Abstract

This paper surveys the literature on the economic effects of sanctions on Iran, with a principal focus on those imposed after 2006. We discuss the challenges of isolating the impacts of sanctions and evaluate recent methodological approaches used to measure causal effects. Specifically, we focus on the application of the synthetic control method to disaggregate the exogenous and endogenous factors responsible for economic underperformance in Iran. We review studies on the macroeconomic impacts of Iran sanctions and examine those that focus on the sectoral effects of sanctions. Our survey reveals a large and growing body of literature that remains incomplete. There are significant gaps in the existing research on the impact of sanctions. Iran will likely remain the most important case study as researchers seek to fill those gaps.

1 Introduction: What are Economic Sanctions and Their Goals?

American President Woodrow Wilson once described economic sanctions as a “peaceful, silent, deadly remedy.” Wilson believed in the unique power of economic warfare, which would exert “a pressure… no modern nation could resist” (Hufbauer, Gary, and Jeffrey 2016, p. 1). A century after Wilson’s assessment, the power of economic sanctions is more evident than ever before. Economic sanctions have been shown to be a uniquely powerful, and even deadly, policy tool that blurs the lines between statecraft and warfare. Nowhere is this clearer than in Iran, which has emerged as the most important case study in debates over the prudence and efficacy of sanctions. Iran has been the focus of major multilateral (2006–2016) and unilateral (2018 to present) sanctions campaigns. These sanctions have had significant deleterious impacts on the country’s economic performance. The sanctions imposed on Iran remain the most stringent in the world and cover Iranian sectors, entities, and individuals under layered authorities related to nuclear proliferation, terrorism, and human rights issues. These sanctions have caused or contributed to a wide range of negative macroeconomic outcomes including rapid currency devaluation, severe trade and fiscal deficits, elevated inflation, and rising poverty rates. Iran has been unable to truly mitigate or resist the economic pressures exerted by sanctions.

Even so, as the sanctions on Iran have intensified, policymakers have debated the efficacy of such measures in relation to two main goals—punishment and compliance. According to Galtung (1967), the general theory of economic sanctions involves measures imposed by international actors (“senders”) against other actors (“receivers”) for the dual purpose of punishing the receivers through economic deprivation or coercing compliance with norms deemed important by the senders. Economic sanctions may also be imposed in response to domestic political pressures and the demands of civil society in the sender country. For example, international media coverage of human rights violations can generate political pressure, particularly in democratic countries, for sanctions to be imposed on the government or individuals engaged in the violations. Addressing domestic political demands can be considered a third goal of contemporary sanctions programs. A recent example of this can be seen in the new wave of sanctions imposed against the Iranian government in response to the suppression of countrywide protests that took place between September and December 2022 under the slogan of “Woman, Life, Freedom.”[1]

The stringent sanctions imposed on Iran have certainly punished the country, and by extension, its people. These sanctions have also allowed Western policymakers to respond to domestic constituents demanding robust action in response to human rights violations in Iran. However, the sanctions have not changed the behavior of the Iranian government—Iran remains noncompliant with a wide range of international norms. It continues to operate an unbridled nuclear program, support proxies across the Middle East, and engage in repression of its citizens at home. Recently, U.S. Treasury Secretary Janet Yellen acknowledged that despite the economic effects of U.S. sanctions on Iran, the desired change in behavior has not occurred. “Our sanctions on Iran have created real economic crisis in the country, and Iran is greatly suffering economically because of the sanctions … Has that forced a change in behavior? The answer is much less than we would ideally like,” she admitted (Lawder and Singh 2023).

Alongside the ongoing debates among policymakers about the efficacy of broad sanctions programs, academic researchers have sought to provide insights about how sanctions have impacted Iran’s political economy. The literature on the political justifications and effects of sanctions is extensive. Scholars shed light on how Iran’s elite have adopted a “resistance” doctrine and modified the country’s political and security institutions, thereby reducing the coercive effect of the measures. Nasr (2023) has argued that the reimposition of sanctions on Iran vindicated the anti-Western views of hardliners in the country who have turned to greater violence and repression. Other scholars have pointed to the possible counterproductive effects of sanctions, which can empower elite actors (Eichenberger and Stadelmann 2022). Batmanghelidj (2023) has argued that the economic disempowerment of ordinary Iranians has limited their capacity for political mobilization, leaving elites unaccountable to the electorate.

However, sanctions are ultimately economic weapons that seek to have political effects, namely changes in the receiver’s policies. The research focusing on the fundamental economic effects of sanctions is surprisingly limited. This paper surveys the literature on the economic effects of sanctions in Iran, with a principal focus on those measures imposed after 2006. It identifies that the scholarship remains beset by unresolved debates over research parameters and methodologies and significant gaps in the analysis of macroeconomic and sectoral effects. Without a more complete body of economic research to draw upon, policymakers lack the ability to comprehensively predict and assess the impact of sanctions, whether on Iran or any other country. They therefore struggle to explain why sanctions that impose significant economic pain can still fail to change the behavior of the receiver. Addressing these gaps in the research is vital given the increasing number of major sanctions programs worldwide—Iran will likely remain the most important case study as researchers seek to fill those gaps. This paper seeks to contribute to that effort by discussing the current state of the literature and its limitations.

2 Emergence of the Synthetic Control Method in the Literature

Understanding the purpose of sanctions at a theoretical level is far easier than identifying the real impact of such economic measures. In the case of Iran, significant debates persist as to whether it is possible to disaggregate the negative economic impacts of sanctions from those of domestic factors, such as government mismanagement, institutional weakness, and corruption. These debates are highly political—they are engaged in questions of whether the economic impact of sanctions is justified. Sanctions proponents ascribe the most egregious economic impacts of sanctions, such as those with humanitarian consequences, to domestic factors. Sanctions opponents argue that sanctions directly target civilians. Between these two positions, there is little doubt that sanctions precipitate a major external shock to the economy that can exacerbate economic challenges caused by domestic factors, especially in ways that lead to worse outcomes for ordinary people.

In Iran, both policymakers and members of the public tend to blame most of the country’s underperformance on domestic factors. Nationally representative surveys show that the majority of Iranians believe that economic mismanagement has a greater negative impact on the Iranian economy than sanctions (Gallagher et al. 2021). Iranian policymakers have likewise acknowledged that sanctions compound domestic mismanagement. In a January 2022 speech, Ayatollah Ali Khamenei, Iran’s Supreme Leader, referred to the role of mismanagement in the country’s economic performance, suggesting that “the main cause of these problems is not only sanctions, but also wrong decisions and shortcomings.”[2] This judgment is also reflected in an open letter by a group of Iranian economists in June 2022, emphasizing the governance deficit and lack of attention given by policymakers to recommendations by the academic community as main causes of economic problems in Iran.[3] Nevertheless, the letter’s signatories also acknowledge the significant role of sanctions in exacerbating both the state of the Iranian economy and the economic welfare of Iranians, suggesting that “The macroeconomic developments of the past decade, i.e. the period of unprecedented intensification of economic, financial, commercial, and technological sanctions, have had the most significant impact on the living conditions of households and the increase in the poverty rate.”[4]

The case of Iran highlights the difficulty in attributing a direct causal effect to economic sanctions. Researchers have sought to employ new econometric methods and develop new models to disentangle the macroeconomic and microeconomic effects of sanctions from the negative effects of mismanagement and other domestic factors. One recent methodology that has been used to isolate the causal effect of sanctions on a target economy is the synthetic control method (SCM). Newiak and Willems (2017) offer a clear explanation of SCM in a 2017 IMF working paper:

[SCM] involves constructing a ‘synthetic control’ for the treated unit. The synthetic control is constructed as a weighted average of units that do not undergo treatment over the sample period (the underlying idea being that a combination of non-treated units might make a better counterfactual than any individual one). The weights are chosen such that relevant economic characteristics in the synthetic control unit, match the treated unit as closely as possible in the pre-intervention period. By comparing the subsequent evolution of an outcome variable in the synthetic control unit with that of the treated unit, one can obtain an estimate of the treatment effect.

SCM is a data-driven and transparent statistical method that has gained widespread usage in the estimation of the causal impact of policies, shocks, and interventions on economic and social outcomes. As described by Susan Athey and Nobel laureate Guido W. Imbens (Athey and Imbens 2017), SCM offers a reliable means of identifying these effects:

The synthetic control approach developed by Abadie et al. (2010, 2015 and Abadie and Gardeazabal (2003) is arguably the most important innovation in the policy evaluation literature in the last 15 years […] The simplicity of the idea, and the obvious improvement over the standard methods, have made this a widely used method in the short period of time since its inception.

The validity of SCM in providing a credible interpretation of the effects of sanctions (the event of interest) rests on two fundamental assumptions (Gilchrist et al. 2023). The first assumption is that the intervention of interest (i.e. sanctions) should have no prior impact on the outcome of interest. The second assumption is that the sample countries used to create the counterfactual of the target economy should not have experienced measures equivalent to sanctions or significant comparable economic shocks, such as revolutions or large-scale wars. Countries that have experienced such comparable shocks would be excluded from the donor sample. However, SCM does consider global economic shocks that affect both the country under examination and the countries in the donor sample during the post-treatment period, such as the COVID-19 pandemic. For further information on the applications of SCM, see Abadie (2021), Cunningham (2021) and Gilchrist et al. (2023).

