Challenges and Countermeasures for the Sustainable Development of Local Finance under the Impact of COVID-19

-

Deyong Zhang

Abstract

In recent years, the risks and challenges at home and abroad have increased significantly, and the downward pressure on the economy has increased, especially the implementation of larger-scale tax and fee cuts under the proactive fiscal policy, while the rigidity of local fiscal expenditure has not been reduced, and the sustainable development of local finance is facing greater challenges. In particular, the COVID-19 pandemic has had a serious impact on the already stressed local finance, which has led to the intensified contradiction between local fiscal revenue and expenditure. This paper analyzes the challenges to the sustainable development of local finance under the impact of COVID-19 from four angles: the greater economic downward pressure combined with larger-scale tax and fee cuts, the fiscal relationship between the central and local governments, land finance, and transfer payment, then puts forward the corresponding policy recommendations.

1 Introduction

In the face of the sudden outbreak of COVID-19, China has devoted all its efforts to the prevention and control of the pandemic, among which fiscal support is particularly important. 2019, China added a total of more than 2 trillion yuan in tax and fee cuts. At the beginning of that year, affected by the pandemic and other factors, the country’s general public budget revenue fell 14.3 percent year on year in the first quarter. [1] At present in China, the epidemic prevention and control continues to improve, the local spread of the pandemic is nearly blocked, the resumption of work and production is accelerated, and the overall economic and social development is stable. How to maintain the sustainable development of local finance under the impact of COVID-19 is an urgent problem.

Local finance is an important part of national finance and the financial guarantee for local governments to perform their functions. After the reform of the tax sharing system in 1994, the fiscal relationship between the central and provincial governments has been basically determined, but the inter-governmental fiscal relationship below the provincial level need to be straightened out. This kind of institutional arrangement leads to the upward concentration of financial resources, and the resources get tighter as they go to the grass-roots level. As the local governments cannot increase local revenue by increasing local taxes or adjusting tax rates, in addition to fiscal revenue, they also have to rely on land transfer funds or urban investment company debt financing to meet the needs of expenditure. However, with adhering to the positioning that “housing is for living in, not for speculation”, land finance is not sustainable; and with the strict control of hidden debt by local governments, their debt financing channels are becoming more and more strict. In this case, local finance is under tremendous pressure of fiscal revenue and expenditure, and its sustainable development has become an important issue that cannot be avoided in the new round of fiscal and tax system reform. At the same time, in recent years, the internal and external environment of China’s economic development is severe and complex, and the downward pressure on the economy tends to increase, especially under the proactive fiscal policy to reduce taxes and fees on a larger scale, while the rigidity of local fiscal expenditure is not reduced. As a result, the contradiction between local fiscal revenue and expenditure has intensified, and the sustainable development of local finance is facing severe challenges. It is worth noting that with the sudden COVID-19 pandemic spread throughout the country, the prevention and control of the pandemic has inevitably affected the macro-economy, the sustainable development of local finance is facing more and more severe challenges.

2 The Connotation of the Sustainable Development of Local Finance

Fiscal sustainability is not only an important guarantee for maintaining economic and social stability, but also the basis for the government to perform its functions, and more of the starting point for promoting the modernization of governance system and capacity. Buiter (1985) first proposed the concept of fiscal sustainability. He believed that fiscal sustainability refers to the state or capacity of a country’s finance, and, to make fiscal sustainable, it is necessary to keep the ratio of net output value of national public sector to GDP at the current level. Fiscal sustainability can be understood from balance of payments, debt, financing capacity, fiscal risk and other aspects. Deng (2001) believed that fiscal sustainability is aimed at the government debt risk that may be caused by the implementation of fiscal policy, that is, in the indefinite period, under the assumption of borrowing new debt, repaying old debt and maintaining stable currency value, the current level of government debt must be equal to the present value of the initial fiscal surplus. Liu (2003) believed that fiscal risk is the possibility that the government’s public resources cannot fulfill the responsibility and obligation of expenditure, resulting in damage to social and economic stability and development. Gong et al. (2015) believed that fiscal sustainability refers to the state that the intertemporal budget constraint can continue to maintain without any adjustment under the current policy and economic and social development trend. Du et al. (2019) believed that the sustainability of local finance is aimed at the rise of debt level or the deterioration of fiscal situation, and the local government will take the initiative in fiscal adjustment to improve the fiscal situation and reduce fiscal risk. The above-mentioned literature explains what is fiscal sustainability from different perspectives, and provide useful enlightenment for us to understand and define the sustainable development of local finance.

