Abstract

In this paper, I extend the seminal commodity-tax competition model of Kanbur and Keen (1993. “Jeux Sans Frontières: Tax Competition and Tax Coordination When Countries Differ in Size.” The American Economic Review 83: 877–92) letting asymmetric producer prices between countries of different sizes. Unlike Kanbur and Keen, I show that there are multiple equilibria, and at some equilibria, small-country consumers cross-shop from the large. Besides, tax harmonization can benefit the small country, and a minimum tax rate can decrease a country’s tax revenue.

Acknowledgments

I thank the participants of TED University FEAS Brown Bag Seminar, 2019 International Conference of TED University Trade Research Center, and 2019 International Conference on Public Economic Theory for stimulating discussions. I also thank editor Tobias Wenzel and two anonymous referees for their valuable comments.

A Appendix: Proof of Lemmas and Propositions

A.1 Proof of Lemma 1

A.1.1 Small Country’s Best-Response Function

Assume that T ≤ p − P − δ. Then, whatever t is all small-country consumers shop from the large country. So, we have t(T) ∈ [0, ∞).

Assume that p − P − δ < T ≤ p − P. There is no tax rate such that the large-country consumers shop from the small country. Thus, the small country’s problem is

Assume that p − P < T. If the small country maximizes its revenue by choosing t ≤ (T + P) − p, its problem is given as

If the small country maximizes its revenue by choosing t ≥ T + P − p, its problem is given as

I analyze which way of maximizing its revenue is optimal for the small country under different values of θ. First, assume that θ < 1. Take T ∈ (p − P, δθ + p − P). If the small country maximizes its revenue by choosing t ≤ (T + P) − p, t = (T + P) − p by Equation (5), and its revenue is [(T + P) − p]h. If it maximizes its revenue by choosing t ≥ (T + P) − p,

Take T > δ + p − P. If the small country maximizes its revenue by choosing t ≤ (T + P) − p,

Second, assume that θ = 1. Take T ∈ (p − P, δ + p − P). If the small country maximizes its revenue by choosing t ≤ (T + P) − p, t = (T + P) − p by Equation (5), and its revenue is [(T + P) − p]h. If it maximizes its revenue by choosing t ≥ (T + P) − p,

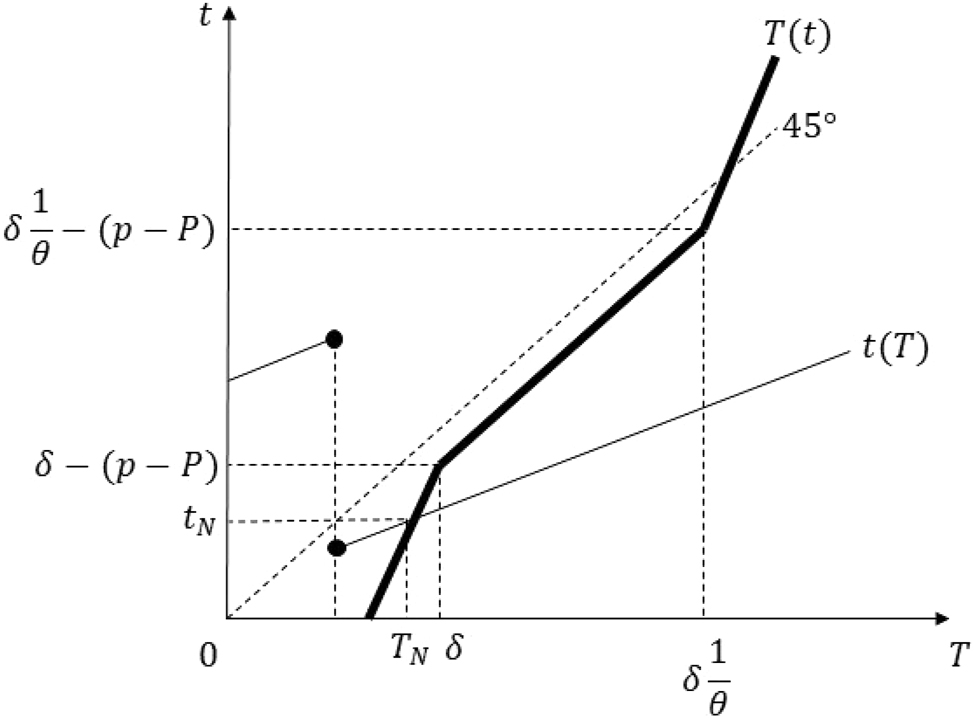

The whole results give us the small country’s best-response function:

A.1.2 Large Country’s Best-Response Function.

Assume that t ≤ −(p − P) − δ. Then, whatever T is all large-country consumers shop from the small country. So, we have T(t) ∈ [0, ∞).

Assume that −(p − P) − δ < t ≤ −(p − P). There is no tax rate such that the small-country consumers shop from the large country. Thus, the large country’s problem is

Assume that −(p − P) < t. If the large country maximizes its revenue by choosing T ≤ (t + p) − P, its problem is given as

If the large country maximizes its revenue by choosing T ≥ t + p − P, its problem is given as

I analyze which way of maximizing its revenue is optimal for the small country under different values of θ.

First, assume that θ = 1. Then, clearly, the best-response function of the large country is analogous to the small country. So, we have

Second, assume that 1 < θ. Take t ∈ (−(p − P), δ − (p − P)). If the large country maximizes its revenue by choosing T ≤ (t + p) − P, T = (t + p) − P by Equation (10), and its revenue is [(t + p) − P]H. If it maximizes its revenue by choosing T ≥ (t + p) − P,

