Abstract

Economic activity is implicated in the long-range spread of invasive species, resulting in ecological and economic damages. Current policies that are used to prevent such spread include specific and ad valorem taxes. However, these taxes are often created under ecological and economic uncertainty. To address this concern, this paper develops a general equilibrium model capable of evaluating the efficiency of specific and ad valorem taxes under uncertainty. Results show that specific taxes are more efficient at achieving a social optimum under imperfect information and that a combination of taxes is needed for multiple forms of long-range transmission.

1 Introduction

The movement of invasive species into territories outside a species biological spread rate is often due to economic activity and has been known to increase the likelihood of invasion success (Wilson et al. 2009). Examples of human-induced invasive species spread include the Burmese python, a reptile currently altering the Florida Everglades ecosystem and spreading through the exotic pet trade (Reed 2005); the zebra mussel, a small mussel damaging economic structures and the ecosystem in the Great Lakes region and spreading through infested boats’ ballast water (Griffiths et al. 1991); and the emerald ash borer (EAB), a beetle threatening North America’s ash trees and spreading through infested firewood and on the wind currents of cars (Prasad et al. 2010). The increased rate of long-range spread is troubling; invasive species cause $120 billion in economic and ecosystem damages in the United States annually (Pimentel, Zuniga, and Morrison 2005). To reduce damages from invasive species, economic instruments can be implemented to help minimize the long-range spread of invasive species.

Current policies are in place to help minimize the damage caused by the introduction of invasive species from economic activity. Such policies include specific taxes, which are charged as a fixed amount on the sale/consumption of each specific unit of a good/service, and ad valorem taxes, which are levied on economic activity according to its value. These market mechanisms are typically applied to alter incentives (prices) and change human behavior, which reduces economic activity that contributes to the long-range spread of invasive species.

Specific taxes have been used by the states of Hawaii, Tennessee, and Maryland as well as by the federal government for controlling the spread of various invasive species. To aid in the state’s fight against invasive species, Hawaii implemented an Invasive Species Prevention Act in 2008, which levies a 50-cent tax on every 1,000 pounds of goods shipped via air cargo (Kim 2008). Tennessee has introduced the “Iris Tag,” a license plate depicting the state’s cultivated flower, which can be obtained by a Tennessee resident for an additional charge (Tennessee State Parks 2011). Maryland, through its Forest Stewardship Program, provides financial assistance, including a property tax reduction of about $150 per acre, to help preserve and restore private property to its natural state[1] (Maryland Department of Natural Resources 2011). The Forest Stewardship Program includes financial assistance for invasive species management. Similarly, The U.S. Fish and Wildlife Service impose fixed excise taxes on hunting and fishing equipment.

Ad valorem taxes/subsidies are also a popular tax instrument and are currently used in Florida, Idaho, Oregon, Montana and Wisconsin. The 2010 Florida Statutes detail an Everglades Agricultural Privilege Tax in and around the Florida Everglades, which is levied on agricultural property for Everglades improvement and management, including the control of invasive species (Florida 2011). Idaho uses a tax instrument that is most similar to an ad valorem tax: The state requires boaters to contribute to the Idaho Invasive Species Fund by purchasing a permit based on the size of their boats (kayaks versus motorboats) (Idaho State Parks and Recreation 2011). Both Oregon and Montana have implemented similar permit requirements for boaters (Oregon 2010; Montana 2002). Wisconsin currently has a Managed Forest Law through the Living Forest Cooperative, which assists with the management of invasive species in forest areas Michigan Department of Agriculture (2013). This program offers a deferment of the forest owner’s property taxes if the owner prepares a sustainable forest management plan with a certified plan writer.[2]

When applied correctly, specific and ad valorem taxes help regulate market failures, including ecosystem externalities resulting from the economic movement of invasive species (Koenig 1985; Crocker and Tschirhart 1992; Pirttilä 2002). However, these market mechanisms are often created under a great deal of uncertainty, including uncertainty in economic damages, control costs and how the invasive species interacts with the native ecosystem (Mehta et al. 2007; Eiswerth and Van Kooten 2002; Keen 1998). Further, little research has been done to determine the efficiency of these policies under economic and ecological uncertainty when multiple market failures exist (Richards et al. 2010; Goulder et al. 1999; Grant and Quiggin 1997).

