Abstract

The pandemic and the last years’ geopolitical disruptions have laid bare the vulnerability of Europe’s supply chains, as well as the challenges posed by insecure oil and gas supplies. In this contribution, we aim to add to this debate by raising awareness of the vulnerability of trade and supply chain infrastructure between Europe and Asia. We give an overview of the risks for supply chain securities due to the risk of military and armed conflicts and geopolitical challenges more broadly, illustrated by a map of central logistic corridors and hubs. We further discuss the contemporary implications for each corridor due to the war in Ukraine. By making use of the example of the Belt and Road Initiative (BRI), we argue that trade along these corridors is highly interdependent and that the continued conflict in Ukraine poses a danger for independent, diversified and resilient trade across Eurasia. The paper calls for future research in economic geography, military geographies and related international business literature to (jointly) reemphasize the economic geographies of war, by for instance analysing shifts in global value chains and global production networks as a result of violent conflicts.

1 Introduction

Europe’s economy is heavily dependent on international supply chain relations and corresponding security of trade routes. Yet the last years have laid bare the immense vulnerability of the many trade routes that Europe depends on, both land- and sea-based. Russia’s war on Ukraine came alongside substantial disruptions to strategic transport routes in the Black Sea. Since Russia's attack on Ukraine, Europe’s insecure oil and gas supplies, as well as the impacts of sanctions on the European economy (e.g. Crescenzi and Harman 2023; Prebilič and Jereb 2022), have dominated the public debate. While the most catastrophic scenarios have so far proven to be overexaggerated (see e.g. Bachmann et al. 2022), significant risks remain. In this paper, we aim to outline and discuss a less regarded but long-term challenge for European economies: the vulnerability of (land-based) supply chain routes and infrastructure between Europe and Asia, particularly China. We argue that the supply chains between Asia and Europe are not only vital for European and Asian consumer and industrial markets but had already been affected by risk and uncertainty long before the war in Ukraine. The attack on Ukraine worsened this already vulnerable situation and challenges related production networks and large-scale infrastructure programmes such as the Chinese Belt and Road Initiative (BRI; Mendez et al. 2022). Furthermore, the situation became even more tense in late 2023 and 2024, when (as a result of the Gaza-Israel conflict) Yemen Houthi rebels attacked multiple container ships and energy tankers in the Red Sea, creating maritime ‘chokepoints’ that pose a threat to global energy markets and increase freight rates (e.g. Aris 2023).

To make our case, we briefly outline on how war and military conflicts are discussed in economic geography and related international business literature, with a focus on trade routes and supply chains. We then look at Eurasian trade routes, particularly in the context of the war in Ukraine. We show that (nearly) all routes between Europe and Asia face serious risks, such as instability, contestation, authoritarian regimes, risk of rebel attacks and military conflicts. The implications of a continuous military conflict in Ukraine stretch beyond the immediate logistics corridor passing through Ukraine. Based on these findings we generally conclude that studies in economic geography and business literature on supply chain relations (e.g. studies on global production networks (GPNs) and global value chains (GPVs)) should more strongly consider conflict-related disruptions. This helps to understand current trade and supply chain dynamics, as well as the interdependency between different routes in the current times of crisis. The combination of vulnerabilities creates an uncertainty for European trade that has substantial implications for Europe’s endeavours to strive for strategic autonomy while continuing to be embedded in global trade.

In highlighting the long-term implications and challenges arising from wars, other violent conflicts and geopolitical tensions more generally, we develop an argument that ‘military’ geographies need to be integrated into work on global production and value chains in fields such as economic geography and international businesses. We even go a step further, suggesting that a specific consideration of the emergence of new ‘economic geographies of war’ is worthwhile in understanding not just GPNs but also in providing new insights for the complementarity of locations. On the one hand global supply chains are disrupted through local tensions. On the other hand geopolitical threats, violent conflicts, and of course wars lead to shifts in international businesses decisions in an effort to secure their long-run GPNs and GPVs. The war on Ukraine is one of these game-changing events at Europe’s eastern periphery. Making use of a map of key Eurasian corridors, we bring together some broader considerations for the shifts within GPNS on the (potential) shifts in GPNs and GPVs. These shifts influence businesses decisions, leading to the emergence of new variations of the economic geographies resulting from these military conflicts. We call these ‘economic geographies of war.’

The paper is structured as follows: The next section summarises the consequences of war and violent conflicts, drawing on, international businesses and military geographies highlighting a research gap in GPN and GPV research. In section three we map nine Eurasian trade routes, then discuss the potential consequences and bottlenecks for each corridor. In the fourth section we discuss the emergence of new economic geographies of war as a result of the Ukraine war and subsequent shifts in the BRI, before fifth coming to a conclusion.

2 Consequences of war and violent conflicts in economic geography and beyond

Beyond the loss of lives, different studies (e.g. Cowen 2014; Hu et al. 2023; Katsaliaki et al. 2021; Le Billon 2001) have already outlined the generally negative effects of war on trade. These factors are caused by a range of harmful factors, such as embargoes, damage to infrastructure, and loss of human capital. In violent conflicts, transport routes and infrastructure (such as airports, resource extraction sites, banking or power stations) are usually the most important and contested assets which conflict parties will fight for, interrupt or even destroy (to avoid them falling into the hands of opponents; see e.g. Le Billon 2001). Military conflicts can therefore lead to serious disruptions and decoupling processes, with severe consequences for global supply chains and trade.

Studies on global production networks (GPNs) or global value chains (GVCs), which are the dominant concepts in economic geography related to supply chains, have been widely silent about the effects of war and military conflicts on supply chains[1] and only recently refocused on geopolitical risks (e.g. Follmann et al. 2024; Yeung 2023). Two further examples are first, Aoyama et al. (2024) who outline the development of diplomacy-driven governance as a result of the current shifts in global world order. Second, Hess and Horner (2024) highlight states strategies to navigate risks in geopolitically turbulent times, and the subsequent processes of coupling, decoupling and recoupling (see as well Pavlínek 2024). Both highlight growing concerns about military security for supply chains, yet the impacts of military wars on GPNs remain largely unstudied. A reason for this could be, that the debate on GPN and GVC has largely unfolded since the 1990s (e.g. Gereffi 1994; Gereffi et al. 2005; Henderson et al. 2002). This means it developed after the cold war, at a time when globalisation (with all its opportunities and problems) seemed unchained and rather free of geopolitical risks and military conflicts in the countries where most global trade took place. Missing widely empirical evidence and a tangible necessity to relate to, most GPN and GVC scholars therefore neglected studying or conceptualizing the impact of military conflicts and wars. Even recent studies on GVC and GPN dealing with risks, ruptures, frictions and decoupling do not discuss wars or military conflicts (for example De Marchi and Gereffi 2023; Völlers et al. 2023;[2] Yeung 2015; Yeung and Coe 2015). This is still quite surprising as modern GPNs require reliable and – if “just-in-time” production and delivery is involved – rapid cargo movement (Maihold and Mühlhöfer 2021). A notable exception are Blažek and Lypianin (2024) show the Ukrainian state-owned companies reoriented after 2014 annexation of Crimea, but also showed that trade barely ceases entirely. Violent conflicts, or even just a high risk of conflict, can seriously challenge and disrupt these movements, however- Concerning geopolitical risks Yeung (2023) calls for more studies which incorporate and theorize the effects of powerful national and supranational actors and their related policies such as the US restrictions on technology exports to China or EU attempts of reshoring manufacturing to reduce import dependencies.

Indeed Follmann et al. (2024) outline that such geopolitics lead to a reconfiguration and recoupling of global supply chains; For example, when involved businesses are developing new strategies of near shoring or friend shoring in order to secure their long-run supply (see also Kalvelage and Tups 2024; Tups et al. 2024; Yang and Chan 2023).

