Abstract

In an era of multiple crises and geopolitical uncertainty, the need to deal with heightened risk drives states to locate strategic global production networks (GPNs) in geopolitically aligned states, a trend known as friendshoring. In this paper, we contribute to the literature on the role of geopolitics in GPNs by exploring why and how states engage in friendshoring. To this end, we distill from the literature three geopolitical imperatives that, in addition to more conventional GPN imperatives, drive strategic coupling dynamics: reducing risk exposure, (de-)weaponizing supply chains, and maintaining extraterritorial influence. States and state-linked institutions respond to these imperatives by actively “pushing out” new inter- and extra-firm relations in GPNs which often includes previously neglected regions in the global periphery – even when regional assets require substantial transformation. To achieve this, states orchestrate efforts at extraterritorial de-risking, outward-oriented network brokering, and extraterritorial institution-building to actively alter the coupling conditions. By applying our framework to qualitative research on the Chinese soybean GPN in Tanzania and German-led green hydrogen investments in Namibia, we demonstrate how GPN friendshoring relies on both coercion or incentivization orchestrated by the state.

1 Introduction

Driven by multiple crises, geopolitics play a growing role in the spatial organization of global production networks (GPNs). After an era of trade liberalization and global convergence (Wang 2022), overlapping and mutually reinforcing global crises such as the Covid-19 pandemic, the war in Ukraine and the ongoing climate crisis drive a reconfiguration of GPNs under the banner of decoupling, re-shoring and de-risking (see Yeung 2023). Foreign investment under the Washington Consensus was driven by cost advantages and access to markets, but today both firm and non-firm GPN actors co-shape global production networks according to strategic in addition to purely market-driven considerations (Blažek and Lypianin 2024). As a consequence, new geographies of global production emerge as lead firms and states renegotiate the trade-off of efficiency and cost-advantage vis-à-vis resilience and security (Gong et al. 2022; Völlers et al. 2023). In this vein, friendshoring has received particular attention by policymakers, describing the attempt to locate the production of sensitive technology, raw materials, energy and food into the territories of geopolitically allied states (Maihold 2022). However, the phenomenon of friendshoring remains largely overlooked in GPN studies.

Therefore, this paper contributes to the growing body of research on the role of geopolitics in GPNs (e.g. Blažek and Lypianin 2024) by conceptualizing the drivers behind friendshoring, and the practices that are used by state and non-state actors to achieve strategic couplings aligned with broader geostrategic goals.

Against this background, we ask: Why do lead firms, states and state-linked institutions allocate their production in geopolitically aligned regions? And how do emerging state-capital alliances achieve strategic coupling in unexpected regions?

Two of these couplings against the odds (cf. Das 2020) are analyzed in this paper: Due to rising geopolitical tensions with the U.S., China is looking to shift away from established soybean producers in Latin America and instead build production capacity in Tanzania. Similarly, in an effort to reduce dependence on Russian natural gas imports following the outbreak of war in Ukraine, Germany is currently seeking to establish energy partnerships for the supply of green hydrogen to stabilize a renewable energy system – one of the partners is Namibia.

Based on the review of existing scholarly work on the role of geopolitics in the spatial organization of global production, in a first step the drivers behind the recent trend towards friendshoring are conceptualized as three geopolitical imperatives in GPNs. In a next step, the practices of states and state-linked actors to alter strategic coupling conditions, and thus, push the network into previously neglected, but geostrategically aligned regions are identified. Following a paragraph on the methods, the usefulness of these deductively constructed concepts are demonstrated by their application to two different case studies: Chinese soybean production in Tanzania and German green hydrogen investment in southern Namibia. The discussion section elaborates on changing bargaining dynamics between GPN actors against the background of geopolitical shifts.

2 Geopolitical imperatives of friendshoring: juggling uncertainty in a crisis-driven world

The development of the GPN framework was arguably inspired by, and fully focused on, the global trend toward “offshoring” production in search of cost efficiencies, market access and development, financialization and capital gains, and risk minimization (Yeung and Coe 2015). Yet, already with the refinement of GPN theory – that is the GPN 2.0 framework – the role of “(geo)political imperatives” are acknowledged, by driving “industries subject to strong state regulation such as resource extraction, automobiles, petrochemicals, retail, telecommunications, and finance (Yeung and Coe 2015: 152)”.

States pursue a range of interests abroad, encompassing not only economic goals in a stricter sense such as capital accumulation, upgrading, and access to emerging markets (McGregor and Coe 2023). As the political and social legitimacy of states hinges on effectively sharing the benefits of GPNs with their citizens (Yeung and Coe 2015), (socio-environmental) welfare, employment security, sustainable development, social redistribution, national security, political stability, and geopolitical objectives inform the relationships between states and lead firms of GPNs (McGregor and Coe 2023).

The latter point requires further scrutiny, as the current era of overlapping crises such as climate collapse, pandemics, geopolitical rivalry, and open warfare presents new imperatives for the dynamic organization of GPNs, characterized by heightened uncertainty (Völlers et al. 2023) and geoeconomic considerations (Gong et al. 2022). GPNs have never operated solely under competitive imperatives defined by a uni-polar and (neo-)liberal world order of unfettered globalization and economic convergence, but the current crises have further augmented the role of geopolitics in the formation of GPNs (Yeung 2023).

There is growing awareness that state and non-state GPN actors must more carefully weigh with which places, which partners, and which economic and geostrategic goals they engage in coupling processes (Blažek and Lypianin 2024; Gong et al. 2022). Given this premise, a central point of interest for contemporary economic geography relates to what Gong et al. (2022: 165) understand as “the phenomenon of value chain and production network reconfigurations in times of uncertainty”.

A major experience of recent crises is that the question for what price essential goods and services can be sourced is to some extent pushed into the background as crises elevate the far more foundational question if these goods and services remain accessible at all (Cf. Jiang et al. 2022). Examples include supply chain bottlenecks for medical equipment during the Covid-19 pandemic (Guerrero et al. 2022) or a new rush of securing supply chains for critical raw materials (e.g. nickel, lithium, natural gas), basic food commodities (e.g. wheat, oilseeds, fertilizers), and semiconductors (Miller 2022), fueled by geopolitical turmoil and climate change-related disasters.

The crisis-driven reorganization of GPNs has been discussed under the umbrella of GPN re-shoring (producing at home), near-shoring (producing at reach) and friend-shoring (producing with geopolitical allies) (Gong et al. 2022; Lund and Steen 2020). A common understanding in this discussion is that overt deglobalization would come with immense costs for all actors involved, since the spatial organization of production would not follow cost-efficiency imperatives, but rather geopolitical ones (Dadush and Prost 2023). Friendshoring of some of the most critical GPN supply chains, however, has been singled out for becoming the potential new meta-structure of a de-risked global economy (Maihold 2022; Vivoda 2023).

In a policy context, friendshoring is defined as a “spatial reordering of supply chains under the criterion of political convergence” (Maihold 2022: 7). As such, friendshoring entails a spatial component of geographically realigning supply chains and a geopolitical component of focussing on trading partners that share similar geostrategic goals. While diversification of trading partners is a common risk mitigation strategy of spreading supply chain risks geographically, friendshoring goes beyond this approach by purposefully selecting trading partners according to existing or envisaged future diplomatic ties. Therefore, friendshoring describes both the relocation of strategic production into geopolitically aligned states as well as diplomatic-economic efforts to create new “friends”. In addition, friendshoring does not only operate through bilateral trade arrangements to steer the geographic distribution of supply chains to favor geopolitical allies, but proactively aims to shape the whole structure of GPNs by influencing inter-firm and firm-state relations more distinctively.

Notably, use of friendshoring is often confined to Western economic policy and framed as a uniquely Western response to China’s growing geo-political influence. Indeed, it was US Treasury Secretary Janet Yellen who coined the term in mid-2022 in a seminal speech that explicitly addressed the future of global supply chains (Vivoda 2023). It would however be misguided to understand friendshoring as a uniquely Western response to the polycrisis. Arguably, the underpinning imperatives and consequential actions of friendshoring are applicable to all geopolitical factions, be it the US or China and their most proximate partners or also bystanders of the Sino–US trade war (Müller 2023).

In the following section, we review current literature on the impact of the polycrisis on the global economy to distill three emerging geopolitical imperatives that complement well-known market-driven imperatives in GPNs: reducing risk exposure, (de-)weaponization, and maintaining extraterritorial influence.

2.1 Reducing risk exposure

Reducing risk exposure is perhaps the most pronounced geopolitical imperative of GPN formation in today’s polycrisis. For firms, reducing risk exposure implies that they are reorganizing production structures from prioritizing just-in-time towards just-in-case production (Jiang et al. 2022). Therefore, lead firms may be willing to incur short-term losses as they opt for less optimized cost-capability ratios in coupling with new suppliers if the respective supply relations are perceived to be more resilient to disruptions on the long run (Müller 2023).

