Abstract

Different organizational perspectives surrounding social enterprises (SEs) have burgeoned over the past few years. However, integrating financial sustainability with social value remains a “black box” with respect to entrepreneurial strategic decision-making (SDM). Drawing from decision theories and the proactivity perspective of personality-based SDM literature, we investigate the impact of synoptic (rationalistic) and incremental (adaptive) process models, and moderate these approaches with the entrepreneur’s proactive personality traits on SEs’ financial and social performance. Our results show that when a rational and intuitive SDM develops in conjunction, financial performance improves. In contrast, a departure from rationality in favor of incremental decision-making processes advances only the social performance of SEs. A proactive entrepreneurial personality positively moderates strategic cognitions in improving SEs’ both financial and social objectives. On the other hand, when proactivity moderates rationality, the financial performance of SEs declines.

1 Introduction

Strategic decision-making (SDM) is reflected in sequences of action that bridge the divide between the current and future state of an organization; it is among the most influential predictors of organizational success (e.g. Bolland and Lopes 2018; Nutt 2000). Strategic decisions occur continuously: their formulation and implementation have long been a central managerial activity for all types of organizations; large and small, private and public, for-profit and not-for-profit (Elbanna and Child 2007). Regardless of the organizational type, decision-makers need to cope with uncertainty and complex situations through sensing the environment, deploying organizational structures, and reconfiguring resources and capabilities in an effort to harmonize the organization with external influences (Möller and Matthew 2023; Teece 2007). This helps their firm to navigate effectively the competitive marketspace (Mintzberg and Waters 1985), contributing towards survival and organizational growth. Yet, evidence on how SDM process influences the extent to which strategic decisions conclude in desired organizational outcomes offers limited understanding (Nummela et al. 2014; Rajagopalan, Rasheed, and Datta 1993). The SDM process-performance linkages in particular, have not yet been so convincingly explicated (McWilliams et al. 2016).

As Papadakis and Barwise (2002) point out, SDM research usually describes the process as a set of different dimensions/characteristics; where rationality, politicization, and intuition are the dominant references (Hickson, Butler, and Wilson 2017). The debate between synoptic (rational) and incremental (political and intuitive) decision models and their impacts on organizational outcomes has been established since the beginnings of strategic management research (Barnard 1938; Calabretta, Gemser, and Winjburn 2017; Eisenhardt and Zbaracki 1992). Nevertheless, empirical studies linking SDM process dimensions with firm performance remain fragmented and equivocal. Tests are generally simple bivariate relationships between rational, political, and intuitive decisions with performance, treating these dimensions as exclusively orthogonal, and producing repeatedly the same kind of results (Hitt, Boyd, and Li 2004). To overcome this limitation, SDM scholars have called for interactionist perspectives, i.e. drawing upon disconnected theories and research from different disciplines. In this light, there is a growing consensus that decision-makers’ personality traits may determine organizational processes, including SDM, which, in turn, influence organizational outcomes (e.g. Franco and Prata 2019; Henssen and Koiranen 2021). Proactivity in particular, the ability of one to take actions to influence environmental changes (Bateman and Crant 1993), is a dispositional psychological personality construct that might interact with SDM dimensions in shaping performance (Shepherd and Rudd 2014).

With respect to performance, SDM process studies have exclusively focused on for-profit ventures (e.g. Bolland and Lopes 2018; Papadakis and Barwise 2002), leaving other organizational forms, such as social enterprises (SEs), untouched. This, despite calls from the business press (e.g. Forbes 2018) and consulting firms (e.g. Deloitte 2018) to investigate organizations located at the intersection of business and society. Given the emergence of social ventures[1] in academia, business, and the popular press, this research paucity seems surprising. Negotiating both social and financial performance imperatives, these “dual-mission” attributes, lead SEs to possess a distinctive entrepreneurial orientation and decision-making heuristics as well as diverse performance objectives, all substantially different from traditional, business firms.

Building on the above suppositions, our study proposes and tests a model that examines the associations among a social entrepreneur’s proactive personality, SDM dimensions, and organizational performance. Drawing upon a unique sample of 85 SEs operating in Greece, we investigate the direct impact of three archetypical SDM process dimensions (rationality, analogu, and intuition) on SEs’ financial and social performance, by also considering the moderating effects of entrepreneurs’ proactive personality in the above relationships. Two research questions motivate our study: (1) How do rational, political and intuitive SDM affect different SEs’ performance dimensions? (2) How do social entrepreneurs’ proactivity moderate SDM dimensions to impact SEs’ performance?

Our study offers two main contributions to existing literature: First, to the best of our knowledge, our research is the first to provide insights on SDM process in SEs, advancing theory and empirical knowledge of both SDM and social entrepreneurship field. Our findings suggest that rational and intuitive SDM improve financial performance, while politicization enhances social performance. Therefore, in the context of SEs, a simultaneous consideration of synoptic and incremental decision processes suggests that positive performance effects are more likely. Second, we employ entrepreneurs’ proactive personality traits to build a model explaining variation in the extent to which synoptic and incremental SDM affect different performance dimensions. In this regard, we lend conceptual clarity and empirical evidence to a small but growing number of studies on psychology-based SDM (e.g. Ahmed, Klobas, and Ramayah 2021; Bateman and Zeithaml 1989; Zhang et al. 2019). SDM process and personality traits have, by and large, evolved independent of each other. Our interaction approach opens up the possibility of integration; we specify the underlying psychological interpretative mechanism of decision-maker’s proactivity that enhance or hinder the diverse performance effects of SDM process dimensions. There are also concrete managerial considerations with respect to the study of proactive personality. In the process of environmental scanning and opportunity recognition, decision-makers may consider forward-looking perceptions and cope behaviors used to gauge performance; literature offers examples of a proactive personality consequences in the for-profit entrepreneurial context of mainly advanced economies (e.g. Kickul and Gundry 2002). Given current interest in context-specific personality traits (e.g. Gabay-Mariani and Boissin 2021; Swab et al. 2021; Tasnim et al. 2018), our paper looks at how these perspectives may need to change in two particularly unique contexts: the social enterprise and the Greek context.

The remainder of the article is organized as follows: We first provide the theoretical background and develop the hypotheses to be tested, and then describe our research methodology and variable definitions. Our model’s econometric specifications are then presented followed by the empirical results and a discussion of their implications. Results from a number of robustness and endogeneity tests are also reported before offering some concluding remarks.

2 Literature Review and Research Hypotheses

2.1 Theoretical Underpinnings of the Study and Research Model

Since seminal work by Mintzberg, Raisinghani, and Theoret (1976), the SDM research field has evolved into an amalgam of types, dimensions, and determinants; underpinned by a wide range of theoretical lenses, including behavioral economics, strategy and resource-based assumptions, transaction cost considerations, upper echelons, and change theories (Das and Teng 1999; Hambrick and Mason 1984; Papadakis, Lioukas, and Chambers 1998; Pettigrew 1990). Within these literatures, SDM is conceptualized from both a content and/or a process perspective. Content research deals with issues of strategy, such as diversification, portfolio management, mergers, and the alignment of organizations to their external environment (Elbanna 2006). SDM process involves a set of actions and dynamic factors that model strategic decisions (Hambrick 1995) and shape the context of their implementation (Elbanna and Child 2007).

Researchers have extensively discussed how SDM process enables the development of an intermediate transformation mechanism that allows organizations to convert their efforts into favorable outcomes, such as improvements in organizational performance (e.g. Baum and Wally 2003; Elbanna and Child 2007; Olson, Parayitam, and Bao 2007). Since SDM is applied in the top levels of an organization, the function of executives in formulating and implementing a process that translates in performance improvements is at the core of governance research. Two approaches dominate the field: the chief executive officer (CEO) and the top management team (TMT) model. The first takes as its unit of analysis the CEO, construed as the firm’s primary leader and principal decision-maker (Arendt, Priem, and Ndofor 2005). His/her impact on firm performance is seen in the literatures on CEO environmental scanning and CEO cognition (Daft, Sormunen, and Parks 1988; Priem 1994). The second model takes as its unit of analysis the firm’s TMT, construed as a dominant coalition that shares responsibility for decision-making (Hambrick and Mason 1984), shaping performance through top executives’ ability to attain individual qualitative decisions, consensus in their implementation, and affective acceptance (Amason and Schweiger 1994). In particular, since strategic decisions deal with complex and ambiguous issues and involve the commitment of significant sums of organizational resources, the ability of individuals to improve the quality of each decision is likely to enhance overall performance (Mason and Mitroff 1981; Wamba et al. 2019). In parallel, the effective implementation of all decisions taken with the purpose to lead organizations into positive performance outcomes hinge on building the level of consensus among decision-makers (Wooldridge and Floyd 1990). Consensus refers to the degree of agreement on organizational priorities. In the presence of dissent, effective SDM implementation is likely to become the victim of foot dragging and organizational politics (Dooley and Fryxell 1999: 389). In an opposite direction, forces of consensus among individual strategic decision-makers provide positive performance implications (González-Benito et al. 2012). Finally, while high-quality strategic decisions and consensus are both necessary for enhanced performance, SDM is an ongoing process, that continuously orchestrate organizational resources (Amason and Schweiger 1994). In that sense, to sustain the ability to produce and implement SDM, decision groups must maintain positive affective relationships among their member (Amason 1996). This improves a team’s ability to function effectively, with that improving firm performance (Miller and Lee 2001).

