Abstract

This study examines the complex relationship between cultural diversity and entrepreneurial intentions. While some scholars argue that cultural diversity fosters entrepreneurship, others contend it creates social barriers. We aim to reconcile these views by exploring how different dimensions of cultural diversity – ethnic, linguistic, and religious – affect entrepreneurial intentions across countries, and how these effects depend on levels of inequality. We use data from the Global Entrepreneurship Monitor combined with macro-level indicators of inequality and diversity. The results show that ethnic and religious diversity are associated to higher entrepreneurial intentions in more equal societies but to lower intentions in highly unequal ones. Linguistic diversity shows the opposite trend. These results suggest that the impact of diversity depends on a country’s level of inequality. The findings highlight the need to consider cultural heterogeneity and structural conditionstogether when analyzing entrepreneurship across nations

1 Introduction

Scholars have long sought to understand the factors that shape individuals’ entrepreneurial intentions, which are key cognitive precursors to entrepreneurial action (Krueger et al. 2000; Moriano et al. 2012). While existing research has explored various factors, including individual personality traits (De Pillis and Reardon 2007), social capital (Fayolle and Gailly 2015), access to financial resources (Nakara et al. 2021), and policy regulation (Lüthje and Franke 2003), the role of cultural diversity in influencing entrepreneurial intentions remains underexamined and theoretically fragmented.

Cultural diversity refers to the variety of cultural elements that coexist within a society and define group boundaries encompassing differences in ethnicity, language, and religion (Wimmer 2008a). This diversity has significant and varied implications for individuals’ entrepreneurial intentions by influencing how they access knowledge, resources, and networks (Audretsch et al. 2022). However, despite growing scholarly interest in the intersection of culture and entrepreneurship (e.g., Bogatyreva et al. 2019; Liñán and Chen 2009), much of this work has approached culture as a broad, homogeneous construct, relying on single-dimensional perspectives such as Hofstede’s (2001) cultural dimensions (e.g., individualism vs. collectivism, power distance). While these approaches have advanced cross-cultural understanding, they often oversimplify the complexity of cultural diversity, which is inherently multifaceted and context-dependent. As a result, they fail to capture how different forms of diversity, such as ethnic, linguistic, and religious heterogeneity, shape entrepreneurial intentions in different and sometimes opposing ways (Moriano et al. 2012; Nikolova and Simroth 2015; Bogatyreva et al. 2019).

This conceptual flattening has led to inconsistent and often contradictory empirical findings. Some studies suggest that cultural diversity enhances opportunity recognition and entrepreneurial activity by fostering cross-cultural knowledge spillovers and innovation (Audretsch et al. 2010, 2022; Smallbone et al. 2010). Others highlight its potential downsides and suggest that cultural diversity introduces communication barriers, mistrust, or social tension that limit knowledge spillovers and cooperation (Nikolova and Simroth 2015). These inconsistencies point to an overlooked theoretical gap: cultural diversity does not operate in a vacuum, and its effects are likely contingent on broader structural conditions (Audretsch et al. 2022) and a region’s “absorptive capacity” (Rodríguez-Pose and Hardy 2015). In particular, societal inequality may determine whether diversity catalyzes entrepreneurial engagement, imposes constraints, or redirects entrepreneurial activity into segmented markets (Smallbone and Welter 2012). Yet few studies have systematically investigated how structural moderators shape the relationship between different forms of diversity and entrepreneurial intentions. This raises a central and unresolved question: Under what conditions, and through which forms, does cultural diversity foster, hinder, or redirect entrepreneurial intentions?

To fill the research gaps, our study examines how ethnic, linguistic, and religious diversity shape individuals’ entrepreneurial intentions across various societal settings while also considering the moderating role of income inequality (Fayolle and Liñán 2014; Smallbone and Welter 2012; Zahra and Wright 2012). We develop an integrative framework that combines Institutional Theory and the Knowledge Spillover Theory of Entrepreneurship (KSTE) to explain how macro-level structural conditions shape the translation of cultural diversity into entrepreneurial intentions. Institutional Theory highlights how formal and informal rules govern access to opportunities, while KSTE emphasizes the role of knowledge flows in enabling opportunity recognition. We integrate these perspectives by proposing that knowledge spillovers are not automatic or evenly distributed; rather, they are filtered through institutional structures that determine who can access and benefit from entrepreneurial knowledge (Qian and Acs 2013).

In this framework, we propose three context-dependent mechanisms that explain how cultural diversity is translated into entrepreneurial intentions depending on the inclusiveness or stratification of institutional environments. This perspective allows us to move beyond static or uniform assumptions about cultural diversity and to examine how institutional contexts foster, suppress, or redirect entrepreneurial engagement (Audretsch et al. 2021; Angulo-Guerrero et al. 2017; Liñán et al. 2013). To empirically test our hypotheses, we analyzed data from the 2017 Global Entrepreneurship Monitor vis-à-vis macro-level indicators of cultural diversity and income inequality. Our findings show that, in line with our hypotheses, cultural diversity is a significant determinant of individuals’ entrepreneurial intentions, with distinct effects emerging from its different dimensions. Moreover, our findings reveal that income inequality within a society plays a significant role in shaping these relationships, which conciliates opposing views found in the literature.

1.1 Entrepreneurship and Entrepreneurial Intentions

Starting up new businesses has been well documented to positively impact a country’s economic and social development: it generates employment opportunities, brings innovation, and enhances the efficiency of various economic sectors (e.g., George et al. 2012). At its core, entrepreneurship involves the identification and pursuit of opportunities, often shaped by broader socio-economic, institutional, and cultural contexts. Opportunity recognition is a crucial cognitive process that precedes entrepreneurial action, as individuals assess the feasibility and desirability of starting a new venture within their specific environment (Krueger et al. 2000). This formative stage is influenced not only by personal attributes and risk perceptions but also by external conditions such as market dynamics, institutional access, and social structures (Audretsch et al. 2021).

Entrepreneurial intention, defined as individuals’ willingness to become entrepreneurs (Bogatyreva et al. 2019), is widely recognized as the most immediate psychological antecedent of entrepreneurial behavior. Bird (1988) was among the first to conceptualize entrepreneurship as an intentional process, arguing that intentions provide a more reliable predictor of entrepreneurial action than attitudes alone. Building on this foundation, Krueger and Carsrud (1993) explicitly applied Ajzen’s (1991) Theory of Planned Behavior (TPB) to entrepreneurship, emphasizing that perceptions of feasibility and desirability shape the formation of entrepreneurial intentions. Kolvereid (1996) provided one of the earliest empirical validations of this approach, showing that TPB variables significantly predict entrepreneurial career choices. Together, these studies established the “intentions turn” in entrepreneurship research and paved the way for subsequent refinements and extensions (e.g., Liñán and Chen 2009; Fayolle and Liñán 2014). They underscore why intentions, rather than realized start-ups, are the most analytically useful measure for cross-national comparisons of entrepreneurship.

Building on this foundation, subsequent work has examined complementary factors such as personality traits (De Pillis and Reardon 2007), entrepreneurship education (Fayolle and Gailly 2015; Liñán and Fayolle 2015), and multicultural exposure (Dheer and Lenartowicz 2018). Collectively, this body of work underscores the robustness of TPB in explaining the proximal, individual-level determinants of entrepreneurial intentions.

At the same time, intentions are not formed in isolation. They serve as a cognitive lens through which individuals evaluate their environment for potential opportunities (Krueger et al. 2000; Dheer and Lenartowicz 2018). Because intentions are shaped by how individuals perceive the feasibility and desirability of starting a business (Ajzen 1991), they are particularly sensitive to institutional conditions such as legal protections, access to financial systems, and perceived fairness in opportunity distribution. Institutions, in this sense, fundamentally shape not only whether individuals believe they can pursue, but also whether they believe they should.

This recognition creates an important pivot for our study. While TPB and related research illuminate how individual cognition drives intentions, they offer limited insight into why entire populations differ systematically across nations. The missing link is the macro-level institutional environment, which shapes how individuals collectively perceive opportunities and constraints. We argue that cultural diversity and income inequality are key structural conditions that filter and shape entrepreneurial intentions across societies.

1.2 Cultural Diversity and Entrepreneurial Intentions

Entrepreneurial processes and activities always occur within a culture and are inherently shaped by culture (Hayton et al. 2002). Shared beliefs, practices, and meanings both affect and are affected by entrepreneurship. Previous studies have shown that shared beliefs and values can legitimize entrepreneurship and cultivate pro-entrepreneurial traits within a population (Mueller and Thomas 2001; Thurik and Dejardin 2011). While national culture provides a foundational context, recent scholarship has shifted focus to the dynamic effects of cultural diversity as a key driver of entrepreneurial activity.

An important contribution by Audretsch et al (2010) demonstrated that regional cultural diversity stimulates entrepreneurship by fostering a richer exchange of ideas and perspectives. This cross-cultural interaction generates novel knowledge spillovers, enabling individuals to identify and exploit new opportunities. In this view, diversity is a direct and positive input into the entrepreneurial ecosystem.

Building on this, subsequent literature suggests that the effects of diversity are not monolithic but operate through multiple, different mechanisms. Nathan and Lee (2013), for example, in their study of London’s high-tech and creative industries, found that generalized “super-diversity” was beneficial for innovation, while specific migrant concentrations were linked to different entrepreneurial outcomes. Similarly, Audretsch et al. (2021) have analyzed the effect of city diversity on entrepreneurship, suggesting that a city’s varied knowledge and skills base can significantly stimulate entrepreneurial activity. Moreover, studies have found that ethnic diversity fosters transnational entrepreneurship, which enables knowledge exchange and access to global markets (Mickiewicz et al. 2019). By contrast, Galbraith and Benitez-Galbraith (2009) link linguistic diversity to segmented market niches, and Nikolova and Simroth (2015) highlight how religious diversity affects legitimacy and institutional trust.

Crucially, these effects are contingent on institutional context. Rodríguez-Pose and Hardy (2015) demonstrated this by showing that diversity’s positive impact on entrepreneurship in the US only materialized in regions with high human capital and strong local institutions capable of absorbing and leveraging new ideas. In weaker institutional settings, diversity led instead to fragmentation. This echoes Cohen and Levinthal’s (1990) concept of absorptive capacity that diversity alone is insufficient without institutional conditions that enable knowledge diffusion.

Together, this literature thus presents an unresolved theoretical paradox. On one hand, theories of knowledge spillover suggest diversity should be an engine of entrepreneurship (Audretsch and Belitski 2013; Ghio et al. 2015). On the other hand, a growing body of research highlights the potential for social friction, where diversity can erode trust, lead to group tensions, and hinder cooperation that supports a healthy entrepreneurial environment (Putnam 2007; Sobel et al. 2010). However, existing research on entrepreneurship often treats diversity as an isolated variable or assumes its effects are uniform, thereby failing to systematically explain why it appears to be enabling in some contexts but constraining in others (Bogatyreva et al. 2019).

