Abstract

This paper analyses possibilities for amending the withdrawal right under the EU consumer law, aiming to reduce the information asymmetry between contracting parties in distance sales and thus increase the number of concluded contracts and the overall contractual surplus. The main findings are that the rules suggested in law and economics theory (the personalized mandatory rules and the mandated-choice model) may not be optimal tools for amending the withdrawal right because they mostly seem to neglect the allocation of risk between contracting parties. Thus, this paper suggests the new ‘risk allocation’ rules as a tool for amending the withdrawal right, focusing on its use in distance sales. If amended in line with those rules, the withdrawal right could deal with information asymmetry problems more efficiently, incentivise contracting parties to enter more distance sales contracts, and increase the overall contractual surplus, especially within the realms of e-commerce. The suggested proposal is conceived – at least for the time being – more as a thought experiment; relevant empirical analysis may follow up at a subsequent phase.

1 Introduction

The withdrawal right (in German: Widerrufsrecht; in French: droit de rétractation) under the EU Consumer Rights Directive 2011/83/EU (hereinafter: CRD) – as amended by Directive 2019/2161/EU as regards the better enforcement and modernisation of EU consumer protection rules – is meant to protect consumers in distance sales and off-premises contracts and thus enable better functioning of the business-to-consumer (B2C) internal market.[1] Namely, distance sales[2] and off-premises contracts[3] usually generate information asymmetries between contracting parties relating to the nature, quality, and functioning of the goods. In particular, in distance sales the information asymmetry as regards the quality and the specific characteristics of the good sold is closely intertwined with the latter’s character as “experience good”, whose quality and specific characteristics can only be discovered once the consumer gets in physical contact with the good and thus has the opportunity to test or try it and ascertain whether it meets their demands and needs; whereas in off-premises contracts the consumer concludes the contract more under psychological pressure – rather than due to information asymmetry –, taken aback by offensive sales practices of the businessman. In the present paper we focus mainly on distance sales, for two reasons: (a) distance sales and especially e-commerce constitutes the hotbed of modern transactions; and (b) as already mentioned, the factor of information asymmetry is more present and intense in such sales than in off-premises contracts, whose practical importance has generally declined in the last years (cf. also Luzak 2013, focusing exclusively on the right of withdrawal in distance selling contracts and exploring the relevant behavioural phenomena). To reduce the information asymmetry and thus increase the internal market efficiency, the European legislator provides consumers with the right to change their minds and free themselves from concluded contracts – or, under a slightly different legal perspective, to withdraw from the definite conclusion of the contract, which may come if the consumer does not exercise the withdrawal right on time. Under the CRD, consumers may use this right to withdraw from the contract within a 14-day cooling-off period (or period of sober reflection), without giving any reason and without incurring any costs to the other party.[4]

In practice, however, many sellers already voluntarily provide consumers with a withdrawal right[5] as a way of signalling the high quality and reliability of their products; especially the big retail businesses (such as Amazon, Walmart, and others) offer, indeed, by themselves a right to return goods, usually within 30 days after the delivery of the good (Ben-Shahar and Posner 2011; Wagner 2011). It is an attempt to demonstrate reliability and negotiate successfully from a distance (i.e., in the physical absence of the parties to the transaction). Companies use the withdrawal right to attract more customers and increase profits (Karampatzos 2020, p. 94).

Nevertheless, it seems that self-regulation is not enough; the risk of the emergence of a ‘market for lemons’ due to information asymmetry, which some irrational sellers are ready to exploit, still hovers. There is always the possibility that an isolated, inexperienced, or simply naïve consumer will be exploited by a powerful company or salesperson that may sell them low-quality products without offering a withdrawal right (Karampatzos 2020, p. 96). ‘Black sheep’ in the market cannot be excluded, especially since between big retail companies and consumers there is regularly a significant imbalance in bargaining power. Even within a default-withdrawal-right setting, there lurks the risk that some sellers will take an exploitative path by excluding the (default) withdrawal right through general contract terms (Karampatzos 2020, pp. 97–98, with further references, also offering additional reasons for rejecting this default option as well as an ex post judicial review of such general contract terms).

Since the problem of information asymmetry in conjunction with a significant imbalance in bargaining power is inherent in distance contracts and in many cases may stand in the way of consumers’ efficient decision-making, the quest should be for an alternative, efficient means of regulatory intervention that would entail the lowest possible burden for the private autonomy of both contracting parties (i.e., consumer and seller).

Up to date, the withdrawal right has been a subject of many debates from the perspective of law and economics. On one hand, there are those who argue in favour of the mandatory law provision of the right. Hellgardt (2013), for instance, considers that in this case the mandatory law provision is desirable, since it leads to equal competition terms between all distance sellers and thus sets the foundations for a competition in prices and quality between them. On the other hand, there are those who make alternative suggestions. Ben-Shahar and Posner (2011), for instance, claim that the withdrawal right – at least as a default rule – has a plausible economic basis.[6] In the same paper, they demonstrate that the withdrawal right enables the trade-off between consumers allowing them to learn more about the goods they purchase and protecting sellers from the depreciation of the value of those goods. Therefore, if properly configurated, the withdrawal right can generate considerable economic benefits, i.e., decrease information asymmetry, increase market efficiency, and thus increase the total contractual surplus and the number of concluded contracts. However, the crucial question remains exactly the optimal configuration of the withdrawal right: namely, is it possible to (re)design this right to increase the economic benefits it generates without restricting the autonomy of the contracting parties and reducing their incentives to enter into distance sales contracts? This paper aims to address this particular question.

