Abstract

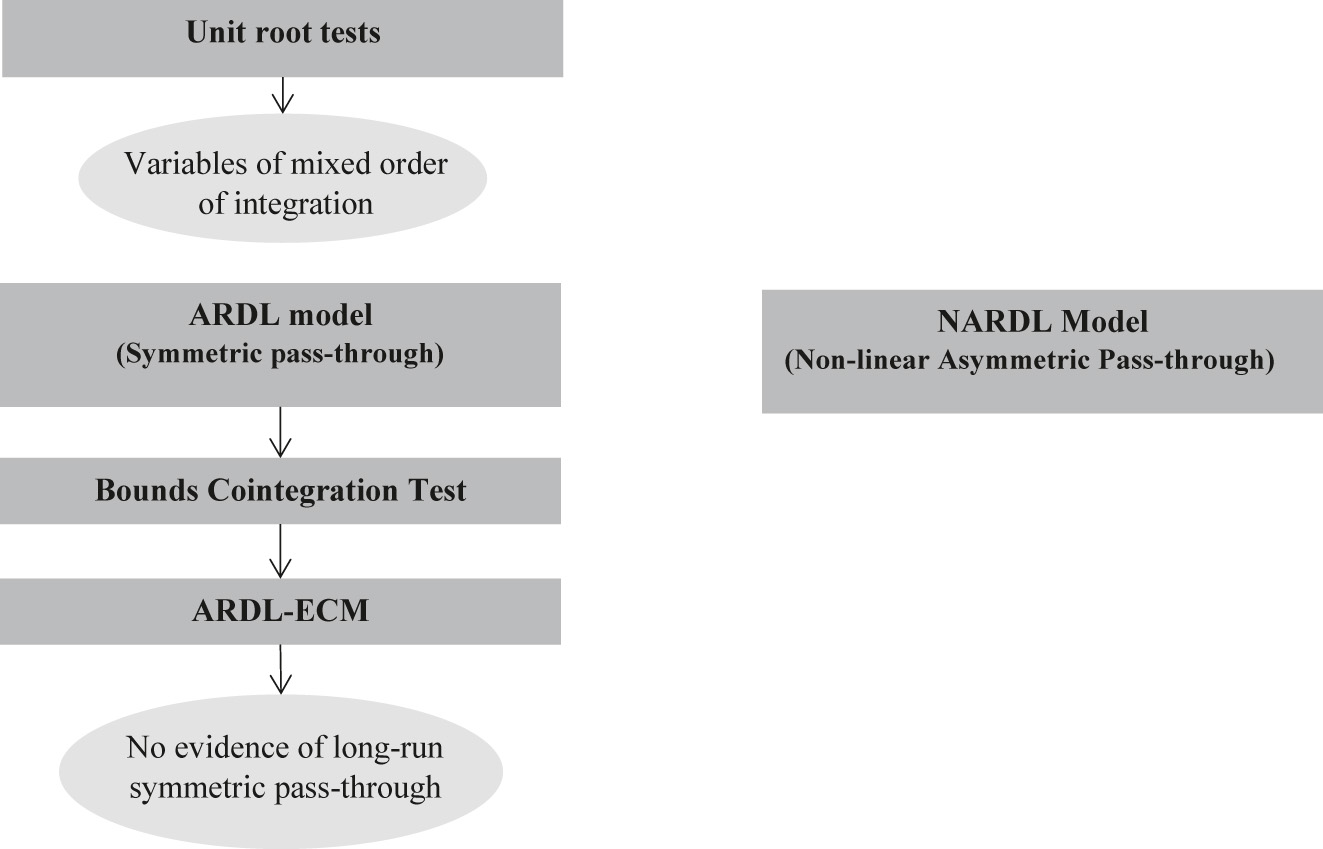

This paper analyses the world oil price pass-through to Egypt’s domestic inflation rate. The paper adopts the augmented Phillips curve framework and further extends it to consider the growing body of empirical evidence, suggesting that oil prices may have asymmetric effects on inflation. Accordingly, the paper examines and compares the symmetric and the asymmetric oil price pass-through to domestic inflation in the short run and the long run. A linear ARDL-ECM and the bounds cointegration tests are applied as well as a nonlinear asymmetric NARDL model and Wald tests for short-run and long-run asymmetries. The sample consists of quarterly data covering the period from 2001 Q3 to 2019 Q2. The results show that, in the short run, the pass-through of world oil prices to the Egyptian domestic inflation rate is symmetric and of small magnitude. However, on the long-run, oil price pass-through to inflation appears to be nonlinear and asymmetric, specifically, declining oil prices lead to a fall in domestic inflation that is more significant than the rise in inflation caused by rising oil prices.

References

Abounoori, Abbas Ali, Rafik Nazarian, and Ashkan Amiri. 2014. “Oil Price Pass-Through into Domestic Inflation: The Case of Iran.” International Journal of Energy Economics and Policy 4 (4): 662–9.Suche in Google Scholar

Abu-Bakar, Muhammad, and Mansur Masih. 2018. Is the Oil Price Pass-Through to Domestic Inflation Symmetric or Asymmetric? New Evidence from India Based on NARDL. Germany: University Library of Munich, MPRA Paper No. 87569. https://mpra.ub.uni-muenchen.de/87569/.Suche in Google Scholar

Asghar, Nabila, and Tanveer Ahmed Naveed. 2015. “Pass-Through of World Oil Prices to Inflation: A Time Series Analysis of Pakistan.” Pakistan Economic and Social Review 53 (2): 269–84.Suche in Google Scholar

