Abstract

Adapting to market and technological turbulence is essential for survival in a developing enterprise and requires making changes. Firms may need to increase their innovation performance to keep up and struggle with these changes to gain a competitive advantage. We believe that the courage of the entrepreneur emerges as a catalyst in such a struggle. Since a firm’s superior performance is contingent on both internal and external environments of the firm, depending on, contingency theory, the current study investigates the effect of market and technological changes, which are part of environmental changes, on innovation performance in nascent enterprises and the moderating role of courage in this effect. The authors collected data from 331 innovative companies acting in free trade zones by using the convenience sampling method via HR department managers. The results showed that market and technological changes were significantly and positively related to innovative performance, and the entrepreneur’s courage moderated this relationship. It can be stated that entrepreneurs with high courage responded to changes with more innovation than those with low courage.

1 Introduction

New initiatives are vital in improving and developing countries’ social and economic situations. They impact creating new job opportunities for people, developing innovation potential, and providing added value (Revuelto-Taboada et al., 2021). Moreover, it is also possible for enterprises to gain sustainable competitive advantages and increase prosperity in their respective countries through the skills the entrepreneurs possess (Eniola & Ektebang, 2014). However, today, the change in customer preferences and, in turn, the shortening of the product life cycle, technological turbulence, and intense competition leave entrepreneurs to navigate severe market turbulence (Tufan & Kılıç, 2019).

This level of change often cannot be predicted in the market and technological areas, which increases interest in environmental turbulence studies in the literature (Bodlaj & Čater, 2019; Wang et al., 2022a; Zhou et al., 2018a). Despite the fact that environmental turbulence in literature often mentions the negative impact on companies (Abbas & Ul Hassan, 2017; Boyne & Meier, 2009; Turulja & Bajgoric, 2019), there is also research that highlights the entrepreneurial opportunities that environmental turbulence can produce for businesses that are aware of how their internal system and dynamics work (Lin & Yi, 2023; Priyono & Hidayat, 2022; Wang et al., 2015, 2020).

Environmental turbulence refers to the changes companies experience in the environment where they operate due to a high degree of uncertainty and unpredictability (Wang et al., 2022a). Environmental turbulence consists of two main elements: (1) market turbulence, (2) technological turbulence (Bodlaj et al., 2012).

Some authors argue that businesses need to adapt to environmental changes in order to cope with environmental turbulence (Dixon et al., 2014; Gyedu et al., 2021). In this context, it is argued that company performance depends on the harmony of the organization with the environment (external) and the harmony between organizational elements (internal) (Wilden et al., 2013).

Furthermore, it asserts that this adaptation also creates a competitive advantage of innovation based on the assumption that the company is trying to adapt to a specific environment and situation. Innovation is among the most important sources of competitive advantage in a fast-changing environment (Abdi et al., 2018). Innovation ability is expressed as one of the most important strategies that can be used by most businesses to successfully respond to fluctuations and market needs in the business environment (Maldonado-Guzman et al., 2019). Initiatives should employ innovation to take advantage of the opportunities that a dynamic market and technology offer (Chakravarty, 2022; Gilsing et al., 2014). However, market opportunities offered by new technologies are uncertain. Thus, entrepreneurs must also foresee technology-related demands and expectations and make innovative changes to meet them (Kashefi, 2016).

Some researchers suggest that businesses are informed by evaluating the environment where they operate, and in this way, they are able to identify appropriate strategies for each environmental level (Gyedu et al., 2021; Pratono & Mahmood, 2014).

The perception, organization, and evaluation of a volatile environment full of uncertainties by an entrepreneur are closely related to the entrepreneur’s behavior as well as his performance (Gomezel & Aleksić, 2020). One of the most important qualities for the entrepreneur (Pinchot, 1985) who successfully implements and manages innovation, is courage (Miller & Le Breton-Miller, 2017). One major variable is the risk that the entrepreneur faces, and this increases the importance of an entrepreneur’s courage (Gomezel & Aleksić, 2020). Therefore, the upper-echelon theory can explain courageous entrepreneurs’ effect on innovation performance. The upper-echelon theory states that entrepreneurs’ experiences, values, and perspectives on the current situation affect their decisions (Hambrick & Mason, 1984).

In the current literature, some studies have been conducted on the influence of changes in the market and technology on an enterprise’s innovation performance (Andotra & Gupta, 2016; Ch’ng et al., 2021; Guo et al., 2023; Gyedu et al., 2021; Tsai & Yang, 2014). However, there is a gap in the literature about the role of technology change in the relationship between market change and innovative performance and the mediating role in this relationship of entrepreneurial courage on the individual level. In order to fill this gap, it is critical element to determine the antecedents that will increase innovation performance for emerging initiatives in market and technological change situations when we address the topic in a long-term context.

For this reason, we have created some research questions:

What are the antecedents that determine the innovation performance of emerging initiatives?

What effects will environmental turbulence situations have on innovation performance?

Is the individual courage of entrepreneurs in environmental turbulence situations affecting the innovative performance of emerging initiatives?

Turkiye, a bridge between Europe and Asia, is located in a geopolitical position due to economic and political difficulties, in addition to political collapses and battles in neighboring countries. Companies that maintain their activities during a high level of uncertainty have difficulty maintaining innovative performance, often due to the unexpected changes in political and economic conditions, in addition to technology and market changes. Due to these conditions, many companies are not able to maintain their operations in the long run (Tufan & Kılıç, 2019). Therefore, we decided to implement our work on innovative-interference businesses in Turkiye, which has similar environmental properties to the topic we are addressing.

During the literary review, we noticed that no other study has explored whether the courage levels of individual entrepreneurs and environmental turbulence situations have an impact on strengthening the innovation performance of emerging companies. For this reason, a goal of this study is to remedy existing deficiencies in the literature, which has been advised by some previous researchers (Dean et al., 2022; Farrukh et al., 2023; Gomezel & Aleksić, 2020; Liu et al., 2019; Santos et al., 2020; Zhang & Duan, 2010).

For example, Liu et al. (2019), as a result of research on companies operating in the production sector in China, have mentioned the necessity of addressing different tools and moderating variables that may affect the relationship between innovation performance and environmental turbulence factors. Jin et al. (2022), at the end of their work on high-tech firms in China, mention that different variables can be used as an explanation of the relationship between technological change and innovation performance.

Le and Do (2023), as a result of research in Vietnam, have mentioned that studies about the variables that can strengthen the relationship between market change and innovation performance are needed. Koksal and Mert (2023), giving importance to the courage levels of employees in certain institutions, expressed that exploring the courage phenomenon could contribute to the existing literature by focusing on the results of the institution’s performance.

As a response to these calls, in this study, we will focus on contingency theory, with the purpose of filling the gap in the literature, to explore the relationship between market and technological change and the moderating role of entrepreneurial courage in this relationship. To this end, a questionnaire was conducted for senior and middle-level managers of innovative-entrepreneurial companies in free zones in Turkiye.

The contributions of this study’s findings to literature can be noted in the following way: First, this study enriches literature by reaching the conclusion that innovative-entrepreneurial firms are the main precursor of market change, technological change, and entrepreneurial courage.

This finding means market change is a critical element of technological change and entrepreneurial courage, so innovative-entrepreneurial companies can effectively improve their innovation performance. This study provides a comprehensive framework for strengthening the innovation performance of innovative-entrepreneurial companies in market change situations, taking into account the role of entrepreneurial courage. The results we achieved with the exploration of variables used in this study can guide the managers of innovative-entrepreneurial companies.

The study was established and informed by a theoretical infrastructure, and the research model was created based on the research questions and hypotheses for research at the next stage. Later, the analyses and results found in the hypothesis testing, using Likert scales, in the study are discussed. Results and limitations of the research were found and are discussed in the recommendations, especially on the subject of sector managers and academicians.

2 Theoretical Framework

As a result of rapid changes in today’s business environment, services, and products become invalid within a short time. Companies, to combat this situation, have to offer new products and services continuously. Tsai and Yang (2014) talk about those who can quickly respond to changing market demands by taking advantage of emerging opportunities due to market change. In the literature, there are researchers who express that environmental turbulence is the antecedent of innovation (Ojha et al., 2021; Turulja & Bajgoric, 2019).

