Abstract

This paper revisits the empirical relationship between volatility and long-run growth, but the key contribution lies in decomposing growth volatility into its business-cycle and trend components. This volatility decomposition also accounts for enormous heterogeneity among countries in terms of their long-run growth trajectories. We identify a negative effect of trend volatility, which we refer to as long-run volatility, on growth, but no effect of business-cycle volatility. However, if long-run volatility is omitted, there would be a spurious (negative) effect of business-cycle volatility. Our results draw attention to a crucial question about different volatility measures and their implications in macroeconomic analyses.

Appendix

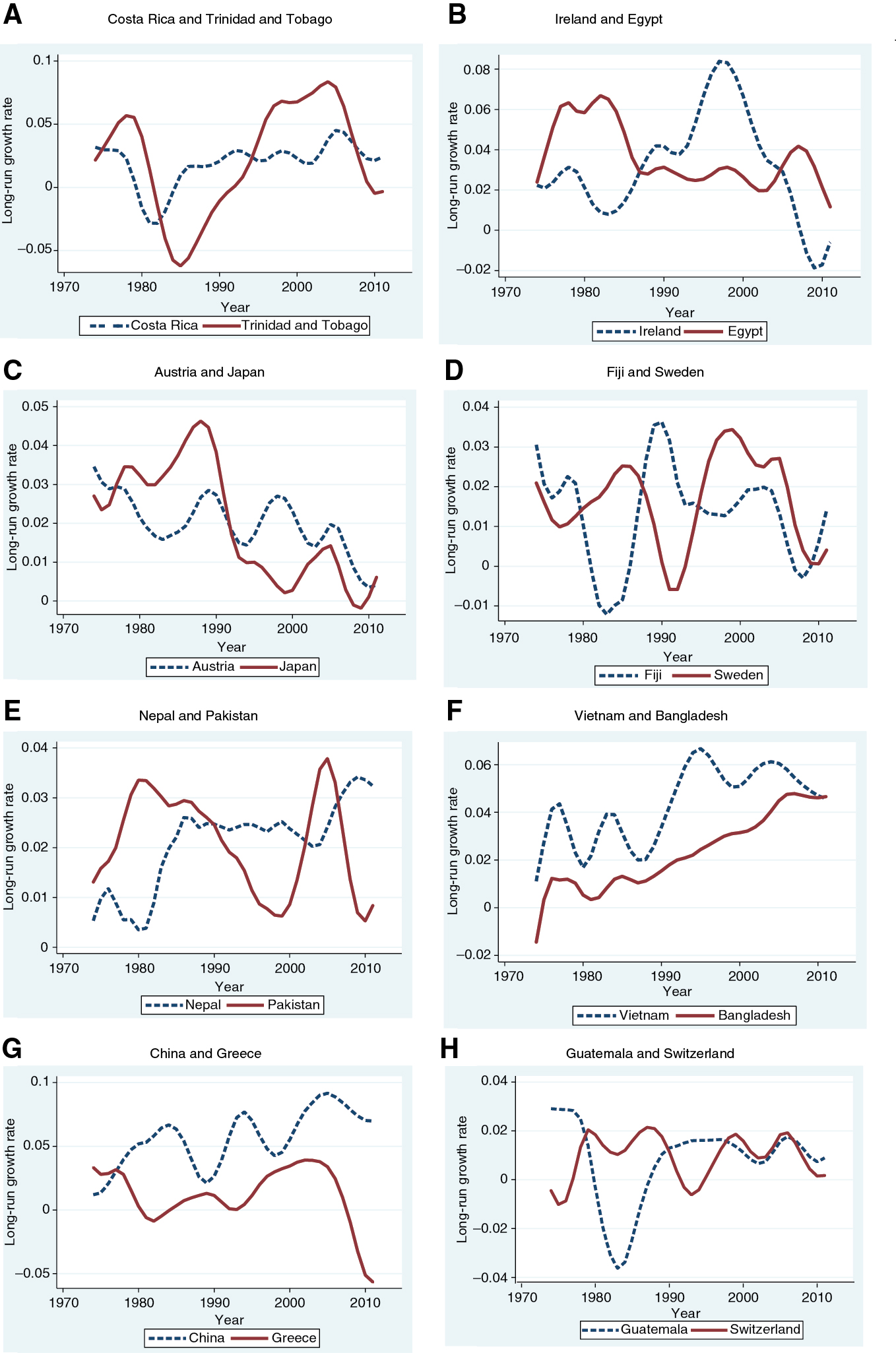

A Examples of heterogeneous growth trajectories

Costa Rica and Trinidad and Tobago: These two developing countries had the same average growth rate (approximately 0.021) and BC volatility (0.026), but LR volatility in Trinidad and Tobago (0.043) was more than twice as large as that in Costa Rica (0.017).

Ireland and Egypt: These countries had nearly the same average growth rate (0.031) and BC volatility (0.0189), but LR volatility in Ireland (0.026) was much larger than that in Egypt (0.015).

Austria and Japan: These two countries are similar in terms of average growth rate (approximately 0.020) and BC volatility (approximately 0.016) but differ with respect to LR volatility (0.007 and 0.015, respectively).