Alsalman, Zeina N., and Mohamad B. Karaki. 2019. “Oil Prices and Personal Consumption Expenditures: Does the Source of the Shock Matter?” Oxford Bulletin of Economics & Statistics 81 (2): 250–70. https://doi.org/10.1111/obes.12276.Suche in Google Scholar

Baumeister, Christiane, and Lutz Kilian. 2016. “Forty Years of Oil Price Fluctuations: Why the Price of Oil May Still Surprise Us.” The Journal of Economic Perspectives 30 (1): 139–60. https://doi.org/10.1257/jep.30.1.139.Suche in Google Scholar

Bermingham, Colin, and Derry O’Brien. 2011. “Testing for Asymmetric Pricing Behaviour in Irish and UK Petrol and Diesel Markets.” Energy Journal 32: 3.10.5547/ISSN0195-6574-EJ-Vol32-No3-1Suche in Google Scholar

Blanchard, Olivier J., and Jordi Gali. 2007. “The Macroeconomic Effects of Oil Shocks: Why are the 2000s So Different from the 1970s?” National Bureau of Economic Research. Working Paper No. 13368. http://www.nber.org/papers/w13368.10.3386/w13368Suche in Google Scholar

BP. 2019. BP Statistical Review of World Energy, 68th ed. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-full-report.pdf.Suche in Google Scholar

Caceres, Carlos, Marcos Poplawski-Ribeiro, and Darlena Tartari. 2013. “Inflation Dynamics in the CEMAC Region.” Journal of African Economies 22 (2): 239–75. https://doi.org/10.1093/jae/ejs035.Suche in Google Scholar

Castro, César, Rebeca Jiménez-Rodríguez, Pilar Poncela, and Eva Senra. 2017. “A New Look at Oil Price Pass-Through into Inflation: Evidence from Disaggregated European Data.” Economia Politica 34: 55–82. https://doi.org/10.1007/s40888-016-0048-9.Suche in Google Scholar

Chen, Shiu-Sheng. 2009. “Oil Price Pass-Through into Inflation.” Energy Economics 31 (1): 126–33. https://doi.org/10.1016/j.eneco.2008.08.006.Suche in Google Scholar

