Abstract

Households are prime locations of risk pooling and redistribution. Household constellations in terms of the number of earners and their occupations define households’ capacity to cushion crises such as the COVID-19 pandemic or rising inflation. The occupational structure and the sociodemographic composition of households continue to vary widely between the former East and West German regions. Against the background of rising levels of in-work poverty in recent years, we extend the prevalence and penalties framework as used in poverty research to two occupational risks that gained significance in post-COVID-19 labour markets. Our study addresses two questions: 1) How prevalent were household constellations in which the sole earner or both earners worked in an occupation that was both non-teleworkable and non-essential (NTNE) in East and West Germany in 2019? 2) Did the poverty penalty associated with the sole or both earners working in NTNE occupations differ in East and West Germany in 2019? The most recent available data from the German Microcensus (2019, N=179,755 households) is linked to new data collected on the teleworkability of occupations and occupations’ classification as essential by German federal state decrees in the spring of 2020. Descriptive statistics and regression models show that the prevalence of household constellations where the sole earner or both earners worked in NTNE occupations was relatively similar across East and West Germany. In contrast to overall similar prevalence, in East Germany the poverty penalty associated with the sole or both earners working in NTNE occupations was substantially elevated. Controlling for known occupational disadvantages, including low education, fixed-term contracts, shift work and the lack of leadership responsibilities narrowed but did not eliminate the sizeable gap in poverty penalties associated with NTNE occupations between East and West Germany.

Zusammenfassung

In Haushalten werden Risiken gepoolt und umverteilt. Das heißt, inwiefern Krisen wie die Covid-19 Pandemie oder steigende Inflation im Haushalt abgefedert werden können, wird unter anderem durch die Anzahl der Erwerbstätigen im Haushalt und deren Berufe bestimmt. Für Ost- und Westdeutschland lassen sich aufgrund der weiterhin bestehenden Differenzen in der Berufsstruktur und der soziodemographischen Zusammensetzung von Haushalten Unterschiede in dieser Kapazität von Haushalten erwarten. Vor dem Hintergrund steigender Erwerbsarmut in den letzten Jahren erweitern wir den ‚prevalence and penalties‘ Ansatz (Brady et al. 2017) aus der internationalen Armutsforschung um zwei berufsspezifische Risiken, die in Post-Covid-19 Arbeitsmärkten an Relevanz gewannen. Wir fragen: 1) Wie verbreitet waren Haushaltskonstellationen, in denen die einzige oder beide erwerbstätige Personen in Haushalt in einem nicht-telearbeitsfähigen und nicht-systemrelevanten Beruf gearbeitet haben in Ost- und Westdeutschland 2019? 2) Inwiefern unterschieden sich die Armutsrisiken dieser Haushaltskonstellationen in Ost- und Westdeutschland 2019? Für die Analyse kombinieren wir die aktuellste Welle des Mikrozensus (2019, N=179,755 Haushalte) mit einem neu erhobenen Datensatz zur Telearbeitsfähigkeit von Berufen und der Klassifikation von Systemrelevanz aus Länderdekreten, die im Zuge der Covid-19 Pandemie im Frühjahr 2020 verabschiedet wurden. Anhand deskriptiver Analysen und Regressionsmodellen zeigen wir, dass die Verbreitung (prevalence) von Haushaltskonstellationen, in denen die einzige oder beide erwerbstätige Personen in Haushalt in einem nicht-telearbeitsfähigen und nicht-systemrelevanten Beruf gearbeitet haben, in Ost- und Westdeutschland relativ ähnlich war. Allerdings zeigt sich auch, dass das Armutsrisiko dieser Haushaltskonstellationen in Ostdeutschland stark erhöht war. Unter Kontrolle bekannter beruflicher Nachteile wie niedrige Bildung, befristeter Arbeitsvertrag, Schichtarbeit und geringe Führungsverantwortung verringern sich die festgestellten Unterschiede zwischen Ost- und Westdeutschland zwar leicht, bleiben aber deutlich sichtbar.

1 Introduction

Households are key units for redistributing and pooling risk. Individuals’ economic disadvantages, such as unemployment or drops in earnings, can either be compensated for or concentrated within households (Biegert/Ebbinghaus 2020; Brady et al. 2017). Household constellations in terms of the number of earners and their occupations define households’ capacity to cushion crises, such as the COVID-19 pandemic, or face challenges such as rising inflation. Research focusing only on individuals, or on characteristics of household heads, cannot capture the extent to which household earner constellations compensate or concentrate economic disadvantages (Hogendoorn/Härkönen 2023).

Poverty research routinely focuses on the social risks of low education, unemployment and single parenthood as predictors of poverty (Brady et al. 2017; Hübgen 2020; Vandecasteele 2011). In recent years, in-work poverty has increased notably across Europe, that is, the share of individuals living in households below the poverty line despite being gainfully employed (Andress/Lohmann 2008; Brülle et al. 2019; Filandri/Struffolino 2019; Lohmann/Marx 2018). This calls for also directing attention towards the occupational risks of in-work poverty in addition to the established social risks of poverty in mostly non-employed households. Already before the pandemic, working in non-teleworkable, and to a lesser extent in non-essential occupations in non-critical infrastructure was on average associated with occupational disadvantages, such as lower skills and lower pay (Nivorozhkin/Poeschel 2022). Since the COVID-19 pandemic, non-teleworkable and non-essential occupations emerged as new dimensions of labour market inequality associated with a higher risk of job loss or income cuts (Brussevich et al. 2022; Cetrulo et al. 2020). Occupations that are both non-teleworkable and non-essential (NTNE) are particularly likely to be disadvantageous, combining lower skills and pay (non-teleworkable) and lower job security and benefits (non-essential). To date, it is not known how non-teleworkable and non-essential occupations are concentrated within household constellations nor the extent to which households where the sole earner or both earners work in NTNE occupations are exposed to greater risks of poverty.

The prevalence of NTNE occupations across households depends on regional labour market and occupational structures, as well as the sociodemographic composition of households. Economically vulnerable households where the sole or both earners work in an occupation that is NTNE are likely to be more prevalent in a downward levelled occupational structure where these jobs make up a larger share of the occupational distribution. The poverty penalty associated with working in NTNE occupations might further depend on related occupational characteristics, such as fixed-term contracts and shift work that are difficult to reconcile with long-term financial planning and family responsibilities. Moreover, poverty penalties associated with the sole or both earners working in NTNE occupations would be higher if the sociodemographic composition of these households disproportionately comprises known social risks of poverty, such as single parenthood, low education, a migrant background or a single earner providing for many economically dependent household members.

Persistent economic inequalities between the former East and West German regions have been of great concern in recent public and academic debates as a potential driver of social unrest and a rise in right-wing populism, especially in the East (Hunt 2002; Mau 2019; Weisskircher 2020). Despite a unified welfare state since the 1990s, the former East and West German regions continue to differ widely in terms of occupational structure and the sociodemographic composition of households following the communist legacy in East Germany and the gender conservative social market capitalism in West Germany (Goldstein/Kreyenfeld 2011). East Germany is characterised by on average lower skilled and lower paying jobs (Hunt 2002; Mau 2019), and a higher prevalence of single-person households, female-headed households and unmarried cohabitation than West Germany (Huinink/Kreyenfeld 2006; Struffolino et al. 2016).

To assess the poverty consequences of social risk factors, Brady, Finnegan and Hübgen (2017) distinguish between the prevalence of a social risk, in their case unemployment, single parenthood, young household headship and low education, and the poverty penalty associated with this risk, that is, how strongly it is associated with the probability of being poor (Brady et al. 2017). In-work poverty has historically been high in the United States and low in most European countries, but has recently been on the rise across Europe as well (Lohmann/Marx 2018; Polizzi et al. 2022). Against the backdrop of a steep increase in in-work poverty in Germany in the last two decades (Brülle et al. 2019), we extend the prevalence and penalties framework to two occupational risks of in-work poverty that gained salience in the COVID-19 pandemic: occupations that are non-teleworkable and non-essential. Specifically, we consider households where the sole earner or both earners work in NTNE occupations.

