Abstract

In early 2013, Ministry of Railways (MOR) is dismantled into administrative and business arms. To tackle with economic performance setbacks and huge financial debt, Chinese Railway Group Corporation (CRGC), who is in charge of business operations, determined to make product innovation for express freight so as to provide the market with value-added logistical services and increase its revenue. This paper aims to analyze the necessity and feasibility of developing innovative express product for CRGC. Under the condition of heavy accumulated debt pressure and continuous economic losses, it is imperative for Chinese railway to increase revenue through the introduction of novel express freight services. Based on complete transportation product theory, this paper summarizes the temporal-and-spatial characteristics of modern logistics, analyzes the prospect of supplying express freight services, and applies Express Freight Network Design Model to identify key factors for express freight product supply. In order to improve service quality of express freight product, it is necessary to optimize transportation organization, put forward market-oriented customized products, and improve informationization standard.

1 Introduction

On March 11th, 2013, China’s Ministry of Railway was split into two arms. The Ministry of Transportation will oversee the railways’ administrative functions, while a state-owned giant enterprise, China Railway Group Corporation, will take over and handle the commercial operations. Saddled by the debts of China’s ambitious railway construction programme (see Figure 1), which hit a historical record of 2.7 trillion Yuan or $435.5 billion at the end of the third quarter of 2012, and has to wrestle away the heavy debt and interest payment nightmare.

Medium-and-long term railway network plan by 2020

According to the Medium-and-Long Term Railway Network Plan, ratified by the State Council in 2004 and further revised in 2008, China aims to build a national railway network of over 120,000 kilometers by 2020, of which, dedicated high-speed railway lines of 17,000 kilometers are envisioned.

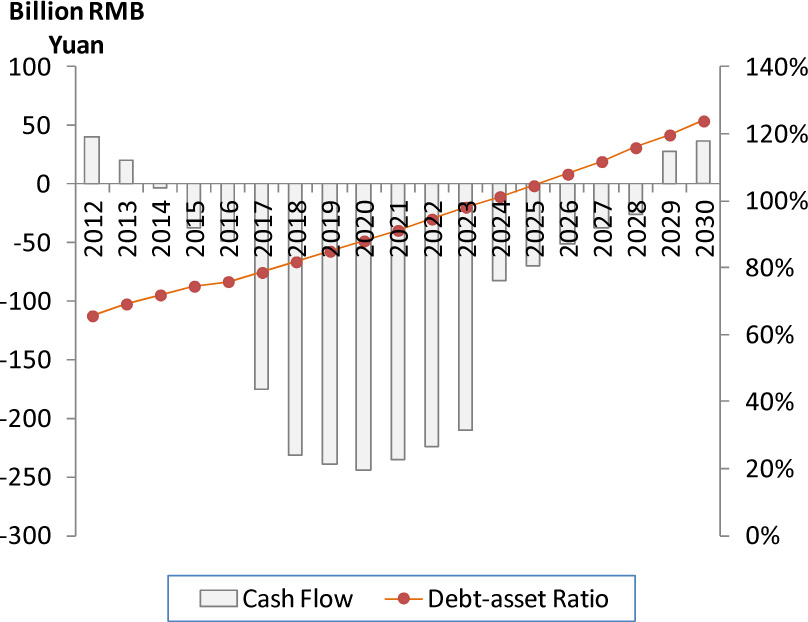

Under such a huge construction programme, astronomical amount of investment, mainly borrowed from the bank through financial leverage, has to be financed. As a consequence, Chinese railway system had a debt-asset ratio of 61.8% and it will be even worse in the next few years forecasted by Commercial Feasibility Study Model, see Figure 2[1].

Cash flow and debt-asset ratio for Chinese railways

The term logistics comes from the late 19th century, and gradually gains its foothold in modern value-added services[2]. In order to improve its performance through market-oriented reform so as to reduce its financial pressure and take advantage of the gradually shaping high speed railway facilities, CRGC puts forward comprehensive measures to provide the market with door-to-door transportation services, and enhance railway transformation process from a traditional transportation provider into a modern logistic service supplier. In 2011, Chinese national railway completed express freight transportation of 429 million tons, which occupies 13% of the total freight volume and contributes a lot to railway revenue and economic performance.

How to design railway express freight product and distribute them on railway network, and what kind of measures taken to make logistical service innovation, are key issues needed to be addressed.

2 Literature Review

2.1 Railway Logistics

Logistics is an unavoidable part of railway industry. A company can perform self-operated logistics, obtain outside logistic services, or outsource its logistics demand to a third-party or fourth-party logistics instead. Logistics supply has become a specialized and dedicated field in which railways can play an irreplaceable role to supply logistic services with characteristics of cost saving, just-in-time, competitive transit options, and comprehensive range of solutions and combinations.

