Tax Sharing and Fiscal Imbalances: Reconstruction of the VAT Sharing System in China

-

Kezhong Zhang

Abstract

Unreasonable distribution of regional fiscal revenue may lead to fiscal imbalance, while narrowing the fiscal gap will help to establish a modern fiscal relationship between the central government and local governments with financial coordination and regional balance. This paper examines the 2016 VAT sharing reform to study the impact of tax sharing on fiscal imbalances, and puts forward a new plan to reconstruct the VAT sharing ratio. It has been found out in the study that the VAT sharing reform has alleviated the vertical fiscal imbalances caused by the reform of “replacing business tax with VAT” to some extent, but has aggravated the horizontal fiscal imbalances and widened the regional fiscal gaps. The deepening of horizontal fiscal imbalances is due to the aggravated differentiation of regional fiscal capacity after the VAT sharing reform. The adjustment of the principle on which the VAT is levied and the way by which it is shared is conducive to reducing interregional fiscal imbalances. This research is of reference to rationalizing the intergovernmental fiscal relationship, which is helpful to further clarify the implications of modern intergovernmental fiscal relationship and promote the construction of a modern fiscal system.

1 Introduction

Fiscal imbalances distort the allocation of resources, and cause inequalities in the welfare of the inhabitants of a jurisdiction, while narrowing the fiscal gap and establishing clear fiscal relationship with clearly defined powers and responsibilities, financial coordination and regional balance are the key to resolving fiscal imbalances (Fajgelbaum, Eduardo and Suárez, 2018; Boadway and Tremblay, 2006). Under the system of fiscal decentralization, fiscal imbalances are common among all countries of the world, including Vertical Fiscal Imbalances (VFI) of governments at different tiers, and Horizontal Fiscal Imbalances (HFI) of governments at the same tier (Hunter, 1974; Sharma, 2011). Fiscal imbalances stem from differences in fiscal capacity within a jurisdiction (Boadway and Tremblay, 2006; Bird and Villancourt, 2006), and adjusting the division of fiscal power and increasing the share of local governments’ tax revenues can help reduce fiscal imbalances (Qian and Zhang, 2018; Kim, 2014; Tsui, 2005; Boadway, Cuff and Marchand, 2003). A large number of studies have examined the impact of tax sharing on vertical fiscal imbalances, but ignored the changes in the horizontal fiscal pattern between places caused by vertical fiscal adjustment. This paper addresses this problem and proposes tax sharing schemes to promote regional fiscal balance.

China’s VAT sharing reform in 2016 has provided the conditions for us to study the impact of tax sharing on fiscal imbalances. Since the tax sharing reform, local governments’ fiscal power has been constantly weakened, while tax sharing has become an important institutional arrangement of China’s intergovernmental fiscal relationship. Since the reform of “replacing business tax with VAT” in 2016, to cope with the pressure on local finance caused by the lack of the main taxes of local governments, the proportion of VAT sharing between the central and local governments has been adjusted from “75:25” to “50:50”, in efforts to keep the local government’s fiscal situation basically unchanged. After eliminating the effect of “replacing business tax with VAT”, the study has found that the VAT sharing reform, has, to some extent, alleviated vertical fiscal imbalances, but on the other hand has also aggravated horizontal fiscal imbalances between regions. In order to explore the formation channels of fiscal imbalances, we examine the changes in regional fiscal capacity after the sharing reform, and find that the imbalance of fiscal capacity is the cause for horizontal fiscal imbalances. The local government revenue under different principles of VAT distribution is simulated, and it is found that adjusting the principle of VAT distribution[1] can help solve the problem of fiscal imbalances.

First of all, this paper finds that compared with the fiscal situation before the reform of “replacing business tax with VAT” and VAT sharing, the adjustment of the proportion of VAT share alleviates the vertical fiscal imbalances caused by “replacing business tax with VAT”, but aggravates the horizontal fiscal imbalances. The reform of “replacing business tax with VAT” has greatly aggravated vertical fiscal imbalances, while the VAT sharing reform has alleviated the impact of “replacing business tax with VAT” on the local government’s fiscal capacity and reduced the degree of vertical imbalances, but still has not restored the relative financial pattern of the central and local governments to the level before the reform of “replacing business tax with VAT”. Excluding the effect of “replacing business tax with VAT”, this study has discovered that the degree of relief of vertical imbalances by the VAT sharing reform varies among the eastern, central and western regions in that the eastern provinces have gained more benefits from the sharing reform, the western provinces have widened the relative fiscal gap, and the degree of inter-provincial financial imbalances has deepened after this reform. The industrial incentive effect of “replacing business tax with VAT” may affect the local tax structure, resulting in the deviation of the estimation results in this paper. In order to solve this problem, this paper uses the data of the 2012 provincial input and output table to simulate the relative fiscal situation of the provinces under different share ratios, and the results show that the VAT sharing reform increases the proportion of VAT in the eastern provinces in the whole country, thus widening the horizontal fiscal gap.

Secondly, this paper discusses the channels for the change in fiscal imbalance caused by the VAT sharing reform. As far as vertical imbalance is concerned, the alleviation of vertical imbalance stems from the adjustment of fiscal distribution rules, and as far as horizontal imbalance is concerned, this paper finds that the differentiation of fiscal capacity is an important reason for the aggravation of horizontal fiscal imbalance after the sharing reform. The differentiation of fiscal capacity is closely related to industrial structure, with the tertiary industry being the main cause for the imbalance of fiscal capacity. Since the adjustment of the sharing ratio, the fiscal capacity of the eastern provinces has been increasing significantly, while that of the western provinces only slightly. The differentiation of fiscal capacity is closely related to the industrial structure, and the tertiary industry is the main reason for uneven fiscal capacity. Since the sharing reform, the tertiary industry in the eastern region has been growing relatively fast.

Finally, we propose a reconstruction plan for the VAT sharing system to reduce the degree of regional fiscal imbalances and establish a coordinated and balanced intergovernmental fiscal relationship among regions. With regard to the 2017 data, for example, the proportion of the total VAT revenue of each province under different sharing principles is calculated to judge the financial equalization effect of different sharing schemes. On the whole, compared with the current division of the principle of the place of production for VAT in China, the principle of the place of consumption, the population of a jurisdiction, fiscal capacity and other principles or a combination of various principles are conducive to realizing regional financial coordination and improving the fiscal situation of backward areas. Among them, the introduction of the principle of fiscal capacity or the development of “consumption + population + fiscal capacity” combined principles can minimize fiscal imbalances. To take into account the incentive effect of sharing rules on governments, this paper holds that the development of a VAT sharing system based on “consumption, population and fiscal capacity” is the best policy solution to the problem of fiscal imbalance in China.

