Vertical Fiscal Imbalance, Transfer Payment and Local Government Governance

-

Deyin Chu

Abstract

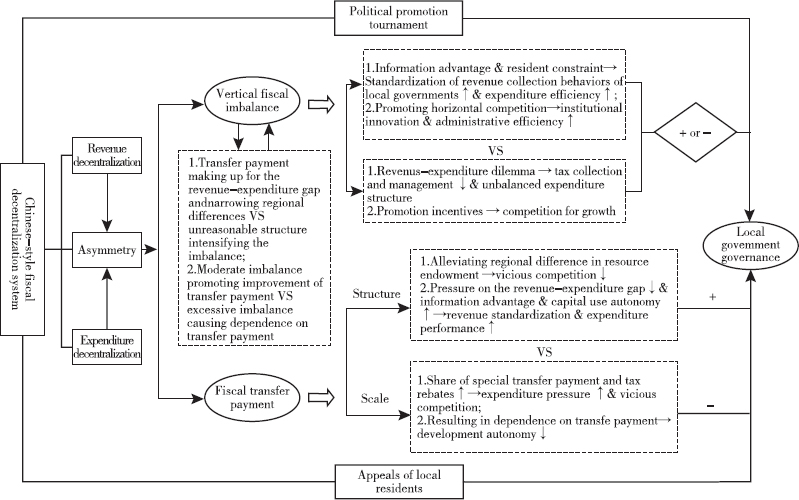

Accelerating the construction of modern fiscal and tax system helps not only free local governments from the shackle of the “competition for growth” development model, but also improve the governance capacity of local governments and realize the good governance of the country in the long term. Firstly, based on the typical fact of Chinese-style fiscal decentralization, this paper theoretically interprets the multiple channels and influencing mechanisms among vertical fiscal imbalance, transfer payment and local government governance. Secondly, it constructs a comprehensive index system to measure the governance capacity of local governments. The result shows that local government governance is relatively low in capacity and slow in improvement, and displays obvious regional heterogeneity. Then, the paper chooses structure and scale of transfer payment as mediator to construct the panel simultaneous equation model, and uses the three-stage least squares estimation (3SLS) for empirical investigation. The study finds that first, both the scale and structure of transfer payment may significantly affect local government governance, but the direction of the effects is opposite; second, the intensified vertical fiscal imbalance and the increase of transfer payment in scale can significantly inhibit local government governance, but the optimization of transfer payment in structure can significantly improve the governance; third, vertical fiscal imbalance not only directly inhibits the improvement of local government governance, but indirectly impedes it through the scale and structure of transfer payment.

1 Introduction

As the contradiction between the people’s growing need for a better life and the unbalanced and insufficient development has become the main contradiction of Chinese society in the new era, it is especially urgent to launch a new round of fiscal and tax system reform and put into play its fundamental and pillar role in order to advance the modernization of China’s system and capacity for governance, which is the objective of deepening reform comprehensively. Under the Chinese-style fiscal decentralization system that is based on the tax sharing system starting in 1994, as fiscal power is collected to higher-level government and administrative power delegated to lower levels, financial concentration and macro-control capacity of central government have been improved. Meanwhile, however, severe vertical fiscal imbalance between central and local governments is shaped as a critical institutional constraint for behaviors of local governments. Also, the transfer payment system, as an important means to regulate the fiscal relationship between central and local governments and ease vertical fiscal imbalance under fiscal decentralization, is subject to the severity of the imbalance with respect to its rectification effect due to inherent defects in its system design. Ultimately, under the interaction between the vertical imbalance and transfer payment, improvement of local government governance may be significantly undermined.

So far, amid domestic and overseas studies on the fiscal decentralization system, the first and second generation of fiscal federalism theory have been developed. The former pays attention to operating performance of fiscal decentralization under the assumption of benevolent government, while the latter discusses fiscal and political incentives under the decentralization system on the level of local government officials (Weingast, 2009). Specifically, prior research is unfolded mainly in three areas. The first is to believe the fiscal decentralization directly affects economic development from the perspective of its economic effects (Lin and Liu, 2000); the second is to study and judge the influence of fiscal decentralization on revenue collection and spending behaviors of local governments (Bardhan and Mookherjee, 2006; Li, 2016); the third is to investigate the influential effect of transfer payment under fiscal decentralization in multiple dimensions (Baretti et al., 2002; Limoeiro, 2015). In the meantime, the relationship between the fiscal system and government governance is touched on only by a few scholars in their study. For instance, Kyriacou et al. (2017) hold that fiscal decentralization has positive effects on government governance and that deepened fiscal decentralization reform and improved governance capacity of government have significantly reduced regional inequality. Van Der Kamp et al. (2017) find in their study on China’s fiscal decentralization reform that when the reform measures adversely affect local development goals, local government could hinder the central governance reform under the decentralization system to some extents instead, and therefore mismatched power delegation may block the governance reform measures.

Similarly, domestic scholars have also explored in depth the influence of fiscal decentralization or vertical system imbalance on revenue collection and spending behaviors of local governments and mostly concluded that such behaviors of local governments have been significantly distorted (Fu and Zhang, 2007; Chu et al., 2019). As the distortion effect of fiscal system imbalance is increasingly clear, some scholars have started to focus on equalizing and rectifying effects of transfer payment, but mainly concentrate on influence of transfer payment on tax efforts and spending behaviors of local government, yet with widely different conclusions (Hu et al., 2013; Lv and Zhang, 2018; Mao et al., 2018). Regarding domestic research on local government governance, some scholars start from budget management to study how to improve governance capacity of government (Lin and Yu, 2011); others dig into the economic and social effects of the capacity improvement (Jiang et al., 2017). In comparison, studies on government governance through the lens of fiscal decentralization or fiscal system imbalance are not many. Lu and Li (2018) investigate the causes of vertical fiscal imbalance in China from the perspective of governance of the country, and believe that the top-down vertical incentives from central government, rational though they are, are not without hidden danger. Liu et al. (2019) holds that as a result of increase of transfer payment in scale, the reform of counties directly under the administration of provinces has significantly weakened fiscal self-sufficiency of local governments and is thus detrimental to improvement of local fiscal governance.