Two most frequently cited reasons used to justify enterprises’ outsourcing logistics activities are cost reduction and service improvement expectations[3]. In the age of re-engineering, lean inventories and global competition, it is imperative for railway enterprises to focus on and control the key module of the value chain, take advantage of its network effect which is critical to survival, and cooperate with highway, civil aviation and water while limit their potential competition threats[4]. Virum[5] maintained that railway third party logistics providers can set up new type relationship with their competitors by developing such strategic alliances as container transportation confederation.

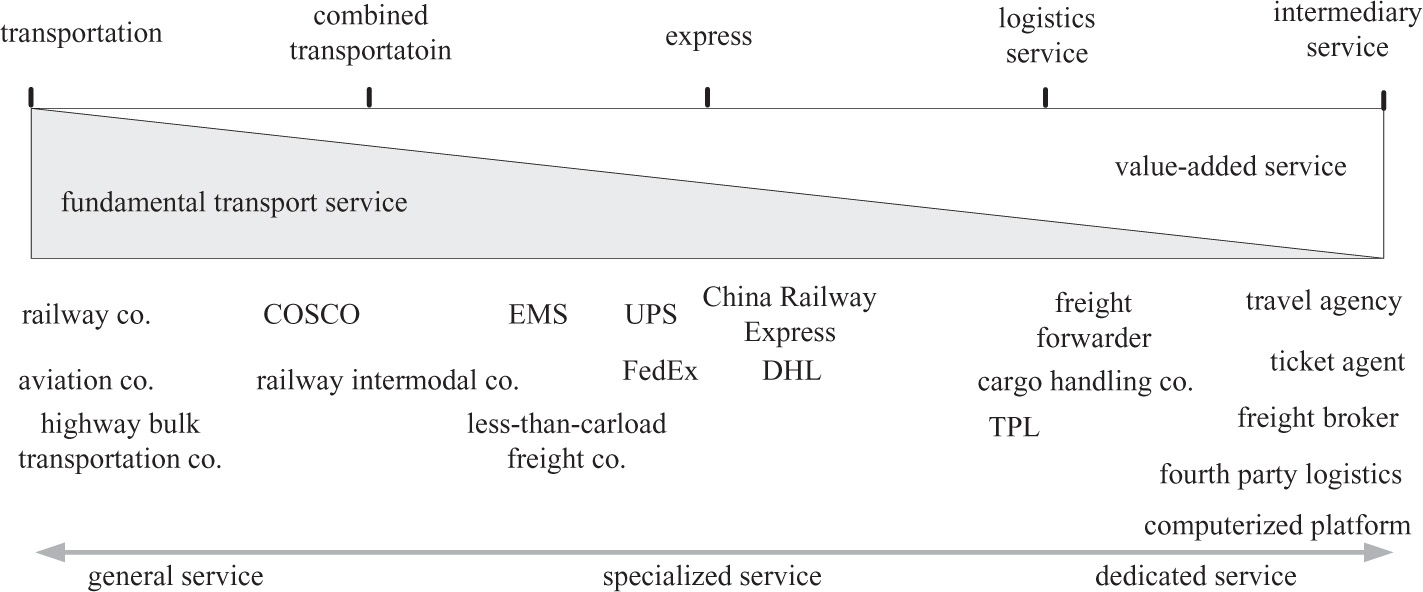

In practice, railway companies around the world strive to deliver customized solutions to meet customer’s logistics and transportation needs. Taking Canada Union Pacific for example, it brings together rail, trucking, ocean transportation and the storage and product handling services to deal with all service suppliers, measure and report performance metrics, and provide consolidated invoicing, see Figure 3.

Logistics solutions provided by Union Pacific

Complementing their concern on core competence, shippers rely heavily on specialized transportation and logistics services for better transportation solutions, cost saving and improved services, simplification of administrative processes, professional and better equipped logistics facilities of specialized transportation enterprise, third party logistics provider, and fourth party logistics suppliers, who devote their specific expertise and computerized systems to specialized social division of logistics value chain[6]. Thus, diversified services and economic actors with dedicated competence come into being and form the typical “logistics spectrum”[7,8], see Figure 4.

Logistics spectrum in terms of specialisation

Railways today are under fierce market competition and value-added services are of crucial importance for their financial sustainability and market positions. Besides fundamental transport service or product, railways realize that it is a very key and urgent task to innovate its freight product for enhancement of competitive power in the marketplace. Chinese railway administrations come up with a package to enhance logistics service and product innovation to better serve market demand[9], of which, express freight and comprehensive logistics solutions like 3PL or 4PL are at the core for the railway transformation.

