Abstract

This article investigates the contractual and proprietary implications of short-term rental (STR) regulation in European cities. Focusing on Berlin, London, Milan, and Paris, it compares regulatory strategies ranging from targeted administrative restrictions to structural redefinitions of housing access. Drawing on private law theory and law-and-economics approaches, the article shows how STR regulation reconfigures the classical balance between contractual autonomy and property rights in light of urban policy goals. Empirical analysis complements the normative argument through a Hedonic Pricing Model estimated across the four cities. Using log-linear regressions with neighbourhood fixed effects and clustered standard errors on Inside Airbnb data, the model reveals robust and significant spatial price differentials. Entire flats and hotel-type listings command substantial premiums, while private and shared rooms are structurally penalized. These effects persist across specifications and point to a regressive structure in platform-mediated rental markets. By combining doctrinal and quantitative methods, the article frames STR regulation as a site of distributive recalibration within private law. Legal categories are not neutral: they structure access to the city. As STRs reshape property use, contract enforcement, and urban residence, the paper argues for a renewed legal framework attentive to spatial inequality, enforcement asymmetries, and platform governance.226

Résumé

Cet article examine les implications de la réglementation des locations à court terme (LCT) dans les villes européennes en matière contractuelle comme en matière de propriété. En se concentrant sur Berlin, Londres, Milan et Paris, il compare les stratégies réglementaires allant des restrictions administratives ciblées à la redéfinition structurelle de l’accès au logement. S’appuyant sur la théorie du droit privé et les approches de law and economics, l’article montre comment la réglementation des LCT reconfigure l’équilibre classique entre l’autonomie contractuelle et les droits de propriété à la lumière des objectifs de la politique urbaine. Une analyse empirique complète l’argument normatif à l’aide d’un modèle de prix hédonique estimé pour les quatre villes. À l’aide de régressions log-linéaires avec effets fixes de quartier et erreurs types groupées sur les données d’Inside Airbnb, le modèle révèle des différences de prix spatiales importantes et significatives. Les appartements entiers et les annonces de type hôtelier bénéficient de primes substantielles, tandis que les chambres privées et partagées sont structurellement pénalisées. Ces effets persistent dans toutes les variantes et indiquent une structure régressive dans les marchés locatifs médiatisés par les plateformes. En combinant des méthodes doctrinales et quantitatives, l’article présente la réglementation des locations de courte durée comme un lieu de recalibrage distributif au sein du droit privé. Les catégories juridiques ne sont pas neutres: elles structurent l’accès à la ville. Alors que les locations de courte durée remodèlent l’utilisation des biens immobiliers, l’exécution des contrats et la résidence urbaine, l’article plaide en faveur d’un cadre juridique renouvelé, attentif aux inégalités spatiales, aux asymétries d’application et à la gouvernance des plateformes.

Zusammenfassung

Dieser Artikel untersucht die Auswirkungen der Regulierung von Kurzzeitvermietungen in europäischen Städten sowohl im Vertragsrecht als auch im Eigentumsrecht. Im Fokus stehen Berlin, London, Mailand und Paris; es werden regulatorische Strategien verglichen, die von gezielten verwaltungsrechtlichen Beschränkungen bis hin zu einer strukturellen Neudefinition des Zugangs zu Wohnraum reichen. Gestützt auf die Theorie des Privatrechts sowie Ansätze der Law-and-Economics-Analyse zeigt der Artikel, wie die Regulierung von Kurzzeitvermietungen das klassische Gleichgewicht zwischen Vertragsfreiheit und Eigentumsrechten neu austariert – im Lichte stadtpolitischer Zielsetzungen. Eine empirische Analyse ergänzt das normative Argument durch ein hedonisches Preismodell, das für alle vier Städte geschätzt wurde. Mittels log-linearer Regressionsanalysen mit quartierbezogenen Fixed Effects und gruppierten Standardfehlern auf Basis der Daten von Inside Airbnb zeigt das Modell deutliche und signifikante räumliche Preisunterschiede. Ganze Wohnungen und inserierte Angebote mit hotelähnlichem Charakter erzielen substanzielle Preisaufschläge, während private oder geteilte Zimmer strukturell benachteiligt sind. Diese Effekte zeigen sich stabil ü227ber alle Modellvarianten hinweg und deuten auf eine regressive Struktur auf den durch Plattformen vermittelten Mietmärkten hin. Durch die Verbindung dogmatischer und quantitativer Methoden präsentiert der Artikel die Regulierung von Kurzzeitvermietungen als einen Ort distributiver Neubewertung innerhalb des Privatrechts. Juristische Kategorien sind nicht neutral – sie strukturieren den Zugang zur Stadt. Während Kurzzeitvermietungen die Nutzung von Immobilien, die Vertragsdurchsetzung und das urbane Wohnen neu gestalten, plädiert der Artikel für einen erneuerten Rechtsrahmen, der räumliche Ungleichheiten, Vollzugsasymmetrien und die Plattform-Governance berücksichtigt.

1 Introduction: Airbnb as a Regulatory Anomaly?

The rapid expansion of platform-mediated short-term rentals (STRs) has reconfigured urban housing markets with the abruptness of a monetary shock and the asymmetry of an unpriced externality.[ ] In cities like Berlin, London, Milan, and Paris this shift has laid bare the inadequacy of existing legal frameworks to mediate between individual entitlement and systemic constraint. Recent estimates from the JRC indicate that STR activity in metropolitan cores absorbs between 12 % and 23 % of the available housing stock, generating spatially concentrated price elasticities that are 3–5 times higher than citywide averages.[ ] This concentration can create an endogenous feedback loop: higher STR returns might increase the shadow value of property, induce reallocation from long-term rental supply, and depress effective availability – particularly for lower-income households. At the macro-institutional level, the European Union has responded by initiating multi-scalar governance mechanisms,[ ] including the Commissioners’ Project Group on Affordable Housing,[ ] the Task Force Housing,[ ] and the Special Committee on the Housing Crisis (HOUS) 228 within the European Parliament.[ ] These bodies are tasked with designing counter-cyclical legal and fiscal instruments to mitigate what the European Economic and Social Committee (EESC) has frame as a platform-induced distortion of rental equilibria.[ ] The EESC Recommendation on Sustainable, Affordable, and Decent Housing,[ ] explicitly calls for a policy mix that includes STR-specific licensing ceilings, data-sharing mandates, and differentiated taxation calibrated to occupancy duration and unit concentration thresholds. Together, these measures signal an emergent consensus: that STR regulation is not a sectoral anomaly, but a core instrument for restoring allocative efficiency, spatial equity, and the social function of housing.[ ] Thus, what appears at first sight as a contractual innovation, or a marginal shift in asset usage, reveals under closer scrutiny a structural recalibration of the balance between property, contract, and market coordination.

This article undertakes a comparative inquiry into the regulation of STRs across four major European cities, interrogating the legal instruments deployed to accommodate – or curtail – the spread of digitally intermediated housing transactions. These responses are not merely instances of administrative fine-tuning. Rather, they constitute inflection points in the legal architecture of housing markets, where the distributive consequences of private law are rendered visible.[ ]

The underlying paradox is classical: housing, a positional good embedded in spatial path-dependencies, is increasingly traded as a liquid asset in frictionless, short-duration cycles.[ ] This temporal disjunction – between the durable materiality of residential life and the instantaneous monetization of space – has unsettled long-standing legal categories. It is no longer sufficient to analyze property as a stable endowment or contract as a bilateral promise.[ ] In the presence of platform effects and locational rents, both concepts become vehicles of rent extraction and, inevitably, of conflict: between owner and tenant, resident and tourist, liquidity and habitability229.

This paper proceeds in five steps. Following this introduction, Section 2 develops a typology of regulatory instruments and compares their deployment across cities. Section 3 revisits the foundational categories of private law, exploring how STR regulation unsettles the distributional neutrality of contract and property, with an eye to socioeconomic inequality.[ ] Section 4 assesses the economic impact of STRs – turning to a simple Hedonic Pricing Model (HPM).[ ] Section 5 concludes by reflecting on the need to reconstruct private law theory in light of market asymmetries and platform-mediated commodification.[ ]

Methodologically, the article draws on doctrinal analysis, comparative institutional logic, and empirical findings. It aims to clarify not simply how STRs are regulated, but what their regulation discloses about the shifting role of law in governing the spatial and temporal dynamics of contemporary housing markets.

2 Legal Taxonomies of Regulation: Between Market Access and Urban Control

Short-term rental (STR) regulation across major European cities exhibits considerable heterogeneity in form, function, and legal basis.[ ] This section builds a comparative framework that distinguishes between (a) direct and indirect regulatory instruments, and (b) the spatial allocation of authority (municipal, regional, national, EU).

Direct regulation comprises rules explicitly targeting STR activity, including registration mandates, quantitative caps (e.g., nights per year), and use restrictions (e.g., authorization of change of use). Paris, Berlin, and London exemplify this form. Indirect regulation, by contrast, involves instruments not originally des230igned for STRs but that exert control through adjacent legal or economic levers – such as zoning, tax law, housing codes, and civil/condominium law. Milan is a case in point.