States are also willing to subsidize substantial GPN reconfigurations as a means of de-risking the supply of strategic goods (Gabor and Sylla 2023). By shoring production to geopolitically aligned regions, a bandwidth of acute risks including geopolitical ruptures, pandemics, climate crisis-related catastrophes and bottlenecks can be alleviated. While this imperative may encourage technological fixes such as replacing risk-exposed by less risk-exposed commodities or intermediate inputs in the production process (Lambert et al. 2022), the reduction of risk exposure is mostly related to spatial fixes to risks that drive “the massive restructuring of global production networks in search for more diversified production bases, supply stability, and network resilience” (Yeung 2021: 435). Both from firm- and from state perspective, friendshoring is seen as a key approach towards raising the overall supply chain resilience against crises (Maihold 2022).

2.2 (De-)weaponizing supply chains

(De-)weaponizing supply chains is a second geopolitical imperative with growing effect on the restructuring of GPNs as it reflects how lead firms and states respond to variegated forms of “weaponized interdependence” (Farrell and Newman 2022). Weaponized interdependence applies when strategic chokepoints in supply chains of a GPN become leveraged by states and firms to coerce and harm their adversaries whilst being heavily dependent on the same inter-firm relations. The widespread return of industrial policy, trade protectionism, neo-mercantilism, and open economic warfare in form of retaliatory tariffs and export sanctions illustrates this trend of weaponized supply chains and as such also of weaponized inter-firm relations in GPN vividly (Aiginger and Rodrik 2020). Geopolitical imperatives of (de-)weaponization affect GPNs in a two-sided way.

Firstly, de-weaponizing supply chains refers to protective actions that safeguard up- and down-stream relations in GPNs from “predatory” interventions by state capital alliances of hostile geopolitical blocks. For instance, in a move complementary to the diversification of supply chains, GPN actors may pursue “geostrategic decouplings” (Blažek and Lypianin 2024) in order to withdraw their supply chains from exposure to adverse interventions. These interventions can take a more direct (e.g. tariffs, sanctions, confiscations of good and assets) or indirect form, when being crowded-out by “home-grown” GPNs receiving preferential support by their origin states (e.g. subsidies, public co-ownership, asymmetric industrial policy). Secondly, and vice versa, weaponizing supply chains can occur by leveraging “home-grown” GPNs to exert pressure on the strategic chokepoints of those GPNs that are predominantly embedded in a competing geopolitical block (Farrell and Newman 2022). The imperative of (de-)weaponizing supply chains is, therefore, not solely about maintaining a GPNs market development which mostly occurs on basis of inter-firm competition, but also about explicitly harming and sabotaging the market expansion or dominance of competitors through state-orchestrated intervention (cf. Laurenceson and Armstrong 2023).

2.3 Maintaining extraterritorial influence

Maintaining extraterritorial influence is a third geopolitical imperative that affects decisions of GPN actors beyond strictly firm-driven considerations of cost efficiency or market development. Extraterritorial influence is an imperative emanating mainly from wider political economic considerations including diplomatic goals and contingencies which may affect how home-grown lead firms must reorganize their GPNs. In order to maintain extraterritorial influence both on political as well as economic level, the friendshoring of GPNs can serve to simultaneously create shared benefits (inter-firm relations) and build political trust (inter-firm and inter-state relations) with existing or potential trading partners. This is especially the case when friendshoring involves assembling new inter-firm relations in GPNs that span across established blocks of geopolitical superpowers such as the US, China, and to some extent the EU and Russia by including “third countries” (Carbone 2023). Maintaining extraterritorial influence implies, therefore, that friendshoring does not only occur along the aim of relocation GPNs into the territory of allied states, but also to nurture new alliances through economic-diplomatic efforts.

Maintaining extraterritorial influence affects GPN restructuring increasingly because growing multipolarity in the global political economy has encouraged geopolitical superpowers to compete more explicitly for strategic partnerships with “small states” (Schindler and Di Carlo 2022). There is growing concern about the geopolitical and economic alignment of third country regions, including the Indo–Pacific region, Latin America, and Africa (Carbone 2023). Notably, competition over spheres of influence occurs not only through infrastructure construction and credit provision (Schindler and Di Carlo 2022), but also through engaging in mutually-beneficial trade partnerships (Müller 2023). On the one hand, these strategic partnerships may entail formations of economic blocs defined by regional free trade zones among “small states”. As a matter of fact, preferential trade agreements will soon cover about two-thirds of world trade (Dadush and Prost 2023). On the other hand, they may also entail bilateral trade agreements with one or another geopolitical superpower (Leshoele 2020).

Regarding GPN friendshoring, the imperative of maintaining extraterritorial influence unfolds, therefore, far from being unidirectional. While lead firm home countries may be driven by the imperative to secure geopolitical support and economic de-risking, target country state-capital alliances may use this imperative to leverage their non-aligned status in negotiating beneficial friendshoring outcomes (Müller 2023).

The three introduced geopolitical imperatives are far from being mutually exclusive but simultaneously at play and self-reinforcing. Just as the polycrisis confronts the world with heightened uncertainty and geoeconomic complexity, so must GPNs adhere to inter-related imperatives when reorganizing their supply chains. Dynamic reorganization under uncertainty and geoeconomic concerns bears, therefore, substantial possibilities for friendshoring outcomes that occur against-the-odds when they are negotiated and implemented between unexpected partners and play out at unexpected places (cf. Das 2020).

3 Strategic coupling against the odds: pushing the network out

In the following, we lay out how practices of state-capital alliances to friendshore production amid multiple crises alter the conditions for strategic coupling to conceptualize a GPN dynamic that we term pushing the network out.

GPNs were never completely detached from state intervention, especially in sectors of geostrategic relevance such as the energy sector. In response to current multiple crises, however, there is a trend towards an even more pronounced role of the state, illustrated by neighboring debates on the ‘entrepreneurial state’ (Mazzucato 2014) or also the rise of “new” state capitalism (Alami and Dixon 2021). In accordance with previous work (cf. McGregor and Coe 2023), we deem it necessary to account for state agency in shaping GPNs against the background of the above-mentioned geopolitical imperatives. This requires two analytical distinctions.

Firstly, state and state-linked actors need to be explicitly distinguished from firm GPN actors (McGregor and Coe 2023) in order to highlight “specific policy mandates, strategic objectives and operational practices (Dawley et al. 2019: 4)”. The GPN concept of regional institutions subsumes a number of organizations at different scales impacting strategic coupling processes in the host region, but fails to clearly outline the contributions of individual (state) organizations. Therefore, scholars have introduced the category of state-linked GPN actors to highlight their involvement in co-shaping the strategic coupling process (McGregor and Coe 2023).

Secondly, it is necessary to distinguish between (extraterritorial) activities of the home state of lead firms on the one hand, and the impact that the recipient country government has on the strategic coupling process on the other hand. Dawley et al. (2019, 2) for instance focus on the host region when analyzing the “institutional and political processes by which regional and national actors work to attract and embed investment from lead firms”, thereby “effectively pulling the network into the region”. While market and geopolitical imperatives create the rules of the game, there is an opportunity space for locally embedded institutions to actively connect with global lead firms thus emphasizing the agency of host region’s local (state and state-linked) institutions to proactively achieve strategic couplings. This is what has been termed an inside-out dynamic, opposed to outside-in strategic couplings, where global actors invest in resource regions (Kalvelage et al. 2023b).

We argue that besides these pulling the network in dynamics, equally important are home states of lead firms pushing the network out into geopolitically allied regions. By reacting to current geopolitical imperatives, state strategies change the preconditions for strategic coupling dynamics in critical sectors (cf. McGregor and Coe 2023). Nation states, through dedicated government agencies, quasi-state development agencies, state-owned enterprises, state-owned banks, sovereign wealth funds, political foundations, and research institutions alter the cost-capability ratio for investments in geostrategically allied regions to push domestic lead firms towards strategic coupling.

States simultaneously are keen to attract and embed GPNs to achieve regional growth and socio-economic welfare, while pushing lead firms out in strategic relevant sectors to meet geopolitical imperatives. However, states differ in their capacity to pursue these complementary goals, depending not only on their bargaining power, related to the availability of regional assets, but also on their capabilities to affect strategic coupling extraterritorially. Furthermore, the wider geopolitical environment is decisive for the rationale of coupling, and the actors behind it. Blažek and Lypianin (2024) distinguish warfare-driven and resilience-driven geopolitical (re-)coupling from more market-driven types of (re-)coupling. The development of such a coupling typology has analytical merits as it permits to emphasize geopolitical trigger events such as trade sanctions or warfare as drivers of spatial restructuring. In this paper, we advance the discussion by firstly, highlighting the long-term strategic goals of states in a crisis-driven environment and secondly, their practices to influence strategic coupling preconditions in target regions to influence coupling decisions. In this way, we offer a framework that allows to analyze the gradients of home state involvement in coupling processes.