Regardless of the unit of analysis, CEO or TMT, most studies differentiate between the SDM process – performance link along synoptic or incremental lines. Synoptic decision models are based on rationality; including rule-based, explicit processes for making logically sound decisions that outline organizational efforts to compose their overall strategy and ensure that strategic plans are consciously developed and mutually reinforced (Fredrickson 1984). Extending synoptic insights, Toft (1989) introduced synoptic formalism as a wide-ranging, quasi-rational, sequential, and comprehensive SDM process that relies upon a systemic use of analysis and information. In synthesis, synoptic perceptions describe SDM as a rather purposive and systematic process, where decision-makers are supposed to start with known objectives, then collect information and develop alternatives, and finally identify the optimal course of action (Das and Teng 1999).

In contrast to synoptic formalism, some scholars have posited that SDM is hardly a linear, rationalistic, and straightforward process, but is characterized by uncertainty and complexity; it is adaptive and incremental in nature (Braybrooke and Lindblom 1970; Quinn 1978). According to Elbanna (2006), SDM incrementalism includes decisions embedded in the inner organizational context, being anchored in two paradigms: political and intuitive. One considers decision-making as a political process, where individuals with conflicting interests and unequal power advance their claims (Dean and Sharfman 1996). The other emphasizes the iteration of decisions through experience and learning, pointing to an intuitive synthesis (Khatri and Ng 2000). In essence, synoptic decisions can be reconstructed and explained ex post (Calabretta, Gemser, and Winjburn 2017), while incremental decisions build on non-rational arguments, reflect the tension between rational and behavioral approaches and indicate how organizations actually undertake SDM.

In recent years, psychological approaches have complemented and competed with the aforementioned SDM streams, focusing particularly upon personality traits (Abatecola, Mandarelli, and Pogessi 2013; Labaki and D’Allura 2021). Since SDM is characterized by ambiguities, uncertainty and a lack of structure, the decisions and the processes by which these decisions are made differ according to individuals’ dispositional personality characteristics. Personality traits may influence SDM process by either restricting information search, processing and/or retrieval activities; or increasing the impact of contextual factors on strategic decisions because of past experiences, education level, and risk propensity (Brouthers, Brouthers, and Werner 2000). A growing number of empirical studies has been carried out (e.g. Herrmann and Nadkarni 2014; Mendes, Mendes, and Salleh 2019) providing support to the prominence of decision-makers’ personality in the outcomes of SDM process. According to Abatecola et al. (2013), there is considerable research potential in this area. Following this cue, we argue that identifiable configurations between synoptic and incremental decision approaches with decision-makers’ proactive personality merit empirical investigation; scholars have already implied the interplay of entrepreneurs’ proactivity traits with synoptic and incremental decision modes (e.g. Shepherd and Rudd 2014; Siebert, Kunz, and Rolf 2020).

We test our theoretical predictions in SEs. Despite the numerous SDM process studies, only a small amount of research has been done to investigate decision correlates in the context of social entrepreneurship; and these mostly relate to nongovernment, voluntary, and not-for-profit or third sector organizations. SEs are distinct, in the sense that they have emerged as a hybrid organizational form to simultaneous address commercial and social concerns (Battilana and Lee 2014; Cucari et al. 2020; Doherty, Haugh, and Lyon 2014), assigning equal importance to their financial and social objectives (Bagnoli and Megali 2011). This performance system, the “double bottom-line” (Dees 1998), bifurcates from both the traditional view of corporations where their only responsibility entails utilizing resources and engaging in activities designed to increase financial wealth (Friedman 1970, cited in Wilburn and Wilburn 2014), and from more recent approaches emphasizing the social aspects of entrepreneurship (e.g. Zahra and Wright 2016). As compared to profit-oriented firms, SEs are systems nested in larger macro-systems, possessing an amplified engagement with external stakeholder networks, internal agility, and higher levels of internal and external collaboration; making their entrepreneurial SDM process challenging (Lundström et al. 2014). They also address the most pressing social issues in a way that neither commercial firms, nor other non-profit organizations have been able to (Wilburn and Wilburn 2014). Finally, they have a substantial economic impact on local communities by providing innovative offerings, increasing employment levels, and revenue generation (Borzaga and Becchetti 2010), and strive to align their SDM process with both social and financial imperatives.

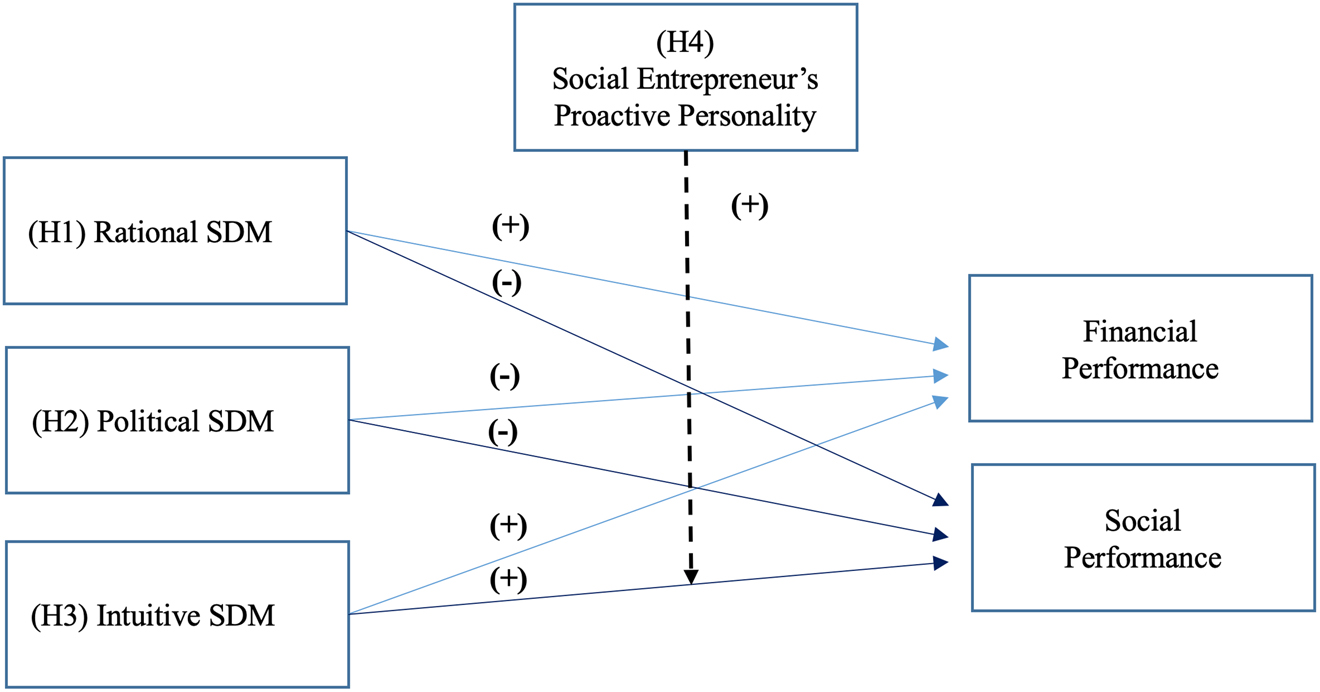

Considering all the above, we thus posit the relationships between rational, political, and intuitive SDM dimensions with SEs’ diverse performance aspirations, moderated by the social entrepreneurs’ proactive personality traits (Figure 1).

Rational, political, intuitive SDM dimensions, proactive personality, and social enterprises’ financial and social performance: a conceptual model.

2.2 Development of Hypotheses

2.2.1 Rationality – Performance Relationship

Synoptic decision models define rationality as a methodical, analytical, and sequential approach towards the accomplishment of organizational objectives. Bounded rationality, however, stymies organizations from fulfilling this paradigmatic cornerstone developed in normative economics models (Simon 1957). By relaxing this stringent assumption of rationality, Dean and Sharfman (1996: 373) interpret rationality as “the extent to which the decision process includes the collection of all available information relevant to the decision, and the reliance upon analysis of this information in making the choice” [emphasis added]. This bounded, procedurally-rational[2] SDM process involves value-maximizing choices among clear alternatives, under specific constraints (Elbanna 2006).

For profit ventures, the relationship between a rational-driven SDM and organizational performance has been a subject of continuing controversy (e.g. Calabretta, Gemser, and Winjburn 2017; Fredrickson and Iaquinto 1989; Goll and Rasheed 1997), failing in that way to produce a meaningful generalization (Sharfman and Dean 1991). The majority of empirical work supports a positive link between rational decision-making dimensions and firms’ financial performance (Bourgeois and Eisenhardt 1988; Elbanna and Child 2007; Judge and Miller 1991; Miller and Cardinal 1994). Some studies have nuanced these findings suggesting a negative relationship in unstable environments and positive relationships in more stable ones (Fredrickson and Mitchell 1984).

Given that financial success of social ventures is an imperative for pursuing their commitment to the social mission, rationality lends itself readily to SEs as well. Becker and Potter (2002) argue that rational decision-making aims at maximizing the financial performance of both profit and not-for-profit ventures. In line with this, we argue that a rational-driven SDM approach will improve SEs’ economic performance, preventing them from diverting attention from financial goals. Though SEs seek net profitability that allows them to also pursue social results, empirical evidence has shown that decision-makers find difficult to simultaneously maximize both social and financial improvements (Zahra et al. 2009). As the organizational efforts dedicated to social purposes increase, firm resources will be depleted. A decrease in resource accumulation and associated capital deployment undermines the ability of organizations to address social problems and deliver social goods (Moizer and Tracey 2010), as they draw resources away from core areas of the business, resulting in lower profits. Thus, in SEs the pursuit of social goals may conflict with decision-makers’ rationality which prioritize financial objectives (Battilana and Dorado 2010). We hypothesize:

Hypothesis 1a:

Rational decision-making increases social enterprises’ financial performance.