To address this issue, I develop a general equilibrium model that is capable of evaluating optimal regulations of market failures caused by invasive species. The model accounts for feedback loops that exist between economic production, natural resource stocks, and invasive species populations. A key natural resource and the associated invasive species are modeled as an interdependent system. The invasive EAB is used as an example to determine the optimal specific and ad valorem taxes for minimizing the associated ecosystem externalities. Specific and ad valorem taxes are then compared. Important results suggest that specific taxes rely on fewer economic and ecological parameters, making them more robust to uncertainty. Additionally, although only one invasive species is considered, the results show that multiple instruments are necessary to correct for multiple forms of invasive species transmission. Although specific taxes are preferred due to uncertainty and distortionary effects, a combination of specific taxes and ad valorem taxes could be implemented to achieve a Pareto optimal outcome. Finally, this methodology is general enough that it could be applied to other serious invasive species such as the Asian longhorned beetle[3] or other non-borer pests (for example, see Aukema et al. 2011).

2 Application to EAB

Invasive forest insects, specifically wood-boring insects, account for the largest economic damages of all invasive species. Wood-boring insects reduce the value of residential property by $830 million annually and cost local governments $1.7 billion annually. The EAB accounts for the largest share of this damage, including annual residential property loss totaling $380 million and annual local government expenditures totaling $850 million (Aukema et al. 2011).

Since its initial detection in Michigan in 2002, the EAB has killed millions of ash trees in the Midwest and, more recently, New England (USDA Forest Service 2008). Scientists believe this beetle, which was introduced from Asia, was transported through solid wood packing materials in cargo ships and on planes. Most notably, the EAB has the capacity to kill an adult ash tree within 3–5 years and saplings within 1 year by feeding on the inner bark (Poland and McCullough 2006).

The EAB spreads locally through flight; economic activity, including driving and ash timber harvesting; and leisure activities such as camping, firewood gathering, and gardening with infested nursery trees (Prasad et al. 2010; Poland and McCullough 2006). Economic activity leads to hundreds of new introduction points and is likely to blame for the blanket of infestation now seen in southeastern Michigan (BenDor et al. 2006; Prasad et al. 2010). For instance, on their own, EABs can move an average of 9.84 km/year; however, they are currently moving over 20 km/year (Taylor et al. 2006). Most recently, Greene and Ulster counties in New York have confirmed EAB infestations, yet the closest EAB-infested county is Steuben County, New York, which is over 350 km away (NYS Dept. of Environmental Conservation 2013). This distance is well beyond the EAB’s ability to fly, suggesting economic activity is contributing to the EAB’s spread.

The current policy that is used to mitigate or slow the spread of the EAB is quarantine. This policy prohibits any ash tree movement outside a confirmed EAB-infested county, and it may actually contribute to ash tree mortality. Under the quarantine, it is legal to move ash trees within and between adjacent quarantined areas, which results in an increased risk of ash tree death in the quarantined county by intensifying the spread of the EAB. Random firewood inspections are established throughout EAB-infested areas to ensure that the quarantine is followed. The state of Michigan levies fines at a rate of $1,000–$250,000 and up to 5 years in jail for the movement of regulated ash tree materials MDARD (2014). In addition to quarantines and inspections, the state of Ohio destroyed all ash trees within an 800-meter radius of an infested tree. This costly practice was suspended in 2006, when the EAB was discovered in numerous ash tree stands.

Quarantine inspections and infested tree removal address local biological spread rates and do not address long-range economic dispersal, as both inspections and tree removal require detection of the EAB prior to implementation. This is troubling because there is a 1-year time lag between infestation and possible detection.[4] Prior to detection and quarantines, economic activity is free to move ash wood that potentially carries the EAB. Therefore, quarantines and tree felling help contain only short-range biological and economic spread once the EAB has been detected. It is imperative to implement policies that address both long- and short-range dispersal because once an area is infested with the EAB, there are almost no effective options for eradication, and EAB-related damage will likely ensue.

3 A General Equilibrium Model: Theory

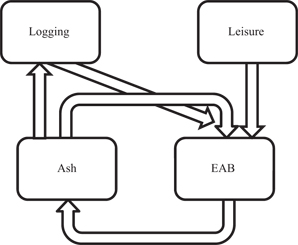

The EAB provides an example of human-induced invasive species spread where movement in and around an EAB-infested area accelerates the rate at which the EAB spreads. This outside movement of EAB in turn degrades ash-resource-dependent economic activity and poses health risks from falling dead ash trees. In this sense, invasive species like the EAB are an environmental externality that operates through interdependent economic–ecological relationships (Figure 1). Using a steady-state general equilibrium analysis following Crocker and Tschirhart (1992),[5] control techniques in the form of taxes/subsidies on economic activity known to contribute to the spread of EAB are examined. This model pays special attention to the predator–prey relationship of EAB and ash trees and the ecological consequences from economic activity.[6]

Ecosystem and economic model flow chart.

The theoretical economy consists of ash tree-dependent production and a representative consumer who derives utility through ash resource services, a composite good, and leisure. A predator–prey ecosystem models the relationship between ash tree population and EAB, where leisure and harvest of ash trees contribute to the growth of EAB. The ash resource-dependent economic activity and consumer utility link the economic and ecosystem services. The ecosystem is introduced into the economy through the harvest equation for ash trees.