Compared with existing research, this paper has three marginal contributions: First, existing research typically uses fiscal revenues to measure fiscal capacity, and in case of any differences in fiscal efforts, the impact of fiscal capacity would be miscalculated (Garg, Goyal and Pal, 2016). While exploring policies to address fiscal imbalances, existing research ignores the impact of fiscal capacity which can induce ineffective competition and result in loss of social efficiency (Bellofatto and Besfamille, 2018). The role of fiscal capacity has been taken into full account in the analytical framework of this paper. Second, most of the research has paid attention to the consequences of fiscal imbalances, and found that fiscal imbalances distort fiscal behaviors of local governments (Han and Kung, 2015), while this paper focuses on the causes for financial imbalances, and examines the formation channels for fiscal imbalances after the VAT sharing reform. The effect of the VAT sharing reform is simulated by using the input and output table publicly available in China, and the relative situation of local governments’ fiscal capacity under different sharing ratios is estimated on this basis. Third, different from proposing VAT sharing improvement measures from the perspectives of population and consumption to improve governments’ financial structure (Liu and Zhang, 2016; Yang and Liu, 2014), this paper’s policy scheme introduces an important factor of fiscal capacity, largely echoing the research of Bellofatto and Besfamille (2018) and Lv and Tai (2019) on fiscal capacity and intergovernmental fiscal relationship.

This research is of great practical significance in that it helps clarify the implications of modern fiscal system from the perspective of intergovernmental fiscal relationship. One of the core contents of modern finance is to clarify the intergovernmental fiscal relationship, reform the mode of dividing fiscal powers and expenditure responsibilities between the central government and local governments, and establish a modern intergovernmental fiscal relationship with financial coordination and regional balance (Gao, 2018). The main challenge facing the current intergovernmental fiscal relationship is to address the problems resulting from the mismatch of resources and the misallocation of funds transferred from the productive tax base. This research is of positive significance for clarifying the intergovernmental fiscal relationship and defining the implications of the modern fiscal system.

The second part of the paper introduces the institutional background and theoretical analysis; the third part is the empirical analysis, exploring the impact of the VAT sharing reform, and analyzing the channels through which the reform plays a role; the fourth part explores how to design a policy scheme to promote fiscal balance; and the fifth part consists of conclusions and policy recommendations.

2 Institutional Background and Theoretical Analysis

2.1 Institutional Background

Over a long period of time, business tax and VAT have been important factors in determining the level of local government’s fiscal capacity, and are also the main reasons for regional fiscal imbalances. Since the tax sharing reform, China’s local government fiscal autonomy has been declining, especially since the income tax sharing reform in 2002, local governments’ fiscal power has been further weakened, followed by the deepening of vertical fiscal imbalances. Since then, China’s central-local fiscal relationships have basically stabilized, the central and local governments share fiscal revenues in important tax sources, while local governments gradually develop a financial pattern with business tax as their main source of fiscal revenue. However, due to the differences in industrial structure and economic scale, the regional distribution of business tax and VAT is very uneven, and the scale of the two taxes in the eastern region is much larger than that in the central and western regions. Table 1, by breaking down the variation coefficient of provincial government revenue according to the composition of budget revenue, presents that two tax revenues, including business tax and VAT, are the main causes of the imbalance of local governments’ fiscal capacity, and the contribution of the two tax revenues to fiscal revenue imbalance is as high as 32%.

Contribution of Income of Different Sources to Imbalances in Inter-Provincial Fiscal Revenues

| Revenue composition | Business and VAT | Corporate income tax | Personal income tax | Other tax | Non-tax revenue | Special revenue | Toll revenue | Confiscated revenue | other revenue | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| The proportion of contributions | 32.01% | 12.75% | 5.02% | 22.09% | 16.48% | 4.71% | 3.64% | 1.5% | 1.76% | 100% |

After the reform of “replacing business tax with VAT”, in the absence of the main taxes of local governments, tax sharing has become an important link in the fiscal relationship of China’s central government and local governments. Since May 1, 2016, China has launched a nationwide pilot of “replacing business tax with VAT”, with all business tax taxpayers paying VAT. Prior to the reform, business tax was the main source of local government revenue, and VAT revenue was shared by the central government and local governments according to the ratio of 75:25. In order to alleviate the impact of “replacing business tax with VAT” on local government revenue, China has adjusted the proportion of central and local VAT sharing, in an attempt to seek the relative stability of central and local fiscal capacity. The State Council has determined that the central return and local surrender base should be determined with the year of 2014 as a base number, and that the central and local governments share 50% of the VAT revenue respectively, and that the VAT paid by enterprises in all industries is included in the scope of central and local sharing. During the transitional period, revenue from VAT sharing becomes the main source of local revenue.[1] In fact, since the reform of 50:50 sharing, there have been obvious differences in the growth of VAT revenue in the eastern, central and western regions of China, with the VAT revenue in the eastern region growing faster and increasing at a faster rate after the reform.[1] However, this trend of VAT may contain two effects, one is the increase of local VAT revenue caused by “replacing bussiness tax with VAT”, and the other is the rapid increase of VAT brought about by the increase of local VAT share, which is the focus of study in this paper.

2.2 Theoretical Analysis

In theory, when residents of different jurisdictions within a state get the same level of utility from government public services, there would be no inefficient flow of laborers among regions due to their preference for public services, thus enhancing the overall well-being of society, which is also the government’s goal. By subsidizing local governments to ensure the smooth realization of their policy objectives, if the central government funds local governments according to the source of tax revenue, which, despite reducing the pressure on local government expenditure, and easing the vertical fiscal imbalances of local governments, also widens the fiscal gap among different regions, leading to horizontal fiscal differentiation. As has been recognized in existing studies, the change in China’s vertical fiscal imbalances stems mainly from the adjustment of fiscal revenues (Lu and Li, 2019), but few studies have noted that such adjustments in intergovernmental fiscal revenues also lead to horizontal fiscal imbalances. Intuitively, the 50:50 VAT sharing scheme is fair to the provinces, but it is easy to ignore that the impact of “replacing business tax with VAT” on local fiscal capacity varies significantly among provinces, and the scale of business tax and the composition of the tax base will affect local governments’ tax revenues after the reform of “replacing business tax with VAT”. In fact, this “one size fits all” sharing method is essentially the redistribution of fiscal revenue according to the source of revenue, with significantly different impact on the fiscal revenues of different provinces. The level of fiscal capacity of a province may be differentiated at a faster pace in the process of sharing, and the degree of vertical and horizontal imbalances of the provinces with scarce fiscal capacity may be deepened.

Horizontal fiscal imbalances are caused by the imbalance of fiscal revenues that can be drawn from different jurisdictions, and the deeper cause is the difference in economic scale and industrial structure across different regions, which determines the total amount and structure of local tax revenue. A number of studies have found that difference in regional fiscal capacity is an important cause for fiscal imbalances (Boadway and Tremblay, 2006; Bird and Villancourt, 2006). In theory, a liquid base tax should not be taxed by local governments, and its allocation to local governments would create a shortage of local governments to provide public goods and induce local governments to compete for fiscal capacity, which could further exacerbate the relative fiscal gap between local governments. The conclusions of empirical studies are in line with theoretical expectations. Some studies have found that the fiscal incentive effect of tax sharing will change the behavior of local governments. The study conducted by Han and Kung (2015) shows that China’s income tax sharing reform has changed the development strategy of local governments, which devote more efforts to develop industries conducive to local tax, so as to grab more business tax revenue, and these actions in the long run can exacerbate horizontal fiscal imbalances.