Structural conditions including institutions, social policies and the labour market can either lower the prevalence of a given risk, or the poverty penalty associated with this risk. Extending the prevalence and penalties framework (Brady et al. 2017; Laird et al. 2018; Zagel et al. 2021) to occupational risks of in-work poverty, we assess how differences in the occupational structure and sociodemographic composition of households in East and West Germany are linked with the prevalence and poverty penalties associated with working in NTNE occupations. Specifically, we address two questions: 1) How prevalent were household constellations in which the sole earner or both earners worked in NTNE occupations in East and West Germany in 2019? 2) Did the poverty penalty associated with the sole or both earners working in NTNE occupations differ between East and West Germany in 2019?

The empirical analyses link the most recent release of the large-scale representative data from the German Microcensus (2019) that became available in the summer of 2022 to new data on the teleworkability from survey data and the classification of occupations as essential from the German federal state decrees classifying essential occupations since May 2020. Descriptive statistics and regression models show that the prevalence of household constellations in which the sole earner or both earners worked in NTNE occupations was relatively similar across East and West Germany. Regional variation in the prevalence of these occupational risks is therefore inappropriate for explaining varying levels of in-work poverty between East and West Germany. Households comprised of one person working in a NTNE occupation were slightly more prevalent in East Germany. Couple households where the sole or both earners worked in NTNE occupations were modestly more prevalent in West Germany.

In contrast to overall similar prevalence, in East Germany the household poverty penalty associated with the sole or both earners working in NTNE occupations was substantially elevated. Controlling for sociodemographic composition of households, including number of children living in the household, migration background, education, age and gender of the main earner decreased poverty levels in West Germany, but not in East Germany. As a result, controlling for the sociodemographic composition of households increased rather than decreased East-West poverty gaps associated with NTNE occupations. This points to suppressor effects, where poverty gaps would be even larger if the sociodemographic composition of households were more similar between East and West Germany, for example if the share of lower educated, migrant, or single-earner couple households with three and more children was as high in East Germany as it was in West Germany in 2019. In contrast, adjusting for additional occupational characteristics, including part-time and atypical employment, fixed-term contracts, shift work and the lack of leadership responsibilities lowered poverty levels associated with NTNE jobs to a much larger extent in East Germany than in West Germany. As a result, the sizeable East-West poverty gap associated with NTNE occupations was reduced by about one half, but still remained sizeable.

Our contribution is threefold. First, we demonstrate the importance of considering household constellations when assessing poverty penalties associated with occupational risks. Working in NTNE occupations was associated with substantially elevated poverty levels for sole earners in single-person households and single-earner couple households. In contrast, poverty levels were only moderately elevated in households where two earners were employed in NTNE occupations. Dual earning remains the best strategy against household poverty, even if both earners work in jobs with unfavourable occupational characteristics. Second, social policies aiming to equalise household living conditions across East and West Germany should target the reduction of poverty penalties associated with NTNE occupations in single-person and single-earner households in East Germany rather than aiming at equalising the prevalence, which is already very similar. Third, our stepwise regression models suggest that to reduce East-West gaps in in-work poverty, it is most promising for social policies to address regional differences in occupational structure, for example through minimum wages and supporting the local availability of different types of occupations, and by broadening access to teleworkability through the digitisation of jobs where possible. Finally, the overlap of being non-teleworkable and non-essential captures an additional dimension of occupational disadvantage that is only partly driven by known occupational disadvantages in these jobs.

2 Background

This section first (2.1) discusses the overlap of occupations being non-teleworkable and non-essential as a dimension of occupational disadvantage and (2.2) introduces the theoretical framework on structural drivers of the prevalence and penalties of poverty risk. We continue by (2.3) highlighting relevant structural differences between East and West Germany that (2.4) guide the specification of hypotheses on the prevalence and associated poverty penalties of the sole earner or both earners in a household working in NTNE occupations in East and West Germany.

2.1 Non-teleworkable and non-essential occupations

Non-teleworkable and, to a lesser extent, non-essential occupations were on average already associated with labour market disadvantages before the COVID-19 pandemic and emerged as dimensions of occupational stratification in 2020 with the onset of the pandemic.

Teleworkability, that is, the ability to complete tasks remotely from home, usually assisted by the internet and telecommunication, is more common in high-skilled, high-status jobs that do not include in-person customer contact, or manual or service tasks that have to be completed on-site (OECD 2021). Teleworkable jobs were relatively well-secured during the pandemic and had lower dismissal and furlough rates (OECD 2021). Conversely, working in non-teleworkable jobs was concentrated in lower-status occupations even before the pandemic and associated with higher dismissal and furlough rates during the pandemic. Evidence for 25 “advanced and emerging” market economies, largely including OECD countries, shows that during the pandemic typically marginal groups on the labour market were least likely to work remotely from home: young workers, those without a college degree, those working in non-standard contracts and at the bottom of the earnings distribution (Brussevich et al. 2022). Moreover, workers least likely to work from home were concentrated in the sectors hardest hit by the crisis (ILO 2020). Working from home was associated with significantly lower risks of short-term work or being infected with the virus (Alipour et al. 2021). If a job was in principle teleworkable before the pandemic, it likely transitioned relatively smoothly into factual remote work during the pandemic. Non-teleworkability therefore can be considered a labour market disadvantage that was associated with lower skills, lower occupational status and lower pay before the pandemic, and came with higher risks of job-loss, short-term work, income loss and infection during the pandemic. In post-COVID-19 labour markets, working from home has remained more common, , for example as employers seek to reduce costs for office maintenance.

Essential occupations are less clearly associated with labour market advantages, such as high skills and high education, compared to teleworkability. Nivorozhkin and Poeschl (2022) show that about two-thirds of essential occupations were associated with favourable occupational characteristics in 2018 in terms of high skill requirements, pay and autonomy, using large-scale occupational data from the German Institute of Employment Research (IAB). About 20 percent of essential occupations were associated with disadvantageous occupational characteristics, and these are disproportionately carried out by women and individuals with a migration background. Typically female essential occupations, such as childminders, cashiers and cleaners were associated with low average hourly pay at the beginning of the pandemic (Koebe et al. 2020). Overall, working in an essential occupation comprehensively shielded from job loss and further income drops during the pandemic, and the majority of essential occupations were associated with favourable occupational characteristics (Nivorozhkin/Poeschel 2022). Essential workers further experienced fewer changes in their work and family lives compared to other occupational groups during the pandemic (Hipp/Bünning 2021).

Our study focuses on occupations that are both non-teleworkable and non-essential (NTNE). Working in non-teleworkable or non-essential occupations was associated with a higher risk of job loss or income cuts during the pandemic (Brugiavini et al. 2021). Among occupations that are non-teleworkable, those that are classified as essential were likely to have been relatively better shielded from some of the risks of very low pay, irregular and informal employment, and job loss. Even low-paid essential occupations, for example childminders are, after all, classified as critical infrastructure that is indispensable for society and often located in the highly regulated public sector in Germany that awards high job security and benefits. Jobs that are NTNE likely combine disadvantages of non-teleworkability, primarily low skills and low pay, with the insecurity and low employment regulation of non-essential occupations.

2.2 Poverty Risks: A Prevalence and Penalties Framework

A useful perspective for understanding the links between different household characteristics and poverty is the framework of the prevalence and penalties of poverty risks introduced by Brady, Finnigan and Hübgen (2017). Their main argument is that poverty results from two factors: first, whether a household is characterised by high risk factors (e. g., low education, unemployment, single motherhood), and second, how the risk factors play out economically in the respective structural (and policy) context. Hence, the framework analytically distinguishes between the occurrence of specific labour market and sociodemographic characteristics that are more common among the poor (prevalence), and the probability of poverty associated with these characteristics (penalties).

