Coordination of Income Distribution System and Promotion of Common Prosperity Path

-

Hao Sun

Abstract

This paper aims at summarizing the evolutionary law of income distribution system and providing a reference for the coordination arrangement of primary distribution, redistribution and third distribution policies. Based on policies, this paper refines the evolutionary law of income distribution and estimates the proportional relationship among primary distribution, redistribution and third distribution by using the national income data. Its new insight lies in abstracting the evolutionary logic of the income distribution system shifting from emphasizing efficiency to prioritizing equity and estimating the proportional relationship among the primary distribution, redistribution and third distribution. The study found that China’s income distribution system follows the evolutionary logic of shifting from efficiency to equity. In addition, China has overcome egalitarianism, given priority to efficiency with due consideration to equity, and placed more emphasis on equity while balancing the relationship between equity and efficiency, promoting the four stages of common prosperity. Primary distribution, the dominant mechanism for income distribution, is required to provide an equitable distribution order. Redistribution, an important means of income distribution, needs to increase expenditures on people’s living and social security. Third distribution, a useful supplement to income distribution, needs to design a policy system for incentive compatibility. This paper provides policy references for promoting common prosperity and conducting fundamental institutional arrangements for primary distribution, redistribution and third distribution.

1 Introduction and Literature Review

China has moved into a new stage of socioeconomic development, whereby fostering common prosperity has emerged as an important strategy. Through a long period of build-up and development, China has a solid economic foundation for promoting common prosperity. After the founding of the People’s Republic of China, especially 40-plus years of reform and opening up, China’s per capita GDP has exceeded USD 10000, the urbanization rate 60% and the middle-income group 400 million people. [1] China’s GDP accounted for only 4.5% of the global total in 1950, but the figure rose to 18.2% by 2017, marking the first quantum leap of China’s economy since 1600 (Jin et al., 2019). China is promoting the supply-side structural reform and demand-side management to maintain the high-standard dynamic balance between supply and demand, and gradually achieving the high-quality development of the economy (Guo, 2019).

At a time of tremendous achievements in China’s economic development, the income gap among Chinese residents faces enormous challenges. According to the data released by China’s National Bureau of Statistics, the Gini coefficient of Chinese residents’ income is around 0.46, [2] higher than the international alert level usually mentioned. Whether it is the vertical widening of the income gap or the horizontal international comparison, Chinese residents’ income gap is at a high level. China’s income inequality hovers high (Li and Zhu, 2018). In a period of fast economic growth, people’s living standards are being improved rapidly and universally. As economic growth slows down, the distribution issue becomes more important, and the population will pay more attention to it. In the new stage of development, it has become an important issue in implementing the new development philosophy, especially the concept of shared development, narrowing the income gap and promoting common prosperity.

Common prosperity is composed of common and prosperity, which encompasses growth and distribution. It is essential to make a big pie and divide it. Common prosperity, a more holistic concept, has profound connotations and extensions in development, sharing and sustainability. It means not only the pursuit of increased economic aggregate and equitable income distribution but also the coordination of economic development with population, resources and environment. Through the adaptation to social progress, it is an integrated embodiment of the all-round development of a socialist society (Yu and Ren, 2021). Common prosperity focuses more on people, people-centered development and people’s all-round development (Cao and Liu, 2019; Liu et al., 2021). The concept of shared development is an approach to enriching and practicing the connotation of common prosperity. It is meant to embody and institutionalize common prosperity, with people as the main body (Yang and Li, 2016). Shared development improves the connotation of common prosperity. It requires the pursuit of more refined and differentiated common prosperity on the premise of development, while also reflecting authenticity (Qu and Zhang, 2016). Shared development can also be understood as a form of pro-poor growth. In other words, economic growth brings the poor a greater rate of income growth than the average and common prosperity is about co-development and sharing in growth (Fan, 2017). Building a new-type government-market relationship plays a vital role in China’s goal of achieving common prosperity. This relationship can be influenced by such mechanisms as conceptual guidance, institutional support, economic growth and distribution regulation (Gao, 2021). In particular, it is important to give full play to the government’s precise regulation role in tax regulation, equal access to basic public services, and transfer payments to low-income people (Tang and Li, 2021).

The distribution relationship essentially involves the interest relationship between people that corresponds to the production relations. The transformation of distribution system is also manifested in adjusting such an interest relationship (Han and He, 2021). Common prosperity refers to the relationship and status of income distribution. Its realization represents a certain level of income distribution relationship and status. The Marxist political economy theory reveals the relationship between income distribution and economic growth. To put it differently, the serious polarization of income distribution will inevitably hinder the sustainable development of the economy (Qiu, 2016). Income distribution, the source of people’s wellbeing, is the most important and direct way to improve people’s living and achieve development results for the people (Yang, 2021). The reform of the income distribution system is going deeper to put in place a sound and orderly pattern of income distribution and see more gains of reform and development benefit all the people more fairly. This is a solid foundation for boosting the high-quality economic development and socialist modernization.

The income distribution system consists of primary distribution, redistribution and third distribution. In the past, the income distribution system reform for common prosperity and economic development focused on primary distribution and redistribution. The primary distribution reform is important because it is fundamental. Also, it results in the widening income gap and the difficulty in handling it (Li, 2013). Empirical tests have shown that the income distribution imbalance and its expanding trend are influenced by both primary distribution and redistribution. It needs to implement the reform for primary distribution and redistribution (Chen and Liu, 2012; Wang et al., 2014). In addition to the two distributions, there is a third distribution, or the income distribution based on moral conviction (Li, 1994). The primary distribution is dominated by the market, and the redistribution by the government. The third distribution can do what “the market does not do” and “the government cannot do”, “serving as the third hand supporting society” (Yuan, 2020). In advancing common prosperity, the third distribution, a useful supplement to primary distribution and redistribution, is conducive to stimulating the endogenous driving force of common prosperity, helping alleviate the anxiety of individuals and facilitating the development of cultural and ethical progress (Jiang and Yu, 2021).