Similar observations can also be made for parts of the international business literature. Here for example various studies location choices and innovation strategies of multinational enterprises (e.g. Cano-Kollmann et al. 2016; Lorenzen and Mudambi 2013; Wang 2022) view economic organizations and territories on different scales (e.g. multinational enterprises, clusters, urban agglomerations or countries) as connected networks, implicitly assume a context of easy flow of investments. While these works rightly outline the importance of international interrelationships and interdependencies for economic organisations and territories, they have to “some degree neglected the boundaries and frictions beyond the national level”; Bathelt et al. 2018; p. 1003). Those works analyzing such international frictions mainly focused on institutional differences such as diversity of languages, traditions, legal systems as well as related labor and business cultures (Bathelt et al. 2018; Berry et al. 2014), or recently on protectionist policies, pandemic related frictions (Bathelt and Li 2022; Lorenzen et al. 2020) but do not focus on the consequences of war and violent conflicts.

Literature on military geography can further enhance this understanding. Generally military geography deals with state military discourses of military power; a broad political geography, focused on the spatiality of armed conflict; and the political economies and sociocultural geographies of militarism (Rech et al. 2015; Woodward 2005). Bearce and Fisher (2002) outline and model explanations why and under which conditions desires for and related conflicts about resources, infrastructures and trade networks lead to war and other violent conflicts, but do not outline the effects of wars and other violent conflicts on international trade, supply chains and related infrastructures. Stewart and Fitzgerald (2001) for example analyse the consequences of a war within nations on their economic and social development. Mykhnenko (2020), analysed the effects on Russia’s first attacks on Ukraine in 2014 and focussed on the direct economic effects of the attacked country (depopulation, economic decline and erosion of development; see below). However, he did not take the perspective off international trade and supply chain effects and risks. Faye et al. (2004) in contrast outlined how wars and violent conflicts in one country can directly endanger or negatively affect a neighboring country, for example when transit countries suffer from violent conflicts, transit routes are damaged or closed, and this results in a rerouting of major trade or in the worst case, a stoppage of transit. Generally, less is known on the large variety of how military power shapes international economic relationships because of the various types of military power in which it can appear (e.g. threats, blockades, occupancy). Here, we can identify a general demand for further economic geographies of war which could link military geography closer with economic geography (in particular with work on global value chains and global production networks) and international business literature.

This could be further enhanced by literature on supply chain disruptions. Here, Katsaliaki et al. (2021) categorize war and other violent conflicts as low frequency but catastrophic macro level risks for supply chains. Similarly, Cowen’s (2014) work on logistics and transport route related disruptions along supply chains distinguishes between everyday delays (e.g. bad weather, failed engines, road closures) and deliberate interruptions in the context of violent and contested human relations. These include labour actions (e.g. strikes and blockades), piracy and border security checks, but also military actions. While some of these disruptions (in particular everyday delays) can at least partly be addressed and calculated within the risk and security management of supply chains, some of these activities are rather incalculable leading to insurable uncertainties and long-term disruptions.[3] In the long run, violent conflicts and wars can therefore lead, not only to serious recalculations concerning increased costs for insurances, concessions and bribes, but also to disinvestment and disengagement from the affected businesses, regions and sectors (Le Billon 2001).

These different literature streams highlight the complexity of developments in regions affected by violent conflicts. In this paper we specifically focus on the Eastern borders of the European Union. Already, before the Russian attack in 2022, scholars were already discussing geopolitical and military risks along the Eurasian trade routes. A systematic literature overview with a particular focus on the Belt and Road routes between China, Europe and other large portions of Asia was undertaken by Hu et al. 2023. Here they defined risks of political stability, external conflicts and military interventions, among others. Hu et al. (2023) show that such risks are not only very significant but also increased from 2005 to 2020, with Afghanistan, Iraq, Russia and Ukraine as the main risk centres and military risks and destabilisation of national sovereign security as the dominant risk types. While many Middle Eastern countries have been threatened for decades by terrorism, ethnic conflicts and political instability, parts of Eastern Europe have again become a friction zone of political (e.g. NATO versus Russia) and military conflicts (e.g. Allison 2014; Russian Attacks on Ukraine 2014). Here Hu et al. (2023) outline a serious lack of awareness to these different risk types in academic literature on trade.

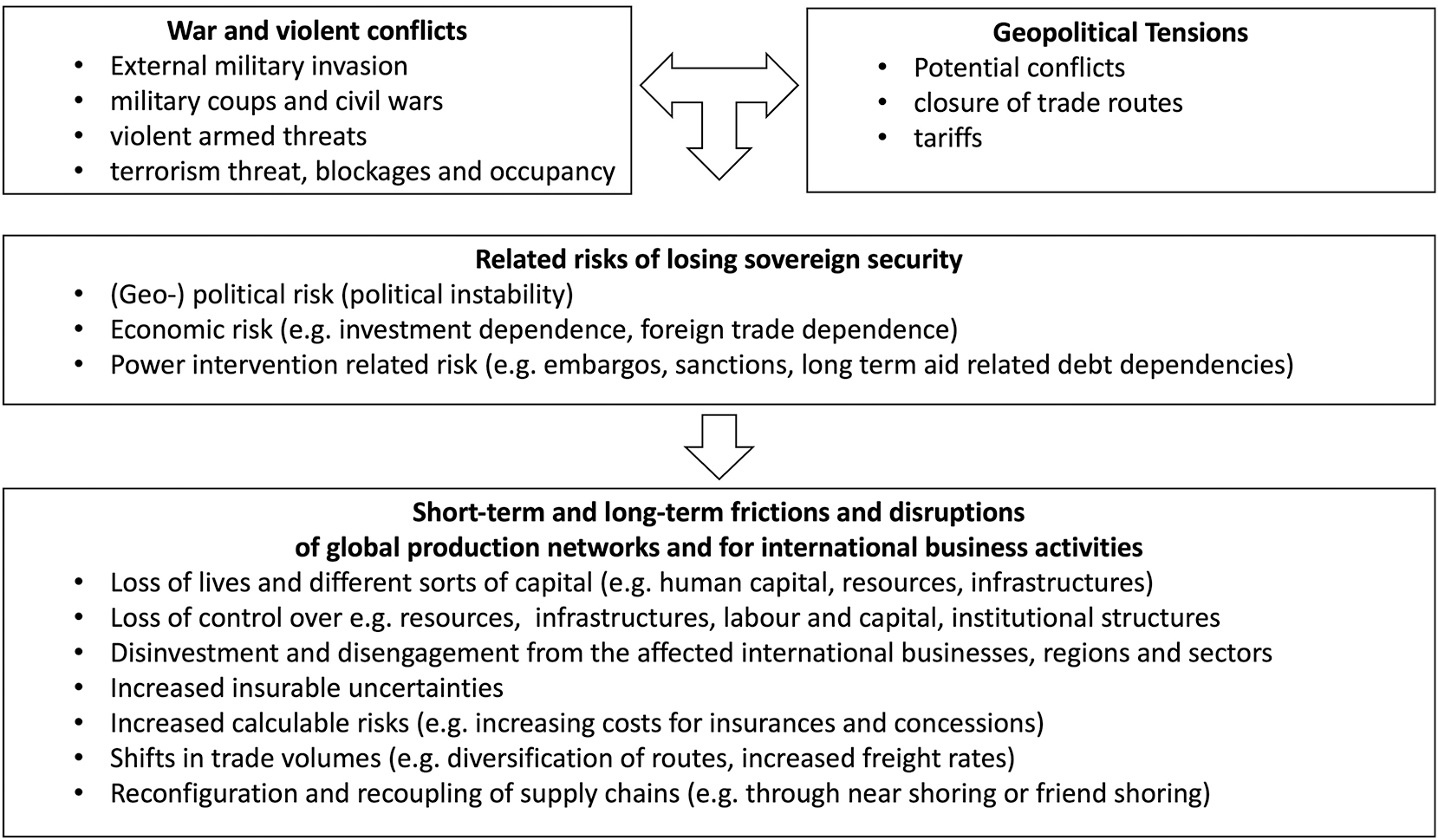

Russia’s attack on Ukraine has increased these risks dramatically. According to Mendez et al. (2022) the land infrastructure between Europe and Asia which passes through Ukraine and its direct neighbors has been affected by a reduction of investment, funding, and international cooperation due to the geopolitical shock. Further, the war negatively affected global value chains (Crescenzi and Harman 2023; Mendez et al. 2022; Nedopil 2022). These negative effects could be directly seen in price jumps in affected value chains such as food or cosmetics, which are highly dependent on Russian and Ukrainian seed oil (Crescenzi and Harman 2023). Li (2023a) further identified a reduction of trade and a general loss of trust from investors in the Belt and Road initiative along Ukraine and Russia but also along the BRI due to the risk of secondary sanctions against Russian allies such as China (see also Bo 2022). Figure 1 outlines the discussed consequences of war and military conflicts and the broader geopolitical insecurities for potential conflicts before we will outline and illustrate for Eurasian trade routes and supply chains in more detail.

