Analysis on Trade Gains from the Economic Dual Circulation in China

-

Shaojun Zhang

Abstract

Accelerating the building of a new development pattern with domestic market as the mainstay and domestic and international markets reinforcing each other is a major decision made by the CPC Central Committee with Comrade Xi Jinping at the core in light of changes in the development stage, environment and conditions in China. Trade gains are an important indicator of the development trend of domestic and international circulations for a country. With the quantitative model of trade gains containing the multi-sectoral input-output relations, this paper estimates the trade gains from the economic dual circulation in China between 1987 and 2017, based on the kernel density estimation and Markov chain, and the main findings are as follows. (1) The trade gains from the domestic circulation in China showed a downward trend, while the trade gains from the international circulation presented a trend of first rising and then declining. But the former still outweighed the latter. (2) Compared with the international circulation, the continuity, spatial correlation effect and rising potential of the trade gains from China’s domestic circulation were greater. (3) There was no positive spatial correlation effect between the trade gains from the domestic and those from the international circulation. China should make overall plans for opening up both externally and internally, and unblock sticking points between the two circulations, so as to realize the positive interaction of the trade gains from the dual circulation, and accelerate the formation of a new development pattern with domestic market as the mainstay and domestic and international markets reinforcing each other.

1 Introduction

Accelerating the building of a new development pattern with domestic market as the mainstay and domestic and international markets reinforcing each other is not only a strategic decision made to achieve the second centenary goal and ensure both development and security, but also a strategic plan to seize the initiative of future development. Since the trade gains are an important part of China’s economic dual circulation, accurately measuring the trade gains from the dual economic circulation and comparing and analyzing its evolution trend and temporal and spatial characteristics are of great significance for accelerating the building of a new development pattern of China’s economy. From the perspective of spatial flow, trade gains can be divided into the gains from the international circulation (that is, trade gains brought by international trade) and the gains from the domestic circulation (that is, trade gains brought by domestic inter-regional trade). For a large economy like China, it is particularly important to measure and compare the two kinds of trade gains.

The quantification of trade gains has always been an important research direction in the field of trade, and great progress has been made in related studies. These studies mainly focus on the following two aspects. First, explore a specific source of trade gains based on the microscopic data at the product or enterprise level, such as product diversity (Broda and Weinstein, 2006; Chen et al., 2011; Hsieh et al., 2020), and productivity (Melitz and Trefler, 2012; Liu and Xu., 2013; Ramanarayanan, 2020). Second, conduct a counterfactual analysis of overall benefits by building sufficient statistics (Arkolakis et al., 2012; Head et al., 2014; Albrecht and Tombe, 2016). When studying trade gains, the existing literature mainly analyzed the gains brought by international trade, while the gains brought by domestic inter-regional trade were ignored mainly for the following two reasons. The first reason is the constraint of theoretical assumptions. The trade theory assumes that the opportunities for domestic inter-regional trade gains have been fully utilized and the allocation of resources is in the optimal state (Krugman, 1997). However, due to the existence of domestic trade costs, it is difficult for a country’s domestic commodity flow and resource allocation to reach the optimal state, which means that potential gains can be obtained through domestic inter-regional trade. As Ohlin (2017) said, domestic regions should not be ignored, and special attention should be given to certain countries; only when a country consists of similar regions, can domestic inter-regional trade be ignored when studying international trade. The second reason is the scarcity of statistics. Due to the lack of special statistical institutions of inter-regional trade, the data of inter-regional trade is very scarce, thus limiting the in-depth and detailed research on the gains of inter-regional trade. Actually, the scale of inter-regional trade is so large that we should pay more attention to the trade gains it brings (Hewings and Oosterhaven, 2021). It is worth pointing out that there is still a gap in the research on the comparative analysis of China’s international trade gains and domestic inter-regional trade gains.

This paper has the following innovations. First, it establishes a quantitative model containing multi-sectoral input-output relations and uses the kernel density estimation and Markov chain to provide an analysis framework for the study of trade gains from the dual circulation in a country. Second, on the basis of the comparative analysis on the trade gains from the economic dual circulation of a country, it clarifies the main position of the domestic economic circulation of a country from three aspects: continuity, spatial correlation and rising potential of the trade gains. Third, it explores the evolution trend and structural characteristics of the trade gains from China’s economic dual circulation in different regions and different sectors, hence a dynamic three-dimensional cognition of the trade gains from China’s economic dual circulation.

2 Model Setting, Research Methods and Data Explanation

2.1 Model Setting

This paper builds a model containing multi-sectoral input-output relations, and quantifies the trade gains from the domestic and international circulations on this basis. The specific model is as follows:

2.1.1 Consumption

Assume that the total household consumption in each region i, j=1…n is as follows:

Wherein, βjs>0 is the expenditure share of goods in sector s of region j, and it meets the condition

Wherein, σs refers to the substitution elasticity of goods of sector s; cijs refers to the quantity of goods of sector s consumed by region j in region i. When the consumer utility reaches its maximum level, the quantity of goods (cijs) consumed by region j in region i is as follows:

Wherein, Cjs refers to the total consumption of sector s in region j; pijs refers to the price of goods in sector s of region i sold in region j; Pjs refers to the total price index of goods in sector s of region j, which meets the condition

Wherein, pijs=Pisτijs, Pis is the price of goods in sector s of region i; τijs=τjis is the trade cost of sector s between region i and region j, which meets the condition τjj=1.