2.2 Complete Transportation Product and Railway Product Innovative Initiatives

2.2.1 Complete Transportation Product

Product is the tangible or intangible goods or service produced by suppliers for the consumers to fulfill their demand and bring about subjective utility which is at the core of economists’ concerns to measure the degree of satisfaction[10]. Transportation product, however, not only has the basic function that satisfies passenger or shipper’s demand to realize spatial movement, but also contributes to the fundamental shift toward large enterprises exerting a far greater influence in determinating size and concentration in railway industry[11,12]. By internalizing many units under control and establishing a hierarchical managerial structure, managers of modern railway enterprises gradually develop the so-called “self-supply system” to achieve greater performance, supervises the supply chain of transportation product[13] to provide the market with better service. Transportation product plays such an important role in transportation industries that Rong[14] argued that procurement of the ability to serve the market with innovative transportation product featured with complete solutions, forms the fundamental drives for the external and internal organizational evolution of transportation enterprises.

In commercial applications, the transportation problem addresses from what origin to what a final destination and over which route to meet customer demand while achieving the goal of cost-saving, punctuality, and better consumer satisfaction. To highlight transportation product from demand perspective may throw light on the fact that completeness of transportation product is of significant importance for transportation enterprises. Passengers and shippers today are more interested in end-to-end logistics service with the combined expertise and transportation facilities available. Transportation enterprises who can provide origin-to-destination solutions are more preferred by market than those who can only cover a few segments of the overall services. Through cooperation and coordination, the integration of product, information and capital is enhanced and logistics value is[15]. To some extent, transportation industry is remarkably characterized by the evolution process of complete transportation product, seamless service and value-added activities.

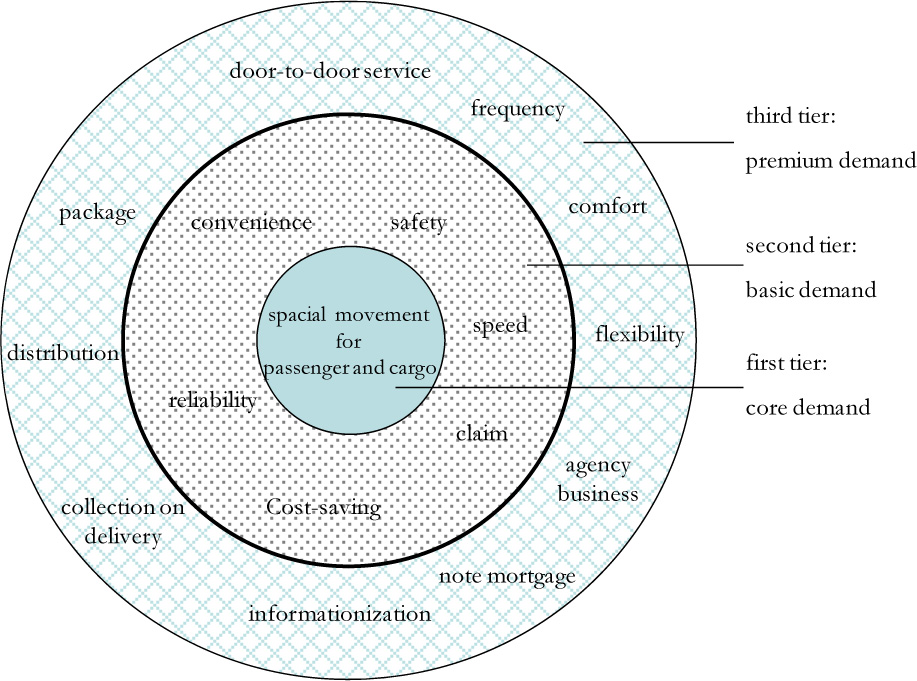

Transportation market is going through significant changes where demand for the quantity and quality of transportation service has become increasingly high. Though transportation product is a topic that has received limited and fragmented theoretical treatment, there are still a few literatures[16] that make major advances in the theoretical development of transportation product. Jara-Diaz illustrated the importance of spatial complementarity of transportation product in transportation activities in shaping transportation function. Rong[17] developed the Complete Transportation Product Theory, in which he classified the functions of transportation product into different tiers, see Figure 5.

Three tiers for complete transportation product

As can be seen from the graph above, complete transportation product consists of 3 tiers, that is, tiers of core demand, basic demand and premium demand. Transportation functionality provides the very essential or core service of spatial movement for passenger and cargo. Based on core demand, customers care about primary qualities of safety, convenience, reliability, speed, damage claim, cost-saving and etc. which ensure products are properly designed, developed, tested, deployed and delivered to the market. Premium demand requires customized product specifications such as frequency, comfort, flexibility, agency business, note mortgage, informationization, collection on delivery, distribution, package, door-to-door service, 3PLs and 4PLs.

Under the circumstance of volatile market demand, zero-inventory and just-in-time production and distribution managements are introduced, and enterprises attach unprecedent importance to matching supply chain with products[18]. Consequently, transportation enterprises adapt themselves to market demand and build competitive advantage by product innovations.