In Paris, the regulation of short-term rentals (STRs) is governed by a multi-tiered legal framework introduced under Article L 324-1-1 of the Code du tourisme [ ] and reinforced by the République Numérique Law (2016) on access to data, the ELAN Law (2018) on rent controls, and the Engagement et Proximité Law (2019) on civic engagement in local life and the proximity of public action.[ ] A mandatory online registration system is required for STRs of entire dwellings, even when used as a primary residence, with a unique number displayed on the listing. A 120-night annual limit applies to such rentals, enforced via platform-integrated booking caps, unless exempted for professional or health-related reasons. For secondary residences or commercial properties, a prior change-of-use authorization is necessary, often subject to a compensation mechanism (e.g., converting equivalent commercial floor area into residential use), as per Articles L 631-7 and R 111-2 of the Code de la construction et de l’habitation. Non-compliance may result in civil fines of up to €50,000, additional daily penalties per square meter, and – if deliberate concealment is proven – even criminal sanctions. Platforms that fail to delist non-compliant units risk fines of up to €50,000 per listing. As of 1 January 2025, the most recent updates under Law No 2024-1039 (Loi La Meur) will further harmonize municipal control, enforcement procedures, and reporting duties for both hosts and platforms.[ ]

With the adoption of the new Plan local d’urbanisme bioclimatique (PLU),[ ] approved by the Paris Council on 20 November 2024 and in force since 29 November 2024, additional restrictions have been introduced. Notably, the PLU designates specific ‘zones de contrôle de l’hébergement touristique’ in the 1st to 11th Arrondissements and the Butte Montmartre, where the creation of new STR units – through construction, extension, elevation, or office conversion – is prohibited. Outside these zones, creation remains strictly conditional, and platform operators must technically enforce the statutory 120-day cap on full-unit rentals of primary residences, as required by Decree No 2017-678 of 28 April 2017 and later strengthened by the national Law No 2024-1039 (19 November 2231024).

In fiscal terms, STR income must be declared under the BIC (bénéfices industriels et commerciaux) regime, with different thresholds and deductions for classified and non-classified properties. Since 2019, Airbnb and similar platforms are obliged to collect the tourist tax (taxe de séjour) on behalf of the City, based on self-declared classification and number of nights. The information-sharing obligations were extended by Article 242 bis of the Code général des impôts, requiring platforms to transmit detailed income and listing data annually. As of January 2023, the EU Directive 2021/514 (DAC7) entered into force in France,[ ] replacing the national transmission framework: platforms must now report user income data – including identity, tax ID, gross earnings, and number of bookings – to the French tax administration for further sharing across EU jurisdictions. Through this complex legal architecture, Paris is regulated by a model that blends fiscal transparency, zoning-based capacity control, and platform liability – a model that re-functionalizes contract and property rules to meet constitutional and urban policy imperatives. This mechanism embeds STR control within a broader strategy of anti-speculation, reinforcing urban residency as a legally protected function.[ ]

Berlin, instead, enacted at the city level the Zweckentfremdungsverbot-Gesetz (ZwVbG), first in 2013, updated multiple times, which directly prohibits the use of residential properties for STR without a permit.[ ] The local housing office can grant authorizations for up to 90 days per year, beyond which the STR operator must demonstrate legitimate grounds. Landlords must display registration numbers, and heavy fines (up to €500,000) apply. ZwVbG works in tandem with the Mietpreisbremse (2015) and federal tenancy law to preserve affordable housing.[ ] Recent rulings by the Bundesverfassungsgericht (e.g., 1 BvR 3332/14) upheld the proportionality of these restrictions in light of Berlin’s housing shortage. In Berlin, only 1050 apartments were rented out on Airbnb for more than 182 days in 2016 – just 0.05 % of the city’s total housing stock – yet regulatory intervention proceeded based on potential micro-local effects and distributional distortions.[ ] Thus, even small-scal232e STR penetration may justify regulation under functional or constitutional housing doctrines. Recent German regulations impose not only registration and disclosure duties on hosts, but foresee platform liability for non-compliant listings, with proposals for real-time verification via public APIs.

In Berlin, thus, the regulatory framework for SRT is primarily anchored in the ZwVbG, which restricts the use of residential dwellings for purposes incompatible with long-term habitation. Section 2(1) prohibits repeated rentals measured by days or weeks, effectively targeting platform-mediated STRs. Temporary furnished rentals may be allowed for up to 12 months, contingent on approval by the relevant District Office (Bezirksamt). Exceptions exist for pre-existing STR use, former commercial premises, and temporary vacancy during renovation or marketing efforts, as per Section 2(2) ZwVbG. The law also introduces rent control parameters for substitute accommodation (Ersatzwohnraum), tying rent levels to the rental price index Mietspiegel when replacement housing is required. A compulsory registration regime has been in force since August 2018 (residential) and November 2021 (non-residential), requiring landlords to obtain and display a registration number for any STR listing.

In Milan, regulation is largely indirect and tax-based. The national legislative framework (Legislative Decree 50/2017, modified by Law 213/2023) imposes a withholding tax (cedolare secca) of 21 %,[ ] distinguishing between hosts renting one or two units and those operating as businesses. The Region of Lombardy (Law 27/2015) and the municipal administration require registration through CIR (Codice Identificativo di Riferimento) and impose notification obligations (Decree 113/2018; Decree 34/2019). Safety and insurance norms apply, but Milan has stopped short of introducing use-conversion authorizations or quantitative caps. Nonetheless, some judicial enforcement has occurred via condominium rules: the Corte di Cassazione held that STR activity may be incompatible with residential by-laws where nuisance is demonstrated.[ ]

In Milan, STR regulation is framed by a regional law (Regional Law 27/2015), which operationalizes the Italian constitutional principle of regional autonomy in tourism (Article 117(4) Cost). The law classifies STRs into three categories, each subject to differentiated obligations. Professional operators (Case e Appartamenti per Vacanze – CAV) are defined as those offering at least three units or operating continuously, and must register with the Chamber of Commerce, comply with insurance and safety standards, and report flows to the Regional Tourism Observatory. Non-professional hosts (Alloggi ad uso turistico) may rent properties – typically primary or secondary residences – for stays under 30 days, provid233ed no ancillary services are offered. A third category includes STRs of rooms within a primary residence, exempt from CAV classification but still subject to municipal notification.

Operators must obtain and display ID code (Codice Identificativo di Riferimento (CIR)), per Article 38 Law 27/2015. Milan’s municipality administers enforcement at the local level. While the region imposes no cap on annual rental days, non-professional hosts are subject to a de facto limitation through the required 90-day inactivity period, aimed at preserving residential use. STR activity is also constrained by private law instruments: condominium statutes (Articles 1138 and 1362 cc) may prohibit short-term rentals via restrictive clauses, and subletting by tenants remains contingent upon landlord consent. Milan’s fiscal regime includes a local tourist tax (max 10 nights per guest), collected directly by platforms.

Finally, in London, the regulation of short-term rentals is governed by a hybrid framework combining planning law, taxation, and contractual restrictions. Under Section 44 of the Deregulation Act 2015[ ] – amending the Greater London Council (General Powers) Act (1973)[ ] – the use of a residential property as ‘temporary sleeping accommodation’ is limited to 90 nights per calendar year without prior planning permission. Exceeding this cap constitutes a material change of use under the Town and Country Planning Act (1990),[ ] triggering enforcement powers by local authorities under Section 172 TCPA. Section 25B(1) of the 1973 Act further allows local councils or the Secretary of State to disapply this exemption in designated areas to protect housing availability or local amenity. The regulatory scheme distinguishes between occasional host activity and systematic STR use. The former is permitted under the 90-day exemption, whereas the latter is effectively reclassified as a commercial activity requiring zoning compliance and formal registration.

The contractual governance layer adds further constraint: leasehold agreements, mortgage contracts, and social housing tenancy terms frequently include explicit prohibitions on STR activity. Violations may trigger legal action from landlords, lenders, or housing associations, particularly in the subsidized housing sector. Insurance exclusions and lender covenants reinforce this regime of embedded contractual controls. Taxation rules distinguish between private and commercial use. The Rent-a-Room Scheme offers a tax exemption up to £7,500 annually for shared occupancy of a primary residence, but does not apply to whole-unit rentals. Properties available for 140+ days annually may be reclassified as self-catering units, liable for business rates rather than council tax. Hosts earning above £85,000 must register for VAT at 20 %. These fiscal thresholds, layered on top of planning rules, act as indirect regulatory filters governing hos234t behavior.

The regulation of Airbnb and STR platform in the four cities is characterized by a multilevel governance, with strong urban competence and high levels of legal stratification. In Germany, STR regulation is devolved to the Länder, but with strong municipal autonomy.[ ] Berlin’s approach is distinctive even within Germany. France has a national legal infrastructure with local calibration, which allows cities like Paris to introduce compensation obligations.[ ] Italy delegates STR regulation to the regions under its constitutional allocation of competences in tourism and housing. This produces significant heterogeneity across cities. The UK centralizes housing and planning competences but delegates enforcement and data management to boroughs. Overall, the four cities differ not only in regulatory instruments, but also in the legal topology of vertical power: subsidiarity is not merely procedural but structural.[ ]

Short-, Medium-, and Long-Term Markets interact, producing segmentation and spillover effects. STRs coexist with medium-term furnished leases and long-term residential tenancies. Regulatory tightening in the STR sector often shifts activity into the medium-term segment, which is less regulated and less visible.[ ] Berlin has partially anticipated this via restrictions on repeated short-term leases. Milan’s tax regime distinguishes professional and non-professional hosts (Article 4, co 5-bis D L 50/2017, as modified by the 2024 Italian Budget Law). In Paris, the legal dichotomy between primary and secondary residences allows regulators to channel enforcement without targeting informal actors. In London, tax incentives such as the Rent-a-Room Scheme continue to blur the line between residential and commercial uses of housing.[ ] These market interdependencies are not merely economic; they have institutional effects on the enforceability of tenancy rights and the very meaning of housing as a le235gal category.