We approach the question of (re)designing the withdrawal right from two different perspectives. First, we analyse the possibilities of the practical application of the personalised-mandatory scheme (Ben-Shahar and Porat 2019) and the mandated-choice model (Eidenmüller 2011a, 2011b; Karampatzos 2020) when (re)designing the withdrawal right under the CRD. Second, we offer a new perspective and suggest ‘risk allocation’ rules that may significantly increase the withdrawal right’s economic benefits without restricting the autonomy of the contracting parties or reducing their incentives to conclude contracts. The concluding remarks will follow.

2 (Re)Designing the Withdrawal Right

One could successfully redesign and enhance the withdrawal right under the CRD based on the recent findings in law and economics theory. Those findings suggest that a legislator should use the personalised mandatory rules or the mandated-choice model to increase the economic efficiency of the withdrawal right, i.e., to maximize the overall economic benefits this right generates. Both options have advantages and disadvantages that one should consider more closely before suggesting any amendments to the current legal regime.

2.1 Personalised Mandatory Rules

Nowadays, there is a general trend toward personalising private law. This idea has been initially advanced by eminent U.S. legal scholars such as Ben-Shahar and Porat (2016, 2019, 2021), Casey and Niblett (2017), Porat and Strahilevitz (2014), Sunstein (2013), and Verstein (2019), but has also found proponents in European academia – such as Busch (2019), Hacker (2017), and Luzak (2021).[7] These scholars claim, by and large, that private law has much to gain from tailoring its regulatory apparatus to the needs of individual legal subjects (Hacker 2017). Therefore, there is an attempt to personalise private law across different regulatory tools, such as disclosures, defaults, and mandates. With the help of personalisation – that is, by considering factors such as the degree of rationality or willpower, the income or wealth of each contracting party – the legal categories constructed by modern law (such as the category of consumers) could be rendered “more precise, granular and refined” to match real needs and characteristics as closely as possible (Hacker 2017, esp. pp. 659, 676). Of course, the holistic attempt to personalise private law raises significant privacy and data protection issues; for this attempt presupposes that a plethora of personal data is collected, stored, and processed (Hacker 2017, p. 664; Karampatzos 2020, pp. 75–76).[8]

Within this general framework, Ben-Shahar and Porat (2019, pp. 255 et seq.) advocate the idea of personalising mandatory rules. Their approach is based on the belief that we should create mandatory rules that better fit the needs and expectations of specific contracting parties and reduce the unintended costs of mandatory law. As Ben-Shahar and Porat suggest, that is already happening in the law and business practices within firms personalising the withdrawal right[9] – to what extent, though, it is hard to tell. According to the authors, a fully personalised law (legal rules) implies that every consumer has their own optimal level of protection, and that the seller charges each consumer a different price. Consequently, Ben-Shahar and Porat (2019, 2021) conclude that personalised legal protection could increase the overall contractual surplus and enable more consumers to enter a contract.

Inter alia, Ben-Shahar and Porat (2019) specifically refer to the mandatory right to withdraw from a contract, suggesting that its protective goal would be better served by a personalised mandatory-rule regime than by a uniformly applicable mandatory-rule regime. For “[s]ome consumers need longer periods to re-evaluate the deal, others can do with shorter. A 72-h right to withdraw from a loan contract may be useless to the weakest of consumers, who are often the neediest, and are also the recipients of the most risky and complicated loan deals. They need more time to overcome the moment-of-purchase confusion. And, conversely, a two-week right to withdraw from online sales may be more than necessary for experienced internet shoppers […]. A uniform duration may be set at the correct “average’ length, but it misfires in individual cases” (Ben-Shahar and Porat 2019, p. 257, also p. 281). Under this prism, if the EU consumers had different cooling-off periods (periods of sober reflection) available at different prices, they would conclude more contracts in the market and increase the overall contractual surplus. The authors rightly point out that, in general, “[p]ersonalized protections also affect redistributive goals, because they eliminate cross-subsidies occurring in equal treatment pools,” for “[w]hen the cross-subsidy is regressive, its elimination is desirable” (op. cit., p. 258). In other words, Ben-Shahar and Porat (2019) advance a personalised mandatory-rule regime that links price differentiation to the degree of legal protection granted to each consumer (meaning that price differentiation goes hand in hand with personalized protection). However, this legal regime is affected by the following disadvantages:

In the first place, creating and implementing a fully personalised withdrawal right is easier to said than done. Such an idea is practically associated with very significant transaction costs, which mostly affect the sellers (Karampatzos 2020, pp. 108–109): for big data must be collected and processed, and thereafter, the sellers must supply different goods with personalised legal protection, along with a corresponding price adjusted to the specific profile of each customer.[10] Ben-Shahar and Porat themselves (2019, p. 281; cf. also 2021, passim, esp. p. 10) acknowledge the problems related to the technical implementation of their idea, including writing a specific computer code, and developing a complex personalisation algorithm that would enable consumers to get an optimal level of legal protection, i.e., an optimally designed withdrawal right. Assuming that the fully personalised rules do not restrict the autonomy of contracting parties, all these difficulties in design and implementation may generate prohibitive high administrative costs that may outweigh the economic benefits a personalised withdrawal right generates.[11] In any case, and if such differentiation would ever be practically feasible, it appears that these administrative costs would considerably increase the final purchase price and thus decrease the overall contractual surplus and the total number of concluded contracts.