The key question, therefore, is not whether diversity is “good” or “bad” for entrepreneurship, but rather under what institutional conditions one mechanism prevails over the other. Our study addresses this gap directly. We propose that cultural diversity should be understood as a socially embedded phenomenon shaped by foundational institutional structures (North 1990; Wimmer 2008b). We argue that societal income inequality is a critical, yet under-examined, institutional feature that determines whether diversity acts as an engine of opportunity or a source of fragmentation.

1.3 Institutional Theory, Knowledge Spillovers, and the Conditional Effects of Cultural Diversity on Entrepreneurial Intentions

Entrepreneurial intentions emerge from a complex interplay between individual cognition and contextual influences. While cultural diversity has been widely recognized as both an enabler and inhibitor of entrepreneurship, prior research lacks a unified framework that reconciles these conflicting perspectives (Acs et al. 2009). To address this gap, we propose an integrative framework that combines Institutional Theory and the Knowledge Spillover Theory of Entrepreneurship (KSTE) to account for the institutional conditions under which diversity fosters, constrains, or redirects entrepreneurial engagement.

KSTE offers a micro-meso perspective to explain how knowledge spillovers foster opportunity recognition and increase perceived feasibility (Acs et al. 2009). From this perspective, diversity expands the pool of ideas, thus potentially enhancing the opportunity space for entrepreneurship. Yet, as institutional theorists argue, knowledge spillovers are never automatic. They are filtered through the broader rules, norms, and structures that regulate access to resources and shape perceptions of feasibility and desirability (North 1990; Welter and Smallbone 2011). Institutions thus determine not only whether diverse knowledge becomes visible, but also who is able to translate it into entrepreneurial action (Qian and Acs 2013).

Within this institutional landscape, we focus on income inequality as a particularly consequential condition. Inequality can shape whether cultural diversity translates into broad-based opportunity or fragmented market enclaves. In highly unequal societies, resources and legitimacy tend to be concentrated among privileged groups, thereby restricting cross-group spillovers and reducing perceived entrepreneurship feasibility among marginalized populations (Stiglitz 2012; Wilkinson and Pickett 2009). Conversely, in more egalitarian contexts, opportunities tend to be more evenly distributed, enabling diverse individuals to collaborate and recognize entrepreneurial possibilities across group boundaries (Sobel et al. 2010).

At the same time, we acknowledge that the relationship between societal equality and entrepreneurship is not linear. Greater equality does not always automatically foster entrepreneurship, as redistribution, taxation, and regulation may raise bureaucratic costs or weaken incentives for venture creation (Djankov et al. 2010; Henrekson and Johansson 2010). Likewise, inequality does not always suppress entrepreneurship; in some contexts it may stimulate necessity-driven entrepreneurship among disadvantaged groups or motivates ambitious ventures through competition and status-seeking (Banerjee and Newman 1993; Acs et al. 2009).

To explain these divergent outcomes, we identify three pathways through which inequality conditions the effects of cultural diversity on entrepreneurial intentions. These pathways are not mutually exclusive but highlight the institutional processes that channel how diversity translates into entrepreneurship:

Opportunity pathway: In inclusive settings, egalitarian institutions amplify the benefits of diversity by fostering collaboration and knowledge exchange across groups. In such contexts, diverse knowledge pools are more accessible, and spillovers are more likely to result in broad-based entrepreneurial opportunities. For instance, Kibler et al. (2017) show how inclusive institutional cultures in Finland support opportunity-driven ventures among immigrants.

Constraint pathway: In exclusionary settings, inequality restrict participation by erecting structural barriers, such as regulatory bias or exclusion from formal networks that suppress the entrepreneurial potential of underrepresented communities. In such contexts, the flow of entrepreneurial knowledge may become highly uneven. Knowledge spillovers may exist, but they are not equally accessible. Instead, they are filtered and restricted through institutional boundaries. For instance, Ram and colleagues (2013) documented how migrant entrepreneurs in the UK often struggled with mainstream business support due to institutional insensitivity.

Segmentation pathway: In stratified contexts, diversity may become channeled into enclave entrepreneurship, where groups pursue ventures that serve culturally homogeneous markets. Such settings encourage localized spillovers and niche innovations but limit cross-group learning and broader entrepreneurial dynamism. As Dheer and Lenartowicz (2018) and Kloosterman (2010) show, minority entrepreneurs often concentrate in culturally specific services such as halal food, language tutoring, or community-based transport.

By embedding KSTE within this refined institutional framework, we thus move beyond simplistic “good vs. bad” arguments of diversity. We theorize that the effects of cultural diversity on entrepreneurial intentions are conditional and context-dependent, shaped by how inequality structures social cohesion, trust, and access to opportunities. This approach reconciles conflicting findings in the literature and explains why diversity can sometimes foster entrepreneurship, sometimes hinder it, and at other times redirect it into segmented paths.

2 Hypotheses

Our integrative framework posits that the effect of cultural diversity on entrepreneurial intentions is conditional on societal inequality, which determines whether diversity acts as a source of opportunity, constraint, or market segmentation. We develop our hypotheses by first considering the primary pathway for each dimension of diversity, including ethnic, religious, and linguistic diversity, and then introducing inequality as the critical moderator that shapes the final outcome.

The primary channel through which ethnic diversity is proposed to foster entrepreneurship is through knowledge spillovers and network expansion. As individuals from different ethnic backgrounds interact, they are exposed to a broader range of novel ideas, market needs, and heterogeneous networks, which expand their perceived feasibility and desirability of entrepreneurship (Audretsch et al. 2010; Nathan and Lee 2013). While social friction can be a factor, the most direct effect is an expansion of opportunities enabled by cross-cultural learning. Based on this primary “opportunity” pathway, we first hypothesize a positive main effect:

Hypothesis 1: The higher the ethnic diversity, the higher the entrepreneurial intentions.

The primary boundary for religious diversity, in contrast, is institutional and value-based. It is defined by competing worldviews and formalized social norms that can heighten the potential for friction and mistrust across different religious groups (Baldwin and Huber 2010; Nikolova and Simroth 2015). We argue that this “constraint” pathway of social friction is likely to be the dominant average effect, as religious boundaries are often deeply institutionalized, thereby creating strong barriers to the cross-group cooperation necessary for entrepreneurship. Therefore, we hypothesize:

Hypothesis 2: The higher the religious diversity, the lower the entrepreneurial intentions.

A third type of cultural diversity is linguistic diversity. The boundary for linguistic diversity is fundamentally practical and operational. Before knowledge can be shared or values can clash, individuals must first be able to communicate. Linguistic diversity’s primary pathway relates to communication costs and market access. While a diversity of languages can be a societal asset for international trade (Smallbone et al. 2010), at the individual level it creates direct, practical barriers. High linguistic diversity increases the communication and coordination costs required to build teams, negotiate with suppliers, and reach customers. This can hinder knowledge spillovers and reduce the perceived feasibility of starting a business (Dale-Olsen and Finseraas 2020). We expect this direct, operational “constraint” to be the dominant main effect and thus posit:

Hypothesis 3: The higher the linguistic diversity, the lower the entrepreneurial intentions.

These different default pathways can be reinforced or reshaped by the broader institutional context. Our framework posits that societal income inequality is an important institutional variable that not only directly impacts entrepreneurship but, more importantly, fundamentally shapes the context in which cultural diversity operates.

First, a large body of literature establishes a direct, negative relationship between inequality and entrepreneurship. Economically, high inequality concentrates resources and political power, leading to underinvestment in public goods and restricting opportunities for the broader population (Piketty and Saez 2003; Stiglitz 2012). Socially, it erodes the social cohesion and trust that are important to a vibrant civil society (Wilkinson and Pickett 2009; Van de Werfhorst and Salverda 2012). By creating systemic barriers and reducing both the means and the motivation for new venture creation across the board, high inequality is expected to lower entrepreneurial intentions overall. Thus, we propose:

Hypothesis 4: the higher the income inequality in society, the lower the entrepreneurial intentions.

Beyond this direct effect, our central argument is that inequality shapes which of our three identified pathways (i.e. opportunity, constraint, and segmentation) prevails for different forms of diversity. As Wilkinson (1999 p. 526) pointed out, income inequality is “strongly and systematically related to the character of social relations and the nature of the social environment in a society”. Hence, how a society translates cultural diversity into a positive outcome may be a function of its social relationships, with inequalities playing a major role.

In low-inequality, egalitarian societies, inclusive institutions foster trust and collaboration and thus amplifies the default opportunity pathway of ethnic diversity. For religious diversity, we argue that inclusive institutions can override its default constraint pathway by bridging social divides and allowing positive knowledge-spillover opportunities to emerge (Sobel et al. 2010; Uslaner 2008;). Conversely, in high-inequality, stratified societies, the context of high friction and mistrust overrides any potential benefits for both ethnic and religious diversity, making the constraint pathway dominant (Churchill 2016). In such settings, institutional gatekeeping mechanisms concentrate knowledge spillovers within privileged groups which may limit the broader entrepreneurial potential of diversity. When institutions fail to provide inclusive access to financial, legal, and educational resources, individuals from diverse backgrounds may struggle to leverage diversity-driven knowledge spillovers, leading to lower entrepreneurial intentions (Churchill 2016; McPherson et al. 2003).

However, inequality activates the segmentation pathway for linguistic diversity. In societies with persistent inequality and are highly stratified, cultural groups are more likely to turn inward, fostering distinct entrepreneurial enclaves that operate independently from mainstream institutions (Audretsch et al. 2022). Within these sheltered market ecosystems, a shared language becomes a crucial asset for reducing transaction costs and serving a niche co-ethnic or co-linguistic community (Kloosterman 2010; Yurko 2011), as institutions and market structures reinforce within-group transactions rather than facilitate cross-group collaboration (Ghosh 2019). While in more egalitarian, integrated societies, such enclaves are weaker, as language differences remain a direct constraint. This leads to our central moderation hypothesis:

Hypothesis 5: The effects of cultural diversity on entrepreneurial intentions are moderated by the degree of income inequality in society, such that:

5a : The effects of ethnic and religious diversity are positive in low-inequality societies and negative in high-inequality societies.

5b : The effect of linguistic diversity is negative in low-inequality societies and positive in high-inequality societies.

3 Data and Methods

3.1 Data

Our data was extracted from the 2017 Global Entrepreneurship Monitor (GEM),[1] which is a cross-national survey that explores individuals’ entrepreneurial behaviors and attitudes since the year 1999. Samples in each country are probabilistic, nationally representative, and ensure a minimum of 2000 adults in each society. The total sample comprises 174,128 respondents from 54 countries.[2] Data was collected through landline telephone for countries with coverage greater than 85 % of all households. For countries with lower coverage, face-to-face interviews and/or mobile phones were used instead. After a listwise deletion and ensuring complete country and individual-level data for all the observations, the analytical sample ultimately included 149,742 individuals from 50 countries. Countries were heterogeneous in terms of geographical location, political institutions, and economic development. Analytical samples by country are reported in Table 3S. All the analyses were weighted using the country-specific weight provided by GEM as part of the harmonization process.