2.1.2 Production

It is assumed that intermediate inputs are mainly produced with two factors, i.e., labor and compound intermediate inputs, which satisfy the conditions of constant returns to scale and fully competitive market. When costs are minimized, the unit production cost (cjs) of sector s in region j (Eaton and Kortum, 2002) is assumed as follows:

Wherein, wj is the wage level in region j, and

Wherein, Mjs is the total amount of intermediate inputs used by sector s in region j, and mjk is the total amount of intermediate inputs in sector k of region j, so the optimal intermediate input is

2.1.3 Wages

Under the condition of a fully competitive market, the commodity price of sector s in region j can be obtained according to Formula (4) and Formula (5):

Wherein,

According to Formula (5) and Formula (7), the price of intermediate inputs in sector k of region j is

When i=j, τjj=1, Formula (9) and Formula (10) can be changed to Formula (11) and Formula (12) respectively:

2.1.4 Quantification of Trade Gains from Dual Circulation

Based on the methods proposed by Dekle et al. (2008), assume that x̂ = x / x′ , wherein x and x’ are respectively values in the factual and counterfactual cases. According to Formula (11) and Formula (12), the changes in actual wages can be expressed as follows:

According to Formula (13) and Formula (14), the actual wage level in region j can be expressed as the function of local expenditure shares (intermediate inputs, final use) and related parameters (Arkolakis et al., 2012). Thus, the parameters that need to be calibrated are the commodity consumption preference βjs of sector s in region j, labor input share φjs of sector s in region j, input preference parameter φjks of sector s in region j for goods in sector k, and elasticity of substitution of sector s. The changes in the share of local expenditure include changes in the share of local final goods expenditure and changes in the share of local intermediate inputs expenditure. This paper calculates the trade gains in three situations, namely, dual circulation, domestic circulation and international circulation, by building counterfactuals, specifically as follows:

Counterfactual 1: Trade gains from the dual circulation (CGj(nt)). Assume that a region is closed to both domestic inter-regional trade and international trade, that is, the region neither imports final goods and intermediate inputs from other countries nor transfers final goods and intermediate inputs from other parts of the country. Thus, under the condition of self-sufficiency, assume that

The trade gains from the dual circulation in the region can be obtained by substituting Formula (15) into Formulas (13) and (14).

Counterfactual 2: Trade gains from the international circulation (CGj(ngt)). Assume that a region is closed to international trade but allows inter-regional trade, that is, the region does not import final goods or intermediate inputs from other countries, but transfers final goods and intermediate inputs from other parts of the country. Therefore, in the case of international trade closure,

Wherein,

Counterfactual 3: Trade gains from the domestic circulation (CGj(nst)). Assume that a region is closed to inter-regional trade but allows trade with other countries, that is, the region does not transfer final goods or intermediate inputs from other parts of the country, but imports final goods and intermediate inputs from other countries. This paper further defines that the trade gains from the dual circulation, trade gains from the international circulation and trade gains from the domestic circulation meet the condition CGj(nt) = CGj(ngt)×CGj(nst), so in the case of inter-regional trade closure:

The trade gains from the domestic circulation in the region can be obtained by substituting Formula (17) into Formulas (13) and (14).

2.2 Research Methods

2.2.1 Kernel Density Estimation

Kernel density estimation is to estimate the probability density of a random variable by introducing space and time factors based on non-parametric kernel density. It can be used to explore the spatial correlation of random variables, and reveal the distribution characteristics and evolution trend of random variables in space-time. The joint kernel density function f(x,y) of random variables x and y can be expressed as follows:

Wherein, n is the number of observations; K(·) is the kernel density function; Xi and Yi are observations;

2.2.2 Markov Chain

Although kernel density estimation can show the overall distribution pattern of samples and the reason for the change of density distribution, it cannot indicate the possibility of state change. This paper will use Markov state transition probability to further examine the stability of the trade gains from China’s economic dual circulation and the possible state transition process of future trade gains in various regions and sectors. The calculation formula of Markov transition probability matrix can be expressed as follows:

Wherein, u, v respectively represent the state of trade gains in different regions or sectors at different times; t is the year, which can be 1987, 1992, 1997, 2002, 2007 and 2012 according to the data in this paper;

2.3 Data Explanation

The data of inter-provincial trade and international trade used in this paper are from the input-output tables of provinces in China in 1987, 1992, 1997, 2002, 2007, 2012 and 2017. The input-output tables of provinces in 1987, 1992 and 1997 used in this paper cover 33 sectors, while the input-output tables of provinces in 2002, 2007, 2012 and 2017 cover 42 sectors. In order to make the data comparable across time, this paper integrates the sectors involved in the input-output tables into 29 sectors, among which 20 are in the industrial sector. In this way, the database built in this paper includes 7 years, 30 provincial-level administrative regions (excluding Xizang) and 29 sectors, with three-dimensional characteristics.

Drawing on the practice of Yilmazkuday (2012), this paper calculates the elasticity of substitution of different sectors by means of dividing the sum of intermediate inputs of sectors in various regions by the sum of intermediate inputs of sectors in various regions and labor compensation. The labor input share φs is measured as the share of labor compensation in value added. The consumption proportion βjs of goods in sector s of region j and the proportion φjks of intermediate inputs in sector k used by sector s of region j can be calculated based on the input-output tables.

