Abstract

How does uncertainty about economic policy translate into uncertainty about macroeconomic outcomes, in particular inflation? New measures of consumer inflation uncertainty are compared to the economic and monetary policy uncertainty indices of [Baker, S., N. Bloom, and S. Davis. 2016. “Measuring Economic Policy Uncertainty.” Quarterly Journal of Economics.]. Economic policy uncertainty is more strongly correlated with uncertainty about shorter-run inflation than with uncertainty about longer-run inflation, while monetary policy uncertainty is more correlated with uncertainty about longer-run than shorter-run inflation. Both economic and monetary policy uncertainty Granger cause inflation uncertainty. Consumer inflation uncertainty can be computed for demographic subgroups. High income and high education consumers have the lowest inflation uncertainty, but their short-run inflation uncertainty is most strongly correlated with policy uncertainty. The long-run inflation uncertainty of the top income quintile is less correlated with policy uncertainty, possibly reflecting stronger anchoring of inflation expectations for this group. Policy uncertainty appears to reflect the expectations of consumers more than professional forecasters or financial markets.

Appendix A

Tables and Figures

Coefficient of variation and autocorrelation for uncertainty indices.

| Variable | Coef. of variation | Autocorrelation |

|---|---|---|

| EPU | 41.6 | 0.76 |

| MPU | 61.8 | 0.60 |

| Short-horizon CIU | 23.2 | 0.87 |

| Long-horizon CIU | 17.7 | 0.71 |

| CF inflation dispersion | 29.3 | 0.76 |

| Inflation risk premium | 13.8 | 0.72 |

Monthly data beginning in 1985. Economic and monetary policy uncertainty indices from Baker, Bloom, and Davis (2016). Consumer inflation uncertainty indices updated from Binder (2017). Consensus Forecasts inflation dispersion from Wright (2011). Inflation risk premium from Haubrich, Pennacchi, and Ritchken (2011) and the Federal Reserve Bank of Cleveland.

Granger causality tests from bivariate VARs of uncertainty indices.

| Response | |||||

|---|---|---|---|---|---|

| EPU | MPU | Short-run CIU | Long-run CIU | ||

| Impulse | EPU | – | 3 | 36.8*** | 14.2*** |

| MPU | 5.2 | – | 24.3*** | 17.8*** | |

| Short-run CIU | 5.1 | 3.4 | – | 11.8*** | |

| Long-run CIU | 16.1*** | 16.0*** | 4.1 | – | |

Table shows χ2 statistic from Granger causality Wald test that the row variable Granger causes the column variable. Each test follows a bivariate VAR with three lags of row and column variable. ***Denotes row variable Granger causes column variable with p < 0.01.

Granger causality test from bivariate VARs of first-differenced uncertainty indices.

| Response | |||||

|---|---|---|---|---|---|

| EPU | MPU | Short-run CIU | Long-run CIU | ||

| Impulse | EPU | – | 1.1 | 38.0*** | 9.2** |

| MPU | 3.4 | – | 18.1*** | 7.5** | |

| Short-run CIU | 0.7 | 2.6 | – | 7.2* | |

| Long-run CIU | 6.8* | 3.6 | 2.9 | – | |

Table shows χ2 statistic from Granger causality Wald test that the row variable Granger causes the column variable. Each test follows a bivariate VAR with three lags of row and column variable, first-differenced. ***denotes row variable Granger causes column variable with p < 0.01, **with p < 0.05, *with p < 0.1.