The income distribution system plays an essential role in promoting common prosperity (Li, 2021; Li and Zhu, 2022). The system for primary distribution, redistribution and third distribution is being improved and is an institutional guarantee that China’s economic development cannot be ignored. Promoting common prosperity is a long-term, arduous and complicated systemic program. By balancing the relationship between equity and efficiency, China needs to establish the fundamental institutional arrangements for primary distribution, redistribution and third distribution so as to promote common prosperity in the high-quality development. The marginal contribution in this paper is embodied in the following three points. First, the evolutionary stages of China’s income distribution system are divided to refine the evolutionary logic of shifting from emphasizing efficiency to prioritizing equity. Second, the proportions of primary distribution, redistribution and third distribution are estimated to establish basic institutional arrangements enabling coordination and complementarity between them. Third, China’s path to common prosperity is proposed by comparing and learning the experience of governing inequality in Zhejiang province of China, and other countries.

2 Evolutionary Stages and Logic of Income Distribution System

The income distribution system, a fundamental institutional arrangement in economic and social development, is the reference standard for income distribution and its regulation. Since the reform and opening up, China has continued to reform the income distribution system and gradually established such a system that conforms to the basic national conditions and the economic development stage.

2.1 Historical Evolution of Income Distribution System from Overcoming Egalitarianism to Promoting Common Prosperity

The income distribution system is an essential part of the socialist market economy and the most important means to regulate the income gap among the people. The historical evolution of China’s income distribution system can be reflected in the statements of policy documents. The socio-economic development and stage are important criteria for regulating the income distribution system. According to the policies and the policy orientation of income distribution system, the paper divides the income distribution system since the reform and opening up into the following four development stages: overcoming egalitarianism, prioritizing efficiency with due consideration to equity, placing greater emphasis on equity while balancing the relationship between equity and efficiency, and promoting common prosperity (see Table 1).

Evolution of China’s Income Distribution System since the Reform and Opening Up

| Development stage | Policy statement | Policy orientation |

|---|---|---|

| The first stage: 1978–1992 | “We must conscientiously implement the socialist principle of distribution according to work, calculate remuneration according to the labor quality and quantity, and overcome egalitarianism.” “The fruits of labor should be handed over to the country and reserved for collective use and the rest are all our own.” (The Third Plenary Session of the 11th CPC Central Committee, 1978) “Social equity is embodied on the premise of enhancing efficiency.” (Report of the 13th CPC National Congress, 1987) | Overcoming egalitarianism: by starting with seeking truth from facts and emancipating the mind, the problems of egalitarianism and getting the same reward or pay regardless of one’s work performance had been overcome to establish the principle of distribution by work contribution and enhance the production efficiency. |

| The second stage: 1992–2012 | “Balancing the relationship between equity and efficiency”. “A range of regulation methods including the market not only encourages progress, promotes efficiency and reasonably widens the income gap but also prevents the polarization.” (Report of the 14th CPC National Congress, 1992) “The income distribution system must be established, featuring the distribution according to work contribution and priority given to efficiency with due consideration to equity. Some people in regions should be encouraged to get rich and follow the road of common prosperity. A multi-level social security system must be developed for urban and rural residents, which should be in line with China’s national conditions.” (The Third Plenary Session of the 14th CPC Central Committee, 1993) “The primary distribution focuses on efficiency, while the redistribution equity”. (Report of the 16th CPC National Congress in 2002) “Both primary distribution and redistribution should handle the relationship between equity and efficiency. Redistribution should pay more attention to equity.” (Report of the 17th CPC National Congress in 2007) | Prioritizing efficiency with due consideration to equity: by combining distribution according to work contributions with distribution according to production factors, distribution according to the contribution of production factors can be determined. In balancing the relationship between equity and efficiency, we should give priority to efficiency and gradually pay attention to equity. |

| The third stage: 2012–2020 | “The proportion of residents’ income in the national income distribution should be increased, and so should the share of labor remuneration in the primary distribution. Both primary distribution and redistribution should strike a balance between equity and efficiency. Redistribution should pay more attention to equity.” (Report of the 18th CPC National Congress in 2012) “We must work to see that individual incomes grow in tandem with economic growth and labor compensation rises along with the increase in labor productivity.” (Report of the 19th CPC National Congress, 2017) | Balancing the relationship between equity and efficiency and paying more attention to equity. Let all the people share the fruits of economic development to ensure that the growth of residents’ income and labor compensation are synchronized with economic growth. |

| The fourth stage: 2020–present | “All the people have made more significant and substantial progress towards common prosperity.” “Exploring ways to increase the factor income of low- and middle-income groups through the use rights of land and capital and income rights... Improving the redistribution mechanism, strengthening the adjustment and precision of taxation, social security and transfer payments”, “playing the role of third distribution, developing charity, and improving the distribution of income and wealth”. (The Fifth Plenary Session of the 19th CPC Central Committee, 2020) “We need to promote common prosperity in the high-quality development, handle the relationship between equity and efficiency, and conduct fundamental institutional arrangements for primary distribution, redistribution and third distribution.” (the 10th Meeting of the Central Committee for Finance and Economic Affairs) | After finishing building a moderately prosperous society in all respects, China is embarking on a new journey to develop a modern socialist country in all respects, utilizing the new development stage, implementing the new development philosophy, building a new development pattern, and promoting common prosperity in high-quality development. |

2.1.1 Overcoming Egalitarianism (1978–1992)

Before the reform and opening up, China implemented a planned economy. Under the egalitarianism, the income gap among residents was small, but workers’ enthusiasm for production was low and economic development was slow. In the early stage of the reform and opening up, overcoming egalitarianism and stimulating production efficiency became the focus of equity and efficiency trade-off. The CPC and the government have overcome egalitarianism, promoted a range of distribution system reforms and greatly enhanced production efficiency by seeking truth from facts and emancipating the mind.

2.1.2 Giving Priority to Efficiency with Due Consideration to Equity (1992–2012)

“Development is the absolute truth.” Under the conditions of the socialist market economy, the fundamental principle of “giving priority to efficiency with due consideration to equity” had been established to boost economic development in the issue of equity and efficiency trade-off. In prioritizing efficiency, it was important to improve the status of the market mechanism in allocating resources, give full play to the fundamental role of market allocation, enhance economic marketization and opening up, better economic efficiency, and promote high-speed growth. In this period of fast economic development, unreasonable and unregulated income distribution appeared, with residents’ income gap widened rapidly. Therefore, the policy consideration of “equity” was added in this later stage.