The European Union Framework produces further regulatory complexity. The CJEU in Airbnb Ireland classified STR platforms as information society services under Directive 2000/31/EC.[ ] However, Cali Apartments affirmed the compatibility of national authorization regimes with EU law under proportionality review.[ ] Most recently, Regulation (EU) 2024/1028 introduces common data-sharing requirements: platforms must transmit listing data to public authorities. While substantive regulatory competences remain national, the Regulation enhances local enforcement and statistical capacity.

Tensions persist, as platforms invoke free movement provisions (Articles 56 and 49 TFEU) to challenge restrictions on host registration or tax reporting. Yet national courts and the CJEU have increasingly upheld local measures,[ ] provided they are non-discriminatory and proportionate. The emerging model is a form of regulatory subsidiarity: the EU defines the framework for data and interoperability, while cities and states retain substantive powers over housing policy.

What is at stake is not simply compliance or housing supply, but the status of urban residence as a legally protected function.[ ] Contemporary theories of distributive urbanism stress the need to view STR regulation as a proxy for larger questions of inequality, access, and spatial control.[ ] Regulatory heterogeneity thus reflects not only legal tools, but divergent normative commitments to what the city is for – accumulation, circulation, or habitation. These regulatory architectures express more than policy pluralism. They embody distinct theories of governance, legality, and distributive capacity. Where Berlin mobilizes a proactive, scarcity-based legal logic, Paris reconstructs market activity within a dense planning framework. Milan emphasizes legal visibility through taxation and typology, while London defers to private initiative, with limited but growing exceptions. The EU’s regulatory framework supports interoperability and transparency but stops short of defining substantive housing rights. Compensation mechanisms operate not as corrective taxes but as tools for functional zoning and social mix. This reflects the city’s long-standing commitment to residential density as a legal 236good.

Several authors argue that STR platforms accelerate processes of residential displacement and asset extraction by shifting housing stock from long-term use to short-stay commodification.[ ] Rather than excluding residents outright, STR saturation stratifies inclusion by segmenting urban access along pricing gradients and spatial filters. Commodified basic goods like housing reproduce inequality not through outright denial, but through market-driven sorting mechanisms.[ ] Regulatory tools such as flat taxation (e.g., Italy’s cedolare secca), registration thresholds, or ‘light-touch’ zoning overlays generate what terms value extraction regimes – legal environments that facilitate rentier income without corresponding social reinvestment. In Milan, for instance, operators managing multiple units can absorb regulatory costs and exploit tax asymmetries, while informal landlords or tenants might face disproportionately high compliance burdens.

In cities like Berlin and Paris, even where rent control or STR caps exist, financialized property owners can shift their strategies to adjacent market segments – medium-term leases, commercial subletting – thus evading the redistributive implications of the law.[ ] These behavioral adaptations are not necessarily market failures, as they can be rational responses to a regulatory architecture that fails to internalize spatial equity as a policy goal. From a macroeconomic perspective, STR-facilitated inequality might operate through dual multipliers: it depresses effective residential supply in high-demand zones, while increasing income concentration among property-holding strata. This dynamic might weaken the redistributive capacity of fiscal policy and amplify territorial disparities, particularly in cities with already segmented labour and housing markets.[ ]

3 The Doctrinal Core: Contracts and Property Under Constraint

237Policies regulating STRs expose foundational tensions in private law, particularly in the interplay between proprietary entitlements and public imperatives. These regulatory measures, while often administrative or fiscal in appearance, operate as structural interventions in the architecture of private law. As hinted above, they call into question both the classical conception of ownership,[ ] and the normative autonomy of contract, by re-situating these doctrines within an urban political economy increasingly defined by asset-based inequality and spatial commodification. Contemporary legal theory increasingly emphasizes that housing is not merely a marketable asset but a foundational infrastructure for full political and civic membership. Access to such basic necessities shapes the very boundaries of democratic inclusion.[ ]

From the standpoint of property law, STR constraints mark a shift from exclusory entitlement toward functionally indexed ownership. The traditional triad – usus, fructus, abusus – is increasingly subordinated to housing’s role as a constrained collective asset. As codified in Article 42(2) Cost and echoed in several decisions of the German Federal Constitutional Court,[ ] the (minimal) social function of property legitimizes use restrictions that internalize the externalities of platform-mediated monetization.

At the macroeconomic level, STR proliferation generates a regime of high-frequency value extraction, transforming housing into a low-duration, price-volatile asset. This dislocates the capital structure of the rental market: long-term contracts, indexed to wage dynamics, are displaced by pseudo-arbitrage flows pegged to tourism demand. In this configuration, contract law no longer allocates under scarcity – it redistributes under distortion. The STR agreement operates as a derivative legal form, encoding algorithmic pricing, temporal mismatch, and asymmetric bargaining. The contractual equilibrium here could be structurally unstable and welfare-reducing unless corrected by regulatory dampening. Thus, STR law serves a dual role: doctrinal recalibration and macro-prudential stabilization.

This doctrinal shift aligns with a broader European debate on the evolution of dominical rights. Contemporary European private law moves away from monolithic and absolute conceptions of property toward a pluralistic, f238unction-sensitive understanding rooted in historical Roman categories.[ ] The emphasis on flexibility and graduated entitlements reflects a systemic transition in which the legitimacy of ownership is increasingly tied to its contribution to collective welfare. Rodotà’s thesis on the ‘terrible right’ (terribile diritto) of property remains salient:[ ] only when bounded by constitutional function can ownership be reconciled with democratic urbanism. Based on this alternative paradigm, housing as commodity is not the only possible paradigm of property, particularly before the 1980s. Following the corporativist movements of the XIX century, the Weimar Constitution (11 August 1919) Article 153 para III, for example, explicitly recognized the essential social function of property: ‘Property obliges. Its use shall at the same time be service for the common good.’ (Eigentum verpflichtet. Sein Gebrauch soll zugleich Dienst sein für das Gemeine Beste).[ ] To avoid the ‘functionalization’ and ‘instrumentalization’ of private property, the dominant post-WWII paradigm clearly rejects the corporatist view, and thus the progressive and activist ideology of the social function. Socialist notions of property are perceived as anachronistic in EU democracies; similarly, the notion that employment is a form of ownership is unrealistic.[ ] The dismantling of the legacy of socialist systems – and the ‘anachronistic’ doctrine of ‘social ownership’[ ] – led to weaker protections for tenants,[ ] which were justified based on an economic use of the housing stock. As a result, the loss of a strong social right to housing does not require compensation.[ ] Based on the dominant post-WWII paradigm, there seems to be no room for considering housing as a merit good, to wit: a good whose allocation mechanism is subtracted from the prevailing market and price dynamics simply because the prevailing market allocation would generate externalities related to moral costs (i.e., rent seeking and wealth concentration dynamics).[ ]

However, looking at the current housing and cost of living crisis, an increasing number of scholars and activists, rejecting the dominant paradigm, claim that housing is a merit good – protected as a universal freedom right,239 [ ] or a human social right[ ] – whose market allocation inevitably generates negative externalities and high moral costs that affect low and middle incomes.[ ] Therefore, they claim, the current system of housing commoditization should be – partly or fully – replaced by a non-market system with fixed prices and State allocation (what Calabresi calls commandization).

In parallel, the debate on common goods proposes a shift from binary public/private models toward a functionalist conception of ownership, where housing is a legally protected social infrastructure.[ ] This reconceptualization carries institutional risks if detached from enforceable norms. Yet this vision is doctrinally consolidated: the legal order admits multiple property regimes – private, public, collective – each subject to constitutional calibration based on social function. In Italy, under a possible interpretation, the constitutional architecture might embed this directly: Article 42(2) Cost subordinates private property to its social function, and Articles 2, 3, 41, and 44 reinforce a solidaristic mandate. Here, social function is not a limit but a directive principle: it shapes ex ante the legitimacy of acquisition, transfer, and use. This would allow STR regulation to be framed not as expropriation, but as systemic correction aligned with spatial equity and long-term affordability.[ ] In abstracto, Germany could share a similar constitutional structure. Article 14(2) GG imposes public-serving obligations (Eigentum verpflichtet) and legitimizes proportional constraints on ownership. Thus, under a possible – but still minoritarian – interpretation, both systems allow property to serve also as an instrument of d240istributive governance.

At the supranational level, this status is reinforced by Article 31 of the European Social Charter (Revised), Article 16 of the European Pillar of Social Rights,[ ] and evolving jurisprudence under Article 8 of the ECHR, which links stable residence to personal and family life.[ ] This multi-level recognition translates into a normative possibility to regulate housing markets in accordance with substantive equality and dignified living standards, especially where market dynamics (e.g., STR saturation) undermine systemic access to shelter.