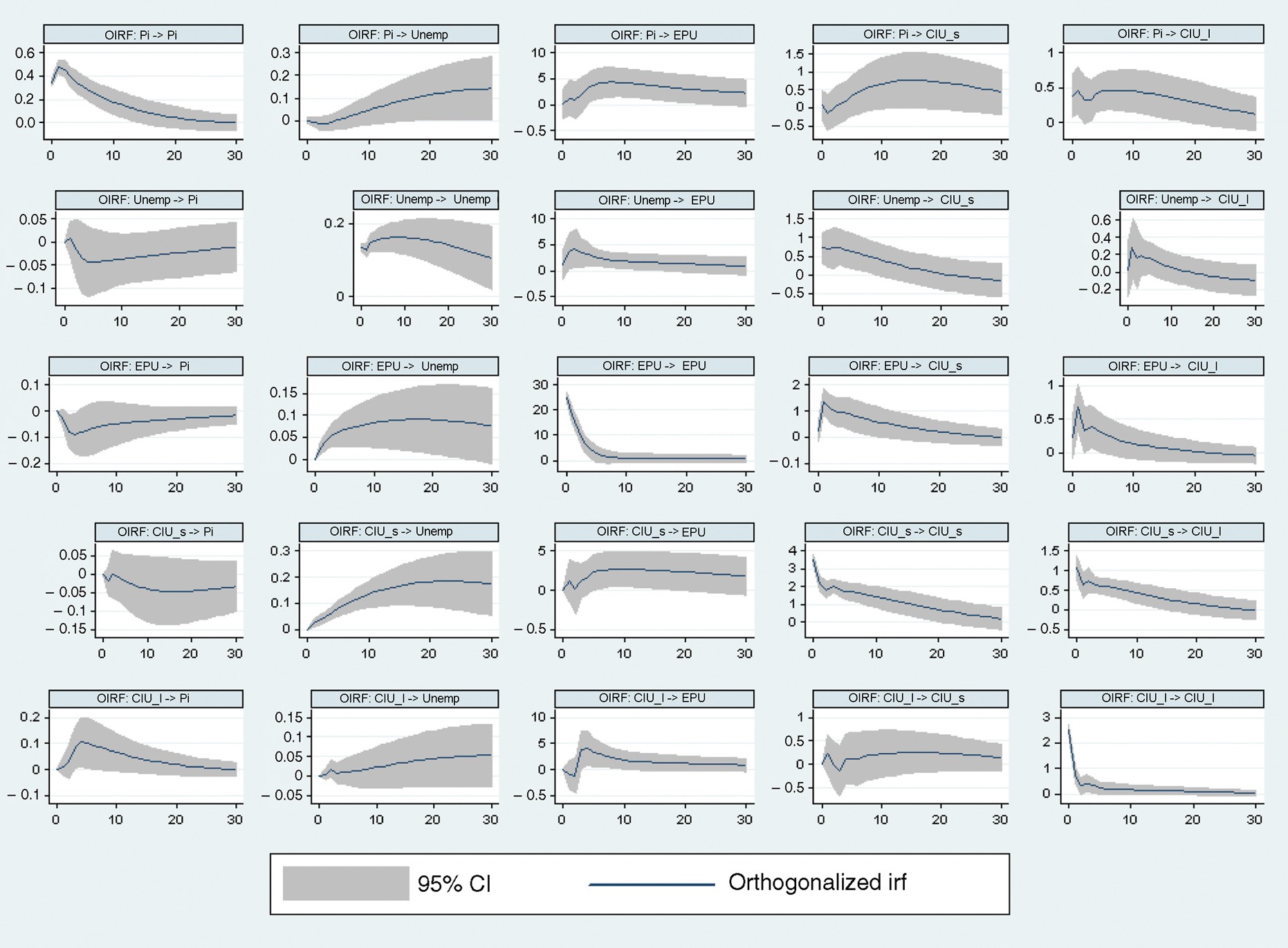

Orthogonalized impulse response functions.

Notes: Recursive VAR with the Cholesky ordering inflation (pi), unemployment (unemp), Economic Policy Uncertainty (EPU), short-horizon consumer inflation uncertainty (CIU_s), long-horizon consumer inflation uncertainty (CIU_l). Three lags of each variable and 303 monthly observations.

