Abstract

One of the acknowledged advantages of patent clearinghouses is that they favor the diffusion of technology. In traditional clearinghouses, patents are usually bundled in pools and sold at a pre-set price. Recently, in the biotechnology industry a new form of clearinghouse has been observed, where patent tariffs are instead bargained over by the clearinghouse members. Exchange is then guaranteed by arbitration agreements to which the negotiating parties are bound, should their bargaining reach a dead end. This paper assesses the effect on technology diffusion of this new type of clearinghouse. We show that such arbitration agreements, through their effect on the outside options, may reduce the incentives of a member of the clearinghouse to license to non-members. This result highlights the role of such arbitration agreements in the diffusion of technology outside the clearinghouse.

Appendix A: Non Profitability for U Not to License or Not to Produce in the Scenario Without PaC

A.1 No Licensing and Production by U (M)

Assume that firm U issues no license. The relevant demand is (4), with i = U. Basic computations return

Direct comparison shows that Π M < Π E .

A.2 Exclusive Contract and No Production by U

(

E

̇

)

Firm U enters an exclusive relationship with firm 1 or 2, with the contract

where the inverse demand p m (q m ) is as in (4) with m = 1, 2. At the last stage, Firm i maximizes its own profit, given T m by setting

Substituting back (36) into (34) and (35) returns

The upstream firm has committed to an exclusive relationship, thus both the outside options of U and i are nil. Accordingly, the Nash product is

where μ (res. 1 − μ) is the bargaining weight of the upstream (res. downstream) firm. Maximization of the Nash product with respect to T m leads to

At optimal tariff the royalty rate equals firm U’s marginal production to maximize the industry surplus, which is appotioned according to the bargaining power distribution. We state

Lemma 5.

With exclusive licensing, an no production by U,

Direct comparison reveals that

A.3 Non-Exclusive Contract and No Production by U

(

N

̇

)

The upstream firm offers two licenses and does not produce. The firms’ profits are

where p i (q i , q j ) is as in (3).

By plugging the best reply

If the negotiation fails, downstream firms cannot operate, thus their profits and outside options nil. Conversely, if negotiation with i fails, U still expects that the negotiation goes ahead successfully with j. Hence the outside option of U with firm i is the profit it would reap in an exclusive relationship with firm j. With non-contingent contracts, the Nash products write

By maximizing Nash products in (45) with respect to T

1 and T

2, substituting back the equilibrium quantities

The royalty rates are set to zero, the marginal cost of the upstream monopolist. The fixed fee dictates the sharing of firm i’s profit with U.

Lemma 6.

With a non-exclusive contract and no production by firm U, the equilibrium tariffs are

Direct comparison reveals that

Appendix B: Non Profitability for U Not to Produce in the Scenario with the PaC

B.1 Exclusive Contract and No Production by Firm U

(

E

C

̇

)

This case coincides with

B.2 Non-Exclusive Contracts and No Production by Firm U

(

N

C

̇

)

This case coincides with

Lemma 7.

With a non-exclusive contract and no production by firm U, equilibrium prices and quantities are

Direct comparison reveals that

Appendix C: Proposition 4

Direct comparison of the profits of firm U Firm in the possible scenarios reveals that U joins the PaC and offers

An exclusive contract (EC) for

μ ∈ [0, 0.2920] ∩ η ∈ [(0.4048μ + 0.5952), 1],

μ ∈ [0.2920, 0.4889] ∩ η ∈ [(1.4550μ + 0.2886), 1].

A non-exclusive contract (NC) for

μ ∈ [0.2920, 0.3447] ∩ η ∈ [(0.0567μ + 0.6968), (1.4550μ + 0.2886)],

μ ∈ [0.3447, 0.4889] ∩ η ∈ [(0.4327μ + 0.5672), (1.4550μ + 0.2886)],

μ ∈ [0.4889, 1] ∩ η ∈ [(0.4327μ + 0.5672), 1].

