Abstract

The paper examines the reasons for growth erosion in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region in the period preceding the Covid-19 crisis. Over the past two decades before the crisis the regions’ growth has been lower relative to its peers, despite facing similar circumstances as those countries, such as low oil prices and weak external demand. The paper argues that key reasons for growth erosion in MENAP have been domestic, primarily negative total factor productivity, weak preparedness for shocks, insufficient fiscal buffers, unsystematic fiscal adjustment with arbitrary cuts in investment, and low investment efficiency. External factors—the decline in oil and other commodity prices, weak external demand, and geopolitical tensions—have also been important, but mainly for oil exporters. Key policy options to reinvigorate growth include leveraging technology and trade to improve productivity, developing a macroeconomic risk management system, implementing growth-friendly fiscal adjustment, improving growth inclusiveness, and fostering the private sector.

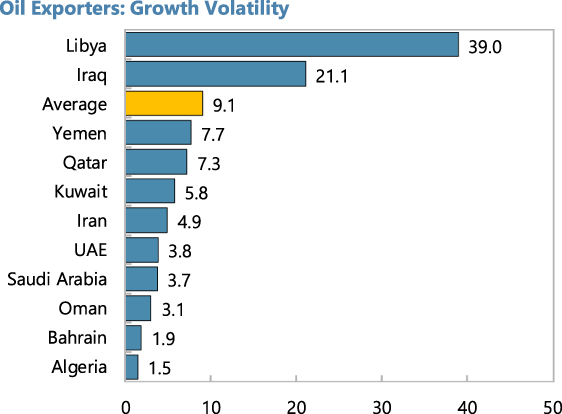

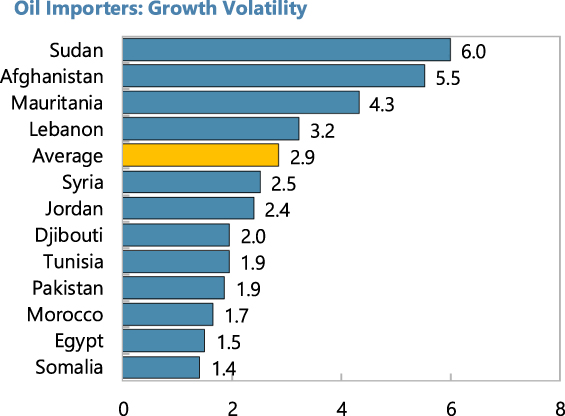

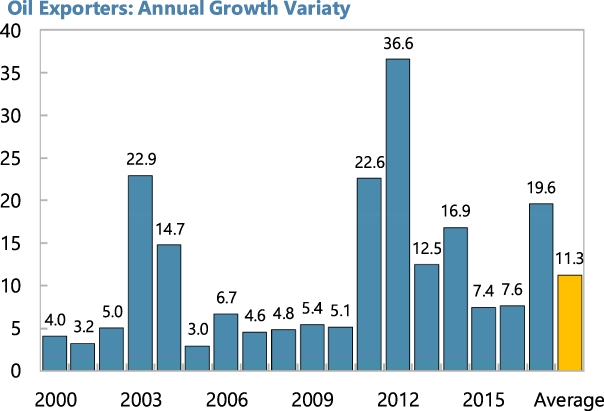

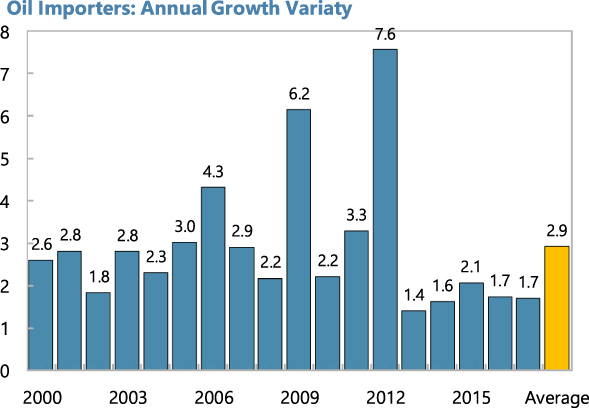

Appendix Growth in Individual MENAP Countries, 2000–2017 (Standard Deviation).