The representative consumer in the model derives utility through ash tree harvests,

Economic activity occurs within two industries in the economy, harvest of ash trees (used for either landscape purposes or timber production) and a composite good. Equation [2] represents a quasi-concave production function,

Ash trees and labor positively impact the harvest production function,

Composite good production is achieved through the use of labor,

As previously mentioned, a consumer derives utility from the non-consumptive use of ash trees, which can be interpreted as yard/forest quality. Ecosystem equations describing ash and EAB growth are introduced to account for the non-consumptive use of ash. For the clearest exposition of the tradeoffs involved assume ash and EAB stocks are in steady state such that net growth equals harvest as represented by eqs [4] and [5], respectively.

Assuming silviculture, the growth of ash trees,

EAB growth is an increasing function in leisure and labor in the ash tree harvest sector because driving and movement around/in an EAB infested area spreads the EAB more quickly than it would naturally,

Finally, the labor resource constraint is represented by

where

The ecosystem and economy are linked through changes in ash tree and EAB population, which directly impacts consumer utility and indirectly adjusts ash tree stocks where increases in EAB will decrease the amount of ash trees available for harvest.

3.1 Centralized Outcome

To determine the centralized Pareto optimal allocation of resources in the economy, a central planner will maximize harvest, labor, and natural resource stocks via the utility function [1] subject to production constraints represented by eqs [2]–[5], along with a time constraint, eq. [6]. The associated Lagrangian is given by

with shadow prices characterized as

Let

Equation [8a] represents the Pareto optimal allocation of ash harvest labor, including the externality from ash harvest. The marginal benefits, left side of eq. [8a], take the form of the consumer’s marginal willingness to pay for ash harvest in terms of the composite good. The marginal costs, right side of eq. [8a], include the direct cost of harvesting, labor stock effects and an ecosystem externality. Labor stock effects are represented by the tradeoffs between ash harvest and silviculture. The third term on the right of eq. [8a] is the ecosystem externality and represents the forgone benefit from increased ash stocks due to an increase in harvesting. The externality accounts for the impact of labor used in ash harvest on EAB growth and the resulting impact on ash stocks, directly impacting consumer’s utility and production in the harvest sector. The consumers’ willingness to pay for improved ash quality in terms of the composite good is represented by

Equation [9a] represents the marginal benefits and costs from leisure. The marginal benefit from leisure is the left side of eq. [9a]. The costs from consuming leisure are on the right side of eq. [9a] and include the labor tradeoff from purchasing the composite good, along with the cost to the ecosystem from consuming leisure. Similar to ash harvest, leisure activities pose a risk of spreading EAB, impacting the consumer’s utility and harvest production function. The ecosystem externality is represented by the second term in eq. [9a]. The consumer’s willingness to pay for ash quality,

3.2 Decentralized Outcome

The decentralized competitive equilibrium for this economy is characterized by households maximizing utility subject to their budget and time constraints and firms maximizing profits. Specifically, two firms exist in this economy; one firm harvests ash and engages in silviculture and the second firm produces the composite good using labor. I assume that the ash tree harvesting firm is familiar with plantation farming and consequently maximizes profits over ash tree stocks. However, I assume the harvesting firm is unaware of an EAB harvest function, or unaware that their activities lead to EAB growth, and does not maximize over EAB stocks (Crocker and Tschirhart 1992). The consumer’s (

where

Using the first-order conditions, the competitive solution is characterized as

The competitive decentralized solution (eqs [14] and [15]) varies significantly from the centralized Pareto optimal outcome (eqs [8a] and [9a]). The difference between eqs [14] and [8a] is the addition of the third term in eq. [8a], which represents the ecosystem externality. Depending on the magnitude of the externality, this economy is producing too much harvest and not enough labor devoted to silviculture because the firm is not accounting for the negative effect of harvest on the spread of EAB. The economy may also be spending too much time on production through silviculture and not enough time harvesting. The impact of the ecosystem externality depends on the magnitude of the difference between labor’s impact on harvest and the ecosystem. It is important to note that if the fraction of economic activity introducing EAB is zero, then

Equations [9a] and [15] differ in the addition of the second term, which represents the ecosystem externality caused by leisure. The ecosystem externality is complicated and illustrates how leisure affects ash quality and EAB population. This externality represents the forgone benefit from improved ash quality in both the utility and production functions. Relative to the Pareto optimal solution, the competitive economy is either producing too much (too little) outside the house leisure,

4 Policy Results

Economic instruments in the form of taxes/subsidies are introduced as a corrective market mechanism to ensure that the externality of economic activity on invasive species is internalized by the firm and the consumer. As mentioned above, current EAB policies address only short-range dispersal. The policies created here attempt to address long-range EAB dispersal through economic activity because the unregulated competitive equilibrium suggests that consumers are participating in more EAB spreading activities than the centralized equilibrium. As a result, tax/subsidy policies adjust prices, and consequently behavior, which lead to less EAB spreading activity and/or more of the composite good or home leisure consumption. Similar corrective instruments have been applied to forest externalities in a partial equilibrium context (Englin 1990; Koskela and Ollikainen 2001). The two most widely used policy options among jurisdictions are considered, specific and ad valorem taxes.