Hypothesis 1b:

Rational decision-making decreases social enterprises’ social performance.

2.2.2 Organizational Politics – Performance Relationship

Drawing from agency arguments, organizations can be viewed as coalitions of people with converging aims. However, uncertainty over the future and the pursuit of personal ambitions results in individuals having competing and often conflicting objectives. The interaction of these attributes implies that the SDM process to be deeply political in nature (Wilson 2003), where individuals compete to satisfy their interests by engaging in political tactics, such as co-opetition, control of agendas, and the strategic use of information (Eisenhardt and Zbaracki 1992). However, influencing the decision-making process in favor of one’s preferences and preferred outcomes can create conflicts, impeding an organization to reach consensus (Schweiger and Sandberg 1991), compromising firm financial and social performance (Amason and Schweiger 1994; Dean and Sharfman 1996; Latham and Dello Russo 2008). Further, political decision-making may also limit the effectiveness of information sharing among organizational members, be time-consuming and lead to incomplete understanding of external contexts (Elbanna 2006). Organizational politics decrease performance by excluding feasible alternatives, reducing decision effectiveness, and increasing transaction costs; leading to resource misallocations (Dean and Sharfman 1996; Eisenhardt and Bourgeois 1988; Elbanna and Child 2007).

In the context of social ventures, there is evidence to support that politics in the SDM process can create a paternalistic culture, increase self-serving behaviors, and reduce financial turnovers (Ohana, Meyer, and Swaton 2012). In parallel, given their complexity and ambiguity, social objectives are rarely articulated in complete details, fomenting political behaviors that limit an adequate understanding among organizational members, and derail the quest of social objectives. In addition, the use of politics in SEs’ SDM process weakens the commitment of employees in the organization, undermining the achievement of its social mission (Meyer et al. 2002), negatively affecting the successful attainment of their social objectives. We argue:

Hypothesis 2a:

Political decision-making decreases social enterprises’ financial performance.

Hypothesis 2b:

Political decision-making decreases social enterprises’ social performance.

2.2.3 Intuition – Performance Relationship

Grounded in the seminal work of Simon (1947), intuition research has been approached by a wide range of theoretical lenses; including behavioral theories (Kahneman 2003; Kahneman and Tversky 1973), cognitive neurobiological assumptions (Agor 1986; Taggart and Valenzi 1990), and normative, dual-process considerations (Shapira 2008). These perspectives advance that intuition allows for incremental adaptations based on intimate knowledge of a given situation (Eisenhardt and Zbaracki 1992), corresponding to thoughts, choices and conclusions derived mainly through subconscious mental processes (Metzger and King 2015; Miller and Ireland 2005). In contrast to rationality’s data-driven analytical process, intuition recognizes a problem through the perception of relevant patterns, seeks holistic information that describes possibilities, activates in a non-consciously manner all relevant cognitive schemas, yet consciously generates a solution (Dane and Pratt 2007). Surprisingly, the majority of studies exploring intuition in the SDM field are rather theoretical (Elbanna 2006). In line with the conceptual developments framing our understanding of the interplay of intuition and analysis in organizational decision processes, intuition is assumed to lead to erroneous, biased, or inaccurate strategic directions, which stem from a number of fallacies and miscomputations inherent in human information processing (Khatri and Ng 2000). However, in actual business scenario the requirement for fast decisions and the limits of decision-makers’ rational information processing capacities may combine to impose severe demands upon executives’ cognitive capabilities to handle masses of information at the necessary speed in order to conclude their organizations into high financial performance levels (Sadler-Smith and Shefy 2004; Salas, Rosen, and Diaz-Granados 2009).

The empirical studies embracing these considerations have generally revealed positive associations between intuitive decision-making and performance in both for-profit (Akinci and Sadler-Smith 2012; Judge and Miller 1991), and non-profit ventures (Ritchie, Kolodinsky, and Eastwood 2007). For SEs in particular, intuition is expected to improve financial performance, since it provides for a more thorough approach to the role of organizations as not only rationally behaving economic entities, but also as social constructs. The intuition of SEs’ decision-makers spurs novel ways to deal with financial issues and validate future choices that could not be evaluated by using only rational decision-making dimensions. In parallel, intuitive decision-making leads to positive reactions to issues that are viewed as having a moral/ethical content, such as the challenge of tackling social problems (e.g. Haidt 2001; Sonenshein 2007). We suggest:

Hypothesis 3a:

Intuitive decision-making increases social enterprises’ financial performance.

Hypothesis 3b:

Intuitive decision-making increases social enterprises’ social performance.

2.2.4 The Interaction of Entrepreneurs’ Proactive Personality with SDM Process Dimensions

Entrepreneurs’ proactive personality traits should be included in models exploring SDM-performance links, as they contribute to the development of firm resources that lead to resource re-combinations that improve organizational competitiveness and maximize chances of survival (Pearce, Fritz, and Davis 2010; Teece 2007). Social entrepreneurs in particular, are often distinguished by a unique ability to envisage, predict, engage, and enact strategic transformational changes in the face of scarce resources, risks, and diverse contexts; with the overall purpose to create a meaningful impact on their environments (Thompson, Alvy, and Lees 2000). These arguments suggest a positive link between social entrepreneurs’ proactive personality with both financial (Thomas, Whitman, and Viswesvaran 2010) and social objectives of their venture (Bateman and Crant 1993).

It also follows that social entrepreneurs’ proactive personality configures SDM dimensions with the differentiated performance aspirations of their ventures. Proactivity generates alternatives (Siebert and Kurtz 2016), minimizes tensions arising from conflicting managerial preferences, and reinforces the effects of strategic cognitions on performance outcomes (Kahnemann and Frederick 2002). In particular, entrepreneurs’ proactive personality reinforces the rational decision-making imperative of SEs to locate and deploy the necessary resources to foster a more competitive posture in their operations (Bagnoli and Megali 2011), while it also leads decision-makers to allocate a part of financial wealth to the commitment of the organization’s social mission and values (DuBrin 2001). Thus, an entrepreneurial proactive personality improves the rational, decision-structuring models attempting to maximize a venture’s both financial and social performance (Torugsa, O’Donohue, and Hecker 2013). A proactive personality may also increase decision-making effectiveness because proactive individuals seek information and opportunities for improving things for both themselves and the employing organization (Crant 2000; DuBrin 2014). Eliminating hindrances caused by politics and power promotes the efficiency of organizational functioning (Morrison and Phelps 1999). So, proactive decision-makers tend to react to the restrictive situations caused by organizational politics by seeking opportunities to remove obstacles (Bateman and Crant 1993), and improve effectiveness in the achievement of both financial and social objectives. Finally, literature suggests that a combination of trait and cognition approaches contributes to a better understanding of entrepreneurial decision-making process (Mitchell et al. 2002). In our case, since personality traits are influenced by the tacit knowledge, perceptions, and experiences of the individuals, the parallel duality of proactivity with intuition is expected to provide new ideas and insights in SEs’ resource allocation decisions for blending economic and social value (Parker, Bindl, and Strauss 2010). We thus expect that social entrepreneurs’ proactive personality moderates the relationships between SDM process dimensions with SEs financial and social performance, as follows:

Hypothesis 4a:

Decision-maker proactivity moderates the relationships between SDM processes and financial performance, such that with greater decision-maker proactivity the positive relationships between rationality and intuition with financial performance become stronger, and the negative relationship between political decision-making and financial performance becomes weaker.

Hypothesis 4b:

Decision-maker proactivity moderates the relationships between SDM processes and social performance, such that with greater decision-maker proactivity the positive relationship between intuition and social performance becomes stronger, and the negative relationships between rationality and political decision-making with social performance become weaker.

3 Methods

3.1 Research Setting and Sampling Frame

This study investigates social ventures in Greece. In contrast to other European countries where SEs comprise a well-established organizational phenomenon, the social sector in the country has only recently emerged under the 4019/2011 law, likely in response to the severe budget cuts affecting the local economy following the 2008 financial recession. In the aftermath of crisis, SEs were conceived as social stopgaps to address failures in social and community services – a market and state failure to address high unemployment rates and vulnerable social groups (see for instance Rosalsky 2020). While the argument above rests on a social motivation as the primary driver, a complementary explanation may be that the collapse of the Greek economy spurred entrepreneurial activity as a substitute to employment. For instance, during the 2007 Great Recession in the United States, areas with lower employment rates were associated with greater new entrepreneurial ventures (Fairlie 2013; Shane 2011) as individuals preferred entrepreneurial endeavors to employment. A large number of businesses were created during that time, including an important number of SEs.

We tested our theoretical model and associated hypotheses using survey data derived from the complete list of 380 social sector’s organizations registered in the Social Insurance and Solidarity Department database of the Greek Ministry of Labor. This registry is considered the most authoritative and reliable source of information for the Greek social sector, enabling us to discern and thus discard other legal forms, such as collective associations, cooperatives, and communal organizations.