Firms start innovation activities with the prospect of positive results for their achievements. Innovative-entrepreneurial firms encourage risk, attach importance to change, support new ideas, and promote new approaches to meet customer demand and expectations (Tsai & Yang, 2014). The managers of innovative companies also prefer to try out different options for solving related problems (Augusto & Coelho, 2009). In addition, innovative companies have added value to change by improving product development processes and methods (Nechaev et al., 2020).

In this study, we used contingency theory to understand the effect of environmental turbulence on innovation. When it comes to innovation, the external environment plays an important role in leading a company to be innovative, depending on its dynamism. Contingency theory is an approach used to explain the effects of variables such as external environment, market, and technology on organizational structure, design, and functioning (Darvishmotevali et al., 2020).

Contingency theory focuses on providing flexible reactions to companies. It also suggests that a company should be located in accordance with the environmental conditions faced to succeed (Turulja & Bajgoric, 2019). Companies need to adapt their strategies and structure quickly according to the new situation in the event that the environmental level increases. Ansoff (1987) spoke about the fact that companies will be appropriate for their strategic and operational activities in the event that the degree of environmental turbulence increases. It is necessary to make innovations to adapt to unexpected situations, which cannot be predicted. Therefore, it depends on the ability to quickly adapt to the situation and to make innovations in cases where environmental dynamism increases (Zhang & Watson, 2020). Based on these descriptions, the theory of conditionality is adopted as background in this study.

All of this depends on the courage of entrepreneurs or managers in the sense that companies can exhibit strategies that allow them to adapt to environmental and technological changes. Finkelstein et al. (1996) said, “We have to understand the strategist if we want to understand the strategy.” In this context, the upper-echelon theory serves as a suitable theory that can be used to explain the impact of entrepreneurial courage on innovation performance. For the first time, the main idea of the theory detailed by Hambrick and Mason (1984) is that organizations are a reflection of senior managers.

The first of the main ideas of the theory is that managers act on the basis of their personal comments while determining the strategic situations they face. The second main idea is that these personal interpretations are a function of managers’ experiences, values, and characters (Hambrick, 2007). Therefore, the experiences, values, and characters of the managers lie on the basis of personal interpretations. The upper-echelon theory has been modeled based on these two interpretations and has taken its place in the strategic management literature.

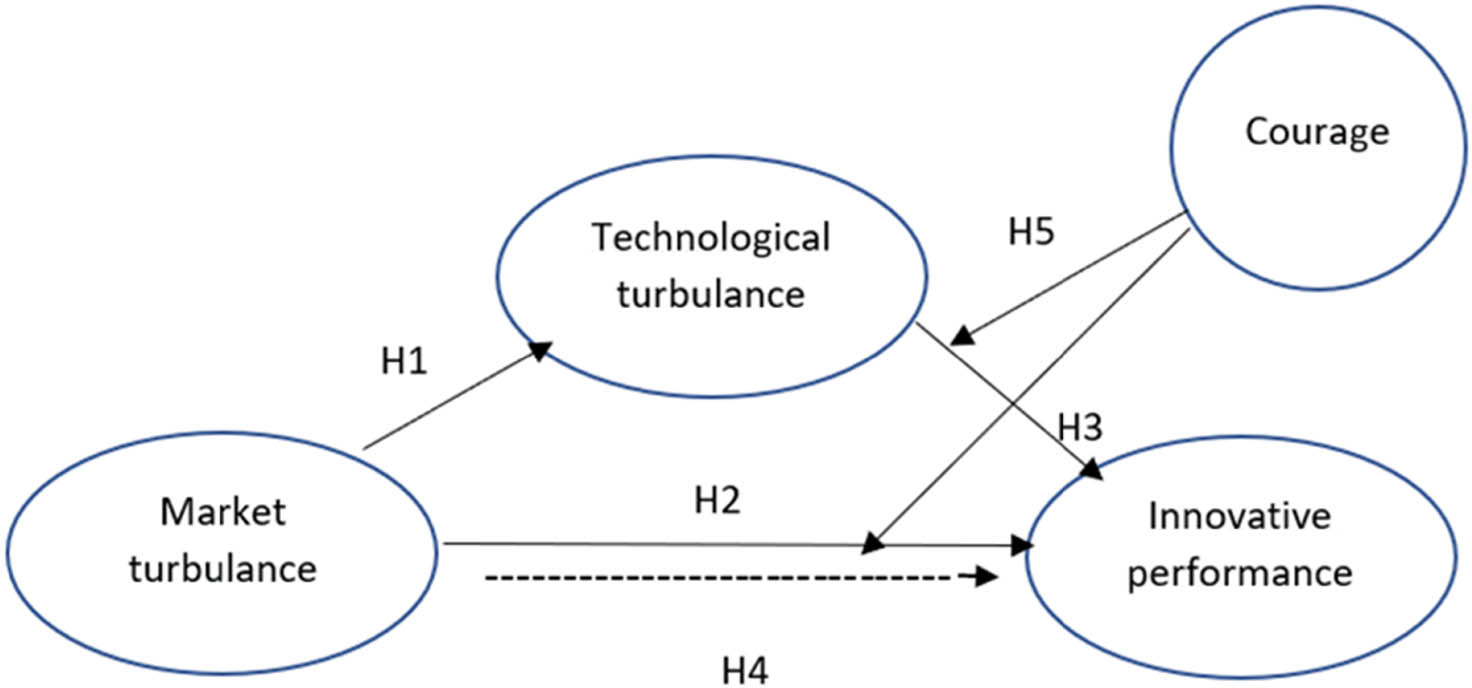

Since emerging initiatives are bound to respond to changes in the market and technology, companies need to keep up with these changes and improve innovation performance to achieve competitive advantage. In this context, we suggest that entrepreneurs are effective in making innovations needed to survive. We built our work on contingency theory and upper-echelon theory. The research model we organized in accordance with the theoretical frames is shown in Figure 1.

The research model.

With the explanations we have provided above, companies are located in the next chapters to suggest factors that affect innovation performance.

3 Literature Review

3.1 Market Turbulence and Technological Turbulence

Environmental turbulence is the term used in expressing complexities and unexpected changes that occur outside of businesses (Arici & Gok, 2023; Tsai & Yang, 2014; Wang et al., 2022a). Due to the unexpected nature and effects of change, turbulence is a dynamic environment. For this reason, the greater the unexpected change, the greater the negative impact on the organizational outputs (Obal et al., 2023). Intensity of competition, market turbulence, and technological turbulence can be counted as environmental turbulence factors for businesses (Bodlaj & Čater, 2019; Zhang et al., 2022). This study focuses on market and technology turbulence.

According to contingency theory, it is not the strategy that determines a company’s performance but rather the match between the environment and the strategy (Donaldson, 2001; Su et al., 2013). For this reason, the environment has been taken as one of the elements of contingency in strategic management literature.

Liu (2013) defined business environments with high environmental turbulence as containing uncertainties and changes that are difficult to predict in advance. The environment’s uncertainty and turbulence also bring companies obstacles and opportunities, which naturally impact commercial organizations’ business approaches. Therefore, coupled with the uncertainty in customer demands, managers who are dealing with high levels of environmental turbulence must be careful when it comes to following long-term decisions regarding the most appropriate market and technology and how to allocate their resources (Santos et al., 2020).

Market turbulence is defined as the constant changes in price and cost structures, customer demands and expectations, and competitor distribution (Gyedu et al., 2021; Senbeto & Hon, 2020). Market turbulence is essential for companies due to the uncertainty and risk it presents in business processes and the increased rate of causality it creates between strategy and company performance (Turulja & Bajgoric, 2019).

In their study, Wang et al. (2015) state that market turbulence is an important environmental factor that plays a role in the organizational performance of dynamic capabilities. Hooley et al. (2003) stated that market turbulence includes some elements, e.g., the speed of change in customer needs, the degree of competition, the various stages of the product life cycle, and the rate of change in the technologies utilized.

Jaworski and Kohli (1993) defined technological turbulence as the rate and speed of technological changes and innovations that cause technological uncertainty around the company. Companies operating in a technologically turbulent environment must adapt to technological changes that include various uncertainties and risks (Gomezel & Aleksić, 2020). Koh (1996) stated that entrepreneurs and managers tend to make decisions that lean toward taking risks in uncertain situations. Tsai and Luan (2016) demonstrated that risk-taking positively correlated with technological turbulence and innovation performance. However, Nicholson et al. (2005) showed that individuals’ risk-taking behaviors, when presented with different situations, were also relatively inconsistent. Thus, the authors argued that technological turbulence affects the perception of risk-taking among entrepreneurs and managers.