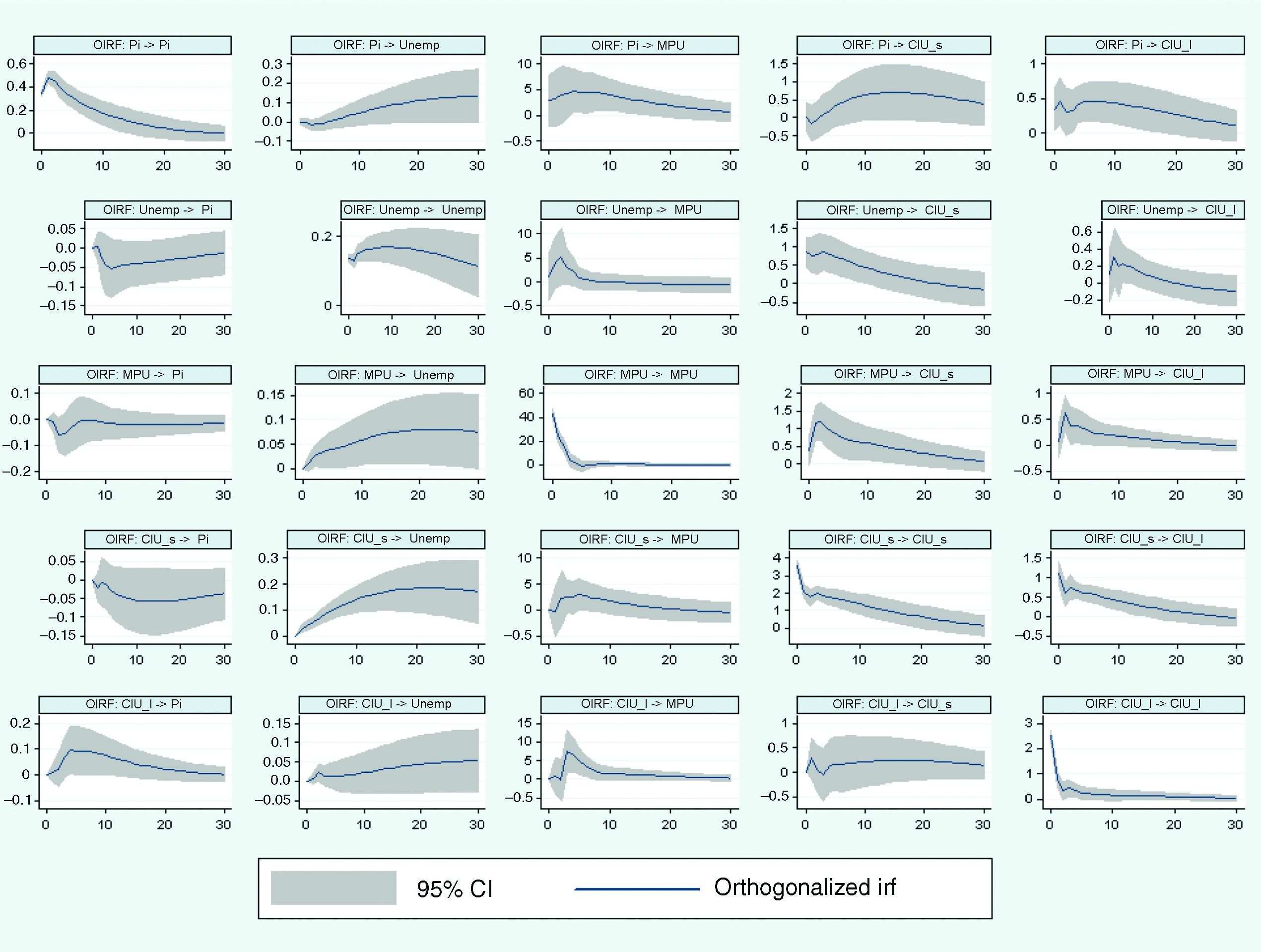

Orthogonalized impulse response functions.

Notes: Recursive VAR with the Cholesky ordering inflation (pi), unemployment (unemp), Monetary Policy Uncertainty (MPU), short-horizon consumer inflation uncertainty (CIU_s), long-horizon consumer inflation uncertainty (CIU_l). Three lags of each variable and 303 monthly observations.

Forecast error variance decomposition for multivariate VARs.

| Response | |||||

|---|---|---|---|---|---|

| EPU | Short CIU | Long CIU | Inflation | Unemp. | |

| a. VAR with EPU, CIU, inflation, and unemployment | |||||

| Impulse | |||||

| EPU | 0.77 | 0.14 | 0.07 | 0.03 | 0.12 |

| Short-run CIU | 0.03 | 0.75 | 0.29 | 0.01 | 0.23 |

| Long-run CIU | 0.05 | 0.01 | 0.48 | 0.05 | 0.01 |

| Inflation | 0.09 | 0.04 | 0.14 | 0.90 | 0.02 |

| Unemployment | 0.06 | 0.07 | 0.01 | 0.01 | 0.63 |

| Response | |||||

| MPU | Short CIU | Long CIU | Inflation | Unemp. | |

| b. VAR with MPU, CIU, inflation, and unemployment | |||||

| Impulse | |||||

| MPU | 0.85 | 0.13 | 0.07 | 0.01 | 0.05 |

| Short-run CIU | 0.02 | 0.74 | 0.29 | 0.01 | 0.25 |

| Long-run CIU | 0.05 | 0.01 | 0.49 | 0.05 | 0.01 |

| Inflation | 0.06 | 0.03 | 0.13 | 0.92 | 0.02 |

| Unemployment | 0.02 | 0.09 | 0.02 | 0.01 | 0.68 |

Table shows the fraction of variance in the response variable explained by the impulse variable at the 12-month forecast horizon.