War and military conflicts, related risks and related effects on trade routes and supply chains (own compilation; see in particular Hu et al. 2023).

While the implications of war and military conflicts on trade are generally understood, we argue that in economic geography there is a lack of understanding of the vulnerabilities of different interdependent trade routes on the overall supply chain security of Europe. We thus re-emphasize the dependence of physical pathways and means of trade with geo-political actors. With this paper, we would like to invite more in-depth discussion on the specific situation concerning Eurasian trade routes and the concrete challenges. We aim to initiate this debate by first providing an overview of the key Eurasian infrastructure corridors and then summarising key challenges. These relate to global dependencies of areas with chokepoints as well as an increased dependency of the global trade networks on individual countries, or geopolitical sensitivities.

3 Mapping key transport routes and their general opportunities and risks

Overall, maritime routes continue to be the backbone of global trade, specifically trade between China and the EU. Dependence on sea-based trade routes was one of the first reasons for China to strengthen its land-based routes. Long before the Belt and Road Initiative was officially launched in 2013 by former Chinese president Xi Jinpeng, China was already putting considerable effort into building Eurasian train routes. Following the fall of the Iron Curtain, Chinese engagement helped to diversify the development of land-based trade routes from Europe to Asia (Sielker and Kaufmann 2020). To this day, however, the North Sea Harbours remain (in terms of volume) Europe’s most important link to global trade. The geopolitically tumultuous times, and specifically the rise of armed conflicts in Ukraine and in Gaza, have raised implications for supply chain and energy security. In Figure 2 we illustrate the major land- and sea-based infrastructure corridors between Europe and Asia, aiming to provide an overview of some challenges associated with each of these routes. Thereby, we show that a substantial and non-substitutable part of land-based trading activities are under serious threats. Many of these routes pass through Russia, through areas where Russia exercises de facto influence, or where it aims to increase its direct influence (Flanagan et al. 2020).

Conflicts and limitations along the main routes between Europe and Asia (own design).

There are nine major infrastructure corridors and routes. The primarily land-based routes from Northernmost entry to Europe to Southernmost are: (1) the Cross-Russia Corridor, (2) the Baltic Crossing, (3) the Ukraine Land Crossing, (4) the Caucasus-Black Sea – Ukraine Crossing, (5) the Caucasus-Black Sea – Danube Crossing, and the (6) Turkey Crossing. The primarily maritime routes, following the entry points to Europe from North to South are: (7) The Arctic – North Sea Corridor (Northern BRI Sea Route), (8) the Suez Channel (Southern BRI Route), and (9) the Cape Route via South Africa, not displayed in Map 1. Many of these routes have been officially associated with the BRI.

In general, we use the terms “corridors” and “crossings” for broad routes, which themselves consist of smaller trade routes. We name the land-based entry points into the EU “crossings.” The Cross-Russia Corridor branches into different potential crossings before entering Europe. We derived these corridors based on the authors’ internal discussions and the BRI Corridors represented by New Silk Road mapping of MERICs and the TEN-T corridors of the European Union. The initial mapping were based on the MERICS tracking map from 2022, and considering updates till 2024 (MERICS 2024), and the TEN-T Corridors in the MFF period 2014–2020 and 2021–2027 (see for example, European Commission 2024). We then discussed these major transport routes in light of geopolitical tensions. The corridors presented here are, in the authors’ estimation, both key transport routes as well as those subject to substantial geopolitical tensions or regional sensitivities. Another key consideration here is whether alternative major funding routes exist in case of military interventions, rising violent conflict or geopolitical tensions, an aspect we consider important to understanding economies of war. We then illustrate in the example of Ukraine how these different routes may be interdependent and how geopolitical tensions affect the trading opportunities across different crossings. We also consider capacity limitations as an additional pressure weighing on businesses’ search for reliable trade routes.

In general, one can say that trade volumes on the various routes have significantly increased since 2011. For example, trade between China and Europe along the Kazakhstan, Russia, Belarus route increased from 100,500 containers TEU (Twenty Foot Equivalent Unit, the unit used to measure volume based on a standard container) in 2016 to 681,200 containers in 2022 (UTLC 2023). In total in 2022, land-route trade between Europe and China reached 1.6 million TEU (GTAI 2023). However, this number was strongly influenced by the COVID pandemic and related challenges for maritime traffic (see below). In our discussion we will not draw on exact trade numbers in these routes or subsequent economic implications. There are two reasons for this. First, overall trade flows are difficult to calculate due to varying sources, measurement methods, etc. Second, corridors are often a combination of a number of different logistic centres and microroutes, which are individually difficult to estimate. Our key argument is rooted instead in the major risks and challenges associated with these corridors, without aiming to estimate specific economic implications.

In general, the risks and challenges along these corridors include a halt in trade along one route due to sanctions or military conflicts, risks of additional conflicts, cost and time implications of using more ‘secure’ trade routes, capacity limitations, and increased dependency on a few countries through which transport routes run. Table 1 summarises prominent examples for risks and challenges along these corridors.

Prominent examples for risks and challenges for trade across different Europe – Asia trade routes (own compilation).

| Route | General risks and challenges for Europe | Risks and challenges related to the changing situation in Ukraine |

|---|---|---|

| European entry points via primarily land-based routes | ||

| Cross-Russia Corridor |

|

|

| Baltic Crossing |

|

|

| Ukraine Land Crossing |

|

|

| Caucasus – Black Sea – Ukraine – Crossing |

|

|

| Caucasus – Black Sea Crossing – Danube Crossing |

|

|

| Turkey Crossing |

|

|

| European entry points via primarily maritime routes | ||

| Arctic – North Sea Corridor (Northern BRI maritime Route, also called the Polar Silk Road) |

|

|

| Suez Channel Corridor (Southern BRI Route) |

|

|

| Cape Route (via South Africa, not in map) |

|

|

The trade bottlenecks between Europe and East Asia differ in route, but show some common patterns. In this section, we summarise these alongside the geopolitical insecurities of the different regions, first for the land-based routes and second for the maritime routes.

3.1 Risks and challenges for primarily land-based routes and their geopolitical tensions

China pushed the development of land-based trade routes over Eurasia as part of the BRI narrative with the promise of more flexibility and speed, despite it being on average costlier than the maritime trade routes (Dannenberg and Sielker 2023). For example, transit times via land from Chonqing to Duisburg are now 10–12 days (down from 28 days in 2007), whereas the transit time from Shanghai to Mediterranean ports can be up to 10 days shorter than to the North Sea harbours (Eurasian Rail Alliance Index 2023, Interviews Duisport). Liu and Ke (2018) find that transit from Shanghai to Piraeus by COSCO takes 21 days, and 31 days for the fastest carriage from Shanghai to Hamburg. Rail routes are thus more attractive for just-in-time deliveries, as needed in the health industry, for example. Furthermore, the land routes gained importance during the COVID pandemic when different Chinese harbours faced substantial volume reductions, in particular during the long lockdowns of key freight harbours in Shenzhen and Shanghai (GTAI 2023).