The effectiveness of SCM depends on the availability of data on economic outcomes, covering the pre-treatment and post-treatment periods (in this case, before and after sanctions) for both the affected country and the other countries in the control sample. SCM is particularly suitable in case studies where both the treated and control groups are small in size (Hodler 2019). It has become “widely regarded as one of the most trustworthy quasi-experimental methods for evaluating policies in political science and economics, especially when combined with supplementary analyses in the form of sensitivity and placebo tests” (Bonander 2018). The application of SCM across different fields, including the use of country-level data, is increasing in the literature. Recently, this approach was used in the case study of Iran to measure the economic costs of sanctions and the economic effects of major political shocks, such as the Islamic revolution of 1978–79 and the subsequent war with Iraq from 1980 to 1988. For instance, the estimated annual loss of income for an average Iranian during the Islamic revolution and war with Iraq is approximately 3000 US$ (Farzanegan 2022a). Using SCM, it is shown that revolution and war were key in the decreasing income inequality in Iran (Farzanegan and Kadivar 2023), mainly by damaging the economic status of higher income Iranians and the significant outmigration of the skilled labor force during this period. Life expectancy, as a key correlate of long term sustainable development, and its trend, as a result of revolution and war, were also examined using SCM by Farzanegan (2021). He found that the average Iranian’s life expectancy would have been approximately five years longer without the revolution and war.

In the context of the economic effects of sanctions, SCM has also been recently used in a few case studies of Iran. The first application of this methodology in this case was in the study by Gharehgozli (2017) who estimated a decline in Iranian GDP by 17 % in 2014, over the course of three years of sanctions (2012–2014). Her estimation shows that the relative to the synthetic Iran benchmark, Iran’s GDP was reduced by 12% in the first year after the sanctions. In a subsequent and more comprehensive study, Ghomi (2022) examined the macroeconomic and distributional effects of economic sanctions on Iran, using the SCM approach. The effects of international sanctions on Iran’s military spending is addressed in a study by Farzanegan (2022b), also using SCM. His counterfactual analysis shows that sanctions reduced the per capita annual military spending of Iran by 117 US $ between the period of 2013–2015. Based on Iran’s average population size post-2012, roughly 77 million, it is estimated that Iran’s military spending experienced an average reduction of approximately $9 billion per year from 2013 to 2015.

The use of SCM in estimating the impact of sanctions can effectively reduce the concern regarding the role of mismanagement or governance quality on the outcome of interest. To ensure the robustness and reliability of the estimate, it is important to select a donor sample of comparable countries that have similar institutional and governance performance as the receiver in the pre-sanction period. This helps to focus on the independent role of sanctions and to distinguish it from any impact by mismanagement or poor governance. By creating a counterfactual scenario that accurately represents the target’s socioeconomic characteristics and quality of governance before sanctions, SCM accounts for the potential influence that mismanagement or poor governance may have on the outcome. This allows for more accurate causal inferences to be made about the effect of sanctions and disentangles the impact of sanctions from other factors.

3 Studies on the Macroeconomic Effects of Sanctions

The use of SCM represents a relatively new addition to a large body of literature that examines the effects of international sanctions on various aspects of Iran’s economy, including the formal economy (Laudati and Pesaran 2023), informal economy (Farzanegan 2013; Farzanegan and Fischer 2021; Farzanegan and Hayo 2019; Moghaddasi Kelishomi and Nisticò 2023; Zamani et al. 2021), household welfare and women’s employment (Demir and Tabrizy 2022; Farzanegan, Khabbazan, and Sadeghi 2016; Gharibnavaz and Waschik 2018; Ghomi 2022; Khabbazan and Farzanegan 2016; Moghaddasi Kelishomi and Nisticò 2022), government expenditures and revenues (Dizaji 2014; Farzanegan 2011), militarization (Dizaji and Farzanegan 2021; Farzanegan 2022b), trade (Haidar 2017; Shirazi et al. 2016), finance (Torbat 2005), and business strategies (Cheratian et al. 2023).

In their recent study, Laudati and Pesaran (2023) provide a comprehensive examination of the impacts of economic sanctions on several key macroeconomic indicators in Iran, including oil exports, exchange rates, inflation, and output growth. The authors take a unique approach by introducing the first newspaper-based indicator to measure sanctions intensity. They examined published news on the sanctions, their imposition, the intensity of their use, as well as their occasional removals in daily newspapers such as the New York Times, Washington Post, Los Angeles Times, Wall Street Journal in the U.S. and the Guardian and Financial Times in the UK. While the authors use international media outlets to track the reflection and intensity of economic sanctions on Iran, this approach is not without shortcomings. There are well-established newspapers in Iran that have covered news of economic sanctions for decades and are likely to have more readership and influence in Iran than Western media outlets. The authors provide several reasons for avoiding the use of Persian newspapers for the news-based index of sanctions, including the political dimensions of the articles, the position of the Western media to cover such news given that they are based in sender countries, and the lack of sufficient Persian newspapers with reliable coverage of economic sanctions since the Islamic Revolution.[5]

Laudati and Pesaran apply structural vector autoregressive (SVAR) models, impulse responses, and variance decomposition methods to estimate the effects of positive shocks to the sanctions index on Iranian economic indicators from 1989 to 2019, excluding periods such as the Iranian Revolution, hostage crisis, war with Iraq, and COVID-19 pandemic. The authors find that the sanctions intensity variable, which ranges from 0 to 1, has a highly statistically significant impact on oil exports, exchange rates, inflation, and output growth but not on money supply growth. The authors conclude that in the absence of sanctions, Iran’s average annual growth could have been 4–5 %, compared to the realized 3 %.

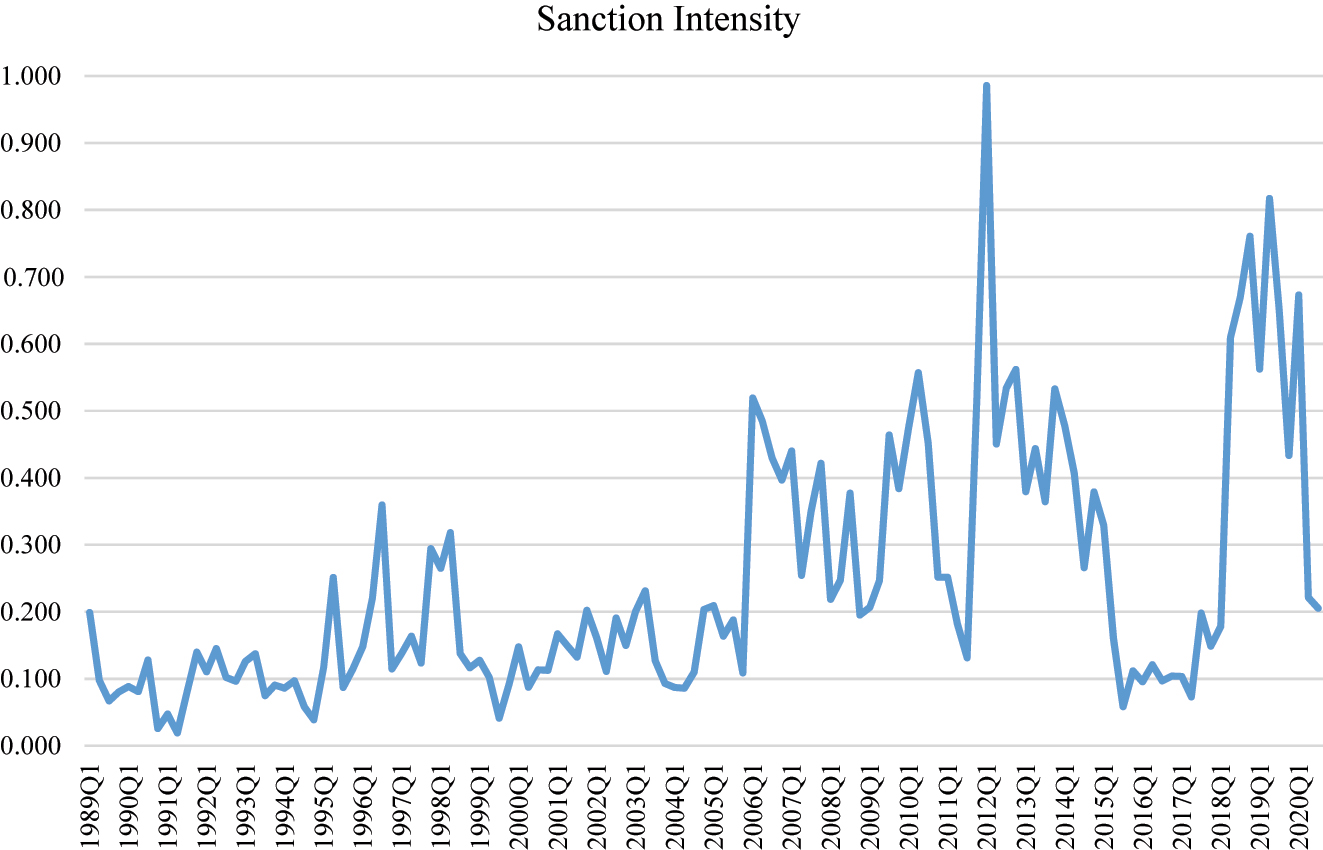

Figure 1 shows the news-based sanctions intensity index for Iran based on this study. Post-revolution Iran experienced different types of economic sanctions, imposed mainly by the U.S. The sanctions intensified in 2011–2012 during the government of Mahmoud Ahmadinejad and Iran’s nuclear program and decreased significantly during the Joint Comprehensive Plan of Action (JCPOA) (2016–2017) but then amplified in 2018 following the Trump administration’s decision to withdraw from the JCPOA and reimpose economic sanctions. While the authors were able to trace the response of the selected economic indicators to changes in the news-based sanctions index, they acknowledge the challenge of separating the role of mismanagement or governance from the effects of sanctions. We discussed in Section 2 that the synthetic control method may help to reduce this concern.

