Abstract

This paper studies volatility dynamics and provides further insights into its relationship with trading volume. In particular, we examine whether trading volume is significantly informative for investors when attempting to apprehend potential changes in volatility dynamics, and hence, in the evolution of market risk. To this end, we apply recent nonlinear modeling tools, namely Switching Transition Regression (STR) models that are robust to asymmetry and nonlinearity as well as TARCH models to check for the nature of transition between volatility regimes. Our findings show that volatility dynamics exhibit nonlinearity and switching regimes for which the transition is smooth rather than abrupt. Furthermore, one regime is associated with low volatility and a weak relationship with trading volume while in the second regime, the causality relationship is stronger and volatility is high. The paper’s novelty is to show that not only does trading volume contribute to explaining market volatility, but also that the change in volatility dynamics is performed through the change in its relationship with trading volume.

- 1

In a parallel approach, the heterogeneity of investors’ opinions and expectations is also used to explain the relationship between volatility and volume; see for example Admati and Pfeiderer (1988), Harris and Raviv (1993), He and Wang (1995) among others.

- 2

For more details about the MDH, its developments and empirical implications, see Epps and Epps (1976), Tauchen and Pitts (1983), Harris (1986, 1987), Gallant, Rossi, and Tauchen (1992), Andersen (1996), Liesenfeld (1998, 2001), Chen, Firth, and Rui (2001), Fleming, Kirby, and Ostdiek (2006) among others.

- 3

The parameters c1 and c2 denote the thresholds associated with regime 1 and regime 2.

- 4

Classification of the markets is based on the MSCI International Equity index definitions and criteria.

- 5

To save space, the results of unit root tests are not reported but are available upon request.

- 6

We would like to thank the editor and two anonymous referees for this suggestion.

- 7

The detailed results of all these misspecification tests are available upon request.

- 8

The optimal lag number of all the VAR models was selected according to the AIC and BIC information criteria.

Appendix 1: VAR estimation results

Whole period: VAR (2).8

| VU | LVU | |

|---|---|---|

| VU(-1) | 0.143912 | 0.147574 |

| [8.96419] | [0.47217] | |

| VU(-2) | 0.275631 | –1.603121 |

| [17.3312] | [–5.17779] | |

| LVU(-1) | 0.000177 | 0.700220 |

| [0.21409] | [43.5437] | |

| LVU(-2) | 0.000923 | 0.272532 |

| [1.12163] | [17.0194] | |

| C | –0.010732 | 0.413400 |

| [–3.09212] | [6.11791] | |

| R2 | 0.129826 | 0.924638 |

| F-statistic | 139.4980 | 11471.76 |

| Log likelihood | 12276.10 | 1158.034 |

| Akaike AIC | –6.553324 | –0.615773 |

| Schwarz SC | –6.545009 | –0.607457 |

Sample 2: VAR (1).