However, land-based trade routes come with increased dependency on a few countries. Russia is the most important player, followed by other Black Sea adjacent countries. The Cross-Russia Corridor is of key importance for Eurasian trading. This is exemplified by Russia receipt of 287 billion USD in BRI investments, the highest amount of all BRI member countries outside China until 2020 (Refinitiv 2020). The Cross-Russia Corridor then splits into different routes. It enters either via Finland and the Gulf of Finland or via the Baltic Crossing (Estonia, Latvia, Lithuania). This second route requires crossing the Suwalki gap, an area of constant tension with Russia. The Suwalki gap is the narrowest passage between Belarus and the Kaliningrad Oblast, a Russian enclave. A military intervention does not seem to be imminent, yet recent commentary by Putin indicates some demand for territorial sovereignty in this region, creating geopolitical tensions particularly with the Baltic States. Another route within this corridor is named “the Belarus Crossing,” connecting to Poland and the Baltic States, as well as Ukraine. Belarus is a close ally of Russia, thus trade routes via Belarus could potentially be disrupted as a result of geopolitical tensions between the EU and Russia.

The Black Sea is a region of major contestation and confrontation, with Russia claiming territorial sovereignty over large portions of its navigable waters. The Ukraine Land Crossing is thus in an extremely sensitive geopolitical location, with ports such as Odessa or Mariupol being crucial to trade routes in the Black Sea. It is likely that their importance for international trading is one reason these ports were targeted early in the Ukraine war.

The three corridors (the Caucasus – Black Sea – Ukraine – Crossing, the Caucasus – Black Sea – Danube Crossing and the Turkey Crossing) that merge in the Black Sea must first pass through Kazakhstan, the Caspian Sea, or Iran. They then continue to Azerbaijan or Armenia and then via either Georgia or Turkey into the Black Sea, or via land through Turkey to Southeast Europe. Another route continues via Russia or Ukraine towards Central Europe. All these routes come with their own potential conflicts.

The Turkey Crossing is the most important land-based route south of the Black Sea connecting international trade routes with Southeast Europe, making Turkey an important European partner. Turkeys’ relevance for trade as well as for other geopolitical matters is also evident through its role in the migration routes, as well as by being a NATO member.

The northernmost route south of the Russian Federation, the Caucasus – Black Sea – Ukraine – Crossing, enters the Black Sea via Georgia and then connects to Poland and Central Europe via Ukraine. Poland itself connects to the North Sea via the Elbe River, which is already running at full capacity much of the year. Here, Russia’s interest and presence in Moldova and Transnistria need to be considered, as well as its presence in Abkhazia and South Ossetia in Georgia. The 2008 Russian war against Georgia in South Ossetia is indicative of the Russian interest in exerting further influence on the regions south of the Great Caucasus range (Flanagan et al. 2020). In Georgia, the conflict over Abkhazia is a longstanding dispute, with Abkhazia seeking autonomy (see for example, Francis 2011). Since Russia’s war on South-Ossetia in Georgia, the Russian Federation has recognised Abkhazia and South-Ossetia as independent states. Gerrits and Bader (2016, p. 297), for example, argue that the “economic, intergovernmental, technocratic and social linkages between Russia and the two regions are extraordinarily deep”. While the conflict between Georgia and Abkhazia is more complicated, the Russian “patronage” of Abkhazia comes with additional access to the Black Sea, near Poti and Batumi, the two main Black Sea harbours of Georgia. During Russia’s 2008 war against Georgia, Russia further displayed its geopolitical dominance in the region as it erected a military sea border stopping shipping in and out of Georgian harbours with the Black Sea Fleet (Cohen and Hamilton 2011). The cumulative effect of this is that Russia has direct control of, influence over, or the ability to obstruct access to, roughly three quarters of the black sea’s borders and gateways. Thus, reliance on this transport route is risky.

The Caucasus – Black Sea – Danube Crossing offers transport routes via Romania or Bulgaria, either via land or via the Danube River. These are of relatively small capacity and comparably slow. Additionally, shipping via the lower Danube is unpredictable as water level variations are exacerbated there (ICPDR et al. 2007). In its aggression towards Ukraine, substantial parts of the armed conflict have focused on the Eastern parts of Ukraine. Five Oblasts Kharkiv, Luhansk, Donetsk (with Mariupol), Zaporizhzaya and Kherson form a land connection for the neighbour Russia to Crimea. This region is of particular importance considering they provide access to the Black Sea. Should they remain occupied by Russia in the long run, this occupation would fundamentally change the geopolitical order within the Black Sea. Therefore, it is questionable when and to what extent the Black Sea can be regarded as a safe passage for shipping, and thus how much it will be considered a risk by international businesses (Prebilič and Jereb 2022).

3.2 Risks and challenges for maritime routes and their geopolitical tensions

The Arctic-North Sea Corridor was first opened for a commercial journey in 2009 with the support of a Russian icebreaker (Rodrigue 2020), and remains a trade route under exploration. Within the Belt and Road Initiative, this route has been named the Polar Silk or Arctic Silk Road (PRC 2017). While the route may offer an alternative in the future, it is currently characterized by reduced traffic capacity and high prices due to the advanced technology needed to navigate in the Artic. Further, this route is still in its infancy as a regular path, and geopolitical demands in the Arctic may become more prominent when numbers increase. The Arctic-North Sea Corridor splits in Norway, with the first arm of the route continuing via land and entering Europe in Kirkenes. The corridor then continues via Finland and across the Gulf of Finland into the Baltic states through the Suwalki gap to Poland, and via different land routes connects with other major European ports (Rail Baltica 2022).

The second arm of the Arctic-North Sea Corridor splits continues towards the North Sea harbour, the main access for shipping goods into Europe. Some of the harbours, such as Hamburg, experience capacity limitations and a constant need to adapt to growing ship sizes (Notteboom 2016). These northern routes are also closely linked to the Silk Road Economic Belt.

The two southern maritime routes are the Suez Canal Corridor, which is the Southern BRI route, and the Cape Route (along the Cape of Good Hope). The Cape Route is an expensive option. Given its much longer traffic distance, more vessels are needed to guarantee weekly calls in each port along the loop, as well as additional voyage and bunker costs, and increased cargo inventory costs in comparison to the Suez Channel (Bulis and Skapars 2014, p. 1224). The Suez Channel links the red Sea and Indian Ocean to Europe through the Mediterranean Sea, thereby linking the Maritime 21st Century Silk Road. The Suez Channel is one of the most important historical and contemporary trade routes, with some of the highest volumes of commercial traffic globally. It regularly reaches capacity already and experiences disruption and congestion (Suez Canal Government 2022). The most recent military conflict in Gaza, for example, quickly escalated, with wide regional consequences. The conflict became a catalyst for Houthi rebel attacks on container ships and energy tankers in the Suez Channel, creating another chokepoint in a military conflict.

To summarise, providing an overview of the trade routes between Europe and Asia allows for a more comprehensive discussion of conflict-induced uncertainties for trade relations. From this analysis, it is clear that the overwhelming majority of land-based Eurasian trade routes are deeply compromised by armed conflicts, geopolitical challenges, and capacity limitations. These geopolitical tensions are exacerbated by a wide range of active military conflicts. Maritime routes, which often are seen as the backbone of global trade are yet often linked to capacity problems, and can be disrupted as a result of geopolitical tensions as well as armed conflicts. The current armed conflict in Israel and Gaza exemplifies the risks associated to armed conflicts which may result from longstanding geopolitical tensions.

4 Geopolitical tensions and the emergence of new economic geographies of wars

The Ukraine war is an example of how military interventions, violent conflicts and geopolitical tensions more generally can lead to new economic geographies of war, where on the one hand global supply chains are disrupted through local tensions, as well as where international businesses in terms of their long-term outlook for GPN and supply chain security avoid specific trading routes as their default option. On the other hand, military conflicts and geopolitical tensions have direct implications on GPNs. In this chapter we exemplify these implications in relation to China’s Belt and Road Initiative.