The framework has been used for explaining differences in poverty rates across contexts and over time, typically focusing on the social risks of unemployment, low education and single parenthood (Brady et al. 2017; Laird et al. 2018; Zagel et al. 2021). The initial study (Brady et al. 2017) was concerned with debunking the focus of US poverty research on individual explanations for poverty by providing the analytical tools of prevalence and penalties. Findings demonstrated that the prevalence of risk factors is actually low in the US compared to other high-income countries, while penalties are high. A common interpretation of comparatively high penalties holds structural conditions responsible, for example welfare state generosity and a regionally uneven distribution of risk factors (Brady et al. 2017; Laird et al. 2018). Suggestions for policy changes may be derived according to the respective risk factors, such as relieving the penalty for unemployment with social security benefits, or lowering the penalty for low education by raising minimum wages. In contrast to (but not refuting) the cross-national perspective of Brady et al. (2017), Laird et al. (2018) show that state-level differences in poverty within the US are mostly linked to differences in the prevalence of risk factors, that is, a regionally uneven distribution of single mothers and lower educated households. They too suggest that states may provide measures to lower prevalence, such as through providing education or fostering employment; but further stress the role of cost-of-living differences for making sense of the state variation in poverty in association with the prevalence of risk factors.

In the present study, we turn our attention to the recently rising in-work poverty across Europe (Lohmann/Marx 2018) and Germany specifically, with even higher in-work poverty in East than in West Germany (Brülle et al. 2019). Our analysis extends the prevalence and penalties framework to occupational risks of in-work poverty. We use the distinction between prevalence and penalties to describe the share of households where the sole or both earners worked in NTNE occupations (prevalence), and to evaluate the associated poverty penalties in East and West Germany. The interpretation of prevalence and penalties follows the logic of previous studies in ascribing any differences between the contexts to structural conditions. If the prevalence of households with the sole or both earners working in NTNE occupations is notably higher in East Germany, this could be one explanation for elevated in-work poverty levels in East Germany (Brülle et al. 2019). To precisely estimate the poverty penalties of a given social or occupational risk, one should condition on other observed social and occupational risks of poverty (Brady et al. 2017), as we do in out models below.

2.3 Structural differences between East and West Germany

Thirty years after the former German Democratic Republic (GDR, ‘East Germany’) was integrated in the Federal Republic of Germany, the two regions continue to differ widely in sociodemographic household composition as well as labour market and occupational structures.

Sociodemographic household composition

West Germany is traditionally classified as the prototype of a gender conservative corporatist welfare regime. East Germany has a legacy of more gender egalitarian state socialism. Since 1990, both parts of the country were absorbed into the West German welfare state (Esping-Andersen 1990; Goldstein/Kreyenfeld 2011; Seeleib-Kaiser 2016). Since then, the same policy regulations apply to the two regions with persistently different sociodemographic characteristics. For example, joint tax splitting is a hallmark of gender conservative family policies in West Germany (Cooke/Gash 2010). Tax splitting primarily sets incentives for low-earning wives with high-earning husbands to withdraw from the labour market or to reduce their working hours. In East Germany, marriage is overall less common, female labour force participation is higher and men earn on average less than in West Germany in a downward levelled occupational structure. As a result, men’s and women’s earnings within couples are on average more equal in East Germany (Dieckhoff et al. 2020) and couples have less to gain from tax splitting between spouses than their western counterparts.

As part of the communist legacy in the East and gender conservatism in the West, marriage is far more widespread in West Germany. In contrast, the rate of cohabiting couples and single parents is substantially higher in the East, where single motherhood is less stigmatised and was associated with priority access to housing and other benefits during state socialism (Bastin 2015; Hübgen 2020). Female employment in the East has been historically higher as part of the communist ideology that practically mandated women’s work and enabled it by providing comprehensive public childcare (Rosenfeld et al. 2004; Trappe 1996). Due to a progressive parental leave reform and an expansion of public childcare in the past two decades in the Western parts of the country as well (Geisler/Kreyenfeld 2011), female employment in West Germany has been catching up with the higher East German levels (Liao/Fasang 2020), although especially in West Germany mothers tend to work part-time (Althaber/Leuze 2020; Gangl/Ziefle 2015; Hipp et al. 2015). Corresponding with West Germany’s history of recruiting labour migrants since the 1960s, and the closed borders of the GDR, the share of individuals with a migration background continues to be notably larger in West Germany and individuals with a migration background and women earn less on average than native men (Sprengholz/Hamjediers 2022).

Labour markets and the occupational structure

Corresponding to the legacy of the state socialist ideology, the occupational structure in the East was designed towards middle and lower occupational status ‘proletarian’ jobs during socialism and never fully caught up with the West since reunification (Brülle et al. 2019; Mau 2019). In particular, the share of manufacturing and manual jobs that are often non-teleworkable and provide low wages remains higher in East Germany (Brülle et al. 2019). Historically, the conservative insurance-based West German welfare state aimed for full employment of male breadwinners with strong employment protection. As a result, redistribution of individual economic risks within households was high with male breadwinners typically providing for dependent wives.

After a decade of economic stagnation and recession in the aftermath of German reunification in the 1990s, labour market dualisation intensified along with welfare state retrenchment. Prominently, the Hartz reforms in the early 2000s reduced unemployment benefits, limited basic welfare and lowered employment protection by introducing new types of non-standard, irregular marginal employment (e. g., the so called “mini-jobs”) (Seeleib-Kaiser 2016). Overall employment protection remains high in Germany, but the reforms introduced since 2000 strengthened dualisation into well-protected labour market insiders and vulnerable labour market outsiders, often in temporary jobs with little job security and low occupational status that are likely to be disproportionately non-teleworkable and non-essential (Cantillon et al. 2021; Schwander/Häusermann 2013). Overall, the reforms likely reduced unemployment, but increased in-work poverty.

Breaking with the legacy of high within-household redistribution through male breadwinners, in the last two decades the polarisation into economically disadvantaged “dual outsider” households and well-protected “dual insider” households increased (Biegert/Ebbinghaus 2020; Brülle 2016). Brülle (2016) reports that households’ compensatory capacity to absorb individual economic risk declined between 1993–1996 and 2009–2012 in line with increasing labour market dualisation and ensuing polarisation of households. Findings further corroborate that in Germany, labour market insecurity tends to be concentrated among partners in a couple, both being either in temporary employment or unemployed. Moreover, unemployment of one partner is associated with prolonged unemployment of the other (Grotti/Scherer 2014; Jacob/Kleinert 2014).

Non-teleworkable occupations likely belong to typical labour market “outsider occupations” with low skill requirements, low technology intensity, a lack of leadership responsibility and a higher prevalence of on-site and non-standard work, such as in service or low skilled manual jobs (see Appendix Tables A1–A4 and the results section). Non-essential occupations are more mixed with regard to typical “insider” or “outsider” characteristics. The overlap of occupations being both non-teleworkable and non-essential is likely associated with even less favourable characteristics than occupations being only non-teleworkable or non-essential, as is also confirmed in our data below (see Appendix Tables A1–A4). Already in 2019, non-teleworkable occupations were more concentrated in economically weak regions in East Germany (Gädecke et al. 2021a). Correspondingly, many peripheral rural regions, in which remote work was less common during the pandemic, were concentrated in East Germany (Corona Datenplattform 2021). In contrast, essential occupations appear more equally distributed between East and West Germany (Gädecke et al. 2021b).

Taken together, the occupational structure, as well as the sociodemographic composition of households continue to differ widely between the former East and West Germany. Overall, in East Germany there is a persistently higher share of lower occupational status jobs, lower average earnings and income, higher unemployment, higher single parenthood, less marriage and higher female employment compared to the former West (Dieckhoff et al. 2020; Goldstein/Kreyenfeld 2011; Hunt 2002; Liao/Fasang 2020; Struffolino et al. 2016).

Given these differences in occupational and household structures, previous research attests that the potential for households to reduce individual poverty risks varies. In West Germany, households have traditionally compensated for female homemakers’ lack of income through strong redistribution in male breadwinner households. As a result, within-household gender inequality was high and between-household inequality relatively low. While the share of dual-earner couples was relatively similar at 80 percent in East and West Germany around 2019, women’s contributions to household incomes were notably larger in East Germany, which largely reflects men’s lower wages in lower occupational status jobs in the East (Dieckhoff et al. 2020).

2.4 Hypotheses

Prevalence

Based on the differences in occupational structure and sociodemographic composition of households, we derive hypotheses on the prevalence of household types where the sole or both earners work in NTNE occupations and the associated poverty penalties.