It also goes without saying that the collection and processing of Big Data raises serious privacy and data protection concerns – an issue that has been generally much discussed in the relevant literature (cf., indicatively, Casey and Niblett 2017; Hacker 2017; Karampatzos 2020, pp. 75–76, 109).

Another general disadvantage of personalised mandatory rules is that they do not enable consumers to waive the protection, i.e., to exclude the withdrawal right; in other words, forced protection and an unwanted price increase cannot be avoided (Karampatzos 2020, p. 108). As a consequence, personalised mandatory rules may still generate destructive or socially unfair cross-subsidies. Namely, consumers who are risk takers and thus do not want the protective shield of the withdrawal right would have to subsidize the provision of the right to those who are risk-averse; this phenomenon may significantly decrease the overall contractual surplus and the number of concluded contracts. A possible counterargument here, though, would be that an efficient fully personalised mandatory-rules regime would take into account the interests of absolute risk takers by totally excluding them from the mandatory imposition of a withdrawal right. However, it appears that, strictly speaking, that would not be a (personalised) mandatory rule.

In light of the above mentioned technical and substantial deficiencies, it seems that (at least at the current level of technological development) one cannot use personalized mandatory rules as an adequate tool for redesigning the withdrawal right under the CRD.

2.2 The Mandated-choice Model

Contrary to the personalised mandatory rules, the mandated-choice model implies that consumers should be given the option to choose between two different contracts, that is, one without a withdrawal right and a lower price, and another one with a withdrawal right and a higher price (Karampatzos 2020, pp. 98 et seq., with further references). If the CRD would provide the consumers with this option on an obligatory (for the seller) basis, it could generate considerable economic benefits. More particularly, the mandated-choice model reflects a reasonable interference with private autonomy, obviously milder than a mandatory imposition of the withdrawal right without a possibility to opt out; as the argument goes, it marries the advantages of the freedom to shape the contractual content to the need to cure existing information asymmetries (Karampatzos 2020, pp. 109–110). It also makes the price of the additional legal protection (embodied in a withdrawal right) visible and transparent.[12] After having been informed of the withdrawal right and the enhanced protection it offers, consumers would weigh the pros and cons of the legal protection and soberly decide whether the withdrawal right is worth the money or not. Simply by (obligatorily) providing that option to all consumers in distance sales, the mandated-choice model may decrease the socially unjust phenomenon of cross-subsidization – which is an often underappreciated flip side of the extended EU legal paternalism – and increase the overall contractual surplus to a great extent.[13] For the costs for providing the withdrawal right are borne only by those consumers who opt for the additional legal protection and pay the relevant insurance premium; on the other hand, the consumers who want to take the risk of information asymmetry (the so-called “risk takers” or “lovers”) do not subsidize the provision of the right to those who are risk averse. At the same time, the implementation of the mandated-choice model produces significantly lower transaction costs compared to the creation of personalized mandatory rules. Consumers may check one of the two boxes available online (without the need of engaging any complex computer programs and algorithms), one indicating a contract with and the other without a withdrawal right.[14]

Hence, under the mandated-choice concept the consumer is free to choose between a contract without a withdrawal right and a contract with the additional insurance of the withdrawal right. The consumer will reach their decision on the basis of their own individual predisposition against risk assumption, their knowledge and experience, as well as the amount of the insurance premium they must pay each time to enjoy the greater legal protection (i.e., the withdrawal right; Eidenmüller 2011a, p. 135). If the consumer opts for higher protection in a distance contract, they are expressing their willingness to buy insurance against the risk of a negative assessment of the good they bought, after having taken possession of it. At that point they might realize that they do not need the good, that it does not meet their expectations, or simply that its (subjective) usefulness or utility does not correspond to the price paid (see Eidenmüller 2011a, p. 135). Having all that in mind, the mandated-choice path seems to be a more suitable tool for redefining the withdrawal right under the CRD. It is, therefore, no coincidence that in the last years this path has found considerable resonance in German legal theory (in German: zwingendes Optionsmodell, optionales Widerrufsrecht) and is embraced by renowned legal scholars such as Eidenmüller (2011a, 2011b) and Wagner (2011).[15]

However, besides those considerable advantages, the mandated-choice scheme may also create, for both transacting parties (i.e., consumers and sellers), incentives for opportunistic behaviour and entail moral hazards (Karampatzos 2020, pp. 102 et seq.). For instance, the consumer could first buy the good with the withdrawal right, test it, and if it meets their requirements or needs, then exercise the withdrawal right, request a refund of the price paid (200€) and immediately repurchase the good at the considerably lower price (150€) without the withdrawal right. In practice, however, “the price difference between the two products will be much smaller, as is, indeed, the transactional practice when the withdrawal right is voluntarily offered by a seller or provider: in all likelihood, the price for the good with withdrawal right will be, for example, 160€, and for the good without withdrawal right 150€” (Karampatzos 2020, p. 102). Apart from that, though, nothing, prima facie, deters the consumer from temporarily acquiring a product by, practically, borrowing it for use in the context of a specific occasion only, and then from exercising the withdrawal right; such opportunistic consumer behaviours cannot be easily eliminated (once again Karampatzos 2020, p. 103, where further reference to possible regulatory means of countering such behaviours, for instance, by imposing return or depreciation costs on the consumer, and so forth; cf. also Luzak 2013).