News-based economic sanctions for Iran.

Laudati and Pesaran also note that sanctions have also been associated with unintended positive outcomes for Iran, such as an increase in non-oil exports, higher foreign exchange diversification, expansion of the high-tech sector, which has become one of the region’s fastest-growing sectors, and significant advances in missiles and other military-related technologies.

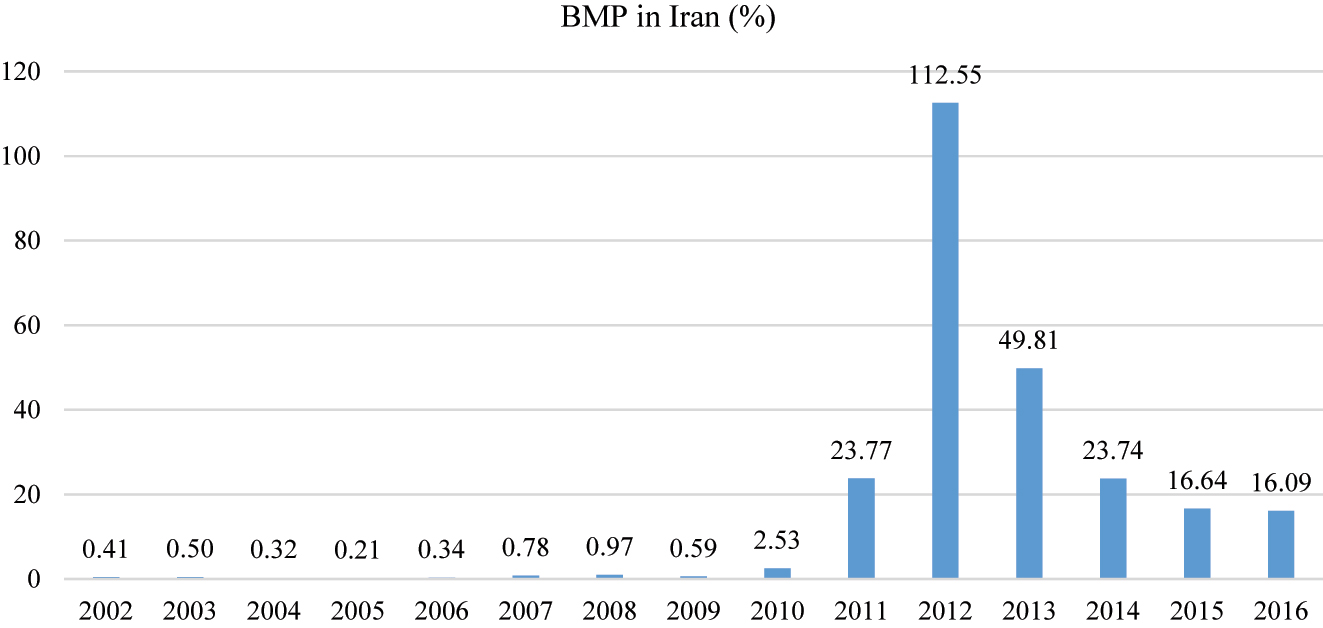

While the focus in measuring the economic costs of sanctions is mainly on the formal economy, a few studies have also provided initial insights on the possible responses of the informal, or shadow, economy to sanctions and their associated distorting effects. One of the first studies on the effects of economic sanctions on the informal economy of Iran was done by Farzanegan (2013) and later by Farzanegan and Hayo (2019). Both studies follow the narrow definition of the shadow economy as explained in detail by Schneider (2005), including all market-based legal production of goods and services that are deliberately concealed from public authorities. This definition of the shadow economy excludes the criminal activities in the illicit economy, such as drug and human trafficking. Farzanegan (2013) provides a descriptive examination on possible channels through which economic sanctions may increase the relative size of the informal economy, with particular focus on currency market distortion. He explains how a combination of higher demand for hard currencies during sanctions and economic uncertainties with a restricted supply of foreign currencies in the market due to oil embargos resulted in the increase of black market premiums (BMP) for major currencies, such as the USD or Euro (i.e. the gap between the free and official exchange rates). The increase of BMP is shown to be a driver of trade mis-invoicing and smuggling, especially for those economic agents who have access to foreign currencies at official subsidized rates. The destructive effect of BMP on increasing the size of the shadow economy and corruption is also shown in earlier studies such as Farzanegan (2009). Empirical support for the contribution of sanctions (measured by negative oil rents shocks) on BMP in Iran is provided by Zamani et al. (2021). Of course, the final effect of BMP on smuggling may depend on the access of traders to official subsidized exchange rates and their political connections. Greater access increases the incentive for rent-seeking and benefiting from growing BMP under sanctions. For petty traders with no access to subsidized exchange rates, a higher BMP may imply higher costs of import smuggling. This mixed effect is also explained in a study on global smuggling by Buehn and Farzanegan (2012). Figure 2 shows the BMP calculated as the relative difference between official and free exchange rates for rial versus USD. A growing BMP in Iran was not limited to the sanctions period. It was also observed during the currency crisis in the early 1990s, in which BMP reached the record highs of almost 2000 %.

The gap between official and black market exchange rate for the U.S. Dollar in Iran (%). Source: https://tsd.cbi.ir/ (Note: Following cyberattacks over the Mahsa Amini protests at the end of 2022, access to the Central Bank of Iran website has been restricted from non-Iranian IP addresses).

While the study of Farzanegan (2013) provides a descriptive analysis of the potential channels through which sanctions have expanded the informal economy in Iran, the study by Farzanegan and Hayo (2019) presents the first empirical evidence using province-level data and a novel approach to measure the growth rate of Iran’s shadow economy. The researchers employ nighttime light data, which consists of two components: one related to officially measured economic activity and the other related to the shadow economy. To measure the development of the shadow economy at the province level, they calculate the difference between growth rates in nighttime lights and the officially reported real GDP for the period of 2001–2013. They investigate whether the impact of sanctions on the shadow economy is stronger or weaker compared to the official GDP. To identify the effect of oil sanctions, they utilize a dummy variable that is set to 1 in 2012 and 2013, and 0 otherwise. Through fixed effects and dynamic GMM estimations, they find that “international sanctions imposed on Iran in 2012/2013 not only reduced the real GDP growth rate but also the growth rate of the shadow economy.” Importantly, their findings reveal that the absolute impact of sanctions on the shadow economy is both economically and statistically larger than the effect on the formal economy. This means that sanctions not only significantly reduced the size of the formal economy, but also substantially damaged activities in the informal economy, leading to increased unemployment and inflation rates and reduced purchasing power of households. Consequently, there is lower demand for all goods and services in the economy. This study suggests that the informal economy is more vulnerable to economic uncertainties under economic sanctions.

In a related study, Farzanegan and Fischer (2021) investigated the impact of lifting sanctions on the development of the shadow economy in Iran following the JCPOA. To measure the size of the shadow economy across Iran’s provinces, they followed the approach of Farzanegan and Hayo, but used a longer time series and an improved version of nighttime lights (the DMSP/OLS and VIIRS/DNB harmonized dataset), spanning from 1992 to 2018. Specifically, they utilized version 2 of the harmonized global NTL dataset by Li and Zhou (2017) and introduced a dummy variable taking the value of 1 during the JCPOA years (2016 and 2017), and 0 otherwise. Using panel fixed effects regressions, their study revealed a consistent and robust positive effect of the lifted sanction dummy variable on the growth rate of Iran’s shadow economy. They argued that the shadow economy is more flexible and can respond faster to positive or negative economic shocks than the formal sector, as businesses and workers in the informal economy are not bound by administrative procedures or hiring practices. Moreover, their results were in line with the observed cyclical trends in the shadow economy, which suggest that the informal sectors in emerging and developing economies experience more significant output changes during the business cycle than in developed countries (Elgin et al. 2021).

