Abstract

The objective of this study is to examine the dynamic adjustment of retail prices following changes in input prices within an oligopolistic and vertically non-integrated market. Data are weekly retail and wholesale prices between February 2010 and August 2013. The methodology employed is the Nonlinear Autoregressive Distributed Lag (NARDL) model, which captures both short- and long-run price dynamics. The empirical findings reveal evidence of the “rockets and feathers” hypothesis for more than half of the products examined, indicating an inflationary impact on retail prices, thus a temporal or permanent decrease in consumer welfare. This result is in contrast with the perishable nature of fruits and vegetables.

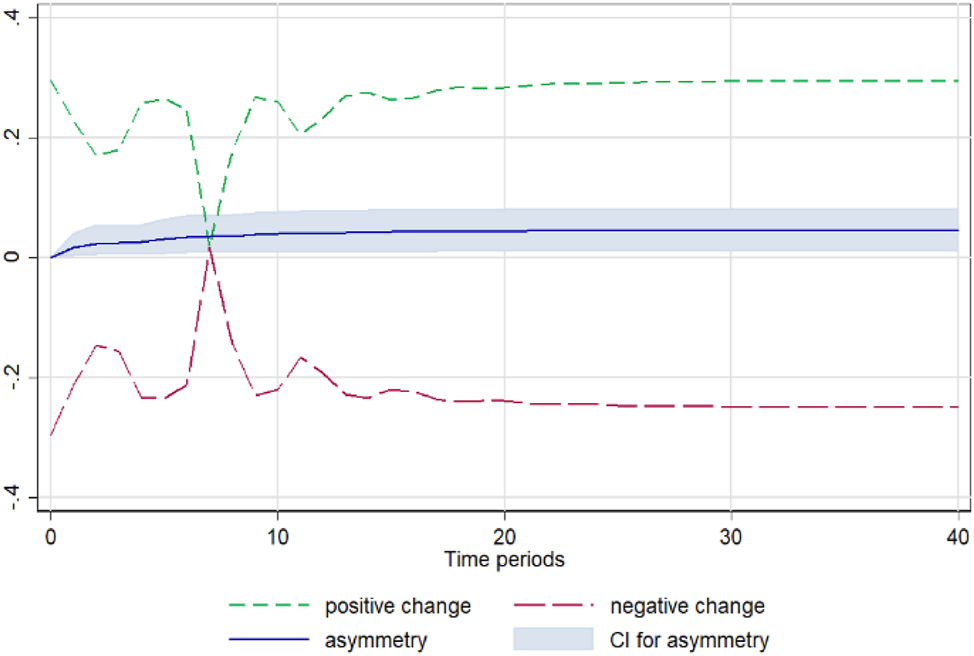

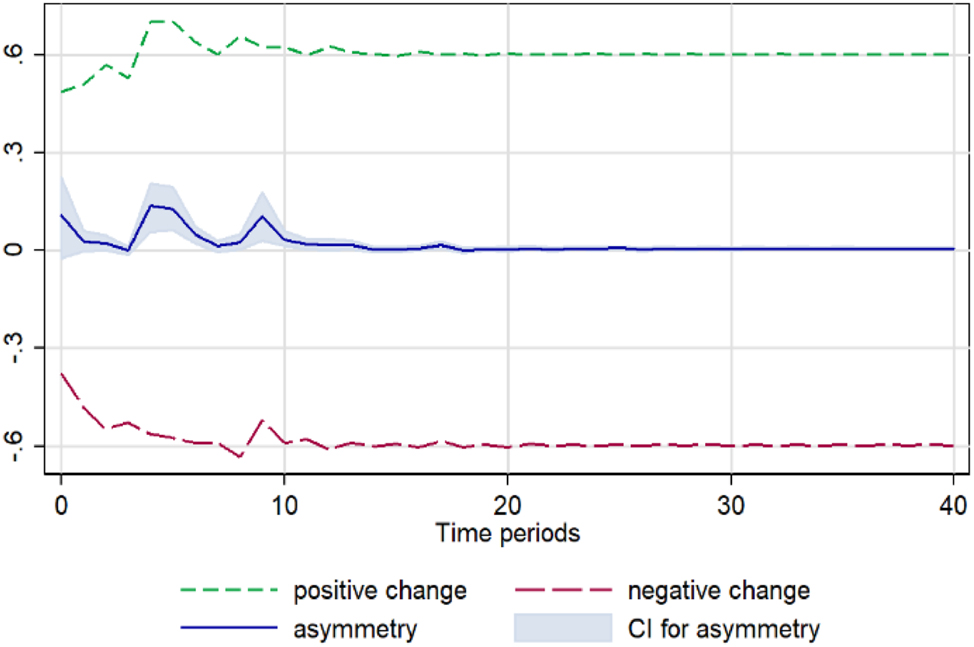