3 Trade Gains from China’s Domestic Economic Circulation

3.1 Evolution Trend of Trade Gains from China’s Domestic Economic Circulation

Figure 1 shows the average value and evolution trend of the trade gains from China’s domestic economic circulation between 1987 and 2017. At the regional level (Figure 1 (a)), the trade gains from China’s domestic circulation showed an overall downward trend from 1987 to 2017 nationwide. The average value of trade gains from the domestic circulation in the provinces fell from 5.47 in 1987 to 1.96 in 2017, an average decline of 12.40% every five years. This suggests that, at the regional level, the trade gains brought by China’s domestic economic circulation were declining. The analysis at the sector level is consistent with that at the regional level. [2]

Trade Gains from China’s Domestic Circulation between 1987 and 2017

From a regional perspective, [1] the trade gains from the domestic circulation in coastal regions and inland regions showed a downward trend overall, and the gap in the trade gains between coastal regions and inland regions was narrowing. In the 1980s, coastal regions took the lead in reform and became the centers of production and circulation. Moreover, they took the lead to break the boundaries of production and circulation with the aid of foreign-invested enterprises, and the restrictions on domestic sales were further relaxed (Pei and Peng, 2008). As a result, there was a large gap in trade gains between coastal regions and inland regions in 1987. After that, as China gradually advanced its reform, the relevant restrictions on inland regions were relaxed, so that the gap in trade gains between coastal and inland regions showed a trend of narrowing.

3.2 Spatial-Temporal Characteristics of Trade Gains from China’s Domestic Economic Circulation

Figure 2 (a) and (b) respectively present the kernel density distribution and density contour plots of the trade gains from the domestic circulation of China’s provinces in time and space. In the kernel density distribution plot (time), the X-axis is the trade gains from the domestic circulation of the provinces in t years; the Y-axis is the trade gains from the domestic circulation of the provinces in t+5 years; and the Z-axis is the probability density, representing the conditional probability of the corresponding point in the X-Y plane. In the density contour plot (time), the X-axis is the trade gains from the domestic circulation of the provinces in t years; and the Y-axis is the trade gains from the domestic circulation of the provinces in t+5 years. From a temporal perspective (Figure 2 (a)), for provinces with the trade gains from the domestic circulation less than 4, the wave peaks were mostly distributed along the 45-degree diagonal line, and some were scattered above the 45-degree diagonal line, while for provinces with the trade gains from the domestic circulation greater than 4, the wave peaks converged parallel to the X-axis, between y=2 and y=3.5. This shows that when the trade gains from the domestic circulation were less than 4, the trade gains from the domestic circulation in the provinces had a certain degree of continuity. When the trade gains from the domestic circulation were greater than 4, the provinces were restricted from further increasing the trade gains from the domestic circulation, and the trade gains from the domestic circulation showed a downward trend after five years. The analysis at the sector level is consistent with that at the regional level (see Figure 2(c) and 2(d)).

Spatial-Temporal Characteristics of Trade Gains from China’s Domestic Circulation

In the kernel density distribution plot (space), the X-axis represents the trade gains from the domestic circulation of the province in t years; the Y-axis represents the trade gains from the domestic circulation of neighboring provinces in t years; [1] and the Z-axis is the probability density, representing the conditional probability of the corresponding point in the X-Y plane. In the density contour plot (space), the X-axis represents the trade gains from the domestic circulation of the province in t years; and the Y-axis represents the trade gains from the domestic circulation of neighboring provinces in t years. From a spatial perspective (Figure 2 (b)), for provinces with the trade gains from the domestic circulation less than 4, the wave peaks were distributed along the 45-degree diagonal line, while for provinces with the trade gains from the domestic circulation greater than 4, the wave peaks were mostly scattered on both sides of the 45-degree diagonal line. This shows that when the trade gains from the domestic circulation were less than 4, there was a positive spatial correlation effect on the trade gains from the domestic circulation in the provinces; and when the trade gains from the domestic circulation were greater than 4, the spatial correlation effect on the trade gains from the domestic circulation in the provinces showed a weakening trend.

3.3 Steady-State Analysis of Trade Gains from China’s Domestic Economic Circulation

Table 1 shows the state transition probability of the trade gains from the domestic circulation in China between 1987 and 2017. At the regional level, the probability of provinces with high, medium and low rankings in terms of the trade gains from the domestic circulation to maintain their original ranking after five years was 0.50, 0.44 and 0.45, respectively, on a national scale; and the diagonal probability was greater than the non-diagonal probability. This indicates that the ranking of the trade gains from the domestic circulation in the provinces was stable to a certain extent, but it failed to reach a “steady state”. Specifically, the probability of low- and medium-ranking provinces rising to a high rank after five years was 0.14 and 0.29 respectively; and the probability of rising from a low rank to a high rank was 0.38. This indicates that the ranking of the provinces had the possibility of rising step by step, and a greater probability of skipping. The probability of medium- and high-ranking provinces falling to a low rank after five years was 0.27 and 0.25 respectively; and the probability of falling from a high rank to a low rank was 0.25. This indicates that provinces with medium and high rankings in terms of the trade gains from the domestic circulation were likely to fall to a low rank. A comparison indicates that the probability of medium-ranking provinces rising to a high rank was higher than the probability of falling to a low rank; and the probability of low-ranking provinces rising to a high rank was lower than the probability of high-ranking provinces falling to a low rank. This means that provinces had a greater probability of rising to a higher rank in terms of the trade gains from the domestic circulation than that of falling to a lower rank. It can be seen that the domestic circulation can bring huge potential gains, and provinces should make full use of their own endowment advantages to increase the trade gains by virtue of the huge domestic market.

