Abstract

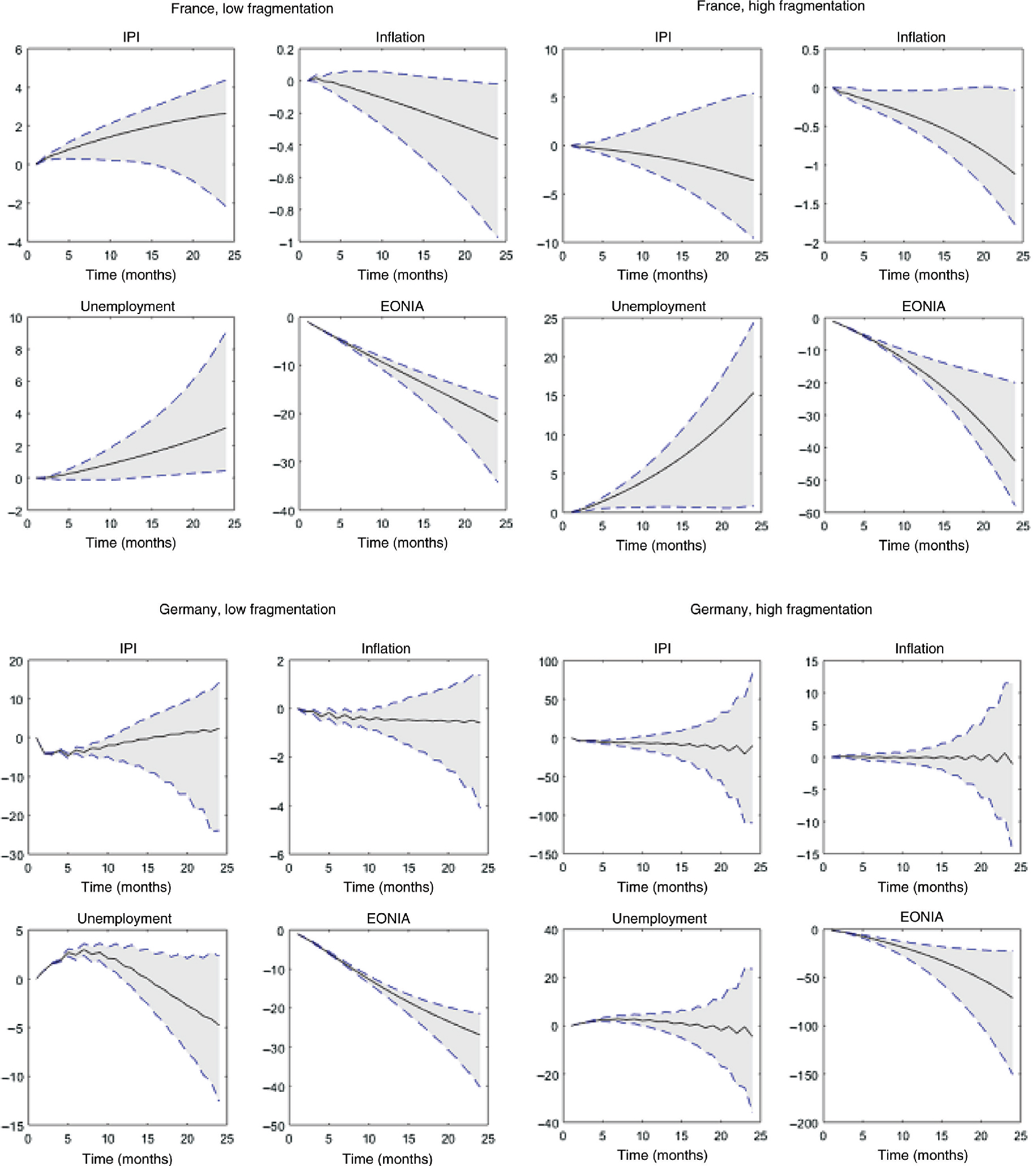

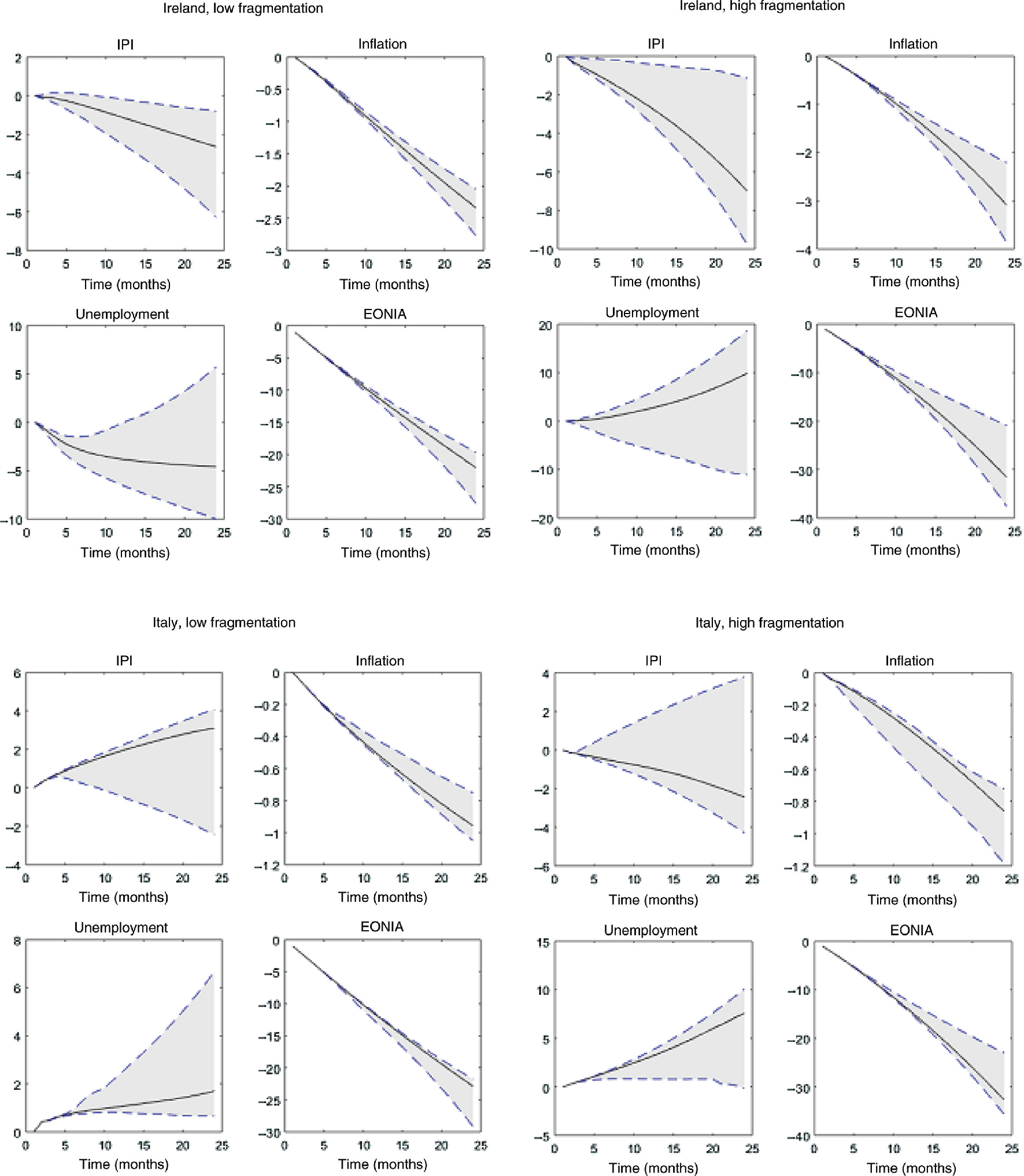

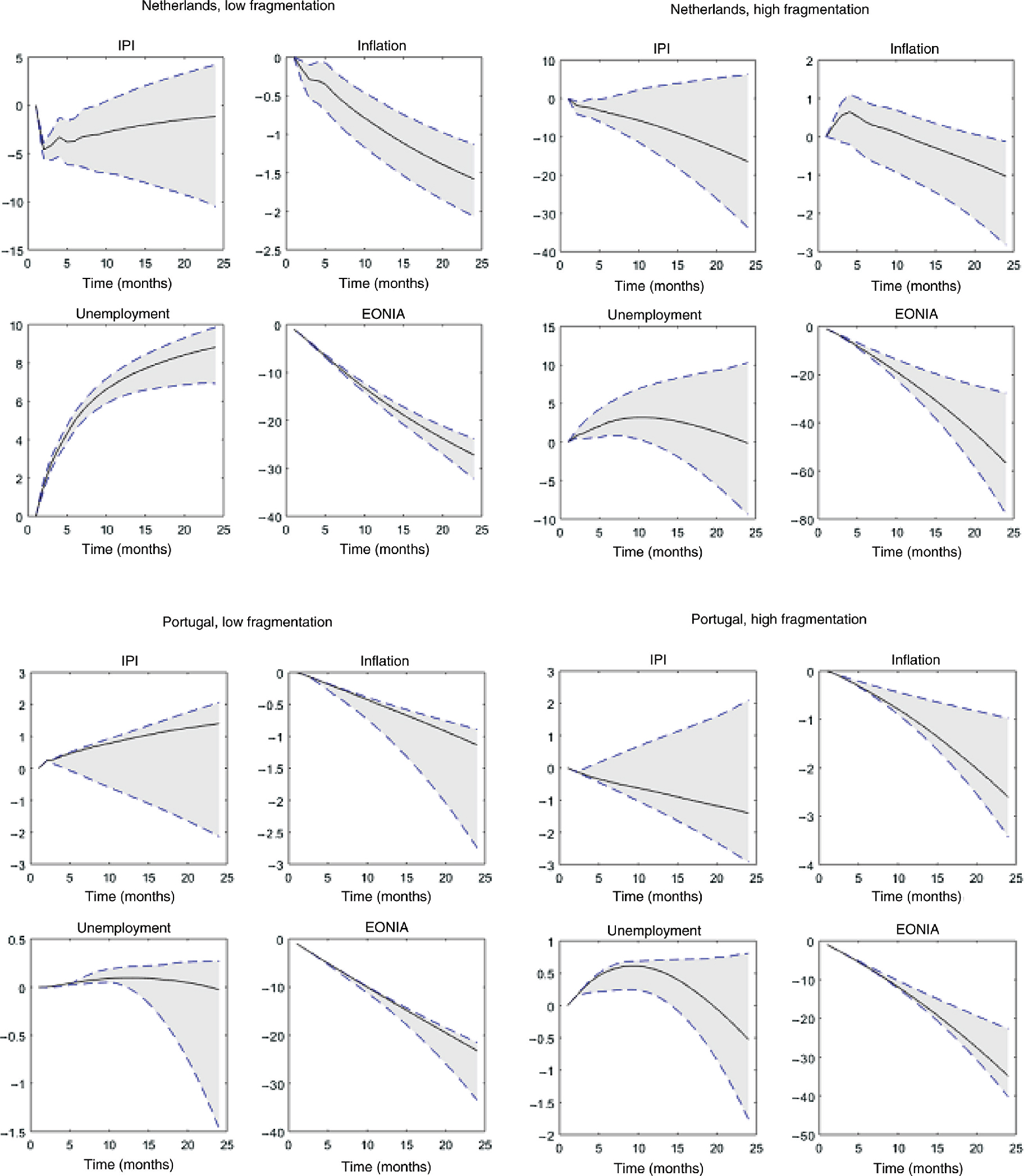

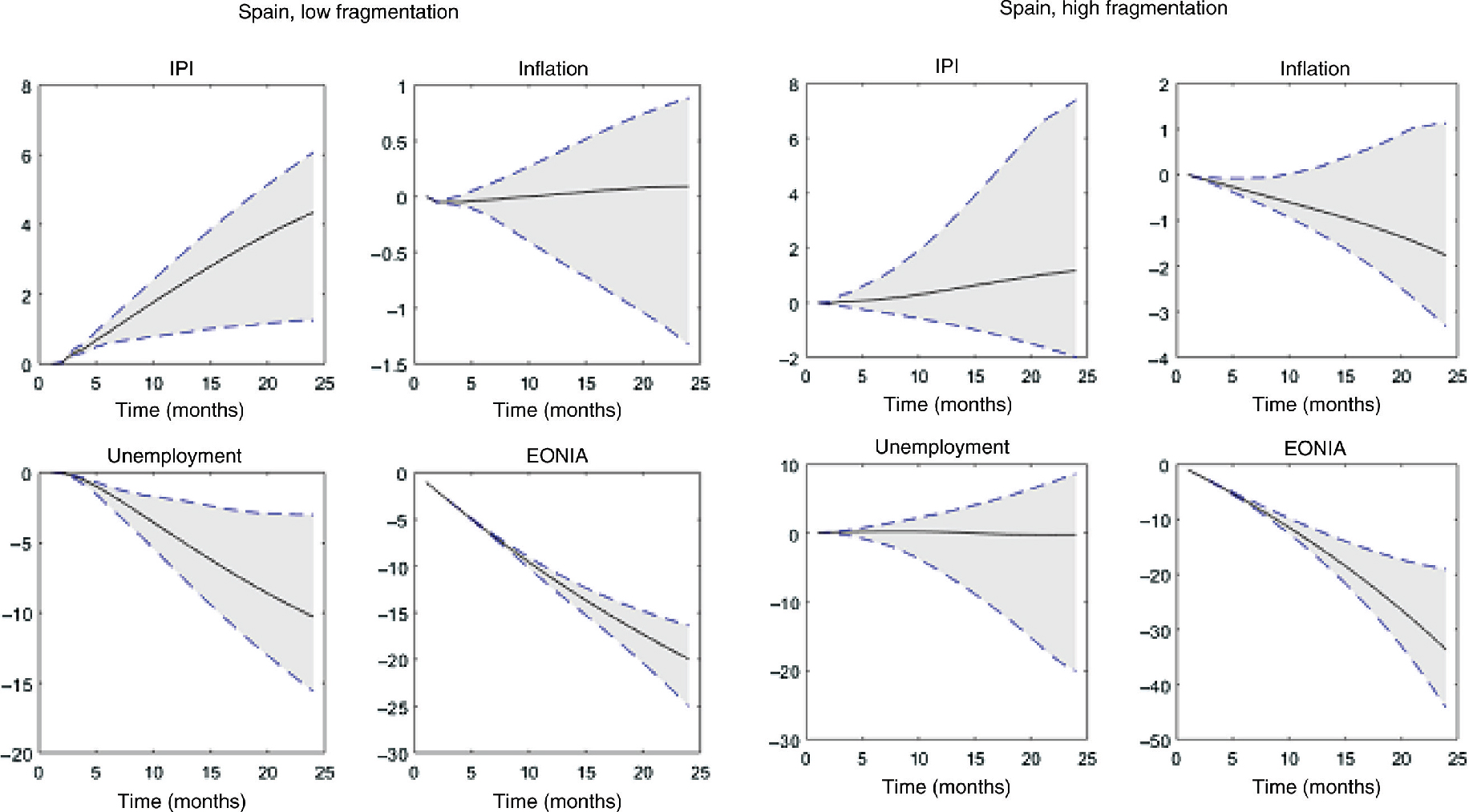

This paper investigates the effect of financial fragmentation on the monetary transmission mechanism in different Euro area economies, categorized into two groups: countries considered as “core” economies and countries characterized as “peripheral” economies. We analyze the effects of financial