4.1 The impact of the war on Ukraine on the trade routes

Among the myriad challenges that Europe faces due to the Russian attack on Ukraine, the acute disruptive threats to logistical trade routes stand out as particularly dangerous. Shocks here will cascade across socio-economic, political, and military structures as seen in other contemporary conflicts. While the situation in Ukraine was already tense due to different environmental and geopolitical conditions (Hu et al. 2023), it has dramatically escalated since Russia’s attack in 2022 (Lau 2022; Mendez et al. 2022). Following the discussion around Figure 2, our argumentation differs from Prebilič and Jereb (2022), who conclude that the war on Ukraine resulted in “a few lost trade routes [which] do not mean a lot” (Prebilič and Jereb 2022, p. 6). While we agree that cargo can be diverted through Pakistan and the Indian Ocean (which means via the Suez Channel) or the Middle East (which means via the Caucasus – Black Sea Crossing – Danube Crossing and Turkey Crossing) or through the Caucasus (which means via Georgia) we concur that these routes come at significant costs, of which longer transport times and perpetual risks of disruptions and congestions are only the beginning.

The situation in the Black Sea has long been complicated, and has been described by Flanagan et al. (2020, without page) as “a central locus of the competition between Russia and the West for the future of Europe.” Russia’s activities in the Black Sea, and aggression towards Georgia (2008) and Ukraine (2014, 2022) as well as in Moldova’s Transnistria, appear to be a grave threat for the long-term reliability and security of these routes (see also Mykhnenko 2020). The free movement of commodities in the Black Sea recurs in media coverage as both a cause and casualty of the war. Often highlighted are the role of Ukraine’s grain exports to the global South and the devastating repercussions should this trade linkage be severed. Because of this threat, Ukraine aims for diversification and to “secure viable routes that offer more protection from Russian aggression” (McGrath 2023). One such example is the Bystre Canal. This 10 km-long waterway connects Ukraine to the Danube’s Chilia branch, which forms a natural border between Romania and Ukraine. Ukraine’s ongoing dredging project here is an attempt to diversify its routes, but has also become a cause for disputes between Kiev and Bucharest. Access to the Black Sea is considered critical and covers all borders as discussed above. The conflict may exacerbate pressure on the existing sea routes as trade will be rerouted to more reliable passages. It may also increase opportunities for Turkey to use their power in unrelated negotiations, as shown with the debate around Finland’s and Sweden’s NATO accession.

Russian aggression can also have severe effects on trade infrastructure, such as seaports and inland logistic hubs within the EU. Harbors like Piraeus, Burgas, Varna, or Constanta are at least partly dependent on secure and stable trade connections with Asia through the Black Sea (and in case of Piraeus also the Suez Canal). An unstable situation could slow down new activities and investment in these vital trade links. Inland logistic hubs like Duisport in Duisburg, which gained investment and attention in the BRI, face many of the same concerns. Here, public and private decision makers fear that the Ukrainian war could lead to long term interruptions of recently increased rail trade with China (Brinza 2022). Insurance companies exacerbated the problem by temporarily canceling their insurances for shipping and transport through Ukraine within the active war zone, and even extending cancelations to routes in the Black Sea that were not directly affected by the war. Other insurers have increased their fees for cargo transported via Russia and its neighboring seas (Mendez et al. 2022).

To summarise, in almost all cases, the future of land-based Eurasian trade routes is marked by substantial military conflict, geopolitical challenges, and capacity limitations. The implications for GPN literature are extensive, as for example the vulnerability of routes becomes apparent and risks such as with insurances lead to additional costs. Importantly, the interdependencies between the different routes and pressures emerging on other route when on a route is weakened by violent conflicts are important considerations for GPNs. The BRI investments in the Eurasia are one example for investments to ensure diversification of routes.

4.2 Implications of the Ukraine war for China’s BRI

The BRI has been the main driver of increased connectivity, new GPNs and GPVs across Eurasian land, and to a lesser extent new maritime-based connections (Cieślik 2019; Dannenberg et al. 2024; Liefner and Li 2023; Mendez et al. 2022). China initiated the BRI with the goal of improving connectivity from Asia to Europe and fostering economic development along this route, including in China’s Hinterland (Miller 2019; Sielker and Kaufmann 2020). By now BRI routes cover 64 countries for which Li (2023b) identifies 11,147 Chinese FDI projects. As part of its activities under the BRI, China has made substantial investments in Ukraine and the surrounding region to facilitate trade routes via land (Song 2017; Szunomár 2014). The development of a railway connection appears to have indeed intensified trade (Li et al. 2016). While this paper is too limited in scope to present an in-depth economic analysis, considering the implications of the war on GPNs, GPVs, the BRI can offer us an insight into the shifting geography of war.

Most countries along the routes between Europe and China have witnessed a sharp increase in geopolitical risks since the BRI’s initiation in 2013, including the risk of military coups, terrorism, religious conflicts, and violent armed threats (Hu et al. 2023). While recent data on the outcomes of the BRI investment for the specific countries are hard to find, Nedopil (2022) calculates a 21 % decrease in new BRI projects in the first quarter of 2022 and sees the Ukraine war as a burden for further BRI investment along the entire route.

The war in Ukraine may lead China to weigh the value of its economic linkages to Europe and the USA against its competing regional geo-political goals. China is particularly keen to avoid vulnerability to sanctions. This will have substantial implications on GPNs (see as well Kalvelage and Tups 2024 on the trends of friend shoring). The USA has warned China that any form of help to Russia, military or otherwise, will be understood as complicity and will be sanctioned as such (Kraemer and Williams 2024). In response to this, the Peoples Republic China has already paused many developments within the BRI framework in Russia (Prebilič and Jereb 2022). Russian aggression toward Ukraine, combined with geopolitical tensions that are directly related to Chinese investments, may lead to a transport infrastructure-independence from Russia. The map above shows that in the future all land routes could potentially be dominated by a couple of countries, with most of the land-based trade routes that emerge from the development of the six BRI corridors being linked to Russia. From a European perspective, this calls transport infrastructure-security into question. To balance the current situation in the short term, Prebilič and Jereb (2022, p. 1) assume that “the [Peoples Republic of China] will have to reroute much of its BRI cargo and projects into other corridors. In the long term, the [Peoples Republic of China] will attempt to divert Russian resources from the West to itself within the BRI framework, thus rendering Western sanctions ineffective and assuring the long-term success of the BRI.” The implications for supply chain security are difficult to measure or estimate in detail. Yet, initial changes in different economic sectors and strategic couplings in line with geopolitical sensitivities can already be observed. For example, Wishnick (2022) points out that Ukraine’s increasing dependence on Western Allies has substantial implications for economic cooperation between Ukraine and China in other sectors, suggesting that Ukraine is ‘China’s Burning bridge to Europe’.

5 Outlook – towards a new economic geography of war

Drawing on Hu et al. (2023), we summarised the military and geopolitical risks for nine transport corridors across Eurasia, as well as the implications of the Ukraine war for these corridors. By providing an overview of the risks alongside the nine key transport corridors from Asia to the EU, our paper re-emphasizes the importance of considering the limitations and vulnerability of physical trade routes and infrastructure. We contend that Europe’s dependency on relatively few global trade routes poses a long-term threat to the European economy and could lead to serious consequences such as supply and trade delays, interruptions, price increases, and higher inflation. We observe that the public – and parts of the scientific – debate on the implications of the Russian aggression for the wider economy falls short in acknowledging this long-term threat to the land-based trade routes between Asia and Europe. Many of the risks related to trade routes between Asia and Europe center around Russia’s unclear, contested role in Eastern Europe. Russia’s president Putin strives for some restatement of dominance and leadership after the fall of the USSR. While there are other adversaries, such as Iran, our analysis shows that the Russian conflicts in the region have now reached a scale that threatens Western European economies. The war on Ukraine among many other challenges exemplified by the Houthi attacks on global commerce, further dramatically increased these risks.