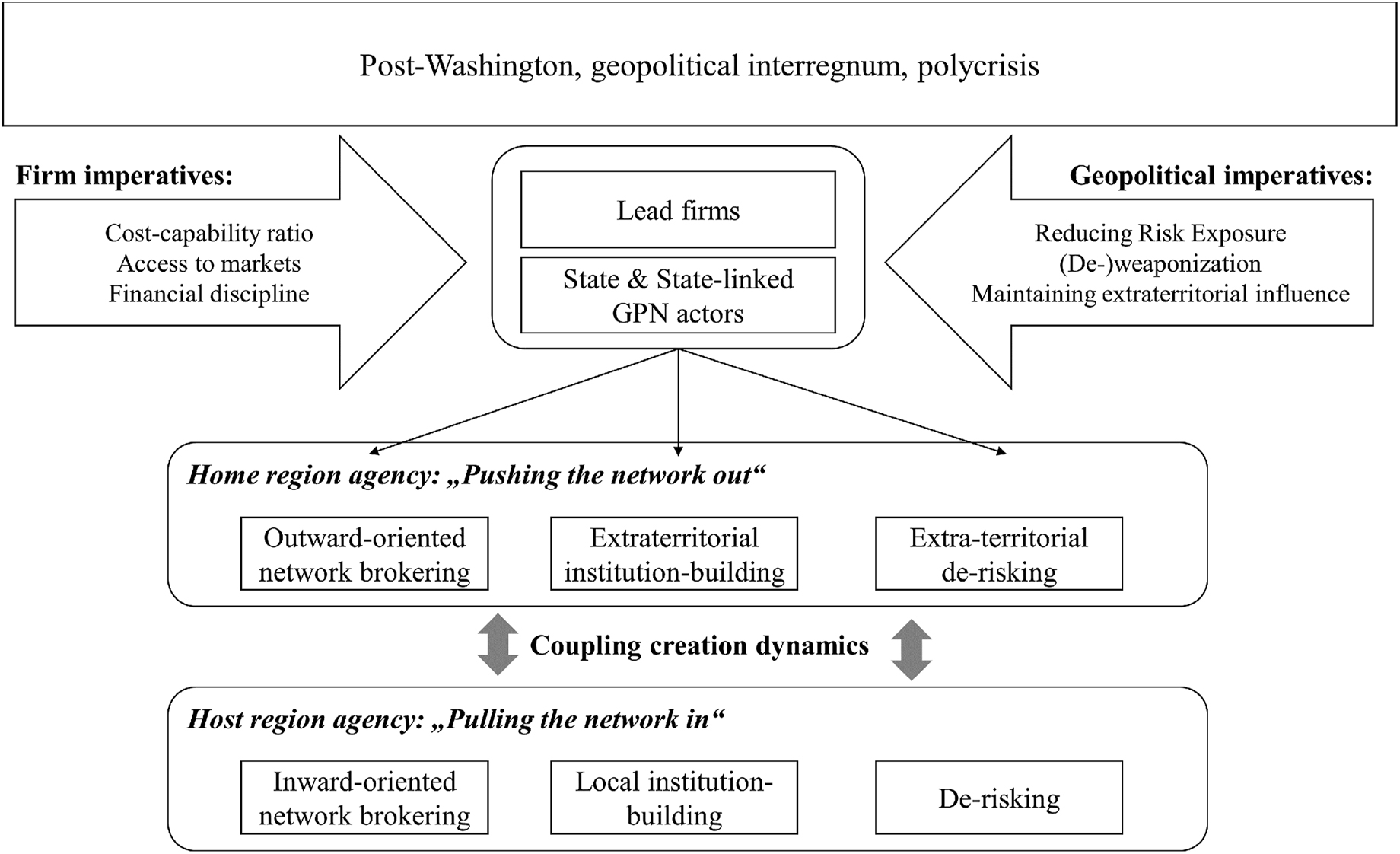

Strategic coupling in the post-Washington Consensus world is thus driven by four main forces: first, the strategic consideration of lead firms to achieve cost-capability ratios; second, geopolitical imperatives that drive states to strategically interfere in the spatial organization of GPNs, third, the agency of regional institutions that pull the network into a region; and fourth, home states that push domestic lead firms to couple with geopolitical allies (compare Figure 1).

Conceptual framework. Own illustration.

In the following, we will focus our analysis on two points which so far have received little attention: the geopolitical imperative and the push-dynamic that state-capital alliances create to adhere to geopolitical circumstances: de-risking, network brokering, and institution-building.

3.1 De-risking extraterritorial investments

De-risking refers to practices where public funds are used to improve the overall risk-return profile of an investment, making it more resilient to adverse market conditions and economic fluctuations. Risks are often associated with concerns about political and financial stability, as well as regulatory and institutional conditions, which together result in a high weighted average cost of capital (Schinko and Komendantova 2016). The practice of de-risking has become “immensely powerful as a vision of statecraft” (Gabor and Sylla 2023: 2): various government programs, such as the Inflation Reduction Act in the US or the Green New Deal in Europe, aim to achieve industrial transformation by accompanying catalytic private investments with public funds to encourage industries to adopt transformative technologies with reduced uncertainties (Kedward and Ryan-Collins 2022]). By shifting financial risks from private to public actors, it is hoped to increase overall economic resilience in times of technological change.

States apply this technique not only to their own territories, but also conduct de-risking exercises in foreign territories of geostrategic interest in order to create a stimulating environment for investment capital (Choi and Laxton 2023). Any form of external financial and institutional support that reduces the risks associated with investment falls under the category of extraterritorial de-risking: preferential loans, green bonds, interest rate subsidies, loan guarantees, or insurances (Steckel and Jakob 2018). Financial de-risking lowers the perceived risks and required returns, thereby reducing the cost of investment. Many development agencies have launched de-risking programs to attract private investment in development projects, and the European Union currently expands its blended finance approach (van Waeyenberge et al. 2020). At the international level, bilateral and multilateral development banks play an important role in supporting development by providing financial and technical assistance. These development finance institutions (DFIs) are usually majority-owned by national governments, which ensures their high creditworthiness and enables them to raise large amounts of capital on the international market. As a result, they are able to offer grants or provide debt and equity at lower interest rates than domestic capital providers (Sweerts et al. 2019).

In sum, states can push domestic lead firms out by altering the risk environment for investment in “friendly” regions. Measures may include international agreements, or policies aimed at creating a more favorable environment for their firms operating abroad. For example, states can negotiate with other nations to establish free trade agreements, protect the rights of their investors, build distinctive financial ecosystems dominated by institutional (patient) capital, or secure markets through long-term off-take agreements.

3.2 Outward-oriented network brokering

To establish new connections in global production networks, agents are needed that bridge ties between regions. Notions of “public knowledge facilitators (Bathelt and Li 2020])” or “boundary spanners (Wu 2022)”, describe a process of outward-oriented coupling driven by individuals and organizations in GPNs. Boundary spanners are understood “as both individuals (e.g. entrepreneurs, inventors, designers and scientists) and organisations (e.g. government actors, firms, universities and trade/professional associations)” engaging in “a set of activities, processes, and practices that connect entities separated by boundaries (Wu 2022: 261)”. Similarly, “knowledge facilitators” are “organizations that voluntarily or on a for-profit basis broker valuable market, industry, and business knowledge across borders – or bridge structural holes across dispersed knowledge pools (Bathelt and Li 2020: 3)”. While private knowledge facilitators such as global consulting firms and law agencies work on a for-profit basis and provide more specific know-how, public knowledge facilitators encompassing trade commissioners, government representatives, business associations, and chambers of commerce provide broad location specific knowledge (ibid). Both concepts have in common that they emphasize the necessity of brokering agents and processes to bridge the gap between regional assets on the one hand, and transnational capital on the other hand, either by building cross-border knowledge pipelines, or by establishing contacts between otherwise separated organizations.

One of the first accounts of this type in the context of GPNs was Kleibert (2014) who analyzed how local coalitions, function as brokers by translating between the interests and ideologies of incoming transnational capital and more local sets of interests and agents. Similarly, geographical political economists have developed the concept of “coupling creation” (Dawley et al. 2019). The coupling creation approach seeks to unpack how temporary coalitions actively use their agency to connect with lead firms. In this understanding, the creation of couplings is seen as the driving force behind the dynamics of inside-out couplings.

