Abstract

Most existing researches on optimal reinsurance contract are based on an insurer’s viewpoint. However, the optimal reinsurance contract for an insurer is not necessarily to be optimal for a reinsurer. Hence, this study aims to develop the optimal reciprocal reinsurance which satisfies the benefits of both the insurer and reinsurer. Additionally, due to legislative restriction or risk management requirement, the wealth of insurer and reinsurer are frequently imposed upon a VaR (Value-at-Risk) or TVaR (Tail Value-at-Risk) constraint. Therefore, this study develops an optimal reciprocal reinsurance contract which maximizes the common benefits (evaluated by weighted addition of expected utilities) of the insurer and reinsurer subject to their VaR or TVaR constraints. Furthermore, for avoiding moral hazard problem, the developed contract is additionally restricted to a regular form or incentive compatibility (both indemnity schedule and retained loss schedule are continuously nondecreasing).

Appendix A: Proof of Proposition 1

Given any outcome of

The first and second derivatives of H with respect to

Let

Based on Expressions (3) and (4), the solution in Eq. (A3) is existent and unique. Indeed, H has a peak at

Incorporating with Equations (A3) and (A4) yields

Since the ARA (absolute risk aversion coefficient) for a utility function

Based on Eq. (A6) and the constraint 0 ≤ I(x) ≤ x, the optimal reinsurance accordingly takes the form

Subsequently, differentiating Eq. (A3) with respect to P yields

Equation (A8) implied that

Equation (A7) is the same as Eq. (17), and combining Equations (A6) and (A9) yields Eq. (18). Thus, the proof of Proposition 1 is completed.

Appendix B: Proof of Proposition 2

Incorporating Expression (26a) and the fact of

Note that Expression (A10) implies that

Based on Expression (A10), we define

The feasible set

Appendix A shows that H is global concave with

Obviously,

Step 1: Find

Step 2: Verify

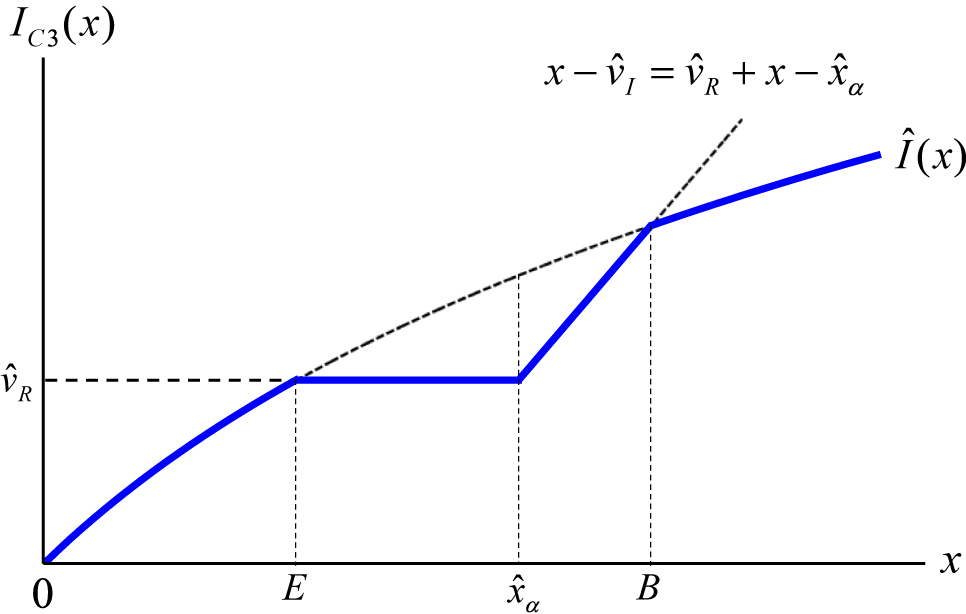

This study employs the geometric analysis to find the

Case 1:

Since

Case 2:

Since

Case 3:

Define

For

For step 2, we can easily check that

Expression (A19) is the same as Expression (27), and hence the proof is completed.

Appendix C: Proof of Proposition 3

Appendix A shows that

Compared Expression (28) to Expression (26), we find that the programming problem for Expression (28) has similar mathematical form as that for Expression (23). Appendix B shows that the programming problem in Expression (26) is equivalent to the following program,

Accordingly, the programming problem for Expression (28) can be rewritten as follows.