On the other hand, technological turbulence shortens existing products’ life cycles and weakens well-established companies’ competitive advantages (Arora et al., 2016). Technological turbulence also creates entrepreneurial opportunities with this aspect and presents a challenge to well-established companies in the market and the norms they have established (Martin et al., 2020).

As a result, market turbulence can also trigger environmental turbulence by increasing the speed of change in technological innovation. In other words, new technologies take the place of old technologies, making products obsolete faster, and thus, companies will be able to achieve a temporary competitive advantage (Santos et al., 2020). As emerging new technologies will increase the innovation capabilities of managers, this will also allow managers to increase their market share and develop products and new business models (Pandit et al., 2018). Frank et al. (2022) state that companies learn to conduct business by integrating technological and market knowledge proportionally to the degree of environmental turbulence.

Huang and Tsai (2014) show that market change affects new product performance through technological innovation. Omri (2015) states that the company should not be ignored by the level of innovation and the change in the sector. Guo et al. (2023) said that market change has a direct effect on the company’s innovation process with the technological exchange. Ch’ng et al. (2021) stated that companies facing the change in customer expectations and preferences are forced to develop new products and talents, leave their comfort area, develop new products with different technologies, and create relationships with new customers. In sum, the presence of market and technological turbulence increases the effect of managers, and therefore companies, on innovation performance (Iqbal et al., 2021).

Current literature talks about the innovative process and product preferences of companies in the face of continuous change in customer preferences and the technological field, leading to innovation within technological turbulence and market turbulence (Arici & Gok, 2023; Turulja & Bajgoric, 2019). With this background, we anticipate that there will be a positive relationship between market turbulence and technological turbulence.

H1: Market turbulence is positively correlated with technological turbulence.

3.2 Market Turbulence and Innovation Performance

Looking at strategic management literature, we observe that innovation is the key factor for companies to maintain their competitive advantages by continuing their activities by creating value in dynamic environments (Tidd & Bessant, 2014). Ardito et al. (2021) defined innovation performance as the sum of the innovations of an enterprise. Ferraris et al. (2019) described innovation performance as taking advantage of a company’s competencies in terms of its new services and products. Innovation emerges when resources and talents are transformed into creativity and new ideas and when unique products are developed (Niroumand et al., 2020).

Innovation performance can be divided into two categories: radical and incremental. Radical innovation is the type of performance that causes fundamental changes in the company’s technologies, processes, products, and organizational structure. Incremental innovation performance, on the other hand, is the improvements made to the existing technology, process, product, and organizational structure (Coccia, 2016). De Visser and Faems (2015) stated that companies should appropriately combine incremental and radical innovation to maintain their competitive edge in the long term.

Market turbulence refers to consumers’ constant introduction into and exit from the market, their wide-ranging needs and expectations, and rapid changes in their preferences (market dynamism), the consistent provision of new products, and presenting innovation (Qiu et al., 2020).

It is only possible for a business to sustain itself by continuously monitoring its environment and adapting to the changes. Previous research states that innovation is paramount for enterprises in the face of changes to their environment and the markets in which they operate (Wang et al., 2015). It is becoming increasingly difficult to define the evolution of environmental forces in dynamic markets, and preferences regarding products and services change constantly. In this context, the products and services companies introduce become unable to meet the needs and expectations of customers after a while (Zhang & Watson, 2020). To overcome this, companies must anticipate new customer demands and show proactive behaviors, such as innovation and creativity, that can direct customer demands (Miles & Snow, 1978). Innovative enterprises are expected to develop strategies to turn this into an opportunity by taking advantage of the changes in customer demands and expectations and entering niche markets by introducing new products. For this reason, innovation becomes very important for enterprises in environments where the market turbulence rate is high to meet customers’ changing needs and expectations (Ding & Ding, 2022). Rhee et al. (2010) also stated that companies use innovation as a strategic tool that they can utilize to counteract changes in their markets.

As a result, when the speed of market turbulence in a company’s particular market increases, it needs to engage in innovation activities at a higher level to perform better (Hult et al., 2004). Companies with innovative performance can take advantage of the change in customer needs and expectations, find new solutions to their problems, and restructure their assets to manage the market changes effectively (Peng et al., 2021).

A study by Rundquist (2012) on R&D managers found that information integration had a more significant impact on innovation performance in environments with higher market and technological turbulence. Further, a study conducted by Gök and Peker (2016) on 305 top-level managers concluded a positive relationship between innovation performance and market performance. Feng et al.’s (2022) study on 253 enterprises in China found that market dynamism moderated the relationship between information management and innovation performance. Moreover, in their research on SMEs in China, Kim et al. (2020) found that environmental uncertainty positively affected innovation. Dean et al. (2022) said that market change is a critical element in increasing innovation. Turulja and Bajgoric (2019), in the research they conducted, explored market diversification’s critical role in improving innovation performance, and they mentioned that variable environments will experience higher levels of process and product innovation as a result. Seo et al. (2020) found a positive relationship between environmental dynamism and innovation. Recently, some researchers in the literature have stated that companies are looking for innovative products and processes in the face of constantly changing customer preferences. In other words, they mentioned that market turbulence leads to innovation. Thus, this existing literature is used as an antecedent in research models to understand the impact of environmental turbulence on innovation (Ahinful et al., 2023; Gemici & Zehir, 2023; Gyedu et al., 2021; Le & Do, 2023).

Based on the body of literature discussed earlier, the following hypothesis argues that enterprises will show higher innovation performance in cases where market turbulence is high.

H2: Market turbulence is positively correlated with innovation performance.

3.3 Technological Turbulence and Innovation Performance

In the current period, new enterprises have to deal with challenges such as the change in customer preferences and expectations, the increase in the speed of technological transformation, and the consequent obsolescence of new products and services (Kamalaldin et al., 2020; Proksch et al., 2021; Rangaswamy et al., 2022; Wilkin & Chenhall, 2020).

To keep up-to-date with new attempts, it is very important that customer preferences and technological changes are closely monitored by maintaining the process, product, and services (Rachinger et al., 2019; Shoemaker et al., 2020; Verhoef et al., 2019).

The differences between the technological turbulence intensity in a company’s operating environment influence the synergy between the company and its environment, information and materials exchange, and its organizational structure and strategy (Li et al., 2018).

In stable environments with a lower level of technological turbulence, companies can utilize existing resources, capabilities, and knowledge for longer (Sheng et al., 2011). They strive to obtain information to maintain their current competitive situation (Achrol & Kotler, 2022). However, when unpredictable technological changes start to increase technological turbulence, operating with the information available to companies can lead to several problems, such as organizational inertia (Azeem et al., 2021). Environments with a higher level of technological turbulence may lead to the company’s information structure becoming obsolete and their existing capabilities becoming insufficient in meeting customers’ changing needs and expectations over time, leading the company toward losing its relevance. For this reason, companies may have to resort to quickly re-combining their capabilities and knowledge (Baofeng et al., 2022; Cai et al., 2021; Hung & Chou, 2013). Edmondson and Nembhard (2009) state that in cases where the level of technological turbulence increases, businesses should develop new products to maintain their existence.

Technological turbulence also presents some opportunities for companies. Coccia (2016) states that technological turbulence leads to changes in demand, a necessary driving force of innovation. In other words, technological turbulence can increase innovation performance by driving enterprises to develop new products based on new and advanced technology (Baofeng et al., 2022). Indeed, previous literature demonstrated that technological turbulence positively affected innovation performance (Baofeng et al., 2022; Li et al., 2018; Song et al., 2005). For example, Bodlaj and Čater (2019), in a study on SMEs, found technological turbulence has a positive relationship with perceived innovation. Guo et al. (2023) found that there is a positive relationship between technological turbulence and innovation performance in a study on digital new initiatives in China. Jin et al. (2022) obtained results from their study on high-tech companies in China that showed a positive, dynamic connection between technological change and innovation performance. Puriwat and Hoonsoponne (2022) found a positive effect on the innovation performance from technological turbulence in the research they did on food, beverage, chemical, and machine industries.

Based on these statements and theoretical foundations, the following hypothesis was created:

H3: Technological turbulence is positively correlated with innovation performance.