3.2 Dependent Variable

Entrepreneurial intentions. Individuals were asked: “Are you, alone or with others, expecting to start a new business, including any type of self-employment, within the next three years?”. Responses were coded in a binary indicator, with 0 representing “No”, and 1 representing “Yes”.

3.3 Independent Variables

We analyzed three dimensions of cultural diversity: ethnic diversity, linguistic diversity, and religious diversity based on the indices of cultural fractionalization proposed by Alesina et al. (2003). Fractionalization is the probability that two randomly drawn individuals from the country’s population do not come from the same ethnic, religious, or linguistic group. The indices range from 0 (the entire population is homogeneous in the criteria) to 1 (the population is divided into two or more unrelated groups of the criteria). These indices have been widely used in economics to study cultural diversity since its publication. A recent historical extension of the index has shown that countries are likely to exhibit changes in ethnic diversity from 1945 to 2013 (Dražanová 2020). However, the same descriptive data suggest that the changes in two decades are rather small, and the cultural diversity in a country can be considered as invariant in the analyzed timespan. Moreover, a Pearson’s correlation between our ethnic diversity index and the score for 2012–2013 provided by Dražanová (2020) is high (ρ = 0.84), which indicates that it is appropriate to use as our indicator herein.

3.4 Covariates

The central macro-level predictor is the level of income inequality of the country. We used the 2017 GINI index as reported by the World Bank. Moreover, following the literature, several individual and country-level control variables were accounted for in the models. We included gender, age, and a harmonized 7-categories indicator of educational level to address the effect of sociodemographic characteristics on entrepreneurship (Barrientos Oradini et al. 2022).

For macro-level characteristics, models were controlled for GDP per capita, life expectancy, proportion of the urban population, V-Dem Index, the 10 Economic Freedom Subindexes, Easy of Doing Business Index, and self-employment rate. V-Dem Index measures the qualities of the democracy regarding elections, principles and practices of liberal democracies (V-Dem Institute 2021). The 10 Economic Freedom Subindexes created by the Heritage Foundation (2025) measure the right of every human to control his or her own labor and property. They include financial freedom, government integrity, freedom from government, investment freedom, labor freedom, monetary freedom, property rights, tax burden, and business freedom. The World Bank’s Easy of Doing Business Index (2017) refers to the regulatory environment and procedures that affect how easy or difficult it is to start and operate a business in a particular location. Self-employment rate is the percentage of jobs where the remuneration is directly dependent upon the profits derived from the goods and services produced (The World Bank 2025). These macroscopic conditions could be related to socioeconomic inequalities and entrepreneurial intentions (e.g., Bjørnskov and Foss 2008; Galindo and Méndez 2014) and, therefore, potential confounders. Thus, the effects of diversity and inequality could be interpreted as net effects of other structural characteristics of the country. All measured for the year 2017.

3.5 Analytical Strategy

Logistic regression models were applied in our analysis, considering that our dependent variable is a binary indicator of entrepreneurial intentions. Unlike linear models, homoscedasticity is not an assumption in logistic regression, which often occurs in cross-national data.2 The estimation of models is stepwise, with a baseline model considering the three indicators of cultural diversity. Control variables were incorporated in blocks in the five subsequent models. The equation below describes our model after control variables were incorporated in blocks in the five subsequent models:

The probability p of individual i in country c having entrepreneurial intentions is modelled as a function of country-level cultural diversity and income inequality. Specifically, the model includes three indicators of cultural diversity at the country level: ethnic (

All the models include region-fixed effects to capture shared characteristics across those regions. This regional grouping reflects meaningful cultural, economic, and institutional commonalities within each category, allowing for more precise control of contextual effects than broader continental classifications. Countries were categorized into seven groups: Western Europe; Eastern Europe; Asia Pacific; Western, Central, and South Asia; North and Central America; South America; and Africa (see Table 3S in the supplementary material for classification into regions). All models include robust standard errors and population weights provided by GEM. We also estimated equivalent linear probability models reported in Table 1S of the supplementary material, and results are consistent.

4 Results

4.1 Descriptive Statistics

Table 1 reports the descriptive statistics of the variables used in the analyses. The key variable of the study is entrepreneurial intention. One-fifth of respondents expect to start-up in the next 3 years. For covariates, half of the sample are females. On average, the respondents were 42 years old, with a third of them (32 %) having completed upper secondary education.

Descriptive statistics.

| Variables | Mean | SD | n | Min | Max |

|---|---|---|---|---|---|

| Individual-levela | |||||

| Entrepreneurial intentions | 0.21 | 0.41 | 149,742 | 0 | 1 |

| Female | 0.5 | 0.5 | 149,742 | 0 | 1 |

| Age | 41.58 | 14.93 | 149,742 | 18 | 99 |

| Pre-primary education | 0.03 | 0.16 | 149,742 | 0 | 1 |

| Primary education or first stage of bas | 0.1 | 0.29 | 149,742 | 0 | 1 |

| (Lower) secondary education | 0.17 | 0.38 | 149,742 | 0 | 1 |

| (Upper) secondary education | 0.32 | 0.47 | 149,742 | 0 | 1 |

| Post-secondary non-tertiary education | 0.13 | 0.34 | 149,742 | 0 | 1 |

| First stage of tertiary education | 0.23 | 0.42 | 149,742 | 0 | 1 |

| Second stage of tertiary education | 0.02 | 0.16 | 149,742 | 0 | 1 |

| Country-level | |||||

| Ethnic diversity | 0.38 | 0.24 | 50 | 0 | 1 |

| Linguistic diversity | 0.33 | 0.26 | 50 | 0 | 1 |

| Religious diversity | 0.42 | 0.23 | 50 | 0 | 1 |

| GINIb | 0.06 | 7.52 | 50 | −13 | 26 |

| GDPb | −742.88 | 23,293.39 | 50 | −24,223 | 85,183 |

| Life expectancy, age 1–4 yearsb | −0.02 | 4.21 | 50 | −12 | 6 |

| Urban populationb | −1.32 | 16.28 | 50 | −38 | 23 |

| Variates of democracy indexb | 0.02 | 0.23 | 50 | 0 | 0 |

| Financial freedomb | 0.2 | 16.3 | 50 | −49.6 | 30.4 |

| Government integrityb | −0.4 | 19.0 | 50 | −26.6 | 33.4 |

| Freedom from governmentb | −0.8 | 23.9 | 50 | −58.4 | 35.9 |

| Investment freedomb | 0.7 | 21.0 | 50 | −65.3 | 29.7 |

| Labor freedomb | −0.3 | 12.3 | 50 | −25.3 | 31.8 |

| Monetary freedomb | 0.1 | 8.6 | 50 | −33.9 | 9.9 |

| Property rightsb | −0.2 | 26.2 | 50 | −44.8 | 35.2 |

| Tax burdenb | −1.0 | 11.6 | 50 | −30.4 | 20.2 |

| Trade freedomb | 0.0 | 7.3 | 50 | −27.5 | 7.9 |

| Business freedomb | −0.4 | 11.3 | 50 | −24.7 | 19.1 |

| Easy of doing businessb | 0.2 | 9.4 | 50 | −27.7 | 13.7 |

| Self-employment rateb | 1.5 | 18.4 | 50 | −22.4 | 63.4 |

| Western Europe | 0.2 | 0.4 | 50 | 0 | 1 |

| Eastern Europe | 0.2 | 0.4 | 50 | 0 | 1 |

| Asia Pacific | 0.16 | 0.37 | 50 | 0 | 1 |

| Western Asia, central Asia, South Asia | 0.12 | 0.33 | 50 | 0 | 1 |

| North and central America | 0.1 | 0.3 | 50 | 0 | 1 |

| South America | 0.14 | 0.35 | 50 | 0 | 1 |

| Africa | 0.08 | 0.27 | 50 | 0 | 1 |

-

aWeighted statistics. bMean-centered variables.

In addition, the descriptive statistics of several country-level indicators are included in Table 1 to provide information about the countries included in the sample. For the key indicators of cultural diversity, the average ethnic, linguistic, and religious diversities are 0.38, 0.33, and 0.42, respectively. The sample of countries exhibits a high level of variability, as suggested by the standard deviation. The remaining variables also indicate a high level of heterogeneity in terms of macro-level features of the sample countries.