We follow this argument, but describe these processes more generally as network brokering to highlight its bidirectionality: not only can local actors of host regions form temporary coalitions and link to lead firms (inward-oriented), but also state-capital alliances of regions with outgoing investments can engage in activities of connecting with regional institutions to prepare for strategic coupling (outward-oriented). Besides individuals, agents of outward-oriented network brokering include export promotion agencies, business fora, or development agencies linking lead firms to local institutions. By establishing new connections to regions equipped with potentially interesting assets, state and state-linked actors can push the network out to strategic coupling.

3.3 Extraterritorial institution-building

States rely on institutions to exercise power. To maintain extraterritorial influence, the existence of institutions abroad linked to state interests is crucial. To pursue geo-economic interests, states actively engage in institution-building abroad (Phelps 2007). GPN research tends to use a rather broad understanding of institutions, including organizations, norms, and conventions (Coe and Yeung 2015). However, following Bathelt and Glückler (2014), we distinguish between organizations as clearly separated entities from their environment on the one hand, and rules, laws, and regulations as codified prescriptions on the other hand, from institutions as stabilized forms of social relations that emerge from interaction.

With respect to rules and regulations, extending the legal reach of states is an important segment of extraterritorial institution-building (Potts 2020). This includes the use of explicitly “extraterritorial” laws that extend regulation to people and activities around the world, transnational certification schemes, or the application of jurisdiction abroad on the basis of minimal connections to foreign activities. With respect to organizations, states are actively building organizations abroad as anchors of extraterritorial influence. Efforts to build a global network of language centers such as the Confucius Institutes, the Alliance Française, the Goethe-Institut, and the British Council can be seen in this light, as they reflect an attempt to gain geopolitical traction through cultural values and ideals (Kluver 2014). These organizations thus act as agents that, on the one hand, change the institutional landscape of regions by enhancing their ability to connect with GPNs, and on the other hand, organizations are used to modify endogenous institutions with the aim of leveraging regional assets.

Enhancing the ability to connect with GPNs refers to actors that are mobilized to bridge relations between regions and thus facilitate strategic coupling (Kleibert 2014). For example, transnational development corridors such as China’s Belt and Road Initiative are used to build discourses that legitimize investments in strategic sectors and thus facilitate strategic couplings (Tups and Dannenberg 2023). Modifying endogenous institutions refers to mobilizing, transforming, and leveraging local assets to meet GPN coupling criteria (Dawley et al. 2019). Local government initiatives can actively engage in institution building to create favorable conditions for strategic coupling: For example, the Namibian government built domestic institutions to meet the coupling criteria of the tourism GPN (Kalvelage et al. 2023a). While most of the literature on these types of institution building refers to intra-regional actors, we suggest that more attention should be paid to extraterritorial institution building activities by states: by deliberately creating, altering, or repurposing organizations in target regions, states alter the institutional fabric of host regions to make them suitable for strategic coupling.

In sum, one possible reaction towards geopolitical imperatives is the friendshoring of production into geopolitically aligned states. To pursue this goal, states and state-linked actors together with lead firms exert extraterritorial practices to alter the conditions for strategic coupling and thus, push the network out. Host states of arriving GPNs on the other hand may use their agency to accelerate or hinder their region’s embeddedness into GPNs. To test the usability of this framework in the following we turn to two different cases of friendshoring: state-directed friendshoring in China versus state-incentivized friendshoring in Namibia.

4 Methods

To address how friendshoring in GPNs is orchestrated by state-capital alliances, this research followed a deductive-inductive approach based on document analysis and expert interviews (cf. Kuckartz and Rädiker 2023). By choosing the cases of China and Germany, we decided to explore two extreme cases in terms of state-led GPN coordination (Seawright and Gerring 2008): China influences its lead firms with a state-capitalist approach and through direct state ownership of outward-oriented SOEs, while Germany, as a liberal market economy, follows a “light touch” approach that relies more on the coordination of various state and state-related institutions such as foreign affairs, development aid, and development finance. Both cases have in common that they are about friendshoring production to African states (Tanzania, Namibia) that are not clearly aligned with one geopolitical bloc or another. The comparison helps to understand the dynamics that arise when industrialized countries compete for geopolitical allies that are resource-rich but less industrialized non-aligned states. In addition, we examine friendshoring in two different but similarly strategic sectors, both being at the core of contemporary geopolitical shifts: energy and agriculture.

As a first step, we identified both existing academic literature and policy documents dealing with the phenomenon of friendshoring and geopolitics more broadly by searching a popular literature search engine (Google Scholar). After a first round of reading, additional works were added by identifying relevant literature that was referenced. By reviewing these works, we deductively constructed analytical categories to arrive at a first interpretation of the drivers behind friendshoring and the practices of friendshoring as demonstrated in Section 2 and 3. In a second step, these analytical categories were integrated into a semi-structured interview guide, which included questions about the nature of relationships between state and private actors, motivations and expectations for engagement abroad, practices and strategies, and perceived threats and risks, as well as questions not related to this specific study. We included GPN actors in the analysis based on their involvement in the host region – Tanzania or Namibia. These included private companies and government actors (both home and host), as well as other organizations (e.g. development agencies, embassies, development banks, business associations, cf. Tables A.1 and A.2) that interviewees considered relevant to the GPN. The purpose of conducting expert interviews was to test the validity of the categories we had previously constructed, and to learn more about the practices and rationales behind friendshoring. For the soybean case study (China – Tanzania), the second author conducted 24 expert interviews in 2022 and 2023 with stakeholders and experts involved in implementing the integration of Tanzanian farmers into the Chinese soybean GPN (Table A.1). For the green hydrogen case study (Germany–Namibia), the first author conducted 27 semi-structured interviews from February to April 2023 with companies, civil society organizations, consultants, academics, and government agencies in Namibia and Germany (Table A.2). Most interviews were conducted with individuals (in English), lasted approximately 60–90 min and were recorded and transcribed, but some interviews were conducted in groups, online, or could not be recorded for confidentiality reasons. In these cases, notes were taken during the interviews and then supplemented with recall minutes. Following the interviews, we conducted a qualitative content analysis, applying our deductively constructed categories to each case (cf. Kuckartz and Rädiker 2023). In an iterative process and by comparing the two cases, we further refined the concepts and arrived at the concepts presented here. The empirical section is therefore structured along the lines of our concepts, and composed of both scholarly literature, policy documents and interview material. Wherever interviews are being quoted, we use abbreviations to reference them (A – business association; B – first tier supplier; C – development cooperation; D – developer; F – firm; G – government agency; O – civil society organization; P – policy analyst; R – research institute).

Overall, such a methodological approach was useful for an exploratory research design on geopolitical drivers, but the research could have benefited from the inclusion of industry visits and policy events that deal more explicitly with geopolitical challenges. Moreover, here we have mainly focused on actors that are active in the host region, further research could complement this perspective by integrating more firmly state and firm actors in China and Germany.

5 Chinese state-directed versus German state-incentivized forms of friendshoring

In the following, we use two case studies of recent friendshoring processes in the Sino–Tanzanian soybean GPN and in the German–Namibian green hydrogen GPN to contrast two extreme types of friendshoring: in a more coercive state-directed friendshoring approach, China influences its lead firms through direct state ownership of outward-oriented SOEs. Germany, as a liberal market economy, follows a “light touch” state-incentivized friendshoring approach that relies more on the coordination of various state and state-related institutions such as foreign affairs, development aid, and development finance.

5.1 Leveraging an old friendship for food security: China’s soybean politics in Tanzania

China’s friendshoring practices in the soybean GPN can be explained by our conceptualization of three main geopolitical imperatives.

First, high import shares of about 60 % of worldwide soybean trade comes with substantial inflationary risks for China’s economy (Wesz Junior et al. 2021). China aims to reduce its supply chain risks through strategic diversification of the China-oriented soybean GPN which is highly dependent on imports from few production regions and their supplying intermediary firms (US, Brazil, Argentina). China used to be a net exporter for soybeans until the mid-1990s. However, following the WTO entry, China made the strategic choice to use Chinese farmland mainly for grain production whilst offshoring the land intensive production of soybeans and using Chinese state-owned enterprises (SOEs) to operate as buying lead firms in off-shored production regions (Oliveira 2016). This decision resulted in a dramatic downturn of China’s soybean self-sufficiency ratio that has dwindled to about 15 per cent (Wesz Junior et al. 2021).