Moreover, similar to the personalised mandatory rules, a seller may also behave opportunistically while offering the mandatory choice. Due to their superior bargaining power, a seller may intentionally overvalue the withdrawal right’s option and incentivise consumers to conclude contracts without withdrawal rights – who may always be tempted to do so, even if they are not, by nature, risk takers, possibly motivated by over-optimism.[16] In this way, a seller may shift all the information asymmetry risk to consumers and behave hazardously to maximize his/her profit; that could decrease the overall contractual surplus and the total number of contracts. Therefore, even though the mandated-choice scheme may solve the critical transaction costs and cross-subsidisation problems, it is still not a perfect tool for redefining the withdrawal right (cf. also Luzak 2013, pp. 30–31).[17] In fact, it seems that there is room for suggesting a significantly improved and more refined version of the mandated-choice path.

2.3 Risk Allocation Rules

After taking a closer look at the pros and cons of personalised mandatory rules and the mandated-choice model, it seems that the main issue in amending the withdrawal right lies with the perspective of (re)allocation of risk. When contracting parties evenly distribute information asymmetry risk, i.e., when every party may take the risk in line with their own subjective preferences and pay the price accordingly, the incentives for opportunistic behaviour and the probability of moral hazard may drastically reduce. Hence, the question that has to be addressed is how to amend the withdrawal right in order to enable efficient risk (re)allocation between contracting parties.

To answer this question, one must first reveal the preferences – or the predisposition – of a contracting party toward information asymmetry risk. After revealing the individual risk preferences, it is necessary to enable efficient exchange between contracting parties, with minimum transaction costs and cross-subsidies. For that purpose, this paper offers the risk allocation rules, overwhelmingly based on the findings in law and economics theory related to the personalised mandatory rules and the mandated-choice model. Our approach is conceived – at least for the time being – more as a thought experiment; relevant empirical analysis may follow up at a subsequent phase.