While the above studies provide useful evidence on the effects of sanctions on Iran’s formal and informal economies, other studies present more detailed insights on household welfare and effects on employment and gender. A recent study by Ghomi (2022) quantifies the aggregate and heterogeneous effects of economic sanctions on Iran between 2012 and 2015. For his analysis, he used SCM to generate a counterfactual Iran that is like the pre-sanction Iran but did not experience sanctions like the factual Iran. His findings show a “considerable, severe, and persistent effect of the sanctions on the Iranian economy.” Over the four years of sanctions before the JCPOA in 2016, the decline in Iran’s overall GDP compared to its counterfactual reached a maximum level of 19 % in 2015. These negative effects persisted for two years after the lifting of the sanctions. His results on the decline of the GDP is in line with the findings of Gharehgozli (2017). However, his study goes further by providing evidence on the distributional effects of the sanctions. His research hypothesis implied that “households with some access to political or economic resources and rents will normally suffer less by trying to use and re-distribute the scarce resources in their favor” while the more vulnerable classes may suffer more significantly from the volatility caused by sanctions. For his micro analysis, he used the household income and expenditure survey (HIES) data provided by the Statistical Center of Iran. He found that “about 10 % of the households in Round 1 moved into poverty during the sanction years and just a maximum of 6 % could move out of poverty.” Importantly, his results show that “rural, young, and low-educated households, households working in the private sector, religious minorities, and households belonging to the low and middle-income group have the highest rate of moving into poverty in the sanction period, while households working in the public sector and high educated households are suffering the least.” This finding can also be seen in line with the results of Farzanegan and Hayo, which suggest the more substantial decline of Iran’s informal economy compared to the formal economy under sanctions. Given that participants in the informal economy are often in the vulnerable groups of society, their results are consistent with the micro evidence provided by Ghomi. In short, Ghomi’s study suggests that sanctions do not punish the government or well-connected groups of the target’s economy but rather increase the suffering of the poorer households and powerless classes.

Using a computable general equilibrium (CGE) model, Gharibnavaz and Waschik (2018) examine the effects of sanctions on urban and rural households in Iran. They supplement the Global Trade Analysis Project 8 data set using income and expenditure shares from the Urban and Rural Household Income and Expenditure Survey by the Statistical Center of Iran (SCI). Their results communicate a similar message from Ghomi’s study that used SCM. They also examine the effects of sanctions on Iranian exports and imports by commodity for oil and petrochemical exports and imports of petroleum products, metal products, and motor vehicles. They show that international sanctions decreased aggregate Iranian welfare by about 15 %. They also find the decrease in the welfare of rural households during sanctions was almost two times of those in urban regions. The poorest urban and rural households also experienced the largest losses in their welfare. Finally, they show that sanctions result “in reductions in real government revenue of 40–50 %”.

Farzanegan, Khabbazan, and Sadeghi (2016) examine the social accounting matrix (SAM) of Iran with a CGE model to simulate various scenarios in which the exportation of oil from Iran to the rest of the world is banned due to an embargo. Their results show that under oil sanctions, higher-income households in both urban and rural areas have higher welfare losses than lower-income households. Moreover, while labor income increased under oil sanctions, capital income fell. In another study using SAM and CGE, Khabbazan and Farzanegan (2016) focus on banking sanctions and how they may influence both macro indicators and the welfare of Iranian households. To better understand how banking sanctions influence Iranian households, they split banking sanctions into three sub-banking sanctioning scenarios: export-only, import-only, and financial-only sanctioning scenarios. They conclude that banking sanctions have a greater negative impact compared to oil sanctions by pushing the country towards autarchy, resulting in inflation, soaring exchange rates, and decreased GDP. Additionally, higher-income households are more vulnerable to welfare losses than lower-income households in both urban and rural areas. The study also finds that bans on exports have a greater negative impact on Iranian households compared to embargos on imports and foreign investments.

Some impacts of sanctions on household welfare can be found by examining their effects on the levels of and compositions of government expenditures. Measuring economic sanctions through negative changes in oil revenues, Farzanegan (2011) employs the VAR model, impulse response functions, and variance decomposition methods to learn about the response of different types of government spending to such shocks. Data from 1959 to 2007 was used to identify the dynamics between variables and simulate the response of spending to a possible shock in oil rents. The result of this study is that the military spending of Iran responds significantly to negative oil shocks while non-military spending responses are insignificant. In a time-series analysis based on an autoregressive distributed lag (ARDL) model using data from 1960 to 2017, Dizaji and Farzanegan (2021) define different binary variables to capture the unilateral and multilateral sanctions and their corresponding degrees of intensity. They examine how Iran’s military spending changed during different phases and types of sanctions. They show that an increase in the intensity of sanctions is associated with a larger decrease in military spending in both the short and long run. They also found that in both cases, the multilateral sanctions have a statistically significant negative effect on the military spending of Iran. In short, these studies show that the Iranian government adjusts its military budget under sanctions. However, a negative adjustment may not always be the case. This depends on the dominance of the income effects of sanctions versus the security effects. If security risks under sanctions exceed the income effects, there may even be an increase in the militarization of the country, as also presented in the theoretical framework of Dizaji and Farzanegan (2021). Given the significant positive linkages of military spending and economic growth in Iran found by Farzanegan (2014), one may see sanctions as a double burden on the Iranian economy. They not only directly reduce economic growth, but lower military expenditures may further decrease growth rates. The possible positive spillover effects of military spending on growth are discussed under the Keynesian hypothesis in which more military expenditures increase the aggregate demand in the economy. Sanctions, by increasing the security risks of the target country far beyond reducing the income, may force the state to reallocate its limited budget from non-military (education, culture, and health) to military projects. This reallocation of resources may hamper investment in its health infrastructure and ability to improve the welfare of human resources in the health sector. The latter may also force the outmigration of highly skilled health experts. In addition to sanctions, the quality of political institutions may also amplify this reallocation effect. As shown by Dizaji, Farzanegan, and Naghavi (2016), “in an autocracy, the state considers only its self-interest and makes decisions to maximize rents and secure its assets against potential losses. A democratic government acts as a representative voice of the people, choosing policies that maximize the well-being of the population, i.e. workers.” Sanctions amplify the distortionary effects of autocratic institutions by cutting education and health budgets.[6]

International trade and how it changes under sanctions can significantly influence welfare levels in the target’s economy. Haidar (2017) investigated the effectiveness of export sanctions on 35,953 non-oil exporters under the 2008 export sanctions. He argues that the key goal of export sanctions is to force the target country to alter its political behavior by reducing its total welfare. This goal is supposed to be achieved either directly by increasing the economic costs of a specific behavior or indirectly through increasing the probability of riots, social revolution, and coups. He concludes “in aggregate, two-thirds of Iranian exports damaged by sanctions were deflected to non-sanctioning countries.” This imposed more costs because exporters needed to reduce their export prices. Therefore, export deflection resulted in welfare losses.

We may also compare the sizes of the effects of sanctions in the case studies of Iran with estimations presented in other studies. A direct comparison can be challenging due to the type, coverage, and intensity of the sanction, as well as its senders and the pre-sanction socio-economic and institutional conditions of the target. Such differences are highlighted by Torbat (2005), showing that the effect of sanction depends on its type. In the case of Iran, he found that financial sanctions are more effective in reducing GDP than trade sanctions, a finding which is in contrast with the results of Kwon et al. (2020). The estimated effect of sanctions on Iran’s real GDP, using counterfactual analysis, is estimated to be between 17 % (Gharehgozli 2017) and a maximum of 19 % (Ghomi 2022) for the first three to four years after the sanctions (2012–2015). Ghomi (2022) also shows that Iran’s GDP remained below its counterfactual two years after the removal of nuclear sanctions between 2015 and 2017. In 2017, Iran’s GDP was still 5 % below the GDP of its synthetic version. Laudati and Pesaran (2023)’s estimation shows that in the absence of sanctions, Iran’s average annual growth could have been 4–5 %, as compared to the realized 3 %.

These estimations can be compared with the available estimated effects in other studies for a larger sample of countries.[7] For example, Gutmann, Neuenkirch, and Neumeier (2023) use a panel-data event study design and find a decline of 2.8 % in the target country’s GDP per capita over the first two years of a sanction episode. They also find no recovery during the first three years following the removal of sanctions. Neuenkirch and Neumeier (2015) focus on UN and U.S. economic sanctions and their effects on GDP growth. They use panel fixed effects regression for a sample of 160 countries (of which 67 experienced economic sanctions) in between 1976 and 2012. They show that UN sanctions reduce the target state’s annual real GDP per capita growth rate by more than two percentage points (pp). The UN sanctions led to an aggregate decline in GDP of 25.5 %. The adverse effects of the UN sanctions last for up to 10 years. The effects of U.S. sanctions on annual GDP per capita growth rates are weaker and are estimated to be about one pp. The U.S. sanctions result in an aggregated decline of 13.4 % in GDP with a shorter duration of seven years.

There is general agreement on the economic costs of sanctions. However, the sanctions have not led to the collapse of the Iranian political system or resulted in any significant changes in its political behavior. In particular, the reimposition of sanctions by the Trump administration under the “maximum pressure” campaign did not result in a regime change or in stopping Iranian nuclear and military projects. In contrast, we have observed the amplification of such projects in Iran due to increased security risks following countrywide protests at the end of 2022. The success rate of economic sanctions in changing the target’s political behavior decreases after the initial three years (Dizaji and van Bergeijk 2013; van Bergeijk 2012) mainly because the economic system adjusts to a new situation and reaches a new equilibrium that is worse than a no-sanction scenario. In the case of Iran, a recent study by Cheratian et al. (2023) examines the strategies of micro, small, and medium-sized enterprises to neutralize the effects of sanctions. They use original survey data collected from 486 firms in five different provinces in Iran between December 2019 and September 2020. Their analysis shows that strategies such as cutting marketing costs, overhead expenses, and research and development (R&D) expenditures and increasing investment in information technology can enhance a firm’s resilience against sanctions. Factors such as having a solid business plan, access to finance and technology, well-educated owners, a focus on exporting, and connections to other businesses also affect a firm’s ability to withstand sanctions. It is interesting to note that some of these strategies, such as cutting R&D, may help these firms survive in the short term but may be harmful for the overall economy in the long run as they can decrease business productivity, efficiency, and competitiveness in the global markets.