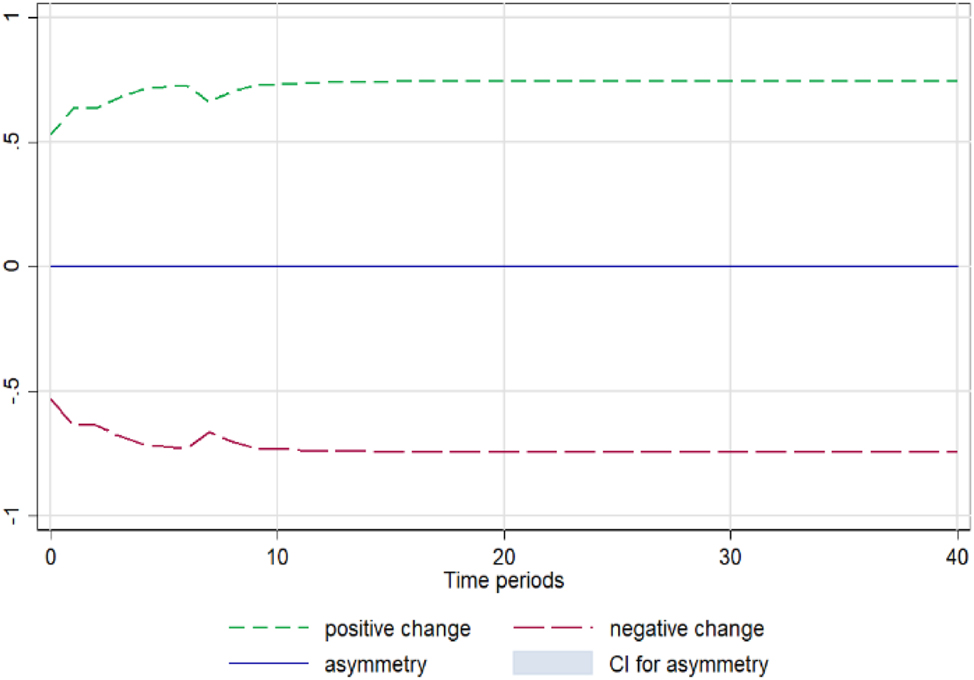

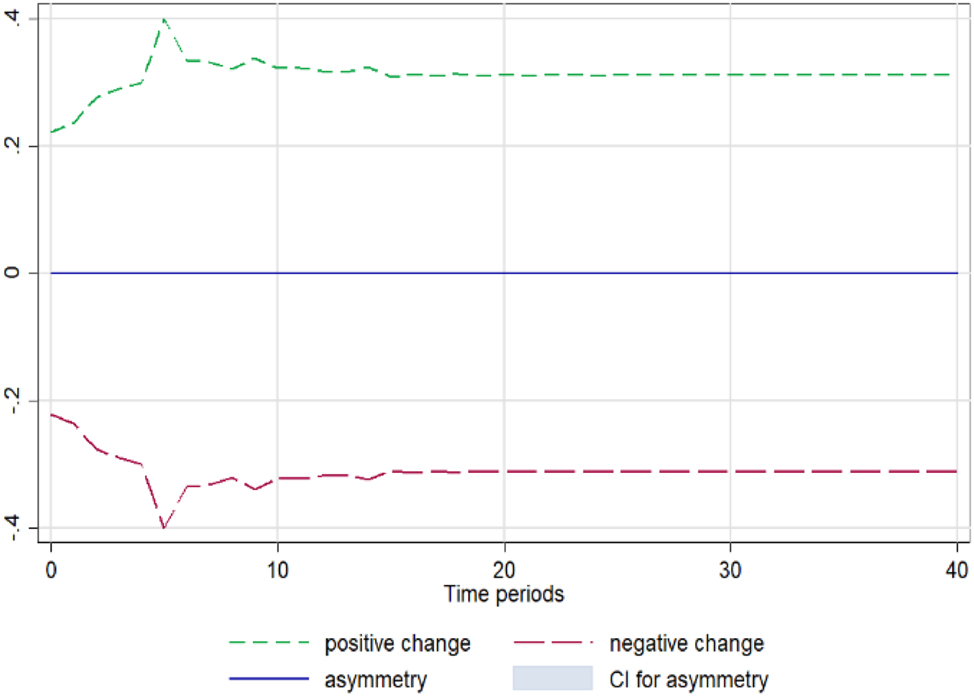

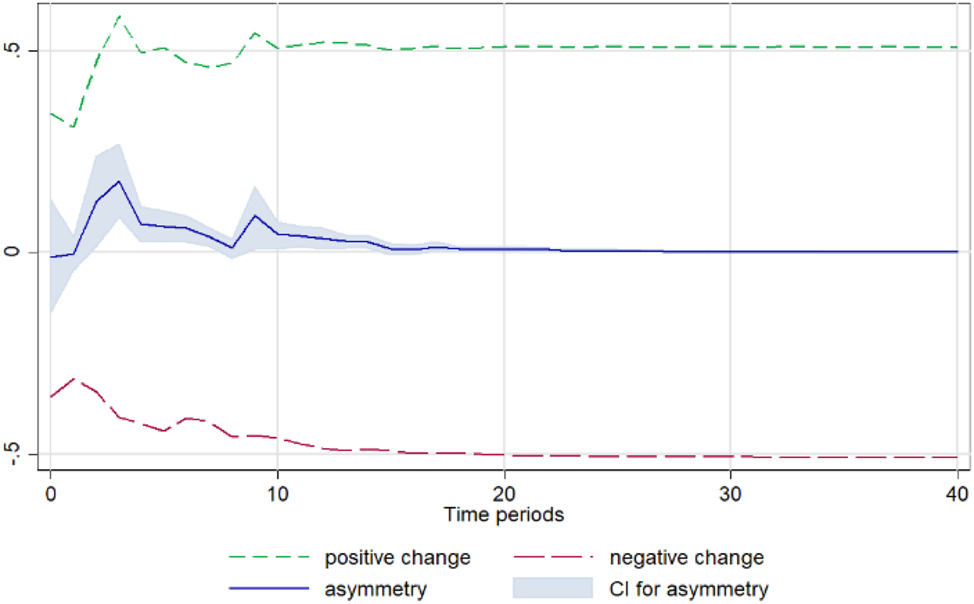

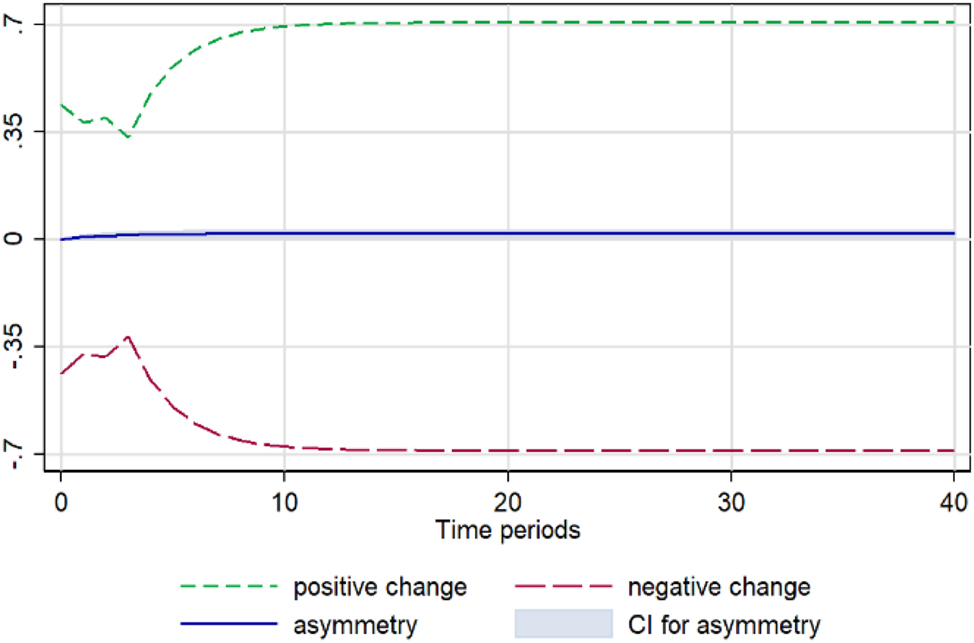

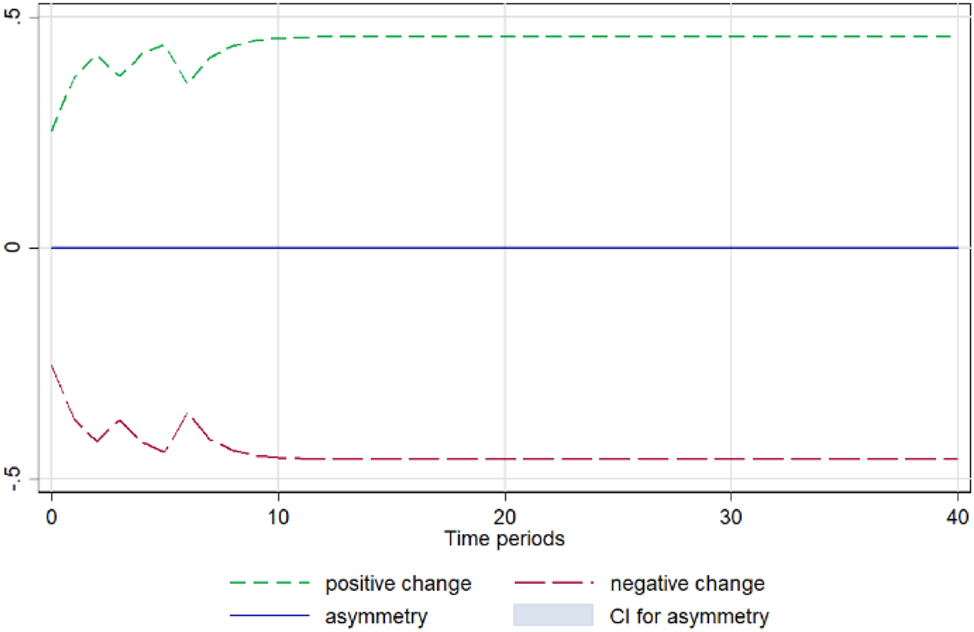

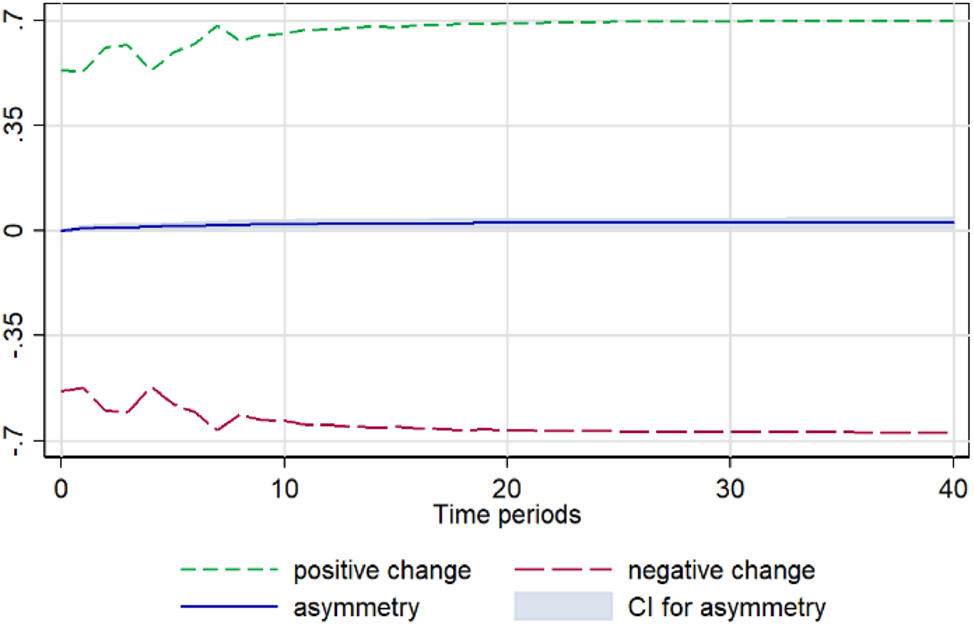

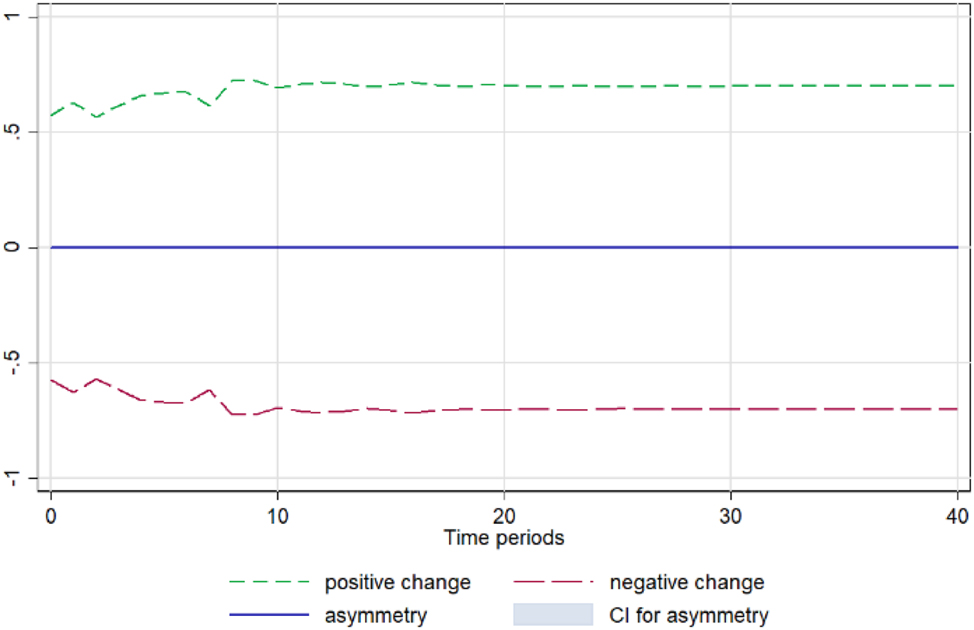

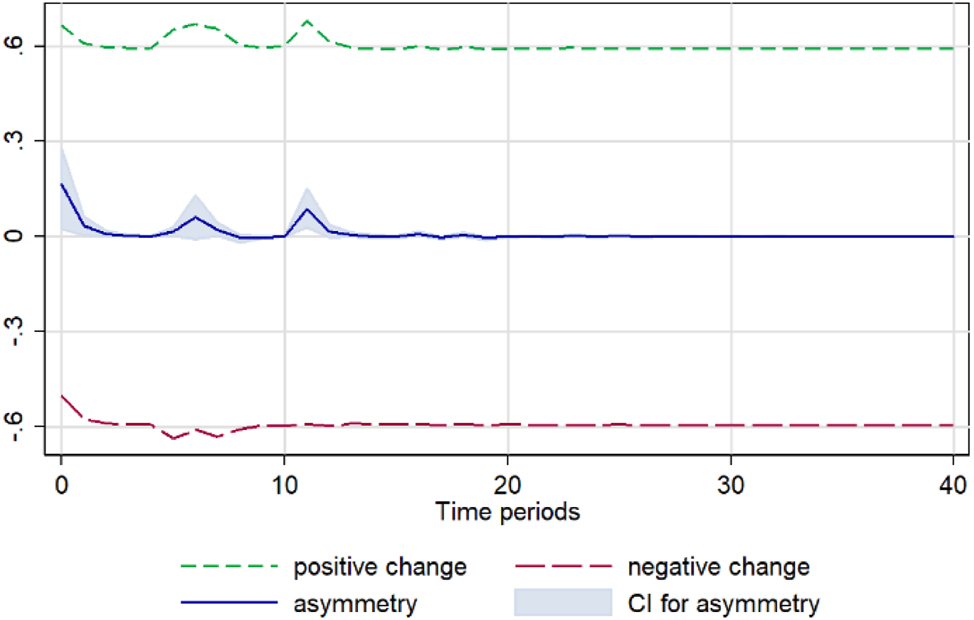

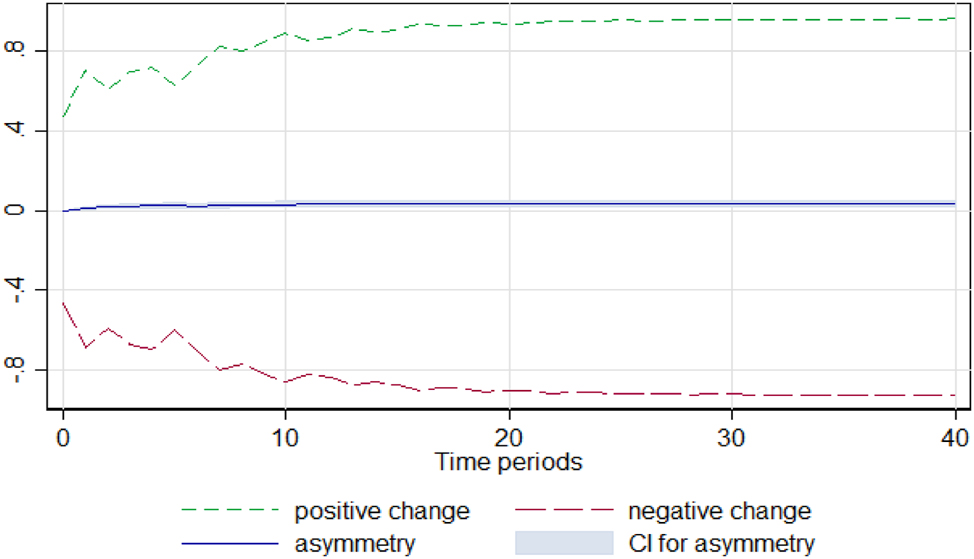

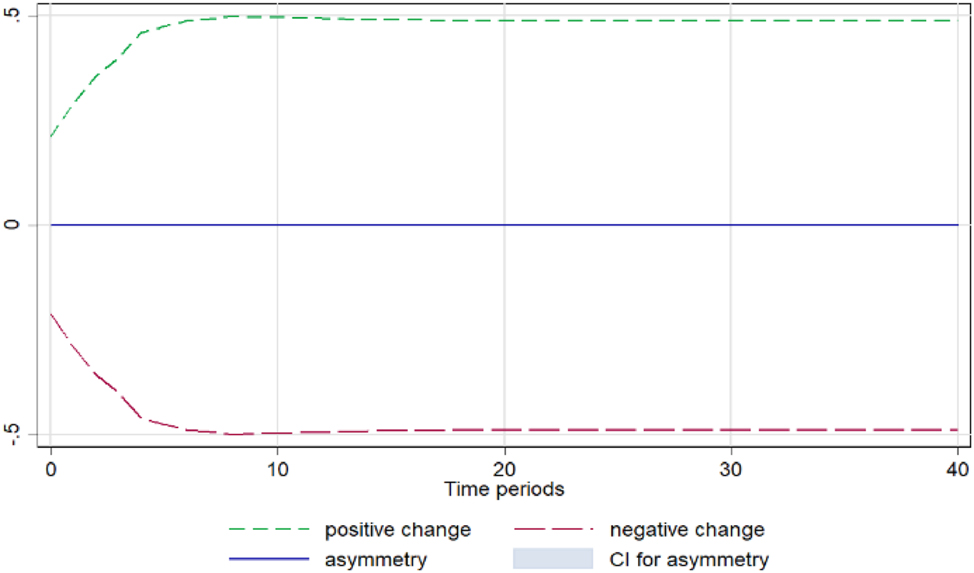