State Transition Probability of Trade Gains from China’s Domestic Circulation between 1987 and 2017

| Regions | Nationwide | Coastal | Inland | ||||||

|---|---|---|---|---|---|---|---|---|---|

| High | Medium | Low | High | Medium | Low | High | Medium | Low | |

| High | 0.50 | 0.25 | 0.25 | 0.50 | 0.29 | 0.21 | 0.49 | 0.22 | 0.27 |

| Medium | 0.29 | 0.44 | 0.27 | 0.33 | 0.44 | 0.22 | 0.30 | 0.44 | 0.30 |

| Low | 0.38 | 0.14 | 0.45 | 0.45 | 0.18 | 0.36 | 0.33 | 0.11 | 0.40 |

| Sectors | Industrial | Intermediate goods | Final goods | ||||||

| High | Medium | Low | High | Medium | Low | High | Medium | Low | |

| High | 0.76 | 0.17 | 0.07 | 0.88 | 0.07 | 0.04 | 0.00 | 0.90 | 0.05 |

| Medium | 0.60 | 0.40 | 0.00 | 0.88 | 0.13 | 0.00 | 0.00 | 0.51 | 0.49 |

| Low | 0.33 | 0.67 | 0.00 | 0.67 | 0.33 | 0.00 | 0.00 | 0.21 | 0.79 |

From a regional perspective, in terms of the trade gains from the domestic circulation, the probability of high-, medium- and low-ranking coastal regions to maintain the original ranking after five years was 0.50, 0.44 and 0.36, respectively; and the probability of high-, medium- and low-ranking inland regions to maintain the original ranking after five years was 0.49, 0.44 and 0.40, respectively. This shows that the ranking stability of high-ranking coastal regions was slightly higher than that of inland regions, while the ranking stability of low-ranking coastal regions was lower than that of inland regions. A further comparison indicates that the probability of low-ranking inland regions rising to a medium or high rank was lower than that of coastal regions; the probability of medium-ranking inland regions rising to a high rank was lower than that of coastal regions, but the probability of falling to a low rank was higher than that of coastal regions; the probability of high-ranking inland regions falling to a medium rank was lower than that of coastal regions, but the probability of falling to a low rank was higher than that of coastal regions. This means that it was more difficult for inland regions to achieve higher trade gains than it was for coastal regions, and they faced greater risks of declining gains from trade.

4 Trade Gains from China’s International Economic Circulation

4.1 Evolution Trend of Trade Gains from China’s International Economic Circulation

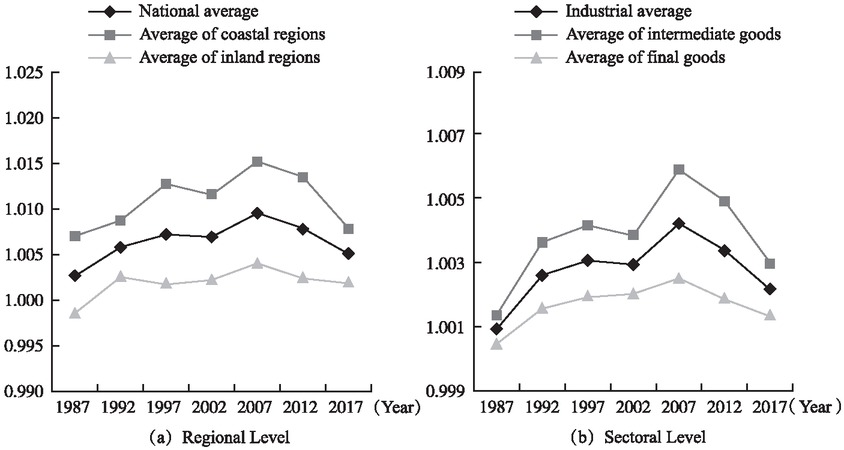

Figure 3 shows the average value and evolution trend of the trade gains from the international economic circulation between 1987 and 2017. Nationwide (Figure 3 (a)), in the sample period, the trade gains from China’s international economic circulation showed a trend of first increasing and then decreasing, indicating that the trade gains brought by China’s international economic circulation showed a trend of first increasing and then decreasing from a regional perspective. This may result from the fact that China’s accession to the WTO in 2001 promoted the development of international trade, and propelled the trade gains from the international economic circulation to show an upward trend. After the international financial crisis in 2008, the rise of trade protectionism, prevalence of anti-globalization, and complicated and severe international trade situation led to a decline in the trade gains from the international circulation after 2007. The analysis at the sector level is consistent with that at the regional level.

Trade Gains from China’s International Circulation between 1987 and 2017

From a regional perspective, the trade gains from the international circulation in coastal regions were always greater than those in inland regions. Coastal regions had always been the main body of China’s foreign trade since the reform and opening up; and the division of labor of coastal regions in the international production and trade system was also higher than that of inland regions (Li, 2020), therefore the trade gains from the international circulation in coastal regions were greater than those in inland regions.

4.2 Spatial-Temporal Characteristics of Trade Gains from China’s International Economic Circulation

Figure 4 (a) and (b) respectively present the kernel density distribution and density contour plots of the trade gains from the international circulation of China’s provinces in time and space. From a temporal perspective (Figure 4 (a)), for provinces with the trade gains from the international circulation less than 1.01, the wave peaks were distributed along the 45-degree diagonal line, while for provinces with the trade gains from the international circulation greater than 1.01, the wave peaks were distributed on both sides of the 45-degree diagonal line, and the greater the trade gains from the international circulation, the greater the degree of dispersion. This shows that when the trade gains from the international circulation were less than 1.01, the trade gains from the international circulation in each province had a certain degree of continuity. When the trade gains from the international circulation were greater than 1.01, the ability of some provinces to obtain the trade gains from the international circulation showed an increasing trend, while the ability of some provinces to obtain the trade gains from the international circulation showed a weakening trend. Moreover, provinces with greater trade gains from the international circulation were more likely to show signs of “slow” growth. The analysis at the sector level is consistent with that at the regional level (see Figure 4(c) and 4(d)).