Appendix D: Proof of Proposition 5

From the proof of Proposition 4 the minimum value of η for which Firm U joins the PaC is

Clearly,

Appendix E: Effect of the IP Owner’s Membership in the PaC on the License Offer

Comparison Propositions 1 and 2 we conclude that:

In region μ ∈ [0.2920, 0.3447] ∩ η ∈ [(0.0567μ + 0.6968), (1.4550μ + 0.2886)], firm U’s membership in the PaC increases the number of license offered.

In region μ ∈ [0.3447, 0.4889] ∩ η ∈ [(1.4550μ + 0.2886), 1], firm U’s membership in the PaC restricts the license offered.

In all other regions firm U’s membership in the PaC does not affect the licenses offered.

Appendix F: Alternative Arbitration Pricing Schemes

We have carried out our analysis by assuming that the arbitrator implements non-linear contracts based on two-part tariffs. Our results remain qualitatively unchanged under two alternative, commonly used, payment schemes: a lump-sum transfer and a linear fee. Here we will limit ourselves to discuss how these pricing schemes affect the arbitration outcomes withing the clearinghouse.[32]

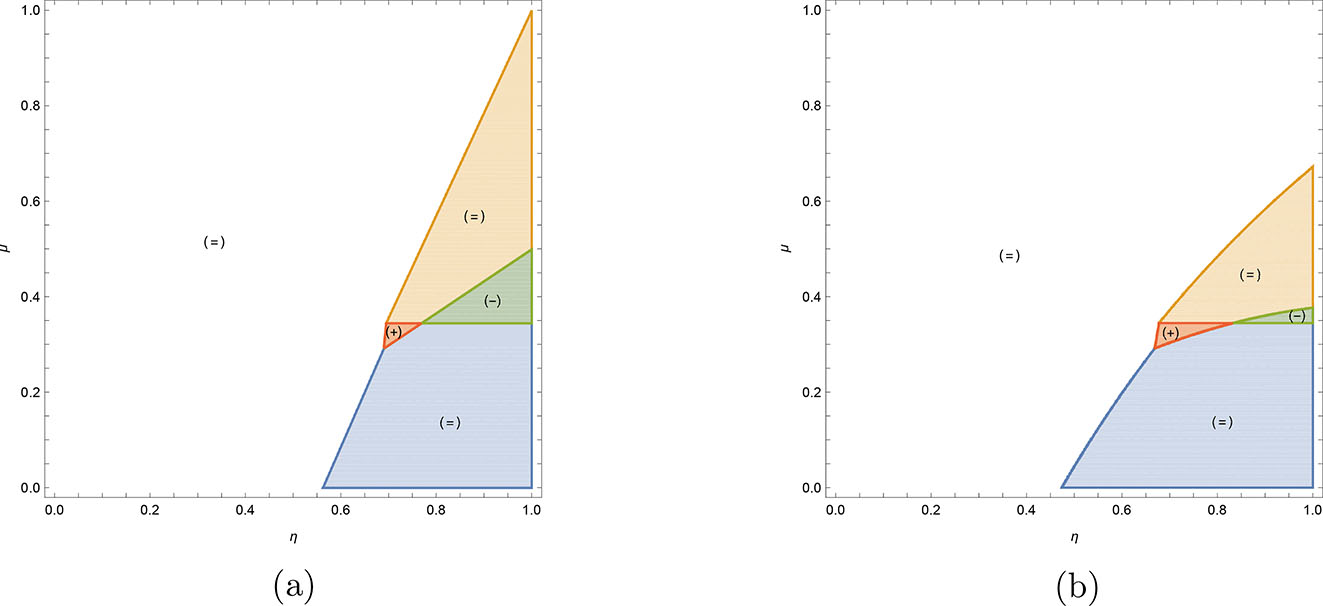

Figure 3 depicts the two alternative tariff structures, and diagrammatically confirms our claim that the main message goes through with different arbitration pricing schemes. Two remarks are worth making, which will be helpful in the ensuing discussion. The first one is that – as in the main model – the IP owner always finds it profitable to produce its own good. The second one is that alternative pricing schemes affect only the outside options of the firms in the platform. This, in turn, entails that the equilibrium two-part tariffs governing the trade between firm U and firm 1 are modified only in the fixed fee, as the royalty rate remains the same as in the main text. The ultimate consequence is that the equilibrium prices, quantities and total surplus generated in the industry do not depend on the tariff structure implemented by the arbitrator, which affects only the equilibrium apportioning between U and 1 of the surplus generated by the sales of good 1.