□

A.2 Proof of Proposition 1

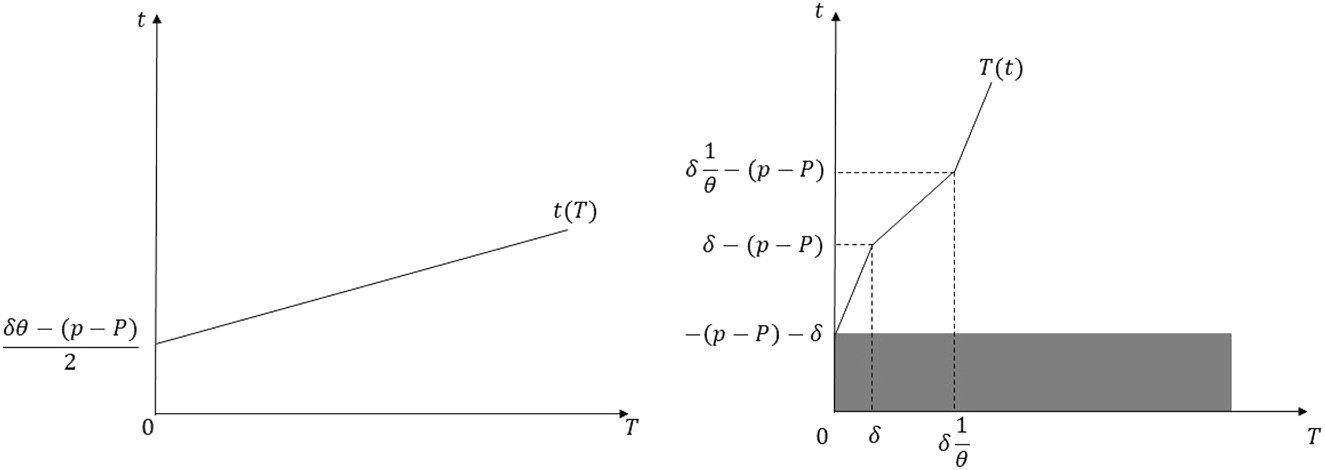

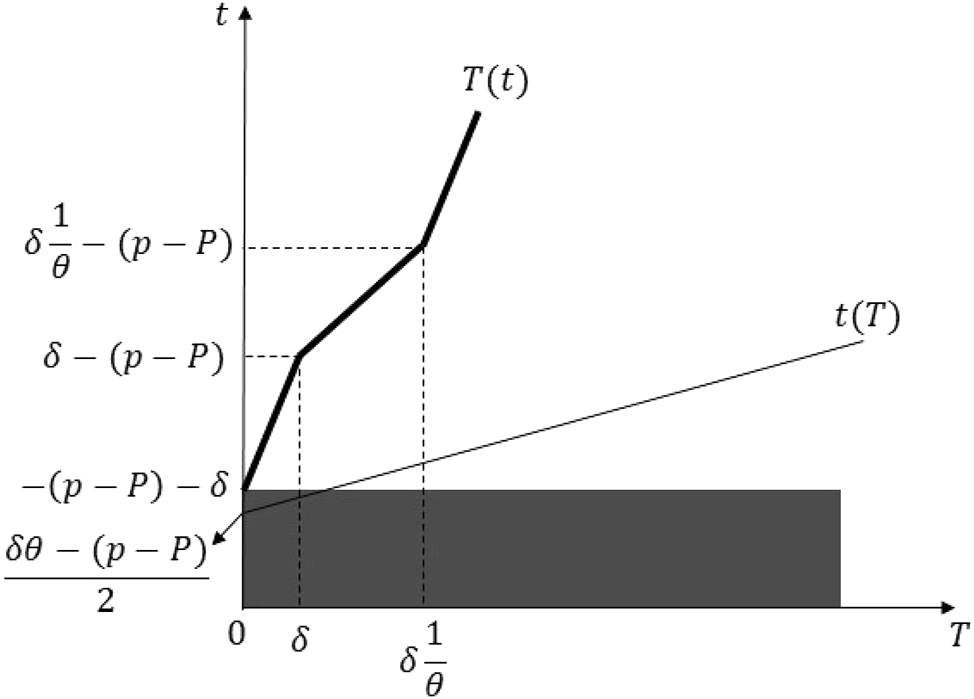

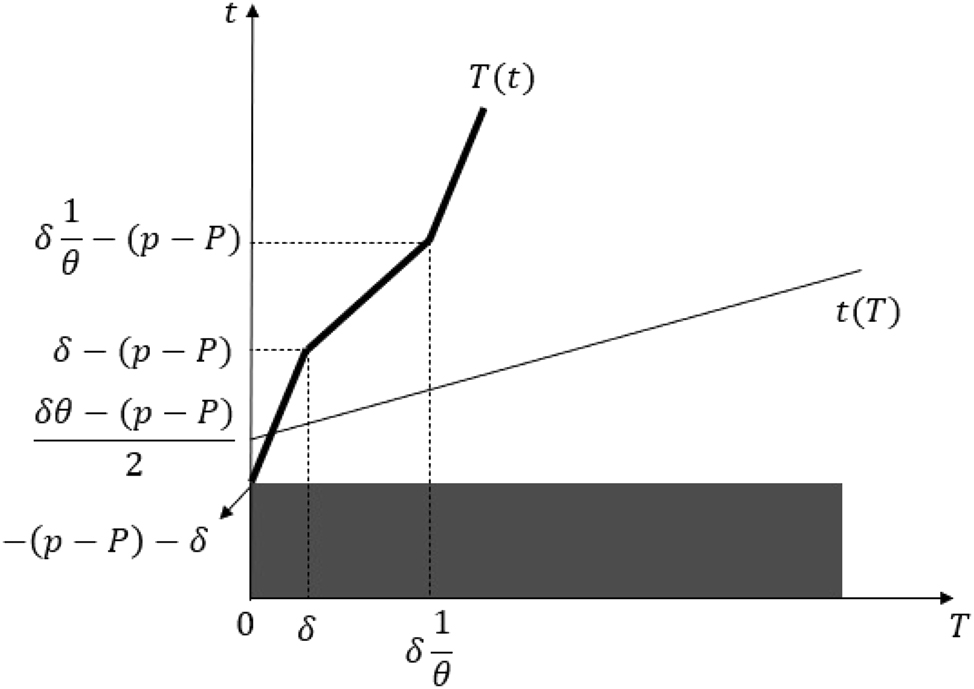

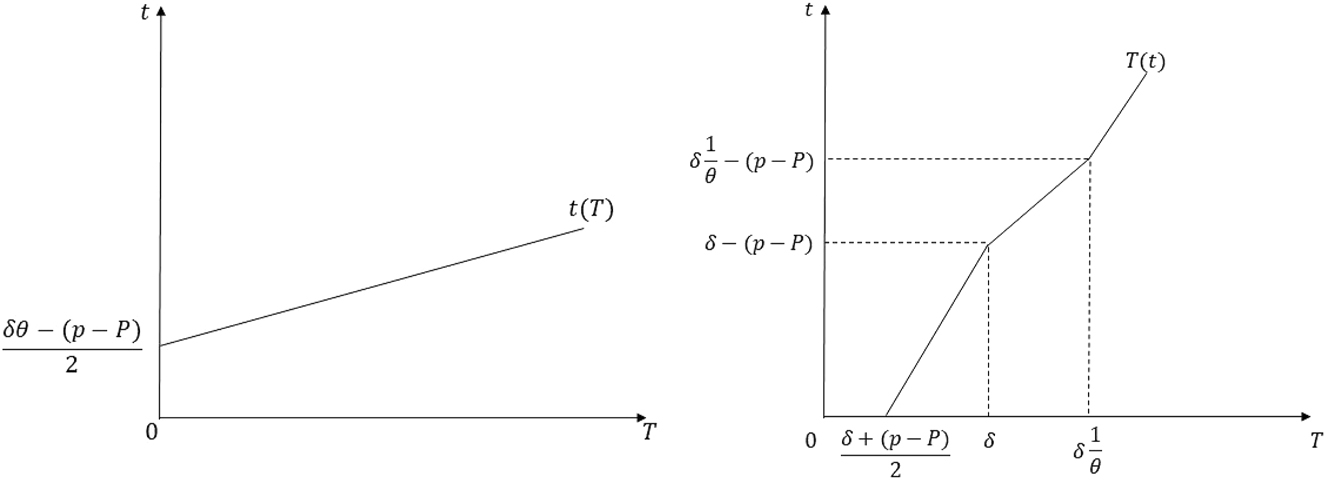

In the following, I assume that θ ≤ 1. So, we have

and

To prove the proposition, I present both countries’ best-response correspondences and find their intersection points for each part of the proposition. Additionally, Part (iii) of the proposition is implied by Parts (ii) and (iv). Thus, I give the proof of Part (iii) after the proof of Part (iv).