2.2.2 Railway Product Innovative Initiatives

Ever since 1980s, countries worldwide gradually shifted their settings of regulatory framework on railways from strict administrative control to a more market-oriented mechanism through deregulation and privatization processes. Railways in Canada, USA, Japan and EU nations took the initiatives to make product innovations, of which, containerization and intermodalization are the most outstanding changes representing railway enterprises’ endeavors towards market-oriented product strategies. Launched in 2005, CN Worldwide schedules and manages door-to-door international shipments moving via rail, truck and water and provides port handling, warehousing, customs and billing services by meeting customers’ forwarding demand. In USA, railway double stack trains have unit capacity of up to 400 TEUs in well cars with a train total length of well above 2 kilometers[19] and can continuously run over 3000 kilometers among main coastal and hinterland hubs[20].

The traditional goods transported by railways involve bulk cargo such as grain, cotton, fertilizer, chemical, salt, and etc. With the speed-up of Chinese railway system and implementation of its mega high speed railway construction plan, Chinese railway capacity constraint is greatly eased. By separating passenger traffic from existing lines, more than 18% transportation capacity is released and can be spared for express freight transportation services, which set a new milestone in passenger train travel[21], and accelerated the development of freight transportation. Chinese railway administrations launched railway transportation product innovative initiatives program to facilitate railway express cargo transportation products including container, ordinary express cargo, small item express delivery and etc. In 2011, The total quantity of express freight completed by Chinese national railways reached a historical record of 429 million tons or 13.0% of the total freight transportation volume[22].

Through railway transportation product innovation program, Chinese railways established its market presence and gained relevantly significant incremental market share. However, railway express freight still occupies a small fraction of high-end transportation market and service competitiveness is far from satisfaction. For example, from 2000 to 2008, railway contrainer transportation obtained an average annual growth rate of 15%, while the number for highway is 32%, ocean shipping 20%. Simultaneously, highway market share of container transportation increased from 44.7% to 58% while that of railway dropped from 16.6% to 12%[23]. Thus, it is imperative to analyze the competitiveness of Chinese railway express services and put forward countermeasures to develop innovative transportation products.

3 Analysis of Market Competitiveness of Chinese Railways Express Freight Service

3.1 Express Freight Service of Chinese Railways

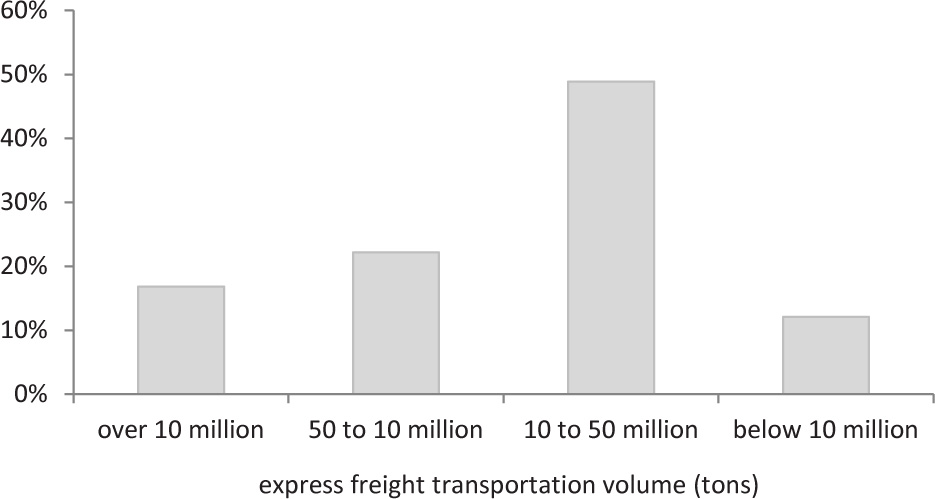

Express freight service of Chinese railways covers a broad range of cities geographically and a series of products customized to consumer demand. In 2011, classified by O-D city pair freight volumes, cities with transportation volume over 10 million tons are Dalian, Kunming, Chengdu, Golmud, Guangzhou, Tianjin, Urumqi and Chongqing with total express freight quantity of 139.24 million tons or 16.8% of the total express freight transportation volume.

There are 27 cities with transportation volume between 5 and 10 million tons and total volume reaches 184.67 million tons or 22.2% of the overall express freight transportation volume. There are 177 cities with transportation volume between 10 to 50 million tons and complete 406.52 million tons transportation volume or 48.9% of the total express freight transportation volume. The left volumes are for small cities, counties or villages, see Figure 6.

City classification according to express freight transportation volume

It is worth noticing that the demand of express transportation service for small items with the characteristics of high value-added, time-effectiveness, small-batch, and etc., is becoming increasingly dominant and contributes a high proportion to railway freight volume and revenue, see Table 1.