3.2 Survey Instrument and Data Collection

Our research took place in two phases. First, we mapped SEs’ SDM process and the extent of social entrepreneurs’ proactive personality by surveying social ventures’ founders: their decision-making is decisive in determining success or failure of their organization (Finkelstein and Boyd 1998). Our questionnaire was shaped with guidance from conceptual and empirical literature on SDM process and personality studies, in both business and social ventures. We conducted the first phase of our survey between July-December 2018. Following an initial mailing, we sent two reminders to SEs with a cover letter to explain our research purpose. After accounting for responses with missing data, 71 questionnaires were gathered. This represents a response rate of 18.7%, which exceeds the 10–15% range suggested for mail surveys (Gaur et al. 2011). To increase our sample size, 14 additional questionnaires were hand-collected during a pre-arranged meeting of the lead author with the founder of the targeted SE. Tests for independence showed no differences between the two subgroups in the means of the study’s constructs, resulting in 85 completed questionnaires. The SEs in our sample address a wide range of social problems, such as culture, education, health and environment, with some overlapping. Their activities are disproportionately concentrated in Greece (vs. foreign markets) with revenues from a combination of operational and non-operational activities (e.g. subsidies).

The second phase of the research (January–March 2020) evaluated SEs’ financial and social performance. Financial performance was sourced from the social ventures’ database provided by the Directorate of Social Protection and Solidarity (SPS) of the Greek Ministry of Labor. Social performance was measured through the administration of a questionnaire to 211 employees of the 85 SEs participating in the first research phase (2.48 respondents per firm). Since little is available in public records for SEs’ social impact, this approach seems to be an appropriate data source. Employees have good knowledge of the SE’s social impact in which they are employed (Sloan 2021), and have been a primary source of data in many studies (e.g. De Roeck et al. 2014; Gaudencio, Coelho, and Ribeiro 2014).

3.3 Bias Issues

While the reliability and validity of entrepreneurs’ self-reported data has been established in many studies (e.g. Chandler and Hanks 1993; Glick et al. 1990), we also assessed the extent of potential non-response bias by comparing respondents with non-respondents on firm age, and sector. No statistically significant differences were found. To reduce the likelihood of common method variance, we have mixed the order of questions when designing our questionnaire. This ex-ante remedy minimizes the likelihood of consistency motives and theory-in-use biases in the informant responses (Chang, van Witteloostuijn, and Eden 2010). To address further common method bias, we obtained data for our independent and dependent measures from separate sources to avoid problems of self-report bias, consistency effect, and illusory correlations (Podsakoff et al. 2003). Finally, with the aim of tackling SE founders’ social desirability bias (SDB), we have followed two approaches derived from the literature (Nga and Shamuganathan 2010): we have used forced-choice questions in our survey instrument and anonymized the names of social ventures and their founders.

3.4 Operationalization of Constructs

3.4.1 Dependent Variables

Financial and social performances were the two dependent variables in this study. While there is a wide variety of financial performance criteria identified in the literature, here we adopt Ritchie, Kolodinsky, and Eastwood (2007), and employ net profitability, provided directly by the SPS Dictorate registry. Profit indicators have been widely used by scholars when assessing firms’ organizational success, including the evaluation of their financial performance (e.g. Barnett and Salomon 2012; Bromiley and Harris 2014); and in particular in the social entrepreneurship context (Bagnoli and Megali 2011). We derived net profits by subtracting costs from revenues over a given period (Bansal and DesJardin 2014) (2019 fiscal year).

Since firms vary significantly in terms of their social aspirations, social performance is multidimensional in nature, and hence a very complex construct to measure (Brower and Mahajan 2013). According to Luo et al. (2015: 130), it refers to “product responsibility, community, human rights, diversity, training and development, health, safety, and employment quality”. Similar performance categories are used to evaluate B-corporations (or benefit organizations); ventures where profit is balanced with social and environmental performance, accountability, and transparency (see https://bcorporation.net/directory/dataworld-inc; Battaglia, Gragnani, and Annesi 2020; de Morais et al. 2021). Here, for developing our social performance indicator, we considered the following assumptions: (i) social performance reflects SEs’ efforts dedicated to both primary and secondary stakeholders (Brower and Dacin 2020), (ii) social performance could be internally, or externally driven (Muller and Kolk 2010), and (iii) social outcomes should be related to SEs’ offering (product or service) (Bagnoli and Megali 2011). We searched for the most common dimensions in scholarly investigations (e.g. Brammer, Brooks, and Pavelin 2006; Brower and Dacin 2020; Matten and Moon 2008; Muller and Kolk 2010; Wang and Berens 2015), consulting firms (PWC 2021), and independent bodies’ professional assessments (e.g. Kinder Lydenberg Domini [KLD], environmental, social, governance [ESG] data, EIRIS global sustainability surveys) to create our measure. Within these studies and reports the most commonly measured dimensions of social performance were environment, employee relations, offering (product and/or service), diversity, and community. Due to the limited availability of data regarding environmental dimensions of SEs’ located in Greece, we restrict our attention to the other measures. For each of these, we employed the following items identified in studies that reported specific performance metrics: for employee relations, we assessed the extent of employees’ satisfaction of health and safety, and vocational training programs provided by the management (two items). For the offering, the frequency of complaints by customers about consumer fraud (for instance the offering does not meet the unique selling proposition). Our indicator of diversity is based upon employees’ perceptions on the extent to which the SE is an equal opportunity employer, and for community relations the extent of interconnectedness with the local community. We asked our informants to evaluate on a seven-point Likert-type scale and used the average score of their responses to develop a composite measure. Our indicator of social performance demonstrates high internal consistency (Cronbach’s alpha and composite reliability above 0.7), and convergent validity (average variance extracted of 0.87).

3.4.2 Explanatory Variables

Our independent constructs have been developed based on concepts derived from the extant literature, and captured through multiple questionnaire items. Rationality and political behavior in SDM process were measured using Dean and Sharfman’s (1996) five-item and three-item measures respectively. Intuition was measured using a four-item scale derived from Khatri and Ng (2000). Entrepreneurs’ proactive personality was assessed with the 10-items, short version of Bateman and Crant’s (1993) 17-item proactive personality scale developed by Seibert, Grant, and Kraimer (1999). Our independent variables are defined and operationalized in Table 1.

Operationalization of core explanatory constructs.

| Multi-item constructs and items | Scale item 1 | Scale item 7 | Composite Reliability | Cronbach’s alpha | Average variance extracted (AVE) |

|---|---|---|---|---|---|

|

Rationality (measured on discrete, seven-points Liken scales)

Source: Dean and Sharfman (1996, p. 395) |

0.90 | 0.90 | 0.65 | ||

| Please evaluate the following statements | |||||

| We look for information in making the decision | not at all | extensively | |||

| We analyze relevant information before making the decision | not at all | extensively | |||

| The process of decision-making is analytical, grounded upon consistent planninga | strongly agree | strongly disagree | |||

| Quantitative analytical techniques in making the decision are considered as: | trivial | very important | |||

| The decision group is very effective at focusing its attention on critical information and ignoring irrelevant informationa | very prevalent | not prevalent at all | |||

|

Political behavior (measured on discrete, seven-points Liken scales)

Source: Dean and Sharfman (1996, p. 395) |

0.86 | 0.84 | 0.70 | ||

| Please evaluate the following statements | |||||

| The members of the organization are primarily concerned with the goals of the organization own rather than their own goalsa | strongly disagree | strongly agree | |||

| The members of the organization are open about their interests and preferences in the decisiona | not at all | extensively | |||

| The decision was a result of negotiations among the members of the organization | not at all | extensively | |||

|

Intuitive synthesis (measured on discrete, seven-points Liken scales)

Source: Khatri and Ng (2000, p. 80) |

0.76 | 0.77 | 0.51 | ||

| Please evaluate the following statements | |||||

| Extent to which you rely on pure judgment in making important strategic decisions | very narrowed | a great deal | |||

| Emphasis you place on past experience in making important strategic decisions | very little | a great deal | |||

| Extent to which you base important strategic decisions on a “gut feeling” | almost never | very prevalent | |||

| An overall assessment of the extent you use tacit knowledge, haunches, past experiences in relation to formal analysis of quantitative information when you take strategic important decisions | very narrow | very extended | |||

|

Proactive personality traits (measured on discrete, seven-points Liken scales)

Source: Seibert, Crant, and Kraimer (1999, p. 427) |

0.92 | 0.92 | 0.58 | ||

| Please evaluate the following statements | |||||

| I am constantly of the lookout for new ways to improve things | strongly disagree | strongly agree | |||

| Where I have been, I have been a powerful source for constructive change | strongly disagree | strongly agree | |||

| Nothing is more exciting than seeing my ideas turn into reality | strongly disagree | strongly agree | |||

| If I see something I do not like, I fix it | strongly disagree | strongly agree | |||

| No matter what’s the odds, If I believe in something, I will make it happen | strongly disagree | strongly agree | |||

| I excel in identifying opportunities | strongly disagree | strongly agree | |||

| I love to be a champion for my ideas, even against others’ opposition | strongly disagree | strongly agree | |||

| I am always looking for better ways to do things | strongly disagree | strongly agree | |||

| If I believe in an idea, no obstacle will prevent me for making it happen | strongly disagree | strongly agree | |||

| I can spot an opportunity long before the others can | strongly disagree | strongly agree |

-

aReverse-coded item.