The war in Ukraine itself, as well as the broader geopolitical reactions to it, create tremendous uncertainty in global value chains and for the locating of international businesses. The shifts in BRI priorities and routes are some of the most significant of these geopolitical reactions. Newer work on global supply chains (in particular GVC and GPN literature, e.g. Völlers et al. 2023), has started to acknowledge risks and resilience to geopolitical confrontation and military conflicts. Yet, these need to be analysed in greater detail, and considered in theorisation. In particular, GPNs offer a good lens through which the newly emerging geographies of war can be analysed. At the same time, reviewing existing GPNs against the geopolitical risks associated with specific routes can help scholars understand international business decisions within a broader framework. Here, the risks both from power shifts through violent conflicts with potential loss of sovereignty, as well as capacity limitations, create short-term potential for shifting trade between routes in case of a military intervention. Considerations of geopolitical sensitivity in international businesses’ decisions reflect these risks.

Overall, our discussion of the geopolitical sensitivities of trade routes and corridors at Europe’s Eastern borders indicate that, in view of the current situation, there is a clear and very concrete need to augment current explanatory approaches to supply chains, both in economic geography and in international business literature, with considerations of these geopolitical risks and the risks of wars and violent conflicts. This is especially true for the current debate on risks and resilience in GVCs and GPNs. With our paper we propose the first concrete levels of analysis of related risks, and short-term and long-term frictions and disruptions occurring as a result of violent conflicts (see Figure 1). These range from power intervention related risks, such as embargos, economic risks, such as investment dependencies, to additional disruptions in terms of trade volumes, increased insurance costs, disinvestment or loss of control over infrastructures. These factors can serve as an entry point into a general academic debate on economic geographies of war.

Acknowledgments

The authors would like to thank two anonymous reviewers and the editor Harald Bathelt for very constructive feedback, which helped to improve the paper significantly. In particular we would like to thank Harald Bathelt for suggesting the formulation ‘economic geographies of war’, which came to be our title. Further we would like to thank Luke Juday for its copy-editing and Regine Spohner for the cartography.

-

Research ethics: Not applicable.

-

Informed consent: Not applicable.

-

Author contributions: All authors have accepted responsibility for the entire content of this manuscript and approved its submission.

-

Use of Large Language Models, AI and Machine Learning Tools: None declared.

-

Conflict of interest: The authors state no conflict of interest.

-

Research funding: None declared.

-

Data availability: Not applicable.

References

Allison, R. (2014). Russian ‘deniable’ intervention in Ukraine: how and why Russia broke the rules. Int. Aff. 90: 1255–1297, https://doi.org/10.1111/1468-2346.12170.Suche in Google Scholar

Aoyama, Y., Song, E., and Wang, S.Y. (2024). Geopolitics and geospatial strategies: the rise of regulatory supply chain controls for semiconductor GPN in Japan, South Korea and Taiwan. ZFW – Adv. Econ. Geogr. 68: 167–181. https://doi.org/10.1515/zfw-2024-0046.Suche in Google Scholar

Aris, B. (2023). Global maritime chokepoints are clogging up, Available at: https://www.intellinews.com/global-maritime-chokepoints-are-clogging-up-305899/ (Accessed 27 January 2023).Suche in Google Scholar

Bachmann, R., Baqaee, D., Bayer, C., Kuhn, M., Löschel, A., Moll, B., Peichl, A., Pittel, K., and Schularick, M. (2022). What if? The economic effects for Germany of a stop of energy imports from Russia. Wirtschaftsdienst 102: 251–255.Suche in Google Scholar

Bathelt, H. and Li, P. (2022). The interplay between location and strategy in a turbulent age. Glob. Strateg. J. 12: 451–471, https://doi.org/10.1002/gsj.1432.Suche in Google Scholar

Bathelt, H., Cantwell, J.A., and Mudambi, R. (2018). Overcoming frictions in transnational knowledge flows: challenges of connecting, sense-making and integrating. J. Econ. Geogr. 18: 1001–1022, https://doi.org/10.1093/jeg/lby047.Suche in Google Scholar

Bearce, D.H. and Fisher, E.O.N. (2002). Economic geography, trade, and war. J. Confl. Resolut. 46: 365–393, https://doi.org/10.1177/0022002702046003003.Suche in Google Scholar

Berry, H., Guillén, M.F., and Hendi, A.S. (2014). Is there convergence across countries? A spatial approach. J. Int. Bus. Stud. 45: 387–404, https://doi.org/10.1057/jibs.2013.72.Suche in Google Scholar PubMed PubMed Central

Blažek, J. and Lypianin, A. (2024). Military conflicts and the performance of state-owned enterprises: a study of Ukraine’s aerospace, defense, and electro-engineering industries before and after the 2014 crimea and Donbas occupation. ZFW – Adv. Econ. Geogr. 68: 182–194. https://doi.org/10.1515/zfw-2024-0049.Suche in Google Scholar

Bo, H. (2022). Implications of the Ukraine war for China: can China survive secondary sanctions? J. Chin. Econ. Bus. Stud. 21: 1–12, https://doi.org/10.1080/14765284.2022.2136933.Suche in Google Scholar

Brinza, A. (2022). Putin’s war has killed China’s Eurasian rail-way dreams. Foreign Policy, Available at: https://foreignpolicy.com/2022/03/01/belt-road-initiative-new-eurasian-land-bridge-china-russia-poland/ (Accessed 27 January 2023).Suche in Google Scholar

Bulis, A. and Skapars, R. (2014). Development of “new silk road” northern branch through seaport of riga in Latvia. Procedia Soc. Behav. Sci. 150: 1222–1229, https://doi.org/10.1016/j.sbspro.2014.09.138.Suche in Google Scholar

Cano-Kollmann, M., Cantwell, J., Hannigan, T.J., Mudambi, R., and Song, J. (2016). Knowledge connectivity: an agenda for innovation research in international business. J. Int. Bus. Stud. 47: 255–262, https://doi.org/10.1057/jibs.2016.8.Suche in Google Scholar

Cieślik, E. (2019). Towards more (un)balanced trade. Production linkages between China and the Visegrad countries: country-level and sector-level analysis. Eur. Plan. Stud. 27: 1523–1541, https://doi.org/10.1080/09654313.2019.1589424.Suche in Google Scholar

Cohen, A. and Hamilton, R. (2011). The Russian military and the Georgia war: lessons and implications. ERAP Monograph, Strategic Studies Institute, Available at: https://www.files.ethz.ch/isn/130048/pub1069.pdf (Accessed 15 December 2023).10.21236/ADA545578Suche in Google Scholar

Cowen, D. (2014). The deadly life of logistics: mapping violence in global trade. University of Minnesota Press, Minneapolis.10.5749/minnesota/9780816680870.001.0001Suche in Google Scholar

Crescenzi, R. and Harman, O. (2023). From local regions in the EU to those in Ukraine (and back again): how FDI and global value chains tie our local economies together. In: Supporting Ukraine: more critical than ever, p. 19.Suche in Google Scholar

Dannenberg, P. and Sielker, F. (2023). Die Belt and Road Initiative – Die neue Seidenstraße von China nach Duisburg. In: China: Geographien einer Weltmacht. Springer Berlin Heidelberg, Berlin, Heidelberg, pp. 445–453.10.1007/978-3-662-66560-2_46Suche in Google Scholar

Dannenberg, P., Sielker, F., and Sobiech, A. (2024). China’s Weltmachtambitionen – Außenwirtschaft und Geopolitik. Geogr. Rundsch. 5-2024: 4–13.Suche in Google Scholar

De Marchi, V. and Gereffi, G. (2023). Using the global value chain framework to analyse and tackle global environmental crises. J. Ind. Bus. Econ. 50: 149–159, https://doi.org/10.1007/s40812-022-00253-x.Suche in Google Scholar