In addition, the transfer of tax revenue caused by the principle of productive tax collection will also have an impact on governments’ fiscal situation. China’s tax system has typical productive characteristics in that the scale of local production determines the level of local fiscal capacity. But consumption ends up in the nationwide market, with goods flowing to other regions at tax-inclusive prices, which causes residents of other jurisdictions to bear the tax burden of this jurisdiction. Tax revenue based on the place of production can result in a tax burden export problem, transferring some tax burdens of some jurisdictions to other jurisdictions, and compromising the fiscal capacity of the tax revenue outflowing places. Consumption-based taxation, which can effectively avoid this defect, is conducive to improving the supply and consumption environment of public goods in a jurisdiction. This may become an important part of future tax reform.

The two characteristics of VAT in China determine that VAT sharing have an impact on governments’ horizontal fiscal pattern. On the one hand, China’s VAT sharing allocates tax revenue according to the source of revenue. The central government returns local VAT revenue according to the size of the VAT collected, with regions of larger VAT size acquiring a larger amount of VAT revenue in sharing. On the other hand, as China’s VAT is levied according to the principle of the place of production, the regional transfer of VAT revenue affects a place’s fiscal revenue. For the inflowing place, the degree of vertical fiscal imbalance may decrease; for outflowing places, fiscal imbalances are likely to deepen.

3 The VAT Sharing Reform and the Adjustment of Government Financial Pattern

3.1 Measurement of Fiscal Imbalances

Fiscal imbalances include vertical and horizontal fiscal imbalances. Vertical fiscal imbalances (VFI) refer to the relative imbalance of fiscal capacity between central and local governments, also known as “fiscal gap” or “transfer payment dependency”, which occur when local governments’ own revenue cannot meet the demands of their expenditure responsibilities. Based on the common practice of the existing literature, this paper uses the proportion of a jurisdiction’s own revenue in fiscal expenditure to construct a measurement index of vertical fiscal imbalance (Boadway and Tremblay, 2006).

In this model, p represents a province, t represents time, Sown represents fiscal expenditure, Rown represents its own fiscal revenue, and VFIpt represents the degree of vertical fiscal imbalance of the p province in the t year, which measures the portion of the province’s expenditure responsibilities that cannot be met by the province’s own income.

Horizontal fiscal imbalances (HFI) refer to financial imbalances between governments at the same level, and the available literature generally uses locally owned fiscal revenue to calculate the Gini coefficient and the Theil index (Tsui, 2005). However, this approach has resulted in fiscal capacity and fiscal effort being included in fiscal revenue, and the policy schemes proposed therefrom are often prone to factor distortions and even reverse incentives to government behaviors (Bird and Villancourt, 2006). To avoid these problems, Liddo et al. (2014) have proposed a measure based on fiscal capacity, arguing that the essence of fiscal imbalances across different jurisdictions lies in the imbalance of fiscal capacity, using imbalance of fiscal capacity between administrative units as a measure of horizontal fiscal imbalances. Fiscal capacity measures the ability of jurisdictions to raise fiscal revenue, which is generally considered to be the part of fiscal revenue excluding fiscal effort, depending on the size of a region’s economy and the degree of its industrial development. A growing number of studies have introduced regression methods to measure fiscal capacity, using socio-economic variables to regress fiscal revenues and predict the size of a region’s fiscal capacity (Bird et al., 2008; Liddo et al., 2014). Fiscal effort reflects the extent to which the government taps into its existing tax base and tax capacity. This paper takes fiscal revenue as an explanatory variable, and takes industrial structure, population, consumption and other variables as control variables, to estimate the fiscal capacity and fiscal effort of the provinces on the basis of controlling the two-way fixed effect.[1]

3.2 VAT Sharing Reform and Fiscal Imbalances

3.2.1 VAT Sharing Reform and Vertical Fiscal Imbalances

The adjustment of the rules of financial distribution between different levels of finance can affect the vertical fiscal structure of the government. To analyze the impact of VAT sharing reform on vertical fiscal imbalances, we must consider the impact of comprehensively “replacing business tax with VAT”. In 2016, China implemented two important fiscal and tax reforms, “replacing business tax with VAT” and VAT sharing. Although both reforms affect vertical fiscal imbalances, they exert impact in the opposite direction on such imbalances. “Replacing business tax with VAT” have an impact on local government fiscal capacity, resulting in the lack of local main taxes, and worsening vertical fiscal imbalances; whereas the VAT sharing reform enhances the ratio of local governments’ VAT sharing and reduces the negative impact of “replacing business tax with VAT”, thus alleviating vertical fiscal imbalances. Therefore, this paper first calculates the degree of fiscal imbalances before “replacing business tax with VAT” as a benchmark, then calculates the degree of vertical imbalances after “replacing business tax with VAT” and VAT sharing reform, as a comprehensive response to the reform effect of “replacing business tax with VAT” and VAT sharing, and finally restores the VAT share ratio to the distribution ratio before “replacing business tax with VAT” to simulate the degree of fiscal vertical imbalances in the counter-factual state of the VAT sharing reform.

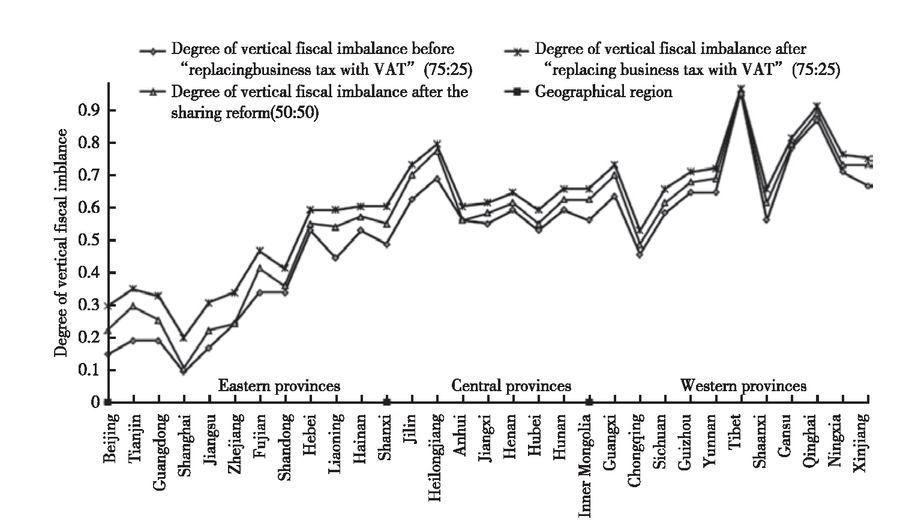

Figure 1 presents the results of measuring vertical fiscal imbalances. On the whole, the degree of vertical fiscal imbalances in the eastern provinces is lower than that in the central and western regions, and the degree of vertical fiscal imbalances in the western provinces is the highest. Comparing the degree of fiscal imbalances after the reform of “replacing business tax with VAT” and VAT sharing, it is found that the reform of VAT has alleviated the vertical imbalance of local finance to a certain extent. Compared with the situation of only “replacing business tax with VAT”, the vertical fiscal imbalance of each province has decreased to varying degrees, but the relative fiscal situation of the provinces has not been restored to the level before the reform of “replacing business tax with VAT”. This means that the VAT sharing reform may have a negative impact on the horizontal fiscal structure of different regions and provinces.

