Abstract

We analyze the transitional dynamics of an economic model with heterogeneous consumption goods where convergence is driven by two different forces: the typical diminishing returns to capital and the dynamic adjustment in consumption expenditure induced by the variation in relative prices. We show that this second force affects the growth rate if the consumption goods are produced with technologies exhibiting different capital intensities and if the intertemporal elasticity of substitution is not equal to one. Because the aforementioned growth effect of relative prices arises only under heterogeneous consumption goods, the transitional dynamics of this model exhibits striking differences with the growth model with a single consumption good. We also show that these differences in the transitional dynamics can give raise to large discrepancies in the welfare cost of shocks.

Acknowledgments

Financial support from the Government of Spain through grants ECO2012-32392, ECO2012-34046 and ECO2011-23959; PR2009-0162 and SM2009-0001; the Generalitat of Catalonia through grants 2014-SGR-803 and 2014-SGR-493; and the Xunta de Galicia through grant 10PXIB300177PR is gratefully acknowledged. Alonso-Carrera also thanks the Research School of Economics (Australian National University) for its hospitality. Caballé also thanks the financial support from the ICREA Academia program. The paper has benefited from comments by the editor and two referees of this journal and by participants in the World Congres of the Econometric Society (Shanghai), DEGIT (Los Angeles), ESEM (Milan), SAEe (Granada), ASSET (Padova), Australasian Workshop in Macroeconomic Dynamics, PET13 (Lisbon), Conference on Structural Change, Dynamics, and Economic Growth (Pisa) and seminars in UPV (Bilbao), IAE-CSIC (Barcelona), Australian National University, University of Melbourne, Monash University, Macquarie University, University of Wollongong, National University of Ireland (Maynooth), Geary Institute (UCD), GREQAM (Marseille), Universidad de Murcia, Universidad de las Islas Baleares, Universitat Rovira i Virgili and Universidade do Minho.

Appendix

A. Solution to the consumer’s optimization problem.

The Hamiltonian function associated with the maximization of (6) subject to (3), (4) and (5) is

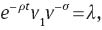

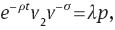

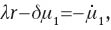

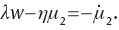

where λ, μ1, and μ2 are the co-state variables corresponding to the constraints (3), (4) and (5), respectively. The first order conditions are

Combining (44) and (45), we obtain Equation (7) and, from log-differentiating this equation with respect to time, we get

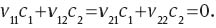

Since v(c1, c2) is linear homogeneous, we establish the following relations:

Using Conditions (51) and (52) in (50), and after some algebra, we obtain

where ξ is the elasticity of substitution of v(·) given in (13). Using (46) and (47), we obtain

which implies that

and (8) follows from using (48) and (49). Log-differentiating with respect to time (44), we obtain

By employing the definition of the elasticity of substitution ξ given in (13), we derive

Combining this equation with (46) and (48), and using Conditions (51) and (52), we obtain

Finally, Equations (9) and (10) follow from combining the previous equation with (53) and combining the resulting expression with (51) and (52).

B. Deriving the Euler equation on expenditure

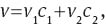

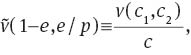

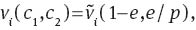

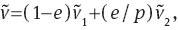

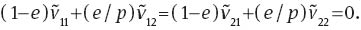

First, we express the solution to the consumer’s problem in terms of total expenditure and the fraction of expenditure on c2. To this end, we use the linear homogeneity of function v(·) to define

and, moreover, we note that

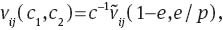

and

for i={1, 2} and j={1, 2}. Using these properties, we rewrite Condition (7) as

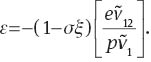

the elasticity of substitution ξ given in (13) as

and the Edgeworth elasticity ε given in (14) as

Since

and

Condition (60) together with (57) implies that

Using the strict quasiconcavity of v and

By using Condition (61), and after some algebra, we obtain

so that (15) follows from using (57) and (62).

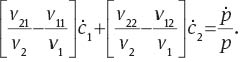

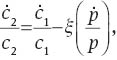

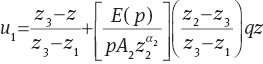

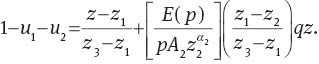

Log-differentiating c1=(1–e)c with respect to time, and combining the resulting expression with (9), we obtain

By combining the previous equation with (57), (59), (62) and (15), and after some algebra, we obtain (16).

C. Proofs of results

Proof of Proposition 3.1.

Consider first the condition α1=α2. We can first combine equations (17), (18), (20) and (21) to get z1=z2. Therefore, by combining equations (17) and (18), it follows that the relative price between the two consumption goods remains constant and equal to p=A1/A2.

