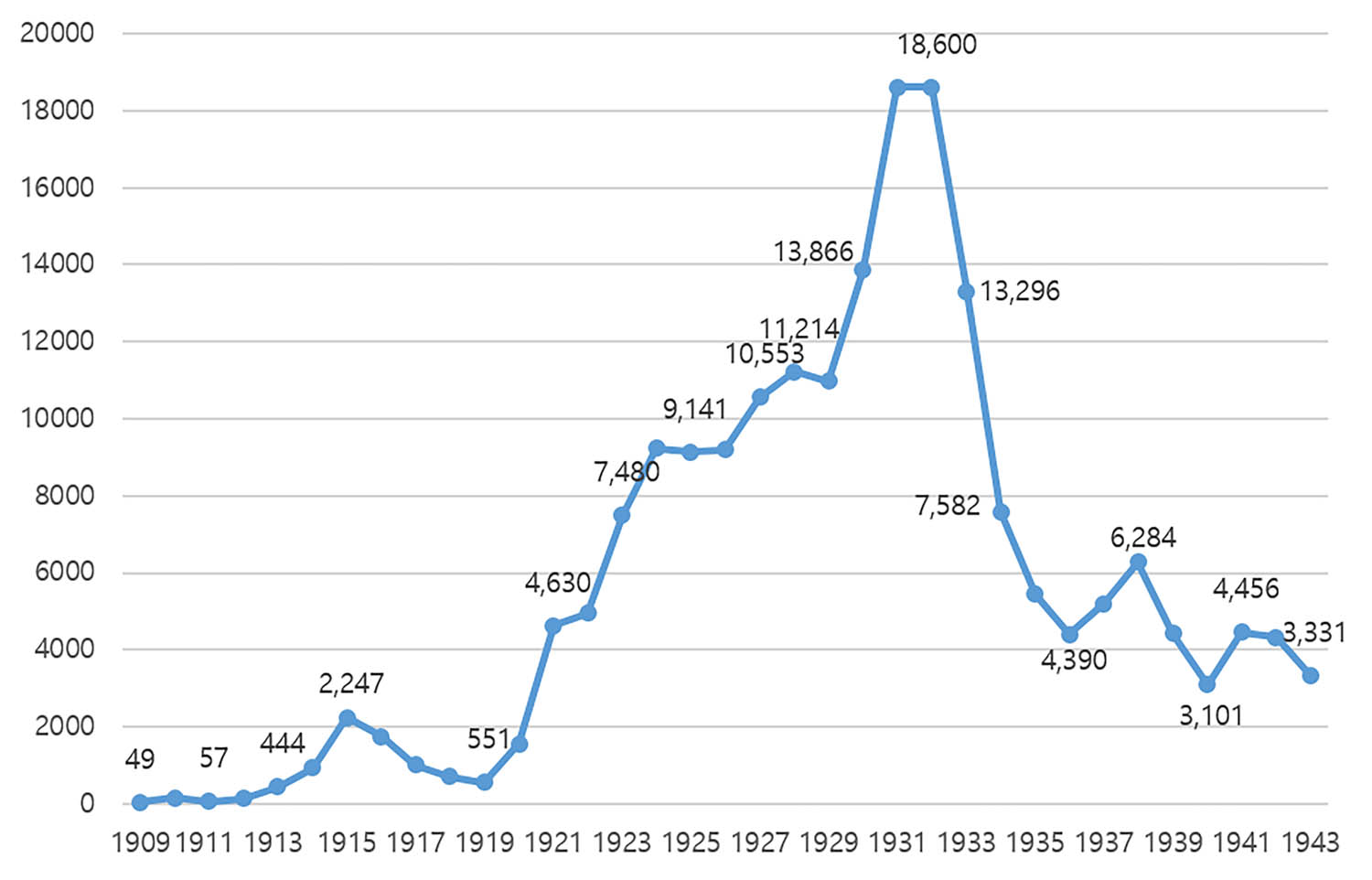

Factory (1909–1940) and factory employee (1911–1940).

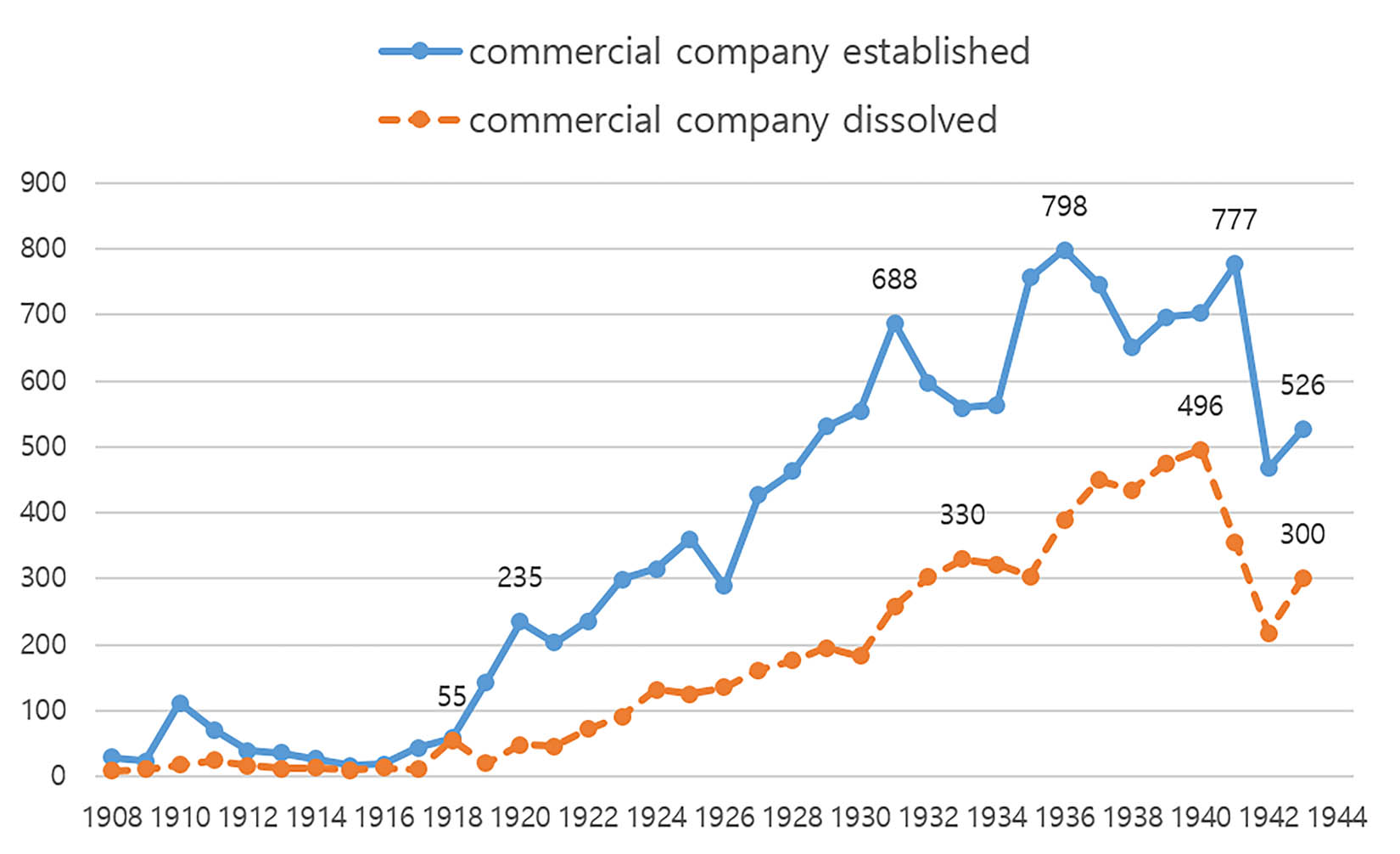

Establishment and dissolution of the commercial company 1908–1943.