The Degree of Vertical Fiscal Imbalance in Different Provinces and Regions

3.2.2 VAT Sharing Reform and Regional Horizontal Fiscal Imbalance

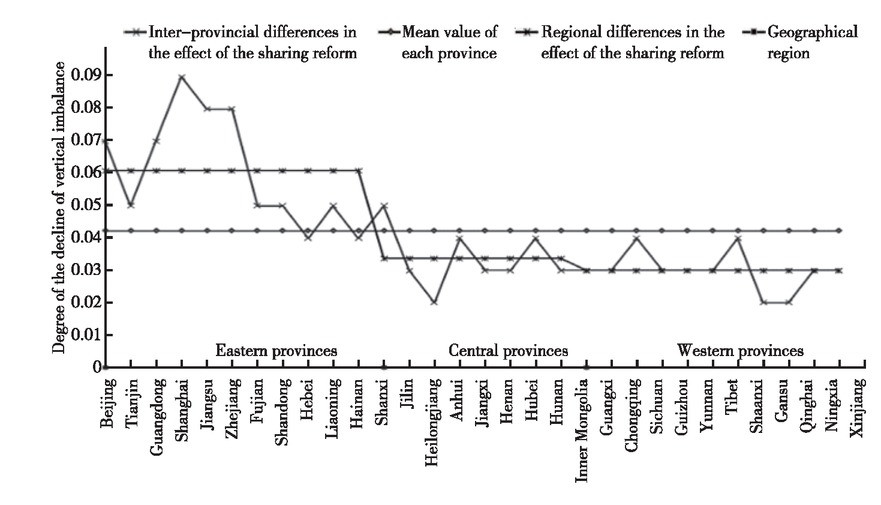

The adjustment of the rules of vertical fiscal allocation not only affects the financial structure governments at different levels, but also changes the relative fiscal situation of governments at the same level. Figure 2 directly calculates the extent of the decline of vertical fiscal imbalances in provinces and regions after the sharing reform, from which it can be found that the distribution of the effect of the VAT sharing reform varies greatly, with Beijing, Guangdong, Shanghai, Jiangsu and Zhejiang having the largest decline in vertical fiscal imbalances, which means that these provinces have benefited the most from the VAT sharing reform. On the whole, the eastern provinces have seen the decline of their fiscal vertical imbalances more than those in the central and western provinces after the sharing reforms, which may mean that the fiscal gap between different regions may widen further after the sharing reform.

VAT Shares the Extent to Which Vertical Fiscal Imbalances Have Declined Since the Reform

The result of this change in vertical fiscal imbalances in Figure 2 tells us that although the reform of VAT 50:50 sharing has led to a decline in the vertical fiscal imbalances of the provinces, the degree of decline is different, and the fiscal capacity of the provinces may be differentiated at a faster pace in the process of sharing. To further investigate the differences in the impact of the VAT sharing reform on different regions, the following measurement model has been constructed.

In this model, ΔVFIpt means the difference between the VFI value after the sharing reform and the VFI value assuming that the sharing reform is not implemented, which measures the vertical fiscal imbalance caused by the VAT sharing reform.[1] This practice excludes the impact of the reform of “replacing business tax with VAT” on vertical fiscal imbalance and directly measures the impact of the sharing reform on vertical imbalance. Regionp means that the provinces of China are divided into eastern, middle and western regions, with the eastern regions taken as the base group, assigned to 1, while the central and western regions are assigned to 2 and 3 respectively. Reformt is the virtual variable of the VAT sharing reform and is assigned to 1 after 2015. Xpt represents a series of control variables, including per capita GDP, industrial structure, tax effort, urbanization level and other variables. λp and δt represent the provincial fixed effect and the time fixed effect respectively. εpt represents residuals. In this model, the impact of the VAT sharing reform on the fiscal capacity of different regions is captured by β1. If β1 is negative, it shows that since the sharing reform, the vertical fiscal imbalance between the central and western regions has deepened, which may lead to a widening of the regional fiscal gap. If β1 is positive, it indicates that the fiscal gap between the central, western and eastern regions is narrowing.

Columns (1) and (2) of Table 2 report the regression results of model (1), present the changes in vertical fiscal imbalances after the sharing reform in the eastern, central and western regions respectively. The first column only controls the time and provincial fixed effect, while the second column adds per capita GDP, industrial structure, tax effort, urbanization level and other variables. It is not difficult to find that after the sharing reform, the vertical fiscal imbalance in the central and western regions has decreased less than that in the eastern region, while the relative vertical fiscal imbalance has deepened. The adjustment of tax sharing ratio will not only affect local governments’ fiscal revenue, but also their fiscal expenditure, although some research has found that China’s fiscal imbalance mainly stems from the adjustment of income (Lu and Li, 2019), but we still want to prove that revenue adjustment has an important impact on the adjustment of local government’s fiscal situation.

Changes in the Relative Level of Fiscal Capacity in the Eastern, Central and Western Regions after the Sharing Reform

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ΔVFI | ΔVFI | ΔVFI_adj | ΔVFI_adj |

| Policy Reform | −0.0178*** | −0.0146*** | −0.000404* | −0.00105*** |

| (0.000906) | (0.000985) | (0.000222) | (0.000244) | |

| 1.92e−09 | 0.0671** | 3.00e−09 | −0.0100 | |

| Constant | (0.000992) | (0.0283) | (0.000243) | (0.00701) |

| Control | NO | YES | NO | YES |

| Year FE | ANDIT’S | ANDIT’S | ANDIT’S | ANDIT’S |

| Pro FE | YES | YES | YES | YES |

| Observations | 341 | 341 | 341 | 341 |

| R2 | 0.915 | 0.931 | 0.971 | 0.976 |

Note: Standard errors in parentheses: *** p<0.01, ** p<0.05, * p<0.1.

To this end, this paper proves the importance of revenue adjustment to the relative level of finance from three aspects: Firstly, we map the trend of changes in per capita fiscal expenditure in different regions, and find no significant change in per capita fiscal expenditure before and after the sharing reform.[1] Secondly, on the basis of controlling the primary and secondary items of the time trend, the per capita fiscal expenditure is used to regress the year of VAT reform, and the regression coefficient is not significantly different.[2] Finally, to directly eliminate the impact of the sharing reform on expenditure, we deduct the increase in revenue brought by the value-added tax sharing reform from the expenditure data, recalculated ΔVFI_adj for regression, and obtained the regression results in columns (3) and (4) in Table 2. The regression results are consistent with the results in column (1).