3.4.3 Controls

We control for gender and educational background of the entrepreneur – critical determinants of organizational processes, including SDM, on performance (Goll and Rasheed 2005). Gender was captured with a 0–1 (female – male) binary variable, whereas educational background was sought to identify on a four-point Likert-type scale (4 = Doctorate, 3 = Master degree, 2 = Bachelor’s degree, 1 = High school/some college). We also used in our analysis three organizational-level controls. First, consistent with Brouthers, Brouthers, and Werner (2000), we control for industry through a dummy variable; coded as 1 (the enterprise is involved in the provision of services) or 0 (the enterprise is involved in trading activity, manufacturing, or within the agricultural sector). A second control variable, firm size was also included as larger firms may be better equipped than smaller firms because of the greater availability of resources (Dean and Sharfman 1993; Fredrickson and Iaquinto 1989), measured as the number of employees. Finally, in line with Forbes (2005), firm age was calculated as the number of months since the foundation of the SE.

4 Results

4.1 Measurement Properties

Our analyses were performed in the R statistical software package (R Core Team 2017). To evaluate our measurement models, we examined the reliability and validity of our explanatory constructs. Face and content validities were assessed by pretesting the questionnaire with four academics, experts in the field, as well as three social entrepreneurs, none of whom participated in the final data collection process. Since our study uses reflective measures, we further examined the internal consistency, convergent and discriminant validity of our measurement scales. With regard to internal consistency, all the constructs demonstrate high composite reliability (CR) that exceeds the suggested threshold of 0.7. Similarly, all the Cronbach’s alphas exceed the recommended value of 0.7 (Nunnally 1967). For assessing discriminant and convergent validity, we consulted Boateng et al.’s (2018) recommendation for small sample sizes (i.e. n ≤ 250), and employed partial least squares (PLS) modeling. By the use of PLS specification, we determine whether a construct shares more variance with its items than it shares with the other constructs of our model (Hulland 1999). Following Zott and Amit (2008), we first calculated the square roots of average variance extracted (AVE) values that measure the average variance shared between a construct and its items and then calculated the correlations between the different constructs of our model. All the corresponding AVEs exceed the proposed threshold of 0.5 (Chin 1998) (see Table 1), indicating satisfactory convergent validity. In order to assess the discriminant validity of our model, we employed the Fornell-Larcker (1981) criterion. This demands that the square root of constructs’ AVE be greater than the highest correlation with any other construct (Fornell and Larcker 1981). All diagonal values are greater than the correlations with the rest of the constructs (Table 2). This suggests that measurement model’s discriminant validity can be considered sufficient.

Descriptive statistics and Pearson correlations (two-tailed)a,c,d.

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Financial performanceb | 21,189.65 | 14,689.89 | n.a | ||||||||||

| 2. Social performance | 3.48 | 1.63 | 0.28g | 0.85 | |||||||||

| 3. Rationality | 3.15 | 1.25 | 0.26g | 0.11 | 0.80 | ||||||||

| 4. Political behavior | 4.23 | 1.39 | 0.10 | 0.24g | −0.25g | 0.83 | |||||||

| 5. Intuitive synthesis | 3.23 | 0.97 | 0.32f | 0.28f | 0.62e | −0.09 | 0.71 | ||||||

| 6. Proactive personality traits | 2.97 | 1.14 | −0.13 | 0.08 | 0.57e | −0.28f | 0.52e | 0.76 | |||||

| 7. Sector | 0.81 | 0.39 | 0.23g | 0.09 | 0.03 | 0.02 | 0.04 | −0.10 | n.a | ||||

| 8. Size (number of employees) | 15.58 | 8.6 | 0.07 | 0.06 | 0.04 | −0.07 | 0.02 | −0.04 | 0.05 | n.a | |||

| 9. Age (in months) | 64.46 | 28.16 | 0.07 | 0.05 | −0.04 | 0.02 | −0.11 | 0.01 | −0.20h | −0.09 | n.a | ||

| 10. Gender | 0.87 | 0.34 | 0.17 | −0.04 | −0.16 | 0.07 | 0.00 | −0.191 | 0.00 | −0.15 | −0.25g | n.a | |

| 11. Education | 2.61 | 0.66 | −0.21h | 0.02 | −0.11 | −0.09 | −0.16 | 0.01 | −0.15 | −0.12 | 0.08 | −0.12 | n.a |

-

a n = 85, bLambert W transformed, cvalues are rounded to two decimal places, dvalues on the diagonal (in bold) reflect the square root of AVE. Significance levels: e p < 0.001, f p < 0.01, g p < 0.05, h p < 0.1. n.a: not available.

4.2 Hypotheses Testing

Table 2 reports bivariate correlations as model-free evidence. The table indicates that our sampled firms operate mainly in the service sector (81%), are on average 5.37 years old and enroll about 16 employees. From the correlation matrix we observe that, while they may be associated with different trade-offs, financial and social performance are positively and significantly associated. We also observe that entrepreneurs’ proactive personality is significantly related to all three SDM process dimensions. Because most of the correlations between our regressors are moderate to low (two-tailed p), and the variance inflation factors (VIFs) range between 1.04 and 2.01, multicollinearity does not pose serious concerns to our analyses (see Hair, Ringle, and Sarstedt 2014). We nevertheless centered our moderating variables to mitigate for multicollinearity between the main effect and interaction terms (Cohen et al. 2003).

Our hypotheses relate to SEs’ financial and social performance. For both specifications, we first estimated a baseline model that omits the interaction effects (models 1 and 3 in Tables 3 and 4, respectively), reporting only the results of the direct influences of the core explanatory and control variables on the performance measurement criteria. The moderation impact of SDM process dimensions with proactive personality was introduced in models 2 and 4. We observe that in interaction models adjusted r-squared values increase, suggesting that the explanatory power of the SDM process-performance relationship increases, when interaction effects are included, consistent with Elbanna and Child (2007): contingent rather than direct relationships may provide improved explanations of performance assessments.

Results of OLS estimations on social enterprises’ financial performance.

| Ψ (Social enterprises’ financial performancea) | Mode 1: (controls and main effects) | Mode 2: (complete model) |

|---|---|---|

| Constant | −14,343.23 | −12,857.08 |

| (13,561.32) | (13,339.36) | |

| Control variables | ||

| Sector | 7398.06d | 7288.16d |

| (3560.35) | (3540.22) | |

| Size | 130.37 | 187.93 |

| (162.55) | (165.86) | |

| Age | 119.94d | 98.24e |

| (51.13) | (50.74) | |

| Gender | 9103.69d | 7441.54e |

| (4378.44) | (4339.37) | |

| Education | −1461.23 | −1845.41 |

| (2153.95) | (2126.03) | |

| Main effect variables | ||

| Rationality | 3995.16d | 3880.70d |

| (1519.88) | (1552.40) | |

| Political behavior | 810.82 | 1195.71 |

| (1031.07) | (1069.87) | |

| Intuitive synthesis | 5011.34d | 5617.66c |

| (1902.47) | (1916.01) | |

| Proactive personality traits | −5342.21c | −6001.94b |

| (1563.21) | (1562.62) | |

| Interaction terms | ||

| Proactive personality traits * rationality | −3099.42d | |

| (1510.97) | ||

| Proactive personality traits * political behavior | −848.89 | |

| (940.34) | ||

| Proactive personality traits * intuitive synthesis | 4285.29d | |

| (1844.02) | ||

| Observations | 85 | 85 |

| Adjusted R-squared | 0.298 | 0.328 |

| F-statistic | 4.955b | 4.419b |

-

aLambert W transformed, Significance levels: b p < 0.001, c p < 0.01, d p < 0.05, e p < 0.1. Standard errors in brackets.

Results of OLS estimations on social enterprises’ social performance.

| Ψ (Social enterprises’ social performance) | Model 3: (controls and main effects) | Model 4: (complete model) |

|---|---|---|

| Constant | −1.53 | −1.45 |

| (1.74) | (1.75) | |

| Control variables | ||

| Sector | 0.38 | 0.44 |

| (0.45) | (0.46) | |

| Size | 0.02 | 0.01 |

| (0.02) | (0.02) | |

| Age | 0.01 | 0.00 |

| (0.01) | (0.01) | |

| Gender | −0.04 | −0.16 |

| (0.56) | (0.57) | |

| Education | 0.29 | 0.23 |

| (0.28) | (0.28) | |

| Main effect variables | ||

| Rationality | −0.02 | −0.09 |

| (0.20) | (0.20) | |

| Political behavior | 0.35c | 0.40b |

| (0.13) | (0.14) | |

| Intuitive synthesis | 0.57c | 0.65c |

| (0.24) | (0.25) | |

| Proactive personality traits | −0.01 | −0.03 |

| (0.20) | (0.20) | |

| Interaction terms | ||

| Proactive personality traits * rationality | −0.13 | |

| (0.20) | ||

| Proactive personality traits * political behavior | 0.09 | |

| (0.12) | ||

| Proactive personality traits * intuititive synthesis | 0.37d | |

| (0.21) | ||

| Observations | 85 | 85 |

| Adjusted R-squared | 0.087 | 0.089 |

| F-statistic | 2.094c | 1.984c |

-

Significance levels: a p < 0.001, b p < 0.01, c p < 0.05, d p < 0.1. Standard errors in brackets.

Turning our attention to the control variables, for financial performance, SEs’ sector of activity, age and respondents’ gender were positive, with varying significance in the main effects and moderated models. The positive and statistically significant association between service SEs and financial performance supports the work of Dess et al. (1990): differences in ventures’ performance may be due to industry effects. Consistent with Smith, Smith, and Verner (2006), we also found a statistically significant relationship between decision-makers’ gender with financial performance. In our case, more established, male-owned/governed SEs have recorded better financial results. The ventures’ age was also significant with financial performance, in line with Wiklund, Baker, and Shepherd (2010) and Mishra, Randøy, and Jenssen (2001). On the contrary, we were unable to replicate Baum and Wally (2003) and Goll and Rasheed (2005) findings for a significant effect of firm size and decision-makers’ educational attainment for financial performance specifications. For social performance, our control variables were not significant.