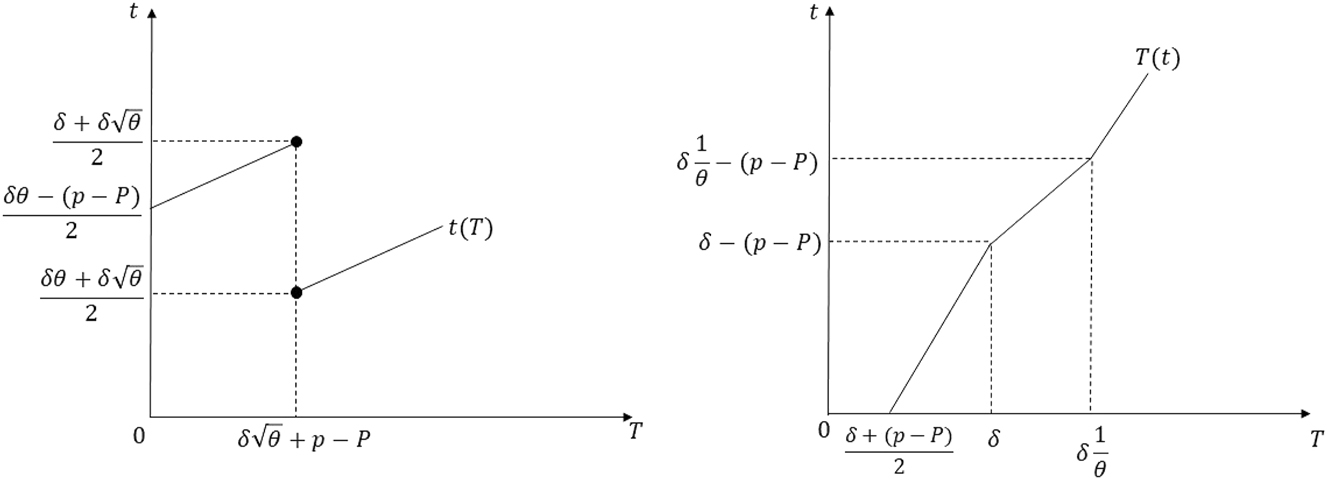

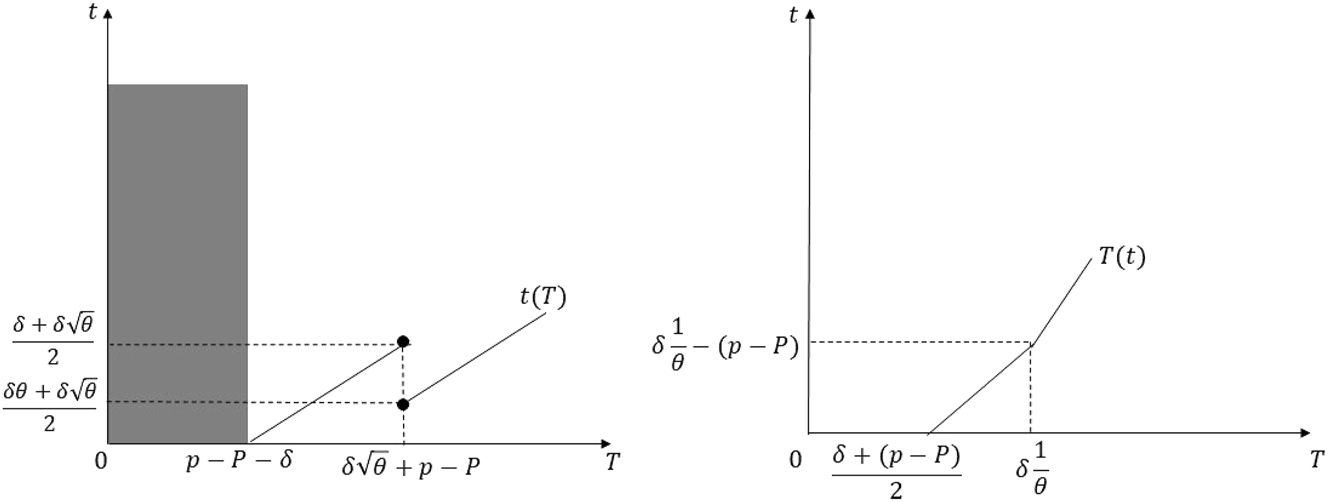

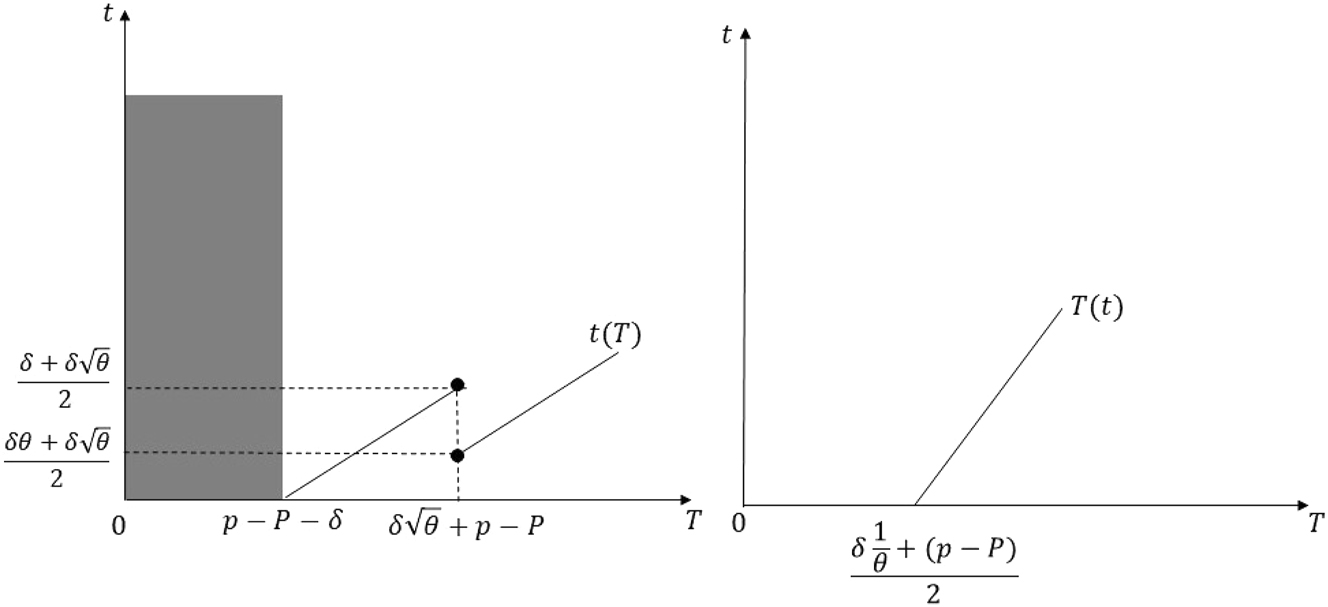

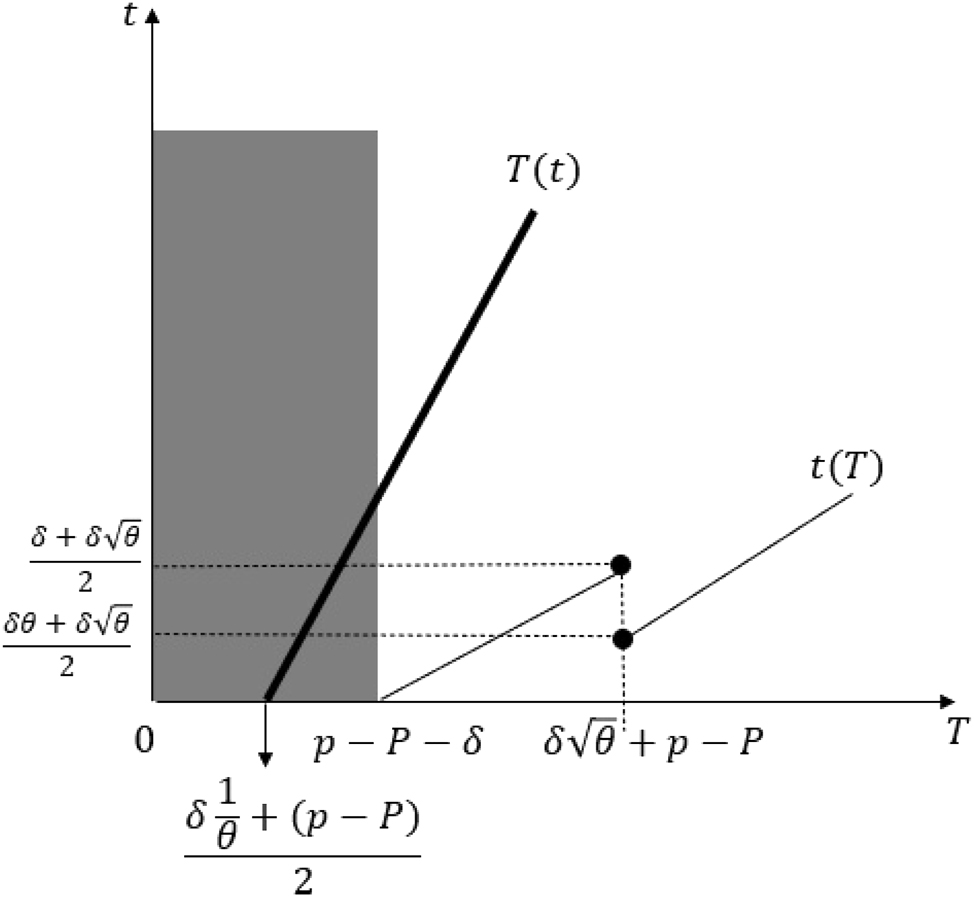

Part i: Assume that (p − P) ≤ −2δ − δθ. Then, the best-response correspondences of the small and large countries are as given in Figure 7. Under the parameter restrictions of Part (i), it is easy to show that the best-response correspondences intersect as in Figure 8. Solving for the intersection points, we get a continuum of equilibria such that

Best-response correspondences in the proof of Proposition 1 Part (i) and (ii) when −2δ − δθ < p − P ≤ −δ.

Equilibria in the proof of Proposition 1 Part (i).

Part ii: I prove Part (ii) of the proposition under three cases, as the shape of the best-response correspondences differs. First, assume that −2δ − δθ < p − P ≤ −δ. Then, the best-response correspondences of the small and large countries are given in Figure 7. Under the parameter of our restrictions, it is easy to show that the best-response correspondences intersect as in Figure 9. Solving for the intersection points, we get the unique equilibrium

Equilibrium in the proof of Proposition 1 Part (ii) when −2δ − δθ < p − P ≤ −δ.

Second, assume that

Best-response correspondences in the proof of Proposition 1 Part (ii) when

Third, assume that

Best-response correspondences in the proof of Proposition 1 Part (ii) when

So, collecting the results, if

Part iii. Proof Part (iii) is given after proof of Part (iv) as it is implied by the proofs of Part (ii) and (iv).

Part iv: I prove Part (iv) of the proposition under two cases, as the shape of the best-response correspondences differs under the two. First, assume that

Best-response correspondences in the proof of Proposition 1 Part (iv) when

Second, assume that

Best-response correspondences in the proof of Proposition 1 Part (iv), when

Collecting the results in both parts of the proof, if

Part iii. By the second part of the proof of Part (ii), there is no equilibrium if

Part v: Assume that

Equilibria in the proof of Proposition 1 Part (v).

A.3 Proof of Proposition 2

We have cross-border sales from small to the large country if and only if t

N

+ p < T

N

+ P. Rewriting the condition under Type A equilibrium, by Proposition 1 Part (ii), we get p − P < δ(1 − θ). By the same proposition, we have Type A equilibrium if and only if

By Proposition 1 Part (ii), we have t

N

< T

N

under Type A equilibrium if and only if

A.4 Proof of Proposition 3

We have cross-border sales from the large country to the small country if and only if T

N

+ P < t

N

+ p. Rewriting the condition using Proposition 1 Part (iv), we have

By Proposition 1 Part (iv), we have t

N

< T

N

if and only if

A.5 Proof of Proposition 4

I prove the proposition under four cases depending on the parameter values.

Case 1: Assume that

Part i: We have R(t

N

) = R(t

N

, t

N

) < R(t

N

, T

N

) as

Part ii: We have r(t

N

, T

N

) < r(t

N

) as

Case 2: Assume that

Part i: We have r(T

N

) = r(T

N

, T

N

) < r(t

N

, T

N

) as

Part ii: We have R(T

N

) > R(t

N

, T

N

) as

Case 3: Assume that

Part i: We have r(T N ) = r(T N , T N ) < r(t N , T N ). Thus, considering that r is increasing, r(τ) < r(t N , T N ) for all τ ∈ [t N , T N ].

Part ii: We have R(T

N

) > R(t

N

, T

N

) as

Case 4: Assume that

Part i: We have r(T N ) = r(T N , T N ) < r(t N , T N ). Thus, considering that r is increasing, r(τ) < r(t N , T N ) for all τ ∈ [t N , T N ].

Part ii: We have R(T

N

) > R(t

N

, T

N

) as

A.6 Proof of Proposition 5

Under a minimum-tax rate, I show the equilibrium tax rates by t m and T m for the small and large countries, respectively.

Part i: Assume that

Equilibrium in the proof of Proposition 5 Part (i).