Volume transported of small item express freight by Chinese railways from 2003 to 2010

| year | volume transported (10,000 tons) | annual growth rate |

|---|---|---|

| 2003 | 768 | — |

| 2004 | 887 | 15.49% |

| 2005 | 947 | 6.76% |

| 2006 | 1,129 | 19.22% |

| 2007 | 1,219 | 7.97% |

| 2008 | 1,319 | 8.20% |

| 2009 | 1,307 | -0.91% |

| 2010 | 1,342 | 2.68% |

It is illustrated in Table 1 that from 2003 to 2010, there is a steady growth trend for transportation volume of small item express. In 2003, the former Ministry of Railway implemented the 5th speed-up project and kicked off the regular express postal and rapid postal trains of 3 and 2 pairs respectively. As a result, it contributed to the outstanding 15.49% annual growth rate. In 2006, railway bureaus handed 14 pairs of dedicated parcel trains over to China Rail Express (CRE), CRE optimized the operational scheme, increased train punctuality and attracted quite a lot diversified market demand. Under time slot constraints, capacity supplied by Chinese railway is far below the level required by market demand. Once there is a chance to have train pairs increased, there will be a subsequent booming in express freight volumes.

3.2 Chinese Railway Market Competitiveness Analysis

There are pros and cons of the conditions for freight product innovation of Chinese railways. At macro policy level, Chinese State Council issued new guidelines to promote healthy development of logistics with favorable tax reduction and land usage policies. At industrial development level, Chinese railway witnessed rapid network expansion, fast technology and equipment development that laid solid foundations for railway product innovation. At the micro level, Chinese railway is highly unified with centralized dispatching and commanding system, which creates preferential conditions to organize container block trains, postal express, dedicated fast cargo trains, and etc., see Table 2.

Market competitiveness analysis for Chinese express freight product innovation

| internal environment | score | weight | weighted score | |

|---|---|---|---|---|

| advantage | high speed | 5 | 0.10 | 0.50 |

| professional management | 3 | 0.05 | 0.15 | |

| market oriented operational mechanism | 2 | 0.05 | 0.10 | |

| time saving within 1,000 kms | 4 | 0.20 | 0.80 | |

| stations adjacent to downtown | 5 | 0.20 | 1.00 | |

| railway brand’s popularity | 5 | 0.15 | 0.75 | |

| skilled personnel | 4 | 0.05 | 0.20 | |

| nationwide agencies | 3 | 0.05 | 0.15 | |

| information system | 3 | 0.10 | 0.30 | |

| dominant market share | 3 | 0.05 | 0.15 | |

| sub-total | 1.00 | 4.10 | ||

| weakness | product structure needs to be optimized | -5 | 0.25 | -1.25 |

| lack of operational experiences | -3 | 0.20 | -0.60 | |

| bullet train accident of 2011 | -4 | 0.20 | -0.80 | |

| imperfect station infrastructure | -3 | 0.10 | -0.30 | |

| over speed of high speed railway and high cost | -5 | 0.15 | -0.75 | |

| diversified operation should be developed | -3 | 0.10 | -0.30 | |

| sub-total | 1.00 | -4.00 | ||

| sum of advantage and weakness | 0.10 | |||

| opportunity | favourable policy support | 4 | 0.15 | 0.60 |

| implementation of Medium and | 4 | 0.25 | 1.00 | |

| Long Term Railway Network Plan 2008 | ||||

| local government supportive policies | 5 | 0.20 | 1.00 | |

| promising market demand | 5 | 0.15 | 0.75 | |

| reform of Ministry of Railways | 4 | 0.15 | 0.60 | |

| increasing traffic volumes | 4 | 0.10 | 0.40 | |

| sub-total | 1.00 | 4.35 | ||

| challenge | civil aviation takes comprehensive competing measures | -5 | 0.3 | -1.50 |

| increasing cost pressure | -5 | 0.25 | -1.25 | |

| challenge inter-mode competition from highway | -3 | 0.2 | -0.60 | |

| construction downsize and speed reduction | -3 | 0.15 | -0.45 | |

| debt payment pressure | -3 | 0.1 | -0.30 | |

| sub-total | 1.00 | -4.10 | ||

| sum of opportunity and challenge | 0.25 | |||

In the era of comprehensive transportation, railway faces keen growing competition from civil aviation, highway, express companies like UPS, Fedex, Shunfeng express and etc. By interviewing officials and scholars from transportation industries, we summarize that advantage of Chinese railway outstrips its weakness, and opportunity goes ahead of challenge by a narrow margin.