Spatial-Temporal Characteristics of Trade Gains from China’s International Circulation

From a spatial perspective (Figure 4 (b)), for provinces with the trade gains from the international circulation less than 1.01, the wave peaks were distributed along the 45-degree diagonal line, while for provinces with the trade gains from the international circulation greater than 1.01, the wave peaks converged parallel to the X-axis, between y=1 and y=1.02. This shows that when the trade gains from the international circulation were less than 1.01, there was a positive spatial correlation effect on the trade gains from the international circulation in the provinces; and when the trade gains from the international circulation were greater than 1.01, the spatial correlation effect on the trade gains from the international circulation in the provinces showed a weakening trend.

4.3 Steady-State Analysis of Trade Gains from China’s International Economic Circulation

Table 2 shows the state transition probability of the trade gains from the international circulation in China between 1987 and 2017. At the regional level, the probability of provinces with high, medium and low rankings in terms of the trade gains from the international circulation to maintain their original ranking after five years was 0.80, 0.31 and 0.33, respectively, on a national scale; and the diagonal probability was greater than the non-diagonal probability only for high-ranking provinces. This shows that high-ranking provinces had a certain degree of stability, and the ranks of the low- and medium-ranking provinces fluctuated more sharply. Specifically, the probability of low- and medium-ranking provinces rising to a high rank after five years was 0.43 and 0.31 respectively; and the probability of rising from a low rank to a high rank was 0.19. This shows that provinces faced certain difficulties in increasing the trade gains from the international circulation, and even greater difficulties in a leapfrog improvement. The probability of medium- and high-ranking provinces falling to a low rank after five years was 0.38 and 0.14 respectively; and the probability of high-ranking provinces falling to a low rank was 0.07. This indicates that provinces with medium and high rankings in terms of the trade gains from the international circulation were likely to fall to a low rank, but the probability of a leapfrog decline was small. A comparison indicates that the probability of medium-ranking provinces rising to a high rank was lower than the probability of falling to a low rank; and the probability of low-ranking provinces rising to a high rank was higher than the probability of high-ranking provinces falling to a low rank. This means that provinces had a greater probability of rising to a higher rank in terms of the trade gains from the international circulation than of falling to a lower rank, and there was a huge potential for the trade gains from the international circulation. The analysis at the sector level is consistent with that at the regional level.

State Transition Probability of Trade Gains from China’s International Circulation between 1987 and 2017

| Regions | Nationwide | Coastal | Inland | ||||||

|---|---|---|---|---|---|---|---|---|---|

| High | Medium | Low | High | Medium | Low | High | Medium | Low | |

| High | 0.80 | 0.14 | 0.07 | 0.98 | 0.02 | 0.00 | 0.43 | 0.37 | 0.20 |

| Medium | 0.31 | 0.31 | 0.38 | 0.22 | 0.78 | 0.00 | 0.33 | 0.19 | 0.47 |

| Low | 0.19 | 0.43 | 0.33 | 0.50 | 0.25 | 0.25 | 0.16 | 0.45 | 0.21 |

| Sectors | Industrial | Intermediate goods | Final goods | ||||||

| High | Medium | Low | High | Medium | Low | High | Medium | Low | |

| High | 0.79 | 0.17 | 0.04 | 0.77 | 0.16 | 0.07 | 0.78 | 0.13 | 0.10 |

| Medium | 0.28 | 0.44 | 0.28 | 0.55 | 0.30 | 0.14 | 0.23 | 0.42 | 0.35 |

| Low | 0.25 | 0.41 | 0.31 | 0.31 | 0.44 | 0.25 | 0.06 | 0.31 | 0.61 |

From a regional perspective, in terms of the trade gains from the international circulation, the probability of high-, medium- and low-ranking coastal regions to maintain the original ranking after five years was 0.98, 0.78 and 0.25, respectively; and the probability of high-, medium- and low-ranking inland regions to maintain the original ranking after five years was 0.43, 0.19 and 0.21, respectively. This shows that the ranking stability of high-, medium- and low-ranking coastal regions was higher than that of inland regions. A further comparison indicates that the probability of low-ranking inland regions rising to a high rank was lower than that of coastal regions; but the probability of rising to a medium rank was higher than that of coastal regions; the probability of medium-ranking inland regions rising to a high rank and falling to a low rank was higher than that of coastal regions; the probability of high-ranking inland regions falling to a low or medium rank was higher than that of coastal regions. This means that the probability of a decline in the trade gains from the international circulation in coastal regions was smaller than that in inland regions.

5 Comparative Analysis and Correlation Effect of Trade Gains from China’s Economic Dual Circulation

5.1 Comparative Analysis on Trade Gains from China’s Economic Dual Circulation

5.1.1 Scale Comparison of Trade Gains from China’s Economic Dual Circulation

During the sample period, from a regional perspective, the trade gains from the domestic/international circulation in China’s provinces decreased from 5.45 in 1987 to 1.95 in 2017, showing an overall downward trend (Table 3), which indicates that the trade gains from the domestic circulation were always greater than those from the international circulation, and the gap between the two showed a narrowing trend overall. At the regional level, the trade gains from the domestic circulation in coastal and inland regions were also greater than those from the international circulation. The size of the market determines the ability to obtain trade gains. Based on the data used in this paper, in the sample period, the average scale of inter-provincial trade was 3.30 times that of international trade, so the trade gains from the domestic circulation were greater than that from the international circulation. The analysis at the sector level is consistent with that at the regional level.