fragmentation on the monetary transmission mechanism through the traditional interest rate channel. To gauge the impact of changes in policy rates on the behavior of real variables such as aggregate output and employment we use a Smooth Transition VAR (VSTAR) model. Employing a nonlinear multivariate time series approach helps us capture the regime-dependent dynamics of the variables under study. The results obtained show that money market rates targeted by the central bank do not completely pass through to banks’ lending rates to firms, particularly in a financially fragmented environment. This finding supports the hypothesis of an impairment of the monetary transmission mechanism as a result of financial fragmentation. Given this impairment in some sectors and regions an accompanying credit volume policy might have been appropriate.

Appendix 1

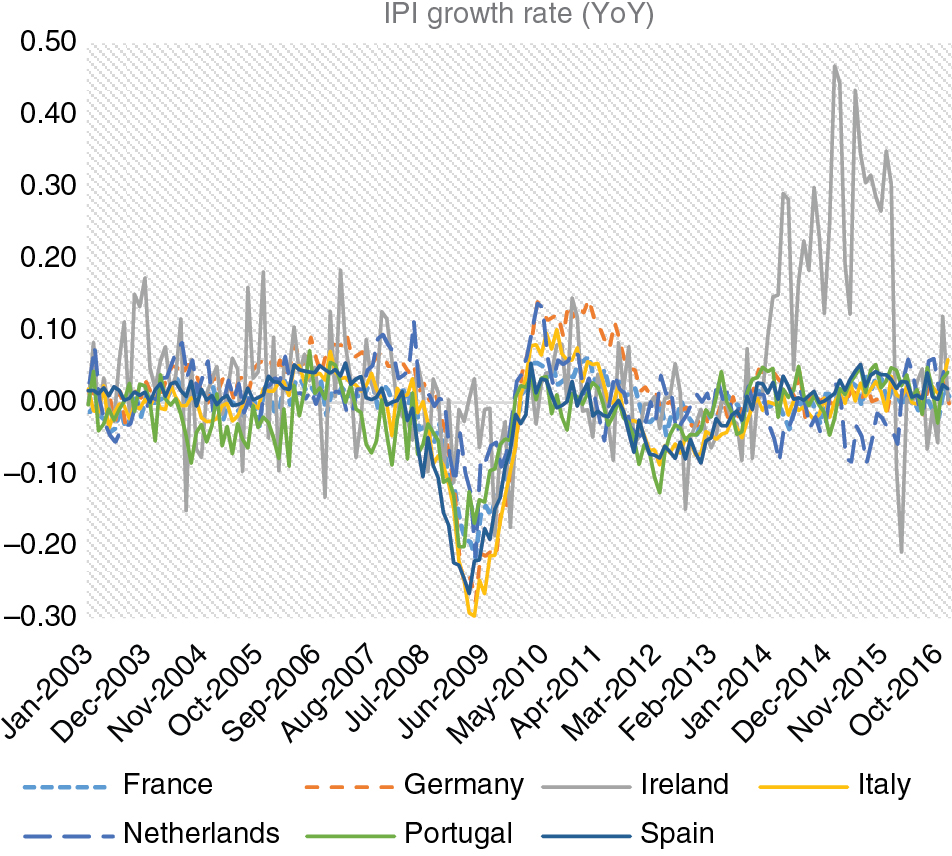

IPI growth rate, year-on-year.