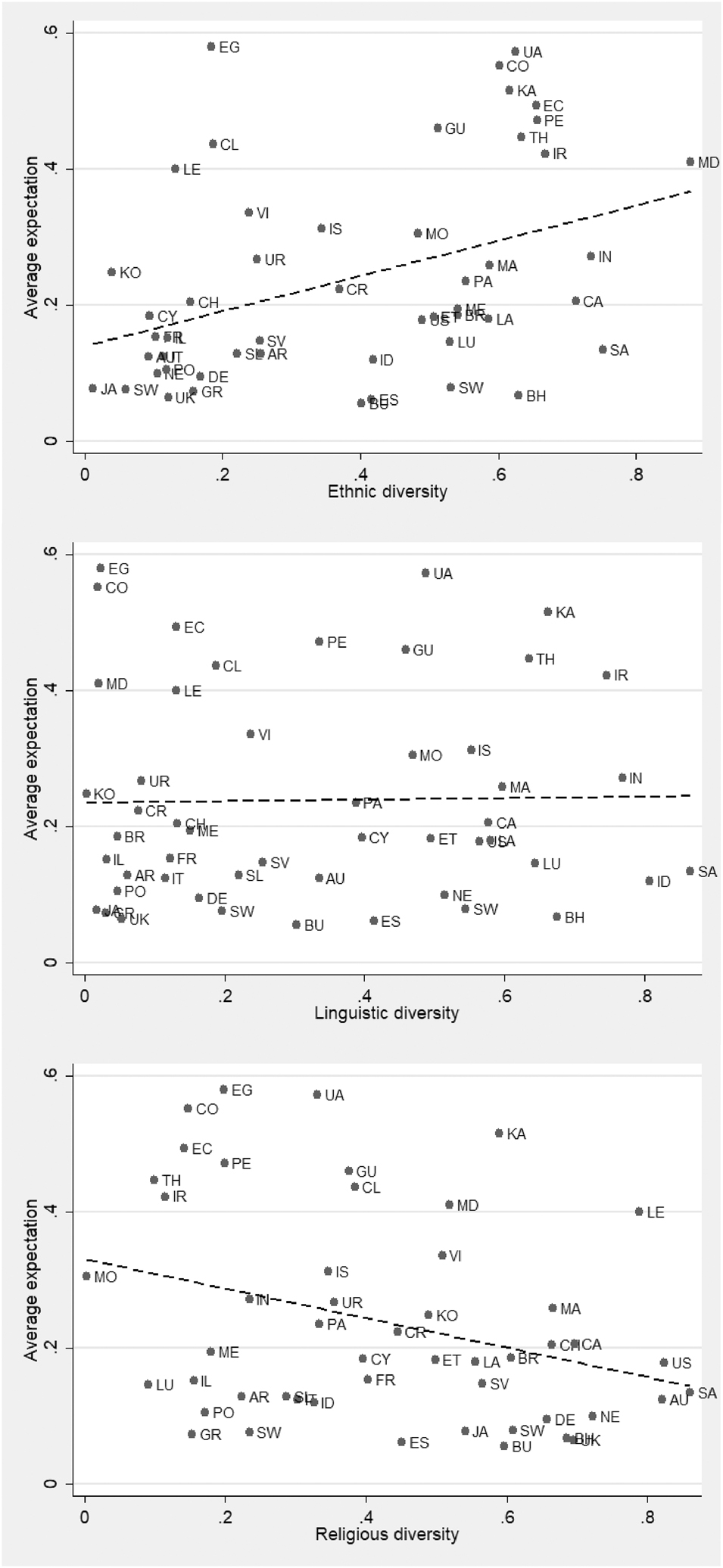

The first step in testing our hypotheses is to examine the binary relationship between cultural diversity indicators and the average entrepreneurial intentions at the country level. As shown in Figure 1, ethnic diversity positively correlates with the average level of entrepreneurial intentions, while the relationship is negative with religious diversity. In the case of linguistic diversity, the bivariate analysis indicates no association between both variables. Although informative, these analyses do not consider covariates or the correlation between the diversity indicators. The following section incorporates those model specifications into the analyses. However, the plots are useful in identifying potential outliers that could affect the results. Therefore, the next section also includes analyses of influential cases as robustness checks.

Binary relationship between cultural diversity indicators and average entrepreneurial intentions.

4.2 Multivariate Analyses

The multivariate analyses enable accounting for different sources of heterogeneity of the results. Table 2 reports a stepwise analysis of the cultural diversity effect on entrepreneurial intentions, with a net of other individual-level variables and country-level indicators. The average VIF value for the diversity measures used as predictors is 1.47, ranging from 1.05 for religious diversity to 1.68 for ethnic diversity. All values are well below conventional thresholds for multicollinearity.[3] Model 1 includes the three indicators of cultural diversity simultaneously with region-fixed effects, but without control variables.[4] The positive relationship between ethnic diversity and intentions (B = 0.86, p < 0.001) is confirmed, along with the negative effect of religious diversity (B = −0.73, p < 0.001). Moreover, there exists a negative effect of linguistic diversity (B = −0.75, p < 0.001) that is not suggested by the binary relationship. Results are consistent when other individual-level indicators (Model 2), GINI (Model 3), development (Model 4), quality of democracy (Model 5), and other economic indicators (Model 6) are incorporated. On average, hypotheses 1, 2, and 3 are all supported. Moreover, there is a negative and significant effect of GINI across models, which is consistent with hypothesis 4: the higher the level of income inequality the lower the entrepreneurial intentions.

Logistic regressions of entrepreneurial intentions on cultural diversity.

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 |

|---|---|---|---|---|---|---|---|

| B | B | B | B | B | B | B | |

| Ethnic diversity | 0.86*** | 0.87*** | 1.09*** | 1.10*** | 0.56*** | 0.65*** | 1.02*** |

| (0.05) | (0.06) | (0.06) | (0.06) | (0.07) | (0.10) | (0.11) | |

| Linguistic diversity | −0.73*** | −0.74*** | −0.58*** | −0.68*** | −0.21*** | −0.60*** | −0.78*** |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.06) | (0.08) | (0.09) | |

| Religious diversity | −0.75*** | −0.66*** | −0.50*** | −0.44*** | −0.18*** | −0.50*** | −0.52*** |

| (0.04) | (0.04) | (0.04) | (0.04) | (0.04) | (0.06) | (0.06) | |

| Female | −0.32*** | −0.32*** | −0.32*** | −0.31*** | −0.31*** | −0.31*** | |

| (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | ||

| Age | −0.03*** | −0.03*** | −0.03*** | −0.03*** | −0.03*** | −0.03*** | |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | ||

| Primary Educationa | −0.15** | −0.12* | −0.12* | −0.08 | 0.03 | 0.02 | |

| (0.06) | (0.06) | (0.06) | (0.06) | (0.06) | (0.06) | ||

| (Lower) secondarya | −0.17** | −0.11* | −0.09 | −0.04 | 0.07 | 0.07 | |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | ||

| (Upper) secondary educationa | −0.03 | −0.01 | 0.01 | 0.04 | 0.12* | 0.11* | |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | ||

| Post-secondary non-tertiary educationa | 0.13* | 0.12* | 0.14** | 0.12* | 0.22*** | 0.23*** | |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | ||

| First stage of tertiary educationa | 0.36*** | 0.34*** | 0.35*** | 0.37*** | 0.43*** | 0.44*** | |

| (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | (0.05) | ||

| Second stage of tertiary educationa | 0.45*** | 0.46*** | 0.50*** | 0.48*** | 0.45*** | 0.44*** | |

| (0.07) | (0.07) | (0.07) | (0.07) | (0.07) | (0.07) | ||

| GINI | −0.03*** | −0.03*** | −0.02*** | −0.01*** | 0.01 | ||

| (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | |||

| GDP | 0.00*** | 0.00*** | 0.00 | 0.00 | |||

| (0.00) | (0.00) | (0.00) | (0.00) | ||||

| Life expectancy | 0.02*** | 0.03*** | 0.05*** | 0.02*** | |||

| (0.00) | (0.00) | (0.01) | (0.01) | ||||

| Urban population | −0.01*** | −0.01*** | −0.02*** | −0.02*** | |||

| (0.00) | (0.00) | (0.00) | (0.00) | ||||

| Variates of democracy index | −1.63*** | −1.37*** | −2.00*** | ||||

| (0.07) | (0.12) | (0.14) | |||||

| Financial freedom | 0.01*** | 0.01*** | |||||

| (0.00) | (0.00) | ||||||

| Government integrity | 0.00 | −0.01* | |||||

| (0.00) | (0.00) | ||||||

| Freedom from government | 0.01*** | 0.01*** | |||||

| (0.00) | (0.00) | ||||||

| Investment freedom | −0.00* | −0.00* | |||||

| (0.00) | (0.00) | ||||||

| Labor freedom | −0.01*** | −0.00 | |||||

| (0.00) | (0.00) | ||||||

| Monetary freedom | −0.01** | −0.00 | |||||

| (0.00) | (0.00) | ||||||

| Property rights | −0.00 | 0.01** | |||||

| (0.00) | (0.00) | ||||||

| Tax burden | −0.00 | −0.01*** | |||||

| (0.00) | (0.00) | ||||||

| Trade freedom | 0.04*** | 0.04*** | |||||

| (0.00) | (0.00) | ||||||

| Business freedom | 0.04*** | 0.04*** | |||||

| (0.00) | (0.00) | ||||||

| Self-employment rate | −0.01*** | −0.02*** | |||||

| (0.00) | (0.00) | ||||||

| Easy of doing business | −0.04*** | −0.07*** | |||||

| (0.00) | (0.00) | ||||||

| Ethnic diversity#GINI | −0.05** | ||||||

| (0.01) | |||||||

| Linguistic diversity#GINI | 0.12*** | ||||||

| (0.01) | |||||||

| Religious diversity#GINI | −0.12*** | ||||||

| (0.01) | |||||||

| Constant | −2.04*** | −0.94*** | −1.22*** | −1.28*** | −1.18*** | −0.98*** | −1.02*** |

| (0.03) | (0.06) | (0.07) | (0.07) | (0.07) | (0.08) | (0.08) | |

| Observations | 149,742 | 149,742 | 149,742 | 149,742 | 149,742 | 149,742 | 149,742 |

-

Robust standard errors in parentheses. Coefficients in log odds. All the models include region fixed effects. aReference category: pre-primary education. ***p < 0.001, **p < 0.01, *p < 0.05.