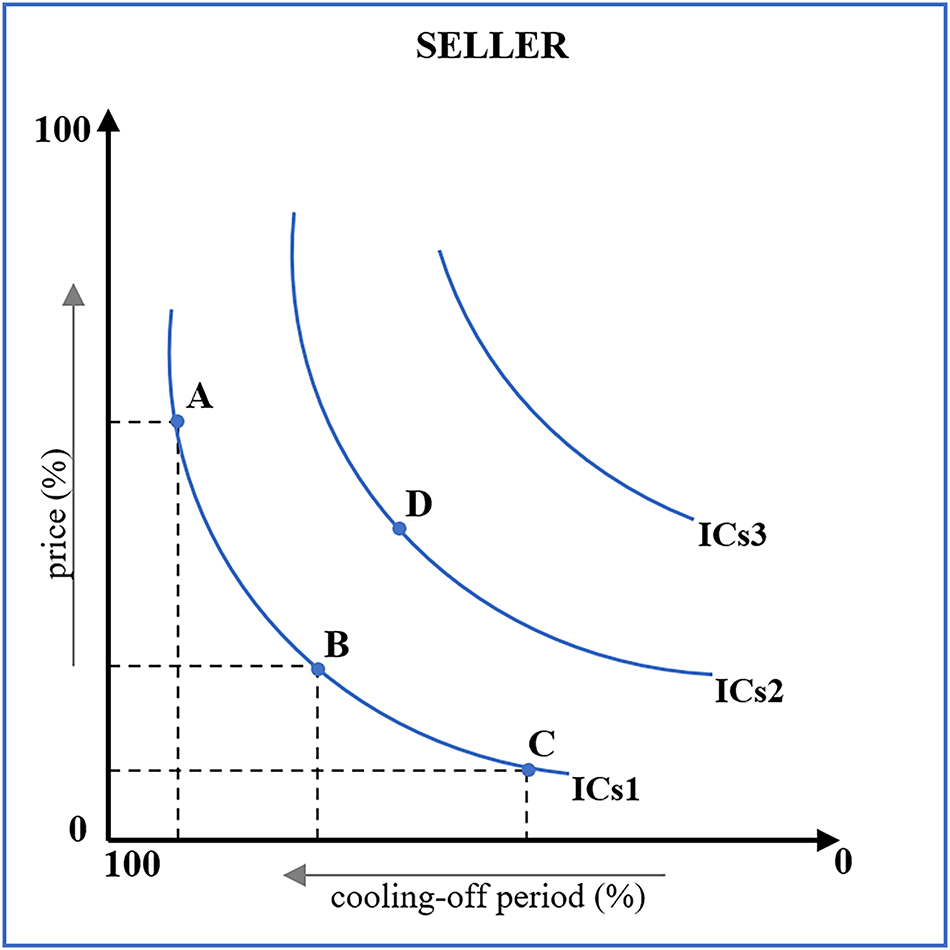

2.4 Risk Preferences

The risk allocation rules are specific because, according to the discussion hypothesis adopted in the following lines, they imply that the seller of goods in distance sales should be obliged to provide different offers for the same commodity, containing different prices and cooling-off period ratios. In that sense, a seller could be obliged under those rules to offer the same good at a high price and long cooling-off period, a medium price and medium cooling-off period, and a low price and short cooling-off period. To make the possible benefits of this approach evident, we assume that, under those rules, a seller is willing to provide a 35 % decrease in price along with a 20 % decrease in the cooling-off period length and a 50 % decrease in price along the 55 % decrease in cooling-off period length (compared to the initial offer, i.e., high price and long cooling-off period length).[18] In this way, the risk allocation rules might help reveal the seller’s preferences toward information asymmetry risk. Namely, the information asymmetry risk, or the risk that the goods will not meet the consumers’ reasonable expectations and that the latter will return the goods to the seller, may be captured and presented as a price/cooling-off period ratio (see Figure 1).

The Seller’s preferences toward information asymmetry risk. Source: Authors.

Figure 1 shows that a seller is indifferent between offering the same good at a relatively high price and a long cooling-off period (A), a medium price and a medium cooling-off period (B – a 35 % decrease in price and a 20 % decrease in the cooling-off period compared to A), and a low price and short cooling-off period (C – a 50 % decrease in price and the 55 % decrease in the cooling-off period compared to A). The different price/cooling-off period combinations between which the seller is indifferent (they generate the same utility) constitute a seller’s indifferent curve (ICs1).[19] Moreover, every seller has an indefinite number of indifference curves (ICs1, ICs2, ICs3 … +∞), and the more remote the curve is from the coordinate origin it represents a higher utility level (U [ICs1] < U[ICs2] < U[ICs3], etc.). Consequently, D (on ICs2) generates greater utility than any other combination – A, B, or C (on ICs1). Based on the same principle, one could construct indifference curves for every seller in distance sales. However, a seller who is a risk taker (risk lover) would offer relatively lower price/cooling-off ratios, and a seller who is risk averse would offer higher ratios due to the different marginal rates of substitution between the cooling-off period and price.[20] In any event, due to those risk allocation rules obliging sellers to provide different options to consumers (presumably A, B, and C), the contract would be concluded in accordance with the seller’s risk preferences, regardless of the price/cooling-off period combination consumers choose.

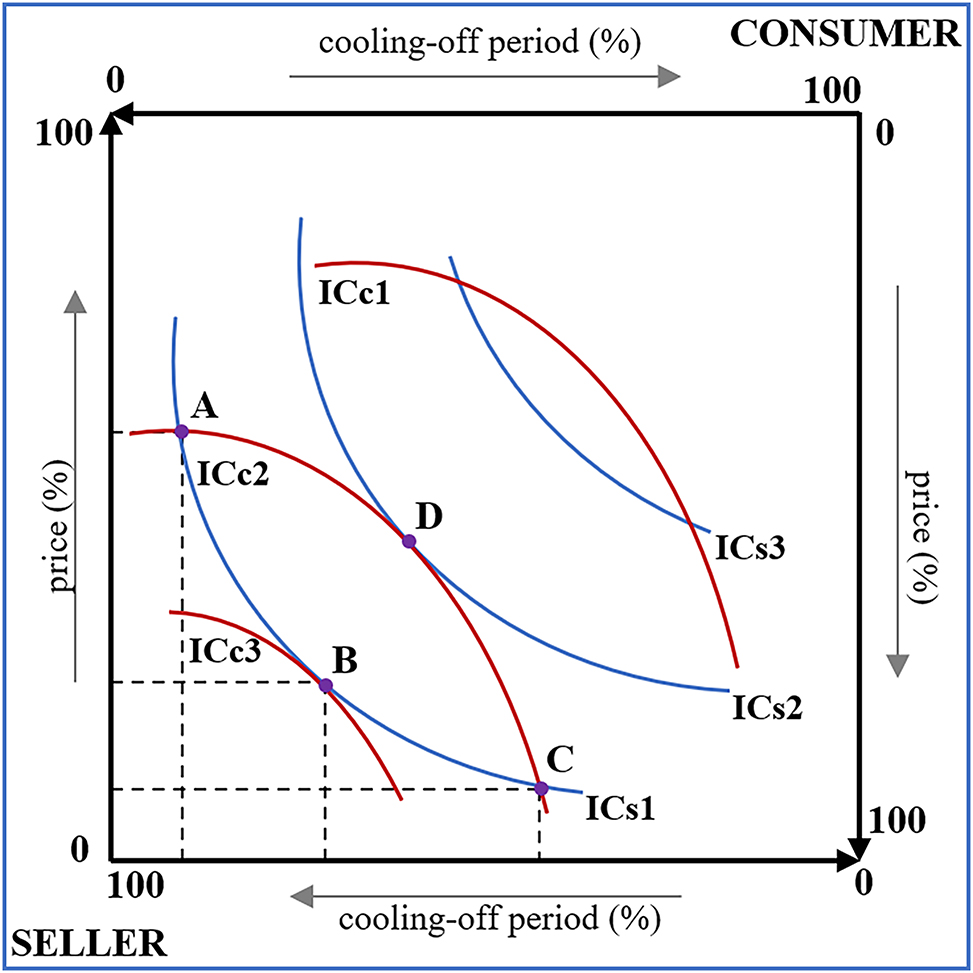

Furthermore, once the seller is obliged to provide different offers for the same commodity and thus expresses their risk preferences (under the risk allocation rules), consumers may also enter the contract following their risk preferences. One may assume that consumers also have their indifference curves, i.e., the different price/cooling-off combinations that generate the same level of utility (see Figure 2).