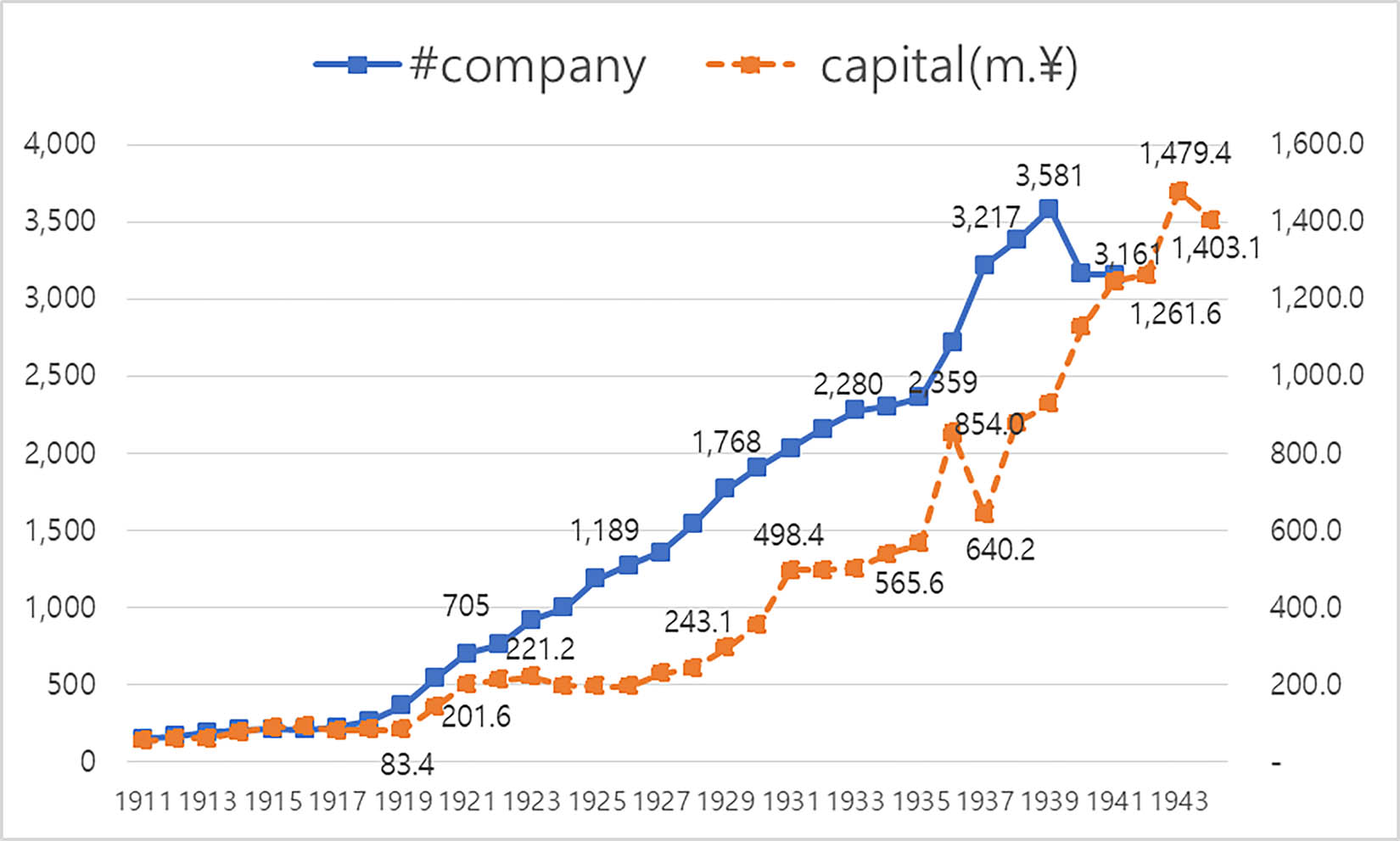

Commercial company and gross capital 1911–1944 (1936 price).

Plotting the registration cases and registered pieces of real estate together, Figure 3 shows that similar developments can be observed for the registered real estate pieces. It reached a local peak of 2,435,655 in 1919, zigzagging subsequently until 1923. The 1920s showed a rapid upsurge to 4,262,486 in 1927, drawing breath after the “banking panic 1927,” and then touched the twin peaks of 1934 (5,368,950) and 1939 (5,430,458), corresponding to the twin peaks of the real estate registration cases in 1936 and 1939. A drastic decline after the conversion to the wartime control economy system is also conspicuous, which was down to 3,361,260 in 1941. The outbreak of the Sino-Japanese War in 1937 made a critical socioeconomic turning point for the Japanese Empire and its colonies, converting a market-based moderate developmental economy to a planned and state-controlled economy. In 1938, Japan passed the National General Mobilization Law and put it into effect for all colonies. In 1937, the Korean economy faced a strategic material mobilizing plan focusing on military purposes, suffering from a shortage of construction resources and a series of inflation. The economic growth after the annexation triggered rapid urbanization, causing severe housing shortages in big cities, especially in Seoul, owing to the chronic excess demand for housing. Nevertheless, the Government General ordered the “Ordinance on Building the Reinforced Concrete Structure” in October 1937 due to material shortage, forbidding the construction of reinforced concrete buildings such as offices, apartments, and factories on the non-governmental level. Moreover, October 1939’s “Rent Regulation” forced the rent for land and housing to return to the level of December 1938 and 1940’s “Land Price Regulation” froze land prices, followed by a sharp drop in the land mortgage. This emergent and excessive intervention into the market mechanism urged civil capital to struggle to run a business over break-even, restraining entrepreneurs from investing in the housing market (most apartments in Seoul were in the 1940s reformed to hotels owing to the rate of return). That, in turn, diminished the housing supply even more.

The transition to the wartime control system was an external shock to the construction and real estate market, so the transformation of property to capital via contracting institutions, i.e., markets, should have been contracted seriously. Accordingly, the registration cases and registered pieces of real estate shrunk drastically after peaks from 1936 to 1939.

The compound annual growth rate (below abbreviated as CAGR) of the real estate registration cases was 18.6%, and the CAGR of registered real estate pieces was 21.0%. They were far higher than the CAGR of GDP from 1911 to 1943, which stood at 3.3%.

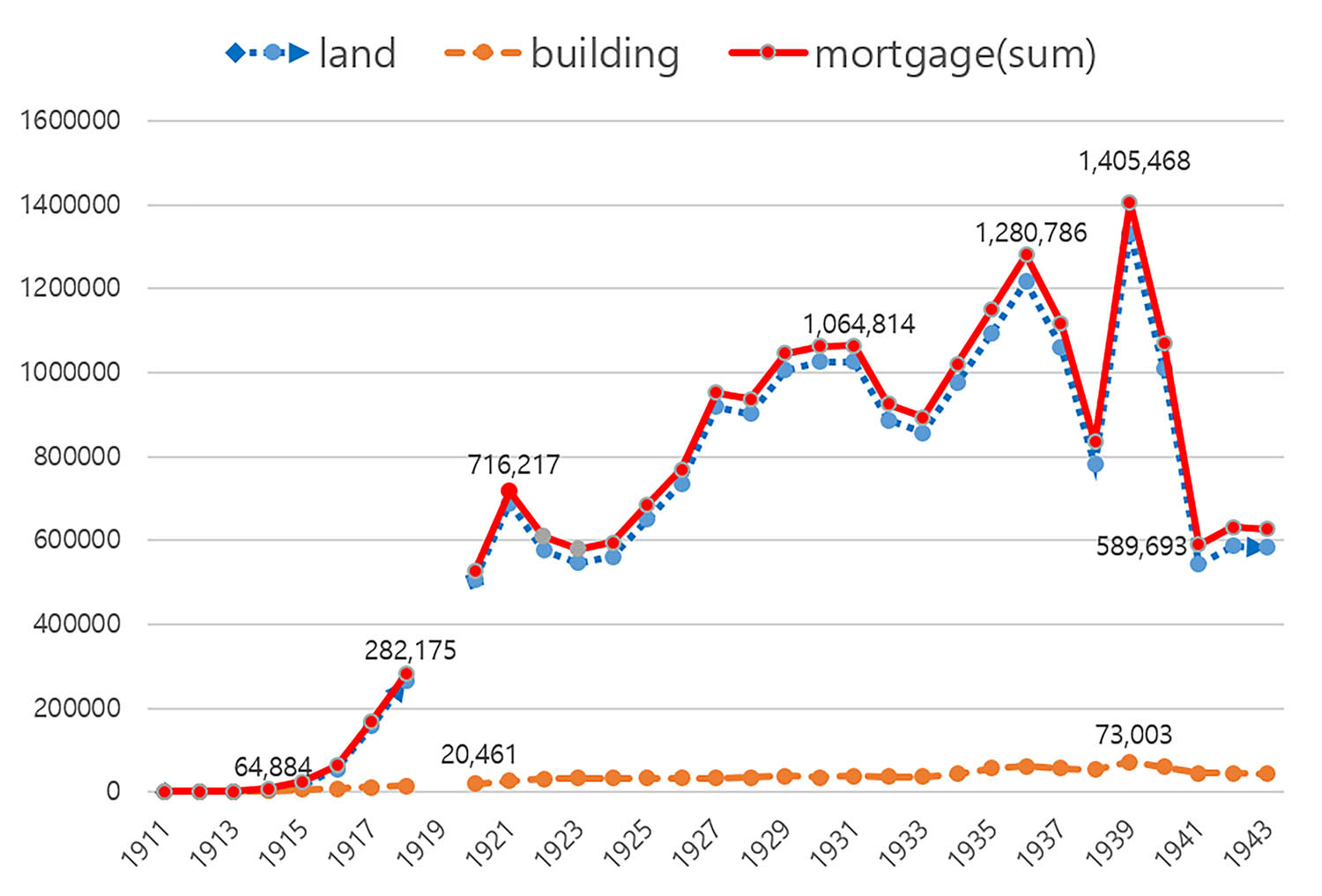

2.2.2 Real estate mortgage registration 1911–1943

The data on real estate mortgages in colonial Korea are a subset of the real estate registration, which encompasses sale (conveyance), preservation of ownership, mortgage, inheritance, superficies, and auction. In the context of the representative property system, mortgage is one of the key routes from property to capital. It acts as a “hydroelectric power plant to create capital” (de Soto, 2000, p. 48), liberating land rights from the feudal and entangled nature and facilitating systematic large-scale property collateralization through modern financial institutions (Hodgson, 2017). The modern credit creation process involves loans, funding, and securitization, stimulating investments necessary for the agricultural revolution, including modern irrigation, fertilization, farm mechanization, and seed improvements, as well as the establishment of companies and the construction of factories for industrialization. As this process gains momentum, the entire society undergoes modernization, benefiting from the network effect and positive feedback loops.