3.4 The Mediating Effect of Technological Turbulence

In an environment with a high speed of market turbulence, it becomes difficult for the companies’ existing production line to respond to these changes, as customer preferences change frequently. In such environments, businesses may not be able to adequately access reliable and accurate information about the state of their industry and the changes in customer preferences by using conventional analysis methods. Thus, it becomes difficult to react to these changes using traditional product development methods (Santos et al., 2020). Such cases make it necessary for businesses to resort to aggressive and proactive behaviors to accelerate technological innovation and present reactive behavior by creating new services and products to create customer value (Zhang et al., 2016).

Tsai and Luan (2016) noted that in the face of changes in customer preferences, companies should resort to creativity and innovation to constantly change their products and services through technological change and adapt their operations accordingly. Thus, businesses with high innovation performance will benefit from the speed of change in customer preferences appropriately. They will also need to restructure their technological assets to develop better solutions to their customers’ problems and successfully manage market turbulence (Iqbal et al., 2021). In sum, changes to the market in which a company carries out its activities will make its existing products obsolete and decrease demand for these products. Businesses will have to offer new products and services using new technologies to cope with this situation. The change in the market will lead to an increase in the speed of technological change, which will effectively increase the company’s innovation performance.

Some researchers have found that technological turbulence drives firms to be innovative and that organizations have a better chance of achieving new product success in turbulent conditions (Jin et al., 2022; Kam-Sing Wong, 2014). Additionally, turbulent environments require firms to use better market approaches (e.g., new designs, new market development activities, and new distribution channels) to cope with changes in customer preferences. In highly turbulent markets, customers constantly change their product preferences, and firms must be aware of these changes and respond by innovating to meet customer and market needs (Zhou et al., 2018b). Turulja and Bajgoric (2019) found a clear role in environmental turbulence in improving innovation performance and concluded that higher levels of product and process innovation likely emerge as a result of highly variable environments. Abbas and Ul Hassan (2017), from a study in Pakistan, found that technological turbulence has a role in the relationship between competition density, market change, and innovative performance. Wang et al. (2022b) conducted research on innovative organizations, and they found the following result: (1) green technological turbulence moderates the relationship between green innovative strategy and green innovation performance; (2) green technological turbulence moderates the relationship between green learning and green innovation performance.

Based on these arguments, we put forward the following hypothesis:

H4: Technological turbulence has a mediating role in the relationship between market turbulence and innovation performance.

3.5 The Moderating Role of Courage

Customer expectations frequently change as a consequence of increased market entry and exit by consumers, as well as shifting customer profiles. The organization’s focus on an innovative approach makes it feasible to satisfy the diverse demands and expectations of customers. In order to address the market volatility, new product development and innovation take center stage (Qiu et al., 2020). But it’s important to accept and be ready to handle the changes that market turmoil brings about. When a situation’s volatility and the impact of its repercussions on a company’s aims and plans are unknown in advance, taking risks requires ongoing bravery (Miller & Le Breton-Miller, 2017). It’s important to accept change when creative performance emerges in response to market instability. To accept change, one must have the courage to analyze corporate objectives and operations in light of long-term performance (Perel, 2002). The creation of creative performance, which comes as a requirement and a response as a result of the growth in market instability, may thus be amplified or diminished by daring. Every invention has dangers and challenges. When accomplishing corporate objectives, courage entails embracing difficulties and taking the chance of failure (Kilmann et al., 2010) and risk (Magnano et al., 2022) even in everyday operations (Baumert et al., 2023).

In business, failure brought on by uncertainty is always a possibility. Going above the conventional methods of goal-setting and managerial authority is what courage is all about. Passive choices and habits must be abandoned in order to go beyond traditional commercial techniques. It also entails taking up riskier and less predictable tasks. Few individuals are prepared to make an attempt since it demands acting while taking the possibility of failure into account (Perel, 2002). Companies with courage may make impromptu, unplanned adjustments to improve productivity and performance (Schilpzand et al., 2015).

The cornerstone of creative activities that promote organizational success, particularly those that face the risk of financial loss, is courage, which is essential for organizational innovation. Since courage involves moving forward in the face of risk and danger, it might sometimes be necessary to improvise (Koerner, 2014). The way firms interpret the instability in technology and the market will also be greatly affected by courage. This is so because an organization’s success in terms of innovation determines its ability to develop new services and goods (Ferraris et al., 2019). According to Sekerka et al. (2009), courage, a management attribute, may significantly boost this inventive performance.

In an environment where technological change is intense and quick, the industry must quickly adapt to technological changes (Gomezel & Aleksić, 2020). Technological turbulence refers to the magnitude and speed of the technological changes and innovations within the company’s field. Nevertheless, depending on the various socio-economic organizational styles, technology systems may pose dangers at the organizational and societal levels or have unfavorable effects (Hellström, 2003). As a result, risk has been a key factor in determining technical advancements for a long time (Bamforth & Bleed, 1997). Lack of bravery might result in overly cautious behavior and a reluctance to take chances (Pavlou & El Sawy, 2010). Therefore, in order for technological change to promote inventive performance, innovation must be accepted as a need. Courage can enable one to consider innovation as a facilitator and an opportunity (Perel, 2002).

Market or technological volatility introduces an inherent element of uncertainty, giving rise to a precarious and apprehensive atmosphere within both corporate entities and their stakeholders. To navigate these challenging conditions effectively and enhance innovative performance, recognized as the optimal strategy for capitalizing on turbulence (Kaya et al., 2020), it becomes imperative to cultivate an environment conducive to heightened collaboration for innovation. Furthermore, organizations must devise structured frameworks to mitigate the pernicious impact of cynicism, a recurrent impediment that often obstructs collaborative endeavors (Sen et al., 2022).

Recent academic inquiries have spotlighted the concept of courage, attracting considerable scholarly attention due to its intricate role across diverse contexts. These investigations have dissected courage’s multifaceted functionality as both a mediator and a moderator, thus shedding light on its nuanced influence. Eminent studies, exemplified by the works of Abdollahi et al. (2022), Mert et al. (2022), and Magnano et al. (2017), have delved into the mediating role of courage. Concurrently, courage has been the subject of scrutiny as a moderator, as evident in studies conducted by Cheng et al. (2019), Koksal and Mert (2023), and Peralta et al. (2021). In the context of exploring the intricate relationship between organizational outcomes and their underlying determinants, courage emerges as a pivotal catalyst, akin to the spark that ignites transformative change. When harnessed skillfully, its influence serves as a bridge, enabling organizations to bridge gaps, fortify their resilience, and stimulate innovation. Given the conspicuous role of courage as a determinant in organizational dynamics, it becomes paramount to expand the purview of academic inquiry. In this regard, it is both pertinent and advantageous for scholarly research to scrutinize the regulatory role of courage, particularly within the volatile domains of market and technology. Such an inquiry promises to shed light on how courage functions as a stabilizing force or a catalyst amidst the tumult of these dynamic environments, and how its presence or absence exerts a discernible impact on innovation performance. This research endeavor holds the potential to enrich our comprehension of the intricate interplay between courage, organizational adaptability, and innovative performance in the face of pervasive uncertainty.

The following theories are the result of our examination of the literature:

H5: Courage plays a moderating role in the relationship between market turbulence and innovation performance.

H6: Courage plays a moderating role in the relationship between technological turbulence and innovation performance.

4 Methodology

The study is an exploratory and cross-sectional study aiming to test the relationships between variables in a theoretical context empirically. The methods we selected will inform about the sampling we obtained, and then, the results after testing the data will be given, respectively.

4.1 Sample

The top managers of innovative-entrepreneurial enterprises that carry out production, patent, and R&D studies in 18 active free zones in Turkiye constitute the sample of this study. Companies that do not have an R&D department but are engaged in innovative activities are also included in the research sample. However, companies that have the status of “production companies” with a license to operate in a free zone but do not continue their activities, as well as companies that buy, sell, rent, or stock within free zones were not included in the research sample.

The authors conducted the study in free zones. Free zones positively contribute to the economy and macroeconomic status of the country they operate in, help the country’s economy by attracting direct foreign investment, and are centers of attraction for entrepreneurial businesses due to the advantages they present, such as tax breaks and incentives. According to 2021 data, the number of domestic and foreign companies engaged in production with a license to operate in free zones in Turkey is 1115 (Republic of Turkey Ministry of Trade, 2022).