| VU | LVU | |

|---|---|---|

| VU(-1) | 0.110498 | 0.915060 |

| [3.36531] | [1.95944] | |

| LVU(-1) | 0.013289 | 0.717772 |

| [8.06105] | [30.6114] | |

| C | –0.193421 | 4.323233 |

| [–7.68799] | [12.0818] | |

| R2 | 0.106744 | 0.544562 |

| F-statistic | 60.10816 | 601.4321 |

| Log likelihood | 2980.339 | 301.5907 |

| Akaike AIC | –5.901565 | –0.591855 |

| Schwarz SC | –5.886946 | –0.577236 |

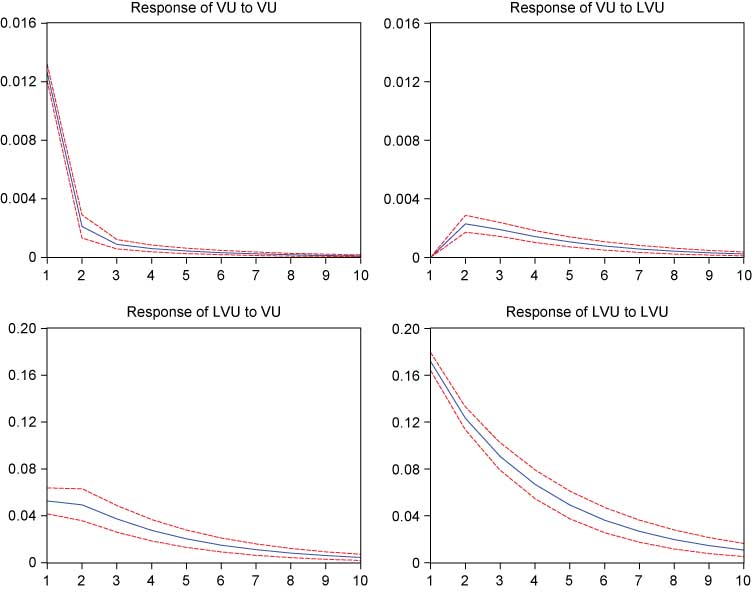

Appendix 2: Impulse-response functions

Response to Cholesky One S.D. Innovations ±2 S.E.

References

Admati, A. D., and P. Pfleiderer. 1988. “A Theory of Intraday Patterns: Volume and Price Variability.” Review of Financial Studies 1: 1–40.10.1093/rfs/1.1.3Search in Google Scholar

Andersen, T. G. 1996. “Return Volatility and Trading Volume: An Information Flow of Stochastic Volatility.” Journal of Finance 51: 169–204.10.1111/j.1540-6261.1996.tb05206.xSearch in Google Scholar

Anderson, H. M. 1997. “Transaction Costs and Nonlinear Adjustment Towards Equilibrium in the US Treasury Bill markets.” Oxford Bulletin of Economics and Statistics 59: 465–484.10.1111/1468-0084.00078Search in Google Scholar

Ané, T., and L. Ureche-Rangau. 2008. “Does Trading Volume Really Explain Stock Return Volatility?.” Journal of International Financial Markets, Institutions and Money 18: 216–235.10.1016/j.intfin.2006.10.001Search in Google Scholar

Asai, M., and A. Unite. 2008. “The Relationship Between Stock Return Volatility and Trading Volume: The Case of the Philippines.” Applied Financial Economics 18: 1333–1341.10.1080/09603100701604274Search in Google Scholar

Balduzzi, P., H. Kallal, and F. Longin. 1996. “Minimal Returns and the Breakdown of the Price-Volume Relation.” Economic Letters 50: 265–269.10.1016/0165-1765(95)00748-2Search in Google Scholar

Boswijk, H. P., C. H. Hommes, and S. Manzan. 2007. “Behavioral Heterogeneity in Stock Prices.” Journal of Economic Dynamics and Control 31: 1938–1970.10.1016/j.jedc.2007.01.001Search in Google Scholar

Bollerslev, T. 1986. “Generalized Autoregressive Conditional Heteroskedasticity.” Journal of Econometrics 31: 307–327.10.1016/0304-4076(86)90063-1Search in Google Scholar

Bollerslev, T., R. Y. Chou, and K. F. Kroner. 1992. “ARCH Modelling in Finance: A Review of the Theory and Empirical Evidence.” Journal of Econometrics 52: 5–59.10.1016/0304-4076(92)90064-XSearch in Google Scholar

Bollerslev, T., R. F. Engle, and D. B. Nelson. 1994. “ARCH models.” In: Handbook of Econometrics Vol. IV, edited by Robert F. Engle and D.L. McFadden. Amsterdam: North-Holland, 2959–3038.Search in Google Scholar

Bollerslev T., and D. Jubinski. 1999. “Equity Trading Volume and Volatility: Latent Information Arrivals and Common Long-Run Dependence.” Journal of Business and Economic Statistics 17: 9–21.Search in Google Scholar

Cai, J. 1994. “A Markov Model of Unconditional Variance in ARCH.” Journal of Business and Economic Statistics 12: 309–316.Search in Google Scholar

Chen, G., M. Firth, and O. M. Rui. 2001. “The Dynamic Relation Between Stock Returns, Trading Volume, and Volatility.” Financial Review 38: 153–174.10.1111/j.1540-6288.2001.tb00024.xSearch in Google Scholar

Clark, P. K. 1973. “A Subordinated Stochastic Process Model with Finite Variance for Speculative Prices”. Econometrica 41: 135–156.10.2307/1913889Search in Google Scholar

Copeland, T. E. 1976. “A Model for Asset Trading Under the Assumption of Sequential Information Arrival.” Journal of Finance 31: 1149–1168.10.2307/2326280Search in Google Scholar