Chi squared statistic for test that EPU or MPU Granger causes inflation uncertainty, by income quintile.

| Short horizon | Long horizon | |||

|---|---|---|---|---|

| Quintile | EPU | MPU | EPU | MPU |

| 1 | 8.8** | 6.0 | 4.8 | 8.7** |

| 2 | 25.3*** | 23.5*** | 17.4*** | 15.8*** |

| 3 | 26.9*** | 24.7*** | 13.2*** | 15.4*** |

| 4 | 31.6*** | 31.6*** | 17.7*** | 19.3*** |

| 5 | 31.1*** | 20.0*** | 9.3** | 9.1** |

Table shows χ2 statistic from Granger causality Wald test that EPU or MPU Granger causes inflation uncertainty by income quintile and horizon. Each test follows a bivariate VAR with three lags of row and column variable. ***p < 0.01, **p < 0.05, *p < 0.1.

Chi squared statistic for test that inflation uncertainty Granger causes EPU or MPU, by income quintile.

| Horizon 1 | Horizon 5 | |||

|---|---|---|---|---|

| Income quintile | EPU | MPU | EPU | MPU |

| 1 | 2.5 | 3.4 | 4.6 | 9.4** |

| 2 | 4.2 | 4.0 | 16.1*** | 22.0*** |

| 3 | 5.3 | 2.7 | 3.7 | 5.5 |

| 4 | 6.2 | 2.3 | 11.2** | 9.6** |

| 5 | 7.5* | 8.7** | 14.5*** | 12.5** |

Table shows χ2 statistic from Granger causality Wald test that inflation uncertainty Granger causes EPU or MPU by income quintile and horizon. Each test follows a bivariate VAR with three lags of row and column variable. ***p < 0.01, **p < 0.05, *p < 0.1.

Policy uncertainty regressed on consumer and professional forecaster inflation uncertainty.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| EPU | MPU | EPU | MPU | |

| SPF Uncertainty(t) | −0.06 | −0.06 | −0.23 | −0.31 |

| (−0.26) | (−0.25) | (−0.88) | (−1.04) | |

| SPF Uncertainty(t−1) | 0.28 | 0.16 | 0.01 | −0.20 |

| (1.45) | (0.71) | (0.03) | (−0.63) | |

| Unemployment | 0.42 | −0.22 | 0.29 | −0.43 |

| (1.41) | (−0.62) | (0.87) | (−1.12) | |

| Inflation | −0.68 | −0.10 | −0.07 | 0.62 |

| (−1.13) | (−0.14) | (−0.09) | (0.64) | |

| Squared Inflation | 0.63 | 0.32 | 0.23 | −0.16 |

| (1.04) | (0.44) | (0.32) | (−0.20) | |

| Fed Funds Rate | −0.36 | −0.59 | −0.44 | −0.66 |

| (−0.83) | (−1.15) | (−0.95) | (−1.22) | |

| Δ Fed Funds Rate | −0.44* | −0.51* | −0.27 | −0.30 |

| (−1.97) | (−1.92) | (−0.95) | (−0.94) | |

| t | −0.53* | −0.60 | −0.44 | −0.47 |

| (−1.81) | (−1.74) | (−1.44) | (−1.35) | |

| CIU Short(t) | 0.55 | 0.71 | ||

| (1.27) | (1.41) | |||

| CIU Short(t−1) | −0.12 | −0.06 | ||

| (−0.32) | (−0.14) | |||

| Observations | 23 | 23 | 23 | 23 |

| R2 | 0.560 | 0.385 | 0.617 | 0.492 |

*p < 0.10, **p < 0.05, ***p < 0.01. Standardized beta coefficients; t statistics in parentheses.