Similar to the real estate registration itself, mortgaged real estate data were also classified into the number of mortgage registration cases and the number of mortgaged real estate pieces. Among the various types of registration, conveyance holds the highest proportion, followed by mortgaged real estate, accounting for 12.3% of the total real estate registration cases and 21.3% of the total registered real estate pieces.

The mortgaged real estate data, shown in Figure 4, were further classified into land and buildings. Land accounted for the majority of real estate mortgages, constituting approximately 95.03% of the total. Buildings, on the other hand, comprised less than 5% of the mortgage registrations. It is worth noting that traditional buildings made of soil, wood, and straw appear to have been rarely mortgaged, possibly due to their weaker durability and faster depreciation. Figure 4 displays the trend of mortgaged real estate pieces, excluding the entry for the year 1919. The pattern observed is similar to that of the overall real estate registration shown in Figure 3, with a surge from 1916 to 1921, followed by a period of stabilization. From 1936 to 1939, there were twin peaks, and then a sharp decline until 1941 due to wartime control measures. However, there is a notable difference between mortgaged real estate and the overall real estate registration. During the Great Depression, mortgaged real estate experienced a significant setback until 1934, while the overall real estate registration showed a more gradual increase without remarkable decreases. This can be attributed to the fact that the conveyance registration of real estate, which constitutes the largest portion of the overall registration, did not decline during the Great Depression. Therefore, it appears that the aftermath of the Great Depression primarily affected mortgage activities in the real estate market during that era.

The CAGR of the mortgaged real estate pieces from 1911 to 1943 was 18.5%, and from 1911 to 1936, until the onset of the wartime economy, it was 27.8%.

2.2.3 Property Relevant Activity: Bank Loan 1909–1943

Mortgaging real estate involves leveraging the asset value of the property to generate monetary claims, with the bank loan playing a central role in this credit creation process. Consequently, a crucial question arises: did the surge in real estate mortgages coincide with an increase in bank loans? To address this question, the data on bank loans from 1909 to 1943, compiled by Kim et al. (2018), are utilized. These data encompass the loan amounts of various financial institutions, including public banks such as the Chosun Bank,[6] Siksan Bank,[7] Savings Bank, Agra-Industry Bank, Financial Association, affiliated Siksan-Gye, and the Oriental Development Company, as well as all civil banks. It is important to note that these figures represent the loan balance (stock) at the year-end, rather than the raised loan amount (flow).

Although it may not be perfect due to the exclusion of “Gye,” a traditional Korean financing convention, and “Mujin,” a traditional Japanese financing institution, which were popular among the common population,[8] the bank loan data listed in Figure 5 (adjusted by the CPI with 1936 price as the base year from Park and Kim (2011)) still offer a comprehensive view of the credit landscape in the Korean Colony.

The noticeable increase in bank loans commenced with the completion of the Land Survey, surpassing 500 million Yen in 1921 and reaching one billion Yen in 1930. However, there was a period of stagnation until 1929, possibly attributable to the post-World War I recession and the banking panic of 1927, which preceded the Great Depression. From 1930 onwards, bank loans experienced a rapid surge, mirroring the swift industrialization that took place in the 1930s after the “Manchurian Incident” in 1931, despite the prevailing global recession. Unlike the real estate registration, which included mortgages, bank loans did not contract considerably during the wartime control system implemented after 1938, with the exception of a brief period in 1937–1938. Instead, there was a pronounced upward trend, indicating that public sector investments in the war industry had crowded out the civil market mechanism and exerted a dominant influence. It is noticeable that the banking panic and the subsequent financial reform in Japan and Korea in 1927 did not affect the bank loan trend in Korea, whereas the surge of the real estate registration was remarkably blocked, as depicted in Figure 2.

The CAGR of bank loans from 1909 to 1943 was 11.7%. The proportion of real estate in bank loans from 1920 to 1936 varied across different financial institutions. Chosun Bank had the lowest percentage at 29.02%, while civil banks had a slightly higher percentage of 35.9%. The Financial Association and Industrial (Shiksan) Bank had even higher proportions, at 42.9 and 44.1% respectively.

2.2.4 Property Relevant Activity: Real Estate Auction 1909–1943

The role of real estate auctions within the property representation system is crucial, as it serves to clear marginal capital both legally and fiscally during times of recession and depression. In this phase, real estate auctions supply new capital that fuels Schumpeterian growth. Real estate auctions facilitate the continuous flow of capital, particularly during debt-laden situations of commercial and industrial business failures within the modern market economy. This distinct characteristic sets it apart from pre-modern insolvency management systems. Figure 6 presents real estate auction data from 1909 to 1943, exhibiting a CAGR of 13.2%. Notably, from 1909 to 1932, the CAGR was even higher at 29.5%.

The data on real estate auctions begin with 49 cases in 1909 and span until 1943. It displays a distinct trend that differs from the patterns observed in real estate registration, mortgage, and bank loan data presented in Figures 2–5. Notably, there is a single peak observed during the period of 1932–1933, coinciding with the shock wave of the Great Depression. Additionally, there is a rapid increase in auction activity following the completion of the Land Survey and the post-World War I recession around 1919. Given the limited number of auction cases, with a maximum of less than 20,000 and an average of 5,709 cases per year, compared to the maximum of 5.4 million registered real estate pieces (average 3.1 million) and the maximum of 1.7 million real estate registration cases (average 911,000), one can ask whether real estate auctions had a relatively minor or insignificant impact on the formation of capital from property, but this remains an open question, as the available data do not include the total liabilities associated with each auction, which in some cases could have been enormous.

2.2.5 Property Relevant Activity: Factory and Employee

The transformation of property to capital would be mirrored in the establishment of factories and modern business companies in the agricultural, manufacturing, and service industries. This relationship is depicted in Figure 7.

The classification of factories underwent essential changes over time, with categories such as steel, rice mill, roof tile, rice wine, and soy sauce prevailing around the time of annexation in 1910. By 1940, the last year of available factory statistics, modern categories including textile, metal, machine, chemistry, ceramic, food, print, wood, and electricity had emerged. The CAGR of factories was 14.4%, indicating a robust pace of industrialization during this period. Similarly, the CAGR of factory employees stood at 10.93%, further highlighting the dynamic nature of industrial growth. Notably, unlike the trends observed in real estate registration, both factories and factory employees continued to expand even during the wartime control system. This can be attributed to the sustained production of war supplies, which propelled the factory activity. Information on employee nationality is available until 1928, with an average composition of 85.9% Korean and 14.0% Japanese employees.

2.2.6 Property Relevant Activity: Company Registration (Establishment and Dissolution)

The establishment and dissolution of commercial companies, depicted in Figure 8, were recorded between 1908 and 1943, specifically for companies headquartered in the Korean peninsula and not including branches of companies headquartered in Japan. The trends closely mirror those seen in the real estate registration data presented in Figures 2 and 3.

2.2.7 Property Relevant Activity: Commercial Company in Operation and Gross Capital

The number of operating commercial companies and their invested gross capital volume are presented in Figure 9 for the years 1911–1941 (1944).

The majority of these companies were stock companies, accounting for 52.2% in terms of numbers and 94.6% in terms of the gross capital sum. The CAGR for the active commercial companies was 10.3%, while their gross capital had a CAGR of 10.2%.

The number of active commercial companies exhibited a noticeable increase, particularly after 1919, reaching over one thousand in 1924 and peaking at 3,581 in 1939. The impact of the wartime control economy is evident from 1939 onwards, indicating a shift in the manufacturing landscape towards larger-scale companies or the expansion of public companies at the expense of civil commercial companies. The invested gross capital of commercial companies, based on data from Kim et al. (2018) and CPI-adjusted (1936 = 100), began to grow significantly after 1920, breaking through 200 million Yen in 1921. It zigzagged from 200 to 300 million Yen until 1929, seemingly owing to the immaturity in industrialization and the Showa financial crisis. Despite the challenges posed by the Great Depression, the gross capital surged to 498 million Yen in 1931 and further to 854 million Yen in 1936, spanning the period from the Manchurian Incident to the outbreak of the Sino-Japanese War. The shock of the war led to a sharp drop of 25% in 1937, but a rapid recovery followed during the wartime control system until 1943, with a maximum of 1,479 million Yen.