Expression (A21) is analogous of Expression (A20), besides different notations. Referring to Expression (27), we can obtain the optimal retained loss schedule:

Since

Expressions (A22) and (A23) are equal to Expressions (29) and (30), respectively. Thus, the proof is completed.

Appendix D: Proof of Proposition 4

For the case of

Situation 1:

In this situation, we will claim that the optimal contractual form can be represented as

First, referring to

Situation 2:

In this situation, we will claim that the optimal contractual form can be represented as

First, referring to

Situation 3:

According to the analyses for Situations 1 and 2, when both the insurer’s and reinsurer’s VaR constraints are binding, we can infer that the line

Optimal reinsurance with

Appendix E: Proof of Proposition 5

The Lagrange function for optimization problem in Expression (37) is as follows.

where μ 1 > 0 and μ 2 > 0 denote the Lagrange multiplier coefficients. For any quantile q, the above optimization problem is equivalent to maximize the Hamiltonian. Mathematically,

The first and second derivatives of H with respect to I(x q ) are as follows.

Similar to Eq. (16),

Additionally, let

Equation (A31) through (A34) implies that

Since H is global concave with x

q

and has a peak at

Based on Equations (A35) and (A36), there exists positive numbers δ 1 > 0, δ 2 > 0 and δ 3 > 0 such that

Similar to Appendix D, the three situations of α I > α R, α I < α R and α I = α R = α are considered to solve the optimization problem.

Situation 1: α I > α R

Since

where δ 2 and δ 3 are selected such that both the insurer’s and reinsurer’s TVaR constraints are simultaneously binding.

Situation 2: α I < α R

Similar to the analysis in situation 1, we can obtain the optimal reinsurance contractual form as follows.

where δ 1 and δ 3 are selected such that both the insurer’s and reinsurer’s TVaR constraints are simultaneously binding.

Situation 3: α I = α R = α

For 0 ≤ q ≤ α, incorporating Expressions (A30) and (A31) yields

Additionally, for α < q ≤ 1, incorporating Expressions (A30) and (A33) yields

Since H is global concave with x

q

and has a peak at

Since

Incorporating Expressions (A40) and (A43) with the assumption of

where δ a and δ b are selected such that both the insurer’s and reinsurer’s TVaR constraints are simultaneously binding. Expression (A44) implies that

Since the reinsurer’s TVaR constraint is binding, Expression (A45) implies that

Finally, Expression (38) can be directly obtained from Expressions (A38), (A39), (A44) and (A46), and hence the proof is completed.

References

Belles-Sampera, J., M. Guillén, and M. Santolino. 2014. “GlueVaR Risk Measures in Capital Allocation Applications.” Insurance: Mathematics and Economics 58 (5): 132–7. https://doi.org/10.1016/j.insmatheco.2014.06.014.Suche in Google Scholar

Bernard, C., and W. Tian. 2009. “Optimal Reinsurance Arrangements under Tail Risk Managements.” Journal of Risk & Insurance 76 (3): 709–25. https://doi.org/10.1111/j.1539-6975.2009.01315.x.Suche in Google Scholar

Borch, K. 1960. “Reciprocal Reinsurance Treaties.” ASTIN Bulletin 1 (4): 171–91. https://doi.org/10.1017/s0515036100009557.Suche in Google Scholar

Borch, K. 1969. “The Optimal Reinsurance Treaties.” ASTIN Bulletin 5 (2): 293–7. https://doi.org/10.1017/s051503610000814x.Suche in Google Scholar

Cai, J., Y. Fang, Z. Li, and G. E. Willmot. 2013. “Optimal Reciprocal Reinsurance Treaties under the Joint Survival Probability and the Joint Profitable Probability.” Journal of Risk & Insurance 80 (1): 145–68. https://doi.org/10.1111/j.1539-6975.2012.01462.x.Suche in Google Scholar

Cai, J., C. Lemieux, and F. Liu. 2016. “Optimal Reinsurance from the Perspectives of Both an Insurer and a Reinsurer.” ASTIN Bulletin 46 (3): 815–49. https://doi.org/10.1017/asb.2015.23.Suche in Google Scholar

Cai, J., H. Y. Liu, and R. D. Wang. 2017. “Pareto-Optimal Reinsurance Arrangements under General Model Settings.” Insurance: Mathematics and Economics 77: 24–37. https://doi.org/10.1016/j.insmatheco.2017.08.004.Suche in Google Scholar