Choi, Sangyup, Davide Furceri, Loungani Prakash, Saurabh Mishra, and Marcos Poplawski-Ribeiro. 2018. “Oil Prices and Inflation Dynamics: Evidence from Advanced and Developing Economies.” Journal of International Money and Finance 82: 71–96. https://doi.org/10.1016/j.jimonfin.2017.12.004.Suche in Google Scholar

Chou, Kuo-Wei, and Yi-Heng Tseng. 2011. “Pass-through of oil prices to CPI inflation in Taiwan.” International Research Journal of Finance and Economics 69 (69): 73–83. https://doi.org/10.5547/01956574.40.6.ccon.Suche in Google Scholar

Conflitti, Cristina, and Matteo Luciani. 2019. “Oil Price Pass-Through into Core Inflation.” Energy Journal 40: 6. https://doi.org/10.5547/01956574.40.6.ccon.Suche in Google Scholar

EIA. 2018. Energy Subsidies: Tracking the Impact of Fossil-Fuel Subsidies. EIA: U.S. Energy Information Administration. https://www.iea.org/topics/energy-subsidies.Suche in Google Scholar

El-Behiry, Dina. 2019. “Economic, Social Impacts of Phasing-Out Energy Subsidies in Egypt.” Egypt Oil & Gas Newspaper. https://egyptoil-gas.com/publications/august-2019/.Suche in Google Scholar

El Behiry, Dina, and Amina Hussein. 2019. “Energy Subsidy Reform Program: The Full Picture.” Egypt Oil & Gas Newspaper. https://egyptoil-gas.com/publications/august-2019/.Suche in Google Scholar

El-Ghandour, Mai. 2019. “Getting Rid of the Elephant in the Room.” Egypt Oil & Gas Newspaper. https://egyptoil-gas.com/publications/august-2019/.Suche in Google Scholar

Gately, Dermot, and Hiliard G. Huntington. 2002. “The Asymmetric Effects of Changes in Price and Income on Energy and Oil Demand.” Energy Journal 23 (1): 19–55, https://doi.org/10.5547/issn0195-6574-ej-vol23-no1-2.Suche in Google Scholar

Ghalayini, Latife. 2011. “The Interaction Between Oil Price and Economic Growth.” Middle Eastern Finance and Economics 13 (21): 127–41.Suche in Google Scholar

Harris, Richard I.D. 1995. Using Cointegration Analysis in Econometric Modeling. London: Prentice Hall.Suche in Google Scholar

Helmy, Omneia, Mona Fayed, and Kholoud Hussien. 2018. “Exchange Rate Pass-Through to Inflation in Egypt: A Structural VAR Approach.” Review of Economics and Political Science 3 (2): 2–19. https://doi.org/10.1108/reps-07-2018-001.Suche in Google Scholar

Herrera, Ana María, Mohamad B. Karaki, and Sandeep Kumar Rangaraju. 2019. “Oil Price Shocks and US Economic Activity.” Energy Policy 129: 89–99. https://doi.org/10.1016/j.enpol.2019.02.011.Suche in Google Scholar

Hussien, Amina, Reham Gamal, and Tanseem Madi. 2019a. “Pursuing Egypt’s Petroleum Production over FY (2010/2011–2018/2019: Report)”. Egypt Oil & Gas Newspaper. https://egyptoil-gas.com/reports/pursuing-egypts-petroleum-production-over-fy-201011-201819/.Suche in Google Scholar

Hussien, Amina, Reham Gamal, and Tanseem Madi. 2019b. “Economics of Refinery in Egypt: Economic Contribution of Industry over FY (2016/2017–2017/2018: Report)”. Egypt Oil & Gas Newspaper. https://egyptoil-gas.com/reports/economics-of-refineries-in-egypt-tracking-economic-contribution-of-refining-industry-fys-201617-201718/.Suche in Google Scholar

Hooker, Mark A. 2002. “Are Oil Shocks Inflationary? Asymmetric and Nonlinear Specifications versus Changes in Regime.” Journal of Money, Credit, and Banking 34 (2): 540–61, https://doi.org/10.1353/mcb.2002.0041.Suche in Google Scholar