The Consumer’s preferences toward information asymmetry risk. Source: Authors.

Figure 2 shows that a consumer is indifferent between purchasing the same goods at a high price and long cooling-off period (C), a medium price and a medium cooling-off period (D), and a low price and short cooling-off period (A). The different price/cooling-off period combinations between which the consumer is indifferent (they generate the same level of utility) constitute a consumer’s indifference curve (ICc2). Same as in the sellers’ case, every consumer has an indefinite number of indifference curves (ICc1, ICc2, ICc3 … +∞), and the more remote the curve is from the coordinate origin it represents a higher utility level (U [ICc1] < U[ICc2] < U[ICc3], etc.). Consequently, combination B (on ICc3) generates more utility than any of the combinations represented by C, D, and A (on ICc2). Based on the same principle, one could construct the indifference curves for every consumer in distance sales.[21] Nevertheless, it is not necessary to fully reveal consumers’ risk preferences. The fact that consumers are rational (know their preferences and aim at maximizing utility) and that sellers have expressed their preferences (under the risk allocation rules) is enough to enable a Pareto improvement, i.e., more efficient allocation of resources through the exchange by concluding a distance sales contract. One could present that graphically by constructing the Edgeworth box based on Figures 1 and 2.

Figure 3 or Edgeworth Box consists of Figure 2 overlapping Figure 1 and then rotating for 180°. In this way, one could simultaneously observe sellers’ and consumers’ risk preferences. In this case, if a seller would offer one price/cooling-off period combination (which is currently the case under the EU law), for instance, combination A, a consumer would be on his second indifference curve (ICc2 – medium utility level), and a seller would be on the first indifference curve (ICs1 – low utility level). However, if the risk allocation rules oblige the seller to offer complementary price/cooling-off period ratios, following their risk preferences (B and C), that could create room for a Pareto improvement or more efficient allocation of resources. In this case, a consumer might opt for the price/cooling-off period combination B and thus switch from the second (ICc2 – medium utility level) to the third indifference curve (ICc3 – high utility level), while the seller would remain in the same indifference curve (ICs1 – low utility level). In other words, under the risk allocation rules, a consumer may significantly increase their level of utility without decreasing seller’s utility.

Price and cooling-off period Pareto improvement. Source: Authors.

2.5 Risk (Re)Allocation

Besides increasing the utility and, thus, the overall contractual surplus, the suggested rules reallocate the risk and create better incentives for the contracting parties. In our hypothetical example, when opting for combination B instead of A, consumers take more risk because they will have a shorter cooling-off period and less time to reduce the information asymmetry and use the withdrawal right. Moreover, they are adequately compensated for that by the reduction in price. In other words, in combination A, the consumer values more additional increase in risk (shortening of the cooling-off period) than the seller values the decrease. In that case, it is more efficient for contracting parties to opt for B because they take the risk in line with their preferences, and the room for moral hazard is shrinking.

When considering opportunistic behaviour, the risk allocation rules have some disadvantages since there is no guarantee that sellers will reveal their risk preferences in the first place (that they will offer the options on the same indifference curve). Namely, sellers may offer one option that shifts the risk to consumers (for instance, a medium price and short cooling-off period) and other options that are less favourable for consumers (for example, an extremely high price and a short cooling-off period, and even higher price and a short cooling-off period). In this way, sellers may behave opportunistically, avoid the risk allocation rules and pass on the risk to consumers. As above-mentioned, the same could happen with the personalised mandatory rules and the mandated-choice model because of sellers’ bargaining power. However, in the case of the risk allocation rules, one may better address this bargaining problem. When obliging sellers to offer different price/cooling-off period options to consumers, a legislator incentivizes sellers to make their risk preferences more transparent than when resorting to the personalised mandatory rules or the mandated-choice model. In this case, sellers have an incentive to reveal their risk preferences because they have to offer all the options in advance (ex-ante), before the conclusion of the contract, to all consumers, and those options are not negotiable. If a seller ex-ante decides to behave opportunistically and offer one option that shifts the risk to consumers and the other options that are even less favourable, (s)he would be significantly less competitive in the market – and eventually (s)he would be driven out of it. Therefore, consumers would go to the other sellers who fully reveal their preferences ex-ante and offer a better price/cooling-off period ratio. In addition, a legislator may reduce incentives for opportunistic behaviour by limiting the price/cooling-off period ratio through the risk allocation rules. For instance, sellers could be obliged to create at least two additional offers based on the initial one – for every new offer, a seller may increase the price up to 30 % (of the previously offered) and prolong the cooling-off period up to 30 % (of the previously offered), excluding offers without the withdrawal right. In this way, one could eliminate extreme allocation of risk between the contracting parties and reduce incentives for moral hazard and opportunistic behaviour.[22]