Fiji and Sweden: These two countries are similar in terms of average growth rate (approximately 0.016) and LR volatility (approximately 0.012) but differ with respect to BC volatility (0.039 and 0.018, respectively).

Nepal vs. Pakistan: These two countries are similar in terms of average growth rate (approximately 0.020) and LR volatility (approximately 0.009) but differ with respect to BC volatility (0.024 and 0.013, respectively).

Guatemala and Switzerland: Although both countries had the same average growth rate (0.010), BC volatility was larger in Switzerland (0.018) than in Guatemala (0.013), whereas LR volatility in Guatemala (0.017) was nearly twice as large as that in Switzerland (0.009).

There are examples in which countries with very different average growth rates experienced similar fluctuations. For example, the growth rate in Vietnam (0.040) was much higher than that in Bangladesh (0.019), but both countries had the same BC volatility (0.021) and LR volatility (0.016). Similarly, China and Greece had the same BC volatility (0.025) and similar LR volatility (0.022), but China’s economy grew at an average rate of 0.054, whereas the Greek economy grew at the slower rate of 0.012.

The above examples illustrate an enormous heterogeneity among countries’ respective growth trajectories. More specifically, very dissimilar growth trajectories can lead to the same average growth, and apparently similar growth trajectories can lead to different average growths. This heterogeneity can also be visualized in Figure 1A–H below, which display the long-run growth trajectories of the country pairs discussed above.

Comparison of long-run growth trajectories (Low-pass filtered annual growth rate).