Table 1 provides an overview of selected studies on the macroeconomic and welfare effects of sanctions (and their removals) on both the formal and informal economies of Iran.

Selected studies on sanctions and macroeconomic effects for the case of Iran.

| Study | Key question/focus | Data and methodology | Key results |

|---|---|---|---|

| Effect of sanctions on the formal economy | |||

|

|

|||

| Laudati and Pesaran (2023) | Identification and quantitative estimation of sanctions on the Iranian economy | Calculation of sanctions intensity based on daily newspaper coverage; Sample quarterly period 1989–2019; structural VAR and impulse response analysis are used. | In the absence of sanctions, Iran’s average annual growth could have been around 4–5 %, as compared to the 3 % realized. |

| Ghomi (2022) | To quantify the aggregate and heterogeneous effects of international sanctions on Iran | Synthetic control method with annual panel country level data from 1990 to 2017; treatment year (sanction) is 2011; sanction period is 2012–2015; Outcome variables are growth rate of real GDP per capita & poverty indicators; composition of synthetic Iran includes Saudi Arabia, Nigeria, Greece, Korea, Sudan, Algeria, and China. |

Outcome of GDP: In the first year of the treatment, Iran’s real GDP drops 7.74 %, resulting in a 12.5 % cost compared to the synthetic economy, mostly due to the decline in oil exports. While the synthetic economy grows slowly during the sanction years, the treated economy either shrinks or slowly recovers after 2013. By the end of 2015, the total GDP cost for Iran relative to synthetic Iran exceeds 19.1 %. |

Outcome of poverty:

|

|||

| Gharehgozli (2017) | The effects of post-2011 sanctions on Iran’s GDP (total and per capita) | Synthetic control method with annual country level panel data for the period 1980–2014; Treatment year (2011) as start of international sanctions on Iran; Pre-treatment period 1995 to 2011 (validation period); Iran’s counter-factual in the case of GDP as the outcome variable is best reproduced by a weighted average of Canada, United Arab Emirates, Turkey, Algeria, Saudi Arabia, and China. |

Outcome of GDP: Iran’s actual GDP experienced a significant drop after 2011 while the synthetic Iran’s GDP continued to grow. In 2014, Iran’s GDP was $271.3 billion lower than it would have been without sanctions, resulting in a 17.3 % drop over three years. Compared to the synthetic Iran, Iran’s GDP decreased by 12.0 % in the first year after the sanctions. In 2014, real GDP per capita would have been 3236.8 US$ higher if no sanctions were imposed. In other words, real GDP per capita suffers a 16.4 % drop over the three years after sanctions. |

| Gharibnavaz and Waschik (2018) | Effects of sanctions on the Iranian economy in general and on upper- and lower-income rural and urban Iranian households, as well as the Iranian government | Using a computable general equilibrium (CGE) model with the Global Trade Analysis Project 8 data set supplemented by income and expenditure shares from the urban and rural household income and expenditure survey by the statistical centre of Iran (SCI). |

|

| Farzanegan, Khabbazan, and Sadeghi (2016) | Effects of oil sanctions on macroeconomic and household welfare in Iran | Using a computable general equilibrium (CGE) model based on a social accounting matrix (SAM). Simulate selected scenarios in which the exportation of oil from Iran is banned. |

|

| Khabbazan and Farzanegan (2016) |

|

Using the SAM-based standard computable general equilibrium (SCGE) model. |

|

| Effect of sanctions on the informal or shadow economy | |||

|

|

|||

| Farzanegan and Hayo (2019) | Effects of sanctions on the shadow economy of Iran | Fixed effect and GMM regressions, province level data from 2001 to 2013; using nighttime lights data to calculate the relative development of the shadow economy growth rate and using a sanction dummy variable for 2012–2013 period. |

|

| Farzanegan and Fischer (2021) | Effects of lifting of sanctions on the shadow economy (SE) of Iran | Using a regression analysis with ordinary least squares and province-fixed effects & unbalanced panel data of 31 Iranian provinces from 2001 to 2018. The dependent variable, the measurement of SE growth, is the difference between the growth rates of nighttime lights and GDP. The key explanatory dummy variable takes the value 1, if the year is 2016 or 2017, which were the two years of lifted sanctions and 0 otherwise. |

|

4 Studies on the Sectoral Effects of Sanctions

While numerous studies have examined the impact of economic sanctions on macroeconomic conditions, the microeconomic effects of the sanctions imposed on Iran have been less studied. Identifying sectoral and firm-level effects of sanctions is vital to understanding the ways in which the Iranian economy has responded to sanctions pressure. Research on the sectoral effects of sanctions tends to fall into two categories. One set of studies uses sectoral or firm-level data to examine the effects of sanctions on certain features of the economy, such as job growth, corporate profits, and supply chains. Another set of studies focuses on specific sectors, especially strategic sectors, such as Iran’s energy and automotive industries. A review of this sector-focused literature reveals a larger proportion of studies authored by academic researchers based in Iran.

Perhaps the most obvious sectoral impact of sanctions is the disruption to supply chains. Several studies have focused on trying to examine exactly how sanctions placed on Iran made it more difficult for Iranian firms to maintain reliable supply chains. Drawing on Haidar (2017), who studied Iran’s ability to “deflect” exports to new markets, Batmanghelidj (2021) suggests that the resilience of Iran’s industrial output under sanctions is related to its ability to “reflect” imports from new markets. Looking at the period between 2000 and 2017, Batmanghelidj (2021) identifies a clear trend where Iranian firms began to substitute “intermediate inputs” supplied by Europe with goods re-exported from markets such as Turkey and the UAE or sourced from Chinese suppliers. By doing so, Iranian firms were able to maintain reasonable inventories of parts and machinery, albeit sometimes at higher cost.

Sanctions are understood to have a negative impact on employment, particularly in the target country’s industrial sectors, which are forced to cut output owing to both supply-side and demand-side factors (see Ezzati et al. 2020). But the impact on employment is not uniform across sectors. Moghaddasi Kelishomi and Nisticò (2022) focus on the impact of the 2012 economic sanctions on employment in Iran and identify a 16.4 % contraction in the rate of employment growth in Iran’s manufacturing sector. However, the authors identify different degrees of impact on employment growth across industrial sectors, due to different levels of labor intensity and dependence on imports.

Sanctions may even have a positive impact on employment in some sectors of the economy. In his study of Iranian household welfare and employment, Salehi-Isfahani (2020) finds evidence that “sanctions may have helped on the employment side, as they appear to have boosted jobs in import-competing sectors.” Salehi-Isfahani (2020) uses labor force survey data to show that while average household incomes stagnated between 2010 and 2019, “employment continued to grow, albeit very slowly,” largely because of the resilience of the manufacturing sector, in which many firms increased domestic market share and targeted exports following the devaluation of the rial.

The effects of sanctions on employment also vary depending on the segment of the workforce. The effects of sanctions on male and female employment in Iran’s manufacturing sector is investigated by Demir and Tabrizy (2022). Their analysis is based on four-digit industry-level employment data from 102 manufacturing industries between 1995 and 2014. They show that sanctions have affected male and female jobs differently, damaging employment opportunities for females far more than for males. This negative effect of sanctions is compounded in capital-intensive industries. Moreover, female employment suffers more in industries that depend more on imported materials during sanctions. In short, their results show that sanctions are not gender blind. They also acknowledge that their study does not capture the effects of sanctions on women and male employment in the informal economy. Given the sizable share of shadow economy in Iran, future studies should further explore the labor market response in that sector during sanctions. Moreover, the focus of the study is on male and female employment growth rates in the manufacturing sector of Iran, excluding developments in the service sector. Notably, according to the World Bank (2023), in recent years, more than 50 % of female employment has been observed in the service sector, and this share has been consistently increasing since 2008. Additionally, there has been a decline in the importance of manufacturing value added in the country’s GDP, decreasing from 16.5 % in 1996 to 14.8 % in 2019. In contrast, the relative share of services value added in the GDP has been rising, increasing from 48.8 % to 55.8 % over the same period. These changes in the relative sizes of the manufacturing and services sectors may result in fewer job opportunities for both men and women in one sector and more opportunities in the other. These developments could be associated with the Dutch disease, which is often observed in oil-based economies like Iran. It is likely that the sanctions have had a negative impact on women’s employment in parts of the manufacturing sector, but they might have had a positive effect on the service sector. The services (and agricultural) sectors have demonstrated greater resilience against sanctions as they have a limited international focus, primarily catering to the domestic market (Farzanegan 2023b). Authors acknowledge that while they have industry-level data for the manufacturing sector through UNIDO’s INDSTAT dataset, they lack disaggregated industry-level data for the services sector. Future research should aim to address this data gap. Furthermore, it is important to note that if the newly established service sector jobs, which replace those in manufacturing, are predominantly in lower-skilled and lower value-added services, it is expected to result in an overall decrease in productivity and economic growth. Another limitation of this study is the absence of employment figures by occupation, with only total male and female employment figures available at the four-digit industry level. It is crucial to consider that sanctions may have varying effects on male and female employment based on their respective occupations. Future research should strive to fill this gap as well.