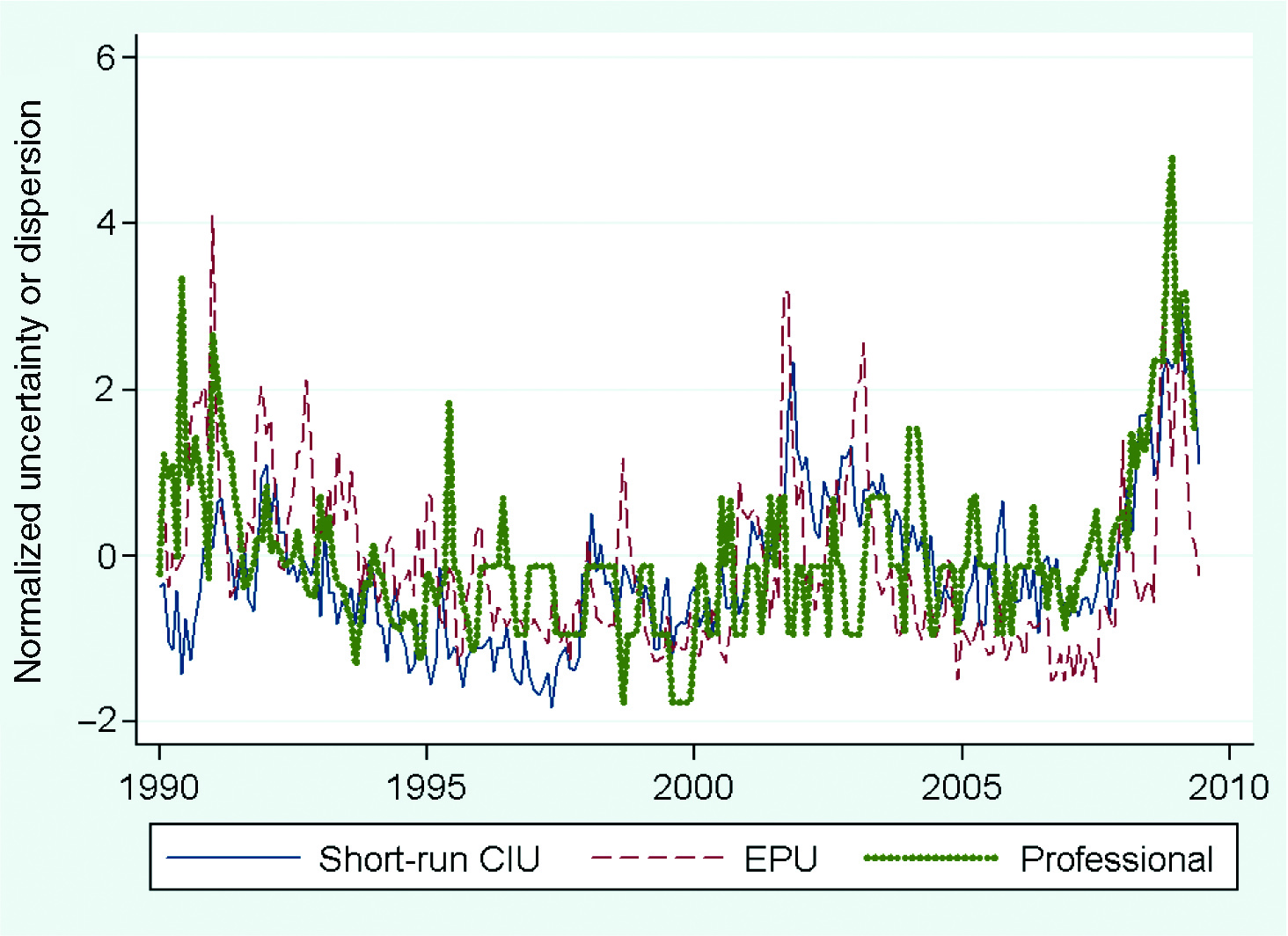

Uncertainty and professional forecaster dispersion.

Notes: All series have been normalized by subtracting the mean and dividing by the standard deviation. The consumer inflation uncertainty index at the 1-year horizon is constructed according to the methodology in Binder (2017). The policy uncertainty index data from Baker, Bloom, and Davis (2016) was downloaded at www.policyuncertainty.com. Professional forecaster dispersion is the standard deviation of forecasts from Consensus Forecasters, downloadable in the replication files for Wright (2011) .

References

Albers, W., and G. Albers. 1983. “Decisionmaking Under Uncertainty.”. In On the prominence structure of the decimal system. 271–288. Bielefeld: Elsevier.10.1016/S0166-4115(08)62203-7Suche in Google Scholar

Armantier, O., G. Topa, W. van der Klaauw, and B. Zafar. 2013. “Introducing the FRBNY Survey of Consumer Expectations: Measuring Price Inflation Expectations.”.Federal Reserve Bank of New York Liberty Street Economics.10.1146/annurev-economics-081512-141510Suche in Google Scholar

Bachmann, R., and C. Bayer. 2013. “Wait-and-See Business Cycles?” Journal of Monetary Economics 60: 704–719.10.1016/j.jmoneco.2013.05.005Suche in Google Scholar