Trade Gains from China’s Domestic/International Circulation between 1987 and 2017

| 1987 | 1992 | 1997 | 2002 | 2007 | 2012 | 2017 | Average | ||

|---|---|---|---|---|---|---|---|---|---|

| Region | National average | 5.45 | 2.68 | 2.51 | 2.15 | 2.68 | 2.61 | 1.95 | 2.86 |

| Average of coastal regions | 6.40 | 2.62 | 2.47 | 2.19 | 2.61 | 2.70 | 2.03 | 3.00 | |

| Average of inland regions | 4.49 | 2.74 | 2.54 | 2.10 | 2.74 | 2.53 | 1.88 | 2.72 | |

| Sector | Industrial average | 2.51 | 1.68 | 1.62 | 1.47 | 1.69 | 1.67 | 1.41 | 1.72 |

| Average of intermediate goods | 3.50 | 2.05 | 1.98 | 1.66 | 2.08 | 2.10 | 1.60 | 2.14 | |

| Average of final goods | 1.51 | 1.31 | 1.27 | 1.29 | 1.30 | 1.24 | 1.21 | 1.30 | |

5.1.2 Continuity Comparison of Trade Gains from China’s Economic Dual Circulation

From a temporal perspective, between 1987 and 2017, the value range (1~4) of the trade gains continuously obtained by provinces in China from the domestic circulation was significantly larger than that (1~1.01) of the trade gains continuously obtained by provinces from the international circulation (Figure 2 (a) and Figure 4 (a)). This indicates that compared with the international circulation, provinces were more able to continue to obtain trade gains from the domestic circulation.

From a spatial perspective, between 1987 and 2017, the value range (1~4) of the spatial correlation effect of the trade gains obtained by provinces in China from the domestic circulation was significantly larger than that (1~1.01) of the trade gains obtained by provinces from the international circulation (Figure 2 (b) and Figure 4 (b)). This indicates that compared with the international circulation, it was easier for China’s provinces to form the spatial correlation effect of trade gains from the domestic circulation. That is to say, the intensity and scope of correlation were larger.

5.1.3 Potential Comparison of Trade Gains from China’s Economic Dual Circulation

From a regional perspective, between 1987 and 2017, the probability (0.38) of the trade gains from the domestic circulation rising from a low rank to a high rank was greater than that (0.19) of the trade gains from the international circulation (Table 1 and Table 2). This indicates that compared with the international circulation, China’s provinces had a stronger ability to enhance the ranking of the trade gains from the domestic circulation. That is to say, the provinces had greater potential to obtain the trade gains from the domestic circulation. The analysis at the sector level is consistent with that at the regional level.

5.2 Correlation Effect of Trade Gains from China’s Economic Dual Circulation

Figure 5 (a) presents the kernel density distribution and density contour plots of the trade gains from the dual circulation of China’s provinces. In the kernel density distribution plot (static), the X-axis represents the trade gains from the domestic circulation of the provinces in t years; the Y-axis represents the trade gains from the international circulation of the provinces in t years; and the Z-axis is the probability density, representing the conditional probability of the corresponding point in the X-Y plane. In the density contour plot (static), the X-axis represents the trade gains from the domestic circulation of the provinces in t years; and the Y-axis represents the trade gains from the international circulation of the provinces in t years. According to the static correlation effect, when the trade gains from the domestic circulation were less than 4, the wave peaks converged parallel to the Y-axis; when the trade gains from the domestic circulation were greater than 4, the wave peaks converged parallel to the X-axis, between y=1 and y=1.02, and some provinces even showed a high-low convergence trend. This means in most provinces, there was no positive spatial correlation effect between the trade gains from the domestic circulation and the international circulation, and there was even negative spatial correlation effect in a few provinces. The analysis at the sector level is consistent with that at the regional level (see Figure 5(c)).

Correlation Effect of Trade Gains from China’s Dual Circulation

Figure 5 (b) presents the kernel density distribution and density contour plots of the trade gains from the dual circulation of China’s provinces. In the kernel density distribution plot (dynamic), the X-axis represents the trade gains from the domestic circulation of the provinces in t years; the Y-axis represents the trade gains from the international circulation in t+5 years, a spatial lag term; and the Z-axis is the probability density, representing the conditional probability of the corresponding point in the X-Y plane. In the density contour plot (dynamic), the X-axis represents the trade gains from the domestic circulation of the provinces in t years; and the Y-axis represents the trade gains from the international circulation in t+5 years, a spatial lag term. According to the dynamic correlation effect, when the trade gains from the domestic circulation were less than 4, the wave peaks converged parallel to the Y-axis; when the trade gains from the domestic circulation were greater than 4, the wave peaks converged parallel to the X-axis, between y=1 and y=1.05, and some provinces even showed a high-low convergence trend. This means after the introduction of spatial lag terms, there was no positive spatial correlation effect between the trade gains from the domestic circulation and the international circulation in most provinces, and there was even negative spatial correlation effect in a few provinces. The analysis at the sector level is consistent with that at the regional level (see Figure 5(d)).

To sum up, there was no positive spatial correlation effect between the trade gains from China’s domestic circulation and international circulation either before the introduction of spatial lag terms (static correlation effect) or after the introduction of spatial lag terms (dynamic correlation effect).