The UK departs sharply. Lacking a codified constitution and doctrinal social function, English law treats ownership as a presumptively exclusive entitlement. Regulatory constraints emerge from statutory exceptions and administrative licensing – not from a general theory of property’s public role. Courts resist structural readings that would assign positive obligations to the state or collective claims to housing. What emerges is a residual model: property is adjusted, when necessary, not normatively programmed for collective utility. This divergence matters. Constitutionalizing the social function of property expands the legal toolkit available for regulating housing markets under stress.[ ] It enables courts and legislatures to treat STR saturation not merely as market failure, but as a constitutional imbalance – thereby legitimizing stronger redistributive interventions and doctrinal innovation in contract and ownership law.

Turning to contract law proper, the structure of STR agreements signals a substantive shift in the grammar of contractuality. No longer a bilateral lease anchored in residential continuity, the STR contract functions as a modular, platform-mediated financial instrument, embedded in algorithmic price discovery, asymmetric information, and ownership–use decoupling. These features disrupt the classical equilibrium of rental contracts, which presuppose mutuality, duration stability, and local knowledge symmetry. Regulatory instruments – caps, registration schemes, zoning overlays – do not merely limit contractual autonomy; they perform a reconstitutionalisation of private law. They reassert the premise, found in contextual theories of contract, should not be viewed in isolation but rather understood and applied within its specific social, economic, and cultural context.[ ] 241 Contracts in high-stakes settings like housing are not distributively neutral – they allocate advantage in legally produced fields of scarcity.

Empirical data, apparently, supports recalibration. Recent studies find that STR bans in U.S. cities reduce intra-urban price stratification and redirect housing supply toward stable tenures.[ ] These effects are not merely regulatory externalities – they reshape participation logics: who enters the market, with what tenure instruments, and under which capital expectations. STR governance, then, is not ancillary to contract law – it is constitutive of a new contractual field. This transformation echoes the Italy’s long-standing doctrine of usus facti, whereby use-based entitlements moderate formal ownership claims.[ ] STR constraints revive this tradition by containing hyper-liquid uses that undermine urban cohesion. A model of differential property captures this logic: contemporary property regimes differentiate not only by ownership title but by functional externality, governance model, and systemic impact – separating residual residential use from speculative rent-maximization. In this light, STR regulation operates as an institutional corrective – a second-best policy instrument deployed to counteract dynamic inefficiencies in contract-mediated allocation. Rather than negating private law, regulation recalibrates its operative boundaries: it reorients contract from a vehicle of unconstrained liquidity extraction toward a stabilizing interface between market coordination and social infrastructure.[ ] STR contracts, in their raw form, can exhibit high temporal discounting, weak internalization of externalities, and structurally asymmetric information – hallmarks of a partial equilibrium pathology.[ ] These features can generate distortions not only at the micro-level (e.g., tenure instability, rent inflation) but at the macro-level: price divergence across space, dislocation of productive residency, and volatility in fisca242l and demographic planning.

By imposing jurisdictional constraints, STR regulation inserts friction by design. It decelerates transactional velocity and restores a form of contract temporality that aligns with the slower rhythms of housing reproduction and social settlement. In doing so, regulation does not merely limit contract: it reconditions it for systemic coherence. This marks a fundamental inversion of classical assumptions. Contract, under STR saturation, is no longer an allocatively neutral choice set – it is a redistributive vector embedded in platform logics, capital cycles, and intertemporal mismatches. Regulation, then, is not exogenous to private law but endogenous to its macro-legitimacy: a necessary mechanism to restore coherence between legal form, economic stability, and distributive equity in urban space.

Ultimately, STR governance performs not merely a regulatory but a doctrinal function. It redefines what property and contract are structurally permitted to do within a democratic urban order. The issue is not whether these private law tools remain valid, but whether their operation remains normatively aligned with collective viability. If law is to preserve housing as shelter rather than yield, if cities are to remain spaces of residence rather than vectors for speculative circulation, then property and contract must be re-anchored in a legal architecture that prioritizes stability, access, and spatial equity over nominal autonomy. This imperative aligns with the right to housing as a fundamental entitlement, embedded in international law (e.g., Article 11 ICESCR)[ ] and increasingly recognized in national constitutional frameworks. From this perspective, STR regulation functions as a legal device to uphold the infrastructural conditions for the realization of social rights – particularly where market logics displace affordability.

Expounding on Mazzucato’s mission-oriented framework,[ ] STR governance becomes part of a public value–driven legal economy, where institutional design actively steers private incentives toward socially desirable outcomes. The goal is not to suppress innovation, but to align legal form with normative ends – redirecting capital and contract toward the reproduction of urban life, not merely its monetization. Housing, in this view, is not only a commodity, but a platform good essential to the democratic functioning of the city. This reconceptualization does not abolish ownership or agreement – it repositions them. It affirms that entitlements in the urban housing market are conditional, not absolute; constructed, not natural; and legitimate only insofar as they do not sabotage the very conditions of collective urban life. Such doctrinal shifts correlate with measurable macroeconomic and redistributive outcomes. Empirical studies increasingly s243how that STR regulation contributes to rent deceleration, reduced volatility in housing supply, and rebalancing of tenure regimes in high-pressure urban zones. In cities like Berlin and Barcelona, post-regulation data show median rent growth halved within three years, and vacancy reabsorption into the long-term market increased by over 18 %.[ ]

These effects might extend beyond pricing: they could mitigate asymmetric exposure to housing precarity, shift investment away from speculative buy-to-let models,[ ] and reduce financialization feedback loops that could exacerbate inequality.[ ] STR regulation thus, acts as a demand dampener and a spatial redistributor, allowing housing systems to approximate a more socially optimal equilibrium. In this sense, doctrinal repositioning operates as a legal-macroeconomic intervention: it retools private law to function as a stabilizer, ensuring that legal entitlements do not outpace the carrying capacity of urban systems.

4 Neighborhood Effects and Heterogeneity

The expansion STR platforms such as Airbnb has produced significant and spatially differentiated effects on urban housing markets. Empirical evidence shows that STR penetration correlates with housing shortages, increased rental prices, and displacement effects[ ] – yet the magnitude and direction of these effects vary considerably by city, neighborhood, and regulatory context.

In markets with inelastic housing supply – typically those with stringent zoning laws, heritage protections, and constrained new development – STR growth exerts upward pressure on both rental and purchase prices. As demonstrated by García-López et al. (2020) in their quasi-experimental study of Barcelona, a 1 % increase in Airbnb activity is associated with a 0.9 % rise in rents and a 0.7 % increase in housing prices, with the strongest effects concentrated in tourist-heavy districts.244 [ ] The ban on STR licenses in 2018 led to a measurable stabilization in rental trends, confirming a causal link between platform activity and affordability dynamics.

The Italian context confirms this pattern. In cities like Milan, the average purchase price per square meter in central zones exceeds €9,800, with average rental prices above €28/m2/month.[ ] Florence, Rome, and Venice display similarly high valuations in central neighborhoods, where STR concentration is also the highest.[ ] This geographical overlap points to a redistributive effect: STRs extract residential units from the long-term market, concentrating returns among owners in prime locations while pushing residents toward peripheral areas with lower amenities and connectivity.