Sustainability refers to a process or state that can be maintained for a long time, and fiscal sustainability is usually used to describe the long-term fiscal policy implemented by the government. Generally, fiscal policy is a discretionary measure to adjust macroeconomic fluctuations. It makes appropriate adjustments on the basis of macroeconomic conditions and economic cycles. Therefore, neither loose fiscal policy nor tight fiscal policy will last for a long time. The sustainable development of finance means that a certain kind of fiscal policy cannot continue indefinitely. When the fiscal situation shows signs of unsustainability, the government needs to make adjustment to maintain the sustainable development of finance.

This paper maintains that the sustainable development of local finance can be understood from three aspects: first, facing the deterioration of local fiscal situation or the rise of debt level, local governments will take the initiative to reduce expenditure and control the scale of debt to improve the fiscal situation; second, local governments pay more attention to the efficiency of fiscal fund utilization and the virtuous cycle of finance itself; third, sustainable development of local finance also includes fiscal support for sustainability in economic, social, cultural and ecological fields, and attaches importance to the role of fiscal support for sustainable development in those fields.

3 Challenges to the Sustainable Development of Local Finance under the Impact of COVID-19

China’s economy is facing greater downward pressure. The impact of the COVID-19 pandemic on economic and social development is unprecedented. The pressure on sustained and stable economic development leads to the pressure on sustainable development of local finance. In recent years, the proactive fiscal policy has strengthened and improved efficiency by implementing larger-scale tax and fee cuts, which left little room for local fiscal maneuver, and resulted in limited growth of fiscal revenue and unchanged rigidity of fiscal expenditure. The great pressure on local finance, coupled with the central and local vertical fiscal imbalance since the reform of the tax sharing system, has posed a great challenge to the current sustainable development of local finance.

3.1 Increased Downward Pressure on the Economy Coupled with Larger Tax and Fee Cuts

There is a close relationship between economy and finance. Economy determines finance, and finance reflects economy. At present, China’s economic development is facing many risks and challenges. China is in a critical period of changing the driving force of economic growth, adjusting and optimizing the economic structure, and changing the mode of development. Their combined impact on economic and social development continues to deepen. Meanwhile, the current international political and economic order is facing challenges, with the global economic growth rate slowing down, and the impact of the pandemic increasing the instability and uncertainty of global economic development. Therefore, the current economic development of China is facing many risks and challenges.

In order to alleviate the downward pressure on the economy, lighten the burden on enterprises, and also slow down the impact of the “black swan” incident of the pandemic on economic development, proactive fiscal policy should be more active and promising. It is necessary to implement larger-scale tax and fee cuts, and it is also an important measure to promote supply-side structural reform. In 2019, China added a total of more than 2 trillion yuan of tax and fee cuts, accounting for about 2% of GDP, driving the growth of GDP by about 0.8% that year. [1] The tax burden of all industries has dropped, which stimulated the vitality of market entities and promoted high-quality economic development in China. But it also brought some problems. First, the implementation of larger-scale tax and fee cuts will lead to a decline in local fiscal revenue growth, or even negative growth. Second, the implementation of larger tax cuts will affect the local fiscal structure. Under the full-scope budget, local governments may seek other sources of income when they reduce revenue but not expenditure. The central government has strict regulations on local transfer payment and tax return, and the operating income of state-owned capital accounts for a small proportion of the total local revenue, so the local government would turn to the government managed funds revenue. According to the 2019 central and local budgets, the revenue from the transfer of state-owned land use rights accounts for about 85% of the national government funds revenue, [2] and the following analysis shows that land finance is not sustainable. Third, since the outbreak of the pandemic, the ministry of Finance has issued a series of fiscal and tax support policies, such as material production, procurement, discount on corporate loans, tax concessions, and guarantee of the priority of medical and pandemic prevention personnel, which has also led to an increase in fiscal expenditure at all levels. Therefore, under the increasing downward pressure on the economy and limited access to other financial sources, coupled with a series of fiscal and tax policies and measures introduced in response to COVID-19, the implementation of larger-scale tax and fee cuts may aggravate the contradiction between local fiscal revenue and expenditure, and the sustainable development of local finance is facing greater challenges.