Extreme growth variability among MENAP countries points to several common trends:

|

|

|

|

|

|

References

Abdelbary, I., and J. Benhin. 2019. “Governance, Capital and Economic Growth in the Arab Region.” The Quarterly Review of Economics and Finance 73: 184–91, https://doi.org/10.1016/j.qref.2018.04.007.Search in Google Scholar

Adler, G., D. Romain, F. Davide, K. Ç. Sinem, K. Ksenia, and M. Poplawski-Ribeiro. 2017. Gone with the Headwinds: Global Productivity. IMF Staff Discussion Note 17/04. Washington: International Monetary Fund.10.5089/9781475589672.006Search in Google Scholar

Al-Mulali, U. 2011. “Oil Consumption, CO2 Emission and Economic Growth in MENA Countries.” Energy 36 (10): 6165–71, https://doi.org/10.1016/j.energy.2011.07.048.Search in Google Scholar

Arayssi, M., and A. Fakih. 2017. “Finance–growth Nexus in a Changing Political Region: How Important Was the Arab Spring?” Economic Analysis and Policy 55 (Issue C): 106–23, https://doi.org/10.1016/j.eap.2017.05.001.Search in Google Scholar

Arayssi, M., A. Fakih, and N. Haimoun. 2019a. “Did the Arab Spring Reduce MENA Countries’ Growth?” Applied Economics Letters 26 (19): 1579–85, https://doi.org/10.1080/13504851.2019.1588938.Search in Google Scholar

Arayssi, M., A. Fakih, and M. Kassem. 2019b. “Government and Financial Institutional Determinants of Development in MENA Countries.” Emerging Markets Finance and Trade 55 (11): 2473–96, https://doi.org/10.1080/1540496x.2018.1507907.Search in Google Scholar

Beser, M., and N. O. Kilic. 2017. “The Influence of Arab Spring Effect on Economic Growth in the Middle East Countries: Structural Break Panel Data Analysis.” Eurasian Journal of Economics and Finance 5 (3): 133–41, https://doi.org/10.15604/ejef.2017.05.03.010.Search in Google Scholar

Dabla-Norris, M. E., G. Ho, M. K. Kochhar, M. A. J. Kyobe, and M. R. Tchaidze. 2013. Anchoring Growth: The Importance of Productivity-Enhancing Reforms in Emerging Market and Developing Economies. International Monetary Fund.10.5089/9781616357290.006Search in Google Scholar

Fabrizio, S., D. Furceri, R. Garcia-Verdu, B. G. Li, S. V. Lizarazo, M. M. Tavares, F. Narita, and A. Peralta-Alva. 2017. Macroeconomic Structural Policies and Income Inequality in Low-Income Developing Countries. IMF Staff Discussion Note 17/01. Washington: International Monetary Fund.10.5089/9781475566222.006Search in Google Scholar

Fakih, A., and P. L. Ghazalian. 2015. “What Factors Influence Firm Perceptions of Labour Market Constraints to Growth in the MENA Region?” International Journal of Manpower 36 (8): 1181–206, https://doi.org/10.1108/ijm-02-2014-0050.Search in Google Scholar

Fakih, A., and W. Marrouch. 2015. “The Electricity Consumption, Employment and Growth Nexus: Evidence from Lebanon.” OPEC Energy Review 39 (3): 298–321, https://doi.org/10.1111/opec.12053.Search in Google Scholar

Fedelino, A., O. Basdevant, G. Basile, and R. Tchaidze. 2017. If Not Now, when? Energy Price Reform in Arab Countries. IMF Policy Paper. Washington: International Monetary Fund.10.5089/9781498346733.007Search in Google Scholar

Global Financial Stability Report. 2017. Is Growth at Risk? Washington: IMF.Search in Google Scholar

Hakimi, A., and H. Hamdi. 2017. “Does Corruption Limit FDI and Economic Growth? Evidence from MENA Countries.” International Journal of Emerging Markets 12 (3): 550–71, https://doi.org/10.1108/IJoEM-06-2015-0118.Search in Google Scholar