Let us now consider the condition α1=α3. Observe that in this case conditions (17), (19), (20) and (22) imply that z1=z3 and, thus, the relative price between the two capitals is constant and given by ph=A1/A3. Equation (8) implies that the ratio w/r remains constant when ph is constant. Then, from combining (17) and (20) we immediately see that z1 is constant when ph is constant. Therefore, both the rental rate r and z2 are constant as follows from (17) and (19). Finally, equation (18) shows that in this case relative price p between the two consumption goods remains constant. ■

Proof of Proposition 3.2. The uniqueness of p* follows from the monotonicity of κ(p), which can be shown using (32),

and the fact that

Combining (26), (27) and (28), we obtain

and

Given the value of p*, the strict quasiconcavity of v(c1, c2) guarantees a unique stationary value of the expenditure shares. Denote by

By using (63) and (64), the previous two equations can be rewritten as the following system of two equations:

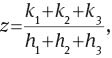

The steady state values of z* and q* are the unique solution of this system of equations and they are equal to

and

where the steady-state values of zi, i={1, 2, 3}, satisfy

Proof of Proposition 4.1. Let J be the Jacobian matrix evaluated at the steady state of the system of differential equations formed by (32), (37) and (38), [13]

where

and

The determinant of the Jacobian matrix is

where

Using (26), (63) and (64), and after some algebra, M simplifies to

Note that N>0 because

where the inequality follows from the transversality condition, which implies that ρ>(1–σ)g*. Thus, the determinant is given by

By using (23) and (25), we obtain that z3>(<)z1 when α1<(>)α3 and, therefore, we derive from the proof of Proposition 3.2 that κ′(p)>(<)0 when z3>(<)z1. We then conclude that Det(J)<0. Next, we obtain the value of the trace,

Using (63) and (64), the trace simplifies, after some tedious algebra, to

Making κ(p)=0, we obtain

and, by using (35) at BGP, we derive

as follows from the transversality condition.

Since the trace of J is positive and the determinant is negative, there exists a unique negative root and the equilibrium is saddle-path stable. When α1>α3 the adjustment process of relative price p is stable so that the negative root of the Jacobian J is pκ′(p). Otherwise, the dynamic process of p is unstable In this case, relative price p instantaneously jumps to its stationary value, and the negative root of J is one of the roots obtained from the sub-system of differential equations formed by equations (37) and (38) with p=p* for all t. [14] ■

Proof of Lemma 4.2. Equation (23) shows that all the physical to human capital ratios in the three sectors, z1, z2 and z3, depend positively (negatively) on relative price p when α1>(<)α2. We can write the aggregate physical to human capital ratio z=k/h as

where ki and hi are the stocks of physical and human capital used in the production of good i, i={1, 2, 3}. When all the ratios z1, z2 and z3 vary in the same direction, the aggregate physical to human capital ratio z also varies in this direction. For instance, if all the ratios z1, z2 and z3 rise, then the following relationship between the increments of the sectoral capital stocks must apply: Δk1>Δh1, Δk2>Δh2, and Δk3>Δh3. Therefore,

Using the previous inequality in (65), and the dependence of the ratios z1, z2 and z3 on relative price p, we obtain the monotonically increasing (decreasing) relationship between the aggregate physical to human capital ratio z and relative price p of human capital along the stable manifold when α1>(<)α2.

Note that equation (23) implies that limp→0zi=0(∞) when α1>(<)α2, with zi=ki/hi, i={1, 2, 3}. This means that either limp→0ki=0(∞) or limp→0hi=∞(0) when α1>(<)α2. In both cases, we will get that limp→0z=0(∞) if α1>(<)α2. However, limp→∞zi=∞(0) when α1>(<)α2, with zi=ki/hi, i={1, 2, 3}, which means that either limp→∞ki=∞(0) or limp→∞hi=0(∞) when α1>(<)α2. In both cases, we will get that limp→∞z=∞(0) if α1>(<)α2. Therefore, as the ratio z may take potentially any value in the interval (0, ∞), the range of values of the price p along the stable manifold is also (0, ∞). ■

Proof of Proposition 4.3. In the proof of Proposition 4.1, we have shown that κ′(p)<0 if α1>α3. This means that the relative price exhibit a monotonic transition. In addition, Lemma 4.2 states that the stable manifold relating prices and the ratio of capitals is strictly monotone. This implies that the ratio z of capitals must also exhibit a monotonic behavior along the entire transition. ■