Second, China’s soybean imports have become a weaponized commodity in the US–China trade war. China used retaliatory tariffs on US soybeans and banned its home grown SOEs from buying US soybeans since mid-2018. This was meant to strategically harm the US (agro-)economy and exert political influence of voter behavior. By gradually shifting the major supply chain of the soybean GPN towards alternative production frontiers including Latin America and more recently Africa and Russia, China de-weaponizes its own supplies (Wesz Junior et al. 2021).

Third, China seeks to establish new spheres of geopolitical influence in Africa. Remarkably, this imperative goes beyond funding and building infrastructures as it also includes the coupling of Chinese GPN with African economies. Embedded in Cold War ties and the socialist brotherhood between China and Tanzania (among a number of African states), agricultural “green lanes” have recently been proposed by China. This coincides with strategies to strengthening Sino–African trade and GPN integration via the Belt and Road Initiative (BRI) (Tups et al. 2024) and demonstrates China’s ambition to compete with Western countries for geopolitical influence (Large 2022; Li 2023).

Taken together, the above geopolitical imperatives define why the Chinese soybean GPN is being friendshored to couple with new production regions in Africa. Below it will be shown how this process is governed by Chinese SOEs and more indirectly orchestrated by the Chinese communist party which can directly define key agendas of soybean SOEs through shareholder rights as well as ownership of key firm assets (Fares 2023).

5.1.1 Extraterritorial de-risking: off-take agreements via Chinese SOEs

Coupling Tanzania’s agrarian hinterland to the Chinese soybean lead firms comes with substantial risks for Chinese and Tanzanian actors. This is due to the investment costs required by Chinese soybean lead firms to equip the immature soybean industry in Tanzania to meet the Chinese criteria (soybean varieties, quality, volumes, costs). As highlighted by an oilseeds trading analyst (P1), more conventional lead firms would be unlikely to invest under these coupling conditions because Tanzanian farmers have much higher production costs than highly industrialized, large-scale farms in the U.S., Brazil, and Argentina (also raised by: G3, D6). This is why extraterritorial practices of de-risking both economic and political risks have been paramount to initiate the coupling process.

Remarkably, de-risking between China and Tanzania does not rely on the Western model of subsidizing outward oriented investments or covering the high costs of political risks. Rather, China uses the state’s tight grip over SOEs in the grains and oilseeds sector to deploy rather diplomatic means to de-risk Tanzania’s soybean frontier (Asian commodities markets analyst [P2]). A substantial off-take agreement which was made on state-to-state rather than firm-to-state level served as a political means of de-risking otherwise unlikely and risky investments – both on Tanzanian (farmers, traders) and Chinese side (SOEs). In October 2020, China and Tanzania announced the signing of a Memorandum of Understanding (MoU) which foresees that China buys at least 600,000 tonnes of soybean annually and up to 2 million tons of soybeans prospectively – compared to Tanzania’s production capacity of about 20,000 tonnes in the same year (Tanzanian Ministry of Agriculture [G1, G3], high-ranking development agent involved in facilitating the MoU [D6]).

5.1.2 Outward-oriented network brokering: soybean diplomacy

Since Tanzania has so far been a net-importer of soybean, supply chains have to be assembled from scratch to allow coupling with the Chinese GPN through practices of network brokering.

Firstly, remobilizing the BRI expansion after its slowdown amid the Covid-19 pandemic, the provincial government in China’s Hunan province was the first to commit to open “green lanes” for agricultural products that had been announced during the eighth Forum on China–Africa Cooperation (FOCAC) in early 2021. The provincial government set up a free-trade zone in Hunan for imported agricultural products from Africa which was flanked by decentralization efforts encouraging local authorities and the private sector to proactively establish trade relations with African partners (Tanzanian Ministry of Agriculture [G1], Asian commodities markets analyst [P2]).

Secondly, the Chinese embassy in Tanzania played a pivotal role in initiating extra-firm bargaining processes between Tanzanian grain and oilseed traders and Chinese SOEs. Already in April 2021, the embassy issued licenses for 49 Tanzanian traders to be eligible for soybean exports via Dar es Salaam port (Soybean trader in Dar es Salaam [B1]). In June 2021, the first batch of soybeans was exported from Tanzania to China (State-owned Assets Supervision and Administration Commission of the State Council, 2021). The trader Dar-Lyon Investment handed over a symbolic trade volume of 120 tons of soybeans to the Chinese SOE COFCO to kick-start the new partnership. In the first year of trade however, only 1,140 tons could be exported to China, as the quality of the soybeans was often insufficient (Tanzanian Ministry of Agriculture [G3]). In 2022 – and thus way before large-scale measures to raise Tanzania’s production output were implemented – 22,000 tons of soybeans were exported to China according to official statistics.

5.1.3 Extraterritorial institution-building: changing regulatory standards

The shift from peasant-oriented and locally adapted soybean varieties towards export-oriented and imported soybean varieties required extraterritorial institution building to fast-track a transformation of regional assets to meet the coupling criteria with the Chinese soybean GPN. As confirmed by Tanzanian seed breeders (R1, R2) Soybean production in Tanzania has so far solely occurred for household (diet substitution) and domestic uses (Tanzanian animal feed industry). Tanzanian soybeans neither reach the fat and protein content required by Chinese soybean processors converting soybeans into edible oils and animal feed, nor do they reach the quality criteria (standardization, phytosanitary controls) and volumes foreseen under the Sino–Tanzanian MoU (Public employee responsible for soybean breeding in Tanzania [R3]).

Firstly, the Chinese embassy agreed with the Tanzanian Ministry of Agriculture to issue a special approval for Longping High-Tech, a subsidiary of the Chinese state-owned investment firm CITIC Group, to be eligible for importing and replicating soybean varieties that were originally bred for the Chinese and Brazilian market. The standardized process for registering new seed varieties usually takes four and more years, but Longping could fast-track the trials to take only two years (R3). Following a scoping tour through the Southern Highlands in Tanzania, Longping received a lease for a 30,000 ha farm by the Tanzanian government and was given the mandate to kick-start local seed reproduction (Regional development agent involved in soybean promotion [D4]).

Secondly, this repurposing of the Tanzanian seed production system was further flanked by institutional alterations of the seed innovation system. In cooperation with Tanzanian universities and the governmental seed breeding institute Uyole, Longping operates several trial farms across the Southern Highlands to gather data to define breeding goals and parameters required to adapt soybean varieties to the local context (Regional development agent involved in soybean promotion [D5]).

5.2 Healing old wounds with development: Germany’s green hydrogen promise for Namibia

Germany’s energy friendshoring efforts respond to the three geopolitical imperatives described above: First, to reduce its exposure to supply security risks, the German government is seeking to diversify its energy imports and increase imports of renewable energy carriers, such as green hydrogen. Second, in response to Russia’s invasion of Ukraine, Germany quickly used its purchasing power for natural gas and oil as a weapon in the trade war. The trade sanctions imposed targeted Russia’s commodity export sector to hit its economy at a vulnerable point. Third, to maintain influence in the region and ease diplomatic tensions from its colonial past, a German development cooperation representative in Namibia confirms that Germany seeks to support economic development in Namibia (C4). Despite years of negotiations between the two countries, they have yet to reconcile the genocide committed by the German Empire in what was then South West Africa (now Namibia) from 1904 to 1908 (Melber 2020). The German Federal Ministry for Economic Affairs and Climate Action (BMWK) has developed green hydrogen partnerships with strategic exporting countries to face the janus-faced challenge of achieving the self-imposed target of climate neutrality, nuclear phase-out, and the need to ensure stable energy supply from reliable partners, including Canada, Egypt, Saudi Arabia, Australia, Chile and Namibia. While some of these countries are already closely aligned with Germany’s geopolitical aims, stronger alignment with other countries is to be achieved via this energy diplomacy (Quitzow et al. 2023). The hydrogen partnership with Namibia took the form of a joint declaration of intent signed in March 2022 and is aiming for a mutually beneficial outcome: exporting green hydrogen to Germany for increased energy security, while fostering significant industrial transformation in Namibia. The mutual benefits of this agreement was confirmed in a group discussion with high-ranking Namibian government officials (G2).

5.2.1 Extraterritorial de-risking: off-take and finance

Germany is taking three main measures to de-risk private green hydrogen investments: first, by signing long-term off-take agreements; second, by matching private capital with government funds (“patient capital”) to reduce capital costs for geostrategically desirable projects; and third, by upgrading relevant infrastructure in the host region.

German development cooperation organizations confirm that Germany established the H2 Global funding mechanism to promote the production and use of green hydrogen worldwide (C4). Facilitated by a government-backed off-taker, long-term purchase agreements provide the necessary investment security to unlock large-scale investments on the supply side and short-term sales contracts on the demand side. The difference between the supply and demand price is compensated by grants from a public funding body, thus promoting the decarbonization of significant CO2 emitters worldwide. Work is underway to Europeanize H2 Global (European Commision 2023): H2Global will be open to all EU governments interested in conducting joint European tenders.

