Abstract

This paper explores the impact of intensity of rivalry in downstream market on the equilibrium locations of the downstream firms under a vertical market structure á la Hotelling. We find that: (i) the presence of upstream firms softens the spatial competition in downstream market; (ii) minimum differentiation cannot be achieved as the equilibrium outcome and the equilibrium product differentiation is insufficient relative to socially optimum; (iii) social welfare is higher with a higher weight attached to intensity of rivalry, which is different from the non-monotonic relationship under the horizontal market case; (iv) the equilibrium product differentiation is independent of bargaining power under the two-part tariff contracts, which is different from Brekke and Straume (2004) under linear pricing.

Funding statement: Jie Li acknowledges support from the key project of the National Natural Science Foundation of China (71333007), National Social Science Fund of China (15BJL087), Guangdong Provincial Natural Science Foundation (2014A030313395), and Fundamental Research Funds for the Central Universities (15JNYH001).

Appendix

Since the downstream firms are symmetric, substituting

We find that when

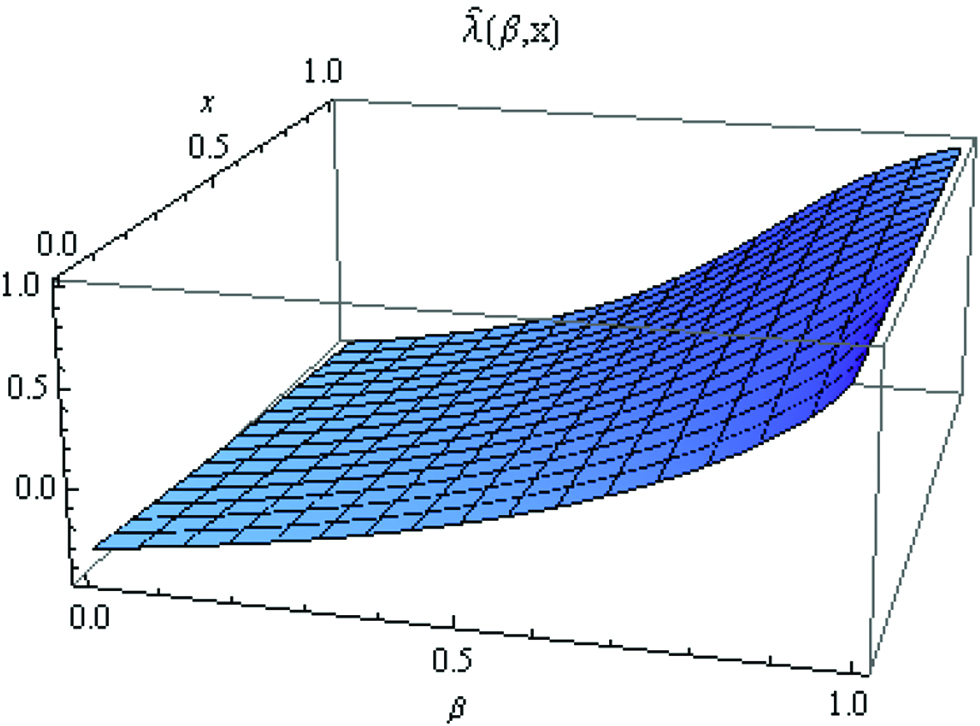

The graph of ˆλ(β,x).

References

Anderson, S. P., and A. de Palma. 2000. “From Local to Global Competition.” European Economic Review 44 (3):423–448.10.1016/S0014-2921(99)00003-3Search in Google Scholar

Brekke, K. R., and O. R. Straume. 2004. “Bilateral Monopolies and Location Choice.” Regional Science and Urban Economics 34 (3):275–288.10.1016/S0166-0462(03)00046-2Search in Google Scholar

d’Aspremont, C., J. J. Gabszewicz, and J. F. Thisse. 1979. “On Hotelling’s ‘Stability in Competition’.” Econometrica 47:1145–1150.10.2307/1911955Search in Google Scholar

Friedman, J. W., and J. F. Thisse. 1993. “Partial Collusion Fosters Minimum Product Differentiation.” The RAND Journal of Economics 24:631–645.10.2307/2555750Search in Google Scholar

Gu, Y., and T. Wenzel. 2009. “A Note on the Excess Entry Theorem in Spatial Models with Elastic Demand.” International Journal of Industrial Organization 27 (5):567–571.10.1016/j.ijindorg.2009.01.002Search in Google Scholar

Hirose, K., and T. Matsumura. 2016. “Payoff Interdependence and the Multi-Store Paradox.” Asia-Pacific Journal of Accounting & Economics 23 (3):256–267.10.1080/16081625.2016.1188447Search in Google Scholar