Ibrahim, Mansor H., and Kanokwan Chancharoenchai. 2014. “How Inflationary Are Oil Price Hikes? A Disaggregated Look at Thailand Using Symmetric and Asymmetric Cointegration Models.” Journal of the Asia Pacific Economy 19 (3): 409–22. https://doi.org/10.1080/13547860.2013.820470.Suche in Google Scholar

IRENA. 2018. Renewable Energy Outlook: Egypt. Abu Dhabi: International Renewable Energy Agency. https://www.irena.org/publications/2018/Oct/Renewable-Energy-Outlook-Egypt.Suche in Google Scholar

Ji, Qiang, and Ying Fan. 2012. “How Does Oil Price Volatility Affect Non-energy Commodity Markets?” Applied Energy 89 (1): 273–80. https://doi.org/10.1016/j.apenergy.2011.07.038.Suche in Google Scholar

Khan, Zeeshan, Shah, Khalid, Khurshid Ali, Shahid Ali, and Alina Kiran. 2017. “Crude Oil Prices and Its Effect on Economic Growth; Analyzing Pre and Post Oil Prices Shocks: A Case Study of Pakistan Economy.” Journal of Energy Technology and Policy 5: 125–47.Suche in Google Scholar

Lahiani, Amine. 2019. “Exploring the Inflationary Effect of Oil Price in the US: A Quantile Regression Approach over 1876-2014.” International Journal of Energy Sector Management 13 (1): 60–76. https://doi.org/10.1108/ijesm-05-2018-0002.Suche in Google Scholar

Long, Shaobo, and Jun Liang. 2018. “Asymmetric and Nonlinear Pass-Through of Global Crude Oil Price to China’s PPI and CPI Inflation.” Economic Research-Ekonomska istraživanja 31 (1): 240–51. https://doi.org/10.1080/1331677x.2018.1429292.Suche in Google Scholar

Malik, Afia. 2016. “The Impact of Oil Price Changes on Inflation in Pakistan.” International Journal of Energy Economics and Policy 6 (4): 727–37.Suche in Google Scholar

Pesaran, M. Hashem, and Yongcheol Shin. 1995. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis, Vol. 9514. Cambridge: Department of Applied Economics, University of Cambridge.Suche in Google Scholar

Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. “Bounds Testing Approaches to the Analysis of Level Relationships.” Journal of Applied Econometrics 16 (3): 289–326. https://doi.org/10.1002/jae.616.Suche in Google Scholar

Shrestha, Min B., and Guna R. Bhatta. 2018. “Selecting Appropriate Methodological Framework for Time Series Data Analysis.” The Journal of Finance and Data Science 4 (2): 71–89. https://doi.org/10.1016/j.jfds.2017.11.001.Suche in Google Scholar

Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo. 2014. “Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework.” In Festschrift in Honor of Peter Schmidt, edited by Sickles, R. and W. Horrace. New York: Springer.10.1007/978-1-4899-8008-3_9Suche in Google Scholar

UN Comtrade. 2018. United Nations Commodity Trade Database. https://wits.worldbank.org/CountryProfile/en/Country/EGY/Year/2010/TradeFlow/Export/Partner/all/Product/Fuels#.Suche in Google Scholar

Viliani, Shima, and Farhad Ghaffari, and Kambiz Hojhabr Kiani. 2019. “Does Oil Price Asymmetrically Pass-Through Banking Stock Index in Iran?” Iranian Economic Review 23 (3): 659–74.Suche in Google Scholar

Zahran, Mohamed Samir Abdalla. 2019. “The Response of Remittances Inflows to Asymmetric Oil Price Shocks in Egypt.” Review of Economics and Political Science, https://doi.org/10.1108/REPS-01-2019-0009.Suche in Google Scholar

© 2023 Walter de Gruyter GmbH, Berlin/Boston