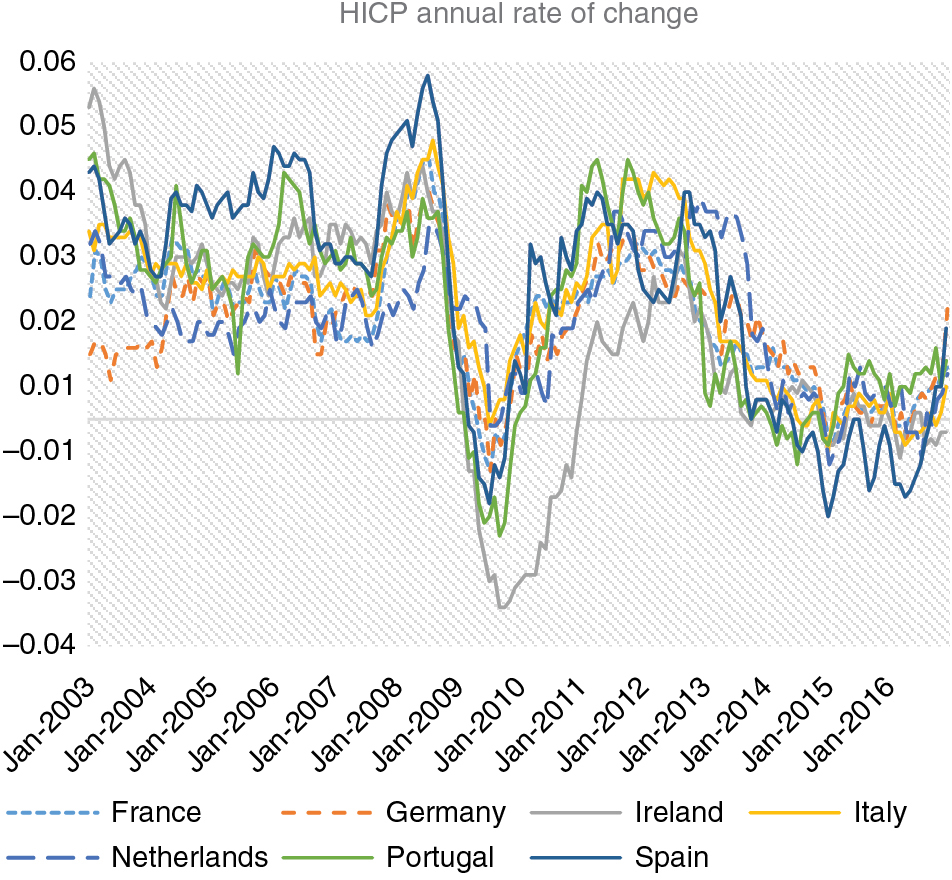

Harmonized Index of Consumer Price, monthly rate of change.

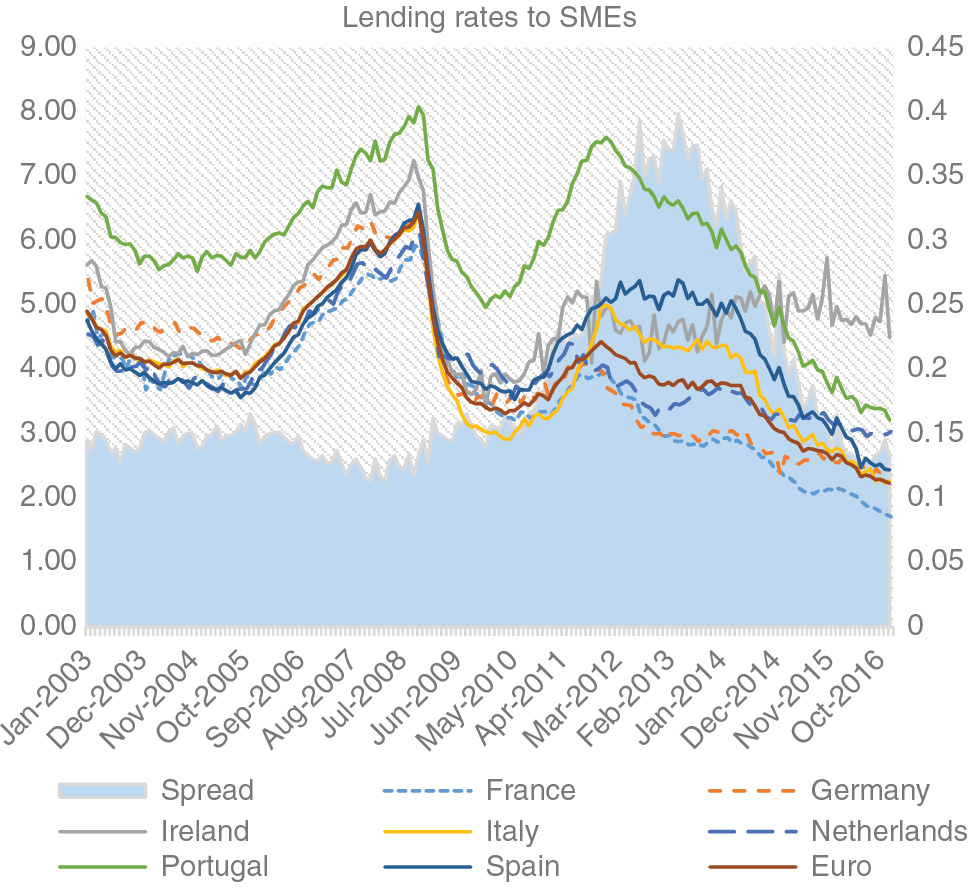

Lending rates to Small and Medium Enterprises, Amounts of up to 1 million Euro.

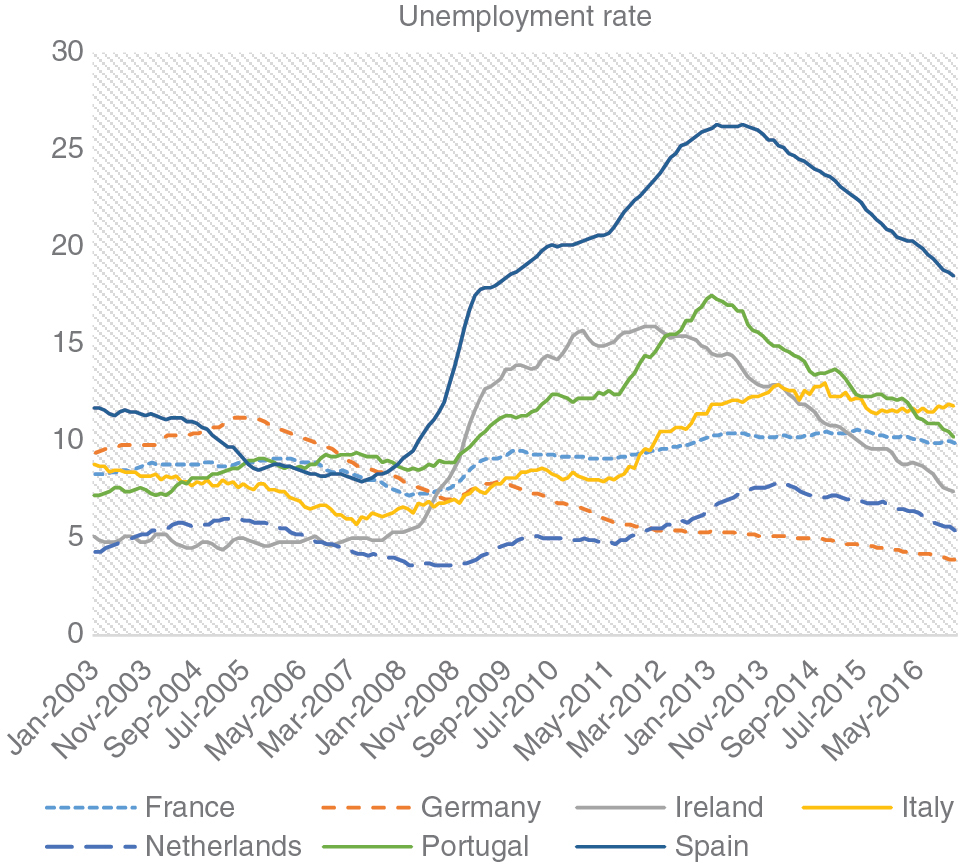

Unemployment rate, total.