Dickey, D. A., and W. A. Fuller. 1981. “Distribution of the Estimators for Autoregressive Time Series with a Unit Root.” Econometrica 49: 1057–1072.10.2307/1912517Search in Google Scholar

Dumas, B. 1992. “Dynamic Equilibrium and the Real Exchange Rate in a Spatially Separated World.” Review of Financial Studies 5: 153–180.10.1093/rfs/5.2.153Search in Google Scholar

Engle, R. F. 1982. “Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of UK Inflation.” Econometrica 50: 987–1008.10.2307/1912773Search in Google Scholar

Epps, T. W., and M. L. Epps. 1976. “The Stochastic Dependence of Security Price Changes and Transaction Volumes: Implications for the Mixture-of-Distributions Hypothesis.” Econometrica 44: 305–321.10.2307/1912726Search in Google Scholar

Erb, C., C. R. Harvey, and T. Viskanta. 1994. “Forecasting International Equity Correlations.” Financial Analyst Journal, November–December: 32–45.Search in Google Scholar

Escribano, A., and O. Jordã. 1999. “Improving Testing and Specification of Smooth Transition Regression Models.” In: Nonlinear Times Series Analysis of Economic and Financial Data, edited by P. Rothman. Boston: Kluwer, 298–319.Search in Google Scholar

Fleming, J., C. Kirby, and B. Ostdiek. 2006. “Stochastic Volatility, Trading Volume, and the Daily Flow of Information.” Journal of Business 79: 1551–1590.10.1086/500685Search in Google Scholar

Fleming, J., and C. Kirby. 2011. “Long Memory in Volatility and Trading Volume.” Journal of Banking and Finance 35: 1714–1726.10.1016/j.jbankfin.2010.11.007Search in Google Scholar

Galati, G. 2000. Trading volumes, volatility and spreads in foreign exchange markets: evidence from emerging market countries. BIS Working Papers 93, Bank for International Settlements.10.2139/ssrn.849255Search in Google Scholar

Gallant, A. R., P. E. Rossi, and G. Tauchen. 1992. “Stock Prices and Volumes.” Review of Financial Studies 5: 199–242.10.1093/rfs/5.2.199Search in Google Scholar

Gallant, A. R., P. E. Rossi, and G. Tauchen. 1993. “Nonlinear Dynamic Structures.” Econometrica 61: 871–907.10.2307/2951766Search in Google Scholar

Gennotte, G., and H. Leland. 1990. “Market Liquidity, Hedging and Crashes.” American Economic Review 80: 999–1021.Search in Google Scholar

Giot, P., S. Laurent, and M. Petitjean. 2010. “Trading Activity, Realized Volatility and Jumps.” Journal of Empirical Finance 17: 168–175.10.1016/j.jempfin.2009.07.001Search in Google Scholar

Girard, E., and R. Biswas. 2007. “Trading Volume and Market Volatility: Developed Versus Emerging Markets.” Financial Review 42: 429–459.10.1111/j.1540-6288.2007.00178.xSearch in Google Scholar

Glosten, L. R., R. Jagannathan, and D. E. Runkle. 1993. “On the Relation Between the Expected Value and the Volatility of the Nominal Excess Return on Stocks.” Journal of Finance 48: 1779–1801.10.1111/j.1540-6261.1993.tb05128.xSearch in Google Scholar

Granger, C. W. J., and T. Teräsvirta. 1993. Modelling nonlinear economic relationships. Oxford: Oxford University Press.Search in Google Scholar

Hamilton, J. D., and R. Susmel. 1994. “Autoregressive Conditional Heteroskedasticity and Changes in Regime.” Journal of Econometrics 64: 307–333.10.1016/0304-4076(94)90067-1Search in Google Scholar

Harris, L. 1986. “Cross Security Tests of the Mixture of Distributions Hypothesis.” Journal of Financial and Quantitative Analysis 21: 39–46.10.2307/2330989Search in Google Scholar

Harris, L. 1987. “Transaction Data Tests of the Mixture of Distributions Hypothesis.” Journal of Financial and Quantitative Analysis 22: 127–141.10.2307/2330708Search in Google Scholar

Harris, M., and A. Raviv. 1993. “Differences of Opinion Make a Horse Race.” Review of Financial Studies 6: 473–506.10.1093/rfs/5.3.473Search in Google Scholar