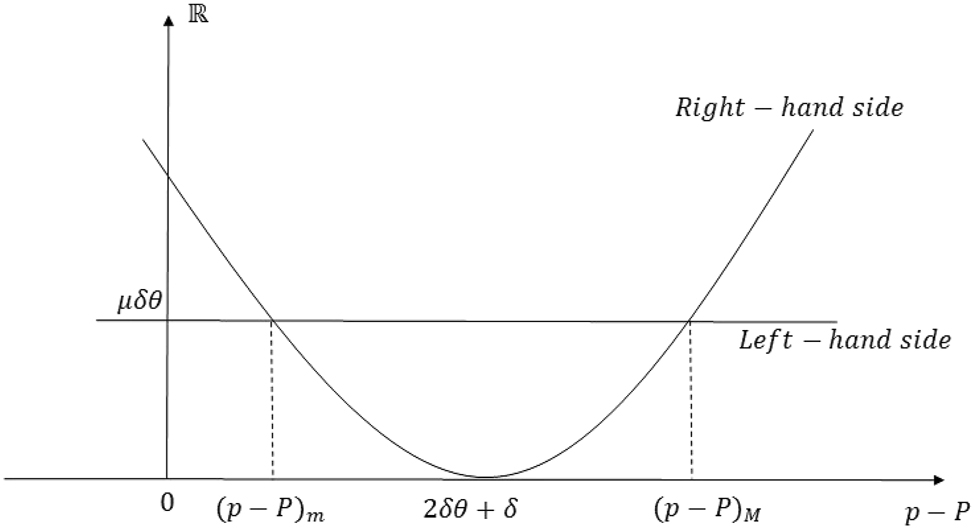

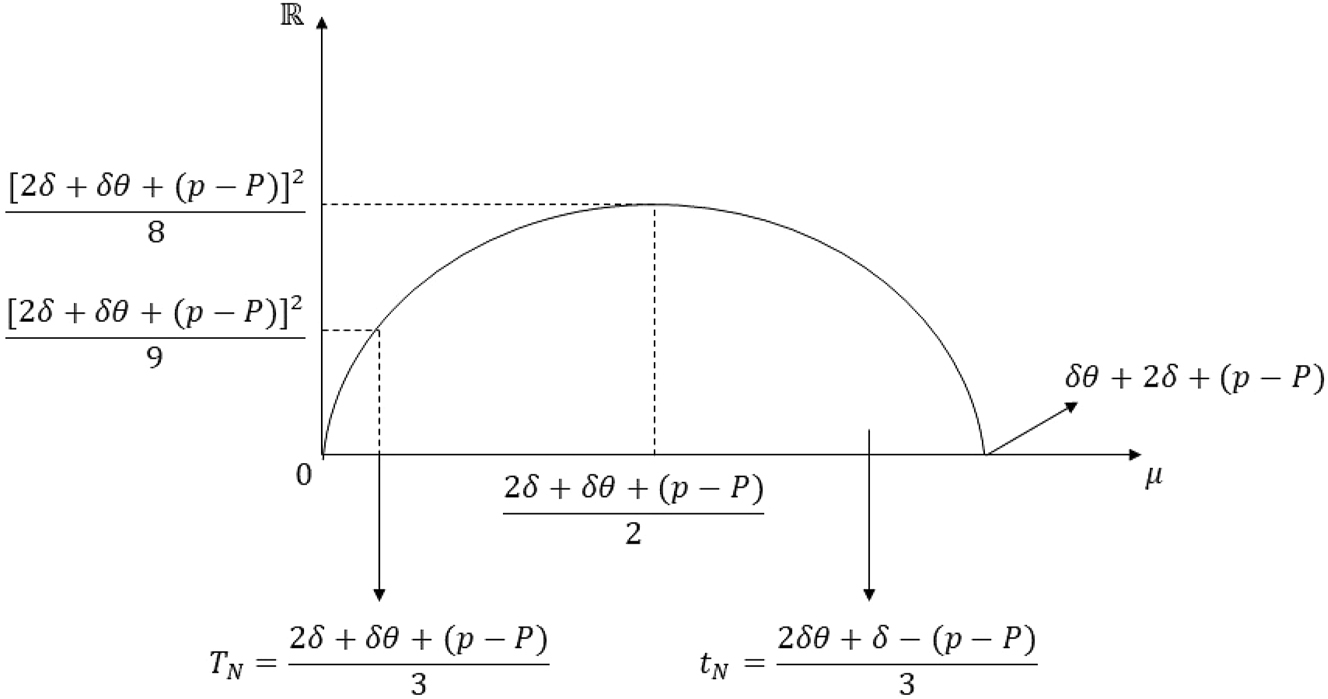

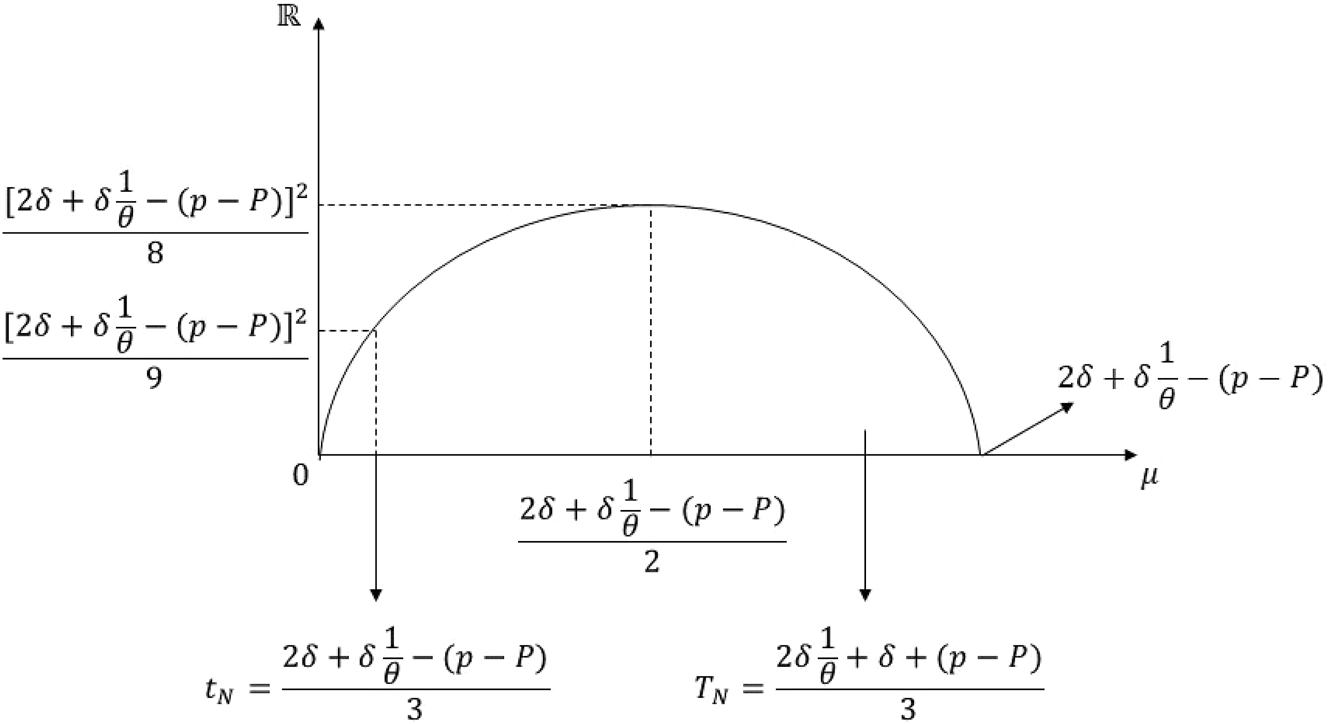

Take the minimum tax rate

We have R(μ) = (μ + p − P)H. Then R(μ) > R(t

N

, T

N

) if and only if

We have r(μ) = μh. Then, r(μ) > r(t

N

, T

N

) if and only if

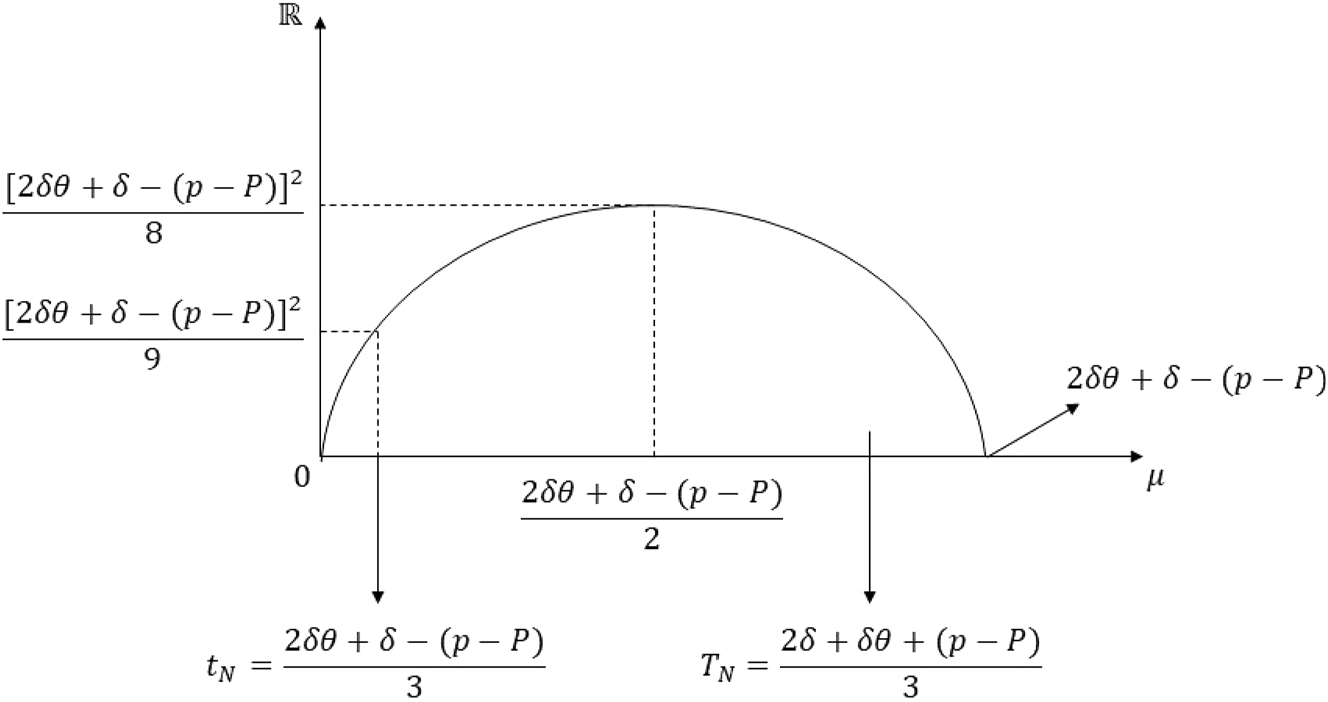

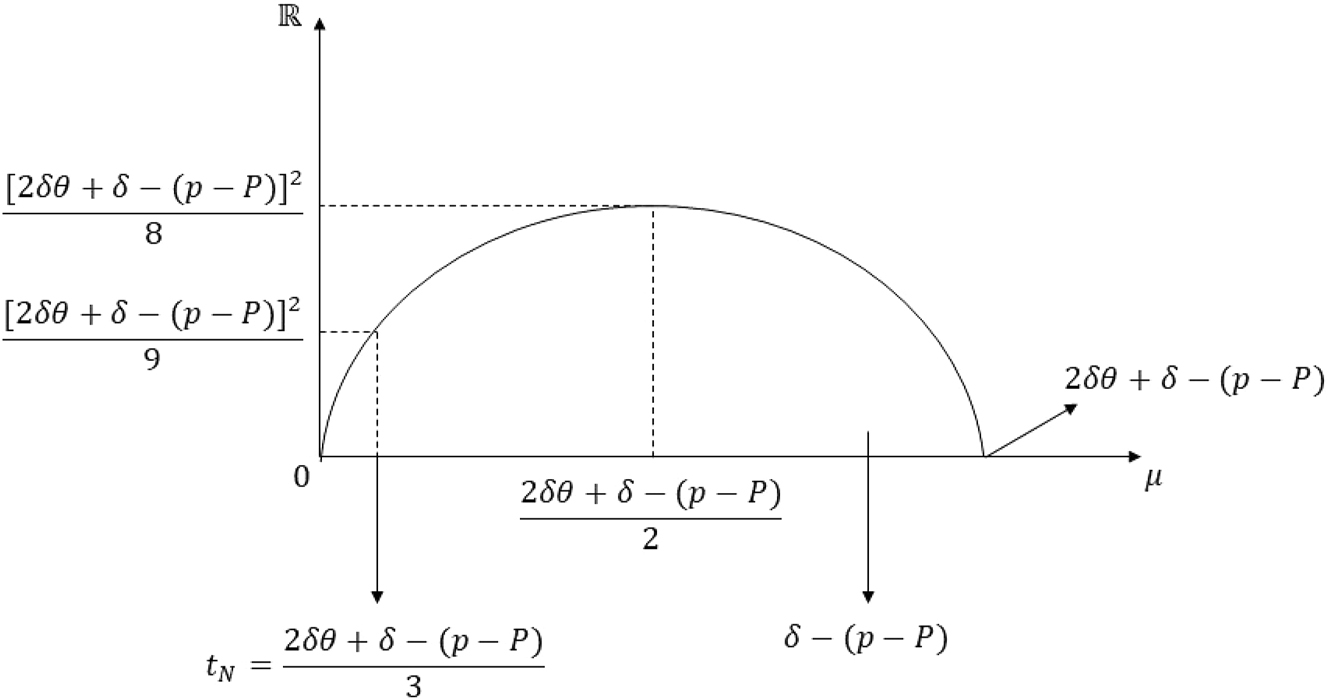

Graph of the inequality in the proof of Proposition 5 Part (i).

Part ii: I prove Part (ii) of the proposition by considering different cases for the value of p − P, as the figure of the best-response correspondences and the range of the feasible values of the minimum-tax rate differ under each case.

