Abstract

We present a two-country model featuring risky lending and cross-border interbank market frictions. We find that (i) the strength of the financial accelerator, when applied to banks operating under uncertainty in an interbank market, will critically depend on the economic and financial structure of the economy; (ii) adverse shocks to the real economy can be the source of banking crisis, causing an increase in interbank funding costs, aggravating the initial shock; and (iii) asset purchases and central bank long-term refinancing operations can be effective substitutes for, or supplements to, conventional monetary policy.

1 Introduction

In the years following the global financial and the euro area sovereign debt crisis, the process of financial integration in the euro area moved into reverse as firms and households in the southern European periphery started to face much higher borrowing costs than their counterparts in the northern core. One of the key channels at the heart of this financial fragmentation was the interbank market, where the costs of cross-border lending rose sharply, and volumes fell dramatically, in particular in peripheral economies, thereby likely having contributed to reinforcing the macroeconomic fallout from the sharp collapse in aggregate demand. Although market segregation gradually receded over the past few years, probably also thanks to the actions taken by the European Central Bank (ECB), normal market functioning has not yet been fully restored. At face value, these facts contradict the predictions of standard open-economy models in which complete financial markets can be expected to facilitate, rather than to mute, effective risk-sharing and thereby help temper the adverse effects of asymmetric shocks.

Against this background, and with a view to improving our understanding of recent events, this article analyses the role of frictions in the interbank market of a currency union and examines how unconventional monetary policy measures may mitigate, or offset, the effects such frictions may have on financial conditions and, ultimately, on output and inflation. To this aim, we develop, calibrate and simulate a two-country dynamic stochastic general equilibrium (DSGE) model in which lending banks obtain funds from both domestic and foreign savings banks to refinance mortgage and private-sector business loans, but where interbank lending is subject to both borrower and country-specific idiosyncratic risk. Using this framework, we show that (i) the strength of the financial accelerator, when applied to banks operating under uncertainty in an interbank market, will critically depend on the economic and financial structure of the economy; (ii) adverse shocks to the real economy can be the source of banking crises, causing an increase in the interbank funding costs, aggravating the initial shock; and (iii) asset purchase policies and central bank long-term refinancing operations can both be an effective substitute, or complement, to changes in the conventional monetary policy instrument.

The interbank market plays a pivotal role in the euro area. Its smooth functioning is central for banks to cope efficiently with idiosyncratic liquidity shocks and to ensure a uniform transmission of the common monetary policy stance. Frictions in the interbank market may blur the signal coming from monetary policy and ultimately hamper its transmission. One reason why interbank markets may not operate efficiently has to do with transaction costs: owing to the unsecured lending nature of the market, and its over-the-counter (OTC) structure,[1] trading relationships are often plagued by asymmetric information, counterparty risk, and search and monitoring costs (see e.g., Afonso, Kovner, and Schoar 2011; Flannery 1996). As a result, banks’ wholesale market funding costs may differ across the currency union, and some banks may face hard borrowing constraints, which could affect both credit supply and the ultimate borrowing conditions of the non-financial sector. This also means that interbank market rates may be insufficient to characterize the monetary policy stance, even at times away from the effective lower bound.

These frictions are particularly relevant in cross-border transactions, where differences in banking supervision up until the introduction of the Single Supervisory Mechanism (SSM) in 2014,[2] the state of the business cycle, insolvency laws or accounting standards may obfuscate the evaluation of the creditworthiness of foreign banks and expose lenders to uncertain counterparty risk. Freixas and Holthausen (2005) show that such market imperfections may cause liquidity shortages or the payment of interest rate premia that reflect the adverse selection of borrowers across countries. In crisis times, these effects may become even more visible. Using bank-to-bank loan-level data from TARGET2[3], Abbassi et al. (2014) find that for the same borrower on the same trading day, and after controlling for lender and borrower fixed effects, cross-border loans were up to 25 basis points more expensive than domestic loans in the first three months following the collapse of the former investment bank Lehman Brothers in 2008. De Andoain, Hoffmann, and Manganelli (2014) estimate that the premium charged to banks in more stressed economies spiked even more dramatically, reaching over 63 basis points. The presence of risk premia unrelated to the specific borrower suggests that information asymmetry constraints are important and that factors other than direct counterparty risks may also drive pricing behavior in interbank markets. Despite the empirical studies quantifying the effects of financial fragmentation, the precise source of these cross-border frictions remains an open question. A common view is that the risk of cross-border lending, particular to stressed economies, was being reassessed in the presence of imperfect information[4]. This view motivates the inclusion of an additional monitoring cost in the cross-border interbank market that rises in the face of heightened risk.

Cross-border interbank lending has been and continues to be an important element of the financial structure in the euro area. Prior to the outbreak of the global financial crisis, more than half of the average daily turnover in the unsecured market was with non-domestic euro area counterparts (ECB 2009a). Strong credit growth in parts of the euro area, buoyant financial innovation and lax financial regulation all contributed to an increasing reliance on confidence-sensitive wholesale funding, with banks in current account surplus countries providing funding to banks in current account deficit countries (see van Rixtel and Gasperini 2013). After the outbreak of the crisis, the share of cross-border interbank lending fell dramatically to just over 25% in 2013 before recovering again to reach levels around 40% in 2014, the latest available figures according to the ECB (ECB 2015).

These sharp variations in the funding structure of banks – broadly speaking the mix between wholesale and deposit funding – may have had severe repercussions on their operations and their willingness and ability to extend credit to the non-financial sector. Several empirical studies document that banks whose liabilities are mainly sticky household deposits, which are often protected by generous government insurance schemes, continued to lend in the aftermath of the crisis, whereas banks that relied predominantly on debt funding fared worse (Cornett et al. 2011; Demirgüç-Kunt and Huizinga 2010; Ivashina and Scharfstein 2010). In other words, wholesale funding, and cross-border funding in particular, makes banks more vulnerable to changes in market financing conditions with possibly strong repercussions on bank lending. These studies therefore tend to suggest that real shocks may be amplified, and financial shocks accelerated, by banks’ structural recourse to wholesale financing.

Despite its empirical relevance, however, few efforts have been undertaken to study the main mechanisms and propagation channels of the interbank market in a structural model of the macroeconomy. Indeed, financing frictions were long absent in a general equilibrium context. The dominance of the Modigliani-Miller theorem (1958) that the financing structure of a firm is irrelevant for its value confined the analysis to real and nominal frictions in the wider economy (Christiano, Eichenbaum, and Evans 2005; Smets and Wouters 2007). The seminal work by Bernanke, Gertler, and Gilchrist (1999) and the subsequent contributions by Christiano, Motto, and Rostagno (2003, 2010, 2014) and Iacoviello (2005) made financial factors acceptable, and even desirable, in workhorse general equilibrium models. Their studies showed that asymmetric information, agency problems and borrowing constraints are important factors in driving and amplifying business cycles.

Yet, less progress has been made in understanding the impact of the financing structure of banks on lending conditions of the private sector and, hence, on aggregate output and inflation. In the pioneering work of Bernanke, Gertler, and Gilchrist (1999) and Christiano, Motto, and Rostagno (2003), and in work that followed (cf. Christensen and Dib 2008; De Graeve 2008; Goodfriend and Mccallum 2007), banks were either relegated to act as simple intermediaries between savers and borrowers or were operating under perfect competition.

It was only more recently that a more prominent role was given to banks in general equilibrium models. Gerali et al. (2010) and Darracq Paries, Sørensen, and Rodriguez-Palenzuela (2011) illustrate the effects of imperfect competition in the banking industry on credit spreads and show that changes in banks’ leverage ratio can impact loan supply conditions. However, in these models, banks can obtain funding in a frictionless interbank market at the rate set by the central bank. Others have made attempts to model the interbank market more explicitly. Gertler and Kiyotaki (2010), building on Kiyotaki and Moore (1997), introduce a borrowing constraint in the interbank market by assuming that banks may divert borrowed assets for personal gain, causing a spread between lending and deposit rates. In the face of an adverse shock, this spread widens, which raises the cost of credit of firms, affecting real activity.

Dib (2010) and de Walque, Pierrard, and Rouabah (2010) include an interbank market in which, due to an implicit enforceability problem, borrowing banks can choose an optimal level of default,[5] and where banks must hold a regulatory level of capital. Calibrated for the US economy, both papers show that bank capital attenuates, rather than amplifies, the real effects of shocks in this framework. Hilberg and Hollmayr (2011) incorporate a secured interbank market into an otherwise standard DSGE model and study the impact of central bank collateral policy on interbank lending rates. They show that a change in the haircut applied to central bank refinancing operations can be effective in steering interbank rates, but that the presence of an interbank market also attenuates the effects of conventional monetary policy. Similarly, Carrera and Vega (2012) model the interactions between banks’ reserve requirements and interbank lending activity, which they assume is costly due to monitoring costs. They find that an increase in required reserves increases demand in the competitive interbank market and pushes up the interest rate charged on these operations as lending banks will have to pay higher monitoring costs. Funding conditions in the interbank market then trickle down to lending and deposit rates, affecting real activity. In the framework of Carrera and Vega (2012), changes in reserve requirements are therefore qualitatively similar to traditional changes in policy rates.

Cross-border interbank lending, by contrast, has been largely ignored so far in the literature. In’t Veld and van Lelyveld (2014) examine the role of international capital flows in the boom-bust cycle in Spain by allowing borrowing-constrained households to borrow directly from foreign lenders. Using an estimated three-country model, they find that the convergence of interest rates in Spain to the levels prevailing in other euro area Member States, a loosening of collateral constraints as well as falling risk premia on Spanish housing and capital has fueled the Spanish housing boom. In similar spirit to our paper, Ueda (2012) studies the international propagation of shocks in an open economy model in which banks lend both domestically and internationally. Whereas intermediaries in our model face a single-layer credit constraint with two parts: a cross-border cost of credit that increases in domestic risk, and the Bernanke, Gertler, and Gilchrist (1999) financial accelerator; Ueda (2012) introduces nested credit constraints so both firms and intermediaries face an external finance premium. The authors use this to assess the necessary conditions to cause a global economic downturn, whereas we focus on the role of policy when cross-border frictions are present. Poutineau and Vermandel (2015) model the banking sector explicitly in a two-country DSGE model. Contrary to Quint and Rabanal (2014), who study the optimal design of macro-prudential policies in the euro area in a two-country DSGE model, they allow for cross-border lending to firms and banks. They find that cross-border loans amplify the propagation of country-specific shocks. Dräger and Proaño (2015) also allow for cross-border banking where an international wholesale branch is collecting deposits from across the currency union and distributes them to retail banks in the two countries. Although their model does not give rise to interbank flows, similar to Poutineau and Vermandel (2015), they find that cross-border banking amplifies the effects of exogenous shocks in a currency union.