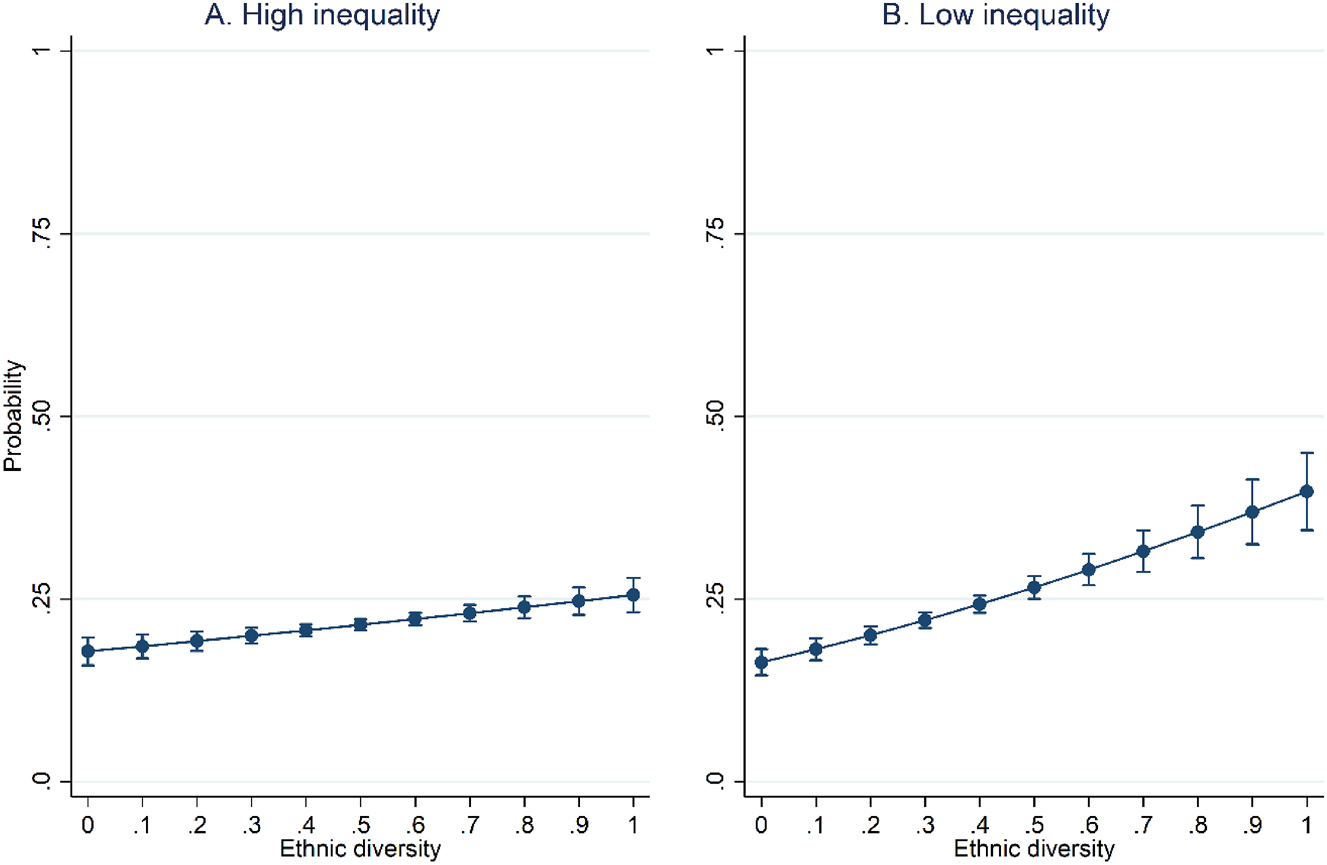

This study aims to understand how country-level cultural diversity interacts with country-level inequality. The average effect of cultural diversity indicators can hide nuances across countries. This is displayed in Model 7 in Table 2, which incorporates the interaction of diversity indicators and GINI coefficient. For ethnic diversity, the interaction with inequality is negative and statistically significant, indicating that the positive effect of ethnic diversity is weather with higher levels of inequality (B = −0.05, p < 0.001), supporting hypothesis 5a. Panel A in Figure 2 shows a smaller slope of ethnic diversity effect than the slope for countries with low inequality in Panel B.

Predicted entrepreneurial intentions by levels of ethnic diversity and inequality. Note: Predicted probabilities of entrepreneurial intentions at different levels of ethnic diversity, based on margins estimates from a logistic regression model (Table 1S in the supplementary material). The model includes key covariates such as age, gender, education, economic development (GDP per capita), life expectancy, urbanization, democracy level, economic freedom subindexes, self-employment rate, and easy of doing business index. Results consistent when quadratic terms of diversity are accounted for. Panel a corresponds to high income inequality (centered Gini = 10), while panel B corresponds to low income inequality (centered Gini = −10).

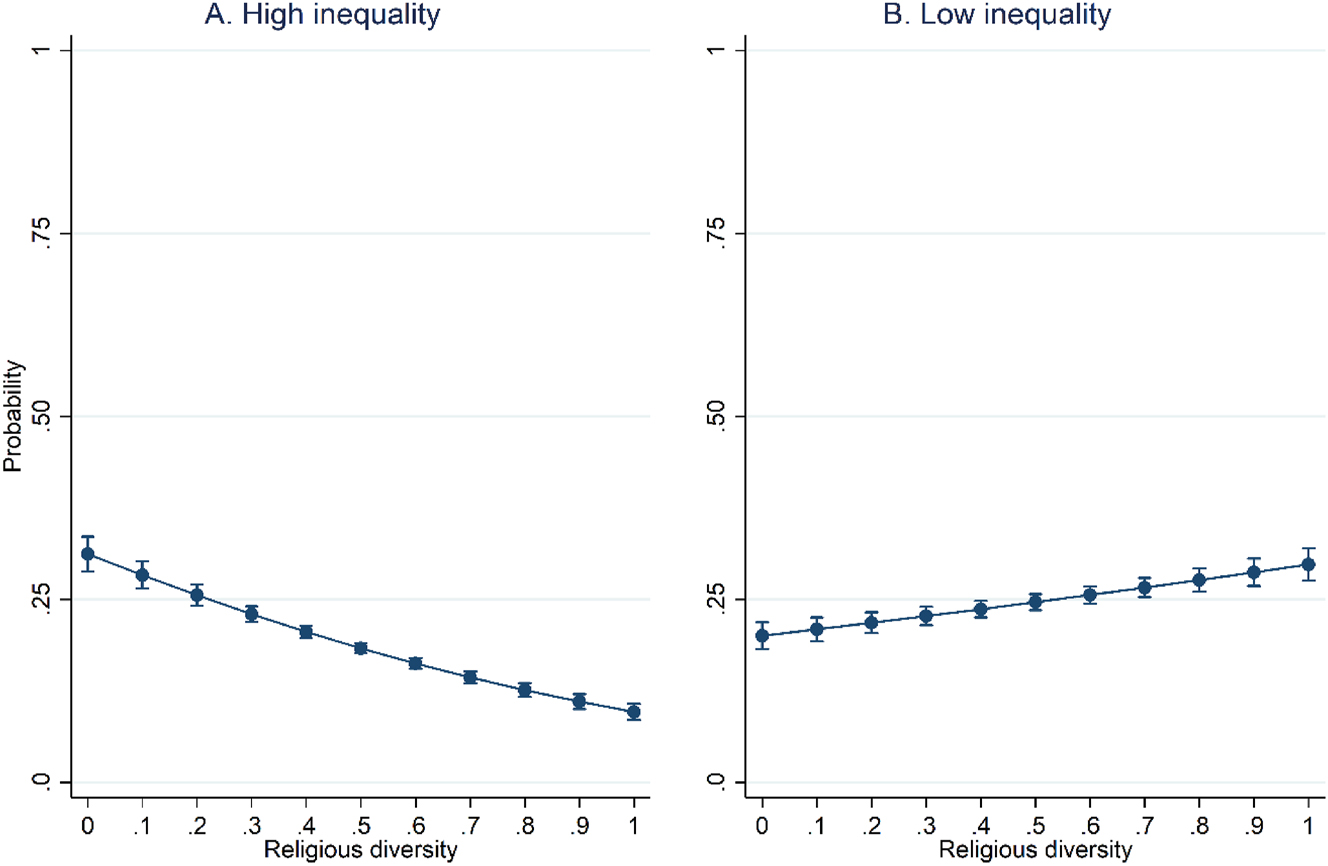

In contrast, the moderation effect of inequality is negative and significant for the case of religious diversity (B = −0.12, p < 0.001). As shown in Panel B in Figure 3, entrepreneurial intentions increase with higher levels of religious diversity in countries with low levels of inequality. However, as displayed in Panel A of Figure 3, higher religious diversity has a negative effect in countries with higher income inequality, confirming our hypothesis 5a.

Predicted entrepreneurial intentions by levels of religious diversity and inequality. Note: Predicted probabilities of entrepreneurial intentions at different levels of religious diversity, based on margins estimates from a logistic regression model (Table 1S in the supplementary material). The model includes key covariates such as age, gender, education, economic development (GDP per capita), life expectancy, urbanization, democracy level, economic freedom subindexes, self-employment rate, and easy of doing business index. Results consistent when quadratic terms of diversity are accounted for. Panel a corresponds to high income inequality (centered Gini = 10), while panel B corresponds to low income inequality (centered Gini = −10).

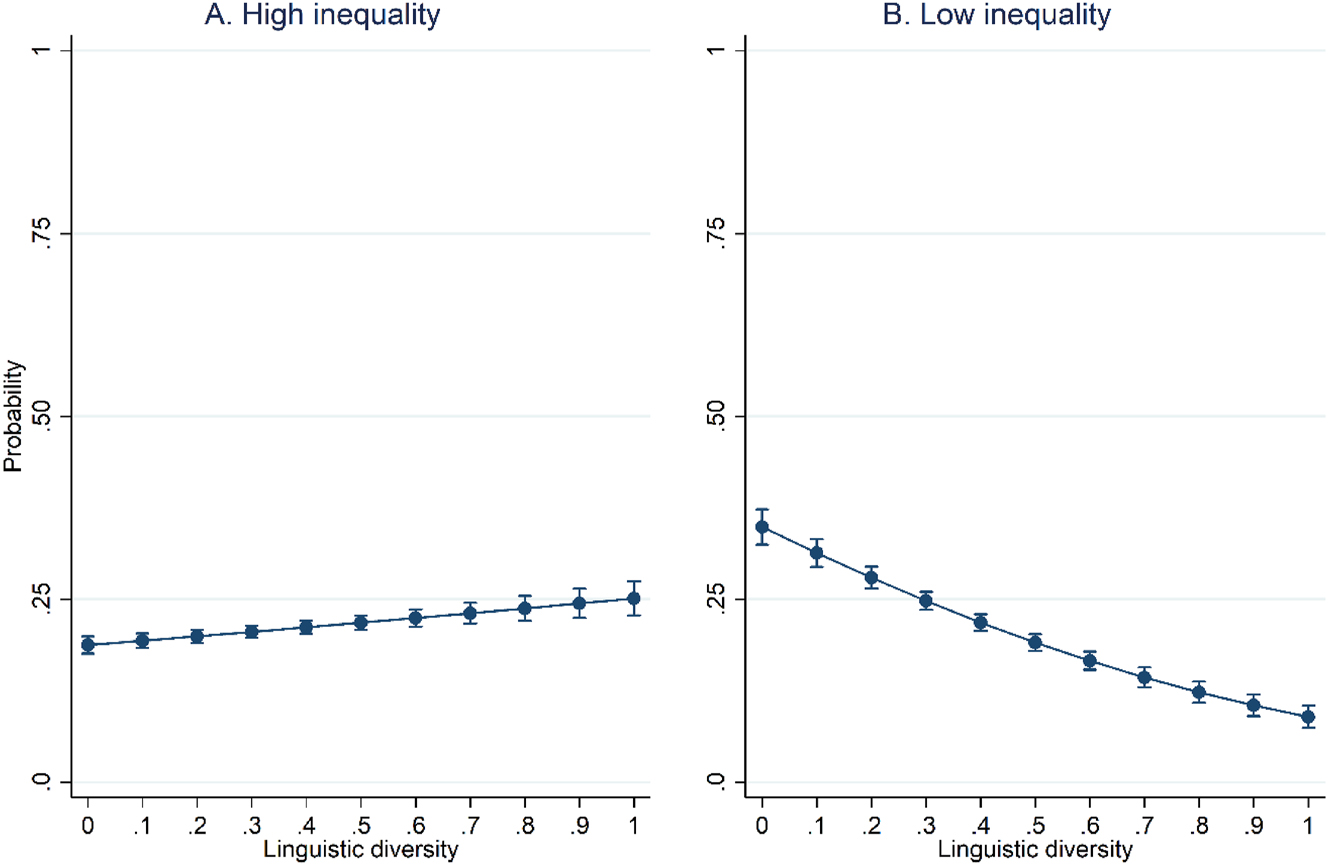

In contrast, linguistic diversity shows the opposite pattern (B = 0.12, p < 0.001). As shown in Figure 4, linguistic diversity has a positive relationship with entrepreneurial intentions in countries with higher levels of inequality, although this effect is negative for more egalitarian countries, which supports our hypothesis 5b.