Eurasian Rail Alliance Index (2023), Five silk road connections added to fixed timetable, Available at: https://index1520.com/en/news/pyat-stykovok-po-shelkovomu-puti-dobavleny-k-fiksirovannomu-raspisaniyu/.Suche in Google Scholar

European Commission (2024). Regulation (EU) 2024/1679 of the European parliament and of the council of 13 June 2024 on union guidelines for the development of the trans-European transport network, amending regulations (EU) 2021/1153 and (EU) No 913/2010 and repealing regulation (EU) No 1315/2013 (text with EEA relevance). OJ L, 2024/1679, 28.6.2024, Available at: http://data.europa.eu/eli/reg/2024/1679/oj (Accessed 15 September 2024).Suche in Google Scholar

Faye, M.L., McArthur, J.W., Sachs, J.D., and Snow, T. (2004). The challenges facing landlocked developing countries. J. Hum. Dev. 5: 31–68, https://doi.org/10.1080/14649880310001660201.Suche in Google Scholar

Flanagan, S.J., Binnendijk, A., Chindea, I.A., Costello, K., Kirkwood, G., Massicot, D., and Reach, C. (2020). Russia, NATO, and Black Sea security. RAND Corporation, Santa Monica, CA, Available at: https://www.rand.org/pubs/research_reports/RRA357-1.html (Accessed 21 January 2023).10.7249/RRA357-1Suche in Google Scholar

Follmann, A., Dannenberg, P., Baur, N., Braun, B., Walther, G., Bernzen, A., Börner, J., Brüntrup, M., Franz, M., Götz, L., et al.. (2024). Conceptualizing sustainability and resilience in value chains in times of multiple crises – notes on agri-food chains. DIE ERDE 155, https://doi.org/10.12854/erde-2024-692.Suche in Google Scholar

Francis, C. (2011). Conflict resolution and status. The case of Georgia and Abkhazia (1989–2008). VUB Press, Brussels.Suche in Google Scholar

Gereffi, G. (1994). The organization of buyer-driven global commodity chains: how US retailers shape overseas production networks. In: Gereffi, G. and Korzeniewicz, M. (Eds.), Commodity clains and global capitalism, Praeger, Westport, pp. 95–122.Suche in Google Scholar

Gereffi, G., Humphrey, J., and Sturgeon, T. (2005). The governance of global value chains. Rev. Int. Polit. Econ. 12: 78–104, https://doi.org/10.1080/09692290500049805.Suche in Google Scholar

Gerrits, A.W.M. and Bader, M. (2016). Russian patronage over Abkhazia and South Ossetia: implications for conflict resolution. East Eur. Polit. 32: 297–313, https://doi.org/10.1080/21599165.2016.1166104.Suche in Google Scholar

Glassman, J. (2011). The geo-political economy of global production networks. Geogr. Comp. 5: 154–164.10.1111/j.1749-8198.2011.00416.xSuche in Google Scholar

GTAI (2023). Mehr Containerzüge rollen zwischen China und Europa, Available at: https://www.gtai.de/de/trade/china/branchen/mehr-containerzuege-rollen-zwischen-china-und-europa-543460 (Accessed 27 January 2023).Suche in Google Scholar

Henderson, J., Dicken, P., Hess, M., Coe, N., and Yeung, H.W.C. (2002). Global production networks and the analysis of economic development. Rev. Int. Polit. Econ. 9: 436–464, https://doi.org/10.1080/09692290210150842.Suche in Google Scholar

Hess, M. and Horner, R. (2024). Driving change in troubling times: security, risk and the state in global production networks. ZFW – Adv. Econ. Geogr. 68: 145–150. https://doi.org/10.1515/zfw-2024-0085.Suche in Google Scholar

Hu, W., Shan, Y., Deng, Y., Fu, N., Duan, J., Jiang, H., and Zhang, J. (2023). Geopolitical risk evolution and obstacle factors of countries along the belt and road and its types classification. Int. J. Environ. Res. Publ. Health 20: 1618, https://doi.org/10.3390/ijerph20021618.Suche in Google Scholar PubMed PubMed Central

International Commission for the Protection of the Danube River, Danube Comission, and International Sava River Comission (2007). Joint statement on guiding principles for the development of inland navigation and environmental protection in the Danube river basin, Available at: http://www.danubecommission.org/uploads/doc/72/Joint%20Statement/EN/Joint_Statement_FINAL.pdf.Suche in Google Scholar

Kalvelage, L. and Tups, G. (2024). Friendshoring in global production networks: state-orchestrated coupling amid geopolitical uncertainty. ZFW – Adv. Econ. Geogr. 64: 151–166. https://doi.org/10.1515/zfw-2024-0042.Suche in Google Scholar

Katsaliaki, K., Galetsi, P., and Kumar, S. (2021). Supply chain disruptions and resilience: a major review and future research agenda. Ann. Oper. Res. 319: 965–1002, https://doi.org/10.1007/s10479-020-03912-1.Suche in Google Scholar PubMed PubMed Central

Kraemer, C. and Williams, M. (2024). US treasury no. 2 warns China over support for Russia, Available at: https://www.reuters.com/world/us-treasury-no-2-warns-china-over-support-russia-2024-05-31/.Suche in Google Scholar

Lau, S. (2022). Down to 14 + 1: Estonia and Latvia quit China’s club in Eastern Europe. In: Politico.eu, Available at: https://www.politico.eu/article/down-to-14-1-estonia-and-latvia-quit-chinas-club-in-eastern-europe/ (Accessed 27 January 2023).Suche in Google Scholar

Le Billon, P. (2001). The political ecology of war: natural resources and armed conflicts. Political Geogr. 20: 561–584, https://doi.org/10.1016/s0962-6298(01)00015-4.Suche in Google Scholar

Li, Y. (2023a). Security challenges and implications of the Russia-Ukraine war in 2022 for China’s belt and road initiative. J. Educ. Humanit. Soc. Sci. 8: 995–1002, https://doi.org/10.54097/ehss.v8i.4392.Suche in Google Scholar

Li, Y. (2023b). Impacts of the belt and road initiative on regional outward FDI from China based on evidence from 2000 to 2015. ZFW – Adv. Econ. Geogr. 67: 20–32, https://doi.org/10.1515/zfw-2022-0007.Suche in Google Scholar

Li, Y., Bolton, K., and Westphal, T. (2016). The effect of the new silk road railways on aggregate trade volumes between China and Europe, Working Papers on East Asian Studies. University of Duisburg-Essen, Institute of East Asian Studies (IN-EAST), Duisburg, No. 109.Suche in Google Scholar

Liefner, I. and Li, Y. (2023). China-international linkages: introduction to the special issue. ZFW – Adv. Econ. Geogr. 67: 1–4, https://doi.org/10.1515/zfw-2023-0037.Suche in Google Scholar

Liu, Q. and Ke, L. (2018). One-belt-one-road policy implication on logistics route competition: case study of China-Germany trade. Maritime Economics Research Center. Hamburg Business School, University of Hamburg, Available at: https://www.bwl.unihamburg.de/merc/research/current-projects/project-report---obor-and-case-study.pdf (Accessed 27 January 2023).Suche in Google Scholar

Lorenzen, M. and Mudambi, R. (2013). Clusters, connectivity and catch-up: bollywood and Bangalore in the global economy. J. Econ. Geogr. 13: 501–534, https://doi.org/10.1093/jeg/lbs017.Suche in Google Scholar

Lorenzen, M., Mudambi, R., and Schotter, A. (2020). International connectedness and local disconnectedness: MNE strategy, city-regions and disruption. J. Int. Bus. Stud. 51: 1199–1222, https://doi.org/10.1057/s41267-020-00339-5.Suche in Google Scholar PubMed PubMed Central

Maihold, G. and Mühlhöfer, F. (2021). Supply chain instability threatens security of supplies: options for industry and policymakers. WP Comment, No. 60/2021, Stiftung Wissenschaft und Politik (SWP), Berlin, https://doi.org/10.18449/2021C60.Suche in Google Scholar