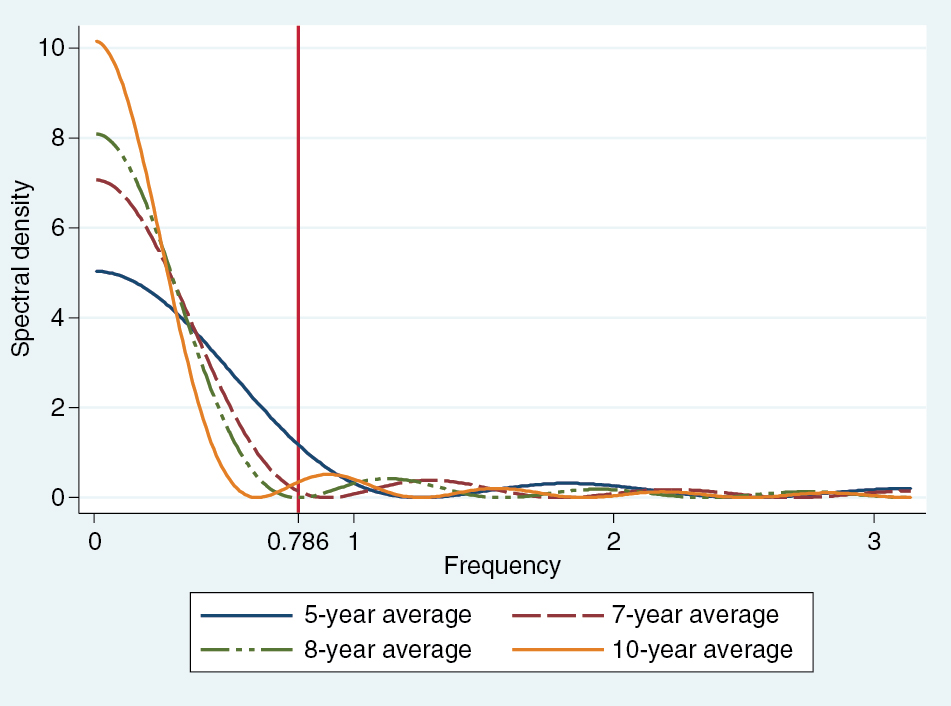

B Comparison of spectral densities for 5-, 7-, 8-, and 10-year averaging

The spectral density for averaging over T years is given by: (1/T)2 (1 – cosTω)/(1 – cosω), where ω is the frequency ranging between 0 and π (for derivation, see Sargent 1987, 275). The spectral densities for T = 5, 7, 8, and 10 are displayed in Figure A.1 below. The spectral densities are normalized, using appropriate scalars, so that the area under all curves are equal. A vertical line is drawn at 0.786 to mark the critical frequency that separates the long-run from the cyclical frequencies. Note that the periodicity (p) and frequency are inversely related by the formula: p = 2π/ω. For a critical periodicity of 8 years, the corresponding critical frequency is 0.786. It can be seen from the graph that 5-year averaging does not reweight the variances of the raw series adequately across low frequencies, thus, the transformed data are more likely to be contaminated by high frequencies. For 5-year averaging, the area to the right of the vertical line is 14% of the total area under the curve. This area substantially reduces to 9.3% for 7-year averaging, remains the same for 8-year averaging, and reduces only to 8.8% for 10-year averaging.

Spectral densities for 5-, 7-, 8-, and 10-year averaging.

References

Acemoglu, D., and F. Zilibotti. 1997. “Was Prometheus Unbound by Chance? Risk, Diversification, and Growth.” Journal of Political Economy 105: 709–751.10.1086/262091Search in Google Scholar

Acemoglu, D., S. Johnson, J. Robinson, and Y. Thaicharoen. 2003. “Institutional Causes, Macroeconomic Symptoms: Volatility, Crises and Growth.” Journal of Monetary Economics 50: 49–123.10.1016/S0304-3932(02)00208-8Search in Google Scholar

Agénor, P., C. J. McDermott, and E. Prasad. 2000. “Macroeconomic Fluctuations in Developing Countries: Some Stylized Facts.” World Bank Economic Review 14: 251–285.10.1093/wber/14.2.251Search in Google Scholar

Aghion, P., and G. Saint-Paul. 1998a. “Virtues of Bad Times: Interaction between Productivity Growth and Economic Fluctuations.” Macroeconomic Dynamics 2: 322–344.10.1017/S1365100598008025Search in Google Scholar

Aghion, P., and G. Saint-Paul. 1998b. “Uncovering Some Causal Relationships between Productivity Growth and the Structure of Economic Fluctuations: A Tentative Survey.” Labour 12: 279–303.10.1111/1467-9914.00069Search in Google Scholar

Aghion, P., and A. V. Banerjee. 2005. Volatility and Growth. New York: Oxford University Press.10.1093/acprof:oso/9780199248612.001.0001Search in Google Scholar

Aguiar, M., and G. Gopinath. 2007. “Emerging Market Business Cycles: The Cycle is the Trend.” Journal of Political Economy 115: 69–102.10.1086/511283Search in Google Scholar

Alvarez, F., and U. J. Jermann. 2004. “Using Asset Prices to Measure the Cost of Business Cycles.” Journal of Political Economy 112: 1223–1256.10.1086/424738Search in Google Scholar