In free zones, these businesses are located in the production sector, and that has been determined by telephone conversations made with the marketing departments of the founder-processor companies of the free zones, when they are from innovative-interference businesses, and also with the human resources departments of each business, to be included in the sample. The companies contacted have been informed about the work we want to do. In addition, permission was requested to be able to conduct the surveys. When the surveys were prepared, opinions and recommendations regarding this subject from the human resources departments of the companies included in the sampling were also considered. Then, the prepared surveys were sent again through e-mail to the human resources departments of the companies included in the sampling. Human resources departments delivered the questionnaires we sent to their managers via the intranet network of the company.

The number of active employees in the companies included in the sample is around 800. Out of that total, 331 responses were received from the questionnaires we sent. Table 1 illustrates the distribution of the companies that returned the surveys by sectors and free zones.

Distribution by sector (sample companies)

| Free Zone | Number of Surveys Returned | Distribution by Sectors |

|---|---|---|

| Adana Yumurtalık Free Zone | 9 | Industry (2), Chemistry (5), Yacht (2) |

| Antalya Free Zone | 40 | Electricity and Electronics (6), Industry (9), Medical (6), Automotive (1), Textile (2), Yacht (16) |

| Ataturk Airport Free Zone | 15 | Informatics (11), Industry (3), Medical (1) |

| Bursa Free Zone | 14 | Industry (7), Chemistry (4), Automotive (1), Textile (2) |

| Denizli Free Zone | 2 | Industry (2) |

| Istanbul Industry and Trade Free Zone | 15 | Industry (3), Food (3), Automotive (1), Chemical (5), Medical (3) |

| Ege (Aegean) Free Zone | 63 | Informatics (10), Electricity and Electronics (9), Industry (13), Food (3), Chemistry (6), Medical (11), Automotive (3), Textile (8) |

| Gaziantep Free Zone | 10 | Industrial (8), Textile (2) |

| Izmir Free Zone | 24 | Informatics (12), Textile (8), Automotive (4) |

| Kayseri Free Zone | 20 | Industry (11), Textile (9) |

| Mersin Free Zone | 48 | Food (5), Chemistry (9), Electricity and Electronics (11) Automotive (12), Textile (7), Medical (8) |

| Samsun Free Zone | There are no manufacturing enterprises | There are no manufacturing enterprises |

| Rize Free Zone | There are no manufacturing enterprises | There are no manufacturing enterprises |

| Trabzon Free Zone | 1 | Food (1) |

| Trakya (Thrace) Free Zone | 17 | Electricity and Electronics (4), Industry (8), Chemistry (4), Medical (1) |

| TUBITAK-MAM Technology Free Zone | 12 | Informatics (9), Chemistry (3) |

| TOTAL | 331 | 331 |

Table 2 shows the descriptive statistics of the enterprises included in the sample. The majority of the participants were men, and they were between the ages of 36 and 45. Most of them were university graduates and worked in expert positions.

Characteristics of the sample

| Descriptive Information | Groups | N | % |

|---|---|---|---|

| Gender | Male | 211 | 74.3 |

| Female | 120 | 25.7 | |

| Age | Younger than 25 | 14 | 4.2 |

| 25–35 | 97 | 29.3 | |

| 36–45 | 138 | 41.7 | |

| Above 45 | 82 | 24.8 | |

| Educational Background | High school degree holder | 31 | 9.4 |

| University degree holder | 261 | 78.8 | |

| Postgraduate degree holder | 39 | 11.8 | |

| Position | General manager | 30 | 9 |

| Manager | 32 | 10 | |

| Middle-level manager | 80 | 24.1 | |

| Expert | 142 | 42.9 | |

| Other | 47 | 14 | |

| Work experience | 1–2 years | 66 | 19.9 |

| 3–5 years | 76 | 22.9 | |

| 6–9 years | 63 | 19.2 | |

| 10 years and more | 126 | 38 | |

| Duration of activity in the sector | 1–5 years | 12 | 3.6 |

| 6–10 years | 21 | 6.3 | |

| 11–15 years | 51 | 15.4 | |

| 16–20 years | 110 | 33.2 | |

| 20 years and more | 137 | 41.5 | |

| R&D Department | Yes | 168 | 50.8 |

| No | 163 | 49.2 | |

| Ownership | Family business | 140 | 42.3 |

| Not a family business | 191 | 57.7 | |

| Total | 331 | 100 | |

4.2 Scales

Innovation performance: The innovation performance of the participants was measured with a five-point unidimensional scale created by Dai et al. (2019) and Tomlinson and Fai (2016) and adapted by and Yu et al. (2022). The participants expressed their opinions through a five-point Likert (1 = Completely disagree, 5 = Completely agree). The scale contains items such as “The improvements we make to existing products are better than that of our competitors” and “Our process of adapting to new technologies is better than that of our competitors.” The high scores on the scale indicate that the innovative performance is high.

Market turbulence: A five-point unidirectional scale, developed by De Clercq et al. (2018), was used to measure market turbulence. The scale measures the change in customer demands in a competitive market The participants rated items such as “The demands and preferences of our customers change unpredictably” and “The sector in which we operate has intense competition” on a five-point Likert scale (1 = Completely disagree, 5 = Completely agree). Thus, high scores indicate that market turbulence perceptions are high.

Technological turbulence: The study used a four-point unidimensional scale developed by Ye et al. (2016) to measure participants’ perceptions of the speed of technological turbulence. Some items on the scale are as follows: “The technologies used in the sector in which we operate change quickly” and “It is quite difficult to predict the trends of technological development in our industry.” The high perceptions collected through the five-point Likert scale (1 = Completely disagree, 5 = Completely agree) indicate that technological turbulence is perceived as high.

Entrepreneurial courage: The study used the scale developed by Norton and Weiss (2009), adapted by Ginevra et al. (2020) adapted into Turkish by Mert and Köksal (2022). The scale consists of six items. Examples are” I tend to face my fears “and “I will do things even though they seem dangerous.” Participants rated the courage items using the five-point Likert scale (1 – never, 5 – always).

5 Empirical Results

5.1 Common Method Variance

Due to the cross-sectional data collection, we first checked for common method variance by using the unconstrained and zero-constrained models. Since the chi-square difference between the generated models is insignificant, it has been shown that the two models are the same or invariant (Δx 2 = 77.000, sd = 171, p > 0.05), so it can be stated that there is no common method variance in the model.

5.2 Validity and Reliability

The construct validity, convergent and discriminant validity, and reliability of the measurement model were checked with construct reliability and Cronbach’s alpha. The coefficients and significance of the factor loads of all of the items were examined to measure convergent validity. It was found that all factor loads were significant and were between the values 0.819 and 0.973. The average variance extracted (AVE), maximum shared variance (MSV), and composite reliability (CR) (Table 3) were above the cut point. In addition, the internal consistency of the scales is also at an adequate level.

Validity and reliability of the measurement model

| Variables | CR | AVE | MSV | Cronbach |

|---|---|---|---|---|

| Courage | 0.937 | 0.714 | 0.070 | 0.937 |

| Innovation performance | 0.969 | 0.862 | 0.139 | 0.969 |

| Market turbulence | 0.954 | 0.807 | 0.017 | 0.954 |

| Technological turbulence | 0.939 | 0.793 | 0.139 | 0.938 |

Finally, the fit between the measurement model and the data set was checked through confirmatory factor analysis. Results showed that the measurement model had fit values (χ 2 = 345.035, sd = 164, χ 2/sd = 2.104, CFI = 0.974, SRMR = 0.031, RMSEA = 0.058, and PClose = 0.063).

5.3 Descriptive Statistics

Table 4 presents the variables’ mean, standard deviation, and correlation values. The average perceptions of all variables were above the midpoint (3). The relationships between market turbulence and the other variables were positive and significant at a low level. There was a medium-level positive relationship between technological turbulence and innovation and a low-level positive relationship between technological turbulence and courage. Moreover, there was a medium-level positive relationship between innovation and courage. Hypotheses H1, H2, and H3 were accepted according to these results.

Descriptive statistics

| Variables | Mean | St. deviation | 1 | 2 | 3 |

|---|---|---|---|---|---|

| 1 – Market turbulence | 4.06 | 0.71 | — | ||

| 2 – Technological turbulence | 4.35 | 0.75 | 0.110* | — | |

| 3 – Innovation performance | 4.21 | 0.91 | 0.132* | 0.370** | — |

| 4 – Courage | 4.14 | 0.77 | 0.165** | 0.279** | 0.385** |

*p < 0.05, **p < 0.01.