Appendix 2

Traditional unit root tests.

| Test variables | France | Germany | Ireland | Italy | Netherland | Portugal | Spain |

|---|---|---|---|---|---|---|---|

| IPI | |||||||

| ADF | [−4.7856] <(0.01) | [−5.0517] <(0.01) | [−6.5869] <(0.01) | [−3.8156] (0.0194) | [−7.0426] <(0.01) | [−6.3127] <(0.01) | [−3.5601] (0.0383) |

| PP | [−288.82] <(0.01) | [−273.8] <(0.01) | [−236.77] <(0.01) | [−275.65] <(0.01) | [−206.04] <(0.01) | [−250.96] <(0.01) | [−287.52] <(0.01) |

| Inflation | |||||||

| ADF | [−5.6445] <(0.01) | [−6.8151] <(0.01) | [−4.6643] <(0.01) | [−4.2252] <(0.01) | [−6.6623] <(0.01) | [−5.2778] <(0.01) | [−4.4513] <(0.01) |

| PP | [−203.58] <(0.01) | [−265.89] <(0.01) | [−202.19] <(0.01) | [−111.18] <(0.01) | [−97.042] <(0.01) | [−130.93] <(0.01) | [−103.28] <(0.01) |

| Unempl. | |||||||

| ADF | [−3.2952] | [−3.5173] (0.04239) | [−3.2233] (0.0855) | [−4.3006] <(0.01) | [−2.3536] (0.428) | [−4.0267] <(0.01) | [−2.341] (0.4332) |

| PP | [−108.61] <(0.01) | [−159.96] <(0.01) | [−64.324] <(0.01) | [−276.52] <(0.01) | [−147.12] <(0.01) | [−152.71] <(0.01) | [−34.27] <(0.01) |

Unit root tests for nonstationarity against LSTAR model.

| Test variables | KSS ADF | Sollis F-test | Shint Inf-t-test |

|---|---|---|---|

| EONIA | [−1.1986] | [2.3769]** | [0.3802] |

| Spread | [−1.2794]* | [−0.2842] | [−0.3034] |

Below, Table 3 represents the critical values for untransformed (raw) series.

% t-tests, SOLLIS F-tests & for Shintani inf-test; 200 < T = 500.

Asymptotic critical values of unit root tests.

| ADF | KSS ADF | Sollis F-test | Shint Inf-t-test | |

|---|---|---|---|---|

| 1% | −2.60 | −2.79 | 4.241 | −3.21 |

| 5% | −1.95 | −2.51 | 2.505 | −2.66 |

Appendix 3

Linearity tests results.

| Linearity test for the LVSTAR model | |||||||

|---|---|---|---|---|---|---|---|

| France | Germany | Ireland | Italy | Netherlands | Portugal | Spain | |

| LR | 140.61 (0.0005) | 216.42 (0.0044) | 101.42 (0.1929) | 554.30 <(0.001) | 213.81 (0.0063) | 116.42 (0.0319) | 113.89 (0.004) |

| LM | 124.71 (0.0098) | 188.96 (0.0971) | 93.416 (0.381) | 407.37 (0.0003) | 185.68 (0.1291) | 104.47 (0.1413) | 104.63 (0.1388) |

| Rescaled LM | 1.62 (0.0012) | 1.204 (0.0600) | 1.217 (0.107) | 1.241 (0.0099) | 1.183 (0.0793) | 1.3618 (0.0258) | 1.363 (0.0252) |

| Wilks | 128.18 (0.0001) | 183.70 (0.0318) | 92.795 (0.080) | 396.56 (0.0001) | 181.39 (0.041) | 106.52 (0.0098) | 104.20 (0.0145) |

| Rao | 2.029 (0.0000) | 1.22 (0.0000) | 1.526 (0.0000) | -0.9038 (0.0000) | 1.200 (0.0000) | 1.5438 (0.0000) | 1.4989 (0.0000) |

Initial values for location and smoothness parameters in the LVSTAR model.