2.1.3 Balancing the Relationship between Equity and Efficiency with Greater Emphasis on Equity (2012–2020)

After a long period of fast economic growth, economic growth at the macro level, for one thing, had been faced with the influence of structural, cyclical and exogenous factors. Traditionally, the unbalanced, uncoordinated and unsustainable extensive growth model was hard to sustain. The economy had changed from high-speed to medium-high-speed growth. It had paid more attention to high-quality development. For another, the economic inequality was hovering at a high level. Economic development was facing challenges like inequality. Income and wealth gaps had become the shackles restricting the high-quality economic development. The slowdown in economic growth and the widening inequality have prompted greater attention to equity and equality in economic development.

2.1.4 Promoting Common Prosperity (2020–Present)

Common prosperity is an essential requirement of socialism, a common aspiration of the people, an important feature of Chinese-style modernization, and a fundamental implication and requirement for the concept of shared development. After finishing building a moderately prosperous society in all respects and meeting the first centenary goal, China is embarking on a new journey toward the second centenary goal of building a modern socialist country. Common prosperity is an important strategic choice for leveraging the new development stage, implementing the new development philosophy, and building a new development pattern. It is also an important way to boost the high-quality economic development.

2.2 Evolutionary Logic of Income Distribution System: from Emphasizing Efficiency to Prioritizing Equity

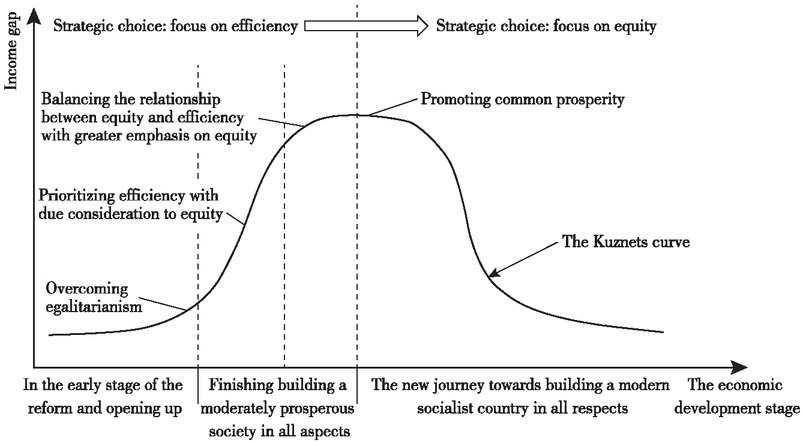

Throughout the four stages of its income distribution system, China has followed the evolutionary logic of shifting from emphasizing efficiency to prioritizing equity. There is a regular fluctuation relationship between economic development and income gap. The Kuznets curve (Kuznets, 1955) depicts a regular relationship that the income distribution gap widens and narrows as the economy develops. The evolution of China’s income distribution system has been embedded in the Kuznets curve (see Figure 1), which is conducive to helping better understand the evolutionary logic of the income distribution system from emphasizing efficiency to prioritizing equity.

Kuznets Curve and Evolutionary Logic of Income Distribution System

Note: The dotted line in the figure indicates the rough division of the stages of economic development and income distribution systems, which is not an accurate measure.

2.2.1 Overcoming Egalitarianism and Stimulating Production Efficiency in the Early Stage of the Reform and Opening Up

In the early days of the reform and opening up, China’s economic development and residents’ per capita income were low. According to the data of China’s National Bureau of Statistics, the per capita disposable income of China’s urban residents was RMB 343.40 in 1978 and RMB 1510 in 1990. China’s per capita GNI is at a low level across the world. According to the 1992 World Bank data, the per capita GNI of developed countries in Europe, Oceania, South America and Asia was much higher than that of China. Most countries in Africa and North America also have higher per capita GNI than China, with a large gap. During this period, China’s economic development far lagged behind the world average (USD 4660). Boosting economic development was the focus of economic work. The emphasis on efficiency became the strategic choice of the income distribution system in that period.

2.2.2 During the Period of Completing Building a Moderately Prosperous Society in All Respects, Efficiency Has Been Given Priority and Equity Is Being Emphasized

In the early stage of building a moderately prosperous society in all respects, the economic development was low, and the higher productivity was the focus of economic work. China ranked among lower-middle-income countries in 1998 but among upper-middle-income countries in 2010. In 2019, China’s per capita GNI reached USD 10390, ranking among the upper-middle-income countries. [1] It has risen sharply over 1992, surpassing that of most developing countries but still falling short of the world’s average (USD 11527), which is far from that of developed countries. As the country remains the world’s largest developing country, development is still the most important issue in its economic sector. As such, emphasizing efficiency remains the strategic choice for the income distribution system at this stage. Compared with the early stage of building a moderately prosperous society, the later stage requires more consideration of equity. This is in line with the change of China’s income distribution policies from “giving priority to efficiency with due consideration to equity” to “balancing equity and efficiency and paying more attention to equity”.

2.2.3 A New Journey of Building a Modern Socialist Country in All Aspects and Promoting Common Prosperity

After completing the building of a moderately prosperous society in an all-round way, China is embarking on a new journey to build a modern socialist country in all respects. Common prosperity is an important feature of Chinese-style modernization. Developing a modern socialist country, implementing the new development philosophy and building a new development pattern all require promoting common prosperity. In the new stage of development, the country has a relatively adequate material base. In 2019, the Engel coefficient for the country was 28.2%, lower than 30%, which met the standard of abundance. It indicated that China had good conditions for promoting common prosperity. As economic growth slows down and income gap widens, income inequality will become a greater focus of economic and social development. In the new stage of development, the excessive income gap among residents has become the shackles of high-quality economic development and building a modern socialist country. As such, the income distribution system has been reviewed and emphasis has been placed on equity as the strategic choice for the income distribution system in the new development stage.

3 Institutional Arrangement of Income Distribution: Proportion Estimation and Policy Coordination

3.1 Proportion Estimation of Primary Distribution, Redistribution and Third Distribution

The income distribution policy is the most direct and important way for the people to share in the economic development results. By estimating the proportion of primary distribution, redistribution and third distribution to the overall income distribution, it is conducive to grasping the income distribution system as a basis for the fundamental institutional arrangements for primary distribution, redistribution and third distribution.