Table 3 presents the results of regression analysis when the dependent variable is financial performance. We have tested our predictions with ordinary least square (OLS) regressions. This is in line with traditional strategic management research that employs OLS models to investigate the impact of strategy-related constructs on organizational performance (e.g. Belenzon, Pattaconi, and Zarutskie 2016). We performed normality and heteroscedasticity tests before interpreting any parameter estimates to test whether any of the assumptions of the OLS were violated. The models (main effects and interactions) appeared to be (marginally) normally distributed and heteroskedastic. We followed a common remedy to these issues by transforming our dependent variable, and conducting nonparametric bootstrap on the models with the untransformed dependent variable as a robustness check. Financial performance in our sample dataset displayed negative skewness (right-skewed), and excess kurtosis (skewness = −0.98, kurtosis = 5.08, and p < 0.05 for the Shapiro–Wilk normality test). Since financial performance takes both positive and negative values, we applied the Lambert W transformation described by Goerg (2011) to normalize the variable which has no difficulties with negative values as a logarithmic transformation does (Box and Cox 1964). The transformed dependent variable displayed a normal distribution (Shapiro–Wilk normality test: W = 0.99, p = 0.74). Subsequently, we reassessed the normality and heteroscedasticity of our models. The residuals of the main effects/interaction model appear to be normally distributed (Shapiro–Wilk normality test: W = 0.99/0.99, p = 0.91/0.95). Finally, with regard to heteroscedasticity, the main effects/interaction models also appear to be homoscedastic (studentized BP test: BP p = 0.59/0.59).

Hypothesis 1a predicts a positive relationship between the rational dimensions of decision-making with SEs’ financial performance. This relationship was found positive and significant (model 1: β = 3995.16, p < 0.05), supporting our hypothesis and corroborating the assumptions of synoptic formalism decision-making modes (e.g. Fredrickson 1984; Toft 1989) that a rational SDM process maximizes the organizational goals when these are evaluated in financial terms. Hypothesis 3a predicts a positive relationship between intuitive decision-making with SEs’ financial performance. The beta coefficient for the relationship between intuitive synthesis and financial performance is positive and significant (model 1: β = 5011.34, p < 0.05). Hypothesis 3a is supported, indicating that in the context of SEs, intuitively-based SDM translates into improved profitability. Overall, in relation to our direct relationships, we found that for financial performance, rationality, intuition, and proactivity were significant; but not political behavior, possibly because politicking in SEs is neither required nor appreciated when looking to maximize financial returns. These findings are at odds with some descriptions suggesting that SDM processes compromise between the exploitation of opportunities and a political solution to problems and crises (e.g. Mintzberg, Raisinghani, and Theoret 1976). For SEs, a conjoint consideration of a continuous, proactive opportunity-seeking SDM process coupled with decision-makers’ cognitive capabilities to recognize contextual patterns and associations seems to improve financial results.

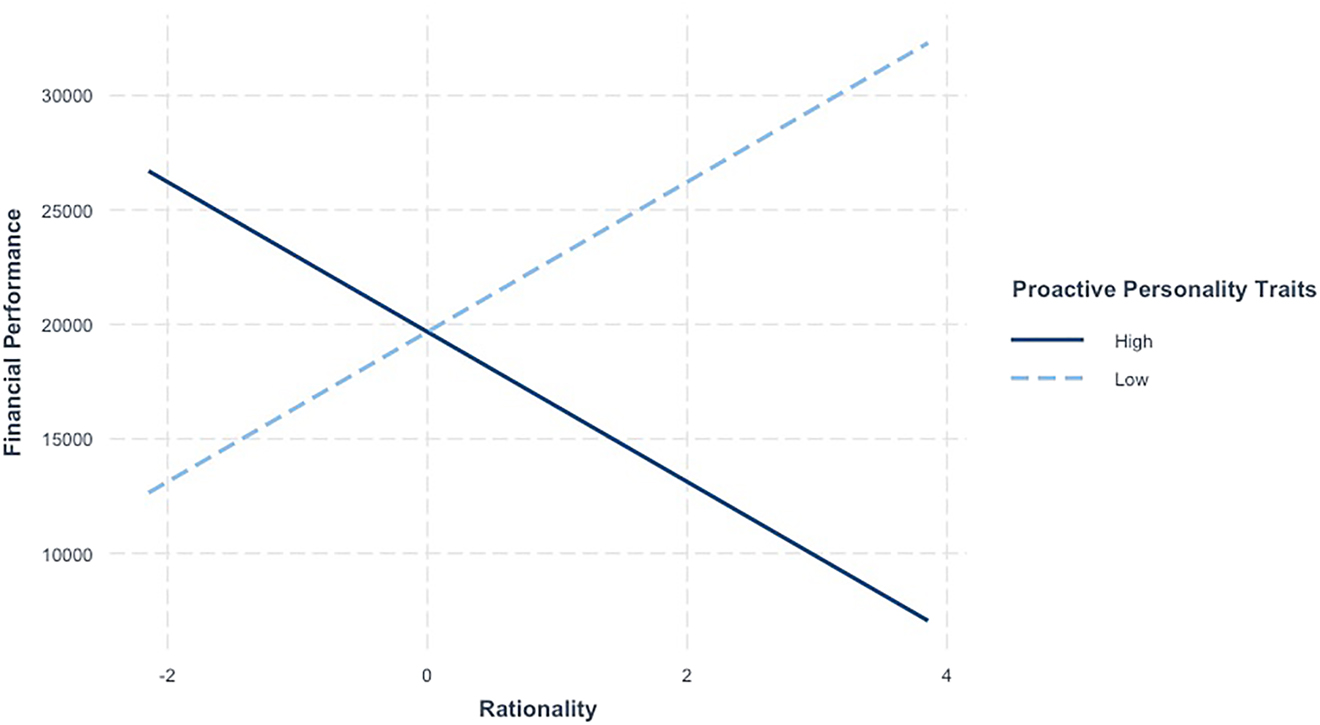

Hypotheses 4a posits that entrepreneurs’ proactive personality moderates the relationships between SDM process dimensions with SEs’ financial performance. Contrary to our expectations though, with greater entrepreneurial proactivity, a statistically significant, negative association between rationality and SEs’ financial performance is recorded in model 2 (β = −3099.42, p < 0.05). However, the plots in Figure 2 indicating a crossover effect of the interaction (see Gardner et al. 2017 for an analysis), suggest that this association is conditional to different levels of proactivity. Thus, a highly proactive entrepreneurial personality has weakening effects on the positive relationship between rational decision-making and SEs’ financial performance, whereas a low extent of proactivity accounts for the reverse situation. We posit that SEs are arbiters of their dual performance mission, weighing financial sustainability against meaningful social impact, and vice-versa. Under a rational SDM process, SEs with a highly proactive decision-making will commit organizational resources to develop, sustain and secure effective and meaningful long-term social initiatives. However, low proactive personalities will prioritize financial performance at the cost of their ventures’ social objectives. This arises to decision-makers’ inability to maximize social and financial performance simultaneously – they must resolve a constrained optimization dilemma.

Interaction effect of rationality and entrepreneurs’ proactive personality on SEs’ financial performance (95% CI, mean-centered, low/high ±1 std dev.).