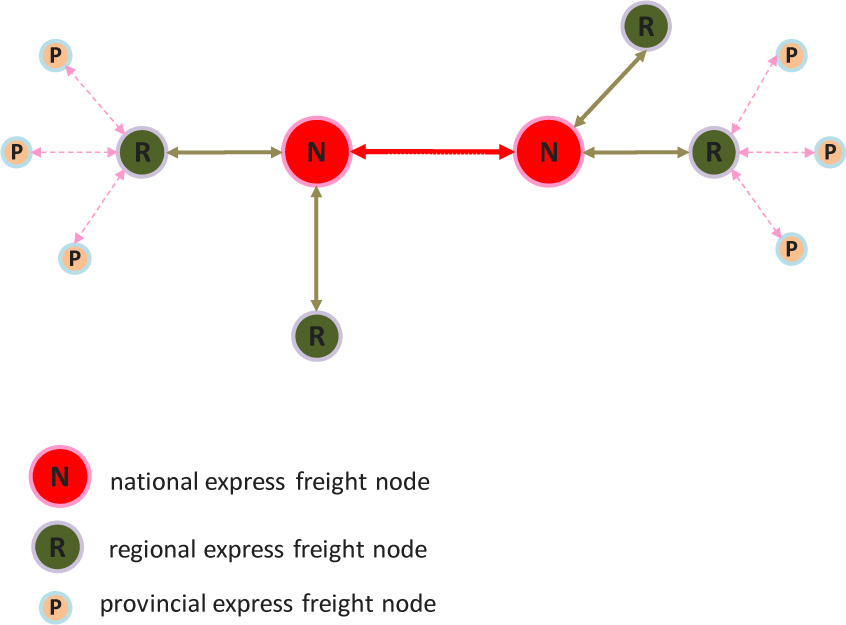

4 Railway Express Freight Network Design Model and Volume Distribution

Express freight network is the foundation for express freight distribution. Combined with the experiences of postal and highway logistics, Chinese railway network nodes can be divided into three levels, that is, national level, regional level and provincial level, see Figure 7.

Railway express freight nodes classification

As seen in Figure 7, national express freight node serves inter-regional express freight train organization and regional express freight collection and distribution, regional express freight node is mainly responsible for provincial express freight collection and distribution and national express node feedings, and provincial express freight node collects cargo and feeds regional express freight node.

Let network be W = W (A, N), of which, N represents node number, R physical routes of city pairs subject to constraints of throughput capacity (TCa) and route distance (Da). In order to provide express freight service, there should be an express freight product network We = W (L, N) where L (l ∈ L) is the set of trains. If rla = 1, express freight train l goes through physical route a, vice versa. Let tl be the transportation time for express freight train l, Cl be the overall transportation capacity, fl be the operational frequency of train l, Fl be the whole maximum operational frequency.

Furthermore, the freight demand from original node i to destination node j is dij ∈ D. For each node n, the outflow and inflow freight quantity are denoted as:

whereby,

Formula (1) is the goal of maximized transportation volume, (2) minimized time, (3) capacity constraints, (4) network freight constraints satisfying conservation law, (5) real volume transported less than that demanded, (6) train number less than capacity, (7) represents up frequency limit, (8) stands budget constraint, (9) and (10) require that variables are integers. By applying planning tool of ILOG CP, we can allocate express O-D freight volume on railway network. Express freight nodes are spatially distributed as shown in Table 3.

Spatial distribution of railway express freight nodes

| No. | province, autonomous region and municipality | node (30) | freight collection and distribution center (61) |

|---|---|---|---|

| 1 | Beijing | Beijing | |

| 2 | Tianjin | Tianjin | |

| 3 | Hebei | Shijiazhuang | |

| 4 | Shanxi | Taiyuan, Yuncheng, Jincheng | |

| 5 | Inner Mongolia | Baotou | Hohehot, Wuhai, Erenhot, Tongliao |

| 6 | Liaoning | Shenyang, Dalian, Yingkou | Jinzhou |

| 7 | Jilin | Changchun | Jilin, Siping, Baicheng |

| 8 | Heilongjiang | Harbin | Manzhouli, Qiqihar, Daqing, Suifenhe, Jixi, Nenjiang, Shuangyashan |

| 9 | Shanghai | Shanghai | |

| 10 | Jiangsu | Lianyungang | Nanjing, Changzhou |

| 11 | Zhejiang | Ningbo, Hangzhou | Yiwu, Quzhou |

| 12 | Anhui | Hefei, Bengbu | |

| 13 | Fujian | Fuzhou | Xiamen |

| 14 | Jiangxi | Nanchang | |

| 15 | Shandong | Qingdao | Jinan, Zibo, Yantai, Lingyi |

| 16 | Henan | Zhengzhou | Luohe, Xinxiang, Shangqiu |

| 17 | Hubei | Wuhan | Xiangfan, Jinmen, Suizhou, Yichang |

| 18 | Hunan | Changsha, Hengyang, Yueyang | |

| 19 | Guangdong | Guangzhou, Shenzhen, Zhanjiang | Foshan, Sanshui, Dongguan, Maoming |