6 Conclusions and Policy Implications

This paper uses a quantitative model containing multi-sectoral input-output relations, and the input-output table of 30 provinces in China in 7 years for the first time to quantify the trade gains from the domestic and international circulations between 1987 and 2017, combined with the kernel density estimation and Markov chain, and the main findings are as follows. First, the trade gains from the domestic circulation showed a downward trend in various provinces and sectors in China, while the trade gains from the international circulation presented a trend of first rising and then declining. The trade gains from the domestic circulation in China were greater than those from the international circulation, although the gap between the two was narrowing. The decline in the trade gains from the domestic circulation in the coastal regions was greater than that in the inland regions; the trade gains from the domestic circulation in the intermediate goods sector were greater than those in the final goods sector. The trade gains from the international circulation in the inland regions were less than that in the coastal regions; the trade gains from the international circulation in the final goods sector were less than those in the intermediate goods sector. Second, from the temporal and spatial perspective, when the trade gains from the domestic and international circulations went beyond the specific range, the continuous improvement and spatial correlation of the trade gains from the dual circulation would show a weakening trend. At the temporal level, China had a greater ability to sustain trade gains from the domestic circulation; while at the spatial level, China could form the spatial correlation effect of trade gains from the domestic circulation more easily. Third, the ranking of the trade gains from China’s domestic and international circulations were more likely to rise than to fall, indicating a huge potential for the trade gains from the dual circulation. Compared with the international circulation, China had a greater probability and potential to improve its trade gains from the domestic circulation. Fourth, regardless of static correlation effect or dynamic correlation effect, there was no positive spatial correlation effect between the trade gains from the domestic and international circulations in various provinces and sectors in China, and even there was negative spatial correlation effect in a few provinces and sectors.

Measuring and analyzing the evolution trend and structural characteristics of the trade gains from China’s dual circulation provides good experience support for grasping the new development stage, implementing the new development philosophy and building the new development pattern. Taking this as a starting point, it can be further discussed from the following three directions. First, influencing factors of the trade gains. As a big country that is striving for the realization of the second centenary goal, China’s phased contradictions, historical contradictions and structural contradictions are interwoven, which makes the factors influencing the trade gains numerous and complex. How to accurately describe the mechanism of trade costs, division of labor network, local protectionism, development strategy, circulation system, marketization level, geo-culture and other factors affecting the trade gains and determine the relative role of these factors is crucial for obtaining more trade gains. Second, introduction of intra-provincial trade. According to the local preference of trade (McCallum, 1995), the order of trade from strong to weak is as follows: intra-provincial trade, inter-provincial trade, and international trade. Correspondingly, the scale of intra-provincial trade is larger than that of inter-provincial trade, and the scale of inter-provincial trade is larger than that of international trade. Therefore, if the intra-provincial trade is introduced into the quantitative model, it can reflect the trade gains from the domestic circulation of China’s economy more comprehensively. Third, differentiation of trade directions. The impediments of border, distance and other factors to trade are asymmetrical and often depend on the direction of trade (Hayakawa, 2017), which, in turn, affects how much trade gains can be made. Therefore, distinguishing the direction of inter-provincial trade, i.e., inter-provincial transfer-out and inter-provincial transfer-in, and the direction of international trade, i.e., export and import, and measuring and studying the trade gains in these four aspects respectively contribute to a better understanding of the trade gains from the dual circulation.

In order to better coordinate the overall situation of the great rejuvenation of the Chinese nation and the great changes in the world unseen in a century, General Secretary Jinping Xi pointed out in the report of the 20th CPC National Congress that “We must fully and faithfully apply the new development philosophy on all fronts, continue reforms to develop the socialist market economy, promote high-standard opening up, and accelerate efforts to foster a new pattern of development that is focused on the domestic economy and features positive interplay between domestic and international economic flows.” This grand strategy is essential for gaining more trade gains and making the most of them. First, both the import substitution strategy and the export-oriented strategy emphasize the role of the international circulation, but ignore the dominant role of the domestic circulation. The new development pattern of dual circulation goes beyond the old import substitution strategy and export-oriented strategy, and integrates the international circulation and domestic circulation, which can help China better obtain and use the trade gains and realize the Chinese modernization. Second, to pursue development in a more uncertain and unstable world, China needs to take the initiative based on the domestic circulation to balance development and security. Therefore, the trade gains from the domestic circulation are the base of coordinating the development and security of the dual circulation. They are not only the biggest “chip” for China to cope with the economic and trade game between China and the United States, but also the “anchor” for the Chinese economy to maintain strategic stability in the complex and volatile international environment. Moreover, they are an endogenous source for China to prevent and control economic risks and promote independent development, a strong support for China to safeguard global free trade and multilateralism, and an important tool to attract stakeholders to build strategic alliances. Third, both the dependent development theory (Singer, 1950) and world system theory (Wallerstein, 2013) point out that developing countries need to move from the “periphery” to the “center” of the international division of labor to replace developed countries if they want to get more trade gains from the international circulation. Making full use of the trade gains from the international circulation that promotes each other with the domestic circulation can not only help China to deal with the relationship with developed countries and transcend the cold war mentality, zero-sum mentality and hegemonic mindset, but also provide a new way for other developing countries to achieve modernization and help them strike a balance between accelerating development and maintaining their independence.