3.2 The Imbalance of Fiscal Relationship between Central and Local Governments

The reform of tax distribution system in 1994 divided the scope of central and local fiscal revenue and expenditure, and formed the fiscal relationship with stronger central finance and weaker local finance.

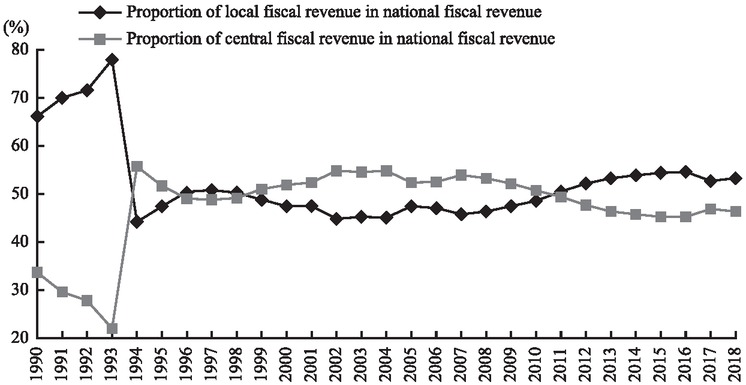

As shown in Figure 1, since the reform of the tax sharing system, the proportion of local fiscal revenue in the national fiscal revenue has been lower than that of the central fiscal revenue for quite a long time. Before the reform, the proportion of local fiscal revenue was higher than that of central fiscal revenue. After the reform, it decreased to 45~55%. In 2002, with the implementation of the income tax revenue sharing reform, it dropped below 50%. Since 2011, the proportion has gradually increased, but with the comprehensive promotion of the reform of replacing business tax with value-added tax in 2016, it declined again.

Proportions of Central and Local Fiscal Revenue

Source: The authors calculated according to China Statistical Yearbooks.

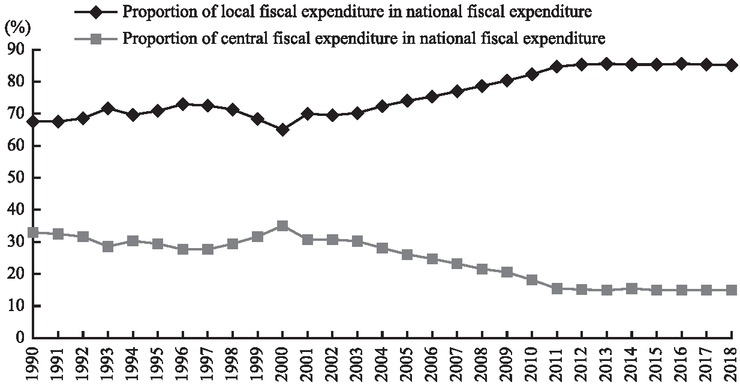

Though the proportion of local fiscal revenue decreased, the expenditure responsibility of local governments did not decrease. China’s local governments are the “all-round” governments, which undertake the expenditure responsibility of local economic and social development, social security, public facilities and so on. The local government should not only be responsible for the local infrastructure construction, but also bear most of the expenditure on health care, education, and ecological protection. Especially in recent years, the local fiscal expenditure grows fast in favor of people’s livelihoods. In 1990, the local fiscal expenditure was 207.945 billion yuan, and in 2019, the local general public budget expenditure was 20375.9 billion yuan, with an average annual growth rate of about 17.1%, far greater than that of GDP and local fiscal revenue. [1] As shown in Figure 2, since 1990, the proportion of local fiscal expenditure in national fiscal expenditure has been maintained at 65~85%, and since 2011, local fiscal expenditure has remained at a high level.