| Parameters evaluation | ||

|---|---|---|

| Initial values | Location parameter c | Smoothness parameter γ |

| France | 0.1763 | −0.2321 |

| Germany | 0.1660 | −0.6101 |

| Ireland | 0.1690 | 0.8916 |

| Italy | 0.1800 | 2.5007 |

| Netherlands | 0.1680 | 0.4389 |

| Portugal | 0.1946 | 3.4012 |

| Spain | 0.1663 | −0.0264 |

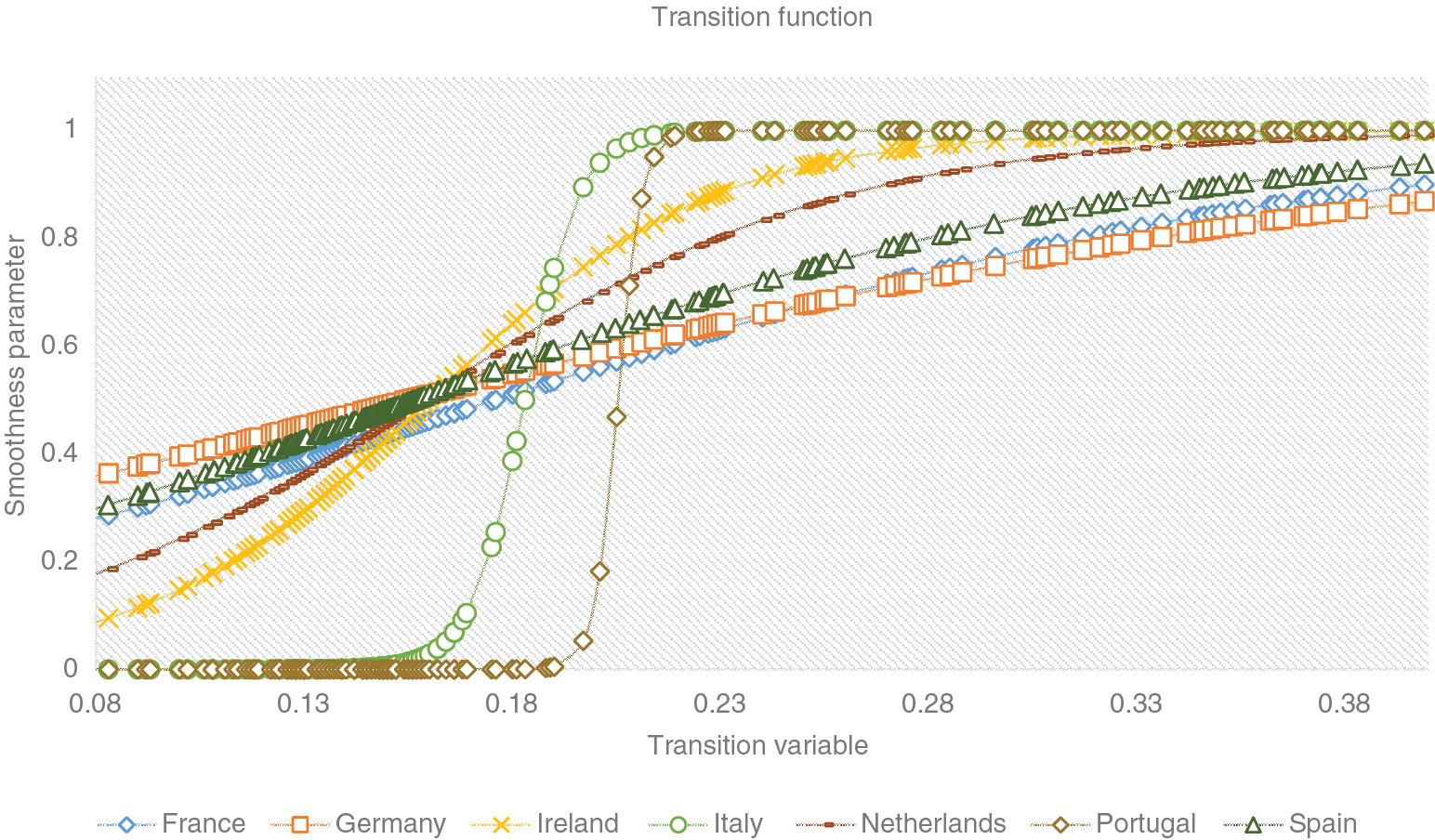

Optimized location and smoothness parameters in the LVSTAR model.

| Optimized parameters | Location parameter c | Smoothness parameter γ |

|---|---|---|

| France | 0.1758 | 0.7850 |

| Germany | 0.1550 | 0.6180 |

| Ireland | 0.1600 | 2.3314 |

| Italy | 0.1830 | 12.209 |

| Netherlands | 0.2639 | 1.5234 |

| Portugal | 0.2080 | 30.000 |

| Spain | 0.1560 | 0.8959 |

Appendix 4

References

Al-Eyd, A. J., and Pelin Berkmen. 2013. “Fragmentation and Monetary Policy in the Euro Area.” IMF Working Papers 13 (208): 1.10.5089/9781484328750.001Search in Google Scholar

Angeloni, I., and M. Ehrmann. 2003. “Monetary Transmission in the Euro Area: Early Evidence.” Economic Policy 18 (37): 469–501.10.1111/1468-0327.00113_1Search in Google Scholar

Aristei, David, and Manuela Gallo. 2014. “Interest Rate Pass-Through in the Euro Area During the Financial Crisis: A Multivariate Regime-Switching Approach.” Journal Of Policy Modeling 36 (2): 273–295.10.1016/j.jpolmod.2013.12.002Search in Google Scholar

Arnold, Ivo J. M., and Saskia E. van Ewijk. 2014. “A State Space Approach to Measuring the Impact of Sovereign and Credit Risk on Interest Rate Convergence in the Euro Area.” Journal of International Money and Finance 49: 340–357.10.1016/j.jimonfin.2014.04.005Search in Google Scholar

Auerbach, Alan J., and Yuriy Gorodnichenko. 2012. “Measuring the Output Responses to Fiscal Policy.” American Economic Journal: Economic Policy 4: (2): 1–27.10.3386/w16311Search in Google Scholar

Bernanke, Ben S, and Mark Gertler. 1995. “Inside the Black Box: The Credit Channel of Monetary Policy Transmission.” Journal of Economic Perspectives 9 (4): 27–48. DOI: 10.1257/jep.9.4.27.Search in Google Scholar

Bernanke, Ben S., Mark L. Gertler, and Simon Gilchrist. 1996. “The Financial Accelerator and the Flight to Quality.” Review of Economics and Statistics 78: (1): 1–15.10.2307/2109844Search in Google Scholar

Blot, Christophe, and Fabien Labondance. (2011). “Bank Interest Rate Pass-Through in the Eurozone: Monetary Policy Transmission During the Boom and Since the Financial Crash,” Annual International Conference on Macroeconomic Analysis and International Finance, Greece: University of Crete.Search in Google Scholar

Brunnermeier, Markus, and Yuri Sannikov. 2014. “Monetary analysis: Price and Financial Stability.” In ECB Forum on Central Banking, 59–86. Portugal: Sintra.Search in Google Scholar

Camacho, Maximo. 2004. “Vector Smooth Transition Regression Models for US GDP and the Composite Index of Leading Indicators.” Journal of Forecasting 23 (3): 173–196.10.1002/for.912Search in Google Scholar

Caruana, Jaime, and Adrian Van Rixtel. 2013. “International Financial Markets and Bank Funding in the Euro Area: Dynamics and Participants.” Bank of International Settlement. http://www.bis.org/publ/othp18.pdf.Search in Google Scholar

Ciccarelli, Matteo, and Fabio Canova. 2013. “Panel Vector Autoregressive Models: A Survey.” In: AR Models in Macroeconomics – New Developments and Applications: Essays in Honor of Christopher A. Sims, edited by Thomas B. Fomby, Lutz Kilian, and Anthony Murphy, Vol. 32, 205–246. Bingley, UK: Emerald Publishing. ISBN: 978-1-78190-752-8.10.1108/S0731-9053(2013)0000031006Search in Google Scholar