Among the goals of the sanctions on Iran is to hurt the financial performance of major firms, regardless if they are state-owned. Ghasseminejad and Jahan-Parvar (2021) studied the profitability of companies listed on the Tehran Stock Exchange between 2011 and 2016. They find that sanctions “have lasting negative effects that manifest in long-term stock return and profitability ratios” given that the firms impacted by sanctions, either through sectoral or targeted measures, “decrease their leverage and increase their cash holding to manage their perceived increased risk.” Notably, “sanctions affect politically connected firms more than ordinary firms.” Looking beyond large publicly traded companies, Salehi Esfahani (2020) used firm-level data to examine whether sanctions imposed between 2009 and 2013 pushed Iranian manufacturing firms out of business. Firm “exits” had a modest impact on “employment, production, capital formation, productivity and imports and exports of manufacturing firms” in Iran.

A larger body of scholarship has examined the impact of sanctions on Iran’s strategic sectors. Sectoral sanctions have been applied most consequentially to Iran’s energy, banking, automotive, aviation, tourism, culture, and healthcare industries. Oil sanctions are the cornerstone of efforts to constrain Iran’s economy and therefore, the energy sector has been the focus of the greatest number of studies. Studies such as Masouleh, Masouleh, and Ebrahimi (2018) and Nakhli et al. (2021) present models to understand the effects of oil sanctions on the wider economy of Iran. Looking at the sector itself, sanctions had a major impact on Iranian oil and gas production and exports and therefore required a significant change in Iran’s energy sector strategy (Ahmadi 2018; Vakhshouri 2020). Like in other sectors, managers in Iranian energy firms were confronted with their dependence on foreign partners in key oil and gas fields. Majidpour (2013) interviewed managers at major Iranian energy firms to understand how the sanctions changed their outlooks. These interviews reveal that the “self-reliance doctrine is well-accepted amongst state-level authorities and Iranian politicians continually assert that restrictions have helped propel industrial growth and Iran is now turning sanctions into opportunities for progress.” However, Iranian energy firms have continued to seek partnerships with foreign energy companies given the challenges in indigenizing key technologies and the need to finance major investments (Jalilvand 2017).

Related to the energy sector is the effect of sanctions on environmental performance in Iran. This is also acknowledged by Madani (2020) where he suggests “while economic sanctions cannot be blamed as the cause of environmental problems in sanctioned states, their role in catalyzing environmental degradation is noteworthy.” Madani (2020) develops a generic causal model to explain how economic sanctions can impact the environment. He concludes that sanctions are positively associated with environmental degradation through decreasing the priority of environmental issues in the sanctioned government’s agenda and through increasing the natural resource-intensity of its economy. He emphasizes that such damages are not intended by senders of the sanctions but are unavoidable in practice. In another related study, focusing on the case of Iran, Madani (2021) suggests three reasons for the destructive role of sanctions on the quality of the environment in Iran: (1) restricting its access to technology, service, and know-how; (2) blocking international environmental aid; and (3) increasing the natural resource-intensity of its economy. In this descriptive study, he provided various examples and documents to support these channels. In a recent study, Balali et al. (2023) use a system dynamic (SD) model to simulate future trends of carbon emissions under different international sanction scenarios in Iran. They show that under a sanctioned scenario, fossil fuel use and CO2 emissions will increase. They conclude that sanctions have been an important barrier in improving the energy intensity and lowering CO2 emissions in Iran. Environmental degradation may also affect socio-economic indicators such as property prices (Farzanegan, Feizi, and Gholipour 2021) and result in political and social tension (Feizi, Janatabadi, and Torshizi 2019) and internal migration (Farzanegan, Gholipour, and Javadian 2023), hampering the stability of the political system.

In recent years, Iran’s financial sector has emerged to be most targeted by sanctions. In an assessment for the International Monetary Fund, El Khoury (2017) examines the challenges facing Iran’s banking sector and identifies that sanctions “contributed to severe damage in its correspondent banking relationships disconnecting Iran from the global financial system.” Dizaji (2022) examines the impact of sanctions on Iran’s banks in the period between 2006 and 2018 and finds that banks saw their cost efficiencies decline during this time.

For Iran’s automotive sector, the imposition of sanctions led to the cancellation of major partnership agreements with international automakers, principally from Europe. In response, policymakers and automotive executives in Iran sought to increase self-sufficiency in automotive production (Rahimi Fatkoohi 2022). Iranian automotive executives cite sanctions as the greatest threat to the ability of the automotive sector to acquire and adopt more advanced technology (Halili 2020).

Self-sufficiency is a key narrative in studies of Iran’s aviation sector under sanctions. As part of a larger discussion of Iran’s defense sector, Czulda (2020) discusses how self-sufficiency became a “strategic priority” for the aviation industry following both the Iran-Iraq war and the imposition of sanctions on the sector. Dadpay (2019) examines the impact of sanctions on Iran’s aviation sector, focusing on the effect of sanctions in depressing growth in domestic and international air travel. Reviewing the safety record of Iranian airlines, he notes that a series of accidents “have highlighted the fact that sanctions have hurt flight safety standards by denying Iranian airlines access to parts and regular maintenance services.” Given public knowledge of the impact of sanctions on air safety, Majidi et al. (2014) conducted a telephone survey to study how sanctions affect how Iranian passengers felt about air safety. Their study finds that “Half of the population had concerns about safely reaching their destination while traveling by Iranian airlines.”

Tourism is another important sector which is affected by sanctions. Seyfi and Hall (2020) argue that a country under sanctions is forced to prioritize development of domestic tourism following the reduction in international mobility. Seyfi, Hall, and Vo-Thanh (2022), by using interviews and a purposeful snowball sampling technique, examine the gendered effects of economic sanctions on Iranian women’s empowerment in the country’s tourism and hospitality industry. They find that “sanctions have negatively affected and deteriorated economic, psychological, social and political aspects of women empowerment.”

Some studies have examined the effect of sanctions on the supply and demand of cultural goods and services. For example, Rafiei Vardanjani (2020) examines the United States’ economic sanctions on Iran and their impact on the Middle Eastern art market. Reviewing twelve art galleries in Tehran and Dubai, he shows that sanctions increase the number of intangible artworks. The term intangible is applied mainly to forms of art that are either transferable through virtual networks (e.g. video and digital arts) or do not need physical shipping. On the impact, he argues that the sanctions impelled international art supplies manufacturers to withdraw from Iran’s market, increasing the migration of many Iranian artists to the Arab states of the Persian Gulf, Europe, and the United States.

Economic sanctions are not imposed on medicine or health-related items. However, the distortionary effects of sanctions on the currency market and the devaluing of a target country’s local currency significantly increases the costs of importing medical good and instruments. It may also increase the cost of the domestic production of such medical products by increasing the costs of importing raw or intermediary materials. As mentioned by Nephew (2017) in his book The Art of Sanctions: “In Iran, for instance, there were reports throughout 2012 and 2013 that medicine and medical devices were unavailable not because their trade was prohibited but rather because they cost too much for the average Iranian due to shortages and the depreciation of the Iranian currency.” Bastani et al. (2022) examine the impact of sanctions on supply chains in Iran’s pharmaceutical sector. They find that although “medicines are exempted from sanctions, pharmaceutical companies have encountered many difficulties importing raw materials and medicines after the sanctions due to foreign exchange restrictions.” This finding supports the descriptive studies and commentaries by Iranian medical professionals, which make clear that sanctions lead to “complications in transportation, difficulty in transferring hard currencies or… lack of capital” for pharmaceutical companies in Iran (see Cheraghali 2013). Finally, in a recent review study conducted by Sajadi et al. (2023), the effects of sanctions on the overall health status of Iranians and the performance of Iran’s health system were examined. The study concludes that economic sanctions will inevitably impact public health, even if essential medicines and supplies are exempted. The authors also highlight a scarcity of solid evidence on effective and feasible measures to enhance the health system’s resilience against economic sanctions. Additionally, they emphasize the need for rigorous research methodologies to analyze the specific effects of economic sanctions on various health outcomes.

5 Conclusions

Sanctions will continue to play a significant role in the Iranian economy for years to come. Even if a diplomatic breakthrough leads to a new period of sanctions relief, the effects of sanctions on the Iranian economy will surely linger. In this regard, Iran will remain an important case in the study of sanctions, encompassing both short-run and long-run effects, especially as the number of major sanctions programs increases. The relevance of Iran’s experience under sanctions to other cases is primarily a function of the design of the sanctions themselves. For example, the sanctions imposed on Russia since 2022 were largely modelled on those developed to target Iran since 2012 (Nephew and Fishman 2022). If the sophisticated sanctions imposed on Iran have failed to achieve their objectives even after such time, and if those sanctions function similarly to sanctions imposed on other countries, then Iran’s case is somewhat of a cautionary tale about how punitive actions may fail to coerce. Indeed, the recent intensification in bilateral political and economic exchanges between Russia and Iran also suggests that countries newly targeted by Western sanctions may seek to learn from Iran’s apparent resilience.