In addition, the German extraterritorial de-risking strategy is embedded in a European approach to spatial development, the Global Gateway Initiative (European Commission 2021). Investment capital for global infrastructure and economic partnerships comes from the EU, member states and financial institutions such as the European Investment Bank. The initiative plans to allocate €135 billion to provide an alternative to China’s BRI by reducing the risks of investing abroad for European companies (European Commission 2021). In this vein, EU Commission President Ursula von der Leyen and Namibian President Hage Geingob announced the EU–Namibia strategic partnership on sustainable commodity value chains and renewable hydrogen (European Commission 2023). €1 billion will be invested to mobilize funding for infrastructure, capacity building, research and regulatory changes in Namibia.

This adds to further funds in infrastructure investments stemming from German government funds: a Namibian town council mentions that €5 million are dedicated to support shaping urban development and infrastructure improvements in the town of Lüderitz, which will accommodate a 10 bn USD investment from British–German consortium Hyphen Energy (G1). Besides creating a long-term horizon for guaranteed off-take, the Namibian government currently plans to directly invest in the incoming Hyphen Energy investment (G2). The agreement between the company and the Namibian government foresees a 24 % Namibian government stake. However, this investment will be backed by a credit provided through the European Investment Bank (Gabor and Sylla 2023).

5.2.2 Outward-oriented network brokering: creating industrial linkages

Namibian government officials and companies alike emphasize the considerable effort that has been put into network brokering by establishing new industry contacts or bridging connections between industry, research and policymaking in Germany and Namibia (A1, G1, G2, G4, F3, F4). Following a Joint Declaration of Intent, a number of B2B platforms, including business roundtables and business delegations to and from Germany, have been organized by German government agencies to strengthening ties between Namibian and German companies, the chairman of the renewable energy business association elaborates (A1). In September 2022, a first German–Namibian business exchange platform was established, and in December 2022, the German Minister for Economic Affairs made a visit to Namibia with a large business delegation to establish contacts (G2). Here again, brokering activities were flanked by efforts on a EU level, such as the EU–Namibia business forum, which took place in Brussels in October 2023. These initiatives are assessed generally positively by Namibian firms as they provide platforms for information sharing and networking opportunities with international companies (A1, D4). However, interviewees raise doubts regarding the readiness of Namibian firms to enter the newly emerging sector, as the majority of Namibian firms lack required capabilities (A1, A5).

To showcase green hydrogen potential for the regional economy, the German government, through the Federal Ministry of Education and Research (BMBF) and the Federal Ministry of Economics and Technology (BMWK), has provided €30 million to fund five pilot projects in Namibia to demonstrate the use of green hydrogen in Namibia (C3). The pilot projects aim to establish fertilizer production from green ammonia, a green steel plant, green marine fuel production, decarbonization of the port of Walvis Bay and a train powered by hydrogen locomotives (C3, D1, D2, D4, F1). While this is a further case of de-risking investments by creating a hydrogen ecosystem with public money, this is also a concrete example of network brokering: involved actors highlight that all projects match European technology leaders with local business partners, thus strengthening ties between lead firms and locally embedded industrial assets (D4). The expectation expressed by Namibian policy-makers is that private investments will follow once the applicability of use cases is displayed (G2).

5.2.3 Extraterritorial institution-building: research and development

Germany’s government and government-related institutions are busy building and rebuilding institutions that are conducive to the development of green hydrogen in Namibia (C1, C2, C3, C4, F2). The BMBF, through its implementing organization, the Southern African Science Centre for Climate Change and Adaptive Land Management (SASSCAL), sponsored the Namibian National Green Hydrogen Strategy, which was implemented by the global consulting firm McKinsey and serves as a roadmap for the sector and is integrated into Namibia’s strategic economic plans (G2, C3).

In addition, German government organizations are creating new structures to improve industry-related skills and knowledge. One example is the PtX hub Namibia project, implemented by the German Society for International Cooperation (GIZ), which focuses on building local green hydrogen skills through training programs (C1). Another example is the BMBF-funded Green Hydrogen Research Institute, which is embedded in the structures of the University of Namibia. The institute conducts research projects to adapt green hydrogen technologies to local environmental conditions. Leading researchers of the institute confirm that in parallel, the curricula of two renewable energy master’s programs are being adapted to the needs of the green hydrogen industry (R1).

5.3 A brief comparison of Chinese and German friendshoring approaches

The two cases show that friendshoring is not a uniquely Western response to geopolitical turmoil and multipolarity, but both GPN actors from China and Germany are responding to pressing geopolitical imperatives by leveraging historical ties between friendshoring partners with the ultimate goal of sourcing strategic commodities from global peripheries (Table 1).

Friendshoring imperatives and practices. Comparing the Sino–Tanzanian soybean GPN with the German–Namibian green hydrogen GPN.

| Soybean GPN China & Tanzania | Green hydrogen GPN Germany & Namibia | |

|---|---|---|

| Geopolitical imperatives | ||

| Reducing risk exposure | – Chinese import dependency for soybeans | – German import dependency for dense energy carriers |

| (such as natural gas, ammonia) | ||

| – Chinese neo-mercantilist approach to food systems | – Decarbonization of domestic energy intensive industry | |

| (De-)weaponizing | – US–China trade war | – EU–Russia trade war |

| supply chains | – Inflationary effects on Chinese domestic economy | – Recessional pressure of high energy prices |

| Extraterritorial | – Multipolar world – Uneven Sino–African trade balance | – EU global gateway competition with Chinese BRI |

| influence | – Slow-down of BRI during Covid-19 pandemic | – Overcoming diplomatic tensions stemming from colonial |

| legacy via economic development promise | ||

| Extraterritorial coupling practices | ||

| Extraterritorial | – MoU with non-binding but high off-take agreement | – H2 global buyer scheme – Infrastructure development |

| de-risking | under global gateway programme | |

| – High-level political commitment to fulfill the trade agreement | – Financial de-risking via development bank | |

| Outward-oriented | – Mobilization of Chinese SOEs | – Establishment of cross-border B2B platforms |

| network brokering | – Going out of Hunan Province state institutions and brokering by | – Funding of joint-venture pilot projects – Diplomatic |

| Chinese embassy | efforts | |

| Extraterritorial | – Reorganization of soybean seed system in Tanzania | – Funding of national hydrogen strategy |

| institution building | – PPPs through Chinese SOEs on local and regional level | – Establishment of green hydrogen research institute |

| – Repurposing of SASSCAL | ||

First, states aim to reduce the risk exposure of crucial GPNs: sourcing strategic commodities from various and preferably more aligned locations and GPN counterparts reduces supply-side risks such as crop failure due to climate change or energy shortages due to political instability (cf. Vivoda 2023). Second, states use their grip over GPNs to (de)weaponize strategic supply chains: in response to the ongoing U.S.-China trade war, China is seeking to simultaneously weaponize (reducing purchases from the US) and de-weaponize (diversifying supplies for the Chinese market) the soybean supply chain through a long-term strategy of spatially reorganizing its soybean GPN (Wesz Junior et al. 2021). Germany has taken an even more active approach of weaponizing GPNs, using its purchasing power to the detriment of the Russian economy by decoupling and sanctioning its energy exports whilst simultaneously fast-tracking alternative supplier relations (Zhang et al. 2024). Third, both countries are linking their friendshoring ambitions with large-scale infrastructure projects to maintain extraterritorial influence conducive to the market imperatives of home-grown lead firms. The revitalization of the BRI after the Covid-19 pandemic is directly linked to the launch of Sino–African green lanes for agricultural products just as Europe’s Global Gateway is linked to state-driven coupling attempts in energy or also critical mineral GPNs with alternative suppliers on the African continent (Heldt 2023). There are, however, differences in the way states influence inter-firm coordination:

Chinese state influence is expressed through mobilization of state-owned soybean SOEs (COFCO, Longping) that are well-coordinated with government institutions, equipped with patient capital and diplomatic backing allowing to de-risk otherwise infeasible investments. China’s high demand guarantees stable off-take agreements for producers which are further backed on diplomatic level. To achieve conducive network brokering and to build new institutions in form of prospective public-private partnerships (PPP) with Tanzanian actors and changing the soybean seed system, China mobilizes its SOEs quite directly.

Germany’s foreign trade policy, on the other hand, remains intertwined with EU initiatives such as the Global Gateway initiative and takes a more indirect approach, focusing on changing the conditions for strategic coupling to incentivize coupling with geopolitically aligning regions endowed with strategic assets. This explains the focus on financial de-risking and institution-building: more than network brokering, these practices alter the regional asset base and prepare the ground for strategic coupling. By orchestrating the actions of a wide range of state and state-linked organizations, diplomatic relations are strengthened in order to create opportunity spaces for domestic lead firms in strategic sectors in geopolitically aligned states.