Ciccarelli, Matteo, Angela Maddaloni, and José-Luis Peydró. 2013. “Heterogeneous Transmission Mechanism: Monetary Policy and Financial Fragility in the Eurozone.” Economic Policy 28 (75): 459–512.10.1111/1468-0327.12015Search in Google Scholar

de Bondt, Gabe. 2002. Retail Bank Interest Rate Pass-Through: New Evidence at the Euro Area Level. Frankfurt: ECB.10.2139/ssrn.357380Search in Google Scholar

Deutsch Bundesbank. (2015). Recent developments in loans to euro-area non-financial corporations, September 2015.Search in Google Scholar

ECB, (European Central Bank). 2013. “Assessing the retail bank interest rate pass-through in the euro area at times of financial fragmentation.” ECB Economic Bulletin (8): 75–91.Search in Google Scholar

Eitrheim, Øyvind, and Timo Teräsvirta. 1996. “Testing the Adequacy of Smooth Transition Autoregressive Models.” Journal of Econometrics (Elsevier) 74 (1): 59–75.10.1016/0304-4076(95)01751-8Search in Google Scholar

Enders, Zeno, Philip Jung, and Gernot J. Müller. 2009. Has the Euro changed the Business Cycle? Bonn: Bonn Graduate School of Economics.Search in Google Scholar

Enoch, Charles, Luc Everaert, Thierry Tressel, and Jianping Zhou. 2013. From Fragmentation to Financial Integration in Europe. Washington D.C.: International Monetary Fund (IMF). ISBN: 9781484387665.Search in Google Scholar

Gambacorta, Leonardo, Anamaria Illes, and Marco Jacopo Lombardi. 2015. “Has the Transmission of Policy Rates to Lending Rates Changed in the Wake of the Global Financial Crisis?.” International Finance 18 (3): 263–280.10.1111/infi.12074Search in Google Scholar

Gefang, Deborah, and Rodney Strachan. 2009. “Nonlinear Impacts of International Business Cycles on the U.K. – A Bayesian Smooth Transition VAR Approach.” Studies in Nonlinear Dynamics & Econometrics 14 (1): 2–2.10.2202/1558-3708.1677Search in Google Scholar

Giannone, Domenico. 2010. Non-Standard Monetary Policy Measures and Monetary Developments. London: Centre for Economic Policy Research.10.2139/ssrn.1739051Search in Google Scholar

Giannone, Domenico, Michele Lenza, Huw Pill, and Lucrezia Reichlin. 2011. “Non-Standard Monetary Policy Measures and Monetary Developments.” ECB Working Paper Series (1290).10.1017/CBO9781139044233.008Search in Google Scholar

Godfrey, L. G. 1989. “Tests for misspecification of regression equations.” In: Misspecification Tests in Econometrics The Lagrange Multiplier Principle and Other Approaches (Econometric Society Monographs), Vol. 16, edited by Thomas B. Fomby, Anthony Murphy, and Killian Lutz. Cambridge: Cambridge University Press. ISBN 9781139052115.10.1017/CCOL0521266165Search in Google Scholar

Holton, Sarah, and Costanza Rodriguez d’Acri. 2015. Jagged Cliffs and Stumbling Blocks: Interest Rate Pass-Through Fragmentation During the Euro Area Crisis. Frankfurt: ECB.10.2139/ssrn.2664161Search in Google Scholar

Hubrich, Kirstin, and Timo Teräsvirta. 2013. “Thresholds and Smooth Transitions in Vector Autoregressive Models.” In: VAR Models in Macroeconomics – New Developments and Applications: Essays in Honor of Christopher A. Sims (Advances in Econometrics), edited by Thomas B. Fomby, Anthony Murphy, and Killian Lutz, Vol. 32. Bingley, UK: Emerald Group Publishing Limited. ISBN: 978-1781907528.10.1108/S0731-9053(2013)0000031008Search in Google Scholar

Illes, Anamaria, and Lombardi Marco. 2013. “Interest rate pass-through since the financial crisis.” BIS Quarterly Review 57–66.Search in Google Scholar

Kapetanios, George, Yongcheol Shin, and Andy Snell. 2003. “Testing for a Unit Root in the Nonlinear STAR Framework.” Journal of Econometrics 112 (2): 359–379.10.1016/S0304-4076(02)00202-6Search in Google Scholar

Kiyotaki, Nobuhiro, and John Moore. 1997. “Credit Cycles.” Journal of Political Economy 105: (2): 211–248.10.1086/262072Search in Google Scholar

Koop, Gary, M. Hashem Pesaran, and Simon M. Potter. 1996. “Impulse response analysis in nonlinear multivariate models.” Journal of Econometrics 74 (1): 119–147. DOI: 10.1016/0304-4076(95)01753-4.Search in Google Scholar

Kotz, Hans-Helmut, Joachim Nagel, and Jürgen Schaaf. 2012. “Central Bank Liquidity Management: Underwriting Stability in a Challenging Environment.” In Revue de la Stabilité Financière (Banque Central du Luxembourg), 114–125.Search in Google Scholar

Li, Yushu, and Ghazi Shukur. 2010. “Testing for Unit Root Against LSTAR Model: Wavelet Improvement Under GARCH Distortion.” Communications in Statistics - Simulation and Computation 39 (2): 277–286.10.1080/03610910903443964Search in Google Scholar

Luukkonen, Ritva, Pentti Saikkonen, and Timo Teräsvirta. 1988. “Testing Linearity Against Smooth Transition Autoregressive Models.” Biometrika 75 (3): 491.10.1093/biomet/75.3.491Search in Google Scholar

Maddala, G. S. 1977. Econometrics. New York: McGraw-Hill.Search in Google Scholar

Milesi-Ferretti, Gian-Maria, and Cédric Tille. 2011. “The Great Retrenchment: International Capital Flows During the Global Financial Crisis.” Economic Policy 26 (66): 289–346.10.1111/j.1468-0327.2011.00263.xSearch in Google Scholar

Mittnik, Stefan, and Willi Semmler. 2012. “Regime Dependence of the Fiscal Multiplier.” Journal of Economic Behavior & Organization 83 (3): 502–522.10.1016/j.jebo.2012.02.005Search in Google Scholar

Papademos, Lucas. 2009. “Monetary Policy and the “Great Crisis” – Lessons and Challenges.” In “Beyond the Crisis: Economic Policy in a New Macroeconomic Environment”. Vienna: Bank of International Settlement. http://www.bis.org/review/r090518de.pdf.Search in Google Scholar

Puspaningrum, Heni, Yan-Xia Lin, and Chandra Gulati. 2013. “Unit Root Tests for ESTAR Models.” Journal of Statistical Theory and Practice 7 (3): 558–595.10.1080/15598608.2012.719812Search in Google Scholar