Based on the Statement of Financial Flows (Transactions in Kind) prepared by China’s National Bureau of Statistics, the total income and current transfers from the primary distribution of funding sources for China’s in-kind transactions are obtained to measure the scale of primary distribution and redistribution, respectively. Third distribution is meant for high-income people to distribute social resources and public wealth in the charitable forms such as fundraising, donations and grants. It includes income transfers of enterprises and the rich, social charitable donations, and volunteer services (Tang and Li, 2021). Social charitable donations account for a large share in the third distribution, so this paper takes the donations as the basis for the proportion estimation of the third distribution. The overall proportion of third distribution is small. Therefore, although the calculation method underestimates the proportion of third distribution to a certain extent, the overall impact is not significant.

Taking 2011–2019 as the research period and based on China Charity Development Report (2012–2020) and the Statement of Financial Flows (Transactions in Kind) by China’s National Bureau of Statistics, the total income from primary distribution (primary distribution scale), current transfers (redistribution scale), and total charitable donations (third distribution scale) can be obtained to conduct the proportion estimation of primary distribution, redistribution and third distribution (see Table 2). As shown in Table 2, the primary distribution, redistribution and third distribution all achieved fast growth from 2011 to 2019, but their proportions remained stable. Primary distribution results from the factor income distribution through the “invisible hands” of the market mechanism. It has always been dominant in income distribution, accounting for about 82.68% of primary distribution, redistribution, and third distribution. Redistribution is the government’s “visible hand” to re-adjust the income distribution based on the primary distribution, making up about 17.18%. Third distribution, a “gentle hand” for social equity and justice, is complementary to the primary distribution and redistribution. Although the third distribution is gradually expanding, it takes up only about 0.14%. Although the above estimated proportions of primary distribution, redistribution and third distribution to the overall income distribution are not necessarily accurate, they provide a reference for establishing basic institutional arrangements enabling coordination and complementarity between primary distribution, redistribution and third distribution.

Proportion Estimation of Primary Distribution, Redistribution and Third Distribution from 2011 to 2019

| Year | Primary distribution of total income (RMB 100 million) | Current transfer (RMB 100 million) | Total charitable donations (RMB 100 million) | Total (RMB 100 million) | Proportion of primary distribution (%) | Proportion of redistribution (%) | Proportion of third distribution (%) |

|---|---|---|---|---|---|---|---|

| 2011 | 468562 | 90014 | 845 | 559422 | 83.76 | 16.09 | 0.15 |

| 2012 | 518215 | 102831 | 889 | 621935 | 83.32 | 16.53 | 0.14 |

| 2013 | 583197 | 117828 | 954 | 701978 | 83.08 | 16.79 | 0.14 |

| 2014 | 644791 | 131206 | 1058 | 777055 | 82.98 | 16.89 | 0.14 |

| 2015 | 686450 | 147600 | 1215 | 835265 | 82.18 | 17.67 | 0.15 |

| 2016 | 740599 | 160753 | 1458 | 902810 | 82.03 | 17.81 | 0.16 |

| 2017 | 820100 | 181475 | 1526 | 1003100 | 81.76 | 18.09 | 0.15 |

| 2018 | 914327 | 193434 | 1270 | 1109031 | 82.44 | 17.44 | 0.11 |

| 2019 | 983751 | 206474 | 1509 | 1191735 | 82.55 | 17.33 | 0.13 |

| Average | — | — | — | — | 82.68 | 17.18 | 0.14 |

Note: The data on the gross income of primary distribution and current transfers are from the Statement of Financial Flows (Transactions in Kind) compiled by China’s National Bureau of Statistics. The data on total charitable donations from 2011 to 2019 are from China Charity Development Report (2012–2020).

3.2 Policy Coordination of Primary Distribution, Redistribution and Third Distribution

The above proportion estimates of primary distribution, redistribution and third distribution provide an important reference for coordinating their institutional arrangements. The dominance of primary distribution in income distribution shows that promoting common prosperity requires the high-quality development and the market’s decisive role in allocating resources. In considering China’s economic development stage and income distribution, common prosperity requires improving distribution in economic development. In other words, sharing the pie equitably while making it bigger, not just sharing the established one. Redistribution is an important means for the government to regulate income distribution. It is essential to emphasize the government’s effectiveness in regulating income distribution and increase spendings on people’s living and social security. The third distribution is a useful supplement to the social regulation of income distribution, making up a small share. It is not advisable to rely too heavily on the third distribution to regulate the income gap. The third distribution has been expanding with great development potential. They are the force that needs to develop for common prosperity. To build basic institutional arrangements that coordinate and complement primary distribution, redistribution and third distribution, it is important to identify the distribution mechanism, distribution status, typical features and coordination policies of various distribution systems and shape a three-dimensional, multi-level, coordinated and complementary distribution system (see Table 3).

Fundamental Institutional Arrangements for Primary Distribution, Redistribution and Third Distribution

| Distribution hierarchy | Distribution mechanism | Distribution orientation | Typical features | Policy coordination |

|---|---|---|---|---|

| Primary distribution | “Invisible hand” of market mechanism | Dominant mechanism | Autonomy and decisiveness | Equitable distribution order |

| Redistribution | “Visible hand” of the government mechanism | Important means | Mandatory and biased | More spendings on people’s living and social security |

| Third distribution | “Gentle hand” of social mechanism | Beneficial supplement | Voluntariness and public welfare | Design of a policy system for incentive compatibility |

3.2.1 Primary Distribution Is the Dominant Mechanism for Promoting Common Prosperity. It Is Essential to Provide an Equitable Distribution Order

According to proportion estimates of primary distribution, redistribution and third distribution, primary distribution is the dominant mechanism for promoting common prosperity. Emphasis needs to be placed on promoting equity and equality in primary distribution. The primary distribution is conducted through the market mechanism’s “invisible hand”, featuring the autonomy of market economy. Its institutional arrangement is decisive to the overall distribution result. Although the primary distribution is autonomous under the conditions of the market mechanism, there are still equity-related problems in the distribution. According to the report of the 17th CPC National Congress, “both primary distribution and redistribution should handle the relationship between equity and efficiency.” The equity-related issues should also be dealt with in the primary distribution. In the case that primary distribution dominates the overall distribution, an equitable distribution order for primary distribution is essential to common prosperity.