4.1 Specific Taxes

Specific taxes can be levied on harvest and leisure at rates

and

The solutions for the optimal taxes on harvest and leisure that would ensure a Pareto optimum are then calculated as

An additional policy consideration includes taxing labor in harvest instead of harvest output. If instead specific taxes were levied on labor in harvest at the rate

with a corresponding tax of

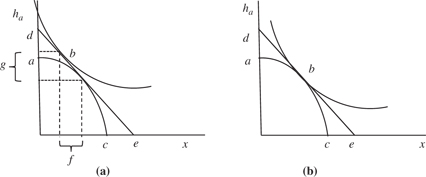

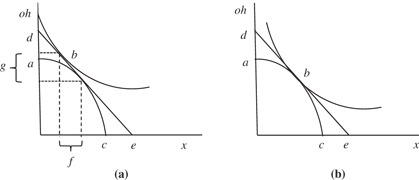

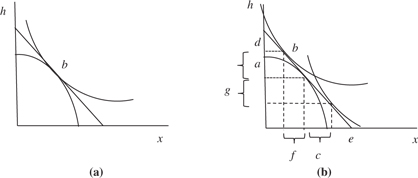

If each of the ecological and economic partial derivatives was known, then the centralized solution would equal the decentralized solution, as demonstrated in Figures 2 and 3. Taxing harvest or labor associated with harvest would produce an efficient allocation, as shown in Figure 4. Taxing labor or harvest output produces the same social optimum but provides the regulator more flexibility if they have varying levels of information on labor or harvest level.

Unit tax on harvest. This figure represents the invasive species externality in a decentralized and centralized framework assuming a negative invasive species externality. Curve ac represents attainable production, while the other curve is the consumer’s indifference curve. Line de is the price system in the market. Graph (a) represents the unregulated decentralized consumption of harvest, in which the firm fails to internalize the invasive species externality. As such, there is a demand surplus of harvest (

Unit tax on leisure outside the home. This figure represents the invasive species externality in a decentralized and centralized framework assuming a negative invasive species externality. Curve ac represents attainable production, while the other curve is the consumer’s indifference curve. Line de is the price system in the market. Graph (a) represents the unregulated decentralized consumption of leisure, in which the consumer fails to internalize the invasive species externality. As such, there is a surplus of demand of leisure (

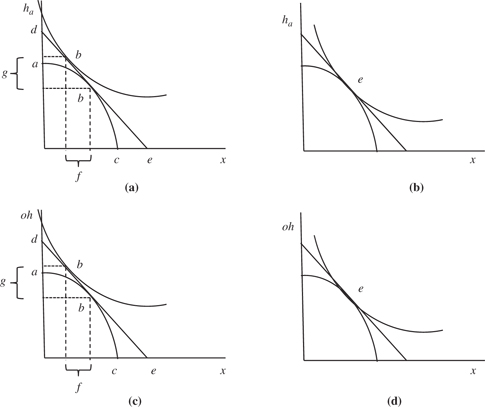

Ad valorem tax on harvest and leisure outside the home. This figure represents the invasive species externality in a decentralized and centralized framework assuming a negative invasive species externality. Curve ac represents attainable production, while the other curve is the consumer’s indifference curve. Line de is the price system in the market. Graph (a) represents the unregulated decentralized consumption of harvest, in which the firm fails to internalize the invasive species externality. As such, there is a surplus of demand of harvest (

Both the producer and consumer taxes are inherently complicated and are increasing in the fraction of economic activity contributing to EAB population and the consumers’ willingness to pay for improved ash quality. To determine the sign of the tax (tax or subsidy), the ecosystem externality must be signed, which is difficult because it includes adjustments throughout the entire ecosystem. Normalized by the price of the composite good, the relative difference of the partials in the ecosystem externalities will determine the sign of the tax on harvest and leisure.