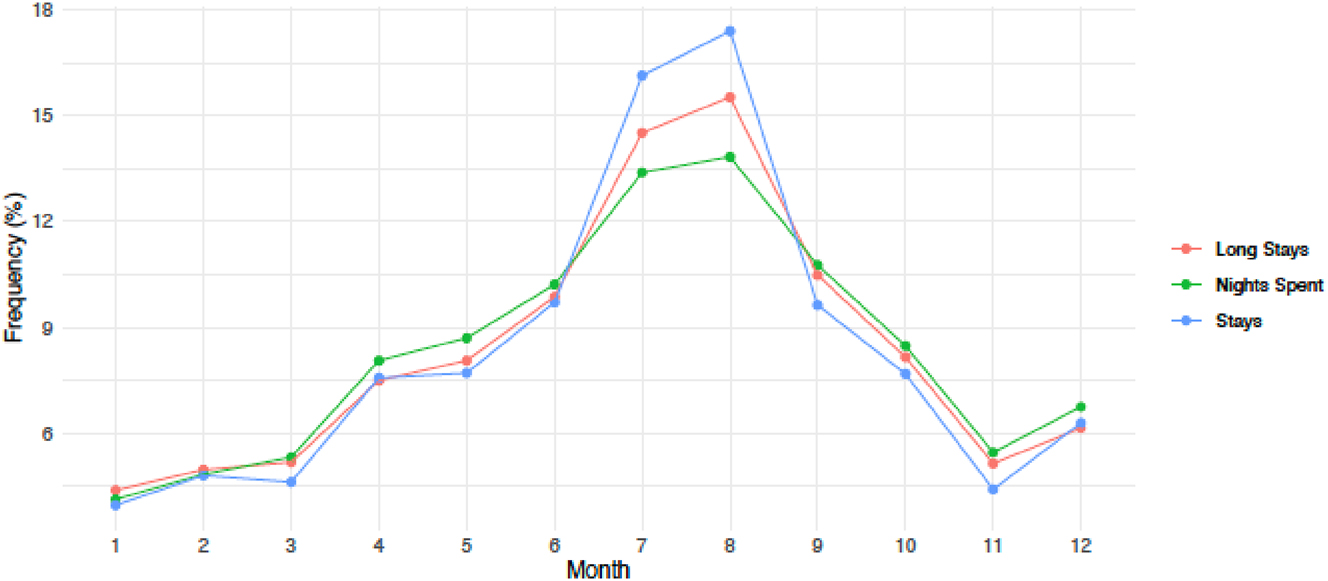

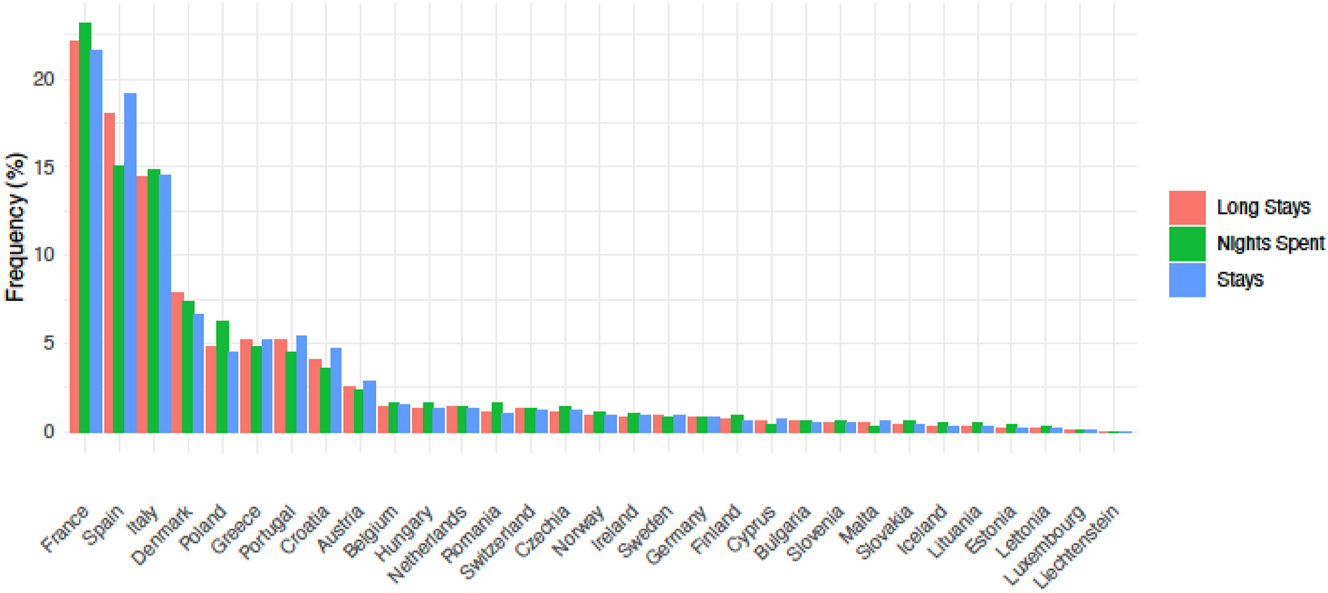

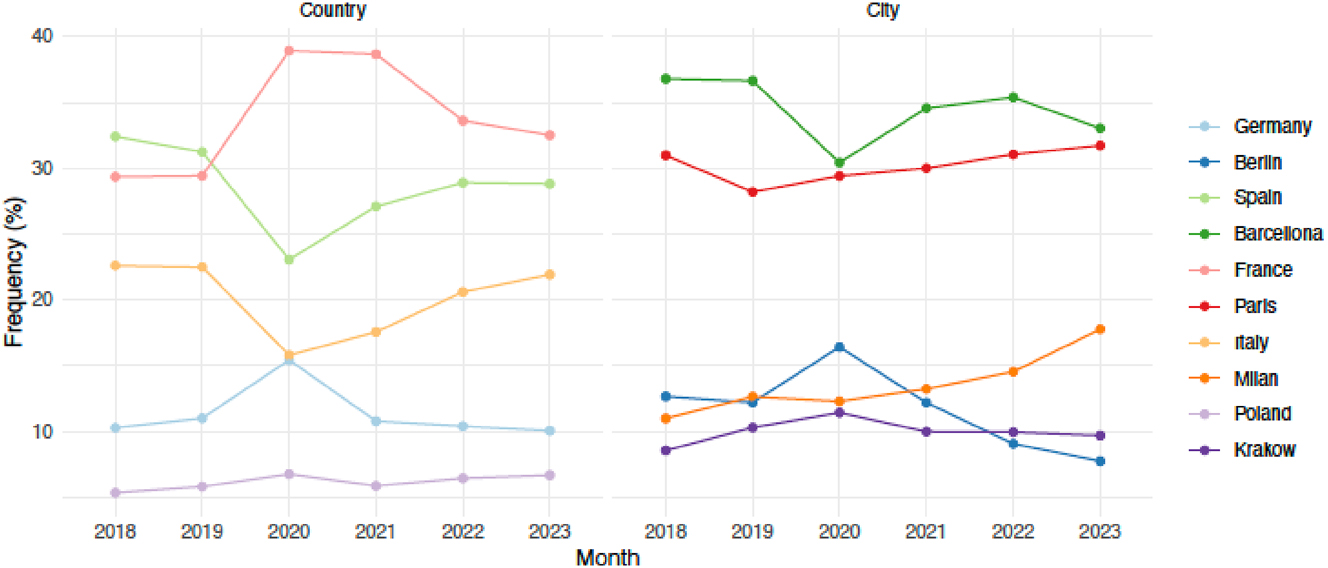

Yet this pattern is not uniform. Data from EUROSTAT reveal substantial variance in Airbnb demand both between and within European cities and countries, as well as a seasonal component (Table 1; Figures 1–3):

Frequency of nights spent in short-stays accommodations in European selected cities by country in 2023.

| Country | City | Freq. | |

|---|---|---|---|

| Germany | 49,278,441 | 2,988,849 | 6.07 |

| Spain | 141,056,225 | 12,715,643 | 9.01 |

| France | 159,111,370 | 12,209,436 | 7.67 |

| Italy | 107,273,361 | 6,840,479 | 6.38 |

| Poland | 32,740,350 | 3,733,421 | 11.40 |

-

Author’s own elaboration. Data: Eurostat.

Frequency of short-stays by month in Europe – 2023. Author’s own elaboration. Data: Eurostat.

Frequency of short-stays in Europe 2018–2023. Author’s own elaboration. Data: Eurostat.

Frequency of short-stays in European countries – 2023. Author’s own elaboration. Data: Eurostat.

Berlin’s policy of strict enforcement under the Zweckentfremdungsverbotgesetz resulted in a much slower rebound of STR stays post-COVID, with city-level listings recovering only 60 % of their pre-2020 levels (Figure 4). Berlin has also succeeded in decoupling STR intensity from residential displacement. Policy mix – enforcement capacity, clarity of rules, and integration with fiscal monitoring – might correlate strongly with STR containment. Importantly, in Berlin, unlike Milan or London, the majority of STR offerings post-regulation were concentrated in owner-occupied units, mitigating investor-driven buy-to-let cycles.

Frequency of nights spent in short-stay accommodations in European selected countries and cities by year 2018–2023. Author’s own elaboration. Data: Eurostat.

In contrast, Milan shows a faster and more uneven STR recovery, particularly concentrated in high-tourism corridors. The ratio of city to national STR activity also varies, suggesting differing levels of centralization and substitution effects (Figure 4; 245 Table 1).

It would be reductive to describe Airbnb and STR platforms as uniformly negative. In low-density regions or declining mid-sized cities, STRs can reactivate dormant housing stock and generate local economic multipliers, especially where tourism is seasonally constrained. The JRC (2025) report highlights instances in Southern Italy and inland France where STRs have not displaced tenants but rather attracted investment and improved regional hospitality infrastructure.[ ] In these cases, STRs supplement rather than supplant the 246long-term market.

A recent counterfactual Impact study by Bei and Celata (2023) on 16 European cities found that cities implementing stringent STR regulation achieved a 28.8 % average reduction in listings of entire apartments, a 24.4 % decline in the ratio of entire apartments to private rooms, and a 25.2 % decrease in professionalized hosting.[ ] These effects persisted over time and were magnified where regulations were reinforced by data-sharing agreements with platforms. Yet the study also shows that spatial concentration of STRs remained largely unaffected, indicating the limits of zoning approaches absent compre247hensive enforcement tools.