3.2.3 VAT Sharing Reform and Inter-Provincial Horizontal Fiscal Imbalances

In addition to regional horizontal fiscal imbalances, inter-provincial fiscal imbalances are also an important aspect in the analysis of horizontal fiscal imbalances. In analyzing inter-provincial fiscal imbalances, we focus on the differences between the changes in provincial government revenue after the sharing reform, and judge the impact of the VAT sharing reform on the imbalance of provincial fiscal capacity by comparing directly the level of provincial government revenue when the sharing reform has been implemented to the level when the reform has not been implemented. To this end, this paper calculates the Gini coefficient for the fiscal situation of the provinces of the country in 2007−2017, finding out that the level of fiscal imbalances increased in 2016 and 2017 compared to the years prior to the reform. However, two points remain to be emphasized. The first point is that the changes in the Gini coefficient of inter-provincial fiscal capacity around 2016 included the dual effects of “replacing business tax with VAT” and the VAT sharing reform. To visually analyze the impact of the VAT sharing reform, this paper adjusts the VAT share ratio for 2016 and 2017 to 75:25 to recalculate the Gini coefficient of fiscal capacity. At this time, the difference between the two can be approximated to measure the impact of the VAT sharing reform on the fiscal differentiation of provincial governments. The second point is that the sharing proportion adjustment may affect fiscal efforts. If the eastern provinces have a higher degree of increase in fiscal efforts, an upward bias will result, that is, the eastern region’s revenue growth is more due to fiscal effort than the VAT sharing reform. In view of this point, this paper also estimates the changes of fiscal effort and fiscal capacity of different provinces before and after the VAT sharing reform.

Table 3 shows the degree of horizontal financial differentiation of provinces in China from 2007 to 2017. The second row of Table 3 shows the Gini coefficient of provincial fiscal capacity after the VAT sharing reform, that is, the Gini coefficient when VAT is shared at a ratio of 50:50. Compared with previous years, the Gini coefficient in 2016 and 2017 rose to more than 0.4. In order to analyze the impact of the VAT sharing reform on provincial fiscal differentiation, this paper has readjusted the VAT sharing ratio to 75:25, and calculated the results in the third row of Table 3. Before 2016, because no VAT sharing reform was going on, the values in the third row and the second row were consistent. However, compared with the situation without the VAT sharing reform, the Gini coefficient of provincial fiscal capacity is higher after the VAT sharing reform, which means that the VAT sharing reform has widened the inequality of provincial fiscal capacity. In order to exclude the influence of fiscal effort, this paper calculates the uneven degree in provincial fiscal capacity from 2007 to 2016. The fourth row gives the results of the imbalance degree of provincial fiscal capacity, which is higher than the differentiation degree of fiscal revenue. After 2016, the uneven degree of fiscal capacity has increased considerably. In addition, this paper regresses fiscal effort and finds that the degree of tax effort in western provinces has increased more since the sharing reform, with a regression coefficient of 0.039, which remains significant at the significance level of 10%.[1] This means that there is no overestimation of the data results in this paper, and even if there are deviations, on the impact of the VAT sharing reform on fiscal differentiation is underestimated.

Gini Coefficient for Inter-Provincial Fiscal Revenues in 2007−2017

| Year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 50:50 | 0.450 | 0.436 | 0.428 | 0.419 | 0.399 | 0.385 | 0.379 | 0.382 | 0.399 | 0.414 | 0.417 |

| 75:25 | 0.409 | 0.412 | |||||||||

| Fiscal capacity | 0.532 | 0.506 | 0.491 | 0.479 | 0.437 | 0.411 | 0.395 | 0.403 | 0.397 | 0.415 | 0.448 |

In theory, fiscal capacity determines fiscal revenue, and fiscal capacity differentiation is the root cause for fiscal imbalances (Boadway and Tremblay, 2006; Bird and Villancourt, 2006). The size of fiscal capacity depends on the economic scale of a jurisdiction; therefore, this paper breaks GDP into three major industries according to its composition, and finds that the uneven fiscal capacity mainly stems from the uneven distribution of the tertiary industry, which, contributing 90% to fiscal capacity, is the key factor causing the differentiation of fiscal capacity.[2]

3.2.4 Why Does the Sharing Reform Exacerbate Horizontal Fiscal Imbalances

What has changed in the VAT sharing reform, as a result of which the fiscal gap between different regions has been widened, and horizontal fiscal imbalances deepened? It is generally believed in the literature that the differentiation of fiscal capacity is the cause of fiscal imbalances, and some studies have used the quasi-natural experiment of the income tax sharing reform to explore the impact of fiscal incentives on local government behavior, and found out that under the influence of fiscal incentives, local governments may choose to vigorously develop industries conducive to expanding their tax base (Han and Kung, 2015). Value-added tax is mainly based on the added value of goods and taxable services in the process of circulation, and after increasing the proportion of local VAT sharing, local governments have more incentive to develop secondary and tertiary industries to consolidate the tax base. In order to examine the channels through which the VAT sharing reform exacerbates horizontal fiscal imbalances, we examine the changes in the fiscal capacity of different regions after the VAT sharing reform, and further, following the idea that the tertiary industry is the main cause for the imbalance in fiscal capacity, we also examine the changes of industrial structure in different regions after the VAT sharing reform.

Columns (1) and (2) of Table 4 show changes in fiscal capacity in the eastern, central and western regions of the sharing reform. The difference between columns (2) and (1) is that control variables have been added to column (2) and it can be found that the fiscal capacity of the western and central regions has declined significantly after the sharing reform compared to the eastern region, which validates the logic in the literature. In the previous analysis, we find that the difference of fiscal capacity is mainly caused by the tertiary industry, and the regional fiscal capacity is mainly reflected in the uneven distribution of the tertiary industry. If this logic holds, we should be able to observe that there should be significant differences in the output value of the tertiary industry in different regions before and after the VAT sharing reform. Columns (3) ~ (5) of Table 4 show the changes in the economic industrial structure of different regions after the VAT sharing reform. The study has found that after the VAT sharing reform, compared with the eastern region, the per capita output value of the tertiary industry in the central and western regions has decreased greatly, and although the coefficient of the secondary industry is positive, its coefficient is only half that of the tertiary industry. These findings illustrate the regional differentiation of industrial growth and further confirm the relationship between fiscal capacity differentiation and deepening fiscal imbalances after the VAT sharing reform.

Changes in Fiscal Capacity of Eastern, Central And Western Regions after the VAT Sharing Reform

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | Fiscal capacity | Fiscal capacity | Industry1 | Industry2 | Industry3 |

| −0.618*** | −0.395*** | 0.000263 | 0.0533** | −0.0824*** | |

| Policy Reform | (0.0737) | (0.0727) | (0.00856) | (0.0224) | (0.0284) |

| Control | NO | ANDIT’S | ANDIT’S | ANDIT’S | ANDIT’S |

| Andear FE | ANDIT’S | ANDIT’S | ANDIT’S | ANDIT’S | ANDIT’S |

| Pro FE | ANDIT’S | ANDIT’S | ANDIT’S | ANDIT’S | ANDIT’S |

| 0.621*** | 1.779 | 0.476* | −2.831*** | 3.136*** | |

| Constant | (0.0807) | (2.092) | (0.246) | (0.645) | (0.818) |

| Observations | 341 | 341 | 341 | 341 | 341 |

| R2 | 0.661 | 0.773 | 0.831 | 0.960 | 0.974 |

Note: Standard errors in parentheses: *** p<0.01, ** p<0.05, * p<0.1.