Cai, J., K. S. Tan, C. G. Weng, and Y. Zhang. 2008. “Optimal Reinsurance under VaR and CTE Risk Measures.” Insurance: Mathematics and Economics 43 (1): 185–96. https://doi.org/10.1016/j.insmatheco.2008.05.011.Suche in Google Scholar

Cheung, K. C., H. K. Ling, Q. Tang, S. C. P. Yam, and F. L. Yuen. 2019. “On Additivity of Tail Comonotonic Risks.” Scandinavian Actuarial Journal 2019 (10): 837–66. https://doi.org/10.1080/03461238.2019.1626762.Suche in Google Scholar

Cheung, K. C., F. Liu, and S. C. P. Yam. 2012. “Average Value-At-Risk Minimizing Reinsurance under Wang’s Premium Principal with Constraints.” ASTIN Bulletin 42 (2): 575–600.Suche in Google Scholar

Chi, Y. 2012. “Reinsurance Arrangements Minimizing the Risk-Adjusted Value of an Insurer’s Liability.” ASTIN Bulletin 42 (2): 529–57.10.2139/ssrn.2039723Suche in Google Scholar

Chi, Y. C., and K. S. Tan. 2021. “Optimal Incentive-Compatible Insurance with Background Risk.” ASTIN Bulletin 51 (2): 661–88. https://doi.org/10.1017/asb.2021.7.Suche in Google Scholar

Chi, Y. C., and S. C. Zhuang. 2020. “Optimal Insurance with Belief Heterogeneity and Incentive Compatibility.” Insurance: Mathematics and Economics 92 (3): 104–14. https://doi.org/10.1016/j.insmatheco.2020.03.006.Suche in Google Scholar

Chi, Y., and K. S. Tan. 2011. “Optimal Reinsurance under VaR and CVaR Risk Measures: A Simplified Approach.” ASTIN Bulletin 41 (2): 487–509.Suche in Google Scholar

Chi, Y., and K. S. Tan. 2013. “Optimal Reinsurance with General Premium Principles.” Insurance: Mathematics and Economics 52 (2): 180–9. https://doi.org/10.1016/j.insmatheco.2012.12.001.Suche in Google Scholar

D’Ortona, N. E., and G. Marcarelli. 2017. “Optimal Proportional Reinsurance from the Point of View of Cedent and Reinsurer.” Scandinavian Actuarial Journal 2017 (4): 366–75.10.1080/03461238.2016.1148627Suche in Google Scholar

Fang, Y., and Z. Qu. 2014. “Optimal Combination of Quota-Share and Stop-Loss Reinsurance Treaties under the Joint Survival Probability.” IMA Journal of Management Mathematics 25 (1): 89–103. https://doi.org/10.1093/imaman/dps029.Suche in Google Scholar

Gavagan, J., L. Hu, G. Y. Lee, H. Liu, and A. Weixel. 2021. “Optimal Reinsurance with Model Uncertainty and Stackelberg Game.” Scandinavian Actuarial Journal. https://doi.org/10.1080/03461238.2021.1925735.Suche in Google Scholar

Golubin, A. Y. 2016. “Optimal Insurance and Reinsurance Policies Chosen Jointly in the Individual Risk Model.” Scandinavian Actuarial Journal 2016 (3): 181–97. https://doi.org/10.1080/03461238.2014.918696.Suche in Google Scholar

Huang, H. H. 2006. “Optimal Insurance Contract under Value-At-Risk Constraint.” The Geneva Risk and Insurance Review 31 (2): 91–110. https://doi.org/10.1007/s10713-006-0557-5.Suche in Google Scholar

Ignatov, Z. G., V. K. Kaishev, and R. S. Krachunov. 2004. “Optimal Retention Levels, Given the Joint Survival of Cedent and Reinsurer.” Scandinavian Actuarial Journal 2004 (6): 401–30.10.1080/03461230410020437Suche in Google Scholar

Jiang, W. J., H. P. Hong, and J. D. Ren. 2021. “Pareto-Optimal Reinsurance Policies with Maximal Synergy.” Insurance: Mathematics and Economics 96 (1): 185–98. https://doi.org/10.1016/j.insmatheco.2020.11.009.Suche in Google Scholar