To empirically assess the spatial and temporal determinants of Airbnb listing prices across major European cities, I estimated a semi-log HPM with neighborhood-level fixed effects and quarter dummies,[ ] employing heteroskedasticity-robust standard errors clustered at the neighbourhood level. The baseline model is specified as:

where

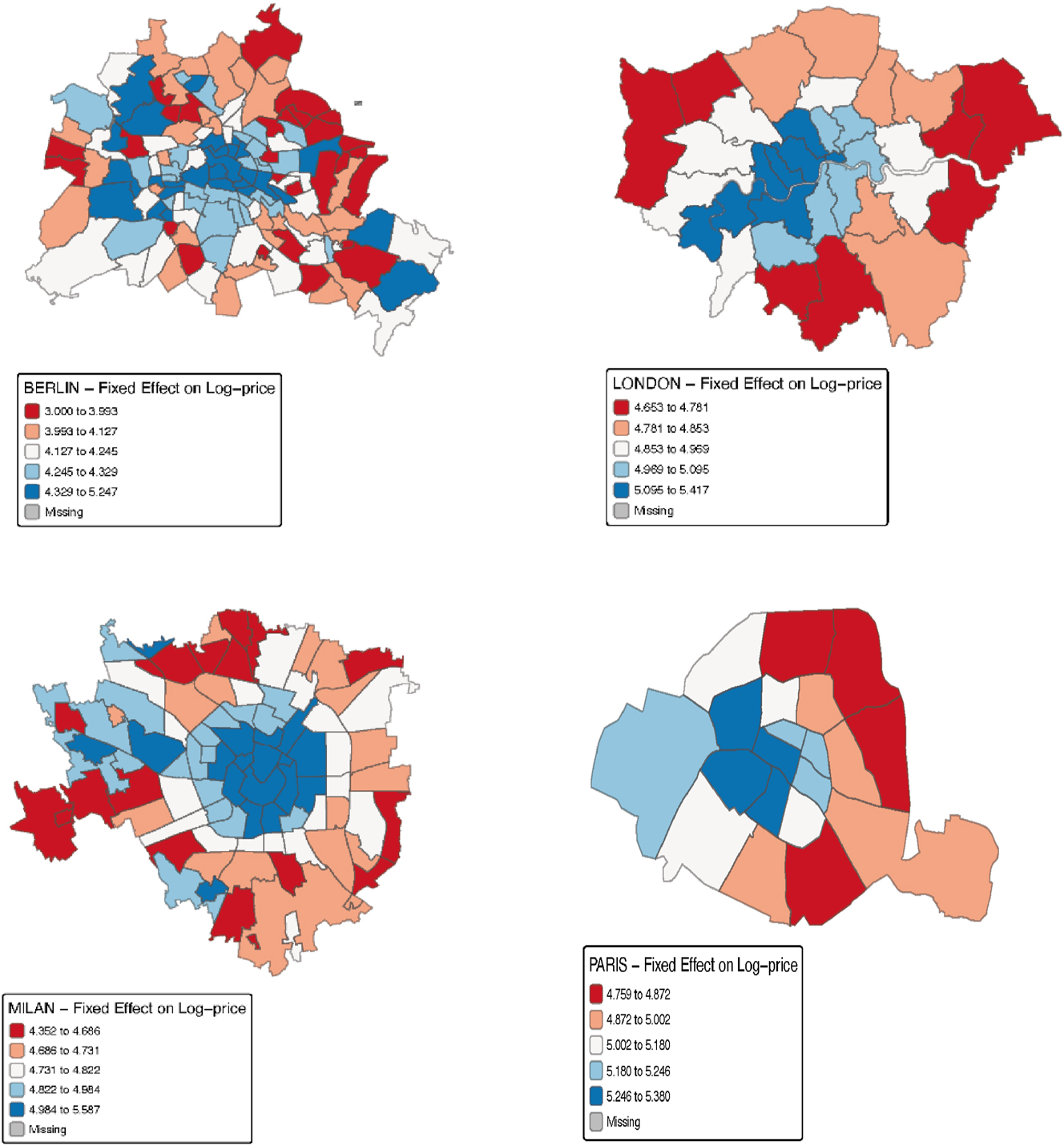

The fixed effects, mapped geographically, reveal strong and spatially persistent price premiums (Figure 5; Table 2). In central, high-income neighborhoods (e.g., Le Marais, Chelsea, Islington, Centro Storico), and systematic penalization of peripheral or socio-economically disadvantaged districts (e249.g., Quarto Oggiaro, Lichtenberg, 19th Arrondissement). Importantly, these spatial effects hold conditional on listing-level covariates, implying that structural differences in amenities or quality do not fully explain the observed price stratification. Heatmaps of average prices by neighborhood (See Appendix) support this spatial decomposition and reveal clear radial gradients from urban cores to the periphery, especially in monocentric cities like Milan and Paris.

Neighborhood fixed effect on log-price in Berlin (top-left), London (top-right), Milan (bottom-left), and Paris (bottom right). Author’s own elaboration. Data: Inside Airbnb. Period: September 2024–June 2025.

Regression results by city (fixed effects model).

| Variable | Berlin | London | Milan | Paris |

|---|---|---|---|---|

| room_type: Hotel room | 0.4411*** (0.1024) | 0.7209*** (0.0996) | 0.3474** (0.1102) | 0.7454*** (0.0529) |

| room_type: Private room | −0.5509*** (0.0330) | |||

| room_type: Shared room | −1.234*** (0.0930) | −0.4322** (0.1224) | −0.5154*** (0.0987) | −0.6653*** (0.0948) |

| room_type: Entire apt | 0.8811*** (0.0156) | 0.3714*** (0.0153) | 0.3032*** (0.0362) | |

| number_of_reviews | −0.0001* (5.7e-5) | −0.0008*** (0.0001) | −0.0009*** (5.86e-5) | −0.0005*** (8.63e-5) |

| availability_365 | 0.0005*** (5.64e-5) | 0.0005*** (3.15e-5) | 0.0003*** (3.8e-5) | 0.0005*** (3.55e-5) |

| quarter = Q2 | −0.1311*** (0.0132) | 0.0136* (0.0052) | −0.1992*** (0.0135) | −0.0501*** (0.0039) |

| quarter = Q3 | −0.1765*** (0.0123) | −0.0811*** (0.0072) | −0.3129*** (0.0123) | −0.0597*** (0.0039) |

| quarter = Q4 | −0.0436*** (0.0103) | 0.0042 (0.0103) | −0.1865*** (0.0060) | 0.0159. (0.0085) |

| R 2 | 0.279 | 0.512 | 0.246 | 0.124 |

| Within R 2 | 0.198 | 0.406 | 0.121 | 0.049 |

| Obs | 35,925 | 245,879 | 76,543 | 228,182 |

-

Author’s own elaboration. Data: Inside Airbnb. Period: September 2024–June 2025. Standard errors clustered by neighbourhood. Dependent variable: log(price). Significance codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1.

Descriptive statistics confirm that the distribution of listing prices is right skewed in all cities, with a long upper tail that reflects luxury and professionally managed units (See Appendix). By estimating the model in logarithmic form and applying upper-bound trimming (typically at 500 or 1000 euros), I mitigate the leverage of extreme values while preserving the interpretability of central tendencies and variance decomposition. This transformation is essential to correct for heteroskedasticity and to allow elastic interpretations of coefficients.

From an equity standpoint, the implications are non-trivial: agents listing private rooms – often lower-income250 individuals, leveraging underutilized space, as it seems reasonable to assume – are systematically penalized both in absolute terms and relative to other room types. In Paris, for instance, the coefficient for private room listings is ceteris paribus nearly 75 log points below hotel-type listings. This differential is even more severe in cities like London and Berlin. Given that private room hosts tend to be from lower deciles of the income distribution (as documented in recent platform-level microdata), this price asymmetry introduces a regressive bias in the platform economy, effectively concentrating economic returns among higher-capitalized actors capable of offering full-unit or hotel-style accommodations.

We observe that STR regulations in Paris and Barcelona had asymmetric effects: Paris saw reduced revenue volatility for long-term landlords, whereas Barcelona’s tighter regime reduced rental price volatility at the neighborhood level.[ ] These findings confirm that STR policies act as localized price stabilizers – but only under specific enforcement and fiscal configurations.

Thus, the core empirical finding is heterogeneity: STRs are neither universally harmful nor universally beneficial. Their impact depends on interaction effects between supply elasticity, demographic pressure, ownership structure, and legal design. Law must incorporate this heterogeneity to avoid static prescriptions. The key is differentiated regulation: strong caps and monitoring in high-pressure cities; moderate fiscalization and disclosure obligations in mixed markets; and enabling policies in structurally weak or depopulating areas.

The number of entire-home listings as a percentage of all active STR units consistently exceeds 80 % in Milan, Paris, and Barcelona, with median host revenue in central districts often reaching 3–5 times local monthly wages.[ ] In Paris’s 18th Arrondissement, for example, the average revenue per STR listing surpasses €22,000 annually, whereas the median residential rent for long-term tenants remains below €12/m2/month. This income gap incentivizes conversion and underpins a structural shift in owner behavior toward yield maximization, particularly for rentier-absentee profiles. Even within cities, intra-municipal variance is extreme: in Milan, STR density in Brera, Navigli, and Duomo exceeds 20 % of the total housing stock, compared to under 3 % in adjacent semi-central districts – producing localized price elasticities that diverge by a factor of 3–1. Such divergences can generate recursive feedback loops: as expected returns rise in central nodes, so too do speculative acquisitions, which crowd out non-investor demand, amplify vola251tility, and redistribute financial risks downstream onto more vulnerable tenants and peripheral geographies. The need for regulatory correction is therefore not only justified on distributive or urbanistic grounds, but as a necessary recalibration of private law theory in light of empirical disequilibria. These transformations underscore a structural divergence between the nominal architecture of private law and the empirical configuration of urban markets. STRs convert residential space into high-frequency, high-yield financial assets, compressing the temporal structure of housing utility into short-cycle liquidity. In doing so, they erode the social function of property – its anchoring in stability, access, and urban continuity – by privileging marginal revenue extraction over cumulative social use. Across major cities, over 80 % of STRs are entire homes, not spare rooms; host revenue exceeds local wage benchmarks in core districts; and income gaps between STR and long-term tenancies are not marginal but exponential. In Milan, host income in Brera and Duomo can reach €35,000/year, while long-term rents stagnate under €14,000 – generating price-to-income ratios incompatible with inclusive housing.[ ]

Policy design should thus consider not only aggregate externalities (e.g., tourism pressure, housing exclusion), but also the distributional structure of platform income across host types and neighborhoods. Regulatory schemes relying solely on thresholds (e.g., number of nights or type of host) risk ignoring the geographic and structural dimensions that condition access to profitability. Results suggest that more granular, spatially aware policy instruments – such as zoning-based caps, differentiated taxation, or quota systems adjusted by room type – may enhance both the efficiency and equity of short-term rental regulation in European urban markets.