Proof of Proposition 4.4. Given the sign of P′(z) characterized by Lemma 4.2, we conclude from (40) that the growth rate of consumption expenditure γ is increasing (decreasing) when Ω(z)>(<)0. Therefore, the statement of the proposition directly follows from (41). Parts (a) and (d) follow since Ω(z)<0 when χ≤0 and Ω(z)>0 when

References

Acemoglu, D., and V. Guerrieri. 2008. “Capital Deepening and Nonbalanced Economic Growth.” Journal of Political Economy 116: 467–498.10.1086/589523Search in Google Scholar

Alvarez-Cuadrado, F. 2008. “Growth Outside the Stable Path: Lessons from the European Reconstruction.” European Economic Review 52: 568–588.10.1016/j.euroecorev.2007.02.003Search in Google Scholar

Alvarez-Cuadrado, F., G. Monterio, and S. Turnovsky. 2004. “Habit Formation, Catching-up with the Joneses, and Economic Growth.” Journal of Economic Growth 9: 47–80.10.1023/B:JOEG.0000023016.26449.ebSearch in Google Scholar

Bond E., P. Wang, and C. Yip. 1996. “A General Two-Sector Model of Endogenous Growth with Human and Physical Capital: Balanced Growth and Transitional Dynamics.” Journal of Economic Theory 68: 149–173.10.1006/jeth.1996.0008Search in Google Scholar

Boppart, T. 2014. “Structural Change and the Kaldor Facts in a Growth Model with Relative Price Effects and Non-Gorman Preferences.” Econometrica, forthcoming.10.3982/ECTA11354Search in Google Scholar

Buera, F. J., and J. P. Kaboski. 2009. “Can Traditional Theories of Structural Change Fit the Data?” Journal of European Economic Association 7: 469–477.10.1162/JEEA.2009.7.2-3.469Search in Google Scholar

Caballé, J., and M. Santos. 1993. “On Endogenous Growth with Physical and Human Capital.” Journal of Political Economy 101: 1042–1067.10.1086/261914Search in Google Scholar

Cooley, T., and E. Prescott. 1995. “Economic Growth and Business Cycles.” In Frontiers of Business Cycle Research, edited by T. Cooley, 1–38. Princeton University Press.10.1515/9780691218052-005Search in Google Scholar

Christiano, L. J. 1989. “Understanding Japan’s Saving Rate: The Reconstruction Hypothesis.” Federal Reserve Bank of Minneapolis Quarterly Review 13: 10–25.10.21034/qr.1322Search in Google Scholar

Echevarria, C. 1997. “Changes in Sectoral Composition Associated with Economic Growth.” International Economic Review 38: 431–452.10.2307/2527382Search in Google Scholar

Fiaschi, D., and A. M. Lavezzi. 2004. “Nonlinear Growth in a Long-run Perspective.” Applied Economic Letters 11: 101–104.10.1080/1350485042000200196Search in Google Scholar

Foellmi, R., and J. Zweimüller. 2008. “Structural Change, Engel’s Consumption Cycles and Kaldor’s Facts of Economic Growth.” Journal of Monetary Economics 55: 1317–1328.10.1016/j.jmoneco.2008.09.001Search in Google Scholar

Hall, R. E. 1988. “Intertemporal Substitution in Consumption.” Journal of Political Economy 96: 339–357.10.1086/261539Search in Google Scholar

Hansen, G., and E. Prescott. 2002. “Malthus to Solow.” American Economic Review 92: 1205–1217.10.1257/00028280260344731Search in Google Scholar

Herrendorf, B., R. Rogerson, and A. Valentinyi. 2013. “Two Perspectives on Preferences and Structural Transformation.” American Economic Review 103: 2752–2789.10.1257/aer.103.7.2752Search in Google Scholar

Jones, L. E., R. E. Manuelli, and P. E. Rosi. 1993. “Optimal taxation in Models of Endogenous Growth.” Journal of Political Economy 101: 485–517.10.1086/261884Search in Google Scholar

Kongsamut, P., S. Rebelo and D. Xie. 2001. “Beyond Balanced Growth.” Review of Economic Studies 68: 869–882.10.1111/1467-937X.00193Search in Google Scholar

Laitner, J. 2000. “Structural Change and Economic Growth.” Review of Economic Studies 67: 545–561.10.1111/1467-937X.00143Search in Google Scholar

Lucas, R. E. 1987. Models of Business Cycles. Basil Blackwell.Search in Google Scholar

Lucas, R. 1988. “On the Mechanics of Economic Development.” Journal of Monetary Economics 22: 3–42.10.1016/0304-3932(88)90168-7Search in Google Scholar

Maddison, A. 2001. The World Economy: A Millennia Perspective. OECD, Paris.10.1787/9789264189980-enSearch in Google Scholar