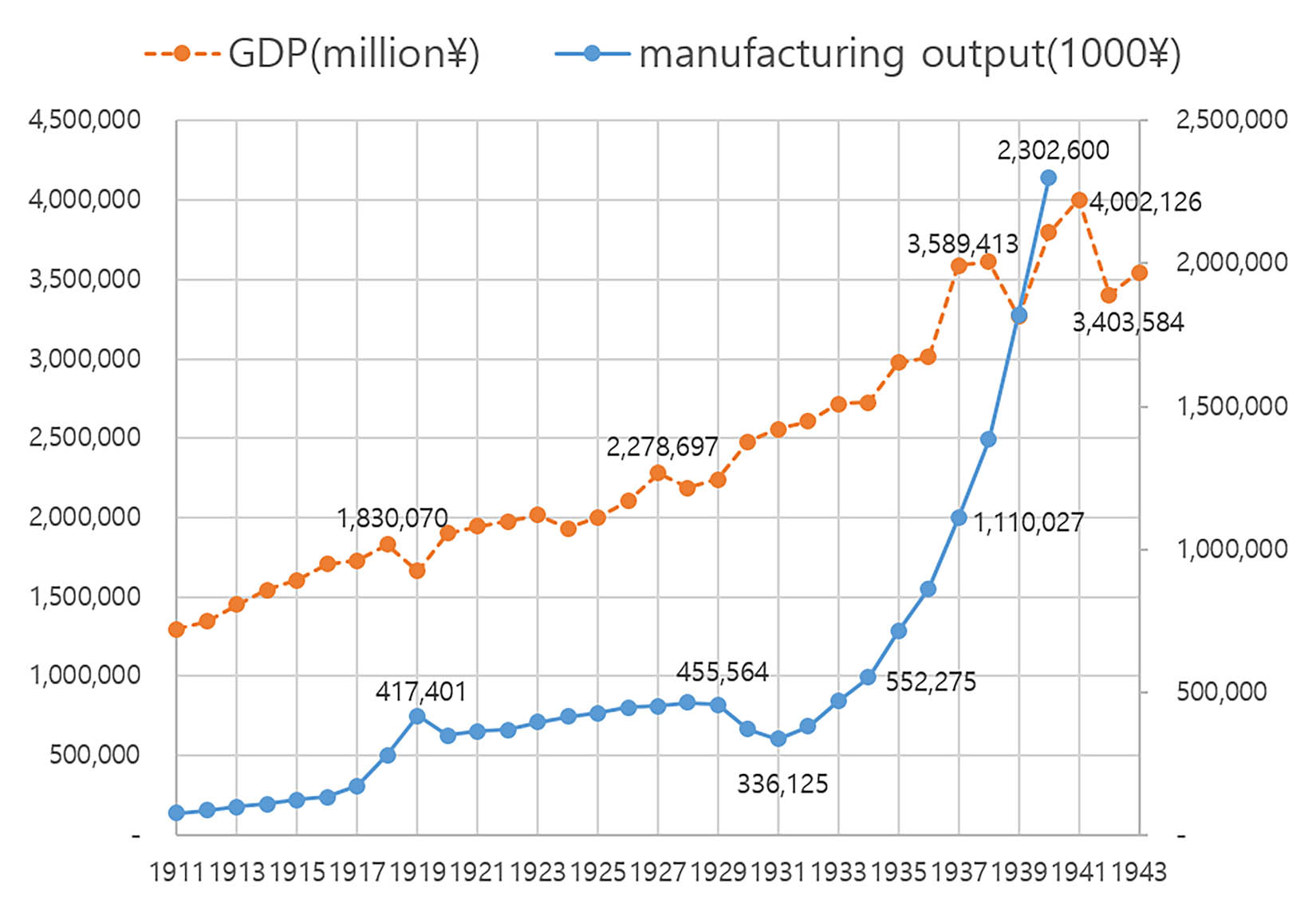

2.3 Manufacturing Output and GDP in Colonial Korea

The indicators of economic progress, such as sustained economic growth accompanying steady population expansion, are key signs of an economic take-off and breaking free from the constraints of the Malthusian trap. This progress is largely driven by the diffusion of manufacturing activities. Figure 10 illustrates the manufacturing output (1911–1940) and GDP (1911–1943) in Colonial Korea. The CAGR of manufacturing output was 12.5%, while the CAGR of GDP was 3.3%.

Manufacturing output (1911–1940) and GDP (1911–1943). Source: National account of Kim et al (2018); manufacturing output in 1935 price; GDP in 2010 price.

The population in Colonial Korea experienced a CAGR of 1.3% from 1911 to 1943. Consequently, the CAGR of GDP per capita was 2.03% (1911–1943) and 2.61% (1911–1941). When comparing these figures to the CAGR of world GDP per capita at 0.87% (1900–1940) and that of Western Europe at 1.13% (1910–1940) and the United States at 0.9% (1912–1939) (Maddison, 2020), the economic performance of Colonial Korea stands out as remarkable and provides support for the hypothesis that the economic take-off of Korea began during the colonial period, as suggested by Cha and Kim (2012).

3 Empirical Models and Results: Time Series Analysis

The previous observations presented in Section 2 involve time series variables, which opens the door to the application of empirical methodologies for analyzing the relationship between legal and economic activities and their impact on economic performance in Colonial Korea. This analysis also delves into the question of how property transforms into capital within the context of the representative property system. However, as noted by Durlauf et al. (2009, p. 1120), there is no easy consensus regarding the econometric methodology used in growth economics, especially when dealing with time series data. Therefore, this article adopts an empirical approach that includes cointegration tests and causality tests to explore these relationships further.

3.1 Structural Change

The F-tests on the structural change and estimations on the structural break points of time series were conducted on the variables interpreted as driving forces in the representative property system model. If these variables played a role in the transformation of property to capital, their trends would have been significantly influenced by the Land Survey Project. The findings of these tests are summarized in Table 2, with ** indicating the rejection of the null hypothesis of no structural change at the 0.01 significance level.

Structural change and break points

| Time series | F-statistics | p-value | Break points |

|---|---|---|---|

| Real estate registration case | 112.76** | <2.2 × 10−16 | 1916 1919 1928 |

| Regt. real estate pieces | 111.44** | <2.2 × 10−16 | 1916 1933 |

| Mortgaged real estate pieces | 66.47** | 1.379 × 10−13 | 1918 1931 1936 |

| Bank loan balance | 307.86** | <2.2 × 10−16 | 1918 1923 1932 1937 |

| Real estate auction | 112.76** | <2.2 × 10−16 | 1916 1926 1935 |

| Factory | 24.42** | 0.00018 | 1913 1921 1928 1934 |

| Establishment of comm. company | 28.78** | 2.024 × 10−5 | 1918 1934 |

| Active commercial companies | 48.97** | 1.114 × 10−9 | 1917 1936 |

| Gross capital invested | 302.62** | <2.2 × 10−16 | 1919 1924 1933 |

According to Table 2, it is observed that all variables, except for the number of factories, exhibit their first structural break points around 1916–1919, which coincides with the approximate completion period of the Land Survey Project. This finding supports the hypothesis that the Land Survey Project played a significant role in facilitating the successful implementation of modern property management practices. As a result, the real estate registration experienced substantial growth, leading to the generation of network effects. These network effects further stimulated activities such as property mortgage, credit creation, establishment of business companies, and capital accumulation.

The second and third structural break points observed in Table 2 have specific implications for the variables under consideration. The break point of 1928 in the real estate registration cases aligns with the sharp decline and slower growth observed in the 1930s, following the period of rapid growth in the 1920s as depicted in Figure 2. Similarly, the break point of 1933 in registered real estate pieces corresponds to the sustained rapid growth until 1933, followed by chaotic fluctuations resulting in a twin peak pattern after 1934, as shown in Figure 3. The break point of 1931 in mortgaged real estate pieces can be attributed to a significant decline resulting from the impact of the Great Depression. Additionally, the break point of 1936 likely reflects the shock of wartime control, evident in the twin peak pattern observed in Figure 4. The break points of the bank loan balance generally align with the descriptions provided in Figure 5, except for the break point of 1923. Regarding real estate auctions, the break points of 1926 and 1935 indicate local structural changes but do not capture the remarkable events during the Great Depression of 1931–1932, as depicted in Figure 6. The break point of 1934 in the establishment of commercial companies coincides with the beginning of the twin peak pattern observed in Figure 8 for the years 1936 and 1941. Similarly, the break point of 1936 in the operating commercial companies reflects an acceleration of growth rates in the late 1930s, as shown in Figure 9. Lastly, the break points in gross capital seem to capture the stagnation observed in the 1920s and the transition to rapid growth since the 1930s.