Proportions of Central and Local Fiscal Expenditure

Source: The authors calculated according to China Statistical Yearbooks.

After the reform of the tax sharing system, the fiscal power is almost controlled by the central government, while the administrative power is gradually delegated to the local government. This kind of fiscal decentralization leads to the “natural fiscal gap” of the local government. Although the transfer payment system can fill a certain local fiscal gap and adjust the financial differences between regional governments, it is difficult to meet the needs of all local expenditures. At the same time, for a long time, GDP growth rate and other economic development indicators are important indicators to evaluate local government officials, which induce local government officials to take various ways to promote local economic growth. Therefore, some local government officials will favor the “resource-intensive” projects to promote the rapid growth of GDP, while the “resource-intensive” projects generally require a lot of capital investment, which also leads to the rapid increase of local fiscal expenditure in the short term, forming a “competitive fiscal gap”.

3.3 Land Finance Is Unsustainable

In order to promote economic development and pursue political achievements, local governments fill the fiscal gap through land-related revenue, resulting in land finance. Most of the revenue related to land resources is obtained by the local government, such as land transfer fee and land value-added tax. Therefore, it is an important way for the local government to compensate for the lack of financial resources through land sale.

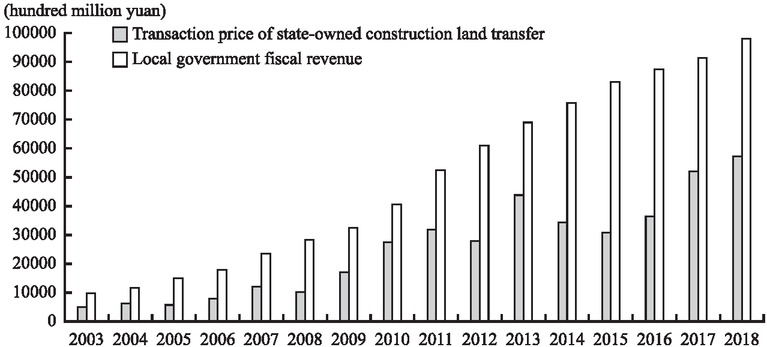

As shown in Figure 3, since 2004, the ratio of the transaction price of state-owned construction land transfer to the local fiscal revenue has remained at about 1:2, and the local government has been filling the local fiscal gap by transferring a large number of state-owned construction land use rights. Thus, the transaction price of state-owned construction land transfer occupies an extremely important position in the local revenue. However, this growth mode is unsustainable and has had considerable negative impact on China’s economic and social development. On the one hand, in order to attract investment, the local government deliberately lowers the transfer price of industrial land, and reduces the compensation for land acquisition; on the other hand, the local government controls the supply scale of commercial and residential land, which leads to the rapid rise of real estate prices and makes it very difficult for the middle and low income groups to buy houses.

Local Fiscal Revenue and Transaction Price of State-Owned Construction Land Transfer

Source: The authors calculated according to China Statistical Yearbooks and China Land and Resources Statistical Yearbooks.

From the perspective of land finance affecting local fiscal revenue, land is a kind of scarce resource, and its total amount is limited. If too much land is consumed at present, inevitably less land can be used in the future, which is unsustainable. That is to say, relying on the transfer of land use rights to obtain a one-time land transfer fee cannot compensate for the lack of local financial resources. What is important is that China’s economy has turned into the stage of high-quality development, and adheres to the orientation of “housing is for living in, not for speculation” to promote the stable and healthy development of the real estate market. This will to a large extent curb the development of land finance, so that land finance cannot continue to provide considerable financial resources for local governments.