Single-person households: The downward levelled occupational structure and the higher prevalence of single-person households in East Germany suggests that the prevalence of single-person households where the sole earner is in a NTNE occupation will be higher than in West Germany (Hypothesis 1).

Single-earner couple households: Given that single-earner couple households, typically male breadwinner households, remain more common in West Germany, we assume that the prevalence of single-earner couple households where the sole earner is in a NTNE occupation will be higher in West Germany than in East Germany (Hypothesis 2).

Dual-earner couple households: For dual-earner couple households where both partners work in NTNE occupations, we derive competing hypotheses. On the one hand, differences in the sociodemographic composition of households with the overall higher share of (married) couple households in West Germany and the dualisation between “insider” and “outsider” households could suggest that the prevalence of couple households where both earners work in NTNE occupations will be higher in West Germany than in East Germany (Hypothesis 3a). On the other hand, differences in women’s employment and the occupational structure between East and West Germany suggest the opposite. The higher rate of women’s employment in East Germany implies an overall higher share of dual-earner households than in West Germany. Paired with the downward levelled East German occupational structure one could expect that the prevalence of couple households where both earners work in NTNE occupations will be higher in East Germany than in West Germany (Hypothesis 3b).

Penalties

Based on the literature reviewed above, we assume that working in an occupation that is NTNE is linked to low individual income. The focus of our study is on households where the sole or both earners work in NTNE occupations. Low individual income of earners in these occupations will translate into elevated household poverty risks in these households that lack other sources of labour income. Based on the structural differences between East and West Germany outlined above, either differences in the occupational structure or the sociodemographic composition of households could drive differences in the poverty penalties associated with NTNE occupations in households between the two parts of the country.

Occupational characteristics could drive East-West differences in poverty penalties if NTNE occupations were on average even more strongly associated with unfavourable occupational characteristics in East Germany than in West Germany. This would be the case if NTNE jobs in East Germany are more strongly associated with very low pay, fixed-term contracts, irregular work and shift work, which are difficult to reconcile with long-term financial planning and family responsibilities. Given the on average downward levelled occupational structure and lower wages in East Germany compared to the West, we hypothesise higher poverty penalties associated with the sole or both earners in a household working in NTNE occupations in East Germany that will decrease once occupational characteristics are controlled for (Hypothesis 4).

Alternatively, East-West differences in the sociodemographic composition of households with the sole or both earners working in NTNE occupations could drive East-West differences in poverty penalties for these households. This would be the case if the social risks of poverty, such as low education, a higher number of dependent children in the household, or migration histories are disproportionately concentrated in these households that also experience occupational risks of in-work poverty. Female primary earners are more common in East Germany, but households with more than three children or a migrant background are more common in West Germany. If NTNE occupations are indeed concentrated in households with a disproportionate cumulation of social risks of poverty in West Germany, the unadjusted poverty penalty of these households would be higher in West Germany than in East Germany. In this case, controlling for the sociodemographic composition of households would lower poverty gaps between East and West Germany. Based on sociodemographic household composition, we assume that poverty penalties associated with the sole or both earners working in NTNE occupations will be higher in West than in East Germany, but decrease once the sociodemographic composition of households is controlled for (Hypothesis 5).

3 Data, Descriptives and Methods

We link the most recent release of the Microcensus (2019) to new data collected on the occupational risks of teleworkability and essential occupations. The Microcensus is a survey of 1 % of households and the individuals living in them that has been conducted in Germany since 1957. The study uses single-stage stratified cluster sampling. Data is mostly collected via computer-assisted personal interviewing (CAPI), and in some cases with computer-assisted telephone interviews (CATI). Participation in the survey is obligatory by law, which makes it the largest and most representative household dataset in Germany. The large sample size of the Microcensus provides an ideal and powerful basis for analysing population subgroups, such as a detailed mapping of household constellations. This is generally not possible with long-running panel studies that follow smaller samples, such as the German Socio-economic Panel (GSOEP) or the National Education Panel Study (NEPS). As a result, research to date on the consequences of the COVID-19 pandemic using these and similar datasets has strongly focused on individual consequences, household income of individuals and couples’ division of labour (Adriaans et al. 2021; Jessen et al. 2022; Möhring et al. 2020; Sánchez et al. 2021), but not yet on detailed household constellations of earners and occupations, which will only be possible once new releases of the Microcensus become available. Due to current data limitations, as of now, we do not have any comprehensive assessment of the poverty consequence of the pandemic (Bauer/Sieglen 2021; Niehues 2022).

We use the household-level data structure of the Microcensus 2019 to map detailed household constellations. Based on partnership status, we select households with married or cohabiting couples and households with single adults, both with and without dependent children. Our sample consists of households with single adults or couples where at least one partner is of working age between 20–64. We include couples where one partner is 65 and above, but exclude those where both are aged 65 or older. If there was more than one couple in the household, we retain only the first, which includes the household reference person (this applies to a very small share of multigenerational households). We also drop households with more than one single adult in the target age group.

Table 1 shows a descriptive overview of the households in our final sample. After all sample restrictions, we retain 179,755 households, of which 43.9 percent (N=78,552) are single-person households, 46.6 percent (N=82,773) are married couple households and 9.5 percent (N=18,430) are unmarried cohabiting couple households (see Table 1). These percentages correspond very closely to official statistics based on the Microcensus (Datenreport 2018). We retain both same-sex and opposite-sex married and unmarried couples.

The Microcensus 2019 does not include information on the teleworkability of occupations, or, naturally, whether occupations were later classified as essential or not. We compiled two new datasets at the level of occupations and linked them to the Microcensus to assess household constellations where the sole or both earners worked in NTNE occupations. Each new dataset contains one indicator: to what extent the occupation was 1) in principle teleworkable before the pandemic, and 2) whether the occupation was classified as essential between April 2020 and May 2021 in the federal states’ lockdown decrees.

Teleworkability indicates the possibility of working from home, not actual remote working during the pandemic. Jobs that were teleworkable even before the pandemic likely transitioned into lockdown and remote working mode during the pandemic relatively smoothly. We measured teleworkability before the pandemic with a task-based approach (Gädecke et al. 2021a). Following previous research, we created a teleworkability index for occupations on the NACE-3 level using data from the German BIBB/BAuA Employment Survey 2018, a representative survey of core employed persons in Germany (Rohrbach-Schmidt/Hall 2018). Core employed persons are at least 15 years old and work at least 10 hours a week for pay. Participants reported how often they execute a series of (17) specific tasks in their jobs (frequently, sometimes or never).

As suggested by Arntz, Ben Yahmed and Berlingieri (2020), we divided these tasks into non-teleworkable tasks and teleworkable tasks. Teleworkable tasks include ‘providing advice and information’, ‘advertising, marketing, public relations PR’, ‘organising, planning and preparing work processes’, ‘developing, researching, constructing’, ‘gathering information, researching, documenting’, ‘working with computers’, ‘use of internet or email processing’, and ‘purchasing, procuring, selling’. Non-teleworkable tasks comprise ‘manufacturing, producing goods and commodities’, ‘measuring, testing, quality control’, ‘monitoring, control of machines, plants, technical processes’, ‘repairing, renovating’, ‘transporting, storing, shipping’, ‘entertaining, accommodating, preparing food’, ‘nursing, caring, healing’, ‘protecting, guarding, monitoring, regulating traffic’, and ‘cleaning, waste disposal, recycling’. ‘Training, instructing, teaching, education’ was considered as partly but not fully teleworkable (Arntz et al. 2020). Our index considers a task as being implemented in that occupation only if the participant indicated that they perform the task frequently, not if it was done sometimes or never. To determine the extent to which the occupation can be exercised remotely, we divided the number of teleworkable tasks by the total number of tasks. The result is a value between 0 and 1, indicating the share of teleworkable tasks by occupation. We define an occupation as non-teleworkable, if less than 80 percent of the tasks can be excercised remotely. To merge this index with the Microcensus, we aggregated the teleworkability scores to the 3-digit level of the International Standard Classification of Occupations (ISCO-08) (130 occupational groups).