Predicted entrepreneurial intentions by levels of linguistic diversity and inequality. Note: Predicted probabilities of entrepreneurial intentions at different levels of linguistic diversity, based on margins estimates from a logistic regression model (Table 1S in the supplementary material). The model includes key covariates such as age, gender, education, economic development (GDP per capita), life expectancy, urbanization, democracy level, economic freedom subindexes, self-employment rate, and easy of doing business index. Results consistent when quadratic terms of diversity are accounted for. Panel a corresponds to high income inequality (centered Gini = 10), while panel B corresponds to low income inequality (centered Gini = −10).

Overall, the interactions indicate that inequality moderates the effect of cultural diversity, consistent with Hypothesis 5. However, the direction of this moderation differs across the cultural dimensions examined.

4.3 Sensitivity Analyses

One central concern in studies using cross-national data is the role of influential countries on the results. Most large-scale comparative studies do not draw random samples of countries. Therefore, the robustness of the findings can be affected by particular countries. The literature has suggested various strategies for dealing with this situation. First, we estimated the DFBETAs and Cook’s D for the fixed effects of a multilevel logistic model. These parameters were compared to cut-off values proposed by Belsley et al. (1980) and were reported as cases detected as influential. We estimated the results without the five countries that have higher values than the cut-off points in at least one of the parameters (applied in countries such as Lebanon, Egypt, Bosnia and Herzegovina, Greece, and Sweden) in Model 1 in Table 2S of the supplementary material. Although the coefficients are not significant due to the reduced sample size, the effect size and direction of the effects are consistent with the main model.

Second, we conducted a jackknife resampling technique with the model. This technique systematically re-estimates the model 50 times, leaving out one country at a time from the dataset and then aggregating these estimations. As shown in Model 2 of Table 2S of the supplementary material, the interactions are in the same direction as the baseline model. Nevertheless, the instability of standard errors generates non-significant coefficients, which can be attributed to the lower number of clusters and the more conservative nature of this test.

5 Discussion and Conclusion

Individuals are more likely to become entrepreneurs through a deliberate decision-making process, rather than by mere chance (Krueger 2009). As the strongest and most immediate predictors of actual entrepreneurial activities (e.g., Fayolle and Gailly 2015), entrepreneurial intentions allow researchers to isolate the early-stage cognitive mechanisms that drive individuals toward entrepreneurship while accounting for contextual influences (Dheer and Lenartowicz 2018). In doing so, intentions provide a clearer window into how contextual factors, such as cultural diversity and institutional inequality, shape the perceived potential for entrepreneurship before structural barriers intervene. This allows us to capture how individuals cognitively assess opportunities and constraints in their socio-institutional environments before resource-based or bureaucratic barriers take effect (Moriano et al. 2012).

The contributions of this paper are threefold. First, we move beyond simply viewing culture as a single-dimensional construct by exploring how various dimensions of cultural diversity (ethnic, linguistic, and religious diversity) influence individuals’ entrepreneurial intentions (Moriano et al. 2012; Bogatyreva et al. 2019; Audretsch et al. 2021; Nikolova and Simroth 2015). On average, our findings support our Hypotheses 1, 2, and 3, indicating that these dimensions of diversity have significant yet divergent and in some cases opposing effects on entrepreneurial intentions. Ethnic diversity is positively associated with entrepreneurial intentions, which may suggest that exposure to diverse ideas, networks, and experiences can broaden opportunity recognition and enhance perceived entrepreneurial feasibility (Boudreaux 2020). The interaction of diverse ethnic groups may facilitate intergroup learning and thus expand individuals’ perceptions of entrepreneurial feasibility and desirability.

Conversely, religious diversity exhibits a negative pathway and reflects a constraint pathway. This suggests that the presence of different religions may create distinct and more challenging religious boundaries to navigate (e.g., Rietveld and Hoogendoorn 2022). While these boundaries can foster a sense of belonging within specific religious groups, they could also create divisions and barriers between them, making intergroup collaboration more difficult. Given that religious affiliations shape norms, expectations, and social legitimacy, individuals from different religious groups may find it harder to engage in entrepreneurial interactions, thereby suppressing their entrepreneurial confidence and intentions (Rietveld and Hoogendoorn 2022).

Similarly, linguistic diversity lowers entrepreneurial intentions, likely due to communication barriers that hinder interaction, coordination, and market access (Dale-Olsen and Finseraas 2020; Pires and Stanton 2000). While ethnic and religious diversity may primarily affect social and perceptual divisions (Montalvo and Reynal-Querol 2021; Baldwin and Huber 2010), language barriers can create direct operational challenges. In high-linguistic-diversity contexts, individuals face greater difficulty collaborating, negotiating, and accessing entrepreneurial networks, increasing the perceived difficulty of venture creation. These findings emphasize the need to examine cultural diversity not as a monolith, but as a set of context-sensitive dynamics with differentiated entrepreneurial consequences (Audretsch et al. 2021).

Second, and central to our contribution, we demonstrate that that the effects of cultural diversity are not uniform across societies but rather contingent upon a country’s level of income inequality. Our findings support Hypothesis 4, which states that higher economic inequalities correlate with lower entrepreneurial intentions. They also affirm our central moderation hypothesis (Hypothesis 5), which show how inequality acts as an institutional factor that determines which pathway (i.e. opportunity, constraint, or segmentation) prevails.

In line with Hypothesis 5a, we show that, in low-inequality societies, both ethnic and religious diversity are positively associated with entrepreneurial intentions. One possible explanation is that inclusive institutions may foster collaborative networks and enable more equitable access to financial, legal, and social resources, reducing perceived entry barriers and making entrepreneurship a more viable career path (e.g., Sobel et al. 2010; Liñán and Fayolle 2015). In such environments, cross-group knowledge diffusion may be facilitated, allowing the benefits of diversity to be more fully realized (Audretsch et al. 2022).

Conversely, in high-inequality, stratified societies, these relationships reverse and become negative (Churchill 2016). This suggests that higher structural barriers, such as limited access to institutional resources or exclusion from mainstream entrepreneurial networks, disproportionately affect marginalized groups and reinforces the constraint pathway. These inequalities may prevent individuals from capitalizing on diversity-driven opportunities, thereby lowering their perceptions of entrepreneurial feasibility in comparison to more equal societies.

Interestingly, linguistic diversity exhibits a redirection effect, confirming Hypothesis 5b. We found a striking reversal, linguistic diversity has a positive effect on entrepreneurial intentions in countries with higher levels of inequality but a negative effect in more egalitarian countries. This pattern may reflect what we theorize as a segmentation pathway, where inequality redirects entrepreneurial efforts into linguistically bounded market niches rather than suppressing them altogether (Ghosh 2019). In more stratified societies, linguistic communities often form self-contained entrepreneurial enclaves, where entrepreneurs serve culturally or linguistically defined market niches with distinct consumer preferences and lower barriers to entry (Pires and Stanton 2000; Yurko 2011). These specialized ecosystems may reduce the need for cross-group communication, enabling entrepreneurs to operate effectively within their linguistic groups.

In contrast, in more egalitarian societies, where institutional and market structures are less segmented, cross-linguistic collaboration becomes more critical to entrepreneurial success. Here, linguistic diversity may create practical challenges – such as communication difficulties, coordination problems, and reduced knowledge diffusion – that hinder entrepreneurial intentions (Dale-Olsen and Finseraas 2020). Without strong linguistic enclaves to buffer these challenges, language diversity can function more as a constraint than an asset, particularly when entrepreneurs are expected to navigate heterogeneous markets. However, the strength of such coordination barriers likely depends on other unobserved factors, such as national rates of bilingualism or multilingual education, which could plausibly reduce communication costs.

Thirdly, our study advances entrepreneurship research by employing an integrative theoretical lens that synthesizes Institutional Theory and the KSTE to explain how cultural diversity interacts with institutional conditions to shape entrepreneurial intentions. This integration bridges a key gap in the literature by showing that the distribution of knowledge spillovers is context-sensitive and institutionally bounded, addressing limitations in prior research that treats diversity as having uniform effects. While KSTE explains how knowledge spillovers fuel entrepreneurial opportunity recognition, it traditionally assumes that knowledge flows freely within open markets (Acs et al. 2009). However, this assumption fails to account for the institutional constraints that regulate access to and utilization of knowledge spillovers to create new entrepreneurial opportunities (Qian and Acs 2013). On the other hand, Institutional Theory highlights the role of formal and informal institutions in shaping access to entrepreneurial opportunities but does not explicitly explain how knowledge diffusion is mediated within different institutional environments (Scott 1995; Welter and Smallbone 2011). By combining these two perspectives, our framework moves beyond individual-centric explanations of entrepreneurial intentions to emphasize how structural conditions moderate the effects of cultural diversity on entrepreneurship.

This integrative approach allows us to identify three competing mechanisms -opportunity, constraint, and segmentation, that shape the relationship between cultural diversity and entrepreneurial intentions. Prior studies have largely focused on opportunity pathway, where diversity enhances innovation and entrepreneurship through knowledge spillovers (e.g., Audretsch et al. 2022). However, our framework highlights constraint pathway, where institutional barriers restrict access to entrepreneurial resources, limiting diversity’s positive impact. Moreover, we introduce segmentation pathway, where economic inequality channels diversity-driven entrepreneurship into fragmented, self-contained market structures rather than fostering cross-group spillovers.

In sum, this study offers a novel and integrative perspective on the relationship between cultural diversity and entrepreneurship by demonstrating that diversity’s effects on entrepreneurial intentions are not universally positive or negative but contingent on institutional and economic contexts. By disaggregating cultural diversity into ethnic, religious, and linguistic dimensions, and linking these to income inequality through the lenses of Institutional Theory and the KSTE, we clarify when and why diversity enables entrepreneurship in some settings but constrains or redirects it in others. These insights advance a more mechanism-based understanding of how opportunity structures, institutional inclusivity, and social segmentation shape entrepreneurial intentions. For scholars, our findings suggest the need to move beyond universalistic assumptions and toward context-sensitive theorizing about entrepreneurship in diverse societies (Audretsch et al. 2022).

For policymakers and entrepreneurial ecosystem builders, our findings demonstrate that policies should be tailored to recognize how different dimensions of cultural diversity shape entrepreneurial dynamics. In more unequal societies, where diversity may exacerbate fragmentation, policymakers should prioritize inclusive initiatives such as intercultural training, anti-discrimination protections, and multilingual support services to foster cross-group collaboration and trust. Second, ecosystem builders should develop targeted support programs, such as culturally sensitive mentorship schemes, language-accessible business training, and cross-cultural networking platforms, to lower entry barriers for underrepresented entrepreneurs. By actively facilitating knowledge exchange across cultural groups, these interventions can help transform diversity from a constraint into a resource for entrepreneurial innovation.