An externality greater than zero (i.e. an increased marginal benefit from harvest and increased marginal cost from leisure),

An externality less than zero (i.e. an increased marginal cost from harvest and increased marginal benefit from leisure),

4.2 Ad Valorem Taxes

If ad valorem taxes, charged as a percentage of the value, were levied on harvest (or labor) at a rate of

The corresponding taxes are

Though this ensures that the producer and consumer internalize the externality as shown in Figure 3, this tax structure creates a distortionary effect on inside leisure,

Ad valorem impact on leisure inside household. This figure represents the impact of the invasive species taxes in a decentralized and centralized framework assuming a negative invasive species externality. Curve ac represents attainable production, while the other curve is the consumer’s indifference curve. Line de is the price system in the market. Graph (a) represents the unregulated decentralized consumption of within household leisure, in which the household consumption of

This distortionary effect occurs because taxes on

Additionally, policy makers could consider taxing labor in harvest instead of harvest output. If instead ad valorem taxes were levied on labor in harvest at the rate

The interpretation and signing of the ad valorem taxes is slightly more complicated as the ad valorem tax relies on more information about the partial derivatives and generates a distortionary effect on leisure inside the household. However, interpretation could be similarly followed in that a positive tax on harvest would reduce EAB spreading economic activity from harvesting ash trees, a positive tax on leisure would reduce leisure outside the home diminishing EAB spread from leisure. Alternatively, a negative tax (or subsidy) would increase EAB spreading economic activity because the economic benefits outweigh the ecological costs.

5 Discussion

For this analysis, policy makers are able to address the producer externality with the choice of taxes imposed on harvest output or labor devoted to harvest. Either of these taxes, when used in conjunction with a tax on leisure, achieves a Pareto-efficient outcome, assuming policy makers can specifically target

While I address the various taxes separately, it would also be possible for a policy maker to combine the economic instruments and still achieve Pareto optimum. For example, it may be easier to tax leisure in the form of income or property taxes, which are often in the form of ad valorem taxes. However, a jurisdiction may prefer to tax logging output per board feet rather than using an ad valorem tax on harvest labor or the value of the harvest output. As shown in the introduction, jurisdictions prefer to use both specific and ad valorem taxes for invasive species policy. As a result, it is possible to present a tax menu to policy makers and allow jurisdictions, with varying laws and limitations, to implement a first-best tax schedule.

Introducing multiple market instruments for multiple market failures is an important considering for invasive species policy going forward. This becomes more important as the expected number of invasive species introductions from economic activity increases. A natural question arises, what if only one policy, either a tax on harvest/labor or leisure, can be implemented? Though welfare ranking is outside the realm of this paper, several observations can still be made. Under specific taxes, if the regulator was only able to implement one tax on either harvest or leisure, the second best solution would never equal the first-best, or the two-tax system. The impact from implementing only one ad valorem tax is uncertain given the distortionary impacts resulting from the ad valorem taxes on leisure outside the household because an ad valorem tax on

6 Concluding Remarks

This paper considers possible corrective mechanisms for invasive species long-range spread. Using the EAB as a case study, policies considered include specific and ad valorem instruments. Such policies are affected by the fraction of economic activity contributing to the spread of EAB and the consumer’s willingness to pay for ash quality. The theoretical model also addresses the importance of having a combination of policies for dealing with multiple forms of long-range transmission. Although the model considers a single invasive species, multiple policies are required to fully internalize the ecosystem externalities. Specifically, the EAB is introduced into the ecosystem via labor devoted to harvest and leisure outside of the home. As the specific and ad valorem taxes show, two taxes, one tax on harvest output or labor in the harvest sector and one tax on leisure, are required for the decentralized solution to equal the centralized solution; one tax will not suffice.

The simple theoretical model shows that the implementation of market policies can achieve a first-best outcome. Should the policy maker face uncertainties in various parameters, the specific taxes may be preferred over ad valorem tax to achieve an efficient first-best scenario, as it relies on fewer parameters from the ecological/economic equations. Likewise, specific taxes may be the easiest to implement in terms of the necessary calculations. This model has shown that a combination of tax options could be presented to the policy maker in order to achieve a social optimum.