3.4 The Increasing Scale of Transfer Payment Can Hardly Solve the Problem of Local Government’s Lack of Financial Resources

In 2019, the central government transferred 7.4 trillion yuan to local governments, [1] and the local general public budget revenue at the same level was 10107.7 billion yuan, [2] with the transfer payment from the central government to the local government accounting for 73.2% of the revenue of the local general public budget, so the transfer payment has become an important source of revenue for local governments. It plays an important role in narrowing the local fiscal gap, promoting the equalization of local financial resources, balancing regional economic development and correcting the externality of public goods. However, transfer payment may also inhibit local fiscal efforts and may cause moral hazard. With the increasing downward pressure on the economy and the implementation of a larger scale of tax and fee cut policy, the demand of local governments for transfer payment has further increased, and so has their dependence on transfer payment. At the same time, with the increasing downward pressure on the economy, the developed areas, the main source of transfer payments, are facing the uncertain economic growth, so the sustainability of transfer payments is confronted with certain challenges.

The experience of other countries in the world shows that, when the government at the higher level fills the fiscal gap of local government through transfer payment, the moral hazard problem may also follow. The problem of “public pool” stems from the mismatch between the cost and benefit of public expenditure. If a certain fiscal expenditure of the local government can only benefit the residents of a specific area, but the source of funding for this expenditure is national, then the local government will overspend. That is to say, the local government can transfer its own fiscal expenditure to the central government or other local governments through transfer payment, but the benefits from the expenditure are enjoyed by the local government, so the transfer payment will stimulate the local government to increase fiscal expenditure.

Therefore, whether in theory or in reality, although transfer payment can fill the local fiscal gap and enhance the equalization of local financial resources to a certain extent, it also suppresses the efforts of local finance, which is not conducive to strengthening the autonomy of local finance, so it does not help to cure the problem of the lack of local financial resources.

4 Measures for Promoting the Sustainable Development of Local Finance under the Impact of COVID-19

Facing the increasing downward pressure on the economy, it is necessary to implement a larger-scale tax and fee cut policy, but it may bring certain risks to finance itself and challenges to the sustainable development of local finance. Therefore, it is necessary to promote the sustainable development of local finance by taking into account the current situation of local finance and focusing on promoting high-quality economic development and deepening the reform of fiscal and tax system in China.

4.1 Promoting the High-Quality Development of Economy is the Cornerstone of Realizing the Sustainable Development of Local Finance

The fundamental way to fill the gap of fiscal revenue and expenditure and promote the sustainable development of local finance is to promote the high-quality economic development. The central and local governments should make joint efforts to promote high-quality economic development, take the new development philosophy as the guide, deepen the supply-side structural reform as the main line, adhere to the decisive role of the market in resource allocation and give better play to the role of the government, accelerate the transformation of development mode, optimize the economic structure and transform of growth drivers. First, local governments should take activating and leading the consumption market and cultivating new consumption hot spots as the driving force to promote regional economic development. Second, local governments should lead the regional economy to the development mode of scientific and technological innovation by fully mobilizing the enterprises for scientific and technological innovation, and helping enterprises solve the problems in their way. Third, local governments should adapt to the new situation of attracting investment. In the past, what foreign businessmen valued was the low factor cost of China’s manufacturing industry. Now, it is the regional business environment that is valued. It is difficult to show the advantages of regional investment promotion only by the low factor cost. Therefore, the local government should constantly optimize the business environment, adjust measures to local conditions, and explore a higher level of open policy system.

4.2 Adjusting the Fiscal Relationship between the Central and Local Governments, and Optimizing the Division of Administrative and Fiscal Powers between Them