However, some limitations must be acknowledged. First, we focused on country-level cultural environments but did not examine the potential effects of regional or local cultural diversity. Cross-cultural research shows that there is non-negligible cultural variability within countries (Taras et al. 2016). As the relationship between cultural diversity and entrepreneurial intentions could be subject to regional variations, future research should consider incorporating either regional or local perspectives to provide a more comprehensive understanding.

Second, our study only relied on cross-sectional data, which may not fully capture the dynamic and evolving nature of cultural diversity and its effects on individuals’ perceptions and attitudes toward entrepreneurship over time. Future studies may leverage the entire time series of GEM, but it will require to construct tie series of cultural diversity which may or may not change substantially in the measured time period. Additionally, integrating qualitative methods, such as interviews or case studies, could provide deeper insights into these individual perspectives and experiences. Additionally, longitudinal studies would be beneficial to observe how changes in cultural diversity influence entrepreneurial intentions as they unfold. Events like humanitarian crisis, genocides and changes of political regimes could also affect changes in the cultural diversity of the countries due to migration flows (e.g., Venezuela, Palestine). Future research using longitudinal and mixed-methods approaches could uncover causal mechanisms and temporal shifts that are invisible in cross-sectional snapshots.

Third, GINI is only one measure of inequality within a country. Therefore, other measures of socioeconomic inequality can be considered, such as access to education, the poverty rate or wealth concentration. Incorporating multiple dimensions of inequality could enrich our understanding of how structural disadvantages intersect with cultural diversity to shape entrepreneurial behaviour. Moreover, because our data did not include measures of bilingualism or multilingualism, we could not examine whether language proficiency moderates the observed effects of linguistic diversity. Future studies should incorporate such indicators to clarify when linguistic diversity becomes a constraint versus an asset. Finally, further studies may consider more sophisticated indicators of cultural diversity. For instance, more analyses could be conducted on how many languages coexist within a country and the extent to which citizens are multilingual.

References

Acs, Z. J., P. Braunerhjelm, D. B. Audretsch, and B. Carlsson. 2009. “The Knowledge Spillover Theory of Entrepreneurship.” Small Business Economics 32 (1): 15–30. https://doi.org/10.1007/S11187-008-9157-3/TABLES/7.Search in Google Scholar

Ajzen, I. 1991. “The Theory of Planned Behavior.” Organizational Behavior and Human Decision Processes 50 (2): 179–211. https://doi.org/10.1016/0749-5978-91-90020-t.Search in Google Scholar

Alesina, A., A. Devleeschauwer, W. Easterly, S. Kurlat, and R. Wacziarg. 2003. “Fractionalization.” Journal of Economic Growth 8 (2): 155–94. https://doi.org/10.1023/A:1024471506938 10.1023/A:1024471506938Search in Google Scholar

Angulo-Guerrero, M. J., S. Pérez-Moreno, and I. M. Abad-Guerrero. 2017. “How Economic Freedom Affects Opportunity and Necessity Entrepreneurship in the OECD Countries.” Journal of Business Research 73: 30–7. https://doi.org/10.1016/j.jbusres.2016.11.017.Search in Google Scholar

Audretsch, D. B., and M. Belitski. 2013. “The Missing Pillar: The Creativity Theory of Knowledge Spillover Entrepreneurship.” Small Business Economics 41 (4): 819–36. https://doi.org/10.1007/S11187-013-9508-6/TABLES/3.Search in Google Scholar

Audretsch, D. B., D. Dohse, and A. Niebuhr. 2010. “Cultural Diversity and Entrepreneurship: A Regional Analysis for Germany.” The Annals of Regional Science 45 (1): 55–85. https://doi.org/10.1007/s00168-009-0291-x.Search in Google Scholar

Audretsch, D. B., M. Belitski, and J. Korosteleva. 2021. “Cultural Diversity and Knowledge in Explaining Entrepreneurship in European Cities.” Small Business Economics 56: 593–611. https://doi.org/10.1007/s11187-019-00191-4.Search in Google Scholar

Audretsch, D. B., M. Belitski, R. Caiazza, C. Günther, and M. Menter. 2022. “From Latent to Emergent Entrepreneurship: The Importance of Context.” Technological Forecasting and Social Change 175: 121356. https://doi.org/10.1016/J.TECHFORE.2021.121356.Search in Google Scholar

Baldwin, K., and J. D. Huber. 2010. “Economic Versus Cultural Differences: Forms of Ethnic Diversity and Public Goods Provision.” American Political Science Review 104 (4): 644–62. https://doi.org/10.1017/S0003055410000419.Search in Google Scholar

Banerjee, A. V., and A. F. Newman. 1993. “Occupational Choice and the Process of Development.” Journal of Political Economy 101 (2): 274–98.10.1086/261876Search in Google Scholar

Barrientos Oradini, N. P., A. Rubio, L. Araya-Castillo, M. Boada-Cuerva, and M. Vallejo-Velez. 2022. “Curiosity as a Moderator of the Relationship Between Entrepreneurial Orientation and Perceived Probability of Starting a Business.” Frontiers in Psychology 13: 884092. https://doi.org/10.3389/FPSYG.2022.884092.Search in Google Scholar

Belsley, D., E. Kuh, and R. Welsch. 1980. Regression Diagnostics: Identifying Influential Data and Sources of Collinearity. John Wiley & Sons.10.1002/0471725153Search in Google Scholar

Bird, B. 1988. “Implementing Entrepreneurial Ideas: The Case for Intention.” Academy of Management Review 13 (3): 442–53. https://doi.org/10.2307/258091.Search in Google Scholar

Bjørnskov, C., and N. J. Foss. 2008. “Economic Freedom and Entrepreneurial Activity: Some cross-country Evidence.” Public Choice 134 (3–4): 307–28. https://doi.org/10.1007/S11127-007-9229-Y/METRICS.Search in Google Scholar

Bogatyreva, K., L. F. Edelman, T. S. Manolova, O. Osiyevskyy, and G. Shirokova. 2019. “When do Entrepreneurial Intentions Lead to Actions? The Role of National Culture.” Journal of Business Research 96: 309–21. https://doi.org/10.1016/J.JBUSRES.2018.11.034.Search in Google Scholar

Boudreaux, C. J. 2020. “Ethnic Diversity and Small Business Venturing.” Small Business Economics 54 (1): 25–41. https://doi.org/10.1007/S11187-018-0087-4/METRICS.Search in Google Scholar

Churchill, S. A. 2016. “Fractionalization, Entrepreneurship, and the Institutional Environment for Entrepreneurship.” Small Business Economics 3 (48): 577–97.10.1007/s11187-016-9796-8Search in Google Scholar

Cohen, W. M., and D. A. Levinthal. 1990. “Absorptive Capacity: a New Perspective on Learning and Innovation.” Administrative Science Quarterly 35 (1): 128–52. https://doi.org/10.2307/2393553.Search in Google Scholar

Dale-Olsen, H., and H. Finseraas. 2020. “Linguistic Diversity and Workplace Productivity.” Labour Economics 64: 101813. https://doi.org/10.1016/J.LABECO.2020.101813.Search in Google Scholar

De Pillis, E., and K. K. Reardon. 2007. “The Influence of Personality Traits and Persuasive Messages on Entrepreneurial Intention: A cross-cultural Comparison.” Career Development International 12 (4): 382–96. https://doi.org/10.1108/13620430710756762/FULL/PDF.Search in Google Scholar

Dheer, R. J., and T. Lenartowicz. 2018. “Multiculturalism and Entrepreneurial Intentions: Understanding the Mediating Role of Cognitions.” Entrepreneurship Theory and Practice 42 (3): 426–66. https://doi.org/10.1111/etap.12260.Search in Google Scholar

Djankov, S., T. Ganser, C. McLiesh, R. Ramalho, and A. Shleifer. 2010. “The Effect of Corporate Taxes on Investment and Entrepreneurship.” American Economic Journal: Macroeconomics 2 (3): 31–64.10.1257/mac.2.3.31Search in Google Scholar

Dražanová, L. 2020. “Introducing the Historical Index of Ethnic Fractionalization (HIEF) Dataset: Accounting for Longitudinal Changes in Ethnic Diversity.” Journal of Open Humanities Data 6 (1). https://doi.org/10.5334/JOHD.16.Search in Google Scholar

Fayolle, A., and B. Gailly. 2015. “The Impact of Entrepreneurship Education on Entrepreneurial Attitudes and Intention: Hysteresis and Persistence.” Journal of Small Business Management 53 (1): 75–93. https://doi.org/10.1111/JSBM.12065.Search in Google Scholar

Fayolle, A., and F. Liñán. 2014. “The Future of Research on Entrepreneurial Intentions.” Journal of Business Research 67 (5): 663–6. https://doi.org/10.1016/J.JBUSRES.2013.11.024.Search in Google Scholar

Galbraith, C. S., and J. Benitez-Galbraith. 2009. “The Impact of Ethnolinguistic Diversity on Entrepreneurial Activity: A cross-country Study.” International Journal of Entrepreneurship and Small Business 8 (3): 309–31. https://doi.org/10.1504/ijesb.2009.025083.Search in Google Scholar

Galindo, M. Á., and M. T. Méndez. 2014. “Entrepreneurship, Economic Growth, and Innovation: Are Feedback Effects at Work?” Journal of Business Research 67 (5): 825–9. https://doi.org/10.1016/J.JBUSRES.2013.11.052.Search in Google Scholar

George, G., A. M. Mcgahan, and J. Prabhu. 2012. “Innovation for Inclusive Growth: Towards a Theoretical Framework and a Research Agenda.” Journal of Management Studies 49 (4): 661–83. https://doi.org/10.1111/J.1467-6486.2012.01048.X.Search in Google Scholar

Ghio, N., M. Guerini, E. E. Lehmann, and C. Rossi-Lamastra. 2015. “The Emergence of the Knowledge Spillover Theory of Entrepreneurship.” Small Business Economics 44 (1): 1–18. https://doi.org/10.1007/S11187-014-9588-Y/METRICS.Search in Google Scholar

Ghosh, J. 2019. “The Uses and Abuses of Inequality.” Journal of Human Development and Capabilities 20 (2): 181–96. https://doi.org/10.1080/19452829.2019.1574282.Search in Google Scholar

Hayton, J. C., G. George, and S. A. Zahra. 2002. “National Culture and Entrepreneurship: A Review of Behavioral Research.” Entrepreneurship Theory and Practice 26 (4): 33–52. https://doi.org/10.1177/104225870202600403.Search in Google Scholar

Henrekson, M., and D. Johansson. 2010. “Gazelles as Job Creators: A Survey and Interpretation of the Evidence.” Small Business Economics 35 (2): 227–44.10.1007/s11187-009-9172-zSearch in Google Scholar