References

Albrecht, L., & Tombe, T. (2016). Internal Trade, Productivity and Interconnected Industries: A Quantitative Analysis, Canadian Journal of Economics, 49(1), 237–263.10.1111/caje.12196Suche in Google Scholar

Arkolakis, C., Costinot, A., & Rodríguez-Clare, A. (2012). New Trade Models, Same Old Gains? American Economic Review, 102(1), 94–130.10.1257/aer.102.1.94Suche in Google Scholar

Broda, C., & Weinstein, D. E. (2006). Globalization and the Gains from Variety. Quarterly Journal of Economics, 121(2), 541–585.10.1162/qjec.2006.121.2.541Suche in Google Scholar

Chen, Y. B., Li, W., & Qian, X. F. (2011). Estimation of the Welfare Effect of the Growth of China’s Import Categories. The Journal of World Economy (Shijie Jingji), 12, 76–95.Suche in Google Scholar

Dekle, R., Eaton, J., & Samud, K. (2008).Global Rebalancing with Gravity: Measuring the Burden of Adjustment. IMF StaffPapers, 55(3), 511–540.10.1057/imfsp.2008.17Suche in Google Scholar

Eaton, J., & Kortum, S. (2002). Technology, Geography, and Trade. Econometrica, 70(5), 1741–1779.10.1111/1468-0262.00352Suche in Google Scholar

Hayakawa, K. (2017). Domestic and International Border Effects: The Cases of China and Japan. China Economic Review, 43, 118–126.10.1016/j.chieco.2017.01.014Suche in Google Scholar

Head, K., Mayer, T., & Thoenig, M. (2014). Welfare and Trade without Pareto. American Economic Review, 104(5), 310–316.10.1257/aer.104.5.310Suche in Google Scholar

Hewings, G. J. D., & Oosterhaven. J. (2021). Interregional Trade: Models and Analyses. In Fischer, M. M., & Nijkamp, P. eds., Handbook of Regional Science. New York: Springer Press, 373–395.10.1007/978-3-662-60723-7_44Suche in Google Scholar

Hsieh, C. T., Li, N., Ossab, R., & Yang, M. J. (2020.) Accounting for the New Gains from Trade Liberalization. Journal of International Economics, 127, 103370.10.1016/j.jinteco.2020.103370Suche in Google Scholar

Krugman, P. R. (1997). Development, Geography, and Economic Theory. Cambridge: MIT Press.Suche in Google Scholar

Li, F. (2020). Chinese Provincial Regions’ Role under the Dual Value Chain. China Industrial Economics (Zhongguo Gongye Jingji), 1, 136–154.Suche in Google Scholar

Liu, Q., & Xu, L. (2013). Reflections on the Welfare Effect and Upgrading of Processing Trade. Economic Research Journal (Jingji Yanjiu), 9, 137–148.Suche in Google Scholar

McCallum, J. T. (1995). National Borders Matter: Canada—U.S. Regional Trade Patterns. American Economic Review, 85(6), 615–623.Suche in Google Scholar

Melitz, M. J., & Trefler, D. (2012). Gains from Trade when Firms Matter. Journal of Economic Perspectives, 26(2), 91–118.10.1257/jep.26.2.91Suche in Google Scholar

Ohlin, B. (2017). Interregional and International Trade (Chinese version). Beijing: Huaxia Publishing House.Suche in Google Scholar

Pei, C. H., & Peng, L. (2008). Review of Reform and Opening-Up in China’s Circulation Area. Social Sciences in China (Zhongguo Shehui Kexue), 6, 86–98, 206–207.Suche in Google Scholar

Ramanarayanan, A. (2020). Imported Inputs and the Gains from Trade. Journal of International Economics, 122, 103260.10.1016/j.jinteco.2019.103260Suche in Google Scholar

Singer, H. W. (1950). The Distribution of Gains between Investing and Borrowing Countries. American Economic Review, 40(2), 473–485.Suche in Google Scholar

Wallerstein, I. (2013). The Modern World System (Chinese version). Beijing: Social Sciences Academic Press (China).Suche in Google Scholar

Yilmazkuday, H. (2012). Understanding Interstate Trade Patterns. Journal of International Economics, 186(1), 158–166.10.1016/j.jinteco.2011.08.015Suche in Google Scholar

Zhang S. J., & Hou, H. F. (2019). Does the Global Value Chain Worsen the Terms of Trade? —The Perspective of Developing Countries. Finance & Trade Economics (Caimao Jingji), 12, 128–142.Suche in Google Scholar

© 2023 Shaojun Zhang, Yuwen Fang, Shantong Li, published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Artikel in diesem Heft

- Frontmatter

- Common Prosperity and Reshaping China’s Economic Cycle: Theoretical Logic and Empirical Evidence from a Political Economic Perspective

- Globalization and Inflation

- Digital Transformation, Information Search, and Women’s High-Quality Employment

- Fiscal Pressure, Inter-Industrial Allocation of Land and Agglomerations Effects

- Analysis on Trade Gains from the Economic Dual Circulation in China

- Digital Trade Rules and the Position of Chinese Enterprises in the Global Value Chain

Artikel in diesem Heft

- Frontmatter

- Common Prosperity and Reshaping China’s Economic Cycle: Theoretical Logic and Empirical Evidence from a Political Economic Perspective

- Globalization and Inflation

- Digital Transformation, Information Search, and Women’s High-Quality Employment

- Fiscal Pressure, Inter-Industrial Allocation of Land and Agglomerations Effects

- Analysis on Trade Gains from the Economic Dual Circulation in China

- Digital Trade Rules and the Position of Chinese Enterprises in the Global Value Chain