3.2 Cointegration

The stationarity of the time series was assessed using the Augmented Dickey–Fuller test, which indicated that all variables are non-stationary with 1 or 2 unit roots. Certain linear combinations of these non-stationary series can exhibit stationarity, indicating a long-run equilibrium relationship. This implies the presence of cointegration among the variables. Various cointegration models have been developed for dynamic time series analysis, following the pioneering work of Engle and Granger (1987). One prominent model is the Johansen cointegration model proposed by Johansen (1991). In this study, Johansen cointegration tests were conducted on six different cointegration models, which focus on economic activities and property management in Colonial Korea. The results of the Johansen cointegration tests are presented in Table 3.

Johansen cointegration tests

| Model | Values of test statistic and critical values of test: | |||

|---|---|---|---|---|

| ① | lgdp∼lpropReg, ecdet = “trend,” type = “trace,” K = 5 | |||

| Test | 10pct | 5pct | 1pct | |

| r ≤ 1 | 14.66 | 10.49 | 12.25 | 16.26 |

| r = 0 | 58.93 | 22.76 | 25.32 | 30.45 |

| Normalized cointegrating coefficients (standard error in parentheses) | ||||

| LGDP | LPROPREG | @TREND(12) | ||

| 1 | 0.219548** | −0.036946 | (**0.01 significance) | |

| (0.037229) | (0.001801) | |||

| ② | lgdp∼lpropReg + lmortgage, ecdet = “trend,” type = “trace,” K = 6 | |||

| r ≤ 2 | 11.66 | 10.49 | 12.25 | 16.26 |

| r ≤ 1 | 43.35 | 22.76 | 25.32 | 30.45 |

| r = 0 | 104.96 | 39.06 | 42.44 | 48.45 |

| ③ | lgdp∼lpropReg + logloan, ecdet = “trend,” type = “trace,” K = 6 | |||

| r ≤ 2 | 14.52 | 10.49 | 12.25 | 16.26 |

| r ≤ 1 | 46.77 | 22.76 | 25.32 | 30.45 |

| r = 0 | 96.78 | 39.06 | 42.44 | 48.45 |

| ④ | lmortgage∼logloan, ecdet = “trend,” type = “trace,” K = 5 | |||

| r ≤ 1 | 9.21 | 10.49 | 12.25 | 16.26 |

| r = 0 | 32.83 | 22.76 | 25.32 | 30.45 |

| ⑤ | lpropReg∼lcompany, ecdet = “trend,” type = “trace,” K = 6 | |||

| r ≤ 1 | 15.72 | 10.49 | 12.25 | 16.26 |

| r = 0 | 48.61 | 22.76 | 25.32 | 30.45 |

| ⑥ | lpropReg∼lMnf_Prod, ecdet = “trend,” type = “trace,” K = 6 | |||

| r ≤ 1 | 11.16 | 10.49 | 12.25 | 16.26 |

| r = 0 | 31.54 | 22.76 | 25.32 | 30.45 |

** denotes 0.01 significance level.

In model ①, the null hypothesis of no cointegration relation between GDP and registered real estate pieces (r = 0) is rejected at the 0.01 significance level. However, the null hypothesis of less than one cointegration (r ≤ 1) cannot be rejected at the same significance level. These findings indicate the presence of one long-run equilibrium relationship between GDP and registered real estate pieces. The cointegration coefficient of registered real estate pieces to GDP is positive and significant at the 0.01 significance level.

In model ②, both the null hypothesis of no cointegration and the null hypothesis of less than one cointegration between GDP, registered real estate pieces, and mortgaged real estate pieces are rejected at the 0.01 significance level. However, the null hypothesis of fewer than two cointegrations (r ≤ 2) cannot be rejected at the same significance level. Therefore, it can be concluded that two cointegration relationships may exist in this case.

In model ③, a similar pattern emerges with cointegration between GDP, registered real estate pieces, and bank loans. Likewise, in model ④, cointegration is observed between registered real estate pieces and bank loans. Model ⑤ demonstrates cointegration between registered real estate pieces and active commercial companies. In model ⑥, cointegration is observed between manufacturing output and registered real estate pieces, indicating a single long-run relationship. Model ⑦ reveals two cointegration relationships between GDP, invested gross capital, and registered real estate pieces. These findings highlight the presence of long-run cointegrated relationships at the macroeconomic level, in line with the theory of institutional economic development.

3.3 Granger Causality

Once the long-run equilibrium relationships between the associated variables are established, employing statistical methods to measure directional influences can help identify the presence of causal relationships. In the institutional approach, this refers to examining whether institutional variables can significantly contribute to economic growth in a one-way manner.

A widely used causality test for time series variables is the Granger causality test. Granger causality test for the nonstationary variables may result in spurious inference (He & Maekawa, 2001), which can be though bypassed by adding an extra lag in the VAR process (Lütkepohl & Krätzig, 2007, p. 148). Table 4 shows the results of the Granger causality test for the key variables discussed in Section 2 (** and *: the rejection of null hypothesis at the significance level of 0.01 and 0.05, respectively; hereafter the same).

Granger causality tests

| Causality direction | p-value | Causality direction | p-value |

|---|---|---|---|

| Registered real estate pieces ⇛ GDP | 0.0063** | GDP ⇛ Registered real estate pieces | 0.1812 |

| Mortgaged real estate pieces ⇛ GDP | 0.00092** | GDP ⇛ Mortgaged real estate pieces | 0.2753 |

| Bank loan ⇛ GDP | 0.00295** | GDP ⇛ Bank loan | 0.6883 |

| Comm. Company ⇛ GDP | 0.01555* | GDP ⇛ Comm. company | 0.2777 |

| Registered real estate pieces ⇛ Bank loan | 0.00051** | Bank loan ⇛ Registered real estate pieces | 0.0071** |

| Mortgaged real estate pieces ⇛ Bank loan | 0.00749** | Bank loan ⇛ Mortgaged real estate pieces | 0.1495 |

| Registered real estate pieces ⇛ comm. Company | 0.02824* | Comm. Company ⇛ Registered real estate pieces | 0.2744 |

| Registered real estate pieces ⇛ manufacturing output | 0.03404* | Manufacturing output ⇛ Registered real estate pieces | 0.8833 |

| Registered real estate pieces ⇛ gross capital invested | 0.5378 | Gross capital invested ⇛ Registered real estate pieces | 0.0225* |

GDP exclusively acts as the passive player in the causality scheme, which aligns with the predictions of the general institutionalist approach, including the representative property system.

3.4 Robustness Check: Vector Error Correction Model (VECM) and Impulse Response Function (IRF)

The VECM enables the examination of multiple Granger causalities within a cointegrated system, as presented in Table 5 (p-values of H0: no Granger causality).[9]

VECM Granger causality test

| ECT | Intercept | ∆gdp –1 | ∆propReg –1 | ∆mortgage –1 | ∆loan –1 | |

|---|---|---|---|---|---|---|

| Equation ∆gdp | 0.0063** | 0.0059** | 0.1960 | 0.0492* | 0.0246* | 0.8692 |

| Equation ∆propReg | 0.1773 | 0.1743 | 0.6899 | 0.0277* | 0.2381 | 0.4395 |

| Equation ∆mortgage | 0.8566 | 0.8454 | 0.7371 | 0.0326* | 0.2284 | 0.3227 |

| Equation ∆loan | 0.2073 | 0.1946 | 0.0218* | 0.0240* | 0.0119* | 0.0038** |

Table 5 shows that the error correction term (ECT) is significant only for the ∆GDP equation. As ECT indicates the convergence from the short-run toward the long-run equilibrium path, it implies that only GDP acts passively in the long run, influenced by the three other variables: property registration, mortgage, and bank loan, while those three variables act as exogenous factors. This suggests that long-run causality only operates interactively through the ECT from property registration, mortgage, and bank loan to GDP. In the short run, there are significant causalities from mortgage to GDP and from property registration to all other three variables. Compared to Table 4, the factor property registration stands out as the exogenous role in Table 5.