Compared with prior literature, this paper is possibly innovative in the following three areas. First, it is based on the typical fact of the Chinese-style decentralization reform and includes vertical fiscal imbalance, transfer payment and local government governance into the same theoretical framework for systematic study. Second, it constructs an integrated index system to comprehensively measure the governance capacity of local governments in China and judge the trend. Third, by developing a panel simultaneous equation model and using three-stage least squares estimation (3SLS), it empirically investigates the mechanisms and influential effects among the three in the two dimensions of structure and scale.

2 Theoretical Mechanisms and Hypotheses

2.1 Mechanisms behind the Effect of Vertical Fiscal Imbalance on Local Government Governance

2.1.1 Positive Promoting Effect

First, moderate vertical imbalance helps stimulate the initiative of local governments and promote government governance to improve by optimizing local resource allocation and refining market operation efficiency. On the one hand, local governments enjoy great autonomy and flexibility regarding expenditure under the Chinese-style fiscal decentralization system and boast greater advantage in information than central government. On this account, based on moderate vertical imbalance, central government can scientifically guide and effectively stimulate local governments to optimize fiscal expenditure in structure and scale and consequently improve the efficiency of fiscal fund use. On the other hand, under the moderate imbalance system, there exists a certain gap between revenue and expenditure of local governments, which tend to collect all the receivables as revenue to ease their own fiscal strain. In this case, while revenue collection behaviors of local governments are being standardized, the macro-regulation role of tax on economic operation is enhanced. Correspondingly, local residents can effectively restrict and supervise government’s revenue collection and spending behaviors and its soft budget constraints through “voting by hand” and “voting by foot” mechanisms. This reinforces the standardizing effect of moderate imbalance on revenue collection and spending behaviors of local governments, encourages the government to pay greater attention to undertakings concerning people’s livelihood, promotes local supply of public services to be constantly optimized, and thus can improve comprehensive governance capacity of local governments.

Second, moderate vertical imbalance is helpful for motivating government for horizontal competition, further standardizing revenue collection and spending behaviors of local governments and improving the efficiency of administrative operation through “learning effect” and “demonstration effect”, and thus improving governance capacity of local governments. Under fiscal decentralization, local government officials in pursuit of promotion may inevitably take the initiative to “compete to the top” with neighboring counterparts as stimulated by “political promotion tournament”, so as to promote economic development and maximize output benefits. Also constrained by the moderate vertical imbalance system, local governments could proactively seek innovation in systems and ideas under “learning effect” and “demonstration effect” to alleviate fiscal pressure, and actively explore unique and advantageous paths of local economic development. Meanwhile, local residents with growing need for a better life also force local governments to proactively learn from neighboring counterparts for advanced experience and valid measures. In another word, institutional innovation in developed and advanced areas has positive spillover effects under horizontal competition, and such effects can spread among neighboring areas through “learning effect” and “demonstration effect”; as a result, overall governance capacity of local governments can be improved.

2.1.2 Negative Inhibiting Effect

First, under excessive vertical imbalance, local governments, with their own revenue being insufficient to cover spending, may be reduced to development dilemma, resulting in distorted revenue collection and spending behaviors that keep their governance capacity from improving. On the one hand, in pursuit of higher revenue, local governments proactively relax tax efforts to attract capital inflow, while investment increase in local areas can promote general economic strength to grow and broaden the tax base. Though such behaviors may help realize stable macro-economic operation by increasing investment demand, excessive preferential tax treatments from local governments and loose taxation enforcement can seriously obstruct the course of statutory taxation and therefore significantly inhibit governance improvement of local governments. On the other hand, for the purpose of conserving tax sources, local governments offer major fiscal support to local industries with high tax contributions for sure, which may unbalance and distort the fiscal expenditure structure, further widen the gap among different industries in local areas and undermine optimized resource allocation among industries. In other words, while optimization of the industrial structure in local areas is hindered, scale and structure of fiscal expenditure are reduced, which is to the disadvantage of government governance improvement.

Second, under excessive vertical imbalance, in the face of the wide revenue and expenditure gap, local governments can proactively dissimilate their own revenue collection and spending behaviors in order to stand out in the “political promotion tournament”; consequently, local areas may be stuck in the vicious development circle of “competition for growth” and eventually have their governance capacity reduced. Under the impact of information asymmetry, performance assessment indicators set by central government focus on economic growth, driving rational local government officials into the development model of “competition for growth”. In order to stand out in the horizontal competition, local governments unanimously take the initiative to distort their revenue collection and spending behaviors under the GDP-oriented assessment system by central government to pursue higher economic output. As constrained in reality by insufficient revenue for covering spending, it is common for local governments to proactively seek and explore extra-budgetary revenues under the vertical imbalance system. Though land finance and local government debts have eased fiscal pressure to some extents, they are also associated with such hidden risks as extra-budgetary revenue management and debt repayment, impeding the improvement of local government governance instead. On such basis, this paper proposes the following hypothesis.

Hypothesis 1: Vertical fiscal imbalance poses direct effects on local government governance, but in two ways at the same time, namely positive promoting effect and negative inhibiting effect.

2.2 Mechanisms behind the Effect of Vertical Fiscal Imbalance and Transfer Payment on Local Government Governance

2.2.1 Mechanisms of Effect of Transfer Payment on Local Government Governance

With respect to structure of transfer payment, in an optimized structure, increase in the share of transfer payment for general purposes can help better local government governance. First, a higher share of transfer payment for general purposes not only augments disposable financial strength of local governments, but effectively narrows the financial difference horizontally, mitigates the vicious competition among areas driven by discrepancy in resource endowments and thus improves local government governance. In China, in addition to transfer payment for general purposes, transfer payment of central government also includes special transfer payment and tax rebates. Specifically, special transfer payment is strictly limited in purpose of use and generally requires local governments for corresponding supportive funds, which may further intensify the revenue-expenditure pressure of local governments instead. Tax rebates remain in effect till today as a transitional policy of the tax sharing system starting in 1994 in favor of local interests. Though its share in transfer payment keeps decreasing, the original way of distribution determines in nature its “Matthew Effect” among areas. In comparison, transfer payment for general purposes that is distributed with the factor method has admirable effects on financial equalizing. It can not only effectively make up for the gap among areas in natural endowments, but also alleviate the distortion effect on revenue collection and spending behaviors of local governments from their “competition for growth” and “competition for promotion”. Second, an optimized structure of transfer payment can promote central government to standardize and restrain revenue and spending behaviors of local governments; in other words, a reasonable transfer payment structure stimulates local governments to standardize revenue management and improve expenditure performance. On the one hand, increase in share of transfer payment for general purposes can directly ease the pressure in the revenue and expenditure gap for local governments, reduce their dependence on land finance and other fund revenue, and promote standardized revenue and spending behaviors. On the other hand, local governments enjoy full autonomy in use of transfer payment for general purposes. Consequently, the optimized structure of transfer payment can stimulate local governments to put into play their own information advantage and improve administration efficiency, maximize benefits of fiscal fund use, and promote local government governance to keep improving. Given so, the paper puts forward a second hypothesis.