Alternative pricing schemes. (a) Lump-sum tariff. (b) Linear tariff.

The situation in which the arbitrator opts for a lump sum transfer mirrors the scenario discussed in the main text, with the royalty rate set to zero in case of disagreement. Because the arbitrator aims at maximizing the value of the license only, with a two-part tariff it sets a negative royalty rate, in order to boost the sales of good 1. As mentioned above, that negative royalty rate is too low from the standpoint of firm U. Consequently, the use by the arbitrator of a lump sum transfer, which implicitly amounts to increasing the royalty rate as compared to the two-part tariff, makes product 1 relatively less competitive than product U and increases the outside option of firm U at the expenses of that of firm 1. Eventually, this results in higher equilibrium profits for firm U than in the two-part tariff case. Yet, the ExE is still at work with a lump-sum tariff, because, the – implicit – royalty rate under a lump sum transfer, although larger than that under the arbitrated two-part tariff, still falls short of the one maximizing the joint profit of firms U and 1. Therefore, for given η and μ, U finds it more attractive to join the PaC with the arbitration tariff being a fixed fee.

With linear tariffs, the royalty rate both determines the total surplus to be shared and the apportioning thereof, thus the efficiency of linear tariffs within the vertical hierarchy is lower than that of non-linear contracts. It is clear that firm 1 would select the lowest rate acceptable to firm U, namely zero, while firm U would choose the one maximizing its own profit: label this royalty rate w U > 0.[33] Clearly the arbitrator must choose a value between these two extremes, and accordingly, we assume that the chosen royalty rate is a weighted average of these extremes, with weights equal to the preference of the arbitrator for the firms, namely η × w U + (1 − η) × 0. An immediate consequence is that, for any η < 1 the arbitrated royalty rate is lower than the one which fully internalizes the effect on the profits of firm U, which results in the existence of the ExE. Interestingly, in this case the actual size of this effect is negatively correlated with η. Consequently, the attractiveness of joining the PaC for firm U is larger under linear contracts than under two-part tariffs only if η is large enough.

References

Ambec, S., C. Langinier, and S. Lemarié. 2008. “Incentives to Reduce Crop Trait Durability.” American Journal of Agricultural Economics 90 (2): 379. https://doi.org/10.1111/j.1467-8276.2007.01110.x.Search in Google Scholar

Aoki, R., and A. Schiff. 2008. “Promoting Access to Intellectual Property: Patent Pools, Copyright Collectives, and Clearinghouses.” R & D Management 38 (2): 189–204. https://doi.org/10.1111/j.1467-9310.2008.00502.x.Search in Google Scholar

Aoki, R., and A. Schiff. 2010. “Intellectual Property Clearinghouses: The Effects of Reduced Transaction Costs in Licensing.” Information Economics and Policy 22 (3): 218–27. https://doi.org/10.1016/j.infoecopol.2010.01.001.Search in Google Scholar

Bacchiega, E., O. Bonroy, and E. Petrakis. 2018. “Contract Contingency in Vertically Related Markets.” Journal of Economics and Management Strategy 27 (4): 772–91. https://doi.org/10.1111/jems.12252.Search in Google Scholar

Bowley, A. L. 1924. The Mathematical Groundwork of Economics. Oxford University Press. reprinted by A. M. Kelley New York, 1965.Search in Google Scholar

Collard-Wexler, A., G. Gowrinsankaran, and R. S. Lee. 2019. “Nash-in-Nash Bargaining: A Microfundation for Applied Work.” Journal of Political Econonomy 1: 163–95.10.1086/700729Search in Google Scholar