The relatively prominent problem in the fiscal relationship between the central and local governments is the asymmetry of administrative power and fiscal power. The local government has undertaken a lot of administrative power but no corresponding fiscal power, while the central government has a lot of fiscal power but has not undertaken the due administrative power. It is an important means to solve the problem of sustainable development of local finance to build a stable system of financial resources, powers and expenditure responsibilities of governments at all levels. First, it is necessary to reasonably divide the administrative powers and clarify the expenditure responsibilities. We should speed up the division of administrative powers and expenditure responsibilities between the central and local governments, improve the fiscal relationship between them, and especially promote the reform of fiscal relationship between governments below the provincial level. On the basis of the reform plan on the division of fiscal powers and expenditure responsibilities between the central and local governments in the fields such as science and technology, education, health care, we should speed up the reform plan in more fields. The central government should strengthen its fiscal powers in the fields of endowment insurance, intellectual property protection and cross regional ecological environment protection. We should reasonably determine the boundaries of the central and local fiscal powers and the joint fiscal powers of the central and local governments, standardize the boundaries of the fiscal powers of the governments at all levels below the provincial level, and give full play to the enthusiasm of the central and local governments. Second, fiscal power should be determined by administrative power, and governments at all levels should be given the fiscal power needed to undertake administrative power. We should strive to optimize the division of intergovernmental administrative power and fiscal power. In particular, we should give local governments corresponding fiscal power to solve the problem that local fiscal power has long been ignored, and further explore the division of intergovernmental revenue while optimizing the division of intergovernmental administrative power and fiscal power. On the whole, in the future, we must plan to form a reasonable and stable intergovernmental revenue division scheme to further enrich the local financial resources by making the reform more systematic, integrated and coordinated.

4.3 Improving the Local Tax System

Based on the current tax system of China, we need to improve the local tax system. First of all, the main way to improve the local tax system is to improve the shared tax model. To perfect the local tax system, on the basis of the concept of “wide scope” local tax, we should regard part of the shared tax controlled and used by the local government as local tax, and increase the local fiscal revenue by using the shared tax with significant revenue such as enterprise income tax and value-added tax. Only in this way can the sound local tax system have reliable support. Second, we should reasonably expand the local government’s tax administration authority. This is also a powerful entry point to promote the modernization of local governance ability, and we should do so according to the requirements of optimizing the division of administrative power and fiscal power between governments. Under the premise of the unified legislation of the central government and the right to levy taxes, according to the characteristics of tax categories, combined with the new situation of the merger of local tax agencies, and through the legislative authorization of the National People’s Congress, provincial governments can be given greater autonomy in tax rate adjustment and tax preferences, so that local governments can improve the local tax system in accordance with local conditions.

4.4 Improving the Transfer Payment System Guided by Expenditure Performance

When filling the gap of local revenue and expenditure through transfer payment, first of all, we should solve the problem of moral hazard that may be caused by transfer payment, which requires the central government to take the local government’s fiscal discipline as an important reference factor when determining the scale of transfer payment, improve the supervision, accountability and punishment mechanism in transfer payment, and cooperate with the reform of budget system to gradually form a standardized, scientific and transparent transfer payment distribution system. Secondly, the transfer payment system should be expenditure performance oriented, which can improve the efficiency of local governments in the use of transfer payment funds through the accountability mechanism. We should build a fiscal funds assessment system that operates both “bottom-up” and “top-down”, and combine the transfer payment funds with the supply efficiency of public goods and services, so that the higher government can better track the use of transfer payment funds. We should make the responsibility for the use of fiscal funds more traceable, and strengthen the supervision over the implementation of various budgets. Finally, to equalize basic public services, we should optimize the transfer payment structure, reform and improve the general transfer payment system, control the scope of special transfer payment, establish and improve the regular evaluation mechanism of special transfer payment, reduce the fiscal burden on local governments, and prioritize special transfer payment to poverty-stricken areas to promote local economic development.

4.5 Further Strengthening Local Fiscal Management

To promote the sustainable development of local finance, local governments should also strengthen their fiscal management, improve the efficiency of the use of fiscal funds by tapping potential, so as to increase revenue and reduce expenditure. Local governments can give full play to their own proactivity, initiative and creativity, and seek more ideas and measures in their fiscal management, so as to effectively promote the sustainable development of local finance.