Hypothesis 2: In an optimized structure of transfer payment, increase in share of transfer payment for general purposes can promote governance capacity of government to improve, i.e. “transfer payment structure ↑→ governance capacity of government ↑”.

In terms of scale of transfer payment, under the precondition of the less reasonable transfer payment structure in China, increase in scale of transfer payment from central government may prevent local government governance from improving. First, larger scale in transfer payment may similarly result in increase in special transfer payment and tax rebates, and then intensify the expenditure pressure for local governments and further widen the horizontal gap among areas. As mentioned above, special transfer payment is likely to put greater expenditure pressure on local governments, while tax rebates could adversely magnify the gap among areas. Therefore, if not accompanied by optimization in structure, growth in scale of transfer payment may inevitably drive up the scale of special transfer payment and tax rebates, which not only limits the equalizing effect of transfer payment for general purposes, but further aggravates the fiscal expenditure pressure of local governments and fuels the vicious competition among areas. Second, larger scale of transfer payment may deepen the dependence of local governments, inhibit their initiative for independent development and consequently undermine improvement of their governance capacity. On the one hand, local governments tend to replace their tax revenue with transfer payment funds (Litvack et al., 1998) and then proactively relax tax efforts and transfer the expenditure cost under the influence of “fiscal illusion” and “public pooling” effect. As a result, the efficiency of tax collection and management could be negatively affected significantly, further impeding the course of statutory taxation. On the other hand, with their own revenue declining, local governments may actively seek land finance or various debt funds, which not only drives extra-budgetary revenues and capital management cost to surge, but also makes rent-seeking behaviors and corruption possible. On this account, under the premise of less reasonable transfer payment structure in China, increase in scale of transfer payment from central government obstructs improvement of local government governance in both revenue and expenditure, hence the following hypothesis.

Hypothesis 3: Larger scale of transfer payment may significantly inhibit improvement of government governance, i.e. “transfer payment scale ↑→ governance capacity of government ↓”.

2.2.2 Mechanisms of Effect of Vertical Fiscal Imbalance and Transfer Payment on Local Government Governance

2.2.2.1 Moderate Vertical Imbalance and Transfer Payment

First, the revenue-expenditure gap under moderate imbalance is not difficult to accept or address. A scientifically designed transfer payment system can not only effectively make up for the gap, but also encourage local governments for innovating in ways of public service supply by enhancing their financial strength, optimize regional resource allocation, improve the soft environment of economic and social development, and thus lay a solid foundation for bettering governance capacity of local governments. Second, a well-designed transfer payment system compatible with moderate imbalance can fully play the regulatory role on horizontal differences among areas, construct a scientific and reasonable incentive mechanism for local governments and guide them for standardized horizontal competition in order. Generally speaking, economically backward areas suffer the risk of under-collection of revenue due to incomplete infrastructure and interest spillover, but tend to be able to secure a higher share of transfer payment (Chu and Chi, 2018), with the vicious competition triggered by regional difference in financial strength being eased. As a result, transfer payment becomes an important policy approach for central government to construct effective incentive mechanisms, and can guide the horizontal competition among local governments to transform from “competition for growth” to “competition for harmony” (Chen and Xu, 2013). Also, it can change governance objectives of local governments and drive governance capacity to improve. At last, a scientifically designed transfer payment system can also bring into play the positive effect of the new-type fiscal relationship between central and local governments and accelerate construction of modern fiscal and tax system. In this way, it may not only effectively alleviate the mismatched administrative power and expenditure responsibility of local governments and mitigate the consequent vertical imbalance that is increasingly intensified, but also cope with the many negative effects of the Chinese-style asymmetric revenue and expenditure decentralization.

2.2.2.2 Excessive Vertical Imbalance and Transfer Payment

First, under the excessive vertical imbalance system, local governments with limited revenue find it difficult to effectively balance their own promotion interests and welfare of local residents. The less reasonable transfer payment system in China not only fails to lift local governments out of their revenue and expenditure dilemma, but drives the government for excessive dependence on transfer payment. Local governments in the “fiscal illusion” blindly expand expenditures, and may proactively use the “public pooling” effect of transfer payment funds to transfer the expenditure cost. As a result, local expenditures keep growing in scale, aggravating local fiscal strain and further intensifying the fiscal imbalance. Second, the transfer payment system in China remains to be refined in design. On the one hand, because of the low share of transfer payment for general purposes, the system fails to ease the financial discrepancy among areas. On the other hand, as stimulated by the GDP-oriented “political promotion tournament”, favoring the industries with high tax contribution in expenditure becomes inevitable for local governments. The government pays excessively close attention to fast economic growth that is prioritized in development goals, but less attention to the growing reasonable appeals of local residents for a better life and the development constraints from local resource endowment, practicing an extensive economic development model that works against the improvement of government governance in the long term. Moreover, the request of special transfer payment for supportive funds and the “Matthew Effect” of tax rebates encourage the subjective motivation of developed areas for expanding the expenditure scale, which may not only exacerbate the unbalanced and insufficient development among areas, but also further intensity the fiscal imbalance. Therefore, the unreasonable vertical imbalance system, intertwined with the imperfect transfer payment structure and system design, will keep local government governance from improving. This leads to the following hypothesis of the paper.

Hypothesis 4: Vertical fiscal imbalance indirectly affects local government governance through the mediator of transfer payment, but the effects differ depending on structure and scale of transfer payment.