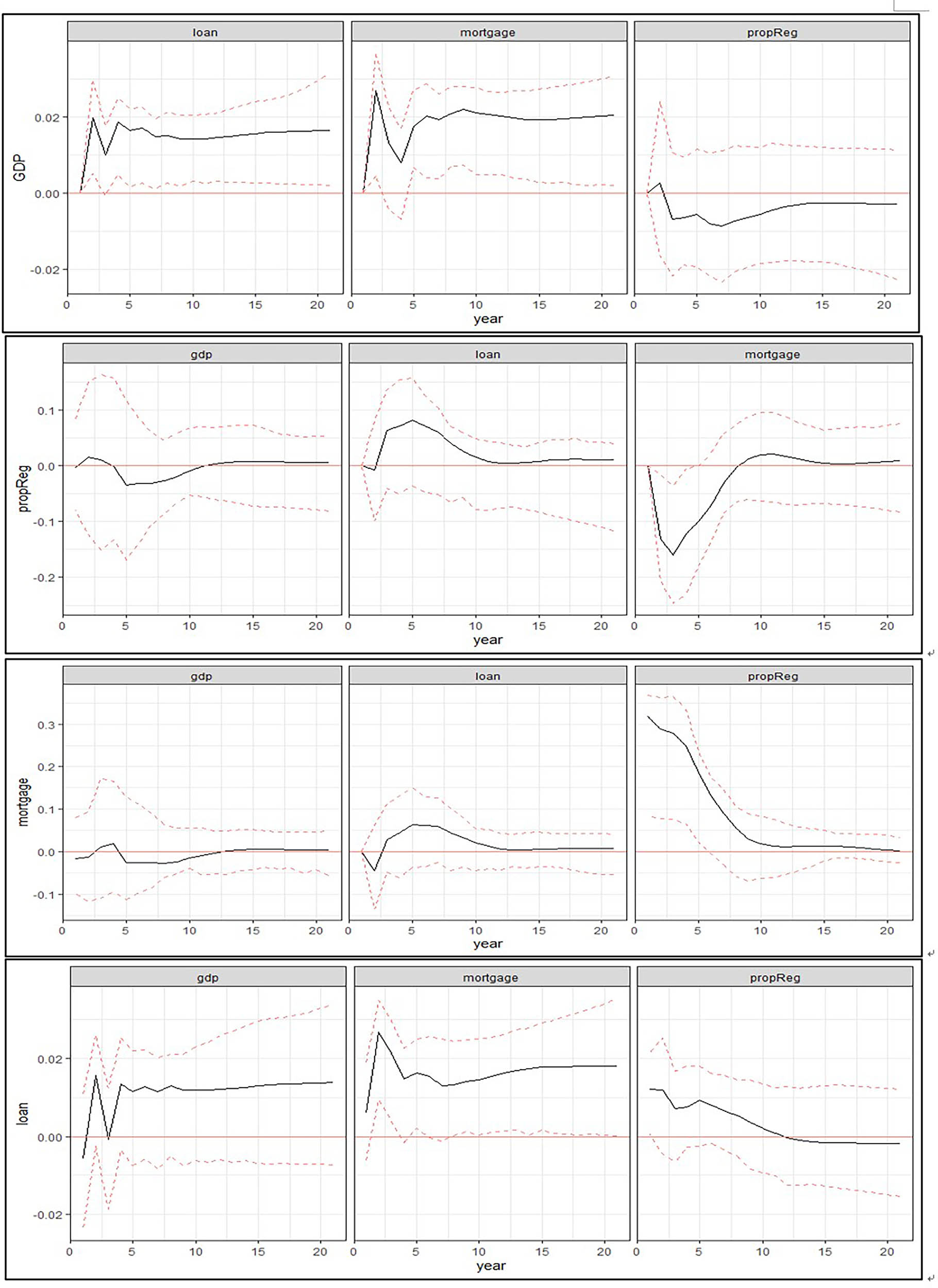

The impulse response function (IRF) is another tool used to examine the direction of causal relationships among variables. The IRF analysis shows the dynamic response of variables to shocks or changes in the system, providing insights into the magnitude and persistence of the effects caused by these shocks. Even though impulse response matrices for the integrated variables can be computed in the same way as for the stationary variables, some shocks in the cointegrated model may have a permanent effect, not dying out asymptotically (Lütkepohl, 2005, p. 263). Figure 11 presents the IRF (20 years) for four variables: GDP, property registration, mortgage, and bank loan.

IRF (response: 20 years).

For the exogenous shock of GDP, it is observed that the impact on the three other variables is not permanent, as indicated by the confidence interval around zero. This finding is consistent with the results of the Granger causality tests and VECM tests. In contrast, the response of GDP to external shocks in mortgage and bank loans, as indicated by the confidence bands, is significantly different from zero. This confirms the exogenous role of mortgages in determining GDP, as shown in Tables 4 and 5, as well as the role of bank loans indicated in Table 4. However, the long-run exogenous effects of property registration on GDP and bank loans are not supported. Additionally, the effect of property registration on mortgages appears to be significant only during the first 5 years following the shock. Furthermore, it is noteworthy that mortgage is found to have a significant long-run effect on bank loans.

In sum, it has been revealed that GDP functions as an endogenous variable, influenced by property registration, mortgage, and bank loans. Notably, mortgage consistently emerges as a significant driver in all three models: simple Granger causality, VECM Granger multiple causality, and IRF. The exogenous roles of property registration and bank loans show significance in the two models. This finding provides support for the notion that property collateralization played a crucial role in triggering economic take-off in Colonial Korea, aligning with historical evidence concerning the trajectory of the British Industrial Revolution described by Hodgson (2017).

4 Conclusion

The rise of the West and its economic take-off, referred to as a “mystery” by de Soto (2000), has long puzzled scholars, for even after 200 years since the Industrial Revolution, the majority of countries around the world have struggled to achieve a modern transition of their economies and societies. They find themselves caught in a vicious cycle of premodernity, unable to break free from the grip of extralegal practices. This phenomenon, also known as the “Lucas paradox,” stands in stark contrast to the advancements made by approximately 25–30 countries. Various paradigms have been proposed to explain the economic take-off of the West. The theory of scientific revolution and technological innovation in Western Europe falls short in explaining why modern devices, ranging from nineteenth-century engines, chemical fertilizers, and cables to today’s smartphones, computer-aided design software, and GPS networks, have been globally disseminated without triggering economic take-offs in many countries, despite substantial international aid in terms of capital and technology over the past 50 years. Similarly, the “Protestant ethic” concept, which emerged in the early twentieth century, fails to account for the economic take-off of countries such as Japan, France, Korea, and Taiwan. The “human capital” approach of the late twentieth century was refuted, as North and Thomas (1973, p. 2) argued, that “…factors (such as) innovation, economies of scale, education, capital accumulation… are not causes of growth; they are growth” (italics original), and still fails to explain the sluggishness observed in countries like India, Russia, and Eastern Europe with their high-tech resources. Therefore, the concept of “bell-jar” capitalism of Braudel (1982, p. 248) remains valid, posing the question “Why that sector of the society, (…) capitalist, should have lived as if in a bell-jar, cut off from the rest; why was it not able to expand and conquer the whole of society?”

The concept of the representative property system, an institutionalist approach, provides a preliminary answer to this question, albeit in a simplified form. This concept encompasses various institutions related to property registration, civil execution processes, finance, credit, administrative executive abilities, information management, capital flow, social conflict control, and market functioning. Empirical confirmation or refutation of this concept requires extensive and diverse data at both the micro and macro levels, spanning at least the eighteenth century. However, existing research has primarily focused on the microeconomic effects of local property registration examples in developing countries. Some studies have examined cases in Peru, the birthplace of de Soto and a pioneer in property registration policies, and have demonstrated the positive effects of modern property titling on labor supply, housing investment, and children’s education. However, these studies have not extensively investigated the macroeconomic effects, particularly in terms of achieving sustained growth and overcoming the “middle-income trap.” Peru has achieved the second-highest average growth rate (5.3%) in Latin America over a 15-year period (2000–2015), but it still faces challenges in achieving economic take-off, as reflected by its GDP per capita of $6,977 (2019) and a HDI index ranking of seventy-ninth. Moreover, the country continues to grapple with political instability.

This study examines the long-run relationship and causality between real estate registration, mortgage, bank loan, commercial company activity, manufacturing activity, and GDP in Colonial Korea, considering real estate registration variables as a direct embodiment of the property rights institution. The findings reveal that variables representing modern socioeconomic activities are associated with structural changes around the completion of the Land Survey. These explanatory variables are significantly cointegrated and demonstrate one-way causality with economic growth, specifically GDP. Robustness checks of the empirical results support the notion that the successful establishment of the property registration system is closely linked to land mortgaging and subsequent macroeconomic growth driven by vigorous financial activities in the long run, thereby exerting a causal influence on economic growth. This provides support for the hypothesis that the property rights institution has a substantial impact on economic growth. However, it does not discount the possibility that other institutional, technical, or cultural factors also have long-term equilibrium relationships and causalities with economic growth. The concept of the representative property system, which highlights the key role of the property system in achieving modernity, can be acknowledged within certain limitations.

The empirical investigation of the critical moment of economic take-off necessitates extensive follow-up studies at both national and international levels. These studies, grounded in the institutional framework, should analyze whether the time series and cross-section data of property rights and financial system can be regarded as a general, modern, open-access institution characterized by fair and swift execution, connected to well-functioning markets that support property collateralization and structured financing. Ultimately, these studies should aim to identify quantitative benchmarks for economic take-off, akin to the concept of atmospheric escape velocity.

Acknowledgments

Thanks to the editors and reviewers for their suggestions for revisions to this article. Of course, the author is fully responsible for the content.