It is easy to understand that the primary distribution under the market mechanism can reflect efficiency. In other words, the supply and demand of the market are regulated through the price mechanism and the scarcity of resources is embodied through factor remuneration, thereby stimulating entities’ enthusiasm for economic activities. Correspondingly, the primary distribution under the market mechanism also involves equity. For example, non-equilibrium wages resulting from the monopoly market structure have led to large wage gaps of various sectors. The division of labor market and the administrative obstacles of factor market have resulted in employment discrimination, identity discrimination and gender discrimination, which have weakened the equity and competitiveness of primary distribution and widened the income gap of groups. The monopoly and information asymmetry of capital market have affected household assets allocation and returns and opportunities of various types of capital. The implementation of land system reform and the development of land transfer market have impacted the returns of rural land. In other words, the primary distribution also needs to make up for market failures and intervene in market forces to form a more equitable distribution order. Based on the autonomous and decisive characteristics of primary distribution, it requires the government to build an institutional environment of equality, rule of law, and social security, to avoid market failures leading to distortions in income distribution and establish an equitable distribution order.

3.2.2 Redistribution, an Important Means to Promote Common Prosperity, Requires More Expenditures on People’s Living and Social Security

Redistribution policies are implemented through tax collection, fiscal expenditure and public transfer payments, representing an essential means to promote common prosperity. Income redistribution has a positive effect on improving income inequality, reducing poverty, and balancing equity and efficiency across the board (Xie, 2018). It is an important means to promote common prosperity. Based on the experimental method, the research of Hoechtl et al. (2012) shows that low-income people have higher redistribution preference than the high-income. The reform for redistribution system should focus more on improving the wellbeing of low-income groups, embodying the biased characteristics. Redistribution, an important means of common prosperity, involves policies and measures including levying real estate tax and inheritance tax, raising the threshold of personal income tax, increasing the progressive degree of personal income tax, curbing the excessive wealth growth of high-income groups, reducing the intergenerational transmission of wealth, and preventing the solidification of social classes.

Tax policy for common prosperity requires more emphasis on its effectiveness. Compared with developed countries, China has the lower average rate of personal income tax, which leads to the little effect of personal income tax on regulating income distribution (Xu et al., 2013). Studies on the redistribution effects of indirect taxes have shown that indirect taxes in China are regressive, increasing inequality within urban and rural areas but reducing inequality between urban and rural areas (Nie and Yue, 2012). In promoting common prosperity, emphasis should be placed on improving low-income groups’ wellbeing and providing them with equitable access to human capital accumulation. The government needs to increase spendings on people’s living and social security to raise such groups’ income and ensure their living. To promote common prosperity, we need to follow the principle of getting rich through diligence and innovation. Redistribution policies therefore emphasize the capability-enhancing program for citizens by shifting from “giving people fish” to “teaching people to fish”, so that people have equal access to the capacity and capital to get rich through diligence and innovation. More efforts should be made in income redistribution policies to reduce and eliminate inequalities between classes by improving the tax system and public transfer payment system. By doing so, opportunities are created for low-income groups to accumulate wealth and make income distribution more equitable (Li et al., 2020).

3.2.3 Third Distribution, a Useful Supplement to Promote Common Prosperity, Requires a Policy System for Incentive Compatibility

Because of its small share in the overall distribution, third distribution is an important supplement to the overall distribution system. The proportion of China’s third distribution in the overall distribution is about 0.14%, which is at a low level. Some Western developed countries have established a fully-fledged charity system and formulated tax incentive policy, making the greater effect of third distribution. According to the Giving USA 2021: US Charitable Endowment Report 2020, the total amount of US charitable endowments reached USD 471.44 billion in 2020, accounting for about 2.3% of US GDP. China’s third distribution therefore has greater potential and development.

The policy system for incentive compatibility should be designed for tapping the potential of third distribution and promoting its development. In 2019, the 4th Plenary Session of the 19th CPC Central Committee proposed to “attach importance to playing the role of third distribution and develop charity and other social welfare undertakings”. In 2020, the 5th Plenary Session of the 19th CPC Central Committee proposed to “play the role of third distribution, develop charity and improve the income & wealth distribution pattern”. As a useful supplement to primary distribution and redistribution, third distribution has been increasingly prioritized in promoting common prosperity. Third distribution, a kind of resources distribution dominated by social mechanisms, is characterized by voluntariness and public welfare. To put it differently, it allows various participants to share in interests and realize public benefits while pursuing personal gains. The incentive compatibility mechanism has been designed to promote the returns of third distribution to the society, including tax incentives and reliefs for charitable entities and simplification of charitable donation procedures, so as to ensure transparency in charitable donations and funds. The public charitable entities need to be fostered to encourage volunteer services and create a social atmosphere in which “everyone does charitable work for the public good and so does the rich”. It is important to explore new mechanisms for common prosperity through third distribution and promote charitable donations through multiple channels.

4 Zhejiang’s Experience and Overseas Reference in Promoting Common Prosperity

As the market economy does not adequately address inequality, reducing inequality requires a range of policies and measures like capital tax (Piketty, 2014). The experience of narrowing the income gap worldwide is a reference for China’s current efforts to promote common prosperity. In 2020, the per capita disposable income of urban and rural residents in Zhejiang province of China was RMB 62699 and RMB 31930, respectively. For 20 consecutive years and 36 consecutive years, Zhejiang ranked first across the country. The urban-rural income gap was 1.96, far below the national average (2.56). Zhejiang has made remarkable achievements in exploring ways to solve the problems of unbalanced and inadequate development. It has the foundation and advantages to build a demonstration zone for common prosperity. It has been selected as a demonstration zone for high-quality development and common prosperity. Some Western developed countries control the income gap at a relatively reasonable level. Their policies and measures can be used as a policy reference for China to promote common prosperity.

4.1 Zhejiang’s Experience in Promoting Common Prosperity

Consistent with the conclusions of the above studies on the fundamental institutional arrangements for primary distribution, redistribution and third distribution, Zhejiang has adopted the most important mechanism for regulating primary distribution and redistribution and reduced the income inequality. Regarding primary distribution, Zhejiang has performed well in enhancing marketization, encouraging and supporting the private economy, and promoting the flow of factors. As such, it has boosted economic development and refined the income distribution pattern. In terms of redistribution, Zhejiang has balanced inter-regional and urban-rural development through a range of policies and measures.