5.4 Regression Analysis

Linear hierarchical regression analysis was performed using the least squares method to test the relationship between mediation and moderation. Before the analysis, the data were checked for normal distribution and collinearity as part of the main regression analysis assumptions. The skewness and kurtosis values of the variables (ranging from −0.975 to 3.186) were acceptable, the highest variance inflation factor (1.011) and the condition index (16.32) were within acceptable limits (Kline, 2011), and the plot graph shows that the error distributions are normal. Table 5 presents the results of the hierarchical regression analysis.

Results of the hierarchical regression analysis

| Variables | β | St. error | t | P | R 2 /ΔR 2 |

|---|---|---|---|---|---|

| Stage 1 | |||||

| Constant | 3.529 | 0.290 | 12.165 | 0.000 | 0.017* |

| Market turbulence | 0.169 | 0.070 | 2.406 | 0.017 | |

| Stage 2 | |||||

| Constant | 1.823 | 0.364 | 5.006 | 0.000 | 0.146**/0.128** |

| Market turbulence | 0.118 | 0.066 | 1.791 | 0.074 | |

| Technological turbulence | 0.439 | 0.063 | 7.007 | 0.000 | |

| Stage 3 | |||||

| Constant | 1.396 | 0.399 | 2.789 | 0.006 | 0.241**/0.096** |

| Market turbulence (P) | 0.030 | 0.064 | 1.038 | 0.074 | |

| Technological turbulence (T) | 0.338 | 0.062 | 5.386 | 0.000 | |

| Courage (C) | 0.302 | 0.064 | 5.168 | 0.000 | |

| Interaction (T × C) | 0.075 | 0.039 | 0.880 | 0.379 | |

| Interaction (P × C) | 0.174 | 0.072 | 2.411 | 0.016 | |

*p < 0.05, **p < 0.01.

The mediating effect was examined according to the method proposed by Baron and Kenny (1986). Results showed that market turbulence significantly positively affects technological turbulence (β = 0.116, s.e. = 0.058, p = 0.046), and market turbulence had a significant positive effect on innovation performance. After adding technological turbulence to the model in the second stage of the regression analysis, while technological turbulence had a statistically significant positive effect on innovation performance, market turbulence did not have a statistically significant effect. Results suggested that technological turbulence had a full mediating effect. This result confirmed Hypothesis 4.

In the third stage of hierarchical regression, courage was added as a moderator variable. Courage had a statistically significant positive effect on innovation performance. The moderating effect of courage was examined with the interaction variables. In comparison, there was no significant effect of the first interaction variable (technological turbulence × courage) but a significant effect of the second interaction variable (market turbulence × courage).

According to these results, hypothesis H5a of the research was rejected, and hypothesis H5b was accepted.

The authors drew an interaction graph according to one plus and minus standard deviation from the mean to interpret the moderating effect of courage (Figure 2). The graph showed that when market turbulence increases, innovation performance tends to decrease in companies with low courage while it increases in companies with high courage. It can be stated that companies with high courage may also present high innovation performance.

Interaction graph.

6 Discussion

This study embarks on a comprehensive exploration, with the aim of acquiring a profound understanding of the intricate dynamics that shape innovation performance within nascent enterprises. The research questions at the heart of this inquiry serve as guiding principles, facilitating our navigation through the complexities of innovation performance amidst environmental and technological turbulence. Also, we scrutinize the role of individual social courage, specifically that of entrepreneurs, as a potential driving force in the context of environmental and technological turbulence, endeavoring to unravel how it influences the innovative performance of nascent enterprises. By addressing these issues, our research seeks to elucidate both the “what” and the “why” behind the study’s design and execution, thereby contributing valuable insights to the broader discourse on innovation and entrepreneurship in turbulent environments.

This research has shown that the level of market and technology uncertainty that participating businesses experience is significant. It may be said that Turkiye has also felt the effects of the pandemic’s changes, which touched the whole globe, quite strongly. Due to high rates of inflation, significant trade deficits abroad, and increasing energy prices in the year this research was done, the current account balance was in deficit (TC Ministry of Commerce, 2022).

6.1 Theoretical Implications

Due to the high perceived level of market and technological volatility, it has been shown that entrepreneurs have a high sense of boldness and innovative performance. The research discovered that the performance of innovation is positively impacted by market instability. These results are consistent with previous research in the area (Bodlaj et al., 2012; Feng et al., 2022; Gök & Peker, 2016; Kim et al., 2020; Rundquist, 2012; Seo et al., 2020; Tsai & Yang, 2014). When they see market volatility, businesses operating in the free zone retain their operations by transforming their resources and competencies into new goods. The favorable impact of technology change on innovation performance was another research conclusion. This result indicated that business owners are more likely to pursue innovation possibilities when they sense technological upheaval.

The findings of the present investigation confirmed those of earlier empirical studies (Baofeng et al., 2022; Song et al., 2005). When technical turbulence occurred, the impact of market turbulence on innovation performance was negligible. In other words, the connection between market turbulence and innovation performance was totally mediated by technical turbulence. According to Jaworski and Kohli (1993), technological turbulence would negate the benefits of market turbulence adaptation. Through the innovative possibilities that technological progress brings, businesses may obtain a competitive edge. According to Yu et al. (2022), the association between strategic flexibility, entrepreneurial leadership, and creative performance was mediated by technology turbulence rather than market turbulence. The study’s concluding result was that the association between market turbulence and inventive success might be moderated by an individual’s level of entrepreneurial bravery. According to the research, strong entrepreneurial bravery boosts innovation performance when perceived market instability is high, whereas low courage lowers innovation performance. Miller and Le Breton-Miller (2017) highlighted the importance of entrepreneurial creativity and bravery as the cornerstones of the value creation process as well as the need for courage while taking risks in ambiguous circumstances. As a result, it is reasonable to assume that entrepreneurs with high levels of bravery will boost their use of innovation and those with low levels of courage would refrain from it in the case of uncertainty brought on by market instability.

Interestingly, the data revealed that bravery did not mitigate the association between technical turbulence and innovation performance, even though we had anticipated a similar outcome. Within the framework of flow theory, Gomezel and Aleksi (2020) demonstrated how technology advancement affects creative performance. In this situation, they argued that an entrepreneur’s enthusiasm for their objectives would override any exertions and risk of failure. When there was technological upheaval, they tended to innovate to thrive. Their research revealed that when there was significant technical turbulence, inventive performance was impacted by the flow experience. When there was little technical disruption, there was no such impact. As a result, we assumed that the association between technological upheaval and innovation performance also includes entrepreneurial bravery. It has been shown that the firms in our sample believe there is a lot of technical uncertainty. Therefore, in a setting of such intense technological flux, improving innovation performance is akin to survival. When a risk may be taken, courage is extremely important (Rate et al., 2007). To this aim, we determine that the sample firms did not exhibit a view about technical turbulence that associated innovation with survival, but did so when it came to market turbulence.

The study’s results point to the precise pathways via which boldness boosts innovative capacity. The results of our research indicate that entrepreneurial daring has a major role in determining innovation performance, particularly in reaction to market instability. To go further into this topic, we may suggest that brave businesspeople are more inclined to take calculated chances and get over their fear of failing, which encourages them to explore new possibilities and ideas. They could be able to explore unexplored territory, try out new ideas, and use disruptive technology if they have this kind of bravery. Furthermore, brave businesspeople may exhibit greater tenacity and fortitude in the face of adversity, enabling them to endure difficult circumstances and maintain creative endeavors.

The research also highlights the need of measuring and developing bravery. Researchers, policymakers, and practitioners may be quite interested in evaluating and promoting boldness in entrepreneurs. Future studies should examine the scales that are already used to evaluate entrepreneurial bravery or create brand-new tools that better reflect the multifaceted character of courage in the context of entrepreneurship. Additionally, research on the elements that may support the growth of bravery, such as formal education, practical experience, or training, may be beneficial in figuring out how to foster this crucial quality in future business owners.