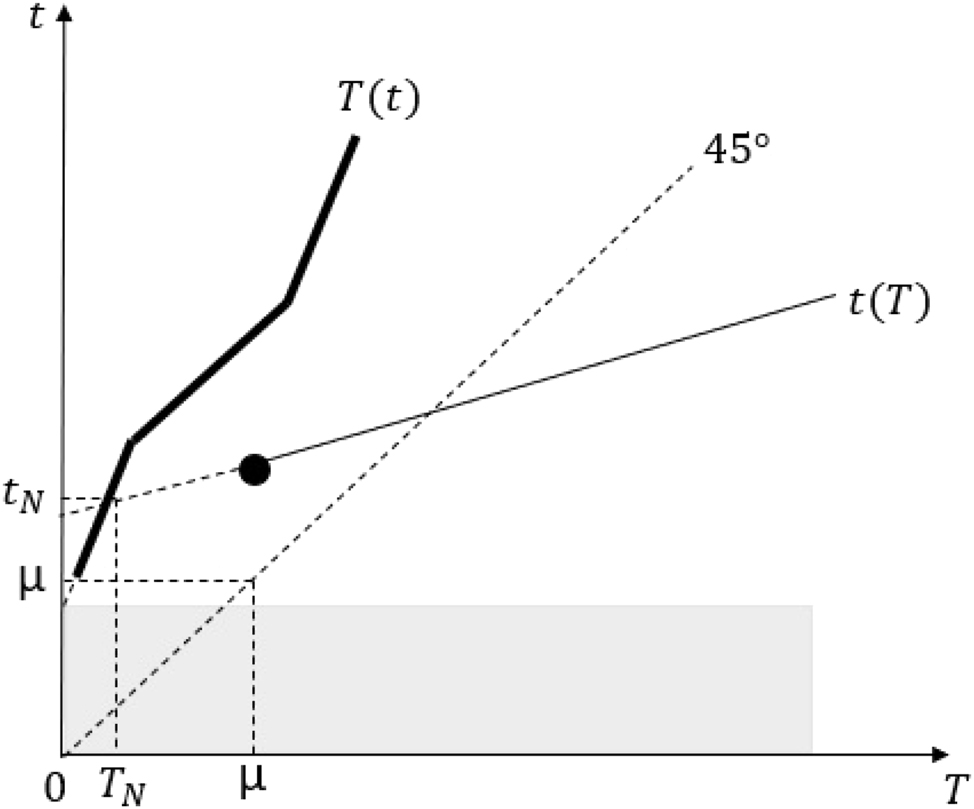

Case 1: Assume that −2δ − δθ < p − P ≤ δ. Then, under a minimum tax rate μ ∈ [T n , t n ], the best-response correspondences are given in Figure 17. As shown by the dashed lines and the lightly shadowed area, both countries’ best-response correspondences are irrelevant for the other country’s tax rate below μ. Then, as seen in the graph, the best-response correspondences do not intersect and we do not have an equilibrium. So, I continue to the proof, by focusing on the remaining cases.

Best-response correspondences in Case 1 of proof of Proposition 5 Part (ii).

Case 2: Assume that

Equilibrium in Case 2 of proof of Proposition 5 Part (ii).