In this article, we try to bring the various strands of the literature together by incorporating credit risk in the interbank market of a currency union in a New Keynesian two-country, two-sector model with sticky prices, habits in consumption and investment adjustment costs. There are two types of banks in each country: savings banks, which have excess liquidity that they are willing to trade across borders in the interbank market, and lending banks, which operate under a structural liquidity deficit and require funding that they can obtain from the unsecured area-wide interbank market. Following the costly state verification framework of Bernanke, Gertler, and Gilchrist (1999), lending banks face idiosyncratic loan return shocks that are unobservable from the point of view of savings banks. A positive probability of default gives rise to an external finance premium that depends on the leverage of the borrower.

In addition, lending banks face a risk premium when taking a position in the cross-border interbank market. This second friction is in the same spirit as the external financial intermediation premium in Christoffel, Coenen, and Warne (2008), but tailored to the features of an interbank market: when the risk in the domestic economy increases, foreign lenders demand a higher rate of interest vis-à-vis the borrower from that country as counterparty risk rises, thereby driving a further wedge between the policy rate and interbank lending rates.

We use our model to answer three important questions: (1) how is the transmission of monetary policy in a currency union affected when financing conditions in the interbank market depend on the quality of banks’ balance sheets; (2) how do asymmetric shocks to the value of assets propagate through a currency union when savings banks differentiate between domestic and foreign borrowers in the interbank market; and (3) how effective are some of the measures central banks have taken in the recent past to address funding bottlenecks in the interbank market?

Regarding the first question, we find that our model exhibits the financial accelerator effect (see Bernanke, Gertler, and Gilchrist 1999) in the face of a common monetary policy shock but that, compared to previous findings in the literature, there are noticeable differences in the way our model can give rise to changes in the transmission of monetary policy. In particular, compared to a situation where the financial accelerator operates directly at the balance sheet of firms, the strength and at times also the direction of propagation crucially depends on the share of saver households in the economy, the asset composition of lending banks’ balance sheets and the degree of competition in the lending market.

Regarding the second question, our model is able to replicate some of the key features of the financial crisis that resulted in a segmented interbank market.[6] We show that capital flows resulting from international financial integration can be highly procyclical, fluctuating in response to business cycles, thereby raising financial and economic fragility even before a crisis emerges, mainly by fostering credit growth. This means that in the wake of an adverse shock to the value of assets in one country, the rate charged by foreign lenders in the common interbank market will rise as banks’ balance sheets deteriorate amid a fall in the collateral value. The increase in the interbank funding cost of banks in this economy offsets, to some extent, the effort by the central bank to stimulate the (area-wide) economy by lowering the policy rate in response to the initial shock. That is, compared to a model without cross-border interbank lending, and contrary to union-wide shocks, monetary policy will be less effective. Moreover, as foreign funding becomes more expensive, the economy that draws the shock is forced to improve its trade balance more sharply relative to the case without financial frictions.

Finally, we study the effectiveness of two of the ECB’s recent non-standard measures. We find that providing long-term refinancing operations (LTROs) to banks increases the effectiveness of monetary policy per unit of stimulus – that is, LTROs empower conventional monetary policy. The second policy focuses on the ECB’s asset-backed securities purchase programme (ABSPP) that is particularly well suited to study in our model economy. Although securitization is more complex in practice, the ultimate effects of the ABSPP can be well approximated by assuming that the central bank purchases risky loans directly from banks, thereby freeing up bank balance sheet capacity and reducing their funding costs in the interbank market. We find that asset purchases in the form of loans, either directly or through purchases of ABS, can be an effective substitute, or complement, to reductions in the key policy rate.

The rest of the paper is organized as follows. Section 2 lays out the model setup. Section 3 discusses model calibration and Section 4 presents numerical simulations, illustrating the role of the interbank market in driving the dynamics of the model. Section 5 analyzes the effects of the ECB’s policy measures, while Section 6 offers some concluding remarks.

2 The Model

The model is made up of two economies that share a single currency and monetary policy. In each economy there are two types of households, savers and borrowers, monopolistic competitive firms, savings and lending banks as well as a fiscal authority. The two economies, of size n and (1−n), trade in both non-durable consumption goods and financial services in the form of interbank credit. In the following, we describe the decision-making problems of the economic agent’s resident in the home economy. Unless otherwise stated, analogous conditions hold for the foreign economy. The time notation refers to the period in which the value is determined.

2.1 Households

The household sector is made up of a mass λ ∈ [0, 1] of patient households with discount factor β and (1−λ) of impatient households with discount factor β B < β. The patient households are referred to as the savers and the impatient households as the borrowers.

2.1.1 Savers

The saver household h ∈ [0, λ] chooses the level of consumption of non-durable goods C h, t , hours worked L h, t , the housing stock D h, t , and bank deposit savings S h, t to maximize its lifetime utility

subject to the nominal budget constraint

where ϱ determines the relative weight of non-durable consumption in the saver’s utility and κ the degree of external habit formation in consumption. The parameter ϕ refers to the inverse of the Frisch labor supply elasticity.

Because saver households have the same preferences over consumption, housing, labor, savings and investment, and are assumed to have the same initial wealth, we focus on a representative saver from now onwards and drop the h subscript. The saver household chooses the optimal inter-temporal plan subject to the budget constraint, resulting in a set of familiar first-order conditions that will hold in equilibrium:

where

2.1.2 Borrowers

Preferences of the borrowers are the same as those of the saver except for the difference in the time discounting. Borrower household h ∈ [λ, 1] maximizes

subject to the nominal budget constraint

The notations are identical to the saver household and where the superscript B characterizes variables specific to borrowers. Following Kiyotaki and Moore (1997) and Iacoviello (2005), borrowers finance their consumption of housing with credit

That is, banks will only lend to the point that total repayment is a fraction m of the expected housing value, with a view to ensuring that households will not default the following period. Under uncertainty, the borrowers could self-insure in some states of the world by borrowing below the limit to protect against the effects of adverse shocks. To avoid issues introduced by occasionally binding constraints, we therefore follow Iacoviello (2005) and choose the parameter m to minimize the probability of this occurring.

The decision-making problems of the representative borrower household lead to a labor supply condition analogous to that of the saver household. The housing investment decision leads to an Euler equation of the form

This differs from that of the savers due to a wedge between the marginal utility of consumption and the marginal benefit of housing, introduced by the borrowing constraint. In the case that m = 0, so there is no constraint, the two expressions are analogous.

2.2 Firms

We introduce nominal rigidities in the price of consumption goods following Calvo (1983). To this end, we assume there are two types of firms in the model economy: intermediate goods firms that are price takers in perfect competition, and final goods firms that operate under monopolistic competition. There is ‘price-stickiness’ introduced in the latter sector as only a fixed proportion of firms is able to update prices each period.

2.2.1 Intermediate Goods Firms

Each intermediate goods producer purchases capital goods

where the superscript D indicates factor demand and A

t

and Z

t

are, respectively, stationary union-wide and country-specific total factor productivity shocks. Both are modeled as AR(1) processes:

where P

w,t

is the price at which the output is sold to all final goods firms. This implies that

If capital depreciates at rate δ K , it follows that the gross nominal return on capital is given by

The end-of-period capital purchase decision of firms will ensure the expected discounted gross return on capital will equal the expected discounted cost of funds. We will return to this in the discussion of the banking sector below.

2.2.2 Capital Producers

For convenience, and without loss of generality, we introduce perfectly competitive capital producers that make new capital goods and sell to firms. Capital follows the law of motion

where

The capital producers solve

where

2.2.3 Final Goods Producers

Each final goods producer firm j purchases output from the intermediate goods sector at price P

w,t

and converts it into a differentiated good sold at price

where σ denotes the elasticity of substitution between the different varieties, assumed to be identical across the currency union. Every period, each firm faces a fixed probability 1−ξ that it will be able to update its price. Denoting the optimal price at time t for good j as

The solution to the price-setting problem yields a price

Using the aggregate producer price index

While the distribution of prices is not required to track the evolution of the aggregate price index, it implies a loss of output due to dispersion in prices. Final output is given by

for non-optimizing firms j = 1, …, J. As a proportion (1−ξ) of firms will optimize prices in period t and knowing that the distribution of non-optimized prices will be the same as the overall distribution, price dispersion can be written as a law of motion:

2.2.4 Consumption Good Producers

Households purchase differentiated final goods and combine bundles of domestically produced goods and aggregate imports to produce the final consumption bundle according to

where τ C can be interpreted as the degree of home bias in household consumption expenditures, and θ C is the elasticity of substitution between domestic and foreign produced goods (see Armington 1969). H t and IM t are bundles of differentiated domestic and foreign-produced goods which households combine into baskets of goods using

where the asterisk indicates variables of the foreign country. The households purchase good H

t

(j) from producer j ∈ (0, 1) at price

Equivalent conditions for the domestic demand of the investment good and government consumption good hold. We assume no pricing to market, which implies that

This leads to the consumer price index

2.2.5 Housing Producers

The price of durable housing goods can differ from that of consumption goods due to the presence of adjustment costs. To ensure that savers and borrowers observe the same house price, we let housing good producers augment the existing total stock,

where we follow the same adjustment costs as faced in capital investment. The housing goods producers solve

which leads to the first-order condition

2.3 Financial Intermediation

There are two types of banks: savings banks that take deposits from domestic households and lend in the currency union-wide interbank market and lending banks that provide loans to both domestic firms and households and finance these using interbank borrowing and their own net worth. A financial friction emerges due to idiosyncratic loan return shocks faced by lending banks. Costly state verification leads to an external finance premium as in Bernanke, Gertler, and Gilchrist (1999). In addition, in light of the empirical evidence that borrower banks often have to pay a premium that reflects not borrower but country-specific risks when accessing the international interbank market (cf. Section 1), we add a further friction whereby cross-border interbank credit faces additional monitoring costs that depend on the prevailing risk in the lending market.

Savings banks operate under perfect competition with free entry, but aggregate shocks can lead to unexpected profits or losses. The banks are owned by the patient households who are paid all bank profits, or recapitalize banks if and when necessary. Lending banks face idiosyncratic shocks when extending credit to the real economy that are costly for creditors to observe. Limited liability implies that these banks earn profits in equilibrium. Lending banks are treated slightly differently to savings banks in that they pay a fixed dividend rate to ensure they cannot become fully self-funded, equivalent to the assumption of an exogenous exit rate or higher banker discounting (see e.g., Bernanke, Gertler, and Gilchrist 1999; Gertler and Kiyotaki 2010). The friction implies that equity is always more valuable than debt, without which banks would not pay dividends in equilibrium. Another difference is that savings banks can access central bank credit whereas lending banks cannot. This is in part motivated by the risk exposure and specialization of lending banks; savings banks are well diversified and the central bank requires a proportion of safe assets as collateral.

2.3.1 Lending Banks

There are many lending banks of unit mass indexed b ∈ [0, 1]. They extend credit CR

t

to the non-financial sector, which they finance with domestic

where, following Poutineau and Vermandel (2015),

where τ IB can be interpreted as a home bias in interbank borrowing and θ IB is the elasticity of substitution between domestic and foreign borrowing.[7] A non-zero θ IB implies that domestic and foreign interbank borrowing are not perfect substitutes, rendering differences in lending rates. Maximization yields the following familiar demand schedules:

where

When granting loans to the non-financial private sector, we assume that lending banks cannot diversify risk in their loan portfolio and that they experience idiosyncratic loan return shocks ω

t

(b) that affect the value of the asset side of their balance sheets.[8] The shocks are log-normally distributed,

After aggregate and idiosyncratic shocks hit the economy, net worth of lending banks evolves according to

where

The lending banks will pay the saver households a fixed dividend rate, investing all remaining profits in their own net worth. It is assumed that a defaulting bank will exit but that for every exiting bank, a new one enters and is given a small start-up fund by the other banks. This ensures that the number of banks is held constant at any point in time. The idiosyncratic loan return and default leads to a distribution of lending banks over all possible values of net worth.