There are some limitations to the modeling approach. First, I only consider specific and ad valorem taxes. Future research could benefit from examining other possible corrective mechanisms such as tradable permits, a two-part tariff, and quadratic taxes. Richards et al. (2010) have shown that quantity-based instruments, such as tradable permits, can be superior to price-based instruments for invasive species control policies, although few real-world applications exist.[12] Two-part tariffs, such as implemented by Fullerton and Wolverton (2005), can be explained as a “deposit-refund” system, in which a dirty (polluting) product is taxed and a clean (nonpolluting) product or service is subsidized. Kossioris et al. (2010) illustrate that while specific, ad valorem, and quadratic taxes converge to a social optimum when correcting a common pool resource, a quadratic tax leads to an improvement in welfare. Second, I assume the taxes are only enforced on economic activity that introduces invasive species. Alternatively, future research could examine the benefits of taxing the forest managers who directly oversee trees impacted by EAB. For example, with the introduction of EAB, it may be socially optimal to remove, destroy, or replace the ash trees sooner than the forest manager would choose on their own. As a result, the removal of trees would prevent or limit the occurrence of ecosystem externalities [for additional examples, please see Englin (1990) and Koskela and Ollikainen (2001)]. Third, my model considers exogenous risk only. However, incorporating endogenous risk into the model would be a worthwhile exercise, as individuals invest in self-protection and self-insurance actions to minimize losses caused by invasive species.[13] Fourth, while a steady-state model is good for initial intuition into this problem, a dynamic model would be a useful contribution to the current literature, along with an empirical application capable of ranking the welfare derived from each policy. Finally, though this model specifically addresses EAB, the application of the techniques could be extended to additional invasive species and future beetle outbreaks.

Acknowledgments

I would like to gratefully acknowledge Cristina Reiser for her critical review on an earlier version of the manuscript. I also thank the anonymous referees and the associate editor for their helpful comments and insights. All remaining errors are my own.

References

Aukema, J. E. , B.Leung, K.Kovacs, C.Chivers, K. O.Britton, et al. 2011. “Economic Impacts of Non-Native Forest Insects in the Continental United States.” PLoS ONE6 (9). doi: 10.1371/journal.pone.0024587.10.1371/journal.pone.0024587Suche in Google Scholar

Bendor, T. , S.Metcalf, L.Fontenot, B.Sangunett, and B.Hannon. 2006. “Modeling the Spread of the Emerald Ash Borer.” Ecological Modeling197 (1–2):221–36. doi:10.1016/j.ecolmodel.2006.03.003.10.1016/j.ecolmodel.2006.03.003Suche in Google Scholar

Bovenberg, A. L. , and R. A.De Mooij. 1994. “Environmental Levies and Distortionary Taxation.” The American Economic Review84:1085–9.Suche in Google Scholar

Crocker, T. D. , and J.Tschirhart. 1992. “Ecosystems, Externalities, and Economies.” Environmental and Resource Economics2 (6):551–67.10.1007/BF00330283Suche in Google Scholar

Eiswerth, M. E. , and G. C.Van Kooten. 2002. “Uncertainty, Economics, and the Spread of an Invasive Plant Species.” American Journal of Agricultural Economics 84:1317–22.10.1111/1467-8276.00396Suche in Google Scholar

Englin, M. S . 1990. “Optimal Taxation: Timber and Externalities.” Journal of Environmental Economics and Management18 (3):263–75.10.1016/0095-0696(90)90006-KSuche in Google Scholar

Florida Legislature. 2011. The 2010 Florida Statutes. Accessed February 1, 2011. http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0300-0399/0373/Sections/0373.4592.html.Suche in Google Scholar

Fullerton, D. , and A.Wolverton. 2005. “The Two-Part Instrument in a Second-Best World.” Journal of Public Economics89:1961–75.10.1016/j.jpubeco.2004.06.011Suche in Google Scholar

Gordon, J. P. F. 1988. “A Many Good, Many Person, Corlett-Hague Tax Rule.” Economic Letters29:157–61.10.1016/0165-1765(89)90267-XSuche in Google Scholar

Goulder, L. , I.Parry, R.Williams iii, and D.Burtraw. 1999. “The Cost-Effectiveness of Alternative Instruments for Environmental Protection in a Second-Best Setting.” Journal of Public Economics72:329–60.10.1016/S0047-2727(98)00109-1Suche in Google Scholar

Grant, S. , and J.Quiggin. 1997. “Strategic Trade Policy under Uncertainty: Sufficient Conditions for the Optimality of Ad Valorem, Specific and Quadratic Trade Taxes.” International Economic Review38:187–203.10.2307/2527414Suche in Google Scholar

Griffiths, R. W. , D. W.Schloesser, J. H.Leach, and W. P.Kovalak. 1991. “Distribution and Dispersal of the Zebra Mussel (Dreissena polymorpha) in the Great Lakes Region.” Canadian Journal of Fisheries and Aquatic Sciences48 (8):1381–8.10.1139/f91-165Suche in Google Scholar

Horan, R. , and F.Lupi. 2004. “Tradeable Risk Permits to Prevent Future Introductions of Invasive Alien Species into the Great Lakes.” Ecological Economics52:289–304.10.1016/j.ecolecon.2004.06.018Suche in Google Scholar

Idaho State Parks and Recreation. 2011. “Idaho Invasive Species Fund.” Invasive Species Prevention in Idaho. Accessed February 1, 2011. http://parksandrecreation.idaho.gov/idahoinvasivespeciesfund.aspx.Suche in Google Scholar