Jorion, P. 2009. Value at Risk: The New Benchmark for Managing Financial Risk, 3rd ed. New York: McGraw-Hill International Edition.Suche in Google Scholar

Lu, Z. Y., L. L. Meng, Y. Wang, and Q. Shen. 2016. “Optimal Reinsurance under VaR and TVaR Risk Measures in the Presence of Reinsurer’s Risk Limit.” Insurance: Mathematics and Economics 68 (5): 92–100. https://doi.org/10.1016/j.insmatheco.2016.03.001.Suche in Google Scholar

Lu, Z. Y., L. P. Liu, and S. W. Meng. 2013. “Optimal Reinsurance with Concave Ceded Loss Functions under VaR and CTE Risk Measures.” Insurance: Mathematics and Economics 52 (1): 46–51. https://doi.org/10.1016/j.insmatheco.2012.10.007.Suche in Google Scholar

Raviv, A. 1979. “The Design of an Optimal Insurance Policy.” The American Economic Review 69 (1): 84–96.10.1007/978-94-015-7957-5_13Suche in Google Scholar

Wang, C. P., and H. H. Huang. 2016. “Optimal Insurance Contract under VaR and CVaR Constraints.” The North American Journal of Economics and Finance 37 (3): 110–27. https://doi.org/10.1016/j.najef.2016.03.007.Suche in Google Scholar

Wang, C. P., D. Shyu, and H. H. Huang. 2005. “Optimal Insurance Design under a Value-At-Risk Framework.” The Geneva Risk and Insurance Review 30 (2): 161–79. https://doi.org/10.1007/s10713-005-4677-0.Suche in Google Scholar

Wang, S. 1996. “Premium Calculation by Transforming the Layer Premium Density.” ASTIN Bulletin 26 (1): 71–92. https://doi.org/10.2143/ast.26.1.563234.Suche in Google Scholar

Xu, Z. Q., X. Y. Zhou, and S. C. Zhuang. 2019. “Optimal Insurance under Rank‐dependent Utility and Incentive Compatibility.” Mathematical Finance 29 (2): 659–92. https://doi.org/10.1111/mafi.12185.Suche in Google Scholar

Zhou, C. Y., and C. F. Wu. 2008. “Optimal Insurance under the Insurer’s Risk Constraint.” Insurance: Mathematics and Economics 42 (3): 992–9. https://doi.org/10.1016/j.insmatheco.2007.11.005.Suche in Google Scholar

Zhou, C. Y., and C. F. Wu. 2009. “Optimal Insurance under the Insurer’s VaR Constraint.” The Geneva Risk and Insurance Review 34 (2): 140–54. https://doi.org/10.1057/grir.2009.3.Suche in Google Scholar

Zhou, C. Y., W. F. Wu, and C. F. Wu. 2010. “Optimal Insurance in the Presence of Insurer’s Loss Limit.” Insurance: Mathematics and Economics 46 (2): 300–7. https://doi.org/10.1016/j.insmatheco.2009.11.002.Suche in Google Scholar

Zhuang, S. C., T. J. Boonen, and K. S. Tan. 2017. “Optimal Insurance in the Presence of Reinsurance.” Scandinavian Actuarial Journal 2017 (6): 535–54. https://doi.org/10.1080/03461238.2016.1184710.Suche in Google Scholar

© 2021 Walter de Gruyter GmbH, Berlin/Boston

Artikel in diesem Heft

- Frontmatter

- Featured Articles (Research Paper)

- From Earthquake Geophysical Measures to Insurance Premium: A Generalised Method for the Evaluation of Seismic Risk, with Application to Italy’s Housing Stock

- Optimal Reciprocal Reinsurance under VaR or TVaR Constraint

- Morbidity and Mortality Analysis for Risk-based Pricing in Cattle Insurance

- Banking Integration in Open, Small Economies of the Pacific Island Countries

Artikel in diesem Heft

- Frontmatter

- Featured Articles (Research Paper)

- From Earthquake Geophysical Measures to Insurance Premium: A Generalised Method for the Evaluation of Seismic Risk, with Application to Italy’s Housing Stock

- Optimal Reciprocal Reinsurance under VaR or TVaR Constraint

- Morbidity and Mortality Analysis for Risk-based Pricing in Cattle Insurance

- Banking Integration in Open, Small Economies of the Pacific Island Countries