Mechanism of Effect of Vertical Fiscal Imbalance and Transfer Payment on Local Government Governance

3 Construction of the Index System on Local Government Governance and Measurement Result

3.1 Construction of the Index System on Local Government Governance

So far, no unified standard has been developed regarding how to measure and evaluate governance capacity of local government in the domestic and international academic community. This paper refers to the empirical study conducted by Jiang et al. (2017) to select indexes in the four dimensions of government performance, corruption control, rule of law and regulation quality, and synthetizes the comprehensive indexes on governance capacity of local government through principal component regression. Given that in measurement of the governance capacity, effects of positive and negative indexes on the capacity rating are opposite, the paper uses different ways to standardize the indexes. Specifically, relative size of government and public security regulation in the second-level indexes are negative indexes, and the standardization formula is Vmin− Vi / Vmax−Vmin; the remaining indexes are all positive, and the standardization formula is Vi−Vmin / Vmax−Vmin. Raw data in the calculation is sourced from Procuratorial Yearbook of China, China Population & Employment Statistics Yearbooks, China Statistical Yearbooks and statistical yearbooks of the provinces.

Comprehensive Index System on the Governance Capacity of Local Government

| First-level index | Second-level index | Calculation formula | |

|---|---|---|---|

| Governance capacity of local government | Government performance | Relative size of government | Population employed in public administration, social security and social organizations/total population |

| Administration efficiency | 1–administrative expense/fiscal revenue | ||

| Rule of law | Lawyer coverage | Number of lawyers for 10000 people on average | |

| Law firm coverage | Number of law firms for 10000 people on average | ||

| Corruption control | Number of corruption cases | Total number of cases in corruption, bribery and dereliction of duty/population in public administration, social security and social organizations | |

| Regulation quality | Environmental regulation | Logarithm of value of industrial governance investment in local areas | |

| Public security regulation | Casualties of traffic accidents/number of traffic accidents |

3.2 Result of Local Government Governance Measurement

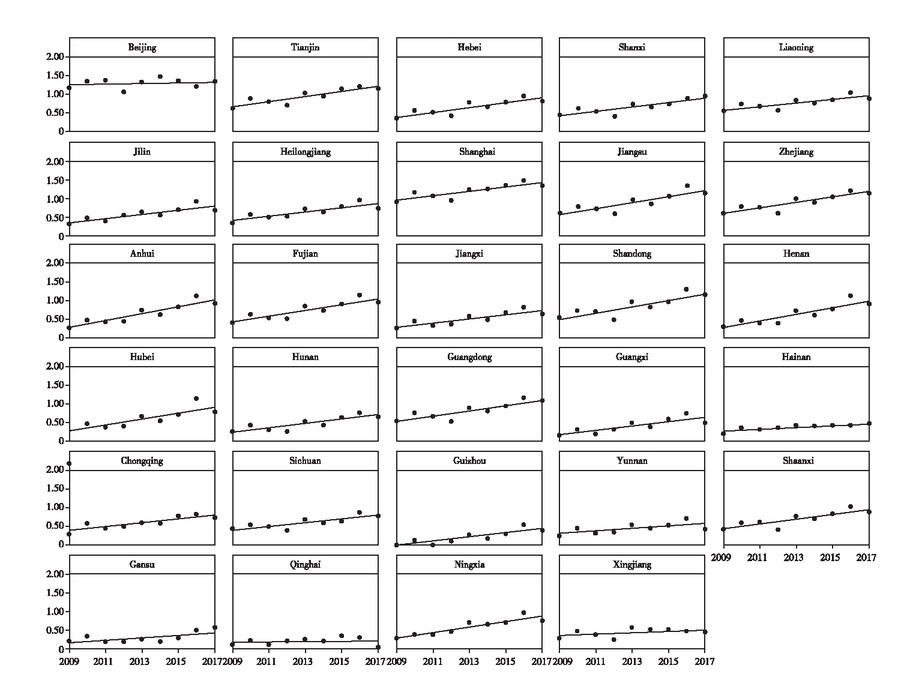

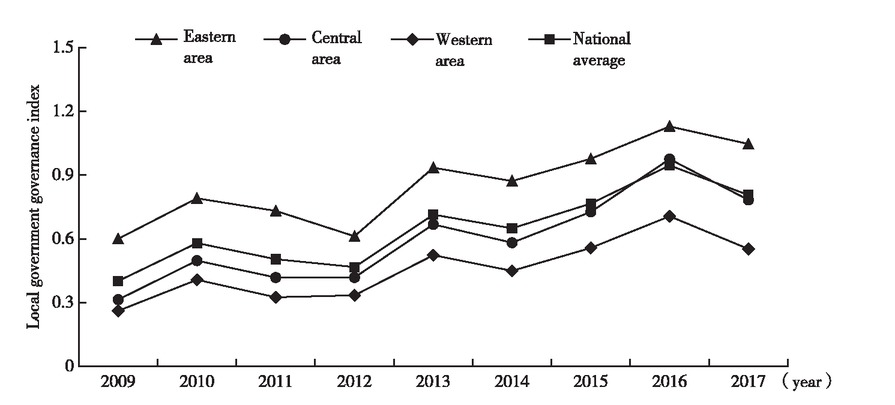

Because of unavailability of data on some provinces, this paper measures the governance capacity of local government in 29 provinces except for Inner Mongolia and Tibet in 2009−2017. The result in shown in Figure 2 and 3.

Changes with Governance Capacity in 2009−2017 in 29 Provinces

Changes with Governance Capacity in 2009−2017 by Area

First, governance capacity of local government is low in absolute level. As indicated in Figure 2, the governance capacity in China in 2009−2017 is averaged at only 0.6451. Specifically, annual average level of Beijing and Shanghai that rank high is 1.2902 and 1.1695 respectively, while that of another 27 provinces and municipalities is all lower than 1. Second, the governance capacity improves slowly. According to Figure 2, the national average level increases from 0.3971 in 2009 to 0.8045 in 2017 at an annual average growth of only 0.0509, while mean value of the majority of provinces lingers in 0.01~0.08. Third, the governance capacity displays evident regional heterogeneity. Figure 3 tells us that the capacity is positively correlated with economic development level and shows the feature of east > middle > west.[1] In particular, the average level in governance capacity of eastern provinces is 0.8538, and that of central and western areas is 0.5951 and 0.4554 respectively.

4 Variable Definition, Data Source and Statistical Characteristics

4.1 Variable Definition

4.1.1 Core Explanatory Variable: Vertical Fiscal Imbalance (VFI)

Based on the typical fact of Chinese-style fiscal decentralization, the paper defines vertical fiscal imbalance as the gap between revenue and expenditure of local governments under Chinese-style asymmetric revenue and expenditure decentralization. Then, it refers to the methods of Eyraud and Lusinyan (2013) and Chu and Shao (2018) to measure the level of vertical fiscal imbalance in China.