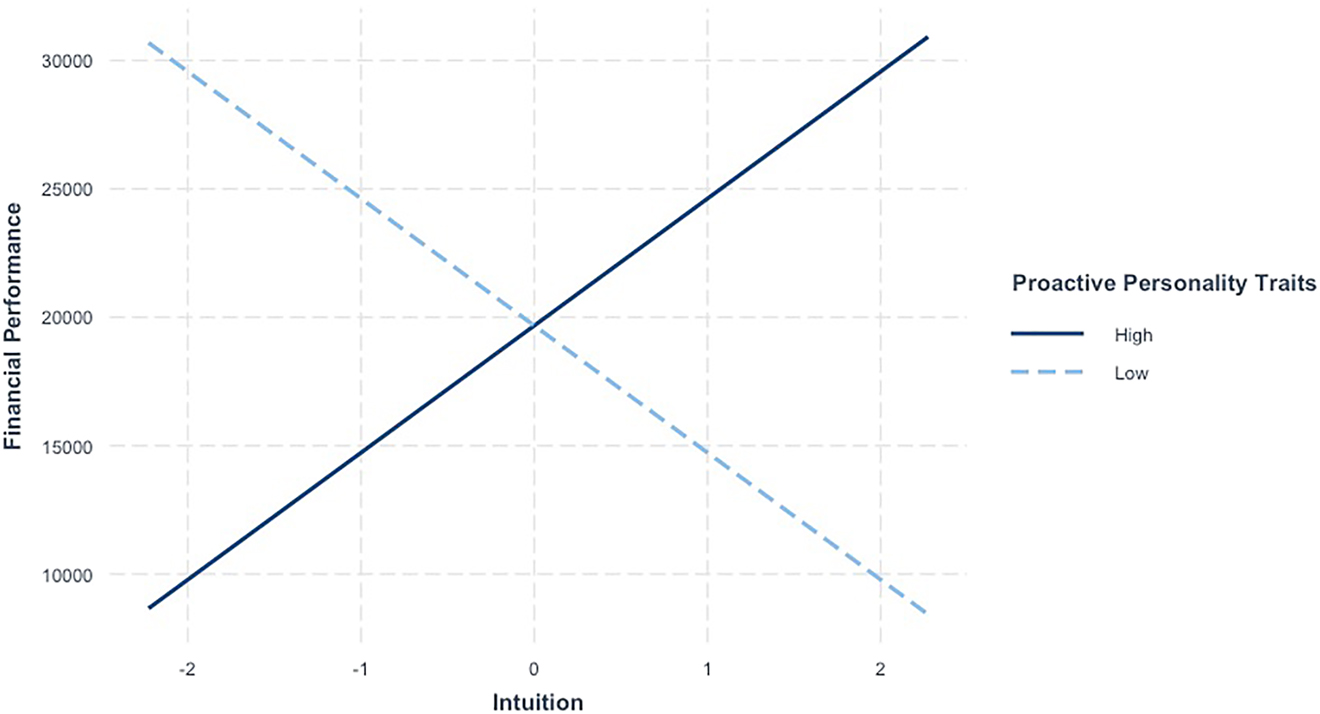

Model 2 also reveals that social entrepreneurs’ proactive personality moderates the positive relationship between intuition with SEs’ financial performance, such that this relationship becomes stronger as social entrepreneurs’ proactivity is at higher levels (β = 4285.29, p < 0.05). In line with our expectations, plots from Figure 3 suggest an accentuating effect of the interaction term in the proposed relationship. As hypothesized, the interplay of proactivity with decision-makers’ intuition reconfigures and redeploy SEs’ resource allocations in a way that conclude their organizations into high financial performance levels which, in turn, enhance their survival prospects.

Interaction effect of intuitive synthesis and entrepreneurs’ proactive personality on SEs’ financial performance (95% CI, mean-centered, low/high ±1 std dev.).

Proactivity as a moderator of political decision-making was not supported for either financial or social performance. As shown in the main effect for financial performance, politicking was not significant. While we argued for the reverse situation; i.e. that political aspects in the SE context would be significant, our study reports that financial performance was unaffected. By adding the moderation of proactivity, it is unsurprising that it remained insignificant. In a financial context, the direct impact of decision-makers proactive personality likely drives financial performance as leadership; social entrepreneurs are able to proactively anticipate, plan, and execute effectively. However, for social performance, the direct effect of political behaviors was positive; coalition building and collective negotiations are likely important antecedents to a SE’s success. Thus, the preoccupation for a social impact – benefits for the collective – suggests a greater role for group dynamics than individual proactivity. It is possible then that the proactive individual is unable to influence political dynamics, despite arguments that proactivity in political SDM entails a number of behaviors and tactics to increase participation levels and reach consensus (Hillman and Hitt 1999).

Table 4 presents OLS results when the dependent variable is social performance. With regard to these models, none of the assumptions related to normality and heteroscedasticity was violated. Hypothesis 2b posits that political decision-making will be negatively, and significantly related to SEs’ social performance. Contrary to our expectations, the relationship between politics and social performance was found positive and significant (model 3: β = 0.35, p < 0.05). Therefore, Hypothesis 2b is rejected. This finding provides support to Eisenhardt, Kahwajy, and Bourgeois (1997), advocating that politics serve as an important mechanism for organizational adaptation in fast changing marketspaces, so as enterprises are enabled to pursue their objectives in the long-term. As such, social entrepreneurs seem to use their position and power to establish consensus among organizational members, and effectively communicate their social vision to employees (Ohana, Meyer, and Swaton 2012). Hypothesis 3b posits that intuitive synthesis will be positively, and significantly related to SEs’ social performance. The relationship between intuition and social performance was found positive and significant (model 3: β = 0.57, p < 0.05). Thus, Hypothesis 3b is supported. This finding indicates that social entrepreneurs’ strategic cognitions (Elbanna 2006) seem determinant for the accomplishment of SEs’ social objectives. For social performance, incremental models advocating political and intuitive decision-making were significant. The synoptic “rational” SDM process and entrepreneurs’ proactive personality were not. Here, rationality in a SE where social performance is primordial is likely overtaken by political considerations and the intuitive competencies of the CEO. Similarly, proactivity is likely insignificant as time, effort and results are more important. Thus, a culture enabling SDM processes along with intuition and politicization seems to impact favorably on SEs social objectives.

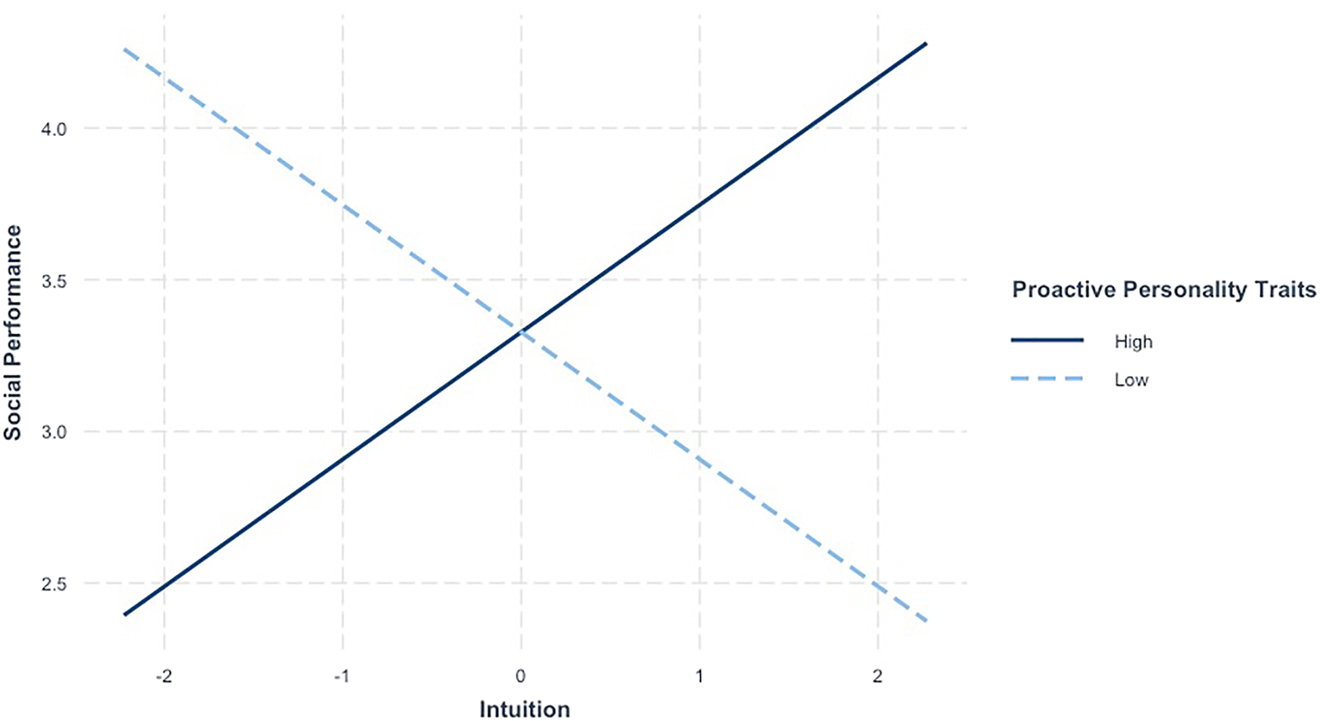

Hypotheses 4b posits that entrepreneurs’ proactive personality moderates the relationships between SDM process dimensions with SEs’ social performance. The interaction of intuitive decision-making with proactive personality traits is positive and significant for social (recall as well as financial) performance (model 4: β = 0.37, p < 0.10) supporting our hypothesis as illustrated in Figure 4. This supports the notion that proactively acting upon intuition leads to superior outcomes. While intuition is an ambiguous phenomenon, the tacit nature of one’s experience, knowledge, and cognition may at times complement or even substitute for rational SDM (Mintzberg, Brunet, and Waters 1986; Mintzberg, Raisinghani, and Theoret 1976). Coupled with proactivity, action-oriented leadership is better able to navigate the complexity of social objectives in meeting their collective aims.

Interaction effect of intuitive synthesis and entrepreneurs’ proactive personality on SEs’ social performance (95% CI, mean-centered, low/high ±1 std dev.).

For the other two SDM process dimensions, the interaction terms for rational and political decision-making with entrepreneurs’ proactive orientation were not significant on ventures’ social performance, as discussed above.