In particular, we should constantly optimize the structure of local fiscal expenditure, which is the focus of further strengthening local fiscal management. What can be solved by the market should be solved by the market, from which the public finance should withdraw; the public goods and sesvices that cannot be provided by the market due to externalities and other reasons should be provided by the public finance. Governments at all levels should adhere to the principle of “determining expenditure on the basis of revenue”. In particular, as the contradiction between fiscal revenue and expenditure intensified as a result of the COVID-19 pandemic, it is all the more necessary to constantly optimize the structure of all kinds of fiscal expenditure and continue to live on a tight budget. Against the trend of shrinking fiscal revenue, governments at all levels should cut their general expenditure and focus on ensuring people’s well-being and some important areas. In a certain sense, whether we can optimize the structure of fiscal expenditure and improve the efficiency of fiscal expenditure reflects the government’s governance capacity, which is the due meaning of promoting the modernization of governance system and capacity in China.

References

Buiter, W. H. (1985). A Guide to Public Sector Debts and Deficits. Economic Policy 1, 14−79.10.2307/1344612Search in Google Scholar

Deng, Z. J. (2011). The Concept of Fiscal Balance and the Sustainability of Positive Fiscal Policy. Contemporary Finance & Economics (Dangdai Caijing) 11, 22−25.Search in Google Scholar

Du, T. W., Zhang, Y. Sh, & Yang, Ch. R. (2019) Fiscal Vertical Imbalance, Transfer Payment and Local Fiscal Sustainability. Finance & Trade Economics (Caimao Jingji) 11, 5−19.Search in Google Scholar

Gong, F., & Yu, J. L. (2015). Population Aging, Tax Burden and Fiscal Sustainability. Economic Research Journal (Jingji Yanjiu) 8, 16−30.Search in Google Scholar

Liu, Sh. X. (2003). Fiscal Risk: An Analytical Framework. Economic Research Journal (Jingji Yanjiu) 5, 23−31.Search in Google Scholar

Lou, J. W. (2013). Rethinking the Fiscal Relationship among Chinese Governments. Beijing: China financial and Economic Publishing House. (in Chinese)Search in Google Scholar

Yan, J. W., & Qin, J. Y. (2004). Land Finance: Helpless Move. Insight China (Xiaokang) 12, 1.Search in Google Scholar

Yu, Y. D. (2000). A Theoretical Framework for the Study of Fiscal Stability. The Journal of World Economy (Shijie Jingji) 6, 3−12.Search in Google Scholar

Zhang D. Y. (2018). The Realistic Choice of Perfecting China’s Local Tax System. Taxation Research (Shuiwu Yanjiu) 4, 57−61.Search in Google Scholar

© 2021 Published by De Gruyter on behalf of the National Academy of Economic Strategy, Chinese Academy of Social Sciences

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- Frontmatter

- Does China’s Financial System Amplify Risks in the Real Economy?

- Macro Debt Burden and Consumption Expansion: An Analysis Based on Panel Model and Panel Quantile Regression Model

- Measurement and Characteristics of the Integration of China’s Trade in Services into Digital Global Value Chain

- Tax Burden, Institutional Environment and Foreign Direct Investment Flow: From the Perspective of Asymmetric International Tax Competition

- The Promotion of Deep Integration of Modern Service Industry and Advanced Manufacturing Industry

- Driving Factors, Effect Analysis and Countermeasures of the Development of China’s Live Broadcast Platform

- Challenges and Countermeasures for the Sustainable Development of Local Finance under the Impact of COVID-19

Articles in the same Issue

- Frontmatter

- Does China’s Financial System Amplify Risks in the Real Economy?

- Macro Debt Burden and Consumption Expansion: An Analysis Based on Panel Model and Panel Quantile Regression Model

- Measurement and Characteristics of the Integration of China’s Trade in Services into Digital Global Value Chain

- Tax Burden, Institutional Environment and Foreign Direct Investment Flow: From the Perspective of Asymmetric International Tax Competition

- The Promotion of Deep Integration of Modern Service Industry and Advanced Manufacturing Industry

- Driving Factors, Effect Analysis and Countermeasures of the Development of China’s Live Broadcast Platform

- Challenges and Countermeasures for the Sustainable Development of Local Finance under the Impact of COVID-19