4.1.2 Core Explanatory Variable: Transfer Payment

In order to comprehensively measure the rectifying effects of transfer payment on the revenue collection and spending behavior bias and the decision-making failure of local governments under the Chinese-style fiscal decentralization system, the paper discusses the subject matter in two dimensions, namely structure and scale of transfer payment. The index of transfer payment structure (Transfer) is share of transfer payment for general purposes in total transfer payment; the index of transfer payment scale (Ptransfer) is natural logarithm of the calculated per capita actual transfer payment in the provinces.

4.1.3 Other Controlled Variables

The first is fiscal transparency (Gtransp). This index is derived from the Report on Fiscal Transparency in China released by Shanghai University of Finance and Economics; also, in order to avoid difference in order of magnitude among the indexes, it is converted and measured against a full score of 10. The second is open-up to the outside (Open), which is the calculated result of the share of total import/export in GDP in each province. The third is average education attainment (Hcap). It reflects attention paid by local areas to talent cultivation, and theoretically speaking, in areas with higher average education attainment, governance capacity of local government should be greater. The fourth is share of income tax (Income), the proportion of the sum of enterprise income tax and personal income tax in total tax revenue. The fifth is government competition (Compete). It is selected to measure the influential effect of competition among local governments on transfer payment, and the study by Miao et al. (2017) is referred to for calculation. The sixth is government expenditure scale (Gscale), the proportion of general public budgetary expenditure in GDP. The seventh is fiscal self-sufficiency (FS), the ratio between general public budgetary revenue and expenditure in each province. The eighth is population density (Density) and urbanization (Urban). The two respectively reflect the influential effect of population aggregation effect and scale effect on local government governance and transfer payment. The ratio between year-end total population and area in each province and the share of urban population in year-end total population are calculated respectively.

4.2 Data Source and Statistical Characteristics

Raw data on all the variables in the paper are sourced from China Statistical Yearbook 2010−2018, Finance Yearbook of China 2010−2018, Collection of Local Financial Statistics, Collection of National Budget and Final Accounts Documents, and statistical yearbooks of the provinces over years. Besides, related indexes are used to eliminate the influence of price factor against the base period of 2009. The eventual empirical samples in the paper are data on 29 provinces, municipalities and autonomous regions except for Inner Mongolia and Tibet during 2009−2017. Table 2 introduces the statistical characteristics of the variables.

Statistical Characteristics of the Variables

| Variable | Sample size | Standard error | Minimum value | Average value | Maximum value |

|---|---|---|---|---|---|

| Government governance (Gov) | 261 | 0.3071 | 0.0019 | 0.6451 | 1.4649 |

| Vertical fiscal imbalance (VFI) | 261 | 0.1949 | 0.1734 | 0.6773 | 0.9383 |

| Transfer payment scale (Ptransfer) | 261 | 0.5407 | 6.7983 | 8.0826 | 9.7541 |

| Transfer payment structure (Transfer) | 261 | 0.1594 | 0.0382 | 0.4429 | 0.657 |

| Share of income tax (Income) | 261 | 0.0761 | 0.1260 | 0.2297 | 0.6114 |

| Open-up to the outside (Open) | 261 | 0.3338 | 0.0169 | 0.2917 | 1.5482 |

| Average education attainment (Hcap) | 261 | 0.9669 | 6.7639 | 9.0328 | 12.3037 |

| Fiscal transparency (Gtransp) | 261 | 1.4044 | 1.4000 | 3.1437 | 7.7700 |

| Population density (Density) | 261 | 1.2239 | 2.0432 | 5.5366 | 8.2559 |

| Government expenditure scale (Gscale) | 261 | 0.1017 | 0.0964 | 0.2392 | 0.6269 |

| Government competition (Compete) | 261 | 3.0187 | 0.6480 | 4.4574 | 15.4574 |

| Fiscal self-sufficiency (FS) | 261 | 0.1964 | 0.1483 | 0.5124 | 0.9314 |

| Urbanization (Urban) | 261 | 0.1315 | 0.2989 | 0.5516 | 0.8960 |

5 Empirical Analysis on the Influence of Vertical Fiscal Imbalance and Transfer Payment Structure on Local Government Governance

5.1 Panel Simultaneous Equation Modeling

Based on the theoretical mechanism analysis in the second part, this paper holds that vertical fiscal imbalance not only directly affects local government governance, but indirectly influences it through the mediator of transfer payment. To this end, the following panel simultaneous equation model is constructed for empirical investigation, as shown in model (1).

Since the equations in (1) are both over-identified, the paper adopts the three-stage least squares estimation (3SLS) and uses the same estimation method after standardizing all the variables on the basis of benchmark regression. The detailed results are listed in Table 3.

Regression Result of the Influence of Vertical Fiscal Imbalance and Transfer Payment Structure on Local Government Governance

| Benchmark regression | Standardized regression | |||

|---|---|---|---|---|

| Explanatory variable | Local government governance (Gov) | Transfer payment structure (Transfer) | Local government governance (Gov) | Transfer payment structure (Transfer) |

| Transfer payment structure | 1.9464*** | — | 1.0101*** | — |

| (Transfer) | (4.16) | (4.16) | ||

| Vertical fiscal imbalance | −0.7467*** | −0.6669*** | −0.4738*** | −0.8153*** |

| (VFI) | (−3.64) | (−2.97) | (−3.64) | (−2.97) |

| Fiscal transparency | 0.0133** | 0.0607** | ||

| (Gtransp) | (2.50) | — | (2.50) | — |

| Open-up to the outside | 0.0939 | 0.1020 | ||

| (Open) | (1.19) | — | (1.19) | — |

| Average education | −0.0754*** | −0.2374*** | ||

| attainment (Hcap) | (−3.26) | — | (−3.26) | — |

| Share of income tax | −0.6229* | — | −0.1543* | — |

| (Income) | (−1.70) | (−1.70) | ||

| Population density | −0.5247** | — | −2.0910** | — |

| (Density) | (−1.96) | (−1.96) | ||

| Government expenditure scale | — | −0.7088*** | — | −0.4521*** |

| (Gscale) | (−6.46) | (−6.46) | ||

| Government competition | 0.0158*** | 0.2994*** | ||

| (Compete) | — | (3.97) | — | (3.97) |

| Fiscal self-sufficiency | −0.7282*** | −0.8971*** | ||

| (FS) | — | (−3.39) | — | (−3.39) |

| Urbanization | 0.1578 | 0.1302 | ||

| (Urban) | — | (1.32) | — | (1.32) |

| Constant term | 6.0425*** | 0.7731*** | 6.8159*** | −3.1785*** |

| (3.07) | (2.85) | (4.29) | (−13.63) | |

| Time effect | Controlled | Controlled | Controlled | Controlled |

| Area effect | Controlled | Controlled | Controlled | Controlled |

| R2 | 0.9332 | 0.9773 | 0.9332 | 0.9773 |

| N | 261 | 261 | 261 | 261 |

Note: ***, ** and * refer to significance at the significance level of 1%, 5% and 10% respectively. In the parentheses of each variable is t value corresponding to the estimated coefficient.