Marketization, an important factor in driving economic development, is also the main way to optimize the resources allocation and promote equitable distribution. Zhejiang is among the first provinces advancing the market-oriented reform, representing one of China’s regions with a high degree of marketization. Encouraging and supporting the private economy is Zhejiang’s development model for allowing the people to enjoy a prosperous life. The active private economy is the most prominent feature of Zhejiang’s economy. Zhejiang private enterprises hold 96 places among China’s top 500 private enterprises, ranking first in all provinces for 22 consecutive years. The free flow of factors is an important way to promote common prosperity. The e-commerce industry has facilitated the free flow of factors. Zhejiang is a major province of e-commerce that has promoted industrial clustering and rural revitalization. The e-commerce economy helps take advantage of China’s large national market and rural factor endowments and promote the development of the rural economy (Wang et al., 2021). Regarding redistribution, the Zhejiang provincial government has vigorously promoted the “Eight-Eight Strategy” and the coordinated development of regions and urban & rural areas. The strategy fully embodies the comprehensive development philosophy and the people-centered development concept. Guided by the strategy, Zhejiang has achieved the coordinated development across regions and enhanced people’s living standards. Notably, Zhejiang has a solid foundation for common prosperity compared with other provinces. Its socio-economic development is at the forefront, but the province remains in the stage of developing the pilot demonstration zone for common prosperity. To truly achieve common prosperity, there is a long way to go.

4.2 Overseas Reference for Regulating Income Gap

Income inequality is a common problem in almost all countries and regions across the world. All countries have their systems and models for governing poverty, narrowing income gap and improving public welfare. Comparing with their experiences of reducing income inequality is of reference significance for China to promote common prosperity.

Germany, with a GNI per capita of USD 48550 in 2019, is a highly affluent country. In 2018, the Gini coefficient of residents’ income was 0.289, which is in an average range. Germany has kept the labor market active and maintained a low unemployment rate by reducing the treatment level for the unemployed. It has established a multi-pillar pension insurance system, a long-term care insurance system, and incentivized the development of public welfare through preferential tax policies.

Japan is a highly affluent country with a GNI per capita of USD 41570 in 2019, which is about four times the world average. In 2018, the Gini coefficient of Japanese residents’ income was 0.334, which is in a relatively reasonable range. Japan has a distinctive employment system. The lifelong employment system is the most prominent feature, in which enterprises and employees form a steady relationship of mutually beneficial cooperation. In the 1960s and 1970s, Japan implemented the “national income doubling program”, forming a large, stable middle class. Japan achieved relatively equal income in the primary distribution stage. It has not invested much in redistribution and third distribution but adopted the world’s popular social insurance system of accumulating funds and promoted the development of charity through legislation.

With a GNI per capita of USD 65910 in 2019, the US was a highly affluent country. In 2018, the Gini coefficient of US residents’ income was 0.414, a figure that exceeded the alert line and lay in the large income gap range. Regarding primary distribution, labor relations are an important factor affecting the income distribution. In recent years, US labor unions have been declining and employees have been at a disadvantage of labor negotiations, which has been detrimental to increasing wage income and has widened the gap between the rich and the poor. In the third distribution, the US has mature public charities, forming the well-performed social public welfare system and the charity supervision mechanism.

Sweden, a typical Nordic country with a per capita GNI of USD 56410 in 2019, is a highly affluent country. With a Gini coefficient of 0.300 in 2018, the income gap between Swedish residents was reasonable. Sweden has combined socialist ideas with a liberal market economy to form a social development model characterized by “universalism”. With regard to redistribution, Swedish social transfers account for more than one quarter of its GDP and provide a high level of social security in health care, education and housing.

It should be noted that the above countries are developed countries, where people enjoy an affluent life. Their development stage is quite different from China’s current development stage. The way inequality is regulated varies greatly at development stages and in political systems. The experience of inequality governance in developed countries is only of reference value to China, not necessarily applicable. The experiences of Zhejiang and some developed countries in regulating income gap supports the policy coordination principle of income distribution, by which the primary distribution is the dominant mechanism, the redistribution is an important means, and the third distribution is a useful supplement.

5 Research Conclusions and Policy Recommendations

5.1 Research Conclusions

Common prosperity is the CPC’s original aspiration and mission to seek happiness for the people and the unwavering pursuit of generations of Communists. Through 40-plus years of the reform and opening up, China has laid a solid foundation for common prosperity. Important ways and guarantees for common prosperity include improving the income distribution system, grasping the proportion relationship between the primary distribution, redistribution and third distribution, and establishing basic institutional arrangements to enable coordination and complementarity between them. First, the income distribution system should be adapted to the economic development stage. China’s income distribution system, since the reform and opening up, has followed the evolutionary logic of shifting from efficiency to equity, and has gone through four stages of development, namely, “overcoming egalitarianism, giving priority to efficiency with due consideration to equity, taking into account both equity and efficiency and promoting common prosperity”. Second, the proportions of primary distribution, redistribution and third distribution are 82.68%, 17.18% and 0.14%, with primary distribution being the leading mechanism for common prosperity, redistribution being an important means to promote common prosperity and third distribution being a useful supplement to promote common prosperity. Third, the policy coordination arrangement of the primary distribution, redistribution and third distributions is as follows: the primary distribution needs to focus on providing an equitable distribution order, the redistribution needs to prioritize increasing expenditures on people’s living and social security, and the third distribution needs to focus on designing a system for incentive compatibility.

5.2 Policy Recommendations

First, it is important to refine distribution in high-quality development, give full play to the dominant mechanism of primary distribution in income distribution, distinguish between fair and unfair distribution, provide an equitable distribution order, allow for a reasonable income gap, and regulate unfair income distribution. Common prosperity is not rigid egalitarianism. It doesn’t mean to bring prosperity to everyone simultaneously. An equitable but disparate distribution should be encouraged and supported to regulate inequitable distribution. The society needs to provide as much as possible an equitable distribution order. The order covers fair opportunity, equal access to human capital accumulation rights, equal school education, and cultivation and improvement of individuals’ capabilities; equitable distribution, rectification of gray income, prohibition of illegal income, stricter economic supervision for platforms, and formulation of antimonopoly policy; promoting free flow of factors, and weakening the unfair distribution caused by administrative division, occupational discrimination, identity discrimination and household registration discrimination; and improving the mechanism for production factors such as labor, capital, land, knowledge, technology, management and data to participate in distribution according to their contributions, and attaching importance to the relationship between “stock” income and “flow” income and its regulation.