3.3 The Effect of Sharing Reform Measured on the Basis of the Input-Output Method

In order to completely separate the impact of “replacing business tax with VAT” and the VAT sharing reform on fiscal imbalance, the key lies in accurately estimating the change of local government tax revenue following the two reforms, which requires accurately defining the tax base of VAT. Although we have tried to prove that the VAT sharing reform will affect the government’s fiscal situation, we are still worried that the “replacing business tax with VAT” may cause a deviation in the measurement. To solve this problem, we use the data of the 2012 provincial input and output table to directly simulate the relative fiscal situation of local governments under the impact of the two policies of “replacing business tax with VAT” and the VAT sharing reform. Using the input and output data for 2012 is not affected by the reform of “replacing business tax with VAT”, and is thus conducive to our relatively clean simulation of the effects of the VAT sharing reform.[1]

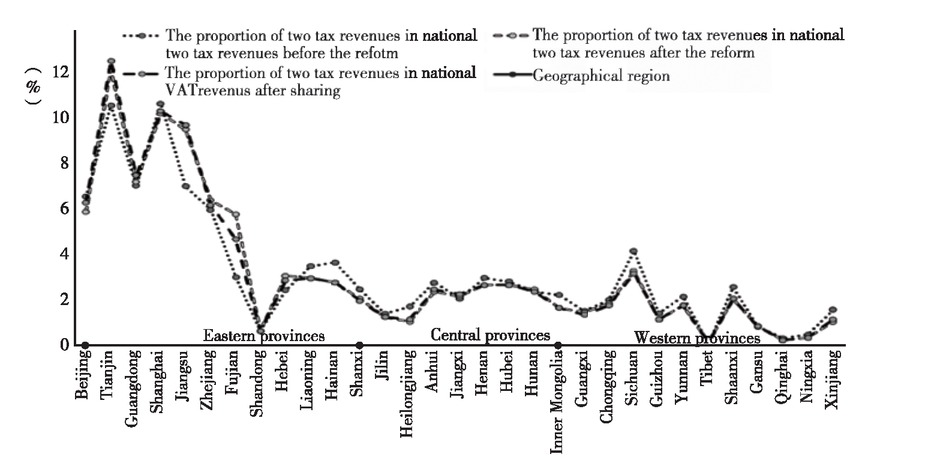

In the literature, there are three ways to estimate the VAT base: the Aggregate National Accounting Account Method,[2] the Industry Account Method[3] and the Input and Output Method[4] (Li and Fang, 2013; Minth, 2007). These three methods theoretically produce the same results, but each of the three approaches has its advantages and disadvantages. The advantage of the input-output method is that it can make full use of input-output and consumption data for goods and services in the economy. To this end, this paper uses China’s input and output data in 2012 to simulate the effects of the reform of “replacing business tax with VAT” and the VAT sharing reform.[5] First of all, the proportion of the two tax revenues of the provinces in the national two tax revenues before the reform of “replacing business tax with VAT” is calculated, and secondly, the proportion of the VAT revenue of the provinces in the national VAT revenue after the reform of “replacing business tax with VAT” is calculated. The result represents the impact of the reform of “replacing business tax with VAT” on the fiscal capacity of the provinces. Numerical simulation results presented in Figure 3 show that it is not difficult to find that the reform of “replacing business tax with VAT” can cause a rapid rise of the proportion of the VAT revenue of regions with a larger scale of the consumption-based service industry in the national VAT revenue; while the proportion of VAT revenue of regions with a larger scale of production-based service industry in the national VAT revenue can decrease in the course of reform. As the eastern region has a larger scale of the consumption-based service industry, the proportion of VAT revenue in the region such as Guangdong, Zhejiang, Jiangsu and Shanghai has significantly risen.

Simulation of the Effects of Reform with the Input-Output Table 2012

4 The Reconstruction of the VAT Sharing Scheme

One of the objectives of China’s current reform in the fiscal and tax system is to establish a balanced central and local fiscal relationship, but fiscal imbalances are objective phenomena under China’s current fiscal and tax system. Although the VAT sharing reform has alleviated vertical fiscal imbalances to some extent, it has aggravated horizontal fiscal imbalances. At the current stage, China’s income tax and VAT are shared taxes, but the difference in the distribution of the VAT base becomes the most important reason for China’s fiscal imbalances, and the VAT is much more important to protect government revenue than income tax. The VAT sharing system is designed as a key to alleviating regional fiscal imbalances, but it is still to be clear how to address regional fiscal imbalances through VAT sharing. The VAT horizontal sharing system of Germany, Canada and other countries provides us with ideas to solve this problem. These countries in the distribution of fiscal revenues mainly take into account local population, consumption and fiscal capacity as well as other factors.

4.1 Comparison of the Equalization Effects of Different Policy Schemes

We compare the equalization effects of different policy schemes from two perspectives: one is to directly compare the changes in the proportion of VAT revenue of different provinces in the national total, to observe the changes in the proportion of different provinces; and the other is to calculate the standard deviation of the proportion of VAT revenue of different provinces in the national total under different sharing schemes, the smaller the standard deviation, the stronger the degree of equalization.