Arrow, K. J. 1962. “The Economic Implications of Learning by Doing.” Review of Economic Studies 29: 155–123.10.2307/2295952Search in Google Scholar

Ascari, G., and A. M. Sbordone. 2014. “The Macroeconomic of Trend Inflation.” Journal of Economic Literature 52: 679–739.10.1257/jel.52.3.679Search in Google Scholar

Baker, S. R., and N. Bloom. 2013. “Does Uncertainty Reduce Growth? Using Disasters as Natural Experiments.” NBER Working Paper No. 19475.10.3386/w19475Search in Google Scholar

Barlevy, G. 2005. “The Cost of Business Cycles and the Benefits of Stabilization.” Economic Perspectives (Federal Reserve Bank of Chicago) 29: 32–49.10.3386/w10926Search in Google Scholar

Baxter, M., and R. G. King. 1999. “Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series.” Review of Economics and Statistics 81: 575–593.10.1162/003465399558454Search in Google Scholar

Bazzi, S., and M. A. Clemens. 2013. “Blunt Instruments: Avoiding Common Pitfalls in Identifying the Causes of Economic Growth.” American Economic Journal: Macroeconomics 5: 152–186.10.1257/mac.5.2.152Search in Google Scholar

Beck, T. 2012. “The Role of Finance in Economic Development: Benefits, Risks, and Politics.” In The Oxford Handbook of Capitalism, edited by D. C. Mueller, 161–203. New York: Oxford University Press.10.1093/oxfordhb/9780195391176.013.0007Search in Google Scholar

Beck, T., A. Demirgüç-Kunt, and R. Levine. 2000. “A New Database on Financial Development and Structure.” World Bank Economic Review 14: 597–605 (Data Revised in November 2013).10.1093/wber/14.3.597Search in Google Scholar

Bekaert, G., C. R. Harvey, and C. Lundblad. 2006. “Growth Volatility and Financial Liberalization.” Journal of International Money and Finance 25: 370–403.10.1016/j.jimonfin.2006.01.003Search in Google Scholar

Berg, A., J. D. Ostry, and J. Zettelmeyer. 2012. “What Makes Growth Sustained?” Journal of Development Economics 98: 149–166.10.1016/j.jdeveco.2011.08.002Search in Google Scholar

Blackburn, K. 1999. “Can Stabilisation Policy Reduce Long-run Growth?” Economic Journal 109: 67–77.10.1111/1468-0297.00391Search in Google Scholar

Blackburn, K., and A. Pelloni. 2004. “On the Relationship between Growth and Volatility.” Economics Letters 83: 123–127.10.1016/j.econlet.2003.10.010Search in Google Scholar

Bloom, N. 2014. “Fluctuations in Uncertainty.” Journal of Economic Perspectives 28: 153–176.10.1257/jep.28.2.153Search in Google Scholar

Bloom, N., M. Floetotto, N. Jaimovich, I. Saporta-Eksten, and S. J. Terry. (in press). “Really Uncertain Business Cycles.” Econometrica.10.3386/w18245Search in Google Scholar

Bluhm, R., D. Crombrugghe, and A. Szirmai. 2014. “Do Weak Institutions Prolong Crises? On the Identification, Characteristics, and Duration of Declines during Economic Slumps.” CESifo Working Paper No. 4594.10.2139/ssrn.2393931Search in Google Scholar

Caballero, R. J., and M. L. Hammour. 1994. “The Cleansing Effect of Recessions.” American Economic Review 84: 1350–1368.10.3386/w3922Search in Google Scholar

Cavalcanti, T., K. Mohaddes, and M. Raissi. 2015. “Commodity Price Volatility and the Sources of Growth.” Journal of Applied Econometrics 30: 857–873.10.1002/jae.2407Search in Google Scholar

Center for Systemic Peace. 2013. “Major Episodes of Political Violence (MEPV) and Conflict Regions, 1946–2012.” http://www.systemicpeace.org/inscr/inscr.htm (accessed on February 3, 2014).Search in Google Scholar