Second, as China’s economic development and financial capacity improve, it is essential to increase efforts to regulate its redistribution and enhance the effectiveness of such regulation. Redistribution is an important means to regulate income distribution. The regulatory capacity and effectiveness of redistribution are related to the financial capacity of the state and the design of the regulatory system. It is necessary to improve the redistribution ability to regulate the income distribution. On the one hand, we need to refine the tax structure and tax collection mechanism and on the other hand, we need to optimize the structure of financial expenditures. In terms of tax collection, the state needs to improve the tax system, increase the proportion of direct tax, enhance the tax progressiveness, accelerate the pilot projects of real estate tax and inheritance tax, refine the tax management system, strengthen the tax supervision, and increase tax revenue to provide higher levels of social welfare. With regard to financial expenditures, the government needs to increase the proportion of spending on social security and people’s wellbeing, improve the social security system for affordable housing, elderly care, health care and education, raise the supply of basic public services, equalize basic public services, and increase financial investment in basic public services of rural and underdeveloped areas.

Third, China needs to design a third distribution system for incentive compatibility. In recent years, China’s charitable undertakings have developed rapidly, social donations have grown rapidly, and the number and quality of charitable organizations and public welfare projects have improved. Systems and laws and regulations in China have been put in place, with the social welfare system taking shape. The role of third distribution in regulating income distribution has gradually received more attention. It is essential for the entire society to play the role of third distribution in promoting common prosperity. To this end, it is essential to design an incentive compatibility system for taxes and subsidies, stimulate the public enthusiasm for donations, set up foundations and a charitable trust system, improve preferential tax policy and unleash the potential of charitable donations. The government needs to build up the charitable supervision system and play the role of public oversight over charities through third-party supervision and information disclosure.

Funding statement: This paper has been funded by the Youth Program of the National Natural Science Foundation of China (71903174), the project of Contemporary Business and Trade Research Center under Zhejiang Gongshang University (2020SMYJ09ZC) and the key research base for humanities and social sciences of China’s Ministry of Education, and the basic research funds of Provincial Universities of Zhejiang Gongshang University (XR202105).

References

Angelopoulos, K., Malley, J., & Philippopoulos, A. (2008). Tax Structure, Growth and Welfare in the UK. Sire Discussion Papers 64(2), 237–258.10.1093/oep/gpr035Search in Google Scholar

Cao, Y., & Liu, Y. (2019). Common Prosperity and Its Realization Path from the Perspective of the New Era. Theory Journal (Lilun Xuekan) 4, 14–21.Search in Google Scholar

Chen, S., & Liu, Y. (2012). The Inverted U-Shaped Hypothesis of Income Difference: Primary Distribution, Redistribution and Policy Choice. Finance and Trade Research (Caimao Yanjiu) 1, 90–101.Search in Google Scholar

Fan, C. (2017). Pro-Poor Growth and Exploration of China’s Common Prosperity Path. Economic Research Journal (Jingji Yanjiu) 12, 14–16.Search in Google Scholar

Gao, F. (2021). New Government-Market Relationship and the Realization of China’s Common Prosperity Goal. Journal of Northwest University (Philosophy and Social Sciences Edition (Xibei Daxue Xuebao (Zhexue Shehui Kexueban)) 6, 5–17.Search in Google Scholar

Guo, K. (2019). The Trend of Industrial Structure Adjustment and Upgrading in China and the Thoughts of Policy Adjustment during the “14th Five-Year Plan”. China Industrial Economics (Zhongguo Gongye Jingji) 7, 24–41.Search in Google Scholar

Guo, Q., & Lyu, B. (2011). The Influence of Tax on Factor Income Distribution. Economic Research Journal (Jingji Yanjiu) 6, 16–30.Search in Google Scholar

Han, X., & He, K. (2021). Communist Party of China’s Principle of Putting People First in Distribution System Reform over the Past Century. Economic Review Journal (Jingji Zongheng) 5, 1–8.Search in Google Scholar

Höchtl, W., Sausgruber, R., & Tyran, J. (2012). Inequality Aversion and Voting on Redistribution. European Economic Review. 56(7), 1406–1421.10.1016/j.euroecorev.2012.07.004Search in Google Scholar

Jiang, Y., & Yu, J. (2021), The Function and Mechanism of the Third Distribution to Promote Common Prosperity. Zhejiang Social Sciences (Zhejiang Shehui Kexue) 9, 76–83.Search in Google Scholar

Jin, X., Guan, H., Li, D., & Broadbery, S. (2019). The Evolution of China’s Share in the Global Economy: 1000–2017 AD. Economic Research Journal (Jingji Yanjiu) 7, 14–29.Search in Google Scholar

Kuznets, S. (1955). Economic Growth and Income Inequality. American Economic Review 45(1), 1–28.Search in Google Scholar

Li, S., & Zhu, M. (2018). Changes in Residents’ Income Gap over 40 Years of China’s Economic Transition. Management World (Guanli Shijie) 12, 19–28.Search in Google Scholar

Li, S., & Zhu, M. (2022). Promoting the Reform of Income Distribution System and the Realization of Common Prosperity. Management World (Guanli Shijie) 1, 52–76.Search in Google Scholar

Li, S. (2021). China’s Goal and Paths of Common Prosperity. Economic Research Journal (Jingji Yanjiu) 11, 4–13.Search in Google Scholar

Li, S., Sicular, T., & Tarp, F. (2020). Income Inequality in China: Development, Transformation and Policy. Journal of Beijing Technology and Business University (Social Sciences) (Beijing Gongshang Daxue Xuebao (Shehui Kexueban)) 4, 21–31.Search in Google Scholar