6 Conclusion and way forward

Our article contributes to the growing body of literature on the geopolitics of GPNs by offering a conceptual perspective on the rise of GPN friendshoring that has received little attention so far. Specifically, this article has advanced the discussion in four ways: by distilling three geopolitical imperatives, by conceptualizing pushing the network out practices, by distinguishing between state-led and state-incentivized friendshoring approaches, and by highlighting state agency more broadly in strategic coupling processes. It is along these lines that further research can make fruitful contributions.

Firstly, by conceptualizing three geopolitical imperatives this article aims to spark debate on the impact of geopolitical imperatives and spatial reconfiguration of GPNs mediated by states and state-linked actors. Geopolitics is primarily a mandate at the national political level, and with rising geopolitical tensions, states need to develop both the power and the tools to persuade lead firms to link up with strategically desirable locations. Therefore we can expect, first, the emergence of new organizational private-public hybrids, even in liberal market economies, and, second, an increased interest on the part of states to transcend their borders in order to exert power extraterritorially. However, we do not claim the list of imperatives presented here to be exhaustive but hope to inspire future research that identifies further non-market imperatives, including for instance decarbonization goals (Blažek and Lypianin 2024) and further responses to climate risks (Coe and Gibson 2024).

Secondly, the three practices of pushing the network out are strongly interrelated. Extraterritorial institution building goes hand in hand with network brokering and de-risking: outward-looking network brokers rely on organizations to anchor their activities in the target region, and de-risking is accompanied by institution building (such as policy-de-risking). More can be done to refine each of these concepts. More broadly speaking, however, this research has set the focus on the agency of home states of lead firms, while widely neglecting the agency of host states to hinder or support these forms of coupling. Rather than being a mere scaffolding for strategic coupling, host regions can co-shape investments in their asset base, leverage diplomatic relations, and steer institution-building activities to become attractive as friendshoring partners. Host regions can also align their activities with those of potential friendshoring partners by engaging in complementary practices of de-risking to amplify the regional development effect on their territories (Gabor and Sylla 2023).

Thirdly, our two case studies have shown that the organizational practices and extraterritorial “tools” that states use to exert power on their strategic GPNs differ widely, from a state-directed approach in the case of China to a state-incentivized form of coupling in the case of Germany. More can be done to typologize different organizational forms underlying state agency to achieve strategic coupling extraterritorially. Recent attempts to conceptualize different drivers and actors in coupling processes are helpful in this regard (Blažek and Lypianin 2024).

Lastly, it will be useful to further understand the regional development effects, power relations involved, and associated risks of these different coupling types on target regions. Especially in non-aligned states, there is a “friendshoring” competition between foreign states that can be exploited by regional institutions in the coupling bargaining process through playing out different interests (Müller 2023). As the regional asset base is modified in the long run, opportunities for further couplings in related sectors may be opened up. However, structural decoupling is a real risk for host regions when the geopolitical landscape changes and geostrategic imperatives are again overridden by market-driven imperatives, or if another crisis overturns former geopolitical imperatives (Blažek and Lypianin 2024): lead firms may decouple from the friendshoring region in favor of more cost-effective regions. Moreover, when institutions are built by foreign states, there is no guarantee that they will work to the benefit of the host region, nor that they will be sustainable once de-risking measures are phased out. For example, scarce endogenous resources, such as skilled labor, may be channeled into the friendshoring sector and thus lacking in alternative, potentially more productive sectors, to the detriment of the host region. This calls for future research to focus on state agency in times of geopolitical turmoil.

Funding source: Deutsche Forschungsgemeinschaft

Award Identifier / Grant number: TRR228/1

Acknowledgments

The authors would like to thank the editor of ZFW – Advances in Economic Geography, Harald Bathelt, and two anonymous reviewers for their valuable comments, which significantly improved this paper. We are also grateful to the guest editors for compiling this special issue, Martin Hess and Rory Horner. Finally, we thank all the interviewees who agreed to share their knowledge with us.

-

Research ethics: Not applicable.

-

Author contributions: The authors have accepted responsibility for the entire content of this manuscript and approved its submission.

-

Competing interests: The authors state no conflict of interest.

-

Research funding: The research was funded by the German Research Foundation (DFG) through the Collaborative Research Center (CRC) “Future Rural Africa”, funding code TRR 228.

-

Data availability: The raw data can be obtained on request from the corresponding author.

List of interviews with soybean stakeholders and experts (Tanzanian case).

| Interviewee affiliation | Date | Code |

|---|---|---|

| Ministry of agriculture | 03.08.2022 | G1 |

| Ministry of agriculture | 14.08.2022 | G2 |

| Ministry of agriculture (online) | 20.09.2022 | G3 |

| Agricultural development project | 02.08.2022 | D1 |

| Agricultural development project/PPP | 06.08.2022 | D2 |

| Agricultural development project | 09.08.2022 | D3 |

| Agricultural development project | 15.08.2022 | D4 |

| Agricultural development project/PPP | 16.08.2022 | D5 |

| Agricultural development project/PPP | 24.08.2022 | D6 |

| Soybean trader | 02.08.2022 | B1 |

| Soybean trader | 11.08.2022 | B2 |

| Soybean buyer | 06.08.2022 | B3 |

| Soybean buyer | 06.08.2022 | B4 |

| Soybean buyer | 06.08.2022 | B5 |

| Soybean buyer | 16.08.2022 | B6 |

| Soybean seeds supplier | 05.08.2022 | B7 |

| Soybean research & development | 01.08.2022 | R1 |

| Soybean research & development | 03.08.2022 | R2 |

| Soybean research & development | 07.08.2022 | R3 |

| Policy analyst – oilseed & grain trade (online) | 20.03.2023 | P1 |

| Policy analyst – Asian markets (online) | 21.04.2023 | P2 |

List of interviews with actors of the green hydrogen GPN (Namibian case).

| Interviewee affiliation | Date | Code |

|---|---|---|

| Business association | 30.03.2023 | A1 |

| Business association | 16.03.2023 | A2 |

| Business association | 31.03.2023 | A3 |

| Business association | 14.04.2023 | A4 |

| Business association | 15.02.2023 | A5 |

| Development cooperation | 23.03.2023 | C1 |

| Development cooperation | 06.04.2023 | C2 |

| Development cooperation | 04.04.2023 | C3 |

| Development cooperation | 03.03.2023 | C4 |

| Green hydrogen project developer | 13.02.2023 | D1 |

| Green hydrogen project developer | 22.02.2023 | D2 |

| Green hydrogen project developer | 23.02.2023 | D3 |

| Green hydrogen project developer | 01.03.2023 | D4 |

| Green hydrogen project developer | 08.03.2023 | D5 |

| Private company | 20.02.2023 | F1 |

| Private company | 20.02.2023 | F2 |

| Private company | 03.03.2023 | F3 |

| Private company | 31.03.2023 | F4 |

| Private company | 02.03.2023 | F5 |

| Namibian government agency | 11.02.2023 | G1 |

| Namibian government agency | 14.02.2023 | G2 |

| Namibian government agency | 02.03.2023 | G3 |

| National government agency | 29.03.2023 | G4 |

| Civil society organization | 16.02.2023 | O1 |

| Civil society organization | 21.02.2023 | O2 |

| Civil society organization | 21.02.2023 | O3 |

| Research institute | 27.02.2023 | R1 |

References

Aiginger, K. and Rodrik, H. (2020). Rebirth of industrial policy and an agenda for the twenty-first century. J. Ind. Compet. Trade 20: 189–207. https://doi.org/10.1007/s10842-019-00322-3.Search in Google Scholar

Alami, I. and Dixon, A.D. (2021). Uneven and combined state capitalism. Environ. Plann. A Econ. Space 55: 72–99. https://doi.org/10.1177/0308518x211037688.Search in Google Scholar

Bathelt, H. and Glückler, J. (2014). Institutional change in economic geography. Prog. Hum. Geogr. 38: 340–363. https://doi.org/10.1177/0309132513507823.Search in Google Scholar

Bathelt, H. and Li, P. (2020). Building better methods in economic geography. Z. Wirtschaftsgeogr. 64: 103–108. https://doi.org/10.1515/zfw-2020-0014.Search in Google Scholar

Blažek, J. and Lypianin, A. (2024). Geopolitical decoupling and global production networks: the case of Ukrainian industries after the 2014 Crimean annexation. J. Econ. Geogr. 24: 23–40. https://doi.org/10.1093/jeg/lbad026.Search in Google Scholar