4.3 Robustness Tests and Endogeneity

We performed several supplementary analyses to examine the robustness of the findings. A major concern was the possibility of endogeneity. Historically, research implied exogenous effects of SDM dimensions on organizational outcomes (e.g. Pearce, Freeman, and Robinson 1987). However, recent studies posit performance as an important contextual variable that may influence SDM process dimensions (e.g. Elbanna and Naguib 2009). Based on Zaefarian et al. (2017), we introduced a time lag between our independent and dependent constructs. As argued by Dean and Sharfman (1996), SDM process allocates resources in the present to influence future organizational performance. By measuring our independent variables (SDM process dimensions and proactive personality) in year t-1, and financial and social performance in year t (i.e. the independent variables are measured in a time-lagged fashion) can significantly lessen endogeneity issues stemming from simultaneity effects. Given though the limitations of this approach (Reed 2015), and in order to further alleviate endogeneity concerns we employ the Durbin–Wu–Hausman endogeneity test for performance outcomes to examine whether rationality and intuition are endogenous explanatory variables. In these tests, we include decision-makers’ amount of work experience as an instrumental variable (IV). This construct is theoretically and statistically significant correlated with rational and intuitive SDM processes (e.g. Forbes 2005; Judge and Miller 1991; Musso and Francioni 2012). While the impact of work experience on job performance is positively related (e.g. Hunter and Thatcher 2007; McDaniel, Schmidtt, and Hunter 1988), its correlations with many financial performance indicators has been generally reported as non-significant by many scholars (e.g. Francioni, Musso, and Cioppi 2015; Judge and Miller 1991: 458; Strandholm, Kumar, and Subramanian 2004: 64). We consult Hitt and Tayler (1991) and measure the amount of work experience as the chronological number of decision-maker’s total years of professional tenure. Our IV reflects the same period as our potentially endogenous repressors (t-1). The test results show that the explanatory variables are not endogenous. In particular, the amount of work experience is statistically significant correlated with both rational and intuitive SDM process (r = 0.30 and 0.23 at the 0.01 and 0.05 level of significance, respectively), but not with SEs’ financial (r = 0.16, not significant) and social performance (r = 0.08, not significant as well). Hence, it appears that there is no endogeneity bias in the OLS estimates (p > 0.05 in all Durbin–Wu–Hausman tests). In addition, all F-statistics are statistically significant during the first stage of the regression (p = 0.00). Finally, the fact that we included important control variables and industry dummies in our analysis can further ease the concern on endogeneity bias (Wang and Berens 2015).

Additional robustness checks have also been conducted to ensure the validity of our findings. First, by adopting Behn’s (2003) recommendation suggesting that an organization’s performance should be evaluated in accordance to the specific objectives set, we have asked SEs’ owners to report the degree to which financial and social-related goals of their ventures have been successfully achieved, by making early 2018 and end-year evaluations (adapted from Morgan et al. 2003). This has created two fractional dependent variables (percentages) which can never be below zero or above one. We adopted Adegbesan and Higgins (2011) and employed the “fractional logit” solution introduced by Papke and Wooldridge (1996). Results were consistent with those of Tables 3 and 4, having though the problem of common method bias.

Second, regarding the hypotheses related to financial performance we conducted nonparametric bootstrapping. We tested our findings on the untransformed dependent variable with 50,000, 100,000, and 500,000 bootstrap samples. None of the bootstrap confidence intervals for the statistically significant parameter estimates in the interaction model crossed zero (no coefficient sign change on the confidence interval 2.50–97.5%), showing that the significant parameter estimates in the OLS model remain statistically significant under the nonparametric tests. We additionally conducted wild bootstrapping as heteroscedastic regression models are present (e.g. Flachaire 2005; Wu 1986). We operationalize this with 50,000, 100,000, and 500,000 bootstrap samples. Again, the findings reported in the regression analysis above have remained robust (no coefficient sign change on the confidence interval 2.50–97.5%).

Next, we have used revenues as an alternative measure for measuring SEs’ financial performance, consistent with Haans (2019) as some may consider financial performance as breaking even or making a small profit. These results were inferior in significance. We used a probit approach to test our models when our dependent variable was social performance. Results were similar in sign and direction with those of Table 4, though the model’s goodness-of-fit measures to the data were slightly lower. As a final robustness check, we also conducted the same set of analysis without any control variables in order to probe the influence of contextual variables (Glaser, Stam, and Takeuchi 2016). According to their perceptions, running analysis with and without control variables is important, since it offers information about the utility of our explanatory variables to explain uncontrolled variance in the dependent variable. Our results were unaffected by exclusion of any of these control variables, providing support for the validity of our findings. Overall, our conclusions remain unchanged with these robustness checks.

5 Discussion and Implications

Organizational scholars have extensively-studied the effects of SDM on performance. Although this literature is burgeoning, we were unable to find any strategy or entrepreneurship research modeling SEs’ SDM challenges. Another concern is that two of the dominant approaches in the SDM process field, one emphasizing rational and non-rational strategic decision models (e.g. Dean and Sharfman 1996; Miller and Ireland 2005), and the other advancing the importance of decision-makers’ personality (e.g. Low and MacMillan 1988) have remained somewhat divergent. Although each of these approaches provides unique and beneficial insights that help explain the outcomes of SDM, Brouthers et al. (2000) suggest that: (1) different perspectives explain only partially the process; (2) there exist interactive effects between the different perspectives; and (3) therefore, researchers ought to propose and test integrated models in SDM research. Following this, our study integrates synoptic and incremental decision dimensions with entrepreneurs’ personality traits, by investigating the interactions of rationality, organizational politics, and intuition with proactivity in assessing SEs’ dual mission. In this regard, we respond to coinciding calls for jointly consider different perspectives of SDM process on organizational outcomes in the third sector organizations (e.g. Pestoff and Hulgård 2016; Ritchie, Kolodinsky, and Eastwood 2007); social entrepreneurs have developed new business models for our century and the investigation of SDM process in SEs is an ever-expanding theme of research. By employing an interaction process model, we also advance our understanding of the interplay of different theoretical fields in explaining an organization’s performance variations. Studying interaction effects is critical for creating, extending, and bounding theory in decision sciences, where typically simple cause/effect relationships between SDM process dimensions and performance are assumed. Linear models may help managers predict, but not necessarily to understand. A model can reproduce observed behavior but does not guarantee that the underlying assumptions are correct. Finally, by integrating multiple perspectives, scholars may gain a deeper understanding of how strategic decisions are made (Eisenhardt and Zbaracki 1992; Hitt and Tyler 1991).

The evidence supports our underlined research assumption. While research has focused on detailing the properties of decision constructs in isolation, the complex structure of SDM provides many opportunities for rational approaches, incremental dimensions, and personality characteristics to coexist. Yet, their impact on SEs’ performance is differentiated, since the analysis of direct relationships detects disparities in the level of significance and relevance between synoptic formalism and incremental decision modes, and their associations with SEs’ financial and social performance. In the area of financial performance, our results record the positive and highly significant effects of rational and intuitive decision models, consistent with Fredrickson’s (1984) theory that organizational approaches to strategic decisions should be simultaneously rational and incremental. In this line, Eisenhardt (1989) and Papadakis and Barwise (2002) suggest that decision-makers need to combine both rationality and intuition. Thus, while intuition and rationality may be conceived as contradictory or mutually exclusive approaches (Calabretta, Gemser, and Winjburn 2017: 368), they are both needed in SEs’ SDM process to improve their financial posture. However, when social objectives come to the fore, a rational approach has proven to be insignificant, and incremental decision models should be prioritized. We argue then that the complexity of social objectives reduces the predictive power of rational-driven decision-making analysis, turning it to be less efficient and effective. In synthesis, if for SEs “the success story is told by the combination of social and financial performances” (Arena, Azzone, and Bengo 2015: 651), social entrepreneurs should use conjointly rational and non-rational SDM dimensions, favoring their complementarity on the performance aspirations of their ventures. These results show that some of the findings of Dean and Sharfman (1996), Eisenhardt and Bourgeois (1988), and Hitt and Tyler (1991) extend beyond business enterprises, to also include SEs as well.

Our findings are though conditional, such that whereas the reliance on an incremental decision style, bolstered by decision-makers’ proactive personality elements serve to enhance SEs’ social performance, the interaction of rational dimensions with entrepreneurs’ proactive personality seems to have a reverse effect on their immediate financial competitiveness (or on their net profitability). We provide the following explanation for this finding: proactive decision-makers seem reluctant to sacrifice long-term value creation in order to smooth earnings, or meet short-term financial targets (Gupta, MacMillan, and Surie 2004). Social entrepreneurs’ SDM rationality is a pathway towards sustainability where the singular pursuit of only short-term financial objectives can create temporal imbalances (Bansal and DesJardine 2014) threatening SEs’ long-term value. Thus, proactive social entrepreneurs make rational, intertemporal rational trade-offs to safeguard long-term benefits by discounting short-term returns.

Several limitations of the study necessitate caution when interpreting the results. SEs represent only a minor fraction of business activity not only in Europe, but also globally, limiting generalization beyond our context. It is unclear, if similar findings would apply to all third sector organizations and to different national contexts. As SEs comprise a hybrid organizational type, responding to social challenges, often locally, it would be beneficial to replicate this research for other types of non-profits, cooperatives, volunteer-based organizations, or even B-Corps in various national contexts. Another important limitation derives from the fact that in our investigation, SEs’ financial performance was captured with an accounting indicator. Some literature suggests that ratio indicators are not particularly suitable for the specific research setting[3] because they could exaggerate relations of interest and confound the interpretation of results (Wiseman 2009). However, we acknowledge that the relationship between SDM process and performance should accommodate time-based information and, in this direction, the use of ratio financial indicators could lead to models that are more powerful. Similarly, our study controlled only for organizational and demographic variables and was limited in our inclusion of environmental conditions; they are an important consideration in making effective strategic decisions (Bourgeois and Eisenhardt 1988). For example, environmental munificence and competitive factors are widely referred to when exploring the relationships between SDM processes and organizational performance (e.g. Dean and Sharfman 1996; Goll and Rasheed 2005). Also, a venture’s financial performance can also be largely driven by product-level variables, such as innovativeness of the product/service offered. Due to data limitations, we could not control for their impact, but future research should account for. Further, with regard to trait literature, it might be useful to account for constructs other than proactivity in future research. Finally, as SDM is dynamic, a longitudinal, process-focused design would provide complementary information to our study.