Chari, V. V., P. J. Kehoe, and E. R. McGrattan. 2007. “Business Cycle Accounting.” Econometrica 75: 781–836.10.1111/j.1468-0262.2007.00768.xSearch in Google Scholar

Chirinko, R. S., and D. Mallick. 2017. “The Substitution Elasticity, Factor Shares, Long-Run Growth, and the Low-Frequency Panel Model.” American Economic Journal: Macroeconomics 9: 225–253.10.2139/ssrn.2479816Search in Google Scholar

Christiano, L. J., and T. J. Fitzgerald. 2003. “The Band Pass Filter.” International Economic Review 44: 435–465.10.1111/1468-2354.t01-1-00076Search in Google Scholar

Čihák, M., A. Demirgüç-Kunt, E. Feyen, and R. Levine. 2012. “Benchmarking Financial Development around the World.” World Bank Policy Research Working Paper 6175.10.1596/1813-9450-6175Search in Google Scholar

Cochrane, J. H. 1988. “How Big is the Random Walk in GNP?” Journal of Political Economy 96: 893–920.10.1086/261569Search in Google Scholar

Comin, D. 2009. “On the Integration of Growth and Business Cycles.” Empirica 36: 1–15.10.1007/s10663-008-9079-ySearch in Google Scholar

Comin, D., and M. Gertler. 2006. “Medium-term Business Cycles.” American Economic Review 96: 523–551.10.1257/aer.96.3.523Search in Google Scholar

Comin, D., N. Loayza, F. Pasha, and L. Serven. 2014. “Medium Term Business Cycles in Developing Countries.” American Economic Journal: Macroeconomics 6: 209–245.10.3386/w15428Search in Google Scholar

Davis, S. J., and J. Haltiwanger. 1990. “Gross Job Creation and Destruction: Microeconomic Evidence and Macroeconomic Implications.” NBER Macroeconomics Annual 5: 123–168.10.1086/654135Search in Google Scholar

Davis, S. J., and J. Haltiwanger. 1992. “Gross Job Creation, Gross Job Destruction, and Employment Reallocation.” Quarterly Journal of Economics 107: 819–863.10.2307/2118365Search in Google Scholar

Dawson, J. W., J. P. Dejuan, J. J. Seater, and E. F. Stephenson. 2001. “Economic Information versus Quality Variation in Cross-country Data.” Canadian Journal of Economics 34: 988–1009.10.1111/0008-4085.00109Search in Google Scholar

Dolmas, J. 1998. “Risk Preferences and the Welfare Cost of Business Cycles.” Review of Economic Dynamics 1: 646–676.10.1006/redy.1998.0020Search in Google Scholar

Döpke, J. 2004. “The Effects of Business Cycles on Growth: Time Series Evidence for the G7-Countries Using Survey-Based Measures of the Business Cycle.” CESifo Economic Studies 50: 333–349.10.1093/cesifo/50.2.333Search in Google Scholar

Easterly, W., M. Kremer, L. Pritchett, and L. H. Summers. 1993. “Good Policy or Good Luck? Country Growth Performance and Temporary Shocks.” Journal of Monetary Economics 32: 459–483.10.1016/0304-3932(93)90026-CSearch in Google Scholar

Fatás, A. 2000a. “Do Business Cycles Cast Long Shadows? Short-Run Persistence and Economic Growth.” Journal of Economic Growth 5: 147–162.10.1023/A:1009885203490Search in Google Scholar

Fatás, A. 2000b. “Endogenous Growth and Stochastic Trends.” Journal of Monetary Economics 45: 107–128.10.1016/S0304-3932(99)00043-4Search in Google Scholar

Fatás, A. 2002. “The Effects of Business Cycles on Growth..”. In Loayza, N., and R. Soto (Eds.) Economic Growth: Sources, Trends and Cycles. Santiago: Central Bank of Chile .Search in Google Scholar

Fatás, A., and I. Mihov. 2013. “Policy Volatility, Institutions, and Economic Growth.” Review of Economics and Statistics 95: 362–376.10.1162/REST_a_00265Search in Google Scholar