International Society of Arboriculture. 2005. Tree Values, Brochure. Champaign: Retrieved 2011. Trees Are Good. International Society of Arboriculture. Accessed February 1, 2011. http://www.treesaregood.org/treecare/tree_values.aspx.Suche in Google Scholar

Keen, M. 1998. “The Balance between Specific and Ad Valorem Taxation.” Fiscal Studies19:1–37.10.1111/j.1475-5890.1998.tb00274.xSuche in Google Scholar

Kim, L. 2008. “New Invasive Species Tax Could Mean Higher Shipping Prices.” Hawaii News Now – KGMB and KHNL. Accessed January 1, 2011. http://www.hawaiinewsnow.com/Global/story.asp?S=8726590.Suche in Google Scholar

Koenig, E. F. 1985. “Indirect Methods for Regulating Externalities under Uncertainty.” The Quarterly Journal of Economics100 (2):479–93.10.2307/1885392Suche in Google Scholar

Koskela, E. , and M.Ollikainen. 2001. “Forest Taxation and Rotation Age Under Private Amenity Valuation: New Results.” Journal of Environmental Economics and Management42:374–84.10.1006/jeem.2000.1165Suche in Google Scholar

Kossioris, G. , M.Plexousakis, A.Xepapadeas, and A.De Zeeuw. 2010. On the Optimal Taxation of Common-Pool Resources. Working paper. Athens University of Economics and Business.10.2139/ssrn.1686967Suche in Google Scholar

Maryland Department of Natural Resources. 2011. Forest Stewardship. Accessed February 1, 2011. http://www.dnr.state.md.us/forests/programapps/stewcon.asp.Suche in Google Scholar

Mehta, S. , R.Haight, F.Homans, S.Polasky, and R.Venette. 2007. “Optimal Detection and Control Strategies for Invasive Species Management.” Ecological Economics61:237–45.10.1016/j.ecolecon.2006.10.024Suche in Google Scholar

Michigan Department of Agriculture. 2013. “Wisconsinʼs Managed Forest Law. A Program Summary PUB-FR-295.” Accessed May 8, 2015. http://dnr.wi.gov/files/pdf/pubs/fr/FR0295.pdf.Suche in Google Scholar

Michigan Department of Agriculture and Rural Development (MDARD). 2014. “Firewood Fact Sheet.” Access May 8, 2015. http://www.michigan.gov/documents/mda/mda_EAB_Firewood_Fact_Sheet_328195_7.pdf.Suche in Google Scholar

Montana Aquatic Nuisance Species (ANS) Technical Committee. 2002. Montana Aquatic Nuisance Species (ANS) Management Plan Final. Accessed February 1, 2011. http://www.anstaskforce.gov/Montana-FINAL_PLAN.pdf.Suche in Google Scholar

NYS Department of Environmental Conservation. 2013. Emerald Ash Borer. Accessed May 2013. http://www.dec.ny.gov/animals/7253.html.Suche in Google Scholar

Oregon State Marine Board. 2010. Invasive Species Protection Program. Accessed February 1, 2011. http://www.dfw.state.or.us/conservationstrategy/invasive_species/quagga_zebra_mussel.asp.Suche in Google Scholar

Pimentel, D. , R.Zuniga, and D.Morrison. 2005. “Update on the Environmental and Economic Costs Associated with Alien-Invasive Species in the United States.” Ecological Economics52 (3):273–88.10.1016/j.ecolecon.2004.10.002Suche in Google Scholar

Pirttilä, J. 2000. “A Many-Person Corlett-Hague Tax Rule with Externalities.” Oxford Economic Papers52:595–605.10.1093/oep/52.3.595Suche in Google Scholar

Pirttilä, J. 2002. “Specific versus Ad Valorem Taxation and Externalities.” Journal of Economics76:177–87.10.1007/s007120200035Suche in Google Scholar

Poland, T. M. , and D. G.McCullough. 2006. “Emerald Ash Borer: Invasion of the Urban Forest and the Threat to North America’s Ash Resource.” Journal of Forestry 104:118–24.10.1093/jof/104.3.118Suche in Google Scholar

Prasad, A. M. , L. R.Iverson, M. P.Peters, J. M.Bossenbroek, S. N.Matthews, T. D.Sydnor, and M. W.Schwartz. 2010. “Modeling the Invasive Emerald Ash Borer Risk of Spread Using a Spatially Explicit Cellular Model.” Landscape Ecology25 (3):353–69.10.1007/s10980-009-9434-9Suche in Google Scholar

Reed, R. N. 2005. “An Ecological Risk Assessment of Nonnative Boas and Pythons as Potentially Invasive Species in the United States.” Risk Analysis25 (3):753–66.10.1111/j.1539-6924.2005.00621.xSuche in Google Scholar