Carbone, M. (2023). When elephants fight, it is the grass that suffers: the Russo–Ukrainian conflict and the decentring-recentring conundrum in EU–Africa relations. J. Eur. Integrat. 45: 539–557. https://doi.org/10.1080/07036337.2023.2190108.Search in Google Scholar

Choi, E. and Laxton, V. (2023). Mobilizing private investment in climate solutions: de-risking strategies of multilateral development banks. Working Paper No. 1. World Resources Institute, Washington, Available at: https://www.wri.org/research/mobilizing-private-investment-climate-solutions-mdbs (Accessed 5 May 2024).10.46830/wriwp.22.00091Search in Google Scholar

Coe, N.M. and Gibson, C. (2023). Progress in economic geography? Decarbonising Global Production Networks (GPNs). Prog. Econ. Geogr. 1: 100002.10.1016/j.peg.2023.100002Search in Google Scholar

Coe, N.M. and Yeung, H.W.C. (2015). Global production networks: theorizing economic development in an interconnected world. Oxford University Press, Oxford.10.1093/acprof:oso/9780198703907.001.0001Search in Google Scholar

Dadush, U. and Prost, E.D. (2023). Preferential trade agreements, geopolitics, and the fragmentation of world trade. World Trade Rev. 22: 278–294. https://doi.org/10.1017/s1474745623000022.Search in Google Scholar

Das, G.G. (2020). Trade war, global restructuring and global production network: beating the odds. Foreign Trade Rev. 55: 7–12. https://doi.org/10.1177/0015732519886770.Search in Google Scholar

Dawley, S., MacKinnon, D., and Pollock, R. (2019). Creating strategic couplings in global production networks: regional institutions and lead firm investment in the Humber region, UK. J. Econ. Geogr. 19: 853–872. https://doi.org/10.1093/jeg/lbz004.Search in Google Scholar

European Commission (2021). Joint communication to the European parliament, the council, the European economic and social committee, the committee of the regions and the European investment bank the global gateway. Press Release, Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021JC0030 (Accessed 5 May 2024).Search in Google Scholar

European Commission (2023). Global gateway: EU and Namibia agree on next steps of strategic partnership on sustainable raw materials and green hydrogen. Press Release, Available at: https://ec.europa.eu/commission/presscorner/detail/en/IP_23_5263 (Accessed 5 May 2024).Search in Google Scholar

Fares, T.M. (2023). China's financialized soybeans: the fault lines of neomercantilism narratives in international food regime analyses. J. Agrar. Change 23: 477–499. https://doi.org/10.1111/joac.12536.Search in Google Scholar

Farrell, H. and Newman, A.L. (2022). Weak links in finance and supply chains are easily weaponized. Nature 605: 219–222. https://doi.org/10.1038/d41586-022-01254-5.Search in Google Scholar PubMed

Gabor, D. and Sylla, N.S. (2023). Derisking developmentalism: a tale of green hydrogen. Dev. Change 54: 1169–1196. https://doi.org/10.1111/dech.12779.Search in Google Scholar

Gong, H., Hassink, R., Foster, C., Hess, M., and Garretsen, H. (2022). Globalisation in reverse? Reconfiguring the geographies of value chains and production networks. Camb. J. Reg. Econ. Soc. 15: 165–181. https://doi.org/10.1093/cjres/rsac012.Search in Google Scholar

Guerrero, D., Letrouit, L., and Pais-Montes, C. (2022). The container transport system during Covid-19: an analysis through the prism of complex networks. Transport Pol. 115: 113–125. https://doi.org/10.1016/j.tranpol.2021.10.021.Search in Google Scholar PubMed PubMed Central

Heldt, E.C. (2023). Europe’s global gateway: a new instrument of geopolitics. Polit. Govern. 11: 223–234. https://doi.org/10.17645/pag.v11i4.7098.Search in Google Scholar

Jiang, B., Rigobon, D., and Rigobon, R. (2022). From just-in-time, to just-in-case, to just-in-worst-case: simple models of a global supply chain under uncertain aggregate shocks. IMF Econ. Rev. 70: 141–184. https://doi.org/10.1057/s41308-021-00148-2.Search in Google Scholar

Kalvelage, L., Diez, J.R., and Bollig, M. (2023a). Valuing nature in global production networks: hunting tourism and the weight of history in Zambezi, Namibia. Ann. Am. Assoc. Geogr. 113: 1818–1834. https://doi.org/10.1080/24694452.2023.2200468.Search in Google Scholar

Kalvelage, L., Hardie, C., Mausch, K., Conti, C., and Hall, A. (2023b). Inside-out strategic coupling for smallholder market integration–mango production in Malawi as a test case. Outlook on Agric. 52: 174–185. https://doi.org/10.1177/00307270231179240.Search in Google Scholar

Kedward, K. and Ryan-Collins, J. (2022). A green new deal: opportunities and constraints. In: Arestis, P. and Sawyer, M. (Eds.), Economic policies for sustainability and resilience. International papers in political economy, Vol. 18. Palgrave Macmillan, Cham, pp. 269–317.10.1007/978-3-030-84288-8_7Search in Google Scholar

Kleibert, J.M. (2014). Strategic coupling in ‘next wave cities’: local institutional actors and the offshore service sector in the Philippines. Singapore J. Trop. Geogr. 35: 245–260. https://doi.org/10.1111/sjtg.12044.Search in Google Scholar

Kluver, R. (2014). The sage as strategy: nodes, networks, and the quest for geopolitical power in the confucius institute. Commun. Cult. Critiq. 7: 192–209. https://doi.org/10.1111/cccr.12046.Search in Google Scholar

Kuckartz, U. and Rädiker, S. (2023). Qualitative content analysis: methods, practice and software. Sage, London.10.4324/9781003213277-57Search in Google Scholar

Lambert, L.A., Tayah, J., Lee-Schmid, C., Abdalla, M., Abdallah, I., Ali, A.H.M., Esmail, S., and Ahmed, W. (2022). The EU’s natural gas cold war and diversification challenges. Energy Strategy Rev. 43: 100934. https://doi.org/10.1016/j.esr.2022.100934.Search in Google Scholar

Large, D. (2022). China, Africa and the 2021 dakar focac. Afr. Aff. 121: 299–319. https://doi.org/10.1093/afraf/adac014.Search in Google Scholar

Laurenceson, J. and Armstrong, S. (2023). Learning the right policy lessons from Beijing’s campaign of trade disruption against Australia. Aust. J. Int. Aff. 77: 258–275. https://doi.org/10.1080/10357718.2023.2212612.Search in Google Scholar

Leshoele, M. (2020). AfCFTA and regional integration in Africa: is African union government a dream deferred or denied? J. Contemp. Afr. Stud. 41: 393–407. https://doi.org/10.1080/02589001.2020.1795091.Search in Google Scholar

Li, Y. (2023). Impacts of the belt and road initiative on regional outward FDI from China based on evidence from 2000 to 2015. ZFW–Adv. Econ. Geogr. 67: 20–32. https://doi.org/10.1515/zfw-2022-0007.Search in Google Scholar

Lund, H.B. and Steen, M. (2020). Make at home or abroad? Manufacturing reshoring through a GPN lens: a Norwegian case study. Geoforum 113: 154–164. https://doi.org/10.1016/j.geoforum.2020.04.015.Search in Google Scholar

Maihold, G. (2022). A new geopolitics of supply chains: the rise of friendshoring. SWP Comment 45: 1–7.Search in Google Scholar

Mazzucato, M. (2014). The entrepreneurial state: debunking public vs. private sector myths. Anthem Press, London.Search in Google Scholar

McGregor, N. and Coe, N.M. (2023). Hybrid governance and extraterritoriality: understanding Singapore’s state capitalism in the context of oil global production networks. Environ. Plann. A Econ. Space 55: 716–741. https://doi.org/10.1177/0308518x211048197.Search in Google Scholar

Melber, H. (2020). Germany and Namibia: negotiating genocide. J. Genocide Res. 22: 502–514. https://doi.org/10.1080/14623528.2020.1750823.Search in Google Scholar

Miller, C. (2022). Chip war: the fight for the world’s most critical technology. Simon, Schuster, New York.Search in Google Scholar

Müller, M. (2023). The ‘new geopolitics’ of mineral supply chains: a window of opportunity for African countries. S. Afr. J. Int. Afr. 30: 177–203. https://doi.org/10.1080/10220461.2023.2226108.Search in Google Scholar

Oliveira, G.D.L. (2016). The geopolitics of Brazilian soybeans. J. Peasant Stud. 43: 348–372. https://doi.org/10.1080/03066150.2014.992337.Search in Google Scholar