Rao, Calyampudi R. 1951. “An asymptotic expansion of the distribution of Wilks’s criterion.” Bulletin of the International Statistical Institute 33 (2): 177–180.Search in Google Scholar

Rao, Calyampudi R. 1965. “The theory of least squares when the parameters are stochastic and its application to the analysis of growth curves.” Biometrika 52 (3/4): 447–458.10.1093/biomet/52.3-4.447Search in Google Scholar

Schleer, Frauke. 2015. “Finding Starting-Values for the Estimation of Vector STAR Models.” Econometrics 3 (1): 65–90.10.3390/econometrics3010065Search in Google Scholar

Schleer, Frauke, and Willi Semmler. 2015. “Financial Sector and Output Dynamics in the Euro Area: Non-Linearities Reconsidered.” Journal of Macroeconomics 46: 235–263.10.1016/j.jmacro.2015.09.002Search in Google Scholar

Schwarz, Gideon. 1978. “Estimating the Dimension of a Model.” The Annals of Statistics 6 (2): 461–464. DOI: 10.1214/aos/1176344136.Search in Google Scholar

Semmler, Willi, and Pu. Chen. 2017. “Short and Long-Run Effects of Productivity on Unemployment.” Available at SSRN: https://ssrn.com/abstract=2907539, forthcoming Open Economy Review, 2018.10.2139/ssrn.2907539Search in Google Scholar

Semmler, Willi, and Ibrahim Tahri. 2017. “Current Account Imbalances: A New Approach to Assess External Debt Sustainability.” Journal of Economic Modelling 62: 161–170.10.1016/j.econmod.2016.12.005Search in Google Scholar

Sims, Christopher A. 1980. “Macroeconomics and Reality.” Econometrica (The Econometric Society) 48 (1): 1–48.10.2307/1912017Search in Google Scholar

Sims, Christopher A, and Tao Zha. 2006. “Were There Regime Switches in U.S. Monetary Policy?.” American Economic Review 96 (1): 54–81.10.1257/000282806776157678Search in Google Scholar

Sollis, Robert. 2009. “A Simple Unit Root Test against Asymmetric STAR Nonlinearity with an Application to Real Exchange Rates in Nordic Countries.” Economic Modelling 26 (1): 118–125.10.1016/j.econmod.2008.06.002Search in Google Scholar

Sorensen, Christoffer Kok, and Thomas Werner. 2006. Bank Interest Rate Pass-Through in the Euro Area: Cross Country Comparison, edited by European Central Bank (ECB). Frankfurt, January.Search in Google Scholar

Stiglitz, Joseph E., and Andrew Weiss. 1992. “Asymmetric Information in Credit Markets and Its Implications for Macroeconomics.” Oxford Economic 44 (4): 694–724. DOI: 10.7916/D8RN3JVC.Search in Google Scholar

Teräsvirta, Timo. 1994. “Specification, Estimation, and Evaluation of Smooth Transition Autoregressive.” Journal of the American Statistical Association (American Statistical Association) 89 (425): 208–218.10.1080/01621459.1994.10476462Search in Google Scholar

Teräsvirta, Timo. 2004. “Smooth transition regression modeling.” In: Applied Time Series Econometrics, edited by Helmut Lütkehpol, and Markus Krätzig, 222–242. Cambridge: Cambridge University Press.10.1017/CBO9780511606885.007Search in Google Scholar

Teräsvirta, Timo, and Yukai Yang. 2014. “Specification, Estimation and Evaluation of Vector Smooth Transition Autoregressive Models with Applications.” Department of Economics and Business Economics, Aarhus University, CREATES.Search in Google Scholar

van Leuvensteijn, Michiel, Christoffer Kok Sørensen, Jacob A. Bikker, and Adrian A.R.J.M. van Rixtel. 2013. “Impact of Bank Competition on the Interest Rate Pass-Through in the Euro Area.” Applied Economics 45 (11): 1359–1380.10.1080/00036846.2011.617697Search in Google Scholar

Venetis, I., I. Paya, and D. Peel. 2009. “ESTAR Model with Multiple Fixed Points: Testing and Estimation.” Working paper, Department of Economics, Lancaster University Management School, Lancaster, UK.Search in Google Scholar

von Borstel, Julia, Sandra Eickmeier, and Leo Krippner. 2016. “The interest rate pass-through in the euro area during the sovereign debt crisis.” Journal of International Money and Finance 68: 386–402. DOI: 10.1016/j.jimonfin.2016.02.014.Search in Google Scholar

Weise, Charles L. 1999. “The Asymmetric Effects of Monetary Policy: A Nonlinear Vector Autoregression Approach.” Journal of Money, Credit and Banking 31 (1): 85.10.2307/2601141Search in Google Scholar

Yang, Yukai. 2012. Modelling Nonlinear Vector Economic Time Series (PhD Thesis). Aarhus University Department of Economics and Business.Search in Google Scholar

Supplementary Material

The online version of this article offers supplementary material (DOI: https://doi.org/10.1515/snde-2017-0097).

©2018 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Interview

- An Interview with Timo Teräsvirta

- Research Articles

- Nonlinear and asymmetric pricing behaviour in the Spanish gasoline market

- Testing for misspecification in the short-run component of GARCH-type models

- Closed-form estimators for finite-order ARCH models as simple and competitive alternatives to QMLE

- Time-varying asymmetry and tail thickness in long series of daily financial returns

- Modeling changes in US monetary policy with a time-varying nonlinear Taylor rule

- Financial fragmentation and the monetary transmission mechanism in the euro area: a smooth transition VAR approach

- P-star model for India: a nonlinear approach

- Can a Taylor rule better explain the Fed’s monetary policy through the 1920s and 1930s? A nonlinear cliometric analysis

- Modeling time-variation over the business cycle (1960–2017): an international perspective

Articles in the same Issue

- Interview

- An Interview with Timo Teräsvirta

- Research Articles

- Nonlinear and asymmetric pricing behaviour in the Spanish gasoline market

- Testing for misspecification in the short-run component of GARCH-type models

- Closed-form estimators for finite-order ARCH models as simple and competitive alternatives to QMLE

- Time-varying asymmetry and tail thickness in long series of daily financial returns

- Modeling changes in US monetary policy with a time-varying nonlinear Taylor rule

- Financial fragmentation and the monetary transmission mechanism in the euro area: a smooth transition VAR approach

- P-star model for India: a nonlinear approach

- Can a Taylor rule better explain the Fed’s monetary policy through the 1920s and 1930s? A nonlinear cliometric analysis

- Modeling time-variation over the business cycle (1960–2017): an international perspective