Essential occupations were classified as occupations that were deemed necessary to ensure the continuity of key functions of society, also described as “critical infrastructure” or “system-relevant” jobs in Germany. As discussed above, in Germany and elsewhere, essential jobs were relatively secure in the pandemic in terms of job security and income, although often exposed to a higher risk of infection from the virus. The 16 federal states of Germany (five in East Germany, eleven in West Germany) issued separate lockdown decrees that varied in timing and types of occupations classified as essential. Classifying an occupation as essential aimed to ensure that it continued to be performed and was used to regulate access to priority vaccinations and restricted services, such as emergency childcare, and in some cases also bonus payments. To code essential occupations, we extracted information from the decrees issued by all federal states between 2 April 2020 and 21 May 2021. To link the classification of essential occupations to the Microcensus, we coded essential occupations (yes=1, no=0) based on the German classification of occupations Kldb 2010 (Klassifikation der Berufe 2010) on the 3-digit level (144 occupational groups), which was the sole available occupational classification in the federal state decrees that we could link directly to individuals through their occupation in the Microcensus.

In our design, we focus on the combination of occupations that are both non-teleworkable and non-essential (NTNE) in contrast to all other occupations that are either teleworkable or essential. A full classification contrasting 1) essential and teleworkable, 2) essential and non-teleworkable, 3) non-essential and teleworkable and 4) non-essential and non-teleworkable occupations in different household constellations is available from the authors. Overall prevalence and penalties of the full classification show that non-teleworkability is associated with higher poverty penalties than an occupation being non-essential, and that the combination of non-teleworkability and non-essential indeed is associated with less favourable sociodemographic characteristics than either one dimension alone.

Appendix Tables A1–A4 further support an added disadvantage of the overlap of non-teleworkable and non-essential occupations. Appendix Tables A1 and A2 show the 12 most common NTNE occupations in West (top) and East (bottom) Germany for the main earner and the secondary earner for dual-earner households in our sample. Tables A3 (West Germany) and A4 (East Germany) show descriptive statistics on the sociodemographic and occupational control variables of the main earner separately for different occupations: 1) teleworkable and essential, 2) teleworkable and non-essential, 3) non-teleworkable and essential, 4) non-teleworkable and non-essential and 5) not working.

Overall, a sizeable 29.8 percent of primary earners and household heads in our sample worked in NTNE occupations in 2019, 30.3 percent in West Germany and 27.9 percent in East Germany (calculated from the data, not visible in the tables). Among dual-earner households in our sample, the share of second earners working in NTNE occupations was almost twice as high: 58.6 of second earners in these households in West Germany and 62.7 percent in East Germany worked in NTNE occupations in 2019 (calculated from the data, not visible in the tables).

Tables A1 and A2 show that occupations that are both non-teleworkable and non-essential largely cover traditional manual blue-collar occupations, such as transport clerks (postal workers), and lower-level service jobs that require on-site presence, such as shop sales staff, waiters and bartenders, domestic cleaners and food preparation assistants. Among the main earners or household heads, which are male to 69.9 percent in West Germany and to 61.3 percent in East Germany (Appendix Tables A3 and A4), blue-collar occupations dominate, including blacksmiths and tool makers, as well as sheet and metal workers (Table A1). Among (potential) second earners in our household constellation (84.2 percent female in West Germany and 69.4 percent female in East Germany, calculated from the data, not visible in tables), lower-level service sector jobs are the most common NTNE occupations.

The twelve most common NTNE occupations overlap relatively strongly in East and West Germany, with some notable differences that reflect known differences in the occupational structures between the two regions (marked in bold in Table A1 and A2). For example, domestic, hotel, and office cleaners as well as manufacturing workers are more common in West Germany in line with a greater share of large companies, tourism and large manufacturing plants relative to East Germany. The most common combination of two members of a couple working in NTNE occupations is shop sales staff who are partnered with shop sales staff in both East and West Germany. The on average low occupational status of the twelve most common NTNE occupations underscores the question whether the overlap of these two dimensions simply captures traditional occupational disadvantages (such as low skills, low pay, lack of leadership responsibilities, and shift work) and if differences in the poverty penalties associated with NTNE occupations persist after controlling for these known occupational disadvantages. Tables A3 and A4 in the Appendix further show that primary earners working in NTNE occupations are on average lower educated, more likely to have a migration background in West Germany but not in East Germany, and have on average less favourable occupational characteristics than the other occupational groups in both parts of the country, although not on all indicators.

First, to assess the prevalence of NTNE occupations across household constellations, we generated a 10-category household classification (Table 2). Our focus is on three household types specifically: 1) single-person households and 2) single-earner couple households where the sole earner worked in a NTNE occupation, and 3) dual-earner households, where both earners worked in NTNE occupations.

Second, we estimated the poverty penalty as the probability that a household is poor using stepwise logistic regression models with the ten household types as core independent variables (Table 2). The poverty threshold is set at 60 percent of the median household income in our analytical sample.[1] The original variable in the Microcensus reports income bands only. To calculate the poverty threshold and to assess if the household was in poverty or not, we followed Stauder and Hüning (Boehle 2015; Stauder/Hüning 2004). The models are pooled for East and West Germany and proceed in four steps. Model 1 includes household type, a variable for the place of residence, that is East and West Germany, and the interaction between these two. Model 2 additionally adjusts model 1 for sociodemographic variables: number of children in the household (0, 1, 2, or 3 or more); educational level of the main earner (low, medium, or high); gender of the main earner (man or woman); age of the main earner (continuous); and main earner born in Germany (yes or no). Model 3 drops the sociodemographic controls and additionally adjusts model 1 for occupation-related variables: type of contract of the main earner (no dependent contract, fixed-term contract, permanent contract, or no information); employment status of the main earner (full-time employment, part-time employment, full-time atypical employment, part-time atypical employment, self-employment, unemployment, or inactivity), frequency of shift work of the main earner (no dependent contract, every day, at least half of days, less than half of days, never, or no information); leadership position of the main earner (no leadership, manager, or supervisor). Finally, model 4 builds on model 1 and adjusts for both sociodemographic and occupation-related variables. Results are presented as predicted probabilities that are comparable across models and samples. The full table of the regression models is displayed in Appendix Table A5.[2]

4 Results

4.1 The prevalence of non-teleworkable and non-essential occupations in households in East and West Germany

Table 2 shows how the 10 household constellations were distributed across East and West Germany in 2019. The percentages sum up to 100 percent of all households with at least one adult of working age (20–64) minus the restrictions above. The top of Table 2 shows single-person households, the middle section shows couple households with a single-earner or dual joblessness, and the bottom displays couple households with two earners. Overall, differences in the prevalence of the 10 household constellations between East and West Germany are in the expected directions and statistically significant (Pearson Chi-square=604.1481, probability=0.000) but small, ranging between one and two percentage points.

Prevalence of household constellations contrasting non-essential and non-teleworkable occupations with occupations that are either essential or teleworkable

|

Main earner |

Secondary earner |

West |

East |

Total |

|

|

% |

% |

% |

N |

||

|

Single-person households |

|||||

|

essential or teleworkable |

– |

22.7 |

24.8 |

23.1 |

40,237 |

|

non-essential and non-teleworkable |

– |

12.3 |

13.1 |

12.4 |

21,335 |

|

not working |

– |

9.1 |

12.2 |

9.8 |

16,887 |

|

Subtotal single-person households |

44.1 |

50.1 |

45.3 |

78,459 |

|

|

Couples: single earner, dual jobless |

|||||

|

essential or teleworkable |

not working |

8.5 |

6.9 |

8.2 |

14,996 |

|

non-essential and non-teleworkable |

not working |

5.8 |

3.9 |

5.5 |

9,796 |

|

not working |

not working |

4.1 |

4.1 |

4.2 |

7,608 |

|

Subtotal single-earner households |

18.4 |

14.9 |

17.9 |

32,400 |

|

|

Couples: dual earner |

|||||

|

essential or teleworkable |

essential or teleworkable |

17.3 |

16.3 |

17.1 |

31,509 |

|

essential or teleworkable |

non-essential and non-teleworkable |

6.9 |

7.0 |

6.9 |

12,740 |

|

non-essential and non-teleworkable |

essential or teleworkable |

7.2 |

6.9 |

7.1 |

13,124 |

|

non-essential and non-teleworkable |

non-essential and non-teleworkable |

6.1 |

4.7 |

5.8 |

10,443 |

|

Subtotal dual-earner households |

37.5 |

34.9 |

36.9 |

67,816 |

|

|

Missing |

.006 |

.005 |

.004 |

1,080 |

|

|

Total |

100 |

100 |

100 |

179,755 |

|

Source: Microcensus 2019 and Gädecke et al. (2021a, 2021b). Authors’ calculations.