5.2 Analysis on the Empirical Regression Result

5.2.1 Local Government Governance Equation

First, vertical fiscal imbalance and local government governance are negatively correlated significantly. The conclusion verifies the Hypothesis 1, and also indicates that the direct effect of vertical fiscal imbalance on local government governance is negative inhibition, i.e. the “vertical fiscal imbalance ↑ local government governance ↓” direct channel. As for the reason, the imbalance level in China is generally high, averaged at up to 0.6954 for the 29 provinces in 2017, and the positive promotion effect of moderate imbalance has obviously been exhausted. Excessive vertical imbalance causes enormous revenue and expenditure pressure on local governments and is ultimately detrimental to the improvement of local government governance.

Second, transfer payment structure and local government governance are in significant positive correlation. This conclusion proves the Hypothesis 2 or existence of the “transfer payment structure ↑→ local government governance ↑” direct channel. An optimized transfer payment structure can effectively narrow the horizontal gap among areas and defuse the risk of vicious competition for local governments by shoring up the development in backward areas. Meanwhile, the optimization can put into full play the information advantage of local governments, stimulate them to proactively refine the public expenditure structure and thus improve the governance capacity of local governments.

Third, fiscal transparency and open-up to the outside are positively correlated with local government governance, but the influence of open-up to the outside is not significant. In comparison, average education attainment, share of income tax and population density are all in significant negative correlation with local government governance.

5.2.2 Transfer Payment Structure Equation

First, vertical fiscal imbalance and transfer payment structure are significantly correlated negatively. This conclusion, in combination with the estimated result of the local government governance equation, validates the Hypothesis 4, or existence of the “vertical fiscal imbalance → transfer payment structure ↓ → local government governance ↓” indirect mechanism. The empirical estimation result shows that higher level in vertical fiscal imbalance may cause the share of transfer payment for general purposes in transfer payment to drop. It therefore proves when faced with excessive imbalance, local governments tend to strive for special transfer payment or tax rebates, which further distorts the revenue collection and spending behaviors of local governments and impedes the improvement of their governance capacity.

Second, relationships between the controlled variables and transfer payment structure differ widely. Government expenditure scale and fiscal self-sufficiency are significantly correlated with transfer payment structure negatively, whereas government competition and urbanization show positive correlation with transfer payment structure, with the regression coefficient of urbanization failing to pass the significance test.

5.3 Channel Testing and Effect Size Comparison

On the basis of the standardized regression result in Table 3, the paper calculates the direct effect, indirect effect and total effect of vertical fiscal imbalance and transfer payment structure on local government governance, as presented in Table 4.

Conduction Path and Size of the Effects of Vertical Fiscal Imbalance and Transfer Payment Structure on Local Government Governance

| Channel | estimation Effect | Estimated result | Total effect | |

|---|---|---|---|---|

| Direct effect | Transfer payment structure → local government governance | α1 | 1.0101 | 1.0101 |

| Direct effect | Vertical fiscal imbalance → local government governance | α2 | −0.4738 | −1.2973 |

| Indirect effect | Vertical fiscal imbalance → transfer payment structure → local government governance | β1×α1 | −0.8235 |

First, increase in the level of vertical fiscal imbalance significantly inhibits the governance capacity of local government, while optimization of transfer payment structure significantly improves the capacity. In another word, there exists two direct channels, “vertical fiscal imbalance ↑→ local government governance ↓” and “transfer payment structure ↑ → local government governance ↑”, and this well verifies the Hypothesis 1 and Hypothesis 2.

Second, vertical fiscal imbalance can indirectly affect local government governance through its influence on transfer payment structure; in other words, the “vertical fiscal imbalance ↑ → transfer payment structure ↓ → local government governance ↓” indirect channel exists, validating the Hypothesis 4. To be specific, higher level in vertical fiscal imbalance indirectly inhibits the improvement of local government governance by hindering the optimization of transfer payment structure, and size of the indirect effect is 0.8235.

6 Empirical Analysis on the Influence of Vertical Fiscal Imbalance and Transfer Payment Scale on Local Government Governance

6.1 Panel Simultaneous Equation Modeling

In order to further study the influence of vertical fiscal imbalance and transfer payment scale on local government governance, the paper replaces the variable of transfer payment structure in the model (1) with transfer payment scale as in model (2). Other than transfer payment scale, all the other variables are consistent with the model (1), and 3SLS is similarly adopted. The estimated result is listed in Table 5.

Regression Result of the Influence of Vertical Fiscal Imbalance and Transfer Payment Scale on Local Government Governance

| Benchmark regression | Standardized regression | |||

|---|---|---|---|---|

| Explanatory variable | Local government governance (Gov) | Transfer payment scale (Ptransfer) | Local government governance (Gov) | Transfer payment scale (Ptransfer) |