| 20 | Guangxi | Nanning | Liuzhou, Qinzhou, Fangcheng, Beihai |

| 21 | Hainan | Haikou | |

| 22 | Chongqing | Chongqing | |

| 23 | Yunnan | Kunming | Dali |

| 24 | Guizhou | Guiyang | Zunyi |

| 25 | Sichuan | Chengdu | Leshan, Yibin, Suining |

| 26 | Tibet | Lhasa | |

| 27 | Shaanxi | Xi’an | Baoji, Xianyang |

| 28 | Gansu | Lanzhou | Wuwei |

| 29 | Qinghai | Xining | Golmud |

| 30 | Ningxia | Yinchuan | |

| 31 | Xinjiang | Urumqi | Kuitun, Alashakou |

| To t a l | 31 | 30 | 61 |

Based on the classification criteria of transportation volume, we can split the estimated O-D transportation volume on railway network, see Table 4.

Railway express freight distribution for 2020

| No. classification standard (10,000 tons) | operational length | Turnover | |||

|---|---|---|---|---|---|

| km % of the network 10,000 tkm % of the total turnover | |||||

| 1 | ≥1000 | 2697 | 3.10 | 325.81 | 14.80 |

| 2 | 1000~500 | 12547 | 14.41 | 880.70 | 40.0 |

| 3 | 500~200 | 20604 | 23.67 | 672.81 | 30.56 |

| 4 | 200~100 | 12058 | 13.85 | 176.88 | 8.03 |

| 5 | 100~50 | 12636 | 14.51 | 95.26 | 4.33 |

| 6 | ≤50 | 26523 | 30.46 | 50.15 | 2.28 |

| Total | 87065 | 100 | 2201.60 | 100 | |

5 Conclusion

CRGC typically has the comparative advantage on transportation of bulk freight. However, it is an inevitable trend for CRGC to get involved in integrated operation, warehousing and other value-added activities in such a market-oriented competition environment, of which, railway express freight product innovation is of great importance. The rapid expansion of Chinese railway lays solid network foundations for express freight product innovation. Complete transportation theory and railway logistics development experiences at home and abroad justify the necessity and feasibility for Chinese railways to transform from a traditional transportation provider to a comprehensive logistics service supplier. Based on Express Freight Network Design Model, cities with transportation volume between 10 to 50 million tons have the potential competitiveness to dominate railway express freight market and cover a large proportion of the railway operational length and turnovers.

References

[1] Li H C, Kuang X J. High speed expansion needs sustainable funding. Railway Gazette International, 2012, 16(2): 35–39.Search in Google Scholar

[2] Wallenburg C. Innovation in logistics outsourcing relationships: Proactive improvement by logistics service providers as a driver of customer loyalty. Journal of Supply Chain Management, 2009, 45(2): 75–93.10.1111/j.1745-493X.2009.03164.xSearch in Google Scholar

[3] Mello J E, Stank T P, Esper T L. A model of logistics outsourcing strategy. Transportation Journal, 2008, 47(4): 5–25.10.5325/transportationj.47.4.0005Search in Google Scholar

[4] Sink H L, Langley Jr C J, Gibson B J. Buyer observations of the US third-party logistics market. International Journal of Physical Distribution & Logistics Management, 1996, 26(3): 38–46.10.1108/09600039610115009Search in Google Scholar

[5] Virum H. Third party logistics development in Europe. Logistics and Transportation Review, 1993, 29(4): 355–361.Search in Google Scholar

[6] Sheffi Y. Third party logistics — Present and future prospects. Journal of Business Logistics, 1990, 11(2): 27–39.Search in Google Scholar

[7] Rong C H. Western Transportation Economics. Beijing: Economic Science Press, 2002.Search in Google Scholar

[8] Li H C, Jiang Y, Gao S. Analysis on the function of intermediary organization in transport and logistics efficiency. Logistics Technology, 2009, 28(7): 114–116.Search in Google Scholar

[9] Sheng G Z. Railway Work Statement 2013. MOR, 2013, 1–30.Search in Google Scholar

[10] Marshall A. The Economics of Industry. Macmillan and Co., 1920.Search in Google Scholar

[11] Chandler A D. The Visible Hand — The Managerial Revolution in American Business. Harvard University Press, 1977.Search in Google Scholar

[12] Chandler A D. Organizational capabilities and the economic history of the industrial enterprise. Journal of Economic Perspective, 1992, 6(3): 79–100.10.1257/jep.6.3.79Search in Google Scholar

[13] Rong C H. Enterprise intermediary theory and the functions of intermediary organizations in transportation market. Beijing Jiatong University Journal, 2006, 17(9): 1–5.Search in Google Scholar