He, H., and J. Wang. 1995. “Differential Information and Dynamic Behavior of Stock Trading Volume.” Review of Financial Studies 8: 919–972.10.1093/rfs/8.4.919Search in Google Scholar

Heimstra, C., and J. D. Jones. 1994. “Testing for Linear and Nonlinear Granger Causality in the Stock Price-Volume Relation.” Journal of Finance 49: 1639–1664.Search in Google Scholar

Hussain, S. M. 2011. “The Intraday Behaviour of Bid-Ask Spreads, Trading Volume and Return Volatility: Evidence from DAX30.” International Journal of Economics and Finance 3: 23–34.10.5539/ijef.v3n1p23Search in Google Scholar

Jawadi, F., and G. Prat. 2012. “Arbitrage Costs and Nonlinear Stock Price Adjustment in the G7 Countries.” Applied Economics 44(12): 1561–1582.10.1080/00036846.2010.543085Search in Google Scholar

Lamoureux, C. G., and W. Lastrapes. 1990. “Heterokedasticity in Stock Return Data: Volume Verus GARCH Effect.” Journal of Finance 45: 221–229.10.1111/j.1540-6261.1990.tb05088.xSearch in Google Scholar

Lamoureux, C. G., and W. Lastrapes. 1994. “Endogenous Trading Volume and Momentum in Stock Return Volatility.” Journal of Business and Economic Statistics 12: 253–260.Search in Google Scholar

Lee, C.-H., S.-H. Lin, and Y.-C. A. Liu. 2010. “Volatility and Trading Activity: An Application of the Component- GARCH Model.” The Empirical Economics Letters 9: 99–106.Search in Google Scholar

Li, J., and C. Wu. 2006. “Daily Return Volatility, Bid-Ask Spreads, and Information Flow: Analyzing the Information Content of Volume.” Journal of Business 79: 2697–2739.10.1086/505249Search in Google Scholar

Liesenfeld, R. 1998. “Dynamic Bivariate Mixture Models: Modeling the Behavior of Prices and Trading Volume.” Journal of Business and Economic Statistics 16: 101–109.10.2307/1392020Search in Google Scholar

Liesenfeld, R. 2001. “A Generalized Bivariate Mixture Model for stock Price Volatility and Trading Volume.” Journal of Econometrics 104: 141–178.10.1016/S0304-4076(01)00062-8Search in Google Scholar

Lobato, I., and C. Velasco. 2000. “Long Memory in Stock Market Trading Volume.” Journal of Business and Economic Statistics 18: 410–427.Search in Google Scholar

Longin, F., and B. Solnik. 1995. “Is the Correlation in International Equity Returns Constant: 1960–1990?” Journal of International Money and Finance 14: 3–26.10.1016/0261-5606(94)00001-HSearch in Google Scholar

Luukkonen, R., P. Saïkkonen, and T. Teräsvirta. 1988. “Testing Linearity Against Smooth Transition Autoregressive Models.” Biometrika 75: 491–499.10.1093/biomet/75.3.491Search in Google Scholar

Mougué, M., and R. Aggarwal. 2011. “Trading Volume and Exchange Rate Volatility: Evidence for the Sequential Arrival of Information Hypothesis.” Journal of Banking and Finance 35: 2690–2703.10.1016/j.jbankfin.2011.02.028Search in Google Scholar

Poon, S.-H., and C. W. Granger. 2003. “Forecasting Volatility in Financial Markets: A Review.” Journal of Economic Literature 41: 478–539.10.1257/.41.2.478Search in Google Scholar

Phillips, P. C. B., and P. Perron. 1988. “Testing for a Unit Root in Time Series Regressions.” Biometrika 75: 335–346.10.1093/biomet/75.2.335Search in Google Scholar

Richarson, M., and T. Smith. 1994. “A Direct Test of the Mixture of Distribution Hypothesis: Measuring the Daily Flow of Information.” Journal of Financial and Quantitative Analysis 29: 101–116.10.2307/2331193Search in Google Scholar

Saatcioglu, K., and L. T. Starks. 1998. “The Stock Price-Volume Relationship in Emerging Stock Markets, The Case of Latin America.” International Journal of Forecasting 14: 215–225.10.1016/S0169-2070(98)00028-4Search in Google Scholar

Sims, C. A. 1980. “Macroeconomics and Reality.” Econometrica 48: 1–48.10.2307/1912017Search in Google Scholar