In line with hypothesis 1, households with a single adult working in a NTNE occupation are slightly more prevalent in East Germany (13.1 percent vs. 12.3 percent in the West). This difference of less than one percentage point is small considering the higher prevalence of single-person households and the downward levelled occupational structure in the East. Yet, the overall percentage (around 13 percent) of all households with an adult of working age that are a one-person household where the adult works in a NTNE occupation is substantial from a social policy perspective.

Supporting hypothesis 2, single-earner couple households where the sole earner works in a NTNE occupation are almost two percentage points more prevalent in West Germany (5.8 percent vs. 3.9 percent in East Germany), reflecting the higher prevalence of single-earner couple households in the traditional gender conservative male-breadwinner welfare state in West Germany. More generally, the prevalence of single-earner couple households working in NTNE occupations could be expected to be low, as these jobs typically will not provide adequate “main-breadwinner” wages, thus setting incentives for added worker effects or searching for more lucrative positions.

Concerning our competing hypotheses 3a and 3b, findings support hypothesis 3a that dual-earner couple households where both earners work in NTNE occupations are more prevalent at 6.1 percent in West Germany compared to 4.7 percent in East Germany. The overall share of dual-earner households (i. e., the sum of all four household constellations of dual earners) is very similar in East and West Germany (bottom four rows of Table 2). This reflects a convergence of the share of dual-earner households in East and West Germany over recent decades, whereas notable differences still exist in a higher share of single-earner couple households in West Germany. Studies that exclude single households (Dieckhoff et al. 2020) therefore find lower shares of dual earners among all couples in the West. Yet, the share of dual earners among all households with at least one adult between 20 and 64 year-old is similar in East and West Germany.

Overall, the share of households with at least one adult between 20 and 64 year-old where the sole or both earners work in NTNE occupations amounts to almost a quarter of households: 21.7 percent in East Germany and 24.3 in West Germany. The higher share in West Germany is mainly driven by a higher prevalence of single-earner couple households where the sole earner works in a NTNE occupation. These households might experience a particularly high poverty risk, given a second dependent adult who is not contributing to household income. More generally, among households where the sole or both earners work in NTNE occupations, the majority are single-person households in both parts of the country. Yet, the prevalence of precarious couple households is notably higher at 11.9 percent in West Germany (the sum of single-earner couple and dual-earner couple households where the sole or both earners work in NTNE occupations), relative to 8.6 percent in East Germany. These findings resonate with the literature emphasising a polarisation into “dual insider” and “dual outsider” households (Biegert/Ebbinghaus 2020; Brülle 2016) that appears even stronger in our results in West Germany, despite the downward levelled occupational structure in the East.

A higher share of couple households, traditionally seen as a source of redistribution and protection against poverty, should not be regarded as a universal buffer against individual occupational risks. On the contrary, high shares of couple households also provide an opportunity structure for disadvantages to become concentrated within households, such as dual joblessness, or the sole or both earners working in NTNE occupations. Our findings imply that policies addressing couple households will disproportionately benefit West German households, while policies addressing single-person households might be more effective in ameliorating disadvantages in East Germany. Yet, single-person households where the adult works in a NTNE occupation represent the majority in both East and West Germany.

Probabilities of being poor by household type, stepwise models, 95 % confidence intervals

Notes: estimates from stepwise multinomial logistic regression models. Full regression tables in Appendix Table A5. All models are further adjusted for place of residence (East or West Germany) and the interaction between the latter and household type. In the labels of the dual-earner household types, the element on the left-hand side of the “/” refers to the primary earner and the element on the right-hand side of the “/” refers to the secondary earner.

Source: Microcensus 2019 and Gädecke et al. (2021a, 2021b). Authors’ calculations.

4.2 Poverty penalties associated with non-teleworkable and non-essential occupations in households in East and West Germany

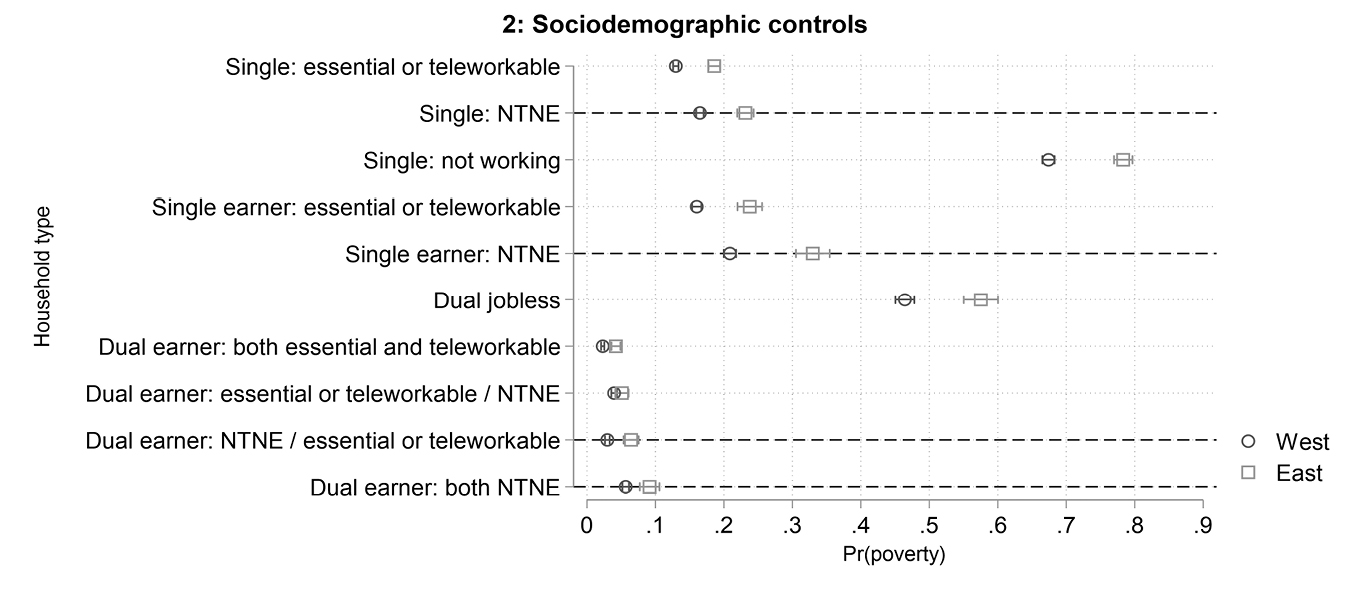

Figure 1 displays predicted probabilities from stepwise logistic regression models: Step 1 without control variables, followed by step 2 with only sociodemographic controls, step 3 with only occupational controls and step 4 combining both sociodemographic and occupational controls (full models in Appendix Figure A5). The dotted horizontal lines indicate the household types where the sole or both earners worked in NTNE occupations in 2019. Single-person households are illustrated at the top of each graph, followed by single-earner couple households, jobless couple households and dual-earner households at the bottom. We also marked dual-earner households where the main earner worked in a NTNE occupation but the secondary earner worked in a teleworkable or essential occupation with a dotted horizontal line to highlight a significant East-West gap in poverty penalties for these households as well. Table 3 shows the predicted probabilities displayed in Figure 1 for the household constellations with the sole, the main or both earners working in NTNE occupations in East and West Germany, as well as the gap between East and West Germany for each model step.