Bachmann, R., and G. Moscarini. 2011. “Business Cycles and Endogenous Uncertainty.”.Society for Economic Dynamics Meeting Papers.Suche in Google Scholar

Bachmann, R., S. Elstner, and E. R. Sims. 2013. “Uncertainty and Economic Activity: Evidence from Business Survey Data.” American Economic Journal: Macroeconomics 5: 217–249.10.3386/w16143Suche in Google Scholar

Baker, S., N. Bloom, B. Canes-Wrone, S. J. Davis, and J. Rodden. 2014. “Why has us Policy Uncertainty Risen Since 1960?” American Economic Review Papers & Proceedings 104: 56–60.10.1257/aer.104.5.56Suche in Google Scholar

Baker, S., N. Bloom, and S. Davis. 2016. “Measuring Economic Policy Uncertainty.”.NBER Working Paper. DOI:10.1093.Suche in Google Scholar

Ball, L 1992. “Why does High Inflation Raise Inflation Uncertainty?” Journal of Monetary Economics 29: 371–388.10.3386/w3224Suche in Google Scholar

Bauer, M. D., G. D. Rudebusch, and J. C. Wu. 2014. “Term Premia and Inflation Uncertainty: Empirical Evidence from an International Panel Dataset: Comment.” American Economic Review 104: 323–337.10.1257/aer.104.1.323Suche in Google Scholar

Bernanke, B 2007. “Inflation Expectations and Inflation Forecasting.”.Monetary Economics Workshop of the National Bureau of Economic Research Summer Institute.Suche in Google Scholar

Bernanke, B 2016. “Why are Interest Rates so Low, Part 4: Term Premiums.”.Ben Bernanke’s Blog, Brookings.Suche in Google Scholar

Binder, C 2016a. “Fed Speak on Main Street.” Manuscript under review.Suche in Google Scholar

Binder, C 2016b. “Whose Expectations Augment the Phillips Curve?” Economic Letters 136: 35–38.10.1016/j.econlet.2015.08.013Suche in Google Scholar

Binder, C 2017. “Measuring Uncertainty based on Rounding: New Method and Application to Inflation Expectations” Manuscript under review.10.1016/j.jmoneco.2017.06.001Suche in Google Scholar

Bryan, M., and G. Venkatu. 2001. “The Demographics of Inflation Opinion Surveys.”.Federal Reserve Bank of Cleveland Economic Commentary October.Suche in Google Scholar

Carroll, C 2003. “Macroeconomic Expectations of Households and Professional Forecasters.” Quarterly Journal of Economics 118: 269–298.10.1162/00335530360535207Suche in Google Scholar

Cochrane, J. H., and M. Piazzesi. 2005. “Bond Risk Premia.” American Economic Review 95: 138–160.10.3386/w9178Suche in Google Scholar

Coibion, O., and Y. Gorodnichenko. 2016. “Is the Phillips Curve Alive and Well After All? inflation Expectations and the Missing Disinflation.” American Economic Journal: Macroeconomics 7: 197–232.10.3386/w19598Suche in Google Scholar

D’Amico, S., and A. Orphanides. 2008. “Uncertainty and Disagreement in Economic Forecasting.”.Finance and Economics Discussion Series, Divisions of Research & Statistics and Monetary Affairs. Washington, D.C.: Federal Reserve Board.10.17016/FEDS.2008.56Suche in Google Scholar

D’Amico, S., and A. Orphanides. 2014. “Inflation Uncertainty and Disagreement in Bond Risk Premia.”.Federal Reserve Bank of Chicago Working Paper.10.2139/ssrn.2539715Suche in Google Scholar

de Bruin, W. B., C. F. Manski, G. Topa, and W. van der Klaauw. 2009. “Measuring Consumer Uncertainty about Future Inflation.”.Federal Reserve Bank of New York Staff Report, 415.Suche in Google Scholar

de Bruin, W. B., W. van der Klaauw, J. Downs, B. Fischhoff, G. Topa, and O. Armantier. 2010. “Expectations of Inflation: The Role of Demographic Variables, Expectation Formation, and Financial Literacy.” The Journal of Consumer Affairs 44: 381–402.10.1111/j.1745-6606.2010.01174.xSuche in Google Scholar

Dehaene, S., and J. Mehler. 1992. “Cross-Linguistic Regularities in the Frequency of Number Words.” Cognition 43: 1–29.10.1016/0010-0277(92)90030-LSuche in Google Scholar

Doms, M., and N. Morin. 2004. “Consumer Sentiment, the Economy, and the News Media.”.Federal Reserve Bank of San Francisco Working Paper, 9.Suche in Google Scholar