In the research, the potential and struggle of encouraging bravery are also underlined. For the creation of a supportive environment that promotes creative behaviors, it is essential to pinpoint the challenges and possibilities for boosting bravery among business owners, managers, and policymakers. Policymakers may create programs that provide rewards and support systems for taking chances and trying new things. Managers may promote a culture that honors and encourages entrepreneurial bravery, enabling staff members to express and try out novel ideas without worrying about negative consequences. To learn from others’ experiences and acquire confidence in managing unpredictable settings, entrepreneurs themselves should look for mentoring and networking possibilities.

6.2 Practical Implications

The results obtained from the research also bring some practical implications. First, this study reveals that environmental turbulence initiates changes in the organization’s internal processes to increase innovation performance. Therefore, managers need to know what specific resources and capabilities they need to use to take advantage of opportunities arising from environmental turbulence. This study also emphasizes that in situations where market and environmental turbulence are high, companies respond to these changes through technological evolutions and thus achieve innovation.

Given the substantial impact of the perceived importance of technology on innovation, firms must consciously work hard to make innovation a top priority and explain its importance to all employees. How innovations maintain or increase the firm’s competitive advantage, drive demand for its products or services, and how important they are to its long-term survival should be emphasized or displayed within the firm.

Management should encourage creativity and innovation at all organizational levels. Openness and courage to new ideas and challenges should be encouraged as part of the company culture. As market and technological turbulence increases the perceived importance of innovation, we advise companies to closely monitor changes in the external environment to recognize new business opportunities quickly. As market and technological turbulence increases the perceived importance of innovation, we advise companies to closely monitor changes in the external environment to recognize new business opportunities quickly. Companies can perceive accelerating technological changes as a profitable opportunity only if they have the appropriate technical knowledge that will enable them to intervene effectively. Therefore, we recommend companies invest in employee training constantly. Companies should also attach great importance to creating a knowledge-based learning culture to recognize better the opportunities that arise during technological/market turbulence, evaluate environmental signals, and turn lessons into innovation.

Entrepreneurs may proactively plan for and embrace change if they recognize that market and technical instability has an influence on the performance of innovation. According to our research, encouraging entrepreneurial daring might be a smart move for businesses looking to prosper in the face of ambiguity. To promote an environment that rewards creativity and risk-taking, entrepreneurs and company leaders may place a high priority on developing bravery in both themselves and their colleagues.

In addition, politicians may use these findings to create programs and regulations that encourage bold business decisions and aid creative endeavors. A more active and dynamic business environment may be created via programs that focus on fostering entrepreneurial skills, encouraging a growth attitude, and providing funding for creative ideas.

7 Conclusion

This research looked at innovative businesses operating in free zones to evaluate the link between market turbulence and innovative performance as well as the mediating function of technical turbulence in this relationship. Additionally, it looked at how entrepreneurial bravery affected the link between market and technological upheaval and innovation performance. The findings showed that market and technical turbulence were connected to innovation performance, and that market turbulence and innovation performance were totally mediated by technological turbulence. In other words, the impact of market turbulence on the effectiveness of innovation is lessened by technical turbulence. Participants concluded that companies adapt to change with new goods when they sense market and technical volatility.

Furthermore, when there was perceived market volatility, high entrepreneurial bravery boosted and low entrepreneurial courage decreased the performance of entrepreneurs in terms of creativity. It has also been discovered that, when it comes to technological upheaval, bravery does not have the same impact. We explain this scenario by proposing that corporations are more driven to innovate by technical upheaval than by market upheaval, which is seen as being comparable to the company’s existence.

The link between market turbulence, technical turbulence, entrepreneurial bravery, and innovation success is usefully illuminated by this research. Our results demonstrate the importance of bravery in motivating creative actions, especially in the face of market uncertainty. We have shown that entrepreneurs with greater degrees of bravery are more likely to adopt creative methods, which improves innovation performance, when they sense intense market volatility. It’s important to notice that, in contrast, technical turbulence did not exhibit the same moderating impact of bravery. This suggests that, regardless of their degree of bravery, organizations may be forced to innovate as a result of technological upheaval.

Our study adds to the corpus of information on entrepreneurship and innovation and has applications for managers, politicians, and business owners alike. Stakeholders may create targeted interventions and support systems by knowing the precise processes via which courage supports innovative performance. Cross-country study might give information on the moderating effect of location in the link between turbulence and innovation, while future longitudinal studies may go further in exploring the causality between these factors. Further research is needed to better understand this complicated link, particularly the function of bravery in negotiating low technological turbulence and how it affects innovation success.

Our research paves the way for a number of exciting new directions in the study of entrepreneurship, innovation, and organizational behavior. On the basis of our results, researchers might look into the impact of other psychological and behavioral variables in determining how turbulence and innovation performance interact. Entrepreneurs’ reactions to unpredictable circumstances may be influenced by traits including bravery, resilience, creative self-efficacy, and optimism.

This study had some limitations. First off, because this is cross-sectional research, it is difficult to determine a causal association between the variables. Future research may use longitudinal analysis to determine causation. Only creative business owners operating in Turkiye’s free zones are included in the research sample. The impression of market and technical turmoil may also be impacted by other national events. Future research might investigate if geography modifies the association between market and technological turbulence and inventive performance by gathering data from other nations. Other empirical research must stress the moderating role of bravery in the relationship between innovation performance and perceived technical turbulence, particularly low turbulence.

Acknowledgments

The authors thank anonymous reviewers for their valuable comments and suggestions.

-

Funding information: The authors state no funding involved.

-

Author contributions: MKN: Conceptualization, writing. CT: Conceptualization, writing, and methodology. ISM: Conceptualization, writing, and data collection. KK: Writing, methodology.

-

Conflict of interest: The authors state no conflict of interest.

-

Article note: As part of the open assessment, reviews and the original submission are available as supplementary files on our website.

References

Abbas, M. W., & Ul Hassan, M. (2017). Moderating impact of environmental turbulence on business innovation and business performance. Pakistan Journal of Commerce and Social Sciences, 11(2), 576–596. http://hdl.handle.net/10419/188306.Suche in Google Scholar

Abdi, K., Mardani, A., Senin, A. A., Tupenaite, L., Naimaviciene, J., Kanapeckiene, L., & Kutut, V. (2018). The effect of knowledge management, organizational culture and organizational learning on innovation in automotive industry. Journal of Business Economics and Management, 19(1), 1–19. doi: 10.3846/jbem.2018.1477.Suche in Google Scholar

Abdollahi, A., Ahmed, A. A. A., Suksatan, W., Kumar, T., Majeed, M. S., Zainal, A. G., & Allen, K. A. (2022). Courage: A potential mediator of the relationship between personality and social anxiety. Psychological Studies, 67(1), 53–62.10.1007/s12646-022-00641-2Suche in Google Scholar

Achrol, R. S., & Kotler, P. (2022). Distributed marketing networks: The fourth industrial revolution. Journal of Business Research, 150, 515–527. doi: 10.1016/j.jbusres.2022.06.029.Suche in Google Scholar

Ahinful, A. A., Opoku Mensah, A., Koomson, S., Nyarko, F. K., & Nkrumah, E. (2023), A conceptual framework of total quality management on innovation performance in the banking sector. The TQM Journal, ahead-of-print. doi: 10.1108/TQM-11-2022-0334.Suche in Google Scholar

Andotra, N., & Gupta, R. (2016). Impact of environmental turbulence on market orientation–business performance relationship in SSIs. Global Business Review, 17(4), 806–820. doi: 10.1177/0972150916645679.Suche in Google Scholar

Ansoff, H. I. (1987). The emerging paradigm of strategic behavior. Strategic management journal, 8(6), 501–515.10.1002/smj.4250080602Suche in Google Scholar

Ardito, L., Raby, S., Albino, V., & Bertoldi, B. (2021). The duality of digital and environmental orientations in the context of SMEs: Implications for innovation performance. Journal of Business Research, 123, 44–56. doi: 10.1016/j.jbusres.2020.09.022.Suche in Google Scholar

Arici, T., & Gok, M. S. (2023). Examining environmental turbulence intensity: A Strategic Agility and Innovativeness Approach on Firm Performance in Environmental Turbulence Situations. Sustainability, 15, 5364. doi: 10.3390/su15065364.Suche in Google Scholar

Arora, A., Arora, A. S., & Sivakumar, K. (2016). Relationships among supply chain strategies, organizational performance, and technological and market turbulences. The International Journal of Logistics Management, 27(1), 206–232. doi: 10.1108/ijlm-09-2013-0103.Suche in Google Scholar