Feenstra, R. C., R. Inklaar, and M. Timmer. 2013. “PWT 8.0 – A User Guide.” http://www.rug.nl/research/ggdc/data/pwt/v80/pwt_80_user_guide.pdf (accessed on November 13, 2013).Search in Google Scholar

Feenstra, R. C., R. Inklaar, and M. Timmer. 2015. “The Next Generation of the Penn World Table.” American Economic Review 105: 3150–3182. (Data accessed from www.ggdc.net/pwt).10.1257/aer.20130954Search in Google Scholar

Giovanni, J., and A. Levchenko. 2009. “Trade Openness and Volatility.” Review of Economics and Statistics 91: 558–585.10.1162/rest.91.3.558Search in Google Scholar

Grier, K. B., and G. Tullock. 1989. “An Empirical Analysis of Cross-national Economic Growth, 1951–1980.” Journal of Monetary Economics 24: 259–276.10.1016/0304-3932(89)90006-8Search in Google Scholar

Hall, R. E. 1991. “Labor Demand, Labor Supply, and Employment Volatility.” NBER Macroeconomics Annual 6: 17–46.10.1086/654155Search in Google Scholar

Hansen, G. D., and L. E. Ohanian. 2016. “Neoclassical Models in Macroeconomics, Chapter 26.” In Handbook of Macroeconomics, Vol. 2b, , edited by J. B. Taylor and H. Uhlig, 2044–2124. North-Holland: Elsevier.Search in Google Scholar

Heston, A., R. Summers, and B. Aten. 2012. “Penn World Table Version 7.1.” Center for International Comparisons of Production, Income and Prices, University of Pennsylvania, PA.Search in Google Scholar

Hnatkovska, V., and N. Loayza. 2005. “Volatility and Growth.” In Managing Economic Volatility and Crises: A Practitioner’s Guide, edited by J. Aizenman and B. Pinto, 65–100. New York: Cambridge University Press.10.1017/CBO9780511510755.005Search in Google Scholar

Hodrick, R. J., and E. C. Prescott. 1997. “Post-War US Business Cycle: An Empirical Investigation.” Journal of Money, Credit and Banking 29: 1–16.10.2307/2953682Search in Google Scholar

Imbs, J. M. 2007. “Growth and Volatility.” Journal of Monetary Economics 54: 1848–1862.10.1016/j.jmoneco.2006.08.001Search in Google Scholar

Kneller, R., and G. Young. 2001. “Business Cycle Volatility, Uncertainty and Long-Run Growth.” Manchester School 69: 534–552.10.1111/1467-9957.00268Search in Google Scholar

Koren, M., and S. Tenreyro. 2007. “Volatility and Development.” Quarterly Journal of Economics 122: 243–287.10.1162/qjec.122.1.243Search in Google Scholar

Kormendi, R. C., and P. G. Meguire. 1985. “Macroeconomic determinants of growth: Cross-country evidence.” Journal of Monetary Economics 16: 141–163.10.1016/0304-3932(85)90027-3Search in Google Scholar

Kose, M. A., C. Otrok, and C. H. Whiteman. 2003. “International Business Cycles: World, Region, and Country-Specific Factors.” American Economic Review 93: 1216–1239.10.1257/000282803769206278Search in Google Scholar

Kose, M. A., E. Prasad, and M. E. Terrones. 2006. “How Do Trade and Financial Integration Affect the Relationship between Growth and Volatility?” Journal of International Economics 69: 176–202.10.1016/j.jinteco.2005.05.009Search in Google Scholar

Kuhn, R. 2012. “On the Role of Human Development in the Arab Spring.” Population and Development Review 38: 649–683.10.1111/j.1728-4457.2012.00531.xSearch in Google Scholar

Lagos, R. 2006. “A Model of TFP.” Review of Economic Studies 73: 983–1007.10.1111/j.1467-937X.2006.00405.xSearch in Google Scholar