The loan portfolio is comprised of mortgage loans to households

2.3.2 Savings Banks

A representative savings bank has access to the central bank’s liquidity providing operations CB

t

, raises deposits S

t

from patient households and extends both domestic

Solving the profit maximization problem,

subject to the balance sheet, leads to the zero-arbitrage condition

where

For the domestic market, the savings banks require the expected real return from granting each interbank loan to be equal to their expected real funding rate, using the household Euler equation. This can be written as

where

When taking positions in the cross-border interbank market, we assume that savings banks incur additional monitoring costs

which causes an increase to the monitoring costs following a shock to the variance of the idiosyncratic loan return shock. That is, country-specific risk shocks will cause an increase in the finance premium of borrowing banks in the cross-border interbank market[11]. Therefore, the participation constraint for international interbank loans can be expressed as

where

2.3.3 Interbank Credit Market

To model the over-the-counter structure of the interbank market, we follow Bernanke, Gertler, and Gilchrist 1999 in our treatment of the lending contract. The lending banks choose credit to the non-financial private sector CR

t

, the volume of interbank lending

where

The solution to the contract problem yields a condition that determines the wedge between the nominal risk-free rate

with key arguments given, although the nominal stochastic discount factors of both countries are also arguments of function s. In this solution, which is given in full in the online appendix, the expected real return to lending is equated with the real marginal cost of external finance. Because the solution is a function of the leverage rather than the bank size, the contract interest rates will be independent of the bank’s own history of shocks. As leverage increases, the capital-asset ratio

2.3.4 Firm and Household Credit

As discussed previously, firm loans are treated as equivalent to equity, and so the return on firm credit is simply the gross return on capital,

subject to

must hold in equilibrium.

2.4 Monetary Policy

The monetary authority sets the nominal short-term interest rate in response to deviations of the consumer price inflation rate from the union-wide inflation target

with weights

With a single policy rate, the economy as presented to this point features a unit root stemming from a single savings rate across both economies. As savers in both countries face the same return on assets, long-run effects from transitory shocks would prevail. For instance, if one of the economies were to draw a positive supply shock, its net foreign asset position would improve and the economy will have a current account surplus that would persist in the long run, with a permanent increase in the wealth of savers. To restore the stationary property of the model, we assume, consistent with past modeling practice in open-economy models, that the central bank applies a small premium on the refinancing rate that depends on the net foreign asset position NFA

t

of the home country.[13] The rates paid on central bank credit

where

Central bank funds are in zero net supply, so if savings banks in the home country borrow from the central bank, it follows that foreign country savings banks are depositors, and

2.5 Market Clearing Conditions

In each economy, the labor market is in equilibrium when total supply by households equals the demand from intermediate good producers

The corresponding domestic capital market equilibrium condition is given by

Total demand for domestically produced goods include the demand from domestic households

with g t following a stationary stochastic process. The net foreign asset position evolves according to the following nominal law of motion:

where the trade balance is defined as

The bilateral terms of trade are given by

and, as discussed previously, the central bank funds are in zero net supply worldwide, so

3 Calibration and Parametrization

A number of the structural parameters of our model are calibrated with the aim of matching key empirical first moments. Other parameters are based on previous estimates in the literature (see Table 1).

Calibration and parametrization of model parameters.

| Parameter | Description | Value |

|---|---|---|

| Β | Patient agent discount factor | 0.995 |

| β B | Borrowers discount factor | 0.94 |

| Ρ | Utility weight of non-durable consumption | 0.82 |

| τ C | Home-bias in consumption | 0.75 |

| Σ | Elasticity of substitution across consumption varieties | 3.86 |

| σ ω | Standard deviation of loan return shock | 0.0339 |

| γ | Retained share of bank profits | 0.947 |

| τ IB | Home-bias in interbank borrowing | 0.75 |

| g | Steady-state G/Y | 0.2 |

| λ | Fraction of savers | 0.65 |

| ϵ C | Habits formation | 0.564 |

| ϕ | Inverse Frisch elasticity | 0.4 |

| θ C | Elasticity between domestic goods/imports | 1.9 |

| α | Capital share of production | 0.3 |

| δ K | Capital depreciation rate | 0.025 |

| δ D | Housing depreciation rate | 0.025 |

| ζ K | Capital adjustment parameter | 5.2 |

| ζ D | Housing adjustment parameter | 1.75 |

| Ξ | Calvo parameter | 0.9 |

| Μ | Monitoring costs | 0.2 |

| M | Borrowers LTV ratio | 0.55 |

| θ IB | Elasticity of substitution between domestic/cross-border interbank credit | 2 |

| ζ σ | Cross-border interbank cost coefficient | 0.01 |

| φ y | Taylor rule response to output growth | 0.15 |

| φ π | Taylor rule response to inflation | 1.9 |

| φ r | Taylor rule persistence | 0.87 |

|

|

Inflation target | 1.005 |

On the household side, we fix the fraction of savers λ in each economy to 0.65, close to the estimate obtained by Quint and Rabanal (2014). The annualized inflation target is set to 2%, and the discount factor of savers (borrowers) β (β B ) is chosen to be 0.995 (0.94), ensuring a nominal steady-state annual return on risk-free savings of around 4%. External habit in consumption κ is set at 0.564 according to estimates of Christoffel, Coenen, and Warne (2008) for the euro area. The relative share of non-durables in consumption ϱ is calibrated to be 0.82 to target the output share of housing investment. The inverse of the Frisch labor supply elasticity ϕ is parametrized to be 0.4 (cf. Quint and Rabanal 2014). The quasi-share of domestic goods in total consumption τ C is fixed at 0.75 to ensure a steady-state share of imports in consumption of 25%. The elasticity of substitution between domestic goods and imports θ C is set at 1.9 in line with Quint and Rabanal (2014) estimates.

On the production side, we choose a value of 0.3 for the share of labor α in the Cobb-Douglas production function. Capital depreciation δ

K

and housing depreciation δ

D

are assumed to be 10% per annum. Adjustment costs ζ

K

in capital investment are fixed at 5.2 (following estimations in Christoffel, Coenen, and Warne 2008), while those in housing investment (

On the banking side, savings banks’ monitoring costs, μ, are assumed to be 0.2 as in Quint and Rabanal (2014) and Carlstrom and Fuerst (1997). For the borrowers’ loan-to-value ratio, we use the estimated value of m = 0.55 from Iacoviello (2005). The steady-state standard deviation of the loan return shock, σ

ω

, and the bank dividend payment rate, 1−γ, are calibrated to 3.39 percentage points and 4.53% respectively to target a steady-state value of the loan-to-value ratio of banks

On the policy side, we fix the share of government spending in GDP at 20%. Together with the other parametrization of our model, this ensures that we are able to get close matches of the relative spending shares of consumption (59%), investment (21%) and housing investment (4.5%) in GDP with their empirical first moments for the euro area as a whole. Regarding monetary policy, we follow Christoffel, Coenen, and Warne (2008) and set the central bank response to inflation

Finally, the standard deviations and persistence coefficients of the shock processes are largely taken from Christoffel, Coenen, and Warne (2008), with the exception of the risk shock, which is taken from Quint and Rabanal (2014), and the government spending shock, which has been calibrated on the basis of estimates obtained by Smets and Wouters (2003). For the interbank risk premium shock, for which no estimates in the literature are available, we assume a persistence of 0.8 and a standard deviation of 0.2. These are shown in Table 2.

Parametrization of shock parameters.

| Parameter | Description | Value |

|---|---|---|

| σ A | Technology shock | 0.0126 |

| σ G | Government spending shock | 0.00325 |

| σ IB | Interbank cost shock | 0.2 |

| σ σ | Risk shock | 0.00339 |

| σ M | Monetary policy shock | 0.00115 |

| ρ A | Technology shock | 0.9 |

| ρ G | Government spending shock | 0.95 |

| ρ IB | Interbank cost shock | 0.8 |

| ρ σ | Risk shock | 0.85 |

4 Numerical Results and Analysis

To evaluate the model dynamics, we compute a second-order Taylor approximation of the decision and transition functions and simulate impulse response functions[14]. In a first step, we look at the implication of our interbank market setup for the transmission of monetary policy by considering a standard monetary policy shock. In a second step, we analyze how frictions in the cross-border interbank market may affect the dynamics of the economy in the face of country-specific idiosyncratic shocks.