Richards, T. J. , P.Ellsworth, R.Tronstad, and S.Naranjo. 2010. “Market-Based Instruments for the Optimal Control of Invasive Insect Species: B. tabaci in Arizona.” Journal of Agricultural and Resource Economics35:349–67.Suche in Google Scholar

Taylor, R. A. J. , T. M.Poland, L. S.Bauer, K. N.Windell, and J. L.Kautz. 2006. “Emerald Ash Borer Flight Estimates Revised. Accessed February 1, 2011. http://www.emeraldashborer.info/files/2007.EAB.flight.revised.Abs.Cinc.pdf.Suche in Google Scholar

Tennessee State Parks. 2011. “TN State Parks: Specialty Plate.” Department of Environment and Conservation. Accessed February 1, 2011. http://www.tn.gov/environment/parks/specplate.shtml.Suche in Google Scholar

USDA Forest Service, Forest Health and Economics. 2015. Asian Longhorned Beetle. Accessed May 1, 2015. http://www.na.fs.fed.us/fhp/alb/.Suche in Google Scholar

USDA Forest Service, Michigan State University, Purdue University, and Ohio State University. 2008. Emerald Ash Borer. Accessed February 1, 2011. http://www.emeraldashborer.info/index.cfm.Suche in Google Scholar

Wilson, J. R. , E. E.Dormontt, P. J.Prentis, A. J.Lowe, and D. M.Richardson. 2009. “Something in the Way You Move: Dispersal Pathways Affect Invasion Success.” Trends in Ecology & Evolution24 (3):136–44.10.1016/j.tree.2008.10.007Suche in Google Scholar

©2015 by De Gruyter

Artikel in diesem Heft

- Frontmatter

- Advances

- Turf and Illegal Drug Market Competition between Gangs

- Do Environmental Regulations Increase Bilateral Trade Flows?

- A Macroeconomic Model of Imperfect Competition with Patent Licensing

- Contributions

- Heterogeneous Effects of Informational Nudges on Pro-social Behavior

- Limiting Profit Shifting in a Model with Heterogeneous Firm Productivity

- Public Education, Accountability, and Yardstick Competition in a Federal System

- Social Status, Conspicuous Consumption Levies, and Distortionary Taxation

- Optimal Regulation of Invasive Species Long-Range Spread: A General Equilibrium Approach

- Cooperation or Competition? A Field Experiment on Non-monetary Learning Incentives

- Geographic Mobility and the Costs of Job Loss

- Supply Chain Control: A Theory of Vertical Integration

- Lexicographic Voting: Holding Parties Accountable in the Presence of Downsian Competition

- Topics

- The Transmission of Education across Generations: Evidence from Australia

- Tying to Foreclose in Two-Sided Markets

- Smoking within the Household: Spousal Peer Effects and Children’s Health Implications

- The Dynamics of Offshoring and Institutions

- Long-Run Effects of Catholic Schooling on Wages

- The Interdependence of Immigration Restrictions and Expropriation Risk

- The Effects of Extensive and Intensive Margins of FDI on Domestic Employment: Microeconomic Evidence from Italy

- Are You There God? It’s Me, a College Student: Religious Beliefs and Higher Education

Artikel in diesem Heft

- Frontmatter

- Advances

- Turf and Illegal Drug Market Competition between Gangs

- Do Environmental Regulations Increase Bilateral Trade Flows?

- A Macroeconomic Model of Imperfect Competition with Patent Licensing

- Contributions

- Heterogeneous Effects of Informational Nudges on Pro-social Behavior

- Limiting Profit Shifting in a Model with Heterogeneous Firm Productivity

- Public Education, Accountability, and Yardstick Competition in a Federal System

- Social Status, Conspicuous Consumption Levies, and Distortionary Taxation

- Optimal Regulation of Invasive Species Long-Range Spread: A General Equilibrium Approach

- Cooperation or Competition? A Field Experiment on Non-monetary Learning Incentives

- Geographic Mobility and the Costs of Job Loss

- Supply Chain Control: A Theory of Vertical Integration

- Lexicographic Voting: Holding Parties Accountable in the Presence of Downsian Competition

- Topics

- The Transmission of Education across Generations: Evidence from Australia

- Tying to Foreclose in Two-Sided Markets

- Smoking within the Household: Spousal Peer Effects and Children’s Health Implications

- The Dynamics of Offshoring and Institutions

- Long-Run Effects of Catholic Schooling on Wages

- The Interdependence of Immigration Restrictions and Expropriation Risk

- The Effects of Extensive and Intensive Margins of FDI on Domestic Employment: Microeconomic Evidence from Italy

- Are You There God? It’s Me, a College Student: Religious Beliefs and Higher Education