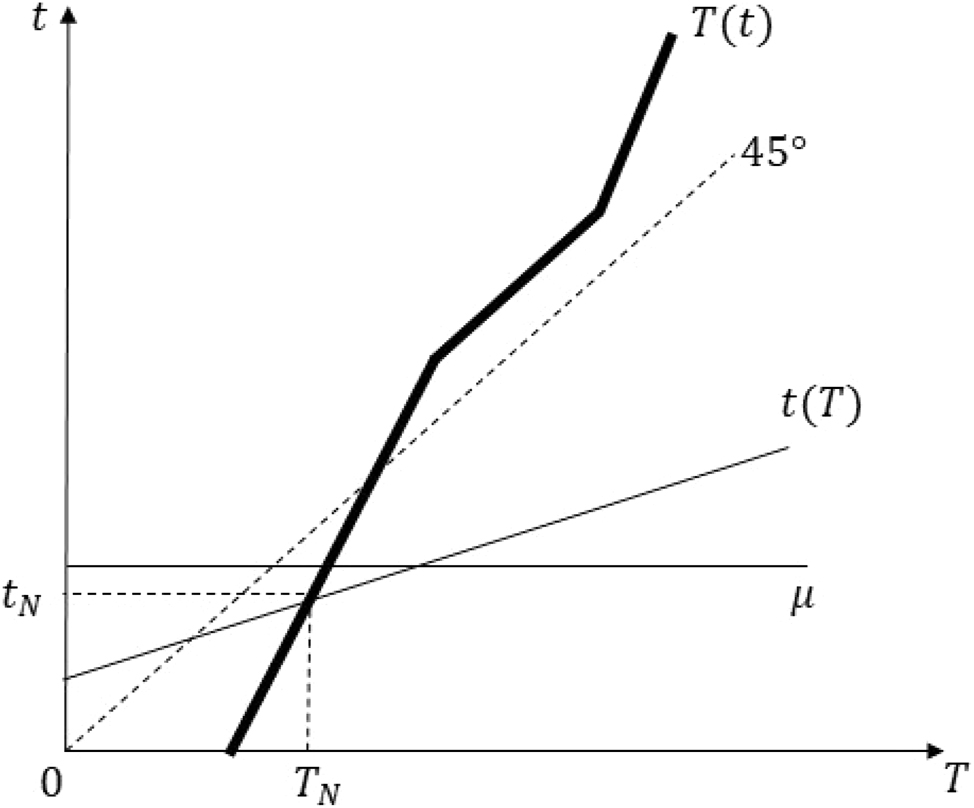

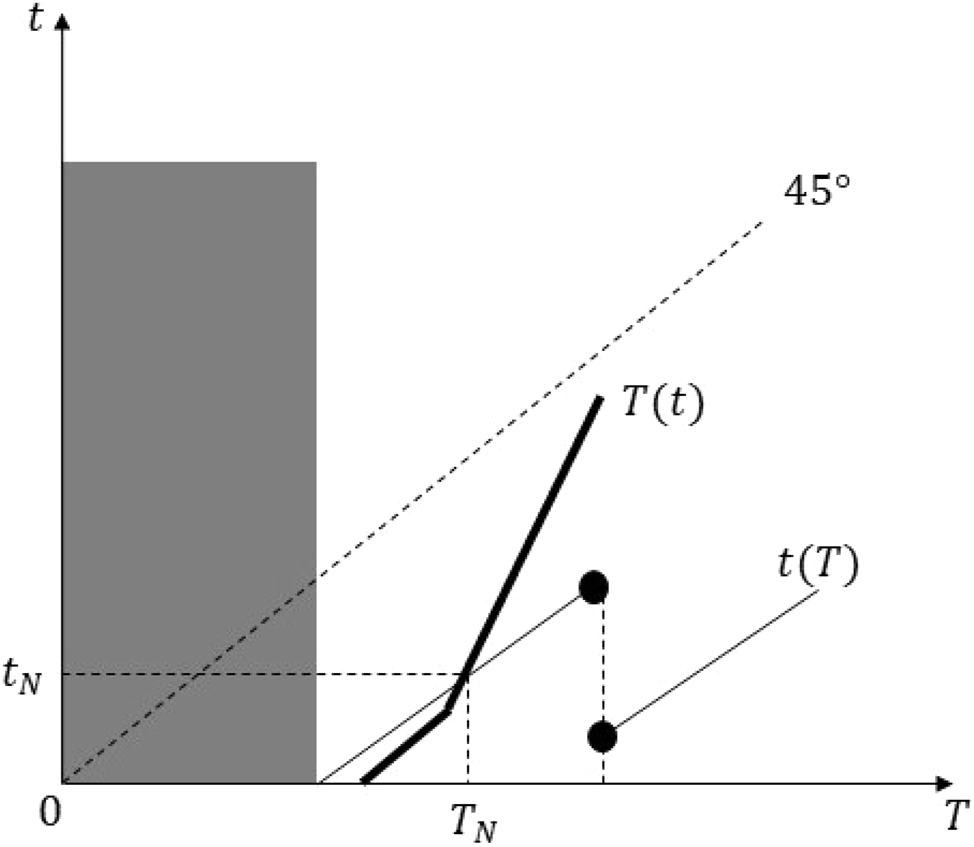

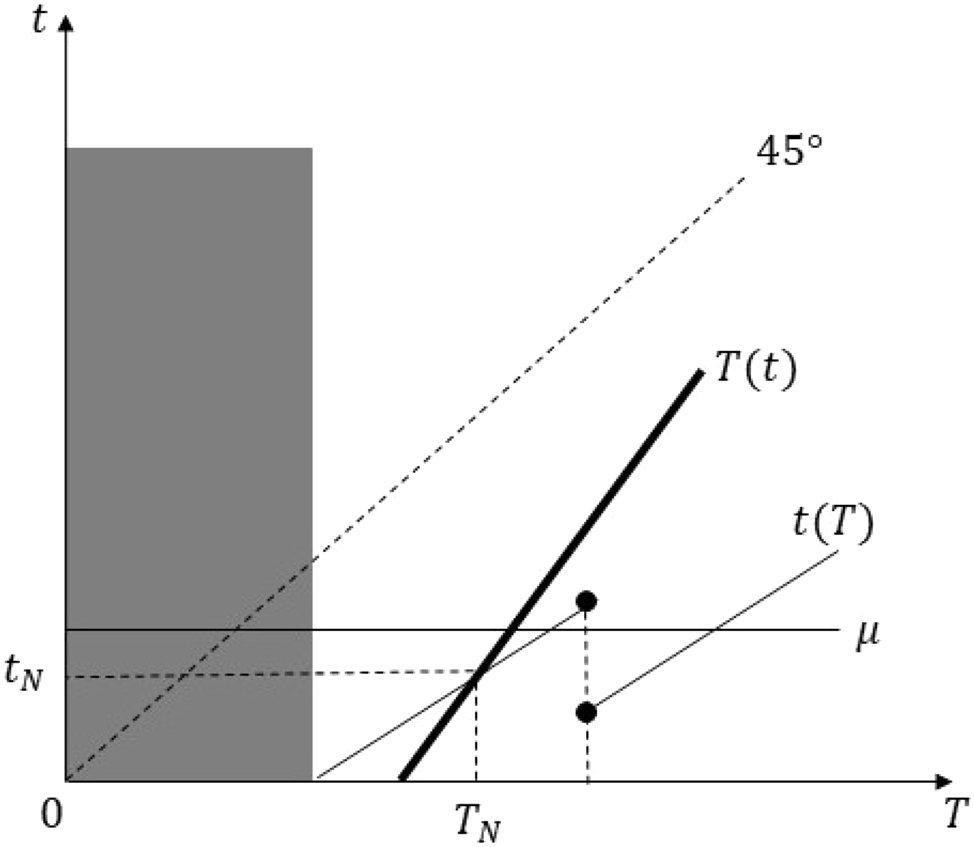

Following the discussion in Section 4, under a minimum-tax rate μ ∈ [T

N

, t

N

], we can ignore T(t) for t < μ. Additionally, as T can not be less than μ, for values of t > μ, we have T = μ until the value of t is such that T(t) = μ. And t(T) will get longer before the discontinuity point and will be equal to μ before the value of T is such that t(T) = μ. Then, we have

We have

Graph of the inequality in Case 1 of proof of Proposition 5 Part (ii).

We have

So, for Case 2, we have

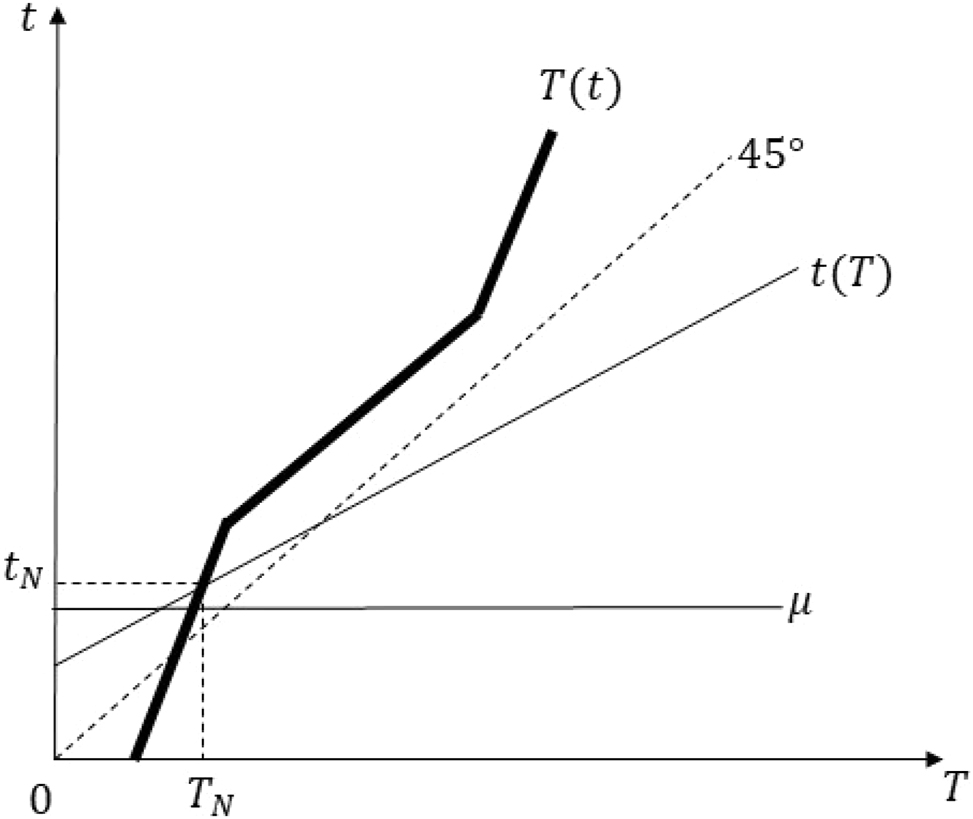

Case 3: Assume that

Equilibrium Case 3 of proof of Proposition 5 Part (ii).