Predicted probabilities of being poor and the East-West probability gap for households where the sole, main or both earners worked in non-teleworkable and non-essential occupations in 2019

|

East |

West |

Gap |

|

|

Single-person household: non-teleworkable and non-essential |

|||

|

Step 1: no controls |

.25 |

.20 |

.05* |

|

Step 2: sociodemographic |

.23 |

.16 |

.07* |

|

Step 3: occupational |

.18 |

.14 |

.04* |

|

Step 4: 2+3 |

.19 |

.14 |

.05* |

|

Single earner: non-teleworkable and non-essential |

|||

|

Step 1: no controls |

.31 |

.25 |

.06* |

|

Step 2: sociodemographic |

.33 |

.21 |

.12* |

|

Step 3: occupational |

.28 |

.27 |

.01 (n.s.) |

|

Step 4: 2+3 |

.30 |

.23 |

.07* |

|

Dual earner: main earner non-teleworkable and non-essential |

|||

|

Step 1: no controls |

.05 |

.03 |

.02* |

|

Step 2: sociodemographic |

.06 |

.03 |

.03* |

|

Step 3: occupational |

.07 |

.05 |

.02* |

|

Step 4: 2+3 |

.08 |

.05 |

.03* |

|

Dual earner: both non-teleworkable and non-essential |

|||

|

Step 1: no controls |

.08 |

.07 |

.01 (n.s.) |

|

Step 2: sociodemographic |

.09 |

.06 |

.03* |

|

Step 3: occupational |

.09 |

.09 |

.00 (n.s.) |

|

Step 4: 2+3 |

.10 |

.08 |

.02* |

Note: * indicates non-overlapping confidence intervals in Figure 1, n.s. indicates not significant as in overlapping confidence intervals in Figure 1, calculated from regression models displayed in Appendix Table A5.

Source: Microcensus 2019 and Gädecke et al. (2021a, 2021b). Authors’ calculations.

The top panel 1 in Figure 1 shows notably elevated poverty penalties for households where the sole or both earners worked in NTNE occupations in 2019. Irrespective of occupation and in line with previous findings (Boehle 2015), the probability of being poor was substantially higher among single-person households and couple households with a single earner or dual joblessness, compared to dual earners. East German households have a significantly and sizeably elevated probability of being poor compared to West Germans in single-person households and single-earner couple households where the sole earner worked in a NTNE job.

Overall, in line with hypothesis 5, adjusting for the sociodemographic composition of households (model step 2) yields a sizeable reduction in poverty penalties for households where the sole or both earners work in NTNE occupations in West Germany (Figure 1 and Table 3). In contrast, the sociodemographic composition of households only marginally impacts the estimates for East Germany and tends to rather increase estimated poverty probabilities (suppressor effects). The opposite is the case for occupational characteristics. In line with hypothesis 4, adjusting for occupational characteristics leads to a sizeable reduction in the probability of being poor in East Germany, but not in West Germany, especially for single-person and single-earner couple households. For dual-earner couples in both parts of the country, occupational characteristics only marginally alter estimated poverty penalties.

As a result, the poverty gaps between East and West Germany shift with the different control scenarios. Adjusting the baseline model step 1 only for sociodemographic factors increases the East-West poverty gaps for the household constellations that we are interested in by lowering poverty estimates for West Germany (H 5), but leaving poverty estimates for East Germany largely unchanged (Figure 1 and Table 3). Adjusting for occupational characteristics in model step 3 narrows the estimated East-West poverty gap by lowering poverty estimates for East Germany (H 4), while leaving poverty estimates for West Germany largely unchanged. Correspondingly, adjusting for both sociodemographic and occupational characteristics yields very similar East-West poverty gaps for the households where the sole earner or both earners work in NTNE occupations as in the baseline model step 1. Yet, in the fully adjusted model step 4, poverty levels are substantially lower than in the unadjusted model step 1, especially for single-person households in East and West Germany. In contrast, poverty estimates for dual-earner households remain largely unchanged or even slightly higher in model step 4 including all controls relative to model step 1 without controls.

5 Discussion

The well-being of adults and children depends on the economic situation of all adult household members. Households are primary locations for redistributing and pooling risk. In view of rising in-work poverty across Europe and in Germany (Brülle et al. 2019; Lohmann/Marx 2018), we extended the recently developed analytical framework of prevalence and penalties (Brady et al. 2017) to the occupational risks of in-work poverty and its concentration within households. The analytical framework juxtaposed differences in occupational structure and the sociodemographic composition of households between East and West Germany to derive five hypotheses on East-West differences in the prevalence of occupational risks in households and associated poverty penalties. We focused on the overlap of occupations being both non-teleworkable and non-essential (NTNE) as occupational risks. Occupations that are NTNE were associated with labour market disadvantages already before the COVID-19 pandemic and gained relevance since. This study combined the large representative sample of the most recent German Microcensus release from 2019 with a new data collection on essential occupations and survey data on the teleworkability of occupations to address two research questions: First, how prevalent were household constellations where the sole earner or both earners worked in NTNE occupations in East and West Germany in 2019? Second, did the poverty penalty associated with the sole earner or both earners working in NTNE occupations differ between East and West Germany in 2019?

Findings from descriptive statistics showed that in almost a quarter of households where at least one adult was of working age in 2019, the sole or both earners worked in NTNE occupations. This is a sizeable share of the working age population. Differences in the prevalence of households where the sole or both earners worked in NTNE occupations between East and West Germany were generally in expected directions, but overall small in magnitude ranging between one and two percentage points. Regional variation in the prevalence of these types of households is therefore not appropriate for explaining differences in poverty between East and West German households.

The main findings from the regression models on poverty penalties can be summarised as follows. First, poverty was elevated for all households where the sole or both earners worked in NTNE occupations compared to all other working households. Generally, poverty penalties for working in NTNE occupations were higher in East Germany than in West Germany, especially for single-person households and single-earner couple households. Second, in West Germany elevated poverty in households where the sole or both earners worked in NTNE occupations are related to a concentration of adverse sociodemographic characteristics in these households, primarily a higher share of individuals with a migration background and with low education (see descriptive Tables A3 and A4 and full regression models in Table A5 in the Appendix).

In contrast, in East Germany the elevated poverty risk of households where the sole or both earners worked in NTNE occupations is largely unrelated to sociodemographic differences between these households compared to other East German households. Instead, their elevated poverty in East Germany is substantially, but not fully, driven by the adverse occupational characteristics of earners working in NTNE occupations. These adverse occupational characteristics primarily include the lack of a permanent contract, lack of leadership responsibilities and a concentration of part-time atypical work (see Table A4 and full regression models in Table A5 in the Appendix).

Two core implications emerge from these results. First, NTNE occupations are associated with higher household poverty levels that are only partly driven by traditional adverse occupational characteristics, and more so in East than in West Germany. Therefore, the combination of occupations being non-teleworkable and non-essential indeed seems to capture an additional dimension of labour market disadvantage already in 2019 before the pandemic hit, and it likely gained importance as a marker of stratification since then.

Second, different types of policy interventions seem more promising for alleviating poverty penalties associated with NTNE occupations in East and West Germany. In West Germany, interventions targeted at making different segments of the labour market accessible for individuals with a migration history, broadening further training programmes and raising basic welfare supplements for low-income working households could lift households working in NTNE occupations above the poverty line. The concept of a basic income for families with children, called Kindergrundsicherung, which is currently being debated, could be effective in this regard, and also holds some potential to alleviate intergenerational cycles of persistent poverty (AWO Bundesverband 2019).

In contrast, in East Germany, labour market interventions seem more promising to ameliorate the poverty penalties of households where the sole or both earners work in NTNE occupations. Specific measures could aim at strengthening employment protection legislation, incentivising permanent contracts and full-time standard employment, and setting up schemes for relocating positions with leadership responsibility to East Germany. The proliferation of atypical employment following the Hartz reforms in the early 2000s has not only led to a polarisation of “dual insider” and “dual outsider” households (Brülle 2016), but has also contributed to the spread of low-quality atypical employment that seems to be particularly strongly concentrated in NTNE occupations in East Germany.