Crawford, V. P. 1979. “On Compulsory-Arbitration Schemes.” Journal of Political Economy 87 (1): 131–59. https://doi.org/10.1086/260743.Search in Google Scholar

Crawford, V. P. 1981. “Arbitration and Conflict Resolution in Labor-Management Bargaining.” The American Economic Review 71 (2): 205–10.Search in Google Scholar

Dixit, A. K. 1979. “A Model of Duopoly Suggesting a Theory of Entry Barriers.” The Bell Journal of Economics 10 (1): 20–32. https://doi.org/10.2307/3003317.Search in Google Scholar

Farber, H. S., and M. H. Bazerman. 1986. “The General Basis of Arbitrator Behavior: An Empirical Analysis of Conventional and Final-Offer Arbitration.” Econometrica: Journal of the Econometric Society 54 (4): 819–44. https://doi.org/10.2307/1912838.Search in Google Scholar

Gabuthy, Y., and A. Muthoo. 2018. “Bargaining and Hold-Up: The Role of Arbitration.” Oxford Economic Papers 71 (1): 292–308. https://doi.org/10.1093/oep/gpy035.Search in Google Scholar

Galushko, V. 2008. Intellectual Property Rights and the Future of Breeding in Canada. PhD thesis, University of Saskatchewan.Search in Google Scholar

Hart, O., and J. Tirole. 1990. “Vertical Integration and Market Foreclosure.” Brookings Papers on Economic Activity. Microeconomics: 205–86. https://doi.org/10.2307/2534783.Search in Google Scholar

Hervouet, A., and C. Langinier. 2018. “Plant Breeders’ Rights, Patents, and Incentives to Innovate.” Journal of Agricultural and Resource Economics 43 (1): 118–50.Search in Google Scholar

Howard, P. 2009. “Visualizing Consolidation in the Global Seed Industry: 1996–2008.” Sustainability 1 (4): 1266–87. https://doi.org/10.3390/su1041266.Search in Google Scholar

Lence, S., D. Hayes, A. McCunn, S. Smith, and W. Niebur. 2005. “Welfare Impacts of Intellectual Property Protection in the Seed Industry.” American Journal of Agricultural Economics 87 (4): 951–68. https://doi.org/10.1111/j.1467-8276.2005.00780.x.Search in Google Scholar

Lence, S. H., D. J. Hayes, J. M. Alston, and J. S. C. Smith. 2016. “Intellectual Property in Plant Breeding: Comparing Different Levels and Forms of Protection.” European Review of Agricultural Economics 43 (1): 1–29. https://doi.org/10.1093/erae/jbv007.Search in Google Scholar

Lerner, J., and J. Tirole. 2004. “Efficient Patent Pools.” The American Economic Review 94 (3): 691–711. https://doi.org/10.1257/0002828041464641.Search in Google Scholar

Matsushima, N., and R. Shinohara. 2014. “What Factors Determine the Number of Trading Partners?” Journal of Economic Behavior & Organization 106 (Supplement C): 428–41. https://doi.org/10.1016/j.jebo.2014.07.014.Search in Google Scholar

McAfee, R. P., and M. Schwartz. 1994. “Opportunism in Multilateral Vertical Contracting: Nondiscrimination, Exclusivity, and Uniformity.” The American Economic Review 84 (1): 210–30.Search in Google Scholar

Milliou, C., and E. Petrakis. 2007. “Upstream Horizontal Mergers, Vertical Contracts, and Bargaining.” International Journal of Industrial Organization 25 (5): 963–87. https://doi.org/10.1016/j.ijindorg.2006.11.007.Search in Google Scholar

Moschini, G., and O. Yerokhin. 2008. “Patents, Research Exemption, and the Incentive for Sequential Innovation.” Journal of Economics and Management Strategy 17 (2): 379–412. https://doi.org/10.1111/j.1530-9134.2008.00182.x.Search in Google Scholar