Heritage Foundation. 2025. “Methodology.” https://static.heritage.org/index/pdf/2025/2025_indexofeconomicfreedom_methodology.pdf.Search in Google Scholar

Hofstede, G. 2001. Culture’S Consequences: Comparing Values, Behaviors, Institutions and Organizations Across Nations. Sage.Search in Google Scholar

Kibler, E., T. Kautonen, and M. Fink. 2017. “Regional Social Legitimacy of Entrepreneurship: Implications for Entrepreneurial Intention and start-up Behaviour.” In Entrepreneurship in a Regional Context, 57–77. Routledge.10.4324/9781315691985-4Search in Google Scholar

Kloosterman, R. C. 2010. “Matching Opportunities with Resources: A Framework for Analysing (Migrant) Entrepreneurship from a Mixed Embeddedness Perspective.” Entrepreneurship & Regional Development 22 (1): 25–45. https://doi.org/10.1080/08985620903220488.Search in Google Scholar

Kolvereid, L. 1996. “Prediction of Employment Status Choice Intentions.” Entrepreneurship Theory and Practice 21 (1): 47–57. https://doi.org/10.1177/104225879602100104.Search in Google Scholar

Krueger, N. 2009. “The Microfoundations of Entrepreneurial Learning and … Education: The Experiential Essence of Entrepreneurial Cognition.” In Handbook of University-wide Entrepreneurship Education, edited by G. P. West III, E. J. Gatewood, and K. G. Shaver. Elgar Publishing.10.4337/9781848449480.00010Search in Google Scholar

Krueger, N. F., and A. L. Carsrud. 1993. “Entrepreneurial Intentions: Applying the Theory of Planned Behaviour.” Entrepreneurship & Regional Development 5 (4): 315–30. https://doi.org/10.1080/08985629300000020.Search in Google Scholar

Krueger, N. F., M. D. Reilly, and A. L. Carsrud. 2000. “Competing Models of Entrepreneurial Intentions.” Journal of Business Venturing 15 (5–6): 411–32. https://doi.org/10.1016/S0883-9026(98)00033-0.Search in Google Scholar

Liñán, F., and Y. W. Chen. 2009. “Development and Cross–Cultural Application of a Specific Instrument to Measure Entrepreneurial Intentions.” Entrepreneurship Theory and Practice 33 (3): 593–617. https://doi.org/10.1111/J.1540-6520.2009.00318.X.Search in Google Scholar

Liñán, F., and A. Fayolle. 2015. “A Systematic Literature Review on Entrepreneurial Intentions: Citation, Thematic Analyses, and Research Agenda.” The International Entrepreneurship and Management Journal 11 (4): 907–33. https://doi.org/10.1007/S11365-015-0356-5 Search in Google Scholar

Liñán, F., I. Romero Luna, and J. Fernández Serrano. 2013. “Necessity and Opportunity Entrepreneurship: the Mediating Effect of Culture.” Revista de Economia Mundial 33: 21–47.Search in Google Scholar

Lüthje, C., and N. Franke. 2003. “The ‘Making’ of an Entrepreneur: Testing a Model of Entrepreneurial Intent Among Engineering Students at MIT.” R&D Management 33 (2): 135–47. https://doi.org/10.1111/1467-9310.00288.Search in Google Scholar

McPherson, M., L. Smith-Lovin, and J. M. Cook. 2003. “Birds of a Feather: Homophily in Social Networks.” Annual Review of Sociology 27 (1): 415–44, https://doi.org/10.1146/ANNUREV.SOC.27.1.415.Search in Google Scholar

Mickiewicz, T., M. Hart, F. Nyakudya, and N. Theodorakopoulos. 2019. “Ethnic Pluralism, Immigration and Entrepreneurship.” Regional Studies 53 (1): 80–94. https://doi.org/10.1080/00343404.2017.1405157.Search in Google Scholar

Montalvo, José G., and M. Reynal-Querol. 2021. “Ethnic Diversity and Growth: Revisiting the Evidence.” The Review of Economics and Statistics 103 (3): 521–32. https://doi.org/10.1162/REST_A_00901.Search in Google Scholar

Moriano, J. A., M. Gorgievski, M. Laguna, U. Stephan, and K. Zarafshani. 2012. “A Cross-Cultural Approach to Understanding Entrepreneurial Intention.” Journal of Career Development 39 (2): 162–85. https://doi.org/10.1177/0894845310384481.Search in Google Scholar

Mueller, S. L., and A. S. Thomas. 2001. “Culture and Entrepreneurial Potential: A Nine Country Study of Locus of Control and Innovativeness.” Journal of Business Venturing 16 (1): 51–75. https://doi.org/10.1016/S0883-9026(99)00039-7.Search in Google Scholar

Nakara, W. A., K. Messeghem, and A. Ramaroson. 2021. “Innovation and Entrepreneurship in a Context of Poverty: A Multilevel Approach.” Small Business Economics 56 (4): 1601–17. https://doi.org/10.1007/S11187-019-00281-3/METRICS.Search in Google Scholar

Nathan, M., and N. Lee. 2013. “Cultural Diversity, Innovation, and Entrepreneurship: Firm-Level Evidence from London.” Economic Geography 89 (4): 367–94. https://doi.org/10.1111/ecge.12016.Search in Google Scholar

Nikolova, E., and D. Simroth. 2015. “Religious Diversity and Entrepreneurship in Transition: Lessons for Policymakers.” IZA Journal of European Labor Studies 4 (1): 1–21, https://doi.org/10.1186/s40174-014-0028-4.Search in Google Scholar

North, D. C. 1990. Institutions, Institutional Change and Economic Performance. Cambridge University.10.1017/CBO9780511808678Search in Google Scholar

Piketty, T., and E. Saez. 2003. “Income Inequality in the United States, 1913–1998.” Quarterly Journal of Economics 118 (1): 1–41. https://doi.org/10.1162/00335530360535135.Search in Google Scholar

Pires, G., and J. Stanton. 2000. “Marketing Services to Ethnic Consumers in Culturally Diverse Markets: Issues and Implications.” Journal of Services Marketing 14 (7): 607–18. https://doi.org/10.1108/08876040010352772/FULL/PDF.Search in Google Scholar

Putnam, R. D. 2007. “E Pluribus Unum: Diversity and Community in the Twenty-First Century the 2006 Johan Skytte Prize Lecture.” Scandinavian Political Studies 30 (2): 137–74. https://doi.org/10.1111/j.1467-9477.2007.00176.x.Search in Google Scholar

Qian, H., and Z. J. Acs. 2013. “An Absorptive Capacity Theory of Knowledge Spillover Entrepreneurship.” Small Business Economics 40 (2): 185–97, https://doi.org/10.1007/s11187-011-9368-x.Search in Google Scholar

Ram, M., T. Jones, P. Edwards, A. Kiselinchev, L. Muchenje, and K. Woldesenbet. 2013. “Engaging with Super-diversity: New Migrant Businesses and the research–policy Nexus.” International Small Business Journal 31 (4): 337–56. https://doi.org/10.1177/0266242611429979.Search in Google Scholar

Rietveld, C. A., and B. Hoogendoorn. 2022. “The Mediating Role of Values in the Relationship Between Religion and Entrepreneurship.” Small Business Economics 58 (3): 1309–35. https://doi.org/10.1007/S11187-021-00454-Z.Search in Google Scholar

Rodríguez-Pose, A., and D. Hardy. 2015. “Cultural Diversity and Entrepreneurship in England and Wales.” Environment and Planning A 47 (2): 392–411. https://doi.org/10.1068/a130146p.Search in Google Scholar

Smallbone, D., and F. Welter. 2012. “Entrepreneurship and Institutional Change in Transition Economies: The Commonwealth of Independent States, Central and Eastern Europe and China Compared.” Entrepreneurship & Regional Development 24 (3–4): 215–33. https://doi.org/10.1080/08985626.2012.670914.Search in Google Scholar

Scott, R. W. 1995. Institutions and Organizations. Thousand Oaks, CA: Sage.Search in Google Scholar

Smallbone, D., J. Kitching, and R. Athayde. 2010. “Ethnic Diversity, Entrepreneurship and Competitiveness in a Global City.” International Small Business Journal 28 (2): 174–90. https://doi.org/10.1177/0266242609355856.Search in Google Scholar

Sobel, R. S., N. Dutta, and S. Roy. 2010. “Does Cultural Diversity Increase the Rate of Entrepreneurship?” The Review of Austrian Economics 23 (3): 269–86. https://doi.org/10.1007/S11138-010-0112-6/TABLES/5.Search in Google Scholar

Stiglitz, J. E. 2012. “Macroeconomic Fluctuations, Inequality, and Human Development.” Journal of Human Development and Capabilities 13 (1): 31–58. https://doi.org/10.1080/19452829.2011.643098.Search in Google Scholar

Taras, V., P. Steel, and B. L. Kirkman. 2016. “Does Country Equate with Culture? Beyond Geography in the Search for Cultural Boundaries.” Management International Review 56 (4): 455–87, https://doi.org/10.1007/s11575-016-0283-x.Search in Google Scholar

The World Bank. 2025. Self-Employed, Total (% of Total Employment) (modeled ILO estimate). International Labour Organization. ILOSTAT database (ILO Modelled Estimates). Available from: https://data.worldbank.org/indicator/SL.EMP.SELF.ZS.Search in Google Scholar

Thurik, R., and M. Dejardin. 2011. “The Impact of Culture on Entrepreneurship.” European Business Review jan-feb: 57–9.Search in Google Scholar

Uslaner, E. 2008. Corruption, Inequality, and the Rule of Law: The Bulging Pocket Makes the Easy Life. Cambridge: Cambridge University Press.10.1017/CBO9780511510410Search in Google Scholar

Van de Werfhorst, H. G., and W. Salverda. 2012. “Consequences of Income Inequality: Introduction to a Special Issue.” Research in Social Stratification and Mobility 30 (4): 377–87. https://doi.org/10.1016/J.RSSM.2012.08.001.Search in Google Scholar

V-Dem Institute. 2021. “Methodology.” https://www.v-dem.net/static/website/img/refs/methodologyv111.pdf.Search in Google Scholar

Welter, F., and D. Smallbone. 2011. “Institutional Perspectives on Entrepreneurial Behavior in Challenging Environments.” Journal of Small Business Management 49 (1): 107–25. https://doi.org/10.1111/j.1540-627x.2010.00317.x.Search in Google Scholar

Wilkinson, R. G. 1999. “Income Inequality, Social Cohesion, and Health: Clarifying the theory--a Reply to Muntaner and Lynch.” International Journal of Health Services: Planning, Administration, Evaluation 29 (3): 525–43. https://doi.org/10.2190/3QXP-4N6T-N0QG-ECXP.Search in Google Scholar