4.1 The Interbank Market and the Transmission of Monetary Policy

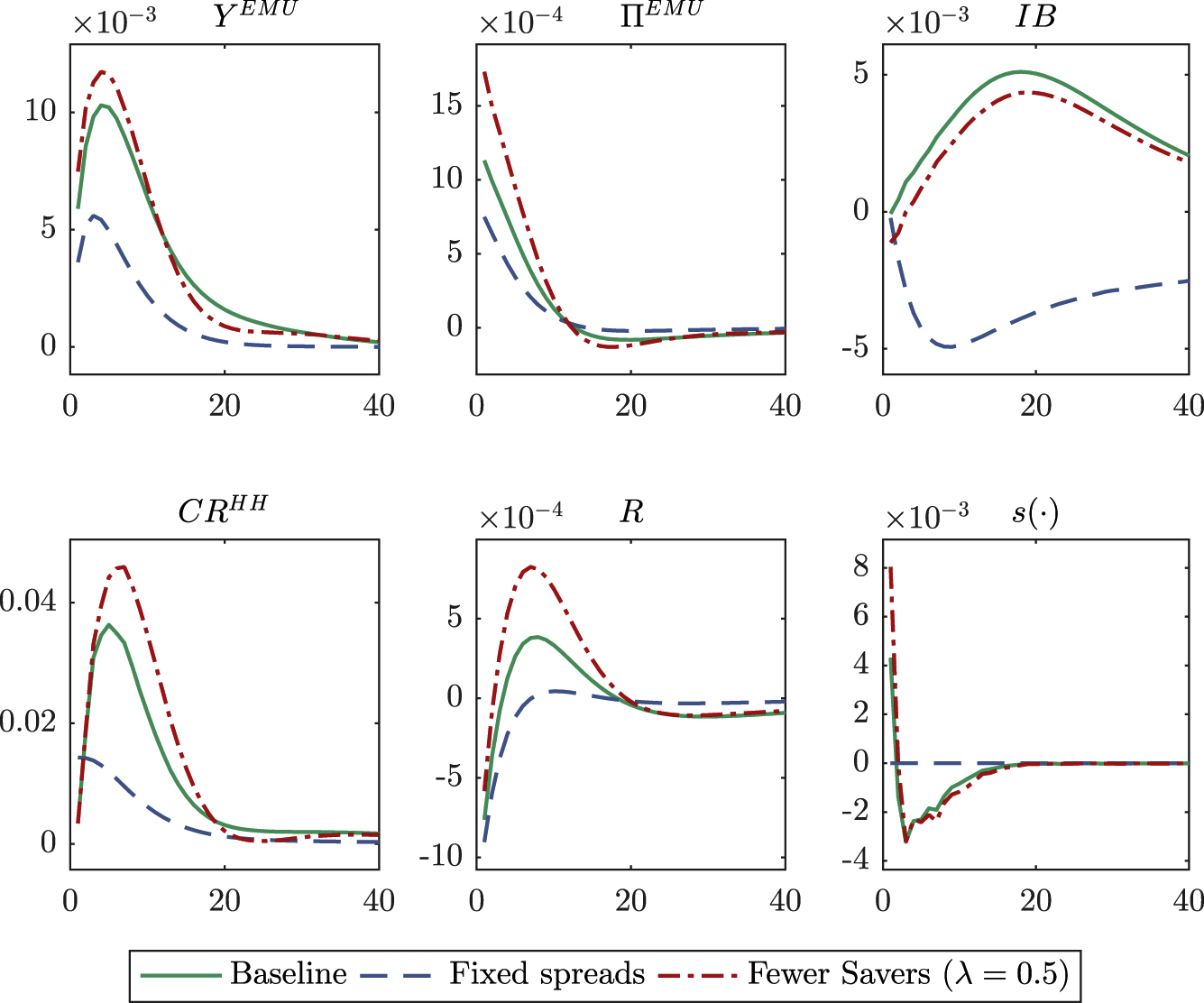

Figure 1 shows the impulse responses of a number of variables to a reduction in the union-wide policy rate and compares these to a modified version of our model in which the interbank frictions are shut off, that is, the model collapses to one of complete financial markets where the spread between bank lending rates and the policy rate is fixed to its steady-state value.

Impulse response functions to a negative monetary policy shock. s(⋅) is the external finance premium. Relative deviations from the stochastic steady state except rates, which are in levels.

In both instances, the interest rate controlled by the monetary authority drops by about the same amount initially. In our baseline model, however, the unanticipated reduction in interest rates leads to an increase in the value of collateral held by lending banks. This, in turn, lowers their funding costs in the interbank market as the perceived risk of default falls. Lending banks operating under perfect competition will pass through the relief in funding costs to their final customers, causing mortgage rates and financing costs faced by non-financial firms to drop by more than the initial reduction in the key policy rate.

It is this additional fall in the borrowing conditions of households and firms that then leads to more investment, more housing demand and, ultimately, higher domestic demand and inflation in the currency union. In other words, like in Bernanke, Gertler, and Gilchrist (1999), the transmission of a conventional change in monetary policy is more powerful in affecting broader macroeconomic conditions. However, unlike in Bernanke, Gertler, and Gilchrist (1999), the amplification in transmission comes directly from banks operating in an interbank market characterized by uncertainty on the part of savings banks when extending short-term credit to counterparties in need of liquidity.

This implies that there are major differences to a situation where the financial accelerator operates directly at the balance sheet of firms. The impact on aggregate demand, as well as the strength of the pass-through of interbank conditions to final borrowing conditions, will ultimately depend on three factors: the relative share of saver and borrower households in the economy, the structure of lending banks’ balance sheets and the degree of competition in the lending market. Starting with the latter, the less concentrated the lending market is, the stronger is the pass through and the more pronounced are the effects on the real economy. That is, modifications of our model along the lines of Gerali et al. (2010), introducing monopolistic competition in the banking sector, can be expected to dampen the accelerator effect as banks would pass on lower interbank funding costs at a pace slower than under our baseline model. Similarly, the larger the share of bank lending to households, the larger the impact on output, given the role played by private consumption in aggregate demand. And, finally, although the friction lowers borrowing costs for firms and impatient households, Figure 1 also shows that the policymaker keeps the interest rate higher relative to the fixed spread economy due to increased output and inflation. Saver households hence face a higher savings rate, causing them to consume less non-durable and durable goods in response. This effect offsets, to some extent, the increase in housing investment coming from borrowers.

We illustrate this last point in 1: the red dashed line shows our baseline model, assuming, however, a smaller share of savers λ = 0.5. As expected, because the financial friction reduces borrowing costs beyond the initial change in the policy rate, the more borrowers there are, the larger the accelerator effect. Fewer savers, in turn, imply that the offset from a higher policy, and hence savings rate, will also be smaller.

Overall, therefore, our simulations tend to suggest that, contrary to previous findings in the literature (e.g., Hilberg and Hollmayr, 2011), the presence of an interbank market can, and in many circumstances is very likely to, amplify changes in the key policy rate. And although the mechanism is similar to the well-known financial accelerator, there are noticeable differences in the way our model setup can give rise to changes in the transmission of monetary policy.

4.2 Asymmetric Shocks and Cross-Country Spillovers

A key result of the previous section is that union-wide shocks will propagate differently through the economy once financial frictions are allowed for and that it matters whether these frictions are operating on the banking or the firm side. In this section we will focus on the implications of our interbank market setup for the propagation and impact of idiosyncratic country-specific shocks. Specifically, we look at how a positive shock to the variance of the idiosyncratic loan return shock ω(b) will affect the behavior of banks in the cross-border interbank market and analyze the footprint this will ultimately leave on aggregate demand.

Recall that savings banks incur additional monitoring costs when taking positions in the cross-border interbank market. These costs are a function of the prevailing level of “economic” risk (cf. equation (2.29)). Therefore, a shock that raises the skewness of the distribution of ω(b) in one country but not in the other, and hence increases the relative risk of bank default, will cause savings banks to raise the risk premium they charge to borrowers resident in the economy hit by the shock, even though the average loan return remains unchanged.

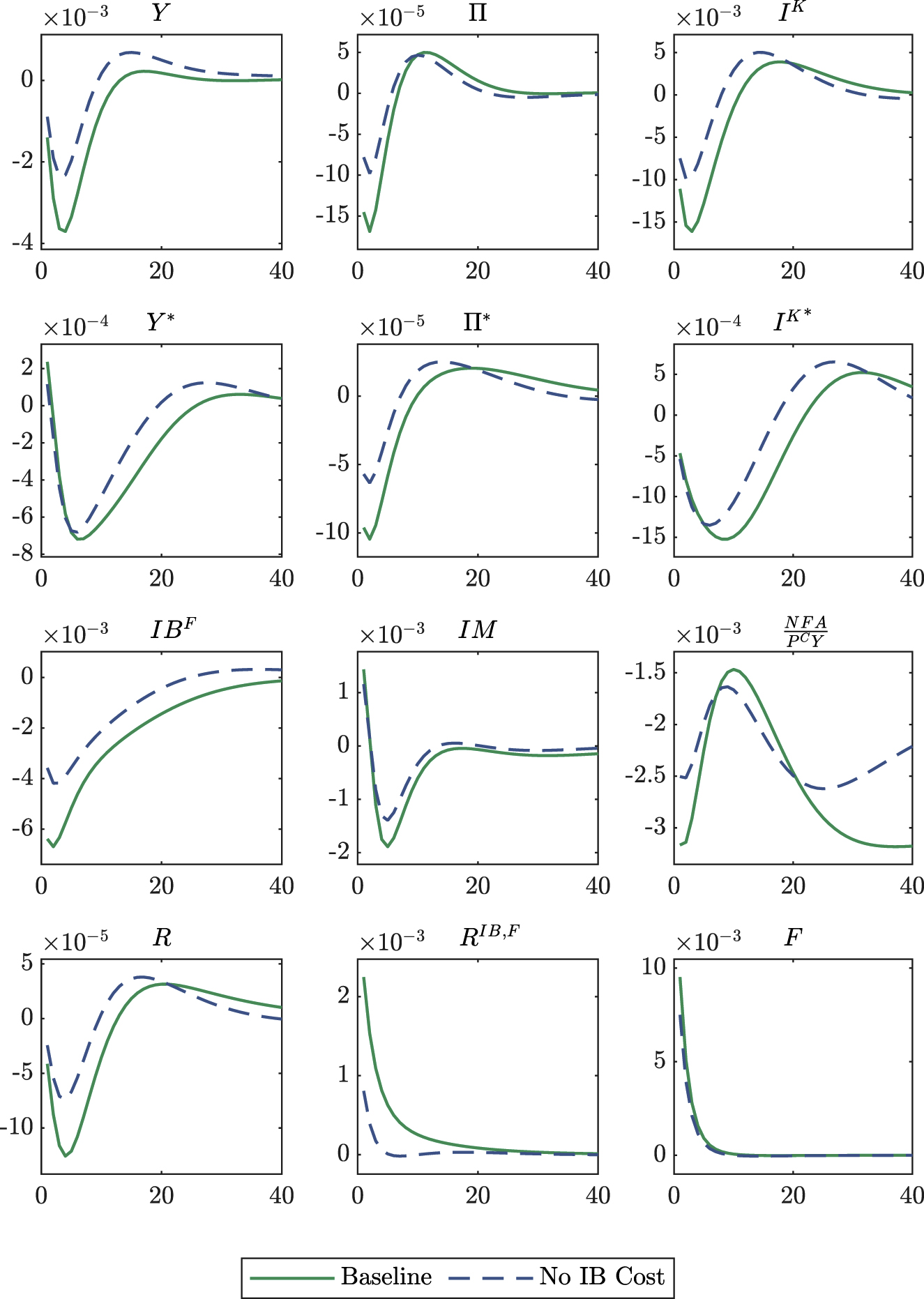

This can be seen in Figure 2: in our baseline model the funding rate in the cross-border interbank market,

Impulse response functions to a transitory risk shock in the home country, comparing baseline model with a version with ζ σ = 0. Relative deviations from the stochastic steady state except rates and relative NFA, NFA/P C Y, and the probability of bank default, F, which are in levels.

Cross-border monitoring costs are, however, only an amplifier of a natural response of our modeling choice. As can be seen in Figure 2, banks resident in the foreign economy would have increased their cross-border interbank rates even in the absence of these costs and despite a measurable reduction in the union-wide monetary policy rate. The reason has to do with the built-in increase in the risk of bank default: with output contracting in response to the shock, domestic banks’ leverage rises, causing foreign banks to increase their lending rates.

What is more, with lending to the real economy having become riskier in the wake of the shock, domestic savings banks too will ration their supply of interbank funds and will increase the rate they charge on the remaining funds, causing a contraction in credit supply to the real economy. The consequences are well-known: with credit less abundant and more expensive, both households and firms reduce their investment and housing activities, amplifying the contraction in aggregate demand that would have prevailed in the absence of frictions in the interbank market.

The consequence is that interbank markets characterized by risky lending and costly state verification have the potential to render monetary policy less effective by contributing to the fragmentation of trades across borders, something that has become evident in the euro area during and after the sovereign debt crisis. At that time, the transmission of the ECB’s monetary policy to banks in the periphery had become severely impaired: although it cut its main refinancing rate by 85 basis points between July 2012 and June 2014, bank lending rates to firms in Spain, for example, fell only by some 20 basis points over the same period, reflecting, in part, effective credit rationing in the (cross-border) interbank market. In response to these impairments, the ECB, starting in June 2014, decided on a number of non-standard measures that aimed at restoring the transmission of monetary policy. Some of these measures are the subject of our analysis in the next section.