Finally, the most significant advantages of the risk allocation rules compared to the personalised mandatory rules and the mandated-choice model are the low transaction costs and the flexibility in their application. On one side, compared to the personalised mandatory rules, the risk allocation rules do not imply complex negotiations and the use of significant resources (algorithms, computer programs, etc.) before and during the conclusion of the contract. On the other side, compared to the mandated-choice scheme, the risk allocation rules better reveal sellers’ preferences toward risk and thus more efficiently reduce incentives for moral hazard and opportunistic behaviour. In other words, the suggested risk allocation rules take the best of both worlds, i.e., they seem to be a golden mean between the personalised mandatory rules and the mandated-choice model. Those rules offer an almost complete personalization of contracts and efficient risk allocation under low transaction costs. Thus, they reduce cross-subsidization and significantly reduce incentives for opportunistic behaviour as well as the moral hazard of contracting parties. In addition, the risk allocation rules are flexible in their application and could be used in all distance sales, regardless of the industry specificities. All the sellers have to do is offer different price/cooling-off period options, following their risk preferences and being aware of the competitive pressure and regulation in the market. That is the first and the most significant precondition for more efficient exchange and a considerable increase in the number of concluded contracts and overall contractual surplus.

Last but not least, risk allocation rules may share with the mandated-choice model the advantage of the statutory standardisation of the withdrawal right (apart from price and period differences of each available option): the content, the exercise and the legal effects of the right are to be statutorily standardised, and this trait secures the main advantages ascribed to mandatory law – that is, the reduction of transaction costs, the safety of transactions and, in particular, the foreseeability of the legal effects deriving from a contractual relationship or the eventual exercise of a right, such as the withdrawal right (see Karampatzos 2020, p. 99; Wagner 2011, pp. 39–40). Standardisation of the right also limits the ability of the seller to mask or frame their preferred option in such a way that may make it more appealing to the consumer.

3 Concluding Remarks

We have provided a model of new ‘risk allocation’ rules that could be a suitable basis for amending the withdrawal right under the CRD in the common interest of sellers and consumers. Those rules are overwhelmingly designed based on the critiques and recent findings in law and economics theory related to the personalized mandatory rules and the mandated-choice model.

Even though the personalized mandatory rules and the mandated-choice model have many advantages as potential tools for amending the withdrawal right, they have one major common disadvantage – they neglect, more or less, the allocation of the information asymmetry risk between contracting parties. Consequently, those rules, besides relatively high administrative costs (which is the case primarily for the personalized mandatory rules), create a fertile ground for opportunistic behaviour and moral hazard. That makes the exchange between contracting parties more expensive and less efficient, i.e., it reduces the total number of concluded distance sales contracts and the overall contractual surplus.

To address these issues and the inefficiencies, we suggested risk allocation rules by simultaneously considering sellers’ and consumers’ risk preferences. If properly designed, those rules can significantly reduce the room for opportunistic behaviour and moral hazard without restricting the autonomy of the contracting parties, i.e., they can enhance the efficiency level of the contracting parties and make the exchange less expensive. Moreover, those rules may reduce cross-subsidies and generate relatively lower administrative costs than the personalized mandatory rules. Consequently, the risk allocation rules can increase the number of concluded contracts and the overall contractual surplus.

The main disadvantage of those rules lies in the possibility of a seller behaving opportunistically ex-ante. We suggested two possible solutions to that problem – i.e., market competition and regulation. However, as already stressed, our approach is conceived overwhelmingly as a thought experiment; relevant empirical analysis and evidence may follow up at a subsequent phase. Finally, by publishing this paper, we are calling on researchers to (re)consider the potential of the risk allocation rules for amending the withdrawal right under the CRD in the common interest of sellers and consumers.

References

Abril Sánchez, P., Blázquez Oliva, F., and Evora Martínez, J. (2018). The right of withdrawal in consumer contracts: a comparative analysis of American and European law, InDret 3/2018. University of Miami Business School Research Paper No. 18-13.Search in Google Scholar

Bar-Gill, O. (2013). Regulatory techniques in consumer protection: a critique of European consumer contract law. Consum. Market. Law Rev. 50: 109–126.10.54648/COLA2013039Search in Google Scholar

Begović, B., Jovanović, A., and Radulović, B. (2022). Ekonomija za pravnike. Pravni fakultet Univerziteta u Beogradu, Belgrade.Search in Google Scholar

Ben-Shahar, O. and Porat, A. (2016). Personalizing negligence law. N. Y. Univ. Law Rev. 91: 627–688.Search in Google Scholar

Ben-Shahar, O. and Porat, A. (2019). Personalizing mandatory rules in contract law. Univ. Chicago Law Rev. 86: 255–282.Search in Google Scholar

Ben-Shahar, O. and Porat, A. (2021). Personalized law – different rules for different people. Oxford University Press, Oxford.10.1093/oso/9780197522813.001.0001Search in Google Scholar

Ben-Shahar, O. and Posner, E. (2011). The right to withdraw in contract law. J. Leg. Stud. 40: 115–148.10.1086/658403Search in Google Scholar

Busch, C. (2019). Implementing personalized law: personalized disclosures in consumer law and data privacy law. Univ. Chicago Law Rev. 86: 309–331.10.2139/ssrn.3181913Search in Google Scholar

Casey, A. and Niblett, A. (2017). The death of rules and standards. Indiana Law J. 92: 1401–1447.Search in Google Scholar