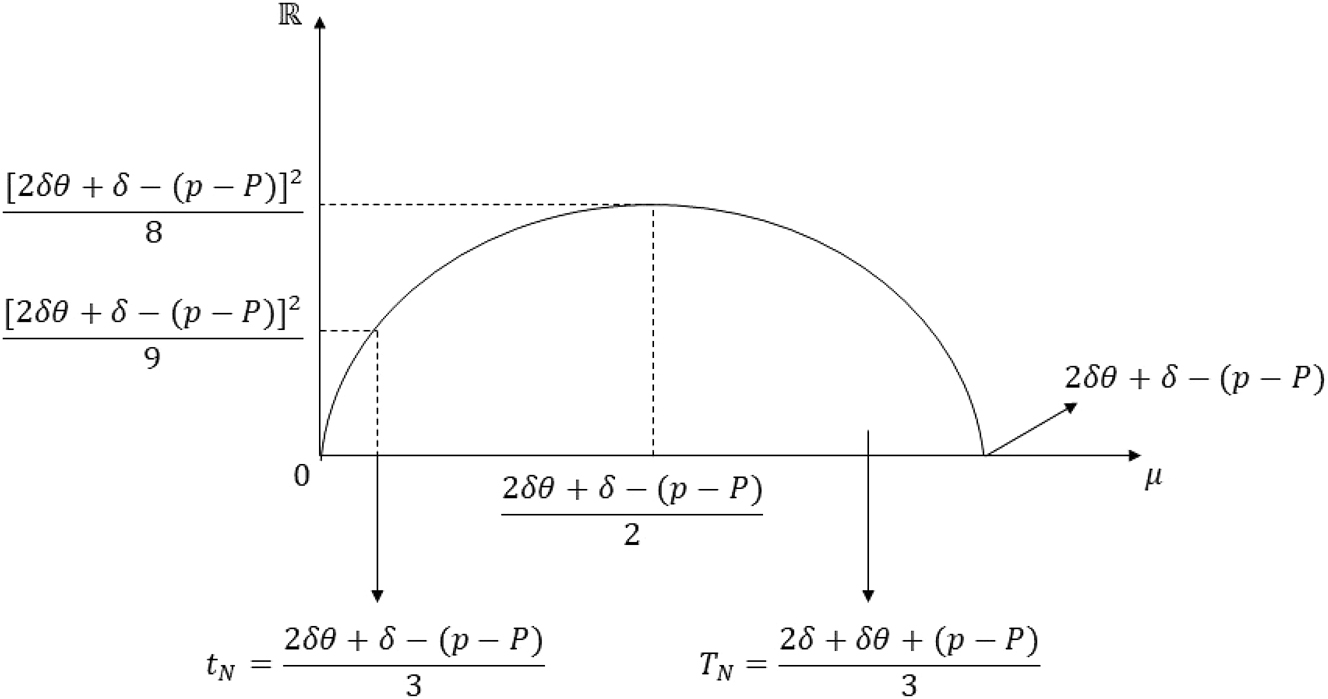

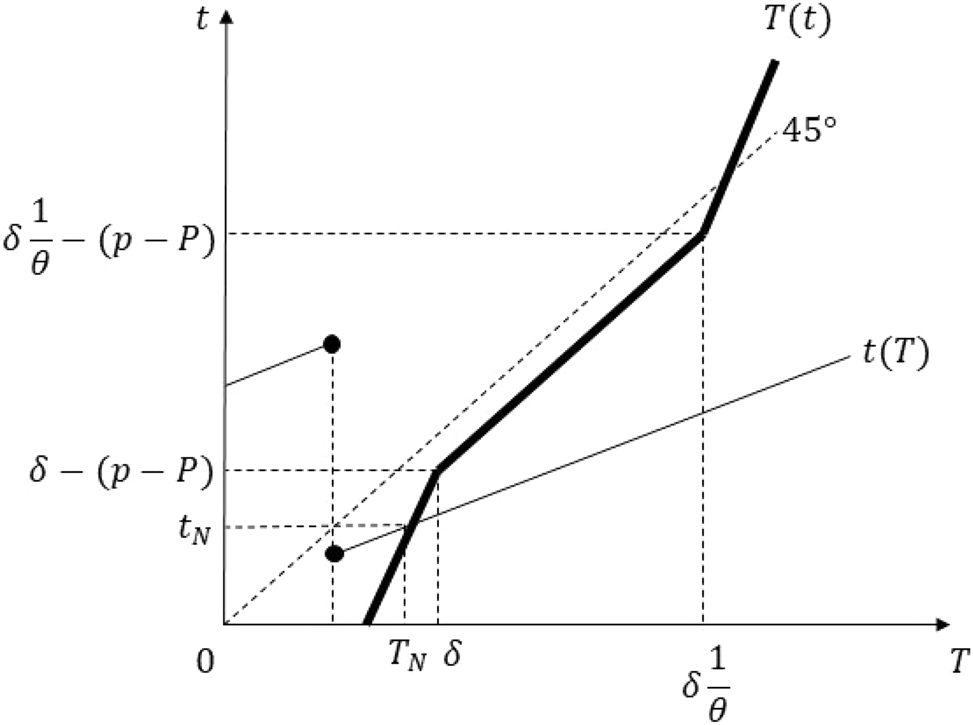

Following the discussion in Section 4, under a minimum-tax rate μ ∈ [t

N

, T

N

], we can ignore T(t) for t < μ. And t(T) will get longer before the discontinuity point and will be equal to μ before the value of T such that t(T) = μ. Then, we have

We have

We have

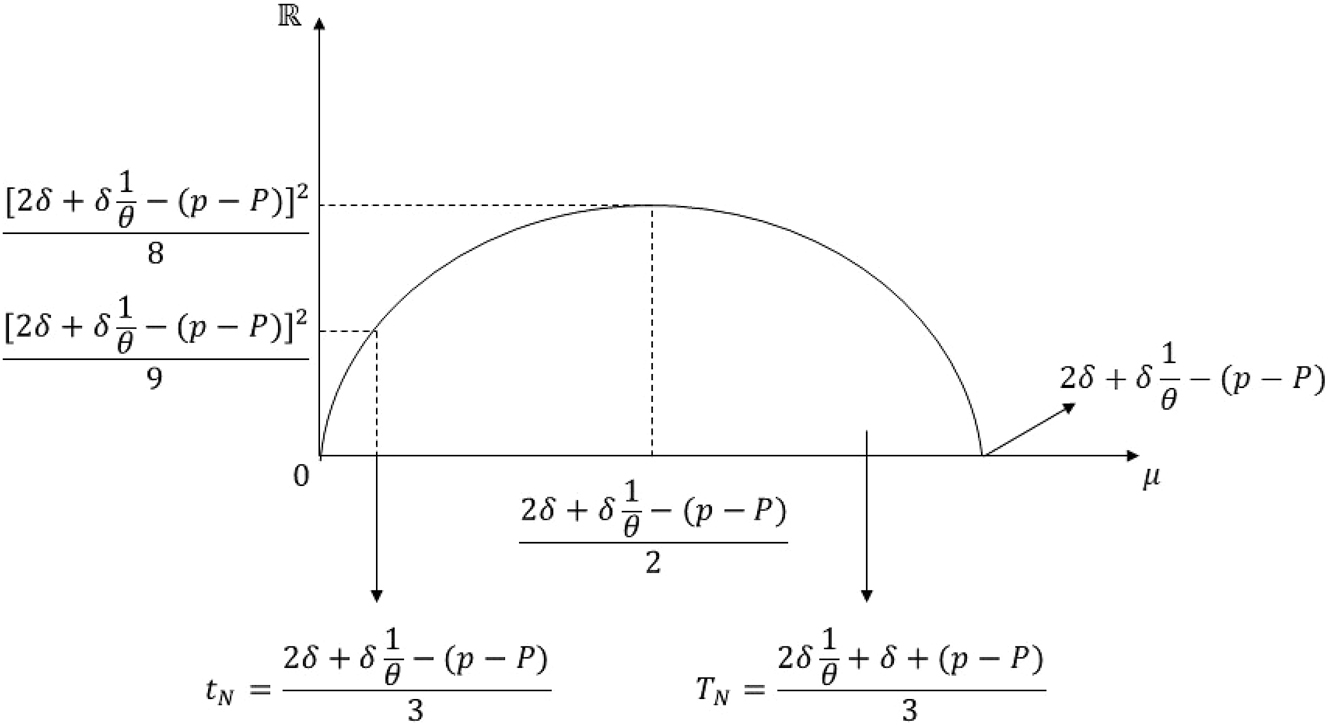

Graph of the inequality in Case 3 of proof of Proposition 5 Part (ii).

So, for Case 3, we have

Case 4: Assume that

Equilibrium in Case 3 of proof of Proposition 5 Part (ii).