| Transfer payment scale | −0.4136*** | −0.7283*** | ||

| (Ptransfer) | (−3.92) | — | (−3.92) | — |

| Vertical fiscal imbalance | −0.3322* | 4.9297*** | −0.2108* | 1.7765*** |

| (VFI) | (−1.77) | (6.91) | (−1.77) | (6.91) |

| Fiscal transparency | 0.0117** | — | 0.0537** | — |

| (Gtransp) | (2.22) | (2.22) | ||

| Open-up to the outside | 0.3642*** | — | 0.3958*** | — |

| (Open) | (3.72) | (3.72) | ||

| Average education | −0.0673*** | −0.2120*** | ||

| attainment (Hcap) | (−2.92) | — | (−2.92) | — |

| Share of income tax | −0.8176** | −0.2025** | ||

| (Income) | (−2.27) | — | (−2.27) | — |

| Population density | −0.9394*** | — | −3.7436*** | — |

| (Density) | (−3.19) | (−3.19) | ||

| Government | 2.9780*** | 0.5598*** | ||

| expenditure scale (Gscale) | — | (8.93) | — | (8.93) |

| Government | −0.0535*** | −0.2989*** | ||

| competition (Compete) | — | (−4.32) | — | (−4.32) |

| Fiscal self-sufficiency | — | 3.9380*** | — | 1.4300*** |

| (FS) | (5.74) | (5.74) | ||

| Urbanization | 3.8846*** | 0.9448*** | ||

| (Urban) | — | (10.26) | — | (10.26) |

| 11.6265*** | −0.9122 | 5.0769*** | −1.8891*** | |

| Constant term | (4.52) | (−1.06) | (3.35) | (−8.90) |

| Time effect | Controlled | Controlled | Controlled | Controlled |

| Area effect | Controlled | Controlled | Controlled | Controlled |

| R2 | 0.9441 | 0.9825 | 0.9441 | 0.9825 |

| N | 261 | 261 | 261 | 261 |

Note: ***, ** and * refer to significance at the significance level of 1%, 5% and 10% respectively. In the parentheses of each variable is t value corresponding to the estimated coefficient.

6.2 Analysis on the Empirical Regression Result

6.2.1 Local Government Governance Equation

Transfer payment scale and local government governance are in significant negative correlation. The conclusion verifies the Hypothesis 3, or existence of the “transfer payment scale ↑ → local government governance ↓” direct channel. Expansion in the scale means synchronized increase in special transfer payment and tax rebates. Under the precondition of a less reasonable transfer payment structure, scale expansion not only limits its own equalizing effect, but meanwhile intensifies the fiscal pressure on local governments and promotes the vicious competition among areas to upgrade. In the meantime, transfer payment in an excessively large scale may heighten the excessive dependence of local governments, which distorts their revenue collection and spending behaviors, further weakens their initiative for institutional innovation and significantly reduces their governance capacity.

Given that the regression result of the local government governance equation only differs from the model (1) in the variable of transfer payment scale, the effects of other variables on government governance will not be elaborated here.

6.2.2 Transfer Payment Scale Equation

First, vertical fiscal imbalance is significantly correlated with transfer payment scale positively. It shows the imbalance at a high level not only results in greater pressure of revenue-expenditure gap on local governments, but further forces central government to expand transfer payment in scale. Also, in combination with the regression result of the transfer payment structure equation, it can be seen that expansion of transfer payment in scale actually reflects the increase in share of special transfer payment and tax rebates, and the two forms of unbalanced transfer payment both distort the revenue collection and spending behaviors of local governments and ultimately obstruct their improvement in governance capacity. This proves the Hypothesis 4, or existence of the “vertical fiscal imbalance ↑ → transfer payment scale ↑ → local government governance ↓” indirect mechanism.

Second, government expenditure scale, fiscal self-sufficiency and urbanization are all in positive correlation with transfer payment scale significantly, while government competition is significantly negatively correlated with transfer payment scale.

6.3 Channel Testing and Effect Comparison

To remain consistent with the previous analysis, this part calculates the direct effect, indirect effect and total effect of vertical fiscal imbalance and transfer payment scale on local government governance on the basis of the standardized regression result in Table 5. The result is introduced in Table 6.

Conduction Path and Size of the Effects of Vertical Fiscal Imbalance and Transfer Payment Scale on Local Government Governance

| Channel | Effect estimation | Estimated result | Total effect | |

|---|---|---|---|---|

| Direct effect | Vertical fiscal imbalance → local government governance | α2 | −0.2108 | −1.5046 |

| Indirect effect | Vertical fiscal imbalance → transfer payment scale → local government governance | β1×α1 | −1.2938 | |

| Direct effect | Transfer payment scale → local government governance | α1 | −0.7283 | −0.7283 |

First, transfer payment scale significantly inhibits improvement of government governance, or there exists the “transfer payment scale ↑ → local government governance ↓” direct channel, which validates the Hypothesis 3. In details, when transfer payment scale is increased by 1%, governance capacity of local government can be reduced by 0.7283 unit.

Second, vertical fiscal imbalance can indirectly influence local government governance by affecting transfer payment scale, or there exists the “vertical fiscal imbalance ↑ → transfer payment scale ↑ → local government governance ↓” indirect channel, verifying the Hypothesis 4. Specifically, higher level of vertical fiscal imbalance indirectly restricts improvement of governance capacity of local governments by driving transfer payment to expand in scale, and size of the indirect effect is 1.2938.

Third, the effects of transfer payment structure and scale show discrepancies. First, optimization in transfer payment structure significantly betters governance capacity of local governments, while the effect of transfer payment scale is exactly opposite. Second, the indirect effects of vertical fiscal imbalance on government governance through transfer payment structure and through transfer payment scale are both negative inhibition.

7 Conclusions and Policy Suggestions

Accelerating the construction of modern fiscal and tax system helps not only free local governments from the shackle of the “competition for growth” development model, but also improve the governance capacity of local governments and realize the good governance of the country in the long term. Study in this paper finds that increase in vertical fiscal imbalance and transfer payment scale significantly inhibits the governance capacity of local governments, while optimization in transfer payment structure can significantly improve the capacity. Meanwhile, vertical fiscal imbalance not only directly restricts improvement of the governance capacity, but indirectly obstructs it by affecting the scale and structure of transfer payment.

First, it is suggested to advance the division of administrative power and expenditure responsibility between central and local governments in an expedited manner, and further reduce the common administrative power between them. The opportunity of the new-round tax reform should be seized to keep refining local tax system and ease the pressure of revenue-expenditure gap for local governments, so as to maintain vertical fiscal imbalance at a moderate level.

Second, it’s necessary to scientifically design and constantly improve the transfer payment system. The share of transfer payment for general purposes should be increased and use of special transfer payment and tax rebates be standardized to guide local governments to change the development model of “competition for growth”. Meanwhile, local governments need be guided to improve their expenditure performance.

Third, attention should be paid to the positive effect of demographic factors on local governance. Efforts need be made to promote the reasonable distribution of human capital among areas and align the course of urbanization with economic development.