O’Brien, D. P., and G. Shaffer. 1992. “Vertical Control with Bilateral Contracts.” The RAND Journal of Economics 23 (3): 299–308. https://doi.org/10.2307/2555864.Search in Google Scholar

Reisinger, M., and E. Tarantino. 2019. “Patent Pools, Vertical Integration, and Downstream Competition.” The RAND Journal of Economics 50 (1): 168–200. https://doi.org/10.1111/1756-2171.12266.Search in Google Scholar

Rey, P., and T. Vergé. 2004. “Bilateral Control with Vertical Contracts.” The RAND Journal of Economics 35 (4): 728–46. https://doi.org/10.2307/1593770.Search in Google Scholar

Smith, S. 2008. “Intellectual Property Protection for Plant Varieties in the 21st Century.” Crop Science 48 (4): 1277–90. https://doi.org/10.2135/cropsci2007.07.0413.Search in Google Scholar

Spence, M. 1976. “Product Differentiation and Welfare.” The American Economic Review 66 (2): 407–14.Search in Google Scholar

Van Overwalle, G. 2018. “Creating Universal and Sustainable Access to Plants and Seeds: The Role of Clearinghouses, Open Source Licenses, and Inclusive Patents.” In The Commons, Plant Breeding and Agricultural Research, 88–106. London and New York: Routledge.10.4324/9781315110387-6Search in Google Scholar

Van Zimmeren, E., B. Verbeure, G. Matthijs, and G. Van Overwalle. 2006. “A Clearing House for Diagnostic Testing: The Solution to Ensure Access to and Use of Patented Genetic Inventions?” Bulletin of the World Health Organization 84: 352–9. https://doi.org/10.2471/blt.06.030445.Search in Google Scholar

Supplementary Material

This article contains supplementary material (https://doi.org/10.1515/bejeap-2023-0220).

© 2024 Walter de Gruyter GmbH, Berlin/Boston

Articles in the same Issue

- Frontmatter

- Research Articles

- Women’s Labour Market Attachment and the Gender Wealth Gap

- Terror in the City: Local Terrorism and Firm Exports

- Achievement Effects of Dual Language Immersion in One-Way and Two-Way Programs: Evidence from a Statewide Expansion

- Test Endurance and Remedial Education Interventions: Good News for Girls

- Patent Clearinghouse and Technology Diffusion: What is the Contribution of Arbitration Agreements?

- How Much Competition is Enough Competition for Regulatory Forbearance?

- Waiting for the Weekend – The Adoption and Proliferation of Weekend Feeding (“BackPack”) Programs in Schools

- The Effect of Inheritance Receipt on Labor Supply: A Longitudinal Study of Japanese Women

- Letters

- Time Preferences and Lunar New Year: An Experiment

- Outsourcing Child Labor

- Future Focus is Surprisingly Linked with Prioritizing Work–Life Balance over Long-Term Savings

- Inmate Assistance Programs

- On Plaintiffs’ Strategic Information Acquisition and Disclosure during Discovery

Articles in the same Issue

- Frontmatter

- Research Articles

- Women’s Labour Market Attachment and the Gender Wealth Gap

- Terror in the City: Local Terrorism and Firm Exports

- Achievement Effects of Dual Language Immersion in One-Way and Two-Way Programs: Evidence from a Statewide Expansion

- Test Endurance and Remedial Education Interventions: Good News for Girls

- Patent Clearinghouse and Technology Diffusion: What is the Contribution of Arbitration Agreements?

- How Much Competition is Enough Competition for Regulatory Forbearance?

- Waiting for the Weekend – The Adoption and Proliferation of Weekend Feeding (“BackPack”) Programs in Schools

- The Effect of Inheritance Receipt on Labor Supply: A Longitudinal Study of Japanese Women

- Letters

- Time Preferences and Lunar New Year: An Experiment

- Outsourcing Child Labor

- Future Focus is Surprisingly Linked with Prioritizing Work–Life Balance over Long-Term Savings

- Inmate Assistance Programs

- On Plaintiffs’ Strategic Information Acquisition and Disclosure during Discovery