[14] Rong C H. Basic analytical frameworks of transport economics. Beijing Jiatong University Journal, 2009, 8(2): 1–9.Search in Google Scholar

[15] Novack R A, Langley Jr C J, Rinehart L M. Creating logistics value: Themes for the future. Council of Logistics Management, 1995.Search in Google Scholar

[16] Jara-Diaz S R. The estimation of transport cost functions: A methodological review. Transport Reviews: A Transnational Transdisciplinary Journal, 1982, 2(3): 257–278.10.1080/01441648208716498Search in Google Scholar

[17] Rong C H. The value of transport-logistics time and its applications in time-spatial analysis. Economic Research Journal, 2011, 57(8): 133–146.Search in Google Scholar

[18] Fisher M L. What is the right supply chain for your product? Harvard Business Review, 1997, 3: 105–116.Search in Google Scholar

[19] Rodrigue J P. The Geography of Transport Systems. Third Edition. London, 2013, 1–30.10.4324/9780203371183Search in Google Scholar

[20] Burns D. USA and China logistic development and railway reform. Internal Report, 2013, 1–20.10.1007/978-3-642-55282-3_1Search in Google Scholar

[21] Amos P, Bullock D, Sondhi J. High-speed rail: The fast track to economic development? The World Bank, 2010, 1–28.10.1596/27812Search in Google Scholar

[22] China Railway Corporation. China Railway Statistics. Internal Report, 2013, 1–10.Search in Google Scholar

[23] Wu Z Z. Discussion on the current development trend. Shanghai Railway Science & Technology, 2012, 2: 13–14.Search in Google Scholar

[24] Zhao J, Su H J. Value of travel time saving and transportation mode choice. Comprehensive Transportation, 2010.Search in Google Scholar

[25] Coyle J J, Bardi E J, Novack R A. South-western college publishing. Transportation, 2000.Search in Google Scholar

[26] Becker G S. A theory of allocation of time. The Economic Journal, 1965, 75(299): 493–517.10.2307/2228949Search in Google Scholar

[27] McFadden D L. The behavioural science of transportation. Transport Policy, 2007, 14.10.1016/j.tranpol.2007.07.001Search in Google Scholar

[28] Estache A, De Rus G. Privatization and Regulation of Transport Infrastructure. The World Bank, 2000.10.1596/0-8213-4721-7Search in Google Scholar

[29] Kasilingam R G. Logistics and Transportation: Design and Planning. London: Kluwer Academic Publishers, 1998.10.1007/978-1-4615-5277-2Search in Google Scholar

[30] Humphries P. Space structure construction logistics. Collection of Technical Papers: Space 2006 Conference, 2006, 385–392.10.2514/6.2006-7236Search in Google Scholar

[31] Daughety A F. Analytical Studies in Transport Economics. Cambridge University Press, 1985.10.1017/CBO9780511895913Search in Google Scholar

[32] Carter C R, Ellram L M. Reverse logistics: A review of the literature and framework for future investigation. Journal of Business Logistics, 1998, 29(1): 85–102.Search in Google Scholar

[33] Profillidis V A. Econometric and fuzzy models for the forecast of demand in the airport of rhodes. Journal of Air Transport Management, 2000, 6(2): 95–100.10.1016/S0969-6997(99)00026-5Search in Google Scholar

© 2015 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Innovation of Express Freight Product for Chinese Railways

- DEA Cross-Efficiency Evaluation Method Based on Good Relationship

- A Dynamic Clustering Method to Large-Scale Distribution Problems

- Managing Pricing of Closed-Loop Supply Chain Under Patent Protection

- A Comparison of Control Variate Methods for Pricing Interest Rate Derivatives in the LIBOR Market Model

- Designing the Optimal Extended Warranty Price with Indirect Network Effect

- Preemptive Scheduling with Controllable Processing Times on Parallel Machines

- Port Multi-Period Investment Optimization Model Based on Supply-Demand Matching

- Heavy OWA Operator of Trapezoidal Intuitionistic Fuzzy Numbers and its Application to Multi-Attribute Decision Making

Articles in the same Issue

- Innovation of Express Freight Product for Chinese Railways

- DEA Cross-Efficiency Evaluation Method Based on Good Relationship

- A Dynamic Clustering Method to Large-Scale Distribution Problems

- Managing Pricing of Closed-Loop Supply Chain Under Patent Protection

- A Comparison of Control Variate Methods for Pricing Interest Rate Derivatives in the LIBOR Market Model

- Designing the Optimal Extended Warranty Price with Indirect Network Effect

- Preemptive Scheduling with Controllable Processing Times on Parallel Machines

- Port Multi-Period Investment Optimization Model Based on Supply-Demand Matching

- Heavy OWA Operator of Trapezoidal Intuitionistic Fuzzy Numbers and its Application to Multi-Attribute Decision Making