Mulligan, C., and X. Sala-i-Martín. 1993. “Transitional Dynamics in Two-Sector Models of Endogenous Growth.” Quarterly Journal of Economics 108: 737–773.10.2307/2118407Search in Google Scholar

Ngai, R. 2004. “Barriers and the Transition to Modern Growth.” Journal of Monetary Economics 51: 1353–1383.10.1016/j.jmoneco.2003.12.005Search in Google Scholar

Ngai, R., and C. Pissarides. 2007. “Structural Change in a Multi-sector Model of Growth.” American Economic Review 97: 429–443.10.1257/aer.97.1.429Search in Google Scholar

Papageorgiou, C., and F. Perez-Sebastian. 2006. “Dynamics in a Non-Scale R&D Growth Model: Explaining the Japanese and South Korean Development Experiences.” Journal of Economic Dynamics and Control 30: 901–930.10.1016/j.jedc.2005.03.005Search in Google Scholar

Perez, F., and D. Guillo. 2010. “Reexamining the Role of Land in Economic Growth.” Manuscript.Search in Google Scholar

Perli, R., and P. Sakellaris. 1998. “Human Capital Formation and Business Cycle Persistence.” Journal of Monetary Economics 42: 67–92.10.1016/S0304-3932(98)00011-7Search in Google Scholar

Rebelo, S. 1991. “Long-run Policy Analysis and Long-run Growth.” Journal of Political Economy 99: 500–521.10.1086/261764Search in Google Scholar

Rebelo, S. 1992. “Growth in Open Economies.” Carnegie-Rochester Conference Series on Public Policy 36: 5–46.10.1016/0167-2231(92)90014-ASearch in Google Scholar

Rostow, W. 1960. The Stages of Economic Growth. Oxford: Oxford University Press.Search in Google Scholar

Steger, T. M. 2000. “Economic Growth with Subsistence Consumption.” Journal of Development Economics 62: 343–361.10.1016/S0304-3878(00)00088-2Search in Google Scholar

Steger, T. M. 2006. “Heterogeneous Consumption Goods, Sectoral Change and Economic Growth,” Studies in Nonlinear Dynamics and Econometrics 10 (1): Article 2.10.2202/1558-3708.1309Search in Google Scholar

Uzawa, H. 1965. “Optimum Technical Change in an Aggregative Model of Economic Growth.” International Economic Review 60: 12–31.10.2307/2525621Search in Google Scholar

Valentinyi, A., and B. Herrendorf. 2008. “Measuring factor income shares at the sectoral level.” Review of Economic Dynamics 11: 820–835.10.1016/j.red.2008.02.003Search in Google Scholar

©2015 by De Gruyter

Articles in the same Issue

- Frontmatter

- Advances

- Consumption composition and macroeconomic dynamics

- Evaluating linear approximations in a two-country model with occasionally binding borrowing constraints

- Contributions

- The bank lending channel and monetary policy rules for Eurozone banks: further extensions

- Investment lags and macroeconomic dynamics

- The zero lower bound: frequency, duration, and numerical convergence

- What drives endogenous growth in the United States?

- Environmental policy and economic growth: the macroeconomic implications of the health effect

- US household deleveraging following the Great Recession – a model-based estimate of equilibrium debt

- Price-level instability and international monetary policy coordination

- Households forming macroeconomic expectations: inattentive behavior with social learning

- Topics

- Complementarity and transition to modern economic growth

- Trend inflation and monetary policy rules: determinacy analysis in New Keynesian model with capital accumulation

- Discussions

- Preface to “Reflections on Macroeconometric Modeling” by Ray C. Fair

- Reflections on macroeconometric modeling

Articles in the same Issue

- Frontmatter

- Advances

- Consumption composition and macroeconomic dynamics

- Evaluating linear approximations in a two-country model with occasionally binding borrowing constraints

- Contributions

- The bank lending channel and monetary policy rules for Eurozone banks: further extensions

- Investment lags and macroeconomic dynamics

- The zero lower bound: frequency, duration, and numerical convergence

- What drives endogenous growth in the United States?

- Environmental policy and economic growth: the macroeconomic implications of the health effect

- US household deleveraging following the Great Recession – a model-based estimate of equilibrium debt

- Price-level instability and international monetary policy coordination

- Households forming macroeconomic expectations: inattentive behavior with social learning

- Topics

- Complementarity and transition to modern economic growth

- Trend inflation and monetary policy rules: determinacy analysis in New Keynesian model with capital accumulation

- Discussions

- Preface to “Reflections on Macroeconometric Modeling” by Ray C. Fair

- Reflections on macroeconometric modeling