Case 4.i: Assume that

We have

We have

Graph of the inequality in Case 4(i) of the proof of Proposition 5 Part (ii).

So, for Case 4.i, we have

Case 4.ii: Assume that

We have

We have

Graph of the inequality in Case 4(ii) of proof of Proposition 5 Part (ii).

So, for Case 4.ii, we have

Case 5: Assume that

Equilibrium in Case 5 of proof of Proposition 5 Part (ii).

We have

We have

Graph of the inequality in the proof of Case 5 of proof of Proposition 5 Part (ii).

So, for Case 5, we have

Case 6: Assume that

Equilibrium in Case 6 of the proof of Proposition 5 Part (ii).

Following the discussion in Section 4, under a minimum-tax rate μ ∈ [t

N

, T

N

], we can ignore T(t) for t < μ. And t(T) will be equal to μ before μ-line cuts t(T) in its middle part, get longer before the discontinuity point, and will be equal to μ before the value of T is such that t(T) = μ. Then we have

We have

We have

Graph of the inequality in Case 6 of proof of Proposition 5 Part (ii).

So, for Case 6, we have

References

Agrawal, D. R. 2012. “Games within Borders: Are Geographically Differentiated Taxes Optimal?” International Tax and Public Finance 19: 574–97. https://doi.org/10.1007/s10797-012-9235-y.Search in Google Scholar

Asplund, M., R. Friberg, and F. Wilander. 2007. “Demand and Distance: Evidence on Cross-Border Shopping.” Journal of Public Economics 91: 141–57, https://doi.org/10.1016/j.jpubeco.2006.05.006.Search in Google Scholar

Behrens, K., J. H. Hamilton, G. I. Ottaviano, and J. F. Thisse. 2009. “Commodity Tax Competition and Industry Location under the Destination and the Origin Principle.” Regional Science and Urban Economics 39: 422–33. https://doi.org/10.1016/j.regsciurbeco.2009.01.008.Search in Google Scholar

Cai, H., and D. Treisman. 2005. “Does Competition for Capital Discipline Governments? Decentralization, Globalization, and Public Policy.” The American Economic Review 95: 817–30. https://doi.org/10.1257/0002828054201314.Search in Google Scholar

Cnossen, S. 2003. “How Much Tax Coordination in the European Union?” International Tax and Public Finance 10: 625–49. https://doi.org/10.1023/a:1026373703108.10.1023/A:1026373703108Search in Google Scholar

Cremer, H., and F. Gahvari. 2006. “Which Border Taxes? Origin and Destination Regimes with Fiscal Competition in Output and Emission Taxes.” Journal of Public Economics 90: 2121–42, https://doi.org/10.1016/j.jpubeco.2005.08.011.Search in Google Scholar

Devereux, M. P., B. Lockwood, and M. Redoano. 2007. “Horizontal and Vertical Indirect Tax Competition: Theory and Some Evidence from the USA.” Journal of Public Economics 91: 451–79. https://doi.org/10.1016/j.jpubeco.2006.07.005.Search in Google Scholar

DHA. 2022. Bulgarlar alisveris icin Edirne’ye akin etti. Birgun. https://www.birgun.net/haber/bulgarlar-alisveris-icin-edirne-ye-akin-etti-bin-leva-bozdurdum-ve-10-bin-lira-harcadim-400566.Search in Google Scholar

Di Matteo, L., and R. Di Matteo. 1996. “An Analysis of Canadian Cross-Border Travel.” Annals of Tourism Research 23: 103–22. https://doi.org/10.1016/0160-7383(95)00038-0.Search in Google Scholar

Eichner, T., and R. Pethig. 2018. “Competition in Emissions Standards and Capital Taxes with Local Pollution.” Regional Science and Urban Economics 68: 191–203. https://doi.org/10.1016/j.regsciurbeco.2017.11.004.Search in Google Scholar

Ferris, J. S. 2000. “The Determinants of Cross Border Shopping: Implications for Tax Revenues and Institutional Change.” National Tax Journal 53: 801–24. https://doi.org/10.17310/ntj.2000.4.01.Search in Google Scholar

Haufler, A. 1996. “Tax Coordination with Different Preferences for Public Goods: Conflict or Harmony of Interest?” International Tax and Public Finance 3: 5–28. https://doi.org/10.1007/bf00400144.Search in Google Scholar

Haufler, A., and C. Lulfesmann. 2015. “Reforming an Asymmetric Union: On the Virtues of Dual Tier Capital Taxation.” Journal of Public Economics 125: 116–27. https://doi.org/10.1016/j.jpubeco.2015.02.002.Search in Google Scholar

Hindriks, J., and Y. Nishimura. 2015. “A Note on Equilibrium Leadership in Tax Competition Models.” Journal of Public Economics 121: 66–8. https://doi.org/10.1016/j.jpubeco.2014.11.002.Search in Google Scholar

Kanbur, R., and M. Keen. 1993. “Jeux Sans Frontières: Tax Competition and Tax Coordination when Countries Differ in Size.” The American Economic Review 83: 877–92.Search in Google Scholar

Karakosta, O. 2018. “Tax Competition in Vertically Differentiated Markets with Environmentally Conscious Consumers.” Environmental and Resource Economics 96: 693–711. https://doi.org/10.1007/s10640-016-0097-0.Search in Google Scholar

Keen, M., and K. A. Konrad. 2013. “The Theory of International Tax Competition and Coordination.” In Handbook of Public Economics, Vol. 5, edited by A. J. Auerbach, R. Chetty, M. Feldstein, and E. Saez, 257–328. Amsterdam: Elsevier.10.1016/B978-0-444-53759-1.00005-4Search in Google Scholar

Kempf, H., and G. Rota-Graziosi. 2010. “Endogenizing Leadership in Tax Competition.” Journal of Public Economics 94: 768–76. https://doi.org/10.1016/j.jpubeco.2010.04.006.Search in Google Scholar

Mintz, J., and H. Tulkens. 1986. “Commodity Tax Competition between Member States of a Federation: Equilibrium and Efficiency.” Journal of Public Economics 29: 133–72. https://doi.org/10.1016/0047-2727(86)90001-0.Search in Google Scholar

Nielsen, S. B. 2001. “A Simple Model of Commodity Taxation and Cross-Border Shopping.” The Scandinavian Journal of Economics 103: 599–623. https://doi.org/10.1111/1467-9442.00262.Search in Google Scholar

Nielsen, S. B. 2002. “Cross-border Shopping from Small to Large Countries.” Economics Letters 77: 309–13. https://doi.org/10.1016/s0165-1765(02)00141-6.Search in Google Scholar

Ogawa, H. 2013. “Further Analysis on Leadership in Tax Competition: The Role of Capital Ownership.” International Tax and Public Finance 20: 474–84. https://doi.org/10.1007/s10797-012-9238-8.Search in Google Scholar

Ohsawa, Y. 1999. “Cross-border Shopping and Commodity Tax Competition Among Governments.” Regional Science and Urban Economics 29: 33–51. https://doi.org/10.1016/s0166-0462(97)00028-8.Search in Google Scholar

Pi, J., and X. Chen. 2017. “Endogenous Leadership in Tax Competition: A Combination of the Effects of Market Power and Strategic Interaction.” The B.E. Journal of Economic Analysis & Policy 17, https://doi.org/10.1515/bejeap-2016-0191.Search in Google Scholar

Šemeta, A. 2011. Tax Coordination in Europe: The Way Forward after the Euro Plus Pact. https://www.europa.eu/rapid/press-release_SPEECH-11-232_en.pdf.Search in Google Scholar

Trandel, G. A. 1994. “Interstate Commodity Tax Differentials and the Distribution of Residents.” Journal of Public Economics 53: 435–57. https://doi.org/10.1016/0047-2727(94)90034-5.Search in Google Scholar

Wang, Y. Q. 1999. “Commodity Taxes under Fiscal Competition: Stackelberg Equilibrium and Optimality.” The American Economic Review 89: 974–81. https://doi.org/10.1257/aer.89.4.974.Search in Google Scholar

© 2025 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Frontmatter

- Research Articles

- Selection Efficiency in Multiple-Prize Tournaments with Sabotage

- Priced Out: Do Adolescents from Low-Income Families Respond More to Cost-Sharing in Primary Care?

- International Commodity-Tax Competition and Asymmetric Producer Prices

- Letters

- Absolute versus Relative Poverty and Wealth: Cooperation in the Presence of Between-Group Inequality

- Cross Ownership Under Strategic Tax Policy

- Central Bank Digital Currencies: Experimental Evidence of Deposit Conversion

- Earthquakes and Intertemporal Preferences: A Field Study in Italy

Articles in the same Issue

- Frontmatter

- Research Articles

- Selection Efficiency in Multiple-Prize Tournaments with Sabotage

- Priced Out: Do Adolescents from Low-Income Families Respond More to Cost-Sharing in Primary Care?

- International Commodity-Tax Competition and Asymmetric Producer Prices

- Letters

- Absolute versus Relative Poverty and Wealth: Cooperation in the Presence of Between-Group Inequality

- Cross Ownership Under Strategic Tax Policy

- Central Bank Digital Currencies: Experimental Evidence of Deposit Conversion

- Earthquakes and Intertemporal Preferences: A Field Study in Italy