Hotelling, H. 1929. “Stability in Competition.” Economic Journal 39:41–57.10.2307/2224214Search in Google Scholar

Kitahara, M., and T. Matsumura. 2013. “Mixed Duopoly, Product Differentiation and Competition.” The Manchester School 81 (5):730–744.10.1111/j.1467-9957.2012.02329.xSearch in Google Scholar

Kou, Z., and M. Zhou. 2015. “Hotelling’s Competition with Relative Performance Evaluation.” Economics Letters 130:69–71.10.1016/j.econlet.2015.02.011Search in Google Scholar

Maggi, G., and A. Rodriguez-Clare. 1998. “The Value of Trade Agreements in the Presence of Political Pressures.” Journal of Political Economy 106 (3):574–601.10.1086/250022Search in Google Scholar

Matsumura, T., and N. Matsushima. 2011. “Collusion, Agglomeration, and Heterogeneity of Firms.” Games and Economic Behavior 72 (1):306–313.10.1016/j.geb.2010.08.003Search in Google Scholar

Matsumura, T., and N. Matsushima. 2012. “Competitiveness and Stability of Collusive Behavior.” Bulletin of Economic Research 64 (s1):s22-s31.10.1111/j.1467-8586.2012.00439.xSearch in Google Scholar

Matsumura, T., and M. Okamura. 2015. “Competition and Privatization Policies Revisited: The Payoff Interdependence Approach.” Journal of Economics 116 (2):137–150.10.1007/s00712-015-0445-5Search in Google Scholar

Matsushima, N. 2004. “Technology of Upstream Firms and Equilibrium Product Differentiation.” International Journal of Industrial Organization 22 (8):1091–1114.10.1016/j.ijindorg.2004.06.004Search in Google Scholar

Symeonidis, G. 2008. “Downstream Competition, Bargaining, and Welfare.” Journal of Economics & Management Strategy 17 (1):247–270.10.1111/j.1530-9134.2008.00177.xSearch in Google Scholar

Yu, Z. 2000. “A Model of Substitution of Non‐Tariff Barriers for Tariffs.” Canadian Journal of Economics 33 (4):1069–1090.10.1111/0008-4085.00054Search in Google Scholar

© 2019 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Articles

- Privatizing Multi-subsidiary Public Firm in Location Model

- Efficient Combinatorial Allocations: Individual Rationality versus Stability

- On Decay Centrality

- Sequential Auctions with Decreasing Reserve Prices

- The core of a strategic game

- Targeted Advertising on Competing Platforms

- Representation in Multi-Issue Delegated Bargaining

- Endogenous Mergers in Markets with Vertically Differentiated Products

- Standards of Proof and Civil Litigation: A Game-Theoretic Analysis

- Retained Earnings, Interest Rates and Lending Relationship

- Uniform Price Auctions with Asymmetric Bidders

- Conformity and Influence

- Sellouts, Beliefs, and Bandwagon Behavior

- Notes

- Eco-Firms and the Sequential Adoption of Environmental Corporate Social Responsibility in the Managerial Delegation

- Vertical Contract and Competition Intensity in Hotelling’s Model

- Constrained Allocation of Projects to Heterogeneous Workers with Preferences over Peers

- Irrelevance of the Strategic Variable in the Case of Relative Performance Maximization

- Critical Efficiencies as Upward Pricing Pressure with Feedback Effects

- On the Openness of Unique Pure-Strategy Nash Equilibrium

- Forecast Dispersion in Finite-Player Forecasting Games

Articles in the same Issue

- Articles

- Privatizing Multi-subsidiary Public Firm in Location Model

- Efficient Combinatorial Allocations: Individual Rationality versus Stability

- On Decay Centrality

- Sequential Auctions with Decreasing Reserve Prices

- The core of a strategic game

- Targeted Advertising on Competing Platforms

- Representation in Multi-Issue Delegated Bargaining

- Endogenous Mergers in Markets with Vertically Differentiated Products

- Standards of Proof and Civil Litigation: A Game-Theoretic Analysis

- Retained Earnings, Interest Rates and Lending Relationship

- Uniform Price Auctions with Asymmetric Bidders

- Conformity and Influence

- Sellouts, Beliefs, and Bandwagon Behavior

- Notes

- Eco-Firms and the Sequential Adoption of Environmental Corporate Social Responsibility in the Managerial Delegation

- Vertical Contract and Competition Intensity in Hotelling’s Model

- Constrained Allocation of Projects to Heterogeneous Workers with Preferences over Peers

- Irrelevance of the Strategic Variable in the Case of Relative Performance Maximization

- Critical Efficiencies as Upward Pricing Pressure with Feedback Effects

- On the Openness of Unique Pure-Strategy Nash Equilibrium

- Forecast Dispersion in Finite-Player Forecasting Games