5 The Effects of Unconventional Monetary Policy

In this final section we ask whether recent non-standard monetary policy measures have been able to overcome, or mitigate, frictions in the interbank market. The two policies we discuss are long-term central bank refinancing operations and asset purchases.

5.1 Long-Term Refinancing Operations

In our model economy, savings banks have access to funding from the central bank (cf. Section 2.3.2). In addition to standard one-period loans to banks, in this policy exercise, the operations of the central bank may take the form of multi-period loan contracts, similar to the ECB’s LTROs[16]. To prevent corner solutions whereby savings banks will choose only short-term or only long-term funding, the central bank sets a single target policy rate on multi-period bonds and allows the short-term rate to be set via the zero-arbitrage condition. As discussed in Section 2.3.2, the short-term central bank funds will be in zero net supply union-wide. This is also the case with long-term funds. Indeed, in equilibrium, we will find that savings banks will not hold long-term bonds at all; the availability of these loans is sufficient to introduce a wedge between the policy rate on long-term refinance operations and the household saving rate.

To maintain tractability and keep the number of state variables manageable, we follow Rudebusch and Swanson (2012) [17] and introduce multi-period loan contracts using geometrically decaying repayments over an infinite horizon. This setup reflects the aggregation of a large number of loans at different points of repayment and of different maturities. As well as introducing just one new state variable rather than potentially very many with long maturities, the appeal is that using infinitely long loans with geometrically declining repayments allows us to control the average maturity ψ ∈ [0, 1) with just one parameter, nesting the possibility of ψ = 0, in which case it collapses to a standard one-period loan contract.

Every period t, a savings bank can take out a new loan CB t and agree to repay an infinite number of declining payments such that the total amount due at period t is given by

When ψ > 0,

with average loan duration d = R/(R−ψ), where R is the steady-state policy rate[18].

We can then express equation (5.1) in recursive form as

The important thing to note is that even if the bank does not borrow from the central bank in equilibrium, as will be the case with purely symmetric shocks, the availability of these loans is sufficient to have an important impact on the household saving rate, a point we will return to later. Using equation 5.3 as a constraint in the profit maximization problem of the savings bank leads to the following first-order conditions:

This, with equation (5.2), gives the spread between the policy rate R

t

and the deposit rate

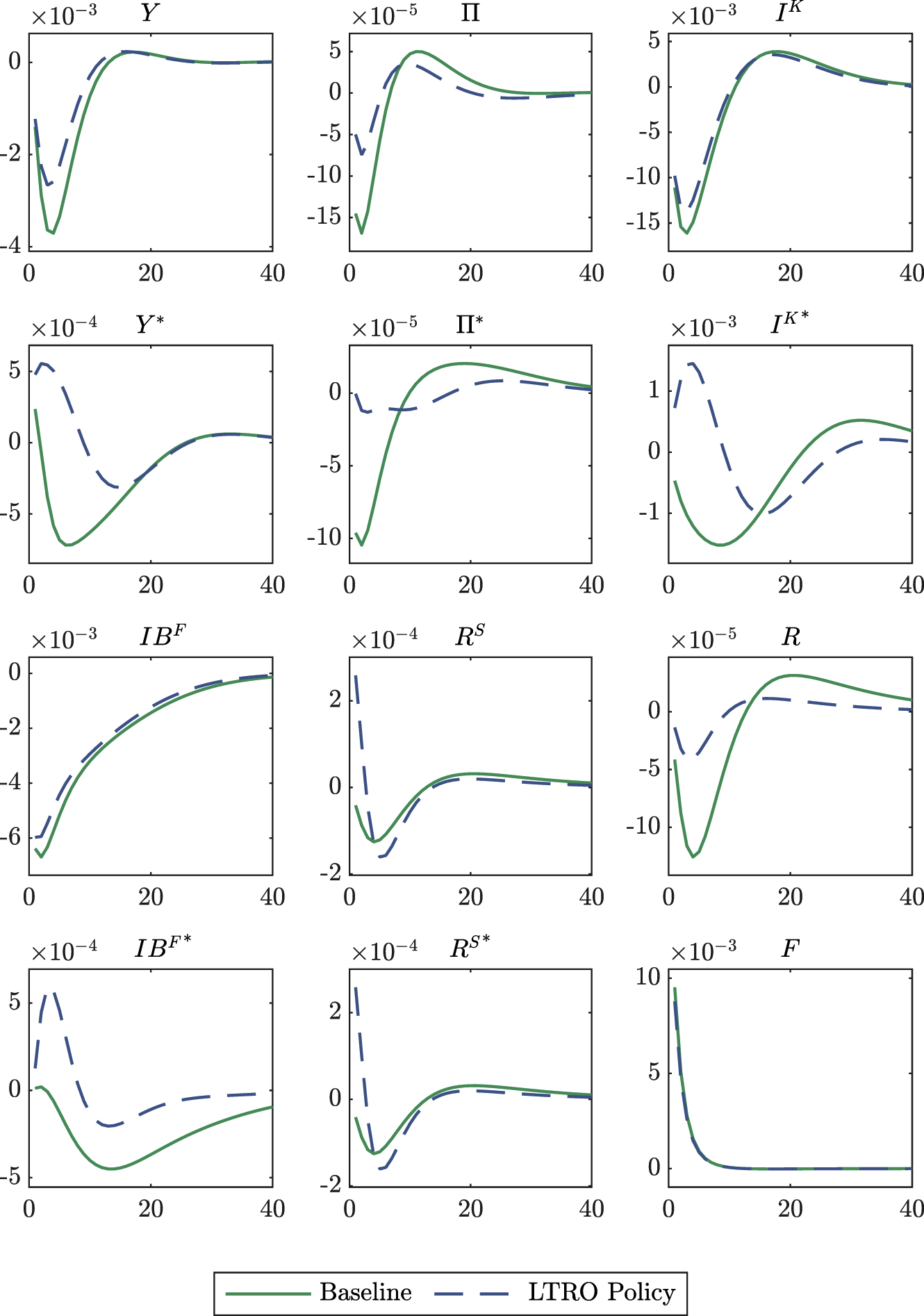

Figure 3 shows the LTROs at work, comparing the impulse response functions to the same risk shock analyzed before, once with d = 1 and once with d = 16 [20]. This calibration mimics the four-year loan duration of the ECB’s targeted LTROs introduced in 2014. The policy has two major effects. First, in the face of an adverse shock, fewer cuts in policy rates are required to achieve the equivalent stimulus in a multi-period loan economy. The reason is that the reduction in policy rates lowers the average rate of interest for a longer period and hence further reduces the effective present funding costs of forward-looking banks. That is, long-term refinancing operations with fixed interest rates, such as the latest series of targeted LTROs, ensure planning certainty for banks and thereby, in practice, provide major help with respect to maturity transformation between longer-term lending and often short-term refinancing. And with banks immediately passing on the additional funding cost relief to the ultimate borrowing conditions of households and firms, policymakers are able to frontload required accommodation and thereby mitigate the economic downturn.

Impulse response functions to a transitory risk shock with central bank with and without LTRO policy response. Relative deviations from the stochastic steady state except rates, which are in levels.

The second interesting feature of LTROs is the asymmetric impact when economies are hit by idiosyncratic shocks. As we argued before, once d > 1 (

where

So, asymmetric shocks will affect the spread differently in each country as a first-order effect. From equations (5.2) and (5.5), a first-order approximation suggests that

In other words, if the expected path of the nominal stochastic discount factor is greater in the domestic economy than in the

This can be seen in Figure 3. Because consumers in the foreign economy, following the shock, expect a lower future marginal utility of consumption relative to the domestic country, LTROs, by easing financial conditions abroad by more, are able to fully offset any negative spillovers of the original shock to the rest of the currency union. Of course, the extent of the easing can differ from shock to shock, but LTROs can generally be thought of as a powerful stabilization tool in a currency union. This has been confirmed by recent ECB analysis (ECB 2017). They show that from June 2014 to July 2015, i.e., after the first TLTRO operation, non-bidders in vulnerable and non-vulnerable economies reduced their lending rates by about the same amount, while after the second operation, in the period from March to December 2016, the reduction in lending rates was larger in non-vulnerable economies, consistent with the predictions from our model. This emphasizes that the sheer existence of the policy is enough to reduce financing conditions across the currency union and, hence, to help central banks reach their price stability objectives.[21]

5.2 Asset Purchases

The second policy instrument we analyze is asset purchases by central banks, which became an integral part of policymakers’ toolkit after, and in some jurisdictions even before, the outbreak of the global financial crisis. Several attempts have been made in the literature to quantify the effects of such purchases [22]. On the theoretical front, Chen, Cúrdia, and Ferrero (2012) and Gertler and Karadi (2013) have recently made useful progress in capturing the effects of asset purchases on the broader macroeconomy. In this paper, we want to focus on one element of the ECB’s asset purchase programme that has received less attention in the literature and that is particularly suited to study within the context of our model setup: its ABSPP.

The aim of this programme, launched in November 2014, is to facilitate credit provision to the real economy by freeing up bank balance sheet capacity. Although the effects of securitization are more complex in practice, mainly related to regulation, the general idea behind this programme can be illustrated by assuming that the central bank purchases assets directly from banks. Indeed, one of the main reasons for banks to engage in securitization is balance sheet relief: securitization typically involves a true sale of the underlying asset to a special purpose vehicle, removing assets from the balance sheet and thereby reducing the amount of capital that a financial institution is required to hold. We therefore follow Gertler and Karadi (2011) and treat asset purchases as if the central bank lends directly to the private sector, which is a convenient shortcut to analyzing the effects of the ECB’s ABSPP.