McGrath, S. (2023). Romania’s Danube dispute with Ukraine sparks Russian propaganda claims. Financial Times, Available at: https://www.ft.com/content/c981b929-3955-443c-8ca2-4ac473c3933d (Accessed 25 January 2023).Suche in Google Scholar

Mendez, A., Forcadell, F.J., and Horiachko, K. (2022). Russia–Ukraine crisis: China’s belt road initiative at the crossroads. Asian Bus. Manag. 21: 488–496, https://doi.org/10.1057/s41291-022-00195-1.Suche in Google Scholar

MERICS (2024). Die Vermessung der Belt and Road Initiative. Eine Bestandsaufnahme, Available at: https://merics.org/de/tracker/die-vermessung-der-belt-and-road-initiative-eine-bestandsaufnahme.Suche in Google Scholar

Miller, T. (2019). China’s Asian dream: empire building along the new silk road. Zed Books, London.Suche in Google Scholar

Mykhnenko, V. (2020). Causes and consequences of the war in Eastern Ukraine: an economic geography perspective. Eur. Asia Stud. 72: 528–560, https://doi.org/10.1080/09668136.2019.1684447.Suche in Google Scholar

Nedopil, C. (2022). China belt and road initiative (BRI) investment report H1 2021. Green Finance & Development Center, FISF Fudan University, Shanghai.Suche in Google Scholar

Notteboom, T. (2016). The adaptive capacity of container ports in an era of mega vessels: the case of upstream seaports Antwerp and Hamburg. J. Transport Geogr. 54: 295–309, https://doi.org/10.1016/j.jtrangeo.2016.06.002.Suche in Google Scholar

Pavlínek, P. (2024). Geopolitical decoupling in global production networks. Econ. Geogr. 100: 138–169, https://doi.org/10.1080/00130095.2023.2281175.Suche in Google Scholar

People’s Republic of China (2017). Vision for maritime cooperation under the belt and road initiative. Xinhua, 20 June, Available at: http://www.xinhuanet.com//english/2017-06/20/c_136380414.htm.Suche in Google Scholar

Prebilič, V. and Jereb, V. (2022). Implications of the war in Ukraine on the belt and road initiative. J. Geogr. Politics Soc. 12: 1–7, https://doi.org/10.26881/jpgs.2022.2.01.Suche in Google Scholar

Rail Baltica (2022). Rail Baltica. Official Project Brochure, Available at: https://www.railbaltica.org/wp-content/uploads/2022/11/RB-TEN_T-broschure_210x210mm_EN_Preview.pdf (Accessed 23 January 2023).Suche in Google Scholar

Rech, M., Bos, D., Jenkings, K.N., Williams, A., and Woodward, R. (2015). Geography, military geography, and critical military studies. Crit. Mil. Stud. 1: 47–60, https://doi.org/10.1080/23337486.2014.963416.Suche in Google Scholar

Refinitiv (2020). BRI connect: an initiative in numbers. 3rd edition. Understanding risks and rewards of infrastructure projects, Available at: http://refinitiv.com (Accessed 30 January 2023).Suche in Google Scholar

Rodrigue, J.P. (2020). The geography of transport systems. Routledge, New York.10.4324/9780429346323Suche in Google Scholar

Sielker, F. and Kaufmann, E. (2020). The influence of the belt and road initiative in Europe, regional studies. Reg. Sci. 7: 288–291, https://doi.org/10.1080/21681376.2020.1790411.Suche in Google Scholar

Song, W. (Ed.) (2017). China’s relations with central and Eastern Europe from “old comrades” to new partners. Routledge, London.10.4324/9781315226644Suche in Google Scholar

Stewart, F. and Fitzgerald, E.V.K. (2001). War and underdevelopment, Vol. 2. Oxford University Press, USA.10.1093/acprof:oso/9780199241880.001.0001Suche in Google Scholar

Suez Canal Government (2022). Monthly umber & net ton by ship type, Available at: https://www.suezcanal.gov.eg/English/Navigation/Pages/NavigationStatistics.aspx (Accessed 30 January 2023).Suche in Google Scholar

Szunomár, A. (2014). Chinese investments and financial engagement in visegrad countries – myth or reality? Institute for World Economics, Centre for Economic and Regional Studies, Hungarian Academy of Sciences, Budapest, Hungary.Suche in Google Scholar

Tups, G., Mbunda, R., Ndunguru, M., and Dannenberg, P. (2024). Multiple Krisen und Globale Produktionsnetzwerke: Neue Sojapartnerschaften zwischen China und Tansania im Rahmen der Belt and Road Initiative. Standort 48: 2–9, https://doi.org/10.1007/s00548-024-00907-z.Suche in Google Scholar

UTLC (2023). Cargo traffic to Russia and Belarus from China, Available at: https://www.utlc.com/en/ (Accessed 27 January 2023).Suche in Google Scholar

Völlers, P., Neise, T., Verfürth, P., Franz, M., Bücken, F., and Schumacher, K.P. (2023). Revisiting risk in the global production network approach 2.0 – towards a performative risk narrative perspective. Environ. Plan. A: Econ. Space 55: 1838–1858, https://doi.org/10.1177/0308518x231169288.Suche in Google Scholar

Wang, H. (2022). National identities and cross-strait relations: challenges to Taiwan’s economic development. ZFW – Adv. Econ. Geogr. 66: 228–240. https://doi.org/10.1515/zfw-2022-0036.Suche in Google Scholar

Wishnick, E. (2022). Ukraine: China’s burning bridge to Europe? The Diplomat, Available at: https://thediplomat.com/2022/02/ukraine-chinas-burning-bridge-to-europe/.Suche in Google Scholar

Woodward, R. (2005). From military geography to militarism’s geographies: disciplinary engagements with the geographies of militarism and military activities. Prog. Hum. Geogr. 29: 718–740, https://doi.org/10.1191/0309132505ph579oa.Suche in Google Scholar

Yang, C. and Chan, D.Y.T. (2023). Geopolitical risks of strategic decoupling and recoupling in the mobile phone production shift from China to Vietnam: evidence from the sino-US trade war and COVID-19 pandemic. Appl. Geogr. 158: 103028, https://doi.org/10.1016/j.apgeog.2023.103028.Suche in Google Scholar

Yeung, H.W.C. (2015). Regional development in the global economy: a dynamic perspective of strategic coupling in global production networks. Reg. Sci. Pol. Pract. 7: 1–23, https://doi.org/10.1111/rsp3.12055.Suche in Google Scholar

Yeung, H.W.C. (2023). Troubling economic geography: new directions in the post-pandemic world. Trans. Inst. Br. Geogr. 48: 672–680, https://doi.org/10.1111/tran.12633.Suche in Google Scholar

Yeung, H.W.C. and Coe, N. (2015). Toward a dynamic theory of global production networks. Econ. Geogr. 91: 29–58, https://doi.org/10.1111/ecge.12063.Suche in Google Scholar

© 2024 the author(s), published by De Gruyter, Berlin/Boston

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Frontmatter

- Research Articles

- The complementarity and connectivity of locations: digitalization, sustainability, and disruptions

- Uneven development instead of complementarity: how the repatriation of FDI-profits fuels capital accumulation in Germany

- How aerospace clusters respond to the challenge of sustainability: a comparison of the Toulouse and Montreal clusters

- New economic geographies of war: risks and disruptions in Eurasian transport routes and supply chains through the military conflict in Ukraine

- Communities in the internationalization process

Artikel in diesem Heft

- Frontmatter

- Research Articles

- The complementarity and connectivity of locations: digitalization, sustainability, and disruptions

- Uneven development instead of complementarity: how the repatriation of FDI-profits fuels capital accumulation in Germany

- How aerospace clusters respond to the challenge of sustainability: a comparison of the Toulouse and Montreal clusters

- New economic geographies of war: risks and disruptions in Eurasian transport routes and supply chains through the military conflict in Ukraine

- Communities in the internationalization process