Hamdan, B. S. 2016. “The Effect of Exports and Imports on Economic Growth in the Arab Countries: A Panel Data Approach.” Journal of Economics Bibliography 3 (1): 100–7.Search in Google Scholar

Hoekman, B. M. 2016. Intra-regional Trade: Potential Catalyst for Growth in the Middle East. MEI Policy Paper 2016-1. Washington: Middle East Institute.Search in Google Scholar

Ianchovichina, E., A. Estache, R. Foucart, G. Garsous, and T. Yepes. 2013. “Job Creation through Infrastructure Investment in the Middle East and North Africa.” World Development 45: 209–22, https://doi.org/10.1016/j.worlddev.2012.11.014.Search in Google Scholar

IMF Fiscal Monitor. 2016. Acting Now, Acting Together. Washington: International Monetary Fund.Search in Google Scholar

IMF Fiscal Monitor. 2017. Tackling Inequality. Washington: International Monetary Fund.Search in Google Scholar

IMF. 2017a. Refional Economic Outlook. Middle East and Central Asia, October. Washington: International Monetary Fund.Search in Google Scholar

IMF. 2017b. Making Trade an Engine of Growth for All: The Case for Trade and for Policies to Facilitate Adjustment, 2017, Prepared by Staff of the IMF, the World Bank Group, and the World Trade Organization. IMF Policy Paper. Washington: International Monetary Fund.Search in Google Scholar

Kalai, M., and N. Zghidi. 2019. “Foreign Direct Investment, Trade, and Economic Growth in MENA Countries: Empirical Analysis Using ARDL Bounds Testing Approach.” Journal of the Knowledge Economy 10 (1): 397–421, https://doi.org/10.1007/s13132-017-0460-6.Search in Google Scholar

Kireyev, A., and J. Chen. 2017. Inclusive Growth Framework. IMF Working Paper 17/127. Washington: International Monetary Fund.10.5089/9781484302156.001Search in Google Scholar

Kutan, A. M., N. Samargandi, and K. Sohag. 2017. “Does Institutional Quality Matter for Financial Development and Growth? Further Evidence from MENA Countries.” Australian Economic Papers 56 (3): 228–48, https://doi.org/10.1111/1467-8454.12097.Search in Google Scholar

Makdisi, S., Z. Fattah, and I. Limam. 2006. “Determinants of Growth in the MENA Countries.” Contributions to Economic Analysis 278: 31–60, https://doi.org/10.1016/s0573-8555(06)78002-6.Search in Google Scholar

Mitra, P., H. Amr, G. Minasyan, M. Fischer, and G. Abajyan. 2016. Avoiding the New Mediocre: Raising Long-Term Growth in the Middle East and Central Asia Middle East and Central Asia. IMF Departmental Paper, No. 16/01. Washington: International Monetary Fund.Search in Google Scholar

Naceur, S. B., and S. Ghazouani. 2007. “Stock Markets, Banks, and Economic Growth: Empirical Evidence from the MENA Region.” Research in International Business and Finance 21 (2): 297–315, https://doi.org/10.1016/j.ribaf.2006.05.002.Search in Google Scholar

Omri, A., S. Daly, C. Rault, and A. Chaibi. 2015. “Financial Development, Environmental Quality, Trade and Economic Growth: What Causes what in MENA Countries.” Energy Economics 48: 242–52, https://doi.org/10.1016/j.eneco.2015.01.008.Search in Google Scholar

World Bank. 2017. Doing Business 2018 Report. Measuring Business Regulations. Washington: World Bank.Search in Google Scholar

© 2021 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Frontmatter

- Research Articles

- Growth Erosion in MENAP during 2000–2018: Reasons and Remedies

- Impact of Covid-19 on Islamic versus Conventional Insurance Performance in OIC

- Decoding the Determinants of Human Capital Formation in Egypt: New Evidence from RALS-EG Cointegration Test and QARDL Technique

Articles in the same Issue

- Frontmatter

- Research Articles

- Growth Erosion in MENAP during 2000–2018: Reasons and Remedies

- Impact of Covid-19 on Islamic versus Conventional Insurance Performance in OIC

- Decoding the Determinants of Human Capital Formation in Egypt: New Evidence from RALS-EG Cointegration Test and QARDL Technique