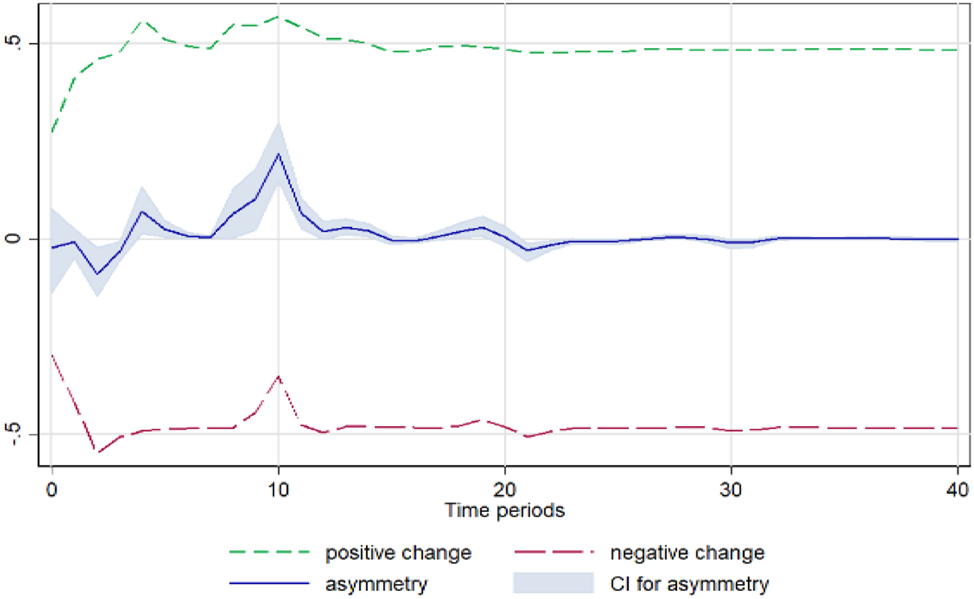

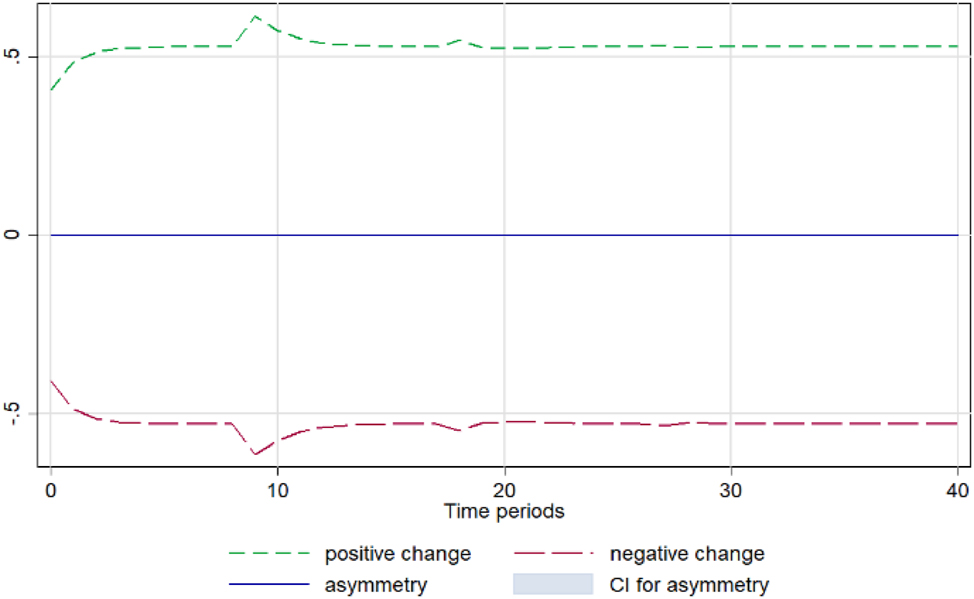

This Appendix presents the wholesale-retail prices dynamic multipliers for each product.

Wholesale-Retail Prices Dynamic Multipliers

See Figures A1, A2, A3, A4, A5, A6, A7, A8, A9, A10, A11, A12, A13, and A14.

Apple. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Cucumber. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Eggplant. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Fresh onion. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Greens. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Lemon. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Lettuce. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Onion. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Orange. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Pepper. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Potato. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Spinach. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Tomato. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Zucchini. Notes: 90 % bootstrap Confidence Interval is based on 200 replications. Source: Author’s calculations based on data from the Greek Ministry of Development and the Central Market.