Li, X., & Ma, Q. (2012). Research on the Income Distribution Gap and Relationship Imbalance between Labor and Capital in China. Studies on Marxism (Makesi Zhuyi Yanjiu) 6, 48–58.Search in Google Scholar

Li, Y. (1994). Joint Stock System and Modern Market Economy. Jiangsu People’s Publishing House. (in Chinese)Search in Google Scholar

Li, Y. (2013). Reform of the Income Distribution System Should Focus on the Primary Distribution Reform. Economic Research Journal (Jingji Yanjiu) 3, 4–6.Search in Google Scholar

Liang, Y., & Zhang, X. (2016). Theoretical Characteristics of the Shared Development Concept. Theory Journal (Lilun Yuekan) 5, 36–40.Search in Google Scholar

Liu, P., Qian, T., Huang, X., & Dong, X. (2021). The Connotation, Realization Path and Measurement Method of Common Prosperity for All. Management World (Guanli Shijie) 8, 117–127.Search in Google Scholar

Nie, H., & Yue, X. (2013). A Comparison Study of the Impact of Indirect Taxes on Income Distribution in Rural and Urban China. China Economic Quarterly (Jingjixue Jikan) 1, 287–312.Search in Google Scholar

Qiu, H. (2016). Scientific Connotations and Achievement Means of Common Prosperity. China Review of Political Economy Review (Zhengzhi Jingjixue Pinglun) 4, 21–26.Search in Google Scholar

Sun, J., & Huang, Q. (2013). The Experience and Enlightenment from Japan’s Adjustment of Income Distribution Gap. International Economics and Trade Research (Guoji Jingmao Tansuo) 4, 35–49.Search in Google Scholar

Tang, R., & Li, C. (2022). The Realization of Common Prosperity: An Investigation Based on the “Three-Wheel Drive” of Market, Government and Society. Journal of Xinjiang Normal University (Philosophy and Social Sciences) (Xinjiang Shifan Daxue Xuebao (Zhexue Shehui Kexueban)) 1, 49–58.Search in Google Scholar

Thomas, P. (2014). Capital in the Twenty-First Century. China CITIC Press.(in Chinese)Search in Google Scholar

Wang, J., Tang, M., & Zhang, L. (2014). Has Chinese Social Security System Failed? A Study on Relationship of Primary Distribution, Redistribution and Urban-Rural Income Gap. Journal of Capital University of Economics and Business (Shoudu Jingji Maoyi Daxue Xuebao) 6, 5–12.Search in Google Scholar

Wang, Q., Niu, G., & Zhao, G. (2021). E-Commerce Development and Rural Revitalization: Evidence from China. Journal of World Economy (Shijie Jingji) 12, 55–75.Search in Google Scholar

Wang, X. (2010). Current Situation, Problems and Countermeasures of China’s National Income Distribution. Journal of National Academy of Education Administration (Guojia Xingzheng Xueyuan Xuebao) 3, 23–37.Search in Google Scholar

Widmalm, F. (2001). Tax Structure and Growth: Are Some Taxes Better Than Others? Public Choice 107(3/4), 199–219.10.1023/A:1010340017288Search in Google Scholar

Xie, E. (2018). Effects of Taxes and Public Transfers on Income Redistribution. Economic Research Journal (Jingji Yanjiu) 8, 116–131.Search in Google Scholar

Xu, J., Ma, G., & Li, S. (2013). Has the Personal Income Tax Improved China’s Income Distribution? A Dynamic Assessment of the 1997–2011 Micro Data. Social Sciences in China (Zhongguo Shehui Kexue) 6, 53–71.Search in Google Scholar

Xu, Y., & Zhang, X. (2011). An Estimate of China’s Gini Coefficient Alert. Statistical Research (Tongji Yanjiu) 1, 81–83.Search in Google Scholar

Yang, C., & Li, Y. (2016). Shared Development: Eliminating Polarization and Achieving Common Prosperity—An Analysis of Optimizing the Function of the Public Sector Economy as the “Main Body” under the New Normal. Ideological Theory Education Guide (Sixiang Lilun Jiaoyu Daokan) 3, 58–64.Search in Google Scholar

Yang, Q. (2021). Promoting the Reform of Income Distribution System and Allowing the People to Share in the Development Achievements. China Human Resources Social Security (Zhongguo Renli Ziyuan Shehui Baozhang) 3, 22–23.Search in Google Scholar

Yu, J., & Ren, J. (2021). Common Prosperity: Theoretical Connotation and Policy Agenda. Journal of Political Science (Zhengzhixue Yanjiu) 3, 13–25.Search in Google Scholar

Yuan, J. (2020). Adhering to and Improving China’s Basic Distribution System and Giving Priority to the Third Distribution Role. Modern Economic Research (Xiandai Jingji Tantao) 9, 9–14.Search in Google Scholar

Zhou, H. et al. (2021). A Comparative Study on the Promotion of Common Prosperity. China Social Sciences Press.(in Chinese)Search in Google Scholar

© 2022 Hao Sun, Xiaoye Cao, published by De Gruyter

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- frontmatter

- China’s High-Quality Economic Growth in the Process of Carbon Neutrality

- Coordination of Income Distribution System and Promotion of Common Prosperity Path

- Financial Pressure, Energy Consumption and Carbon Emissions: A Quasi-Natural Experiment Based on the Educational Authority Reform

- Study on Cleaner Production Subsidies, Income Distribution Imbalance and Carbon Emissions Permit Reallocation Mechanism

- Emission Reduction Investment, Technology Choice and Business Environmental Performance: Evidence from China’s Foreign Investment Liberalization Reform

- Fintech, Macroprudential Supervision and Systematic Risk in China’s Banks

Articles in the same Issue

- frontmatter

- China’s High-Quality Economic Growth in the Process of Carbon Neutrality

- Coordination of Income Distribution System and Promotion of Common Prosperity Path

- Financial Pressure, Energy Consumption and Carbon Emissions: A Quasi-Natural Experiment Based on the Educational Authority Reform

- Study on Cleaner Production Subsidies, Income Distribution Imbalance and Carbon Emissions Permit Reallocation Mechanism

- Emission Reduction Investment, Technology Choice and Business Environmental Performance: Evidence from China’s Foreign Investment Liberalization Reform

- Fintech, Macroprudential Supervision and Systematic Risk in China’s Banks