Đurović, 2020 Đurović, M. (2020). Adaptation of consumer law to the digital age: EU directive 2019/2161 on modernisation and better enforcement of consumer law. Ann. Facul. Law Belgr. 2: 62–79, https://doi.org/10.5937/analipfb2002062d.Search in Google Scholar

Eidenmüller, H. (2011a). Widerrufsrechte. In: Zimmermann, R., Eidenmüller, H., Faust, F., Grigoleit, H.C., Jansen, N., and Wagner, G. (Eds.), Revision des verbraucher-acquis. Mohr Siebeck, Tübingen, pp. 109–165.Search in Google Scholar

Eidenmüller, H. (2011b). Why withdrawal rights? Eur. Rev. Contract Law 7: 1–24, https://doi.org/10.1515/ercl.2011.1.Search in Google Scholar

Hacker, P. (2017). Personalizing EU private law: from disclosures to nudges and mandates. Eur. Rev. Priv. Law 3: 651–679, https://doi.org/10.54648/erpl2017040.Search in Google Scholar

Hellgardt, A. (2013). Privatautonome Modifikation der Regeln zu Abschluss, Zustandekommenund Wirksamkeit des Vertrags, Möglichkeit und Grenzen der Abdingbarkeitder §§ 116 ff., 145 ff. BGB innerhalb von Geschäftsbeziehungen und auf privatenMarktplätzen. Archiv. für Civilistische Prax. 213: 760–825.10.1628/000389914X13920224936258Search in Google Scholar

Ilic, N. (2020). Book review: private law, Nudging and behavioural economic analysis – the mandated-choice model -- Antonios Karampatzos (2020), Routledge. J. Eur. Consum. Mark. Law 9: 177–178.Search in Google Scholar

Karampatzos, A. (2020). Private law, Nudging and behavioural economic analysis – the mandated-choice model. Routledge, UK.10.4324/9781003014652Search in Google Scholar

Loos, M. (2009). Rights of withdrawal. In: Howells, G. and Schulze, R. (Eds.). Modernising and harmonising consumer contract law. De Gruyter European Law Pub, Berlin, pp. 237–278.10.2139/ssrn.1350224Search in Google Scholar

Luzak, J. (2013). To withdraw or not to withdraw? – Evaluation of the mandatory right of withdrawal in consumer distance selling contracts taking into account its behavioural effects on consumers. In: Amsterdam law school legal studies research paper No. 2013–21, 1–38, Centre for the Study of European Contract Law Working Paper No. 2013-04.10.2139/ssrn.2243645Search in Google Scholar

Luzak, J. (2021). Tailor-made consumer protection: personalisation’s impact on the granularity of consumer information. In: Corrales Compagnucci, M., Haapio, H., Hagan, M., and Doherty, M. (Eds.). Legal design: integrating business, design and legal thinking with technology. Edward Elgar Publishing, UK, pp. 105–129.10.4337/9781839107269.00013Search in Google Scholar

Porat, A. and Strahilevitz, L.J. (2014). Personalizing default rules and disclosure with big data. Mich. Law Rev. 112: 1417–1478.10.2139/ssrn.2217064Search in Google Scholar

Ranchordás, S. (2018). Online reputation and the regulation of information asymmetries in the platform economy. Crit. Anal. Law 5: 127–147, https://doi.org/10.33137/cal.v5i1.29508.Search in Google Scholar

Sunstein, C. (2013). Impersonal default rules vs. active choices vs. personalized default rules: a triptych, Available at: <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2171343>.10.2139/ssrn.2171343Search in Google Scholar

Varian, H.R. (2014). Intermediate microeconomics: a modern approach. W.W. Norton & Co, New York.Search in Google Scholar

Verstein, A. (2019). Privatizing personalized law. Univ. Chicago Law Rev. 86: 551–580.10.2139/ssrn.3206834Search in Google Scholar

Wagner, G. (2011). Mandatory contract law: functions and principles in light of the proposal for a directive on consumer rights. In: Ogus and van Boom (Eds.). Juxtaposing autonomy and Paternalism in private law. Hart Publishing, UK, pp. 34–78.Search in Google Scholar

Zöchnling-Jud, B. (2012). Acquis-Revision, Common European Sales Law und Verbraucherrechterichtlinie. Arch. für Civilistische Prax. 212: 550–574.10.1628/000389912803571158Search in Google Scholar

© 2023 the author(s), published by De Gruyter, Berlin/Boston

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- Frontmatter

- Articles

- Expressive Law and Escalating Penalties: Accounting for the Educational Function of Punishment

- Do US State Breach Notification Laws Decrease Firm Data Breaches?

- Dark Web Drug Markets and Cartel Crime

- Intermittent Collusive Agreements: Antitrust Policy and Business Cycles

- Anonymity and Online Search: Measuring the Privacy Impact Of Google’s 2012 Privacy Policy Change

- Law and Economics of the Withdrawal Right in EU Consumer Law

Articles in the same Issue

- Frontmatter

- Articles

- Expressive Law and Escalating Penalties: Accounting for the Educational Function of Punishment

- Do US State Breach Notification Laws Decrease Firm Data Breaches?

- Dark Web Drug Markets and Cartel Crime

- Intermittent Collusive Agreements: Antitrust Policy and Business Cycles

- Anonymity and Online Search: Measuring the Privacy Impact Of Google’s 2012 Privacy Policy Change

- Law and Economics of the Withdrawal Right in EU Consumer Law