Acknowledgements

This paper is based on Chapter 2 of my Ph.D. thesis at the Department of Economics of the Athens University of Economics and Business. I am indebted to Christos Genakos for helpful discussions and constructive criticism. I am also grateful to colleagues at the Hellenic Competition Commission, and especially to Ioannis Lianos and Ioannis Kalozymis for fruitful discussions and valuable comments. All errors are mine.

References

Apergis, N., and G. Vouzavalis. 2018. “Asymmetric Pass-Through of Oil Prices to Gasoline Prices: Evidence from a New Country Sample.” Energy Policy 114: 519–28. https://doi.org/10.1016/j.enpol.2017.12.046.Suche in Google Scholar

Atil, A., A. Lahiani, and D. K. Nguyen. 2014. “Asymmetric and Nonlinear Pass-Through of Crude Oil Prices to Gasoline and Natural Gas Prices.” Energy Policy 65: 567–73. https://doi.org/10.1016/j.enpol.2013.09.064.Suche in Google Scholar

Bachmeier, J. L., and M. J. Griffin. 2003. “New Evidence on Asymmetric Gasoline Price Responses.” The Review of Economics and Statistics 85 (3): 772–6. https://doi.org/10.1162/003465303322369902.Suche in Google Scholar

Bacon, R. W. 1991. “Rockets and Feathers: The Asymmetric Speed of Adjustment of U.K. Retail Gasoline Prices to Cost Changes.” Energy Economics 13 (3): 211–8. https://doi.org/10.1016/0140-9883(91)90022-R.Suche in Google Scholar

Bajo-Buenestado, R., and M. Á. Borrella-Mas. 2022. “The Heterogeneous Tax Pass-Through Under Different Vertical Relationships.” The Economic Journal 132: 1684–708. https://doi.org/10.1093/ej/ueac007.Suche in Google Scholar

Banerjee, A., J. Dolado, and R. Mestre. 1998. “Error‐Correction Mechanism Tests for Cointegration in a Single‐Equation Framework.” Journal of Time Series Analysis 19 (3): 267–83. https://doi.org/10.1111/1467-9892.00091.Suche in Google Scholar

Bareith, T., I. Fertő, and S. Podruzsik. 2025. “Price Transmission in the Hungarian Pork Market.” Agriciltural and Food Economics 13: 11. https://doi.org/10.1186/s40100-025-00353-x.Suche in Google Scholar

Borenstein, S., Cameron A. Colin, and R. Gilbert. 1997. “Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes?” The Quarterly Journal of Economics 112 (1): 305–39. https://doi.org/10.1162/003355397555118.Suche in Google Scholar

Chavas, J.-P., and F. Pan. 2020. “The Dynamics and Volatility of Prices in a Vertical Sector.” American Journal of Agricultural Economics 102: 353–69. https://doi.org/10.1093/ajae/aaz038.Suche in Google Scholar

Delatte, A. L., and A. Lopez-Villavicencio. 2012. “Asymmetric Exchange Pass-Through: Evidence from Major Countries.” Journal of Macroeconomics 34 (3): 833–44. https://doi.org/10.1016/j.jmacro.2012.03.003.Suche in Google Scholar

Deltas, George. 2008. “Retail Gasoline Price Dynamics and Local Market Power.” The Journal of Industrial Economics LVI (3): 613–28. https://doi.org/10.1111/j.1467-6451.2008.00350.x.Suche in Google Scholar

European Competition Network. 2012. ECN Activities in the Food Sector.Suche in Google Scholar

Fousekis, P., C. Katrakilidis, and E. Trachanas. 2016. “Vertical Price Transmission in the US Beef Sector: Evidence from the Nonlinear ARDL Model.” Economic Modelling 52 (2): 499–506. https://doi.org/10.1016/j.econmod.2015.09.030.Suche in Google Scholar

Frey, G., and M. Manera. 2007. “Econometric Models of Asymmetric Price Transmission.” Journal of Economic Surveys 21 (2): 349–415. https://doi.org/10.1111/j.1467-6419.2007.00507.x.Suche in Google Scholar

Gopinath, G., R. Rigobon, and O. Itskhoki. 2010. “Currency Choice and Exchange Rate Pass-Through.” American Economic Review 100 (1): 304–36. https://doi.org/10.1257/aer.100.1.304.Suche in Google Scholar

Granger, Clive W. J., and G. Yoon. 2002. “Hidden Cointegration.” University of California. Economics Working Paper No. 2002-02, Available at SSRN: https://ssrn.com/abstract=313831 (accessed April 23, 2025).10.2139/ssrn.313831Suche in Google Scholar

Greenwood-Nimmo, M., Y. Shin, T. van Treeck, and B. Yu. 2013. “The Decoupling of Monetary Policy from long-term Rates in the U.S. During the Great Moderation.” Working paper, Available at SSRN: https://ssrn.com/abstract=1894621 (accessed April 22, 2025).10.2139/ssrn.1894621Suche in Google Scholar