References

Bardhan, P., & Mookherjee, D. (2006). Decentralization and Accountability in Infrastructure Delivery in Developing Countries. The Economic Journal, 116, 101−127.10.1111/j.1468-0297.2006.01049.xSuche in Google Scholar

Baretti, C., Huber, B., & Lichtblau, K. (2002). A Tax on Tax Revenue: The Incentive Effects of Equalizing Transfers: Evidence from Germany. International Tax and Public Finance, 9 (6), 631−649.10.2139/ssrn.263343Suche in Google Scholar

Chen, Z., & Xu, T. (2011). Towards “Rival for Harmony”: Changes with Central and Local Governance Models under Promotion Tournament. The Journal of World Economy (Shijie Jingji), 9, 3−18.Suche in Google Scholar

Chu, D., & Chi, S. (2018). Does Transfer Payment Mitigate the Vertical Fiscal Imbalance in China? Finance & Trade Economics (Caimao Jingji), 10, 23−38.Suche in Google Scholar

Chu, D., & Shao, J. (2018). Financial Vertical Imbalance, Public Expenditure Structure and Economic Growth. Economic Theory and Business Management (Jingji Lilun Yu Jingji Guanli), 10, 30−43.Suche in Google Scholar

Chu, D., Shao, J., & Chi, S. (2019). Does the Fiscal System Imbalance Inhibit Local Government’s Tax Efforts? Economic Research Journal (Jingji Yanjiu), 10, 41−56.Suche in Google Scholar

Eyraud, L., & Lusinyan, L. (2013). Vertical Fiscal Imbalance and Fiscal Performance in Advanced Economies. Journal of Monetary Economics, 60 (5), 571−587.10.1016/j.jmoneco.2013.04.012Suche in Google Scholar

Fu, Y., & Zhang, Y. (2007). The Chinese Style Decentralization and Fiscal Expenditure Composition: The Cost of Rival for Growth. Management World (Guanli Shijie), 3, 4−22.Suche in Google Scholar

Hu, Z., Huang, X., & Liu, Y. (2013). Intergovernmental Fiscal Transfer and Local Tax Effort: Some Empirical Evidence from China. China Economic Quarterly (Jingjixue Jikan), 3, 799−822.Suche in Google Scholar

Jiang, Y., Fan, X., & Zhao, X. (2017). Government Governance and Public Happiness. Management World (Guanli Shijie), 3, 172−173.Suche in Google Scholar

Kyriacou, A. P., Muinelo-Gallo, L., & Roca-Sagalés, O. (2017). Regional Inequalities, Fiscal Decentralization and Government Quality. Regional Studies, 51 (6), 945−957.10.1080/00343404.2016.1150992Suche in Google Scholar

Li, Q. (2016). Fiscal Decentralization and Tax Incentives in the Developing World. Review of International Political Economy, 23 (2), 232−260.10.1080/09692290.2015.1086401Suche in Google Scholar

Limoeiro, D. (2015). Beyond Income Transfers: The Decline of Regional Inequality in Brazil during the 2000s. Progress in Development Studies, 15 (1), 6−21.10.1177/1464993414546975Suche in Google Scholar

Lin, M., & Yu, Li. (2011). An Empirical Research of Effect of Participatory Budgeting on Public Expenditure Structure. Finance & Trade Economics (Caimao Jingji), 8, 13−20.Suche in Google Scholar

Lin, Y., & Liu, Z. (2000). Fiscal Decentralization and Economic Growth in China. Economic Development and Cultural Change, 49 (1), 1−21.10.1086/452488Suche in Google Scholar

Litvack, J., Ahmad, J., & Bird, R. (1998). Rethinking Decentralization in Developing Countries. Washington, D. C.: World Bank.10.1596/0-8213-4350-5Suche in Google Scholar

Liu, Y., Jia, J., & Ding, S. (2019). Local Fiscal Governance: Give People Fish or Teach Them How to Fish — A Study on Fiscal Reform in Counties Directly Administered by Provinces. Social Sciences in China (Zhongguo Shehui Kexue), 7, 43−63.Suche in Google Scholar

Lu, J., & Li, Y. (2018). Transcending the Fiscal Problem: Vertical Imbalances in China’s Fiscal System from the Perspective of State Governance. Sociological Studies (Shehuixue Yanjiu), 2, 62−87.Suche in Google Scholar

Lv, B., & Zhang, K. (2018). Fiscal Transfers and Tax Efforts: The Impact of Government Preferences. The Journal of World Economy (Shijie Jingji), 7, 98−121.Suche in Google Scholar

Mao, J., Lv, B., & Ma, G. (2015). Transfer Payment and Government Expansion: A Study Based on “the Price Effect”. Management World (Guanli Shijie), 7, 29−41.Suche in Google Scholar

Miu, X., Wang, T., & Gao, Y. (2017). The Effect of Fiscal Transfer on the Gap Between Urban-Rural Public Services Based on a Grouping Comparison of Different Economic Catching-Up Provinces. Economic Research Journal (Jingji Yanjiu), 2, 52−66.Suche in Google Scholar

Van Der Kamp, D., Lorentzen, P., & Mattingly, D. (2017). Racing to the Bottom or to the Top? Decentralization, Revenue Pressures, and Governance Reform in China. World Development, 95, 164−176.10.1016/j.worlddev.2017.02.021Suche in Google Scholar

Weingast, B. R. (2009). Second Generation Fiscal Federalism: The Implications of Fiscal Incentives. Journal of Urban Economics, 65 (3), 279−293.10.1016/j.jue.2008.12.005Suche in Google Scholar

© 2021 Deyin Chu and Maosheng Fei, published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Frontmatter

- Are the Economic Consequences of Climate Change Really “Pro-Poor”?

- Tax Sharing and Fiscal Imbalances: Reconstruction of the VAT Sharing System in China

- Vertical Fiscal Imbalance, Transfer Payment and Local Government Governance

- Does Rising House Price Push Chinese Households to “Leverage Up” More?

- Resources Allocation and Utilization Efficiency in China’s Healthcare Sector

- China’s Government Information Capacity, Medical Resource Allocation and COVID−19 Prevention and Control

Artikel in diesem Heft

- Frontmatter

- Are the Economic Consequences of Climate Change Really “Pro-Poor”?

- Tax Sharing and Fiscal Imbalances: Reconstruction of the VAT Sharing System in China

- Vertical Fiscal Imbalance, Transfer Payment and Local Government Governance

- Does Rising House Price Push Chinese Households to “Leverage Up” More?

- Resources Allocation and Utilization Efficiency in China’s Healthcare Sector

- China’s Government Information Capacity, Medical Resource Allocation and COVID−19 Prevention and Control