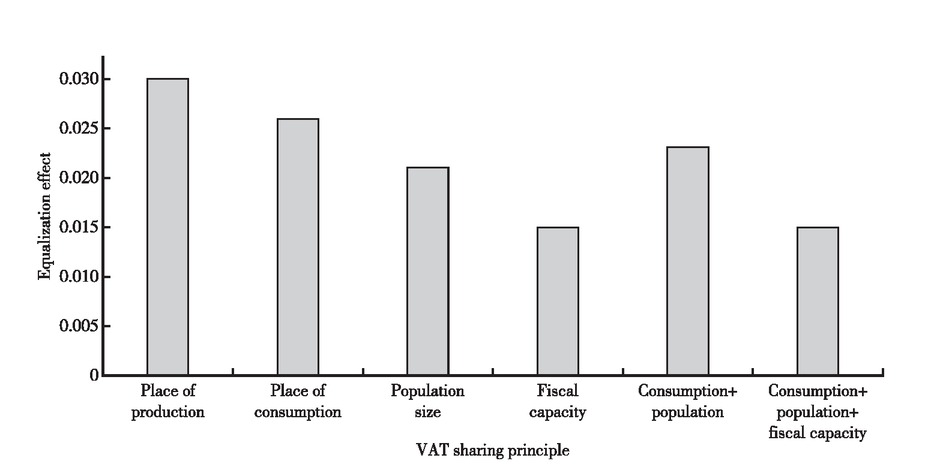

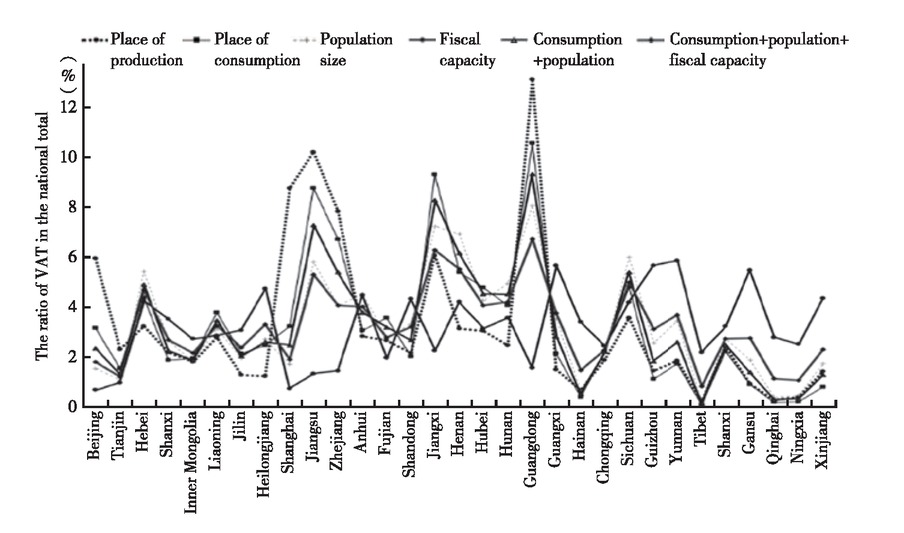

Based on a given central and local share ratio of 50:50, this paper measures the equalization effect of different sharing methods based on the 2017 data, and the numerical results show that considering other VAT distribution principles will help promote the balance of fiscal capacity in the a jurisdiction.[1]Figure 4 shows the standard deviation of the VAT proportion in the country under different sharing schemes, and it can be found that the introduction of other criteria for the distribution of VAT is conducive to the equalization of fiscal capacity in different jurisdictions and the enhancement of their capacity to supply public services. From the measured results, it is not difficult to find that the degree of VAT revenue inequality is the highest under the principle of the place of production, which also means that compared with other distribution methods, the degree of horizontal fiscal imbalances under this method is the most serious. Distribution according to the principle of the place of consumption can alleviate horizontal fiscal imbalances, and compared with the principle of the place of production, the standard deviation under this principle falls by 0.04. The distribution of VAT revenue according to population size and fiscal capacity can further highlight the equalization effect of distribution. The method of distribution according to fiscal capacity or in line with the “population + consumption + fiscal capacity” multi-principle method can best highlight the equalization effect and improve the current unfair distribution of VAT revenue in China.

Fiscal Equalization Effects of Different Sharing Schemes

4.2 The Choice of the Best Sharing Scheme for VAT

In theory, the residents of a country can avoid the inefficient flow of labor and maximize social welfare when they enjoy equal public services. However, the decentralization system may cause different scales and standards of government public services in different jurisdictions, which could lead to the different public services received by residents. The key to address this problem is to improve the public services supply capacity and realize fiscal equalization in areas with backward fiscal capacity. As far as VAT per se is concerned, if it is levied according to the principle of place of production, local governments would be induced to compete for fiscal capacity and distort the allocation of resources. In practice, how should the optimal allocation method be chosen? In choosing the optimal allocation method of VAT, there are two dimensions to consider. The first is whether the equalization effect of a sharing scheme is conducive to narrowing the regional fiscal gap. The second is an incentive mechanism of government behaviors. Under the principle of production place, the government would try to expand the scale of local productive tax base to maximize budget constraints, and the most direct reactions of the government are to attract investment, increase the scale of revenue by promoting enterprises in the jurisdiction to expand their production. Under the principle of place of consumption and population, to increase fiscal revenue, the government would focus on creating a good consumption environment and be encouraged to be responsible to the residents in its jurisdiction. The principle of fiscal capacity has a great distortion effect on the incentive of government behavior, because places with less fiscal revenue would get larger subsidies from the central government, which may cause the government to race to the bottom.

The VAT sharing reform aims to establish a VAT distribution mechanism combining equalization and government incentive. From the experience of other countries, Germany’s VAT is mainly distributed on the basis of population and fiscal capacity, and Canada has established a system of Harmonized Sales Tax (HST). China’s VAT sharing scheme, on the basis of the principle of tax collection from consumption places, should gradually establish a VAT sharing system that takes into account various factors of consumption, population and fiscal capacity. Figure 5 compares the equalization effect of different VAT sharing schemes, with the highest degree of imbalance under the principle of place of production. From the point of view of equalization effect, the effect of fiscal capacity and “consumption + population + fiscal capacity” is similar, but the distribution of VAT revenue according to the principle of fiscal capacity alone could have a huge distorting effect on local government behavior. It can be found from the figure that the areas with higher VAT revenue get lower share of revenue in this distribution scheme, which makes local governments race to the bottom. The advantage of collecting VAT according to the principle of place of consumption is that it can improve the degree of responsibility of the local government to the residents of the jurisdiction and improve the quality and level of public service supply. Meanwhile, on the basis of the principle of consumption place, the inclusion of comprehensive factors such as population and fiscal capacity can not only promote the equalization of fiscal capacity, but also establish incentives in fiscal revenue distribution from many dimensions. Therefore, the gradual establishment of a “consumption + population + fiscal capacity” combined collection method on the basis of the principle of consumption place is an ideal policy scheme for future VAT sharing in China.

A Comparison of the Equalization Effects of Different Sharing Schemes

5 Conclusions and Policy Recommendations

Starting from the VAT 50:50 sharing reform, this paper studies the relative changes of the government’s fiscal capacity pattern before and after the reform in an attempt to provide a new analytical perspective for understanding the intergovernmental fiscal relationship in China. The study in this paper finds that although the VAT sharing reform alleviates vertical fiscal imbalances, it aggravates horizontal fiscal imbalances, which may be due to the aggravated differentiation of regional fiscal capacity; the adjustment of the VAT distribution principle is conducive to improving the relative fiscal capacity pattern of provincial governments. These findings provide theoretical and empirical support to further improve the fiscal relationship between the central and local governments and clarify the implications of the modern fiscal system.

First, we should adjust the principle of the place of production for VAT collection, and gradually transition to the principle of the place of consumption or the direction of comprehensive consideration of consumption, population and fiscal capacity. The principle of the place of production for VAT collection results in the cross-regional transfer of VAT revenue, which would bring welfare losses to a great extent. In fact, China’s VAT, income tax and consumption tax and other major taxes are all distributed according to production places, which is a tax system causing a large-scale mismatch of resources. Changing the uniform distribution principle according to places of production is undoubtedly an important step in China’s tax reform. At present, as China is gradually promoting the VAT reform and legislation, how to reduce the distortion effect of VAT on government behavior should be an important part of the VAT reform.