Levy, D., and H. Dezhbakhsh. 2003. “International Evidence on Output Fluctuation and Shock Persistence.” Journal of Monetary Economics 50: 1499–1530.10.1016/j.jmoneco.2003.08.005Search in Google Scholar

Loayza, N. V., R. Rancière, L. Servén, and J. Ventura. 2007. “Macroeconomic Volatility and Welfare in Developing Countries: An Introduction.” World Bank Economic Review 21: 343–357.10.1093/wber/lhm017Search in Google Scholar

Lucas, R. E. 1987. Models of Business Cycles. New York: Basil Blackwell.Search in Google Scholar

Maddison, A. 1991. Dynamic Forces in Capitalist Development: A Long-Run Comparative View. New York: Oxford University Press.Search in Google Scholar

Male, R. 2011. “Developing Country Business Cycles: Characterizing the Cycle.” Emerging Markets Finance and Trade 47: 20–39.10.2753/REE1540-496X4703S202Search in Google Scholar

Mallick, D. 2014. “Financial Development, Shocks, and Growth Volatility.” Macroeconomic Dynamics 18: 651–688.10.1017/S1365100512000569Search in Google Scholar

Martin, P., and C. A. Rogers. 1997. “Stabilization Policy, Learning-by-Doing, and Economic Growth.” Oxford Economic Papers 49: 152–166.10.1093/oxfordjournals.oep.a028601Search in Google Scholar

Martin, P., and C. A. Rogers. 2000. “Long-Term Growth and Short-Term Economic Instability.” European Economic Review 44: 359–381.10.1016/S0014-2921(98)00073-7Search in Google Scholar

Mendoza, E. 1995. “The Terms of Trade, the Real Exchange Rate, and Economic Fluctuations.” International Economic Review 36: 101–137.10.2307/2527429Search in Google Scholar

Mobarak, A. M. 2005. “Democracy, Volatility and Development.” Review of Economics and Statistics 87: 348–361.10.1162/0034653053970302Search in Google Scholar

Moro, A. 2015. “Structural Change, Growth, and Volatility.” American Economic Journal: Macroeconomics 7: 259–294.10.1257/mac.20130057Search in Google Scholar

Müller, U. K., and M. W. Watson. 2017. “Low-Frequency Econometrics.” In Advances in Economics and Econometrics: Eleventh World Congress of the Econometric Society, Volume II, edited by B. Honoré and L. Samuelson, 53–94. Cambridge: Cambridge University Press.10.1017/9781108227223.003Search in Google Scholar

Nakamura, E., D. Sergeyev, and J. Steinsson. 2017. “Growth-Rate and Uncertainty Shocks in Consumption: Cross-Country Evidence.” American Economic Journal: Macroeconomics 9: 1–39.10.3386/w18128Search in Google Scholar

Ploeg, F., and S. Poelhekke. 2009. “Volatility and the Natural Resource Curse.” Oxford Economic Papers 61: 727–760.10.1093/oep/gpp027Search in Google Scholar

Ponomareva, N., and H. Katayama. 2010. “Does the Version of the Penn World Tables Matter? An Analysis of the Relationship between Growth and Volatility.” Canadian Journal of Economics 43: 152–179.10.1111/j.1540-5982.2009.01567.xSearch in Google Scholar

Priestly, M. B. 1981. Spectral Analysis and Time Series, Vols. 1 & 2. London: Academic Press.Search in Google Scholar

Pritchett, L. 2000. “Understanding Patterns of Economic Growth: Searching for Hills amongst Plateaus, Mountains, and Plains.” World Bank Economic Review 14: 221–250.10.1093/wber/14.2.221Search in Google Scholar

Rafferty, M. 2005. “The Effects of Expected and Unexpected Volatility on Long-Run Growth: Evidence from 18 Developed Economies.” Southern Economic Journal 71: 582–591.10.2307/20062062Search in Google Scholar

Ramey, G., and V. A. Ramey. 1995. “Cross-Country Evidence on the Link between Volatility and Growth.” American Economic Review 85: 1138–1150.10.3386/w4959Search in Google Scholar