Fajgelbaum, P., E. Schaal, and M. Taschereau-Dumouchel. 2014. “Uncertainty Traps.”.NBER Working Paper.10.3386/w19973Suche in Google Scholar

Fernandez-Villaverde, J., P. Guerron-Quintana, K. Kuester, and J. Rubio-Ramirez. 2016. “Fiscal Volatility Shocks and Economic Activity.” American Economic Review 105: 3352–3384.10.1257/aer.20121236Suche in Google Scholar

Friedman, M 1977. “Nobel Lecture: Inflation and Unemployment.” Journal of Political Economy 85: 451–472.10.1086/260579Suche in Google Scholar

Golob, J. E 1994. “Does Inflation Uncertainty Increase with Inflation?” Federal Reserve Bank of Kansas City 3: 27–38.Suche in Google Scholar

Grimme, C., S. Henzel, and E. Wieland. 2014. “Inflation Uncertainty Revisited: A Proposal for Robust Measurement.” Empirical Economics 47: 1497–1523.10.1007/s00181-013-0789-zSuche in Google Scholar

Haubrich, J., G. Pennacchi, and P. Ritchken. 2011. “Inflation Expectations, Real Rates, and Risk Premia: Evidence from Inflation Swaps.”.Federal Reserve Bank of Cleveland, Working Paper.10.26509/frbc-wp-201107Suche in Google Scholar

Hwang, Y., and S.-H. Jeong. 2009. “Revisiting the Knowledge Gap Hypothesis: A Meta Analysis of Thirty Five Years of Research.” J&MC Quarterly 86: 513–532.10.1177/107769900908600304Suche in Google Scholar

Istrefi, K., and A. Piloiu. 2013. “Economic Policy Uncertainty, Trust and Inflation Expectations.”.CESifo Working Paper 4294.Suche in Google Scholar

Iyengar, S., and J. Curran. 2009. “Media Systems, News Delivery and Citizens’ Knowledge of Current Affairs.”.ICA Mini-Plenary Transformations of the Public Sphere.Suche in Google Scholar

Jansen, C., and M. Pollmann. 2001. “On Round Numbers: Pragmatic Aspects of Numerical Expressions.” Journal of Quantitative Linguistics 8: 187–201.10.1076/jqul.8.3.187.4095Suche in Google Scholar

Kendall, M., and A. Stuart. 1977. The Advanced Theory of Statistics. Vol. 1, 4th ed. Macmillan978-0-02-847630-8.Suche in Google Scholar

Krifka, M 2002. “Be Brief and Vague! and how Bidirectional Optimality Theory Allows for Verbosity and Precision.”. In Sounds and Systems. Studies in Structure and Change. , edited by Restle, D., and D. Zaefferer, (Eds.), 429–448. Berlin: Mouton de Gruyter.Suche in Google Scholar

Lahiri, K., and X. Sheng. 2010. “Measuring Forecast Uncertainty by Disagreement: The Missing Link.” Journal of Applied Econometrics 25: 514–538.10.1002/jae.1167Suche in Google Scholar

Lamla, M., and T. Maag. 2012. “The Role of Media for Inflation Forecast Disagreement of Households and Professional Forecasters.” Journal of Money, Credit and Banking 7: 1325–1350.10.1111/j.1538-4616.2012.00534.xSuche in Google Scholar

Lusardi, A 2008. “Financial Literacy: An Essential Tool for Informed Consumer Choice?.”.NBER Working Paper, 14084.10.3386/w14084Suche in Google Scholar

Mankiw, N. G., R. Reis, and J. Wolfers. 2004. “Disagreement about Inflation Expectations.”. In NBER Macroeconomics Annual. , edited by Gertler, M., and K. Rogoff, (Eds.) Vol. 18 MIT Press.10.1086/ma.18.3585256Suche in Google Scholar

Manski, C., and F. Molinari. 2010. “Rounding Probabilistic Expectations in Surveys.” Journal of Business and Economic Statistics 28: 219–231.10.1198/jbes.2009.08098Suche in Google Scholar

Orlik, A., and L. Veldkamp. 2012. “Understanding Uncertainty Shocks.”.Economic Dynamics Meeting Paper, 391, working Paper.Suche in Google Scholar

Pastor, L., and P. Veronesi. 2013. “Political Uncertainty and Risk Premia.” Journal of Financial Economics 110: 520–545.10.3386/w17464Suche in Google Scholar