-

Funding information: The author states no funding involved.

-

Author contributions: The author has accepted responsibility for the entire content of this manuscript and consented to its submission to the journal, reviewed all the results, and approved the final version of the manuscript. Z.H.: conceptualization, methodology, software, investigation, formal analysis, original draft, review, and editing.

-

Conflict of interest: The author states no conflict of interest.

-

Data availability statement: The datasets analyzed during the current study are available in the repository; https://kosis.kr/statisticsList/statisticsListIndex.do?vwcd=MT_CHOSUN_TITLE&menuId=M_01_04_01&outLink=Y&entrType=#content-group; http://www.naksung.re.kr/statistics.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Acemoglu, D., & Johnson, S. (2005). Unbundling institutions. Journal of Political Economy, 113(5), 949–995.10.1086/432166Search in Google Scholar

Acemoglu, D., Johnson, S., & Robinson, J. A. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401.10.1257/aer.91.5.1369Search in Google Scholar

Besley, T., Burchardi, K., & Ghatak, M. (2012). Incentives and the de Sote Effect. Quarterly Journal of Economics, 127(1), 237–282.10.1093/qje/qjr056Search in Google Scholar

Besley, T., & Ghatak, M. (2010). Property rights and economic development. In D. Rodrik & M. Rosenzweig (Eds.), Handbook of development economics (Vol. 5, pp. 4525–4595). Elsevier.10.1016/B978-0-444-52944-2.00006-9Search in Google Scholar

Bogart, D., & Richardson, G. (2011). Property rights and parliament in industrializing Britain. Journal of Law and Economics, 54, 241–274.10.1086/652901Search in Google Scholar

Braudel, F. (1982). The wheels of commerce. Harper & Row.Search in Google Scholar

Cha, M., & Kim, N. N. (2012). Korea’s first industrial revolution: 1911–1940. Explorations in Economic History, 49(1), 60–74.10.1016/j.eeh.2011.09.003Search in Google Scholar

de Soto, H. (2000). The mystery of capital: Why capitalism triumphs in the West and fails everywhere else. Basic Books.Search in Google Scholar

Durlauf, S., Johnson, P., & Temple, J. (2009). The methods of growth econometrics. In T. Mills & K. Patterson (Eds.), Palgrave handbook of econometrics, Ch. 24 (Vol. 2, pp. 1119–1179). Palgrave Macmillan.10.1057/9780230244405_24Search in Google Scholar

Eckert, C. (1991). Offspring of empire: The Koch’ang Kims and the colonial origins of Korean capitalism, 1876–1945. University of Washington Press.Search in Google Scholar

Engle, R., & Granger, C. W. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251–276.10.2307/1913236Search in Google Scholar

Field, E. (2005). Property rights and investment in urban slums. Journal of the European Economic Association, 3(2), 279–290.10.1162/1542476054472937Search in Google Scholar

Field, E. (2007). Entitled to work: Urban property rights and labor supply in Peru. Quarterly Journal of Economics, 122(4), 1561–1602.10.1162/qjec.2007.122.4.1561Search in Google Scholar

Field, E., & Torero, M. (2006). Do property titles increase credit access among the urban poor? Evidence from a nationwide titling program. Working Paper, Harvard University.Search in Google Scholar

Frank, A. G. (1998). ReOrient: Global economy in the Asian age. University of California Press.10.1525/9780520921313Search in Google Scholar

Galiani, S., & Schargrodsky, E. (2010). Property rights for the poor: Effects of land titling. Journal of Public Economics, 94(9–10), 700–729.10.1016/j.jpubeco.2010.06.002Search in Google Scholar

Han, Z. (2020). Japanese colonial land survey project and Korean economic take-off. Research in World Economy, 11(6), 185–195.10.5430/rwe.v11n6p185Search in Google Scholar

He, Z., & Maekawa, K. (2001). On spurious Granger causality. Economics Letters, 73(3), 307–313.10.1016/S0165-1765(01)00498-0Search in Google Scholar

Hodgson, G. M. (2017). 1688 and all that: Property rights, the Glorious Revolution and the rise of British capitalism. Journal of Institutional Economics, 13(1), 79–107.10.1017/S1744137416000266Search in Google Scholar

Hoppit, J. (2011). Compulsion, compensation and property rights in Britain, 1688–1833. Past and Present, 210(1), 93–128.10.1093/pastj/gtq060Search in Google Scholar

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian Vector Autoregressive models. Econometrica, 59, 1551–1580.10.2307/2938278Search in Google Scholar

Johansen, S. (2006). Cointegration: An overview. In T. Mills & K. Patterson (Eds.), Palgrave handbook of econometrics (Vol. 1, pp. 540–577). Palgrave Macmillan.Search in Google Scholar

Johnson, C. (1982). MITI and the Japanese miracle: The growth of industrial policy, 1925–1975. Stanford University Press.10.1515/9780804765602Search in Google Scholar

Kim, N. N., et al. (2018). Historical statistics of Korea. Haenam.Search in Google Scholar

Kohli, A. (1994). Where do high growth political economies come from? The Japanese lineage of Korea’s ‘developmental state’. World Development, 22(9), 1269–1293.10.1016/0305-750X(94)90004-3Search in Google Scholar

Lütkepohl, H. (2005). New introduction to multiple time series analysis. Springer.10.1007/978-3-540-27752-1Search in Google Scholar

Lütkepohl, H., & Krätzig, M. (2007). Applied time series econometrics. Cambridge University Press.Search in Google Scholar

Maddison, A. (2020). Maddison project database. Groningen Growth and Development Centre. https://www.rug.nl/ggdc/historicaldevelopment/maddison/?lang=en.Search in Google Scholar

Marks, R. (2015). The origins of the modern world (3rd ed.). Rowman & Littlefield.Search in Google Scholar

Morris, I. (2010). Why the West rules – for now. Farrar, Straus & Giroux.Search in Google Scholar

North, D., & Thomas, R. P. (1973). The rise of the Western world, a new economic history. Cambridge University Press.10.1017/CBO9780511819438Search in Google Scholar

Ogilvie, S., & Carus, A. W. (2014). Institutions and economic growth in historic perspective. In P. Aghion & S. Durlauf (Eds.), Handbook of economic growth (1st ed). Chapter 8, Vol. 2, (pp. 403–513). Elsevier.10.1016/B978-0-444-53538-2.00008-3Search in Google Scholar

Pande, R., & Udry, C. (2005). Institutions and development: A view from below. In R. Blundell, W. Newey, & T. Persson (Eds.), Advances in economics and econometrics (pp. 349–412). Cambridge University Press.10.1017/CBO9781139052276.016Search in Google Scholar

Park, K. J., & Kim, N. N. (2011). An estimate of consumer price index of colonial Korea: 1907–1939. Economic Analysis, Bank of Korea, 17(1), 131–168.Search in Google Scholar

Research Commission for Real Estate Law. (1909). Essential report to real estate law. Residency General, Seoul.Search in Google Scholar

Steiger, O. (2006). Property economics versus new institutional economics: Alternative foundations of how to trigger economic development. Journal of Economic Issue, 40(1), 183–208.10.1080/00213624.2006.11506889Search in Google Scholar

Wang, S. Y. (2012). Credit constraints, job mobility and entrepreneurship: Evidence from a property reform in China. Review of Economics and Statistics, 94(2), 532–551.10.1162/REST_a_00160Search in Google Scholar

© 2025 the author(s), published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- Research Articles

- Research on the Coupled Coordination of the Digital Economy and Environmental Quality

- Optimal Consumption and Portfolio Choices with Housing Dynamics

- Regional Space–time Differences and Dynamic Evolution Law of Real Estate Financial Risk in China

- Financial Inclusion, Financial Depth, and Macroeconomic Fluctuations

- Harnessing the Digital Economy for Sustainable Energy Efficiency: An Empirical Analysis of China’s Yangtze River Delta

- Estimating the Size of Fiscal Multipliers in the WAEMU Area

- Impact of Green Credit on the Performance of Commercial Banks: Evidence from 42 Chinese Listed Banks

- Rethinking the Theoretical Foundation of Economics II: Core Themes of the Multilevel Paradigm

- Spillover Nexus among Green Cryptocurrency, Sectoral Renewable Energy Equity Stock and Agricultural Commodity: Implications for Portfolio Diversification

- Cultural Catalysts of FinTech: Baring Long-Term Orientation and Indulgent Cultures in OECD Countries

- Loan Loss Provisions and Bank Value in the United States: A Moderation Analysis of Economic Policy Uncertainty

- Collaboration Dynamics in Legislative Co-Sponsorship Networks: Evidence from Korea

- Does Fintech Improve the Risk-Taking Capacity of Commercial Banks? Empirical Evidence from China