5 Taking Stock

The comparative analysis developed in this paper reveals that STR regulation is not merely a reactive set of public constraints but a constitutive element within the evolving architecture of private law. Property and contract doctrines, far from being insulated, are reshaped by the dynamics of platform intermediation, by fiscal incentives, and by the urban conditions in which they operate. The transformation of housing from a stable asset or basic entitlemen252t into a high-frequency investment good reconfigures both ownership and contractual autonomy, exposing private law to forms of functional strain and distributive tension.

STR regulation acts as a normative filter through which spatial inequalities are reinforced or mitigated. The empirical analysis demonstrates the structural impact of location, listing type, and seasonality on price formation. The hedonic model confirms that price differentials are not random, but strongly associated with neighbourhood-specific effects, listing segmentation, and access to full-unit property. These effects are statistically significant, robust across model specifications, and reveal a marked advantage for capital-intensive hosts over those offering shared or private rooms, often with more precarious economic profiles. In this regard, platform dynamics mirror and amplify urban stratification.

Across jurisdictions, we observe diverging yet path-dependent approaches to regulation: Berlin relies on strong municipal enforcement; Paris retains granular caps with partial segmentation; Milan exhibits regressive outcomes through fiscal neutrality; London maintains formal limits with limited efficacy. These trajectories reflect different legal cultures, but they also expose the ambivalence of private law in dealing with spatialized economic power. Legal categories such as ownership, lease, and personal use are increasingly stretched across policy, fiscal, and technological registers. The result is not legal obsolescence, but doctrinal mutation.

What STR platforms make visible is the performative dimension of legal institutions. Doctrines are not neutral containers of rights – they function as instruments of spatial ordering and socio-economic differentiation. In this light, regulation is not external to private law, but internal to its reproduction. My analysis suggests that a renewed legal-economic framework is needed: one that moves beyond efficiency metrics to incorporate bounded rationality, enforcement asymmetries, and socio-spatial sustainability. It also calls for a reconsideration of how legal entitlements are allocated, taxed, and licensed in relation to collective needs such as housing. If private law is to remain normatively coherent in the governance of urban space, it must integrate the empirical realities revealed by STR markets. This does not entail rejecting contractual innovation or reifying public control, but recognizing that ‘legal design choices’ structure access to the city itself. STR regulation, in this sense, becomes a paradigmatic site for rethinking the foundations of private law in a platform-mediated, spatially unequal economy.

Robustness

Berlin – Robustness

| Baseline | Trim outliers | Interaction | log(reviews) | Only entire apt | |

|---|---|---|---|---|---|

| room_typeEntire home/apt | 0.551 | 0.538 | 0.562 | 0.555 | |

| (0.033) | (0.026) | (0.044) | (0.033) | ||

| room_typeHotel room | 0.992 | 0.806 | 0.972 | 0.971 | |

| (0.088) | (0.057) | (0.085) | (0.092) | ||

| room_typeShared room | −0.683 | −0.448 | −0.771 | −0.691 | |

| (0.081) | (0.059) | (0.089) | (0.082) | ||

| number_of_reviews | −0.000 | −0.000 | −0.000 | 0.000 | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| availability_365 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| quarter = Q2 | −0.131 | −0.125 | −0.061 | −0.132 | −0.122 |

| (0.013) | (0.013) | (0.013) | (0.013) | (0.012) | |

| quarter = Q3 | −0.176 | −0.163 | −1.260 | −0.177 | −0.171 |

| (0.012) | (0.012) | (0.587) | (0.012) | (0.010) | |

| quarter = Q4 | −0.044 | −0.034 | −0.278 | −0.045 | −0.034 |

| (0.010) | (0.011) | (0.134) | (0.010) | (0.010) | |

| room_typePrivate room × quarter = Q1 | −0.227 | ||||

| (0.144) | |||||

| room_typeEntire home/apt × quarter = Q1 | −0.245 | ||||

| (0.135) | |||||

| room_typeHotel room × quarter = Q1 | 0.058 | ||||

| (0.134) | |||||

| room_typePrivate room × quarter = Q2 | −0.306 | ||||

| (0.141) | |||||

| room_typeEntire home/apt × quarter = Q2 | −0.307 | ||||

| (0.126) | |||||

| room_typeHotel room × quarter = Q2 | −0.415 | ||||

| (0.142) | |||||

| room_typeShared room × quarter = Q2 | 0.120 | ||||

| (0.146) | |||||

| room_typePrivate room × quarter = Q3 | 0.871 | ||||

| (0.436) | |||||

| room_typeEntire home/apt × quarter = Q3 | 0.844 | ||||

| (0.450) | |||||

| room_typeHotel room × quarter = Q3 | 0.777 | ||||

| (0.562) | |||||

| room_typeShared room × quarter = Q3 | 0.657 | ||||

| (0.385) | |||||

| log1p(number_of_reviews) | 0.020 | ||||

| (0.004) | |||||

| Num obs | 35,925 | 35,331 | 35,925 | 35,925 | 26,475 |

| R2 | 0.279 | 0.276 | 0.280 | 0.282 | 0.104 |

| R2 adj | 0.276 | 0.273 | 0.277 | 0.279 | 0.099 |

| R2 within | 0.198 | 0.195 | 0.200 | 0.201 | 0.016 |

| R2 within adj | 0.198 | 0.194 | 0.199 | 0.201 | 0.016 |

| AIC | 57,386.8 | 51,683.2 | 57,327.5 | 57,231.2 | 42,247.9 |

| BIC | 58,626.2 | 52,920.2 | 58,660.3 | 58,470.6 | 43,401.8 |

| RMSE | 0.54 | 0.50 | 0.54 | 0.53 | 0.53 |

| Std errors | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood |

| FE: neighbourhood | X | X | X | X | X |

London – Robustness

| Baseline | Trim outliers | Interaction | log(reviews) | Only entire apt | |

|---|---|---|---|---|---|

| room_typeEntire home/apt | 0.881 | 0.851 | −0.484 | 0.882 | |

| (0.016) | (0.019) | (0.069) | (0.014) | ||

| room_typeHotel room | 0.721 | 0.718 | −0.163 | 0.732 | |

| (0.100) | (0.122) | (0.057) | (0.099) | ||

| room_typeShared room | −0.432 | −0.381 | −2.046 | −0.447 | |

| (0.122) | (0.116) | (0.179) | (0.118) | ||

| number_of_reviews | −0.001 | −0.001 | −0.001 | −0.001 | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| availability_365 | 0.001 | 0.000 | 0.001 | 0.000 | 0.001 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| quarter = Q2 | 0.014 | 0.010 | −0.092 | 0.014 | 0.012 |

| (0.005) | (0.004) | (0.047) | (0.005) | (0.006) | |

| quarter = Q3 | −0.081 | −0.076 | −0.911 | −0.081 | −0.086 |

| (0.007) | (0.005) | (0.103) | (0.007) | (0.005) | |

| quarter = Q4 | 0.004 | −0.003 | −0.464 | 0.004 | 0.022 |

| (0.010) | (0.007) | (0.112) | (0.010) | (0.013) | |

| room_typePrivate room × quarter = Q1 | −1.848 | ||||

| (0.163) | |||||

| room_typeEntire home/apt × quarter = Q1 | −0.485 | ||||

| (0.121) | |||||

| room_typeHotel room × quarter = Q1 | −0.917 | ||||

| (0.197) | |||||

| room_typePrivate room × quarter = Q2 | −1.736 | ||||

| (0.163) | |||||

| room_typeEntire home/apt × quarter = Q2 | −0.382 | ||||

| (0.105) | |||||

| room_typeHotel room × quarter = Q2 | −0.715 | ||||

| (0.182) | |||||

| room_typePrivate room × quarter = Q3 | −0.999 | ||||

| (0.083) | |||||

| room_typeEntire home/apt × quarter = Q3 | 0.339 | ||||

| (0.023) | |||||

| room_typeHotel room × quarter = Q3 | −0.319 | ||||

| (0.129) | |||||

| room_typeShared room × quarter = Q3 | 0.200 | ||||

| (0.086) | |||||

| room_typePrivate room × quarter = Q4 | −1.409 | ||||

| (0.070) | |||||

| room_typeHotel room × quarter = Q4 | −0.570 | ||||

| (0.147) | |||||

| log1p(number_of_reviews) | −0.047 | ||||

| (0.004) | |||||

| Num obs | 245,879 | 236,602 | 245,879 | 245,879 | 164,828 |

| R2 | 0.512 | 0.532 | 0.512 | 0.518 | 0.162 |

| R2 adj | 0.511 | 0.532 | 0.512 | 0.518 | 0.162 |

| R2 within | 0.406 | 0.445 | 0.407 | 0.414 | 0.032 |

| R2 within adj | 0.406 | 0.445 | 0.407 | 0.414 | 0.032 |

| AIC | 363,910.1 | 296,540.8 | 363,575.4 | 360,772.5 | 250,535.4 |

| BIC | 364,337.0 | 296,966.2 | 364,127.3 | 361,199.5 | 250,915.9 |

| RMSE | 0.51 | 0.45 | 0.51 | 0.50 | 0.52 |

| Std errors | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood |

| FE: neighbourhood | X | X | X | X | X |

Milan – Robustness

| Baseline | Trim outliers | Interaction | log(reviews) | Only entire apt | |

|---|---|---|---|---|---|

| room_typeEntire home/apt | 0.371 | 0.345 | 0.369 | 0.390 | |

| (0.015) | (0.015) | (0.037) | (0.015) | ||

| room_typeHotel room | 0.347 | 0.373 | 0.621 | 0.347 | |

| (0.110) | (0.104) | (0.221) | (0.101) | ||

| room_typeShared room | −0.515 | −0.463 | −0.511 | −0.502 | |

| (0.099) | (0.101) | (0.079) | (0.092) | ||

| number_of_reviews | −0.001 | −0.001 | −0.001 | −0.001 | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| availability_365 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| quarter = Q2 | −0.199 | −0.190 | −0.222 | −0.196 | −0.213 |