Looking forward, policymakers seeking to make sanctions programs more effective and humane must be empowered with better economic research. The literature on the effects of sanctions on Iran would benefit from greater adoption of econometric methods such as SCM, greater focus on political, social, environmental, and sectoral effects, and increased collaborations between researchers based in Iran and abroad, particularly to improve the range of quantitative and qualitative data used. A review of the existing literature also reveals very few comparative studies that examine the effects of sanctions in Iran in tandem with effects in other sanctioned countries. Such studies would help identify which effects are unique to specific cases and which are more general. Overall, many hypotheses about the economic effects of sanctions remain untested. A century after Woodrow Wilson spoke about the special pressure that sanctions can bear on targeted countries, our understanding of how exactly that pressure is exerted remains limited.

References

Abadie, A. 2021. “Using Synthetic Controls: Feasibility, Data Requirements, and Methodological Aspects.” Journal of Economic Literature 59 (2): 391–425. https://doi.org/10.1257/jel.20191450.Search in Google Scholar

Abadie, A., A. Diamond, and J. Hainmueller. 2010. “Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program.” Journal of the American Statistical Association 105 (490): 493–505. https://doi.org/10.1198/jasa.2009.ap08746.Search in Google Scholar

Abadie, A., A. Diamond, and J. Hainmueller. 2015. “Comparative Politics and the Synthetic Control Method.” American Journal of Political Science 59 (2): 495–510. https://doi.org/10.1111/ajps.12116.Search in Google Scholar

Abadie, A., and J. Gardeazabal. 2003. “The Economic Costs of Conflict: A Case Study of the Basque Country.” The American Economic Review 93 (1): 113–32. https://doi.org/10.1257/000282803321455188.Search in Google Scholar

Ahmadi, A. 2018. “The Impact of Economic Sanctions and the JCPOA on Energy Sector of Iran.” Global Trade and Customs Journal 13 (5): 198–223, https://doi.org/10.54648/gtcj2018023.Search in Google Scholar

Athey, S., and G. W. Imbens. 2017. “The State of Applied Econometrics: Causality and Policy Evaluation.” The Journal of Economic Perspectives 31 (2): 3–32. https://doi.org/10.1257/jep.31.2.3.Search in Google Scholar

Balali, H., M. R. Farzanegan, O. Zamani, and M. Baniasadi. 2023. “Air Pollution and Economic Sanctions in Iran.” MAGKS Papers on Economics 202303. Philipps-Universität Marburg, Faculty of Business Administration and Economics, Department of Economics (Volkswirtschaftliche Abteilung). Also available at https://ideas.repec.org//p/mar/magkse/202303.html.Search in Google Scholar

Bastani, P., Z. Dehghan, S. M. Kashfi, H. Dorosti, M. Mohammadpour, and G. Mehralian. 2022. “Challenge of Politico-Economic Sanctions on Pharmaceutical Procurement in Iran: A Qualitative Study.” Iranian Journal of Medical Sciences 47 (2): 152–61. https://doi.org/10.30476/IJMS.2021.89901.2078.Search in Google Scholar

Batmanghelidj, E. 2021. “The Ins and Outs of Iranian Industrial Resilience under Sanctions.” The Muslim World 111: 96–112. https://doi.org/10.1111/muwo.12374.Search in Google Scholar

Batmanghelidj, E. 2023. “How Sanctions Hurt Iran’s Protesters.” Foreign Affairs. Also available at https://www.foreignaffairs.com/middle-east/iran-sanctions-how-protesters (accessed April 4, 2023).Search in Google Scholar

Bonander, C. 2018. “Compared with What? Estimating the Effects of Injury Prevention Policies Using the Synthetic Control Method.” Injury Prevention 24, no. S1: i60–6. https://doi.org/10.1136/injuryprev-2017-042360.Search in Google Scholar

Buehn, A., and M. R. Farzanegan. 2012. “Smuggling Around the World: Evidence from a Structural Equation Model.” Applied Economics 44 (23): 3047–64. https://doi.org/10.1080/00036846.2011.570715.Search in Google Scholar

Cheraghali, A. M. 2013. “Impacts of International Sanctions on Iranian Pharmaceutical Market.” Daru Journal of Pharmaceutical Sciences 21 (1): 64. https://doi.org/10.1186/2008-2231-21-64.Search in Google Scholar

Cheratian, I., S. Goltabar, and M. R. Farzanegan. 2023. “Firms Persistence Under Sanctions: Micro-Level Evidence from Iran.” The World Economy, https://doi.org/10.1111/twec.13378.Search in Google Scholar

Cunningham, S. 2021. Causal Inference: The Mixtape. Yale University Press.10.12987/9780300255881Search in Google Scholar

Czulda, R. 2020. “Defence Industry in Iran – Between Needs and Real Capabilities.” Defense and Security Analysis 36 (2): 201–17. https://doi.org/10.1080/14751798.2020.1750184.Search in Google Scholar

Dadpay, A. 2019. Iran Aviation Industry and Nuclear Deal: The Poster Child of Sanctions and JCPOA. SSRN Scholarly Paper. Rochester.10.2139/ssrn.3364680Search in Google Scholar

Demir, F., and S. S. Tabrizy. 2022. “Gendered Effects of Sanctions on Manufacturing Employment: Evidence from Iran.” Review of Development Economics 26 (4): 2040–69. https://doi.org/10.1111/rode.12917.Search in Google Scholar

Dizaji, S. F. 2014. “The Effects of Oil Shocks on Government Expenditures and Government Revenues Nexus (With an Application to Iran’s Sanctions).” Economic Modelling 40: 299–313. https://doi.org/10.1016/j.econmod.2014.04.012.Search in Google Scholar

Dizaji, S. F. 2022. “How Did Sanctions Impact the Cost Efficiency of Iranian Banks?” Bourse & Bazaar Foundation. https://www.bourseandbazaar.com/indicator-articles/2022/5/14/how-did-sanctions-impact-the-cost-efficiency-of-iranian-banks (accessed May 15, 2022).Search in Google Scholar

Dizaji, S. F., and P. A. G. van Bergeijk. 2013. “Potential Early Phase Success and Ultimate Failure of Economic Sanctions: A VAR Approach with an Application to Iran.” Journal of Peace Research 50 (6): 721–36. https://doi.org/10.1177/0022343313485487.Search in Google Scholar

Dizaji, S. F., and M. R. Farzanegan. 2021. “Do Sanctions Constrain Military Spending of Iran?” Defence and Peace Economics 32 (2): 125–50. https://doi.org/10.1080/10242694.2019.1622059.Search in Google Scholar

Dizaji, S. F., M. R. Farzanegan, and N. Alireza. 2016. “Political Institutions and Government Spending Behavior: Theory and Evidence from Iran.” International Tax and Public Finance 23 (3): 522–49. https://doi.org/10.1007/s10797-015-9378-8.Search in Google Scholar

Eichenberger, R., and D. Stadelmann. 2022. “Sanctions are Costly for Citizens but Beneficial for Autocrats: A Political-Economic Perspective.” The Economists’ Voice 19 (2): 109–23. https://doi.org/10.1515/ev-2022-0026.Search in Google Scholar

Elgin, C., M. Ayhan Kose, F. Ohnsorge, and S. Yu. 2021. “DP16497 Understanding Informality.” Also available at https://cepr.org/publications/dp16497.10.2139/ssrn.3914265Search in Google Scholar

El Khoury, C. A. 2017. “Impediments to Correspondent Banking in Iran.” International Monetary Fund. Also available at https://www.elibrary.imf.org/downloadpdf/journals/002/2017/063/article-A001-en.xml.Search in Google Scholar

Ezzati, M., H. Heydari, and P. Moridi. 2020. “The Effect of Economic Sanctions on Industrial Production and Employment of in Iran.” Quarterly Journal of the Macro and Strategic Policies 8 (29): 38–65. https://doi.org/10.30507/jmsp.2020.102274.Search in Google Scholar

Farzanegan, M. R. 2009. “Illegal Trade in the Iranian Economy: Evidence from a Structural Model.” European Journal of Political Economy 25 (4): 489–507. https://doi.org/10.1016/j.ejpoleco.2009.02.008.Search in Google Scholar

Farzanegan, M. R. 2011. “Oil Revenue Shocks and Government Spending Behavior in Iran.” Energy Economics 33 (6): 1055–69. https://doi.org/10.1016/j.eneco.2011.05.005.Search in Google Scholar

Farzanegan, M. R. 2013. “Effects of International Financial and Energy Sanctions on Iran’s Informal Economy.” The SAIS Review of International Affairs 33 (1): 13–36. https://doi.org/10.1353/sais.2013.0008.Search in Google Scholar

Farzanegan, M. R. 2014. “Military Spending and Economic Growth: The Case of Iran.” Defence and Peace Economics 25 (3): 247–69. https://doi.org/10.1080/10242694.2012.723160.Search in Google Scholar

Farzanegan, M. R. 2021. Years of Life Lost to Revolution and War in Iran. SSRN Scholarly Paper. Rochester.10.2139/ssrn.3842327Search in Google Scholar

Farzanegan, M. R. 2022a. “The Economic Cost of the Islamic Revolution and War for Iran: Synthetic Counterfactual Evidence.” Defence and Peace Economics 33 (2): 129–49. https://doi.org/10.1080/10242694.2020.1825314.Search in Google Scholar

Farzanegan, M. R. 2022b. “The Effects of International Sanctions on Iran’s Military Spending: A Synthetic Control Analysis.” Defence and Peace Economics 33 (7): 767–78. https://doi.org/10.1080/10242694.2021.1941548.Search in Google Scholar