The 2023 Bürgergeld reform seems unlikely to substantially ameliorate poverty penalties of households working in NTNE jobs. The Bürgergeld reform only moderately increased the basic welfare benefit at a time of massively rising inflation and introduced some support for further training in addition to a few other smaller amendments. Further training might help individuals to qualify for teleworkable jobs, which would be effective if a sufficient number of these jobs also existed in East Germany. Yet, strengthening employment protection legislation through raising minimum wages and mandating permanent contracts in NTNE occupations as well would likely more immediately alleviate the poverty penalties of households working in these jobs in East Germany. Expanding the digitisation of jobs to increase access to teleworkability could also be effective, but seem unrealistic for many of the most prevalent NTNE occupations listed in Tables A1 and A2 (e. g., bartenders and waitresses, hairdresser or transport clerks).

Taken together, policies aiming to equalise regional living conditions and lowering in-work poverty gaps between East and West Germany should prioritise labour market interventions to improve general employment conditions in the East. In contrast, interventions targeted at the higher concentration of adverse sociodemographic characteristics in West German households working in NTNE occupations will likely widen the East-West in-work poverty gap by reducing poverty primarily in West Germany. Nonetheless, such policies are important to ameliorate child poverty in Germany, a central policy goal in its own right, given that children are the age group most affected by poverty in Germany (Datenreport 2018).

Our findings are specific to Germany, but have implications for other countries. Results for West Germany might generalise to other conservative corporatist welfare contexts where single parenthood and female labour force participation are moderate, and gender inequality within households is high, such as Switzerland or Austria. Conversely, our findings for East Germany likely resemble countries in more advanced stages of the second demographic transition, such as the Nordic countries, where female labour force participation is higher and marriage is less widespread. However, the downward levelled occupational structure with many economically weak peripheral regions in East Germany might map more closely on to some of the countries in Central and Eastern Europe and peripheral regions in Southern Europe that generally have weaker state provision. For liberal welfare contexts of high inequality, limited welfare provision and a strong stratification of household structures there is likely more between-household inequality and less gender-inequality within households. As a result, a polarisation between single-person households into risky “outsider” NTNE occupations appears likely relative to dual-earner “insider” households in secured teleworkable occupations.

Our findings should be interpreted in the context of several limitations. We presented a cross-sectional snapshot of household types that captures the prevalence of household constellations of NTNE occupations and associated poverty penalties in 2019 before the COVID-19 pandemic. The theoretical framing and analyses neglected microlevel dynamics, such as assortative mating, selection into partnerships and parenthood, and within-household decision-making processes about earner models. These microlevel dynamics also play a role for how structural conditions shape the prevalence of household constellations and associated poverty penalties. Future research should investigate these and related microlevel decision-making processes with regard to the selection into household constellations where the sole or both earners work in NTNE occupations. This will likely best be accomplished by analysing couple and single-person households separately, and using longitudinal data. Households are not static, but change in structure and composition. Ongoing research is also investigating the extent to which pandemic-related economic shocks affected fertility, separation and re-partnering that all impact a household’s capacity to absorb individual economic risks (Luppi et al. 2020; Manning/Payne 2021).

In addition, household members dynamically adapt their labour supply decisions to new economic circumstances, known as added worker effects (Lundberg 1985). Single-earner couple households might have increased their labour supply during or after the pandemic, if the formerly non-employed adult seeks employment, for example when the previously employed adult lost their job or experienced reduced income. To date, available longitudinal data covering the pandemic period does not allow a detailed mapping of household types, which is only possible with the large case numbers of the Microcensus and 2019 is the most recent currently available data release. As more recent Microcensus data from the pandemic period are released, households’ dynamic labour supply decisions as strategies to avoid initial losses in the pandemic could be analysed, along with actual changes in poverty risks of the household types identified in our study during and since the pandemic. The Microcensus does include short rotating panels of up to four years that may also allow some longitudinal analyses in future releases, although changes in the measurement of poverty in the Microcensus in a context of rising inflation might challenge future comparisons over time (Niehues 2022).

The assessment of pre-pandemic household constellations offered in this study is important for assessing pre-pandemic risk groups and, later on, gauging inequality reducing or enhancing effects of the COVID-19 pandemic. Our analysis thus presents a first step for assessing long-term trends in the accumulation of economic disadvantages within households over time during the COVID-19 pandemic. We provide a baseline estimation of how working in NTNE occupations was distributed across household constellations with different poverty risks before the pandemic in East and West Germany.

Irrespective of the COVID-19 pandemic, our study extends the prevalence and penalties framework from poverty research to the occupational risks of in-work poverty based on detailed household constellations of earners at a time of substantially rising in-work poverty across Europe.

Funding

Funder Name: Bundesministerium für Arbeit und Soziales, Funder Id: http://dx.doi.org/10.13039/501100016370, Grant Number: MPR.00.00017.20 – FIS-Corona

Acknowledgement

The Microcensus data (doi: 10.21242/12211.2019.00.00.3.1.0) are from the RDC of the Federal Statistical Office and Statistical Offices of the Federal States. All calculations are by the authors.

Supplemental Material

This article contains supplementary material (https://doi.org/10.1515/zsr-2022-0107).

References

Adriaans, J.; Bohmann, S.; Liebig, S.; Priem, M.; Richter, D. (2021): Soziale Folgen der COVID-19-Pandemie: Ergebnisse einer repräsentativen Befragung, Begleitforschung zum Sechsten Armuts-und Reichtumsbericht der Bundesregierung. DIW ECON, Berlin.Suche in Google Scholar

Alipour, J. V.; Fadinger, H.; Schymik, J. (2021): “My home is my castle – The benefits of working from home during a pandemic crisis”, Journal of Public Economics 196: 104373. https://doi.org/10.1016/j.jpubeco.2021.10437310.1016/j.jpubeco.2021.104373Suche in Google Scholar

Andress, H.-J.; Lohmann, H. (2008): The working poor in Europe: Employment, poverty and globalisation. Cheltenham, UK: Edward Elgar Publishing.10.4337/9781848443761.00006Suche in Google Scholar

AWO Bundesverband e.V. (2019) Armut im Lebenslauf – Forderungen der Arbeiterwohlfahrt. https://awo.org/sites/default/files/2019-11/191104_Br_Armut_im_CV_bf.pdfSuche in Google Scholar

Bastin, S. (2015): Partnerschaftsverläufe alleinerziehender Mütter: eine quantitative Untersuchung auf Basis des Beziehungs-und Familienpanels. Wiesbaden: Springer-Verlag.10.1007/978-3-658-10685-0Suche in Google Scholar

Bauer, F.; Sieglen, G. (2021): Stellungnahme des IAB für das Fachgespräch des Parlamentarischen Begleitgremiums „Covid-19-Pandemie“ des Landtags Nordrhein-Westfalen am 16. November 2021. https://iab.de/en/publications/publication/?id=12099747Suche in Google Scholar

Biegert, T.; Ebbinghaus, B. (2020): Accumulation or absorption? Changing disparities of household non-employment in Europe during the Great Recession. Socio-Economic Review, Volume 20, Issue 1, January 2022, Pages 141–168. https://doi.org/10.1093/ser/mwaa00310.1093/ser/mwaa003Suche in Google Scholar

Boehle, M. (2015): Armutsmessung mit dem Mikrozensus: methodische Aspekte und Umsetzung für Armutsmessung mit dem Mikrozensus. Methodische Aspekte und Umsetzung für Querschnitts- und Trendanalysen (GESIS Papers). Köln.Suche in Google Scholar

Brady, D.; Finnigan, R. M.; Hübgen, S. (2017): Rethinking the risks of poverty: A framework for analyzing prevalences and penalties. American Journal of Sociology 123(3): 740–786.10.1086/693678Suche in Google Scholar

Brugiavini, A.; Buia, R. E.; Simonetti, I. (2021): “Occupation and working outcomes during the Coronavirus Pandemic”, European Journal of Ageing. Advance online publication. https://doi.org/10.1007/s10433-021-00651-510.2139/ssrn.3781534Suche in Google Scholar

Brülle, J. (2016): “Demographic trends and the changing ability of households to buffer poverty risks in Germany”, European Sociological Review 32(6): 766–778.10.1093/esr/jcw033Suche in Google Scholar