Specifically, the central bank issues one-period bond at the market rate and uses the proceeds to purchase a certain share

where T

t

are transfers to households and

At the start of the period during which the asset purchase will take place, the policymaker announces the purchase decision. This implies that the lending banks’ first-order conditions are unchanged except for the volume of loans on banks’ balance sheets, which changes to

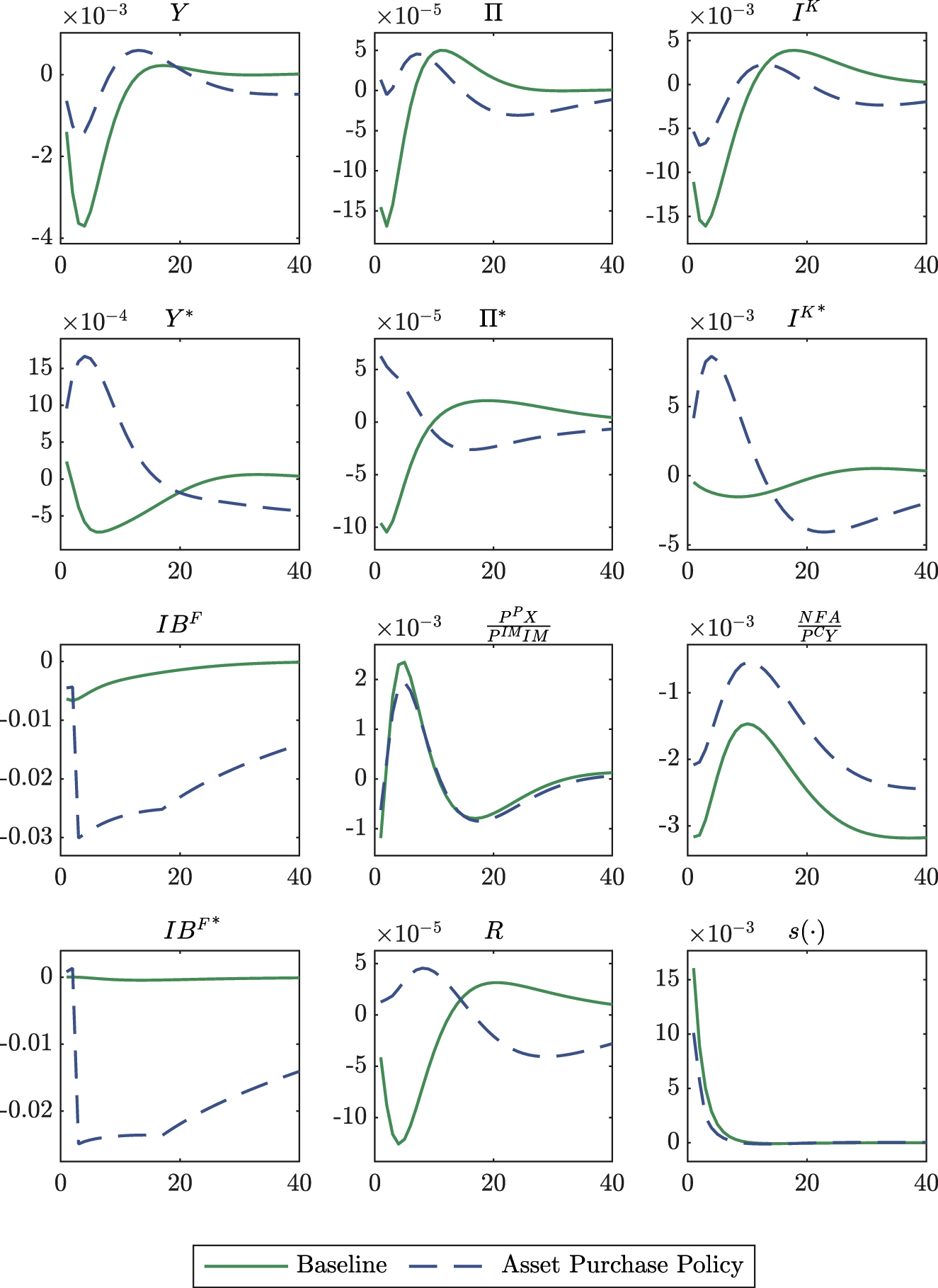

With this in mind, we now examine how asset purchases can help stabilize the economy in the face of an adverse shock, using again, for reasons of comparability, a risk shock in the domestic economy. Figure 4 shows the general workings of a temporary asset purchase programme. In our calibration the central bank is assumed to purchase 2% of all available assets in the first period, in equal proportions across economies, and to hold them for four years. At this point, the assets are gradually resold to the private sector, causing the central bank’s balance sheet to contract by 2.5% every quarter.

Impulse response functions to a transitory risk shock with central bank asset-purchase policy response. Relative deviations from the stochastic steady state except rates, net exports, P P X/P IM IM, and relative NFA, NFA/P C Y, which are in levels.

The message is unambiguous: asset purchases in the form of loans, either directly or through purchases of ABS, can be an effective substitute, or complement, to reductions in the key policy rate. By reducing banks’ risk exposure to the real economy, policymakers are able to lower banks’ market-based funding needs and to compress their external finance premium in the interbank market. Lower interbank funding costs, in turn, are passed on to households and firms, which stimulate demand for loans and mortgages and, ultimately, investment and aggregate demand. As can be seen in Figure 4, in our example purchases of loans succeed in effectively mitigating the fall in output and inflation without lowering the key policy rate. This means that, at the effective lower bound, such a policy can be an effective complement to changes in the conventional policy instrument. Note the interbank market lending volumes in Figure 4 mirror the asset purchases; the central bank makes a large purchase in the first period, the assets are held for four years before being gradually resold to the private sector.

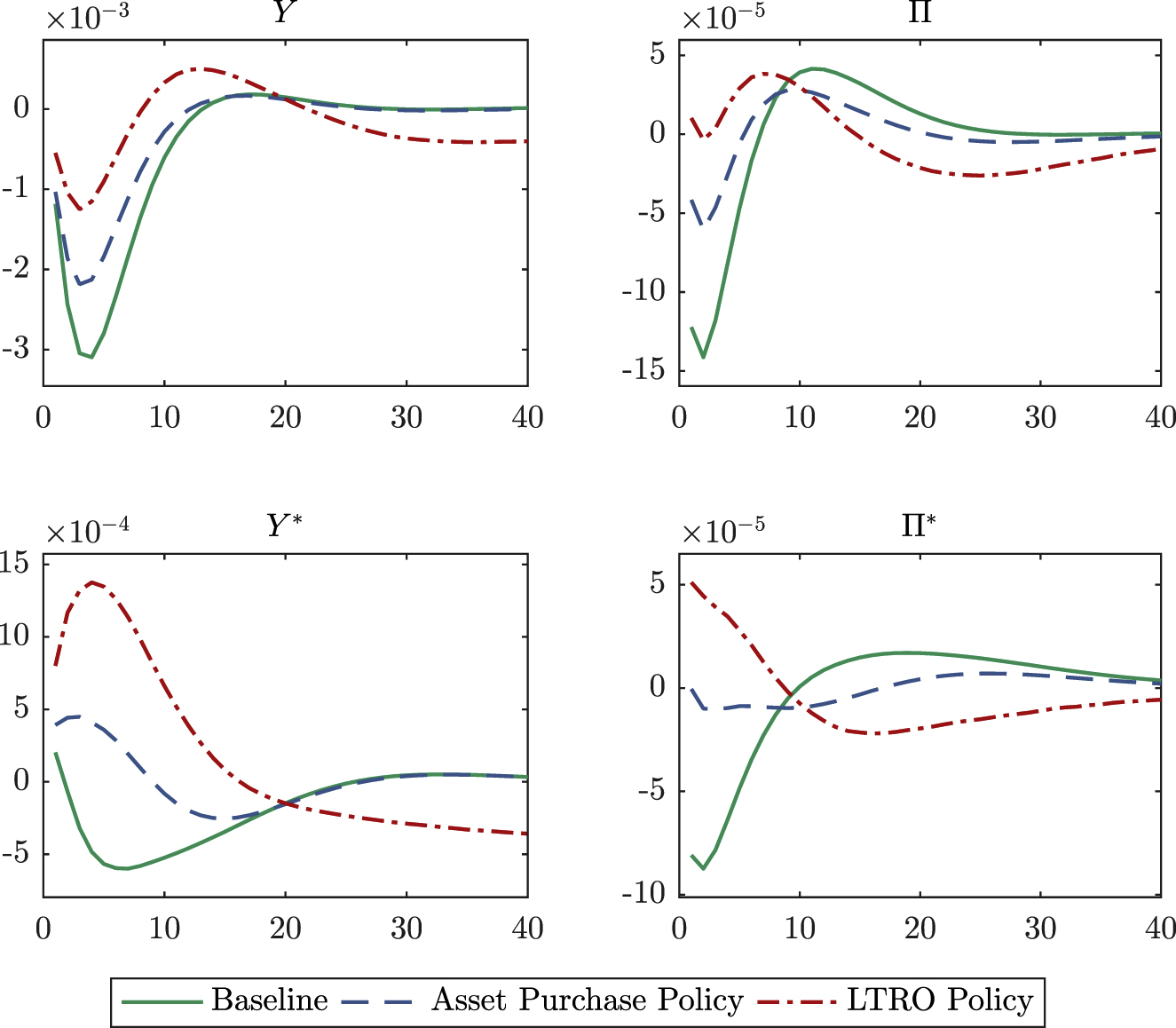

Finally, in Figure 5, we perform a comparative analysis of the efficiency of our two unconventional policy instruments to the same transitory risk shock. To ensure broad comparability, both policies are calibrated to ensure the same target horizon of four years. The chart emphasizes that while both policies can effectively mitigate the impact of adverse shocks on output and inflation, asset purchases, even in relatively small size, are likely to be more powerful, reflecting the direct risk transfer from private to public balance sheets. This means there is a trade-off for policymakers between policy effectiveness and risk exposure. While an analysis of the optimal policy use goes beyond the scope of this article, it may seem advisable to central banks to choose the optimal policy mix depending on the severity and persistence of the shock, also bearing in mind that very large adverse shocks may affect the supply side of the economy through hysteresis effects. In these instances, policy may prefer to minimize the initial impact of the shock by choosing a policy that would re-establish quickly orderly trading conditions in interbank markets.

Impulse response functions to a transitory risk shock comparing central bank asset-purchase policy response and LTROs. Y shows relative deviations from the stochastic steady state and

5.3 Welfare Considerations

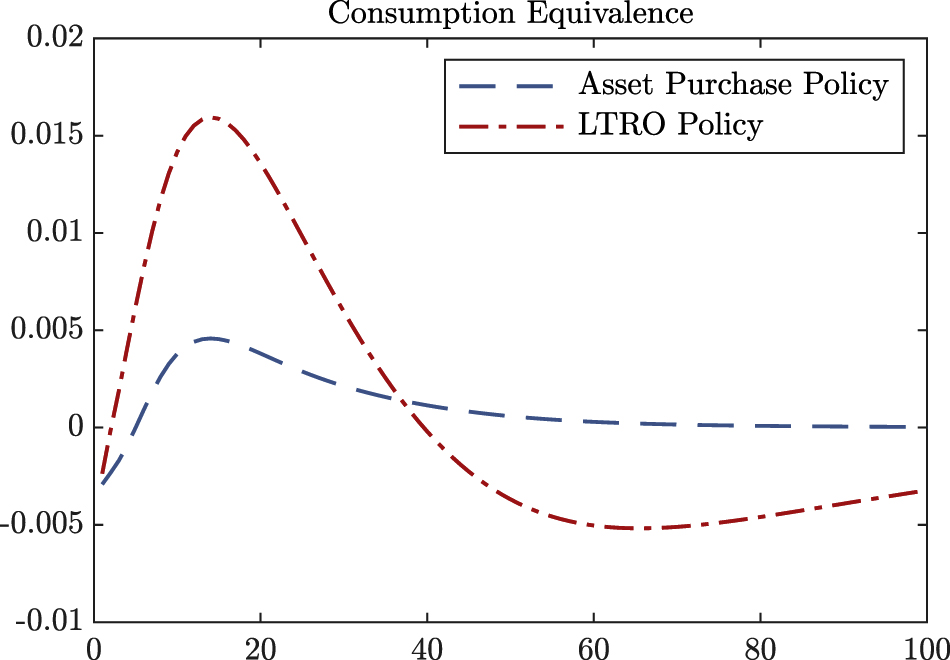

Although the analysis of optimal policy is beyond the scope of this study, it is possible to compare welfare outcomes conditional on the scenarios shown in Figure 5. We show the welfare of the alternative policies relative to the baseline model in Figure 6. Welfare for each household is defined as the discounted sum of future utility with total welfare given as the average, weighting households by their population share. The figure gives this in consumption equivalence terms and shows the period-by-period proportion of consumption that all households would give up in order to be under the alternative policy framework[24]. As this is a conditional welfare comparison, to give a value for the effect of a policy programme on welfare we calculate the total value in terms of annual consumption, finding that the asset purchase policy leads to total welfare gains of 2.7% of a single year of consumption[25]. The LTRO policy, in contrast, in the end leads to welfare losses equivalent to 1.2% of annual consumption despite offering welfare gains in the short term.