Augusto, M., & Coelho, F. (2009). Market orientation and new-to-the-world products: Exploring the moderating effects of innovativeness, competitive strength, and environmental forces. Industrial Marketing Management, 38(1), 94–108. doi: 10.1016/j.indmarman.2007.09.007.Suche in Google Scholar

Azeem, M., Ahmed, M., Haider, S., & Sajjad, M. (2021). Expanding competitive advantage through organizational culture, knowledge sharing and organizational innovation. Technology in Society, 66, 101635. doi: 10.1016/j.techsoc.2021.101635.Suche in Google Scholar

Bamforth, D. B., & Bleed, P. (1997). Technology, flaked stone technology, and risk. Archeological Papers of the American Anthropological Association, 7(1), 109–139.10.1525/ap3a.1997.7.1.109Suche in Google Scholar

Baofeng, H., Beifen, W., & Zhibao L. (2022). How to deal with technological turbulence for improving innovation performance. Technology Analysis & Strategic Management, 1–14. doi: 10.1080/09537325.2022.2042510.Suche in Google Scholar

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. doi: 10.1037/0022-3514.51.6.1173.Suche in Google Scholar

Baumert, A., Mentrup, F. E., Klümper, L., & Sasse, J. (2023). Personality processes of everyday moral courage. Journal of Personality, 91(4), 1–20. doi: 10.1111/jopy.12850.Suche in Google Scholar

Bodlaj, M., Coenders, G., & Zabkar, V. (2012). Responsive and proactive market orientation and innovation success under market and technological turbulence. Journal of Business Economics and Management, 13(4), 666–687. doi: 10.3846/16111699.2011.620143.Suche in Google Scholar

Bodlaj, M., & Čater, B. (2019). The ımpact of environmental turbulence on the perceived importance of innovation and innovativeness in SMEs. Journal of Small Business Management, 57, 417–435. doi: 10.1111/jsbm.12482.Suche in Google Scholar

Boyne, G. A., & Meier, K. J. (2009). Environmental turbulence, organizational stability, and public service performance. Administration & Society, 40(8), 799–824. doi: 10.1177/0095399708326333.Suche in Google Scholar

Cai, W., Wu, J., & Gu, J. (2021). From CEO passion to exploratory and exploitative innovation: The moderating roles of market and technological turbulence. Management Decision, 59(6), 1363–1385. doi: 10.1108/MD-02-2020-0233.Suche in Google Scholar

Ch’ng, P. C., Cheah, J., & Amran, A. (2021). Eco-innovation practices and sustainable business performance: The moderating effect of market turbulence in the Malaysian technology industry. Journal of Cleaner Production, 283, 124556. doi: 10.1016/j.jclepro.2020.124556.Suche in Google Scholar

Chakravarty, S. (2022). Resource constrained innovation in a technology intensive sector: Frugal medical devices from manufacturing firms in South Africa. Technovation, 112, 1–16. doi: 10.1016/j.technovation.2021.102397.Suche in Google Scholar

Cheng, J., Bai, H., & Yang, X. (2019). Ethical leadership and internal whistleblowing: A mediated moderation model. Journal of Business Ethics, 155, 115–130.10.1007/s10551-017-3517-3Suche in Google Scholar

Coccia, M. (2016). Sources of technological innovation: Radical and incremental innovation problem-driven to support competitive advantage of firms. Technology Analysis & Strategic Management, 29(9), 1048–1061. doi: 10.1080/09537325.2016.1268682.Suche in Google Scholar

Dai, Y., Byun, G., & Ding, F. (2019). The direct and ındirect ımpact of gender diversity in new venture teams on ınnovation performance. Entrepreneurship Theory and Practice, 43(3), 505–528. doi: 10.1177/1042258718807696.Suche in Google Scholar

Darvishmotevali, M., Altinay, L., & Koseoglu, M. A. (2020). The link between environmental uncertainty, organizational agility, and organizational creativity in the hotel industry. International Journal of Hospitality Management, 87, 102499. doi: 10.1016/j.ijhm.2020.102499.Suche in Google Scholar

De Clercq, D., Thongpapanl, N., & Voronov, M. (2018). Sustainability in the face of ınstitutional adversity: Market turbulence, network embeddedness, and ınnovative orientation. Journal of Business Ethics, 148(2), 437–455. doi: 10.1007/s10551-015-3004-7.Suche in Google Scholar

De Visser, M., & Faems, D. (2015). Exploration and exploitation within firms: The impact of CEOs’ cognitive style on incremental and radical innovation performance. Creativity and Innovation Management, 24(3), 359–372.10.1111/caim.12137Suche in Google Scholar

Dean, T., Zhang, H., & Xiao, Y. (2022). The role of complexity in the Valley of Death and radical innovation performance. Technovation, 109, 102–111. doi: 10.1016/j.technovation.2020.102160.Suche in Google Scholar

Ding, W., & Ding, J. (2022). New venture’s product innovativeness strategy, institutional environment and new product performance. Technological Forecasting and Social Change, 174, 1–11. doi: 10.1016/j.techfore.2021.121211.Suche in Google Scholar

Dixon, S., Meyer, K., & Day, M. (2014). Building dynamic capabilities of adaptation and ınnovation: A study of micro-foundations in a transition economy. Long Range Planning, 47(4), 186–205. doi: 10.1016/j.lrp.2013.08.011.Suche in Google Scholar

Donaldson, L. (2001). The contingency theory organizations. Thousand Oaks, CA: Sage.10.4135/9781452229249Suche in Google Scholar

Edmondson, A. C., & Nembhard, I. M. (2009). Product development and learning in project teams: The challenges are the benefits. Journal of Product Innovation Management, 26, 123–138.10.1111/j.1540-5885.2009.00341.xSuche in Google Scholar

Eniola, A., & Ektebang, H. (2014). SME firms performance in Nigeria: Competitive advantage and its impact. International Journal of Research Studies in Management, 3(2), 75–86. doi: 10.5861/IJRSM.2014.854.Suche in Google Scholar

Farrukh, M., Raza, A., & Waheed, A. (2023). Your network is your net worth: Political ties and innovation performance. European Journal of Innovation Management, 26(1), 256–264. doi: 10.1108/EJIM-04-2021-0174.Suche in Google Scholar

Feng, L., Zhao, Z., Wang, J., & Zhang, K. (2022). The ımpact of knowledge management capabilities on ınnovation performance from dynamic capabilities perspective: Moderating the role of environmental dynamism. Sustainability, 14, 4577. doi: 10.3390/su14084577.Suche in Google Scholar

Ferraris, A., Giachino, C., Ciampi, F., & Couturier, J. (2019). R&D internationalization in medium-sized firms: The moderating role of knowledge management in enhancing innovation performances. Journal of Business Research. doi: 10.1016/j.jbusres.2019.11.00.Suche in Google Scholar

Finkelstein, S., Hambrick, D., & Cannella, A. A. (1996). Strategic leadership. St. Paul: West Educational Publishing.Suche in Google Scholar

Frank, A. G., de Souza Mendes, G. H., Benitez, G. B., & Ayala, N. F. (2022). Service customization in turbulent environments: Service business models and knowledge integration to create capability-based switching costs. Industrial Marketing Management, 100, 1–18.10.1016/j.indmarman.2021.10.010Suche in Google Scholar

Gemici, E., & Zehir, C. (2023). High-performance work systems, learning orientation and innovativeness: The antecedent role of environmental turbulence. European Journal of Innovation Management, 26(2), 475–503. doi: 10.1108/EJIM-05-2021-0243.Suche in Google Scholar

Gilsing, V., Vanhaverbeke, W., & Pieters, M. (2014). Mind the gap. Balancing alliance network and technology portfolios during periods of technological uncertainty. Technological Forecasting and Social Change, 81(1), 351–362. doi: 10.1016/j.techfore.2013.04.010.Suche in Google Scholar

Ginevra, M. C., Santilli, S., Camussi, E., Magnano, P., Capozza, D., & Nota, L. (2020). The Italian adaptation of courage measure. International Journal for Educational and Vocational Guidance, 20(3), 457–475. doi: 10.1007/s10775-019-09412-4.Suche in Google Scholar

Gök, O., & Peker, S. (2016). Understanding the links among innovation performance, market performance and financial performance. Review of Managerial Science, 11(3), 605–631. doi: 10.1007/s11846-016-0198-8.Suche in Google Scholar