Farzanegan, M. R. 2023a. “Economic Sanctions and Military Expenditure in Iran: A Brief Survey.” EconPol Forum 24 (3): 31–5.Search in Google Scholar

Farzanegan, M. R. 2023b. “What Are the Big Economic Challenges Facing the Government in Iran?” In Economics Observatory (blog). Also available at https://www.economicsobservatory.com/what-are-the-big-economic-challenges-facing-the-government-in-iran.Search in Google Scholar

Farzanegan, M. R., M. M. Khabbazan, and H. Sadeghi. 2016. “Effects of Oil Sanctions on Iran’s Economy and Household Welfare: New Evidence from a CGE Model.” In Economic Welfare and Inequality in Iran: Developments Since the Revolution, edited by M. R. Farzanegan, and P. Alaedini, 185–211. New York: Palgrave Macmillan US.10.1057/978-1-349-95025-6_8Search in Google Scholar

Farzanegan, M. R., M. Feizi, and H. F. Gholipour. 2021. “Drought and Property Prices: Empirical Evidence from Provinces of Iran.” Economics of Disasters and Climate Change 5 (2): 203–21. https://doi.org/10.1007/s41885-020-00081-0.Search in Google Scholar

Farzanegan, M. R., H. F. Gholipour, and M. Javadian. 2023. “Air Pollution and Internal Migration: Evidence from an Iranian Household Survey.” Empirical Economics 64 (1): 223–47. https://doi.org/10.1007/s00181-022-02253-1.Search in Google Scholar

Farzanegan, M. R., and S. Fischer. 2021. “Lifting of International Sanctions and the Shadow Economy in Iran—A View from Outer Space.” Remote Sensing 13 (22): 4620. https://doi.org/10.3390/rs13224620.Search in Google Scholar

Farzanegan, M. R., and B. Hayo. 2019. “Sanctions and the Shadow Economy: Empirical Evidence from Iranian Provinces.” Applied Economics Letters 26 (6): 501–5. https://doi.org/10.1080/13504851.2018.1486981.Search in Google Scholar

Farzanegan, M. R., and M. A. Kadivar. 2023. “The Effect of Islamic Revolution and War on Income Inequality in Iran.” Empirical Economics, https://doi.org/10.1007/s00181-023-02365-2.Search in Google Scholar

Farzanegan, M. R., and R. Zamani. 2022. “The Effect of Corruption on Internal Conflict in Iran Using Newspaper Coverage.” Defence and Peace Economics, https://doi.org/10.1080/10242694.2022.2108571.Search in Google Scholar

Feizi, M., N. H. Janatabadi, and A. S. Torshizi. 2019. “Rainfall and Social Disputes in Iran.” Water Policy 21 (4): 880–93. https://doi.org/10.2166/wp.2019.101.Search in Google Scholar

Gallagher, N., E. Mohseni, and C. Ramsay. 2021. “Iranian Public Opinion at the Start of the Raisi Administration.” Center for International and Security Studies at Maryland. https://cissm.umd.edu/research-impact/publications/iranian-public-opinion-start-raisi-administration (accessed October 18, 2021).Search in Google Scholar

Galtung, J. 1967. “On the Effects of International Economic Sanctions: With Examples from the Case of Rhodesia.” World Politics 19 (3): 378–416. https://doi.org/10.2307/2009785.Search in Google Scholar

Gharehgozli, O. 2017. “An Estimation of the Economic Cost of Recent Sanctions on Iran Using the Synthetic Control Method.” Economics Letters 157: 141–4. https://doi.org/10.1016/j.econlet.2017.06.008.Search in Google Scholar

Ghasseminejad, S., and M. R. Jahan-Parvar. 2021. “The Impact of Financial Sanctions: The Case of Iran.” Journal of Policy Modeling 43 (3): 601–21. https://doi.org/10.1016/j.jpolmod.2021.03.001.Search in Google Scholar

Gharibnavaz, M. R., and R. Waschik. 2018. “A Computable General Equilibrium Model of International Sanctions in Iran.” The World Economy 41 (1): 287–307. https://doi.org/10.1111/twec.12528.Search in Google Scholar

Ghomi, M. 2022. “Who is Afraid of Sanctions? The Macroeconomic and Distributional Effects of the Sanctions Against Iran.” Economics & Politics 34 (3): 395–428. https://doi.org/10.1111/ecpo.12203.Search in Google Scholar

Gilchrist, D., T. Emery, N. Garoupa, and R. Spruk. 2023. “Synthetic Control Method: A Tool for Comparative Case Studies in Economic History.” Journal of Economic Surveys 37 (2): 409–45, https://doi.org/10.1111/joes.12493.Search in Google Scholar

Gutmann, J., M. Neuenkirch, and F. Neumeier. 2023. “The Economic Effects of International Sanctions: An Event Study.” Journal of Comparative Economics, https://doi.org/10.1016/j.jce.2023.05.005.10.1016/j.jce.2023.05.005Search in Google Scholar

Haidar, J. I. 2017. “Sanctions and Export Deflection: Evidence from Iran.” Economic Policy 32 (90): 319–55. https://doi.org/10.1093/epolic/eix002.Search in Google Scholar

Halili, Z. 2020. “Identifying and Ranking Appropriate Strategies for Effective Technology Transfer in the Automotive Industry: Evidence from Iran.” Technology in Society 62: 101264. https://doi.org/10.1016/j.techsoc.2020.101264.Search in Google Scholar

Hodler, R. 2019. “The Economic Effects of Genocide: Evidence from Rwanda.” Journal of African Economies 28 (1): 1–17. https://doi.org/10.1093/jae/ejy008.Search in Google Scholar

Hufbauer, G. C., J. J. Schott, K. A. Elliott, and B. Oegg. 2016. “Economic Sanctions Reconsidered.” 3rd ed. (Paper). PIIE. https://www.piie.com/bookstore/economic-sanctions-reconsidered-3rd-edition-paper (accessed April 21, 2016).Search in Google Scholar

Jalilvand, D. R. 2017. Iranian Energy: A Comeback with Hurdles. The Oxford Institute for Energy Studies. Also available at https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2017/01/Iranian-Energy-a-comeback-with-hurdles.pdf.Search in Google Scholar

Khabbazan, M. M., and M. R. Farzanegan. 2016. “Household Welfare in Iran Under Banking Sanctions: From Open Economy Toward Autarchy.” In Economic Welfare and Inequality in Iran: Developments Since the Revolution, edited by M. R. Farzanegan, and P. Alaedini, 213–32. New York: Palgrave Macmillan US.10.1057/978-1-349-95025-6_9Search in Google Scholar

Kwon, O., Constantinos Syropoulos, and Y. Yotov. 2020. “Pain and Gain: The Short-and Long-Run Effects of Economic Sanctions on Growth.” Also available at https://www.semanticscholar.org/paper/Pain-and-Gain%3A-The-Short-and-Long-run-Effects-of-on-Kwon-Syropoulos/72e2f76cc08e84ca374223e813b009588caba679.Search in Google Scholar

Laudati, D., and M. Hashem Pesaran. 2023. “Identifying the Effects of Sanctions on the Iranian Economy Using Newspaper Coverage.” Journal of Applied Econometrics 38 (3): 271–94. https://doi.org/10.1002/jae.2947.Search in Google Scholar

Lawder, D., and K. Singh. 2023. “Yellen: Iran’s Actions Not Impacted by Sanctions to the Extent US Would Like.” Reuters. sec. World. https://www.reuters.com/world/yellen-irans-actions-not-impacted-by-sanctions-extent-us-would-like-2023-03-23/ (accessed March 23, 2023).Search in Google Scholar

Li, X., and Y. Zhou. 2017. “A Stepwise Calibration of Global DMSP/OLS Stable Nighttime Light Data (1992–2013).” Remote Sensing 9 (6): 637. https://doi.org/10.3390/rs9060637.Search in Google Scholar

Madani, K. 2020. “How International Economic Sanctions Harm the Environment.” Earth’s Future 8 (12): e2020EF001829. https://doi.org/10.1029/2020EF001829.Search in Google Scholar

Madani, K. 2021. “Have International Sanctions Impacted Iran’s Environment?” World 2 (2): 231–52. https://doi.org/10.3390/world2020015.Search in Google Scholar

Majidpour, M. 2013. “The Unintended Consequences of US-Led Sanctions on Iranian Industries.” Iranian Studies 46 (1): 1–15. https://doi.org/10.1080/00210862.2012.740897.Search in Google Scholar

Majidi, A., S. Nedjat, A. Mohammadi, E. Jamshidi, and R. Majdzadeh. 2014. “Impact of Sanctions on Iranian Airlines: How People in Iran Feel About Air Travel Safety?” International Journal of Disaster Risk Reduction 10: 67–74. https://doi.org/10.1016/j.ijdrr.2014.04.005.Search in Google Scholar

Masouleh, E., S. S. Masouleh, and I. Ebrahimi. 2018. “The Effect of External Shocks on Iran’s Oil Economy: A BVAR-DSGE Approach.” OPEC Energy Review 42 (4): 279–300. https://doi.org/10.1111/opec.12131.Search in Google Scholar

Moghaddasi Kelishomi, A., and R. Nisticò. 2022. “Employment Effects of Economic Sanctions in Iran.” World Development 151: 105760. https://doi.org/10.1016/j.worlddev.2021.105760.Search in Google Scholar