Rand, J., and F. Tarp. 2002: “Business Cycles in Developing Countries: Are They Different?” World Development 30: 2071–2088.10.1016/S0305-750X(02)00124-9Search in Google Scholar

Ravn, M. O., and H. Uhlig. 2002. “On Adjusting the Hodrick-Prescott Filter for the Frequency of Observations.” Review of Economics and Statistics 84: 371–376.10.1162/003465302317411604Search in Google Scholar

Rodrik, D. 1999. “Where Did All the Growth Go? External Shocks, Social Conflict, and Growth Collapses.” Journal of Economic Growth 4: 385–412.10.1023/A:1009863208706Search in Google Scholar

Romer, D. 2012. Advanced Macroeconomics, Fourth Edition. New York: McGraw-Hill.Search in Google Scholar

Saint-Paul, G. 1997. “Business Cycles and Long-Run Growth.” Oxford Review of Economic Policy 13: 145–153.10.1093/oxrep/13.3.145Search in Google Scholar

Sargent, T. J. 1987. Macroeconomic Theory, Second Edition. San Diego: Academic Press Inc.Search in Google Scholar

Schumpeter, J. A. 1939. Business Cycle: A Theoretical, Historical, and Statistical Analysis of the Capitalist Process. New York: McGraw-Hill.Search in Google Scholar

Stadler, G. W. 1990. “Business Cycles Models with Endogenous Technology.” American Economic Review 80: 763–778.Search in Google Scholar

Stastny, M., and M. Zagler. 2007. “Empirical Evidence on Growth and Volatility.” RSCAS Working Papers No. 22, European University Institute, Italy.Search in Google Scholar

Stock, J. H. and M. W. Watson. 2007. “Why Has U.S. Inflation Become Harder to Forecast?.” Journal of Money, Credit and Banking 39: 3–33.10.1111/j.1538-4616.2007.00014.xSearch in Google Scholar

The Maddison-Project. 2013. http://www.ggdc.net/maddison/maddison-project/home.htm (accessed on August 12, 2013).Search in Google Scholar

Wolf, H. 2005. “Volatility: Definitions and Consequences.” In Managing Economic Volatility and Crises: A Practitioner’s Guide, edited by J. Aizenman and B. Pinto, 45–64. New York: Cambridge University Press.10.1017/CBO9780511510755.004Search in Google Scholar

Young, A. 1993. “Invention and Bounded Learning by Doing.” Journal of Political Economy 101: 443–472.10.1086/261882Search in Google Scholar

©2019 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Advances

- What does a relative price of investment wedge reveal about the role of investment-specific technology?

- Envelope wages, hidden production and labor productivity

- Should individuals migrate before acquiring education or after? A new model of Brain Waste vs. Brain Drain

- Investment, technological progress and energy efficiency

- Bounded rationality and the ineffectiveness of big push policies

- Contributions

- Dissecting the act of god: an exploration of the effect of religiosity on economic activity

- Cross-industry growth differences with asymmetric industries and endogenous market structure

- Persistent Inequality, Corruption, and Factor Productivity

- The Finnish Great Depression of the 1990s: reconciling theory and evidence

- The growth-volatility relationship redux: what does volatility decomposition tell?

- Fiscal stimulus and unemployment dynamics

Articles in the same Issue

- Advances

- What does a relative price of investment wedge reveal about the role of investment-specific technology?

- Envelope wages, hidden production and labor productivity

- Should individuals migrate before acquiring education or after? A new model of Brain Waste vs. Brain Drain

- Investment, technological progress and energy efficiency

- Bounded rationality and the ineffectiveness of big push policies

- Contributions

- Dissecting the act of god: an exploration of the effect of religiosity on economic activity

- Cross-industry growth differences with asymmetric industries and endogenous market structure

- Persistent Inequality, Corruption, and Factor Productivity

- The Finnish Great Depression of the 1990s: reconciling theory and evidence

- The growth-volatility relationship redux: what does volatility decomposition tell?

- Fiscal stimulus and unemployment dynamics