Second, we should strengthen the development of local fiscal capacity and reduce the degree of fiscal imbalances. On the one hand, we should give local governments more fiscal autonomy, enhance the level of local government’s fiscal capacity, and reduce vertical fiscal imbalances. On the other hand, efforts should be made to narrow regional fiscal gaps and alleviate horizontal fiscal imbalances. In the specific policy scheme of consumption tax in the future, we should further consider how to distribute consumption tax revenue across regions and enhance the balance of regional fiscal capacity.

Third, we should rationalize intergovernmental fiscal relationships and accelerate the improvement of the modern fiscal system. This paper finds that although the VAT sharing reform is conducive to alleviating the impact of “replacing business tax with VAT” on local fiscal capacity, it also aggravates the degree of fiscal differentiation between localities, a problem which we attempt to solve from the perspective of the reconstruction of the VAT sharing system. These conclusions are valuable for constructing an intergovernmental fiscal relationship characterized by clearly defined powers and responsibilities, appropriate financial resource allocation, and greater balance between regions, and promoting fiscal reforms in the new era.

References

Bellofatto, A. A., & Besfamille, M. (2018). Regional State Capacity and the Optimal Degree of Fiscal Decentralization. Journal of Public Economics, 159, 225−243.10.1016/j.jpubeco.2017.12.010Suche in Google Scholar

Bird, R. M., Martinez-Vazquez, T., & Torgler, B. (2008). Tax Effort in Developing Countries and High Income Countries: The Impact of Corruption, Voice and Accountability. Economic Analysis and Policy, 38(1), 55−71.10.1016/S0313-5926(08)50006-3Suche in Google Scholar

Bird, R. M., & Vaillancourt, F. (2006). Perspectives on Fiscal Federalism. Washington, DC: World Bank Institute.10.1596/978-0-8213-6555-7Suche in Google Scholar

Boadway, R., & Tremblay, J. F. (2006). A Theory of Fiscal Imbalance. FinanzArchiv: Public Finance Analysis, 62(1), 1−27.10.1628/001522106776667004Suche in Google Scholar

Boadway, R., Cuff, K., & Marchand, M. (2003). Equalization and the Decentralization of Revenue-Raising in a Federation. Journal of Public Economic Theory, 5(2), 201−228.10.1111/1467-9779.00130Suche in Google Scholar

Fajgelbaum, P. D., Eduardo, M., Suárez, J. C. S., & Zadar, O. (2019). State Taxes and Spatial Misallocation. The Review of Economic Studies, 86(01), 333−376.10.3386/w21760Suche in Google Scholar

Gao, P. (2018). Forty Years of Fiscal and Tax Reform in China: Basic Tracks, Experiences and Laws. Economic Research (Jingji Yanjiu), 17, 60−71.Suche in Google Scholar

Garg. S., Goyal, A., & Pal, R. (2017). Why Tax Effort Falls Short of Tax Capacity in Indian States: A Stochastic Frontier Approach. Public Finance Review, 45(2), 1−28.10.1177/1091142115623855Suche in Google Scholar

Han, L., & Kung, J. (2015). Fiscal Incentives and Policy Choices of Local Governments: Evidence from China. Journal of Development Economics, 116, 89−104.10.1016/j.jdeveco.2015.04.003Suche in Google Scholar

Hunter, J. S. H. (1974). Vertical Intergovernmental Financial Imbalance: A Framework for Evaluation. FinanzArchiv / Public Finance Analysis, 32, 481−492.Suche in Google Scholar

Kim, J. (2014). Intergovernmental Distribution of VAT Revenue in Korea: Local Consumption Tax. Korean Economic Review, 30(1), 109−131.Suche in Google Scholar

Liddo, G. D., Longobardi, E., & Porcelli, F. (2016). Measuring Horizontal Fiscal Imbalance: The Case of Italian Municipalities. Local Government Studies, 42(3), 385−419.10.1080/03003930.2016.1150836Suche in Google Scholar

Li, Q., & Fang, J. (2013). The Impact of the Comprehensive “Expansion” of VAT on Provincial Government Tax Revenues: A Simulation Based on Input and Output Tables. Finance Trade Economics (Caimao Jingji), 6, 33−42.Suche in Google Scholar

Liu, Y., & Zhang, N. (2016). The Principle of Places of Consumption and the Horizontal Sharing of Value Added Tax Revenue across Regions. Taxation Research (Shuiwu Yanjiu), 12, 8−14.Suche in Google Scholar

Lu, B., & Tai, H. (2019). Relationship between National Capacity and Intergovernmental Finance. Journal of Political Science (Zhengzhixue Yanjiu), 3, 94−107+128.Suche in Google Scholar

Lu, J., & Li, Y. (2018). Transcending the Fiscal Problem: Vertical Imbalances in China’s Fiscal System from the Perspective of State Governance. Sociological Studies (Shehuixue Yanjiu), 2, 62−87.Suche in Google Scholar

Minth, T. L. (2007). Estimating the VAT Base: Method and Application. Tax Notes International, 46(9), 203−210Suche in Google Scholar

Qian, T., & Zhang, Q. (2018). Intra-Provincial Revenue Sharing and the Subnational Government’s Fiscal Capacity in China: The Case of Zhejiang Province. China & World Economy, 26(4), 24−40.10.1111/cwe.12247Suche in Google Scholar

Sharma, C. K. (2012). Beyond Gaps and Imbalances: Re-Structuring the Debate on Intergovernmental Fiscal Relationships. Public Administration, 90(1), 99−128.10.1111/j.1467-9299.2011.01947.xSuche in Google Scholar

Tsui, K. Y. (2005). Local Tax System, Intergovernmental Transfers and China’s Local Fiscal Disparities. Journal of Comparative Economics, 33(1), 173−196.10.1016/j.jce.2004.11.003Suche in Google Scholar

Yang, F., & Liu, Y. (2014). Reconstructing the Interregional VAT Sharing System. Taxation Research (Shuiwu Yanjiu), 8, 12−18.Suche in Google Scholar

© 2021 Kezhong Zhang et al., published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Frontmatter

- Are the Economic Consequences of Climate Change Really “Pro-Poor”?

- Tax Sharing and Fiscal Imbalances: Reconstruction of the VAT Sharing System in China

- Vertical Fiscal Imbalance, Transfer Payment and Local Government Governance

- Does Rising House Price Push Chinese Households to “Leverage Up” More?

- Resources Allocation and Utilization Efficiency in China’s Healthcare Sector

- China’s Government Information Capacity, Medical Resource Allocation and COVID−19 Prevention and Control

Artikel in diesem Heft

- Frontmatter

- Are the Economic Consequences of Climate Change Really “Pro-Poor”?

- Tax Sharing and Fiscal Imbalances: Reconstruction of the VAT Sharing System in China

- Vertical Fiscal Imbalance, Transfer Payment and Local Government Governance

- Does Rising House Price Push Chinese Households to “Leverage Up” More?

- Resources Allocation and Utilization Efficiency in China’s Healthcare Sector

- China’s Government Information Capacity, Medical Resource Allocation and COVID−19 Prevention and Control