- Multidimensional Poverty in Rural China: Human Capital vs Social Capital

- Property Registration and Economic Growth: Evidence from Colonial Korea

- More Philanthropy, More Consistency? Examining the Impact of Corporate Charitable Donations on ESG Rating Uncertainty

- Can Urban “Gold Signboards” Yield Carbon Reduction Dividends? A Quasi-Natural Experiment Based on the “National Civilized City” Selection

- How GVC Embeddedness Affects Firms’ Innovation Level: Evidence from Chinese Listed Companies

- The Measurement and Decomposition Analysis of Inequality of Opportunity in China’s Educational Outcomes

- The Role of Technology Intensity in Shaping Skilled Labor Demand Through Imports: The Case of Türkiye

- Legacy of the Past: Evaluating the Long-Term Impact of Historical Trade Ports on Contemporary Industrial Agglomeration in China

- Unveiling Ecological Unequal Exchange: The Role of Biophysical Flows as an Indicator of Ecological Exploitation in the North-South Relations

- Exchange Rate Pass-Through to Domestic Prices: Evidence Analysis of a Periphery Country

- Private Debt, Public Debt, and Capital Misallocation

- Impact of External Shocks on Global Major Stock Market Interdependence: Insights from Vine-Copula Modeling

- Informal Finance and Enterprise Digital Transformation

- Wealth Effect of Asset Securitization in Real Estate and Infrastructure Sectors: Evidence from China

- Consumer Perception of Carbon Labels on Cross-Border E-Commerce Products and its Influencing Factors: An Empirical Study in Hangzhou

- How Agricultural Product Trade Affects Agricultural Carbon Emissions: Empirical Evidence Based on China Provincial Panel Data

- The Role of Export Credit Agencies in Trade Around the Global Financial Crisis: Evidence from G20 Countries

- How Foreign Direct Investments Affect Gender Inequality: Evidence From Lower-Middle-Income Countries

- Big Five Personality Traits, Poverty, and Environmental Shocks in Shaping Farmers’ Risk and Time Preferences: Experimental Evidence from Vietnam

- Academic Patents Assigned to University-Technology-Based Companies in China: Commercialisation Selection Strategies and Their Influencing Factors

- Review Article

- Bank Syndication – A Premise for Increasing Bank Performance or Diversifying Risks?

- Special Issue: The Economics of Green Innovation: Financing And Response To Climate Change

- A Bibliometric Analysis of Digital Financial Inclusion: Current Trends and Future Directions

- Targeted Poverty Alleviation and Enterprise Innovation: The Mediating Effect of Talent and Financing Constraints

- Does Corporate ESG Performance Enhance Sustained Green Innovation? Empirical Evidence from China

- Can Agriculture-Related Enterprises’ Green Technological Innovation Ride the “Digital Inclusive Finance” Wave?

- Special Issue: EMI 2025

- Digital Transformation of the Accounting Profession at the Intersection of Artificial Intelligence and Ethics

- The Role of Generative Artificial Intelligence in Shaping Business Innovation: Insights from End Users’ Perspectives and Practices

- The Mediating Role of Climate Change Mitigation Behaviors in the Effect of Environmental Values on Green Purchasing Behavior within the Framework of Sustainable Development

- Special Issue: The Path to Sustainable And Acceptable Transportation

- Factors Influencing Environmentally Friendly Air Travel: A Systematic, Mixed-Method Review

- Special Issue: Shapes of Performance Evaluation - 2nd Edition

- Redefining Workplace Integration: Socio-Economic Synergies in Adaptive Career Ecosystems and Stress Resilience – Institutional Innovation for Empowering Newcomers Through Social Capital and Human-Centric Automation

- Knowledge Management in the Era of Platform Economies: Bibliometric Insights and Prospects Across Technological Paradigms

- The Impact of Quasi-Integrated Agricultural Organizations on Farmers’ Production Efficiency: Evidence from China

Articles in the same Issue

- Research Articles

- Research on the Coupled Coordination of the Digital Economy and Environmental Quality

- Optimal Consumption and Portfolio Choices with Housing Dynamics

- Regional Space–time Differences and Dynamic Evolution Law of Real Estate Financial Risk in China

- Financial Inclusion, Financial Depth, and Macroeconomic Fluctuations

- Harnessing the Digital Economy for Sustainable Energy Efficiency: An Empirical Analysis of China’s Yangtze River Delta

- Estimating the Size of Fiscal Multipliers in the WAEMU Area

- Impact of Green Credit on the Performance of Commercial Banks: Evidence from 42 Chinese Listed Banks

- Rethinking the Theoretical Foundation of Economics II: Core Themes of the Multilevel Paradigm

- Spillover Nexus among Green Cryptocurrency, Sectoral Renewable Energy Equity Stock and Agricultural Commodity: Implications for Portfolio Diversification

- Cultural Catalysts of FinTech: Baring Long-Term Orientation and Indulgent Cultures in OECD Countries

- Loan Loss Provisions and Bank Value in the United States: A Moderation Analysis of Economic Policy Uncertainty

- Collaboration Dynamics in Legislative Co-Sponsorship Networks: Evidence from Korea

- Does Fintech Improve the Risk-Taking Capacity of Commercial Banks? Empirical Evidence from China

- Multidimensional Poverty in Rural China: Human Capital vs Social Capital

- Property Registration and Economic Growth: Evidence from Colonial Korea

- More Philanthropy, More Consistency? Examining the Impact of Corporate Charitable Donations on ESG Rating Uncertainty

- Can Urban “Gold Signboards” Yield Carbon Reduction Dividends? A Quasi-Natural Experiment Based on the “National Civilized City” Selection

- How GVC Embeddedness Affects Firms’ Innovation Level: Evidence from Chinese Listed Companies

- The Measurement and Decomposition Analysis of Inequality of Opportunity in China’s Educational Outcomes

- The Role of Technology Intensity in Shaping Skilled Labor Demand Through Imports: The Case of Türkiye

- Legacy of the Past: Evaluating the Long-Term Impact of Historical Trade Ports on Contemporary Industrial Agglomeration in China

- Unveiling Ecological Unequal Exchange: The Role of Biophysical Flows as an Indicator of Ecological Exploitation in the North-South Relations

- Exchange Rate Pass-Through to Domestic Prices: Evidence Analysis of a Periphery Country

- Private Debt, Public Debt, and Capital Misallocation

- Impact of External Shocks on Global Major Stock Market Interdependence: Insights from Vine-Copula Modeling

- Informal Finance and Enterprise Digital Transformation

- Wealth Effect of Asset Securitization in Real Estate and Infrastructure Sectors: Evidence from China

- Consumer Perception of Carbon Labels on Cross-Border E-Commerce Products and its Influencing Factors: An Empirical Study in Hangzhou

- How Agricultural Product Trade Affects Agricultural Carbon Emissions: Empirical Evidence Based on China Provincial Panel Data

- The Role of Export Credit Agencies in Trade Around the Global Financial Crisis: Evidence from G20 Countries

- How Foreign Direct Investments Affect Gender Inequality: Evidence From Lower-Middle-Income Countries

- Big Five Personality Traits, Poverty, and Environmental Shocks in Shaping Farmers’ Risk and Time Preferences: Experimental Evidence from Vietnam

- Academic Patents Assigned to University-Technology-Based Companies in China: Commercialisation Selection Strategies and Their Influencing Factors

- Review Article

- Bank Syndication – A Premise for Increasing Bank Performance or Diversifying Risks?

- Special Issue: The Economics of Green Innovation: Financing And Response To Climate Change

- A Bibliometric Analysis of Digital Financial Inclusion: Current Trends and Future Directions

- Targeted Poverty Alleviation and Enterprise Innovation: The Mediating Effect of Talent and Financing Constraints

- Does Corporate ESG Performance Enhance Sustained Green Innovation? Empirical Evidence from China

- Can Agriculture-Related Enterprises’ Green Technological Innovation Ride the “Digital Inclusive Finance” Wave?

- Special Issue: EMI 2025

- Digital Transformation of the Accounting Profession at the Intersection of Artificial Intelligence and Ethics

- The Role of Generative Artificial Intelligence in Shaping Business Innovation: Insights from End Users’ Perspectives and Practices

- The Mediating Role of Climate Change Mitigation Behaviors in the Effect of Environmental Values on Green Purchasing Behavior within the Framework of Sustainable Development

- Special Issue: The Path to Sustainable And Acceptable Transportation

- Factors Influencing Environmentally Friendly Air Travel: A Systematic, Mixed-Method Review

- Special Issue: Shapes of Performance Evaluation - 2nd Edition

- Redefining Workplace Integration: Socio-Economic Synergies in Adaptive Career Ecosystems and Stress Resilience – Institutional Innovation for Empowering Newcomers Through Social Capital and Human-Centric Automation

- Knowledge Management in the Era of Platform Economies: Bibliometric Insights and Prospects Across Technological Paradigms

- The Impact of Quasi-Integrated Agricultural Organizations on Farmers’ Production Efficiency: Evidence from China