| (0.013) | (0.010) | (0.016) | (0.014) | (0.013) | |

| quarter = Q3 | −0.313 | −0.304 | −0.540 | −0.310 | −0.326 |

| (0.012) | (0.009) | (0.071) | (0.012) | (0.011) | |

| quarter = Q4 | −0.186 | −0.176 | −0.417 | −0.181 | −0.184 |

| (0.006) | (0.005) | (0.022) | (0.006) | (0.005) | |

| room_typePrivate room × quarter = Q1 | −0.283 | ||||

| (0.031) | |||||

| room_typeEntire home/apt × quarter = Q1 | −0.231 | ||||

| (0.020) | |||||

| room_typeHotel room × quarter = Q1 | −0.330 | ||||

| (0.251) | |||||

| room_typeShared room × quarter = Q1 | −0.236 | ||||

| (0.082) | |||||

| room_typePrivate room × quarter = Q2 | −0.149 | ||||

| (0.033) | |||||

| room_typeEntire home/apt × quarter = Q2 | −0.222 | ||||

| (0.016) | |||||

| room_typeHotel room × quarter = Q2 | −0.577 | ||||

| (0.234) | |||||

| room_typeShared room × quarter = Q2 | −0.289 | ||||

| (0.097) | |||||

| room_typePrivate room × quarter = Q3 | 0.036 | ||||

| (0.047) | |||||

| room_typeEntire home/apt × quarter = Q3 | −0.016 | ||||

| (0.080) | |||||

| room_typeHotel room × quarter = Q3 | −0.645 | ||||

| (0.254) | |||||

| room_typePrivate room × quarter = Q4 | −0.062 | ||||

| (0.043) | |||||

| log1p(number_of_reviews) | −0.067 | ||||

| (0.004) | |||||

| Num obs | 76,543 | 74,629 | 76,543 | 76,543 | 67,040 |

| R2 | 0.246 | 0.263 | 0.247 | 0.263 | 0.199 |

| R2 adj | 0.245 | 0.262 | 0.246 | 0.262 | 0.198 |

| R2 within | 0.121 | 0.133 | 0.122 | 0.140 | 0.073 |

| R2 within adj | 0.120 | 0.133 | 0.122 | 0.140 | 0.073 |

| AIC | 115,397.1 | 93,716.5 | 115,300.9 | 113,652.0 | 98,620.7 |

| BIC | 116,284.7 | 94,601.6 | 116,299.4 | 114,539.5 | 99,468.2 |

| RMSE | 0.51 | 0.45 | 0.51 | 0.51 | 0.50 |

| Std errors | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood |

| FE: neighbourhood | X | X | X | X | X |

Paris – Robustness

| Baseline | Trim outliers | Interaction | log(reviews) | Only entire apt | |

|---|---|---|---|---|---|

| room_typeEntire home/apt | 0.303 | 0.292 | 0.305 | 0.303 | |

| (0.036) | (0.034) | (0.040) | (0.035) | ||

| room_typeHotel room | 0.745 | 0.701 | 0.909 | 0.745 | |

| (0.053) | (0.049) | (0.074) | (0.053) | ||

| room_typeShared room | −0.665 | −0.641 | −0.703 | −0.668 | |

| (0.095) | (0.085) | (0.104) | (0.092) | ||

| number_of_reviews | −0.001 | −0.000 | −0.001 | −0.000 | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| availability_365 | 0.001 | 0.000 | 0.001 | 0.000 | 0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| quarter = Q2 | −0.050 | −0.039 | −0.047 | −0.044 | −0.052 |

| (0.004) | (0.003) | (0.058) | (0.005) | (0.004) | |

| quarter = Q3 | −0.060 | −0.054 | −0.206 | −0.054 | −0.060 |

| (0.004) | (0.003) | (0.057) | (0.004) | (0.004) | |

| quarter = Q4 | 0.016 | 0.010 | −0.029 | 0.027 | 0.014 |

| (0.008) | (0.006) | (0.024) | (0.007) | (0.009) | |

| room_typePrivate room × quarter = Q1 | −0.052 | ||||

| (0.022) | |||||

| room_typeEntire home/apt × quarter = Q1 | −0.043 | ||||

| (0.021) | |||||

| room_typeHotel room × quarter = Q1 | −0.250 | ||||

| (0.052) | |||||

| room_typeShared room × quarter = Q1 | 0.082 | ||||

| (0.062) | |||||

| room_typePrivate room × quarter = Q2 | −0.022 | ||||

| (0.076) | |||||

| room_typeEntire home/apt × quarter = Q2 | −0.049 | ||||

| (0.074) | |||||

| room_typeHotel room × quarter = Q2 | −0.284 | ||||

| (0.085) | |||||

| room_typePrivate room × quarter = Q3 | 0.093 | ||||

| (0.048) | |||||

| room_typeEntire home/apt × quarter = Q3 | 0.103 | ||||

| (0.044) | |||||

| room_typeHotel room × quarter = Q3 | −0.071 | ||||

| (0.055) | |||||

| log1p(number_of_reviews) | −0.044 | ||||

| (0.006) | |||||

| Num obs | 228,182 | 214,292 | 228,182 | 228,182 | 205,465 |

| R2 | 0.124 | 0.122 | 0.124 | 0.133 | 0.085 |

| R2 adj | 0.124 | 0.121 | 0.124 | 0.133 | 0.085 |

| R2 within | 0.049 | 0.050 | 0.049 | 0.059 | 0.014 |

| R2 within adj | 0.049 | 0.050 | 0.049 | 0.059 | 0.014 |

| AIC | 422,930.1 | 332,991.3 | 422,886.3 | 420,487.5 | 378,806.1 |

| BIC | 423,219.5 | 333,279.0 | 423,279.2 | 420,777.0 | 379,061.9 |

| RMSE | 0.61 | 0.53 | 0.61 | 0.61 | 0.61 |

| Std errors | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood | By: neighbourhood |

| FE: neighbourhood | X | X | X | X | X |

© 2025 the author(s), published by De Gruyter, Berlin/Boston

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Frontmatter

- Articles

- Contract Law and the Right to Housing – An Introduction

- Contract, Property, and the Market: Regulating Short-Term Rentals in Comparative Perspective

- The Exclusion of the Arbitrary Ordinary Termination in German Residential Tenancy Law: A Private Law Perspective

- What Role for the Right to Housing in Mortgage Law? Homeownership and Systemic Considerations in Private Law Beyond the State

- Mistakes that Marginalize. Vulnerable Households, Access to Housing, and Financial Advice

- French Community Land Trusts and the Creation of the Bail Réel Solidaire (BRS): A Contractual Innovation Promoting Autonomy and the ‘Right to Housing’?

- The Brazilian Legal Right of ‘Laje’ (Rooftop Property): A Path Towards the Recognition of Popular Housing Entitlements

- Contractarian Risks for Tenant Rights in a Time of Constitutional Property Formalism

- Binding Rights: Contractual Federalism and the Right to Housing in Canada

- Outcome Contracts and Partnerships: Public and Private Duties for an Emerging Customary Housing Law

Artikel in diesem Heft

- Frontmatter

- Articles

- Contract Law and the Right to Housing – An Introduction

- Contract, Property, and the Market: Regulating Short-Term Rentals in Comparative Perspective

- The Exclusion of the Arbitrary Ordinary Termination in German Residential Tenancy Law: A Private Law Perspective

- What Role for the Right to Housing in Mortgage Law? Homeownership and Systemic Considerations in Private Law Beyond the State

- Mistakes that Marginalize. Vulnerable Households, Access to Housing, and Financial Advice

- French Community Land Trusts and the Creation of the Bail Réel Solidaire (BRS): A Contractual Innovation Promoting Autonomy and the ‘Right to Housing’?

- The Brazilian Legal Right of ‘Laje’ (Rooftop Property): A Path Towards the Recognition of Popular Housing Entitlements

- Contractarian Risks for Tenant Rights in a Time of Constitutional Property Formalism

- Binding Rights: Contractual Federalism and the Right to Housing in Canada

- Outcome Contracts and Partnerships: Public and Private Duties for an Emerging Customary Housing Law