Welfare relative to baseline in period-by-period consumption equivalence terms. Conditional on the impulse responses shown in Figure 5, for each period this shows value of the policy at time t in terms of period t consumption.

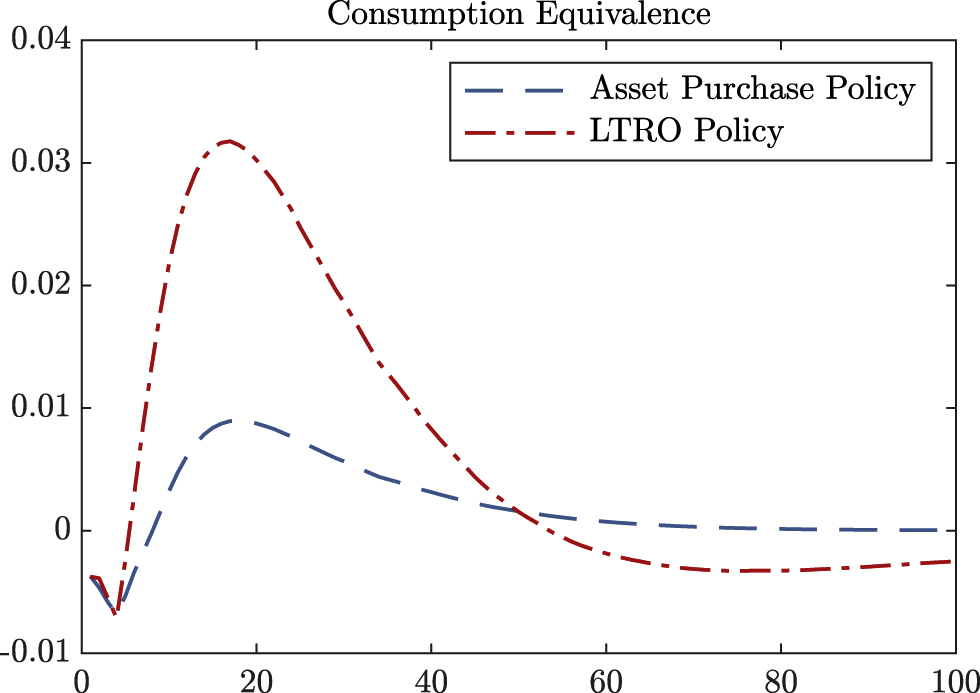

This comparison does not give a full picture, as it assumes that the central bank has full freedom to utilize conventional monetary policy. If this were not possible, because of the zero-lower bound on nominal interest rates, for example, then the LTRO policy could be an effective substitute for conventional interest rate adjustments. To illustrate this point, we repeat the exercise, only this time preventing the interest rate from adjusting downward for four periods. The period-by-period relative welfare for each policy is shown in Figure 7.

Welfare relative to baseline in period-by-period consumption equivalence terms conditional on a risk shock and interest rates prevented from falling from 4 quarters. For each period this shows value of the policy at time t in terms of period t consumption.

This time, the LTRO policy offers total welfare gains equivalent to 5% of annual consumption over the baseline case, highlighting the value of credibly promising low-for-long interest rates. The asset purchase programme leads to welfare gains equal to 13% of annual consumption, up from just 2.7%. Although an illustration, the exercise indicates the potential of significant welfare gains from an expanded policy toolkit when conventional policy is constrained.

6 Conclusion

Growing levels of excess liquidity in the wake of the ECB’s asset purchase programme, together with attractive conditions attached to the ECB’s targeted longer-term refinancing operations, have reduced the need of banks to seek funds in the euro area interbank market. Although these measures have undoubtedly contributed to restoring the transmission of monetary policy, and thereby to reinforcing the economic expansion the euro area has been enjoying since about mid-2013, they also mask the prevailing fragilities related to the trading of central bank reserves in a currency union characterized by structural differences across borders. Such differences may lead to persistent cross-border capital flows intermediated, in part, by banks that are likely to price interbank loans not only according to the credit quality of their counterparts, but taking also into account differences in macroeconomic risk across euro area jurisdictions.

This article showed that such frictions in the interbank market may severely constrain the ability of monetary policymakers to achieve their area-wide price stability objective using merely conventional policy instruments. In good times, credit frictions in the interbank market may amplify changes in the key policy rate and contribute to boosting cross-border interbank loans, creating risks of irrational exuberance. In bad times, pro-cyclicality in bank lending and pricing may offset efforts by the central bank to stimulate the economy.

The good news is that the crisis has proven that unconventional policy measures can be highly effective in overcoming frictions in the interbank market. The findings in this article confirm, by and large, this intuition. In particular, long-term refinancing operations as well as asset purchase programmes can complement, or substitute for, changes in the key policy rate and ease financial conditions at a time when access to interbank credit might be restricted or excessively expensive. This is especially true when there is restricted room to adjust the policy rates downward due, for example, to the zero-lower bound on nominal interest rates. Limiting the recourse to such facilities in future crises, however, requires a more forceful convergence in the growth capacities of euro area economies, a task that lies beyond central bank mandates.

Acknowledgments

The authors would like to thank Stephan Fahr for all his help on the project. Thanks also to Dominic Quint, Paul Levine, Cristiano Cantore, Raf Wouters, Tiago Cavalcanti and an anonymous referee for helpful suggestions.

-

Research funding: The paper was based on work written while Jonathan was a doctoral candidate; he gratefully acknowledges the financial support from the Economic and Social Research Council [grant number ES/J500148/1] received during this period.

References

Abbassi, P., F. Bräuning, F. Fecht, and J.-L. Peydró. 2014. “Cross-border Liquidity, Relationships and Monetary Policy: Evidence from the Euro Area Interbank Crisis.” Deutsche Bundesbank, Discussion Paper Series 45/2014.10.2139/ssrn.2797022Search in Google Scholar

Adjemian, S., H. Bastanie, F. Karamé, M. Juillard, J. Maih, F. Mihoubi, G. Perendia, J. Pfeifer, M. Ratto, and S. Villemot. 2011. “Dynare: Reference Manual Version 4.” 160. Dynare Working Paper Series (1).Search in Google Scholar

Afonso, G., A. Kovner, and A. Schoar. 2011. “Stressed, Not Frozen: The Federal Funds Market in the Financial Crisis.” The Journal of Finance 66 (4): 1109–39, https://doi.org/10.1111/j.1540-6261.2011.01670.x.Search in Google Scholar

Al-Eyd, A. J., and P. Berkmen. 2013. Fragmentation and Monetary Policy in the Euro Area. Washington D.C: International Monetary Fund, Working Paper 13/208.10.5089/9781484328750.001Search in Google Scholar

Altavilla, C., G. Carboni, and R. Motto. 2015. Asset Purchase Programmes and Financial Markets: Lessons from the Euro Area. Frankfurt am Main: European Central Bank, Working Paper Series, No. 1864.10.2139/ssrn.2717398Search in Google Scholar

Armington, P. S. 1969. A Theory of Demand for Products Distinguished by Place of Production. Washington DC: International Monetary Fund, Staff papers, No. 16.10.2307/3866403Search in Google Scholar

Benes, J., and K. Lees. 2010. Multi-period Fixed-Rate Loans, Housing and Monetary Policy in Small Open Economies. Wellington: Reserve Bank of New Zealand, Discussion Paper Series, DP2010/03.Search in Google Scholar

Bernanke, B. S., M. Gertler, and S. Gilchrist. 1999. “The Financial Accelerator in a Quantitative Business Cycle Framework.” In Handbook of Macroeconomics, Vol. 1, edited by J. B. Taylorand M. Woodford, 1341–93. Amsterdam: Elsevier B.V. chapter 21.10.1016/S1574-0048(99)10034-XSearch in Google Scholar

Blattner, T. S., and M. A. S. Joyce. 2016. Net Debt Supply Shocks in the Euro Area and the Implications for QE. Frankfurt am Main: European Central Bank, Working Paper Series, No 1957.10.2139/ssrn.2839833Search in Google Scholar

Calvo, G. 1983. “Staggered Prices in a Utility Maximizing Framework.” Journal of Monetary Economics 12 (3): 383–98, https://doi.org/10.1016/0304-3932(83)90060-0.Search in Google Scholar

Carlstrom, C. T., and T. S. Fuerst. 1997. “Agency Costs, Net Worth, and Business Fluctuations: A Computable General Equilibrium Analysis.” The American Economic Review 87 (5): 893–910.10.26509/frbc-wp-199602Search in Google Scholar

Carrera, C., and H. Vega. 2012. Interbank Market and Macroprudential Tools in a DSGE Mode. Banco Central de Reserva del Perú, Working Paper Series, No. 2012-014.Search in Google Scholar

Chen, H., V. Cúrdia, and A. Ferrero. 2012. “The Macroeconomic Effects of Large-Scale Asset Purchase Programmes.” The Economic Journal 122 (564): 289–315, https://doi.org/10.1111/j.1468-0297.2012.02549.x.Search in Google Scholar

Christensen, I., and A. Dib. 2008. “The Financial Accelerator in an Estimated New Keynesian Model.” Review of Economic Dynamics 11: 155–78, https://doi.org/10.1016/j.red.2007.04.006.Search in Google Scholar

Christiano, L. J., M. Eichenbaum, and C. L. Evans. 2005. “Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy.” Journal of Political Economy 113 (1): 1–45, https://doi.org/10.1086/426038.Search in Google Scholar

Christiano, L., R. Motto, and M. Rostagno. 2003. The Great Depression and the Friedman-Schwartz Hypothesis. Cambridge, MA: National Bureau of Economic Research, Working Paper Series 6, No. 10255.10.26509/frbc-wp-200318Search in Google Scholar

Christiano, L., R. Motto, and M. Rostagno. 2010. Financial Factors in Economic Fluctuations. European Central Bank, Working Paper Series, No. 1192.10.2139/ssrn.1600166Search in Google Scholar

Christiano, L., R. Motto, and M. Rostagno. 2014. “Risk Shocks.” The American Economic Review 104 (1): 27–65, https://doi.org/10.1257/aer.104.1.27.Search in Google Scholar