Solnik, B., C. Boucrelle, and Y. Le Fur. 1996. “International Market Correlation and Volatility.” Financial Analyst Journal, September–October, 17–34.Search in Google Scholar

Subrahmanyan, A. 1991. “A Theory of Trading in Stock Index Futures.” Review of Financial Studies 4: 17–51.10.1093/rfs/4.1.17Search in Google Scholar

Tauchen, G., H. Zhang, and M. Liu. 1996. “Volume, Volatility, and Leverage: A Dynamic Analysis.” Journal of Econometrics 74: 177–208.10.1016/0304-4076(95)01755-0Search in Google Scholar

Tauchen, G., and M. Pitts. 1983. “The Price Variability–Volume Relationship on Speculative Markets.” Econometrica 51: 485–505.10.2307/1912002Search in Google Scholar

Teräsvirta, T. 1994. “Specification, Estimation and Evaluation of Smooth Transition Autoregressive Models.” Journal of the American Statistical Association 89: 208–218.Search in Google Scholar

Teräsvirta, T., and H. M. Anderson. 1992. “Characterizing Nonlinearities in Business Cycles Using Smooth Transition Autoregressive Models.” Journal of Applied Econometrics 7: 119–136.10.1002/jae.3950070509Search in Google Scholar

Ureche-Rangau, L., and Q. DeRorthays. 2009. “More on the Volatility-Trading Volume Relationship in Emerging Markets: The Chinese Stock Market.” Journal of Applied Statistics 36: 779–799.10.1080/02664760802509101Search in Google Scholar

Ureche-Rangau, L., F. Collado, and U. Galiay. 2011. “The Dynamics of the Volatility–Trading Volume Relationship: New Evidence from Developed and Emerging Markets.” Economics Bulletin 31: 2569–2583.Search in Google Scholar

Van Dijk, D., T. Teräsvirta, and P. H. Franses. 2002. “Smooth Transition Autoregressive Models–a Survey of Recent Developments.” Econometric Review 21: 1–47.10.1081/ETC-120008723Search in Google Scholar

Wagner, N., and T. A. Marsh. 2005. “Surprise Volume and Heteroskedasticity in Equity Market Returns.” Quantitative Finance 5: 153–168.10.1080/14697680500147978Search in Google Scholar

Wang, J. 1994. “A Model of Competitive Stock Trading Volume.” Journal of Political Economy 102: 127–168.10.1086/261924Search in Google Scholar

Wang, H. 2004. Dynamic volume-volatility relation. University of Hong Kong School of Economics and Finance Working Paper.10.2139/ssrn.603841Search in Google Scholar

Wang, P., P. Wang, and A. Liu. 2005. “Stock Return Volatility and Trading Volume: Evidence from the Chinese Stock Market.” Journal of Chinese Economic and Business Studies 3: 39–54.10.1080/14765280500040518Search in Google Scholar

Wang, T., and Z. Huang. 2012. “The Relationship Between Volatility and Trading Volume in the Chinese Stock Market: A Volatility Decomposition Perspective.” Annals of Economics and Finance 13: 217–242.Search in Google Scholar

Zakoian, J. 1994. “Threshold Heteroskedastic Models.” Journal of Economic Dynamics and Control 18: 931–995.10.1016/0165-1889(94)90039-6Search in Google Scholar

©2013 by Walter de Gruyter Berlin Boston

Articles in the same Issue

- Masthead

- Masthead

- The Danish krone-euro exchange rate and Danmark Nationalbank intervention operations

- Common large innovations across nonlinear time series

- The forward rate premium puzzle: a case of misspecification?1)

- A smooth transition long-memory model

- Nonlinear causality tests and multivariate conditional heteroskedasticity: a simulation study

- Threshold linkages between volatility and trading volume: evidence from developed and emerging markets

- Inventory investment and the business cycle: the usual suspect

Articles in the same Issue

- Masthead

- Masthead

- The Danish krone-euro exchange rate and Danmark Nationalbank intervention operations

- Common large innovations across nonlinear time series

- The forward rate premium puzzle: a case of misspecification?1)

- A smooth transition long-memory model

- Nonlinear causality tests and multivariate conditional heteroskedasticity: a simulation study

- Threshold linkages between volatility and trading volume: evidence from developed and emerging markets

- Inventory investment and the business cycle: the usual suspect