Hellenic Competition Commission. Fruits and Vegetables Sectorial Study. 2013. Summary available at (in Greek): https://www.taxheaven.gr/pagesdata/EKTHESI/PERILIPSI.pdf, and Appendix1 available at (in Greek): https://www.taxheaven.gr/pagesdata/EKTHESI/PARARTHMAi.pdf (accessed April 7, 2025).Suche in Google Scholar

Hellenic Statistical, Authority. 2013. Household Budget Survey. Available at (in Greek): https://www.statistics.gr/el/statistics/-/publication/SFA05/2013 (accessed April 7, 2025).Suche in Google Scholar

Lundberg, C., T. Skolrud, B. Adrangi, and A. Chatrath. 2021. “Oil Price Pass Through to Agricultural Commodities.” American Journal of Agricultural Economics 103: 721–42. https://doi.org/10.1002/ajae.12088.Suche in Google Scholar

Meyer, J., and S. von Cramon-Taubadel. 2004. “Asymmetric Price Transmission: A Survey.” Journal of Agricultural Economics 55 (3): 581–611, https://doi.org/10.1111/j.1477-9552.2004.tb00116.x.Suche in Google Scholar

Nakamura, E. and D. Zerom. 2010. “Accounting for Incomplete Pass-Through.” Review of Economic Studies 77 (3): 1192–230. https://doi.org/10.1111/j.1467-937X.2009.589.x.Suche in Google Scholar

Panagiotou, D. 2021. “Asymmetric Price Responses of the US Pork Retail Prices to Farm and Wholesale Price Shocks: A Nonlinear ARDL Approach.” The Journal of Economic Asymmetries 23: e00185. https://doi.org/10.1016/j.jeca.2020.e00185.Suche in Google Scholar

Peltzman, Sam. 2000. “Prices Rise Faster Than They Fall.” Journal of Political Economy 108 (3): 462–502. https://doi.org/10.1086/262126.Suche in Google Scholar

Pesaran, M. H., and Y. Shin. 1998. “An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis.” In Econometrics and Economic Theory: The Ragnar Frisch Centennial Symposium, edited by S. Strom. Cambridge: Cambridge University Press.Suche in Google Scholar

Pesaran, M. H., Y. Shin, and J. R. Smith. 2001. “Bounds Testing Approaches to the Analysis of Level Relationships.” Journal of Applied Econometrics 16 (3): 289–326. https://doi.org/10.1002/jae.616.Suche in Google Scholar

Polemis, M., and M. Tsionas. 2016. “An Alternative Semiparametric Approach to the Modelling of Asymmetric Gasoline Price Adjustment.” Energy Economics 56 (3): 384–8. https://doi.org/10.1016/j.eneco.2016.04.004.Suche in Google Scholar

Rahman, M. C., V. O. Pede, and J. Balié. 2022. “Welfare Impact of Asymmetric Price Transmission on Rice Consumers in Bangladesh.” Review of Development Economics 26: 1600–17. https://doi.org/10.1111/rode.12882.Suche in Google Scholar

Remer, M. 2015. “An Empirical Investigation of the Determinants of Asymmetric Pricing.” International Journal of Industrial Organization 42 (3): 46–56. https://doi.org/10.1016/j.ijindorg.2015.07.002.Suche in Google Scholar

Rezitis, N. A.. 2019. “Investigating Price Transmission in the Finnish Dairy Sector: An Asymmetric NARDL Approach.” Empirical Economics 57 (3): 861–900. https://doi.org/10.1007/s00181-018-1482-z.Suche in Google Scholar

Shin, Y., B. Yu, and M. Greenwood-Nimmo. 2014. “Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework.” In Festschrift in Honor of Peter Schmidt, edited by R. Sickles, and W. Horrace, 281–314. New York: Springer.10.1007/978-1-4899-8008-3_9Suche in Google Scholar

Tripathi, A. K. 2024. “Price Support Policy and Market Price Dynamics: The Case of Indian Wheat.” Agricultural Economics 55: 412–27. https://doi.org/10.1111/agec.12825.Suche in Google Scholar

Verheyen, F. 2013. “Exchange Rate Nonlinearities in EMU Exports to the U.S.” Economic Modelling 32 (1): 66–76. https://doi.org/10.1016/j.econmod.2013.01.039.Suche in Google Scholar

Ward, R. W. 1982. “Asymmetry in Retail, Wholesale, and Shipping Point Pricing for Fresh Vegetables.” American Journal of Agricultural Economics 64 (2): 205–12. https://doi.org/10.2307/1241124.Suche in Google Scholar

Yang, J. 2007. “Is Exchange Rate Pass-Through Symmetric? Evidence from US Imports.” Applied Economics 39 (2): 169–78. https://doi.org/10.1080/00036840500427320.Suche in Google Scholar

© 2025 Walter de Gruyter GmbH, Berlin/Boston