Christoffel, K. K., G. Coenen, and A. Warne. 2008. The New Area-wide Model of the Euro Area: A Micro-Founded Open-Economy Model for Forecasting and Policy Analysis. Frankfurt-am-Main: European Central Bank, Working Paper Series, No. 944.10.2139/ssrn.1271865Search in Google Scholar

Colangelo, A., and M. Lenza. 2013. “Cross-border Banking Transactions in the Euro Area.” In Proceedings of the Sixth IFC Conference on “Statistical Issues and Activities in a Changing Environment”, 28–29 August 2012, 518–31. Basel: Bank for International Settlements.Search in Google Scholar

Cornett, M. M., J. J. McNutt, P. E. Strahan, and H. Tehranian. 2011. “Liquidity Risk Management and Credit Supply in the Financial Crisis.” Journal of Financial Economics 101 (2): 297–312, https://doi.org/10.1016/j.jfineco.2011.03.001.Search in Google Scholar

Darracq Paries, M., C. K. Sørensen, and D. Rodriguez-Palenzuela. 2011. “Macroeconomic Propagation under Different Regulatory Regimes: Evidence from an Estimated DSGE Model of the Euro Area.” International Journal of Central Banking 7 (4): 49–113.10.2139/ssrn.1682085Search in Google Scholar

De Andoain, C. G., P. Hoffmann, and S. Manganelli. 2014. “Fragmentation in the Euro Overnight Unsecured Money Market.” Economics Letters 125 (2): 298–302. https://doi.org/10.1016/j.econlet.2014.09.017.Search in Google Scholar

De Graeve, F. 2008. “The External Finance Premium and the Macroeconomy: US Post-WWII Evidence.” Journal of Economic Dynamics and Control 32 (11): 3415–40, https://doi.org/10.1016/j.jedc.2008.02.008.Search in Google Scholar

de Walque, G., O. Pierrard, and A. Rouabah. 2010. “Financial (In)stability, Supervision and Liquidity Injections: A Dynamic General Equilibrium Approach.” The Economic Journal 120 (549): 1234–61, https://doi.org/10.1111/j.1468-0297.2010.02383.x.Search in Google Scholar

Demirgüç-Kunt, A., and H. Huizinga. 2010. “Bank Activity and Funding Strategies: The Impact on Risk and Returns.” Journal of Financial Economics 98 (3): 626–50, https://doi.org/10.1016/j.jfineco.2010.06.004.Search in Google Scholar

Dib, A. 2010. Banks, Credit Market Frictions, and Business Cycles. Ottawa: Bank of Canada. Staff Working Papers 10–24.Search in Google Scholar

Dixit, A., and J. E. Stiglitz. 1977. “Monopolistic Competition and Optimum Product Diversity.” The American Economic Review 67 (3): 297–308.Search in Google Scholar

Dräger, L., and C. R. Proaño. 2015. Cross-border Banking and Business Cycles in Asymmetric Currency Unions. Hamburg: University of Hamburg, DEP (Socioeconomics)Discussion Papers, Macroeconomics and Finance Series 1/2015.Search in Google Scholar

European Central Bank. 2009a. Euro Money Market Study 2008, Technical report. Frankfurt am Main: European Central Bank.Search in Google Scholar

European Central Bank. 2009b. Housing Finance in the Euro Area, Structural Issues Report. Frankfurt am Main: European Central Bank.Search in Google Scholar

European Central Bank. 2015. Euro Money Market Study 2014, Technical report. Frankfurt am Main: European Central Bank.Search in Google Scholar

European Central Bank. 2017. Impact of the ECB’s Non-standard Measures on Financing Conditions: Taking Stock of Recent Evidence. Frankfurt am Main: Economic Bulletin (2017), Issue 2.Search in Google Scholar

European Central Bank. 2020. ESRB Risk Dashboard, 10 June 2020. Frankfurt-am-Main: European Central Bank and the European Systemic Risk Board.Search in Google Scholar

Flannery, M. J. 1996. “Financial Crises, Payment System Problems, and Discount Window Lending.” Journal of Money, Credit, and Banking 28 (4): 804–24, https://doi.org/10.2307/2077922.Search in Google Scholar

Freixas, X., and C. Holthausen. 2005. “Interbank Market Integration under Asymmetric Information.” Review of Financial Studies 18 (2): 459–90, https://doi.org/10.1093/rfs/hhi001.Search in Google Scholar

Gagnon, J., M. Raskin, and J. Remache. 2011. “The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases.” International Journal of Central Banking 7 (1): 3–43.Search in Google Scholar

Gerali, A., S. Neri, L. Sessa, and F. M. Signoretti. 2010. “Credit and Banking in a DGSE Model of the Euro Area.” Journal of Money, Credit, and Banking 42 (6): 107–41, https://doi.org/10.1111/j.1538-4616.2010.00331.x.Search in Google Scholar

Gertler, M., and P. Karadi. 2011. “A Model of Unconventional Monetary Policy.” Journal of Monetary Economics 58 (1): 17–34, https://doi.org/10.1016/j.jmoneco.2010.10.004.Search in Google Scholar

Gertler, M., and P. Karadi. 2013. “QE 1 vs. 2 vs. 3…: A Framework for Analyzing Large-Scale Asset Purchases as a Monetary Policy Tool.” International Journal of Central Banking 9 (S1): 5–53.Search in Google Scholar

Gertler, M., and N. Kiyotaki. 2010. “Financial Intermediation and Credit Policy in Business Cycle Analysis.” Handbook of Monetary Economics 3 (11): 547–99, https://doi.org/10.1016/b978-0-444-53238-1.00011-9.Search in Google Scholar

Goodfriend, M., and B. T. Mccallum. 2007. “Banking and Interest Rates in Monetary Policy Analysis: A Quantitative Exploration.” Journal of Monetary Economics 54 (2007): 1480–507, https://doi.org/10.1016/j.jmoneco.2007.06.009.Search in Google Scholar

Hilberg, B., and J. Hollmayr. 2011. Asset Prices, Collateral and Unconventional Monetary Policy in a DSGE Model. Frankfurt-am-Main, Frankfurt: European Central Bank. Working Paper Series, No. 1373.10.2139/ssrn.1911771Search in Google Scholar

Iacoviello, M. 2005. “House Prices, Borrowing Constraints, and Monetary Policy in the Business Cycle.” The American Economic Review 95 (3): 739–64, https://doi.org/10.1257/0002828054201477.Search in Google Scholar

IMF. 2013. European union: Publication of Financial Sector Assessment Program Documentation—Technical Note on Financial Integration and Fragmentation in the European Union. Washington D.C: International Monetary Fund. Country report no. 13/71.10.5089/9781475546149.002Search in Google Scholar

in’t Veld, Daan, and Iman van Lelyveld. 2014. “Finding the Core: Network Structure in Interbank Markets.” Journal of Banking & Finance 49: 27–40, https://doi.org/10.1016/j.jbankfin.2014.08.006.Search in Google Scholar

Ivashina, V., and D. Scharfstein. 2010. “Bank Lending during the Financial Crisis of 2008.” Journal of Financial Economics 97 (3): 319–38, https://doi.org/10.1016/j.jfineco.2009.12.001.Search in Google Scholar

Kiyotaki, N., and J. Moore. 1997. “Credit Cycles.” Journal of Political Economy 105 (2): 211–48, https://doi.org/10.1086/262072.Search in Google Scholar

Krishnamurthy, A., and A. Vissing-Jorgensen. 2011. “The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy,” Brookings Papers on Economic Activity, Fall 2011, No. 2.10.1353/eca.2011.0019Search in Google Scholar

Marrison, C. 2002. The Fundamentals of Risk Measurement. Boston, MA: McGraw-Hill.Search in Google Scholar

Modigliani, F., and M. H. Miller. 1958. “The Cost of Capital, Corporation Finance and the Theory of Investment.” The American Economic Review 48 (3): 261–97.Search in Google Scholar

Nouy, D. 2017. Banking Union: Safe and Sound Finance for Europe. Vienna: Speech at the RZB EU Sky Talk. 2 May 2017.Search in Google Scholar

Poutineau, J.-C., and G. Vermandel. 2015. “Cross-border Banking Flows Spillovers in the Eurozone: Evidence from an Estimated DSGE Model.” Journal of Economic Dynamics and Control 51: 378–403, https://doi.org/10.1016/j.jedc.2014.11.006.Search in Google Scholar

Quint, D., and P. Rabanal. 2014. “Monetary and Macroprudential Policy in an Estimated DSGE Model of the Euro Area.” International Journal of Central Banking 10 (2): 169–236.10.2139/ssrn.2347273Search in Google Scholar

Rudebusch, G., and E. Swanson. 2008. The Bond Premium in a DSGE Model with Long-Run Real and Nominal Risks. San Francisco: Federal Reserve Bank of San Francisco, Working Paper Series 2008–31.10.24148/wp2008-31Search in Google Scholar

Rudebusch, G. D., and E. T. Swanson. 2012. “The Bond Premium in a DSGE Model with Long-Run Real and Nominal Risks.” American Economic Journal: Macroeconomics 3 (4): 105–43, https://doi.org/10.1257/mac.4.1.105.Search in Google Scholar

Schmitt-Grohe, S., and M. Uribe. 2003. “Closing Small Open Economy Models.” Journal of International Economics 61 (1): 163–85, https://doi.org/10.1016/s0022-1996(02)00056-9.Search in Google Scholar

Smets, F., and R. Wouters. 2003. “An Estimated Dynamic Stochastic General Equilibrium Model.” Journal of the European Economic Association 1 (5): 1123–75, https://doi.org/10.1162/154247603770383415.Search in Google Scholar

Smets, F., and R. Wouters. 2007. “Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach.” The American Economic Review 97 (3): 586–606, https://doi.org/10.1257/aer.97.3.586.Search in Google Scholar

Townsend, R. M. 1979. “Optimal Contracts and Competitive Markets with Costly State Verification.” Journal of Economic Theory 21 (2): 265–93, https://doi.org/10.1016/0022-0531(79)90031-0.Search in Google Scholar

Ueda, K. 2012. “Banking Globalization and International Business Cycles: Cross-Border Chained Credit Contracts and Financial Accelerators.” Journal of International Economics 86 (1): 1–16, https://doi.org/10.1016/j.jinteco.2011.08.012.Search in Google Scholar

van Rixtel, A., and G. Gasperini. 2013. Financial Crises and Bank Funding: Recent Experience in the Euro Area. Basel: Bank for International Settlements. BIS Working Papers No. 406.Search in Google Scholar

Supplementary material

The online version of this article offers supplementary material (https://doi.org/10.1515/bejm-2019-0097).

© 2020 Tobias S. Blattner and Jonathan M. Swarbrick, published by De Gruyter, Berlin/Boston

This work is licensed under the Creative Commons Attribution 4.0 International License.

Articles in the same Issue

- Contributions

- Quantifying the Effects of Patent Protection on Innovation, Imitation, Growth, and Aggregate Productivity

- Sectoral Productivity Gaps and Aggregate Productivity

- Optimal Industrial Policies in a Two-Sector-R&D Economy