Piazzesi, M., and M. Schneider. 2006. “Equilibrium Yield Curves.”.NBER Macroeconomics Annual Vol. 21, 389–472.Suche in Google Scholar

Rosengren, E 2016. “Economic Uncertainty – the Implications for Monetary Policy.”.Keynote Remarks at the Global Interdependence Center’s Seventh Annual Rocky Mountain Economic Summit.Suche in Google Scholar

Rowland, M 1990. “Self-Reported Weight and Height.” American Journal of Clinical Nutrition 52: 1125–1133.10.1093/ajcn/52.6.1125Suche in Google Scholar

Selten, R 2002. Bounded Rationality: The Adaptive Toolbox. Cambridge : The MIT Press.10.7551/mitpress/1654.001.0001Suche in Google Scholar

Shiller, R 2000. Irrational Exuberance. Princeton: Princeton University Press.Suche in Google Scholar

Sigurd, B 1988. “Round Numbers.” Language in Society 17: 243–252.10.1017/S0047404500012781Suche in Google Scholar

Souleles, Nicholas 2004. “Expectations, Heterogeneous Forecast Errors, and Consumption: Micro Evidence from the Michigan Consumer Sentiment Surveys.” Journal of Money, Credit and Banking 36: 39–72.10.1353/mcb.2004.0007Suche in Google Scholar

Tichenor, P., G. A. Donohue, and C. N. Olien. 1970. “Mass Media Flow and Differential Growth in Knowledge.” The Public Opinion Quarterly 34: 159–170.10.1086/267786Suche in Google Scholar

Ulrich, M 2012. “Economic Policy Uncertainty and Asset Price Volatility.” Working Paper.Suche in Google Scholar

Westerhoff, F 2003. “Anchoring and Psychological Barriers in Foreign Exchange Markets.” Journal of Behavioural Finance 4: 65–70.10.1207/S15427579JPFM0402_03Suche in Google Scholar

Wright, J 2011. “Term Premia and Inflation Uncertainty: Empirical Evidence from an International Panel Dataset.” American Economic Review 101: 1514–34.10.1257/aer.101.4.1514Suche in Google Scholar

Zhao, J., W.-Y. Kuo, and T.-C. Lin. 2012. “Does Cognitive Limitation Affect Investor Behavior and Performance? Evidence from Limit Order Clustering.”. Technical report.10.2139/ssrn.1988236Suche in Google Scholar

©2017 Walter de Gruyter GmbH, Berlin/Boston

Artikel in diesem Heft

- Advances

- Does microfinance reduce poverty? Some international evidence

- Exchange rate policy and the role of non-traded goods prices in real exchange rate fluctuations

- Democracy and income: taking parameter heterogeneity and cross-country dependency into account

- Pass-through of imported input prices to domestic producer prices: evidence from sector-level data

- Economic policy uncertainty and household inflation uncertainty

- Corruption, fiscal policy, and growth: a unified approach

- Monetary policy and energy price shocks

- Government education expenditures and economic growth: a meta-analysis

- Has the forecasting performance of the Federal Reserve’s Greenbooks changed over time?

- Life-cycle consumption, precautionary saving, and risk sharing: an integrated analysis using household panel data

- Can removing the tax cap save Social Security?

- A non-monotonic relationship between public debt and economic growth: the effect of financial monopsony

- The Euler equation around the world

- Structural change and non-constant biased technical change

- Contributions

- Trade and growth in a model of allocative inefficiency

- Macroeconomic Shocks and Corporate R&D

Artikel in diesem Heft

- Advances

- Does microfinance reduce poverty? Some international evidence

- Exchange rate policy and the role of non-traded goods prices in real exchange rate fluctuations

- Democracy and income: taking parameter heterogeneity and cross-country dependency into account

- Pass-through of imported input prices to domestic producer prices: evidence from sector-level data

- Economic policy uncertainty and household inflation uncertainty

- Corruption, fiscal policy, and growth: a unified approach

- Monetary policy and energy price shocks

- Government education expenditures and economic growth: a meta-analysis

- Has the forecasting performance of the Federal Reserve’s Greenbooks changed over time?

- Life-cycle consumption, precautionary saving, and risk sharing: an integrated analysis using household panel data

- Can removing the tax cap save Social Security?

- A non-monotonic relationship between public debt and economic growth: the effect of financial monopsony

- The Euler equation around the world

- Structural change and non-constant biased technical change

- Contributions

- Trade and growth in a model of allocative inefficiency

- Macroeconomic Shocks and Corporate R&D